| Item 1. | Business |

1

Through its division known as The Governance Institute (“TGI”), NRC also offers subscription-based governance information and educational conferences designed to improve the effectiveness of hospital and health care systems by continually strengthening their healthcare boards, medical leadership, and management performance in the United States. TGI conducts timely conferences, produces publications, videos, white papers, and research studies, and tracks industry trends showcasing the best practices of healthcare boards across the country.

On May 30, 2006, the Company acquired substantially all of the assets of TGI Group, LLC, operating as TGI. TGI provides board members, executive management and physician leaders of hospitals and health systems with knowledge and solutions to successfully confront a wide array of strategic issues. The purchase price for TGI was $19.8 million in cash, plus the assumption of certain liabilities.

Information Services

The Qualisys System (“Qualisys”) is

The Company has developed NRC+Picker subscription-based educational services asonline improvement tools, including a way of bridgingone-page report which provides a basis on which improvements can be made, shows healthcare organizations which service factors impact their customer group’s value and which have the gap between measurementgreatest impact on satisfaction levels, and improvement of patient-centered care. These products consist of the Symposium, the Patient-Centered Care Learning Network and eLearning. The Symposium is an annual event which is dedicatedhow their performance in relationship to the improvement of the patient experience. Patient-Centered Care Learning Network is a membership-based product that enables members to participate in calls with industry experts, have access to experts, participate in monthly presentations and receive monthly journals or white papers, all of which focus on topics of improvement of the patient experience. An interactive online educational product, eLearning, is used by the providers to understand the dimensions of patient-centered care.

3

Market Guidethese key indicators changes over time.

Numerous marketing

4

5

| Name | Age | Position | ||

| Michael D. Hays | 55 | President, Chief Executive Officer and Director | ||

Patrick E. Beans | 52 | Vice President, Treasurer, Chief Financial Officer, | ||

| Secretary and Director |

Jona S. Raasch has served as President of the Governance Institute, a division of National Research Corporation since May 2006. Prior to May 2006, Ms. Raasch held various positions with the Company since September 1988, most recently as Vice President and Chief Operations Officer from September 1997 to May 2006. Prior to joining the Company, Ms. Raasch held various positions with A.C. Nielsen Corporation.

Patrick E. Beans has served as Vice President, Treasurer, Chief Financial Officer, and Secretary and a director since 1997. He has served as the principal financial officer since he joined the Company in August 1994. From June 1993 until joining the Company, Mr. Beans was the finance director for the Central Interstate Low-Level Radioactive Waste Commission, a five-state compact developing a low-level radioactive waste disposal plan. From 1979 to 1988 and from June 1992 to June 1993, he practiced as a certified public accountant.

6

| Item 1A. | Risk Factors |

We rely on a limited number of key clients, and a loss of one or more of these key clients will adversely affect our operating results.

We rely on a limited number of key clients for a substantial portion of our revenues. The Company’s ten largest clients accounted for 32%, 40%, and 43% of the Company’s total revenues in 2006, 2005 and 2004, respectively. The U.S. Department of Veterans Affairs accounted for 8%, 11% and 12% of total revenues in 2006, 2005 and 2004, respectively.

We cannot assure you that we will maintain our existing client base, maintain or increase the level of revenue or profits generated by our existing clients, or be able to attract new clients. Furthermore, the healthcare industry continues to undergo consolidation and we cannot assure you that such consolidation will not cause us to lose clients. The loss of one or more of our large clients or a significant reduction in business from such clients, regardless of the reason, will have a negative effect on our revenues and a corresponding effect on our operating and net income. See “Risk Factors — Because our clients are concentrated in the healthcare industry, we may be adversely affected by a business downturn or consolidation with respect to the healthcare industry.”

7

8

9

10

In addition, severalrevenue.

| Item 1B. | Unresolved Staff Comments |

| Item 2. | Properties |

| Item 3. | Legal Proceedings |

No matters were submitted to a vote of the Company’s shareholders during the fourth quarter of the Company’s 2006 fiscal year.

11

PART IIItem 5.Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity SecuritiesThe Company’s Common Stock, $.001 par value (“Common Stock”), is traded on the NASDAQ Global Market under the symbol “NRCI.” The following table sets forth the range of high and low sales prices for, and dividends declared on, the Common Stock for the period from January 1, 2005,2008, through December 31, 2006:High Low Dividends

Declared Per

Common Share 2005 Quarter Ended: March 31 $15.65 $13.44 $.08 June 30 $16.15 $12.36 $.08 September 30 $17.68 $14.35 $.08 December 31 $17.79 $15.50 $.08

2006 Quarter Ended: March 31 $24.79 $17.00 $.10 June 30 $24.49 $21.30 $.10 September 30 $26.91 $21.47 $.10 December 31 $26.39 $21.85 $.10

High Low DividendsDeclared PerCommon Share 2008 Quarter Ended: March 31 $ 27.94 $ 24.75 $ .14 June 30 $ 32.06 $ 25.14 $ .14 September 30 $ 35.58 $ 23.01 $ .14 December 31 $ 34.93 $ 19.00 $ .14 2009 Quarter Ended: March 31 $ 29.01 $ 19.48 $ .16 June 30 $ 28.10 $ 23.10 $ .16 September 30 $ 26.74 $ 23.55 $ .16 December 31 $ 25.30 $ 20.32 $ .16

On March 15, 2007,30, 2010, there were approximately 3319 shareholders of record, and approximately 500beneficial500 beneficial owners of the Common Stock.In March 2005, the Company announced the commencement of a quarterly cash dividend. Cash dividends of $2.8$4.3 million and $2.3$3.8 million in the aggregate were declared and paid during the twelve-month periodperiods ended December 31, 20062009 and 20052008, respectively. The payment and amount of future dividends is at the discretion of the Company’s Board of Directors and will depend on the Company’s future earnings, financial condition, general business conditions and other factors.The table below summarizes the Company’s repurchases of its common stock during the three-month period ended December 31, 2006.Period Total

Number of

Shares

Purchased Average

Price Paid

per Share Total Number

of Shares

Purchased as Part

of Publicly

Announced Plans

or Programs (1) Maximum Number of

Shares that May Yet Be

Purchased Under the Plans

or Programs October 1 - October 31, 2006 6,405 $24.48 6,405 700,683

November 1 - November 30, 20062,100 $24.30 2,100 698,583

December 1 - December 31, 2006 800 $22.82 800 697,783

Period Total Numberof SharesPurchased AveragePrice PaidPer Share Total Numberof SharesPurchased as Partof PubliclyAnnounced Plansor Programs(1) Maximum Number ofShares That May Yet BePurchased Under the Plans or Programs October 1 - October 31, 2009 — — — 289,275 November 1 - November 30, 2009 — — — 289,275 December 1 - December 31, 2009 210 $ 21.69 210 289,065

(1) In February 2006, the Company’s Board of Directors authorized a stock repurchase plan providing for the repurchase of an additional 750,000 shares. The plan has no expiration date.

12

12

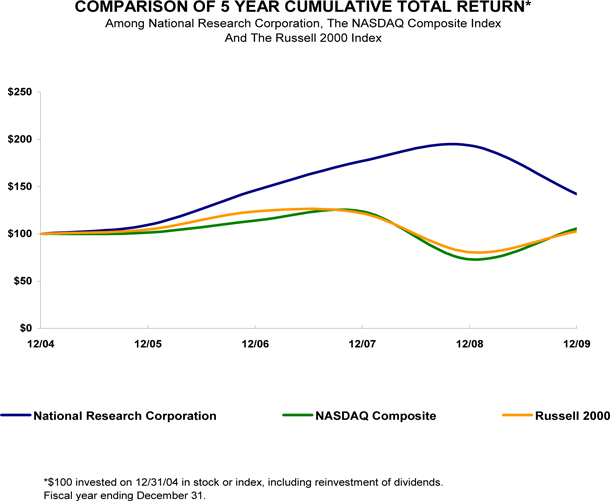

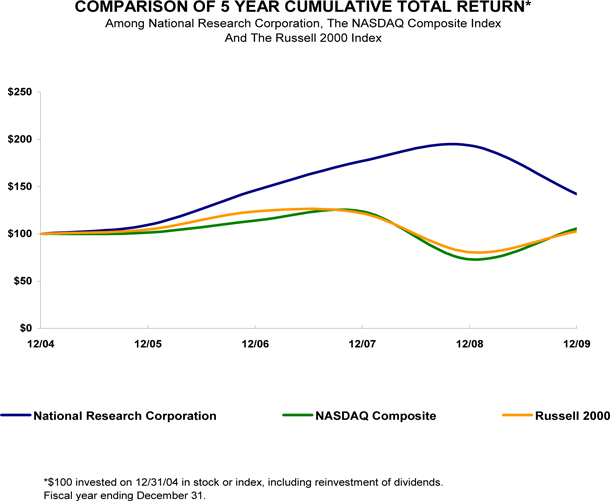

The following graph below compares the cumulative five year5-year total return toprovided shareholders on National Research Corporation’sCorporation's common stock versusrelative to the cumulative total returns of the NASDAQ Composite indexIndex and the Russell 2000 index. The graph assumes that the valueIndex. An investment of the investment$100 (with reinvestment of all dividends) is assumed to have been made in the Company’sour common stock and in each of the indexes (including reinvestment of dividends) was $100 on December 31, 20012004, and tracks itits relative performance is tracked through December 31, 2006.

2009.

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURN DATA

12/04 12/05 12/06 12/07 12/08 12/09 National Research Corporation 100.00 109.35 146.03 177.05 193.68 142.27 NASDAQ Composite 100.00 101.33 114.01 123.71 73.11 105.61 Russell 2000 100.00 104.55 123.76 121.82 80.66 102.58

The stock price performance included in this graph is not necessarily indicative of future stock price performance.performance.

13

13

Item 6. Selected Financial Data

The selected statement of income data for the years ended December 31, 2006, 20052009, 2008, and 2004,2007, and the selected balance sheet data at December 31, 20062009 and 2005,2008, are derived from, and are qualified by reference to, the audited consolidated financial statements of the Company included elsewhere in this Annual Report on Form 10-K. The selected statement of income data for the years ended December 31, 20032006 and 2002,2005, and the balance sheet data at December 31, 2004, 20032007, 2006, and 2002,2005, are derived from audited consolidated financial statements not included herein.Year Ended December 31,

2006

2005

2004

2003

2002

(In thousands, except per share data) Statement of Income Data: Revenues $ 43,771 $ 32,437 $ 29,683 $ 26,922 $ 22,387 Operating expenses: Direct expenses 19,445 13,642 12,869 12,029 9,556 Selling, general and administrative 12,158 8,617 7,394 5,987 4,737 Depreciation and amortization (1) 2,260 1,762 2,018 1,941 1,675

Total operating expenses 33,863 24,021 22,281 19,957 15,968 Operating income 9,908 8,416 7,402 6,965 6,419 Other income (expenses) (402 ) 99 (119 ) (49 ) (258 )

Income before income taxes 9,506 8,515 7,283 6,916 6,161 Provision for income taxes 3,622 3,279 2,732 2,532 2,311

Net income $ 5,884 $ 5,236 $ 4,551 $ 4,384 3,850

Net income per share - basic $ 0.86 $ 0.74 $ 0.63 $ 0.60 $ 0.54

Net income per share - diluted $ 0.85 $ 0.74 $ 0.63 $ 0.60 $ 0.54

Dividends per share $ 0.40 $ 0.32 $ -- $ -- --

Weighted average shares outstanding - basic 6,836 7,038 7,181 7,259 7,163 Weighted average shares outstanding - diluted 6,954 7,118 7,249 7,326 7,193

Year Ended December 31, 2009 2008 2007 2006 2005 (In thousands, except per share data) Statement of Income Data: Revenue $ 57,692 $ 51,013 $ 48,923 $ 43,771 $ 32,437 Operating expenses: Direct expenses 24,574 23,611 21,801 19,445 13,642 Selling, general and administrative 15,590 12,728 13,173 12,158 8,617 Depreciation and amortization 3,831 2,685 2,583 2,260 1,762 Total operating expenses 43,995 39,024 37,557 33,863 24,021 Operating income 13,697 11,989 11,366 9,908 8,416 Other income (expenses) (580 ) (6 ) (248 ) (402 ) 99 Income before income taxes 13,117 11,983 11,118 9,506 8,515 Provision for income taxes 4,626 4,538 4,278 3,622 3,279 Net income $ 8,491 $ 7,445 $ 6,840 $ 5,884 $ 5,236 Net income per share - basic $ 1.28 $ 1.11 $ 1.00 $ 0.86 $ 0.74 Net income per share - diluted $ 1.26 $ 1.09 $ 0.98 $ 0.85 $ 0.74 Dividends per share $ 0.64 $ 0.56 $ 0.48 $ 0.40 $ 0.32 Weighted average shares outstanding – basic 6,637 6,685 6,850 6,836 7,038 Weighted average shares outstanding – diluted 6,723 6,831 7,011 6,954 7,118 December 31, 2009 2008 2007 2006 2005 (In thousands) Balance Sheet Data: Working capital (deficit) $ (4,432 ) $ (10,650 ) $ (2,384 ) $ (1,482 ) $ 8,058 Total assets 72,499 72,145 61,869 61,532 44,675 Total debt, including current portion 7,719 12,954 2,993 11,093 1,471 Total shareholders’ equity $ 44,171 $ 38,598 $ 42,286 $ 36,751 $ 32,593

14

December 31,

2006

2005

2004

2003

2002

(In thousands) Balance Sheet Data: Working capital $ (1,482 ) $ 8,058 $ 19,434 $ 16,817 $ 12,919 Total assets 61,532 44,675 47,954 45,673 38,832 Total debt, including current portion 11,093 1,471 4,901 5,044 5,176 Total shareholders’ equity 36,750 32,593 35,018 32,424 28,018

(1)On January 1, 2002, the Company adopted the provisions of Statement of Financial Accounting Standards (“SFAS”) No. 142,Goodwill and Other Intangible Assets, and ceased amortizing goodwill and other non-amortizable intangible assets.

14

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

OverviewThe Company believes it is a leading provider of ongoing survey-based performance measurement, analysis, tracking, improvement services and governance education to the healthcare industry in the United States and Canada. Since 1981, the Company has provided these services using traditional market research methodologies such as direct mail, telephone-basedtelephone, internet-based surveys, focus groups and in-person interviews. Since 2002, the current primary data collection methodology used is direct mail, but the Company still uses other methodologies for certain types of studies. The Company addresses the growing need of healthcare providers and payers to measure the care outcomes, specifically experience and health status of their patients and/or members, and provides information on governance issues. NRC develops tools that enable healthcare organizations to obtain performance measurement information necessary to comply with industry and regulatory standards, and to improve their business practices so that they can maximize new memberresident and/or patient attraction, experience, member retention and profitability. The Company believes that a driver of its growth and the growth of its industry will be the increase in demand for performance measurement, improvement and educational services as a result of more public reporting programs. The Company’s primary types of information services are performance tracking services, custom research, subscription-based educational and improvement services, and its Market Guide.Ticker.

AcquisitionsOn September 16, 2005,December 19, 2008, the Company acquired substantially all of the assets of Geriatric Health Systems, LLCMy InnerView, Inc. (“GHS”MIV”), a healthcare survey researchleading provider of quality and analytics firm based in California that specializes in measuring health status, health riskperformance improvement solutions to the senior care profession. MIV offers resident, family and memberemployee satisfaction for health plansmeasurement and improvement products to the long-term care, assisted and independent living markets in the United States. MIV works with over 8,000 senior care providers throughout the United States housing what the Company believes is the largest dataset of senior care satisfaction metrics in the nation. The purchase priceconsideration paid at closing for the acquisition was $4.0 millionMIV included payment of $11,500,000 in cash plus the assumptionand $440,000 of certain liabilities. On May 30, 2006,direct expenses capitalized as purchase price. The merger agreement under which the Company acquired substantially allMIV provided for contingent earn-out payments of which $581,000 of the assets2009 earn-out was included in this amount.

On April 1, 2008, approximately 10 customer contracts were purchased from SQ Strategies for $249,000. The recording of TGI Group, LLC, operating as TGI. TGI provides board members, executive managementthis asset purchase increased customer related intangibles by $260,000 and physician leaders of hospitals and health systems with knowledge and solutions to successfully confront a wide array of strategic issues. The purchase price for TGI was $19.8 million in cash, plus the assumption of certain liabilities.deferred revenue by $11,000.

Critical Accounting Policies and EstimatesThe preparation of financial statements requires management to make estimates and assumptions that affect amounts reported therein. The most significant of these areas involving difficult or complex judgments made by management with respect to the preparation of the Company’s consolidated financial statements for fiscal year 20062009 include:· Revenue recognition;

· Valuation of long-lived assets;

· Valuation of goodwill and identifiable intangible assets; and

· Income taxes.

15

Revenue recognition;Recognition

Valuation of long-lived assets;

Valuation of goodwill and identifiable intangible assets; and

Income taxes.

Revenue Recognition

The Company derives a majority of its operating revenuesrevenue from its annually renewable services, which include performance tracking services, subscription-based educational services and Market Guide.Ticker. The Company provides interim and annual performance tracking to its clients under annual client service contracts, although such contracts are generally cancelable on short or no notice without penalty. The Company provides subscription-based educational services to clients generally under annual service contracts over a twelve monthtwelve-month period and publishes healthcare market information for its clients through its Market GuideTicker. Starting in May 2008, the Company began providing Ticker subscription-based services to clients on a monthly basis generally over a twelve-month period, however, some Ticker subscriptions will continue to be sold and delivered on an annual basis. The Company also derives revenuesrevenue from its custom and other research projects.

15

The Company’s performance tracking services are performance tracking and improvement tools for gathering and analyzing data from survey respondents. Such services are provided pursuant to contracts which are generally renewable annually, and that provide for a customer specificcustomer-specific study which is conducted via a series of surveys and delivered via a series of updates or reports, the timing and frequency of which vary by contract (such as monthly or weekly). These contracts are generally cancelable on short or no notice without penalty and, since progress on these contracts can be tracked and regular updates and reports are made, clients are entitled to any work-in-process, but are obligated to pay for all services performed through cancellation. Typically, these contracts are fixed feefixed-fee arrangements andwith a portion of the project fee is billed in advance and the remainder is billed periodically over the duration of the project. The Company conducts custom research which measures and monitors market issues specific to individual healthcare organizations. The majority of the Company’s custom research is performed under contracts which provide for advance billing of 65% of the total project fee with the remainder due upon delivery. RevenuesRevenue and direct expenses for the Company’s performance tracking services are recognized under the proportional performance method.Under the proportional performance method, the Company recognizes revenue based on output measures or key milestones such as survey set up,set-up, survey mailings, survey returns and reporting. The Company measures its progress based on the level of completion of these output measures and recognizes revenue accordingly. Management judgments and estimates must be made and used in connection with revenue recognized using the proportional performance method. If management made different judgments and estimates, then the amount and timing of revenue for any period could differ materially from the reported revenue.The Company recognizes subscription-based educational service revenuesrevenue over the period of time the service is provided. Generally, the subscription periods are for twelve months and revenue is recognized equally over the subscription period. The Company’s Market Guide serves as a stand-alone market information and competitive intelligence source, as well as a comparative performance database. Published

Ticker was published by NRC annually, thissolely on an annual basis from 1996 to September 2008. The Company recognizes revenue on Ticker contracts upon delivery to the principal customers. Revenue under some annual contracts which do not include monthly updates is fully recognized upon delivery, typically in the third quarter of the year. Starting in May 2008, the Company added subscription-based services, the revenue from which is generally recognized on a monthly basis over a twelve-month period. Until September 2008, the Company would defer costs of preparing the survey is a comprehensive consumer-based healthcare assessment. Market Guidedata for Ticker and expense these at the time the annual contract revenue was recognized. Starting in October 2008, these costs were expensed monthly. The Company generates additional revenue from incidental customers subsequent to the completion of each monthly edition. Revenue and costs for these subsequent services are recognized as the services are performed and completed. Ticker is generally provided pursuant to contracts which have durations of four to six months and that provide for the receipt of survey results that are customized to meet an individual client’s specific information needs. Typically, these contracts are not cancelable by clients, clients receive no rights in the comprehensive healthcare database which results from this survey, other than the right to use the customized reports purchased pursuant thereto, and amounts due for Market GuideTicker are billed prior to or at delivery. The Company recognizes revenue on Market Guide contracts upon delivery to the principal customers, typically in the third quarter

16

As a result of the year. The Company defers coststiming of preparing the survey data for Market Guide. These costs are primarily incremental external direct costs solely related to fulfilling the Company’s obligations under Market Guide contracts. The Company expenses these deferred costs at the timerecognition of revenue is recognized. The Company monitors and assesses the recoverability of the deferred direct costs based on contracted revenues and whenever changes in circumstances warrant such assessment. The Company generates additional revenues from incidental customers subsequent to the completion of each edition. Revenue and costs for these subsequent services are recognized as the customization services are performed and completed. The profit margin earned on such revenues is generally higher than that earned on revenues realized from customers under contract at the time of delivery. As a result,associated with Ticker, the Company’s margins vary throughout the year. The Company’s revenue recognition policy for Market GuideTicker is not sensitive to significant estimates and judgments.16

Valuation of Long-Lived Assets Under the provisions of Statement of Financial Accounting Standards (“SFAS”) No. 144,Accounting for the Impairment or Disposal of Long-Lived Assets, the

The Company monitors events and changes in circumstances that may require the Company to review the carrying value of its long-lived assets. The Company assesses the recoverabilitywhether an impairment of its long-lived assets based on estimatedheld and used may have occurred using undiscounted future operating cash flows. Impairments, if they occur, are measured using the fair value of the assets. The assessment of the recoverability of long-lived assets willmay be adversely impacted if estimated future operating cash flows are not achieved.The Company assesses the impairment of long-lived assets whenever events or changes in circumstances indicate that the carrying value of such assets may not be recoverable. ManagementAmong others, management believes the following circumstances are important indicators of potential impairment of such assets and, as a result, may trigger an impairment review:Significant underperformance in comparison to historical or projected operating results;

Significant changes in the manner or use of acquired assets or the Company’s overall strategy;· Significant underperformance in comparison to historical or projected operating results;

Significant negative trends in the Company’s industry or the overall economy;

A significant decline in the market price for the Company’s common stock for a sustained period; and· Significant changes in the manner or use of acquired assets or the Company’s overall strategy;

The Company’s market capitalization falling below the book value of the Company’s net assets.

· Significant negative trends in the Company’s industry or the overall economy;

· A significant decline in the market price for the Company’s common stock for a sustained period; and

· The Company’s market capitalization falling below the book value of the Company’s net assets.

Valuation of Goodwill and Identifiable Intangible AssetsIntangible assets include customer relationships, trade name and goodwill. Goodwill represents the difference between the purchase price paid in acquisitions using the purchase method of accounting, and the fair value of the net assets acquired. The Company adopted the provisions of SFAS No. 142,Goodwill and Other Intangible Assets,indefinite-lived intangibles are assessed annually for impairment and as a result, the Company doesare not amortize goodwill.

amortized.

As of December 31, 2006,2009, the Company had net goodwill of $30$39.9 million. As of October 1 of each year (or more frequently as changes in circumstances indicate), the Company evaluates the estimated fair value of the Company’s goodwill. On these evaluation dates, to the extent that the carrying value of the net assets of the Company’s reporting unitunits having goodwill is greater than the estimated fair value, impairment charges will be recorded. The Company’s analysis has not resulted in fair value substantially exceeding its carrying value in four of the recognitionfive business units having goodwill. For the newest business unit, MIV, the estimated fair value did not substantially exceed its carrying value. This was due, in part, to the 2009 MIV revenues and operating margins being below original projections, but management believes that the performance is improving during the first part of an2010. No impairment loss has been recorded on goodwill in 2006, 20052009, 2008 or 2004.2007. The Company will continue to evaluate for impairment as unforeseen future events may impact the goodwill valuation.

Income TaxesThe Company uses the asset and liability method of accounting for income taxes. Under that method, deferred income tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases using enacted tax rates. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. Valuation allowances, if any, are established when necessary to reduce deferred tax assets to the amount that is more likely than not to be realized. Management judgment is required to determine the provision for income taxes and to determine whether deferred income taxes will be realized in full or in part.

17

Results of OperationsThe following table sets forth, for the periods indicated, selected financial information derived from the Company’s consolidated financial statements, expressed as a percentage of total revenuesrevenue and the percentage change in such items versus the prior comparable period. The trends illustrated in the following table may not necessarily be indicative of future results. The discussion that follows the table should be read in conjunction with the Company’s consolidated financial statements.Percentage of Total Revenues

Year Ended December 31,

Percentage

Increase

2006

2005

2004

2006 over

2005

2005 over

2004

Revenues 100.0 % 100.0 % 100.0 % 34.9 % 9.3 % Operating expenses: Direct expenses 44.4 42.1 43.4 42.5 6.0 Selling, general and administrative 27.8 26.6 24.9 41.1 16.5 Depreciation and amortization 5.2 5.4 6.8 28.3 (12.7 )

Total operating expenses 77.4 74.1 75.1 41.0 7.8

Operating income 22.6 % 25.9 % 24.9 % 17.7 % 13.7 %

Percentage of Total RevenueYear Ended December 31, PercentageIncrease (Decrease) 2009 2008 2007 2009over2008 2008over2007 Revenue 100.0 % 100.0 % 100.0 % 13.1 % 4.3 % Operating expenses: Direct expenses 42.6 46.3 44.6 4.1 8.3 Selling, general and administrative 27.0 25.0 26.9 22.5 (3.4 ) Depreciation and amortization 6.6 5.3 5.3 42.7 4.0 Total operating expenses 76.3 76.5 76.8 12.7 3.9 Operating income 23.7 % 23.5 % 23.2 % 14.2 % 5.5 %

Year Ended December 31, 20062009, Compared to Year Ended December 31, 20052008RevenueTotal revenues. Total revenuesRevenue increased 34.9%13.1% in 2006,2009 to $43.7$57.7 million from $32.4$51.0 million in 2005.2008. This was primarily due to the acquisition of MIV in December 2008.

Direct expenses. Direct expenses increased 4.1% to $24.6 million in 2009 from $23.6 million in 2008. The change was mainly due to increased costs of servicing the additional revenue from the MIV business, partially offset by the reductions in costs of servicing decreased revenue in other areas of the Company. Direct expenses decreased as a percentage of revenue to 42.6% in 2009 from 46.3% in 2008, primarily due to MIV’s current business model with direct expenses as a percentage of revenue lower than the other operating business units of the Company and growth in margin in the Ticker division.Selling, general and administrative expenses. Selling, general and administrative expenses increased 22.5% to $15.6 million in 2009 from $12.7 million in 2008. The change was primarily due to increases in expenses related to the MIV acquisition and expansions in the sales force. Selling, general and administrative expenses increased as a percentage of revenue to 27.0% in 2009 from 25.0% in 2008, mainly due to sales expansion efforts in the latter portion of 2009 throughout the Company.Depreciation and amortization. Depreciation and amortization expenses increased 42.7% to $3.8 million in 2009 from $2.7 million in 2008. Depreciation and amortization increased as a percentage of revenue to 6.6% in 2009 from 5.3% in 2008. The increase was primarily due to the depreciation of the fixed assets and amortization of intangible assets associated with the acquisition of MIV.

18

Provision for income taxes. The provision for income taxes totaled $4.6 million (35.3% effective tax rate) for 2009 compared to $4.5 million (37.9% effective tax rate) for 2008. The effective tax rate was lower in 2009 due to increases in research and development tax credits and state investment and growth act credits, and decreases in Canadian statutory income tax rates.Year Ended December 31, 2008, Compared to Year Ended December 31, 2007Revenue. Revenue increased 4.3% in 2008 to $51.0 million from $48.9 million in 2007. This was primarily due to increases in the scope of work from existing clients and the addition of new clients, including the acquisition of GHS’s health plan business and TGI, which generated $4 million and $3.5 million in revenue in 2006, respectively.clients.Direct expenses. Direct expenses increased 42.5%8.3% to $19.4$23.6 million in 20062008 from $13.6$21.8 million in 2005.2007. The increase in direct expenses in 2006change was primarily due to servicing the 34.9%an increase in revenue including additional expensessalaries, benefits and travel of $1.2 million, the result of the change in the business model, and the allocation of responsibilities related to sales and servicing clients. In 2008, the GHS health planCompany divided its sales force into two groups, one focused only on bringing in prospective new clients and TGI businesses. The change inthe second focused exclusively on servicing current clients. As a result, salaries, benefits and travel attributable to the group focused on current clients are now classified as direct expenses included increases in salariesrather than selling, general and benefits of $1.8 million, postage and printing of $1.6 million, and fieldwork and other product costs of $1.8 million.administrative expenses. Direct expenses increased as a percentage of total revenuesrevenue to 44.4%46.3% in 20062008 from 42.1%44.6% in 2005 due to the mix of business during the period, including certain health plan projects which have higher direct expenses than the balance of the Company’s business. The Company’s model for direct expenses ranges from 43% to 45% as a percentage of total revenue. The Company expects direct expenses as a percentage of total revenues for 2007 to be in the upper end of the Company’s model of 43% to 45% of total revenues.2007.Selling, general and administrative expenses. Selling, general and administrative expenses increased 41.1%decreased 3.4% to $12.1$12.7 million in 20062008 from $8.6$13.2 million in 2005.2007. The change was primarilylargely due to increasesthe 2008 change in salary, benefitsthe business model and commissionsthe allocation of $2.9 million and travel expenses of $494,000. These increases were primarily attributedresponsibilities related to sales and marketing expansion initiatives, additional expenses related to the GHS health plan and TGI businesses and additional compensation expense related to the application of Statement of Financial Accounting Standards No. 123R (“SFAS No. 123R”).servicing clients. Selling, general and administrative expenses increaseddecreased as a percentage of total revenuesrevenue to 27.8%25.0% in 20062008 from 26.6% in 2005. The Company’s model for selling, general and administrative expenses ranges from 23% to 25% as a percentage of total revenue. The Company expects to be in the upper end of the Company’s model26.9% in 2007.18

Depreciation and amortization. Depreciation and amortization expenses increased 28.3%4.0% to $2.3$2.7 million in 20062008 from $1.8$2.6 million in 2005. The increase was primarily due to the amortization of intangibles associated with the acquisitions of GHS and TGI.2007. Depreciation and amortization expenses decreased slightly as a percentage of total revenues to 5.2%revenue remained at 5.3% in 2006 from 5.4% in 2005 due to increased revenues2008 and assets becoming fully depreciated. The Company’s model for depreciation and amortization expenses ranges from 4.5% to 6.0% as a percentage of total revenue. Depreciation and amortization expenses are expected to increase in dollar amount, but remain within the Company’s model of 4.5% to 6.0% as a percentage of total revenues for 2007.2007 respectively.Provision for income taxes. The provision for income taxes totaled $3.6$4.5 million (38.1%(37.9% effective tax rate) for 20062008 compared to $3.3$4.3 million (38.5% effective tax rate) for 2005.2007. The effective tax rate was lower in 20062008 due to differencesdecreases in stateprovincial income taxes.tax rates.Year Ended December 31, 2005 Compared to Year Ended December 31, 2004

Total revenues. Total

Inflation and Changing PricesInflation and changing prices have not had a material impact on revenues increased 9.3% in 2005, to $32.4 millionor net income from $29.7 million in 2004. The increase was primarily due to increases in scope of work from existing clients, and the addition of new clients, including $575,000 revenue generated from the acquisition of GHS’s health plan business.Direct expenses. Direct expenses increased 6.0% to $13.6 million in 2005 from $12.9 million in 2004. The increase in direct expenses in 2005 was due primarily to increases in salaries and benefits of $424,000, other expenses of $264,000 including contracted services, fieldwork and fees expenses of $143,000 and labor and payroll expenses of $112,000 to service the increase in revenue. These increases were partially offset by a decrease in printing and postage expenses of $180,000. Direct expenses decreased as a percentage of total revenues to 42.1% in 2005 from 43.4% in 2004, primarily due to the mix of services and data collection methodology during the year, as well as a related $194,000 reduction in a tax accrual due to a change to a web-based method of delivering the Healthcare Market Guide.

Selling, general and administrative expenses. Selling, general and administrative expenses increased 16.5% to $8.6 million in 2005 from $7.4 million in 2004. The net increase was primarily due to increases in salary, benefits, commissions and travel expenses of $1.2 million, and legal and accounting expenses of $106,000. These increases were partially offset by a decrease in direct marketing expenses of $202,000. Much of the overall increase was due to the continuation of the sales and marketing expansion initiatives which the Company startedcontinuing operations in the fourth quarter of 2003. Selling, general and administrative expenses increased as a percentage of total revenues to 26.6% in 2005 from 24.9% in 2004.

Depreciation and amortization. Depreciation and amortization expenses decreased 12.7% to $1.8 million in 2005 from $2.0 million in 2004. The decrease was primarily due to assets becoming fully depreciated. Depreciation and amortization expenses decreased as a percentage of total revenues to 5.4% in 2005 from 6.8% in 2004 due to increased revenues and assets becoming fully depreciated.

Provision for income taxes. The provision for income taxes totaled $3.3 million (38.5% effective tax rate) for 2005 compared to $2.7 million (37.5% effective tax rate) for 2004. The effective tax rate was higher in 2005 due to differences in state income taxes.

last three years.

Liquidity and Capital ResourcesThe Company believes it has adequate capital resources and operating cash flow to meet its projected capital and debt maturity needs for the foreseeable future. Requirements for working capital, capital expenditures, and debt maturities will continue to be funded by operations and the Company’s borrowing arrangements.19

Working CapitalThe Company had a working capital deficiency of $1.5$4.4 million on December 31, 2006,2009, as compared to a $10.7 million working capital of $8.1 milliondeficiency on December 31, 2005.2008. The changedecrease in the working capital from 2005deficiency was primarily due to 2006 was mainlypaying off the line of credit in 2009 that had a balance of $3.9 million as of December 31, 2008. The working capital deficiency balance is primarily due to a decrease in marketable securities, an increase in notes payable,deferred revenue balance of $11.9 million and an increase in billings in excess$12.9 million as of December 31, 2009 and 2008, respectively.

19

The deferred revenue earned partially offset by an increase in customer receivables and unbilled revenue. The decrease in marketable securities and increase in notes payable was incurred to fund the acquisition of TGI. The purchase price paid for TGI was $19.8 million in cash plus the assumption of certain liabilities. Accounts receivable and unbilled revenue increased due to the timing of billing of certain renewal and new sales contracts. Billings in excess of revenue earned increasedbalance is primarily due to TGI, as the Company invoices annual memberships at the beginningtiming of the membership period.initial billings on new and renewal contracts. The Company typically invoices clients for performance tracking services and custom research projects before they have been completed. Billed amounts are recorded as billings in excess of revenuesrevenue earned, or deferred revenue, on the Company’s consolidated financial statements, and are recognized as income when earned. In addition, when work is performed in advance of billing, the Company records this work as revenuesrevenue earned in excess of billings, or unbilled revenue. Substantially all deferred revenue and all unbilled revenuesrevenue will be earned and billed respectively, within 12 months of the respective period ends.

Capital ExpendituresCapital expenditures for the twelve-month periodyear ended December 31, 2006,2009, were $1.5$2.9 million. These additionsexpenditures consisted mainly consisted of computer software, computer hardware, and furniture and other equipment. The Company expects capital expenditure purchases in 2010, consisting primarily of computer software and furniture. The Company has budgeted approximately $1.0 million for additional capital expenditures in 2007hardware and other equipment, to be funded through cash generated from operations. The Company expects that the additional capital expenditures during 2007 will be primarily for computer hardware and software, production equipment and furniture.

Debt and Equity As of December 31, 2006 the Company’s debt totaled $11.1 million. This consisted of the balance remaining on the $12.5 million credit facility used to fund the TGI acquisition. During 2006, the Company paid off the $1.4 million note payable that was outstanding as of December 31, 2005.

On May 26, 2006, the Company entered into a credit facility pursuant to which it borrowed $9.0 million under a term note and $3.5 million under a revolving credit note in order to partially finance the acquisition of TGI. The term note is payable pursuant towas refinanced on February 25, 2008, for the credit facility in 83 equal installmentsremaining balance of $106,000, with the balanceterm note of $1.6 million. The refinanced term note required payments of principal and interest payable on Mayin 17 monthly installments of $93,000, beginning March 31, 2013.2008, and ending August 31, 2009. Borrowings under the refinanced term note bearbore interest at aan annual rate of 7.21% per year.5.14%. The revolving creditCompany paid off the term note provides a revolving credit facility that matures on July 31, 2007. in October 2008.

The maximum aggregate amount available under the revolving credit facilitynote was originally $3.5 million, but an addendum to the revolving credit note dated March 26, 2008, changed the revolving credit note amount to $6.5 million. The revolving credit note was renewed in July 2009 to extend the term to July 31, 2010. The Company may borrow, repay and re-borrow amounts under the revolving credit note from time to time until its maturity on July 31, 2010. The maximum aggregate amount available under the revolving credit note is $3.5$6.5 million, subject to a borrowing base equal to 75% of the Company’s eligible accounts receivable. The Company may borrow, repay and reborrow amounts under the revolving credit facility from time to time until its maturity on July 31, 2007. Borrowings under the revolving credit facilitynote bear interest at a variable rate equal to (1) prime (as defined in the credit facility) less 0.50% or (2) one-, two-, three-, six- or twelve-month LIBOR. Monthly installmentThe Company expects to extend the term of the revolving credit note for at least one year beyond the maturity date. If, however, the note cannot be extended, the Company believes it has adequate cash flows from operations to meet its debt and capital needs. As of December 31, 2009, the revolving credit note did not have a balance. According to borrowing base requirements, the Company had the capacity to borrow $4.2 million as of December 31, 2009.On December 19, 2008, the Company borrowed $9.0 million under a term note to partially finance the acquisition of MIV. The term note is payable in 35 equal installments of $97,000, with the balance of principal and interest payable in a balloon payment due on December 31, 2011. Borrowings under the term note bear interest at a rate of 5.2% per year. In 2009, the Company made principal payments, were madein addition to the monthly installments, on the term note in accordance with the credit facility.loan totaling $650,000.

The credit facilityterm note is secured by certain of the Company’s assets, including the Company’s land, building, accounts receivable and intangibles. The credit facilityterm note contains various restrictions and covenants applicable to the Company, including requirements that the Company maintain certain financial ratios at prescribed levels and restrictions on the ability of the Company to consolidate or merge, create liens, incur additional indebtedness or dispose of assets. As of December 31, 2006,2009, the Company was in compliance with these restrictions and covenants.The merger agreement under which the Company acquired MIV provided for contingent earn-out payments over three years based on growth in revenue and earnings. As of December 31, 2009, a contingent earn-out payment of $795,000 was accrued, which was then paid in February 2010. The Company currently projects that the earn-out for 2010 and 2011 could be $3.0 million and $1.0 million, respectfully to be funded through cash flow from operations.

20

Debt assumed through the MIV acquisition included $90,000 in capital leases. The capital leases are for production and mailing equipment meeting capitalization requirements where the lease term exceeds more than 75% of the estimated useful life. The equipment is being depreciated over the lease term of 4.25 years ending in 2011.

The Company had contractual obligations to make cash payments in the following amounts in the future as of December 31, 2006:Contractual Obligations

Total

Payments

Less than

1 Year

1 to

3 Years

4 to

5 Years

After

5 Years

Operating leases $ 892,623 $ 361,695 $ 507,016 $ 23,912 $ -- Long-term debt 8,697,973 715,106 1,478,415 1,712,218 4,792,234 Revolving line of credit 2,395,000 2,395,000 -- -- -- Other long term liabilities (see below) -- -- -- -- --

Total $ 11,985,596 $ 3,471,801 $ 1,985,431 $ 1,736,130 $ 4,792,234

2009:

Contractual Obligations TotalPayments Less thanOne Year One toThree Years Three toFive Years AfterFive Years (In thousands) Operating leases $ 1,600 $ 524 $ 1,066 $ 10 $ — Capital leases(1) 65 37 28 — — Uncertain tax positions(2) 78 — — — — Long-term debt(1) 8,376 1,162 7,214 — — Total $ 10,119 $ 1,723 $ 8,386 $ 10 $ —

(1) Includes interest(2) It is uncertain when the tax benefits will be settled.

The Company generally does not make unconditional, non-cancelable purchase commitments. The Company enters into purchase orders in the normal course of business, but these purchase obligations do not exceed one year. The purchase price for Smaller World Communications Inc. includes two additional scheduled payments of additional purchase price in 2006 and 2008. In 2006 the Company made the first aggregate payment of $536,200 based on meeting certain revenue goals. The second aggregate payment, also based upon certain revenue goals, has a minimum of $0 and a maximum of $601,000.

Shareholders’ equity increased $4.2$5.6 million to $36.8$44.2 million in 20062009 from $32.6$38.6 million in 2005.2008. The increase was primarily reflecteddue to net income exercise of $8.5 million, non-cash stock options,compensation expense of $619,000, and issuancechange in cumulative translation adjustment of restricted stock. This was partially$775,000, offset by the paymentdividends paid of dividends and purchase of treasury stock. During 2006, the Company paid $2.8 million in cash dividends and $1.2 million for the purchase of treasury stock.$4.3 million.

Stock Repurchase ProgramIn February 2006, the Board of Directors of the Company authorized the repurchase of an additional 750,000 shares of common stock in the open market or in privately negotiated transactions. As of December 31, 20062009, the remaining shares that can be purchased are 697,783.289,065.

Off-Balance Sheet ObligationsThe Company has no significant off-balance sheet obligations other than the operating lease commitments disclosed in “Liquidity and Capital Resources.”Adoption of New Accounting PronouncementsIn December 2004,June 2009, FASB issued the Financial Accounting Standards Board,Codification™ (“FASB”Codification”) issued Statementas the source of Financial Accounting Standardsauthoritative U.S. generally accepted accounting principles (“SFAS”GAAP”) No. 123RShare Based Payment (“SFAS No. 123R”), which eliminatesrecognized by FASB to be applied by nongovernmental entities. The Codification supersedes all then-existing non-SEC accounting and reporting standards. In accordance with the alternativeCodification, references to useaccounting literature in this report are presented in plain English. The Codification did not change GAAP, but reorganizes the intrinsic value method of accounting set forth in APB Opinion No. 25 (which generally resulted in recognition of no compensation cost) and instead requires a company to recognize in itsliterature. The Codification is effective for financial statements the cost of employee services received in exchangeissued for valuable equity instruments issued,interim and liabilities incurred, to employees in share-based payment transactions, including stock options. Effective January 1, 2006, the Company adopted SFAS No. 123R using a modified version of the prospective transition method. Under this transition method, compensation cost is recognized on or after the required effective date for the portion of outstanding awards for which the requisite service has not yet been rendered, based on the grant date fair value of those awards calculated under SFAS No. 123R for either recognition or pro forma disclosures. Share-based compensation expense for the twelve months ended December 31, 2006 was $707,218. There was no cumulative effect of initially adopting SFAS No. 123R. The impact of this new accounting standard was six cents per share for the yearannual periods ending December 31, 2006, representing expense to be recognized for the unvested portion of awards granted to date.21

In February 2006, the FASB issued SFAS No. 155,Accounting for Certain Hybrid Financial Instruments — An Amendment of FASB Statements No. 133 and 140. SFAS No. 155 amends SFAS No. 133,Accounting for Derivative Instruments and Hedging Activities, and SFAS No. 140,Accounting for Transfer and Servicing of Financial Assets and Extinguishments of Liabilities, and eliminates the exemption from applying SFAS No. 133 to interests in securitized financial assets so that similar items are accounted for in the same way. The provisions of SFAS No. 155 are effective for all financial instruments acquired by a company or issued after the beginning of its first fiscal year that begins after September 15, 2006. Management believes that SFAS No. 155 will2009. The adoption of the Codification has not have a material effecthad an impact on the consolidated financial statements.

21

Recent Accounting PronouncementsIn March 2006,September 2009, the FASB issued SFAS No. 156,Accountingnew guidance for Servicingrevenue recognition with multiple deliverables, which is effective for revenue arrangements entered into or materially modified in fiscal years beginning on or after June 15, 2010, although early adoption is permitted. This guidance eliminates the residual method under the current guidance and replaces it with the “relative selling price” method when allocating revenue in a multiple deliverable arrangement. The selling price for each deliverable shall be determined using vendor-specific objective evidence of Financial Assets — An Amendmentselling price, if it exists, otherwise third-party evidence of FASB Statement No. 140. SFAS No. 156 amends SFAS No. 140,Accountingselling price. If neither exists for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities, and requires that all separately recognized servicing assets and servicing liabilities be initially measured at fair value, if practicable. The provisions of SFAS No. 156 are effective asa deliverable, the vendor shall use its best estimate of the beginningselling price for that deliverable. After adoption, this guidance will also require expanded qualitative and quantitative disclosures. Management continues to assess the impact of a company’s first fiscal year that begins after September 15, 2006. Management believes that SFAS No. 156 will not have a material effect on the consolidated financial statements. In June 2006, the FASB issued FASB Interpretation No. 48 (“FIN 48”),Accounting for Uncertainty in Income Taxes — An Interpretation of FASB Statement No. 109. FIN 48 prescribes a recognition threshold and measurement process for recording in the financial statements uncertain tax positions taken or expected to be taken in a tax return. Additionally, this interpretation provides guidance on the derecognition, classification, accounting in interim periods and disclosure requirements for uncertain tax positions. The provisions of FIN 48 will be effective at the beginning of the first fiscal year that begins after December 15, 2006. Management believes that the adoption of FIN 48 will not have a material effect on the consolidated financial statements.

In September 2006, the FASB issued SFAS No. 157,Fair Value Measurements. SFAS No. 157 defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles (GAAP), and expands disclosures about fair value measurements. The provisions of SFAS No. 157 are effective as of the beginning of a company’s first fiscal year that begins after November 15, 2007. Management believes that SFAS No. 157 will not have a material effect on the consolidated financial statements.

In September 2006, the Securities and Exchange Commission published Staff Accounting Bulletin (“SAB”) No. 108 (Topic 1N),Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements. SAB No. 108 requires registrants to quantify prior year misstatements using both the balance sheet and income statement approaches, with adjustment required if either method results in a material error. The Company was required to adopt the provisions of SAB No. 108 in its financial statements for the fiscal year ended December 31, 2006. The adoption of SAB No. 108 had no effect on the consolidated financial statements of the Company.

authoritative guidance.Item 7A. Quantitative and Qualitative Disclosure About Market Risk

The impact of financialCompany’s primary market risk exposure is changes in foreign currency exchange rates and interest rates.The Company’s Canadian subsidiary uses as its functional currency the local currency of the country in which it operates. It translates its assets and liabilities into U.S. dollars at the exchange rate in effect at the balance sheet date. It translates its revenue and expenses at the average exchange rate during the period. The Company includes translation gains and losses in accumulated other comprehensive income (loss), a component of shareholders’ equity. Foreign currency translation gains or (losses) were $775,000, ($937,000), and $568,000 in 2009, 2008, and 2007, respectively. Gains and losses related to transactions denominated in a currency other than the functional currency of the countries in which the Company is not significant. operates and short-term intercompany accounts are included in other income (expense) in the consolidated statements of income.The Company’s primary financial marketinterest rate risk exposure consistsis related to interest expense from the Company’s revolving credit note with a variable interest rate. However, the revolving credit note had no balance as of December 31, 2009.The Company has limited interest rate risk related to interest income from the Company’s investments in United States government securitiesnotes with maturities of three years90 days or less.less at the purchase date for the security. The Company has investedclassified these as cash equivalents. The discounted notes bear interest at .041% and expects to continue to invest a substantial portion.091% annually. One of its excess cash in such securities. See Notethe notes matured on February 3, to2010, and payment was received for the Company’s consolidated financial statements. Generally, if the overall average return on such securities would have decreased .5% from the average return during the years ended December 31, 2006 and 2005, then the Company’s interest income and pre-tax income would have decreased approximately $19,000 and $81,000, respectively. These amounts were determined by considering the impact of a hypothetical change in interest rates on the Company’s interest income.full principal amount.

22

Item 8. Financial Statements and Supplementary Data

Quarterly Financial Data (Unaudited)The following table sets forth selected financial information for each of the eight quarters in the two-year period ended December 31, 2006.2009. This unaudited information has been prepared by the Company on the same basis as the consolidated financial statements and includes all normal recurring adjustments necessary to present fairly this information when read in conjunction with the Company’s audited consolidated financial statements and the notes thereto.(In thousands, except per share data)

Quarter Ended

Dec. 31,

2006

Sept 30,

2006

June 30,

2006

Mar. 31,

2006

Dec. 31,

2005

Sept 30,

2005

June 30,

2005

Mar. 31,

2005

Revenues $ 10,319 $ 13,313 $ 10,663 $ 9,476 $ 8,558 $ 10,132 $ 7,150 $ 6,597 Direct expenses 4,604 5,761 4,980 4,100 3,801 2,331 3,073 2,750 Selling, general and administrative 3,150 2,960 3,042 3,006 2,012 4,018 2,089 2,185 Depreciation and amortization 690 600 500 470 428 456 454 424

Operating income 1,875 3,992 2,141 1,900 2,317 3,327 1,534 1,238 Other income (expense) (224 ) (200 ) (36 ) 58 44 46 6 3 Provision for income taxes 645 1,450 786 741 827 1,344 615 493

Net income $ 1,006 $ 2,342 $ 1,319 $ 1,217 $ 1,534 $ 2,029 $ 925 $ 748

Net income per share - basic $ 0.15 $ 0.34 $ 0.19 $ 0.18 $ 0.22 $ 0.29 $ 0.13 $ 0.10 Net income per share - diluted $ 0.14 $ 0.34 $ 0.19 $ 0.18 $ 0.22 $ 0.29 $ 0.13 $ 0.10 Weighted average shares outstanding - basic 6,838 6,845 6,845 6,819 6,921 6,961 7,122 7,150 Weighted average shares outstanding - diluted 6,976 6,986 6,970 6,918 7,012 7,056 7,179 7,202

(In thousands, except per share data) Quarter Ended Dec. 31,2009 Sept 30,2009 June 30,2009 Mar. 31,2009 Dec. 31,2008 Sept 30,2008 June 30,2008 Mar. 31,2008 Revenue $ 13,841 $ 13,517 $ 13,594 $ 16,740 $ 12,189 $ 13,469 $ 11,901 $ 13,454 Direct expenses 5,548 5,446 6,304 7,276 5,766 6,598 5,320 5,927 Selling, general and administrative 4,042 3,872 3,697 3,979 2,768 3,053 3,348 3,559 Depreciation and amortization 929 901 891 1,110 682 661 676 666 Operating income 3,322 3,298 2,702 4,375 2,973 3,157 2,557 3,302 Other income (expense) (134 ) (166 ) (183 ) (97 ) 70 14 (58 ) (32 ) Provision for income taxes 951 1,138 910 1,627 1,148 1,205 918 1,267 Net income $ 2,237 $ 1,994 $ 1,609 $ 2,651 $ 1,895 $ 1,966 $ 1,581 $ 2,003 Net income per share – basic $ 0.34 $ 0.30 $ 0.24 $ 0.40 $ 0.29 $ 0.30 $ 0.24 $ 0.29 Net income per share – diluted $ 0.33 $ 0.30 $ 0.24 $ 0.39 $ 0.28 $ 0.29 $ 0.23 $ 0.29 Weighted average shares outstanding – basic 6,639 6,637 6,637 6,633 6,642 6,644 6,637 6,818 Weighted average shares outstanding – diluted 6,725 6,735 6,734 6,713 6,782 6,803 6,793 6,970

23

23

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMTo the Shareholders and Board of Directors

National Research Corporation:

We have audited the accompanying consolidated balance sheets of National Research Corporation and subsidiary (the Company) as of December 31, 20062009 and 2005,2008, and the related consolidated statements of income, shareholders’ equity and comprehensive income, and cash flows for each of the years in the three-year period ended December 31, 2006.2009. In connection with our audits of the consolidated financial statements, we have also audited the financial statement schedule for eachlisted in Item 15(a)(2) of the years in the three-year period ended December 31, 2006.this Form 10-K. These consolidated financial statements and financial statement schedule are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements and financial statement schedule based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of National Research Corporation and subsidiary as of December 31, 20062009 and 2005,2008, and the results of their operations and their cash flows for each of the years in the three-year period ended December 31, 2006,2009, in conformity with U.S. generally accepted accounting principles. In addition,Also, in our opinion, the related financial statement schedule, referred to above, when considered in relation to the basic consolidated financial statements taken as a whole, presentpresents fairly, in all material respects, the information set forth therein.As discussed in notes 1 and 8, the Company changed it’s method of recording stock-based compensation in 2006.

/s/ KPMG LLPLincoln, NebraskaMarch 29, 200731, 2010

24

24

NATIONAL RESEARCH CORPORATION AND SUBSIDIARY

CONSOLIDATED BALANCE SHEETS AS OF(In thousands, except share amounts)

DECEMBER 31, 2006 AND 2005Assets

2006

2005

Current assets: Cash and cash equivalents $ 876,360 $ 843,959 Investments in marketable debt securities 1,110,104 9,451,835 Trade accounts receivable, less allowance for doubtful accounts of $44,302 and $103,183 in 2006 and 2005, respectively 6,733,595 5,494,689 Unbilled revenues 2,272,194 1,182,657 Prepaid expenses and other 1,058,017 934,699 Recoverable income taxes 898,264 183,970 Deferred income taxes 48,410 125,771

Total current assets 12,996,944 18,217,580

Net property and equipment 11,715,933 11,890,809 Goodwill, net of accumulated amortization 30,014,337 11,483,401 Intangible assets, net of accumulated amortization 6,473,644 3,043,987 Deferred income taxes 279,865 -- Other 51,268 39,575

Total assets $ 61,531,991 $ 44,675,352

Liabilities and Shareholders’ Equity

Current liabilities: Current portion of note payable $ 3,110,106 $ 1,471,283 Accounts payable 1,152,657 1,065,717 Accrued wages, bonus and profit sharing 1,593,823 1,248,001 Accrued expenses 358,577 940,634 Billings in excess of revenues earned 8,263,692 5,434,321

Total current liabilities 14,478,855 10,159,956

Note payable, net of current portion 7,982,867 -- Deferred income taxes 2,267,688 1,921,905 Other long-term liabilities 52,068 --

Total liabilities 24,781,478 12,081,861

Shareholders’ equity: Common stock, $.001 par value; authorized 20,000,000 shares, issued 7,837,848 in 2006 and 7,740,571 in 2005, outstanding 6,890,631 in 2006 and 6,845,571 in 2005 7,838 7,741 Additional paid-in capital 21,819,709 20,046,027 Retained earnings 26,488,308 23,360,297 Unearned compensation -- (432,631 ) Accumulated other comprehensive income, net of taxes 359,025 300,369 Treasury stock, at cost; 947,217 shares in 2006 and 895,000 shares in 2005 (11,924,367 ) (10,688,312 )

Total shareholders’ equity 36,750,513 32,593,491

Total liabilities and shareholders’ equity $ 61,531,991 $ 44,675,352

2009 2008 Assets Current assets: Cash and cash equivalents $ 2,512 $ 1,109 Trade accounts receivable, less allowance for doubtful accounts of $279 and $241 in 2009 and 2008, respectively 5,214 6,531 Unbilled revenue 1,173 810 Prepaid expenses and other 1,864 1,300 Recoverable income taxes 803 574 Deferred income taxes 98 115 Total current assets 11,664 10,439 Net property and equipment 13,975 13,747 Intangible assets, net 6,883 8,056 Goodwill 39,924 39,276 Other 53 627 Total assets $ 72,499 $ 72,145 Liabilities and Shareholders’ Equity Current liabilities: Current portion of note payable $ 816 $ 4,581 Accounts payable 598 863 Accrued wages, bonus and profit sharing 1,926 1,375 Accrued expenses 848 1,344 Deferred revenue 11,907 12,926 Total current liabilities 16,095 21,089 Note payable, net of current portion 6,903 8,374 Deferred income taxes 5,126 4,084 Deferred revenue 204 — Total liabilities 28,328 33,547 Shareholders’ equity: Common stock, $.001 par value; authorized 20,000,000 shares, issued 8,018,044 in 2009 and 8,019,922 in 2008, outstanding 6,662,111 in 2009 and 6,667,517 in 2008 8 8 Additional paid-in capital 27,871 27,217 Retained earnings 37,905 33,677 Accumulated other comprehensive income (loss), net of taxes 769 (6 ) Treasury stock, at cost; 1,355,933 shares in 2009 and 1,352,405 shares in 2008 (22,382 ) (22,298 ) Total shareholders’ equity 44,171 38,598 Total liabilities and shareholders’ equity $ 72,499 $ 72,145

See accompanying notes to consolidated financial statements.

25

NATIONAL RESEARCH CORPORATION AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF INCOME FOR THE(In thousands, except for per share amounts)

THREE YEARS ENDED DECEMBER 31, 20062006

2005

2004

Revenues $ 43,771,455 $ 32,436,502 $ 29,683,091

Operating expenses: Direct expenses 19,445,925 13,642,195 12,869,259 Selling, general and administrative 12,158,004 8,617,372 7,394,567 Depreciation and amortization 2,259,669 1,761,623 2,017,621

Total operating expenses 33,863,598 24,021,190 22,281,447

Operating income 9,907,857 8,415,312 7,401,644

Other income (expense): Interest income 171,273 488,120 344,570 Interest expense (517,482 ) (379,464 ) (458,581 ) Other, net (55,893 ) (9,507 ) (4,777 )

Total other income (expense) (402,102 ) 99,149 (118,788 )

Income before income taxes 9,505,755 8,514,461 7,282,856

Provision for income taxes 3,621,687 3,278,370 2,732,222

Net income $ 5,884,068 $ 5,236,091 $ 4,550,634

Net income per share - basic $ 0.86 $ 0.74 $ 0.63

Net income per share - diluted $ 0.85 $ 0.74 $ 0.63

2009 2008 2007 Revenue $ 57,692 $ 51,013 $ 48,923 Operating expenses: Direct expenses 24,574 23,611 21,801 Selling, general and administrative 15,590 12,728 13,174 Depreciation and amortization 3,831 2,685 2,583 Total operating expenses 43,995 39,024 37,558 Operating income 13,697 11,989 11,365 Other income (expense): Interest income 2 42 139 Interest expense (405 ) (139 ) (483 ) Other, net (177 ) 91 96 Total other expense (580 ) (6 ) (248 ) Income before income taxes 13,117 11,983 11,117 Provision for income taxes 4,626 4,538 4,278 Net income $ 8,491 $ 7,445 $ 6,839 Net income per share - basic $ 1.28 $ 1.11 $ 1.00 Net income per share - diluted $ 1.26 $ 1.09 $ 0.98 Weighted average shares and shares equivalent outstanding - basic 6,637 6,685 6,850 Weighted average shares and shares equivalent outstanding - diluted 6,723 6,831 7,011

See accompanying notes to consolidated financial statements.

26

26

NATIONAL RESEARCH CORPORATION AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

AND COMPREHENSIVE INCOME AS OF AND FOR THE(In thousands except share and per share amounts)

THREE YEARS ENDED DECEMBER 31, 2006Common

Stock

Additional

Paid-in

Capital

Retained

Earnings

Unearned

Compensation

Accumulated

Other

Comprehensive

Income

Treasury

Stock

Total

Balances at December 31, 2003 $ 7,641 $ 18,875,520 $ 15,831,700 $ (393,994 ) $ (27,148 ) $ (1,869,430 ) $ 32,424,289 Purchase of 175,300 shares of treasury stock -- -- -- -- -- (2,886,407 ) (2,886,407 ) Issuance of 57,857 common shares for the exercise of stock options 57 332,991 -- -- -- -- 333,048 Tax benefit from the exercise of options -- 233,345 -- -- -- -- 233,345 Issuance of 2,483 restricted common shares, net of 16,153 shares cancelled (14 ) (96,287 ) -- 96,301 -- -- -- Non-cash stock compensation expense -- -- -- 115,339 -- -- 115,339 Comprehensive income Change in unrealized gain/(loss) on marketable securities net of tax -- -- -- -- (56,850 ) -- (56,850 ) Change in cumulative translation adjustment -- -- -- -- 304,259 -- 304,259 Net income -- -- 4,550,634 -- -- -- 4,550,634

Total comprehensive income -- -- 4,550,634 -- 247,409 -- 4,798,043

Balances at December 31, 2004 7,684 19,345,569 20,382,334 (182,354 ) 220,261 (4,755,837 ) 35,017,657

Purchase of 385,700 shares of treasury stock -- -- -- -- -- (5,932,475 ) (5,932,475 ) Issuance of 30,873 common shares for the exercise of stock options 31 253,846 -- -- -- -- 253,877 Tax benefit from the exercise of options -- 84,140 -- -- -- -- 84,140 Issuance of 25,692 restricted common shares, net of 2,036 cancelled 26 362,472 -- (362,498 ) -- -- -- Non-cash stock compensation expense -- -- -- 112,221 -- -- 112,221 Dividends declared of $0.32 per common share -- -- (2,258,128 ) -- -- -- (2,258,128 ) Comprehensive income Change in unrealized gain/(loss) on marketable securities net of tax -- -- -- -- 4,280 -- 4,280 Change in cumulative translation adjustment -- -- -- -- 75,828 -- 75,828 Net income -- -- 5,236,091 -- -- -- 5,236,091

Total comprehensive income -- -- 5,236,091 -- 80,108 -- 5,316,199

Balances at December 31, 2005 7,741 20,046,027 23,360,297 (432,631 ) 300,369 (10,688,312 ) 32,593,491

Purchase of 52,217 shares of treasury stock -- -- -- -- -- (1,236,055 ) (1,236,055 ) Issuance of 89,307 common shares for the exercise of stock options 89 926,102 -- -- -- -- 926,191 Tax benefit from the exercise of options -- 404,535 -- -- -- -- 404,535 Issuance of 13,218 restricted common shares, net of 5,250 cancelled 8 (8 ) -- -- -- -- -- Non-cash stock compensation expense -- 875,684 -- -- -- -- 875,684 Reclassify unearned compensation -- (432,631 ) -- 432,631 -- -- -- Dividends declared of $0.10 per common share -- -- (2,756,057 ) -- -- -- (2,756,057 ) Comprehensive income Change in unrealized gain/(loss) on marketable securities net of tax -- -- -- -- 67,436 -- 67,436 Change in cumulative translation adjustment -- -- -- -- (8,780 ) -- (8,780 ) Net income -- -- 5,884,068 -- -- -- 5,884,068

Total comprehensive income -- -- 5,884,068 -- 58,656 -- 5,942,724

Balances at December 31, 2006 $ 7,838 $ 21,819,709 $ 26,488,308 $ -- $ 359,025 $ (11,924,367 ) $ 36,750,513

CommonStock AdditionalPaid-inCapital RetainedEarnings AccumulatedOtherComprehensiveIncome TreasuryStock Total Balances at December 31, 2006 8 21,820 26,488 359 (11,924 ) 36,751 Purchase of 61,849 shares of treasury stock — — — — (241 ) (241 ) Issuance of 22,829 common shares for the exercise of stock options — 338 — — — 338 Tax benefit from the exercise of options and vested restricted stock — 111 — — — 111 Issuance of 32,115 restricted common shares, net of 9,109 cancelled — — — — — — Non-cash stock compensation expense — 1,240 — — — 1,240 Dividends declared of $0.48 per common share — — (3,324 ) — — (3,324 ) Comprehensive income Change in unrealized gain/(loss) on marketable securities, net of tax — — — 4 — 4 Change in cumulative translation adjustment — — — 568 — 568 Net income — — 6,839 — — 6,839 Total comprehensive income 7,411 Balances at December 31, 2007 $ 8 $ 23,509 $ 30,003 $ 931 $ (12,165 ) $ 42,286, Purchase of 395,558 shares of treasury stock — — — — (10,133 ) (10,133 ) Issuance of 144,614 common shares for the exercise of stock options — 1,856 — — — 1,856 Tax benefit from the exercise of options and vested restricted stock — 836 — — — 836 Cancellation of 7,981 restricted common shares — — — — — — Non-cash stock compensation expense — 1,016 — — — 1,016 Dividends declared of $0.56 per common share — — (3,771 ) — — (3,771 ) Comprehensive income Change in cumulative translation adjustment — — — (937 ) — (937 ) Net Income 7,445 7,445 Total comprehensive income — — — — — 6,508 Balances at December 31, 2008 $ 8 $ 27,217 $ 33,677 $ (6 ) $ (22,298 ) $ 38,598 Purchase of 3,528 shares of treasury stock — — — — (84 ) (84 ) Issuance of 2,023 common shares for the exercise of stock options — 18 — — — 18 Tax benefit from the exercise of options and vested restricted stock — 17 — — — 17 Cancellation of 3,901 restricted common shares — — — — — — Non-cash stock compensation expense — 619 — — — 619 Dividends declared of $0.64 per common share — — (4,263 ) — — (4,263 ) Comprehensive income Change in cumulative translation adjustment — — — 775 — 775 Net income 8,491 8,491 Total comprehensive income — — — — — 9,266 Balances at December 31, 2009 $ 8 $ 27,871 $ 37,905 $ 769 $ (22,382 ) $ 44,171

See accompanying notes to consolidated financial statements.27

NATIONAL RESEARCH CORPORATION AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF CASH FLOWS(In thousands)

FOR THE THREE YEARS ENDED DECEMBER 2009 2008 2007 Cash flows from operating activities: Net income $ 8,491 $ 7,445 $ 6,839 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 3,831 2,686 2,583 Deferred income taxes 1,733 430 117 Loss (gain) on sale of property and equipment 1 — (3 ) Tax benefit from exercise of stock options — 156 31 Non-cash stock compensation expense 619 1,016 1,093 Change in assets and liabilities, net of effect of acquisitions: Trade accounts receivable 1,396 637 616 Unbilled revenue (315 ) 603 900 Prepaid expenses and other (516 ) (155 ) 30 Accounts payable (278 ) (408 ) (73 ) Accrued expenses, wages, bonus and profit sharing (73 ) 6 330 Income taxes payable and recoverable (326 ) (249 ) 563 Deferred revenue (897 ) 3,008 1,540 Net cash provided by operating activities 13,666 15,175 14,566 Cash flows from investing activities: Purchases of property and equipment (2,909 ) (2,812 ) (1,956 ) Acquisition, net of cash acquired and earn-out on acquisition (93 ) (12,551 ) — Purchases of securities available-for-sale — — (2,990 ) Proceeds from the maturities of securities available-for-sale — 99 4,007 Net cash used in investing activities (3,002 ) (15,264 ) (939 ) Cash flows from financing activities: Proceeds from notes payable 4,916 18,564 375 Payments on notes payable (10,152 ) (8,952 ) (8,474 ) Proceeds from exercise of stock options 18 731 338 Tax benefit on exercise of stock options and vested restricted stock 17 680 80 Purchase of treasury stock (84 ) (9,007 ) (241 ) Payment of dividends on common stock (4,263 ) (3,771 ) (3,324 ) Net cash used in financing activities (9,548 ) (1,755 ) (11,246 ) Effect of exchange rate changes on cash 287 (402 ) 98 Net increase (decrease) in cash and cash equivalents 1,403 (2,246 ) 2,479 Cash and cash equivalents at beginning of period 1,109 3,355 876 Cash and cash equivalents at end of period $ 2,512 $ 1,109 $ 3,355 Supplemental disclosure of cash paid for: Interest expense $ 498 $ 122 $ 483 Income taxes $ 2,999 $ 3,502 $ 3,457

Supplemental disclosures of non-cash investing activities:In connection with the Company’s Equity Incentive plans, certain optionees tendered to the Company previously owned shares to pay for the option strike price. The total non-cash stock options exercised was $0, $1.1 million and $0 for the years ended December 31, 20062006

2005

2004

Cash flows from operating activities: Net income $ 5,884,068 $ 5,236,091 $ 4,550,634 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 2,259,669 1,761,623 2,017,621 Deferred income taxes 99,135 264,049 614,871 Loss (gain) on sale of property and equipment (50 ) 239 (4,090 ) Loss (gain) on sale of other investments 47,616 (43 ) 75 Tax benefit from exercise of stock options 63,005 84,140 233,345 Non-cash stock compensation expense 1,022,624 112,221 115,339 Change in assets and liabilities, net of effect of acquisitions: Trade accounts receivable (884,575 ) (2,079,193 ) 2,160,923 Unbilled revenues (1,089,431 ) 29,026 (187,482 ) Prepaid expenses and other 256,809 45,597 (315,139 ) Accounts payable 22,006 602,326 (48,381 ) Accrued expenses, wages, bonus and profit sharing (58,680 ) 328,718 (15,420 ) Income taxes payable and recoverable (714,293 ) 442,865 (876,140 ) Billings in excess of revenues earned (95,723 ) 1,360,425 (429,427 )

Net cash provided by operating activities 6,812,180 8,188,084 7,816,729

Cash flows from investing activities: Purchases of property and equipment (1,453,128 ) (1,088,172 ) (2,066,807 ) Proceeds from sale or property and equipment 50 1,500 4,863 Acquisition, net of cash acquired and earn-out on acquisition (20,620,521 ) (4,459,198 ) -- Purchases of securities available-for-sale (1,378,523 ) (19,453,522 ) (9,211,409 ) Proceeds from the maturities of securities available-for-sale 9,784,215 25,353,137 6,537,109

Net cash provided by (used in) investing activities (13,667,907 ) 353,745 (4,736,244 )

Cash flows from financing activities: Proceeds from notes payable 14,795,000 -- -- Payments on notes payable (5,173,310 ) (3,429,571 ) (142,710 ) Payments on other long term liabilities -- -- (143,081 ) Proceeds from exercise of stock options 926,191 253,877 333,048 Tax benefit on exercise of stock options and vested restricted stock 341,530 -- -- Purchase of treasury stock (1,236,055 ) (5,932,475 ) (2,886,407 ) Payment of dividends on common stock (2,756,057 ) (2,258,128 ) --

Net cash provided by (used in) financing activities 6,897,299 (11,366,297 ) (2,839,150 )

Effect of exchange rate changes on cash (9,171 ) 20,734 (34,557 )

Net increase (decrease) in cash and cash equivalents 32,401 (2,803,734 ) 206,778

Cash and cash equivalents at beginning of period 843,959 3,647,693 3,440,915

Cash and cash equivalents at end of period $ 876,360 $ 843,959 $ 3,647,693

Supplemental disclosure of cash paid for: Interest expense $ 600,719 $ 364,210 $ 458,581 Income taxes $ 3,839,192 $ 2,479,834 $ 2,759,669

Supplemental disclosures of non-cash investing activities:

In connection with the Company’s acquisition of businesses in 2006 and 2005, the Company acquired current assets of $730,804 and $53,046, respectively, and assumed current liabilities of $3,201,691 and $151,685, respectively.

See accompanying notes to consolidated financial statements.

28