DONALDSON COMPANY, INC.

ANNUAL REPORT ON FORM 10-K

|

|

|

| |||

|

|

| Page | |||

|

|

| ||||

| ||||||

| 1 | |||||

| ||||||

| 1 | |||||

| ||||||

|

| |||||

1 | ||||||

|

| 2 | ||||

| ||||||

| 2 | |||||

|

| 2 | ||||

| ||||||

| 2 | |||||

|

| 2 | ||||

| ||||||

|

| |||||

| ||||||

|

| |||||

| ||||||

|

| |||||

| ||||||

|

| |||||

2 | ||||||

| 3 | |||||

| 5 | |||||

| 5 | |||||

| 6 | |||||

|

|

| ||||

| ||||||

|

| |||||

|

| |||||

7 | ||||||

|

| |||||

10 | ||||||

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

| ||||

| ||||||

|

|

| ||||

23 | ||||||

|

| |||||

24 | ||||||

|

| |||||

25 | ||||||

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

| ||||

54 | ||||||

|

| |||||

54 | ||||||

|

| |||||

|

| |||||

55 | ||||||

|

| |||||

55 | ||||||

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

| ||||

55 | ||||||

Certain Relationships and Related Transactions, and Director Independence |

|

| ||||

56 | ||||||

|

| |||||

|

| |||||

| ||||||

|

| |||||

| ||||||

|

| |||||

| ||||||

|

| |||||

|

| |||||

|

| |||||

Donaldson Company, Inc. (“Donaldson” or the “Company”) was founded in 1915 and organized in its present corporate form under the laws of the State of Delaware in 1936.

The Company is a worldwide manufacturer of filtration systems and replacement parts. The Company’s product mix includes air and liquid filtration systems and exhaust and emission control products. Products are manufactured at 4039 plants around the world and through three joint ventures. The Company has two reporting segments: Engine Products and Industrial Products. Products in the Engine Products segment consist of air filtration systems, exhaust and emissions systems, liquid filtration systems, and replacement parts.filters. The Engine Products segment sells to original equipment manufacturers (“OEMs”) in the construction, mining, agriculture, aerospace, defense, and truck markets and to independent distributors, OEM dealer networks, independent distributors, private label accounts, and large equipment fleets. Products in the Industrial Products segment consist of dust, fume, and mist collectors, compressed air purification systems, liquidair filtration systems, air filter systems for gas turbines, PTFE membrane-based products, and specialized air filtration systems for diverse applications including computer hard disk drives. The Industrial Products segment sells to various industrial end-users, OEMs of gas-fired turbines and OEMs and end-users requiring clean air.

The table below shows the percentage of total net sales contributed by the principal classes of similar products for each of the last three fiscal years:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year Ended July 31 |

|

| Year Ended July 31, |

| ||||||||||||||

|

| 2009 |

| 2008 |

| 2007 |

|

| 2011 |

| 2010 |

| 2009 |

| ||||||

Engine Products segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Off-Road Equipment Products (including Aerospace and Defense products) |

| 20 | % |

| 20 | % |

| 18 | % | |||||||||||

Off-Road Products |

| 14 | % |

| 12 | % |

| 13 | % | |||||||||||

Aerospace and Defense Products |

| 5 | % |

| 6 | % |

| 6 | % | |||||||||||

On-Road Products |

| 4 | % |

| 6 | % |

| 9 | % |

| 5 | % |

| 4 | % |

| 4 | % | ||

Aftermarket Products (including replacement part sales to the Company’s OEM’s) |

| 30 | % |

| 29 | % |

| 30 | % | |||||||||||

Aftermarket Products* |

| 38 | % |

| 37 | % |

| 30 | % | |||||||||||

Retrofit Emissions Products |

| 1 | % |

| 1 | % |

| 2 | % | |||||||||||

*includes replacement part sales to the Company’s OEMs customers |

|

|

|

|

|

|

| |||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

Industrial Products segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Industrial Filtration Solutions Products |

| 27 | % |

| 27 | % |

| 27 | % |

| 22 | % |

| 22 | % |

| 26 | % | ||

Gas Turbine Systems Products |

| 11 | % |

| 10 | % |

| 8 | % | |||||||||||

Gas Turbine Products |

| 7 | % |

| 8 | % |

| 11 | % | |||||||||||

Special Applications Products |

| 8 | % |

| 8 | % |

| 8 | % |

| 8 | % |

| 10 | % |

| 8 | % | ||

Financial information about segment operations appears in Note JK in the Notes to Consolidated Financial Statements on page 51.49.

The Company makes its annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to those reports, available free of charge through its website, at www.donaldson.com, as soon as reasonably practicable after it electronically files such material with (or furnishes such material to) the Securities and Exchange Commission. Also available on the Company’s website are corporate governance documents, including the Company’s code of business conduct and ethics, corporate governance guidelines, Audit Committee charter, Human Resources Committee charter, and Corporate Governance Committee charter. These documents are available in print, free of charge to any shareholder who requests them. The information contained on the Company’s website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered to be part of this Form 10-K.

In general, the Company’s Engine and Industrial Products segments are not considered to be seasonal. However, aA number of the Company’s end markets are dependent on the construction, agricultural, and power generation industries, which are generally stronger in the second half of the Company’s fiscal year. The first two quarters of the fiscal year also contain the traditional summer and winter holiday periods, which are characterized by more Customer plant closures.

Principal methods of competition in both the Engine and Industrial Products segments are technology, price, geographic coverage, service, and product performance. The Company competes in a number of highly competitive filtration markets in both segments. The Company believes it is a market leader with many of its product lines. The Company believes within the Engine Products segment it is a market leader in its Off-Road Equipment and On-Road Products lines for OEMs and is a significant participant in the aftermarket for replacement filters. The Engine Products segment’s principal competitors include several large global competitors and many regional competitors, especially in the Engine Aftermarket Products business. The Industrial Products segment’s principal competitors vary from country to country and include several large regional and global competitors and a significant number of smaller competitors who compete in a specific geographical region or in a limited number of product applications.

The principal raw materials that the Company uses are steel, filter media, and plastics. The Company purchases a variety of types of steel. Commodity prices were high during the first half ofgenerally increased throughout the year, but decreasedthe impact was moderated by certain long term supply contracts. The Company anticipates a further impact from rising commodity prices in Fiscal 2012, as compared to Fiscal 2011, specifically for steel and media, as these supply contracts expired during the secondlatter half such that the full year was comparable withof Fiscal 2008.2011. The Company experienced no significant supply problems in the purchase of its major raw materials. The Company typically has multiple sources of supply for the raw materials essential to its business. The Companybusiness, and is not required to carry significant amounts of raw material inventory to secure supplier allotments. However, the Company does stock finished goods inventory at its regional distribution centers in order to meet anticipated Customer demand.

The Company owns various patents and trademarks, which it considers in the aggregate to constitute a valuable asset, including patents and trademarks for products sold under the Ultra-Web®, PowerCore®, and Donaldson® trademarks. However, it does not regard the validity of any one patent or trademark as being of material importance.

There were no Customers that accounted for over 10 percent of net sales in Fiscal 2011, 2010 or 2009. Sales to Caterpillar Inc. and its subsidiaries (“Caterpillar”) accounted for 10 percent of net sales in Fiscal 2008 and Fiscal 2007. Caterpillar has been a customer of the Company for many years and purchases many models and types of products for a variety of applications. Sales to the U.S. Government do not constitute a material portion of the Company’s business. There were no Customers over 10 percent of gross accounts receivable in Fiscal 20092011 or 2008.2010.

At August 31, 2009,2011, the backlog of orders expected to be delivered within 90 days was $259,181,000.$423.8 million. All of this backlog is expected to be shipped during Fiscal 2010.2012. The 90-day backlog at August 31, 2008,2010, was $415,078,000.$361.1 million. Backlog is one of many indicators of business conditions in the Company’s markets. However, it is not always indicative of future results for a number of reasons, including short lead times in the Company’s replacement parts businessbusinesses and the timing of orders in many of the Company’s Engine OEM and Industrial markets.

During Fiscal 2009,2011, the Company spent $40,643,000$55.3 million on research and development activities. Research and development expenses include basic scientific research and the application of scientific advances to the development of new and improved products and their uses. The Company spent $43,757,000$44.5 million and $40.6 million in Fiscal 20082010 and $36,458,000 in Fiscal 20072009, respectively, on research and development activities. Substantially all commercial research and development is performed in-house.

The Company does not anticipate any material effect on its capital expenditures, earnings, or competitive position during Fiscal 20102012 due to compliance with government regulations regulating the discharge of materials into the environment or otherwise relating to the protection of the environment.

The Company employed over 10,60013,000 persons in worldwide operations as of August 31, 2009.2011.

Financial information about geographic areas appears in Note JK of the Notes to Consolidated Financial Statements on page 51.49.

There are inherent risks and uncertainties associated with our global operations that involve the design, manufacturing and sale of products for highly demanding Customer applications throughout the world. These risks and uncertainties associated with our business could adversely affect our operating performance and financial condition. The following discussion, along with discussions elsewhere in this report, outlines the risks and uncertainties that we believe are the most material to our business. In light of the current global economic slowdown in recent years and the continued uncertainty, we want to further highlight the risks and uncertainties associated with: world economic factors;factors and the reduction in sales volume and orders due to decreased global demandongoing economic uncertainty that is impacting many regions of the world, the financial condition of our suppliers and Customers, aggressively workingthe potential for some Customers to reduceincrease their levelsreliance on their own filtration capabilities, currency fluctuations, commodity prices, political factors, the Company’s international operations, the possible reduced demand for hard disk drive products with the increased use of inventory; increasedflash memory, highly competitive markets, governmental laws and regulations, including the unprecedentedimpact of the various economic stimulus and financial actionsreform measures being undertakenimplemented by governments around the world; a significant tighteningworld, the implementation of credit availability; andour new information systems, potential global events resulting in instability and unpredictability in the world’s markets, including financial bailouts of sovereign nations, political changes, military and terrorist activities, health outbreaks. We undertakeoutbreaks, and other factors discussed below. The Company undertakes no obligation to publicly update or revise any forward-looking statements.statements, whether as a result of new information, future events or otherwise.

Operating internationally carries risks which could negatively affect our financial performance.

We have sales and manufacturing operations throughout the world, with the heaviest concentrations in North America, Europe and Asia. Our stability, growth, and profitability are subject to a number of risks of doing business internationally that could harm our business, including:

|

|

|

| • | political and military events, |

|

|

|

| • | legal and regulatory requirements, including import, export, |

|

|

|

| • | tariffs and trade barriers, |

|

|

|

| • | potential difficulties in staffing and managing local operations, |

|

|

|

| • | credit risk of local Customers and distributors, |

|

|

|

| • | difficulties in protecting intellectual property, |

|

|

|

| • | local economic, political and social conditions, specifically in China and Thailand where we have significant investments and |

|

|

|

| • | potential global health outbreaks. |

Maintaining a competitive advantage requires continuing investment with uncertain returns.

We operate in highly competitive markets and have numerous competitors who may already be well establishedwell-established in those markets. We expect our competitors to continue improving the design and performance of their products and to introduce new products that could be competitive in both price and performance. We believe that we have certain technological advantages over our competitors, but maintaining these advantages requires us to continually invest in research and development, sales and marketing, and Customer service and support. There is no guarantee that we will be successful in maintaining these advantages. We make investments in new technologies that address increased performance and regulatory requirements around the globe. There is no guarantee that we will be successful in completing development or achieving sales of these products or that the margins on such products will be acceptable. Our financial performance may be negatively impacted if a competitor’s successful product innovation reaches the market before ours or gains broader market acceptance.

SeveralA few of our major OEM Customers also manufacture filtration systems. Although these OEM Customers rely on us and other suppliers for some of their filtration systems, they sometimes choose to manufacture additional filtration systems for their own use. There is also a risk that a Customer could acquire one or more of our competitors.

We may be adversely impacted by changes in technology that could reduce or eliminate the demand for our products. These risks include:

|

|

|

| • | breakthroughs in technology which provide a viable alternative to diesel engines and |

|

|

|

| • | reduced demand for disk drive products |

We participate in highly competitive markets with pricing pressure. If we are not able to compete effectively our margins and results of operations could be adversely affected.

The businesses and product lines in which we participate are very competitive and we risk losing business based on a wide range of factors including technology, price, delivery,geographic coverage, product performance, and Customer service. Large Customers continue to seek productivity gains and lower prices from their suppliers. We may lose business or negatively impact our margins if we are unable to deliver the best value to our Customers.

Demand for our products relies on economic and industrial conditions worldwide.

Demand for our products tends to respond to varying levels of economic, construction, agricultural, mining, and industrial activity in the United States and in other industrialized nations.

Sales to Caterpillar accounted for slightly less than 10 percent of our net sales in Fiscal 20092011, 2010 and 10 percent of our net sales in Fiscal 2008.2009. An adverse change in Caterpillar’s financial performance or a material reduction in our sales to Caterpillar could negatively impact our operating results.

Changes in our product mix impacts our financial performance.

We sell products that have varying profit margins. Our financial performance can be impacted depending on the mix of products we sell during a given period.

Unavailable or higher cost materials could result inimpact our Customers being dissatisfied.financial performance.

We obtain raw material,materials including steel, filter media, and plastics, and other components from third-party suppliers and tend to carry limited raw material inventories. An unanticipated delay in delivery by our suppliers could result in the inability to deliver on-time and meet the expectations of our Customers. This could negatively affect our financial performance. An increase in commodity prices during a recession or an otherwise challenging business and economic environment could also result in lower operating margins.

Difficulties with the Company’s information technology systems could adversely affect the Company’sour results.

The Company has many information technology systems that are important to the operation of its businesses. The Company could encounter difficulties in developing new systems or maintaining and upgrading existing systems. Such difficulties could lead to significant expenses due to disruption in business operations and could adversely affect the Company’s results.

Unfavorable fluctuations in foreign currency exchange rates could negatively impact our results and financial position.

We have operations in many countries. Each of our subsidiaries reports its results of operations and financial position in its relevant foreign currency, which is then translated into U.S. dollars. This translated financial information is included in our consolidated financial statements. The strengthening of the U.S. dollar in comparison to the foreign currencies of our subsidiaries could have a negative impact on our results and financial position.

Acquisitions may have an impact on our results.

We have made and continue to pursue acquisitions. We cannot guarantee that these acquisitions will have a positive impact on our results. These acquisitions could negatively impact our profitability due to operating and integration inefficiencies, the incurrence of debt, contingent liabilities, and amortization expenses related to intangible assets. There are also a number of other risks involved in acquisitions. We could lose key existing Customers, have difficulties in assimilating the acquired operations, assume unanticipated legal liabilities, or lose key employees.

Compliance with environmental and product laws and regulations can be costly.

We are subject to many environmental laws and regulations in the jurisdictions in which we operate. We routinely incur costs in order to comply with these laws and regulations. We may be adversely impacted by new or changing laws and regulations that affect both our operations and our ability to develop and sell products that meet our Customers’ requirements.

Item 1B. Unresolved Staff Comments

None.

The Company’s principal administrative office and research facilities are located in Bloomington, Minnesota, a suburb of Minneapolis, Minnesota. The principal European administrative and engineering offices are located in Leuven, Belgium. The Company also has extensive operations in the Asia-Pacific region.

The Company’s principal plantmanufacturing and distribution activities are carried out inlocated throughout the United States and internationally. Followingworld. The following is a summary of the principal plants and other materially important physical properties owned or leased by the Company.

|

| |

Americas | Europe / Middle East / Africa | |

Auburn, Alabama (E) | Kadan, Czech Republic (I) | |

Riverbank, California (I)* | Klasterec, Czech Republic | |

Valencia, California (E)* | Domjean, France (E) | |

Dixon, Illinois | Paris, France (E)* | |

Frankfort, Indiana | Dulmen, Germany (E) | |

Cresco, Iowa | Flensburg, Germany (I) | |

Grinnell, Iowa (E) | Haan, Germany (I) | |

Nicholasville, Kentucky | Ostiglia, Italy | |

Bloomington, Minnesota |

| |

Chillicothe, Missouri (E) | Johannesburg, South Africa* | |

Chesterfield, Missouri (E)* | Hull, United Kingdom | |

| Philadelphia, Pennsylvania (I) | Leicester, United Kingdom (I) |

|

| |

Greeneville, Tennessee |

|

|

Baldwin, Wisconsin | Australia | |

Stevens Point, Wisconsin | Wyong, Australia | |

Sao Paulo, Brazil (E)* |

|

|

| Asia | |

Aguascalientes, Mexico |

| |

| Hong Kong, China* | |

Monterrey, Mexico (I) | Wuxi, China | |

|

| New Delhi, India |

| Joint Venture Facilities | Gunma, Japan |

Champaign, Illinois (E) | Rayong, Thailand (I) | |

Jakarta, Indonesia |

| |

Dammam, Saudi Arabia (I) | Third-Party Logistics Providers | |

|

| |

Distribution Centers | Wuxi, China | |

Wyong, Australia | Mumbai, India | |

Brugge, Belgium | Plainfield, Indiana (I) | |

|

| |

Rensselaer, Indiana | Gunma, Japan | |

Ostiglia, Italy |

| |

Aguascalientes, Mexico | Greeneville, Tennessee (I) | |

Johannesburg, South Africa |

|

|

The Company’s properties are utilized for both the Engine and Industrial Products segments except as indicated with an (E) for Engine or (I) for Industrial. The Company leases certain of its facilities, primarily under long-term leases. The facilities denoted with an asterisk (*) are leased facilities. In Wuxi, China and Bloomington, Minnesota a portion of the operationsactivities are conducted in leased facilities. The Company uses third-party logistics providers for some of its product distribution and neither leases nor owns the facilities. The Company considers its properties to be suitable for their present purposes, well-maintained, and in good operating condition.

In accordance with SFAS No. 5, “Accounting for Contingencies,” (SFAS No. 5), theThe Company records provisions with respect to identified claims or lawsuits when it is probable that a liability has been incurred and the amount of the loss can be reasonably estimated. Claims and lawsuits are reviewed quarterly and provisions are taken or adjusted to reflect the status of a particular matter. The Company believes the recorded reserves in its consolidated financial statements are adequate in light of the probable and estimable outcomes. Any recorded liabilities were not material to the Company’s financial position, results of operation andor liquidity, and the Company does not believe that any of the currently identified claims or litigation will materially affect its financial position, results of operation or liquidity.

The Company has reached a preliminary agreement to settle the class action lawsuits that were previously disclosed in its SEC filings, including most recently the Form 10-Q for the quarter ending April 30, 2011. On March 31, 2008, S&E Quick Lube, a filter distributor, filed a lawsuit alleging that 12 filter manufacturers, including the Company, engaged in a conspiracy to fix prices, rig bids, and allocate U.S. Customers for aftermarket automotive filters. The U.S. cases have been consolidated into a single multi-district litigation in the Northern District of Illinois. The Company denies any liability and has vigorously defended the claims raised in these lawsuits. The settlement will fully resolve all claims brought against the Company in the lawsuits and the Company does not admit any liability or wrongdoing. The settlement is still subject to Court approval and will not have a material impact on the Company’s financial position, results of operations or liquidity.

The Company has reached a preliminary agreement with the Air Resources Board for the State of California (“ARB”) to settle regulatory claims brought by ARB in connection with the sales of our Diesel Multi-Stage Filter System (“DMF”) for an immaterial amount. On May 19, 2010, ARB revoked its verification of the Company’s DMF for use with on-road diesel engines, for which verification was originally issued on December 16, 2005. The Company denies that any sales were made in California without ARB verification. The Company is not currently selling any DMF product and is working with the Environmental Protection Agency to verify the product for any future sales.

Item 4. Submission of Matters to a Vote of Security Holders(Removed and Reserved)

No matters were submitted to a vote of security holders of the Company during the quarter ended July 31, 2009.

Executive Officers of the Registrant

Current information regarding executive officers is presented below. All terms of office are for one year. There are no arrangements or understandings between individual officers and any other person pursuant to which the officer was selected as an executive officer.

|

|

|

|

|

|

|

|

|

|

|

|

| ||

Name |

|

| Age |

| Positions and Offices Held |

| First Year Elected or |

| Age |

| Positions and Offices Held |

| First Fiscal Year | |

Tod E. Carpenter | Tod E. Carpenter |

| 50 |

| Vice President, Europe and Middle East |

| 2008 | Tod E. Carpenter |

| 52 |

| Vice President, Europe and Middle East |

| 2008 |

|

|

|

|

|

|

|

|

|

|

| ||||

William M. Cook | William M. Cook |

| 56 |

| Chairman, President and Chief Executive Officer |

| 1994 | William M. Cook |

| 58 |

| Chairman, President and Chief Executive Officer |

| 1994 |

|

|

|

|

|

|

|

|

|

|

| ||||

Sandra N. Joppa | Sandra N. Joppa |

| 44 |

| Vice President, Human Resources |

| 2005 | Sandra N. Joppa |

| 46 |

| Vice President, Human Resources |

| 2005 |

|

|

|

|

|

|

|

|

|

|

| ||||

Norman C. Linnell | Norman C. Linnell |

| 50 |

| Vice President, General Counsel and Secretary |

| 1996 | Norman C. Linnell |

| 52 |

| Vice President, General Counsel and Secretary |

| 1996 |

|

|

|

|

|

|

|

|

|

|

| ||||

Charles J. McMurray | Charles J. McMurray |

| 55 |

| Senior Vice President, Industrial Products |

| 2003 | Charles J. McMurray |

| 57 |

| Senior Vice President, Industrial Products |

| 2003 |

|

|

|

|

|

|

|

|

|

|

| ||||

Mary Lynne Perushek | Mary Lynne Perushek |

| 51 |

| Vice President and Chief Information Officer |

| 2006 | Mary Lynne Perushek |

| 53 |

| Vice President and Chief Information Officer |

| 2006 |

|

|

|

|

|

|

|

|

|

|

| ||||

Lowell F. Schwab |

| 61 |

| Senior Vice President, Global Operations |

| 1994 | ||||||||

|

|

|

|

| ||||||||||

David W. Timm | David W. Timm |

| 56 |

| Vice President, Asia-Pacific |

| 2007 | David W. Timm |

| 58 |

| Vice President, Asia-Pacific |

| 2007 |

|

|

|

|

|

|

|

|

|

|

| ||||

Thomas R. VerHage | Thomas R. VerHage |

| 56 |

| Vice President and Chief Financial Officer |

| 2004 | Thomas R. VerHage |

| 58 |

| Vice President and Chief Financial Officer |

| 2004 |

|

|

|

|

|

|

|

|

|

|

| ||||

Jay L. Ward | Jay L. Ward |

| 45 |

| Senior Vice President, Engine Products |

| 2006 | Jay L. Ward |

| 47 |

| Senior Vice President, Engine Products |

| 2006 |

|

|

|

|

|

|

|

|

|

|

| ||||

Debra L. Wilfong | Debra L. Wilfong |

| 54 |

| Vice President and Chief Technology Officer |

| 2007 | Debra L. Wilfong |

| 56 |

| Vice President and Chief Technology Officer |

| 2007 |

|

|

|

|

|

| |||||||||

Mr. Carpenter joined the Company in 1996 and has held various positions, including Gas Turbine Systems General Manager from 2002 to 2004; General Manager, Industrial Filtration Systems (IFS)(“IFS’) Sales from 2004 to 2006; General Manager, IFS Americas in 2006; and Vice President, Global IFS from 2006 to 2008. Mr. Carpenter was appointed Vice President, Europe and Middle East in August 2008. Mr. Carpenter has been appointed Senior Vice President, Engine Products, effective October 1, 2011.

Mr. Cook joined the Company in 1980 and has held various positions, including CFO and Senior Vice President, International from 2001 to 2004 and President and CEO from 2004 to 2005. Mr. Cook was appointed Chairman, President and CEO in July 2005.

Ms. Joppa was appointed Vice President, Human Resources and Communications in November 2005. Prior to that time, Ms. Joppa held various positions at General Mills, a consumer food products company, from 1989 to 2005, including service as Director of Human Resources for several different operating divisions from 1999 to 2005.

Mr. Linnell joined the Company in 1996 as General Counsel and Secretary and was appointed Vice President, General Counsel and Secretary in 2000.

Mr. McMurray joined the Company in 1980 and has held various positions, including Director, Global Information Technology from 2001 to 2003; Vice President, Human Resources from 2004 to 2005; and Vice President, Information Technology, Europe, South Africa, and Mexico from 2005 to 2006. Mr. McMurray became Senior Vice President, Industrial Products in September 2006. Mr. McMurray has been appointed Senior Vice President and Chief Administrative Officer, effective October 1, 2011.

Ms. Perushek was appointed Vice President and Chief Information Officer in November 2006. Prior to that time, Ms. Perushek was Vice President of Global Information Technology at H.B. Fuller Company, a worldwide manufacturer of adhesive products, from 2005 to 2006 and Chief Information Officer for Young America Corporation, a marketing company, from 1999 to 2004.

Mr. Schwab joined the Company in 1977 and has held various positions, including Senior Vice President, Operations from 1994 to 2004 and Senior Vice President, Engine Products from 2004 to 2008. Mr. Schwab was appointed Senior Vice President, Global Operations, in August 2008.

Mr. Timm joined the Company in 1983 and has held various positions, including General Manager, Disk Drive from 1995 to 2005 and General Manager, Gas Turbine Systems Products from 2005 to 2006. Mr. Timm was appointed Vice President, Asia-Pacific in December 2006.

Table The Company has announced that Mr. Timm will retire from the Company at the end of Contents2011, with his replacement to be announced at a later date.

Mr. VerHage was appointed Vice President and Chief Financial Officer in March 2004. Prior to that time, Mr. VerHage was a partner for Deloitte & Touche, LLP, an international accounting firm, from 2002 to 2004. The Company has announced that Mr. VerHage is leaving the Company on October 31, 2011 and that James F. Shaw, age 42, currently Controller and Principal Accounting Officer for the Company, has been appointed Vice President and Chief Financial Officer, effective November 1, 2011.

Mr. Ward joined the Company in 1998 and has held various positions, including Director, Operations from 2001 to 2003; Director, Product and Business Development, IFS Group from 2003 to 2004; Managing Director, Europe from 2004 to 2006; and Vice President, Europe, and Middle East from 2006 to 2008. Mr. Ward was appointed Senior Vice President, Engine Products in August 2008. Mr. Ward has been appointed Senior Vice President, Industrial Products, effective October 1, 2011.

Ms. Wilfong was appointed Vice President and Chief Technology Officer in May 2007. Prior to that time, Ms. Wilfong held various director positions in researchwas Director, Research and developmentDevelopment at 3M Company, an international consumer products company, from 2000 to 2007, most recently as Director, Research and Development for the 3M Automotive Division from 2006 to 2007.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The common shares of the Company are traded on the New York Stock Exchange under the symbol DCI. The amount and frequency of all cash dividends declared on the Company’s common stock for Fiscal 20092011 and 20082010 appear in Note NP of the Notes to Consolidated Financial Statements on page 55.54. The Company’s dividend payout ratio target is 20 percent to 30 percent of the average earnings per share of the last three years. This guidance is expected to be used for future dividend payouts. As of September 23, 2009,22, 2011, there were 2,1091,950 shareholders of record of common stock.

The low and high sales prices for the Company’s common stock for each full quarterly period during Fiscal 20092011 and 20082010 were as follows:

|

|

|

|

|

|

|

|

|

|

| First Quarter |

| Second Quarter |

| Third Quarter |

| Fourth Quarter |

Fiscal |

| $ |

| $ |

| $ |

| $ |

Fiscal |

| $ |

| $ |

| $ |

| $ |

The following table sets forth information in connection with purchases made by, or on behalf of, the Company or any affiliated purchaser of the Company, of shares of the Company’s common stock during the quarterly period ended July 31, 2009.2011.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period |

| Total Number of |

| Average Price |

| Total Number of |

| Maximum Number |

| |||||

May 1-May 31, 2009 |

|

| — |

|

| — |

|

| — |

|

| 930,210 |

| |

June 1-June 30, 2009 |

|

| 18,972 |

| $ | 36.12 |

|

| — |

|

| 930,210 |

| |

July 1-July 31, 2009 |

|

| — |

|

| — |

|

| — |

|

| 930,210 |

| |

Total |

|

| 18,972 |

| $ | 36.12 |

|

| — |

|

| 930,210 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period |

| Total Number of |

| Average Price |

| Total Number of |

| Maximum Number |

| ||||

May 1 - May 31, 2011 |

|

| — |

| $ | — |

|

| — |

|

| 6,187,240 |

|

June 1 - June 30, 2011 |

|

| 900,000 |

| $ | 56.35 |

|

| 900,000 |

|

| 5,287,240 |

|

July 1 - July 31, 2011 |

|

| 291,558 |

| $ | 59.23 |

|

| 256,648 |

|

| 5,030,592 |

|

Total |

|

| 1,191,558 |

| $ | 57.06 |

|

| 1,156,648 |

|

| 5,030,592 |

|

The Company initiated the purchase of an additional 162,900 shares for $9.2 million in July 2011 that are not included in Fiscal 2011 repurchases as the transactions did not settle until after fiscal year end. These repurchases will be included in Fiscal 2012 activity.

|

|

|

| ||

(1) | On March |

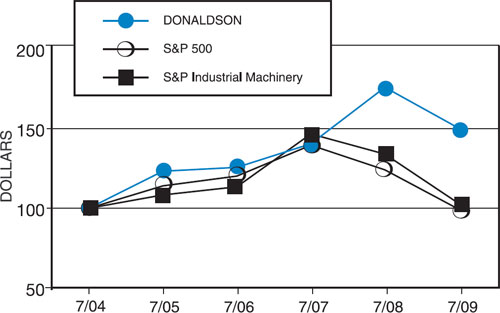

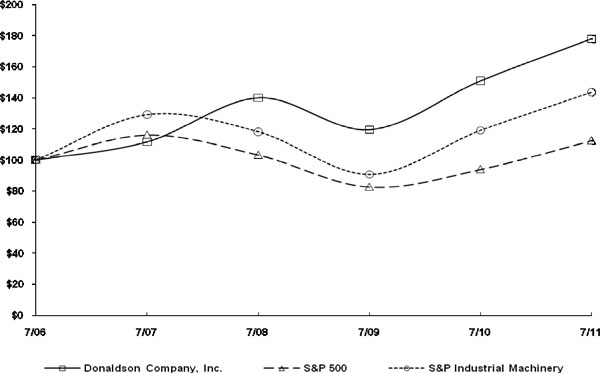

The graph below compares the cumulative total stockholder return on the Company’s Common Stockcommon stock for the last five fiscal years with the cumulative total return of the Standard & Poor’s 500 Stock Index and the Standard & Poor’s Index of Industrial Machinery Companies.Index. The graph and table assume the investment of $100 in each of the Company’s Common Stockcommon stock and the specified indexes at the beginning of the applicable period, and assume the reinvestment of all dividends.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

Among Donaldson Company, Inc., Thethe S&P 500 IndexAnd Theand the S&P Industrial Machinery Index

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year ended July 31, |

|

| Year Ended July 31, |

| ||||||||||||||||||||||||||||||||

|

| 2009 |

| 2008 |

| 2007 |

| 2006 |

| 2005 |

| 2004 |

|

| 2011 |

| 2010 |

| 2009 |

| 2008 |

| 2007 |

| 2006 |

| ||||||||||||

Donaldson Company, Inc. |

| $ | 150.18 |

| $ | 175.88 |

| $ | 140.46 |

| $ | 125.67 |

| $ | 123.27 |

| $ | 100.00 |

|

| $ | 177.91 |

| $ | 150.95 |

| $ | 119.50 |

| $ | 139.95 |

| $ | 111.77 |

| $ | 100.00 |

|

S&P 500 |

| 99.33 |

| 124.10 |

| 139.58 |

| 120.19 |

| 114.05 |

| 100.00 |

|

| 112.56 |

| 94.07 |

| 82.64 |

| 103.25 |

| 116.13 |

| 100.00 |

| ||||||||||||

S&P Industrial Machinery |

| 102.93 |

| 133.98 |

| 146.65 |

| 113.48 |

| 108.37 |

| 100.00 |

|

| 143.55 |

| 119.05 |

| 90.70 |

| 118.06 |

| 129.23 |

| 100.00 |

| ||||||||||||

Item 6. Selected Financial Data

The following table sets fourthforth selected financial data for each of the fiscal years in the five-year period ended July 31, 20092011 (in millions, except per share data):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year ended July 31, |

|

| Year Ended July 31, |

| ||||||||||||||||||||||||||

|

| 2009 |

| 2008 |

| 2007 |

| 2006 |

| 2005 |

|

| 2011 |

| 2010 |

| 2009 |

| 2008 |

| 2007 |

| ||||||||||

Net sales |

| $ | 1,868.6 |

| $ | 2,232.5 |

| $ | 1,918.8 |

| $ | 1,694.3 |

| $ | 1,595.7 |

|

| $ | 2,294.0 |

| $ | 1,877.1 |

| $ | 1,868.6 |

| $ | 2,232.5 |

| $ | 1,918.8 |

|

Income from continuing operations |

| 131.9 |

| 172.0 |

| 150.7 |

| 132.3 |

| 110.6 |

|

| 225.3 |

| 166.2 |

| 131.9 |

| 172.0 |

| 150.7 |

| ||||||||||

Diluted earnings per share |

| 1.67 |

| 2.12 |

| 1.83 |

| 1.55 |

| 1.27 |

|

| 2.87 |

| 2.10 |

| 1.67 |

| 2.12 |

| 1.83 |

| ||||||||||

Total assets |

| 1,334.0 |

| 1,548.6 |

| 1,319.0 |

| 1,124.1 |

| 1,111.8 |

|

| 1,726.1 |

| 1,499.5 |

| 1,334.0 |

| 1,548.6 |

| 1,319.0 |

| ||||||||||

Long-term obligations |

| 253.7 |

| 176.5 |

| 129.0 |

| 100.5 |

| 103.3 |

|

| 205.7 |

| 256.2 |

| 253.7 |

| 176.5 |

| 129.0 |

| ||||||||||

Cash dividends declared per share |

| 0.460 |

| 0.430 |

| 0.370 |

| 0.410 |

| 0.180 |

|

| 0.560 |

| 0.480 |

| 0.460 |

| 0.430 |

| 0.370 |

| ||||||||||

Cash dividends paid per share |

| 0.455 |

| 0.420 |

| 0.360 |

| 0.320 |

| 0.235 |

|

| 0.535 |

| 0.470 |

| 0.455 |

| 0.420 |

| 0.360 |

| ||||||||||

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation

Results of Operation

The following discussion of the Company’s financial condition and results of operations should be read in conjunction with the Consolidated Financial Statements and Notes thereto and other financial information included elsewhere in this report.

Overview

The Company manufactures and distributesis a worldwide manufacturer of filtration systems and replacement parts. The Company’s core strengths are leading filtration technology, strong Customer relationships, and its global presence. The Company operates through two reporting segments, Engine Products and Industrial Products, and has a product mix including air and liquid filtersfiltration systems and exhaust and emission control products. As a worldwide business, the Company’s results of operations are affected by conditions in the global economic environment. Under normal economic conditions, the Company’s diversitymarket diversification between its original equipmentOEM and replacement parts Customers, its diesel engine and industrial end markets, and its North American and international end markets has helped to limit the impact of weakness in any one product line, market or geography on the consolidated results of the Company. However, the global recession had a dramatic negative impact on the Company’s results in Fiscal 2009 as nearly every product group and geographic area was impacted.

The Company reported record sales in Fiscal 20092011 of $1,868.6$2,294.0 million, down 16.3up 22.2 percent from $2,233.5$1,877.1 million in the prior year. The Company’s results were negativelypositively impacted by foreign currency translation. The impact of foreign currency translation, decreasedwhich increased sales by $76.8$49.8 million. Excluding the current year impact of foreign currency translation, worldwide sales decreased 12.9 percent during the year.increased 19.6 percent.

Although net sales excluding foreign currency translation is not a measure of financial performance under GAAP, the Company believes it is useful in understanding its financial results and provides a comparable measure for understanding the operating results of the Company between different fiscal periods excluding the impact of foreign currency translation. The following is a reconciliation to the most comparable GAAP financial measure of this non-GAAP financial measure (in millions):

|

|

|

|

|

|

|

| |||||||

|

|

|

|

|

|

|

|

| Year Ended July 31, |

| ||||

|

| July 31, |

| July 31, |

|

| 2011 |

| 2010 |

| ||||

Net sales, excluding foreign currency translation |

| $ | 1,945.4 |

| $ | 2,110.0 |

|

| $ | 2,244.2 |

| $ | 1,833.9 |

|

Foreign currency translation impact |

|

| (76.8 | ) |

| 122.5 |

|

| 49.8 |

|

| 43.2 |

| |

Net sales |

| $ | 1,868.6 | $ | 2,232.5 |

| $ | 2,294.0 |

| $ | 1,877.1 |

| ||

Although not as large asThe Company also reported record net earnings in Fiscal 2011 of $225.3 million, an increase of 35.6 percent from $166.2 million in the impact on net sales, theprior year. The Company’s net earnings were also negativelypositively impacted by foreign currency translation. The impact of foreign currency translation, during the year decreasedwhich increased net earnings by $3.8$6.1 million. Excluding the current year impact of foreign currency translation, net earnings decreased 21.1increased 31.9 percent.

Although net earnings excluding foreign currency translation is not a measure of financial performance under GAAP, the Company believes it is useful in understanding its financial results and provides a comparable measure for understanding the operating results of the Company between different fiscal periods excluding the impact of foreign currency translation. The following is a reconciliation to the most comparable GAAP financial measure of this non-GAAP financial measure (in millions):

|

|

|

|

|

|

|

| |||||||

|

|

|

|

|

|

|

|

| Year Ended July 31, |

| ||||

|

| July 31, |

| July 31, |

|

| 2011 |

| 2010 |

| ||||

Net earnings, excluding foreign currency translation |

| $ | 135.7 |

| $ | 159.1 |

|

| $ | 219.2 |

| $ | 162.6 |

|

Foreign currency translation impact, net of tax |

|

| (3.8 | ) |

| 12.9 |

|

| 6.1 |

|

| 3.6 |

| |

Net earnings |

| $ | 131.9 | $ | 172.0 |

| $ | 225.3 |

| $ | 166.2 |

| ||

The Company reported diluted earnings per share of $1.67,$2.87, a 21.236.7 percent decreaseincrease from $2.12$2.10 in the prior year.

Included inAs discussed above, the results are pre-tax restructuring chargesCompany recorded full year records for net sales and net earnings. In addition, operating margin was a record of $17.8 million resulting primarily from workforce reductions of 2,800 since the beginning of13.7 percent for the year. Gross marginThe Company’s manufacturing plants and distribution centers executed very well and continued to make both capital and operating expenses include $10.1 millioninvestments which, along with the Company’s Continuous Improvement initiatives, resulted in a record year and $7.7 million of restructuring expenses, respectively. Theputs the Company also realized $43.0 million in cost savings from restructuring actions completed throughout the year.

The effective tax rate for Fiscal 2009 was 18.3 percent compareda position to 27.2 percent in Fiscal 2008. This decrease is attributable to a number of discrete tax items, partiallyprofitably support its Customers’ global growth plans. These improvements were slightly offset by increased expense from the repatriation of foreign earnings. Absent these items, the underlying tax rate for the Fiscal 2009 has decreased

from Fiscal 2008 by 1.2 points to 30.4 percent. The reinstatement of the U.S. Researchincreases in purchased raw material and Experimentation credit, changes in current year unrecognized tax benefits, reduced statutory tax rates and the mix of earnings between foreign jurisdictions all contributed to the reduction in the underlying rate.

The Company continued to improve an already strong liquidity position which allowed for continued investment in business and debt reduction while increasing cash reserves and maintaining its dividend. While Fiscal 2009 was significantly impacted by the global recession, there are signs that some of the Company’s end markets have begun to stabilize. While the Company’s future visibility remains limited and it’s too early to call a recovery, the Company believes that the worst of the global economic downturn is behind it in many of its early and mid-cycle end markets, including the heavy truck, construction, special applications and replacement parts markets. This view is factored into the Fiscal 2010 outlook discussed below.freight costs.

Following is financial information for the Company’s Engine and Industrial Products segments. Corporate and Unallocated includes corporate expenses determined to be non-allocable to the segments and interest income and expense. See further discussion of segment information in Note JK of the Company’s Notes to Consolidated Financial Statements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Engine |

| Industrial |

| Corporate & |

| Total |

|

| Engine |

| Industrial |

| Corporate & |

| Total |

| ||||||||

|

| (thousands of dollars) |

| |||||||||||||||||||||||

2011 |

|

|

|

|

|

|

|

|

| |||||||||||||||||

Net sales |

| $ | 1,440,495 |

| $ | 853,534 |

| $ | — |

| $ | 2,294,029 |

| |||||||||||||

Earnings before income taxes |

| 211,255 |

| 123,871 |

| (22,863 | ) |

| 312,263 |

| ||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

2010 |

|

|

|

|

|

|

|

|

| |||||||||||||||||

Net sales |

| $ | 1,126,007 |

| $ | 751,057 |

| $ | — |

| $ | 1,877,064 |

| |||||||||||||

Earnings before income taxes |

| 155,833 |

| 91,084 |

| (16,741 | ) |

| 230,176 |

| ||||||||||||||||

|

| (thousands of dollars) |

|

|

|

|

|

|

|

|

|

| ||||||||||||||

2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Net sales |

| $ | 1,001,961 |

| $ | 866,668 |

| $ | — |

| $ | 1,868,629 |

|

| $ | 1,027,685 |

| $ | 840,944 |

| $ | — |

| $ | 1,868,629 |

|

Earnings before income taxes |

| 83,797 |

| 89,526 |

| (11,898 | ) |

| 161,425 |

|

| 85,896 |

| 87,427 |

| (11,898 | ) |

| 161,425 |

| ||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

2008 |

|

|

|

|

|

|

|

|

| |||||||||||||||||

Net sales |

| $ | 1,229,171 |

| $ | 1,003,350 |

| $ | — |

| $ | 2,232,521 |

| |||||||||||||

Earnings before income taxes |

| 158,931 |

| 102,420 |

| (25,188 | ) |

| 236,163 |

| ||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

2007 |

|

|

|

|

|

|

|

|

| |||||||||||||||||

Net sales |

| $ | 1,084,262 |

| $ | 834,566 |

| $ | — |

| $ | 1,918,828 |

| |||||||||||||

Earnings before income taxes |

| 140,762 |

| 80,321 |

| (16,222 | ) |

| 204,861 |

| ||||||||||||||||

During FiscalFor the twelve months ended July 31, 2010 and 2009, net sales reflect the Company’sreclassification of $31,636 and $25,724, respectively, earnings before income taxes reflect a reclassification of $5,360 and $2,099, respectively, as a result of an internal reorganization of Industrial Hydraulics from Industrial Products to Engine Products, segment net sales decreased as a percent of total net sales to 53.6 percent compared to 55.1 percent in the prior year. For the Company’s Industrial Products segment, net sales as a percent of total net sales increased to 46.4 percent from 44.9 percent in the prior year.which became effective August 1, 2010.

Factors within the Company’s reporting segments thatMany factors contributed to the Company’s results for Fiscal 2009 included a significant impact fromeach of the Company’s distributorsreporting segments for Fiscal 2011, including an improvement in global economic conditions, the Company’s program of Continuous Improvement initiatives, new product introductions, emerging market growth, and OEM customers aggressively working down their inventory levels.the expansion of the Company’s distribution capabilities.

In the Engine Products segment, the Company experienced weak business conditionsincreased sales in most end marketsall end-markets and regions. Spending inregions with the construction and mining end-markets in the United States, Europe and Asia was down, resulting in a decrease in off-road equipment related sales. This decrease was partially offset by an increase inexception of Aerospace and Defense salesProducts. The earnings improvement for the current fiscal year was primarily driven by better absorption of fixed costs due to improved volumes at our manufacturing plants, and the benefit of the acquisition of Western Filter Corporation in October 2008. On-roadContinuous Improvement initiatives. The Aftermarket Products sales decreased in the United States, Europe and Asia due to a drop in demand for new trucks, which lowered new truck build rates. Aftermarket sales also decreased due to decreasesincreases were driven by continued improvement in equipment utilization in most off-road end markets and decreased freight activity which impacted on-road markets, partially offset by increases in retrofit emissions salesrates in the United States. In the Industrial Products segment,mining, construction, and transportation industries globally. The Off-Road Product sales increase is driven by higher demand for agriculture and mining equipment, due to continued strong commodity prices and improved sales of heavy construction equipment, which was also weakdue to increased global infrastructure spending, especially in all markets across all regions. Demand for Industrial Filtration Solutions Products was down as a result of the decline in general industrial activity. Also contributing to the decrease in Industrial Filtration Solutionsdeveloping economies. On-Road Products sales was the sale of the air dryer business in Maryville, Tennessee, in October 2008, partially offset by the benefit from the acquisition of LMC West, Inc. in February of 2008. Worldwide sales in Gas Turbine Products weakened late in the yearimproved as North America and full year sales were slightly lower as compared to the prior year. Gas Turbine Products sales are typically large systems and, as a result, the Company’s shipments and revenues fluctuate from quarter to quarter. Sales of Special Applications Products were weak due to decreased demand for semiconductor fabrications and industrial uses for PTFE membranes and a sudden contraction of the disk drive market that resulted in decreased demand for the Company’s hard disk drive filters.Europe heavy truck build rates continued rebounding.

In the Industrial Products segment, where many product lines are later economic cycle businesses, sales increased due to improving global economies leading to greater Customer demand. In Industrial Filtration Solutions Products, sales of new dust collection equipment and replacement filters continued to grow. Gas Turbine Products sales remained slow due to static Customer demand for large gas turbine power generation projects as a result of unchanged global power generation requirements. The increase in sales in Special Applications Products is due to strong sales in certain product lines serving the membrane, semiconductor, imaging, and venting end markets.

Following are net sales by product within both the Engine and Industrial Products segments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2009 |

| 2008 |

| 2007 |

|

| 2011 |

| 2010 |

| 2009 |

| ||||||

|

| (thousands of dollars) |

|

| (thousands of dollars) |

| ||||||||||||||

Engine Products segment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Off-Road Products* |

| $ | 362,785 |

| $ | 448,681 |

| $ | 352,065 |

| ||||||||||

Off-Road Products |

| $ | 327,557 |

| $ | 222,329 |

| $ | 243,691 |

| ||||||||||

Aerospace and Defense Products |

| 104,883 |

| 111,977 |

| 119,094 |

| |||||||||||||

On-Road Products |

| 71,958 |

| 123,146 |

| 166,370 |

|

| 127,107 |

| 81,874 |

| 71,958 |

| ||||||

Aftermarket Products** |

|

| 567,218 |

|

| 657,344 |

|

| 565,827 |

| ||||||||||

Aftermarket Products* |

| 861,393 |

| 691,899 |

| 561,846 |

| |||||||||||||

Retrofit Emissions Products |

|

| 19,555 |

|

| 17,928 |

|

| 31,096 |

| ||||||||||

Total Engine Products segment |

|

| 1,001,961 |

|

| 1,229,171 |

|

| 1,084,262 |

|

|

| 1,440,495 |

|

| 1,126,007 |

|

| 1,027,685 |

|

Industrial Products segment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Industrial Filtration Solutions Products |

| 503,611 |

| 600,526 |

| 515,022 |

|

| 507,646 |

| 423,050 |

| 477,908 |

| ||||||

Gas Turbine Products |

| 206,760 |

| 213,138 |

| 158,025 |

|

| 154,726 |

| 150,131 |

| 206,760 |

| ||||||

Special Applications Products |

|

| 156,297 |

|

| 189,686 |

|

| 161,519 |

|

|

| 191,162 |

|

| 177,876 |

|

| 156,276 |

|

Total Industrial Products segment |

| 866,668 | 1,003,350 | 834,566 |

|

| 853,534 |

|

| 751,057 |

|

| 840,944 |

| ||||||

| ||||||||||||||||||||

Total Company |

| $ | 1,868,629 | $ | 2,232,521 | $ | 1,918,828 |

| $ | 2,294,029 |

| $ | 1,877,064 |

| $ | 1,868,629 |

| |||

|

|

|

|

| |

| ||

| Includes replacement part sales to the Company’s OEM Customers. | |

Outlook

While it appears that conditions may have stabilized at many of the Company’s Customers andThe Company forecasts continued expansion in many of its end markets, thewith higher growth in emerging economies. The Company continuesforecasts its full year Fiscal 2012 EPS to have limited visibility into the future. Consequently, the Company remains cautious in the near-term about forecasting a return to growth.be between $3.15 and $3.45.

|

|

|

| • | The Company is planning its total Fiscal |

|

|

|

| • | The |

• | The Company’s full year Fiscal 2012 tax rate is projected to be between | |

|

|

|

| • | The Company |

|

|

Engine Products– The Company expectsforecasts full year sales to decrease 3increase 8 to 815 percent, inclusive ofincluding the impact of foreign currency translation.

|

|

|

| • |

|

|

|

|

| • |

|

|

|

|

| • |

|

|

|

|

|

|

|

| networks continue to |

• | The Company forecasts modest sales gains in Aerospace and Defense Products for Fiscal 2012 as the continued slowdown in military spending is anticipated to be offset by increased commercial aerospace sales. |

Industrial Products– - The Company forecasts full year Fiscal 2010FY12 sales to decrease 11increase 7 to 1615 percent, inclusive ofincluding the impact of foreign currency translation.

|

|

|

| • | The Company’s Industrial Filtration Solutions Products’ sales are projected to |

|

|

|

| • | The Company |

|

|

|

| • | Special Applications Products’ sales are projected to |

Fiscal 20092011 Compared to Fiscal 20082010

Engine Products SegmentThe Engine Products segment sells to OEMs in the construction, mining, agriculture, aerospace, defense, and truck markets and to independent distributors, OEM dealer networks, private label accounts, and large equipment fleets. Products include air filtration systems, exhaust and emissions systems, liquid filtration systems, and replacement filters.

Sales for the Engine Products segment were $1,002.0$1,440.5 million, a decreasean increase of 18.527.9 percent from $1,229.2$1,126.0 million in the prior year. International Engine Products sales decreased 24.3 percent and sales in the United States decreased 12.4increased by 25.9 percent in Fiscal 2011 compared to Fiscal 2010. International Engine Products sales increased 29.8 percent from the prior year. The impact of foreign currency decreasedincreased total sales by $38.9$31.5 million, or 3.22.8 percent. Earnings before income taxes as a percentage of Engine Products segment sales of 8.414.7 percent decreasedincreased from 12.913.8 percent in the prior year. The Engine Products segment has been negatively impactedearnings improvement for the current fiscal year was driven by lowerbetter absorption of fixed manufacturing costs due to the drop in salesimproved volumes and increased costs related to restructuring,the Company’s ongoing Continuous Improvement initiatives, partially offset by cost savings as a result of workforce reductions already completed, improved distribution efficiencies asincreased commodity costs compared to the prior year andyear. There were $1.9 million in restructuring expenses for the impact of cost control measures including reductionsEngine Products segment in incentive compensation.the prior year.

Worldwide sales of Off-Road Products were $362.8$327.6 million, an increase of 47.3 percent from $222.3 million in the prior year. Sales in the United States increased 35.8 percent over the prior fiscal year. Internationally, sales of Off-Road Products were up 56.0 percent from the prior year, with sales increasing in Asia and Europe by 58.2 percent and 55.6 percent, respectively. The Company’s overall increase was driven by higher demand for agriculture, construction, and mining equipment due to continued strong commodity prices and improved sales of heavy construction equipment, which was due to increased global infrastructure spending, especially in developing economies. Off-Road Products sales in the U.S. also benefited from market share gains on new platforms that began production during calendar year 2011. These increases were slightly offset by U.S. residential and non-residential construction markets, which showed continued weakness, resulting in lower sales of the Company’s products into those markets.

Worldwide sales of Aerospace and Defense Products were $104.9 million, a 6.3 percent decrease of 19.1 percent from $448.7$112.0 million in the prior year. Sales in the United States decreased 7.2 percent. Global mining activity started declining due to decreased commodity prices in the second quarter of Fiscal 2009, and remained weak throughout the remainder of the year. Spending in U.S. residential and non-residential construction markets was down more than 278.7 percent and 5 percent, respectively, over prior year, resulting in a decrease in the sales of the Company’s products into those markets. Domestic Aerospace and Defense sales benefited from the recent acquisition of Western Filter Corporation, which resulted in $15.4 million of incremental sales over the prior year and continued strong demandas a result of slowdowns in U.S. military activity, which is causing an associated slowdown in government procurement spending for filters for military equipment.major programs. Internationally, sales of Off-RoadAerospace and Defense Products were down 31.3increased 3.0 percent fromover the prior year, withyear. The international sales decreasing in both Europe and Asia by 32.5 percent and 29.5 percent, respectively. Sales in the European construction equipment end market decreasedincreased primarily due to a declinemarket share gains resulting from improving the Company’s Aerospace distribution capabilities in construction activity related to the economic downturn. Sales to the European agricultural end market also decreased. In Asia, sales have declined significantly in Japan in the construction end markets.Europe.

Worldwide sales of On-Road Products were $72.0$127.1 million, a decreasean increase of 41.655.2 percent from $123.1$81.9 million in the prior year. On-Road Products sales in the United States decreased 43.2increased 86.0 percent from the prior year, primarily as a result of a 29 percent decrease inyear. Class 8 truck build rates 40increased 47.8 percent decrease inand medium duty truck build rates by the Company’s Customers and a reduction in high value product mixincreased 37.1 percent over the prior year. International On-Road Products sales decreased 39.6increased 27.4 percent from the prior year, driven by decreasedincreased sales in Europe and Asia of 51.0 percent and 32.5 percent, respectively, reflecting45.6 percent. This increase is consistent with the current economic downturn for freight activity and newincrease in European build rates. The overall sales increase was a result of an increase in Customer truck build rates.rates, higher content per truck, and a slightly higher market share.

Worldwide Engine Aftermarket Products sales of $567.2$861.4 million decreased 13.7increased 24.5 percent from $657.3$691.9 million in the prior year. Sales in the United States decreased 9.5increased 26.3 percent over the prior year, drivenyear. International sales increased 23.1

by inventory adjustments at the Company’s Customers and decreases in utilization rates in the mining, construction and transportation industries, partially offset by increases in retrofit emission sales of $5.2 million. International sales decreased 17.4 percent from the prior year, primarily driven by sales decreasesincreases in Asia, Latin America and Europe and Asia of 26.137.8 percent, 25.7 percent, and 8.013.5 percent, respectively, duerespectively. The sales increases in the U.S. and internationally were attributable to weak economic conditions.improved On-Road and Off-Road equipment utilization rates from a year ago, the Company’s increased distribution and market share growth, and the continued increase in the percentage of equipment in the field that uses the Company’s proprietary filtration systems.

Worldwide sales of Retrofit Emissions Products were $19.6 million, an increase of 9.1 percent from $17.9 million in the prior year. The Company’s Retrofit Emissions Products sales are solely in the United States. Sales of Retrofit Emissions Products increased overall, but challenges still remain in the supply chain for certain components and delays in regulatory approval for certain of the Company’s products have impacted the Company’s sales.

Industrial Products SegmentThe Industrial Products segment sells to various industrial end-users, OEMs of gas-fired turbines, and OEMs and end-users requiring highly purifiedclean air. Products include dust, fume, and mist collectors, compressed air purification systems, liquid filters and parts, air filterfiltration systems for gas turbines, PTFE membrane and laminates,based products, and specialized air filtration systems for applications, including computer hard disk drives.

Sales for the Industrial Products segment were $866.7$853.5 million, a decreasean increase of 13.6 percent from $1,003.4$751.1 million in the prior year. International Industrial Products sales decreased 14.2increased 8.5 percent and sales in the United States decreased 12.3increased 27.2 percent from the prior year. The impact of foreign currency decreasedincreased sales by $37.9$18.3 million, or 3.82.4 percent. Despite the 13.6 percent decrease in sales, earningsEarnings before income taxes as a percentage of Industrial Products segment sales of 10.314.5 percent increased from 10.212.1 percent in the prior year. The improvement in earnings as a percent of sales over the prior year was driven by better execution on large project shipments, cost savings from restructuring actions and the impact of cost control measures including reductions in incentive compensation expense. These were slightly offset by lower absorptionleverage of fixed operating costs and restructuring costs.better plant utilization. Restructuring expenses in Fiscal 2011 were $0.7 million, a decrease from $8.3 million in Fiscal 2010.

Worldwide sales of Industrial Filtration Solutions Products of $503.6$507.6 million decreased 16.1increased 20.0 percent from $600.5$423.1 million in the prior year. Sales in the United States, Europe and Europe decreased 18.3Asia increased 25.3 percent, 12.9 percent, and 21.026.2 percent, respectively. SalesThe increased sales were due to increased manufacturing activity, higher investment in Asiacapital equipment by manufacturers, and the continued strengthening of replacement filter sales due to utilization of existing equipment. North American general industrial activity remained relatively flatstrong as evidenced by a 110 percent increase in machine tool consumption in the United States during Fiscal 2011 as compared to the prior year. The decline in Europe was due to reduced demand for industrial dust collectors and compressed air purification systems which fell with the downturn in general manufacturing activity during the year. Domestic sales decreased from the prior year as a result of this same decline in general industrial activity. The results in the year were also influenced by the sale of the air dryer business in Maryville, Tennessee, on October 31, 2008 and the acquisition of LMC West, Inc. (LMC West) in February of Fiscal 2008. The sale of the air dryer business in Maryville, Tennessee, decreased sales $7.6 million over last year. The acquisition of LMC West contributed to $7.0 million of sales during the twelve months of Fiscal 2009 and $4.7 million during the latter six months of Fiscal 2008.2010.

Worldwide sales of Gas Turbine Products were $206.8$154.7 million, a decreasean increase of 3.03.1 percent from $213.1$150.1 million in the prior year. Gas Turbine Products sales are typically large systems and, as a result, the Company’s shipments and revenues fluctuate from quarterperiod to quarter. Incoming orders declined 58 percent in Fiscal 2009 versus Fiscal 2008, a reflection of the reducedperiod. Sales slightly improved due to additional demand for smaller systems used in the oil and gas industry as a result of higher average oil prices and an increase in Aftermarket sales for replacement filters. These increases were slightly offset by a decline in the sales of air filtration systems for large turbines used for power generation projects globally. This trend is expected to continue in Fiscal 2010.generation.

Worldwide sales of Special Applications Products were $156.3$191.2 million, a 17.67.5 percent decreaseincrease from $189.7$177.9 million in the prior year. Domestic Special Application Products sales decreased 10.0 percent. International sales of Special Application Products decreased 18.7increased 6.1 percent over the prior year. The primary decreases internationally wereyear, primarily in Europe, which increased 47.0 percent. Domestic Special Application Products sales increased 17.1 percent. The global sales increases were driven by strong sales in some of the Company’s product lines serving the membrane, semiconductor, imaging, and Asia, which decreased 25.5 and 17.3 percent, respectively,venting end markets, partially offset by a slight decline in the Company’s disk drive filter sales due to a significant reductionsoft demand in demandthe global end market for hard disk drives. Overall, the decline in disk drive filters, semiconductor filtration systems and PTFE membrane filtration products. The reduction in demandsales is primarily a result of a worldwide contraction in the end markets for computers, data storage devices and other electronic products that began in the second quarter of Fiscal 2009.comparable with published disk drive build rates.

Consolidated ResultsThe Company reported net earnings for Fiscal 20092011 of $131.9$225.3 million compared to $172.0$166.2 million in Fiscal 2008, a decrease2010, an increase of 23.335.6 percent. Diluted net earnings per share was $1.67, down 21.2were $2.87, up 36.7 percent from $2.12$2.10 in the prior year. The Company’s operating income of $170.0$315.3 million decreasedincreased from prior year operating income of $245.8$238.2 million by 30.932.3 percent.

The table below shows the percentage of total operating income contributed by each segment for each of the last three fiscal years. Corporate and Unallocated includes corporate expenses determined to be non-allocable to the segments, and interest income, and interest expense:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| 2009 |

| 2008 |

| 2007 |

|

| 2011 |

| 2010 |

| 2009 |

| ||||||

Engine Products |

| 44.5 | % |

| 61.1 | % |

| 62.9 | % |

|

| 64.1 | % |

| 63.1 | % |

| 45.7 | % | |

Industrial Products |

| 51.8 | % |

| 42.1 | % |

| 37.8 | % |

|

| 38.7 | % |

| 37.8 | % |

| 50.6 | % | |

Corporate and Unallocated |

| 3.7 | % |

| (3.2 | %) |

| (0.7 | %) |

|

|

| (2.8 | )% |

| (0.9 | )% |

| 3.7 | % |

Total Company |

| 100 | % |

| 100 | % |

| 100 | % |

|

|

| 100.0 | % |

| 100.0 | % |

| 100.0 | % |

International operating income, prior to corporate expense allocations, totaled 77.980.2 percent of consolidated operating income in Fiscal 20092011 as compared to 89.480.3 percent in Fiscal 2008.2010. Total international operating income decreased 39.8increased 32.1 percent from the prior year. This decreaseincrease is attributable to restructuring charges internationally exceeding domestic restructuringincreased Customer sales and the leverage of fixed costs weaker foreign currencies and overall weak business conditions abroad.with the higher volume of sales. The table below shows the percentage of total operating income contributed by each major geographic region for each of the last three fiscal years:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| 2009 |

| 2008 |

| 2007 |

|

| 2011 |

| 2010 |

| 2009 |

| ||||||

United States |

| 22.1 | % |

| 10.6 | % |

| 22.3 | % |

|

| 19.8 | % |

| 19.7 | % |

| 22.1 | % | |

Europe |

| 23.3 | % |

| 43.3 | % |

| 34.8 | % |

|

| 31.0 | % |

| 24.6 | % |

| 23.3 | % | |

Asia |

| 43.5 | % |

| 37.9 | % |

| 38.6 | % |

| ||||||||||

Asia - Pacific |

| 39.6 | % |

| 45.3 | % |

| 43.5 | % | |||||||||||

Other |

| 11.1 | % | 8.2 | % |

| 4.3 | % |

|

|

| 9.6 | % |

| 10.4 | % |

| 11.1 | % | |

Total Company |

| 100 | % |

| 100 | % |

| 100 | % |

|

|

| 100.0 | % |

| 100.0 | % |

| 100.0 | % |