UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2002

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 2008

OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to __________________

Commission File Number: 333-61547

001-32886

CONTINENTAL RESOURCES, INC.

(Exact

(Exact name of registrant as specified in its charter)

Oklahoma 73-0767549

(State or other jurisdiction of (I.R.S. Employer

incorporation or organization) Identification No.)

302 N. Independence, Enid, Oklahoma 73701

(Address of principal executive offices) (Zip Code)

Registrant's

| Oklahoma | 73-0767549 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 302 N. Independence, Suite 1500, Enid, Oklahoma | 73701 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (580) 233-8955

Securities registered under Section 12(b) of the Exchange Act:

| Title of Class | Name of Exchange on Which Registered | |

| Common Stock, $0.01 par value | New York Stock Exchange |

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if registrant is not required to file reports pursuant to Section 12 (b)13 or Section 15(d) of the Act: None

Securities registered pursuant to Section 12 (g) of the Act: None

Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ ]x No [X]

The Registrant is not subject to the filing requirements of Section 13 and 15(d)

of the Securities Exchange Act of 1934, but files reports required by those

sections pursuant to contractual obligation requirements.

¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant'sregistrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.[X]

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.)Exchange Act). Yes [ ]¨ No [X]x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked prices of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. As of March 28, 2003, there were 14,368,919June 30, 2008 aggregate market value was $3,138,228,490.

As of February 23, 2009, the registrant had 169,556,833 shares of the registrant's common stock paroutstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement of Continental Resources, Inc. for the Annual Meeting of Stockholders to be held May 28, 2009, which will be filed with the Commission no later than April 30, 2009 are incorporated by reference into Part III of this Form 10-K.

Glossary of Oil and Natural Gas Terms

The terms defined in this section are used throughout this report:

“AMI.” Area of mutual interest.

“Bbl.” One stock tank barrel, of 42 U.S. gallons liquid volume, used herein in reference to crude oil, condensate or natural gas liquids.

“Bcf.” One billion cubic feet of natural gas.

“Bcfe.” One billion cubic feet of natural gas equivalent with one barrel of oil converted to six thousand cubic feet of natural gas.

“Boe.” Barrels of oil equivalent, with six thousand cubic feet of natural gas being equivalent to one barrel of oil.

“Basin.” A large natural depression on the earth’s surface in which sediments generally brought by water accumulate.

“Completion.” The process of treating a drilled well followed by the installation of permanent equipment for the production of natural gas or oil, or in the case of a dry hole, the reporting of abandonment to the appropriate agency.

“DD&A.” Depreciation, depletion, amortization and accretion.

“Developed acreage.” The number of acres that are allocated or assignable to productive wells or wells capable of production.

“Development well.” A well drilled within the proved area of an oil or natural gas reservoir to the depth of a stratigraphic horizon known to be productive.

“Dry hole.” A well found to be incapable of producing hydrocarbons in sufficient quantities such that proceeds from the sale of such production exceed production expenses and taxes.

“Enhanced recovery.” The recovery of oil and natural gas through the injection of liquids or gases into the reservoir, supplementing its natural energy. Enhanced recovery methods are often applied when production slows due to depletion of the natural pressure.

“Exploratory well.” A well drilled to find and produce natural gas or oil reserves not classified as proved, to find a new reservoir in a field previously found to be productive of natural gas or oil in another reservoir or to extend a known reservoir.

“Field.” An area consisting of a single reservoir or multiple reservoirs all grouped on, or related to, the same individual geological structural feature or stratigraphic condition. The field name refers to the surface area, although it may refer to both the surface and the underground productive formations.

“Formation.” A layer of rock which has distinct characteristics that differs from nearby rock.

“Horizontal drilling.” A drilling technique used in certain formations where a well is drilled vertically to a certain depth and then drilled at a right angle within a specified interval.

“HPAI.” High pressure air injection.

“Infill wells.” Wells drilled into the same pool as known producing wells so that oil or natural gas does not have to travel as far through the formation.

i

“MBbl.” One thousand barrels of crude oil, condensate or natural gas liquids.

“Mcf.” One thousand cubic feet of natural gas.

“MBoe.” One thousand Boe.

“MMBoe.” One million Boe.

“MMBtu.” One million British thermal units.

“MMcf.” One million cubic feet of natural gas.

“NYMEX.” The New York Mercantile Exchange.

“Net acres.” The percentage of total acres an owner has out of a particular number of acres, or a specified tract. An owner who has 50% interest in 100 acres owns 50 net acres.

“PUD.” Proved undeveloped.

“PV-10.” When used with respect to oil and natural gas reserves, PV-10 means the estimated future gross revenue to be generated from the production of proved reserves, net of estimated production and future development and abandonment costs, using prices and costs in effect at the determination date, before income taxes, and without giving effect to non-property-related expenses, discounted to a present value $.01 per share, outstanding. The common stockusing an annual discount rate of 10% in accordance with the guidelines of the SEC. PV-10 is privatelynot a financial measure calculated in accordance with generally accepted accounting principles (“GAAP”) and generally differs from Standardized Measure, the most directly comparable GAAP financial measure, because it does not include the effects of income taxes on future net revenues. Neither PV-10 nor Standardized Measure represents an estimate of the fair market value of our oil and gas properties. We and others in the industry use PV-10 as a measure to compare the relative size and value of proved reserves held by affiliatescompanies without regard to the specific tax characteristics of such entities.

“Productive well.” A well that is found to be capable of producing hydrocarbons in sufficient quantities such that proceeds from the sale of the registrant.

Document incorporatedproduction exceed production expenses and taxes.

“Proved developed reserves.” Reserves that can be expected to be recovered through existing wells with existing equipment and operating methods.

“Proved reserves.” The estimated quantities of oil, natural gas and natural gas liquids which geological and engineering data demonstrate with reasonable certainty to be commercially recoverable in future years from known reservoirs under existing economic and operating conditions.

“Proved undeveloped reserves (“PUD”).” Proved reserves that are expected to be recovered from new wells on undrilled acreage or from existing wells where a relatively major expenditure is required for recompletion.

“Reservoir.” A porous and permeable underground formation containing a natural accumulation of producible oil and/or natural gas that is confined by reference: None

CONTINENTAL RESOURCES, INC.

Annual Reportimpermeable rock or water barriers and is separate from other reservoirs.

“Simul-Frac.” Simultaneously fracture treating two or more wells within the same fracture plane in order to create pressure interference between the wells and thereby increasing the stimulated reservoir volume.

“Spacing.” The distance between wells producing from the same reservoir. Spacing is often expressed in terms of acres, e.g., 40-acre spacing, and is often established by regulatory agencies.

ii

“Standardized Measure.” Discounted future net cash flows estimated by applying year-end prices to the estimated future production of year-end proved reserves. Future cash inflows are reduced by estimated future production and development costs based on Form 10-Kperiod-end costs to determine pre-tax cash inflows. Future income taxes, if applicable, are computed by applying the statutory tax rate to the excess of pre-tax cash inflows over our tax basis in the oil and gas properties. Future net cash inflows after income taxes are discounted using a 10% annual discount rate.

“Unit.” The joining of all or substantially all interests in a reservoir or field, rather than a single tract, to provide for development and operation without regard to separate property interests. Also, the Year Ended December 31, 2002

TABLE OF CONTENTS

PART I

ITEM 1. BUSIESS ..........................................................3

ITEM 2. PROPERTIES ......................................................14

ITEM 3. LEGAL PROCEEDINGS ...............................................22

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS .............22

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER

MATTERS..........................................................22

ITEM 6. SELECTED FINANCIAL AND OPERATING DATA ...........................22

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS .......................................24

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK ......30

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA .....................32

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING

AND FINANCIAL DISCLOSURE ........................................32

PART III

ITEM 10. DIRECTORS AND EXECUTIVE OFFICERS OF THE REGISTRANT ..............32

ITEM 11. EXECUTIVE COMPENSATION ..........................................34

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT...35

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS ..................36

PART IV

ITEM 14. EXHIBITS, FINANCIAL STATEMENT SCHEDULES, AND REPORTS ON FORM 8-K.37

PART I

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certainarea covered by a unitization agreement.

“Waterflood.” The injection of water into an oil reservoir to “push” additional oil out of the statements under this Itemreservoir rock and elsewhere in this Form 10-K

are "forward-looking statements"into the wellbores of producing wells. Typically an enhanced recovery process.

“Wellbore.” The hole drilled by the bit that is equipped for oil or gas production on a completed well. Also called well or borehole.

“Working interest.” The right granted to the lessee of a property to explore for and to produce and own oil, gas, or other minerals. The working interest owners bear the exploration, development, and operating costs on either a cash, penalty, or carried basis.

Cautionary Statement Regarding Forward-Looking Statements

This report contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act").amended. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control. All statements, other than statements of historical factsfact included in this Form 10-K, including without limitationreport, regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this report, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Except as otherwise specifically indicated, these statements assume no significant changes will occur in the operating environment for oil and natural gas properties and that there will be no material acquisitions, divestitures or financings except as otherwise described.

Forward-looking statements may include statements about our:

business strategy;

reserves;

technology;

financial strategy;

oil and natural gas realized prices;

timing and amount of future production of oil and natural gas;

the amount, nature and timing of capital expenditures;

drilling of wells;

competition and government regulations;

marketing of oil and natural gas;

exploitation or property acquisitions;

iii

costs of exploiting and developing our properties and conducting other operations;

general economic conditions;

credit markets;

liquidity and access to capital;

uncertainty regarding our future operating results; and

plans, objectives, expectations and intentions contained in this report that are not historical.

All forward-looking statements speak only as of the date of this report. You should not place undue reliance on these forward-looking statements. Although we believe that our plans, intentions and expectations reflected in or suggested by the forward-looking statements we make in this report are reasonable, we can give no assurance that these plans, intentions or expectations will be achieved. We disclose important factors that could cause our actual results to differ materially from our expectations under "Item 1. Business," "Item 2. Properties"“Item 1A.—Risk Factors” and "Item“Item 7.

Management's—Management’s Discussion and Analysis of Financial Condition and Results of Operations" regarding budgeted capital expenditures, increasesOperation” and elsewhere in oil and

gas production, the Company's financial position, oil and gas reserve

estimates, business strategy and other plans and objectives for future

operations, are forward-looking statements. Although the Company believes

that the expectations reflected in suchthis report. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf.

iv

You should read this entire report carefully, including “Risk Factors” and our historical consolidated financial statements and the notes to those historical consolidated financial statements included elsewhere in this report. Unless the context otherwise requires, references in this report to “Continental Resources,” “we,” us,” “our,” or “ours” refer to Continental Resources, Inc., and its subsidiary.

| Item 1. | Business |

We are reasonable, it can give no assurance that such expectations will prove to

have been correct. There are numerous uncertainties inherent in estimating

quantities of provedan independent oil and natural gas reserves and in projecting future

rates of production and timing of development expenditures, including many

factors beyond the control of the Company. Reserve engineering is a

subjective process of estimating underground accumulation of oil and

natural gas that cannot be measured in an exact way, and the accuracy of

any reserve estimate is a function of the quality of available data and of

engineering and geological interpretation and judgment. As a result,

estimates made by different engineers often vary from one another. In

addition, results of drilling, testingexploration and production subsequent to the

date of an estimate may justify revisions of such estimates and such

revisions, if significant, would change the schedule of any further

production and development drilling. Accordingly, reserve estimates are

generally different from the quantities of oil and natural gas that are

ultimately recovered. Additional important factors that could cause actual

results to differ materially from the Company's expectations are disclosed

under "Risk Factors" and elsewhere in this Form 10-K. Should one or more of

these risks or uncertainties occur, or should underlying assumptions prove

incorrect, the Company's actual results and plan for 2003 and beyond could

differ materially from those expressed in forward-looking statements. All

subsequent written and oral forward-looking statements to the Company or

persons acting on its behalf are expressly qualified in their entirety by

such factors.

ITEM 1. BUSINESS

OVERVIEW

Continental Resources, Inc. and its subsidiaries, Continental Gas, Inc.

("CGI"), Continental Resources of Illinois, Inc. ("CRII") and Continental Crude

Co. ("CCC") (collectively "Continental" or the "Company"), are engaged in the

exploration, exploitation, development and acquisition of oil and gas reserves,

primarilycompany with operations in the Rocky Mountain, Mid-Continent and Mid-ContinentGulf Coast regions of the United States,

and to a lesser but growing extent, in the Gulf Coast region of Texas and

Louisiana. In addition to its exploration, development, exploitation and

acquisition activities, the Company currently owns and operates 700 miles of

natural gas pipelines, eight gas gathering systems and three gas processing

plants in its operating areas. The Company also engages in natural gas

marketing, gas pipeline construction and saltwater disposal. Capitalizing on its

growth through the drill-bit and its acquisition strategy, the Company has

increased its estimated proved reserves from 26.6 million barrels of oil

equivalent ("MMBoe") in 1995 to 74.9 MMBoe at year-end 2002, and has increased

its annual production from 2.2 MMBoe in 1995 to 5.4 MMBoe in 2002. As of

December 31, 2002, the Company's reserves had a present value of estimated

future net revenues, discounted at 10% ("PV-10") of $633.4 million calculated in

accordance with the Securities and Exchange Commission (the "Commission" or

"SEC") guidelines. At that date, approximately 84% of the Company's estimated

proved reservesStates. We were oil and approximately 60% of its total estimated reserves

were classified as proved developed. At December 31, 2002, the Company had

interests in 2,385 producing wells of which it operated 1,823. The Company was originally formed in 1967 to explore, develop and produce oil and natural gas in

Oklahoma.properties. Through 1993, the Company'sour activities and growth remained focused primarily in Oklahoma. In 1993, the Companywe expanded itsour activity into the Rocky Mountain and Gulf Coast regions. Through drilling success and strategic

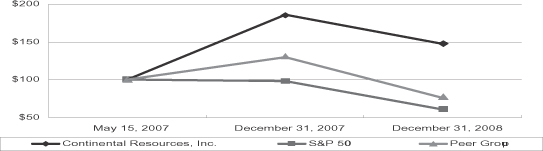

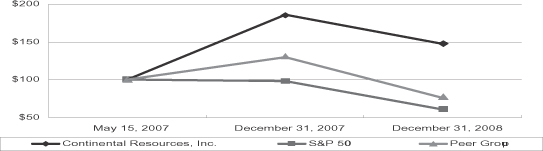

acquisitions, 83%Approximately 70% of the Company'sour estimated proved reserves as of December 31, 20022008 are now foundlocated in the Rocky Mountain region. The Company'sWe completed an initial public offering of our common stock on May 14, 2007, and our common stock began trading on the New York Stock Exchange on May 15, 2007 under the ticker symbol “CLR”.

We focus our exploration activities in large new or developing plays that provide us the opportunity to acquire undeveloped acreage positions for future drilling operations. We have been successful in targeting large repeatable resource plays where horizontal drilling, advanced fracture stimulation and enhanced recovery technologies provide the means to economically develop and produce oil and natural gas reserves from unconventional formations. As a result of these efforts, we have grown substantially through the drillbit, adding 121.7 MMBoe of proved oil and natural gas reserves through extensions and discoveries from January 1, 2004 through December 31, 2008 compared to 3.1 MMBoe added through proved reserve purchases during that same period.

As of December 31, 2008, our estimated proved reserves were 159.3 MMBoe, with estimated proved developed reserves of 106.0 MMBoe, or 67% of our total estimated proved reserves. Crude oil comprised 67% of our total estimated proved reserves. For the year ended December 31, 2008, we generated revenues of $960.5 million and operating cash flows of $719.9 million. For the year and quarter ended December 31, 2008, daily production averaged 32,803 and 36,018 Boe per day, respectively. This represents growth in the

Gulf Coast region during the mid-1990's was slowed dueof 13% and 19% as compared to the rapid growthyear and quarter ended December 31, 2007, when daily production averaged 29,099 Boe and 30,369 Boe, respectively.

The following table summarizes our total estimated proved reserves, PV-10 and net producing wells as of the Rocky Mountain region. Since 1999, drilling activity has increased in the

Gulf Coast region and it is expected to be another core operating areaDecember 31, 2008, average daily production for the Company. To further expandthree months ended December 31, 2008 and the reserve-to-production index in our principal regions. Our reserve estimates as of December 31, 2008 are based primarily on a reserve report prepared by Ryder Scott Company, L.P., our independent reserve engineers. In preparing its Mid-Continent operations,report, Ryder Scott Company, L.P. evaluated properties representing approximately 83% of our PV-10. Our technical staff evaluated properties representing the Company acquired

Mt. Vernon, Illinois-based Farrar Oil Company in 2001. Farrar has been a long

time partner with the Companyremaining 17% of our PV-10.

| At December 31, 2008 | Average daily production fourth quarter 2008 (Boe per day) | Percent of Total | Annualized reserve/ production index(2) | ||||||||||||||

| Proved reserves (MBoe) | Percent of total | PV-10(1) (in millions) | Net producing wells | ||||||||||||||

Rockies: | |||||||||||||||||

Red River units | 59,386 | 37.3 | % | $ | 697 | 242 | 14,058 | 39.0 | % | 11.5 | |||||||

Bakken field | |||||||||||||||||

Montana Bakken | 28,228 | 17.7 | % | 240 | 100 | 6,410 | 17.8 | % | 12.0 | ||||||||

North Dakota Bakken | 17,507 | 11.0 | % | 160 | 48 | 4,401 | 12.2 | % | 10.9 | ||||||||

Other | 6,900 | 4.3 | % | 62 | 272 | 2,508 | 7.0 | % | 7.5 | ||||||||

Mid-Continent: | |||||||||||||||||

Arkoma Woodford | 30,749 | 19.3 | % | 184 | 42 | 3,276 | 9.1 | % | 25.6 | ||||||||

Other | 16,062 | 10.1 | % | 170 | 752 | 4,750 | 13.2 | % | 9.2 | ||||||||

Gulf Coast | 430 | 0.3 | % | 10 | 17 | 615 | 1.7 | % | 1.9 | ||||||||

Total | 159,262 | 100.0 | % | $ | 1,523 | 1,473 | 36,018 | 100.0 | % | 12.1 | |||||||

| (1) | PV-10 is a non GAAP financial measure and generally differs from Standardized Measure, the most directly comparable GAAP financial measure, because it does not include the effects of income taxes on future net revenues. The Standardized Measure at December 31, 2008 is $1.3 billion, a $0.2 billion difference from PV-10 because of the tax effect. Neither PV-10 nor Standardized Measure represents an estimate of the fair market value of our oil and gas properties. We and others in the industry use PV-10 as a measure to compare the relative size and value of proved reserves held by companies without regard to the specific tax characteristics of such entities. |

| (2) | The Annualized Reserve/Production Index is the number of years proved reserves would last assuming current production continued at the same rate. This index is calculated by dividing annualized fourth quarter 2008 production into the proved reserve quantity at December 31, 2008. |

The following table provides the assets and experienced personnel

from which the Company can expand its operations into the Illinois and

Appalachian basins of the eastern United States.

BUSINESS STRATEGY

The Company's business strategyadditional information regarding our key development areas:

| Developed acres | Undeveloped acres | Gross wells planned for drilling | Capital expenditures (in millions)(1) | ||||||||||

| Gross | Net | Gross | Net | ||||||||||

Rockies: | |||||||||||||

Red River units | 147,235 | 131,320 | — | — | 4 | $ | 46 | ||||||

Bakken field | |||||||||||||

Montana Bakken | 82,182 | 64,438 | 131,422 | 101,010 | — | 7 | |||||||

North Dakota Bakken | 76,337 | 37,135 | 865,116 | 378,425 | 86 | 72 | |||||||

Other | 61,963 | 46,818 | 309,741 | 189,818 | 2 | 2 | |||||||

Mid-Continent: | |||||||||||||

Arkoma Woodford | 61,461 | 13,288 | 99,158 | 33,568 | 63 | 56 | |||||||

Other | 138,437 | 95,093 | 584,215 | 382,377 | 19 | 27 | |||||||

Gulf Coast | 40,748 | 11,733 | 36,304 | 29,247 | — | 1 | |||||||

Total | 608,363 | 399,825 | 2,025,956 | 1,114,445 | 174 | $ | 211 | ||||||

| (1) | Capital expenditures budgeted for 2009 includes amounts for drilling, capital workovers and facilities and excludes amounts for land of $54 million, seismic of $4 million, and $6 million for vehicles, computers and other equipment. While the above capital expenditures budget reflects our current intentions, we intend to manage our 2009 capital expenditures to be inline with our cash flow from operations. Continued weakness in oil and natural gas prices could cause us to curtail our actual capital expenditures. Conversely, an increase in commodity prices could result in increased capital expenditures. |

Our goal is to increase production, cash flowshareholder value by finding and reserves through the exploration, development, exploitation and acquisition of

properties in the Company's core operating areas. The Company seeks to increase

production and cash flow, and develop additional reserves by drilling new wells

(including horizontal wells), secondary recovery operations, workovers,

recompletions of existing wells and the application of other techniques designed

to increase production. The Company's acquisition strategy includes seeking

properties that have an established production history, have undeveloped reserve

potential, and through use of the Company's technical expertise in horizontal

drilling and secondary recovery, allow the Company to maximize the utilization

of its infrastructure in core operating areas. The Company's exploration

strategy is designed to combine the knowledge of its professional staff with the

competitive and technical strengths of the Company to pursue new field

discoveries in areas that may be out of favor or overlooked. This strategy

enables the Company to build a controlling lease position in targeted projects

and to realize the full benefit of any project success. The Company tries to

maintain an inventory of three or four new exploratory projects at all times for

future growth and development. On an ongoing basis, the Company evaluates and

considers divesting ofdeveloping crude oil and natural gas properties consideredreserves at costs that provide an attractive rate of return on our investment. The principal elements of our business strategy are:

Focus on Oil. During the late 1980’s we began to be non-corebelieve that the valuation potential for crude oil exceeded that of natural gas. Accordingly, we began to the

Company'sshift our reserve growth plans with the goal that all Company assets are

contributing to its long-term strategic plan.

PROPERTY OVERVIEW

Rocky Mountain Region. The Company's Rocky Mountain properties are

concentrated in the North Dakota, South Dakota and Montana portionsproduction profiles towards crude oil. As of the

Williston Basin, and in the Big Horn Basin in Wyoming. These properties

represented 83%December 31, 2008, crude oil comprises 67% of the Company's estimatedour total proved reserves and 76% of the PV-10our 2008 annual production. Although we do pursue natural gas opportunities, we continue to believe that crude oil valuations will be superior to natural gas valuations on a relative Btu basis.

Growth Through Low-Cost Drilling. Substantially all of our annual capital expenditures are invested in drilling projects and acreage and seismic acquisitions. From January 1, 2004 through December 31, 2008, proved oil and natural gas reserve additions through extensions and discoveries were 121.7 MMBoe compared to 3.1 MMBoe of proved reserve purchases.

Internally Generate Prospects. Our technical staff has internally generated substantially all of the Company's proved reservesopportunities for the investment of our capital. As an early entrant in new or emerging plays, we expect to acquire undeveloped acreage at a lower cost than those of later entrants into a developing play.

Focus on Unconventional Oil and Natural Gas Resource Plays. Our experience with horizontal drilling, advanced fracture stimulation and enhanced recovery technologies allows us to commercially develop unconventional oil and natural gas resource plays, such as the Red River B dolomite, Bakken Shale and Arkoma Woodford formations. Production rates in the Red River units also have been increased through the use of enhanced recovery technology. Our production from the Red River units, the Bakken field, and the Arkoma Woodford comprised approximately 9,302 MBoe, or 77% of our total oil and natural gas production during the year ended December 31, 2008.

Acquire Significant Acreage Positions in New or Developing Plays. In addition to the 513,003 net undeveloped acres held in the Montana and North Dakota Bakken shale and Arkoma Woodford fields, we held 359,120 net undeveloped acres in other oil and natural gas shale plays as of December 31, 2002.2008. Our technical staff is focused on identifying and testing new unconventional oil and natural gas resource plays where significant reserves could be developed if commercial production rates can be achieved through advanced drilling, fracture stimulation and enhanced recovery techniques.

We have a number of strengths that we believe will help us successfully execute our strategies:

Large Acreage Inventory. We own 1,114,445 net undeveloped and 399,825 net developed acres as of December 31, 2008. Approximately 78% of the undeveloped acres are located within unconventional shale resource plays including the Bakken shale in North Dakota and Montana, the Woodford shale in southeast and western Oklahoma, the Atoka shale in western Oklahoma and the Texas Panhandle, the New Albany shale in Indiana and Kentucky and the Lower Huron, Rhinestreet and Marcellus shales in West Virginia, Pennsylvania, New York and Ohio. The Company owns

approximately 465,000 net leasehold acres, has interestsbalance of the undeveloped acreage is located primarily in 710 gross (615 net)

producingconventional plays

including 3D defined locations for the Trenton-Black River of Michigan, Red River of Montana and North Dakota, Morrow-Springer of western Oklahoma and Frio in South Texas.

Horizontal Drilling and Enhanced Recovery Experience. In 1992, we drilled our initial horizontal well, and we have drilled over 600 horizontal wells issince that time. We also have substantial experience with enhanced recovery methods and currently serve as the operator of 93%48 waterflood units. Additionally, we operate eight high pressure air injection (“HPAI”) floods.

Control Operations Over a Substantial Portion of these wells,Our Assets and has identified 86

potential drilling locations in the Rocky Mountain region.

The Williston Basin properties represented 74% of the Company's estimated

proved reserves and 70% of the PV-10 of its proved reserves at December 31,

2002. In the Williston Basin, the Company owns approximately 369,000 net

leasehold acres, has interests in 381 gross (328 net) producing wells and has

identified 86 potential drilling locations. The Company's principal properties

in the Williston Basin include eight high-pressure air injections, or HPAI,

secondary recovery units located in the Cedar Hills, Medicine Pole Hills and

Buffalo Fields. The Company's extensive experience has demonstrated that its

secondary recovery methods have increased the reserves recovered from existing

fields by 200% to 300% through the injection and withdrawal of fluids or gases.

The combination of injection and withdrawal recovers additional oil from the

reservoir that cannot be recovered by primary recovery methods. The Buffalo

Field units are the oldest of the Company's secondary recovery projects and have

been in operations since 1978. The Cedar Hills Field units are the most recent

and largest of the Company's secondary recovery units representing approximately

59% of the proved reserves and 58% of the PV-10 attributable to the Company's

proved reserves at December 31, 2002. Combined, the Company's eight HPAI

secondary recovery projects represent 80% of the HPAI projects in North America.

In the Big Horn Basin, the Company's properties are focused in and around

the Worland Field. The Worland Field represents 9% of the Company's estimated

proved reserves and 6% of the PV-10 of the Company's proved reserves at December

31, 2002. In the Worland Field, the Company owns approximately 96,000 net

leasehold acres and has interests in 329 gross (287 net) producing wells, of

which the Company operates 303. In the Worland Field, the Company has identified

70 potential workovers or recompletions and has initiated three pilot secondary

recovery projects to increase recovery of known oil in the field.

Mid-Continent Region. The Company's Mid-Continent properties are located

primarily in the Anadarko Basin of western Oklahoma, southwestern Kansas,

Illinois, and in the Texas Panhandle. At December 31, 2002, the Company's

estimated proved reserves in the Mid-Continent region represented 16% of the

Company's total estimated proved reserves, 66% of the Company's natural gas

reserves and 22% of the Company's PV-10. In the Mid-Continent region, the

Company owns approximately 162,000 net leasehold acres, has interests in 1,574

gross (956 net) producing wells and has identified 32 potential drilling

locations. The Company operates 68% of the gross wells in which it has

interests.

Gulf Coast Region. The Company's Gulf Coast properties are located

primarily onshore, along the Texas and Louisiana coasts, and include the Pebble

Beach and Luby projects in Nueces County, Texas and the Jefferson Island project

in Iberia Parish, Louisiana. The Company also participates in Gulf of Mexico

drilling ventures as part of the Company's ongoing expansion in the Gulf Coast

region. During 2002, the Company's Gulf Coast producing wells represented only

4% of the Company's total producing well count, but produced 21% of the

Company's total gas production for the year.Investments. As of December 31, 2002,2008, we operated properties comprising 91% of our PV-10. By controlling operations, we are able to more effectively manage the Company's Gulf Coast properties represented 1% of the Company's total estimated

proved reserves, 4% of its estimated proved gas reserves and 2% PV-10 of the

Company's proved reserves. In the Gulf Coast, the Company owns approximately

24,000 net leasehold acres; has interests in 101 gross (83 net) producing wells

and has identified 53 potential drilling locations from 95 square miles of

proprietary 3-D data and several hundred miles of non-proprietary 2-D and 3-D

seismic data. The Company operates 79% of the gross wells in which it has

interests.

OTHER INFORMATION

The Company's subsidiary, Continental Gas, Inc., was formed as a gas

marketing company in April 1990. Currently, Continental Gas, Inc. specializes in

gas marketing, pipeline construction, gas gathering systems and gas plant

operations. On June 19, 2001, the Company formed a new subsidiary, Continental

Resources of Illinois, Inc., or CRII. On July 9, 2001, the Company, through

CRII, purchased the assets of Farrar Oil Company and Har-Ken Oil Company, oil

and gas operating companies in Illinois and Kentucky, respectively. The

Company's remaining subsidiary, Continental Crude Co., has been inactive since

its formation in 1998.

Continental Resources, Inc. and its subsidiaries are headquartered in Enid,

Oklahoma, and Mt. Vernon, Illinois, with additional offices in Baker, Montana;

Buffalo, South Dakota; and field offices located within its various operating

areas.

BUSINESS STRENGTHS

The Company believes that it has certain strengths that provide it with

competitive advantages and provide it with diversified growth opportunities,

including the following:

PROVEN GROWTH RECORD. The Company has demonstrated consistent growth

through a balanced program of development, exploitation and exploratory drilling

and acquisitions. The Company has increased its proved reserves 182% from 26.6

MMBoe in 1995 to 74.9 MMBoe as of December 31, 2002.

SUBSTANTIAL AND DIVERSIFIED DRILLING INVENTORY. The Company is active in

seven different geologic basins in 11 states and has identified more than 171

potential drilling locations based on geological and geophysical evaluations. As

of December 31, 2002, the Company held approximately 651,000 net acres, of which

approximately 57% were classified as undeveloped. Management believes that its

current inventory and acreage holdings could support three to five years of

drilling activities depending upon oil and gas prices.

LONG-LIFE NATURE OF RESERVES. The Company's producing reserves are

primarily characterized by relatively stable, mature production that is subject

to gradual decline rates. As a result of the long-lived nature of its

properties, the Company has relatively low reinvestment requirements to maintain

reserve quantities and primary and secondary production levels. The Company's

properties have an average reserve life of approximately 14 years.

SUCCESSFUL DRILLING AND ACQUISITION RECORD. The Company has maintained a

successful drilling record. During the five years ended December 31, 2002, the

Company participated in 239 gross wells of which 83% were completed as

producers. During this time, reserves added from drilling, workovers and related

activities totaled 34.4 MMBoe of proved developed reserves at an average finding

cost of $7.36 per barrel of oil equivalent ("Boe"). During 2002, the Company

spent $57.0 million on the development of the Cedar Hills field. $32.4 million

was spent drilling injection wells and $24.6 million was spent on

infrastructure, including compressors and pipelines, which resulted in no

additional reserves in 2002. Excluding these costs, our 5year average finding

cost would be $5.71. During the same period, the Company acquired 21.2 MMBoe at

an average cost of $4.60 per Boe. Including major revisions of 12.0 MMBoe due

primarily to fluctuating prices, the Company added a total of 67.7 MMBoe at an

average cost of $5.19 per Boe during the last five years.

SIGNIFICANT OPERATIONAL CONTROL. Approximately 97.4% of the Company's PV-10

at December 31, 2002, was attributable to wells operated by the Company, giving

Continental significant control over the amount and timing of capital

expendituresexploration and production, operating and marketing activities.

TECHNOLOGICAL LEADERSHIP. The Company has demonstrated significant

expertise indevelopment of our properties, including the continually evolving technologies of 3-D seismic, directional drilling and precision horizontal drilling, and is among the few companies in

North America to successfully utilize high pressure air injection enhanced

recovery technology on a large scale. Through the use of precision horizontal

drilling the Company has experienced a 400% to 700% increase in initial flow

rates. From inception, the Company has drilled 243 horizontal wells in the Rocky

Mountains and Mid-Continent regions. Through the combination of precision

horizontal drilling and secondary recovery technology, the Company has

significantly enhanced the recoverable reserves underlying its oil and gas

properties. Since its inception, Continental has experienced a 300% to 400%

increase in recoverable reserves through use of these technologies.

EXPERIENCED AND COMMITTED MANAGEMENT. Continental'sfracture stimulation methods used.

Experienced Management Team. Our senior management team has extensive expertise in the oil and gas industry. The Company'sOur Chief Executive Officer, Harold G. Hamm, began his career in the oil and gas industry in 1967. EightOur seven senior officers have an average of 2428 years of oil and gas industry experience. Additionally, the Company'sour technical staff, which includes 1427 petroleum engineers, 17 geoscientists and 11 geoscientists, havelandmen, has an average of more than 2520 years experience in the industry.

DEVELOPMENT, EXPLORATION AND EXPLOITATION ACTIVITIES

CAPITAL EXPENDITURES. The Company's projected

Strong Financial Position. As of February 23, 2009, we had outstanding borrowings under our revolving credit facility of approximately $474.4 million and available borrowing capacity under our selected commitment level of $198.1 million. We have elected to set the commitment level at $672.5 million, which is below the revolving credit facility note amount of $750.0 million and the established borrowing base of $850.0 million. We believe that our planned exploration and development activities will be funded substantially from our operating cash flows and borrowings under our revolving credit facility. Our 2009 capital expenditures for

development, exploitation and exploration activities in 2003 total $105.9

million. Approximately $74.0 million (69%) is targeted for drilling, $8.3

million (8%) for lease acquisitions and seismic, $4.0 million (4%) for workovers

and recompletions, $3.3 million (3%) for acquisitions, and $16.4 million (16%)

for secondary recovery projects and facilities. Funding for these expenditures

will come from a combinationbudget has been established based on our current expectation of available cash flow and the Company'sfrom operations. Should expected available cash flow from operations materially vary from expectations, we believe our credit facility.

Top priority will be givenfacility has sufficient availability to completing installation of secondary recovery

facilities at the Cedar Hills Field by year-end 2003. This will account for

$52.6 millionfund any deficit or 50% of the Company's projectedthat we can further reduce our capital expenditures for 2003.

This includes $40.2 million for drilling injector wells and $12.4 million for

compressors, equipment and facilities. Approximately $33.8 million willto be spent

on development and exploration drilling outside of the Cedar Hills unit.

Expenditures on projects outside of Cedar Hills are discretionary and may vary

from projections in response to commodity prices and available cash flow.

DEVELOPMENT AND EXPLOITATION. The Company's development and exploitation

activities are designed to maximize the value of existing properties. Activities

include the drilling of vertical, directional and horizontal development wells,

workover and recompletions in existing wellbores, and secondary recovery water

flood and HPAI projects. During 2003, the Company expects to invest $52.0

million drilling 59 development-drilling projects, representing 70% of the

Company's total 2003 drilling budget. Within the development drilling budget,

77% will be spent drilling injector wells within the Cedar Hills units, 5% on

other projects in the Williston and Big Horn Basins, 10% in the Gulf Coast

region and 8% in the Mid-Continent region. The Company also expects to invest

$4.0 million during 2003 on workovers and recompletions, $3.3 million for

acquisitions, and $16.4 million on secondary recovery projects and related

facilities.

EXPLORATION ACTIVITIES. The Company's exploration projects are designed to

locate new reserves and fields for future growth and development. The Company's

exploration projects vary in risk and reward based on their depth, location and

geology. The Company routinely uses the latest in technology, including 3-D

seismic, horizontal drilling and new completion technologies to enhance its

projects. The Company will continue to build exploratory inventory throughout

the year for future drilling.

The Company will initiate, on a priority basis, as many projects asline with cash flow prudently justifies. The Company anticipates investing $21.9 million

drilling 36 exploratory projects during 2003, representing 30% of the Company's

total 2003 drilling budget with 14% to be spent in the Mid-Continent region, 50%

in the Rocky Mountain regionfrom operations.

Oil and 36% in the Gulf Coast region.

Gas Operations

The following table summarizes the number of projects Continental expects

to complete in 2003.

| December 31, 2008 | |||||||||

| Oil (MBbls) | Gas (MMcf) | Total (MBoe) | PV-10(1) (in millions) | ||||||

Proved developed producing | 79,845 | 153,038 | 105,351 | $ | 1,267 | ||||

Proved developed non-producing | 542 | 498 | 625 | 5 | |||||

Proved undeveloped | 25,852 | 164,602 | 53,286 | 251 | |||||

Total proved reserves | 106,239 | 318,138 | 159,262 | $ | 1,523 | ||||

Standardized measure | $ | 1,277 | |||||||

Rockies: Red River units Bakken field Montana Bakken North Dakota Bakken Other Mid-Continent: Arkoma Woodford Other Gulf Coast Total Oil

(MBbls) Gas

(MMcf) Total

(MBoe) % Proved

developed PV-10(1)

(in millions) 54,917 26,812 59,386 85 % $ 697 24,154 24,443 28,228 64 % 240 14,832 16,047 17,507 52 % 160 5,524 8,255 6,900 99 % 62 62 184,120 30,749 24 % 184 6,657 56,439 16,062 86 % 170 93 2,022 430 100 % 10 106,239 318,138 159,262 67 % $ 1,523

| (1) | PV-10 is a non GAAP financial measure and generally differs from Standardized Measure, the most directly comparable GAAP financial measure, because it does not include the effects of income taxes on future net revenues. The Standardized Measure at December 31, 2008 is $1.3 billion, a $0.2 billion difference from PV-10 because of the tax effect. Neither PV-10 nor Standardized Measure represents an estimate of the fair market value of our oil and gas properties. We and others in the industry use PV-10 as a measure to compare the relative size and value of proved reserves held by companies without regard to the specific tax characteristics of such entities. |

Developed and Undeveloped Acreage

The following table presents the total gross and net developed and undeveloped acreage by region as of December 31, 2008:

| Developed acres | Undeveloped acres | Total | ||||||||||

| Gross | Net | Gross | Net | Gross | Net | |||||||

Rockies: | ||||||||||||

Red River units | 147,235 | 131,320 | — | — | 147,235 | 131,320 | ||||||

Bakken field | ||||||||||||

Montana Bakken | 82,182 | 64,438 | 131,422 | 101,010 | 213,604 | 165,448 | ||||||

North Dakota Bakken | 76,337 | 37,135 | 865,116 | 378,425 | 941,453 | 415,560 | ||||||

Other | 61,963 | 46,818 | 309,741 | 189,818 | 371,704 | 236,636 | ||||||

Mid-Continent: | ||||||||||||

Arkoma Woodford | 61,461 | 13,288 | 99,158 | 33,568 | 160,619 | 46,856 | ||||||

Other | 138,437 | 95,093 | 584,215 | 382,377 | 722,652 | 477,470 | ||||||

Gulf Coast | 40,748 | 11,733 | 36,304 | 29,247 | 77,052 | 40,980 | ||||||

Total | 608,363 | 399,825 | 2,025,956 | 1,114,445 | 2,634,319 | 1,514,270 | ||||||

The following table sets forth the Commissionnumber of gross and net undeveloped acres as of December 31, 2008 that will expire over the next three years by region unless production is established within the spacing units covering the acreage prior to constant oilthe expiration dates:

| 2009 | 2010 | 2011 | ||||||||||

| Gross | Net | Gross | Net | Gross | Net | |||||||

Rockies: | ||||||||||||

Red River units | — | — | — | — | — | — | ||||||

Bakken field | ||||||||||||

Montana Bakken | 18,037 | 10,920 | 24,557 | 19,510 | 57,527 | 48,367 | ||||||

North Dakota Bakken | 156,404 | 83,394 | 137,899 | 59,424 | 224,552 | 79,934 | ||||||

Other | 49,311 | 20,334 | 37,656 | 20,141 | 56,662 | 41,995 | ||||||

Mid-Continent: | ||||||||||||

Arkoma Woodford | 49,015 | 17,005 | 23,808 | 8,801 | 15,225 | 6,811 | ||||||

Other | 24,848 | 18,009 | 207,604 | 113,643 | 236,500 | 157,324 | ||||||

Gulf Coast | 3,200 | 2,443 | 5 | 3 | 29,586 | 25,692 | ||||||

Total | 300,815 | 152,105 | 431,529 | 221,522 | 620,052 | 360,123 | ||||||

During the three years ended December 31, 2008, we drilled exploratory and gas prices, drilling and

operating expenses, capital expenditures, taxes and availability of funds. The

process of estimating oil and gas reserves in complex, requiring significant

decisions and assumptions in the evaluation of available geological,

geophysical, engineering and economic data for each reservoir. As a result, such

estimates are inherently imprecise. Actual future production, oil and gas

prices, revenues, taxes, development expenditures, operating expenses and

quantities of recoverable oil and gas reserves may vary substantially from those

estimated in the report. Any significant variance in these assumptions could

materially affect the estimated quantity and value of reserveswells as set forth in this

annual reportthe table below:

| 2008 | 2007 | 2006 | ||||||||||

| Gross | Net | Gross | Net | Gross | Net | |||||||

Exploratory wells: | ||||||||||||

Oil | 41 | 18.2 | 33 | 15.6 | 17 | 8.4 | ||||||

Natural gas | 73 | 19.5 | 79 | 13.1 | 25 | 4.9 | ||||||

Dry | 12 | 8.9 | 4 | 2.5 | 17 | 9.4 | ||||||

Total exploratory wells | 126 | 46.6 | 116 | 31.2 | 59 | 22.7 | ||||||

Development wells: | ||||||||||||

Oil | 153 | 89.3 | 92 | 69.5 | 83 | 57.0 | ||||||

Natural gas | 72 | 13.4 | 49 | 10.3 | 34 | 14.5 | ||||||

Dry | 8 | 3.2 | 5 | 1.1 | 7 | 4.3 | ||||||

Total development wells | 233 | 105.9 | 146 | 80.9 | 124 | 75.8 | ||||||

Total wells | 359 | 152.5 | 262 | 112.1 | 183 | 98.5 | ||||||

As of December 31, 2008, there were 117 gross (40 net) wells in the process of drilling, completing or waiting on Form 10-K. In addition, the Company's reserves maycompletion.

As of February 23, 2009, we operated 7 rigs on our properties. Our rig activity during 2009 will be subject

to downward or upward revision, based upon production history, results of future

explorationhighly dependent on oil and development, prevailing oil andnatural gas prices and other factors,

many of which are beyond the Company's control. The PV-10 of the Company's

proved oil and gas reserves does not necessarily represent theaccordingly our rig count may increase or decrease from current or fair

market value of such proved reserves, and the 10% discount rate required by the

Commission may not reflect current interest rates, the Company's cost of capital

or any risks associated with the development and production of the Company's

proved oil and gas reserves. At December 31, 2002, the estimated future net cash

flow of $1,304 million and PV-10 of $633.4 million attributable to the Company's

proved oil and gas reserves are based on prices in effect at the date ($29.04

per barrel ("Bbl") of oil and $3.33 per thousand cubic feet ("Mcf") of natural

gas), which may be materially different from actual future prices.

PROPERTY ACQUISITION RISKS

The Company's growth strategy includes the acquisition of oil and gas

properties.levels. There can be no assurance, however, that the Companyadditional rigs will be ableavailable to identifyus at an attractive acquisition opportunities, obtain financing for acquisitionscost. See “Risk Factors—The unavailability or high cost of additional drilling rigs, equipment, supplies, personnel and oilfield services could adversely affect our ability to execute our exploration and development plans within our budget and on satisfactory terms or successfully acquire identified targets. In addition,

no assurance cana timely basis.”

Summary of Oil and Natural Gas Properties and Projects

Throughout the following discussion, we discuss our budgeted number of wells and capital expenditures. While the discussion reflects our current intentions, we intend to manage 2009 capital expenditures to be given that the Company will be successfulinline with our cash flow from operations. Continued weakness in integration

acquired business into its existing operations,oil and such integration maynatural gas prices could cause us to curtail our actual capital expenditures. Conversely, an increase in commodity prices could result in unforeseen operational difficulties or require a disproportionate amountincreased capital expenditures.

Rocky Mountain Region

Our properties in the Rocky Mountain region represented 76% of management's attention. Future acquisitions may be financed throughour PV-10 as of December 31, 2008. During the incurrence of additional indebtedness to the extent permitted under the

Indenture or through the issuance of capital stock. Furthermore, there can be no

assurance that competition for acquisition opportunities in these industries

will not escalate, thereby increasing the cost to the Company or making further

acquisitions or causing the Company to refrain from making additional

acquisitions.

The Company is subject to risks that properties acquired by it will not

perform as expected and that the returnsthree months ended December 31, 2008, our average daily production from such properties was 24,536 net Bbls of oil and 17,041 net Mcf of natural gas. Our principal producing properties in this region are in the Red River units, the Bakken field and the Big Horn Basin.

Red River Units

Our Red River units represented 59.6% of our PV-10 in the Rocky Mountain region as of December 31, 2008 and 51% of our average daily Rocky Mountain region Boe production for the three months ended December 31, 2008. The eight units comprising the Red River units are located along the Cedar Creek Anticline in North Dakota, South Dakota and Montana and produce oil and natural gas from the Red River “B” formation, a thin, continuous, dolomite formation at depths of 8,000 to 9,500 feet. Our Red River units comprise a portion of the Cedar Hills field, listed by the Energy Information Administration in 2007 as the 6 th largest onshore, lower 48 field in the United States ranked by liquid proved reserves.

Cedar Hills Units. The Cedar Hills North unit (“CHNU”) is located in Bowman and Slope Counties, North Dakota. We drilled the initial horizontal well in the CHNU, the Ponderosa 1-15, in April 1995. As of December 31, 2008, we had drilled 225 horizontal wells within this 49,700-acre unit, with 128 producing wellbores and the remainder serving as injection wellbores. We operate and own a 98% working interest in the CHNU.

The Cedar Hills West unit (“CHWU”), in Fallon County, Montana, is contiguous to the northern portion of CHNU. As of December 31, 2008, this 7,800-acre unit contained eleven horizontal producing wells and six horizontal injection wells. We operate and own a 100% working interest in the CHWU.

In January 2003, we commenced enhanced recovery in the two Cedar Hills units, with HPAI used throughout most of the area and water injected generally along the boundary of the CHNU. Under HPAI, compressed air injected into a reservoir oxidizes residual oil and produces flue gases (primarily carbon dioxide and nitrogen) that mobilize and sweep the crude oil into producing wellbores. In response to the HPAI, water injection and increased density drilling operations, production from the Cedar Hills units increased to 11,451 net Boe per day in December 2008 from 2,185 net Boe per day in November 2003. As of December 31, 2008, the average density in the Cedar Hill units was approximately one producing wellbore per 420 acres. We currently plan to drill 4 new horizontal wellbores and 2 horizontal extensions of existing wellbores in the Cedar Hills units during 2009, increasing the density of both the producing and injection wellbores. The reduced distance between wells allows part of the field to be converted from air injection to water injection. This conversion began in 2008 and is forecast to lower operating expenses, as water is less costly to inject than air. In 2009, we plan to invest approximately $41.3 million drilling and improving facilities in the Cedar Hills units. This expenditure is lower than previously forecast due to the elimination of 25 gross wells from the increased density development program. This adjustment to the plan is a result of reduced commodity prices. The peak rate for the field will be reduced but we expect no reduction in ultimate reserves.

On August 22, 2007 the Hiland Partners, LP (“Hiland”) Badlands gas plant became operational for the processing and treatment of gas produced from the CHNU, CHWU and Medicine Pole Hills Unit. Under the terms of the November 8, 2005 contract we deliver low pressure gas to Hiland for compression, treatment and processing. Nitrogen and carbon dioxide must be removed from the gas production associated with oil production from the units for the gas production to be marketable. We pay $0.60 per Mcf in gathering and treating fees, and 50% of the electrical costs attributable to compression and plant operation and receive 50% of the proceeds from residue gas and plant product sales. After we deliver 36 Bcf of gas, the $0.60 per Mcf gathering and treating fee is eliminated. During December 2008, we sold 7,800 net Mcf of natural gas per day from the Cedar Hills Units.

Medicine Pole Hills Units. The Medicine Pole Hills units (“MPHU”) are approximately five miles east of the southern portion of the CHNU. We acquired the Medicine Pole Hills unit in 1995. At that time, the 9,600-

acre unit consisted of 18 vertical producing wellbores and four injection wellbores under HPAI producing 525 net Bbls of oil per day. We have since drilled 47 horizontal wellbores extending production to the west with the formation of the 15,000-acre Medicine Pole Hills West unit and to the south, with the 11,500-acre Medicine Pole Hills South unit. All three units are under HPAI. We operate and own an average 77% working interest in the three units. Production from the units averaged 1,391 net Bbls of oil and 178 net Mcf of natural gas per day during December 2008. During 2008 we drilled 7 new horizontal wellbores, 2 horizontal extensions of existing wellbores, and 2 horizontal re-entries of vertical wellbores, increasing the density of both producing and injection wellbores. We believe these operations will increase production and sweep efficiency. In 2009, we plan to invest approximately $3.4 million for capital workover and facilities in MPHU.

Buffalo Red River Units. Three contiguous Buffalo Red River units (Buffalo, West Buffalo and South Buffalo) are located in Harding County, South Dakota, approximately 21 miles south of the MPHU. When we purchased the units in 1995, there were 73 vertical producing wellbores and 38 injection wellbores under HPAI producing approximately 1,906 net Bbls of oil per day. We operate and own an average working interest of 95% in the 32,900 acres comprising the three units. From 2005 through 2008, we re-entered 48 existing vertical wells and drilled horizontal laterals to increase production and sweep efficiency from the three units. Production for the month of December 2008 was 1,670 net Bbls of oil per day compared to an average of 1,162 net Bbls of oil per day for the first half of 2005. In 2009, we plan to invest $0.7 million for capital workover and facilities in the Buffalo Red River units.

Bakken Field

We control one of the largest acreage positions in the Bakken field of Montana and North Dakota with approximately 1,155,000 gross (581,000 net) acres as of December 31, 2008. Approximately 17% of the net acreage is producing and 83% of the net acreage is undeveloped as of December 31, 2008. Our properties within the Bakken field in Montana and North Dakota represented 35% of our PV-10 in the Rocky Mountain region as of December 31, 2008 and 39% of our average daily Rocky Mountain region Boe production for the three months ended December 31, 2008. As of December 31, 2008 we had completed 308 gross (148.5 net) wells in the Bakken field.

The Bakken formation or “Bakken Shale”, as it is often called, is one of the most actively drilled unconventional oil resource plays in the United States with approximately 83 rigs drilling in the play as of December 31, 2008, including 76 in North Dakota and seven in Montana. A report issued by the United States Geologic Survey (“USGS”) in April 2008 estimates that the Bakken Shale contains up to 4.3 billion barrels of recoverable oil using today’s technology and classifies it as the largest continuous oil accumulation ever assessed by the USGS.

The Bakken formation is a Devonian-age shale found within the Williston Basin underlying portions of North Dakota and Montana that contains three lithologic members including the upper shale, middle member and lower shale that combined range up to 130 feet thick. The upper and lower shales are highly organic, thermally mature and over pressured and act as both a source and reservoir for the oil. The middle member, which varies in composition from a silty dolomite to shalely limestone or sand, also serves as a reservoir and is thought to be a critical component for commercial production. The Three Forks/Sanish formation found immediately under the Lower Bakken Shale has also proven to contain productive reservoir rock that may add incremental reserves to the play. The Three Forks/Sanish typically consists of interbedded dolomites and shale with local development of a discontinuous sandy member at the top, known as the Sanish sand. All of these reservoir rocks have low porosity and permeability and depend on natural fracturing and artificial fracture stimulation to produce economically. Horizontal drilling and multi-stage fracture stimulation technology has enabled commercial production from this historically non-commercial reservoir. Generally, the Bakken formation is found at vertical depths of 9,000 to 10,500 feet and drilled horizontally on 320, 640 or 1,280-acre spacing with single, dual or triple leg horizontal laterals extending 4,500 to 9,000 feet into the formation. These wells are fracture stimulated to maximize recovery and economic returns. The fracture stimulation techniques vary but most commonly utilize multi-stage mechanically diverted stimulations using un-cemented liners and packers.

Montana Bakken. Our Montana Bakken production is located in the Elm Coulee field in Richland County, Montana. The Elm Coulee field is listed by the Energy Information Administration as the 16th largest onshore, lower 48 field in the United States ranked by liquid proved reserves. Since drilling our first well in August 2003, we have completed a total of 156 gross (100.2 net) wells in the field as of December 31, 2008. Our daily average production from these wells was approximately 5,727 net Bbls of oil and 3,944 net Mcf of natural gas during the month of December 2008. The field has been developed exclusively with horizontal drilling and has been substantially drilled on 640-acre spacing. During 2008, we began to further develop our acreage in the field on 320 acre spacing and have identified 57 undrilled 320 acre infield locations on our acreage as of December 31, 2008. Out of the 22 gross (16.2 net) wells we drilled in the field during 2008, 12 gross (10.3 net) were 320 acre infield wells. These wells are performing in line with our expected reserve model of 279 MBoe per well.

In December 2008 we also began operations on a one well secondary recovery pilot project to evaluate the potential to increase oil recovery from the Bakken reservoir utilizing CO2 injection. Laboratory tests indicate this technique is feasible and could increase oil recovery from the Bakken reservoir. Using a technique known as the huff and puff method, we began injecting CO2 in January 2009 and expect to complete the injection phase by March 2009. After allowing the CO2 to soak into the reservoir for approximately 30 days, we will flow the CO2 and associated fluids back from the well. Production from the well will be measured and the performance will be analyzed to assess the incremental recovery and economics of the technique.

As of December 31, 2008, we held 131,422 gross (101,010 net) undeveloped acres in the Montana Bakken play within and adjacent to the Elm Coulee field. We have recently suspended drilling in the Montana Bakken due to weakness in oil and natural gas prices and will resume drilling as prices improve.

North Dakota Bakken.Our 2008 drilling program significantly expanded the proven extents of our North Dakota Bakken acreage along the Nesson anticline. During the year we completed 98 gross (27.2 net) wells and exited 2008 producing at an average daily rate of 5,081net Bbls of oil during the month of December 31, 2008, a 276% increase over the same period in 2007 and 1,744 net Mcf of natural gas during the month of December 2008, an increase of 113% over the same period in 2007.

During the year we drilled almost exclusively 1,280-acre spaced, long single leg laterals, up to 9,000 feet long and fracture stimulated these wells with up to 14 mechanically diverted stages using un-cemented liners and packers. We found this technique provided better wellbore integrity and on average delivered higher initial flow rates. Of significance, we completed 27 gross (10.3 net) Three Forks/Sanish wells during 2008. The Three Forks/Sanish formation which lies immediately below the lower Bakken shale is known to be productive locally throughout the Williston Basin and may add incremental reserves to the Bakken play. Our Three Forks/Sanish completions were strategically located throughout our acreage along the Nesson anticline over a distance of approximately 100 miles north to south. The success of these Three Forks/Sanish wells demonstrates the widespread productive potential of the Three Forks/Sanish reservoir underlying our acreage. Although the results in themselves do not supportdemonstrate the indebtedness incurredThree Forks/Sanish formation adds incremental reserves to the Bakken play, it is notable that the 20 gross (8.9 net) Three Forks/Sanish completions we operated in 2008 had an average initial production rate of 640 gross Boe per day which is 17% higher than our average operated Middle Bakken completion in 2008.

As of December 31, 2008, we held 865,000 gross (378,000 net) undeveloped acres in the North Dakota Bakken field. As of February 23, 2009, we had 10 rigs drilling in the North Dakota Bakken field, including 4 operated by Continental Resources, Inc, and 6 operated by ConocoPhillips through a joint-venture. We plan to invest $71 million drilling 86 gross (20.2 net) wells in the North Dakota Bakken field during 2009.

Big Horn Basin and Other Rockies

Our wells within the Big Horn Basin in northern Wyoming and other areas within the Rocky Mountain region represented 5% of our PV-10 in the Rocky Mountain Region as of December 31, 2008 and 9% of our average daily Rocky Mountain Region Boe production for the three months ended December 31, 2008. During the three months ended December 31, 2008, we produced an average of 1,794 net Bbls of oil and 4,280 net Mcf of natural gas per day from our wells in the Big Horn Basin and other areas within the Rocky Mountain region.

Our principal property in the Big Horn Basin, the Worland field, produces primarily from the Phosphoria formation. We also have several other ongoing projects in the Rockies including conventional 3D defined Red River and Lodgepole structures in North Dakota and Montana, horizontal Fryburg opportunities in North Dakota and the Lewis Shale and Fort Union in Wyoming.

Conventional Red River.The Red River is a well known conventional producing oil and gas reservoir throughout the Williston Basin of North Dakota and Montana. The production can be quite prolific with individual Red River wells producing up to 1.5 million barrels of oil but the productive reservoir is generally confined to structural closures and structural-stratigraphic traps of 320 acres to 640 acres in size. The potential exists to find this type of conventional Red River production underlying any portion of our Bakken acreage in North Dakota and Montana. To identify these Red River traps generally requires 3D seismic. We own or have under license 964 square miles of 3D seismic over portions of our acreage in Montana and North Dakota. As of December 31, 2008 we had interpreted approximately 8% of this data using our proprietary processing techniques and have identified 9 undrilled potential locations. In 2008, we drilled and completed 6 gross (3.1 net) vertical Red River wells with 4 gross (2.2 net) wells completed as producers for a 71% success rate. During 2009, we plan to continue re-processing and evaluating our 3D seismic to identify new potential drilling locations.

Mid-Continent and Gulf Coast Region

Our properties in the other consideration usedMid-Continent and Gulf Coast region represented 24% of our PV-10 as of December 31, 2008. During the three months ended December 31, 2008, our average daily production from such properties was 2,321 net Bbls of oil and 37,922 net Mcf of natural gas. Our principal producing properties in this region are located in the Anadarko and Arkoma Basins of Oklahoma, the Michigan Basin and the Illinois Basin.

Arkoma Woodford

The Arkoma Woodford play in Atoka, Coal, Hughes and Pittsburg Counties, Oklahoma has matured into one of the more active unconventional gas resource plays in the United States with 36 rigs drilling in the play industry wide as of December 31, 2008. We owned approximately 161,000 gross (47,000 net) acres in the Woodford play as of December 31, 2008. Since drilling our first well in February, 2006, we have completed a total of 259 gross (41.4 net) horizontal Woodford wells through December 31, 2008. These Arkoma Woodford wells represent 52% of the PV-10 in the Mid-Continent Region as of December 31, 2008 and 41% of our average daily Mid-Continent Region equivalent production for the three months ended December 31, 2008. During 2008, production from our Arkoma Woodford wells grew 213% from an average of 8,428 Mcf of natural gas equivalent per day during December 2007 to acquire, or26,380 Mcf of natural gas equivalent per day in December 2008.

We completed 115 gross (23.3 net) Woodford wells during 2008. This drilling consisted of a combination of exploratory, step-out and development drilling designed to secure acreage and delineate areas of economic production for further development. Of significance, we expanded the capital expenditures neededknown extents of commercial production to the western extents of our Ashland AMI and south into our Big Mac Prospect. We also completed our first well in the East McAlester area. As of December 31, 2008, approximately 72% of our net acreage remained undeveloped.

During the year ended December 31, 2008, we began to develop the properties.field on various densities including 320, 160 and 80-acre spacing, to determine the optimum spacing for development. Results indicated that 80-acre development is economically feasible on much of our acreage. We also began simul-fracing wells when possible to more effectively stimulate and produce the Woodford shale while causing minimal disruption to existing production. We also reduced our average cost per lateral foot drilled by 20% compared to 2007 through improved mud systems, bit selections and operational efficiencies. We also successfully demonstrated that we can drill and complete wells across faults that previously limited the length of lateral drilled. To guide our drilling we acquired 49 square miles of 3-D seismic data during the year bringing the total of 3D seismic we own or have under license to 93 square miles.

We plan to invest approximately $56.0 million drilling 63 gross (8.0 net) horizontal wells in the Arkoma Woodford during 2009. We currently have one operated rig drilling in the play and are in the process of acquiring 53 square miles of 3-D seismic to guide future drilling on our East McAlester acreage.

Anadarko Basin

Our properties within the Anadarko Basin represented 27% of our PV-10 in the Mid-Continent Region as of December 31, 2008 and 40% of our average daily Mid-Continent Region equivalent production for the three months ended December 31, 2008. Our wells within the Anadarko Basin produce from a variety of sands and carbonates in both stratigraphic and structural traps. During the year we drilled 19 gross (11.5 net) wells with a 90% gross (84% net) success rate. In addition, expansion2009, we plan to invest approximately $23.0 million in the drilling of 18 gross (5.0 net) wells in the Anadarko Basin.

Anadarko Woodford. We owned 189,246 gross (117,665 net) acres in the emerging Anadarko Woodford shale play of western Oklahoma as of December 31, 2008. This includes 144,000 gross (93,000 net) undeveloped acres acquired in 2008 and 44,923 gross (24,586 net) acres held by production. Our acreage is strategically positioned within the window of thermal maturation for natural gas along the eastern flank of the Company's operations may placeAnadarko basin extending across portions of Grady, Canadian, Blaine, Custer and Dewey Counties of Oklahoma. The Woodford shale underlying this acreage ranges from 75 to 250 feet thick and occurs at depth ranging from 10,000 to 15,000 feet. Industry peers began drilling and completing horizontal Woodford shale wells in Canadian County, Oklahoma in August of 2007 and as of December 31, 2008 there were 17 rigs drilling in the play. Results announced by various operators in the play have been encouraging, with initial daily production rates of up to 8,300 Mcf of natural gas equivalent per well. Based on our economic model, we expect to recover approximately 5 Bcf to 7 Bcf per well. During 2008 we drilled 2 gross (1.9 net) horizontal Woodford wells and both are currently in the process of being completed.

Anadarko Atoka.We owned 44,938 gross (27,566 net) acres in the emerging Anadarko Atoka Shale play of Western Oklahoma and the Panhandle of Texas as of December 31, 2008. Our acreage is focused in Ellis County, Oklahoma and Lipscomb County, Texas and strategically located along trend with the development of the Novi Lime formation. The Novi Lime formation is important as it serves as both reservoir and drilling conduit for the horizontal wellbore through which the surrounding natural gas charged Atoka shales can be fracture stimulated and produced. The Atoka shales range from 75 feet to 125 feet thick and are present throughout our properties. Public records show as of February 23, 2009, 37 horizontal Atoka wells have been completed by industry peers with initial production rates of up to 7,500 Mcf of natural gas per day. During 2008, we drilled 2 gross (2 net) horizontal Atoka wells. The first well, the Shrewder 1-22H (100% WI) completed flowing 1,297 Mcf of natural gas per day from a significant strainshort, 1,300 foot, horizontal lateral. The second well, the Jones Trust 1-168H (100% WI) was recently fracture stimulated and currently flow testing at a rate of approximately 700 Mcf of natural gas per day.