UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20202023

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________to__________

Commission file number 0-22705

NEUROCRINE BIOSCIENCES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 33-0525145 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | | |

| 12780 El Camino Real, | San Diego, | California | | 92130 |

| (Address of principal executive offices) | | (Zip Code) |

(858) 617-7600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Common Stock, $0.001 par value | | NBIX | | Nasdaq Global Select Market |

| (Title of each class) | | (Trading Symbol) | | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | | Accelerated filer | ☐ | | Non-accelerated filer | ☐ | | Smaller reporting company | ☐ | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☑ No ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of registrant’s common stock held by non-affiliates of the registrant, computed by reference to the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter, June 30, 2020,2023, was approximately $11,231,617,436.$7.9 billion.

As of January 29, 2021, 93,943,645February 5, 2024, 99,507,490 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to the registrant’s annual meeting of stockholders to be filed pursuant to Regulation 14A within 120 days following the end of the registrant’s fiscal year ended December 31, 20202023 are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

| | | | | | | | |

| | | Page |

| | |

| | | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | | |

| | |

| | | |

| Item 5. | | |

Item 6. | Selected Financial Data | 34 |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | | |

| | |

| | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | | |

| | |

| | | |

| Item 15. | | |

NEUROCRINE, the Neurocrine logo, INGREZZA,® the INGREZZA logo, and ONGENTYS® other Neurocrine Biosciences trademarks are registered trademarksthe property of Neurocrine Biosciences, Inc. ALKINDI, EFMODY, and other Diurnal trademarks are the property of Diurnal Limited, a Neurocrine Biosciences company. Any other brand names or trademarks appearing in this Annual Report that are not the property of Neurocrine Biosciences, Inc. are the property of their respective holders.

PART I

Forward-Looking Statements

This Annual Report on Form 10-K and the information incorporated herein by reference contain forward-looking statements that involve a number of risks and uncertainties. Although our forward-looking statements reflect the good faith judgment of our management, these statements can only be based on facts and factors currently known by us. Consequently, these forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from results and outcomes discussed in the forward-looking statements.

Forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “hopes,” “may,” “will,” “plan,” “intends,” “estimates,” “could,” “should,” “would,” “continue,” “seeks,” “pro forma,” or “anticipates,” or other similar words (including their use in the negative), or by discussions of future matters such as the development of new products, technology enhancements, possible changes in legislation and other statements that are not historical. These statements include but are not limited to statements under the captions “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” as well as other sections in this report. You should be aware that the occurrence of any of the events discussed under the heading in Part I titled “Item 1A. Risk Factors” and elsewhere in this report could substantially harm our business, results of operations and financial condition and that if any of these events occurs, the trading price of our common stock could decline and you could lose all or a part of the value of your shares of our common stock.

The cautionary statements made in this report are intended to be applicable to all related forward-looking statements wherever they may appear in this report. We urge you not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. Except as required by law, we assume no obligation to update our forward-looking statements, even if new information becomes available in the future.

Item 1. Business

Overview

We areNeurocrine Biosciences is a neuroscience-focused, biopharmaceutical company dedicatedwith a simple purpose: to discovering, developing and delivering life-changing treatmentsrelieve suffering for people with serious, challenging and under-addressed neurological, endocrine and psychiatric disorders. Our diverse portfolio includes United States Food and Drug Administration, or FDA, approved treatments for tardive dyskinesia, Parkinson’s disease, endometriosis*, uterine fibroids* and clinical programs in multiple therapeutic areas.great needs, but few options. For nearly three decades, we have specialized in targetingapplied our unique insight into neuroscience and interrupting disease-causing mechanisms involving the interconnected pathwaysinterconnections between brain and body systems to advance medicines for the treatment of under-addressed neurological, neuroendocrine and neuropsychiatric disorders and we will continue to relentlessly pursue medicines to ease the nervousburden of debilitating diseases and endocrine systems. (*in collaboration with AbbVie Inc.)

Product Pipeline

Exclusive and Partnered Commercial Products

The following table summarizes our exclusive and partnered commercial products and is followed by detailed descriptions of each product:

INGREZZA (valbenazine)disorders.

We launched INGREZZA in the U.S. in May 2017 after receiving FDA approval for INGREZZA as the first FDA-approvedU.S. Food and Drug Administration (FDA)-approved drug for the treatment of tardive dyskinesia and in April 2017.August 2023 for the treatment of chorea associated with Huntington's disease. INGREZZA provides a once-daily dosing treatment option for tardive dyskinesia and has two dosing options (40 mg and 80 mg capsules), with a recommended dose of 40 mg taken for the first seven days of treatment for tardive dyskinesia and fourteen days for chorea associated with Huntington’s disease, and an option to take 40 mg, 60 mg, or 80 mg thereafter, depending on the patient’s dosing needs.

In February 2021, Mitsubishi Tanabe Pharmaceutical Company, or MTPC, reported positive top-line results from the J-KINECT Phase III study, designed to evaluate the efficacy and safety of valbenazine in tardive dyskinesia. Detailed results from this trial will be presented at a future medical conference. With positive data in hand, a marketing authorization with the Ministry of Health and Welfare is planned for 2021 in Japan. In addition, MTPC submitted filings for marketing authorizations in South Korea, Thailand, Singapore, Indonesia, and Malaysia in 2020.

Tardive dyskinesia is defined by hyperkinetic involuntary movements which arise after months or years of treatment with dopamine receptor blocking agents, such as antipsychotics used for treating schizophrenia, bipolar disorder and depression, and certain treatments for nausea, vomiting and gastric emptying in patients with gastroparesis. While the prevalence rates of tardive dyskinesia can vary greatly in accordance with the population being studied, it is estimated that over 500 thousand individuals are2023, INGREZZA helped more people affected by tardive dyskinesia than ever before, reflecting higher prescription demand driven by increased commercial activities, including the continued investment in our branded direct-to-consumer INGREZZA advertising campaign and benefit from the U.S. alone (Kantar Health).

expansion of our sales force completed in April 2022. Going forward, key elements of our commercial strategy include maximizing the opportunity in INGREZZA through consistent and effective commercial execution, continued development of valbenazine as the best-in-class treatment for new patient populations and to lead the evolving understanding of VMAT2 biology and its role in disease. INGREZZA net product sales totaled $993.1 million, $752.9 million$1.8 billion for 2023, $1.4 billion for 2022 and $409.6 million$1.1 billion for 2020, 20192021 and 2018, respectively, and represented the significant majorityaccounted for approximately 99% of our total net product sales for 20202023.

Our internal research and all ofdevelopment efforts are focused on innovative therapies with clear and defined clinical and regulatory paths to approval. From time to time, we supplement our net product sales for 2019internal research and 2018.development efforts by in-licensing the rights to certain clinical development programs or by acquiring businesses that synergize with and allow us to capitalize on our existing development and commercial capabilities.

ONGENTYS (opicapone)

We launched ONGENTYSCommercial Products

| | | | | | | | | | | |

| Product | Indication | | Major Markets |

| | | |

| Tardive Dyskinesia | | U.S., Japan, Select Asian Markets (1) |

| Chorea Associated with Huntington’s Disease | |

| | |

| | | |

| Adrenal Insufficiency | | U.S., United Kingdom, EU4 (2)(3) |

| | |

| | | |

| Classic Congenital Adrenal Hyperplasia | | United Kingdom, EU4 (3) |

| | |

| | | |

| Endometriosis | | U.S. (4) |

| | |

| | | |

| Uterine Fibroids | | U.S. (4) |

| | |

(1) INGREZZA is marketed as DYSVAL® (valbenazine) in Japan and REMLEAS® (valbenazine) in other select Asian markets, where Mitsubishi Tanabe Pharma Corporation retains commercialization rights.

(2) ALKINDI is marketed as ALKINDI SPRINKLE® (hydrocortisone) in the U.S. in September 2020, after receiving FDA approval for ONGENTYS as an adjunctive therapy to levodopa/DOPA decarboxylase inhibitors in adult Parkinson's disease patients in April 2020. We acquired, where Eton Pharmaceuticals, Inc. retains commercialization rights.

(3) The EU4 market is made up of the U.S.following countries: Germany, France, Italy and CanadaSpain.

(4) AbbVie Inc. retains global commercialization rights to ONGENTYS from BIAL – Portela & Ca, S.A., or BIAL, in the first quarterelagolix.

Marketing and Distribution

Our specialty sales force consists of 2017.

ONGENTYS is a novel, once-daily, peripherally acting, highly selective Catechol-O-methyltransferase, or COMT, inhibitor utilized as an adjunct therapy to levodopa/carbidopa in patients with Parkinson’s disease experiencing motor fluctuations. COMT inhibitors are utilized to prolong the duration of effect of levodopa, the primary treatment option for Parkinson’s disease patients, during periods of the day where the effects of levodopa wear off and motor symptoms worsen, also referred to as “off-time.” Parkinson’s disease is a chronic and progressive movement disorder that affects approximately 1 million individuals in the U.S. alone.

ORILISSA (elagolix)

AbbVie Inc., or AbbVie, launched ORILISSA400 experienced sales professionals located in the U.S. and Canada in Augustis divided into three dedicated sales teams focused on psychiatry, neurology and November 2018, respectively, after receiving FDA and Health Canada approval for ORILISSA for the management of moderate to severe endometriosis pain in women in July and October 2018, respectively. Discovered and developed through Phase II clinical studies by us, we out-licensed the global rights to elagolix to AbbVie in 2010.long-term care.

The World Endometriosis Research Foundation estimates that there are over 170 million women worldwide who suffer from endometriosis, including approximately 7.5 million womenFor INGREZZA, our customers in the U.S. alone.consist of a limited network of specialty pharmacy providers that deliver INGREZZA to patients by mail, wholesale distributors that distribute INGREZZA primarily to certain specialty pharmacies, and specialty distributors that distribute INGREZZA primarily to closed-door pharmacies and government facilities. We rely on third-party service providers to perform a variety of functions related to the packaging, storage and distribution of INGREZZA.

ORIAHNN (elagolix, estradiol,

Manufacturing and norethindrone acetate; elagolix)Supply

AbbVie launched ORIAHNN in the U.S. in June 2020, after receiving FDA approval for ORIAHNN as the first FDA-approved non-surgical, oral medication optionWe currently rely on, and intend to continue to rely on, third-party manufacturers for the managementproduction of heavy menstrual bleeding associatedINGREZZA and our product candidates. Raw materials, active pharmaceutical ingredients (API) and other supplies required for the production of INGREZZA and our product candidates are sourced from various third-party manufacturers and suppliers in quantities adequate to meet our needs. Continuing adequate supply of such raw materials and API is assured through our long-term commercial supply and manufacturing agreements with uterine fibroidsmultiple manufacturers and our continued focus on the expansion and diversification of our third-party manufacturing relationships.

We believe our outsourced manufacturing strategy enables us to direct our financial resources to the maximization of our opportunity with INGREZZA, investment in pre-menopausal womenour internal research and development programs and expansion of our clinical pipeline through business development opportunities.

Our third-party manufacturers, suppliers and service providers may be subject to routine current Good Manufacturing Practice (cGMP) inspections by the FDA or comparable agencies in May 2020.other jurisdictions. We out-licensed the global rights to elagolix to AbbVie in 2010.

Uterine fibroids are benign hormonally responsive tumors that form in the walldepend on our third-party partners and our quality system oversight of the uterusthem for continued compliance with a prevalence rate of at least 25% (American College of ObstetricianscGMP requirements and Gynecologists) and are a leading indication for hysterectomy in the U.S., with approximately 250,000 hysterectomies performed each year related to uterine fibroids (Whiteman et al AJOG 2008, 198, e1).applicable foreign standards.

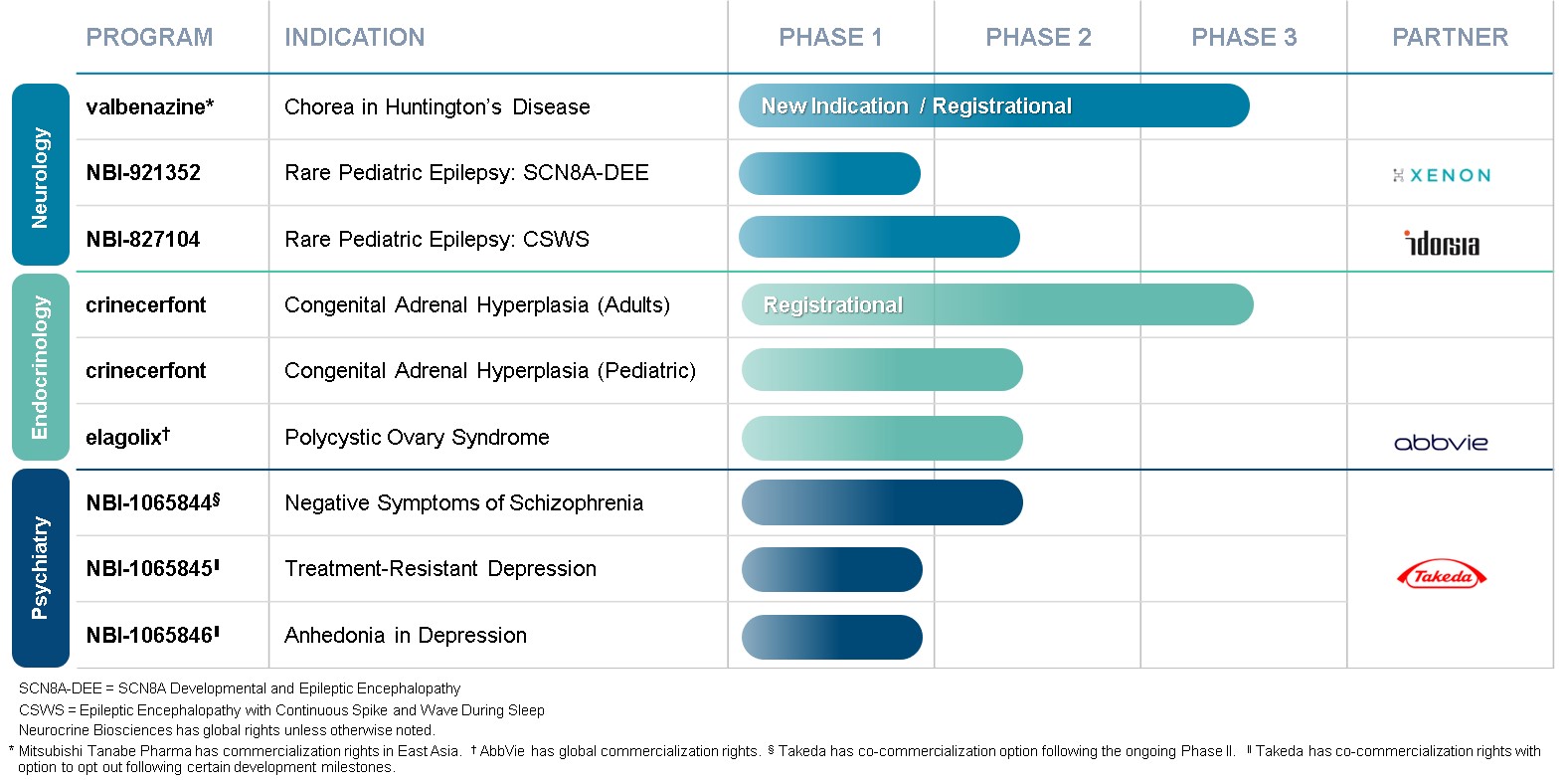

Clinical Development PipelinePrograms

The following table summarizeshighlights our current clinical development pipelineprograms and is followed by detailed descriptionsthe current phase of each program:

development for such programs.

_________________________

* Mitsubishi Tanabe Pharma Corporation retains commercialization rights in Japan and other select Asian markets.

† Heptares Therapeutics Limited retains commercialization rights in Japan, where Neurocrine Biosciences retains the right to opt in to a 50:50 profit sharing arrangement upon certain development events.

(1) This program was in-licensed from Heptares Therapeutics Limited.

(2) This program was in-licensed from Idorsia Pharmaceuticals Ltd.

(3) This program was in-licensed from Xenon Pharmaceuticals Inc.

(4) This program was in-licensed from Sanofi S.A.

(5) This program was in-licensed from Takeda Pharmaceutical Company Limited

Neurocrine Biosciences retains global rights unless otherwise noted.

Neurology

valbenazine – VMAT2 Inhibitor | | | | | |

| Program | Indication |

Valbenazine. Valbenazine is a highly selective VMAT2 inhibitor. VMAT2 is a protein concentrated in the human brain that is essential for the transmission of nerve impulses between neurons. VMAT2 is primarily responsible for packaging and transporting monoamines (dopamine, norepinephrine, serotonin and histamine) in neurons. Specifically, dopamine enables neurotransmission among nerve cells that are involved in voluntary and involuntary motor control. | Dyskinetic Cerebral Palsy. Dyskinetic cerebral palsy is a non-progressive, permanent disorder marked by involuntary movement and is a result of damage to the fetal or infant brain’s basal ganglia. The basal ganglia are responsible for submitting messages to the body to help coordinate and control movements. When damaged, voluntary movements are compromised, resulting in involuntary and abnormal movements. It affects development and movement and has long term effects on patients’ quality of life. The long-term outlook for patients with dyskinetic cerebral palsy will depend upon the severity of the brain damage and how well the treatment works. Dyskinetic cerebral palsy affects up to 15% of the estimated 500,000 to 1 million people affected by cerebral palsy in the U.S. |

NBI-921352. NBI-921352 is a potent, highly selective Nav1.6 sodium channel inhibitor being developed to treat pediatric patients with SCN8A-DEE and other potential indications. We acquired the global rights to NBI-921352 in December 2019. | SCN8A Developmental and Epileptic Encephalopathy Syndrome, or SCN8A-DEE. SCN8A-DEE is a rare, extremely severe, single-gene epilepsy caused by mutations in the SCN8A gene that activates Nav1.6, the most highly expressed sodium channel in the excitatory pathways of the central nervous system. Children born with SCN8A-DEE typically start experiencing seizures between birth and 18 months of age, and most have multiple seizures per day. Other symptoms include learning difficulties, muscle spasms, low or high muscle tone, poor coordination, developmental delay and features similar to autism. As SCN8a mutations were discovered only recently, prevalence estimates will be determined in the future as awareness of and access to genetic surveillance increases. NBI-921352 has been granted orphan drug and rare pediatric disease designations for the treatment of SCN8A-DEE in the U.S. |

VMAT2 is a protein concentratedValbenazine in the human brain that is essential for the transmission of nerve impulses between neurons. VMAT2 is primarily responsible for packagingPediatrics and transporting monoamines (dopamine, norepinephrine, serotonin and histamine) in neurons. Specifically, dopamine enables neurotransmission among nerve cells that are involved in voluntary and involuntary motor control. Disease states such as tardive dyskinesia, Tourette syndrome, Huntington’s chorea, schizophrenia, and tardive dystonia are characterized in part by a hyperdopaminergic state in the brain, and modulation of neuronal dopamine levels may provide symptomatic benefits for patientsAdults with these conditions, among others.

Dyskinetic Cerebral Palsy.We are currently conducting the KINECT-HD study, ahave an ongoing Phase III,3 randomized, placebo-controlled, double-blind, multi-center Phase IIIplacebo-controlled clinical study to evaluate the efficacy, safety and tolerability of valbenazine for the treatment of choreadyskinetic cerebral palsy in 120 patientspediatrics and adults (aged 6 to 70 years).

NBI-921352 in Pediatrics and Adolescents with Huntington’s disease, or HD, withSCN8A-DEE. We have ongoing the KAYAKTM study, a Phase III top-line data expected in2 randomized, double-blind, placebo-controlled clinical study to evaluate the fourth quarter of 2021.

HD is a hereditary progressive neurodegenerative disorder, in which neurons within the brain break down, resulting in motor, cognitive and psychiatric symptoms. Symptoms generally appear between the ages of 30 to 50 and worsen over a 10 to 25-year period. Many patients with HD experience chorea, a troublesome involuntary movement disorder, in which patients develop abnormal, abrupt or irregular movements. Chorea can affect various body parts, and interfere with speech, swallowing, posture and gait. HD is estimated to affect approximately 30,000 adults in the U.S., with more than 200,000 at risk of inheriting the disease (NORD).

NBI-921352 (XEN901) – Nav1.6 Sodium Channel Inhibitor

NBI-921352 is a potent, highly selective Nav1.6 sodium channel inhibitor being developed to treat pediatric patients with SCN8A-DEE and other potential indications, including adult focal epilepsy.

Theefficacy, safety tolerability and pharmacokinetics of NBI-921352 have been evaluatedas adjunctive therapy for seizures in a randomized, double-blind, placebo-controlled Phase I study using a powder-in-capsule formulation of NBI-921352 in healthy adult subjects.

Xenon has developed a pediatric-specific, granule formulation of NBI-921352, and completed juvenile toxicology studiesadolescents (aged 12 to support pediatric development activities.

In October 2020, the FDA requested additional non-clinical data to support the IND we submitted in August 2020 in support of a Phase II clinical study for NBI-921352 in patients21 years) with SCN8A-DEE. Based on feedback received inIn January 2021, we plan to initiate a Phase II clinical study in adolescent patients (aged 12 years and older) with SCN8A-DEE in the third quarter of 2021, and2022, the study protocol will bewas amended to include younger pediatric patientspediatrics (aged 2-112 to 11 years) with SCN8A-DEE as soon as the FDA has reviewed and approved additional non-clinical information. We are also advancing clinical plans to initiate a Phase II clinical study of NBI-921352 for the treatment of adult focal epilepsy in 2021. In addition, in October 2020, we announced the FDA granted us Rare Pediatric Disease Designation for NBI-921352 for the treatment of SCN8A-DEE.

SCN8A-DEE is a rare, extremely severe, single-gene epilepsy caused by mutations in the SCN8A gene that activates Nav1.6, the most highly expressed sodium channel in the excitatory pathways of the central nervous system, or CNS. Children born with SCN8A-DEE typically start experiencing seizures between birth and 18 months of age, and most have multiple seizures per day. Other symptoms include learning difficulties, muscle spasms, low or high muscle tone, poor coordination, developmental delay, and features similar to autism. An estimated 10% of people with SCN8A are reported to have experienced sudden unexpected death in epilepsy. The prevalence of SCN8A-DEE is estimated to be 1% of all developmental and epileptic encephalopathies (Larsen et al, Neurology 2015, 84, 480). As SCN8A mutations were discovered only recently (i.e., in 2012), the number of SCN8A-DEE cases is expected to increase as awareness of and access to genetic surveillance increases. SCN8A-DEE is generally refractory to anti-epilepsy treatments.

We are developing NBI-921352 with Xenon Pharmaceuticals Inc., or Xenon, as part of a strategic collaboration announced in December 2019.

NBI-827104 (ACT-709478) – T-type Calcium Channel Blocker

We acquired the global rights to NBI-827104 from Idorsia Pharmaceuticals Ltd., or Idorsia, in May 2020. NBI-827104 is a potent, selective, orally active and brain penetrating T-type calcium channel blocker, being developed for the treatment of a rare pediatric epilepsy and other potential indications, including essential tremor.

In November 2020, we initiated a Phase II clinical study for NBI-827104 in a rare pediatric epileptic encephalopathy known as Continuous Spike and Wave During Sleep, or CSWS. CSWS typically impacts children initially between the ages of two and four years old and manifests itself via a variety of seizure types, including atypical absence seizures, generalized tonic-clonic seizures and focal seizures that usually occur during sleep. In addition, children with CSWS often present with cognitive, behavioral and developmental regression or delay. Due to the differentiated mechanism of action of this molecule, when compared to non-selective calcium channel inhibitors, treatment with NBI-827104 could lead to an enhanced benefit risk profile for patients with this rare pediatric form of epilepsy. In parallel we are advancing clinical plans to initiate a Proof of Concept clinical study of NBI-827104 for the treatment of essential tremor in 2021.

Endocrinology

crinecerfont (NBI-74788) – CRF1 Antagonist

Crinecerfont is a potent, selective, orally active, corticotropin-releasing factor1, or CRF1, receptor antagonist as demonstrated in a range of in vitro and in vivo assays. CRF1, is a hypothalamic hormone released directly into the hypophyseal portal vasculature which acts on the CRF1 receptor, a G protein-coupled receptor, or GPCR, in the anterior pituitary to stimulate the release of adrenocorticotropin hormone, or ACTH. The primary role of ACTH is the stimulation of the synthesis and release of adrenal steroids, including cortisol. Cortisol from the adrenals have a negative feedback role at the level of the hypothalamus that decreases CRF1 release as well as at the level of the pituitary to inhibit the release of ACTH. This tight control loop is known as the hypothalamic-pituitary-adrenal axis. Blockade of CRF1 receptors at the pituitary has been shown to decrease the release of ACTH, which in turn decreases the production of adrenal steroids including androgens, and potentially the symptoms associated with classic CAH. Lower ACTH levels would also reduce the amount of exogenous corticosteroid necessary for classic CAH patients to thrive avoiding the side-effects currently associated with excessive steroid therapy.

Classic CAH is a group of autosomal recessive genetic disorders that affects approximately 30 thousandNeuroendocrinology

| | | | | |

| Program | Indication |

Crinecerfont. Crinecerfont is an investigational, oral, selective corticotropin-releasing factor type 1 (CRF1) receptor antagonist being developed to reduce and control excess adrenal androgens through a steroid-independent mechanism for the treatment of classic congenital adrenal hyperplasia (CAH) due to 21-hydroxylase deficiency (21-OHD). Crinecerfont has received orphan drug designation in the U.S. from the FDA and in the European Union (EU) from the European Medicines Agency (EMA). Crinecerfont has also received Breakthrough Therapy designation in the U.S. from the FDA for the treatment of CAH due to 21-OHD in adults and pediatrics. | Classic Congenital Adrenal Hyperplasia. CAH is a genetic disorder that causes little to no cortisol production and increased secretion of adrenocorticotropic hormone (ACTH) and androgens. In approximately 75% of cases, the adrenal glands cannot produce aldosterone, which can result in salt wasting adrenal crisis, causing extreme weakness, low blood pressure, shock, and even death. There are currently no non-steroidal FDA-approved treatments for CAH. CAH affects up to an estimated 30,000 people in the U.S. and 50,000 people in Europe. |

EFMODY. EFMODY is a modified-release preparation of hydrocortisone that mimics the physiological circadian rhythm of cortisol and has been specifically designed for patients with diseases of cortisol deficiency, such as CAH and adrenal insufficiency. | Classic Congenital Adrenal Hyperplasia. |

Adrenal Insufficiency. Adrenal insufficiency is a rare condition caused by inadequate production of steroid hormones in the cortex of the adrenal glands. Adrenal insufficiency can result in severe fatigue and, if left untreated, adrenal crisis that may be life threatening. |

Crinecerfont in the U.S. and approximately 50 thousand people in the EU, and results in an enzyme deficiency altering the production of adrenal steroids. Because of this deficiency, the adrenal glands have little to no cortisol biosynthesis resulting in a potentially life-threatening condition. If left untreated, classic CAH can result in salt wasting, dehydration, and eventually death. EvenAdults with cortisol replacement, persistent elevation of ACTHCAH.In September 2023, we announced positive top-line data from the pituitary gland results in excessive androgen levels leading to virilization of females including precocious puberty, menstrual irregularity, short stature, hirsutism, acne and fertility problems.

Corticosteroids are the current standard of care for classic CAH and are used chronically to both correct the endogenous cortisol deficiency and to reduce the excessive ACTH levels and androgen excess. However, the dose and duration of steroid use required to suppress ACTH is well above the normal physiological level of cortisol; resulting in metabolic syndrome, bone loss, growth impairment, and Cushing’s syndrome as common and serious side effects. We have been granted orphan drug designation for crinecerfont in the treatment of classic CAH in the U.S. and the EU.

In June 2020, positive data from a completed Phase II, open-label, pharmacokinetic/pharmacodynamic3 CAHtalyst™ clinical study of crinecerfont in adults with CAH due to 21-OHD. The Phase 3 adult patientsstudy met its primary endpoint at Week 24, demonstrating that treatment with classic CAH, which assessedcrinecerfont resulted in a statistically significant percent reduction in daily glucocorticoid (GC) dose versus placebo while maintaining androgen control (p-value <0.0001). The study also met important key pharmacodynamic biomarkers including ACTH, 17-hydroxyprogesterone (17-OHP), androgen and cortisol levels collected the morning following bedtime dosing on Day 1 and Day 14, demonstrated meaningful reductions in elevated ACTH and 17-hydroxyprogesterone (17-OHP) levels (by 54% to 75%) at all doses studied, togethersecondary endpoints, with a dose-relatedstatistically significant decrease in androstenedione (A4) levels, ranging from 21% to 64%at Week 4 versus placebo (p-value <0.0001). At Week 24, approximately 63% of patients on crinecerfont achieved a reduction to a physiologic GC dose versus approximately 18% on placebo (p-value <0.0001). The data from the highest dosePhase 3 adult study, including data from the open-label treatment period, will support New Drug Application (NDA) submission to the FDA in the second quarter of 2024.

Crinecerfont in Pediatrics with CAH.In October 2023, we announced positive top-line data from the Phase 3 CAHtalyst™ clinical study of crinecerfont (100 mg twice daily), 75% of patients showedin pediatrics (aged 2 to 17 years) with CAH due to 21-OHD. The Phase 3 pediatric study met its primary endpoint, demonstrating that treatment with crinecerfont resulted in a response ofstatistically significant decrease in serum androstenedione from baseline at least 50%Week 4 versus placebo following a GC stable period (p = 0.0002). Consistent with the results from the Phase 3 adult study, crinecerfont treatment led to a statistically significant percent reduction from baseline in daily GC dose while maintaining androgen control at Week 28 versus placebo (p < 0.0001). Approximately 30% of participants receiving crinecerfont achieved a reduction to a physiologic GC dose while maintaining androgen control compared to 0% of participants receiving placebo. The study also met the other key secondary endpoint demonstrating a statistically significant decrease in serum 17-hydroxyprogesterone from baseline at Week 4 versus placebo (p < 0.0001). The data from the Phase 3 pediatric study, including data from the open-label treatment period, will support NDA submission to the FDA in the second quarter of 2024.

EFMODY in Adolescents and Adults with CAH. We have an ongoing Phase 2 randomized, double-blind, active-controlled clinical study to evaluate the efficacy, safety and tolerability of twice-daily EFMODY compared with twice-daily Cortef® (immediate-release hydrocortisone tablets) in adolescents and adults (aged 16 years and older) with CAH. We anticipate having top-line data for eachthis clinical study in the first half of 2024.

EFMODY in Adults with Adrenal Insufficiency. We have ongoing the three hormone markers at day 14. Treatment with crinecerfont was well tolerated with a favorable safety profile with no related serious adverse events reported. Adverse events reported in two or more participants included headache, upper respiratory tract infection, fatigue, contusion, insomnia and nausea.

In July 2020, we initiated the CAHtalystCHAMPAIN study, a global registrational Phase III,2 randomized, double-blind, double-dummy, two-way crossover clinical study to evaluate the efficacy, safety and tolerability of twice-daily EFMODY compared with once-daily Plenadren® (modified-release hydrocortisone tablets) in adults with primary adrenal insufficiency. We anticipate having top-line data for this clinical study in the first half of 2024.

Neuropsychiatry | | | | | |

| Program | Indication |

Valbenazine. Valbenazine is a highly selective VMAT2 inhibitor. VMAT2 is a protein concentrated in the human brain that is essential for the transmission of nerve impulses between neurons. VMAT2 is primarily responsible for packaging and transporting monoamines (dopamine, norepinephrine, serotonin and histamine) in neurons. Specifically, dopamine enables neurotransmission among nerve cells that are involved in voluntary and involuntary motor control. | Schizophrenia. Schizophrenia is a spectrum of serious neuropsychiatric brain diseases in which people interpret reality abnormally. Schizophrenia may result in some combination of hallucinations, delusions and extremely disordered thinking and behavior that impairs daily life. People with schizophrenia typically require lifelong treatment. Early treatment may help improve long-term prognosis and get symptoms under control before serious complications develop. Schizophrenia affects an estimated 3.5 million people in the U.S. All currently approved antipsychotic medications are believed to work through direct action on monoaminergic receptors, with approximately 40% of patients reporting negative side effects and approximately 30% not benefiting adequately from these medications. |

NBI-1117568. NBI-1117568 is a potential first-in-class muscarinic M4 receptor agonist with the potential to be developed for the treatment of schizophrenia. As a selective M4 orthosteric agonist, NBI-1117568 offers the potential for an improved safety profile without the need for combination therapy to ameliorate off-target effects or for cooperativity with acetylcholine. Muscarinic receptors are central to brain function and validated as drug targets in psychosis and cognitive disorders. We acquired the global rights to NBI-1117568 in December 2021. |

Luvadaxistat. Luvadaxistat is a potential first-in-class D-Amino Acid Oxidase (DAAO) inhibitor with the potential to be developed for the treatment of cognitive impairment associated with schizophrenia. We acquired the global rights to luvadaxistat in June 2020. | Cognitive Impairment Associated with Schizophrenia, or CIAS. CIAS, which may include deficits in attention, working memory and executive function, has a negative impact on patients’ quality of life and ability to function. Although cognitive symptoms in schizophrenia are well characterized, no formal diagnostic criteria exist. Furthermore, no pharmacological agents are approved to treat the condition, and no marketed therapy tested to date has established clear, meaningful efficacy, which underscores the difficulty of drug development in this arena and accentuates the unmet need for proven treatment options. Approximately 80% of the estimated 3.5 million people affected by schizophrenia in the U.S. experience clinically relevant cognitive impairment. |

NBI-1065845. NBI-1065845 is a potential first-in-class Alpha-Amino-3-Hydroxy-5-Methyl-4-Isoxazole Propionic Acid (AMPA) potentiator with the potential to be developed for the treatment of inadequate response to treatment in major depressive disorder. We acquired the global rights to NBI-1065845 in June 2020. NBI-1065845 is currently designated as a 50:50 profit-share product with Takeda Pharmaceutical Company Limited, which retains a one-time opt-out right to convert the designation to a royalty-bearing product. | Major Depressive Disorder. Major depressive disorder is one of the leading causes of disability and is characterized by a persistently depressed mood or loss of interest in daily activities that is present most of the day in addition to other symptoms that can impact normal daily functioning, relationships and overall quality of life. Treatments range from selective serotonin reuptake inhibitors, serotonin norepinephrine reuptake inhibitors, atypical antipsychotics, tricyclic antidepressants and psychotherapies, among others. Approximately 30% of the more than 16 million people affected by the disorder in the U.S. do not adequately respond to treatment. |

Valbenazine in Adolescents and Adults with Schizophrenia.We have an ongoing Phase 3 randomized, double-blind, placebo-controlled clinical study to evaluate the efficacy, safety and efficacytolerability of crinecerfontvalbenazine when administered orally once daily as adjunctive treatment in 165 adult patientsadolescents and adults (aged 13 years and older) with classic CAH, followed byschizophrenia who have had an open-label treatment period.inadequate response to antipsychotics.

In July 2019, we initiated aNBI-1117568 in Adults with Schizophrenia. We have an ongoing Phase IIa proof-of-concept, pharmacokinetic/pharmacodynamic2 multi-center, randomized, double-blind, placebo-controlled, multi-arm, multi-stage clinical study to evaluate the efficacy, safety and tolerability of crinecerfontNBI-1117568 in pediatric patientsadults with classic CAH.schizophrenia who are experiencing an acute exacerbation or relapse of symptoms. We plan to initiate a single global registrational Phase IIIanticipate having top-line data for this clinical study for crinecerfont in pediatric patients with CAH in 2021.

elagolix – GnRH Antagonist

The gonadotropin-releasing hormone, or GnRH, is the endogenous peptide that binds to the GnRH receptor and stimulates the secretion of the pituitary hormones that are responsible for sex steroid production and normal reproductive function. Researchers have found that chronic administration of GnRH agonists, after initial stimulation, reversibly shuts down this transmitter pathway and is clinically useful in treating hormone-dependent diseases such as Polycystic Ovary Syndrome, orPCOS.

AbbVie initiated a Phase II clinical study of elagolix in patients with PCOS in mid-2019. The study is designed to evaluate whether there is a potential impact on disordered hormonal dynamics in women with PCOS. We out-licensed the global rights to elagolix to AbbVie in 2010.

PCOS is one of the most common hormonal disorders among women of reproductive age, affecting approximately 3.5 million women in the U.S. PCOS occurs when the ovaries or adrenal glands produce more male hormones (androgens) than normal. Women with PCOS experience irregular menstrual periods, infertility, pelvic pain, weight gain, acne and excess hair growth on the face, chest, stomach and thighs. There is no cure for PCOS, and treatment options are limited. If left untreated, PCOS can lead to certain cancers, diabetes and coronary artery disease.second half of 2024.

Psychiatry

Luvadaxistat in Adults with CIAS.We acquiredhave ongoing the global rightsERUDITE™ study, a Phase 2 randomized, double-blind, parallel, placebo-controlled clinical study to developevaluate the efficacy, safety, tolerability and commercialize NBI-1065844 (TAK-831), NBI-1065845 (TAK-653) and NBI-1065846 (TAK-041) from Takeda Pharmaceutical Company Limited, or Takeda,pharmacokinetics of luvadaxistat when administered orally once daily as adjunctive treatment in June 2020.

NBI-1065844 (TAK-831) – DAAO Inhibitor

NBI-1065844 is a potential first-in-class D-Amino Acid Oxidase, or DAAO, inhibitor that has completed multiple Phase I clinical studies and is currently in on-going Phase II clinical studies, including the Phase II INTERACT proof-of-conceptadults with CIAS. We anticipate having top-line data for this clinical study in negative symptomsthe second half of schizophrenia,2024.

NBI-1065845 in Adults with Inadequate Response to Treatment in Major Depressive Disorder.We have ongoing the SAVITRI™ study, a Phase II2 randomized, double-blind, placebo-controlled clinical study to evaluate the efficacy and safety of NBI-1065845 as adjunctive treatment in adults with inadequate response to treatment in major depressive disorder. We anticipate having top-line data expectedfor this clinical study in the first quarterhalf of 2021.

According to the World Health Organization, or WHO, 20 million people across the globe are affected by schizophrenia. In the U.S., the prevalence of schizophrenia is estimated to be approximately 0.6% of the population. The negative symptoms associated with schizophrenia describe a lessening or absence of behaviors and functions related to motivation and interest, or verbal and emotional expression. There are currently no approved treatment options in the U.S. for patients with predominant negative symptoms of schizophrenia.

NBI-1065844 is currently designated as a royalty-bearing product for Takeda. Takeda retains a one-time opt-in right for a 50:50 profit share arrangement upon achievement of a certain development event.

NBI-1065845 (TAK-653) – AMPA Potentiator

NBI-1065845 is a potential first-in-class Alpha-Amino-3-Hydroxy-5-Methyl-4-Isoxazole Propionic Acid, or AMPA, potentiator with the potential to be developed for treatment-resistant depression. NBI-1065845 has completed multiple Phase I clinical studies. We plan to initiate a Phase II clinical study of NBI-1065845 in treatment-resistant depression in 2021.

According to the WHO, major depressive disorder, or MDD, is one of the leading causes of disability. While there are a number of marketed treatments for MDD, approximately 1/3 of patients do not benefit from them. There is a significant need to develop new therapies with improved, faster onset of efficacy that are well tolerated.

NBI-1065845 is currently designated as a 50:50 profit share product with Takeda. Takeda retains a one-time opt-out right to convert the designation to a royalty-bearing product dependent on a certain development event.

NBI-1065846 (TAK-041) – G Protein-Coupled Receptor 139 Agonist

NBI-1065846 is a potential first-in-class G Protein-Coupled Receptor 139, or GPR139, agonist with the potential to be developed for the treatment of anhedonia in depression. NBI-1065846 has completed multiple Phase I clinical studies. We plan to initiate a Phase II clinical study of NBI-1065846 in anhedonia in 2021.

Anhedonia is a psychological condition characterized by the inability to experience pleasure. In patients with depression, anhedonia often does not improve with current treatments and predicts lack of functional improvement.

NBI-1065846 is currently designated as a 50:50 profit share product with Takeda. Takeda retains a one-time opt-out right to convert the designation to a royalty-bearing product dependent on a certain development event.

Research Programs

We invest in research and development in order to address diseases and disorders of the central nervous and endocrine systems, which include therapeutic categories ranging from hypothalamic-pituitary-adrenal disorders to stress-related disorders and neurological/neuropsychiatric diseases. CNS and endocrinology drug therapies are among the largest therapeutic categories, accounting for over $110 billion in drug sales in the U.S. alone according to IQVIA (2018).

Business Strategy

Our mission is to improve the lives of patients living with serious and under-addressed neurological, neuro-endocrinology and psychiatry related diseases and disorders. The following are the key elements of our business strategy:

Commercializing Our Product Portfolio. In April 2017, we received approval from the FDA for INGREZZA for the treatment of tardive dyskinesia. In April 2020, we received FDA approval for ONGENTYS as an adjunctive therapy to levodopa/DOPA decarboxylase inhibitors in adult Parkinson's disease patients. We market INGREZZA and ONGENTYS in the U.S. The commercial launch of INGREZZA occurred in May 2017 and ONGENTYS occurred in September 2020. We have built a specialty sales force in the U.S. of approximately 250experienced sales professionals. This specialty sales force focuses on promotion to physicians, primarily psychiatrists and neurologists.Ourcommercial team is comprised of experienced professionals in marketing, access and reimbursement, managed markets, market research, commercial operations, and sales force planning and management. In addition, our commercial infrastructure includes capabilities in manufacturing, medical affairs, quality control and compliance. We intend to retain commercial rights to certain products, including INGREZZA, that we can effectively and efficiently develop, secure regulatory approval and commercialize, which includes products with a concentrated prescriber base and well-defined patient population that can be accessed with an efficient patient and prescriber outreach program.

Advancing Life-Changing Discoveries in Neurology, Neuro-Endocrinology and Psychiatry. We believe that by continuing to advance and extend our product pipeline, we can mitigate some of the clinical development risks associated with drug development. We currently have multiple programs in various stages of research and development, including symptomatic disease modifying and curative treatments. We take a portfolio approach to managing our pipeline that balances the size of the market opportunities with clear and defined clinical and regulatory paths to approval. By doing so, we focus our internal development resources on innovative therapies with improved probabilities of technical and commercial success.

Discovering Novel Medicines to Address Unmet Patient Needs. We seek to identify and validate new medicines on novel targets for internal development or collaboration. We believe the creativity and productivity of our discovery research group will continue to be a critical component for our ongoing success.

Acquiring Rights to Commercial Products, Drug Development Candidates and Technologies. We plan to continue to selectively acquire rights to programs at all stages of development and commercial products to take advantage of our drug development and commercial capabilities.

Corporate Collaborations and Strategic Alliances

One of our business strategies is to utilize strategic alliances to enhance our development and commercialization capabilities. The following is a summary of our significant collaborations/alliances:

Takeda. In June 2020, we entered into an exclusive license agreement with Takeda, which became effective in July 2020, to develop and commercialize certain compounds in Takeda’s early to mid-stage psychiatry pipeline. Specifically, Takeda granted us an exclusive license to the following seven assets: (i) NBI-1065844 (TAK-831) for schizophrenia, (ii) NBI-1065845 (TAK-653) for treatment-resistant depression, (iii) NBI-1065846 (TAK-041) for anhedonia (which together with the NBI-1065845 are referred to as the Phase II Ready Assets), and (iv) four non-clinical stage assets, or the Non-Clinical Assets.

NBI-1065844 is deemed a royalty-bearing product under the license agreement pursuant to which we will be responsible for all costs and expenses associated with the development, manufacture, and commercialization of such asset, subject to certain exceptions, and Takeda will be eligible to receive development and commercial milestones and royalties with respect to such asset, or a Royalty-Bearing Product, and Takeda will retain the right to opt-in to a profit sharing arrangement pursuant to which we and Takeda will equally share in the operating profits and losses related to such asset, subject to certain exceptions, in lieu of receiving milestones and royalties, or a Profit-Share Product. Subject to specified conditions, Takeda may elect to exercise such opt-in right for NBI-1065844 before we initiate a Phase III clinical trial. Each of the Phase II Ready Assets is deemed a Profit-Share Product and Takeda will retain the right to opt-out of the profit-sharing arrangement for such asset pursuant to which such asset would become a Royalty-Bearing Product. Takeda may elect to exercise such opt-out rights with respect to a Phase II

Ready Asset immediately following the completion of the second Phase II clinical trial for such Phase II Ready Asset. In addition, under certain circumstances related to the development and commercialization activities to be performed by us, Takeda may elect to opt-out of the profit-sharing arrangement for a Profit-Share Product before the initiation of a Phase III clinical trial for such product.

Each of the Non-Clinical Assets will be Royalty-Bearing Products pursuant to which we will be responsible for all costs and expenses associated with the development, manufacture, and commercialization of such assets, subject to certain exceptions.

Unless earlier terminated, the license agreement will continue on a licensed product-by-licensed product and country-by-country basis until the date on which, (i) for any Royalty-Bearing Product, the royalty term has expired in such country; and (ii) for any Profit-Share Product, for so long as we continue to develop, manufacture, or commercialize such licensed product.We may terminate the license agreement for convenience in its entirety or in one or more (but not all) of the United States, Japan, the European Union, and the United Kingdom, or the Major Markets, on 6 months’ written notice to Takeda (i) with respect to all licensed products prior to the first commercial sale of the first licensed product for which first commercial sale occurs, or (ii) with respect to all licensed products in one or more given target classes, as defined in the agreement, prior to the first commercial sale of the first licensed product in such target class(es) for which first commercial sale occurs. We may terminate the license agreement for convenience in its entirety or in one or more (but not all) of the Major Markets on 12 months’ written notice to Takeda (i) with respect to all licensed products following the first commercial sale of the first licensed product for which first commercial sale occurs, or (ii) with respect to all licensed products in one or more given target classes following the first commercial sale of the first licensed product in such target class(es) for which first commercial sale. Takeda may terminate the license agreement, subject to specified conditions, (i) if we challenge the validity or enforceability of certain Takeda intellectual property rights or (ii) on a target class-by-target class basis, in the event that we do not conduct any material development or commercialization activities with respect to any licensed product within such target class for a specified continuous period. Subject to a cure period, either party may terminate the license agreement in the event of any material breach, solely with respect to the target class of a licensed product to which such material breach relates, or in its entirety in the event of any material breach that relates to all licensed products.

Idorsia. We acquired the global rights to NBI-827104 from Idorsia in May 2020. NBI-827104 is a potent, selective, orally active and brain penetrating T-type calcium channel blocker, being developed for the treatment of a rare pediatric epilepsy and other potential indications, including essential tremor. The agreement also included a research collaboration to discover and identify additional novel T-type calcium channel blockers as development candidates. Under the terms of the agreement, we are responsible for all manufacturing, development and commercialization costs of any collaboration product. We may terminate the collaboration and licensing agreement, in its entirety or with respect to a particular compound or development candidate, by providing 90 days’ written notice to Idorsia. Further, in the event a party commits a material breach and fails to cure such material breach within 90 days after receiving written notice thereof, the non-breaching party may terminate the agreement in its entirety immediately upon written notice to the breaching party.

Xenon. In December 2019, we entered into a license and collaboration agreement with Xenon to identify, research, and develop sodium channel inhibitors, including clinical candidate NBI-921352 and three preclinical candidates, which compounds we will have the exclusive right to further develop and commercialize under the terms and conditions set forth in the agreement.

We will be solely responsible, at our sole cost and expense, for all development and manufacturing of the compounds and any pharmaceutical product that contains a compound, subject to Xenon’s right to elect to co-fund the development of one product in a major indication and thus receive a mid-single digit percentage increase in royalties owed on the net sales of such product in the U.S. If Xenon exercises such option, the parties will share equally all reasonable and documented costs and expenses incurred in connection with the development of such product in the applicable indication, except costs and expenses that are solely related to the development of such product for regulatory approval outside the U.S.

Unless earlier terminated, the term of the license and collaboration agreement will continue on a product-by-product and country-by-country basis until the expiration of the royalty term for such product in such country. Upon the expiration of the royalty term for a particular product and country, the exclusive license granted by Xenon to us with

respect to such product and country will become fully paid, royalty free, perpetual, and irrevocable. We may terminate the license and collaboration agreement by providing at least 90 days’ written notice, provided that such unilateral termination will not be effective for certain products until we have used commercially reasonable efforts to complete certain specified clinical studies. Either party may terminate the agreement in the event of a material breach in whole or in part, subject to specified conditions.

Voyager.We entered into a collaboration and license agreement with Voyager, a clinical-stage gene therapy company, which became effective in March 2019. The agreement is focused on the development and commercialization of four programs using Voyager’s proprietary gene therapy platform. The four programs consist of the following: NBIb-1817 for Parkinson’s disease, the Friedreich’s ataxia program and two undisclosed programs.

Pursuant to development plans agreed to by us and Voyager, unless Voyager exercises its co-development and co-commercialization rights as provided for in the agreement, we will be responsible for all development costs. Further, upon the occurrence of a specified event for each program, we will assume responsibility for the development, manufacturing, and commercialization activities of such program.

On February 2, 2021, we notified Voyager of our termination of the NBIb-1817 for Parkinson’s disease program. The effective date of this termination will be August 2, 2021. The termination does not apply to any other development program other than NBIb-1817 for Parkinson’s disease, and our collaboration and license agreement with Voyager will otherwise continue in effect. With respect to the other programs, we may terminate the collaboration and license agreement with Voyager upon 180 days written notice to Voyager prior to the first commercial sale of any collaboration product or upon 1 year after the date of notice if such notice is provided after the first commercial sale of any collaboration product. Unless terminated earlier, the agreement will continue in effect until the expiration of the last to expire royalty term with respect to any collaboration product or the last expiration or termination of any exercised co-development and co-commercialization rights by Voyager as provided for in the agreement.

BIAL.We acquired the U.S. and Canada rights to ONGENTYS from BIAL in the first quarter of 2017. We launched ONGENTYS in the U.S. in September 2020, after receiving FDA approval for ONGENTYS as an adjunctive therapy to levodopa/DOPA decarboxylase inhibitors in adult Parkinson's disease patients in April 2020.

Under the terms of the agreement, we are responsible for the commercialization of ONGENTYS in the U.S. and Canada. Further, werely on BIAL for the commercial supply of ONGENTYS. Upon our written request prior to the estimated expiration of the term of a licensed product, the parties shall negotiate a good faith continuation of BIAL’s supply of such licensed product after the term. After the term, and if BIAL is not supplying a certain licensed product, we shall pay BIAL a trademark royalty based on the net sales of such licensed product.

Upon commercialization of ONGENTYS, we determined certain annual sales forecasts. In the event we fail to meet the minimum sales requirements for a particular year, we would be obligated to pay BIAL an amount equal to the difference between the actual net sales and minimum sales requirements for such year.

Unless earlier terminated, the agreement will continue on a licensed product-by-product and country-by-country basis until a generic product in respect of such licensed product under the agreement is sold in a country and sales of such generic product are greater than a specified percentage of total sales of such licensed product in such country.

Either party may terminate the agreement if the other party materially breaches the agreement and does not cure the breach within a specified notice period, or upon the other party’s insolvency. BIAL may terminate the agreement if we fail to use commercially reasonable efforts to submit a new drug application, or NDA, for a licensed product by a specified date, in the event we fail to meet the minimum sales requirements for any two years, or under certain circumstances involving a change of control of Neurocrine Biosciences. Under certain circumstances where BIAL elects to terminate the agreement in connection with a change of control of Neurocrine Biosciences, BIAL would be obligated to pay us a termination fee. We may terminate the agreement at any time for any reason upon nine months’ written notice to BIAL.

MTPC. In March 2015, we entered into a collaboration and license agreement with MTPC for the development and commercialization of INGREZZA for movement disorders in Japan and other select Asian markets. Under the terms of the agreement, MTPC is responsible for all development, marketing and commercialization costs in Japan and other select Asian markets, with the exception of a single Huntington’s chorea study to be performed by us. We will

be entitled to a percentage of sales of INGREZZA in Japan and other select Asian markets for the longer of ten years or the life of the related patent rights. MTPC may terminate the agreement at its discretion upon 180 days’ written notice to us. In such event, all INGREZZA product rights for Japan and other select Asian markets would revert to us.

AbbVie. In June 2010, we entered into an exclusive worldwide collaboration with AbbVie to develop and commercialize elagolix and all next-generation GnRH antagonists, or collectively the GnRH Compounds, for women’s and men’s health.

AbbVie received approval of ORILISSA for the management of moderate to severe endometriosis pain in women from the FDA in July 2018 and Health Canada in October 2018. In May 2020, AbbVie received approval from the FDA for ORIAHNN for the management of heavy menstrual bleeding associated with uterine fibroids in pre-menopausal women.

Under the terms of the agreement, AbbVie is responsible for all third-party development, marketing, and commercialization costs. We are entitled to a percentage of worldwide sales of GnRH Compounds for the longer of ten years or the life of the related patent rights. AbbVie may terminate the collaboration at its discretion upon 180 days’ written notice to us.

Intellectual Property

We actively seek to protect our products, and product candidates, and related inventions and improvements that we consider important to our business. We own a portfolio of U.SU.S. and non-U.S.ex-U.S. patents and patent applications, and have also licensed rights to a number of U.S. and non-U.S.ex-U.S. patents and patent applications. Our owned and licensed patents and patent applications cover or relate to our products and product candidates, including certain formulations, useduses to treat particular conditions, and methods of administration, drug delivery technologies and delivery profiles, and methods of manufacturing.

We own or have licensed rights toBelow is a description of the following U.S. and ex-U.S. patents relating to INGREZZA and our other products and product candidates in our pipeline (in addition to non-U.S. patents and certain patents covering our early-stage product candidates):crinecerfont:

•INGREZZA, our highly selective VMAT2 inhibitor approved in the U.S. for the treatment of tardive dyskinesia and of chorea associated with Huntington’s disease, is covered by eight22 issued, FDA Orange Book-listed U.S. patents that are listed in the FDA’s Orange Book andwhich are set to expire between 2027 and 2037. There is also a potential patent2040. Patent term extension corresponding to regulatory approval delay of up to an additional two years552 days has been received for U.S. Patent No. 8,039,627, which is currently set to expirenow expires in 20292031 and is the earliest patent coveringcovers valbenazine, the active pharmaceutical ingredient contained in INGREZZA. In Japan and in certain other East Asian markets, we are actively pursuing most of the patents corresponding to those listed in the FDA’s Orange Book entry for INGREZZA. In 2023, we entered into settlement agreements resolving all patent litigation brought by us against the companies that filed ANDAs seeking approval to market generic versions of INGREZZA, and all cases have been dismissed. Pursuant to the terms of the respective settlement agreements, such companies have the right to sell generic versions of INGREZZA in the U.S. beginning March 1, 2038, or earlier under certain circumstances. Refer to Note 13 to the consolidated financial statements for a more detailed description of these matters.

•ONGENTYS,Crinecerfont, a highly selective COMT inhibitor for Parkinson’s disease, is covered by nine issued U.S. patents that are listed in the FDA’s Orange Book and set to expire between 2026 to 2035 (not including a potential patent term extension of up to an additional four years for one of these patents).

•ORILISSA, our small molecule GnRHCRF1 receptor antagonist for the treatment of endometriosis pain, is covered by eight issued U.S. patents that are listed in the FDA’s Orange Book and are set to expire between 2021 to 2036 (not including a potential patent term extension of up to an additional five years for one of the patents currently set to expire either in 2021 or 2024).

•ORIAHNN, containing our small molecule GnRH antagonist for the treatment of menstrual bleeding associated with uterine fibroids, is covered by six issued U.S. patents that are listed in the FDA’s Orange Book and are set to expire between 2021 to 2024 (not including a potential patent term extension of up to an additional five years for one of the patents).

•Valbenazine, our highly selective VMAT2 inhibitor under further clinical development for the treatment of choreaCAH in Huntington’s disease, is covered by at least six of the issued U.S. patents that are listed in the FDA’s Orange Book entry for INGREZZAadults and are set to expire between 2027 and 2036 . There is also a potential patent term extension of up to an additional two years for U.S. Patent No. 8,039,627, which is currently set to expire in 2029.

•Crinecerfont, our CRF1 antagonist for the treatment of CAH,children, is covered by U.S. Patent No.Nos. 10,905,690, which expires in 2035 (not including a potential11,311,544, and 11,730,739, among other patents and pending patent term extension of up to an additional five years).

•NBI-1065844, a DAAO inhibitor for the treatment of negative symptoms of schizophrenia, is covered by U.S. Patent No. 9,290,456, among others, which expires in 2032 (not including a potential patent term extension of up to an additional five years).

•NBI-827104, an inhibitor of T-type calcium channels for the treatment of CSWS epilepsy, is covered by U.S. Patent No. US 9,932,314, among others, which expires in 2035 (not including a potential patent term extension of up to an additional five years).

•NBI-921352, an inhibitor of the Nav1.6 voltage-gated sodium channel for the treatment of SCN8A-DEE epilepsy, is covered by U.S. Patent No. US 10,246,453, among others, which expires in 2037 (not including a potential patent term extension of up to an additional five years).

•Elagolix, our small molecule GnRH antagonist under further development for the treatment of polycystic ovary syndrome, is covered by six of the issued U.S. patents that are listed in the FDA’s Orange Book entry for ORILISSA and areapplications, set to expire between 2021 to 20242035 and 2044 (not including aany potential patent term extension of up to an additional five years for one of the patents)extensions).

•NBI-1065845, a positive allosteric modulator of AMPA for the treatment of treatment-resistant depression is covered by U.S. Patent No. 8,778,934, among others, which expires in 2031 (not including a potential patent term extension of upWe also own, or have licensed rights to, an additional five years).

•NBI-1065846, a GPR139 agonist for the treatment of anhedonia in depression, is covered by U.S. Patent No. 9,556,130, among others, which expires in 2035 (not including a potential patent term extension of up to an additional five years).

patents covering our other products and earlier stage product candidates. In addition to the potential patent term extensions referenced above, the products and product candidates in our pipeline may be subject to additional terms of exclusivity that we mightmay obtain by future patent issuances.

Separately, the U.S., the European Union, or EU, and Japan alleach provide data and marketing exclusivity for new medicinal compounds. If this protection is available, no competitor may use the original applicant’s data as the basis of a generic marketing application during the period of data and marketing exclusivity, which is measured from the date of marketing approval by the FDA or corresponding foreign regulatory authority. This period of exclusivity is generally five years in the U.S., six years in Japan and ten10 years in the EU, except that for biologics, thisthe period of exclusivity in the U.S. is twelve12 years under the Biologics Price Competition and Innovation Act. In addition, if granted orphan drug designation, certain of our product candidates, including, for example, crinecerfont, may also be eligible for marketmarketing exclusivity in the U.S. and EU for seven years and ten years, respectively.EU for 10 years.

ManufacturingRefer to Part I, Item 1A. Risk Factors for a discussion of the challenges we may face in obtaining or maintaining patent and/or trade secret protection and Supply

We currently rely on, and intendNote 13 to continue to rely on, third-party manufacturers for the production of INGREZZA and our product candidates. Raw materials, active pharmaceutical ingredients, consolidated financial statements for API, and other supplies required for the production of INGREZZA and our product candidates are procured from various third-party manufacturers and suppliers in quantities adequate to meet our needs. Continuing adequate supply of such raw materials and API is assured through our long-term commercial supply and manufacturing agreements with multiple manufacturers and our continued focus on the expansion and diversificationa description of our third-party manufacturing relationships. In addition, under the terms of our agreement with BIAL, we rely on BIAL and its supplierslegal proceedings related to supply all drug product for the commercialization of ONGENTYS.

We believe our outsource manufacturing strategy enables us to direct our financial resources to the maximization of our opportunities with INGREZZA and ONGENTYS, investment in our internal R&D programs and expansion of our clinical pipeline through business development opportunities.

Our third-party manufacturers, suppliers and service providers may be subject to routine current Good Manufacturing Practice, or cGMP, inspections by the FDA or comparable agencies in other jurisdictions. We depend on our third-party partners for continued compliance with cGMP requirements and applicable foreign standards.intellectual property matters.

Marketing, SalesCompetition

The biotechnology and Distribution

Our sales forcepharmaceutical industries are subject to rapid and intense technological change. We face, and will continue to face, competition in the U.S. consistsdevelopment and marketing of approximately 250 experienced sales professionals focused on educating health care professionals,our products and product candidates from academic institutions, government agencies, research institutions and biotechnology and pharmaceutical companies. Many of our competitors have significantly greater financial resources and expertise in research and development, manufacturing, preclinical testing, conducting clinical trials, obtaining regulatory approval and marketing than we do.

Competition may also arise from, among other things, other drug development technologies, methods of preventing or reducing the incidence of disease, including psychiatristsvaccines, and neurologists, who treat patientsnew small molecule or other classes of therapeutic agents. Such developments by others (including the development of generic equivalents) may render our product candidates or technologies obsolete or noncompetitive.

•INGREZZA competes with AUSTEDO® (deutetrabenazine), marketed by Teva Pharmaceuticals Industries, for the treatment of tardive dyskinesia in adults and Parkinson’schorea associated with Huntington's disease. A once-daily dosing of AUSTEDO (AUSTEDO XR) was introduced in February 2023. Additionally, there are a number of commercially available medicines used to treat tardive dyskinesia off-label, such as XENAZINE® (tetrabenazine) and generic equivalents, and various antipsychotic medications (e.g., clozapine), anticholinergics, benzodiazepines (off-label), and botulinum toxin. In addition, there are several programs in clinical development by other companies targeting Huntington's disease.

•ORILISSA and ORIAHNN each compete with several FDA-approved products for the treatment of endometriosis, uterine fibroids, infertility and central precocious puberty. Additionally, there is also competition from surgical intervention, including hysterectomies and ablations. Separate from these options, there are many programs in clinical development which serve as potential future competition. Lastly, there are numerous medicines used to treat the symptoms of disease (vs. endometriosis or uterine fibroids directly) which may also serve as competition: oral contraceptives, NSAIDs and other pain medications, including opioids.

•For INGREZZA, our customers inCAH, high doses of corticosteroids are the current standard of care to both correct the endogenous cortisol deficiency as well as reduce the excessive ACTH levels. In the U.S. consist of a limited network of specialty pharmacy providers that deliver INGREZZA to patientsalone, there are more than two dozen companies manufacturing steroid-based products. In addition, there are several programs in clinical development by mail and a specialty distributor that distributes INGREZZA primarily to closed-door pharmacies and government facilities. For ONGENTYS, our customers in the U.S. consist primarily of wholesale distributors. We rely on third-party service providers to performother companies targeting CAH with a variety of functions relatedapproaches including gene therapy.

•Our investigational treatments for potential use in epilepsy may in the future compete with numerous approved anti-seizure medications and development-stage programs being pursued by several other companies. Commonly used anti-seizure medications include phenytoin, levetiracetam, brivaracetam, cenobamate, carbamazepine, clobazam, lamotrigine, valproate, oxcarbazepine, topiramate, lacosamide, perampanel and cannabidiol, among others. There are currently no FDA-approved treatments specifically indicated for the early infantile epileptic encephalopathy SCN8A-DEE; however, a number of different anti-seizure medications are currently used in these patient populations.

•Our investigational treatments for potential use in schizophrenia, anhedonia and depression may in the future compete with several development-stage programs being pursued by other companies. Currently, there are no FDA-approved treatments specifically indicated for anhedonia or CIAS; however, there are a number of different anti-psychotic medications currently used in these patient populations.

•Our investigational treatments for potential use in neurology, neuroendocrinology and neuropsychiatry may in the future compete with numerous approved products and development-stage programs being pursued by several other companies.

Collaboration and License Agreements

Refer to Note 2 to the packaging, storageconsolidated financial statements for more information on our significant collaboration and distribution of INGREZZA and ONGENTYS.license agreements.

Government Regulation

Our business activities are subject to extensive regulation by the U.S. and other countries. Regulation by government authorities in the U.S. and foreign countries is a significant factor in the development, manufacture, distribution, tracking, marketing and sale of our proposed products and in our ongoing research and product development activities. All of our products in development will require regulatory approval by government agencies prior to commercialization. The process of obtaining these approvals and the subsequent compliance with appropriate federal and state statutes and regulations require the expenditure of substantial time and financial resources.

In addition, federal and state healthcare laws, and equivalent supranational and foreign laws, restrict business practices in the pharmaceutical industry. These laws include, without limitation, federal, state and stateforeign fraud and abuse laws, false claims laws, data privacy and security laws, as well as transparency laws and industry codes of conduct regarding payments or other items of value provided to healthcare providers. We have a comprehensive compliance program designed to ensure our business practices remain compliant.