DONALDSON COMPANY, INC.

ANNUAL REPORT ON FORM 10-K

Page | ||||

1 | ||||

1 | ||||

2 | ||||

2 | ||||

2 | ||||

2 | ||||

2 | ||||

2 | ||||

3 | ||||

3 | ||||

3 | ||||

3 | ||||

3 | ||||

5 | ||||

5 | ||||

6 | ||||

7 | ||||

7 | ||||

8 | ||||

9 | ||||

Management’s Discussion and Analysis of Financial Condition and Results of | 9 | |||

26 | ||||

26 | ||||

27 | ||||

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 55 | |||

55 | ||||

56 | ||||

Directors, | 56 | |||

56 | ||||

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 56 | |||

Certain Relationships and Related Transactions, and Director Independence | 58 | |||

58 | ||||

58 | ||||

59 | ||||

60 | ||||

61 | ||||

Consent of Independent Registered Public Accounting Firm | 63 | |||

Certifications of Officers | 64 |

Donaldson Company, Inc. (“Donaldson” or the “Company”) was founded in 1915 and organized in its present corporate form under the laws of the State of Delaware in 1936.

The Company is a worldwide manufacturer of filtration systems and replacement parts. The Company’s product mix includes air and liquid filtersfiltration systems and exhaust and emission control products for mobile equipment; in-plant air cleaning systems; compressed air purification systems; air intake systems for industrial gas turbines and specialized filters for such diverse applications as computer disk drives and semi-conductor processing.products. Products are manufactured at more than 3040 plants around the world and through three of our joint ventures. The Company has two reporting segments engaged in the design, manufacture and sale of systems to filter air and liquid and other complementary products. The two segments aresegments: Engine Products and Industrial Products. Products in the Engine Products segment consist of air intakefiltration systems, exhaust and emissions systems, liquid filtration systems and replacement parts. The Engine Products segment sells to original equipment manufacturers (“OEM”OEMs”) in the construction, mining, agriculture, aerospace, defense, and transportationtruck markets and to independent distributors, OEM dealer networks, private label accounts and large equipment fleets. Products in the Industrial Products segment consist of dust, fume and mist collectors, compressed air purification systems, liquid filters and parts, static and pulse-cleanfiltration systems, air filter systems for gas turbines, and specialized air filtration systems for diverse applications including computer hard disk drives. The Industrial Products segment sells to various industrial end-users, OEMs of gas-fired turbines and OEMs and end-users requiring highly purifiedclean air.

The table below shows the percentage of total net sales contributed by the principal classes of similar products for each of the last three fiscal years:

| Year Ended July 31 | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2006 | 2005 | 2004 | |||||||||||||

| Engine Products segment | |||||||||||||||

| Off-road equipment products (including defense products) | 18 | % | 18 | % | 17 | % | |||||||||

| Truck products | 11 | % | 11 | % | 11 | % | |||||||||

| Aftermarket products (including replacement part sales to our OEMs) | 29 | % | 29 | % | 29 | % | |||||||||

| Industrial Products segment | |||||||||||||||

| Industrial filtration solutions products | 26 | % | 27 | % | 26 | % | |||||||||

| Gas turbine systems products | 8 | % | 7 | % | 9 | % | |||||||||

| Special applications products | 8 | % | 8 | % | 8 | % | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| Year Ended July 31 |

| |||||||

|

| 2009 |

| 2008 |

| 2007 |

| |||

Engine Products segment |

|

|

|

|

|

|

|

|

|

|

Off-Road Equipment Products (including Aerospace and Defense products) |

|

| 20 | % |

| 20 | % |

| 18 | % |

On-Road Products |

|

| 4 | % |

| 6 | % |

| 9 | % |

Aftermarket Products (including replacement part sales to the Company’s OEM’s) |

|

| 30 | % |

| 29 | % |

| 30 | % |

Industrial Products segment |

|

|

|

|

|

|

|

|

|

|

Industrial Filtration Solutions Products |

|

| 27 | % |

| 27 | % |

| 27 | % |

Gas Turbine Systems Products |

|

| 11 | % |

| 10 | % |

| 8 | % |

Special Applications Products |

|

| 8 | % |

| 8 | % |

| 8 | % |

Financial information about segment operations appears in Note J in the Notes to Consolidated Financial Statements on page 44.51.

The Company makes its annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to those reports, available free of charge through its website, at www.donaldson.com, as soon as reasonably practicable after it electronically files such material with (or furnishes such material to) the Securities and Exchange Commission. Also available on the Company’s website are various corporate governance documents, including the Company’s code of business conduct and ethics, corporate governance guidelines, Audit Committee charter, Human Resources Committee charter, and Corporate Governance Committee charter. These documents are available in print, free of charge to any shareholder who requests them. The information contained on the Company’s website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered to be part of this Form 10-K.

1

TheIn general, the Company’s business in aggregate isEngine and Industrial Products segments are not considered to be seasonal. AHowever, a number of ourthe Company’s end markets are dependent on the construction, agricultural and agriculturalpower generation industries, which are generally stronger in the second half of ourthe Company’s fiscal year.

Principal methods of competition in both the Engine Products and Industrial Products segments are technology, price, geographic coverage, service and product performance. The Company competes in a number of highly competitive filtration markets in both the Engine Products and Industrial Products segments. The Company believes it is a market leader inwith many of its primary product lines. The Company believes within the Engine Products segment it is a market leader in its Off-Road Equipment and On-Road Products lines for OEMs and is a significant participant in the aftermarket for replacement filters. The Engine Products segment’s principal competitors include several large global competitors and regional competitors, especially in the Engine Aftermarket Products business. The Industrial Products segment’s principal competitors vary from country to country and include several large regional orand global competitors and a significant number of smallsmaller competitors who compete in a limitedspecific geographical region or in a limited number of product applications.

The principal raw materials that the Company uses are steel, filter media and plastics. The Company believes within the Engine Products segment it ispurchases a market leader in its off-road equipment and truck product lines for OEMs and is a significant participant in the aftermarket for replacement filters and hard parts. The Engine Products segment’s principal competitors vary from country to country and include several large regional or global competitors, and small regional competitors, especially in the engine aftermarket businesses.

Although the Company experienced an increase in commodityvariety of types of steel. Commodity prices were high during the first half of the year, but decreased during the Company responded through a combination of cost reductions and by recovering a portion of these price increases from customers.second half such that the full year was comparable with Fiscal 2008. The Company experienced no other significant or unusualsupply problems in the purchase of its raw materials or commodities.materials. The Company typically has more than one sourcemultiple sources of supply for the raw materials essential to its business. The Company is not required to carry significant amounts of raw material inventory to meet rapid delivery demands or secure supplier allotments. However, the Company does stock limited amounts offinished goods inventory at its regional distribution centers in order to meet anticipated customerCustomer demand.

The Company owns various patents and trademarks, which it considers in the aggregate to constitute a valuable asset.asset, including patents and trademarks for products sold under the Ultra-Web®, PowerCore®, and Donaldson® trademarks. However, it does not regard the validity of any one patent or trademark as being of material importance.

There were no Customers that accounted for over 10 percent of net sales in Fiscal 2009. Sales to Caterpillar Inc. and its subsidiaries (“Caterpillar”) accounted for 12 percent of net sales in 2006 and 2005, respectively, and 10 percent of net sales in 2004.Fiscal 2008 and Fiscal 2007. Caterpillar has been a customer of the Company for many years and it purchases many models and types of products for a variety of applications. Sales to the U.S. Government do not constitute a material portion of the Company’s business. There were no customersCustomers over 10 percent of gross accounts receivable in 2006Fiscal 2009 or 2005.2008.

At August 31, 2006,2009, the backlog of orders expected to be delivered within 90 days was $291,011,000.$259,181,000. All of this backlog is expected to be shipped during Fiscal 2010. The 90-day backlog at August 31, 20052008, was $227,243,000.$415,078,000. Backlog is one of many indicators of business conditions in our market.the Company’s markets. However, it is not always indicative of future results for a number of reasons, including short lead times in our aftermarketthe Company’s replacement parts business and the timing of receipt of orders in many of our original equipmentthe Company’s Engine OEM and industrialIndustrial markets.

During 2006,Fiscal 2009, the Company spent $33,887,000$40,643,000 on research and development activities relatingactivities. Research and development expenses include basic scientific research and the application of scientific advances to the development of new and improved products or improvements of existing products or manufacturing processes.and their uses. The Company spent $32,234,000$43,757,000 in 2005Fiscal 2008 and $30,487,000$36,458,000 in 2004Fiscal 2007 on research and development activities. EssentiallySubstantially all commercial research and development is Company-sponsored.

2

Table of Contentsperformed in-house.

The Company does not anticipate any material effect on its capital expenditures, earnings or competitive position during fiscal 2007Fiscal 2010 due to compliance with government regulations involving environmental matters.regulating the discharge of materials into the environment or otherwise relating to the protection of the environment.

The Company employed approximately 11,500over 10,600 persons in worldwide operations as of August 31, 2006.2009.

Financial information about geographic areas appears in Note J of the Notes to Consolidated Financial Statements on page 44.51.

Item 1A. RISK FACTORSRisk Factors

There are inherent risks and uncertainties associated with our global operations that involve the design, manufacturing and sale of products for highly demanding customerCustomer applications throughout the world. TheThese risks and uncertainties associated with our business could adversely affect our operating performance orand financial condition. The following discussion, along with discussions elsewhere in this report, outlines the risks and uncertainties that we believe are the most material to our business. However, these are not the only risks or uncertainties that could affect our business. Therefore, the following is not intended to be a complete discussion of all potential risks or uncertainties.

Unfavorable fluctuations in foreign currency exchange rates could negatively impact our results of operations and financial position.

We have operations in many countries. Each of our subsidiaries reports its results of operations and financial position in its relevant foreign currency, which is then translated into United States dollars. The translated financial information is included in our consolidated financial statements. The strengtheningIn light of the United States dollarcurrent global economic slowdown, we want to further highlight the risks and uncertainties associated with: world economic factors; the reduction in comparisonsales volume and orders due to decreased global demand and Customers aggressively working to reduce their levels of inventory; increased governmental laws and regulations, including the foreign currenciesunprecedented financial actions being undertaken by governments around the world; a significant tightening of our subsidiaries could have a negative impact on our results of operationscredit availability; and potential global health outbreaks. We undertake no obligation to publicly update or financial position.revise any forward-looking statements.

Operating internationally carries risks which could negatively effectaffect our financial performance.

We have sales and manufacturing operations throughout the world, with the heaviest concentrations in North America, Europe and Asia. Our stability, growth and profitability are subject to a number of risks of doing business internationally that could harm our business, including:

• | political and military events, | |

• | legal and regulatory requirements, | |

• | tariffs and trade barriers, | |

• | potential difficulties in staffing and managing local operations, | |

• | credit risk of local | |

• | difficulties in protecting intellectual property, | |

• | local economic, political and social conditions, specifically in China and Thailand where we have significant investments, | |

• | potential global health outbreaks. |

Maintaining a competitive advantage requires continuing investment with uncertain returns.

We operate in highly competitive markets and have numerous competitors who may already be well established in those markets. We experience price pressures from these competitors in certain product lines and geographic markets. We expect our competitors to continue improving the design and performance of their products and to introduce new products that arecould be competitive in both price and performance. We believe that we have certain technological advantages over our competitors, but maintaining

3

these advantages requires us to continually invest in research and development, sales and marketing and customerCustomer service and support. There is no guarantee that we will be successful in maintaining these advantages. We are currently makingmake investments in emissions technology development to meet the changingnew technologies that address increased performance and regulatory requirements worldwide.around the globe. There is no guarantee that we will be successful in completing development or achieving sales of these products or that the margins on such products will be acceptable. Our financial performance may be negatively impacted if a competitor’s successful product innovation reaches the market before ours or gains broader market acceptance before our product offerings.acceptance.

A numberSeveral of our major OEM customersCustomers also manufacture component products for their own use.filtration systems. Although these OEM customersCustomers rely on us and other suppliers for othersome of their component products,filtration systems, they couldsometimes choose to manufacture additional component productsfiltration systems for their own use. There is also a risk that one of our customers woulda Customer could acquire one or more of our competitors.

We may be adversely impacted by changes in technology that could reduce or eliminate the demand for our products. We are at risk with respect to:These risks include:

• | breakthroughs in technology which provide a viable alternative to diesel | |

• | reduced demand for disk drive products if |

AcquisitionsWe participate in highly competitive markets with pricing pressure. If we are not able to compete effectively our margins and results of operations could be adversely affected.

The businesses and product lines in which we participate are very competitive and we risk losing business based on a wide range of factors, including technology, price, delivery, product performance and Customer service. Large Customers continue to seek productivity gains and lower prices from their suppliers. We may not necessarilylose business or negatively impact our margins if we are unable to deliver the best value to our Customers.

Demand for our products relies on economic and industrial conditions worldwide.

Demand for our products tends to respond to varying levels of construction, agricultural, mining and industrial activity in the United States and in other industrialized nations.

Sales to Caterpillar accounted for slightly less than 10 percent of our net sales in Fiscal 2009 and 10 percent of our net sales in Fiscal 2008. An adverse change in Caterpillar’s financial performance or a material reduction in our sales to Caterpillar could negatively impact our operating results.

Changes in our product mix impacts our financial performance.

We sell products that have varying profit margins. Our financial performance can be impacted depending on the mix of products we sell during a given period.

Unavailable or higher cost materials could result in our Customers being dissatisfied.

We obtain raw material, including steel, filter media and plastics, and other components from third-party suppliers and tend to carry limited raw material inventories. An unanticipated delay in delivery by our suppliers could result in the inability to deliver on-time and meet the expectations of our Customers. This could negatively affect our financial performance. An increase in commodity prices during a recession or an otherwise challenging business and economic environment could result in lower operating margins.

Difficulties with the Company’s information technology systems could adversely affect the Company’s results.

The Company has many information technology systems that are important to the operation of its businesses. The Company could encounter difficulties in developing new systems or maintaining and upgrading existing systems. Such difficulties could lead to significant expenses due to disruption in business operations and could adversely affect the Company’s results.

Unfavorable fluctuations in foreign currency exchange rates could negatively impact our results and financial position.

We have operations in many countries. Each of our subsidiaries reports its results of operations and financial position in its relevant foreign currency, which is then translated into U.S. dollars. This translated financial information is included in our consolidated financial statements. The strengthening of the U.S. dollar in comparison to the foreign currencies of our subsidiaries could have a positivenegative impact on our results and financial position.

Acquisitions may have an impact on our results.

We have made and continue to pursue acquisitions of complementary product lines, technologies and businesses.acquisitions. We cannot guarantee that these acquisitions will have a positive impact on our results. These acquisitions could negatively impact our profitability due to dilutive issuances of equity securities,operating and integration inefficiencies, the incurrence of debt, and contingent liabilities and amortization expenses related to intangible assets. There are also a number of other risks involved in acquisitions. For example, weWe could lose key existing Customers, have difficulties in assimilating the acquired operations, assume unanticipated legal liabilities or lose key employees of the acquired company.employees.

Compliance with environmental laws and regulations can be costly.

We are subject to many environmental laws and regulations in the jurisdictions in which we operate. We routinely incur product development capital and operating costs in order to comply with these laws and regulations. We may be adversely impacted by new or changing environmental laws and regulations that affect both our operations and our ability to develop and sell products that meet our customers’ product and performanceCustomers’ requirements.

Demand for our products relies on economic and industrial conditions worldwide.

Demand for certain of our products tends to be cyclical and responds to varying levels of construction, agricultural, mining and industrial activity in the United States and in other industrialized nations.

Sales to Caterpillar, Inc. and its subsidiaries have accounted for greater than 10 percent of our net sales in the past three fiscal years. An adverse change in Caterpillar’s financial performance or a material reduction in our sales to it could negatively impact our operating results.

Unavailable or higher cost materials could result in our customers being dissatisfied.

We obtain raw material and certain manufactured components from third-party suppliers and tend to carry limited raw material inventories. Even a brief unanticipated delay in delivery or increases in prices by our suppliers could result in the inability to satisfy our customers on delivery and pricing. This could negatively affect our financial performance.

Changes in our product mix impacts our financial performance.

We sell products in various product lines that have varying profit margins. Our financial performance can be impacted positively or negatively depending on the mix of products we sell during a given period as compared to a previous period.

Item 1B. UNRESOLVED STAFF COMMENTSUnresolved Staff Comments

None.

4

The Company’s principal office and research facilities are located in Bloomington, Minnesota, a suburb of Minneapolis, Minnesota. The principal European administrative and engineering offices are located in Leuven, Belgium. The Company also has extensive operations in Asia-Pacific.the Asia-Pacific region.

The Company’s principal plant activities are carried out in the United States and internationally. Following is a summary of the principal plants and other materially important physical properties owned or leased by the Company.

Americas |

| |

Auburn, Alabama (E) | Kadan, Czech Republic (I) | |

Riverbank, California (I)* | Klasterec, Czech Republic | |

Valencia, California (E)* | Domjean, France (E) | |

Dixon, Illinois | Paris, France (E) | |

Frankfort, Indiana | Dulmen, Germany (E) | |

Cresco, Iowa | Flensburg, Germany (I) | |

Grinnell, Iowa (E) | Haan, Germany (I) | |

Nicholasville, Kentucky | Ostiglia, Italy | |

Bloomington, Minnesota | Barcelona, Spain (I) | |

Chillicothe, Missouri (E) | Hull, United Kingdom | |

St. Charles, Missouri* (E) | Leicester, United Kingdom (I) | |

Philadelphia, Pennsylvania (I) | Cape Town, South Africa | |

Greeneville, Tennessee | Johannesburg, South Africa* | |

Baldwin, Wisconsin | ||

Stevens Point, Wisconsin | Australia | |

Sao Paulo, Brazil (E)* | Wyong, Australia | |

Athens, Canada (I) | ||

Aguascalientes, Mexico | Asia | |

Monterrey, Mexico | Hong Kong, China* | |

Wuxi, China | ||

Joint Venture Facilities | New Delhi, India | |

Most, Czech Republic (E) | Gunma, Japan | |

Champaign, Illinois (E) | Rayong, Thailand (I) | |

Jakarta, Indonesia | ||

Dammam, Saudi Arabia (I) | Third-Party Logistics Providers | |

Alsip, Illinois | ||

Distribution Centers | Plainfield, Indiana (I) | |

Brugge, Belgium | New Hampton, Iowa | |

Rensselaer, Indiana | Waterloo, Iowa (E) | |

Aguascalientes, Mexico | Greeneville, Tennessee (I) | |

Johannesburg, South | Singapore |

The Company’s properties are utilized for both the Engine and Industrial ProductProducts segments except as indicated with an (E) for Engine or (I) for Industrial. The Company also leases certain of its facilities, primarily under long-term leases, some of which provide for options to purchase theleases. The facilities at the end of the lease term. The denoted facilitieswith an asterisk (*) are leased facilities. In Wuxi, China, a portion of the operations are conducted in leased facilities. The Company’sCompany uses third-party logistics providers for some of its product distribution and neither leases nor owns the facilities. The Company considers its properties are considered to be suitable for their present purposes, well-maintained and in good operating condition.

Item 3. LEGAL PROCEEDINGSLegal Proceedings

In accordance with SFAS No. 5, “Accounting for Contingencies,” (SFAS No. 5), the Company records provisions with respect to identified claims or lawsuits when it is probable that a liability has been incurred and the amount of the loss can be reasonably estimated. Claims and lawsuits are reviewed quarterly and provisions are taken or adjusted to reflect the status of a particular matter. The Company isbelieves the recorded reserves in its consolidated financial statements are adequate in light of the probable and estimable outcomes. Any recorded liabilities were not currently subject to any pending litigation other than litigation which arises out of and is incidentalmaterial to the conductCompany’s financial position, results of the Company’s business. All such matters are subject to many uncertaintiesoperation and outcomes that are not predictable with assurance. Theliquidity and the Company does not considerbelieve that any of such proceedings that arethe currently pending to be likely to result in a material adverse effect on the Company’s consolidatedidentified claims or litigation will materially affect its financial position, or results of operation.operation and liquidity.

Item 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERSSubmission of Matters to a Vote of Security Holders

No matters were submitted to a vote of security holders of the Company during the quarter ended July 31, 2006.

5

Table of Contents2009.

Executive Officers of the Registrant

Current information regarding executive officers is presented below. All terms of office are for one year. There are no arrangements or understandings between individual officers and any other person pursuant to which the officer was selected as an executive officer.

|

|

|

|

|

|

| |||||||

| Name | Age | Positions and Offices Held | First Year Elected or Appointed as an Executive Officer |

|

| Age |

| Positions and Offices Held |

| First Year Elected or | |||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Tod E. Carpenter | Tod E. Carpenter |

| 50 |

| Vice President, Europe and Middle East |

| 2008 | ||||||

|

|

|

|

| |||||||||

| William M. Cook | 53 | Chairman, President and Chief Executive Officer | 1994 | William M. Cook |

| 56 |

| Chairman, President and Chief Executive Officer |

| 1994 | |||

|

|

|

|

|

| ||||||||

Sandra N. Joppa | Sandra N. Joppa |

| 44 |

| Vice President, Human Resources |

| 2005 | ||||||

|

|

|

|

|

| ||||||||

Norman C. Linnell | Norman C. Linnell |

| 50 |

| Vice President, General Counsel and Secretary |

| 1996 | ||||||

|

|

|

|

|

| ||||||||

Charles J. McMurray | Charles J. McMurray |

| 55 |

| Senior Vice President, Industrial Products |

| 2003 | ||||||

|

|

|

|

|

| ||||||||

Mary Lynne Perushek | Mary Lynne Perushek |

| 51 |

| Vice President and Chief Information Officer |

| 2006 | ||||||

|

|

|

|

|

| ||||||||

Lowell F. Schwab | Lowell F. Schwab |

| 61 |

| Senior Vice President, Global Operations |

| 1994 | ||||||

|

|

|

|

|

| ||||||||

David W. Timm | David W. Timm |

| 56 |

| Vice President, Asia-Pacific |

| 2007 | ||||||

|

|

|

|

|

| ||||||||

| Thomas R. VerHage | 53 | Vice President and Chief Financial Officer | 2004 | Thomas R. VerHage |

| 56 |

| Vice President and Chief Financial Officer |

| 2004 | |||

| Norman C. Linnell | 47 | Vice President, General Counsel and Secretary | 1996 | ||||||||||

| Charles J. McMurray | 52 | Senior Vice President, Industrial Products, Technology and South Africa | 2003 | ||||||||||

| Lowell F. Schwab | 58 | Senior Vice President, Engine Systems and Parts | 1994 | ||||||||||

| William I. Vann | 61 | Vice President, NAFTA Operations and Mexico | 2004 | ||||||||||

| Geert Henk Touw | 60 | Senior Vice President, Asia-Pacific | 2004 | ||||||||||

| Sandra N. Joppa | 41 | Vice President, Human Resources, Communications and Facilities | 2005 | ||||||||||

|

|

|

|

|

| ||||||||

Jay L. Ward | Jay L. Ward |

| 45 |

| Senior Vice President, Engine Products |

| 2006 | ||||||

|

|

|

|

|

| ||||||||

Debra L. Wilfong | Debra L. Wilfong |

| 54 |

| Vice President and Chief Technology Officer |

| 2007 | ||||||

Mr. Carpenter joined the Company in 1996 and has held various positions, including Gas Turbine Systems General Manager from 2002 to 2004; General Manager, Industrial Filtration Systems (IFS) Sales from 2004 to 2006; General Manager, IFS Americas in 2006; and Vice President, Global IFS from 2006 to 2008. Mr. Carpenter was appointed Vice President, Europe and Middle East in August 2008.

Mr. Cook joined the Company in 1980 and has held various positions, including CFO and Senior Vice President, International from 2001 to 2004 and President and CEO from 2004 to 2005. Mr. Cook was appointed Chairman, President and CEO in July 2005.

Ms. Joppa was appointed Vice President, Human Resources and Communications in November 2005. Prior to that time Ms. Joppa held various positions at General Mills, a consumer food products company, from 1989 to 2005, including service as Director of Human Resources for several different operating divisions from 1999 to 2005.

Mr. Linnell joined the Company in 1996 as General Counsel and Secretary and was appointed Vice President, General Counsel and Secretary in 2000.

Mr. McMurray joined the Company in 1980 and has held various positions, including Director, Global Information Technology from 2001 to 2003; Vice President, Human Resources from 2004 to 2005; and Vice President, Information Technology, Europe, South Africa and Mexico from 2005 to 2006. Mr. McMurray became Senior Vice President, Industrial Products, in September 2006.

Ms. Perushek was appointed Vice President and Chief Information Officer in November 2006. Prior to that time, Ms. Perushek was Vice President of Global Information Technology at H.B. Fuller Company, a worldwide manufacturer of adhesive products, from 2005 to 2006 and Chief Information Officer for Young America Corporation, a marketing company, from 1999 to 2004.

Mr. Schwab each has served as an officer ofjoined the Company duringin 1977 and has held various positions, including Senior Vice President, Operations from 1994 to 2004 and Senior Vice President, Engine Products from 2004 to 2008. Mr. Schwab was appointed Senior Vice President, Global Operations, in August 2008.

Mr. Timm joined the past five years.Company in 1983 and has held various positions, including General Manager, Disk Drive from 1995 to 2005 and General Manager, Gas Turbine Systems Products from 2005 to 2006. Mr. Timm was appointed Vice President, Asia-Pacific in December 2006.

Mr. VerHage was appointed Vice President and Chief Financial Officer in March 2004. Prior to that time, Mr. VerHage was a partner for Deloitte & Touche, LLP, an international accounting firm, from 2002 to 20042004.

Mr. Ward joined the Company in 1998 and prior to this a partner for Arthur Andersen, LLP, an international accounting firm, from 1987 to 2002. Mr. McMurray was appointed Vice President, Human Resources in September 2003 and was promoted to Vice President, Human Resources, Information Technology, Europe, South Africa and Mexico in August 2005. In September 2006, Mr. McMurray was promoted to Senior Vice President, Industrial Products, Technology, and South Africa. Mr. McMurray served ashas held various positions, including Director, of Information TechnologyOperations from 2001 to 2003. Mr. Vann was appointed2003; Director, Product and Business Development, IFS Group from 2003 to 2004; Managing Director, Europe from 2004 to 2006; and Vice President, Operations in May 2004Europe and priorMiddle East from 2006 to that served as General Manager of Industrial Air Filtration from 2000 to 2004.2008. Mr. TouwWard was appointed Senior Vice President, Asia-PacificEngine Products in November 2004 and prior to that served as Vice President and General Manager of Donaldson Europe, Middle East and South Africa from 2000 to 2004.August 2008.

Ms. JoppaWilfong was appointed Vice President Human Resources and CommunicationsChief Technology Officer in November 2005.May 2007. Prior to that time, Ms. Joppa was a Director of Human ResourcesWilfong held various director positions in research and development at General Mills, a3M Company, an international consumer food products company, from 19992000 to 2005. In September2007, most recently as Director, Research and Development for the 3M Automotive Division from 2006 James R. Giertz resigned his position as an executive officer of the Company to accept a position with Residential Capital Corporation.2007.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The common shares of the Company are traded on the New York Stock Exchange under the symbol DCI. The amount and frequency of all cash dividends declared on the Company’s common stock for 2006Fiscal 2009 and 20052008 appear in Note LN of the Notes to Consolidated Financial Statements on page 48. Also see Note D on page 33 for restrictions on payment of dividends.55. As of September 30, 2006,23, 2009, there were 1,9052,109 shareholders of record of common stock.

6

The low and high sales prices for the Company’s common stock for each full quarterly period during 2006Fiscal 2009 and 20052008 were as follows:

First Quarter | Second Quarter | Third Quarter | Fourth Quarter | |||||

Fiscal 2008 | $ | $ | $ | $ | ||||

Fiscal 2009 | $28.04 — 49.00 | $23.40 — 36.29 | $21.82 — 34.37 | $31.00 — 38.93 |

The following table sets forth information in connection with purchases made by, or on behalf of, the Company or any affiliated purchaser of the Company, of shares of the Company’s common stock during the quarterly period ended July 31, 2006.2009.

| Period | Total Number of Shares Purchased(1) | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| May 1-May 31, 2006 | — | — | — | 7,596,800 | ||||||||||||||

| June 1-June 30, 2006 | 868,000 | $ | 31.94 | 868,000 | 6,728,800 | |||||||||||||

| July 1-July 31, 2006 | 567,290 | $ | 31.94 | 566,800 | 6,162,000 | |||||||||||||

| Total | 1,435,290 | $ | 31.94 | 1,434,800 | 6,162,000 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period |

| Total Number of |

| Average Price |

| Total Number of |

| Maximum Number |

| |||||

May 1-May 31, 2009 |

|

| — |

|

| — |

|

| — |

|

| 930,210 |

| |

June 1-June 30, 2009 |

|

| 18,972 |

| $ | 36.12 |

|

| — |

|

| 930,210 |

| |

July 1-July 31, 2009 |

|

| — |

|

| — |

|

| — |

|

| 930,210 |

| |

Total |

|

| 18,972 |

| $ | 36.12 |

|

| — |

|

| 930,210 |

| |

(1) | On March 31, 2006, the Company announced that the Board of Directors authorized the repurchase of up to 8.0 million shares of common stock. This repurchase authorization, which is effective until terminated by the Board of Directors, replaced the existing authority that was authorized on January 17, 2003. There were no repurchases of common stock made outside of the Company’s current repurchase authorization during the quarter ended July 31, | |

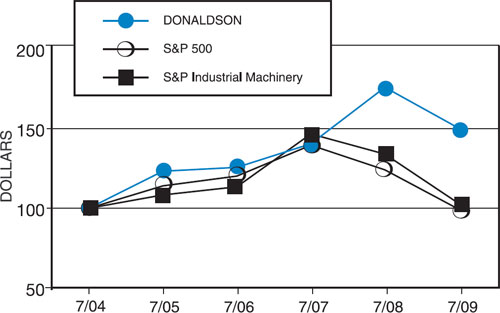

The graph below compares the cumulative total stockholder return on the Company’s Common Stock for the last five fiscal years with the cumulative total return of the Standard & Poor’s 500 Stock Index and the Standard & Poor’s Index of Industrial Machinery Companies. The graph and table assume the investment of $100 in each of the Company’s Common Stock and the specified indexes at the beginning of the applicable period, and assume the reinvestment of all dividends.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

Among Donaldson Company, Inc., The S&P 500 Index

And The S&P Industrial Machinery Index

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year ended July 31, |

| ||||||||||||||||

|

| 2009 |

| 2008 |

| 2007 |

| 2006 |

| 2005 |

| 2004 |

| ||||||

Donaldson Company, Inc. |

| $ | 150.18 |

| $ | 175.88 |

| $ | 140.46 |

| $ | 125.67 |

| $ | 123.27 |

| $ | 100.00 |

|

S&P 500 |

|

| 99.33 |

|

| 124.10 |

|

| 139.58 |

|

| 120.19 |

|

| 114.05 |

|

| 100.00 |

|

S&P Industrial Machinery |

|

| 102.93 |

|

| 133.98 |

|

| 146.65 |

|

| 113.48 |

|

| 108.37 |

|

| 100.00 |

|

Item 6. SELECTED FINANCIAL DATASelected Financial Data

The informationfollowing table sets fourth selected financial data for the years 2002 through 2006 on page 8each of the 2006 Annual Report to Shareholders is incorporated herein by reference.fiscal years in the five-year period ended July 31, 2009 (in millions, except per share data):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year ended July 31, |

| |||||||||||||

|

| 2009 |

| 2008 |

| 2007 |

| 2006 |

| 2005 |

| |||||

Net sales |

| $ | 1,868.6 |

| $ | 2,232.5 |

| $ | 1,918.8 |

| $ | 1,694.3 |

| $ | 1,595.7 |

|

Income from continuing operations |

|

| 131.9 |

|

| 172.0 |

|

| 150.7 |

|

| 132.3 |

|

| 110.6 |

|

Diluted earnings per share |

|

| 1.67 |

|

| 2.12 |

|

| 1.83 |

|

| 1.55 |

|

| 1.27 |

|

Total assets |

|

| 1,334.0 |

|

| 1,548.6 |

|

| 1,319.0 |

|

| 1,124.1 |

|

| 1,111.8 |

|

Long-term obligations |

|

| 253.7 |

|

| 176.5 |

|

| 129.0 |

|

| 100.5 |

|

| 103.3 |

|

Cash dividends declared per share |

|

| 0.460 |

|

| 0.430 |

|

| 0.370 |

|

| 0.410 |

|

| 0.180 |

|

Cash dividends paid per share |

|

| 0.455 |

|

| 0.420 |

|

| 0.360 |

|

| 0.320 |

|

| 0.235 |

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation

Results of Operation

The following discussion of the Company’s financial condition and results of operations should be read in conjunction with the Consolidated Financial Statements and Notes thereto and other financial information included elsewhere in this report.

Overview

The Company manufactures and distributes filtration systems and replacement parts. The Company’s core strengths are leading filtration technology, strong customerCustomer relationships and global presence. The Company operates through two reporting segments, Engine Products and Industrial Products, and has a product mix including air and liquid filters and exhaust and emission control products. As a worldwide business, the Company’s results of operations are affected by conditions in the global industrial and economic factors. Theenvironment. Under normal economic conditions, the Company’s diversity between its original equipment and replacement parts customers,Customers, its diesel engine and industrial end markets, and its North American and international end markets has helped to limit the impact of these factorsweakness in any one product line, market or geography on the consolidated results of the Company. The continued strong demand in most ofHowever, the global recession had a dramatic negative impact on the Company’s end markets drove record earningsresults in fiscal 2006.Fiscal 2009 as nearly every product group and geographic area was impacted.

The Company reported record sales in 2006Fiscal 2009 of $1.694 billion, up 6.2$1,868.6 million, down 16.3 percent from $1.596 billion$2,233.5 million in the prior year. The Company’s results were negatively impacted by foreign currency translation for the year.translation. The impact of foreign currency translation during the year decreased sales by $25.3$76.8 million. Excluding the current year impact of foreign currency translation, worldwide sales increased 7.8decreased 12.9 percent during the year.

7

Although net sales excluding foreign currency translation is not a measure of financial performance under GAAP, the Company believes it is useful in understanding its financial results and provides a comparable measure for understanding the operating results of the Company’s foreign entitiesCompany between different fiscal periods excluding the impact of foreign currency translation. FollowingThe following is a reconciliation to the most comparable GAAP financial measure of this non-GAAP financial measure (in millions):

| July 31, 2006 | July 31, 2005 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Net sales, excluding foreign currency translation | $ | 1,719.6 | $ | 1,561.6 | ||||||

| Current year foreign currency translation impact | (25.3 | ) | 34.1 | |||||||

| Net sales | $ | 1,694.3 | $ | 1,595.7 | ||||||

Commodity prices continued to impact the Company during the year. These cost pressures were effectively offset by cost reduction programs, improved production efficiencies and selective price adjustments. Gross margin of 32.9 percent was up from the gross margin of 31.7 percent in the prior year.

Operating expenses as a percent of net sales in fiscal 2006 were 21.5 percent, down from 21.9 percent in the prior year. Operating expenses in fiscal 2006 included $2.8 million of stock option expense that was not included in fiscal 2005. However, operating expenses in fiscal 2005 included $6.4 million, or $.05 per share, related to the ruling of the Federal Circuit on the patent litigation between the Company and Engineered Products Company, Inc. (“EPC”).

|

|

|

|

|

|

|

|

|

| July 31, |

| July 31, |

| ||

Net sales, excluding foreign currency translation |

| $ | 1,945.4 |

| $ | 2,110.0 |

|

Foreign currency translation impact |

|

| (76.8 | ) |

| 122.5 | |

Net sales |

| $ | 1,868.6 | $ | 2,232.5 | ||

Although not as significantlarge as the impact on net sales, the Company’s net earnings were also negatively impacted by foreign currency translation for the year.translation. The impact of foreign currency translation during the year decreased net earnings by $0.8$3.8 million. Excluding the current year impact of foreign currency translation, net earnings increased 20.4 percent during the year.decreased 21.1 percent.

Although net earnings excluding foreign currency translation is not a measure of financial performance under GAAP, the Company believes it is useful in understanding its financial results and provides a comparable measure for understanding the operating results of the Company’s foreign entitiesCompany between different fiscal periods excluding the impact of foreign currency translation. FollowingThe following is a reconciliation to the most comparable GAAP financial measure of this non-GAAP financial measure (in millions):

| July 31, 2006 | July 31, 2005 |

|

|

|

|

|

|

| |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| July 31, |

| July 31, |

| |||||||||||||

| Net earnings, excluding foreign currency translation | $ | 133.1 | $ | 108.6 |

| $ | 135.7 |

| $ | 159.1 |

| ||||||

| Current year foreign currency translation impact, net of tax | (0.8 | ) | 2.0 | ||||||||||||||

Foreign currency translation impact, net of tax |

|

| (3.8 | ) |

| 12.9 | |||||||||||

| Net earnings | $ | 132.3 | $ | 110.6 |

| $ | 131.9 | $ | 172.0 | ||||||||

The Company reported record diluted earnings per share of $1.55,$1.67, a 22.121.2 percent increasedecrease from $1.27$2.12 in the prior year.

During fiscal 2006,Included in the Company’s Engine Products segment increased slightlyresults are pre-tax restructuring charges of $17.8 million resulting primarily from workforce reductions of 2,800 since the prior year as a percentbeginning of total net sales at 58.5the year. Gross margin and operating expenses include $10.1 million and $7.7 million of restructuring expenses, respectively. The Company also realized $43.0 million in cost savings from restructuring actions completed throughout the year.

The effective tax rate for Fiscal 2009 was 18.3 percent compared to 57.927.2 percent in Fiscal 2008. This decrease is attributable to a number of discrete tax items, partially offset by increased expense from the prior year. Forrepatriation of foreign earnings. Absent these items, the underlying tax rate for the Fiscal 2009 has decreased

from Fiscal 2008 by 1.2 points to 30.4 percent. The reinstatement of the U.S. Research and Experimentation credit, changes in current year unrecognized tax benefits, reduced statutory tax rates and the mix of earnings between foreign jurisdictions all contributed to the reduction in the underlying rate.

The Company continued to improve an already strong liquidity position which allowed for continued investment in business and debt reduction while increasing cash reserves and maintaining its dividend. While Fiscal 2009 was significantly impacted by the global recession, there are signs that some of the Company’s Industrial Products segment, percent of total net sales decreased slightlyend markets have begun to 41.5 percent from 42.1 percent instabilize. While the prior year. The comparable sales percentages reflectCompany’s future visibility remains limited and it’s too early to call a recovery, the strength inCompany believes that the conditions in the markets that both segments serve and the continued strong demand in mostworst of the global economic downturn is behind it in many of its early and mid-cycle end markets, in each segment.including the heavy truck, construction, special applications and replacement parts markets. This view is factored into the Fiscal 2010 outlook discussed below.

Following is financial information for the Company’s Engine Products and Industrial Products segments. Corporate and Unallocated includes corporate expenses determined to be non-allocable to the segments and interest income and expense, non-operating income and expense and expenses not allocated to the business segments in the same period. During the first quarter of 2006, the Company adjusted its basis of measurement for earnings before income taxes such that certain expenses, such as amortization of intangibles, which were previously considered to be Corporate and Unallocated, are now included in the Engine and Industrial Products segment results. The impact of the change in the basis of measurement resulted in approximately $16.0 million of Corporate and Unallocated expenses being charged to

8

the Engine and Industrial Products segments’ aggregate earnings before income taxes in fiscal 2006 as compared to fiscal 2005. This change resulted in approximately $8.0 million of additional expense to each of the Engine and Industrial Products segments during fiscal 2006. This adjustment to the basis of measurement of segment earnings did not change the business components included in each of the Company’s reportable segments.expense. See further discussion of segment information in Note J of the Company’s Notes to Consolidated Financial Statements.

| Engine Products | Industrial Products | Corporate & Unallocated | Total Company |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Engine |

| Industrial |

| Corporate & |

| Total |

| ||||||||||||||||||||||||

| (thousands of dollars) |

| (thousands of dollars) |

| |||||||||||||||||||||||||||||

| 2006 | ||||||||||||||||||||||||||||||||

2009 |

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

| Net sales | $ | 991,554 | $ | 702,773 | $ | — | $ | 1,694,327 |

| $ | 1,001,961 |

| $ | 866,668 |

| $ | — |

| $ | 1,868,629 |

| |||||||||||

| Earnings before income taxes | 135,994 | 65,550 | (12,377 | ) | 189,167 |

| 83,797 |

| 89,526 |

| (11,898 | ) |

| 161,425 |

| |||||||||||||||||

| 2005 | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

2008 |

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

| Net sales | $ | 923,840 | $ | 671,893 | $ | — | $ | 1,595,733 |

| $ | 1,229,171 |

| $ | 1,003,350 |

| $ | — |

| $ | 2,232,521 |

| |||||||||||

| Earnings before income taxes | 125,454 | 53,709 | (24,430 | ) | 154,733 |

| 158,931 |

| 102,420 |

| (25,188 | ) |

| 236,163 |

| |||||||||||||||||

| 2004 | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

2007 |

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

| Net sales | $ | 811,543 | $ | 603,437 | $ | — | $ | 1,414,980 |

| $ | 1,084,262 |

| $ | 834,566 |

| $ | — |

| $ | 1,918,828 |

| |||||||||||

| Earnings before income taxes | 114,662 | 42,985 | (15,811 | ) | 141,836 |

| 140,762 |

| 80,321 |

| (16,222 | ) |

| 204,861 |

| |||||||||||||||||

During Fiscal 2009, the Company’s Engine Products segment net sales decreased as a percent of total net sales to 53.6 percent compared to 55.1 percent in the prior year. For the Company’s Industrial Products segment, net sales as a percent of total net sales increased to 46.4 percent from 44.9 percent in the prior year.

Factors within the Company’s reporting segments that contributed to the Company’s results for fiscal 2006Fiscal 2009 included strong business conditions acrossa significant impact from the products withinCompany’s distributors and OEM customers aggressively working down their inventory levels. In the Engine Products segment, worldwide. North American heavy truck build rates remained at record levels. Strengththe Company experienced weak business conditions in newmost end markets and regions. Spending in the construction and mining equipment spurredend-markets in the United States, Europe and Asia was down, resulting in a decrease in off-road equipment related sales. This decrease was partially offset by an increase in Aerospace and Defense sales worldwide. Additionally,and the benefit of the acquisition of Western Filter Corporation in October 2008. On-road Products sales decreased in the United States, Europe and Asia due to a drop in demand for new trucks, which lowered new truck build rates. Aftermarket sales also decreased due to decreases in equipment utilization rates remained strongin most off-road end markets and decreased freight activity which impacted on-road markets, partially offset by increases in retrofit emissions sales of diesel emission retrofit equipment continued to ramp up throughoutin the year, driving aftermarket parts sales growth.United States. In the Industrial Products segment, improvement initiatives, higher volumes anddemand was also weak in all markets across all regions. Demand for Industrial Filtration Solutions Products was down as a focus on selling more replacement parts droveresult of the decline in general industrial activity. Also contributing to the decrease in Industrial Filtration Solutions Products sales growthwas the sale of the air dryer business in Maryville, Tennessee, in October 2008, partially offset by the Company’s industrial filtration solutions products.benefit from the acquisition of LMC West, Inc. in February of 2008. Worldwide sales in gas turbine productsGas Turbine Products weakened late in the year and full year sales were higher thanslightly lower as compared to the prior yearyear. Gas Turbine Products sales are typically large systems and, as business conditions in that market begana result, the Company’s shipments and revenues fluctuate from quarter to strengthen, specifically in the Middle East, Asia and parts of Africa.quarter. Sales of special application productsSpecial Applications Products were strong with continued strongweak due to decreased demand for computer hard drivessemiconductor fabrications and other consumer electronics impactingindustrial uses for PTFE membranes and a sudden contraction of the disk drive market that resulted in decreased demand for the Company’s special application products sales.hard disk drive filters.

Following are net sales by product within both the Engine Products segment and Industrial Products segment:segments:

| 2006 | 2005 | 2004 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (thousands of dollars) | |||||||||||||||

| Engine Products segment: | |||||||||||||||

| Off-road products | $ | 308,175 | $ | 286,230 | $ | 244,749 | |||||||||

| Truck products | 184,303 | 175,048 | 156,373 | ||||||||||||

| Aftermarket products* | 499,076 | 462,562 | 410,421 | ||||||||||||

| Total Engine Products segment | 991,554 | 923,840 | 811,543 | ||||||||||||

| Industrial Products segment: | |||||||||||||||

| Industrial filtration solutions | 440,230 | 424,727 | 370,095 | ||||||||||||

| Gas turbine products | 121,194 | 112,872 | 117,705 | ||||||||||||

| Special application products | 141,349 | 134,294 | 115,637 | ||||||||||||

| Total Industrial Products segment | 702,773 | 671,893 | 603,437 | ||||||||||||

| Total Company | $ | 1,694,327 | $ | 1,595,733 | $ | 1,414,980 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| 2009 |

| 2008 |

| 2007 |

| |||

|

| (thousands of dollars) |

| |||||||

Engine Products segment: |

|

|

|

|

|

|

|

|

|

|

Off-Road Products* |

| $ | 362,785 |

| $ | 448,681 |

| $ | 352,065 |

|

On-Road Products |

|

| 71,958 |

|

| 123,146 |

|

| 166,370 |

|

Aftermarket Products** |

|

| 567,218 |

|

| 657,344 |

|

| 565,827 |

|

Total Engine Products segment |

|

| 1,001,961 |

|

| 1,229,171 |

|

| 1,084,262 |

|

Industrial Products segment: |

|

|

|

|

|

|

|

|

|

|

Industrial Filtration Solutions Products |

|

| 503,611 |

|

| 600,526 |

|

| 515,022 |

|

Gas Turbine Products |

|

| 206,760 |

|

| 213,138 |

|

| 158,025 |

|

Special Applications Products |

|

| 156,297 |

|

| 189,686 |

|

| 161,519 |

|

Total Industrial Products segment |

| 866,668 | 1,003,350 | 834,566 | ||||||

Total Company |

| $ | 1,868,629 | $ | 2,232,521 | $ | 1,918,828 | |||

* | Includes Aerospace and Defense products. | |

** | Includes replacement part sales to | |

Outlook

While it appears that conditions may have stabilized at many of the Company’s Customers and in many of its end markets, the Company continues to have limited visibility into the future. Consequently, the Company remains cautious in the near-term about forecasting a return to growth.

• | The Company is planning its total Fiscal 2010 sales to be between $1.65 and $1.75 billion, or approximately the pace of the past two quarters. For the full year Fiscal 2010 versus Fiscal 2009, sales are projected to be down 6 to 12 percent. Foreign currency translation is expected to provide a small benefit based on the Company’s planned rates for the Euro of US$1.39 and 98 Yen to the US Dollar for Fiscal 2010. | |

• | The Company did not complete all of its planned restructuring actions by the end of the fourth quarter of Fiscal 2009 and anticipates there could be additional restructuring charges of up to $17 million in Fiscal 2010. Including these costs, the full year Fiscal 2010 operating margin is still expected to be between 9.5 to 10.5 percent. | |

• | The Company expects its full year Fiscal 2010 tax rate to be between 30 and 32 percent. The Company does not anticipate significant discrete tax benefits as occurred in Fiscal 2009. | |

• | The Company expects that cash generated by operating activities will exceed $150 million in Fiscal 2010. Capital spending in Fiscal 2010 is planned at $30.0 million to $40.0 million. The Company will continue to use its cash flow for dividends, potential acquisitions, capital projects and maintenance of its strong liquidity position. |

OutlookEngine Products– The Company expects mid single-digitfull year sales growth in fiscal 2007 for sales in its Engine Products segment. North American heavy-duty truck build rates are expected to remain at their current high levels through calendar 2006 as truck manufacturers are near capacity. Build rates are thendecrease 3 to 8 percent, inclusive of the impact of foreign currency translation.

• | In its On-Road Products businesses, the Company believes that global build rates for heavy- and medium-duty trucks are stabilizing at the current levels. | |

• | The Company is forecasting slightly lower sales for its Aerospace and Defense Products as the level of Customer demand for defense products is decreasing. | |

• | The Company expects activity in the global construction and mining end markets to remain at their current levels during the first half of Fiscal 2010, and anticipates Customer demand in the farm equipment market outside of North America to continue its current decline. | |

• | The Company’s Aftermarket sales are expected to improve slightly from their current levels as utilization rates for both heavy trucks and off-road equipment are stabilizing. The Company expects |

9

to benefit from the increasing amount of equipment in the field with PowerCore® technology as well as its other proprietary filtration systems. |

expectedIndustrial Products– The Company forecasts full year Fiscal 2010 sales to decrease resulting in a decrease in sales of approximately $30 million11 to $35 million in the second half of fiscal 2007 as compared to the second half of 2006 as a result16 percent, inclusive of the implementationimpact of the new diesel emissions standards. Strong worldwide conditions are expected to continue in the production of new construction and mining equipment. Aftermarket sales are expected to grow with continued strong equipment utilization, ongoing growth by our OEM customers of their replacement parts business and the increasing amount of equipment in the field with the Company’s PowerCore™ filtration systems. The Company expects sales growth in fiscal 2007 for its Industrial Products segment to be in the low double-digits. Industrial filtration solutions sales growth is expected to continue with healthy global industrial conditions. Globally, the Company expects full-year gas turbine sales to continue rebounding with sales increasing approximately 20 percent. Market conditions for special applications products are expected to remain strong.foreign currency translation.

• | Industrial Filtration Solutions sales are projected to decrease 10 to 15 percent for the year due to difficult comparable sales in the first half of Fiscal 2010. The Company expects general manufacturing activity to remain near its current level. | |

• | The Company expects full year sales of its Gas Turbine Products to decrease 21 to 26 percent due the slowdown in demand for large power generation projects. | |

• | Special Applications Products’ sales are projected to be flat to down 5 percent, as conditions appear to have stabilized in the hard disk drive market but may continue to weaken in the short-term in the Company’s membrane products’ industrial end-markets. |

Fiscal 20062009 Compared to Fiscal 20052008

Engine Products SegmentThe Engine Products segment sells to OEMs in the construction, mining, agriculture, aerospace, defense, and transportationtruck markets and to independent distributors, OEM dealer networks, private label accounts and large equipment fleets. Products include air intakefiltration systems, exhaust and emissions systems, liquid filtration systems and replacement filters.

Sales for the Engine Products segment were $991.6$1,002.0 million, an increasea decrease of 7.318.5 percent from $923.8$1,229.2 million in the prior year, reflecting increasedyear. International Engine Products sales across all products within this segment bothdecreased 24.3 percent and sales in the United States and internationally.

Withindecreased 12.4 percent from the prior year. The impact of foreign currency decreased sales by $38.9 million, or 3.2 percent. Earnings before income taxes as a percentage of Engine Products segment worldwide sales of off-road products8.4 percent decreased from 12.9 percent in the prior year. The Engine Products segment has been negatively impacted by lower absorption of fixed manufacturing costs due to the drop in sales volumes and increased costs related to restructuring, offset by cost savings as a result of workforce reductions already completed, improved distribution efficiencies as compared to the prior year and the impact of cost control measures including reductions in incentive compensation.

Worldwide sales of Off-Road Products were $308.2$362.8 million, an increasea decrease of 7.719.1 percent from $286.2$448.7 million in the prior year. Sales in the United States showed an increase of 5.8 percentdecreased 7.2 percent. Global mining activity started declining due to decreased commodity prices in the second quarter of Fiscal 2009, and remained weak throughout the remainder of the year. Spending in U.S. residential and non-residential construction markets was down more than 27 percent and 5 percent, respectively, over prior year, resulting in a decrease in the sales of the Company’s products into those markets. Domestic Aerospace and Defense sales benefited from the recent acquisition of Western Filter Corporation, which resulted in $15.4 million of incremental sales over the prior year, and continued improvements in new construction and mining equipment demand.strong demand for filters for military equipment. Internationally, sales of off-road productsOff-Road Products were up 9.9down 31.3 percent from the prior year, with sales increasingdecreasing in both Europe and Asia and Europe by 14.032.5 percent and 8.429.5 percent, respectively, reflecting the strengthrespectively. Sales in the off-roadEuropean construction equipment end market internationally.decreased due to a decline in construction activity related to the economic downturn. Sales to the European agricultural end market also decreased. In Asia, sales have declined significantly in Japan in the construction end markets.

Worldwide sales of truck productsOn-Road Products were $184.3$72.0 million, an increasea decrease of 5.341.6 percent from $175.0$123.1 million in the prior year. Truck productsOn-Road Products sales in the United States increased 6.9decreased 43.2 percent from the prior year, due to record heavy truck build rates and strong diesel emission sales. International truck products sales increased 0.9 percent from the prior year. Strong sales in Europe resulted in an increase of 10.4 percent from stronger build rates and increased market share. Offsetting Europe’s increase was a decrease in sales in Asia of 5.9 percent primarily as a result of a 29 percent decrease in Class 8 truck build rates, 40 percent decrease in medium duty truck build rates by the weaker Japanese Yen.Company’s Customers and a reduction in high value product mix over the prior year. International On-Road Products sales decreased 39.6 percent from the prior year, driven by decreased sales in Europe and Asia of 51.0 percent and 32.5 percent, respectively, reflecting the current economic downturn for freight activity and new truck build rates.

Worldwide aftermarket productEngine Aftermarket Products sales of $499.1$567.2 million increased 7.9decreased 13.7 percent from $462.6$657.3 million in the prior year as equipment utilization rates remained high spurring demand for replacement filters.year. Sales in the United States increased 9.1decreased 9.5 percent over the prior year, while internationaldriven

by inventory adjustments at the Company’s Customers and decreases in utilization rates in the mining, construction and transportation industries, partially offset by increases in retrofit emission sales increased 6.5of $5.2 million. International sales decreased 17.4 percent withfrom the prior year, primarily driven by sales increasingdecreases in Europe and Asia and Mexico by 6.1 percent, 5.4of 26.1 percent and 25.78.0 percent, respectively.respectively, due to weak economic conditions.

Industrial Products SegmentThe Industrial Products segment sells to various industrial end-users, OEMs of gas-fired turbines, and OEMs and end-users requiring highly purified air. Products include dust, fume and mist collectors, compressed air purification systems, liquid filters and parts, static and pulse-clean air filter systems, PTFE membrane and laminates, and specialized air filtration systems for diverse applications including computer hard disk drives and PTFE membrane and laminates.drives.

Sales for the Industrial Products segment were $702.8$866.7 million, an increasea decrease of 4.613.6 percent from $671.9$1,003.4 million in the prior year resultingyear. International Industrial Products sales decreased 14.2 percent and sales in the United States decreased 12.3 percent from strongerthe prior year. The impact of foreign currency decreased sales by $37.9 million, or 3.8 percent. Despite the 13.6 percent decrease in sales, earnings before income taxes as a percentage of industrial filtration solutions, gas turbine products and special application products.

Within the Industrial Products segment worldwide sales of industrial filtration solutions products10.3 percent increased from 10.2 percent in the prior year. The improvement in earnings as a percent of $440.2sales over the prior year was driven by better execution on large project shipments, cost savings from restructuring actions and the impact of cost control measures including reductions in incentive compensation expense. These were slightly offset by lower absorption of fixed costs and restructuring costs.

Worldwide sales of Industrial Filtration Solutions Products of $503.6 million increased 3.6decreased 16.1 percent from $424.7$600.5 million in the prior year. Sales in the United States Asia, South Africa and Mexico increased 5.8 percent, 2.7 percent, 33.6Europe decreased 18.3 percent and 45.121.0 percent, respectively. Sales in Asia remained relatively flat as compared to the prior year. The decline in Europe was due to reduced demand for industrial dust collectors and compressed air purification systems which fell with the downturn in general manufacturing activity during the year. Domestic sales decreased 0.9 percent from the prior year reflecting stabilityas a result of this same decline in general industrial activity. The results in the market despiteyear were also influenced by the negative impactsale of foreign currency translation.

10

Tablethe air dryer business in Maryville, Tennessee, on October 31, 2008 and the acquisition of ContentsLMC West, Inc. (LMC West) in February of Fiscal 2008. The sale of the air dryer business in Maryville, Tennessee, decreased sales $7.6 million over last year. The acquisition of LMC West contributed to $7.0 million of sales during the twelve months of Fiscal 2009 and $4.7 million during the latter six months of Fiscal 2008.

Worldwide sales of gas turbine productsGas Turbine Products were $121.2$206.8 million, an increasea decrease of 7.43.0 percent from $112.9 million in the prior year as business conditions strengthened primarily toward the end of fiscal 2006.

Worldwide sales of special application products were $141.3 million, a 5.3 percent increase from $134.3$213.1 million in the prior year. SalesGas Turbine Products sales are typically large systems and, as a result, the Company’s shipments and revenues fluctuate from quarter to quarter. Incoming orders declined 58 percent in Fiscal 2009 versus Fiscal 2008, a reflection of the reduced demand for power generation projects globally. This trend is expected to continue in Fiscal 2010.

Worldwide sales of Special Applications Products were $156.3 million, a 17.6 percent decrease from $189.7 million in the United Statesprior year. Domestic Special Application Products sales decreased 16.910.0 percent. International sales of Special Application Products decreased 18.7 percent fromover the prior yearyear. The primary decreases internationally were in Europe and Asia, which decreased 25.5 and 17.3 percent, respectively, due to a significant reduction in demand for hard disk drive filters, semiconductor filtration systems and PTFE membrane filtration products. The reduction in demand is primarily to softnessa result of a worldwide contraction in the end markets served by our membrane product line while sales in Europe and Asia increased 13.4 percent and 8.5 percent from the prior year, respectively, due to strong demand for computer hard drivescomputers, data storage devices and other consumer electronics.electronic products that began in the second quarter of Fiscal 2009.

Consolidated ResultsThe Company reported record net earnings for 2006Fiscal 2009 of $132.3$131.9 million compared to $110.6$172.0 million in 2005, an increaseFiscal 2008, a decrease of 19.723.3 percent. Diluted net earnings per share was a record $1.55, up 22.1$1.67, down 21.2 percent from $1.27$2.12 in the prior year. The Company’s operating income of $192.8$170.0 million increaseddecreased from prior year operating income of $156.5$245.8 million by 23.230.9 percent. Operating income in

The table below shows the Engine Products segment as a percentpercentage of total operating income decreased to 67.7 percent from 77.4 percent incontributed by each segment for each of the prior year. Operating income in the Industrial Products segment as a percent of total operating income of 33.6 percent decreased from the prior year of 34.2 percent. This change is primarily attributable to the Company’s decision to adjust its basis of measurement for earnings before income taxes such that certain expenses, such as amortization of intangibles, which were previously considered to belast three fiscal years. Corporate and Unallocated are now included inincludes corporate expenses determined to be non-allocable to the Enginesegments and Industrial Products segment results. This adjustment is discussed further in Note J.interest income and expense:

|

|

|

|

|

|

|

|

|

|

|

|

| 2009 |

|

| 2008 |

|

| 2007 |

|

|

Engine Products |

| 44.5 | % |

| 61.1 | % |

| 62.9 | % |

|

Industrial Products |

| 51.8 | % |

| 42.1 | % |

| 37.8 | % |

|

Corporate and Unallocated |

| 3.7 | % |

| (3.2 | %) |

| (0.7 | %) |

|

Total Company |

| 100 | % |

| 100 | % |

| 100 | % |

|

International operating income, prior to corporate expense allocations, totaled 77.277.9 percent of consolidated operating income in 2006Fiscal 2009 as compared to 82.789.4 percent in 2005. Of the 2006 international operating income, prior to corporate expense allocations, Europe contributed 42.4 percent while Asia contributed 48.5 percent.Fiscal 2008. Total international operating income increased 15.0decreased 39.8 percent from the prior year. This increasedecrease is attributable to strong salesrestructuring charges internationally exceeding domestic restructuring costs, weaker foreign currencies and overall weak business conditions abroad. The table below shows the percentage of special application products and gas turbine systems.total operating income contributed by each major geographic region for each of the last three fiscal years:

|

|

|

|

|

|

|

|

|

|

|

|

| 2009 |

|

| 2008 |

|

| 2007 |

|

|

United States |

| 22.1 | % |

| 10.6 | % |

| 22.3 | % |

|

Europe |

| 23.3 | % |

| 43.3 | % |

| 34.8 | % |

|

Asia |

| 43.5 | % |

| 37.9 | % |

| 38.6 | % |

|

Other |

| 11.1 | % | 8.2 | % |

| 4.3 | % |

| |

Total Company |

| 100 | % |

| 100 | % |

| 100 | % |

|

Gross margin for 2006Fiscal 2009 was 32.931.6 percent, an increasea decrease from 31.732.5 percent in the prior year. The Company had $10.1 million in restructuring costs which reduced gross margin benefitedin the year. In addition, lower absorption of fixed costs due to the drop in production volumes, net of savings from completed restructuring related activities, negatively impacted gross margin by approximately $23 million. Partially offsetting these factors were the Company’s focus on cost reduction efforts, productionpositive impacts of improved product mix, improved distribution efficiencies and some selective price increases.better execution on large project shipments. During Fiscal 2008, the Company began using a new warehouse management system at its main U.S. distribution center. The company encountered start-up problems during the transition to the new systems which, although now resolved, resulted in $7.6 million in unanticipated charges in Fiscal 2008 that did not recur in Fiscal 2009. The Company continuedalso incurred a charge of approximately $5.0 million to pretax income related to the use of the Last-In, First-Out (LIFO) accounting method for its effortsU.S. inventories, which charges increasing commodity costs to improve manufacturing infrastructure and reduce productincome immediately. As commodity costs through plant rationalization. Plant rationalization and start-up costs for new facilities were $5.4 millionrelatively flat in 2006, upFiscal 2009, the Company did not experience a similar impact from the $4.0 million in the prior year.rising commodity prices.

Operating expenses for 2006Fiscal 2009 were $363.8$419.8 million or 21.522.5 percent of sales, up from $349.1as compared to $480.1 million or 21.921.5 percent in the prior year. Operating expenses as a percent of sales increased due to sales volume declines and $7.7 million in fiscal 2006 included $2.8restructuring cost during the year, offset by $19.4 million in benefits from restructuring actions taken and $19.5 million of stock optionlower incentive compensation expense that was not included in fiscal 2005. Operating expenses in fiscal 2005 included a $6.4 million increaseas compared to the prior year. The Company’s legal reserve for the EPC patent infringement judgment. The Company continued to focus on operating expense controlsreduction programs remain in 2006.effect.