UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K10-K/A

Amendment No. 1

(Mark One)

X Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended

December 31, 2016

or

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to

Commission file number001-32978

SOLITARIO EXPLORATION & ROYALTY CORP.

(Exact name of registrant as specified in charter)

| Colorado (State or other jurisdiction of incorporation or organization) | 84-1285791 (I.R.S. Employer Identification No.) | |

| 4251 Kipling St. Suite 390, Wheat Ridge, CO (Address of principal executive offices) | 80033 (Zip Code) | |

| Registrant's telephone number, including area code | (303) 534-1030 |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of exchange on which registered |

| Common Stock, $0.01 par value | NYSE MKT |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES [ ] NO [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

YES [ ] NO [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES [X] NO [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained to the best of registrant's knowledge in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated Filer [ ] (Do not check if a smaller reporting company) | Smaller Reporting Company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

YES [ ] NO [X]

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant as of the last business day of the registrant's most recently completed second fiscal quarter, based upon the closing sale price of the registrant's common stock on June 30, 2016 as reported on NYSE MKT, was approximately $18,598,000.

There were 38,686,989 shares of common stock, $0.01 par value, outstanding on March 10, 2017.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement for the Registrant’s Annual Meeting of Shareholders, which is expected to be filed by April 28, 2017, have been incorporated by reference into Part III of this Annual Report on Form 10-K

| 1 |

TABLE OF CONTENTSDOCUMENTS INCORPORATED BY REFERENCE

None

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this “Amendment”) to the Annual Report on Form 10-K of Solitario Exploration & Royalty Corp. (“Solitario” or "the “Company”) for the fiscal year ended December 31, 2016, initially filed with the Securities and Exchange Commission (the “SEC”) on March 13, 2017 (the “Original Filing”), is being filed to include the information required in Part III of the Company’s Annual Report on Form 10-K. The Part III information was previously omitted from the Original Filing in reliance on General Instruction G (3) to Form 10-K, which permits the information in the above referenced items to be incorporated in the Form 10-K by reference to our definitive proxy statement if such statement is filed no later than 120 days after our fiscal year end. The reference on the cover of the Original Filing to the incorporation by reference to portions of our definitive proxy statement into Part III of the Original Filing is hereby deleted.

In addition, pursuant to the rules of the SEC, the exhibit list included in Item 15 of Part IV of the Original Filing has been amended to contain currently-dated certifications from the Company’s Chief Executive Officer and Chief Financial Officer, as required by Section 302 of the Sarbanes-Oxley Act of 2002. The certifications of the Company’s Chief Executive Officer and Chief Financial Officer are attached as exhibits to this Amendment.

Except for the foregoing amended information, this Amendment does not amend or update any other information contained in the Original Filing. Therefore, this Amendment should be read together with other documents that the Company has filed with the SEC subsequent to the filing of the Original Filing. Information in such reports and documents updates and supersedes certain information contained in the Original Filing.

| 2 |

Item 10.PART IDirectors, Executive Officers and Corporate Governance

ThisDirectors and Officers

| (a) | Identification of Directors |

| Name | Age | |

| Brian Labadie Chairman (1)(2)(3)(4) | 64 | Mr. Labadie has been a director of Solitario since June 2006 and Chairman since March of 2009. He is an independent mining industry consultant. He was a director of Crown Resources Corporation (CRS: TSX) ("Crown") from June of 2002 until August 2006 upon completion of Crown’s merger with Kinross Gold Corporation ("Crown-Kinross Merger") and a director of Battle Mountain Gold Exploration Corporation (BMGX:OTC) from June 2005 to June 2007. In evaluating Mr. Labadie’s qualifications as a director, Solitario’s Board of Directors (the “Board”) considered the experience Mr. Labadie has in over forty years-experience in the mining industry. The specific experience that Mr. Labadie brings to Solitario includes formal training and experience as a mining engineer including developing and operating mines, both as a mine manager and as a senior executive at Miramar Mining Corporation and Echo Bay Mines. The Board believes Mr. Labadie’s operating experience complements and enhances the knowledge and understanding the other Board members and management of Solitario have in mining exploration, and corporate finance. Mr. Labadie spent ten years with Miramar Mining Corporation from November 1996 to September 2006 as the Executive Vice President, COO. Prior to that, Mr. Labadie spent nine years with Echo Bay Mines, Ltd. as Vice President of Operations. Mr. Labadie holds a Bachelor of Science degree in geological engineering from the University of Toronto. |

John Labate | 67 | Mr. Labate has been a director of Solitario since December 2016 and is the Audit Committee Chairman. Since May 2015 he has been the CFO of Gold Resources Corporation. Mr. Labate has held management positions in the mining industry for the past 36 years. These included Operations Analysis Manager for Anaconda Minerals Company (1980-1986), Corporate Controller for Bond International Gold (1987-1991), CFO for Crown (1992-1997), CFO for GeoBiotics (1997-1999); CFO for Applied Optical Technologies (1999-2004), CFO for Constellation Copper (2004-2008, CFO for Golden Star Resources (2008-2012) and principal of East Cape Advisors (2012-2015). Mr. Labate is experienced in all aspects of accounting, finance and regulatory management within the public sector of the mining industry in both the United States and Canada. The Board believes Mr. Labate’s formal training in accounting and finance, coupled with his 36 years of industry experience, makes him uniquely suited to serve on the Board. Mr. Labate received a Bachelor of Science, Accounting, from San Diego State University and passed all parts of the CPA examination. |

| 3 |

| Leonard Harris (1)(2)(3)(4) | 89 | Mr. Harris has been a director of Solitario since June 1998. Prior to his retirement from Newmont Mining Corporation, Mr. Harris gained over 60 years of experience in the mining industry serving in various capacities including as the former General Manager of Minera Yanacocha, South America's largest gold mine, and former Vice President and General Manager of Newmont Latin America. Mr. Harris has over 20 years of experience in managing mining operations in Latin America that include base metal and gold deposits, underground and open pit mines, gold and base metal processing plants and smelting and refining operations. In evaluating Mr. Harris’s qualifications to serve as a director, the Board believes Mr. Harris experience in managing and developing mines all over the world, but specifically in Peru and Latin America, where much of Solitario’s exploration efforts have been focused, is paramount to the success of Solitario. In addition, Mr. Harris has a strong reputation in the mining industry and has provided Solitario with numerous opportunities and introductions that Solitario would likely not have had without his association with Solitario as a Board member. Mr. Harris currently serves on the board of directors of Aztec Metals Corp., Canarc Resources, Wealth Minerals, Inc and Cardero Resources Corp. He is a 1949 graduate metallurgist of The Mount Morgan School of Mines (Australia). |

| Christopher E. Herald | 63 | Mr. Herald has been a director of Solitario since August 1992. He has also served as Chief Executive Officer since June 1999 and President since August 1993. Mr. Herald also served as a director of Crown starting in April 1989, as Chief Executive Officer of Crown starting in June of 1999, President of Crown from November 1990 until August 2006, when he resigned from such positions upon completion of the Crown-Kinross Merger. In evaluating Mr. Herald’s qualifications to serve as a director, the Board of Solitario believes his leadership of Solitario since Solitario’s inception as Chief Executive Officer, as well as his knowledge of the operations, make him an invaluable member of the Board. In addition, Mr. Herald has shown a keen insight in the evaluation of various opportunities in the mining industry, including the acquisition of properties for exploration and potential merger and acquisition candidates for Solitario. Mr. Herald has a track record of operating mining companies both with Crown and Solitario and the Board believes these are significant contributors to the success of Solitario. Prior to joining Crown, Mr. Herald was a Senior Geologist with Echo Bay Mines and Anaconda Minerals Mr. Herald was formerly a director of Underworld Resources Inc. (UW: V) from June 2009 to June 2011, and Atna Resources from May 2009 to June 2015. Mr. Herald is past Chairman of the Denver Gold Group, a non-profit industry trade group that organizes the preeminent gold mining industry institutional conferences in the United States and Europe. Mr. Herald received a M.S. in Geology from the Colorado School of Mines and a B.S. in Geology from the University of Notre Dame. |

| ||

| (b) | Identification of Executive Officers |

Executive Officers

The following biographies describe the business experience of our executive officers (each also being a "Named Executive Officer" as defined in Item 402 of Regulation S-K):

Christopher E. HeraldSee biography above under the heading “Identification of Directors.”

Walter H. Hunt (66) has been Chief Operating Officer of Solitario since June 2008 and Vice President - Operations and President - South American Operations of Solitario since June 1999. He also served as Vice President - Peru Operations from July 1994 until June 1999. Mr. Hunt was also Vice President - Operations of Crown from 1994 until completion of the Crown - Kinross Merger in August of 2006. Mr. Hunt has over 35 years of exploration, development and operational experience with Anaconda Minerals, Noranda and Echo Bay Mines where he served as Superintendent, Technical Services and Chief Geologist at Echo Bay's Kettle River Operations. Mr. Hunt received his M.S. degree in Geology from the Colorado School of Mines and a B.S. degree from Furman University.

James R. Maronick (61) has served as Chief Financial Officer, Secretary and Treasurer of Solitario since 1999 and was Chief Financial Officer of Crown from June 1999 until completion of the Crown - Kinross Merger in August of 2006. Prior to that, Mr. Maronick served as Vice President - Finance and Secretary/Treasurer of Consolidated Nevada Gold Fields Corporation from November 1994 to September 1997. Mr. Maronick graduated with honors from the University of Notre Dame in 1977 with a BA in accounting and received his Master’s degree in Finance with highest honors from the University of Denver in 1986.

| 4 |

(c) Identification of Certain Significant Employees

Not Applicable.

(d) Family Relationships

There are no family relationships among any director or executive offices of the Company

(e) Business Experience

The business experience of each of our directors and executive officers is set forth in Item 10(a)—Identification of Directors of this Annual Report on Form 10-K contains statements that constitute "forward-looking statements" within10-K/A and the meaningbusiness experience of section 27Athose executive officers who are not also our directors is set forth in Item 10(b)—Identification of the Securities ActExecutive Officers of 1933 and section 21Ethis Annual Report on Form 10-K/A.

The directorships held by each of our directors in any company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements can be identified by the fact that they do not relate strictly to historical information and include the words "expects", "believes", "anticipates", "plans", "may", "will", "intend", "estimate", "continue" or other similar expressions. These forward-looking statements are subject to various risks and uncertainties that could cause actual results to differ materially from those currently anticipated. These risks and uncertainties include, butSection 15(d) of the Exchange Act or any company registered as an investment company under the Investment Company Act of 1940, as amended, are not limited to, items discussed belowset forth in Item 1A "Risk Factors"10(a)—Identification of Directors of this Annual Report on Form 10-K/A.

(f) Involvement in this Form 10-K. Forward-looking statements speak only asCertain Legal Proceedings

During the past ten years none of the date made. We undertake no obligationpersons serving as executive officers and/or directors of the Company has been the subject matter of any of the following legal proceedings that are required to publicly releasebe disclosed pursuant to Item 401(f) of Regulation S-K including: (a) any bankruptcy petition filed by or update forward-looking statements, whether asagainst any business of which such person was a resultgeneral partner or executive officer either at the time of new information, future eventsthe bankruptcy or otherwise. You are, however, advised to consult any further disclosures we make on related subjects in our quarterly reports on Form 10-Q and any reports made on Form 8-K to the United States Securities and Exchange Commission (the "SEC").

Item 1.Business

The Company

Solitario Exploration & Royalty Corp. (“Solitario,” “Company,” “we,” or “us”) is an exploration stage company at December 31, 2016 under Industry Guide 7, as issued by the SEC. Solitario was incorporated in the state of Colorado on November 15, 1984 as a wholly-owned subsidiary of Crown Resources Corporation ("Crown"). In July 1994, Solitario became a publicly traded company on the Toronto Stock Exchange (the “TSX”) through its initial public offering. We have been actively involved in mineral exploration since 1993. Our primary business is to acquire exploration mineral properties or royalties on mineral properties, and/or to discover economic deposits on our mineral properties and advance these deposits, either on our own or through joint ventures, up to the development stage (development activities include, among other things, completion of a feasibility study for the identification of proven and probable reserves, as well as permitting and preparing a deposit for mining). At that point, or sometimewithin two years prior to that point, we would likely attempttime; (b) any criminal convictions; (c) any order, judgment, or decree permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; (d) any finding by a court, the SEC or the U.S. Commodity Future Trading Commission to sellhave violated a given mineral property, pursue its development either on our own,federal or through a joint venture with a partner that has expertise in mining operations,state securities or obtain a royalty from a third party that continues to advance the property. In addition to focusing on our current assets and the evaluationcommodities law, any law or regulation respecting financial institutions or insurance companies, or any law or regulation prohibiting mail or wire fraud; or (e) any sanction or order of mineral properties for acquisitionany self-regulatory organization or purchase of royalty interests, we also evaluate potential strategic corporate transactions for the potential acquisition of new precious and base metal properties and assets with exploration potentialregistered entity or business combinations we determineequivalent exchange, association or entity. Further, no such legal proceedings are believed to be favorable to Solitario.contemplated by governmental authorities against any director or executive officer.

Sale of Mt. Hamilton LLC(g) Promoters and Control Persons

On August 25, 2015, we, along with DHI Minerals (US) Ltd. (“DHI”), sold our combined interests in the Mt. Hamilton gold project to Waterton Nevada Splitter, LLC, (“Waterton”) for total cash proceeds of US$30 million (the “Transaction”) pursuant to a definitive agreement entered into on June 10, 2015 (the “Agreement”). We sold our 80% interest in Mt. Hamilton LLC (“MH-LLC”), a limited liability company which held 100% of the Mt. Hamilton project assets, and DHI sold its 20% interest in MH-LLC. DHI is a wholly-owned subsidiary of Ely Gold and Minerals, Inc. (“Ely”). We received gross cash proceeds of US$24 million and Ely received gross cash proceeds of US$6 million. Our costs and fees related to the Transaction, including broker fees and professional service fees, were $439,000. The Transaction was structured as the sale of DHI’s and our combined membership interests in MH-LLC. We recorded a gain on sale related to the Transaction of $12,309,000. Concurrent with the closing of the Transaction, we paid $5,000,000 plus $7,000 of interest and fees to fully repay the funds we had borrowed (the “RMB Loan”) pursuant to a facility agreement (the “Facility Agreement”) with RMB Australia Holdings Limited (“RMBAH”) and RMB Resources, Inc. (“RMBR”).Not Applicable.

Corporate structure(h) Meetings of Board of Directors Annual Meeting Attendance

Solitario Exploration & Royalty Corp. [Colorado]

- Minera Chambara, S.A. [Peru] (85%)

- Minera Solitario Peru, S.A. [Peru]

- Minera Bongará, S.A. [Peru] (39%)

- Minera Soloco, S.A. [Peru]

Our Bongará and Chambara projects are joint ventured to Compania Minera Milpo S.A.A. (“Milpo”). Milpo is traded onDuring the Lima exchange under the symbol “MILPOCI”. In January 2015, Solitario began accounting for its interest in both Bongará and Minera Chambara under the equity method of accounting. During thefiscal year ended December 31, 2016, we sold our previously owned subsidiary, Solitario Mexico, SA,there were four meetings of the Board. Each of the incumbent directors attended each of those Board meetings. Each of the incumbent directors attended all meetings held by committees of the Board (described below) on which had held interest in exploration properties in Mexico.

they served during 2016. All of the references to meetings exclude actions taken by written consent.

At December 31, 2016, we had three mineral exploration properties in Peru and our Yanacocha royalty property in Peru,The Company does not have a retained royalty onformal policy regarding the Pedra Branca project in Brazil, a retained royalty on the Norcan and Aconchi non-producing exploration properties in Mexico, and during 2016 we acquired a royalty on certain non-producing mineral claims in Montana. We are conducting exploration activities and limited property evaluation activities in those countries either on our own using contract geologists, or through joint ventures operated by our partners.

Our exploration activities and thoseattendance of our joint venture partners are carried out on a property-by-property basis. When these activities, including drilling, samplingBoard members at our annual meetings of shareholders and geologic testing, indicate a project may not be economic or contain sufficient geologic or economic potential, we may impair or completely write-off the property. Another significant factor in the success or failure of our activities is the price of commodities. For example, when the price of gold is down, the value of any of our gold-bearing mineral exploration properties decreases; however, it may also become easier and less expensive to locate and acquire new gold-bearing mineral exploration properties with potential to have economic deposits.

Our current and near-term future exploration activities in Peru consist of reconnaissance exploration for the identification of new properties for acquisition, as well as evaluation of strategic corporate opportunities and ongoing exploration activities on our existing exploration projects through the use of contract geologists, and oversight of our joint ventures in Peru that are managed by our partners.

Solitario has recorded revenue in the past from the sale of mineral properties, joint venture property payments and the sale of a royalty on its formerly-held Mt. Hamilton property. Proceeds from the sale or joint venture of properties, although potentially significant when they occur, have not been a consistent source of cash and may only occur in the future, if at all, on an infrequent basis. Accordingly, while we conduct exploration activities on our projects, we need to maintain and replenish our capital resources. We have met our need for capital in the past through (i) proceeds of the Transaction; (ii) sale of our shares of common stock of Kinross Gold Corporation (“Kinross”); (iii) borrowing in the form of short-term margin debt secured by our investment in Kinross; (iv) borrowing under the Facility Agreement (v) joint venture delay rental payments, including payments on our Bongará project; (vi) a royalty sale for $10,000,000 in 2012; (vii) issuance of common stock; (viii) sale of covered call options on our Kinross common stock; and (ix) interest on short term Treasury Notes and Bank CDs. In the past, we have reduced our exposure to the costs of our exploration activities through the use of joint ventures.

We operate in one segment, mineral exploration. We currently conduct exploration activities in Peru and exploration evaluation activities throughout North and South America, including Canada, Peru, Mexico and the United States. As of March, 10, 2017, we had five full-time employees, located in the United States and no full-time employees outside of the United States. We utilize contract managers, geologists and laborers to execute our Latin American project work and acquisition evaluations.

A large number of companies are engaged in the acquisition, exploration and development of mineral properties, many of which have substantially greater technical and financial resources than we have and, accordingly, we may be at a disadvantage in being able to compete effectively for the acquisition, exploration and development of mineral properties. WeBoard members are not aware of any single competitor or group of competitors that dominate the exploration and development of mineral properties. In acquiring mineral properties for exploration and development, we rely on the experience, technical expertise and knowledge of our employees and advisors, which is limited by the size of our company compared to many of our competitors who may have either more employees or employees with more specialized knowledge and experience.

Governmental Regulations

Mineral development and exploration activities are subject to various national, state/provincial, and local laws and regulations, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. Similarly, if any of our properties are developed and/or mined those activities are also subject to significant governmental regulation and oversight. We are required to obtainattend such meetings. Mr. Herald was the licenses, permits and other authorizations in order to conduct our exploration programs.only director that attended the annual meeting of shareholders held on June 14, 2016.

Environmental Regulations

Our current and planned activities are subject to various national and local laws and regulations governing protection of the environment. These laws are continually changing and, in general, are becoming more restrictive. We are required to conduct our operations in compliance with applicable laws and regulations. Changes to current local, state or federal laws and regulations in each jurisdiction in which we conduct our exploration activities could, in the future, require additional capital expenditures and increased operating and/or reclamation costs. Although we are unable to predict what additional legislation, if any, might be proposed or enacted, additional regulatory requirements could impact the economics of our projects. During 2016, we had no material environmental incidents or non-compliance with any applicable environmental regulations.

Financial Information about Geographic Areas

Included in the consolidated balance sheets at December 31, 2016 and 2015 are total assets of $60,000 and $86,000, respectively, related to Solitario's operations located outside of the United States.

Available Information

We file our Annual Report on Form 10-K, our quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports electronically with the SEC. The public may read and copy any materials we file with the SEC at the SEC's public reference room at 100 F Street NE, Washington, DC 20549 or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an internet website, http://www.sec.gov, which contains reports, proxy information and other information regarding issuers that file electronically with the SEC.

Paper copies of our Annual Report to Shareholders, our Annual Report on Form 10-K, our quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports are available free of charge by writing to Solitario at its address on the front of this Form 10-K. In addition, electronic versions of the reports we file with the SEC are available on our website, www.solitarioxr.com as soon as practicable, after filing with the SEC.

Item 1A.Risk Factors

In addition to considering the other information in this Form 10-K, you should consider carefully the following factors. The risks described below are the significant risks we face and include all material risks. Additional risks not presently known to us or risks that we currently consider immaterial may also adversely affect our business.

Our mineral exploration activities involve a high degree of risk, and a significant portion of our business model envisions the sale or joint venture of mineral property. If we are unable to sell or joint venture these properties, the money spent on exploration may never be recovered and we could incur an impairment of our investments in our projects.

The exploration for mineral deposits involves significant financial and other risks over an extended period of time. Few properties that are explored are ultimately developed into producing mines. Major expenditures are required to determine if any of our mineral properties may have the potential to be commercially viable and be salable or joint ventured. Prior to completion of the feasibility study on our Mt. Hamilton project, we had never established reserves on any of our properties. Significant additional expense and risks, including drilling and determining the feasibility of a project, are required prior to the establishment of reserves. It is impossible to ensure that the current or proposed exploration programs on properties in which we have an interest will be commercially viable or that we will be able to sell, joint venture or develop our properties. Whether a mineral deposit will becommercially viable depends on a number of factors, some of which are the particular attributes of the deposit, such as its size and grade, costs and efficiency of the recovery methods that can be employed, proximity to infrastructure, financing costs and governmental regulations, including regulations relating to prices, taxes, royalties, infrastructure, land use, importing and exporting of gold or other minerals, and environmental protection.

We believe the data obtained from our own exploration activities or our partners' activities to be reliable; however, the nature of exploration of mineral properties and analysis of geological information is often subjective and data and conclusions are subject to uncertainty. Even if exploration activities determine that a project is commercially viable, it is impossible to ensure that such determination will result in a profitable sale of the project or development either on our own or by a joint venture in the future and that such project will result in profitable commercial mining operations. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur an impairment of our investment in such property interest. All of these factors may result in losses in relation to amounts spent, which are not recoverable. We have experienced losses of this type from time to time including during 2016 when we wrote down our investments in our exploration projects in Mexico and abandoned our Canta Colorado project in Peru, recording mineral property impairments totaling $13,000.

A significant portion of our liquid assets consist of U.S. Treasuries and bank certificates of deposit. The failure of the financial institutions that issued or hold these financial instruments could have a material adverse impact on the market price of our common stock and our liquidity and capital resources.

| 5 |

(i) Procedures for Stockholder Nominations to the Registrant’s Board of Directors

At

No material changes to the procedures for nominating directors by our shareholders, as described in the Proxy Statement filed by the Company on April 28, 2016 with respect to the 2016 annual meeting of shareholders, has been made since such Proxy Statement was filed.

(j) Audit Committee and Financial Expert

Solitario has a separately-designated standing audit committee established in accordance with section 3(a)(58)(A) of the Exchange Act. The Audit Committee consists of Mr. Labate, Mr. Harris and Mr. Labadie, each of whom is “independent” in accordance with NYSE MKT standards, as well as the independence requirements for audit committee members under Rule 10A-3 promulgated under the Exchange Act. The Board has determined that Mr. Labate is the audit committee financial expert as defined in Item 407(d)(5) of Regulation S-K. The Audit Committee acts under a written charter that was adopted and approved by the Board on July 26, 2006, a current copy of which is available on the Company website at www.solitarioxr.com. The Audit Committee’s primary function is to review Solitario's financial reporting process on behalf of the Board. Management has the primary responsibility for the financial statements and the reporting processes, including the system of internal controls. The Audit Committee met five times during the year ended December 31, 2016.

Audit Committee Report

In performing its duties the Audit Committee reviewed and discussed the audited financial statements contained in the 2016 Annual Report on Form 10-K with management and Solitario's independent registered public accountant, EKS&H LLLP. The Audit Committee met with EKS&H LLLP, and discussed all issues deemed to be significant by EKS&H LLLP, including any matters required by Rule 2-07 of Regulation S-X, "Communication with Audit Committees" and by the statements on Auditing Standard No. 16, as amended (AICPAProfessional Standards, Vol. 1, AU section 380), as adopted by the Public Company Oversight Board, and without management present, discussed and reviewed the results of the independent auditor's examination of the financial statements. In addition, in accordance with Independence Standards Board Standard No. 1, "Independence Discussions with Audit Committees" as amended or supplemented, the Audit Committee discussed with EKS&H LLLP its independence from Solitario and its management, and has received and reviewed the written disclosures and letter from EKS&H LLLP required by applicable requirements of the Public Company Accounting Oversight Board regarding EKS&H LLLP’s communications with the Audit Committee including that EKS&H LLLP is independent and has discussed EKS&H LLLP’s independence with them.

Based on the reviews and discussions outlined above, the Audit Committee recommended to the Board that Solitario include the audited financial statements in its Annual Report on Form 10-K for the year ended December 31, 2016 we have invested approximately $7,499,000 in separate, FDIC insured certificates of depositwhich was filed with the maximum individual bank exposureSEC on March 13, 2017.

AUDIT COMMITTEE

John Labate, Chairman

Leonard Harris

Brian Labadie

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of $250,000. Further, asthe Exchange Act requires Solitario's directors and executive officers, and persons who own more than ten percent of a registered class of Solitario's equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of the Company’s Common Stock and other equity securities of Solitario. Officers, directors, greater than ten percent shareholders are required by SEC regulation to furnish Solitario with copies of all Section 16(a) reports they file. Based solely on review of the copies of such reports, furnished to Solitario and written representations that no other reports were required, during the year ended December 31, 2016, we have invested $7,751,000 in United States Treasury securities, with maturities of between 30 daysMr. Labadie, Mr. Jones (a former Director), Mr. Hainey (a former Director), Mr. Harris, Mr. Herald, Mr. Maronick and 18 monthsMr. Hunt, each filed a single Form 4 reporting one transaction late. No other person failed to timely meet the Section 16(a) filing requirements applicable to officers, directors, and we have approximately $94,000 of our cash in uninsured deposit accounts including $57,000 held in a brokerage account at Charles Schwab, none of which are covered by FDIC insurance. The failure of either Charles Schwab orgreater than ten percent beneficial owners during the financial institutions holding these funds and assets could have a material impact on the market price of our common stock and our liquidity and capital resources.year ended December 31, 2016.

We have no reported mineral reserves and none of our current projects are likely to be monetized in the near future and any projects we may acquire are not likely to offer the opportunity for near term revenues or sale proceeds, and if we are unsuccessful in identifying mineral reserves in the future, we may not be able to realize any profit from these property interests.

None of our projects have reported mineral reserves. Any mineral reserves on these projects will only come from extensive additional exploration, engineering and evaluation of existing or future mineral properties. The lack of reserves on these mineral properties could prohibit us from any near-term sale or joint venture of our mineral properties and we would not be able to realize any proceeds and or profit from our interests in such mineral properties, which could materially adversely affect our financial position or results of operations.

Our mineral exploration activities are inherently dangerous and could cause us to incur significant unexpected costs, including legal liability for loss of life, damage to property and environmental damage, any of which could materially adversely affect our financial position or results of operations.

Our operations are subject to the hazards and risks normally related to exploration of a mineral deposit, including mapping and sampling, drilling, road building, trenching, assaying and analyzing rock samples, transportation over primitive roads or via small contract aircraft or helicopters and severe weather conditions, any of which could result in damage to life or property, environmental damage and possible legal liability for such damage. Any of these risks could cause us to incur significant unexpected costs that could have a material adverse effect on our financial condition and ability to finance our exploration and development activities.

We have a history of losses and if we do not operate profitably in the future it could have a material adverse effect on our financial position or results of operations and the trading price of our common stock would likely decline.

We have reported losses in 20 of our 23 years of operations. We can provide no assurance that we will be able to operate profitably in the future or begin to generate significant and consistent sources of revenues or cash flows from operations. We have had net income in only three years in our history; during 2015, as a result of the Transaction, during 2003, as a result of a $5,438,000 gain on a derivative instrument related to our investment in certain Crown warrants and during 2000, when we sold our former Yanacocha property. We cannot predict when, if ever, we will be profitable again or able to begin generating consistent revenues or cash flows from our operations or assets. If we do not operate profitably or identify and execute on outside sources of funding, we may be unable to fund our current or contemplated exploration activities, acquire new assets, or otherwise further our business plan.

Our operations outside of the United States of America may be adversely affected by factors outside of our control, such as changing political, local and economic conditions, any of which could materially adversely affect our financial position or results of operations.

Our mineral properties located in Latin America consist primarily of mineral concessions granted by national governmental agencies and are held 100% by us or in conjunction with our joint venture partners, or under lease, option or purchase agreements. Our mineral properties are located in Peru and we hold royalties on non-producing exploration properties in Peru, Mexico, Brazil and Montana (U.S.). We act as operator on all of our mineral properties that are not held in joint ventures or royalty properties. The success of projects held under joint ventures or royalty properties that are not operated by us is substantially dependent on the joint venture partner, over which we have limited or no control.

Our exploration activities, mineral properties and royalties located outside of the United States are subject to the laws of Peru, Mexico and Brazil. Exploration and potential development activities in these countries are potentially subject to political and economic risks, including:

| 6 |

·cancellation or renegotiationCode of contracts;

·disadvantages of competing against companies from countries that are not subject to US laws and regulations, including the Foreign Corrupt Practices Act;

·changes in foreign laws or regulations;

·changes in tax laws;

·royalty and tax increases or claims by governmental entities, including retroactive claims;

·expropriation or nationalization of property;

· �� currency fluctuations (particularly related to declines in the US dollar compared to local currencies);

·foreign exchange controls;

·restrictions on the ability for us to hold US dollars or other foreign currencies in offshore bank accounts;

·import and export regulations;

·environmental controls;

·risks of loss due to community opposition to our activities, civil strife, acts of war, guerrilla activities, insurrection and terrorism; and

·other risks arising out of foreign sovereignty over the areas in which our exploration activitiesare conducted.Ethics

Accordingly,We adopted a Code of Business Conduct and Ethics including a Code of Ethics applicable to the principal executive officer and the principal financial and accounting officer of Solitario (the "Code of Ethics") on June 27, 2006, a copy of which may be found on our current exploration activities outsidewebsite at www.solitarioxr.com and on SEDAR at www.sedar.com. Any person who wishes to receive a copy of the United StatesCode of Ethics may be substantially affecteddo so at no charge by factors beyond our control, any of which could materially adversely affect the value of certain of our assets or results of operations. Furthermore, in the event of a dispute arising from such activities, we would likely be subjectwritten request to the exclusive jurisdiction of courts outside of the United States or may not be successful in subjecting persons to the jurisdictions of the courts in the United States, which could adversely affect the outcome of a dispute.Investor Relations, Solitario Exploration & Royalty Corp., 4251 Kipling St, Suite 390, Wheat Ridge, CO 80033.

Item 11.Executive Compensation

We may not have sufficient funding for explorationCompensation Discussion and development, which may impair our profitability and growth.Analysis

The capital requiredfollowing discussion provides information regarding the compensation program for Solitario's Named Executive Officers for 2016.

Objectives of the Company’s Compensation Program

The Compensation and Management Development Committee (the “Compensation Committee”) has responsibility for approving the compensation program for Solitario's Named Executive Officers and acts according to a charter that has been approved by the Board and is available on the Company website at www.solitarioxr.com. The compensation program is designed to attract, retain and reward our executives who contribute to Solitario's long-term success. This in turn is intended to build value for Solitario and its shareholders. The program is based upon three fundamental principles:

(1) A substantial portion of Solitario's Named Executive Officer compensation should be performance and equity-based to achieve alignment with shareholder interests.

This principle is accomplished in two primary ways; first, through the award of stock options or, other equity awards contemplated in the equity compensation plans adopted by Solitario, in an amount and with such terms intended to encourage our Named Executive Officers to promote the long-term growth and performance of Solitario as may be reflected in the price of our Common Stock as quoted on the TSX and the NYSE-MKT.

Second, this is also reflected in terms of cash compensation in the form of cash bonuses. These bonuses are set by the Compensation Committee, in its sole discretion, in a range of zero to 100% of base salary. The extent to which bonuses are paid depends entirely on the extent to which the Compensation Committee believes Solitario has met its development, exploration, budget and developmentshareholder goals, as set by the Compensation Committee and the current and expected financial condition of mineral properties is substantial.the Company. In March 2016 the past we have financed operationsCompensation Committee awarded a $60,000 bonus to Mr. Herald, a $44,000 bonus to Mr. Hunt and a $40,000 bonus to Mr. Maronick for the performance of the Named Executive Officers and the achievement of certain Company goals during 2015. The Compensation Committee considered the milestones achieved during 2015 by the Company, including (i) completion of the sale of our former interest in the Mt. Hamilton project through the sale of interestsour interest in mineral properties, includingMt. Hamilton LLC (“MH-LLC”) to Waterton Nevada Splitter, Ltd. (“Waterton”) for gross proceeds of $24,000,000 (the “Transaction”), (ii) the refinancing and eventual repayment, upon the closing of the Transaction, in 2015, the utilization of joint venture arrangements with third parties (generally providing that the third party will obtain a specified percentage$5,000,000 short-term debt due to RMB Australia Holdings, Ltd., and (iii) successful marketing of our interest in a certain property or a subsidiary owning a propertyMH-LLC, including obtaining approval of the Transaction by holders of over 90% of our outstanding shares at our annual meeting held in exchange forAugust 2015. Primarily due to the expenditurelimited financial resources of a specified amount),the Company during 2015, prior to the sale of other assets, sale of marketable equity securities we hold, short-term margin loans, funds fromour interest in MH-LLC, no bonuses were authorized by the Facility Agreement,Compensation Committee to be paid during 2015. The Compensation Committee considered the bonuses paid in 2016 as earned in 2015 and the issuance of common stock. We may need to raise additional capital, or enter into joint venture arrangements, in order to fund the exploration activities required to determine whether mineral deposits on our projectsthese bonuses are commercially viable. New financing or acceptable joint venture partners may or may not be available on a basis that is acceptable to us. The inability to obtain new financing or joint venture partners on acceptable terms may prohibit us from continued development or exploration of our mineral properties. Without the successful sale or future development of our mineral properties through joint ventures, or on our own, we will not be able to realize any profit from our interests in such properties, which could have a material adverse effect on our financial position and results of operations.

A large number of companies are engagedincluded in the exploration and development or sale of mineral properties, many of which have substantially greater technical and financial resources than us and, accordingly, we may be unablesummary compensation table below for each Named Executive Officer for the year ended December 31, 2015. The Compensation Committee did not award any bonuses for the year ended December 31, 2016 to compete effectively in this sectorany Named Executive Officer based upon their review of the mining industry which could haveperformance of the price of the Company’s common stock during the year and upon the absence of a material adverse effect on our financial position or results of operations.

We are at a disadvantage with respect to many of our competitors in the acquisition, exploration and development or sale of mining projects. Our competitors with greater financial resources than us will be better able to withstand the uncertainties and fluctuations associated with sustained downturns in the market and to acquire high quality exploration and mining properties when market conditions are favorable. In addition, we compete with other companies in the mineral properties sector to attract and retain key executives and other employees with technical skills and experience in the mineral exploration business. There can be no assurance that we will continue to attract and retain skilled and experienced employees or to acquire additional exploration projects. The realization of any of these risks from competitors could have a material adverse effect on our financial position or results of operations.

The title to our mineral properties may be defective or challenged which could have a material adverse effect on our financial position or results of operations.

In connection with the acquisition of our mineral properties, we conduct limited reviews of title and related matters, and obtain certain representations regarding ownership. These limited reviews do not necessarily preclude third parties from challenging our title and, furthermore, our title may be defective. Consequently, there can be no assurance that we hold good and marketable title to all of our mineral interests. Additionally, we have to make annual filings to various government agencies on all of our mineral properties. If we fail to make such filings, or improperly document such filings, the validity of our title to amajor mineral property could be lostacquisition and / or challenged. If any of our mineral interests were challenged, we could incur significant costs in defending such a challenge. These costs or an adverse ruling with regards to any challenge of our titles could have a material adverse effect on our financial position or results of operations.

strategic investment during the year ended December 31, 2016.

| 7 |

(2) Solitario's compensation program for Named Executive Officers is intended to enable the Company to compete for the best executive talent available.

The Compensation Committee believes shareholders are best served when the Company can attract and retain the highest caliber executives appropriate for a company of our size and complexity. This is done with compensation packages we believe to be fair and competitive. Our operations could be negatively affected byNamed Executive Officers have served Solitario for many years. During 2016 and 2015 the Compensation Committee reviewed published compensation surveys and publically available compensation disclosures of several of our peer group companies (“Peer Group Companies”) for which Solitario competes for executive talent as the Compensation Committee believes that each of these public companies share some attributes of Solitario with regard to similar size to, and in a similar industry as Solitario. These Peer Group Companies included the following companies:

| Vista Gold Corp. | Midas Gold Corp. |

| Entree Gold Corp. | Riverside Resources Inc. |

These reviews were not used to create specific benchmarks applicable to our Named Executive Officer compensation levels. These reviews were used to inform the Compensation Committee of current standards in the industry as such standards may relate, in their independent judgment, to appropriate modifications to Solitario's existing lawscompensation levels. During 2016, Solitario's activities were generally focused on the evaluation of mineral properties for acquisition and on junior mining companies with mineral properties for strategic investment in the form of potential merger, acquisition or sale; during most of 2015 Solitario’s activities were more narrowly focused initially on the development of the Mt. Hamilton project, and subsequently on the marketing and eventual sale of the Mt. Hamilton project, as well as potential changesother early stage exploration. As the focus of Solitario during the two most recent fiscal years did not directly compare in lawsall cases to the activities of the Peer Group Companies, the Compensation Committee took the difference in focus into consideration when reviewing compensation of Solitario’s Named Executive Officers compared to the peer companies. Additionally, Solitario has traditionally maintained a very minimal staff and regulatory requirements to which we are subject, including regulation of mineral exploration and ownership, environmental regulations and taxation.

The exploration and development of mineral properties is subject to federal, state, provincial and local laws and regulationsthe difference in the countriesnumber of total employees of Solitario, which currently has six employees world-wide, compared to the Peer Group Companies; do not lend itself to effective use of specific benchmarks.

Subsequent to the completion of the Transaction, the Compensation Committee, in which we operateconsultation with the Named Executive Officers, in light of the then difficult financial conditions in the junior mining sector as a varietyresult of ways, including regulation of mineral explorationcontinued low precious and land ownership, environmental regulation and taxation. These laws and regulations,base metal prices as well as future interpretationthe reduction in Mt. Hamilton related Company activities, decided to reduce the annual salaries of or changesits Named Executive Officers, as of October 1, 2015; with the salary of Mr. Herald being reduced from $230,000 to existing laws and regulations, may require substantial increases in capital and operating costs$198,000, the salary of Mr. Maronick being reduced from $160,000 to us and delays, interruptions, or a termination of operations.

In the United States$150,000 and the other countriessalary of Mr. Hunt being reduced from $178,000 to $158,000. The Named Executive Officers’ salaries remained at the reduced amount during 2016, except for an increase in which we operate,September 2016 to Mr. Hunt’s salary of $1,000 per month and an increase to Mr. Herald’s salary in orderJune of $500 per month related to obtain permits for exploration or potential future developmentan increase in health care costs. At the beginning of mineral properties, environmental regulations generally require a description2015, based upon the difficult financial markets and the limited financial resources of the existing environment,Company, the Compensation Committee decided to leave the ending annual 2014 salary amounts the same during 2015 with the salary of Mr. Herald at $230,000, the salary of Mr. Maronick at $164,000 and the salary of Mr. Hunt at $178,000. However, to conserve cash resources during 2015, all employees of Solitario, including but not limitedits Named Executive Officers agreed to natural, archeologicaldefer between 15% and socio-economic environments, at34% of the project sitegross cash salary payments due during 2015. Upon completion of the Transaction, and given the strong financial condition of Solitario, all amounts previously deferred during 2015, were paid in the region; an interpretationfourth quarter of 2015.

(3) Solitario's compensation program for the natureNamed Executive Officers should be fair to the executive, the Company and magnitude of potential environmental impacts that might result fromall its employees and perceived as such, activities;both internally and a description and evaluation of the effectiveness of the operational measures planned to mitigate the environmental impacts. Currently the expenditures to obtain exploration permits to conduct our exploration activities are not material to our total exploration cost.

externally.

The lawsCompensation Committee strives to create a compensation program that promotes good corporate practice, encourages our Named Executive Officers to perform at a high level and regulationspromotes teamwork among our employees. The Compensation Committee takes these goals into consideration by comparison of executive pay in relation to all other Solitario salary costs for internal consistency, and by comparison to both Peer Group Companies and industry salaries for external consistency. In addition, the countries in which we operate are continually changingcompensation program is intended to enhance shareholder value and are generally becoming more restrictive, especially environmental lawsthe Compensation Committee strives to provide transparency and regulations. As part of our ongoing exploration activities, we have made expendituresfull disclosure to comply with such laws and regulations, but such expenditures could substantially increase our costs to achieve compliance in the future. Delays in obtaining or failure to obtain government permits and approvals or significant changes in regulation could have a material adverse effect on our exploration activities, our ability to locate economic mineral deposits, and our potential to sell, joint venture or eventually develop our properties, which could have a material adverse effect on our financial position or results of operations.all interested parties.

Occurrence of events for which we are not insured may materially adversely affect our business.

Mineral exploration is subject to risks of human injury, environmental liability and loss of assets. We maintain limited insurance coverage to protect ourselves against certain risks related to loss of assets for equipment in our operations and limited corporate liability coverage; however, we have elected not to have insurance for other risks because of the high premiums associated with insuring those risks or for various other reasons including those risks where insurance may not be available. There are additional risks in connection with investments in parts of the world where civil unrest, war, nationalist movements, political violence or economic crisis are possible. These countries may also pose heightened risks of expropriation of assets, business interruption, increased taxation and a unilateral modification of concessions and contracts. We do not maintain insurance against political risk. Occurrence of events for which we are not insured could have a material adverse effect on our financial position or results of operations.

Severe weather or violent storms could materially affect our operations due to damage or delays caused by such weather.

Our exploration activities in Peru are subject to normal seasonal weather conditions that often hamper and may temporarily prevent exploration or development activities. There is a risk that unexpectedly harsh weather or violent storms could affect areas where we conduct these activities. Delays or damage caused by severe weather could materially affect our operations or our financial position.

Our business is dependent on the market price of commodities and currency exchange rates over which we have no control.

Our operations are significantly affected by changes in the market price of commodities since the evaluation of whether a mineral deposit is commercially viable is heavily dependent upon the market price of the commodities related to any specific project, such as gold or zinc. The price of commodities also affects the value of exploration projects we own or may wish to acquire or joint venture. These commodity prices fluctuate on a daily basis and are affected by numerous factors beyond our control. The supply and demand for commodities, the level of interest rates, the rate of inflation, investment decisions by large holders of these commodities, including governmental reserves, and stability of exchange rates can all cause significant fluctuations in prices. Currency exchange rates relative to the United States dollar can affect the cost of doing business in a foreign country in United States dollar terms, which is our functional currency. Consequently, the cost of conducting exploration in the countries where we operate, accounted for in United States dollars, can fluctuate based upon changes in currency exchange rates and may be higher than we anticipate in terms of United States dollars because of a decrease in the relative strength of the United States dollar to currencies of the countries where we operate. We currently do not hedge against currency or commodity fluctuations. The prices of commodities as well as currency exchange rates have fluctuated widely and future significant price declines in commodities or changes in currency exchange rates could have a material adverse effect on our financial position or results of operations.

| 8 |

The Compensation Committee has no authority to recover salary, bonuses or stock option awards or other equity awards made to Named Executive Officers. Although the Compensation Committee has the ability to consider prior compensation (e.g. gains from prior option grants or other equity awards) in setting current compensation, it has no formal procedure or requirement to do so. The Compensation Committee does not set or utilize benchmarks of any kind to set, evaluate or allocate compensation. There have been no actions taken or adjustments made to the process of setting executive compensation discussed herein by the Compensation Committee subsequent to December 31, 2016.

Our business is dependent on keyKey Elements of Executive Compensation

The elements of the Company’s compensation program are intended to balance long term and short term compensation for its executives and attempt to motivate executives to provide excellent leadership and achieve Company goals by linking short-term (such as salaries and benefits) and long-term incentives (such as equity based compensation) to the lossachievement of anybusiness objectives, thereby aligning the interests of executives and shareholders. In addition the Compensation Committee recognizes the performance of the Company’s Common Stock is often influenced by the general investment climate of the junior mining industry, which is not within the control of the specific performance of the Named Executive Officers in achieving the objectives set by the Company. The key elements of the compensation of the Named Executive Officers are outlined below. The Compensation Committee considers shareholder input when setting compensation for Named Executive Officers. At our 2016 annual meeting of shareholders, greater than 91% of the votes cast on the advisory vote on executive compensation were in favor of our key executives could adversely affectexecutive compensation program. The Board of Directors and the Compensation Committee reviewed these vote results and determined that, given the significant level of support, no major re-examination of our business, future operations and financial condition.executive compensation program was necessary at that time.

| (1) | Base Salary |

WeThe Compensation Committee attempts to provide base salary to the Named Executive Officers that is commensurate with their review of our Peer Group Companies. The Compensation Committee fixed the base salary for the Named Executive Officers for 2016 (which commenced on January 1, 2016) during its meeting in September 2015. Increases or decreases in base salary are dependent on the servicesCompensation Committee's evaluation of key executives, including our Chiefeach individual Named Executive Officer Christopher E. Herald, our Chief Operating Officer, Walter H. Hunt, and our Chief Financial Officer, James R. Maronick. Allperformance, the effect of those officers have many yearsa peer group review, the performance of experience and an extensive background with Solitario and in the mining industry in general. We may not be able to replace that experience and knowledge with other individuals. We do not have "Key-Man" life insurance policies on any of our key executives. The loss of these persons or our inability to attract and retain additional highly skilled employees may adversely affect our business, future operations and financial condition.

Our business model relies significantly on other companies to joint venture our projects and we anticipate continuing this practice in the future. Therefore, our results are subjectentire Company relative to the additional risks associated withCompany’s general goals and objectives, and the Company’s current and projected financial condition, operational expertiseresources. No Named Executive Officers receive minimum base salary payments pursuant to any employment agreement, or other written agreement. The Compensation Committee has authority from the Board to set the base salary at any amount it believes is appropriate. Although the Compensation Committee, has used its review of the accomplishments of the Named Executive Officers against general goals of the Company, including planned exploration programs, potential mineral property acquisitions, evaluation of strategic opportunities for a corporate merger, acquisition or sale; the 2015 sale of the Mt. Hamilton project, corporate financing activities and corporate prioritiesmarket price of our joint venture partners.Solitario’s Common Stock, among other things, the Compensation Committee has full discretion to set compensation levels and has not set specific compensation levels to specific criteria. Some of the general criteria are discussed below.

| (2) | Bonuses |

The Compensation Committee may provide bonuses to the Named Executive Officers, in its sole discretion, based upon their evaluation of the individual Named Executive Officer in light of the certain parameters, including the following:

| (i) | Bonuses based upon operational goals and parameters; |

| (ii) | The desire, discussed above, to provide a substantial portion of compensation based on performance |

| (iii) | The performance of the Company relative to Company goals including share price performance; |

| (iv) | The financial strength of the Company, including liquid financial assets; |

| (v) | The quality of mineral property assets, including exploration assets and mineral properties under joint venture; and |

| (vi) | The financial strength and prospects for the smaller (junior) exploration mining industry. |

Our Bongará project is joint-ventured with another mining company that manages the exploration and development activities on the project and we are the minority-interest party. Although our joint venture agreements provide certain voting rights and other minority-interest safeguards, the majority partner not only manages operations, but controls most decisions, including budgets and scope and pace of exploration and development activities. Consequently, we are highly dependent on the operational expertise and financial condition of our joint venture partner, as well as its own corporate priorities. For instance, even though our joint venture property may be highly prospective for exploration success, or economically viable based on feasibility studies, our partner may decide to not fund the further exploration or development of our project based on their respective financial condition or other corporate priorities. Therefore, our results are subject to the additional risks associated with the financial condition, operational expertise and corporate priorities of our joint venture partners, which could have a material adverse effect on our financial position or results of operations.

We may look to joint venture with another mining company in the future to develop and/or operate one of our foreign projects; therefore, in the future, our results may become subject to additional risks associated with development and production of our foreign mining projects.

We are not currently involved in mining development or operating activities at any of our properties. In order to realize a profit from these mineral interests we either have to: (1) sell such properties outright at a profit; (2) form a joint venture for the project with a larger mining company with greater resources, both technical and financial, to further develop and/or operate the project at a profit; (3) develop and operate such projects at a profit on our own; or (4) create and retain a royalty interest in a property with a third party that agrees to advance the property toward development and mining. In the future, if our exploration results show sufficient promise in one of our foreign projects, we may either look to form a joint venture with another mining company to develop and/or operate the project, or sell the property outright and retain partial ownership or a retained royalty based on the success of such project. Therefore, in the future, our results may become subject to the additional risks associated with development and production of mining projects in general.

In the future, we may participate in a transaction to acquire a new property, royalty or another company that requires a substantial amount of capital or the issuance of Solitario equity to complete. Our acquisition costs may never be recovered due to changing market conditions, or our own miscalculation concerning the recoverability of our acquisition investment. Such an occurrence could adversely affect our business, future operations and financial condition.

We have evaluated a wide variety of acquisition opportunities involving mineral properties and companies for acquisition and we anticipate evaluating potential acquisition opportunities in the future. Some of these opportunities may involve a substantial amount of capital or the issuance of Solitario equity to successfully acquire. As many of these opportunities do not have reliable feasibility-level studies, we may have to rely on our own estimates for investment analysis. Such estimates, by their very nature, contain substantial uncertainty. In addition, economic assumptions, such as future costs and commodity prices, also contain significant uncertainty. Consequently, if we are successful in acquiring any new opportunities and our estimates prove to be in error, either through miscalculations or changing market conditions, this could have a material adverse effect on our financial position or results of operations.

| 9 |

In establishing its goals for any particular year, the Compensation Committee strives to ensure that the goals provide both an incentive and an attainable goal that provides shareholders with the opportunity for return on their investment while minimizing corporate and shareholder risk to the extent possible. Although certain targets and goals related certain operational goals, such as to potential property acquisitions and/or potential merger or acquisition activities, if any, are confidential, the Compensation Committee has structured these types of goals to be reasonable and obtainable by our Named Executive Officers, without undue risk to the assets of Solitario. Due to the nature of Solitario's corporate activities relating to (i) the evaluation of mineral properties for acquisition; (iii) the evaluation of strategic opportunities for a corporate merger, acquisition or sale; (iii) the sale of the Mt. Hamilton project during 2015 and (iv) early-stage exploration of mineral properties located in Peru, the goals for Named Executive Officers are not specifically related to traditional financial metrics, such as revenue growth, earnings or earnings per share. The marketoperational targets and goals are more subjective and generally include (i) the evaluation, negotiation and acquisition of mineral property agreements; (ii) evaluation of strategic opportunities; (iii) land and royalty joint ventures on our existing properties, (iv) exploration activities and success, both on our own and through joint ventures; (v) training and retaining employees, (vi) operational activities including: maintaining adequate liquidity to fund future exploration activities, financial reporting and disclosure, and shareholder return. The Compensation Committee also evaluates the financial strength and prospects for sharesthe junior exploration segment of the mining industry. The Compensation Committee reviews the annual goals with the Named Executive Officers at or near the start of each year. The evaluation of the performance of our common stock has limited liquidity and the market price of our common stock has fluctuated and may decline.

An investment in our common stock involves a high degree of risk. The liquidity of our shares, or the ability of a shareholder to buy or sell our common stock, may be significantly limited for various unforeseeable periods. The average combined daily volume of our shares traded on the NYSE MKT and the TSX during 2016 was approximately 81,000 shares. The market price of our shares has historically fluctuated within a wide range. The price of our common stock may be affected by many factors, including an adverse change in our business, a decline in the price of gold or other commodity prices, negative news on our projects, negative investment sentiment for mining and commodity equities and general economic trends.

We are dependent upon information technology systems, which are subject to disruption, damage, failure and risks associated with implementation and integration.

We are dependent upon information technology systems in the conduct of our operations. Our information technology systems are subject to disruption, damage or failure from a variety of sources, including, without limitation, computer viruses, security breaches, cyber-attacks, natural disasters and defects in design. Cybersecurity incidents, in particular, are evolving and include, but are not limited to, malicious software, attempts to gain unauthorized access to data and other electronic security breaches that could lead to disruptions in systems, unauthorized release of confidential or otherwise protected information and the corruption of data. Various measures have been implemented to manage our risks related to information technology systems and network disruptions. However, given the unpredictability of the timing, nature and scope of information technology disruptions, we could potentially be subject to operational delays, the compromising of confidential or otherwise protected information, destruction or corruption of data, security breaches, other manipulation or improper use of our systems and networks or financial losses from remedial actions, any of which could have a material adverse effect on our cash flows, competitive position, financial condition or results of operations.

Failure to comply with the United States Foreign Corrupt Practices Act (“FCPA”) could subject us to penalties and other adverse consequences.

As a Colorado corporation, we are subjectNamed Executive Officers, relative to the FCPA and similar worldwide anti-bribery laws, which generally prohibit United States companies and their intermediaries from engaging in bribery or other improper payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some that may compete with our company, are not subject to U.S. laws and regulations, including the FCPA, and therefore our exploration, development, production and mine closure activities are subject to the disadvantage of competing against companies from countries that are not subject to these prohibitions.

In addition, we could be adversely affected by violations of the FCPA and similar anti-bribery laws in other jurisdictions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices may occur from time-to-time in the countries outside of the United States in which we operate. Our mineral properties are located in countries that may have experienced governmental corruption to some degree and, in certain circumstances, strict compliance with anti-bribery laws may conflict with local customs and practices. Our policies mandate compliance with these anti-bribery laws; however, we cannot assure you that our internal controls and procedures always will protect us from the reckless or criminal acts committed by our employees or agents. We can make no assurance that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices or we are found to be liable for FCPA violations, we could suffer severe criminal or civil penalties or other sanctions and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

Item 1B.Unresolved Staff Comments

None

Item 2.Properties

Joint Ventures and Strategic Alliance Properties

Bongará Zinc Project (Peru)

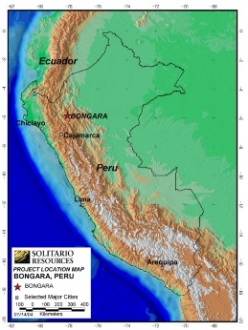

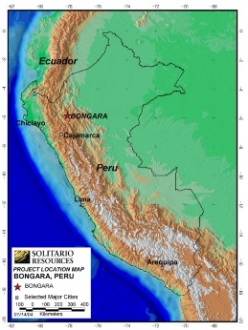

1.Property Description and Location

(Map of Bongará Property)

The Bongará project consists of 16 concessions comprising 12,600 hectares of mineral rights granted to Minera Bongará S.A., our subsidiary incorporated in Peru. The property is located in the Department of Amazonas, northern Peru. On August 15, 2006, Solitario signed a Letter Agreement with Votorantim Metais Cajamarquilla, S.A., a wholly-owned subsidiary of Votorantim Metais (both companies referred to as "Votorantim”) on Solitario's 100%-owned Bongará zinc project (the “Bongará Letter Agreement”). On March 24, 2007, Solitario signed the Framework Agreement with Votorantim for the Exploration and Potential Development of Mining Properties, (the "Framework Agreement") pursuant to, and replacing, the Bongará Letter Agreement. Solitario's and Votorantim's property interests are held through the ownership of shares in Minera Bongará S.A., a joint operating company that holds a 100% interest in the mineral rights and other project assets. Solitario currently owns 39% of the shares in Minera Bongará S.A.

During 2015 Votorantim completed the steps required to earn a 61% interest in the Bongará project, with Solitario retaining a 39% interest. In addition, Solitario consented to the transfer of Votorantim’s interest in both the Bongará and Chambara projects to Compañía Minera Milpo S.A.A. (“Milpo”). Milpo, an 80%-owned affiliate of Votorantim, is traded on the Lima exchange under the symbol MILPOCI.