UNITED STATES

SECURITIES AND EXCHANGE COMMISSIONWashington,

WASHINGTON, D.C. 20549

FORM 10-K

Annual report pursuant to Section 13 of theSecurities Exchange Act of 1934 for(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended May 31, 200727, 2010

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-12604

THE MARCUS CORPORATION

(Exact name of registrant as specified in its charter)

| Wisconsin | 39-1139844 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 100 East Wisconsin Avenue, Milwaukee, Wisconsin | 53202-4125 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (414) 905-1000

A Wisconsin corporationIRS Employer Identification No. 39-1139844Commission File No. 1-12609

We have one class of securitiesSecurities registered pursuant to Section 12(b) of the Act: our Common Stock, $1 par value, which is registered on the New York Stock Exchange.

We do not have any securities

Title of Each Class | Name of Each Exchange on Which Registered | |

| Common stock, $1.00 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act.Act: None

We are notIndicate by check mark if the registrant is a well-known seasoned issuer, (asas defined in ruleRule 405 of the Securities Act).Act. Yes ¨ No x

We areIndicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. We haveYes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and have(2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

DisclosureIndicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in our definitive proxy statementor information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.¨

We areIndicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, (as defineda non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Act).Exchange Act. (Check one):

We are

Large accelerated filer ¨ | Accelerated filer x | Non-accelerated filer ¨ | Smaller reporting company¨ | |||

(Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the votingregistrant’s common equity held by non-affiliates as of November 23, 200626, 2009 was $522,367,369.71.approximately $256,000,000. This value includes all shares of our Common Stock,the registrant’s common stock, except for treasury shares and shares beneficially owned by ourthe registrant’s directors and executive officers listed in Part I below.

AsIndicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Common stock outstanding at August 10, 2007, there were 21,539,284 shares of our Common Stock, $1 par value, and 8,889,588 shares of our 5, 2010—20,769,509

Class B Common Stock, $1 par value, outstanding.common stock outstanding at August 5, 2010—8,854,179

Portions of ourthe registrant’s definitive Proxy Statement for our 2007its 2010 annual meeting of shareholders, which will be filed with the Commission under Regulation 14A within 120 days after the end of our fiscal year, will be incorporated by reference into Part III to the extent indicated therein upon such filing.

PART I

Special Note Regarding Forward-Looking Statements

Certain matters discussed in this Annual Report on Form 10-K and the accompanying annual report to shareholders, particularly in the Shareholders’ Letter and Management’s Discussion and Analysis, are “forward-looking statements” intended to qualify for the safe harbors from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements may generally be identified as such because the context of such statements will include words such as we “believe,” “anticipate,” “expect” or words of similar import. Similarly, statements that describe our future plans, objectives or goals are also forward-looking statements. Such forward-looking statements are subject to certain risks and uncertainties that couldwhich may cause results to differ materially from those expected, including, but not limited to, the following: (1) the availability, in terms of both quantity and audience appeal, of motion pictures for our theatre division, as well as other industry dynamics such as the maintenance of a suitable window between the date such motion pictures are released in theatres and the date they are released to other distribution channels; (2) the effects of increasing depreciation expenses, reduced operating profits during major property renovations, and preopening and start-up costs due to the capital intensive nature of our businesses; (3) the effects of adverse economic conditions in our markets, particularly with respect to our hotels and resorts division; (4) the effects of adverse weather conditions, particularly during the winter in the Midwest and in our other markets; (5) the effects on our occupancy and room rates from the relative industry supply of available rooms at comparable lodging facilities in our markets; (6) the effects of competitive conditions in our markets; (7) our ability to identify properties to acquire, develop and/or manage and continuing availability of funds for such development; and (8) the adverse impact on business and consumer spending on travel, leisure and entertainment resulting from terrorist attacks in the United States, the United States’ responses thereto and subsequent hostilities; and (9) the successful integration of the Cinema Entertainment Corporation theatres into our theatre circuit.hostilities. Shareholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are made only as of the date of this Form 10-K and we undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

Item 1. Business.

General

We are engaged primarily in two business segments: movie theatres and hotels and resorts.

As of May 31, 2007,27, 2010, our theatre operations included 5054 movie theatres with 608668 screens throughout Wisconsin, Ohio, Illinois, Minnesota, North Dakota, Nebraska and Iowa, including two movie theatres with 2011 screens in IllinoisWisconsin and WisconsinNebraska owned by third parties but managed by us. We also operate a family entertainment center,Funset Boulevard, that is adjacent to one of our theatres in Appleton, Wisconsin. We are currently the 6th largest theatre circuit in the United States.

As of May 31, 2007,27, 2010, our hotels and resorts operations included eight8 owned and operated hotels and resorts in Wisconsin, Missouri, Illinois and Oklahoma. We also manage twelve11 hotels, resorts and other properties for third parties in Wisconsin, Minnesota, Ohio, Texas, Arizona, Missouri, Nevada and California. As of May 27, 2010, we owned or managed nearly 5,200 hotel and resort rooms.

Both of these business segments are discussed in detail below. For information regarding the revenues, operating income or loss, assets and certain other financial information of these segments for the last three fiscal years, please see our Consolidated Financial Statements and the accompanying Note 11 in Part II below.

Strategic Plans

Please see our discussion under “Current Plans” in Item 7 – 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations.

2

Theatre Operations

At the end of fiscal 2007,2010, we owned or operated 5054 movie theatre locations with a total of 608668 screens in Wisconsin, Illinois, Minnesota, Ohio, North Dakota, Nebraska and Iowa for an average of 12.212.4 screens per location, compared to an average of 11.212.5 and 12.1 screens per location at the end of fiscal 20062009 and 2005.2008, respectively. Included in the fiscal 2007 totals2010 total are two theatres with 2011 screens that we manage for other owners. Included in theWe managed one theatre with 6 screens for another owner during fiscal 20062009 and 2005 totals are four theatres with 40 screens that we managed for other owners.fiscal 2008. Our 4852 company-owned facilities include 2832 megaplex theatres (12 or more screens), representing 72%75% of our total screens, 19 multiplex theatres (two to 11 screens) and one single-screen theatre. At fiscal year-end, we operated 585647 first-run screens, 2011 of which are operated under management contracts, and 2321 budget-oriented screens.

On November 17, 2006,In May 2009, we opened our circuit’s 13thUltraScreen® at our newly-renovated North Shore Cinema in Mequon, Wisconsin. In addition, in November 2009, we opened the new 12-screenMarcus Midtown Cinema at Midtown Crossing in Omaha, Nebraska. We are managing this unique upscale four-level, five-screen entertainment destination for the owner, Mutual of Omaha. This theatre offers our exclusiveCineDineSM in-theatre dining concept in Green Bay,all five auditoriums and also featuresZaffiro’s pizza. The theatre also features two sophisticated cocktail lounges, meeting and event space and a full catering service. The initial response to this distinctive new theatre has been positive.

We continue to review opportunities to build additional new locations and recently purchased land in Sun Prairie, Wisconsin and ourwith plans to build a new 13-screen theatre to replace the existing Eastgate Theatre in Sturtevant/Racine,Madison, Wisconsin. TheWe currently own land in six different communities that may be used for new theatres in Green Bay and Sturtevant/Racine, Wisconsin replaced older existing facilitiesat a future date. We also will continue to offer moviegoers the latest technology and amenities. In addition, on May 4, 2007, we opened our new flagship theatre, The Marcus Majestic of Brookfield, in Brookfield, Wisconsin. The Majestic replaced two smaller existing theatres with 17 screens in the same market and features 16 stadium-style auditoriums, including two 72-feet-wideUltraScreens®, and a multi-use auditorium called the AT&T Palladium, fully equipped for live performances, meetings, broadcast concerts and sporting events and regular screenings of first-run movies, with an attached kitchen from which we offer a full menu. The Majestic also has two cafes – one serving branded pizza and another serving branded coffee, ice cream and chocolates.consider additional potential acquisitions as opportunities arise.

On April 19, 2007, we completed the acquisition of 11 multi-screen movie theatres owned and/or leased by Cinema Entertainment Corp. in portions of Minnesota, Wisconsin, North Dakota and Iowa. The acquisition added 122 screens to our theatre operations. Additionally, we plan to add up to three new 72-foot-wideUltraScreens® to existing theatres during the next year, as well as expand our food and beverage offerings at several existing locations.

Revenues for the theatre business, and the motion picture industry in general, are heavily dependent on the general audience appeal of available films, together with studio marketing, advertising and support campaigns, factors over which we have no control. ThreeConsistent with prior years in which blockbusters accounted for a significant portion of our total box office, our top 15 performing films accounted for 42% of our fiscal 2007 films produced2010 box office receipts in excess of $3 million for our circuit, compared to two films that reached that amount32% during fiscal 2006.2009. The following five fiscal 20072010 films accounted for approximately 20% of our total box office and produced the mostgreatest box office receipts for our circuit:PiratesAvatar,Transformers: Revenge of the Caribbean: Dead Man’s ChestFallen,Spider-Man 3Harry Potter and the Half-Blood Prince,Night at the Museum,Shrek the ThirdThe Blind Side andCarsThe Twilight Saga: New Moon.

We obtain our films from several national motion picture production and distribution companies and are not dependent on any single motion picture supplier. Our booking, advertising, concession purchases and promotional activities are handled centrally by our administrative staff. Including our own theatres, we currently are providing film buying, booking and other related services for 837 screens in seven states.

We strive to provide our movie patrons with high-quality picture and sound presentation in clean, comfortable, attractive and contemporary theatre environments. Substantially all of our movie theatre complexes feature either digital sound, Dolby or other stereo sound systems; acoustical ceilings; side wall insulation; engineered drapery folds to eliminate sound imbalance, reverberation and distortion; tiled floors; loge seats; cup-holder chair-arms; and computer-controlled heating, air conditioning and ventilation. We offer stadium seating, a tiered seating system that permits unobstructed viewing, at approximately 90% of our first-run screens. Computerized box offices permit all of our movie theatres to sell tickets in advance. Our theatres are accessible to persons with disabilities and provide wireless headphones for hearing-impaired moviegoers. Other amenities at certain theatres include THX auditoriums, which allow customers to hear the softest and loudest sounds, and touch-screen, computerized, self-service ticket kiosks, which simplify advance ticket purchases. We own a minority interest in MovieTickets.com, a joint venture of movie and entertainment companies that was created to sell movie tickets over the internet and represents a large majority of the top 50 market theatre screens throughout the United States and Canada. As a result of our association with MovieTickets.com, moviegoers can buy tickets to movies at any of our first-run theatres via the internet and print them at home.

3

We are currently testingIn fiscal 2010, we continued our installation of Digital 3D Cinema technology, with the installation of 33 digital cinema hardware and software3D systems in our theatres, including the installation of 3D systems at eight of our signatureUltraScreens that we have branded asUltraScreen XL3D. As of May 27, 2010, we offer digital 3D systems at 60 screens at 43 of our theatre locations in seven states. There are currently nearly 30 3D films scheduled for release during fiscal 2011, compared to 15 digital 3D films played in our theatres during fiscal 2010.

An anticipated broad roll-out of digital cinema into our theatres, as well as the rest of the industry, was delayed during fiscal 2010 due to the increased difficulties of proposed third-party implementers to obtain the necessary financing during the current economic climate. During the latter half of fiscal 2010, progress was made regarding financing and system pricing and an expected industry-wide roll-out is now expected to occur over the course of several years. We currently expect to expandbegin a broader roll-out of digital projection technology in our testingcircuit beginning in fiscal 2011. The actual costs that we may incur when such a roll-out begins are yet to be determined, but it is our expectation that the majority of the costs would be paid for by the film studios through the payment of virtual print fees to us or a selected digital cinema implementation partner. Our goals from digital cinema include digital 3D technology. Digital cinema may be able to deliverdelivering an improved film presentation to our customers, increase ourguests, increasing scheduling flexibility, and provide an opportunityas well as maximizing the opportunities for alternate programming in our auditoriums other than movies, but the reliability of the hardware and software and the potential costs associatedthat may be available with this new technology are yet to be determined. Upon completion of successful testing and the determination of a suitable financing methodology (all film studios have indicated that they will participate in the financing of the new technology implementation), we would anticipate a broader roll-out of digital cinema to our theatres in the future.technology.

We sell food and beverage concessions in all of our movie theatres. We believe that a wide variety of food and beverage items, properly merchandised, increases concession revenue per patron. Although popcorn and soda remain the traditional favorites with moviegoers, we continue to upgrade our available concessions by offering varied choices. For example, some of our theatres offer hot dogs, pizza, ice cream, pretzel bites, frozen yogurt, coffee, mineral water and juices. We have recentlyalso added self-serve soft drinks to many of our theatres. In recent years, we have added branded pizza (Zaffiro’s) and branded coffee, ice cream and chocolates – as well as an expanded concessionHot Zonethat serves pizza, hamburgers, wraps, sandwiches and other hot appetizers – to selected theatres. Certain of our theatres have also introducedTake Fivecocktail lounges and a multi-use “dinner-theatre” concept we have branded asCineDineSM, fully equipped for live performances, meetings, broadcast concerts and sporting events and regular screenings of first-run movies, with an attached kitchen from which we offer a full menu. Our new Marcus Midtown Cinema at Midtown Crossing in Omaha, Nebraska, offers our exclusiveCineDineSM in-theatre dining concept in all five auditoriums, featuresZaffiro’s pizza and also offers two sophisticated cocktail lounges, meeting and event space and a full catering service. Our newly remodeled North Shore Cinema in Mequon, Wisconsin now includes a cocktail lounge, aHot Zone and a separate full-serviceZaffiro’s Pizzeria and Bar. The initial response to our new food and beverage offerings at the Majesticthese theatres has been positive and we are currently exploring opportunitiescontinue to duplicate and/or expand onrefine these existing food and beverage strategiesopportunities so as to determine whether they may be profitably duplicated at several of our existing theatres.additional locations in the future.

We have a variety of ancillary revenue sources in our theatres, with the largest related to the sale of pre-show and lobby advertising.advertising (through our advertising provider, Screenvision). Additional ancillary revenues can come from corporate and group meeting sales, sponsorships, and alternate auditorium uses.uses and naming rights. In addition, we are a party to a digital network affiliate agreement with National CineMedia, LLC for the presentation of live and pre-recorded in-theatre events in 24 of our locations in multiple markets. The expanded programming, which has included live performances of the Metropolitan Opera, as well as sports, music and other events, has been well received by our customers and has the ability of providing revenue during our theatres’ slower periods. We continue to pursue additional strategies to increase our ancillary revenue sources.

We also own a family entertainment center,Funset Boulevard, adjacent to our 14-screen movie theatre in Appleton, Wisconsin.Funset Boulevard features a 40,000 square foot Hollywood-themed indoor amusement facility that includes a restaurant, party room, laser tag center, virtual reality games, arcade, outdoor miniature golf course and batting cages.

4

Hotels and Resorts Operations

Owned and Operated Hotels and Resorts

The Pfister Hotel

We own and operate the Pfister Hotel, which is located in downtown Milwaukee, Wisconsin. The Pfister Hotel is a full service luxury hotel and has 307 guest rooms (including 82 luxury suites and 176 tower rooms), threetwo restaurants, three cocktail lounges and a 275-car parking ramp. The Pfister also has 24,000 square feet of banquet and convention facilities. The Pfister’s banquet and meeting rooms accommodate up to 3,000 people and the hotel features two large ballrooms, including one of the largest ballrooms in the Milwaukee metropolitan area, with banquet seating for 1,200 people. A portion of the Pfister’s first-floor space is leased for use by retail tenants. In fiscal 2007,2010, the Pfister Hotel earned its 3134stth consecutive four-diamond award from the American Automobile Association. The Pfister is also a member of Preferred Hotels and Resorts Worldwide Association, an organization of independent luxury hotels and resorts, and the Association of Historic Hotels of America. We have addedThe hotel has a new signature restaurant to this hotel named the Mason Street Grill, (replacing an existing restaurant) and we recently addedas well as a newstate-of-the-art spa and salon. Renovations to guest rooms, meeting spaces and the parking garage are also planned at this hotel.

The Hilton Milwaukee City Center

We own and operate the 729-room Hilton Milwaukee City Center. Several aspects of Hilton’s franchise program have benefited this hotel, including Hilton’s international centralized reservation and marketing system, advertising cooperatives and frequent stay programs. The Hilton Milwaukee City Center also features Paradise Landing, an indoor water park and family fun center that features water slides, swimming pools, a sand beach, lounge and restaurant. The hotel also has two cocktail lounges, two restaurants and an 870-car parking ramp. We recently completed major renovations to this hotel’s guestrooms, corridors and main lobby.

4

Hilton Madison at Monona Terrace

We own and operate the 240-room Hilton Madison at Monona Terrace in Madison, Wisconsin. The Hilton Madison, which also benefits from the aspects of Hilton’s franchise program noted above, is connected by skywalk to the Monona Terrace Community and Convention Center, has four meeting rooms totaling 2,400 square feet, an indoor swimming pool, a fitness center, a lounge and a restaurant.

The Grand Geneva Resort & Spa

We own and operate the Grand Geneva Resort & Spa in Lake Geneva, Wisconsin, which is the largest convention resort in Wisconsin. This full-facility destination resort is located on 1,300 acres and includes 355 guest rooms, over 60,000 square feet of banquet, meeting and exhibit space, (including approximately 12,000 square feet added during the past year), over 13,000 square feet of ballroom space, three specialty restaurants, two cocktail lounges, two championship golf courses, several ski-hills,ski hills, two indoor and five outdoor tennis courts, three swimming pools, a spa and fitness complex, horse stables and an on-site airport. In fiscal 2007,2010, the Grand Geneva Resort & Spa earned its 9th12th consecutive four-diamond award from the American Automobile Association. We are currently reviewing plans for a guest room renovation andrecently completed a major renovation ofto this hotel’s exterior pool, WELL Spa, and guest rooms, including the outdoor pool complex.

Through fiscal 2006, we managed and sold units of a vacation ownership development, the Marcus Vacation Club, that is adjacent to the Grand Geneva Resort & Spa. The development includes 62 timeshare units and a timeshare sales center. In early fiscal 2007, we sold the remaining inventory in this development to Orange Lake Resort & Country Club of Orlando, Florida, but will continue to provide hospitality management services for the property, including check-in, housekeeping and maintenance.hotel’s luxury suites.

Hotel Phillips

We own and operate the Hotel Phillips, a 217-room hotel in Kansas City, Missouri. After purchasing and completely restoring this landmark hotel, we reopened it in September 2001. The Hotel Phillips has conference rooms totaling 5,600 square feet of meeting space, a 2,300 square foot ballroom, a restaurant and a lounge.

InterContinental Milwaukee

We own and operate the InterContinental Milwaukee in Milwaukee, Wisconsin. The InterContinental Milwaukee has 220 rooms, 12,000 square feet of flexible banquet and meeting space, on-site parking, a fitness center, a restaurant and a lounge and is located in the heart of Milwaukee’s theatre and financial district.

5

Skirvin Hilton

We are the principal equity partner and operator of the Skirvin Hilton hotel in Oklahoma City, Oklahoma, the oldest hotel in Oklahoma. This historic hotel has 225 rooms, including 20 one-bedroom suites and one Presidential Suite. The Skirvin Hilton benefits from the aspects of Hilton’s franchise program noted above and has a restaurant, lounge, fitness center, indoor swimming pool, business center and approximately 18,500 square feet of meeting space.

Four Points by Sheraton Chicago Downtown/Magnificent Mile

We own andPursuant to a long-term lease, we operate the Four Points by Sheraton Chicago Downtown/Magnificent Mile, a 226-room (including 130 suites) hotel in Chicago, Illinois. The Four Points by Sheraton Chicago Downtown/Magnificent Mile has affordable, well-appointed guest rooms and suites, 3,000 square feet of high-tech meeting rooms, an indoor swimming pool and fitness room and an on-site parking facility. The hotel leases space to onetwo area restaurant and plans to lease space to up to two additional area restaurants or retail outlets.restaurants.

InterContinental Milwaukee

We own and operate the InterContinental Milwaukee in Milwaukee, Wisconsin. Formerly the Wyndham Milwaukee Center, this hotel recently underwent a major renovation and rebranding to the upscale InterContinental brand. The InterContinental Milwaukee has 220 rooms, 12,000 square feet of flexible banquet and meeting space, on-site parking, a restaurant and two lounges and is located in the heart of Milwaukee’s theatre and financial district.

Skirvin Hilton

We are the principal equity partner and operator of the Skirvin Hilton hotel in Oklahoma City, Oklahoma, the oldest hotel in Oklahoma. This historic hotel has 225 rooms, including 20 one-bedroom suites and one Presidential Suite, and was renovated and reopened on February 26, 2007 by a public-private joint venture. The Skirvin Hilton will benefit from the aspects of Hilton’s franchise program noted above and has a restaurant, lounge, fitness center, indoor swimming pool, business center and approximately 18,500 square feet of meeting space.

5

Managed Hotels, Resorts and Other Properties

We also manage hotels, resorts and other properties for third parties, typically under long-term management agreements. Revenues from these management contracts may include both base management fees, often in the form of a fixed percentage of defined revenues, and incentive management fees, typically calculated based upon defined profit performance. We may also earn fees for technical and preopening services before a property opens, as well as for on-going accounting and technology services.

We manage the Crowne Plaza-Northstar Hotel in Minneapolis, Minnesota. The Crowne Plaza-Northstar Hotel is located in downtown Minneapolis and has 226 guest rooms, 13 meeting rooms, 6,370 square feet of ballroom and convention space, a restaurant, a cocktail lounge and an exercise facility.

We manage the Hotel Mead in Wisconsin Rapids, Wisconsin. The Hotel Mead has 157 guest rooms, ten meeting rooms totaling 14,000 square feet of meeting space, two cocktail lounges, two restaurants and an indoor pool with a sauna and whirlpool. The Hotel Mead is expected to be sold during fiscal 2008, at which point we would likely cease managing the hotel.

We manage Beverly Garland’s Holiday Inn in North Hollywood, California. The Beverly Garland has 257 guest rooms, including 12 suites, meeting space for up to 600, including an amphitheater and ballroom, an outdoor swimming pool and lighted tennis courts. The mission-style hotel is located on seven acres near Universal Studios.

We also provide hospitality management services, including check-in, housekeeping and maintenance, for a vacation ownership development adjacent to the Grand Geneva Resort & Spa owned by Orange Lake Resort & Country Club of Orlando, Florida. The development includes 62 timeshare units and a timeshare sales center.

We manage the Hilton Garden Inn Houston NW/Chateau in Houston, Texas. The Hilton Garden Inn has 171 guest rooms, a ballroom, a restaurant, a fitness center, a convenience mart and a swimming pool. The hotel is a part of Chateau Court, a 13-acre, European-style mixed-use development that also includes retail space and an office village.

We manage and own a 15% minority equity interest in the Sheraton Madison Hotel in Madison, Wisconsin. The Sheraton Madison features 237 rooms and suites, an indoor heated swimming pool, whirlpool, fitness center, a restaurant, lounge and 18,000 square feet of meeting space. It is adjacent to the Alliant Energy Center, which includes more than 150,000 square feet of exhibit space, and is located approximately 1.5 miles from the Monona Terrace Convention Center, the city’s convention center facility.

We manage and own a 15% minority equity interest in the Westin Columbus in Columbus, Ohio. The Westin Columbus is a AAA four-diamond full-service historic hotel that currently includes 186 rooms and suites and offers more than 12,000 square feet of meeting, banquet and ballroom space, a restaurant and a cocktail

6

lounge. The hotel is located in the heart of the downtown business district and is connected to the Southern Theatre, a historically restored performing arts theater. In fiscal 2009, a substantial renovation of the guest rooms and public space of this property was completed.

We manage Xona Resort Suites, a four-star destination resort in Scottsdale, Arizona, offering 431 suites, four swimming pools, three whirlpools, a fitness center, a 24-hour concierge and 7,600 square feet of meeting space. The resort recently completed a multi-million dollar renovation of its public space, restaurant and grounds.

We manage the Sheraton Clayton Plaza Hotel in St. Louis, Missouri, which offers 257 rooms and suites, an indoor swimming pool, a fitness facility, and a business center. A multi-million dollar renovation of the public space and guest rooms of the hotel was recently completed.

We manage the new Hilton Minneapolis/Bloomington in Bloomington, Minnesota. This “business class” hotel, which opened on January 26, 2008, offers 256 rooms, an indoor swimming pool, a club level, a fitness center, a business center and 9,100 square feet of meeting space.

We also manage two condominium-hotels under long-term management contracts. Revenues from these management contracts are larger than typical management contracts because, under an agreed-upon rental pool arrangement, room revenues are shared at a defined percentage with individual condominium owners. In addition, we own all of the common areas of these facilities, including any restaurants, lounges, spas and gift shops, and keep all of the revenues from these outlets.

We manage the Timber Ridge Lodge, an indoor/outdoor waterpark and condominium complex in Lake Geneva, Wisconsin. The Timber Ridge Lodge is a 225-unit condominium hotel on the same campus as our Grand Geneva Resort & Spa. The Timber Ridge Lodge has meeting rooms totaling 3,640 square feet, a general store, a restaurant-cafe, a snack bar and lounge, a state-of-the-art fitness center and an entertainment arcade.

We manage the Hilton Garden Inn Houston NW/Chateau in Houston, Texas. The Hilton Garden Inn has 171 guest rooms, a ballroom, a restaurant, a fitness center, a convenience mart and a swimming pool. The hotel is a part of Chateau Court, a 13-acre, European-style mixed-use development that also includes retail space and an office village.

We manage the Platinum Hotel & Spa, a condominium hotel in Las Vegas, Nevada just off the Las Vegas Strip. DevelopedStrip, and opened in October 2006 by a joint venture that we originally owned a 50% interest in, we now own 100% of the hotel’s public space (with all condominium units to be ultimately individually-owned). In addition to earning a management fee equal to a share of room revenue when any of thespace. The Platinum Hotel & Spa has 255 one and two-bedroom suites are rented, we have the opportunity to earn revenues from thesuites. This non-gaming, non-smoking hotel also has an on-site restaurant, lounge, spa and 8,440 square feet of meeting space at this non-gaming, non-smoking hotel.

In February 2007, we formed a joint venture to acquire the Sheraton Madison Hotel in Madison, Wisconsin.space. We own a 15% minority interest in16 previously unsold condominium units at the joint venturePlatinum and will manage the hotel and oversee a major renovation of the property. The hotel features 237 rooms and suites, an indoor heated swimming pool, whirlpool, fitness center and 18,000 square feet of meeting space. It is adjacent to the Alliant Energy Center, which boasts more than 150,000 square feet of exhibit space, and is located approximately 1.5 miles from the Monona Terrace Convention Center, the city’s convention center facility.

We manage the Westin Columbus in Columbus, Ohio. Formerly a company-owned hotel, in April 2007 we sold the Westin Columbus into a joint venture with Waterton Tactical Real Estate Fund I, a discretionaryanticipate selling these units when Las Vegas real estate fund sponsored by Chicago-based Waterton Commercial, LLC. We own a 15% minority interest in the joint venture and will continue to operate and manage the hotel. The Westin Columbus is a AAA four-diamond full-service historic hotel that currently includes 186 rooms and suites and offers more than 12,000 square feet of meeting, banquet and ballroom space, a restaurant and a cocktail lounge. The hotel is located in the heart of the downtown business district and is connected to the Southern Theatre, a historically restored performing arts theater. This property will undergo a substantial renovation during our fiscal 2008.market conditions improve.

6

In fiscal 2007, we also signed agreements to operate four additional properties for other owners. We now manage Brynwood Country Club in Milwaukee, Wisconsin. Brynwood has an 18-hole golf course, four tennis courts, a fitness center, swimming pool and banquet facilities. We also now manage Resort Suites, a four-star destination resort in Scottsdale, Arizona, offering 483 suites, four swimming pools, three whirlpools, a fitness center, a 24-hour concierge and 7,600 square feet of meeting space. Plans for renovations of and modifications to this property are under development. In February 2007, we signed an agreement to manage the Sheraton Clayton Plaza Hotel in St. Louis, Missouri, which offers 257 rooms and suites, an indoor swimming pool, a fitness facility, and a business center. The hotel will undergo a multi-million dollar renovation beginning later in 2007. Finally, we were selected to manage an under-construction Hilton Hotel in Bloomington, Minnesota. The hotel, scheduled to open in January of 2008, will offer 256 rooms, an indoor swimming pool, a club level, a fitness center, a business center and 9,100 square feet of meeting space.

Both of our businesses experience intense competition from national, regional and local chain and franchise operations, some of which have substantially greater financial and marketing resources than we have. Most of our facilities are located in close proximity to competing facilities.

Our movie theatres compete with large national movie theatre operators, such as AMC Entertainment, Cinemark, Regal Cinemas and Carmike Cinemas, as well as with a wide array of smaller first-run exhibitors. Movie exhibitors also generally compete with the home video, pay-per-view and cable television markets. We believe that such ancillary markets have assisted the growth of the movie theatre industry by encouraging the production of first-run movies released for initial movie theatre exhibition, which has historically established the demand for such movies in these ancillary markets.

Our hotels and resorts compete with the hotels and resorts operated by Hyatt Corporation, Marriott Corporation, Ramada Inns, Holiday Inns and others, along with other regional and local hotels and resorts.

We believe that the principal factors of competition in both of our businesses, in varying degrees, are the price and quality of the product, quality and location of our facilities and customer service. We believe that we are well positioned to compete on the basis of these factors.

7

Seasonality

Historically, our first fiscal quarter has produced the strongest operating results because this period coincides with the typical summer seasonality of the movie theatre industry and the summer strength of our lodging business. Our third fiscal quarter has historically produced the weakest operating results in our hotels and resorts division primarily due to the effects of reduced travel during the winter months. Our third fiscal quarter for our theatre division has historically been our second strongest quarter but is heavily dependent upon the quantity and quality of films released during the Thanksgiving to Christmas holiday period.

Environmental Regulation

We do not expect federal,Federal, state orand local environmental legislation to havehas not had a material effect on our capital expenditures, earnings or competitive position. However, our activities in acquiring and selling real estate for business development purposes have been complicated by the continued emphasis that our personnel must place on properly analyzing real estate sites for potential environmental problems. This circumstance has resulted in, and is expected to continue to result in, greater time and increased costs involved in acquiring and selling properties associated with our various businesses.

7

As of the end of fiscal 2007,2010, we had approximately 6,8006,200 employees, approximately one-half44% of whom were employed on a part-time basis. A number of our (1) hotel employeesprojectionists in Milwaukee, Wisconsin are covered by a collective bargaining agreement that expired on May 30, 2007 and are operating under the terms of the old agreement on a day-to-day basis; (2) projectionists at the Crowne Plaza Northstar in Minneapolis, MinnesotaChicago locations are covered by a collective bargaining agreement that expires on April 30, 2010; (2) operating engineers in the Hilton Milwaukee City Center and Pfister Hotel are covered by collective bargaining agreements that expired on December 31, 2006 and April 30, 2007, respectively, and have been extended on a day-to-day basis during on-going negotiations;July 7, 2011; (3) a number of our hotel employees inat the Hilton Milwaukee City Center and the Pfister Hotel are covered by a collective bargaining agreement that expires on February 14, 2013; (4) operating engineers at the Sheraton Clayton Plaza Hotel are covered by a collective bargaining agreement that expires on November 30, 2010; (5) hotel employees at the Sheraton Clayton Plaza Hotel are covered by a collective bargaining agreement that expires on December 14, 2010; (6) operating engineers at the Hilton Milwaukee City Center and Pfister Hotel are covered by collective bargaining agreements that expire on December 31, 2010 and April 30, 2011, respectively; (7) hotel employees at the Crowne Plaza Northstar in Minneapolis, Minnesota are covered by a collective bargaining agreement that expired on June 15, 2009; (4)30, 2010 and are operating under the terms of the old agreement on a day-to-day basis; (8) painters at the Sheraton Clayton Plaza Hotel are covered by a collective bargaining agreement that expires on August 31, 2010; (9) projectionists in Omaha, Nebraska are covered by a collective bargaining agreement that expires on March 31, 2011; (10) projectionists in Madison, Wisconsin are covered by a collective bargaining agreement that expires on April 5, 2012; and (11) painters in the Hilton Milwaukee City Center and the Pfister Hotel are covered by a collective bargaining agreement that expires on May 31, 2008; (5) projectionists at a Chicago, Illinois theatre that we manage for a third party2013.

As of the end of fiscal 2010, approximately 11% of our employees are covered by a collective bargaining agreement, that expires on October 20, 2008; (6) projectionists at other Chicago locationsof which 2% are covered by a collective bargainingan agreement that expires on December 31, 2008; (7) projectionists in Madison, Wisconsin are covered by a collective bargaining agreement that expires on April 2, 2008; (8) projectionists in Milwaukee, Wisconsin are covered by a collective bargaining agreement that expires on May 30, 2008; (9) a number of hotel employees at the Sheraton Clayton Plaza Hotel that we manage for a third party are covered by a collective bargaining agreement that expires on December 14, 2009; (10) operating engineers at the Sheraton Clayton Plaza Hotel are covered by a collective bargaining agreement that expires on November 30, 2009; and (11) painters at the Sheraton Clayton Plaza Hotel are covered by a collective bargaining agreement that expires on August 31, 2010.will expire within one year.

Web Site Information and Other Access to Corporate Documents

Our corporate web site is www.marcuscorp.com. All of our Form 10-Ks, Form 10-Qs and Form 8-Ks, and amendments thereto, are available on this web site as soon as practicable after they have been filed with the SEC. We are not including the information contained on our website as part of, or incorporating it by reference into, this Annual Report. In addition, our corporate governance guidelines and the charters for our Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee are available on our web site. If you would like us to mail you a copy of our corporate governance guidelines or a committee charter, please contact Thomas F. Kissinger, Vice President, General Counsel and Secretary, The Marcus Corporation, 100 East Wisconsin Avenue, Suite 1900, Milwaukee, Wisconsin 53202-4125.

8

Item 1A. Risk Factors.

The following risk factors and other information included in this Annual Report on Form 10-K should be carefully considered. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. If any of the following risks occur, our business, financial condition, operating results, and cash flows could be materially adversely affected.

The Lack of Both the Quantity and Audience Appeal of Motion Pictures May Adversely Affect Our Financial Results.

The financial results of our movie theatre business and the motion picture industry in general are heavily dependent on the general audience appeal of available films, together with studio marketing, advertising and support campaigns, factors over which we have no control. The relative success of our movie theatre business will continue to be largely dependent upon the quantity and audience appeal of films made available by the movie studios and other producers. Poor performance of films, a disruption in the production of films due to events such as a strike by actors, writers or directors, or a reduction in the marketing efforts of the film distributors to promote their films could have an adverse impact on our business and results of operations. Also, our quarterly results of operations are significantly dependent on the quantity and audience appeal of films that we exhibit during each quarter. As a result, our quarterly results may be unpredictable and somewhat volatile.

8A Deterioration in Relationships with Film Distributors Could Adversely Affect Our Ability to Obtain Commercially Successful Films.

We rely on the film distributors for the motion pictures shown in our theatres. Our business depends to a significant degree on maintaining good relationships with these distributors. Deterioration in our relationships with any of the major film distributors could adversely affect our access to commercially successful films and adversely affect our business and results of operations. Because the distribution of motion pictures is in large part regulated by federal and state antitrust laws and has been the subject of numerous antitrust cases, we cannot ensure a supply of motion pictures by entering into long-term arrangements with major distributors. Rather, we must compete for licenses on a film-by-film and theatre-by-theatre basis and are required to negotiate licenses for each film and for each theatre individually.

Our Financial Results May be Adversely Impacted by Unique Factors Affecting the Theatre Exhibition Industry, Such as the Shrinking Video Release Window, the Increasing Piracy of Feature Films and the Increasing Use of Alternative Film Distribution Channels and Other Competing Forms of Entertainment.

Over the last decade, the average video release window, which represents the time that elapses from the date of a film’s theatrical release to the date a film is available on video or DVD, has decreased from approximately six months to less than four and one-half months. Some studios have recently expressed a desire to have a shorter window for a select number of films that might be released during traditionally slower seasons of the year. There have also been discussions recently regarding the possibility of a new shorter premium-priced video on-demand window. We cannot assure you that this release window, which is determined by the film studios, will not shrink further, which could have an adverse impact on our movie theatre business and results of operations.

Piracy of motion pictures is prevalent in many parts of the world. Technological advances allowing the unauthorized dissemination of motion pictures increase the threat of piracy by making it easier to create, transmit and distribute high quality unauthorized copies of such motion pictures. The proliferation of unauthorized copies and piracy of motion pictures may have an adverse effect on our movie theatre business and results of operations.

We face competition for movie theatre patrons from a number of alternative motion picture distribution channels, such as DVD, network, cable and satellite television, video on-demand, pay-per-view television and downloading utilizing the internet. We also compete with other forms of entertainment competing for our

9

patrons’ leisure time and disposable income such as concerts, amusement parks, sporting events, home entertainment systems, video games and portable entertainment devices such as the iPod®iPod®. An increase in popularity of these alternative film distribution channels and competing forms of entertainment may have an adverse effect on our movie theatre business and results of operations.

Industry-wide Conversion to Digital Cinema May Increase Our Costs.

The theatre industry is in the process of conversion from film-based media to digital-based media. There are a variety of constituencies associated with this anticipated change that may significantly impact industry participants, including content providers, distributors, equipment providers and exhibitors. While content providers and distributors have indicated they would bear substantially all of the costs of this change, there can be no assurance that we will have access to adequate capital to finance the conversion costs associated with this potential change, nor can there be any assurance that we will not see an increase in related operating costs of the new media that would adversely affect our results of operations. There is also a risk that if we, or other exhibitors, do not proceed with a conversion to digital cinema on a timely basis, the film distributors could reduce the amount they are willing to contribute towards the conversion costs in the future or, less likely, choose to not provide film product at some point.

The Relative Industry Supply of Available Rooms at Comparable Lodging Facilities May Adversely Affect Our Financial Results.

Historically, a material increase in the supply of new hotel rooms in a market can destabilize that market and cause existing hotels to experience decreasing occupancy, room rates and profitability. If such over-supply occurs in one or more of our major markets, we may experience an adverse effect on our hotels and resorts business and results of operations.

If the Amount of Sales Made Through Third-Party Internet Travel Intermediaries Increases Significantly, Consumer Loyalty to Our Hotels Could Decrease and Our Revenues Could Fall.

We expect to derive most of our business from traditional channels of distribution. However, consumers now use internet travel intermediaries regularly. Some of these intermediaries are attempting to increase the importance of price and general indicators of quality (such as “four-star downtown hotel”) at the expense of brand/hotel identification. These agencies hope that consumers will eventually develop brand loyalties to their reservation system rather than to our hotels. If the amount of sales made through internet travel intermediaries increases significantly and consumers develop stronger loyalties to these intermediaries rather than to our hotels, we may experience an adverse effect on our hotels and resorts business and results of operations.

Our Businesses are Heavily Capital Intensive and Preopening and Start-Up Costs and Increasing Depreciation Expenses May Adversely Affect Our Financial Results.

Both our movie theatre and hotels and resorts businesses are heavily capital intensive. Purchasing properties and buildings, constructing buildings, renovating and remodeling buildings and investing in joint venture projects all require substantial upfront cash investments before these properties, facilities and joint ventures can generate sufficient revenues to pay for the upfront costs and positively contribute to our profitability. In addition, many growth opportunities, particularly for our hotels and resorts division, require lengthy development periods during which significant capital is committed and preopening costs and early start-up losses are incurred. We expense these preopening and start-up costs currently. As a result, our results of operations may be adversely affected by our significant levels of capital investments. Additionally, to the extent we capitalize our capital expenditures, our depreciation expenses may increase, thereby adversely affecting our results of operations.

Adverse Economic Conditions in Our Markets May Adversely Affect Our Financial Results.

Downturns or adverse economic conditions affecting the United States economy generally, and particularly downturns or adverse economic conditions in the Midwest and in our other markets, adversely affect our results

10

of operations, particularly with respect to our hotels and resorts division. Poor economic conditions can significantly adversely affect the business and group travel customers, which are the largest customer segments for our hotels and resorts division. Specific economic conditions that may directly impact travel, including financial instability of air carriers and increases in gas and other fuel prices, may adversely affect our results of operations. Additionally, although our theatre business has historically performed well during economic downturns as consumers seek less expensive forms of out-of-home entertainment, a significant reduction in consumer confidence or disposable income in general may temporarily affect the demand for motion pictures or severely impact the motion picture production industry, which, in turn, may adversely affect our results of operations.

9Adverse Economic Conditions, Including Disruptions in the Financial Markets, May Adversely Affect Our Ability to Obtain Financing on Reasonable and Acceptable Terms, if at All, and Impact Our Ability to Achieve Certain of Our Growth Objectives.

We expect that we will require additional financing over time, the amount of which will depend upon a number of factors, including the number of theatres and hotels and resorts we acquire and/or develop, the amount of capital required to refurbish and improve existing properties, the amount of existing indebtedness that requires repayment in a given year and the cash flow generated by our businesses. Downturns or adverse economic conditions affecting the United States economy generally, and the United States stock and credit markets specifically, may adversely impact our ability to obtain additional short-term and long-term financing on reasonable terms or at all, which would negatively impact our liquidity and financial condition. As a result, a prolonged downturn in the stock or credit markets would also limit our ability to achieve our growth objectives.

Adverse Weather Conditions, Particularly During the Winter in the Midwest and in Our Other Markets, May Adversely Affect Our Financial Results.

Poor weather conditions adversely affect business and leisure travel plans, which directly impacts our hotels and resorts division. In addition, theatre attendance on any given day may be negatively impacted by adverse weather conditions. In particular, adverse weather during peak movie-going weekends or holiday time periods may negatively affect our results of operations. Adverse winter weather conditions may also increase our snow removal and other maintenance costs in both of our divisions.

Each of Our Business Segments and Properties Experience Ongoing Intense Competition.

In each of our businesses we experience intense competition from national, regional and local chain and franchise operations, some of which have substantially greater financial and marketing resources than we have. Most of our facilities are located in close proximity to other facilities which compete directly with ours. The motion picture exhibition industry is fragmented and highly competitive with no significant barriers to entry. Theatres operated by national and regional circuits and by small independent exhibitors compete with our theatres, particularly with respect to film licensing, attracting patrons and developing new theatre sites. Moviegoers are generally not brand conscious and usually choose a theatre based on its location, the films showing there and its amenities. With respect to our hotels and resorts division, our ability to remain competitive and to attract and retain business and leisure travelers depends on our success in distinguishing the quality, value and efficiency of our lodging products and services from those offered by others. If we are unable to compete successfully in either of our divisions, this could adversely affect our results of operations.

Our Ability to Identify Suitable Properties to Acquire, Develop and Manage Will Directly Impact Our Ability to Achieve Certain of Our Growth Objectives.

A portion of our ability to successfully achieve our growth objectives in both our theatre and hotels and resorts divisions is dependent upon our ability to successfully identify suitable properties to acquire, develop and manage. Failure to successfully identify, acquire and develop suitable and successful locations for new lodging properties and theatres will substantially limit our ability to achieve these important growth objectives.

11

Investing Through Partnerships or Joint Ventures Decreases Our Ability to Manage Risk.

In addition to acquiring or developing hotels and resorts or entering into management contracts to operate hotels and resorts for other owners, we have from time to time invested, and expect to continue to invest, as a joint venturer. Joint venturers may have shared control or disproportionate control over the operation of the joint venture assets. Therefore, joint venture investments may involve risks such as the possibility that the co-venturer in an investment might become bankrupt or not have the financial resources to meet its obligations, or have economic or business interests or goals that are inconsistent with our business interests or goals, or be in a position to take action contrary to our instructions or requests or contrary to our policies or objectives. Consequently, actions by a co-venturer might subject hotels and resorts owned by the joint venture to additional risk. Further, we may be unable to take action without the approval of our joint venture partners. Alternatively, our joint venture partners could take actions binding on the joint venture without our consent.

Our Properties are Subject to Risks Relating to Acts of God, Terrorist Activity and War and Any Such Event May Adversely Affect our Financial Results.

Acts of God, natural disasters, war (including the potential for war), terrorist activity (including threats of terrorist activity), epidemics (such as SARs, bird flu and birdswine flu), travel-related accidents, as well as political unrest and other forms of civil strife and geopolitical uncertainty may adversely affect the lodging and movie exhibition industries and our results of operations. Terrorism incidents, such as the events of September 11, 2001, and wars, such as the Iraq war, significantly impact business and leisure travel and consequently demand for hotel rooms. In addition, inadequate preparedness, contingency planning, insurance coverage or recovery capability in relation to a major incident or crisis may prevent operational continuity and consequently impact the reputation of our businesses.

10

Historically, our first fiscal quarter has produced our strongest operating results because this period coincides with the typically strong summer performance of the movie theatre industry and the summer strength of our lodging business. Our third fiscal quarter has historically produced our weakest operating results in our hotels and resorts division, primarily due to the affects of reduced travel during the winter months. Our third fiscal quarter for our theatre division has historically been our second strongest quarter but is heavily dependent upon the quantity and quality of films released during the Thanksgiving to Christmas holiday period.

Item 1B. Unresolved Staff Comments.

None.

None.

12

Item 2. Properties.

We own the real estate of a substantial portion of our facilities, including, as of May 31, 2007,27, 2010, the Pfister Hotel, the Hilton Milwaukee City Center, the Hilton Madison at Monona Terrace, the Grand Geneva Resort & Spa, the Hotel Phillips, the InterContinental Milwaukee, the Skirvin Hilton and the majority of our theatres. We lease the remainder of our facilities. As of May 31, 2007,27, 2010, we also managed twelvetwo hotels for joint ventures in which we have an interest and nine hotels, resorts and other properties and two theatres that are owned by third parties. Additionally, we own properties acquired for the future construction and operation of new facilities.facilities and we have an interest in a joint venture hotel managed by a third party. All of our properties are suitably maintained and adequately utilized to cover the respective business segment served.

Our owned, leased and managed properties are summarized, as of May 31, 2007,27, 2010, in the following table:

| Business Segment | Total Number of Facilities in Operation | Owned(1) | Leased from Unrelated Parties(2) | Managed for Related Parties | Managed for Unrelated Parties(2) |

|---|---|---|---|---|---|

| Theatres: | |||||

| Movie Theatres | 50 | 40 | 8 | 0 | 2 |

| Family Entertainment Center | 1 | 1 | 0 | 0 | 0 |

| Hotels and Resorts: | |||||

| Hotels | 16 | 6 | 1 | 2 | 7 |

| Resorts | 2 | 1 | 0 | 0 | 1 |

| Other Properties | 2 | 0 | 0 | 0 | 2 |

| Limited-Service Lodging: | |||||

| Baymont Inns & Suites | 2 | 0 | 0 | 2 | 0 |

| Total | 73 | 48 | 9 | 4 | 12 |

| Business Segment | Total Number of Facilities in Operation | Owned(1) | Leased Parties(2) | Managed Parties | Managed Parties(2) | |||||

Theatres: | ||||||||||

Movie Theatres | 54 | 44 | 8 | 0 | 2 | |||||

Family Entertainment Center | 1 | 1 | 0 | 0 | 0 | |||||

Hotels and Resorts: | ||||||||||

Hotels | 16 | 6 | 1 | 2 | 7 | |||||

Resorts | 2 | 1 | 0 | 0 | 1 | |||||

Other Properties | 1 | 0 | 0 | 0 | 1 | |||||

Total | 74 | 52 | 9 | 2 | 11 | |||||

| (1) |

| (2) | The eight theatres leased from unrelated parties have |

Certain of the above individual properties or facilities are subject to purchase money or construction mortgages or commercial lease financing arrangements, but we do not consider these encumbrances, individually or in the aggregate, to be material.

Over 90%All of our operating property leases expire on various dates after the end of fiscal 20082011 (assuming we exercise all of our renewal and extension options).

11Item 3. Legal Proceedings.

We do not believe that any pending legal proceedings involving us are material toGoodman, et al. v. Platinum Condominium Development, LLC, Case No. 09-CV-957 (D. Nev.). As reported in our business. No legal proceeding required to be disclosed under this itemQuarterly Report on Form 10-Q for the period ended February 25, 2010, on December 5, 2008, a class action complaint was terminated duringfiled in the fourth quarterEighth Judicial District Court of fiscal 2007.

No matters were submitted to a voteNevada for Clark County against Platinum Condominium Development, LLC (“Platinum LLC”), one of our shareholders duringsubsidiaries. On April 30, 2009, Platinum LLC was served with a summons and a copy of an amended complaint. The amended complaint also named another one of our subsidiaries, Marcus Management Las Vegas, LLC (“Marcus Management LV”), as a defendant. Subsequently, Platinum LLC and Marcus Management LV removed the fourth quartercase to the United States District Court for the District of fiscal 2007.Nevada, where it is currently pending. The amended complaint in Goodman seeks an unspecified amount of damages and alleges violations of federal and Nevada law, and that Platinum LLC and Marcus Management LV made various representations in connection with the Platinum Hotel & Spa development in Las Vegas, Nevada. On June 29, 2009, both Platinum LLC and Marcus Management LV moved to dismiss the amended complaint in its entirety. On March 29, 2010, the District of Nevada granted in part and denied in part the motion to dismiss, and dismissed most of the claims against Platinum LLC and Marcus Management LV without prejudice. On April 28, 2010, Goodman filed a second amended complaint, which Platinum LLC and Marcus Management LV have answered, in part, and moved to dismiss, in part. The parties are currently briefing the motion to dismiss.

13

Baroi, et al. v. Platinum Condominium Development, LLC, Case No. 09-CV-671 (D. Nev.) andBenson, et al. v. Platinum Condominium Development, LLC,et al., Case No. 09-CV-1301 (D. Nev.). As we reported in our Quarterly Report on Form 10-Q for the period ended February 25, 2010, on March 27, 2009, another complaint was filed in the Eighth Judicial District Court of Nevada for Clark County against Platinum LLC, which Platinum LLC subsequently removed to the United States District Court for the District of Nevada. On May 29, 2009, plaintiffs in Baroi amended their complaint and named Marcus Management LV, as well as two of our other subsidiaries, Marcus Development, LLC (“Marcus Development”) and Marcus Hotels, Inc. (“Marcus Hotels”), as additional defendants. On July 2, 2009, Marcus Management LV, Marcus Development, and Marcus Hotels moved to dismiss the amended complaint. That motion was granted, without prejudice, and with leave to amend.

In addition, as we reported in our Quarterly Report on Form 10-Q for the period ended February 25, 2010, on July 17, 2009, the Benson action was filed in the United States District Court for the District of Nevada, and the complaint made allegations similar to those of the Baroi action. The Benson action also named Platinum LLC, Marcus Management LV, Marcus Development and Marcus Hotels as defendants.

Subsequent to the District of Nevada’s order in Baroi granting the motion to dismiss of Marcus Management LV, Marcus Development, and Marcus Hotels, the plaintiffs in Baroi and Benson agreed to consolidate the two actions. On January 25, 2010, the plaintiffs filed a consolidated amended complaint against Platinum LLC, Marcus Management LV, and Marcus Hotels. Plaintiffs did not name Marcus Development as a defendant. The consolidated amended complaint seeks declaratory relief and an unspecified amount of damages, and alleges violations of Nevada law and that the defendants made various representations in connection with the Platinum Hotel & Spa development in Las Vegas, Nevada. On March 16, 2010, the defendants responded to the consolidated amended complaint. Marcus Management LV answered the consolidated amended complaint, and Platinum LLC answered it in part and moved to dismiss it in part. Marcus Hotels moved to dismiss the complaint in its entirety. The defendants’ motions to dismiss are currently pending before the District of Nevada.

Platinum LLC, Marcus Management LV, and Marcus Hotels believe the allegations against all of the defendants in these lawsuits are without merit and they intend to vigorously defend against them. Since these matters are in the preliminary stages, we are unable to predict the scope or outcome or quantify their eventual impact, if any, on us. At this time, we are also unable to estimate associated expenses or possible losses.

Item 4. Reserved.

14

EXECUTIVE OFFICERS OF COMPANY

Each of our executive officers is identified below together with information about each officer’s age, position and employment history for at least the past five years:

| Name | Position | Age | ||||

Stephen H. Marcus | Chairman of the Board | 75 | ||||

Gregory S. Marcus | President and Chief Executive Officer | 45 | ||||

Bruce J. Olson | Senior Vice President and President of Marcus Theatres Corporation | 60 | ||||

Thomas F. Kissinger | Vice President, General Counsel and Secretary | 50 | ||||

Douglas A. Neis | Chief Financial Officer and Treasurer | 51 | ||||

William J. Otto | President and Chief Operating Officer of Marcus Hotels, Inc. | |||||

Stephen H. Marcus has been our Chairman of the Board since December 1991 and1991. He served as our President and Chief Executive Officer sincefrom December 1988.1988 to January 2009 and as our President from December 1988 until January 2008. Mr. Marcus has worked at the Companyour company for 4547 years.

Gregory S. Marcus joined our company in March 1992 as Director of Property Management/Corporate Development. He was promoted in 1999 to our Senior Vice President – Corporate Development and became an executive officer in July 2005. He has served as our President since January 2008 and was elected our Chief Executive Officer in January 2009. He was elected to serve on our Board of Directors in October 2005. He is the son of Stephen H. Marcus, our Chairman of the Board.

Bruce J. Olson joined the Companyour company in 1974. Mr. Olson served as the Executive Vice President and Chief Operating Officer of Marcus Theatres Corporation from August 1978 until October 1988, at which time he was appointed President of that corporation.subsidiary. Mr. Olson also served as our Vice President-Administration and Planning from September 1987 until July 1991. In July 1991, he was appointed as our Group Vice President and in October 2004, he was promoted to Senior Vice President. He was elected to serve on our Board of Directors in April 1996.

Thomas F. Kissinger joined the Companyour company in August 1993 as our Secretary and Director of Legal Affairs. In August 1995, he was promoted to our General Counsel and Secretary and in October 2004, he was promoted to Vice President, General Counsel and Secretary. Prior to August 1993, Mr. Kissinger was associated with the law firm of Foley & Lardner LLP for five years.

Douglas A. Neis joined the Companyour company in February 1986 as Controller of the Marcus Theatres division and in November 1987, he was promoted to Controller of Marcus Restaurants. In July 1991, Mr. Neis was appointed Vice President of Planning and Administration for Marcus Restaurants. In September 1994, Mr. Neis was also named as our Director of Technology and in September 1995 he was elected as our Corporate Controller. In September 1996, Mr. Neis was promoted to our Chief Financial Officer and Treasurer.

William J. Otto joined the Companyour company in 1993 as the Senior Vice President of Operations of Marcus Hotels, Inc. In 1996, Mr. Otto was promoted to Senior Vice President and Chief Operating Officer of Marcus Hotels, Inc. and in April 2001 he was further promoted to President and Chief Operating Officer of Marcus Hotels, Inc.

Gregory S. Marcus joined the Company in March 1992 as Director of Property Management/Corporate Development. He was promoted in 1999 to Senior Vice President – Corporate Development and became an executive officer of the Company in July 2005. He was elected to serve on our Board of Directors in October 2005.

12

Our executive officers are generally elected annually by theour Board of Directors after the annual meeting of shareholders. Each executive officer holds office until his successor has been duly qualified and elected or until his earlier death, resignation or removal.

15

PART II

| Item 5. | Market for the Company’s Common Equity, Related Shareholder Matters and Issuer Repurchases of Equity Securities. |

(a) Stock Performance Graph

The following information under the caption “Stock Performance Graph” in this Item 5 of this Annual Report on Form 10-K is not deemed to be “soliciting material” or to be “filed”” with the SEC or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934 or to the liabilities of Section 18 of the Securities and Exchange Act of 1934 and will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent we specifically incorporate it by reference into such a filing.

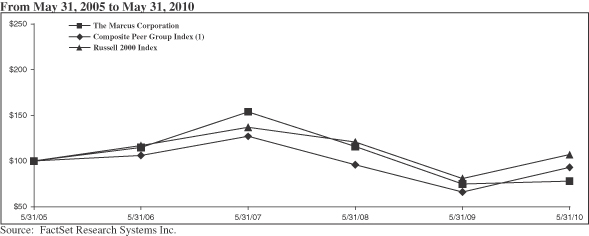

Set forth below is a graph comparing the annual percentage change during our last five fiscal years in our cumulative total shareholder return (stock price appreciation on a dividend reinvested basis) of our Common Shares compared to: (1)to the cumulative total return ofof: (1) a composite peer group index selected by us and (2) companies included in the Russell 2000 Index. The composite peer group index is comprised of a hotels and resorts index we selected that includes Choicethe Dow Jones U.S. Hotels International, Inc., Four Seasons Hotels Inc., John Q. Hammons Hotels Inc., Lodgian Inc., Orient Express Hotels, Ltd., Sonesta International Hotels Corp. and Red Lions Corporation (formerly WestCoast Hospitality Corp.)Index (weighted 50%) and a theatre index we selected that includes Regal Cinemas and Carmike Cinemas (weighted 50%). Loews Cineplex Entertainment Corp., which was previously included in our peer group for the theatre index, was acquired by a private company and no longer has a class of stock that is publicly traded. As a result, Loews Cineplex is no longer included in our peer group for the theatre index. Additionally, John Q. Hammons, which was taken private, is reflected only through September 18, 2005.

The indices within the composite peer group index are weighted to approximate the relative annual revenue contributions of each of our continuing business segments to our total annual revenues in ourover the past several fiscal 2007.years. The shareholder returns of the companies included in the hotels and resorts index and theatre index are weighted based on each company’s relative market capitalization as of the beginning of the presented periods.

Source: FactSet Data Systems, Inc.

13

| 5/31/02 | 5/31/03 | 5/31/04 | 5/31/05 | 5/31/06 | 5/31/07 | |

|---|---|---|---|---|---|---|

| The Marcus Corporation | $100 | $97 | $115 | $158 | $181 | $244 |

| Composite Peer Group Index(1) | 100 | 90 | 126 | 168 | 192 | 236 |

| Russell 2000 Index | 100 | 90 | 117 | 127 | 148 | 174 |

| 5/31/05 | 5/31/06 | 5/31/07 | 5/31/08 | 5/31/09 | 5/31/10 | |||||||||||||

The Marcus Corporation | $ | 100 | $ | 115 | $ | 154 | $ | 116 | $ | 75 | $ | 78 | ||||||

Composite Peer Group Index(1) | 100 | 106 | 127 | 96 | 66 | 93 | ||||||||||||

Russell 2000 Index | 100 | 117 | 137 | 121 | 81 | 107 | ||||||||||||

| (1) | Equal Weighted 50.0% for the |

16

(b) Market Information

Our Common Stock, $1 par value, is listed and traded on the New York Stock Exchange under the ticker symbol “MCS.” Our Class B Common Stock, $1 par value, is neither listed nor traded on any exchange. During the first and second quarterseach quarter of fiscal 2006, we paid a dividend of $0.055 per share of our Common Stock2009 and $0.05 per share of our Class B Common Stock. During the third and fourth quarters of fiscal 2006, and the first and second quarters of fiscal 2007, we paid a dividend of $0.075 per share of our Common Stock and $0.06818 per share of our Class B Common Stock. During the third and fourth quarters of fiscal 2007,2010, we paid a dividend of $0.085 per share ofon our Common Stock and $0.07727 per share ofon our Class B Common Stock. The following table lists the high and low sale prices of our Common Stock for the periods indicated.indicated (NYSE trading information only).

| Fiscal 2007 | 1st Quarter | 2nd Quarter | 3rd Quarter | 4th Quarter |

|---|---|---|---|---|

| High | $21.68 | $26.10 | $26.31 | $24.17 |

| Low | $17.15 | $19.30 | $22.52 | $20.18 |

Fiscal 2006 | 1st Quarter | 2nd Quarter | 3rd Quarter | 4th Quarter |

| High | $15.73 | $18.34 | $18.95 | $19.99 |

| Low | $12.18 | $11.35 | $14.05 | $15.20 |

| Fiscal 2010 | 1st Quarter | 2nd Quarter | 3rd Quarter | 4th Quarter | ||||||||

High | $ | 14.35 | $ | 14.25 | $ | 13.50 | $ | 14.00 | ||||

Low | $ | 9.54 | $ | 11.14 | $ | 10.04 | $ | 10.03 | ||||

| Fiscal 2009 | 1st Quarter | 2nd Quarter | 3rd Quarter | 4th Quarter | ||||||||

High | $ | 19.51 | $ | 20.00 | $ | 16.78 | $ | 13.57 | ||||

Low | $ | 13.07 | $ | 8.92 | $ | 7.37 | $ | 6.45 | ||||

On August 6, 2007,5, 2010, there were 2,1851,653 shareholders of record of our Common Stock and 5145 shareholders of record of our Class B Common Stock.

(c) Stock Repurchases

As of May 31, 2007,27, 2010, our Board of Directors had authorized the repurchase of up to 4.76.7 million shares of our outstanding Common Stock. Pursuant to this board authorization,Under these authorizations, we may repurchase shares of our Common Stock from time to time in the open market, pursuant to privately negotiated transactions or otherwise. The repurchased shares are held in our treasury pending potential future issuance in connection with employee benefit, option or stock ownership plans or other general corporate purposes. Pursuant to this board authorization,Under these authorizations, we have repurchased approximately 3.64.5 million shares of Common Stock as of May 31, 2007. This board authorization does27, 2010. These authorizations do not have an expiration date.

The following table sets forth information with respect to purchases made by us or on our behalf of our Common Stock during the periods indicated. All of these repurchases were made in the open market and pursuant to the publicly announced repurchase authorization described above.

| Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Programs | Maximum Number of Shares that May Yet be Purchased Under the Plans or Programs |

|---|---|---|---|---|

| February 23 - March 22 | -- | -- | -- | 1,307,357 |

| March 23 - April 22 | 35,900 | $21.87 | 35,900 | 1,271,457 |

| April 23 - May 31 | 124,031 | 21.95 | 124,031 | 1,147,426 |

| Total | 159,931 | $21.94 | 159,931 | 1,147,426 |

14

| Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Programs | Maximum Number of Shares that May Yet be Purchased Under the Plans or Programs | |||||

February 26 – March 27 | — | $ | — | — | 2,273,155 | ||||

March 28 – April 27 | 405 | $ | 13.60 | 405 | 2,272,750 | ||||

April 28 – May 27 | 43,654 | $ | 10.80 | 43,654 | 2,229,096 | ||||

Total | 44,059 | $ | 10.83 | 44,059 | 2,229,096 | ||||

17

Item 6. Selected Financial Data.