1400 West 94th Street, Minneapolis, Minnesota 55431 (Address of principal executive offices) (Zip Code) Common Stock, $5 Par Value ☒ Non-accelerated filer Factors” in this Annual Report on Form 10-K (Annual Report). Year Ended July 31, 2014 2013 2012 Engine Products segment Off-Road Products 14% 15% 15% On-Road Products 5% 5% 7% Aftermarket Products* 41% 38% 37% Aerospace and Defense Products 4% 4% 4% *includes replacement part sales to the Company’s OEM Customers Industrial Products segment Industrial Filtration Solutions Products 23% 22% 22% Gas Turbine Products 6% 9% 7% Special Applications Products 7% 7% 8% years ended July 31, 2016, 2015 and 2014: included in Item 8 of this Annual Report. substitution, process improvement, and product redesigns. July 31, 2015.xAnnual Report Pursuant to Section 13 or 15(d) of the Securities ExchangeAct of 1934 for the fiscal year ended July 31, 2014 oroTransition Report Pursuant to Section 13 or 15(d) of the SecuritiesExchange Act of 1934 for the transition period from __________ to __________☒ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended July 31, 2016 or ☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from __________ to __________

DONALDSON COMPANY, INC.(Exact name of registrant as specified in its charter)Delaware 41-0222640 Delaware41-0222640(I.R.S. EmployerTitle of each class Name of each exchange

on which registeredNew York Stock Exchange Preferred Stock Purchase RightsNew York Stock Exchangex ☒ Yeso ☐ Noo ☐ Yesx ☒ Nox ☒ Yeso ☐ Nox. ☒ Yeso ☐ NoxLarge accelerated filer x☒Accelerated filer o☐o☐ (Do not check if a smaller reporting company)Smaller reporting company o☐o☐ Yesx ☒ No2014,2016, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant was $5,927,321,901$3,714,825,006 (based on the closing price of $41.26$28.18 as reported on the New York Stock Exchange as of that date).24, 2014,21, 2016, there were approximately 138,365,916132,675,711 shares of the registrant’s common stock outstanding.20142016 annual meeting of stockholders (the “2014“2016 Proxy Statement”) are incorporated by reference in Part III, as specifically set forth in Part III.PagePage 3677710102626275858595959606161616263Customercustomer relationships and its global presence. Products are manufactured at 3942 plants around the world and through three joint ventures.andsystems as well as replacement filters. The Engine Products segment sells to original equipment manufacturers (OEMs) in the construction, mining, agriculture, aerospace, defense and truck markets, and to independent distributors, OEM dealer networks, private label accounts and large equipment fleets. Products in the Industrial Products segment consist of dust, fume and mist collectors, compressed air purification systems, air filtration systems for gas turbines, PTFEpolytetrafluoroethylene (PTFE) membrane-based products and specialized air and gas filtration systems for applications including computer hard disk drives and semi-conductor manufacturing. The Industrial Products segment sells to various industrial dealers, distributors, OEMs of gas-fired turbines and OEMs and end-users requiring clean filtration solutions and replacement filters.this report in Part I, Item 1A, “Risk Factors.”last three fiscal years: Year Ended July 31, 2016 2015 2014 Engine Products segment Off-Road Products 10% 11% 14% On-Road Products 6% 6% 5% Aftermarket Products* 43% 41% 41% Aerospace and Defense Products 4% 5% 4% Industrial Products segment Industrial Filtration Solutions Products 23% 22% 23% Gas Turbine Products 7% 8% 6% Special Applications Products 7% 7% 7% * Includes replacement part sales to the Company’s OEM customers K18 in the Notes to Consolidated Financial Statements on page 54.and current reports on Form 8-K, proxy statements and other information (including amendments to those reports,reports) available free of charge through its website at www.donaldson.com, as soon as reasonably practicable after it electronically files such material with (or furnishes such material to) the Securities and Exchange Commission. Also available on the Company’s website are corporate governance documents, including the Company’s Code of Business Conduct and Ethics, Corporate Governance Guidelines, Audit Committee charter, Human Resources Committee charter and Corporate Governance Committee charter. These documents are also available in print, free of charge, to any person who requests them in writing to the attention of Investor Relations, MS 102, Donaldson Company, Inc., 1400 West 94th94th Street, Minneapolis,Bloomington, Minnesota 55431. The information contained on the Company’s website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered to be part of this Form 10-K.report.Customercustomer plant closures. and innovation, price, geographic coverage, service and product performance. The Company competes in a number of highly competitive filtration markets in both segments. The Company believes it is a market leader within many of its product lines, specifically within its Off-Road Equipment and On-Road Products lines for OEMs, and is a significant participant in the aftermarket for replacement filters. The Engine Products segment’s principal competitors include several large global competitors and many regional competitors, especially in the Engine Aftermarket Products business. The Industrial Products segment’s principal competitors vary from country to country and include several large regional and global competitors and a significant number of smaller competitors who compete in a specific geographical region or in a limited number of product applications.products.products including plastics, rubber, and adhesives. Purchased raw materials represent approximately 6060% to 65 percent65% of the Company’s cost of goods sold. Of that amount, steel, including fabricated parts, represents approximately 25 percent.20%. Filter media represents approximately 15 to 20 percent20% and the remainder is primarily made up of petroleum-based products and other raw material components.typically has multiple sourcesanticipates a moderately favorable impact from commodity prices in fiscal 2017, as compared to fiscal 2016, specifically for petroleum-based products. On an ongoing basis, the Company enters into selective supply arrangements with certain of supply forits suppliers that allow the raw materials essentialCompany to reduce volatility in its costs. The Company strives to recover or offset all material cost increases through selective price increases to its business, but does rely primarily on two media suppliers. The Company is not required to carry significant amounts of rawcustomers and the Company’s cost reduction initiatives, which include material inventory to secure supplier allotments. However, the Company does stock finished goods inventory at its regional distribution centers in order to meet anticipated Customer demand. The Company has not experienced significant supply problems in the purchase of its major raw materials., and Donaldson® trademarks. However, itthe Company does not regard the validity of any one patent or trademark as being of material importance. There wereCustomerscustomers that accounted for over 10 percent10% of net sales in Fiscal 2014, 2013, or 2012. There werethe years ended July 31, 2016, 2015 and 2014. The Company had no Customerscustomers that accounted for over 10 percent10% of gross accounts receivable in Fiscal 2014at July 31, 2016 or Fiscal 2013.2014,2016, the backlog of orders expected to be delivered within 90 days was $375.1$323.0 million. The 90-day backlog at August 31, 2013,2015, was $351.7$331.0 million. Backlog is one of many indicators of business conditions in the Company’s markets. However, it is not always indicative of future results for a number of reasons, including short lead times in the Company’s replacement parts businesses and the timing of orders in many of the Company’s Engine Products OEM and Industrial Products markets.Fiscalthe years ended July 31, 2016, 2015 and 2014, the Company spent $55.5 million, $60.2 million and $61.8 million, respectively, on research and development activities. Research and development expenses include basic scientific research and the application of scientific advances to the development of new and improved products and their uses. The Company spent $62.6 million and $59.6 million in Fiscal 2013 and Fiscal 2012, respectively, on research and development activities. Substantially all commercial research and development is performed in-house.

2016.

Customercustomer applications throughout the world. These risks and uncertainties could adversely affect our operating performance and financial condition. The following discussion, along with discussions elsewhere in this report, outlineoutlines the risks and uncertainties that we believe are the most material to our business at this time. We want to further highlight the risks and uncertainties associated with: world economic factors and ongoing global economic uncertainty, the reduced demand for hard disk drive products with the increased use of flash memory, the potential for some Customers to increase their reliance on their own filtration capabilities, currency fluctuations, commodity prices, political factors, our international operations, highly competitive markets, governmental laws and regulations, including the impact of the various economic stimulus and financial reform measures, the implementation of our new information technology systems, information security and data breaches, potential global events resulting in market instability including financial bailouts and defaults of sovereign nations, military and terrorist activities, including political unrest in the Middle East and Ukraine, other political changes, health outbreaks, natural disasters, and other factors discussed below. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.Operating internationally carries risks whichnegatively affectimpact our results or financial performance. We have sales and manufacturing operations throughout the world, with the heaviest concentrationscondition in the Americas, Europe, and Asia. Our stability, growth, and profitability are subject to a number of risks of doing business internationally that could harmany particular period as our business including:•political and military events,•legal and regulatory requirements, including import, export, defense regulations, anti-corruption laws, and foreign exchange controls,•tariffs and trade barriers,•potential difficulties in staffing and managing local operations,•credit risk of local Customers and distributors,•difficulties in protecting intellectual property,•local economic, political, and social conditions, specifically in the Middle East, Ukraine, China, Thailand, and other emerging markets where we do business,•potential global health outbreaks, and•natural disasters. Duecan be sensitive to the international scope of our operations, we are subject to a complex system of import-varying conditions in all major geographies and export-related laws and regulations. Any alleged or actual violations may subject us to government scrutiny, investigation, and civil and criminal penalties, and may limit our ability to import or export our products or to provide services outside the United States (U.S.). In addition, the U.S. Foreign Corrupt Practices Act andsimilar foreign anti-corruption laws generally prohibit companies and their intermediaries from making improper payments or providing anything of value to improperly influence foreign government officials for the purpose of obtaining or retaining business, or obtaining an unfair advantage. Recent years have seen a substantial increase in the global enforcement of anti-corruption laws. Violations of these laws may result in severe criminal or civil sanctions, could disrupt our business, and result in an adverse effect on our reputation, business, and results of operations or financial condition.MaintainingProducts - maintaining a competitive advantage requires continuing investment with uncertain returns.

We In addition, we may be adversely impacted by changes in technology that could reduce or eliminate the demand for our products. These risks include:

|

| |

|

| |

|

|

Difficultiesinclude wider adoption of technologies providing alternatives to diesel engines.

Demand for our products relies on economic and industrial conditions worldwide.

Changes in economic or industrial conditions could impact our results of operations or financial condition in any particular period as our business can be sensitive to varying conditions by region across the globe.

While sales to Caterpillar accounted for slightly less than 10 percent of our net sales in Fiscal 2014, 2013, and 2012,

We participate in highly competitive markets with pricing pressure. If we are not able to compete effectively our margins and results of operations could be adversely affected.

The businesses and product lines in which we participate are very competitive and we risk losing business based on a wide range of factors including technology, price, geographic coverage, product performance, and Customer service. Large Customers continue to seek productivity gains and lower prices from us and their other suppliers. We may lose business or negatively impact our margins if we are unable to deliver the best value to our Customers.

Changes in our product mix impact our financial performance.

We sell products that have varying profit margins. Our financial performance can be impacted depending on the mix of products we sell during a given period. Our outlook assumes a certain geographic mix of sales as well as a product mix of sales. If actual results vary from this projected geographic and product mix of sales, our results could be negatively impacted.

Unavailable or higher cost materials could impact our financial performance.

We obtain raw materials including steel, filter media, petroleum-based products, and other components from third-party suppliers and tend to carry limited raw material inventories. An unanticipated delay in delivery by our suppliers could result in the inability to deliver on-time and meet the expectations of our Customers. This could negatively affect our financial performance. An increase in commodity prices could also result in lower operating margins.

Unfavorable fluctuationsunfavorable fluctuation in foreign currency exchange rates could negativelyadversely impact our results and financial position.

result of operations.

Acquisitions In addition, decreased value of local currency may have an impact onmake it difficult for some of our results.

We have madecustomers, distributors and continueend users to pursue acquisitions. We cannot guarantee that these acquisitions will have a positive impact onpurchase our results. These acquisitions could negatively impact our profitability due to operatingproducts.

CostsRegulatory - costs associated with lawsuits, investigations or investigationscomplying with laws and regulations may have an adverse effect on our results of operations.

Additional

net income.

assessments of our tax exposures may have an adverse effect on the Company’sour provision for income taxes and cash tax liability.

Compliance

Weno assurance, however, that the cost or availability of future borrowings will not be impacted by future capital market disruptions.

Americas Riverbank, California (I)* Valencia, California (E)* Dixon, Illinois Frankfort, Indiana Cresco, Iowa Nicholasville, Kentucky Chesterfield, Missouri (E)* Stevens Point, Wisconsin Sao Paulo, Brazil (E)* Brockville, Canada (E)* New Delhi, India Aguascalientes, Mexico Rayong, Thailand (I) Distribution Centers Most, Czech Republic Dammam, Saudi Arabia (I) The Company’s properties are utilized for both the Engine and Industrial Products segments except as indicated with an (E) for Engine or (I) for Industrial. The Company leases certain of its facilities, primarily under long-term leases. The facilities denoted Name Age Positions and Offices Held First Fiscal Year Amy C. Becker 49 Vice President, General Counsel and Secretary 2014 Tod E. Carpenter 55 Chief Operating Officer 2008 William M. Cook 61 Chairman, President and Chief Executive Officer 1994 Sandra N. Joppa 49 Vice President, Human Resources 2006 Mary Lynne Perushek 56 Vice President and Chief Information Officer 2007 Thomas R. Scalf 48 Senior Vice President, Engine Products 2014 James F. Shaw 45 Vice President and Chief Financial Officer 2012 Wim Vermeersch 48 Vice President, Europe and Middle East 2012 Jay L. Ward 50 Senior Vice President, Industrial Products 2006 Eugene X. Wu 46 Vice President, Asia Pacific 2012 On April 1, 2015, Mr. Chief Executive Officer. 2013, Ms. PricewaterhouseCoopers LLP. President of Blow Molded Specialties, Inc., a manufacturing company focused on the extrusion of blow molded parts and assemblies. $ $ $ $ Period Total Number of Average Price Total Number of Maximum Number May 1 - May 31, 2014 756,257 $ 41.35 756,257 10,544,144 June 1 - June 30, 2014 1,204,889 $ 41.29 1,204,889 9,339,255 July 1 - July 31, 2014 801,028 $ 40.86 795,545 8,543,710 Total 2,762,174 $ 41.18 2,756,691 8,543,710 (1) On Year Ended July 31, 2009 2010 2011 2012 2013 2014 Donaldson Company, Inc. $ 100.00 $ 126.32 $ 148.88 $ 185.33 $ 199.13 $ 216.11 S&P 500 100.00 113.83 136.21 148.64 185.80 217.28 S&P Industrial Machinery 100.00 131.25 158.27 166.58 233.72 274.37 Year Ended July 31, 2014 2013 2012 2011 2010 Net sales $ 2,473.5 $ 2,436.9 $ 2,493.2 $ 2,294.0 $ 1,877.1 Net earnings 260.2 247.4 264.3 225.3 166.2 Basic earnings per share 1.79 1.67 1.76 1.46 1.07 Diluted earnings per share 1.76 1.64 1.73 1.43 1.05 Total assets 1,942.4 1,743.6 1,730.1 1,726.1 1,499.5 Long-term obligations 243.7 102.8 203.5 205.7 256.2 Cash dividends declared per share 0.610 0.450 0.335 0.280 0.240 Cash dividends paid per share 0.575 0.410 0.320 0.268 0.235 1995 statement below. decreased 4.5% Net Sales Percent Year ended July 31, 2012 $ 2,493.2 NA Net sales change, excluding foreign currency translation impact (24.1 ) (1.0 )% Foreign currency translation impact (32.2 ) (1.3 )% Year ended July 31, 2013 $ 2,436.9 (2.3 )% Net sales change, excluding foreign currency translation impact 48.0 2.0 % Foreign currency translation impact (11.4 ) (0.5 )% Year ended July 31, 2014 $ 2,473.5 1.5 % Net Earnings Percent Year ended July 31, 2012 $ 264.3 NA Net earnings change, excluding foreign currency translation impact (14.8 ) (5.6 )% Foreign currency translation impact (2.1 ) (0.8 )% Year ended July 31, 2013 $ 247.4 (6.4 )% Net earnings change, excluding foreign currency translation impact 13.8 5.6 % Foreign currency translation impact (1.0 ) (0.4 )% Year ended July 31, 2014 $ 260.2 5.2 % 2014 2013 2012 (thousands of dollars) Engine Products segment: Off-Road Products $ 342,205 $ 358,834 $ 376,870 On-Road Products 130,029 128,446 163,934 Aftermarket Products* 1,012,165 912,717 922,660 Aerospace and Defense Products 99,628 104,191 106,676 Total Engine Products segment 1,584,027 1,504,188 1,570,140 Industrial Products segment: Industrial Filtration Solutions Products 553,356 529,751 553,453 Gas Turbine Products 156,860 232,922 180,669 Special Applications Products 179,223 170,087 188,986 Total Industrial Products segment 889,439 932,760 923,108 Total Company $ 2,473,466 $ 2,436,948 $ 2,493,248 Engine Industrial Corporate & Total (thousands of dollars) 2014 Net sales $ 1,584,027 $ 889,439 $ — $ 2,473,466 Earnings before income taxes 233,920 133,978 (7,195 ) 360,703 2013 Net sales $ 1,504,188 $ 932,760 $ — $ 2,436,948 Earnings before income taxes 220,892 139,108 (11,819 ) 348,181 2012 Net sales $ 1,570,140 $ 923,108 $ — $ 2,493,248 Earnings before income taxes 227,941 149,249 (6,410 ) 370,780 2014 2013 2012 Engine Products 61.5 % 60.8 % 59.1 % Industrial Products 37.9 % 39.7 % 40.3 % Corporate and Unallocated 0.6 % (0.5 )% 0.6 % Total Company 100.0 % 100.0 % 100.0 % 2014 2013 2012 United States 20.3 % 26.0 % 30.3 % Europe 33.7 % 31.6 % 29.9 % Asia - Pacific 33.8 % 30.3 % 31.1 % Other 12.2 % 12.1 % 8.7 % Total Company 100.0 % 100.0 % 100.0 % address its level of profitability and also invest in other strategic initiatives. 5.5%. North America, and new program wins in Europe. in North America. fluctuations, Aftermarket products sales increased 2.1% with sales in the Americas increasing by 1.6%, Europe by 3.1% and Asia by 0.8%. Industrial Products Segment 3.5%. In constant currency fiscal 2016 Industrial Products sales decreased $27.3 million, or 3.1%. are consistent with fiscal 2015. $16.3 million. 2013 2012 2011 Engine Products 60.8 % 59.1 % 64.1 % Industrial Products 39.7 % 40.3 % 38.7 % Corporate and Unallocated (0.5 )% 0.6 % (2.8 )% Total Company 100.0 % 100.0 % 100.0 % 2013 2012 2011 United States 26.0 % 30.3 % 19.8 % Europe 31.6 % 29.9 % 31.0 % Asia - Pacific 30.3 % 31.1 % 39.6 % Other 12.1 % 8.7 % 9.6 % Total Company 100.0 % 100.0 % 100.0 % Payments Due by Period Contractual Obligations Total Less than 1 - 3 3 - 5 More than Long-term debt obligations $ 241,051 $ — $ — $ 116,051 $ 125,000 Capital lease obligations 3,177 1,329 1,766 82 — Interest on long-term debt obligations 64,861 10,294 20,481 10,836 23,250 Operating lease obligations 31,464 12,877 13,504 4,976 107 Purchase obligations(1) 162,727 154,297 8,412 2 16 Pension and deferred compensation(2) 91,504 17,913 10,670 10,597 52,324 Total(3) $ 594,784 $ 196,710 $ 54,833 $ 142,544 $ 200,697 2016. 1.25%. At July 31, 2016 and 2015, there was $38.2 million and $49.7 million, respectively, available under these two credit facilities. 2015, which had a maturity date of less than twelve months. At July 31, 2016 and 2015, there were no amounts drawn upon these letters of credit. Cash Equivalents Off-Balance Sheet Arrangements incurred in the future. The Company will continue to monitor results and expected cash flows in the future to assess whether goodwill impairment in the GTS reporting unit may be necessary. Defined Benefit Pension PlansThe Company incurs expenses relating to employee benefits such as non-contributory defined benefit pension plans. In accounting for these defined benefit pension plans, management must make a variety of assumptions and estimates including mortality rates, discount rates, overall Company compensation increases, expected return on plan assets, and health care cost trend rates. The Company considers historical data as well as current facts and circumstances and uses a third-party specialist to assist management in determining these estimates. Reflecting the relatively long-term nature of the U.S. plans’ obligations, approximately allocations for the U.S. plans. The Company relevant projected cash outflows. this Annual Report. Tod E. Carpenter September Year ended July 31, 2014 2013 2012 (thousands of dollars, except share Net sales $ 2,473,466 $ 2,436,948 $ 2,493,248 Cost of sales 1,595,640 1,589,821 1,619,485 Gross profit 877,826 847,127 873,763 Selling, general, and administrative 460,250 441,168 451,158 Research and development 61,837 62,630 59,589 Operating income 355,739 343,329 363,016 Other income, net (15,164 ) (15,762 ) (19,253 ) Interest expense 10,200 10,910 11,489 Earnings before income taxes 360,703 348,181 370,780 Income taxes 100,479 100,804 106,479 Net earnings $ 260,224 $ 247,377 $ 264,301 Weighted average shares - basic 145,594,300 148,273,904 150,286,403 Weighted average shares - diluted 147,641,113 150,455,193 152,940,605 Net earnings per share - basic $ 1.79 $ 1.67 $ 1.76 Net earnings per share - diluted $ 1.76 $ 1.64 $ 1.73 At July 31, 2014 2013 2012 (thousands of dollars, except share amounts) Net earnings $ 260,224 $ 247,377 $ 264,301 Foreign currency translation gain (loss) (2,122 ) 17,435 (98,723 ) Gain (loss) on hedging derivatives, net of deferred taxes of ($69), ($196), and $117, respectively 71 120 (672 ) Pension and postretirement liability adjustment, net of deferred taxes of $1,319, ($25,656), and $23,527, respectively (6,286 ) 46,860 (42,520 ) Total comprehensive income $ 251,887 $ 311,792 $ 122,386 At July 31, 2014 2013 (thousands of dollars, Assets Current assets Cash and cash equivalents $ 296,418 $ 224,138 Short-term investments 127,201 99,750 Accounts receivable, less allowance of $6,763 and $7,040 474,157 430,766 Inventories, net 253,351 234,820 Deferred income taxes 27,886 26,464 Prepaids and other current assets 46,264 39,724 Total current assets $ 1,225,277 $ 1,055,662 Property, plant, and equipment, net 451,665 419,280 Goodwill 166,406 165,568 Intangible assets, net 36,045 41,307 Other long-term assets 63,018 61,739 Total assets $ 1,942,411 $ 1,743,556 Liabilities and shareholders’ equity Current liabilities Short-term borrowings $ 185,303 $ 9,190 Current maturities of long-term debt 1,738 98,664 Trade accounts payable 216,603 186,460 Accrued employee compensation and related taxes 84,944 68,954 Accrued liabilities 40,845 38,527 Other current liabilities 80,147 74,640 Total current liabilities 609,580 476,435 Long-term debt 243,726 102,774 Deferred income taxes 22,386 23,604 Other long-term liabilities 64,236 55,556 Total liabilities 939,928 658,369 Commitments and contingencies (Note L and Note N) Shareholders’ equity Preferred stock, $1.00 par value, 1,000,000 shares authorized, none issued — — Common stock, $5.00 par value, 240,000,000 shares authorized, 758,216 758,216 Retained earnings 702,435 532,307 Stock compensation plans 19,601 21,745 Accumulated other comprehensive income (loss) (45,810 ) (37,473 ) Treasury stock, 11,237,522 and 5,490,725 shares in 2014 and 2013, at cost (431,959 ) (189,608 ) Total shareholders’ equity 1,002,483 1,085,187 Total liabilities and shareholders’ equity $ 1,942,411 $ 1,743,556 Year ended July 31, 2014 2013 2012 (thousands of dollars) Operating Activities Net earnings $ 260,224 $ 247,377 $ 264,301 Adjustments to reconcile net earnings to net cash provided by operating activities Depreciation and amortization 67,163 64,290 61,165 Equity in losses (earnings) of affiliates, net of distributions (3,384 ) 1,637 (2,380 ) Deferred income taxes (7,762 ) 8,347 6,344 Tax benefit of equity plans (8,781 ) (11,191 ) (10,316 ) Stock compensation plan expense 11,640 9,148 10,553 Loss on sale of business 905 — — Other, net 10,041 (6,175 ) (24,346 ) Changes in operating assets and liabilities, net of acquired businesses Accounts receivable (44,851 ) 3,705 (17,877 ) Inventories (19,273 ) 20,142 (4,149 ) Prepaids and other current assets (7,769 ) 13,495 (17,378 ) Trade accounts payable and other accrued expenses 59,686 (34,852 ) (6,205 ) Net cash provided by operating activities 317,839 315,923 259,712 Investing Activities Purchases of property, plant, and equipment (97,210 ) (94,895 ) (78,139 ) Proceeds from sale of property, plant, and equipment 395 558 969 Purchases of short-term investments (108,793 ) (99,339 ) (187,575 ) Proceeds from sale of short-term investments 81,486 97,365 88,277 Net cash used in investing activities (124,122 ) (96,311 ) (176,468 ) Financing Activities Proceeds from long-term debt 125,000 — — Repayments of long-term debt (81,898 ) (1,353 ) (46,205 ) Change in short-term borrowings 175,344 (86,957 ) 96,715 Purchase of treasury stock (279,395 ) (102,572 ) (130,233 ) Dividends paid (83,070 ) (60,320 ) (47,684 ) Tax benefit of equity plans 8,781 11,191 10,316 Exercise of stock options 14,437 16,043 13,691 Net cash used in financing activities (120,801 ) (223,968 ) (103,400 ) Effect of exchange rate changes on cash (636 ) 2,705 (27,549 ) Increase (decrease) in cash and cash equivalents 72,280 (1,651 ) (47,705 ) Cash and cash equivalents, beginning of year 224,138 225,789 273,494 Cash and cash equivalents, end of year $ 296,418 $ 224,138 $ 225,789 Supplemental Cash Flow Information Cash paid during the year for: Income taxes $ 93,086 $ 84,898 $ 91,915 Interest 11,050 13,531 13,410 Common Additional Retained Stock Accumulated Treasury Total (thousands of dollars, except per share amounts) Balance July 31, 2011 $ 443,216 — $ 925,542 $ 24,736 $ 40,027 $ (498,810 ) $ 934,711 Comprehensive income Net earnings 264,301 264,301 Foreign currency translation (98,723 ) (98,723 ) Pension liability adjustment, net of deferred taxes (42,520 ) (42,520 ) Net gain on cash flow hedging derivatives (672 ) (672 ) Comprehensive income 122,386 Treasury stock acquired (130,233 ) (130,233 ) Stock options exercised (9,834 ) (5,116 ) 27,698 12,748 Deferred stock and other activity (2,158 ) 312 213 1,926 293 Performance awards (9 ) (1 ) (10 ) Stock option expense 7,800 7,800 Tax reduction - employee plans 11,992 11,992 Two-for-one Stock split 315,000 (776,369 ) 461,369 — Dividends ($0.335 per share) (49,673 ) (49,673 ) Balance July 31, 2012 758,216 — 366,788 24,948 (101,888 ) (138,050 ) 910,014 Comprehensive income Net earnings 247,377 247,377 Foreign currency translation 17,435 17,435 Pension liability adjustment, net of deferred taxes 46,860 46,860 Net gain on cash flow hedging derivatives 120 120 Comprehensive income 311,792 Treasury stock acquired (102,572 ) (102,572 ) Stock options exercised (10,836 ) (21,256 ) 44,463 12,371 Deferred stock and other activity (2,125 ) (1,677 ) (1,586 ) 4,496 (892 ) Performance awards (573 ) (1,161 ) (1,617 ) 2,055 (1,296 ) Stock option expense 8,300 8,300 Tax reduction - employee plans 13,534 13,534 Dividends ($0.450 per share) (66,064 ) (66,064 ) Balance July 31, 2013 758,216 — 532,307 21,745 (37,473 ) (189,608 ) 1,085,187 Comprehensive income Net earnings 260,224 260,224 Foreign currency translation (2,122 ) (2,122 ) Pension liability adjustment, net of deferred taxes (6,286 ) (6,286 ) Net gain on cash flow hedging derivatives 71 71 Comprehensive income 251,887 Treasury stock acquired (279,395 ) (279,395 ) Stock options exercised (7,000 ) (10,493 ) 30,538 13,045 Deferred stock and other activity (3,144 ) (1,772 ) (431 ) 4,855 (492 ) Performance awards (409 ) (505 ) (1,713 ) 1,651 (976 ) Stock option expense 9,933 9,933 Tax reduction - employee plans 10,553 10,553 Dividends ($0.61 per share) (87,259 ) (87,259 ) Balance July 31, 2014 $ 758,216 $ — $ 702,435 $ 19,601 $ (45,810 ) $ (431,959 ) $ 1,002,483 At July 31, 2014 2013 Raw materials $ 112,522 $ 99,814 Work in process 17,256 29,097 Finished products 123,573 105,909 Total inventories $ 253,351 $ 234,820 At July 31, 2014 2013 Land $ 20,558 $ 21,116 Buildings 273,599 270,022 Machinery and equipment 753,637 687,797 Construction in progress 51,394 46,078 Less accumulated depreciation (647,523 ) (605,733 ) Total property, plant, and equipment, net $ 451,665 $ 419,280 Income TaxesThe provision for income taxes is computed based on the pre-tax income reported for financial statement purposes. Deferred tax assets and liabilities are recognized for the expected future tax consequences attributed to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using the enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to reverse. Valuation allowances are recorded to reduce deferred tax assets when it is more-likely-than-not that a tax benefit will not be realized. At July 31, 2014 2013 2012 Foreign currency translation adjustment $ 48,289 $ 50,411 $ 32,976 Net loss on cash flow hedging derivatives, net of deferred taxes (101 ) (172 ) (292 ) Pension and postretirement liability adjustment, net of deferred taxes (93,998 ) (87,712 ) (134,572 ) Total accumulated other comprehensive loss $ (45,810 ) $ (37,473 ) $ (101,888 ) 2014 2013 2012 (thousands, except per share amounts) Weighted average shares - basic 145,594 148,274 150,286 Diluted share equivalents 2,047 2,181 2,655 Weighted average shares - diluted 147,641 150,455 152,941 Net earnings for basic and diluted earnings per share computation $ 260,224 $ 247,377 $ 264,301 Net earnings per share - basic $ 1.79 $ 1.67 $ 1.76 Net earnings per share - diluted $ 1.76 $ 1.64 $ 1.73 Treasury StockRepurchased common stock is stated at cost (determined on an average cost basis) and is presented as a reduction of shareholders’ equity. Stock-Based CompensationThe Company offers stock-based employee compensation plans, which are more fully described in Note expenses for the years ended July 31, 2016, 2015 and 2014, respectively. calculate basic and diluted earnings per share (in millions, except per share amounts): Engine Industrial Total (thousands of dollars) Balance as of July 31, 2012 $ 71,747 $ 91,202 $ 162,949 Foreign exchange translation 574 2,045 2,619 Balance as of July 31, 2013 $ 72,321 $ 93,247 $ 165,568 Foreign exchange translation 52 786 838 Balance as of July 31, 2014 $ 72,373 $ 94,033 $ 166,406 Gross Accumulated Net (thousands of dollars) Balance as of July 31, 2012 $ 80,075 $ (33,875 ) $ 46,200 Amortization expense — (5,503 ) (5,503 ) Foreign exchange translation 1,807 (1,197 ) 610 Balance as of July 31, 2013 $ 81,882 $ (40,575 ) $ 41,307 Amortization expense — (5,154 ) (5,154 ) Retirements (775 ) 600 (175 ) Foreign exchange translation 176 (109 ) 67 Balance as of July 31, 2014 $ 81,283 $ (45,238 ) $ 36,045 2015 (in millions): Fiscal Year 2015 $ 5,029 2016 $ 5,027 2017 $ 4,910 2018 $ 3,474 2019 $ 2,923 Thereafter $ 14,682 1.25%. At July 31, 2016 and 2015, there was $38.2 million and $49.7 million, respectively, available for under these two credit facilities. less than twelve months. 2014 2013 (thousands of dollars) 6.59% Unsecured senior notes, interest payable semi-annually, principal payment of $80.0 million due November 14, 2013 — 80,000 5.48% Unsecured senior notes, interest payable semi-annually, principal payment of $50.0 million due June 1, 2017 50,000 50,000 5.48% Unsecured senior notes, interest payable semi-annually, principal payment of $25.0 million due September 28, 2017 25,000 25,000 5.48% Unsecured senior notes, interest payable semi-annually, principal payment of $25.0 million due November 30, 2017 25,000 25,000 3.72% Unsecured senior notes, interest payable semi-annually, principal payment of $125.0 million due March 27, 2024 125,000 — 2.019% Guaranteed senior note, interest payable semi-annually, principal payment of ¥1.65 billion due May 18, 2014 — 16,848 Variable Rate Guaranteed senior note, interest payable quarterly, principal payment of ¥1.65 billion due May 19, 2019 and an interest rate of 0.56% as of July 31, 2014 16,051 — Capitalized lease obligations and other, with various maturity dates and interest rates 3,177 2,520 Terminated interest rate swap contracts 1,236 2,070 Total 245,464 201,438 Less current maturities 1,738 98,664 Total long-term debt $ 243,726 $ 102,774 In November 2010, the shareholders approved the 2010 Master Stock Incentive Plan (the Plan). The Plan extends through September 2020 and allows for the granting of nonqualified stock options, incentive stock options, restricted stock, restricted stock units, stock appreciation rights, dividend equivalents and other stock-based awards. Options under the Plan are granted to key employees whereby the option exercise price is equivalent to the market price of the Company's common stock at the date of grant. Options are generally exercisable for up to 10 years from the date of grant. The Plan also allows for the granting of performance awards to a limited number of key executives. As administered by the Human Resources Committee of the Company’s Board of Directors to date, these performance awards are payable in common stock and are based on a formula which measures performance of the Company over a three-year period. Performance award expense under these plans totaled $0.3 million, $0.1 million and $0.7 million in the years ended July 31, 2016, 2015 and 2014, respectively. Significant Other Observable Inputs At July 31, 2014 2013 (thousands of dollars) Asset derivatives recorded under the caption Prepaids and other current assets Foreign exchange contracts $ 931 $ 734 Liability derivatives recorded under the caption Other current liabilities Foreign exchange contracts (1,242 ) (845 ) Forward exchange contracts - net liability position $ (311 ) $ (111 ) The Company assesses the impairment of 2014 2013 2012 (thousands of dollars) Service cost $ 18,821 $ 19,439 $ 15,464 Interest cost 19,499 16,953 19,436 Expected return on assets (30,794 ) (28,111 ) (28,114 ) Prior service cost and transition amortization 590 591 725 Actuarial loss amortization 7,403 10,362 5,696 Net periodic benefit cost $ 15,519 $ 19,234 $ 13,207 2014 2013 (thousands of dollars) Change in benefit obligation: Benefit obligation, beginning of year $ 444,943 $ 461,492 Service cost 18,821 19,439 Interest cost 19,499 16,953 Plan amendments — (9 ) Participant contributions 1,308 1,207 Actuarial loss/(gain) 29,638 (27,176 ) Currency exchange rates 8,873 1,225 Divestiture (3,200 ) — Curtailment — (11,692 ) Benefits paid (21,229 ) (16,496 ) Benefit obligation, end of year $ 498,653 $ 444,943 Change in plan assets: Fair value of plan assets, beginning of year $ 452,724 $ 387,576 Actual return on plan assets 45,978 51,524 Company contributions 4,263 28,186 Participant contributions 1,308 1,207 Currency exchange rates 9,912 727 Divestiture (3,086 ) — Benefits paid (21,229 ) (16,496 ) Fair value of plan assets, end of year $ 489,870 $ 452,724 Funded status: Funded/(Underfunded) status at July 31, 2014 and 2013 $ (8,783 ) $ 7,781 Amounts recognized on the consolidated balance sheets consist of: Other long-term assets 17,800 23,234 Other current liabilities (832 ) (949 ) Other long-term liabilities (25,751 ) (14,504 ) Recognized asset / (liability) $ (8,783 ) $ 7,781 Weighted average actuarial assumptions 2014 2013 All U.S. plans: Discount rate 4.33 % 4.58 % Rate of compensation increase 2.61 % 2.61 % Non - U.S. plans: Discount rate 3.64 % 4.04 % Rate of compensation increase 2.79 % 2.92 % Weighted average actuarial assumptions 2014 2013 2012 All U.S. plans: Discount rate 4.58 % 3.59 % 4.91 % Expected return on plan assets 7.50 % 7.50 % 7.75 % Rate of compensation increase 2.61 % 2.61 % 4.50 % Non - U.S. plans: Discount rate 4.04 % 4.13 % 5.36 % Expected return on plan assets 5.48 % 5.20 % 6.03 % Rate of compensation increase 2.92 % 2.86 % 3.57 % Asset Category Quoted Prices in Significant Significant Total 2014 Cash $ 14.2 — — $ 14.2 Global Equity Securities 107.3 87.3 21.1 215.7 Fixed Income Securities 27.0 — 58.7 85.7 Real Assets 7.1 — 13.5 20.6 Total U.S. Assets at July 31, 2014 $ 155.6 $ 87.3 $ 93.3 $ 336.2 2013 Cash $ 18.5 $ — $ — $ 18.5 Global Equity Securities 82.5 50.2 19.4 152.1 Fixed Income Securities 42.9 20.8 60.8 124.5 Real Assets — — 22.1 22.1 Total U.S. Assets at July 31, 2013 $ 143.9 $ 71.0 $ 102.3 $ 317.2 2012 Cash $ 0.9 $ — $ — $ 0.9 Global Equity Securities 61.5 57.3 19.4 138.2 Fixed Income Securities 29.2 19.5 55.0 103.7 Real Assets — — 31.4 31.4 Total U.S. Assets at July 31, 2012 $ 91.6 $ 76.8 $ 105.8 $ 274.2 Global Equity Fixed Income Real Assets Total Beginning balance at August 1, 2011 $ 17.9 $ 31.4 $ 38.0 $ 87.3 Unrealized gains 0.1 0.6 (2.1 ) (1.4 ) Realized gains 1.5 0.4 — 1.9 Purchases 1.0 17.0 2.8 20.8 Sales (1.1 ) (1.7 ) — (2.8 ) Net transfers into (out of) Level 3 — 7.3 (7.3 ) — Ending balance at July 31, 2012 $ 19.4 $ 55.0 $ 31.4 $ 105.8 Unrealized gains (0.8 ) 6.4 1.1 6.7 Realized gains 1.7 0.7 — 2.4 Purchases 2.1 — 1.0 3.1 Sales (3.0 ) (1.3 ) (11.4 ) (15.7 ) Ending balance at July 31, 2013 $ 19.4 $ 60.8 $ 22.1 $ 102.3 Unrealized gains 1.7 (2.0 ) — (0.3 ) Realized gains 2.4 8.9 0.8 12.1 Purchases 2.0 20.0 2.7 24.7 Sales (4.4 ) (29.0 ) (12.1 ) (45.5 ) Ending balance at July 31, 2014 $ 21.1 $ 58.7 $ 13.5 $ 93.3 Fair Value Unfunded Redemption Frequency Redemption Global Equity $ 215.7 $ 5.2 Daily, Monthly, Quarterly, Annually 10 - 100 days Fixed Income 85.7 — Daily, Quarterly, Semi-Annually 60 - 120 days Real Assets 20.6 6.9 Daily, Quarterly 95 days Total $ 322.0 $ 12.1 Asset Category Quoted Prices in Significant Significant Total 2014 Cash $ 5.7 $ — $ — $ 5.7 Global Equity Securities 71.3 — — 71.3 Fixed Income Securities 4.8 23.3 — 28.1 Equity/Fixed Income 18.0 — 30.5 48.5 Total Non-U.S. Assets at July 31, 2014 $ 99.8 $ 23.3 $ 30.5 $ 153.6 2013 Cash $ 0.6 $ — $ — $ 0.6 Global Equity Securities 63.8 — — 63.8 Fixed Income Securities 6.9 21.0 — 27.9 Equity/Fixed Income 16.9 — 26.3 43.2 Total Non-U.S. Assets at July 31, 2013 $ 88.2 $ 21.0 $ 26.3 $ 135.5 2012 Global Equity Securities $ 37.1 $ — $ — $ 37.1 Fixed Income Securities 5.9 28.4 — 34.3 Equity/Fixed Income 13.3 — 21.8 35.1 Real Assets — 6.8 — 6.8 Total Non-U.S. Assets at July 31, 2012 $ 56.3 $ 35.2 $ 21.8 $ 113.3 Equity/Fixed Beginning balance at August 1, 2011 $ 26.3 Unrealized gains 1.4 Foreign currency exchange (3.8 ) Purchases 2.6 Sales (4.6 ) Net transfers into (out of) Level 3 (0.1 ) Ending balance at July 31, 2012 $ 21.8 Unrealized gains 1.1 Foreign currency exchange 1.7 Purchases 2.6 Sales (0.9 ) Ending balance at July 31, 2013 $ 26.3 Unrealized gains 4.3 Realized gains 0.1 Foreign currency exchange 0.1 Purchases 3.1 Sales (3.4 ) Ending balance at July 31, 2014 $ 30.5 Fair Value Unfunded Redemption Frequency Redemption Fixed Income 23.3 — Weekly 7 days Equity/Fixed Income 30.5 — Yearly 90 days Total $ 53.8 $ — Fiscal Year 2015 $ 23,032 2016 $ 22,728 2017 $ 27,717 2018 $ 25,059 2019 $ 27,754 2020-2024 $ 149,865 NOTE Stock Compensation PlansThe Stock Compensation Plans in the Consolidated Statements of Changes in Shareholders’ Equity consist of the balance of amounts payable to eligible participants for stock compensation that was deferred to a Rabbi Trust pursuant to the provisions of the 2010 Master Stock Incentive Plan, as well as performance awards payable in common stock discussed further in Note 2014 2013 Beginning balance 5,490,725 3,980,832 Stock repurchases 6,795,545 2,986,794 Net issuance upon exercise of stock options (863,249 ) (1,288,560 ) Issuance under compensation plans (175,160 ) (174,408 ) Other activity (10,339 ) (13,933 ) Ending balance 11,237,522 5,490,725 (Thousands of dollars) Foreign Pension Derivative Total Balance as of July 31, 2013, net of tax $ 50,411 $ (87,712 ) $ (172 ) $ (37,473 ) Other comprehensive (loss) income before reclassifications and tax (2,949 ) (16,120 ) 413 (18,656 ) Tax benefit (expense) — 4,391 (145 ) 4,246 Other comprehensive (loss) income before reclassifications, net of tax $ (2,949 ) $ (11,729 ) $ 268 (14,410 ) Reclassifications, before tax 827 8,514 (273 ) 9,068 Tax benefit (expense) — (3,071 ) 76 (2,995 ) Reclassifications, net of tax 827 5,443 (b) (197 ) 6,073 Other comprehensive (loss) income, net of tax (2,122 ) (6,286 ) 71 (c) (8,337 ) Balance as of July 31, 2014, net of tax $ 48,289 $ (93,998 ) $ (101 ) $ (45,810 ) (a) Taxes are not provided on cumulative translation adjustments as substantially all translation adjustments relate to earnings that are intended to be indefinitely reinvested outside the U.S. Relates to foreign currency cash flow hedges that were reclassified from accumulated other comprehensive loss to other income, net (see Note 2014 2013 2012 Risk - free interest rate 0.31 - 2.8 % 0.02 - 1.7 % 0.10 - 1.8 % Expected volatility 18.2 - 28.0 % 22.5 - 29.7 % 25.8 - 31.9 % Expected dividend yield 1.4 - 1.6 % 1.0 - 1.4 % 1.0 % Expected life Director and officer grants 8 years 8 years 8 years Non - officer original grants 7 years 7 years 7 years Reload grants ≤6 years ≤5 years ≤8 years Options Weighted Outstanding at July 31, 2011 8,387,994 $ 17.72 Granted 1,082,979 34.76 Exercised (1,379,827 ) 11.90 Canceled (34,819 ) 27.45 Outstanding at July 31, 2012 8,056,327 20.97 Granted 965,050 33.91 Exercised (1,607,081 ) 14.79 Canceled (84,476 ) 33.94 Outstanding at July 31, 2013 7,329,820 23.88 Granted 900,073 42.17 Exercised (1,008,848 ) 18.80 Canceled (23,163 ) 34.02 Outstanding at July 31, 2014 7,197,882 26.84 Range of Exercise Prices Number Weighted Weighted Number Weighted $0.00 to $16.69 1,003,381 1.18 $ 15.93 1,003,381 $ 15.93 $16.70 to $22.69 2,197,543 4.12 19.13 2,197,543 19.13 $22.70 to $28.69 400,114 3.41 22.97 400,114 22.97 $28.70 to $34.69 1,839,809 7.25 31.58 1,254,101 30.59 $34.70 and above 1,757,035 8.10 38.64 622,680 35.52 7,197,882 5.44 26.84 5,477,819 23.31 credit. At July 31, 2016 and 2015, there were no amounts drawn upon these letters of credit. Options Weighted Non - vested at July 31, 2013 1,805,803 $ 9.18 Granted 849,850 11.63 Vested (915,677 ) 9.24 Canceled (19,913 ) 9.47 Non - vested at July 31, 2014 1,720,063 10.35 2014 2013 2012 (thousands of dollars) Earnings before income taxes: United States $ 131,396 $ 147,317 $ 171,101 Foreign 229,307 200,864 199,679 Total $ 360,703 $ 348,181 $ 370,780 2014 2013 2012 (thousands of dollars) Income taxes: Current Federal $ 48,981 $ 35,820 $ 45,468 State 4,724 4,337 4,012 Foreign 54,536 52,300 50,655 108,241 92,457 100,135 Deferred Federal (9,465 ) 7,071 7,391 State 365 312 722 Foreign 1,338 964 (1,769 ) (7,762 ) 8,347 6,344 Total $ 100,479 $ 100,804 $ 106,479 2014 2013 2012 Statutory U.S. federal rate 35.0 % 35.0 % 35.0 % State income taxes 1.1 % 1.2 % 1.2 % Foreign operations (6.1 )% (6.3 )% (5.2 )% Export, manufacturing, and research credits (0.8 )% (1.5 )% (1.0 )% Change in unrecognized tax benefits (1.1 )% 0.5 % (1.0 )% Other (0.2 )% 0.1 % (0.3 )% 27.9 % 29.0 % 28.7 % 2014 2013 (thousands of dollars) Deferred tax assets: Accrued expenses $ 11,118 $ 11,580 Compensation and retirement plans 32,317 23,578 NOL and tax credit carryforwards 3,471 3,279 LIFO and inventory reserves 5,482 5,037 Other 4,470 3,890 Deferred tax assets, gross 56,858 47,364 Valuation allowance (3,471 ) (3,228 ) Net deferred tax assets 53,387 44,136 Deferred tax liabilities: Depreciation and amortization (49,901 ) (45,737 ) Other (1,025 ) (663 ) Deferred tax liabilities (50,926 ) (46,400 ) Prepaid tax assets 4,392 4,015 Net tax asset $ 6,853 $ 1,751 The Company 2014 2013 2012 (thousands of dollars) Gross unrecognized tax benefits at beginning of fiscal year $ 18,419 $ 16,514 $ 20,005 Additions for tax positions of the current year 2,959 5,453 3,323 Additions for tax positions of prior years 1,706 407 261 Reductions for tax positions of prior years (7,113 ) (1,640 ) (4,462 ) Settlements (240 ) (277 ) — Reductions due to lapse of applicable statute of limitations (726 ) (2,038 ) (2,613 ) Gross unrecognized tax benefits at end of fiscal year $ 15,005 $ 18,419 $ 16,514 The Company has an internal measurement system to evaluate performance and allocate resources based on Engine Industrial Corporate & Total (thousands of dollars) 2014 Net sales $ 1,584,027 $ 889,439 $ — $ 2,473,466 Depreciation and amortization 38,925 23,942 4,296 67,163 Equity earnings in unconsolidated affiliates 5,596 940 — 6,536 Earnings before income taxes 233,920 133,978 (7,195 ) 360,703 Assets 900,083 572,000 470,328 1,942,411 Equity investments in unconsolidated affiliates 17,439 3,959 — 21,398 Capital expenditures 56,340 34,652 6,218 97,210 2013 Net sales $ 1,504,188 $ 932,760 $ — $ 2,436,948 Depreciation and amortization 35,815 22,447 6,028 64,290 Equity earnings in unconsolidated affiliates 4,000 693 — 4,693 Earnings before income taxes 220,892 139,108 (11,819 ) 348,181 Assets 826,151 527,416 389,989 1,743,556 Equity investments in unconsolidated affiliates 15,563 3,277 — 18,840 Capital expenditures 52,864 33,134 8,897 94,895 2012 Net sales $ 1,570,140 $ 923,108 $ — $ 2,493,248 Depreciation and amortization 36,646 18,852 5,667 61,165 Equity earnings in unconsolidated affiliates 3,966 769 — 4,735 Earnings before income taxes 227,941 149,249 (6,410 ) 370,780 Assets 845,176 520,739 364,167 1,730,082 Equity investments in unconsolidated affiliates 17,304 2,822 — 20,126 Capital expenditures 46,816 24,083 7,240 78,139 2014 2013 2012 (thousands of dollars) Engine Products segment: Off-Road Products $ 342,205 $ 358,834 $ 376,870 On-Road Products 130,029 128,446 163,934 Aftermarket Products* 1,012,165 912,717 922,660 Aerospace and Defense Products 99,628 104,191 106,676 Total Engine Products segment 1,584,027 1,504,188 1,570,140 Industrial Products segment: Industrial Filtration Solutions Products 553,356 529,751 553,453 Gas Turbine Products 156,860 232,922 180,669 Special Applications Products 179,223 170,087 188,986 Total Industrial Products segment 889,439 932,760 923,108 Total Company $ 2,473,466 $ 2,436,948 $ 2,493,248 Net Sales Property, Plant, & (thousands of dollars) 2014 United States $ 1,019,926 $ 196,712 Europe 728,554 128,904 Asia - Pacific 517,305 72,089 Other 207,681 53,960 Total $ 2,473,466 $ 451,665 2013 United States $ 1,010,934 $ 166,614 Europe 678,996 123,710 Asia - Pacific 546,406 75,206 Other 200,612 53,750 Total $ 2,436,948 $ 419,280 2012 United States $ 1,064,474 $ 146,328 Europe 678,619 114,266 Asia - Pacific 572,163 80,200 Other 177,992 44,115 Total $ 2,493,248 $ 384,909 equipment by geographic region are summarized as follows (in millions): 2015. Balance at July 31, 2012 $ 10,905 Accruals for warranties issued during the reporting period 5,940 Accruals related to pre-existing warranties (including changes in estimates) (1,081 ) Less settlements made during the period (5,238 ) Balance at July 31, 2013 $ 10,526 Accruals for warranties issued during the reporting period 4,339 Accruals related to pre-existing warranties (including changes in estimates) (1,185 ) Less settlements made during the period (4,651 ) Balance at July 31, 2014 $ 9,029 First Second Third Fourth (thousands of dollars) 2014 Net sales $ 599,384 $ 581,622 $ 624,234 $ 668,226 Gross profit 214,394 201,648 223,461 238,323 Net earnings 61,592 58,340 67,336 72,956 Basic earnings per share 0.42 0.40 0.46 0.51 Diluted earnings per share 0.41 0.39 0.46 0.50 Dividends declared per share 0.140 0.140 0.165 0.165 Dividends paid per share 0.130 0.140 0.140 0.165 2013 Net sales $ 588,947 $ 596,036 $ 619,371 $ 632,594 Gross profit 198,293 198,977 221,501 228,356 Net earnings 54,113 50,813 69,842 72,609 Basic earnings per share 0.36 0.34 0.47 0.49 Diluted earnings per share 0.36 0.34 0.46 0.48 Dividends declared per share 0.090 0.100 0.130 0.130 Dividends paid per share 0.090 0.090 0.100 0.130 The Company of this Annual Report. Report. Plan Category Number of securities Weighted - average Number of securities (a) (b) (c) Equity compensation plans approved by security holders: 1980 Master Stock Compensation Plan: Deferred Stock Gain Plan 44,312 $ 8.1173 — 1991 Master Stock Compensation Plan: Deferred Stock Option Gain Plan 527,737 $ 19.3285 — Deferred LTC/Restricted Stock 200,760 $ 12.7226 — 2001 Master Stock Incentive Plan: Stock Options 3,166,009 $ 19.3330 — Deferred LTC/Restricted Stock 238,861 $ 18.9174 — 2010 Master Stock Incentive Plan: Stock Options 2,936,465 $ 34.9944 See Note 1 Stock Options for Non-Employee Directors 517,712 34.7748 Long-Term Compensation 52,128 $ 32.6187 — Subtotal for plans approved by security holders 7,683,984 $ 26.1980 Equity compensation plans not approved by security holders: Non-qualified Stock Option Program for Non-Employee Directors 577,696 $ 19.4558 See Note 2 ESOP Restoration 35,367 $ 7.5708 See Note 3 Subtotal for plans not approved by security holders 613,063 18.7702 Total 8,297,047 25.6491 President, Chief Executive Officer (Principal Executive Officer) /s/ Vice President and Chief Financial Officer (Principal Financial Officer) /s/ Melissa A. Osland Controller Melissa A. Osland (Principal Accounting Officer) * Director Michael J. Hoffman Willard D. Oberton James J. Owens Ajita G. Rajendra * Amy C. Becker As attorney-in-fact Additions Description Balance at Charged to Charged to Deductions Balance at Year ended July 31, 2014: Allowance for doubtful accounts deducted from accounts receivable $ 7,040 $ 393 $ (1 ) $ (669 ) $ 6,763 Year ended July 31, 2013: Allowance for doubtful accounts deducted from accounts receivable $ 6,418 $ 1,241 $ 230 $ (849 ) $ 7,040 Year ended July 31, 2012: Allowance for doubtful accounts deducted from accounts receivable $ 6,908 $ 1,151 $ (676 ) $ (965 ) $ 6,418 EXHIBIT INDEX *3-B — Certificate of Designation, Preferences and Rights of Series A Junior Participating Preferred Stock of Registrant, dated as of March 3, 2006 (Filed as Exhibit 3-B to 2011 Form 10-K Report) *3-C — Amended and Restated Bylaws of Registrant (as of *4 — ** *4-A — Preferred Stock Amended and Restated Rights Agreement between Registrant and Wells Fargo Bank, N.A., as Rights Agent, dated as of January 27, 2006 (Filed as Exhibit 4-A to 2011 Form 10-K Report) *10-A — Officer Annual Cash Incentive Plan (Filed as Exhibit 10-A to 2011 Form 10-K Report)*** *10-B — 1980 Master Stock Compensation Plan as Amended (Filed as Exhibit 10-A to Form 10-Q Report filed for the first quarter ended October 31, 2008)*** *10-C — Form of Performance Award Agreement under 1991 Master Stock Compensation Plan (Filed as Exhibit 10-B to Form 10-Q Report filed for the first quarter ended October 31, 2008)*** *10-D — ESOP Restoration Plan (2003 Restatement) (Filed as Exhibit 10-D to 2009 Form 10-K Report)*** *10-E — Compensation Plan for *10-F — Independent Director Retirement and Death Benefit Plan as amended (Filed as Exhibit 10-D to Form 10-Q Report filed for the first quarter ended October 31, 2008)*** *10-G — Supplemental Executive Retirement Plan (2008 Restatement) (Filed as Exhibit 10-G to 2011 Form 10-K Report)*** *10-H — 1991 Master Stock Compensation Plan as amended (Filed as Exhibit 10-E to Form 10-Q Report filed for the first quarter ended October 31, 2008)*** *10-I — Form of Restricted Stock Award under 1991 Master Stock Compensation Plan (Filed as Exhibit 10-F to Form 10-Q Report filed for the first quarter ended October 31, 2008)*** *10-J — Form of Agreement to Defer Compensation for certain Executive Officers (Filed as Exhibit 10-G to Form 10-Q Report filed for the first quarter ended October 31, 2008)*** *10-K — Stock Option Program for Non-employee Directors (Filed as Exhibit 10-H to Form 10-Q Report filed for the first quarter ended October 31, 2008)*** *10-L — Note Purchase Agreement among Donaldson Company, Inc. and certain listed Insurance Companies Dated as of July 15, 1998 (Filed as Exhibit 10-I to Form 10-Q Report filed for the first quarter ended October 31, 2008) *10-M — Second Supplement and First Amendment to Note Purchase Agreement among Donaldson Company, Inc. and certain listed Insurance Companies dated as of September 30, 2004 (Filed as Exhibit 10-N to 2010 Form 10-K Report) *10-N — 2001 Master Stock Incentive Plan (Filed as Exhibit 10-O to 2009 Form 10-K Report)*** *10-O — Form of Officer Stock Option Award Agreement under the 2001 Master Stock Incentive Plan (Filed as Exhibit 10-P to 2010 Form 10-K Report)*** *10-P — Form of Non-Employee Director Non-Qualified Stock Option Agreement under the 2001 Master Stock Incentive Plan (Filed as Exhibit 10-Q to 2010 Form 10-K Report)*** *10-Q — Restated Compensation Plan for Non-Employee Directors dated July 28, 2006 (Filed as Exhibit 10-Q to 2011 Form 10-K Report)*** *10-R — Restated Long-Term Compensation Plan dated May 23, 2006 (Filed as Exhibit 10-R to 2011 Form 10-K Report)*** *10-S — Qualified Performance-Based Compensation Plan (Filed as Exhibit 10-S to 2011 Form 10-K Report)*** *10-T — *10-U — Deferred Stock Option Gain Plan (2008 Restatement) (Filed as Exhibit 10-U to 2011 Form 10-K Report) *** *10-V — Excess Pension Plan (2008 Restatement) (Filed as Exhibit 10-V to 2011 Form 10-K Report) *** *10-W — Form of Management Severance Agreement for Executive Officers (Filed as Exhibit 10-A to Form 10-Q Report for the Third Quarter ended April 30, 2008)*** *10-X — 2010 Master Stock Incentive Plan (Filed as Exhibit 4.5 to Registration Statement on Form — Form of Officer Stock Option Award Agreement under the 2010 Master Stock Incentive Plan (Filed as Exhibit 10.1 to Form 8-K Report filed on December 16, 2010) *** *10-Z — Form of Restricted Stock Award Agreement under the 2010 Master Stock Incentive Plan (Filed as Exhibit 10.2 to Form 8-K Report filed on December 16, 2010) *** *10-AA — Non-Employee Director Automatic Stock Option Grant Program (Filed as Exhibit 10-AA to 2011 *10-BB — Form of Indemnification Agreement for Directors (Filed as Exhibit 10.1 to Form 8-K Report filed on April 2, 2012)*** *10-CC — Form of Non-Employee Director Non-Qualified Stock Option Agreement under the 2010 Master Stock Incentive Plan (Filed as Exhibit 10-CC to 2012 Form 10-K Report)*** *10-DD — Form of Management Severance Agreement for Executive Officers (Filed as Exhibit 10.1 to Form 8-K Report filed October 4, 2012)*** *10-EE — Compensation Plan for Non-Employee Directors (Filed as Exhibit 10-B to Form 10-Q Report filed December 6, 2012)*** *10-FF — Non-Employee Director Automatic Stock Option Grant Program (Filed as Exhibit 10-FF to 2013 Form 10-K Report)*** *10-GG — Credit Agreement among Donaldson Company, Inc. and certain listed lending parties dated as of December 7, 2012 (Filed as Exhibit 10.1 to Form 8-K Report filed December 13, 2012)* *10-HH — Note Purchase Agreement, dated as of March 27, 2014, by and among Donaldson Company, Inc. and the purchasers named therein (Filed as Exhibit 10.1 to Form 8-K filed April 2, 2014) *10-II — Form of Employment Agreement for Director Level Employees in Belgium (unofficial English translation) (Filed as Exhibit 10-II to 2014 Form 10-K Report)*** — First Amendment, dated as of March 9, 2015, to Note Purchase Agreement dated as of March 27, 2014, by and among Donaldson Company, Inc. and the purchasers named therein (Filed as Exhibit 10.1 to Form 8-K on March 12, 2015) 21 — Subsidiaries 23 — Consent of PricewaterhouseCoopers LLP 24 — Powers of Attorney 31-A — Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 31-B — Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 32 — Certifications of Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 101 — The following financial information from the Donaldson Company, Inc. Annual Report on Form 10-K for the fiscal year ended July 31, ** ***Item1B. a suburb of Minneapolis, Minnesota. The Company’s principal European administrative and engineering offices are located in Leuven, Belgium. The Company also has extensive operations in the Asia-Pacific and Latin America regions.Company.Company as of July 31, 2016.AmericasEurope / Middle East / AfricaEurope/Africa/Middle East Auburn, Alabama (E) Kadan, Czech Republic (I) Klasterec, Czech Republic Domjean, France (E) Paris, France (E)* Dulmen, Germany (E) Haan, Germany (I) Grinnell,Waterloo, Iowa (E)Ostiglia, Italy (E) Skarbimierz, Poland Bloomington, Minnesota Cape Town, South Africa Bloomington, MinnesotaJohannesburg, South Africa*Johannesburg, South Africa* Chillicothe, Missouri (E) Abu Dhabi, United Arab Emirates Harrisonville, Missouri (I) Hull, United Kingdom Chillicothe, Missouri (E)Leicester, United Kingdom (I) Philadelphia, Pennsylvania (I)Greeneville, TennesseeAustraliaAsia/Pacific Baldwin, WisconsinWyong, AustraliaWyong, Australia AsiaWuxi, China Wuxi, ChinaAguascalientes, MexicoGunma, Japan Monterrey, Mexico (I) Gunma, JapanThird-Party Logistics Providers Wyong, Australia Santiago, Chile Brugge, Belgium Wuxi, China Sao Paulo, Brazil* Bogotá, Colombia Rensselaer, Indiana Cartagena, Colombia Jakarta, Indonesia Mumbai, India Aguascalientes, Mexico Chennai, India Lozorno, Slovakia Plainfield, Indiana (I) Johannesburg, South Africa Gunma, Japan Seoul, South Korea* Auckland, New Zealand Lima, Peru Singapore Greeneville, Tennessee (I) Laredo, Texas Joint Venture Facilities Jakarta, Indonesia Champaign, Illinois (E) Third-Party Logistics ProvidersJakarta, IndonesiaSantiago, ChileWuxi, ChinaMumbai, IndiaDistribution CentersChennai, IndiaWyong, AustraliaPlainfield, Indiana (I)Brugge, BelgiumGunma, JapanSao Paulo, Brazil*Lima, PeruRensselaer, IndianaSingaporeJakarta, IndonesiaGreeneville, Tennessee (I)Aguascalientes, MexicoJohannesburg, South AfricaSeoul, South Korea*reservesestimated liability in its consolidated financial statements areis adequate in light of the probable and estimable outcomes. Any recorded liabilities were not material to the Company’s financial position, results of operations or liquidity and the Company does not believe that any of the currently identified claims or litigation will materially affect its financial position, results of operations or liquidity.terms ofofficers hold office until their successors are for one year.elected and qualify, or their earlier death, resignation or removal. There are no arrangements or understandings between individual officers and any other person pursuant to which the officer was selected as an executive officer.

Appointed as an

Executive OfficerName Age Positions and Offices Held Amy C. Becker 51 Vice President, General Counsel and Secretary 2014 Tod E. Carpenter 57 President and Chief Executive Officer 2008 Sheila G. Kramer 57 Vice President, Human Resources 2015 Scott J. Robinson 49 Vice President and Chief Financial Officer 2015 Thomas R. Scalf 50 Senior Vice President, Engine Products 2014 Jeffrey E. Spethmann 51 Senior Vice President, Industrial Products 2016 Wim Vermeersch 50 Vice President, Europe, Middle East and Africa 2012 Cook joined the Company in 1980 and has held various positions, including CFO and Senior Vice President, International from 2001 to 2004 andCarpenter was appointed President and CEO from 2004 to 2005. Mr. Cook was appointed Chairman, President and CEO in July 2005.JoppaKramer was appointed Vice President, Human Resources in November 2005.October 2015. Prior to that time,joining the Company, Ms. Joppa held various positions at General Mills, a consumer food products company, from 1989 to 2005, including service as Director ofKramer was Vice President, Human Resources for several different operating divisionsTaylor Corporation, a print and graphics media company, from 19992013 until September 2015. From 1991 to 2005.PerushekKramer was with Lifetouch, Inc., a photography company, where she held various human resources roles including Corporate Vice President, Human Resources from 2009 to 2013.InformationFinancial Officer in November 2006.December 2015. Prior to joining the Company, Mr. Robinson was the Chief Financial Officer for Imation Corp. a global scalable storage and data security company, a position he held since August 2014. During his 11 years with Imation, he also served as the Investor Relations Officer, Corporate Controller and Chief Accounting Officer. Prior to that, time, Ms. Perushek was Vice President of Global Information Technologyhe held positions at H.B. Fuller Company, a worldwide manufacturer of adhesive products, from 2005 to 2006,Deluxe Corporation and Chief Information Officer for Young America Corporation, a marketing company, from 1999 to 2004.ShawSpethmann joined the Company in 20042013 and has held various positions, including Director, Corporate Compliance/Internal Audit,Vice President of the Exhaust & Emissions business unit from 2013 to 2014 and Corporate Controller and Principal Accounting OfficerVice President, Global Industrial Air Filtration from 20042014 to 2011.2016. Mr. Shaw Spethmannand Chief Financial Officer effective November 2011.of Industrial Products in April 2016. Prior to joining Donaldson,the Company, from 1999 to 2012, Mr. ShawSpethmann held various positions at Deloitte & Touche, LLPof General Manager and Arthur Andersen, LLP.Gas Turbine Systems,GTS, Asia Pacific from 2000 to 2005; Manager, Aftermarket and Service IFS,Industrial Filtration Solutions, Belgium from 2005 to 2006; Manager, IFS,Industrial Filtration Solutions, Belgium from 2006 to 2007; Director, Gas Turbine Systems,GTS, Europe, Middle East and North Africa, from 2007 to 2010; and Director, Engine, Europe, Middle East and North Africa from 2010 to 2011. Mr. Vermeersch was appointed Vice President, Europe and Middle East in January 2012. Mr. Ward joined the Company in 1998 and has held various positions, including Director, Operations from 2001 to 2003; Director, Product and Business Development, IFS Group from 2003 to 2004; Managing Director, Europe from 2004 to 2006; and Vice President, Europe and Middle East from 2006 to 2008. Mr. Ward was appointed Senior Vice President, Engine Products in August 2008 and was appointed Senior Vice President, Industrial Products, in October 2011. Mr. Wu was appointed Vice President, Asia Pacific in January 2012. Prior to that time, Mr. Wu was the Global Vice President and President of Asia Pacific at Greif, Inc., a global leader in industrial packaging products and services, from 2005 to 2010; and Chief Advisor to Chairman of the Board of Wanhua Industrial Group, a global chemical industry leader, from 2010 to 2011.shares of the Company arestock, par value $5.00 per share, is traded on the New York Stock Exchange under the symbol DCI. The amount and frequency of all cash dividends declared on the Company’s common stock for Fiscal 2014 and 2013 appear in Note O of the Notes to Consolidated Financial Statements on page 58."DCI." The Company’s dividend payout ratio target is approximately 30 percent35% to 40 percent45% of the average earnings per share offor the last three years. This guidance is expected to be used for future dividend payouts. As of September 24, 2014,21, 2016, there were 1,7791,615 shareholders of record of common stock.lowhigh and highlow sales prices for the Company’s common stock for each full quarterly period during Fiscal 2014the years ended July 31, 2016 and 20132015 were as follows:First QuarterSecond QuarterThird QuarterFourth QuarterFiscal 2014$34.60 - 41.31$38.98 - 43.74$38.66 - 43.39$38.77 - 43.00Fiscal 201330.9034.38 - 38.1831.8331.88 - 38.3034.2633.57 - 38.0834.3537.08 - 39.362015 $42.63 - 36.47 $43.31 - 36.04 $38.46 - 36.16 $37.79 - 31.62 Year Ended July 31, First Quarter Second Quarter Third Quarter Fourth Quarter 2016 $ 0.170 $ 0.170 $ 0.170 $ 0.175 2015 $ 0.165 $ 0.165 $ 0.165 $ 0.170 sets forthsummarizes information in connection with purchases made by, or on behalf of, the Company or any affiliated purchaser of the Company, of shares of the Company’s common stock during the quarterly periodthree months ended July 31, 2014.

Shares Purchased (1)

Paid per Share

Shares Purchased

as Part of Publicly

Announced Plans

or Programs

of Shares that May

Yet Be Purchased

Under the Plans or

ProgramsPeriod Total Number of

Shares Purchased (1) Average Price

Paid per Share Total Number of

Shares Purchased

as Part of Publicly

Announced Plans

or Programs Maximum Number

of Shares that May

Yet Be Purchased

Under the Plans or

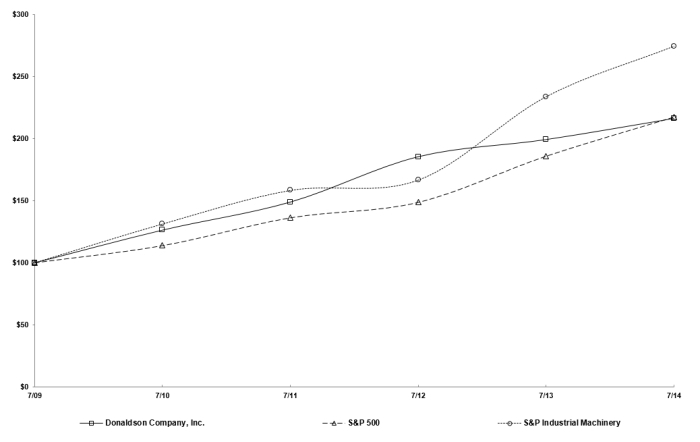

ProgramsMay 1 - May 31, 2016 — $ — — 10,974,199 June 1 - June 30, 2016 290,877 $ 35.07 270,000 10,704,199 July 1 - July 31, 2016 200,000 $ 34.23 200,000 10,504,199 Total 490,877 $ 34.73 470,000 10,504,199 September 27, 2013, the Company announced thatMay 29, 2015, the Board of Directors authorized the repurchase of up to 15.014.0 million shares of the Company's common stock. This repurchase authorization which is effective until terminated by the Board of Directors, replaced the existing authority that was authorized on March 26, 2010.Directors. There were no470,000 repurchases of common stock made outside of the Company’sCompany's current repurchase authorization during the quarterthree months ended July 31, 2014.2016. However, the “Total"Total Number of Shares Purchased”Purchased" column of the table above includes 5,48320,877 shares of previously owned shares tendered by option holders in payment of the exercise price of options during the quarter. While not considered repurchases of shares, the Company does at times withhold shares that would otherwise be issued under equity-based awards to cover the withholding of taxes due as a result of exercising stock options or payment of equity-based awards. On January 27, 2012, the Company announced that its Board of Directors declared a two-for-one stock split effected in the form of a 100 percent stock dividend. The stock split was distributed March 23, 2012, to stockholders of record as of March 2, 2012. Earnings and dividends per share and weighted average shares outstanding are presented in this Form 10-K after the effect of the 100 percent stock dividend. The two-for-one stock split is reflected in the share amounts in all periods presented in the table above and elsewhere in this annual Form 10-K.reportAnnual Report is also incorporated herein by reference.stockholdershareholder return on the Company’s common stock for the last five fiscal years with the cumulative total return of the Standard & Poor’s 500 Stock Index and the Standard & Poor’s Industrial Machinery Index. The graph and table assume the investment of $100 in each of the Company’s common stock and the specified indexes at the beginning of the applicable period and assume the reinvestment of all dividends.

Year Ended July 31, 2011 2012 2013 2014 2015 2016 Donaldson Company, Inc. $ 100.00 $ 124.48 $ 133.75 $ 145.16 $ 127.96 $ 140.61 S&P 500 100.00 109.13 136.41 159.52 177.40 187.36 S&P Industrial Machinery 100.00 105.26 147.68 173.36 184.07 213.16 sets forthsummarizes selected financial data for each of the fiscal years in the five-year period ended July 31, 20142016 (in millions, except per share data): Year Ended July 31, 2016 2015 2014 2013 2012 Net sales $ 2,220.3 $ 2,371.2 $ 2,473.5 $ 2,436.9 $ 2,493.3 Net earnings 190.8 208.1 260.2 247.4 264.3 Basic earnings per share 1.43 1.51 1.79 1.67 1.76 Diluted earnings per share 1.42 1.49 1.76 1.64 1.73 Total assets 1,788.6 1,809.5 1,942.4 1,743.6 1,730.1 Long-term obligations 351.8 389.2 243.7 102.8 203.5 Cash dividends declared per share 0.690 0.670 0.610 0.450 0.335 Cash dividends paid per share 0.685 0.665 0.575 0.410 0.320 Item7. The following discussion (MD&A) is intended to help the reader understand the Company's results of the Company’soperations and financial condition and results of operationsfor the three years ended July 31, 2016. The MD&A should be read in conjunction with the Company's Consolidated Financial Statements and Notes theretoincluded in Item 8 of this Annual Report. This discussion contains forward-looking statements that involve risks and other financial information includeduncertainties. The Company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those discussed elsewhere in this report. The CompanyCustomercustomer relationships and its global presence. The Company operates through two reporting segments, Engine Products and Industrial Products, and has a product mix including air filtration systems, exhaust and emission systems, liquid filtration systems includingfor hydraulics, fuel, and lube andapplications as well as replacement filters. As a worldwide business, the Company’s results of operations are affected by conditions in the global economic environment. Under most economic conditions, the Company’s market diversification between its OEM and replacement parts Customers,customers, its diesel engine and industrial end markets and its global end markets has helped to limit the impact of weakness in any one product line, market or geography on the consolidated operating results of the Company. �� The Company reportedin Fiscal 2014 of $2,473.5for the year ended July 31, 2016 were $2,220.3 million up 1.5 percent from $2,436.9as compared to $2,371.2 million in the prior year. The Company’s resultsyear, a decrease of $150.9 million or 6.4%. Net sales were negatively impacted by foreign currency translation which decreased sales by $11.4$74.2 million. ExcludingOn a constant currency basis, net sales for the current year impactended July 31, 2016 decreased 3.2% from the prior fiscal year.foreign currency translation, worldwide sales increased 2.0 percent. The Company reported net earnings in Fiscal 2014 of $260.2$17.3 million an increase of 5.2 percentor 8.3%, from $247.4$208.1 million in the prior year.fiscal 2015. The Company’s net earnings were negatively impacted by foreign currency translation, which decreased net earnings by $1.0approximately $7.9 million. Excluding the current year impact of foreign currency translation, net earnings increased 5.6 percent. Year Ended July 31, Percent of Net Sales 2016 2015 2014 2016 2015 2014 Net sales $ 2,220.3 $ 2,371.2 $ 2,473.5 100.0 % 100.0 % 100.0 % Cost of sales 1,465.5 1,562.6 1,595.7 66.0 % 65.9 % 64.5 % Gross profit 754.8 808.6 877.8 34.0 % 34.1 % 35.5 % Selling, general and administrative 425.1 460.1 460.3 19.1 % 19.4 % 18.6 % Research and development 55.5 60.2 61.8 2.5 % 2.5 % 2.5 % Operating income 274.2 288.3 355.7 12.3 % 12.2 % 14.4 % Other income, net (3.9 ) (15.5 ) (15.2 ) (0.2 )% (0.7 )% (0.6 )% Interest expense 20.7 15.2 10.2 0.9 % 0.6 % 0.4 % Earnings before income taxes 257.4 288.6 360.7 11.6 % 12.2 % 14.6 % Income taxes 66.6 80.5 100.5 3.0 % 3.4 % 4.1 % Net earnings $ 190.8 $ 208.1 $ 260.2 8.6 % 8.8 % 10.5 % Net earnings per share – diluted $ 1.42 $ 1.49 $ 1.76 Year Ended July 31, Percent of Net Sales 2016 2015 2014 2016 2015 2014 Engine Products $ 1,391.3 $ 1,484.1 $ 1,584.0 62.7 % 62.6 % 64.0 % Industrial Products 829.0 887.1 889.5 37.3 % 37.4 % 36.0 % Net sales $ 2,220.3 $ 2,371.2 $ 2,473.5 100.0 % 100.0 % 100.0 % Year Ended July 31, Percent of Net Sales 2016 2015 2014 2016 2015 2014 United States $ 937.3 $ 1,007.3 $ 1,019.9 42.2 % 42.5 % 41.2 % Europe 632.7 671.3 728.6 28.5 % 28.3 % 29.5 % Asia Pacific 449.9 470.7 517.3 20.3 % 19.9 % 20.9 % Other 200.4 221.9 207.7 9.0 % 9.3 % 8.4 % Total $ 2,220.3 $ 2,371.2 $ 2,473.5 100.0 % 100.0 % 100.0 % and net earnings excluding foreign currency translation areis not measuresa measure of financial performance under generally accepted accounting principles in the United States of America (U.S. GAAP),GAAP, the Company believes they arethat it is useful in understanding its financial results and provide comparable measures for understanding the operating results of the Company between different fiscal periods. Following are reconciliationsThe following is a reconciliation to the most comparable U.S. GAAP financial measuresmeasure of thesethis non-GAAP financial measuresmeasure for the years ended July 31, 2016, 2015 and 2014 (in millions):

Change in

Net Sales

Change in

Net Earnings The Company reported diluted earnings per share of $1.76, a 7.3 percent increase from $1.64 in the prior year. Following are net sales by product within the Company’s Engine and Industrial Products segments and a comparison of earnings before income taxes. Corporate and Unallocated includes corporate expenses determined to be non-allocable to the segments, such as interest income and interest expense. See further discussion of segment information in Note K of the Company’s Notes to Consolidated Financial Statements. Year Ended July 31, 2016 2015 2014 Prior year net sales $ 2,371.2 $ 2,473.5 $ 2,436.9 Change in net sales excluding translation (76.7 ) 32.5 48.0 Impact of foreign currency translation (1) (74.2 ) (134.8 ) (11.4 ) Current year net sales $ 2,220.3 $ 2,371.2 $ 2,473.5 * Includes replacement part sales to(1)The impact of foreign currency translation is calculated by translating current period foreign currency revenue into U.S. dollars using the Company’s OEM Customersaverage foreign currency exchange rates for the prior fiscal year period rather than actual current period foreign currency exchange rates.

Products

Products

Unallocated