Use these links to rapidly review the document

INDEX TO FINANCIAL STATEMENTS AND FINANCIAL STATEMENT SCHEDULES

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

(x)ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year endedDecember 31, 20002004

or

( )o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period fromto

| Commission Commision

File Number

| | | | Registrant, State of Incorporation,

Address and Telephone Number

| | | | I.R.S. Employer

Identification No.

|

|---|

| | | | |

1-11377 | | CINERGY CORP.

(A Delaware Corporation)

139 East Fourth Street

Cincinnati, Ohio 45202

(513) 287-1099421-9500 | | 31-1385023 |

| | | | |

1-1232 | | THE CINCINNATI GAS & ELECTRIC COMPANY

(An Ohio Corporation)

139 East Fourth Street

Cincinnati, Ohio 45202

(513) 287-1099421-9500 | | 31-0240030 |

| | | | |

1-3543 | | PSI ENERGY, INC.

(An Indiana Corporation)

1000 East Main Street

Plainfield, Indiana 46168

(513) 287-1099421-9500 | | 35-0594457 |

| | | | |

2-7793 | | THE UNION LIGHT, HEAT AND POWER COMPANY

(A Kentucky Corporation)

139 East Fourth Street

Cincinnati, Ohio 45202

(513) 287-1099421-9500 | | 31-0473080 |

| | | | |

| | | | |

| | | | |

Each of the following classes or series of securities registered pursuant to Section 12(b) of the Act is registered on the New York Stock Exchange:

| Registrant

| | | | Title of each class

| |

|

|---|

| | | | | |

Cinergy Corp. | | Common Stock | | | |

| | | | | |

The Cincinnati Gas & Electric Company | | Cumulative Preferred Stock | | 4 | % |

| | Junior Subordinated Debentures | | 8.28 | % |

PSI Energy, Inc. | | Cumulative Preferred Stock | | 4.32 | % |

| | Cumulative Preferred Stock | | 4.16 | % |

| | Cumulative Preferred Stock | | 6-7/6-7/8 | % |

| | | | | |

The Union Light, Heat and Power Company | | None | | | |

| | | | | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether each registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that such registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes /x/ý No / /o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrants'registrants’ knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ( )o

Requirements pursuant to Item 405 of Regulation S-K are not applicable forThe Union Light,,Heat and Power Company.

The Union Light,,Heat and Power Company meets the conditions set forth in General Instruction I (1)(a) and (b) of Form 10-K and is therefore filing this Form 10-K with the reduced disclosure format specified in General Instruction I (2) of Form 10-K.

Indicate by check mark whether each registrant is an accelerated filer (as defined in Rule 12b-2 of the Act).

| Cinergy Corp. | Yes | ý | No | o |

| The Cincinnati Gas & Electric Company | Yes | o | No | ý |

| PSI Energy, Inc. | Yes | o | No | ý |

| The Union Light, Heat and Power Company | Yes | o | No | ý |

As of January 31, 2001,June 30, 2004, the aggregate market value of the common equity ofCinergy Corp. held by nonaffiliatesnon-affiliates (shareholders who are not directors or executive officers) was $4.8$6.8 billion. All of the common stock ofThe Cincinnati Gas & Electric Company andPSI Energy,,Inc. is owned byCinergy Corp., and all of the common stock ofThe Union Light,,Heat and Power Company is owned byThe Cincinnati Gas & Electric Company. As of January 31, 2001,2005, each registrant had the following shares of common stock outstanding:

| Registrant

| | |

| Description

| | |

| Shares

|

|

|---|

| | | | | |

Cinergy Corp. | | Par value $.01 per share | | 158,980,363191,404,406 | |

| | | | | |

The Cincinnati Gas & Electric Company | | Par value $8.50 per share | | 89,663,086 | |

| | | | | |

PSI Energy, Inc. | | Without par value, stated value $.01 per share | | 53,913,701 | |

| | | | | |

The Union Light, Heat and Power Company | | Par value $15.00 per share | | 585,333 | |

| | | | | |

2

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement ofCinergy Corp. and the Information Statement ofPSI Energy, Inc. filed, or to be filed with the Securities and Exchange Commission in 2005 are incorporated by reference into Part III of this report.

This combined Form 10-K is separately filed byCinergy Corp.,The Cincinnati Gas & Electric Company,PSI Energy,,Inc., andThe Union Light,,Heat and Power Company. Information contained herein relating to any individual registrant is filed by such registrant on its own behalf. Each registrant makes no representation as to information relating to registrants other than itself.

3

CAUTIONARY STATEMENTS

In this reportCinergy (which includesCinergy Corp. and all of our regulated and non-regulated subsidiaries) is, at times, referred to in the first person as "we"“we”, "our"“our”, or "us"“us”.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

In this report we discuss various matters that may make management's corporate visionThis document includes forward-looking statements within the meaning of Section 27A of the future clearer for you. This report outlines management's goalsSecurities Act of 1933 and projections forSection 21E of the future. These goals and projections are considered forward-lookingSecurities Exchange Act of 1934. Forward-looking statements and are based on management'smanagement’s beliefs and assumptions. These forward-looking statements are identified by terms and phrases such as “anticipate”, “believe”, “intend”, “estimate”, “expect”, “continue”, “should”, “could”, “may”, “plan”, “project”, “predict”, “will”, and similar expressions.

Forward-looking statements involve risks and uncertainties that may cause actual results to be materially different from the results predicted. Factors that could cause actual results to differ are often presented with forward-looking statements. In addition, other factors could cause actual results to differ materially from those indicated in any forward-looking statement. These include:statement include, but are not limited to:

•

- Factors affecting operations, such as:

(1)

(1) unusual unanticipated weather conditions;

(2) catastrophic weather-related damage;

(3) unscheduled generation outages;

(4)

(3) unusual maintenance or repairs;

(5)

(4) unanticipated changes in fossil fuel costs, gas supply costs, or availability constraints;

(6)costs;

(5) environmental incidents; and

(7)

(6) electric transmission or gas pipeline system constraints.

•

- Legislative and regulatory initiatives

regarding deregulation of the industry, including potential deregulation legislation in Indiana, and potential national deregulation legislation.

- legal developments.

•

The timing and extent of the entry of additional Additional competition in electric or gas markets and the effects of continued industry consolidation through the pursuit of mergers, acquisitions, and strategic alliances.

- consolidation.

•

Regulatory factors such as changes in the policies or procedures that set rates; changes in our ability to recover capital expenditures for environmental compliance, purchased power costs and investments made under traditional regulation through rates; and changes to the frequency and timing of rate increases.

•- Financial or regulatory accounting principles

or policies imposed by governing bodies.

•Political, legal,including costs of compliance with existing and economic conditions and developments in the United States (U.S.) and the foreign countries in which we have a presence. This would include inflation rates and monetary fluctuations.

- future environmental requirements.

•

- Changing market conditions and other factors related to physical energy and financial trading activities.

These would include price, basis, credit, liquidity, volatility, capacity, transmission, currency exchange rates, interest rates, and warranty risks.

•

- The performance of projects undertaken by our non-regulated businesses and the success of efforts to invest in and develop new opportunities.

•

- Availability of, or cost of, capital.

•

- Employee workforce

factors, including changes in key executives, collective bargaining agreements with union employees, and work stoppages.

- factors.

•

Legal and regulatory delays Delays and other obstacles associated with mergers, acquisitions, and investments in joint ventures.•

•- Costs and effects of legal and administrative proceedings, settlements, investigations, and claims.

Examples can be found in Note 12We undertake no obligation to update the information contained herein.

5

BUSINESS

We make our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, filed or furnished pursuant to section 13(a) or 15(d) of the "NotesSecurities Exchange Act of 1934 available free of charge on or through our internet website, www.cinergy.com, as soon as reasonably practicable after we electronically file such material with, or furnish it to, Financial Statements" in "Part I. Financial Information".

•Changes in international, federal, state, or local legislative requirements, such as changes in tax laws, tax rates, and environmental laws and regulations. Unless we otherwise have a duty to do so, the Securities and Exchange Commission'sCommission (SEC) rules do not require forward-looking statements to be revised or updated (whether as a result of changes in actual results, changes in assumptions, or other factors affecting the statements). Our forward-looking statements reflect our best beliefs as of the time they are made and may not be updated for subsequent developments.

PART I.

ITEM 1. BUSINESS

ORGANIZATION

Cinergy Corp., a Delaware corporation createdorganized in October 1994,1993, owns all outstanding common stock of The Cincinnati Gas & Electric Company (CG&E) and PSI Energy, Inc. (PSI), both of which are public utility subsidiaries.utilities. As a result of this ownership, we are considered a utility holding company. Because we are a holding company whosewith material utility subsidiaries operateoperating in multiple states, we are registered with and are subject to regulation by the SEC under the Public Utility Holding Company Act of 1935, as amended (PUHCA).amended. Our other principal subsidiaries are:

•are Cinergy Services, Inc. (Services);

• and Cinergy Investments, Inc. (Investments);

• Cinergy Global Resources, Inc. (Global Resources);

• Cinergy Technologies, Inc. (Technologies); and

• Cinergy Wholesale Energy, Inc. (CWE).

CG&E, an Ohio corporation organized in 1837, is a combination electric and gas public utility company that provides service in the southwestern portion of Ohio and, through its subsidiaries, in nearby areas of Kentucky and Indiana. It has three wholly-owned utility subsidiaries and two wholly-owned non-utility subsidiaries.CG&E's principal utility subsidiary, The Union Light, Heat and Power Company (ULH&P), in nearby areas of Kentucky. CG&Eis responsible for the majority of our power marketing and trading activity. CG&E’s principal subsidiary, ULH&P, a Kentucky corporation thatorganized in 1901, provides electric and gas service in northern Kentucky.

CG&E's&E is in a market development period for residential customers and in the competitive retail electric market for non-residential customers, transitioning to deregulation of electric generation and a competitive retail electric service market in the state of Ohio. Applicable legislation governing the transition period provides for a market development (frozen rate) period that began January 1, 2001, ended December 31, 2004 for non-residential customers and is scheduled to end December 31, 2005 for residential customers. At the end of these market development periods, CG&E will not implement market rates, but rather a rate stabilization plan (RSP) approved by the Public Utilities Commission of Ohio (PUCO) that covers the period after the market development period through 2008. The RSP, among other subsidiaries are insignificantthings, increases rates for environmental costs and capacity reserves and provides for a fuel and emission allowance tracker through 2008. See “Electric Industry” in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A)” for the various filings that led to its resultsthe PUCO’s approval of operations.CG&E’s RSP, further details of the plan, and a discussion of key elements of Ohio deregulation.

PSI, an Indiana corporation organized in 1942, is ana vertically integrated and regulated electric utility that provides service in north central, central, and southern Indiana.

6

The following table presents further information related to the operations of our domestic utility companies, CG&E, PSI, and ULH&P(our utility operating companies):

| | |

|

| Principal

Line(s) of Business

| | |

| Major Cities

Served |

| Approximate Population Served

| | | Approximate

Population

Served

|

|---|

|

|

|

|

|

|

|

|

CG&E and subsidiaries | | • Generation, transmission,

distribution, and sale of

electricity

• Sale and/or transportation of

natural gas • Electric commodity marketing and trading operations | | Cincinnati, OH

Middletown, OH

Covington, KY

Florence, KY

Newport, KY

Lawrenceburg, IN | | 2,017,0002,064,000 | |

|

|

| | | | | | | |

PSI |

|

• Generation, transmission,

distribution, and sale of

electricity |

| Bloomington, IN

Bloomington,Carmel, IN

Columbus, IN

Kokomo, IN

Lafayette, IN

New Albany, IN

Terre Haute, IN |

|

2,202,0002,283,000 | |

| | | | | | | |

ULH&P(1) |

|

• Transmission, distribution,

and sale of electricity

• Sale and transportation of

natural gas |

|

Covington, KY

Florence, KY

Newport, KY |

|

330,000345,000 | |

|

(1)See “Generation — Fuel Supply and Emission Allowances” under the “Regulated” section for further discussion of the possible transfer of generation assets.

Services is a service company that provides our regulated and non-regulated subsidiaries with a variety of centralized administrative, management, and support services. Investments holds most of our domestic non-regulated, energy-related businesses and investments. Global Resources holds our international businesses and investments, and directs our renewable energy investing activities (for example, wind farms). Technologies primarily holds our portfolio of technology-related investments. In

November 2000, CWE was formed to act as a holding company forCinergy's energy commodity businesses, including production, as the generation assets eventually become unbundled from the utility subsidiaries. See Note 18 of the "Notes to Financial Statements" in "Item 8. Financial Statements and Supplementary Data" for a discussion on Ohio deregulation.

We have collective bargaining agreements with the International Brotherhood of Electrical Workers (IBEW), the United Steelworkers of America (USWA), the Independent Utilities Union (IUU), and various international union organizations.

The following table indicates the number of employees by classification at December 31, 2000:

| | Regulated

| | Non-Regulated

|

|---|

Classification

| | CG&E(4)

| | PSI

| | ULH&P

| | Total

Regulated

| | Domestic(5)

| | International

| | Total Non-

Regulated

| | Cinergy

Total(6)

|

|---|

| IBEW(1) | | 1,098 | | 1,319 | | 61 | | 2,478 | | 315 | | — | | 315 | | 2,793 |

| USWA(2) | | 297 | | — | | 87 | | 384 | | — | | — | | — | | 384 |

| IUU(3) | | 464 | | — | | 63 | | 527 | | 393 | | — | | 393 | | 920 |

| Various Union Organizations | | — | | — | | — | | — | | 17 | | 492 | | 509 | | 509 |

| Non-Bargaining | | 376 | | 600 | | 20 | | 996 | | 2,341 | | 419 | | 2,760 | | 3,756 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| | | 2,235 | | 1,919 | | 231 | | 4,385 | | 3,066 | | 911 | | 3,977 | | 8,362 |

(1) IBEW #1347 contract will expire on April 1, 2006, and IBEW #1393 will expire on April 30, 2002.

(2) Contract will expire May 15, 2002.

(3) Contract will expire April 1, 2002.

(4) CG&E and subsidiaries excludingULH&P.

(5) Includes Services' employees who provide services to both regulated and non-regulated operations.

(6) On January 1, 2001, 1,448 of our employees were transferred to a non-regulated domestic subsidiary of CWE. For

more information on "Ohio deregulation" see Note 18 of the "Notes to Financial Statements" in "Item 8. Financial

Statements and Supplementary Data".

CURRENT TRENDS

The structure of the electric industry in our service territory and throughout the U.S. has been relatively stable for many years. In recent years, however, there have been both federal and state developments aimed at industry restructuring and increasing competition. This process is leading to an industry model whereby the generating assets become deregulated and the transmission and distribution systems remain under some type of regulation. The underlying belief, which we share, is that over the long-term, deregulation of wholesale generation markets will, through increased competition, result in lower commodity prices than would otherwise be achieved. However, in recent months, unprecedented high prices, extreme price volatility, a lack of market liquidity, and inadequate generation supply led to customer blackouts in California, demonstrating the necessity for a constructive approach to deregulation. Within our service territory, Ohio is the first state to implement electric deregulation legislation. See the "Retail Market Developments" section in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" for a discussion of key elements of Ohio deregulation, which became effective January 1, 2001. Ohio's situation is different than California's in many respects, including the following:

•In California, demand for electricity has risen sharply over the last decade, with no new increased generating capacity; however, within Ohio, demand has risen more steadily, with increased capacity being added. For example, according to statistics reported by the Public Utilities Commission of Ohio (PUCO), 1,230 megawatts (MW, the basic unit of electric energy equal to one million watts) of generating capacity was added during this past year in Ohio;

another 1,330 MW is planned for service during 2001. By comparison, California, which is estimated at about three times Ohio's population, has added minimal capacity over the last several years.

•California's restructuring plan required utilities to divest their generation assets and prohibited the utilities from entering into long term contracts for supply; this forced the utilities to rely on the spot market to meet demand. Ohio's restructuring plan does not require utilities to divest their generation assets and allows for utilities to negotiate long-term commodity supply contracts at fixed prices for commodity purchases.

•Existing transmission constraints limit the amount of electricity California can access from outside its borders. Ohio, however, shares interconnections with such states as Indiana, Kentucky, Michigan, Pennsylvania, and West Virginia.

•California's generation is largely dependent on natural gas the costmarketing and trading operations (which are primarily conducted through Cinergy Marketing and Trading, LP (Marketing & Trading), one of which has increased dramatically in recent months, and also on hydroelectric production, which has been reduced due to drought conditions. Generation in Ohio, however, is largely fueled by coal, which has been more stable in price.

Twenty-four states and the District of Columbia have adopted deregulation plans. In response to the situation in California, some of these states, while not having similar experiences as California, are considering delaying or altering terms of implementation. A number of the remaining states are reconsidering their deregulation timetables. While we believe the situation in Ohio, as described above, and generally within the Midwest are different than California, we cannot predict the consequences, if any, on efforts to deregulate the remaining markets within our service territory. Indiana and Kentucky have not yet approved legislation.

BUSINESS UNITS

its subsidiaries).

We conduct operations through our subsidiaries and manage our businesses through the following four business units:three reportable segments:

• Energy CommoditiesCommercial Business Unit (Commodities)(Commercial);

• Energy DeliveryRegulated Business Unit (Delivery)(Regulated);

and

• Cinergy InvestmentsPower Technology and Infrastructure Services Business Unit (Cinergy Investments);(Power Technology and

• International Business Unit (International) Infrastructure).

The following section describes the activities of our business unitssegments as of December 31, 2000. As the utility industry continues to evolve,Cinergy will continue to analyze its operating structure and make modifications as appropriate. In early 2001, we announced certain organizational changes, which further aligned the business units consistent withCinergy's strategic vision. The revised structure reflects three business units, as follows:2004.

•Energy Merchant—will operate power plants, both domestically and abroad, and conduct all wholesale energy marketing, trading, origination, and risk management services;

•Regulated Businesses—will operate all gas and electric transmission and distribution services, both domestically and abroad, and will be responsible for all regulatory planning for the regulated utility businesses ofCG&E,PSI, andULH&P; and

•Power Technology and Infrastructure Services—will originate and manage a portfolio of emerging energy businesses.

See Note 1516 of the "Notes“Notes to Financial Statements"Statements” in "Item“Item 8. Financial Statements and Supplementary Data"Data” for financial information by business segment.

Commercial

CommoditiesCommercial manages our wholesale generation and energy marketing and trading activities. Commercial’s wholesale generation consists of CG&E’s electric generation in Ohio due to Ohio’s transition to deregulation of electric generation and a competitive retail service market. See “Electric Industry” in “Item 7. MD&A” for further detail of key elements of Ohio deregulation. Commercial also performs energy risk management activities, provides

Commodities operates

7

customized energy solutions and maintains our domestic regulated and non-regulated electric generating plants and someis responsible for all of our jointly-owned plants. international operations. See the “Market Risk Sensitive Instruments” section of “Item 7. MD&A” for information on risks associated with these activities.

Detail of Commercial’s operations can be found in the following sections:

•Generation — Fuel Supply and Emission Allowances — Describes Commercial’s generation capacity, sources of fuel, and its various cost recovery mechanisms;

•Trading Operations and Risk Management — Describes Commercial’s energy marketing and trading activities in the United States and Canada;

•Competition — Describes the key competitors to Commercial’s various business operations;

•Energy Services — Describes Commercial’s operations consulting services and its operation of a synthetic fuel production facility;

•International — Describes Commercial’s operations outside of the United States; and

•Revenue Data and Customer Base — Describes the primary revenue generators for the various business operations of Commercial.

Generation — Fuel Supply and Emission Allowances

As of December 31, 2000,2004, the total winter electric capabilitycapacity (including our portion of the total capacity for the jointly-owned plants) of theseCommercial’s domestic generating plants was 11,889 MW. These plants are mostly6,276 megawatts (MW). Approximately 67 percent of this generation portfolio is coal-fired. In December 2000,Cinergy announced its intent to acquire an additional 998 MW of natural-gas fired generation. See "Item“Item 2. Properties"Properties” for a further discussion of the generating facilities. Commodities also conducts the following activities:

• wholesale energy marketing and trading;

• energy risk management;

• financial restructuring services; and

• proprietary arbitrage activities.

See the "Market Risk Sensitive Instruments and Positions" section of "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" for information on risks associated with these activities.

Fuel SupplyEach year throughCG&E andPSI, we purchase approximately 27 purchases over 10 million tons of coal to generate electricity. The majority of this coal is obtained through long-term coal supply agreements. The remaining coal is purchased either on the spot market or through short-term supply agreements. We receive our coal supplyelectricity, primarily from mines located in Indiana, West Virginia, Ohio, Kentucky, Pennsylvania, Illinois, and Illinois.Colorado. The price of coal has increased dramatically in 2004 as compared to 2003. Contributing to the rise in the price of coal are (1) increases in demand for electricity, (2) environmental regulation, and (3) decreases in the number of suppliers of coal from prior years. To help mitigate the price fluctuation of coal, Cinergy has a general practice to procure a substantial portion of coal through fixed-price contracts of varying length. We hold fixed-price contracts that will source a substantial portion of our expected 2005 coal requirements. We evaluate the appropriate amount of contract coal and length of contracts based on market conditions, including pricing trends, volatility and supplier reliability. See “Contractual Cash Obligations” in “Item 7. MD&A” for further detail on CG&E’s total commitment under fixed-price coal contracts.

Commodities

Commercial has natural gas-fired peaking plants that have a capacity of 1,766 MW. The fuel for these units is primarily obtained through the natural gas spot market as it is difficult to forecast the natural gas requirements for these plants. For further information on the risk of purchasing natural gas, see the “Market Risk Sensitive Instruments” section of “Item 7. MD&A”.

A joint operating agreement, effective in April 2002, allows Cinergy to jointly dispatch the regulated generating assets of PSI in conjunction with the deregulated generating assets of CG&E. Under this agreement, transfers of power between PSI and CG&E are generally priced at market rates.

Commercial monitors alternative sources of coal and natural gas to assure a continuing availability of economical fuel supplies. As such, it will maintain its practice of purchasing a portion of coal and natural gas requirements on the spotopen market and will continue to investigate least-cost coal options to comply with new and existing environmental requirements.

BothCinergy and CG&E andPSI believe that they can continue to obtain enough coal and natural gas to meet future needs. However, future environmental requirements may significantly impact the availability and price of coal.these fuels.

Purchased Power

At times, we purchaseCommercial purchases power to meet the energy needs of our wholesale customers and to meet the requirements of our retail native load customers (end-use customers within our operating companies' franchise territory).its customers. Factors that could causeCinergy Commercial to purchase power for retail native loadits customers include generating plant outages, extreme weather conditions, summer reliability, growth, and other factors associated with supplying full requirements electricity.price. We believe we can obtain enough purchased power to meet future needs. However, during periods of excessive demand, such as those which occurred in the summers of 1998 and 1999, the price and availability of these purchases may be significantly impacted. See the "Significant Rate Developments" section of "Item 7. Management's Discussion

8

Commercial emits sulfur dioxide (SO2) and Analysis of Financial Condition and Results of Operations" for additional information onPSI's Purchased Power Tracker.

Environmental Matters In December 2000,Cinergy reached an agreement in principle with the U.S. Environmental Protection Agency (EPA) and various parties, that may serve as the basis for a negotiated resolution of the Clean Air Act (CAA) claims and other related matters brought against coal-fired power plants owned and operated byCinergy's operating companies. The estimated cost for these capital expenditures is expected to be approximately $700 million. These capital expenditures are in addition to our previously announced commitment to install nitrogen oxideoxides (NOX) controls overin the next five years at an estimated costgeneration of approximately $700 million. In 2000, we spent $75 million forelectricity and maintains emission allowances to offset their emissions in order to comply with NOX and other environmental compliance as comparedSO2 emission reduction requirements. In 2004, the market prices of SO2 allowances rose more than 200 percent from 2003. Cinergy is continually evaluating market conditions and managing our overall cost structure through the addition of pollution control equipment, where economically feasible, and the use of emission allowance markets to $16 millionhelp manage our emissions costs.

Under CG&E’s new RSP, retail fuel and emission allowance costs will be recovered through a cost tracking mechanism that recovers costs that exceed the amount originally included in 1999. Forecasted expendituresthe rates frozen in CG&E’s earlier transition plan. CG&E willrecover retail fuel and emission allowance costs consumed in serving retail load and collect a Provider of Last Resort charge from non-residential customers from 2005 through 2008 and from residential customers from 2006 through 2008. See “Electric Industry” in “Item 7. MD&A” for NOXfurther detail of CG&E’s RSP.

Trading Operations and Risk Management

Commercial’s energy marketing and trading activities principally consist of Marketing & Trading’s natural gas marketing and trading operations and CG&E’s power marketing and trading operations. In April 2002, CG&E and PSI executed a new joint operating agreement whereby new power marketing and trading contracts since April 2002 are originated on behalf of CG&E only. Historically, such contracts were executed on behalf of CG&E and PSI jointly.

Our domestic operations market and trade over-the-counter (an informal market where the buying/selling of commodities occurs) contracts for the purchase and sale of electricity (primarily in the midwest region of the United States), natural gas, and other environmental compliance (in nominal dollars)energy-related products, including coal and emission allowances. Our natural gas domestic operations provide services that manage storage, transportation, gathering, and processing activities. In addition, our domestic operations also market and trade natural gas and other energy-related products on the New York Mercantile Exchange.

Marketing & Trading’s natural gas marketing and trading operations also extend to Canada where natural gas marketing and management services are $210 million for 2001provided to producers and $789 million for 2001-2005. industrial customers. Our Canadian operations also market and trade over-the-counter contracts.

See the "Environmental Issues"“Market Risk Sensitive Instruments” section of “Item 7. MD&A” for information on risks associated with these activities.

Competition

Commercial competes for wholesale contracts for the purchase and "Constructionsale of electricity and Other Commitments" sectionsnatural gas. Commercial’s main competitors include public utilities, power and natural gas marketers and traders, and independent power producers.

Energy Services

Commercial, through Cinergy Solutions Holding Company, Inc., is an on-site energy solutions and utility services provider. We provide utility systems construction, operation and maintenance of "Item 7. Management's Discussionutility facilities, energy efficiencies and Analysisconservation consulting services, as well as cogeneration. Cogeneration is the simultaneous production of two or more forms of useable energy from a single fuel source.

Commercial, through Cinergy Capital & Trading, Inc., owns a coal-based synthetic fuel production facility which converts coal feedstock into synthetic fuel for sale to a third party. As of December 31, 2004, Cinergy has produced and sold approximately 7.8 million tons of synthetic fuel at this facility. The synthetic fuel produced at this facility qualifies for tax credits (through 2007) in accordance with the Internal Revenue Code Section 29 if certain requirements are satisfied. The three key requirements are that (a) the synthetic fuel differs significantly in chemical composition from the coal used to produce such synthetic fuel, (b) the fuel produced is sold to an unrelated entity

9

and (c) the fuel was produced from a facility that was placed in service before July 1, 1998. For further information on the tax credit qualifications see Note 11(c)(iv) of the “Notes to Financial ConditionStatements” in “Item 8. Financial Statements and ResultsSupplementary Data”.

International

As of Operations"December 31, 2004, we had ownership interests in (1) generation assets located in three countries capable of producing approximately 150 MW of electricity and 700 MW equivalents of steam; and (2) approximately 1,200 miles of gas and electric transmission and distribution systems through jointly-owned investments in two countries, through which we serve approximately 8,500 transmission and distribution customers. These assets serve retail and wholesale customers by providing utility services including generation of electricity and heat as well as the distribution of gas and electric commodities.

Revenue Data and Customer Base

Commercial primarily recognizes revenues from generation provided to customers in CG&E’s service territory who have not switched to an alternative generation supplier under Ohio’s electric deregulation market. Because rates are frozen during the market development period in Ohio, the majority of these revenues are under a fixed-price tariff. Under the Ohio customer choice program, CG&E’s retail customers may choose their electric supplier. The percentage of customers switching to other electric suppliers and the related volume by customer class was as follows:

| | | | | | MW Hours For the | | Switching | |

| | MW at December 31 | | Years Ended December 31 | | Percentage at December 31(1) | |

Revenue Class | | 2004 | | 2003 | | 2004 | | 2003 | | 2004 | | 2003 | |

| | | | | | | | | | | | | |

Residential | | 75 | | 92 | | 334,224 | | 283,477 | | 4.07 | % | 5.17 | % |

Commercial | | 339 | | 374 | | 1,722,822 | | 1,654,061 | | 19.17 | % | 21.55 | % |

Industrial | | 226 | | 295 | | 1,376,210 | | 1,591,345 | | 17.89 | % | 23.60 | % |

Other Public Authorities | | 89 | | 91 | | 284,214 | | 265,039 | | 19.09 | % | 19.95 | % |

Total | | 729 | | 852 | | 3,717,470 | | 3,793,922 | | | | | |

(1) The residential switching percentage is based on annual energy consumption and the non-residential switching percentages are based on average monthly peak demand.

Customer switching reduces retail revenues by the generation component of rates and shopping incentives. CG&E still collects transmission and distribution revenues from the delivery of electricity to switched customers (see Regulated section for further information.

Deliveryinformation). During the market development period, the reduction in revenues due to customer switching is mitigated by wholesale power sales from the freed-up generation capacity. For further discussion on Ohio deregulation and the recently approved RSP see “Electric Industry” in “Item 7. MD&A”.

Delivery

Commercial’s operating revenue is also derived by providing electricity at wholesale and trading electricity primarily in the midwest region of the United States. In addition, Commercial provides and trades natural gas primarily to wholesale customers across the United States. The majority of these customers are public utilities, power and natural gas marketers and traders, and independent power producers.

Energy services operating revenues are derived primarily by providing steam, electricity, and operation and maintenance services to large industrial customers.

No single Commercial customer provides more than 10 percent of total operating revenues.

Regulated

Regulated consists of PSI’s regulated generation and transmission and distribution operations, and CG&E and its subsidiaries’ regulated electric and gas transmission and distribution systems. Regulated plans, constructs, operates, and maintains our operating companies'Cinergy’s transmission and distribution systems and providesdelivers gas and electric energy to customers. Deliveryconsumers. Regulated also earns revenues from wholesale customers primarily by these customers transmitting electric power

10

through Cinergy’s transmission system. These businesses are subject to cost of service rate making where rates to be charged to customers are based on prudently incurred costs over a test period plus a reasonable rate of return. Regulated operated approximately 45,80048,000 circuit miles (the total length in miles of separate circuits) of electric lines to provide regulated transmission and distribution service to approximately 1.5 million customers as of December 31, 2000. Delivery2004. Regulated operated approximately 7,5509,226 miles of gas mains (gas distribution lines that serve as a common source of supply for more than one service line) and service lines to provide domestic regulated transmission and distribution serviceservices to approximately 489,000500,000 customers as of December 31, 2000.2004. See "Item“Item 2. Properties"Properties” for a further discussion of the transmission and distribution linessystems owned by our utility operating companies.

Detail of Regulated’s operations can be found in the following sections:

•Generation - - Fuel Supply and Emission Allowances — Describes Regulated’s generation capacity, sources of fuel, and its various cost recovery mechanisms;

•Transmission and Distribution — Describes Regulated’s agreements with the regional utilities and regional transmission organization (RTO) that coordinate the planning and operation of generation and transmission facilities and the associated cost recovery mechanisms;

•Gas Supply — Describes Regulated’s responsibility to purchase and deliver natural gas to native load (the total requirements of a wholesale utility’s franchised retail market) customers and the mechanisms used to fulfill their responsibility; and

•Revenue Data and Customer Base — Describes the primary revenue generators for the various business operations of Regulated.

Electric OperationsGeneration - - Fuel Supply and Emission Allowances

As of December 31, 2004, the total winter electric capacity (including our portion of the total capacity for the jointly-owned plants) of Regulated’s generating plants was 7,055 MW. Approximately 78 percent of this generation portfolio is coal-fired. See “Item 2. Properties” for a further discussion of the generating facilities.

Each year PSI purchases over 15 million tons of coal to generate electricity, primarily from mines located in Indiana, Pennsylvania, and Illinois. The price of coal has increased dramatically in 2004 as compared to 2003. The primary driving forces behind the increase in coal prices are (1) increases in demand for electricity, (2) environmental regulation, and (3) decreases in the number of suppliers of coal from prior years. To help mitigate the price fluctuation of coal, Cinergy has a general practice to procure a substantial portion of coal through fixed-price contracts of varying length. We hold fixed-price contracts that will source a substantial portion of our expected 2005 coal requirements. We evaluate the appropriate amount of contract coal and length of contracts based on market conditions, including pricing trends, volatility and supplier reliability. See “Contractual Cash Obligations” in “Item 7. MD&A” for further detail on PSI’s total commitment under fixed-price coal contracts.

Regulated Deliveryhas natural gas-fired peaking plants that have a capacity of 1,263 MW. The fuel for these units is primarily obtained through the natural gas spot market as it is difficult to forecast the natural gas requirements for these plants. For further information on the risk of purchasing natural gas see the “Market Risk Sensitive Instruments” section of “Item 7. MD&A”.

A joint operating agreement, effective in April 2002, allows Cinergy to jointly dispatch the regulated generating assets of PSI in conjunction with the deregulated generating assets of CG&E. Under this agreement, transfers of power between PSI and CG&E are generally priced at market rates.

At times, Regulated purchases power to meet the energy needs of its customers. Factors that could cause Regulated to purchase power for its customers include generating plant outages, extreme weather conditions, summer reliability, growth, and price. We believe we can obtain enough purchased power to meet future needs. However, during periods of excessive demand, the price and availability of these purchases may be significantly impacted.

ULH&P purchases energy from CG&E pursuant to a contract effective January 1, 2002, which was approved by the Federal Energy Regulatory Commission (FERC) and the Kentucky Public Service Commission (KPSC). This five-year agreement is a negotiated fixed-rate contract with CG&E.

11

The KPSC has conditionally approved a long-term electric supply plan for ULH&P that will replace the current contract with CG&E as previously discussed. Under this new plan, CG&E will transfer ownership of approximately 1,100 MW of electric generating capacity to ULH&P. The capacity is currently part of CG&E’s generating assets used to service ULH&P under a multi-year wholesale power supply contract as previously discussed. ULH&P is currently seeking approval of the transaction from the SEC, wherein the Ohio Consumers Counsel has intervened in opposition, and the FERC. The transfer, which will be paid for at net book value, will not affect current electric rates for ULH&P’s customers, as power will be provided under the same terms as under the current wholesale power contract with CG&E through December 31, 2006. Assuming receipt of regulatory approvals, we would anticipate the transfer to take place in the second quarter of 2005.

Cinergy is studying the feasibility of constructing a commercial integrated coal gasification combined cycle (IGCC) generating station to help meet increased demand over the next decade. PSI would own all or part of the facility and operate it. Cinergy will partner with Bechtel Corporation and General Electric Company to complete this study. An IGCC plant turns coal to gas, removing most of the SO2 and other emissions before the gas is used to fuel a combustion turbine generator. The technology uses less water and has fewer emissions than a conventional coal-fired plant with currently required pollution control equipment. Another benefit is the potential to remove mercury and carbon dioxide (CO2) upstream of the combustion process at a lower cost than conventional plants. If a decision is reached to move forward with constructing such a plant, PSI would seek approval from the Indiana Utility Regulatory Commission (IURC) to begin construction. If approved, we would anticipate the IURC’s subsequent approval to include the assets in PSI’s rate base.

Regulated monitors alternative sources of coal and natural gas to assure a continuing availability of economical fuel supplies. As such, it will maintain its practice of purchasing a portion of coal and natural gas requirements on the open market and will continue to investigate least-cost coal options to comply with new and existing environmental requirements. Cinergy and PSI believe that they can continue to obtain enough coal and natural gas to meet future needs. However, future environmental requirements may significantly impact the availability and price of these fuels.

PSI recovers retail and a portion of its wholesale fuel costs from customers on a dollar-for-dollar basis through a cost tracking recovery mechanism (commonly referred to as a fuel adjustment clause). In addition to the fuel adjustment clause, PSI utilizes a purchased power tracking mechanism approved by the IURC for the recovery of costs related to certain specified purchases of power necessary to meet native load peak demand requirements to the extent such costs are not recovered through the existing fuel adjustment clause.

Regulated emits SO2 and NOX in the generation of electricity and maintains emission allowances to offset their emissions in order to comply with NOX and SO2 emission reduction requirements. In 2004, the market prices of SO2 allowances rose more than 200 percent from 2003. PSI utilizes a cost tracking mechanism as approved by the IURC allowing it to recover substantially all of its emission allowance costs from its customers. Cinergy is continually evaluating market conditions and managing our overall cost structure through the addition of pollution control equipment, where economically feasible, and the use of emission allowance markets to help manage our emissions costs.

Transmission and Distribution

Cinergy (through our utility operating companies) and other non-affiliated utilities in an eight-statea nine-state region participate inare parties to the East Central Area Reliability Coordination Agreement (ECAR Agreement). The(ECAR) Agreement. Through the ECAR Agreement, coordinatesECAR supports the planning and operation of generation and transmission facilities, which provides for maximum reliability of regional bulk power supply.

Midwest ISOCinergy As part of the effort to create(through our utility operating companies) is also a competitive wholesale power marketplace, the Federal Energy Regulatory Commission (FERC) approved the formationmember of the Midwest Independent Transmission System Operator, Inc. (Midwest ISO) during 1998. In that same year,Cinergy agreed to join the Midwest ISO, a RTO established in preparation for meeting anticipated changes in the FERC regulations and future deregulation requirements. The Midwest ISO was established1998 as a non-profit organization to maintainwhich maintains functional control over the combined transmission systems of its members. The organization was expected to begin operations in November 2001.

In

The Midwest ISO is the fallprovider for transmission service requested on the transmission facilities under its tariff. It is responsible for the reliable operation of 2000, threethose transmission owners announced their intent to leavefacilities and the regional planning of new

12

transmission facilities. The Midwest ISO also will administer energy markets utilizing Locational Marginal Pricing (i.e., the energy price for the next MW may vary throughout the Midwest ISO market based on transmission congestion and joinenergy losses) as the proposed Alliance Regional Transmission Organization (Alliance RTO) bymethodology for relieving congestion on the endtransmission facilities under its functional control. ECAR will maintain the responsibility for establishing the level of 2001. The Alliance RTO is a planned for-profit transmission company involving variousoperating reserves for those utilities which have transmission systems that cover partsparticipating in the ECAR Agreement and the operation of Michigan, Ohio, Indiana, West Virginia, and Virginia.

On December 13, 2000, six additional transmission owners, includingCinergy, announced a planthe Automatic Reserve Sharing system upon the Midwest ISO’s implementation of its Energy Markets Tariff. See “Electric Industry” in “Item 7. MD&A” for conditional withdrawal fromfurther detail regarding the Midwest ISO if theenergy markets.

Transmission and Distribution Cost Recovery

Transmission cost recovery mechanisms will be established under CG&E’s new RSP to, among other three withdrawing members left the organization.things, permit CG&E

On January 24, 2001, the FERC issued an order providing 30 days of confidential settlement talks between the Alliance RTO and the to recover Midwest ISO charges. CG&E also plans to file a distribution rate case to recover certain distribution costs with rates to become effective January 1, 2006 and its stakeholders,has deferred certain costs in an effort to resolve issues related to such withdrawals.Cinergy actively participated in the settlement process. On February 23, 2001, the settlement judge reported to the FERC that settlement talks produced a unanimous comprehensive settlement between all related parties. Specific details of this settlement are yet to be finalized2004 and will need approval by the FERC. The definitive settlement agreement language isdefer costs in 2005 pursuant to be filed with the FERC on March 19, 2001. If approved, the settlement agreement is not expected to present any material adverse impacts to the company.its RSP. See “Electric Industry” in “Item 7. MD&A” for further detail of CG&E’s RSP.

PSI has received IURC approval for the recovery of Midwest ISO costs and is currently seeking IURC approval that would further define the mechanisms for recovery of such costs.

13

Transmission System Interconnections

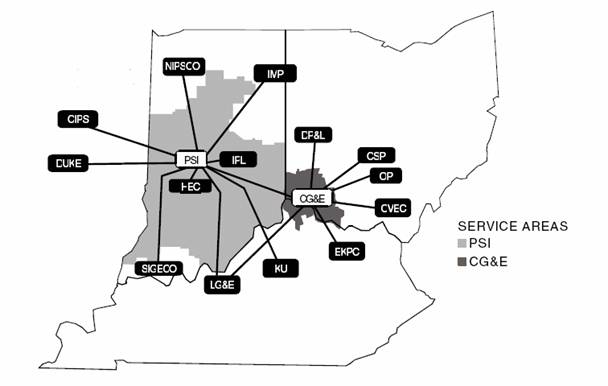

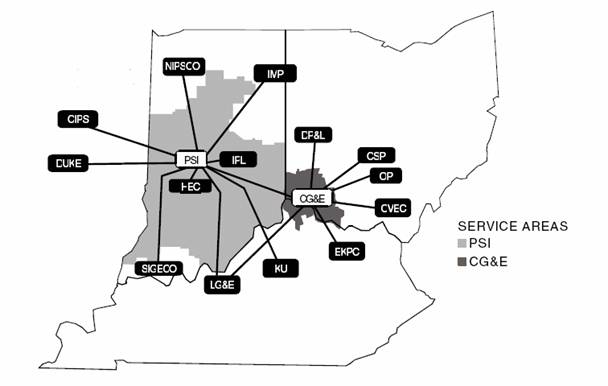

The following map illustrates the interconnections between our electric systems and other electric systems.

Electricity Supply Delivery currently receives all of its electricity from Commodities at a transfer price based upon current regulatory ratemaking methodology. With the implementation of electric deregulation in Ohio, effective January 1, 2001, Delivery continues to acquire its electricity requirements through Commodities for those retail customers who do not switch suppliers. For further details on electricity supply ofCG&E refer to Note 18 of the "Notes to Financial Statements" in "Item 8. Financial Statements and Supplementary Data".

ULH&P purchases its energy fromCG&E pursuant to a FERC-approved contract that is due to expire on December 31, 2001. Currently the contract is under negotiation with the involvement of the Kentucky Public Service Commission. The Ultimate supplier(s) ofULH&P's energy and the pricing of electric commodity requirements contained in any new arrangement could reflect a market-based approach. At the current time we are unable to predict the outcome of this matter.

14

Gas Supply Delivery

Regulated is responsible for the purchase and the subsequent delivery of natural gas to native load customers. Delivery'sRegulated’s natural gas procurement strategy is to buy firm natural gas supplies (natural gas intended to be available at all times) and firm interstate pipeline transportation capacity during the winter season (November through March) and buy spot supply and capacity during the non-heating season (April through October). through a combination of firm supply and transportation capacity along with spot supply and interruptible transportation capacity. This strategy allows DeliveryRegulated to assure reliable natural gas supply for its high priority (non-curtailable) firm customers during peak winter conditions and provides DeliveryRegulated the flexibility to reduce its contract commitments if firm customers choose alternate gas suppliers.suppliers under Regulated’s customer choice/gas transportation programs. In 2000,2004, firm supply (gas intended to be available at all times) purchase commitment agreements provided approximately 55%63 percent of the natural gas supply. Thesupply, with the remaining gas was purchased on the spot market. These firm supply agreements feature two levels of gas supply, specifically (1) base load, which is a continuous supply to meet normal demand requirements, and (2) swing load, which is gas available on a daily basis to accommodate changes in demand. Delivery pays reservation chargesdemand due primarily to changing weather conditions.

Regulated manages natural gas procurement-price volatility mitigation programs forCG&E and ULH&P. These programs pre-arrange between 20-75 percent of winter heating season base load gas requirements and swingup to 50 percent of summer season base load supplies. These charges secure delivery fromrequirements. CG&E and ULH&P use primarily fixed-price forward contracts and contracts with a ceiling and floor on the supplier during periodsprice. As of extreme weather or high demand.December 31, 2004, CG&E and ULH&P, combined, had hedged approximately 60 percent of their winter 2004/2005 base load requirements. See the "Gas Industry"“Gas Industry” section of "Item“Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations"MD&A” for further information.

Interstate pipelines either (1) transport gas purchased directly to the distribution systems or (2) inject gas purchased into pipeline storage facilities for future withdrawal and delivery. The majority of the gas supply comes from the Gulf of Mexico coastal areas of Texas and Louisiana. In addition, a limited supply comes from the mid-continent (Arkansas-Oklahoma) basin. Also, industrial transportation customers behindCinergy's city gate (point where the distribution system connects to an interstate gas pipeline) are obtaining methane gas recovered locally from an Ohio landfill. Delivery expects the natural gas market will remain competitive in future years. However, short-term price fluctuations could occur as a result of weather conditions, availability of supply, changes in demand, and storage inventories. The market price of natural gas has increased significantly in 2000, which has causedCG&E andULH&P to pay more for the gas they deliver to customers. Under the gas cost recovery mechanism that is mandated under state law, gas commodity cost is passed through directly to the customer dollar-for-dollar. It is expected that gas commodity prices will remain at these historically high levels well into 2001.

Revenue Data and Customer Base

Regulated’s generation revenue is derived from the fulfillment of its native load requirements. The percent of retail operating revenues derived from full service electricity and gas sales and fromtransportation for each of the sale and/or transportation of natural gas for thethree years ended December 31 were as follows:

| | Operating Revenues

|

|---|

| | 2000

| | 1999

| | 1998

|

|---|

Registrant

| | Electric %

| | Gas %

| | Electric %

| | Gas %

| | Electric %

| | Gas %

|

|---|

| Cinergy(1) | | 64 | | 36 | | 73 | | 27 | | 81 | | 19 |

| CG&Eand subsidiaries | | 85 | | 15 | | 85 | | 15 | | 86 | | 14 |

| PSI | | 100 | | — | | 100 | | — | | 100 | | — |

| ULH&P | | 71 | | 29 | | 75 | | 25 | | 75 | | 25 |

(1)The results ofCinergyalso include amounts related to non-registrants.

| | Operating Revenues | |

Registrant | | 2004 | | 2003 | | 2002 | |

| | Electric | | Gas | | Electric | | Gas | | Electric | | Gas | |

| | | | | | | | | | | | | |

Cinergy | | 76 | % | 24 | % | 76 | % | 24 | % | 81 | % | 19 | % |

CG&E and subsidiaries | | 45 | | 55 | | 46 | | 54 | | 56 | | 44 | |

PSI | | 100 | | — | | 100 | | — | | 100 | | — | |

ULH&P | | 65 | | 35 | | 67 | | 33 | | 74 | | 26 | |

Electric and gas sales are seasonal. Electricity usage in our service territory peaks during the summer and gas usage peaks during the winter. Air conditioning increases electricity demand and heating increases the demand for electricity and gas.gas demand.

The service territory ofCG&E and its utility subsidiaries, includingULH&P, is heavily populated and is characterized by a stable residential customer base and a diverse mix of industrial customers. The territory served byPSI is composed of residential, agricultural, and widely diversified industrial customers. No single retail customer provides more than ten10 percent of total operating revenues (electric or gas) for anyRegulated.

Power Technology and Infrastructure

Power Technology and Infrastructure primarily manages Cinergy Ventures, LLC (Ventures), Cinergy’s venture capital subsidiary. Ventures identifies, invests in, and integrates new energy technologies into Cinergy’s existing businesses, focused primarily on operational efficiencies and clean energy technologies. In addition, Power

15

Technology and Infrastructure manages our investments in other energy infrastructure and telecommunication service providers.

In March 2004, Cinergy announced that it would begin offering broadband over power line (BPL) services in the Cincinnati, Ohio area. BPL utilizes the low and medium voltage distribution lines ofCinergy to transmit high speed data and other digital information to and from the internet via home electrical outlets and can be used for monitoring utility infrastructure. These services are being offered through joint ventures created by Ventures and Current Communications Group LLC, marketing to Cinergy service territory and municipal and co-op utilities throughout the United States. Ventures has invested approximately $18 million to date.

We have collective bargaining agreements with the International Brotherhood of Electrical Workers (IBEW), the United Steelworkers of America (USWA), the Utility Workers Union of America (UWUA), and various international union organizations.

The following table indicates the number of employees by classification at January 31, 2005:

Classification | | CG&E(4) | | PSI | | ULH&P | | Cinergy(5) | |

| | | | | | | | | |

IBEW(1) | | 1,018 | | 1,218 | | 60 | | 2,546 | |

USWA(2) | | 280 | | — | | 79 | | 398 | |

UWUA(3) | | 387 | | — | | 58 | | 768 | |

Various Union Organizations | | — | | — | | — | | 355 | |

Non-Bargaining | | 198 | | 354 | | 19 | | 3,775 | |

| | 1,883 | | 1,572 | | 216 | | 7,842 | |

(1) IBEW #1347 contract will expire on April 1, 2006, IBEW #1393 contract will expire on May 1, 2005, and IBEW #352 contract expired on February 5, 2005 and was replaced with a new contract set to expire on February 5, 2008.

(2) USWA #12049 and #5541-06 contracts will expire on May 15, 2007.

(3) Contract will expire on March 31, 2005.

(4) CG&E and subsidiaries excluding ULH&P.

(5) Includes 3,154 Services’ employees who provide services to our operating utilities and other non-regulated companies.

Cinergy Investments is currently affected by several different issues which involve compliance with federal and state regulations regarding the protection of the environment including, but not limited to, reductions in mercury, NOX, and SO2 emissions. Cinergy is able to recover certain costs of this environmental compliance equipment through various trackers set up with Cinergy’s respective state regulatory agencies. See the “Environmental Issues” section in “Item 7. MD&A” for a discussion of these environmental issues and the estimated capital expenditures.

Cinergy Investments manages the development, marketing, and sales of our domestic non-regulated, and non-wholesale energy and energy-related products and services. This is accomplished through various subsidiaries and joint ventures. These products and services include the following:

•providing energy management-consulting services and infrastructure solutions to government, industrial, and commercial customers that operate retail facilities;

•providing various utility services to utilities (for example, providing underground locating and construction services for utilities);

•providing telecommunication services including dark fiber, high capacity service, internet service, local phone service, and long distance service;

•leasing of space on wireless telecommunication towers and the purchase and construction of such towers;

•providing various engineering, procurement, construction, operation, and maintenance functions such as designing and constructing turnkey gas pipelines, electric transmission and distribution lines, substations for industrial and large commercial customers, and fiber optic telecommunication cables;

•providing information, systems, and services to multi-site national chains in retail industries to optimize their energy, telecommunications, and other facility-wide costs;

•building, owning, operating, and maintaining combined heat and power facilities; and

•

International

International primarily directs and manages our international business holdings. These holdings include wholly-owned and jointly-owned companies in ten foreign countries. In addition, International directs our renewable energy investing activities (for example, wind farms) which include investments within the U.S. as well as abroad.

In 1999, we sold our 50% ownership interest in Midlands Electricity plc (Midlands). Prior to the sale, Midlands had provided the majority of International's earnings. See Note 10 of the "Notes to Financial Statements" in "Item 8. Financial Statements and Supplementary Data" for further information on the sale of our ownership interest in Midlands.

During the fourth quarter of 2000, a joint venture between a subsidiary ofCinergy and a subsidiary of Royal Dutch Petroleum (Shell) was awarded a 49% interest and operational control of the gas distribution business in Athens, Greece. We expect this transaction to close during the first half of 2001. International's plans for 2001 include development of the Greek gas business itself and other opportunities which may arise in the Greek market. In addition, International expects to continue its development of, and investment in, renewable energy projects in both the U.S. and Europe. The timing of International's investments depends on changing market conditions and regulatory approvals. Our international investments present certain risks, including foreign exchange risk. See the "Market Risk Sensitive Instruments and Positions" section of "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" for further information on these risks and how we address our exposure to them. See Note 15 of the "Notes to Financial Statements" in "Item 8. Financial Statements and Supplementary Data" for further information on revenues from foreign operations and long-lived assets.

OTHER DEVELOPMENTS

Our ability to invest in growth initiatives, such as Exempt Wholesale Generators (EWG) and Foreign Utility Companies (FUCO) is limited by certain legal and regulatory requirements, including the PUHCA. An EWG is a special-purpose entity that owns or operates domestic or foreign electric generating facilities whose power is sold entirely at wholesale. FUCOs are companies whose utility assets and operations are located entirely outside the U.S. and which are used for the generation, transmission, or distribution of electric energy for sale, or the distribution of gas at retail. In late 1999, we filed a request with the SEC under the PUHCA for an additional $5 billion in authority to invest in EWGs and FUCOs. On June 23, 2000, the SEC issued an interim order granting us authority to invest a total of $1.7 billion in EWGs and FUCOs, replacing an earlier order capping our investment authority under PUHCA at an amount equal toCinergy's average retained earnings from time to time. As of December 31, 2000, we had invested or committed to invest $1.4 billion of the $1.7 billion available.

In January 2001,Cinergy modified its request to the SEC for additional investment authority, proposing a new investment limitation capped at $4 billion, subject to various terms and conditions. This request is pending before the SEC. While we currently cannot predict the outcome of this request, the existing limits could restrict our ability to invest in future transactions.

FUTURE EXPECTATIONS/TRENDS

See the information appearing under the same caption in "Item“Item 7. Management's DiscussionMD&A” for the following discussions:

•Regulatory Outlook and Analysis of Financial Condition and Results of Operations" for discussion of "Future Expectations/Trends."

Significant Rate Developments;

•FERC and Midwest ISO;

•Gas Industry; and

•Other Matters.

16

PROPERTIES

ITEM 2. PROPERTIES

Electric

Domestic Power Generation

COMMODITIES

Regulated

Our operating companies'Commercial’s domestic power generating stations’ total winter electric capabilitiescapacity, reflected in MWmegawatts (MW), as of December 31, 2000,2004, are shown in the table that follows. OurCommercial’s electric generating plants are primarily located in Ohio Kentucky, and IndianaKentucky and are wholly-owned andor jointly-owned facilities.

| | | | | | Natural | | | | | |

| | | | Coal | | Gas | | Oil | | Total | |

Commercial(1) | | Stations | | MW | | MW | | MW | | MW | |

| | | | | | | | | | | |

The Cincinnati Gas & Electric Company (CG&E) | | 9 | | 4,186 | | 736 | | 324 | | 5,246 | |

Cinergy Investments, Inc. (Investments)(2) | | 2 | | — | | 1,030 | | — | | 1,030 | |

| | | | | | | | | | | |

Total | | 11 | | 4,186 | | 1,766 | | 324 | | 6,276 | |

Registrant(1)

| | Stations

| | Coal

MW

| | Natural

Gas

MW

| | Oil

MW

| | Hydro

MW

| | Total

MW

|

|---|

| CG&E | | 9 | | 4,186 | | 736 | | 323 | | — | | 5,245 |

| PSI | | 8 | | 5,578 | | 120 | | 261 | | 45 | | 6,004 |

| | |

| |

| |

| |

| |

| |

|

| Total | | 17 | | 9,764 | | 856 | | 584 | | 45 | | 11,249 |

| | |

| |

| |

| |

| |

| |

|

(1)

- This table includes only our portion of the total capacity for the jointly-owned plants.

Refer to Note 13 of(2) Represents natural gas peaking plants located in Tennessee and Mississippi, owned by Investments, that sell electricity on the "Notes to Financial Statements" in "Item 8. Financial Statements and Supplementary Data" for a discussion of the jointly-owned plants.

wholesale market.

During 2000, our2004, Commercial’s electric generating plants, operatedincluding those that we own but do not operate, performed reliably, as evidenced by our annual capacity factor of 73% (excluding natural gas peaking stations),68 percent and a utilization factor of greater than 86%.83 percent (excluding natural gas and fuel oil peaking stations) and anequivalent availability factor of 84 percent. A capacity factor is a percentage that indicates how much of a power plant'splant’s capacity is used over time. A utilization factor is a percentage that indicates how much of a power plant’s capacity is used while being available. An equivalent availability factor is a percentage that indicates how much of a unit is available to generate compared to its potential maximum generation.

17

Below is a geographical map showing the locations of Commercial’s generation plants.

During August, we experienced peak loads

Legend | |

Number | | Generation Plant | | Fuel Type | | MW Capacity | |

| | | | | | | |

1 | | Dick’s Creek | | Gas | | 172 | |

2 | | Woodsdale | | Gas | | 564 | |

3 | | Miami Fort | | Coal/Oil | | 962 | |

4 | | East Bend | | Coal | | 414 | |

5 | | Beckjord | | Coal/Oil | | 1,107 | |

6 | | Wm. Zimmer | | Coal | | 604 | |

7 | | J.M. Stuart | | Coal | | 913 | |

8 | | Killen | | Coal | | 198 | |

9 | | Conesville | | Coal | | 312 | |

10 | | Brownsville | | Gas | | 480 | |

| | Caledonia(1) | | Gas | | 550 | |

| | | | Total | | 6,276 | |

(1) Commercial’s generation plant not included in the map is located in Caledonia, Mississippi.

Cogeneration

As of 4,731December 31, 2004, Cinergy had ownership interests in and/or operated 27 domestic cogeneration facilities capable of producing 5,357 MW forCG&Eof electricity, 4,303 MW equivalents of steam and 5,410236 MW forPSI. At times we purchase power to meetequivalents of chilled water. Cogeneration is the energy needssimultaneous production of our wholesale customers and to meet the requirements of our retail native load customers. Factors that could causeCinergy to purchase power for retail native load customers include outages, extreme weather conditions, growth, and other factors associated with supplying full requirements electricity. We believe we can obtain enough purchased power to meet future needs.

Promptly after receipt of all required regulatory approvals and third-party consents,CG&E anticipates transferring its generating stations and their related assets and obligations to onetwo or more non-regulated corporate subsidiary(ies). Subsequent to this transferCG&E will continue operations asforms of useable energy from a transmission and distribution company. To facilitate this transfer, the generation assetssingle fuel source. During 2005, Cinergy anticipates completion ofCG&E as of August 2000, were released from the first mortgage indenture lien allowing them to move un-encumbered to the non-regulated subsidiary. Generating assets added after August 2000, remain subject to the lien ofCG&E's first mortgage bond indenture and will require release an expansion at some future date prior to being transferred. For a further discussion on Ohio deregulation see Note 18 of the "Notes to Financial Statements" in "Item 8. Financial Statements and Supplementary Data".

Non-Regulated

During 1999, one of our non-regulated subsidiaries formedexisting cogeneration facilities, which is expected to provide an additional 70 MW equivalents of steam and 42 MW equivalents of chilled water.

18

Synthetic Fuel

Cinergy Capital & Trading, Inc. owns a partnership (each party havingcoal-based synthetic fuel production facility, which converts coal into synthetic fuel for sale to a 50% ownership) with Duke Energy North America LLC (Duke). The partnership was formedthird party. See “Synthetic Fuel Production” in “Item 7. MD&A” for the purposeadditional information regarding this business initiative.

International

As of jointly constructing and owning three wholesale generating facilitiesDecember 31, 2004, we had ownership interests in (1) generation assets located in southwestern Ohio,three countries capable of producing approximately 150 MW of electricity and east central700 MW equivalents of steam; and western Indiana. Two(2) approximately 1,200 miles of these properties became fully operational in June 2000. The total capacity of these plants is 1,280 MW. Construction of the third facility, with a capacity of 129 MW, has been suspended by order of the Indiana Utility Regulatory Commission (IURC). For further information on the IURC's order, see the "Wholesale Market Developments" section of "Item 7. Management's Discussiongas and Analysis of Financial Condition and Results of Operations".

In December 2000,Cinergy announced that one of its non-regulated subsidiaries entered into a definitive agreement to acquire two natural gas-fired merchant electric generating facilities from Enron. The facilities are located in Tennessee and Mississippi and have a total combined capacity of 998 MW. It is anticipated that this transaction will close in the second quarter of 2001.

DELIVERY

Electric

Metrics for our operating companies' electric transmission and distribution systems through jointly-owned investments in two countries, through which we serve approximately 8,500 transmission and distribution customers. These assets serve retail and wholesale customers by providing utility services including generation of electricity and heat as well as the distribution of gas and electric commodities.

Electric

Domestic Power Generation

Regulated’s domestic power generating stations’ total winter electric capacity, reflected in MW, as of December 31, 2004, are shown in the table that follows. The electric generating plants are located in Indiana and Ohio and are wholly-owned or jointly-owned facilities.

| | | | | | Natural | | | | | | | |

| | | | Coal | | Gas | | Oil | | Hydro | | Total | |

Regulated(1) | | Stations | | MW | | MW | | MW | | MW | | MW | |

| | | | | | | | | | | | | |

PSI | | 11 | | 5,488 | | 1,263 | | 259 | | 45 | | 7,055 | |

(1) This table includes only our portion of the total capacity for the jointly-owned plants.

During 2004, Regulated’s electric generating plants, including those that we own but do not operate, performed reliably, as evidenced by our annual capacity factor of 74 percent and a utilization factor of 85 percent (excluding natural gas and fuel oil peaking stations) and anequivalent availability factor of 89 percent. A capacity factor is a percentage that indicates how much of a power plant’s capacity is used over time. A utilization factor is a percentage that indicates how much of a power plant’s capacity is used while being available. An equivalent availability factor is a percentage that indicates how much of a unit is available to generate compared to its potential maximum generation.

19

Below is a geographical map showing the locations of Regulated’s generation plants.

Legend | |

Number | | Generation Plant | | Fuel Type | | MW Capacity | |

| | | | | | | |

1 | | Cayuga | | Coal/Gas/Oil | | 1,135 | |

2 | | Wabash River | | Coal/Oil | | 966 | |

3 | | Edwardsport | | Coal/Oil | | 160 | |

4 | | Gibson | | Coal | | 2,844 | |

5 | | Miami Wabash | | Oil | | 104 | |

6 | | Noblesville | | Gas | | 310 | |

7 | | Henry County | | Gas | | 129 | |

8 | | Connersville | | Oil | | 98 | |

9 | | Gallagher | | Coal | | 560 | |

10 | | Markland | | Hydro | | 45 | |

11 | | Madison | | Gas | | 704 | |

| | | | Total | | 7,055 | |

20

Transmission and Distribution

Relevant information for our proportionate share of jointly-owned facilities) are estimatedutility operating companies’ electric transmission and distribution systems located in Ohio, Kentucky, and Indiana is as follows:

| | Electric | | Electric | | Substation | |

| | Transmission | | Distribution | | Combined | |

Registrant | | Systems | | Systems | | Capacity | |

| | (circuit miles) | | (circuit miles) | | (kilovolt-amperes)(1) | |

| | | | | | | |

CG&E and subsidiaries | | | | | | | |

CG&E | | 1,561 | | 16,743 | | 21,121,288 | |

The Union Light, Heat and Power Company (ULH&P) | | 106 | | 2,883 | | 1,419,878 | |

Other subsidiaries | | 40 | | — | | — | |

Total CG&E and subsidiaries | | 1,707 | | 19,626 | | 22,541,166 | |

PSI Energy, Inc. (PSI) | | 5,354 | | 20,917 | | 30,569,289 | |

| | | | | | | |

Total | | 7,061 | | 40,543 | | 53,110,455 | |

Registrant

| | Electric

Transmission

Systems

| | Electric

Distribution

Systems

| | Substation

Combined

Capacity

|

|---|

| | (circuit miles)

| | (circuit miles)

| | (kilovolt-amperes)(1)

|

|---|

| CG&E | | 1,641 | | 15,315 | | 20,518,621 |

| | ULH&P | | 105 | | 2,646 | | 1,115,298 |

| | Other subsidiaries | | 40 | | 10 | | — |

| | |

| |

| |

|

| CG&E and subsidiaries | | 1,786 | | 17,971 | | 21,633,919 |

| PSI | | 5,515 | | 20,557 | | 28,946,637 |

| | |

| |

| |

|

| Total | | 7,301 | | 38,528 | | 50,580,556 |

| | |

| |

| |

|

(1)

- Kilovolt-amperes (1,000 volt-amperes) are a broad measure of our substation transformer capacity.

At the end of 19992004, our utility operating companies'companies’ electric systems were interconnected with thirteen14 other utilities. An additional interconnection was completed in 2000 betweenCinergy and a new generation-only area established by Enron bringing the total number of interconnections to fourteen.

Our electric transmission and distribution systems are designed and constructed to further the goal of providing reliable service to our customers. Every effort is made to ensure that sufficient facilities are in service to meet this goal without installing facilities beyond what is required to operate reliably and within design orthe designed parameters. Through our ongoing review of these systems, enhancements are developed and constructed to meet our planning, loading, and reliability guidelines. This process allows us to prudently invest in capacity additions only when and where they are required. The Midwest Independent Transmission System Operator, Inc. (Midwest ISO) holds functional control of Regulated’s transmission systems.