PART I

ITEM 1. BUSINESS

OVERVIEW

The terms “we,” “our,” “us,” “Company”“Company,” "Integra LifeSciences," and “Integra” refer to Integra LifeSciences Holdings Corporation, a Delaware corporation, and its subsidiaries, unless the context suggests otherwise.

Integra headquartered in Princeton, New Jersey,LifeSciences is a worldglobal leader in medical technology. The Company was foundedregenerative tissue technologies and neurological solutions dedicated to limiting uncertainty for clinicians so they can focus on providing the best patient care. Founded in 1989 with the acquisition of an engineered collagen technology platform used to repair and regenerate tissue. Since then,tissue, Integra LifeSciences Holdings Corporation common stock trades on the Nasdaq Global Select Market (“Nasdaq”) under the symbol “IART.” Integra has developed numerous product lines from this technology for applications ranging from burn and deep tissue wounds to the repair of dura mater in the brain, as well as nerves and tendons. The Company has expanded its base regenerative technology business to include surgical instruments, neurosurgical products and advanced wound care and orthopedic hardware, through a combination of several global acquisitions and product development of products internally to further meet the evolving needs of its customers and impactenhance patient care.

Integra products are sold in more than 130 countries through a direct sales force as well as distributors and wholesalers. We manufacture and sell ourmedical technologies and products in two reportable business segments: Codman Specialty Surgical and Orthopedics and Tissue Technologies. Our Codman Specialty Surgical products comprise specialty surgical implants and instrumentation for a broad range of specialties. This segment includes products and solutions for dural access and repair, precision tools and instruments, advanced energy, cerebral spinal fluid ("CSF"CSS") management and neuro monitoring including market-leading product portfolios used in neurosurgery operation suites and critical care units. Our Orthopedics and Tissue Technologies product portfolios consist("TT"). The CSS segment, which represents approximately two-thirds of differentiated regenerative technology productsour total revenue, consists of market-leading technologies and instrumentation used for soft tissue repaira wide range of specialties, such as neurosurgery, neurocritical care and tissue regeneration products,otolaryngology. We are the world leader in neurosurgery and one of the top three providers in instruments used in precision, specialty, and general surgical procedures. Our TT segment generates about one-third of our overall revenue and focuses on three main areas: complex wound surgery, surgical reconstruction, and small bone fixation and joint replacement hardware products for both upper extremities and lower extremities. This business also includes private label sales of a broad set of our regenerative and wound care medicine technologies.peripheral nerve repair.

We have key manufacturing and research facilities located in California, Indiana, Maryland, Massachusetts, New Jersey, Ohio, Massachusetts,Puerto Rico, Tennessee, Texas, Canada,Utah, France, Germany, Ireland Switzerland, and Puerto Rico. Switzerland. We also source most of our handheld surgical instruments specialty metal and pyrocarbon implants, and dural sealant products through specialized third-party vendors.

We aspire to continue to be a worldwide leader in neurosurgery &and reconstructive surgery with a portfolio of leading businesses that delivers outstanding customer experienceexperiences through innovation, execution and teamwork to positively impact the lives of millions of patients and their families.

Integra is committed to delivering high quality products that positively impact the lives of millions of patients and their families. We focus on four key pillars of our strategy: 1) buildingenabling an execution-focused culture, 2) achievingoptimizing relevant scale, 3) improvingadvancing innovation and agility, and innovation, and 4) leading in customer experience. We believe that by sharpening our focus on these areas through improved planning and communication, optimization of our infrastructure, and strategically aligned tuck-in acquisitions, we can build scale, increase competitiveness and achieve our long-term goals.

To this end, the executive leadership team has established the following key priorities aligned to the following areas of focus:

Strategic Acquisitions. An important part of the our strategy is pursuing strategic transactions and licensing agreements that increase relevant scale in the clinical areas in which Integra competes. In 2019, we closed outOur growth strategy includes the acquisition of 45 transition service agreements, covering 90 countries, markingbusinesses, assets or products lines to increase the successful completionbreadth of our offerings, the integrationreach of our product portfolios and drive relevant scale to our customers. On December 6, 2022, the Codman NeurosurgeryCompany completed the acquisition of Surgical Innovation Associates, Inc. ("SIA"), which develops, markets and sells DuraSorb®, a resorbable synthetic matrix for plastic and reconstructive surgery. This acquisition will advance Integra’s global strategy in breast reconstruction, expanding plans to access the most significantU.S. market where SIA is pursuing pre-market approval for use in implant-based breast reconstruction ("IBBR"). We also continued to expand our product offering of regenerative technologies from our 2021 acquisition of ACell, Inc. ("ACell"), an innovative regenerative medicine company specializing in the Company’s history. This acquisition expanded our portfoliomanufacturing of neurosurgery productsporcine urinary bladder extracellular matrices. See Note 4, Acquisitions and established us asDivestitures, to the world leader in neurosurgery. It has also enabled usNotes to bring our entire product portfolio to a global market. In 2019, Integra acquired Arkis Biosciences, Inc. and Rebound Therapeutics Corporation, bothConsolidated Financial Statements (Part IV, Item 15 of which align with Company’s strategy to acquire and develop innovative technologies that address unmet needs in patient care.this Annual Report on Form 10-K) for additional details.

As such, we may opportunistically divest businesses or discontinue products where we see limited runway for future value creation in line with our aspirations due in part to changes in the market, business fundamentals or the regulatory environment.

4

In August 2022, we completed the sale of our non-core traditional wound care ("TWC") business to Gentell, LLC ("Gentall") for $28.8 million, which consists of $27.8 million in cash plus $1.0 million in contingent consideration which may be received upon the achievement of certain revenue-based performance milestones. In January 2021, we completed the sale of our Extremity Orthopedics business to Smith & Nephew USD Limited ("Smith & Nephew"), a subsidiary of Smith & Nephew plc, for approximately $240 million in cash. Our portfolio optimization actions over the past two years have allowed us to increase our focus on Integra’s core portfolio of market-leading products in neurosurgery, surgical instrumentation and product franchisesregenerative tissue and moves us closer to achieving our long-term organic growth and profitability targets. See Note 4, Acquisitions and Divestitures, to the Notes to Consolidated Financial Statements (Part IV, Item 15 of this Annual Report on Form 10-K) for discontinuation.additional details.

Commercial Channel Investments.Investments With acquisitions, new product introductions and a broader portfolio of products, investing. Investing in our sales channels is a core part of our strategy to create specialization and greater focus on reaching new and existing customers and addressing their needs. To support our commercial efforts in Tissue Technologies, we utilize a two-tier specialist model to increase our presence in focused segments to help serve the evolving needs of our customers. In addition, we continue to build upon our leadership brands across our product franchises in both CSS and TT to engage customers through enterprise-wide contracts with leading hospitals, integrated delivery networks and global purchasing organizations in the United States. Internationally, we have increased our commercial resources significantly in manykey emerging markets and are making investments to support our sales organization and maximize our commercial opportunities. We nowDomestically, we have a strongalso increased our TT sales force in the United States to support the expanded regenerative tissue product portfolio that includes ACell products. These investments in our international and domestic sales channel that will deliver our current portfolio as well as position us well for expansion. In addition, we continue to build upon our leadership brands across our product franchises to enable us to engage hospital systems through enterprise-wide contracts.expansion and long-term growth.

Customer Experience. We aspire to be ranked as a best-in-class provider and are committed to strengthening our relationships with all customers. We strive to consistently deliver outstanding customer service and continue to invest in technologies, systems and processes to improveenhance the way our customers do business with us. Additionally,customer experience. In 2022, we expectoutsourced certain transactional back-office finance and customer service activities to enhance customer quality, build on the success of our professional educationscale for future growth, and capture cost efficiencies. We also launched digital tools and programs, resources and virtual product training to drive continued customer familiarity with our growing portfolio of medical technologies globally. .

BUSINESS SEGMENTS

Codman Specialty Surgical

In 2022, we made progress to several enhancements to our CUSA Clarity Tissue Ablation System. The acquisitionextended laparoscopic tip was launched in the U.S. to enhance laparoscopic liver procedures. In addition, a single-sided bone tip received 510(k) clearance. Commercial launch is expected in the first quarter of Codman Neurosurgery from Johnson & Johnson increased2023. We continue to update our global direct sales representationCUSA Clarity platform by incorporating new ultrasonic handpiece and commercial presence. This acquisition expandedintegrated electrosurgical capabilities.

Moreover, we are expanding into minimally invasive surgery ("MIS") and the product portfoliosurgical management of intracerebral hemorrhages ("ICH"), with the 2021 clinical launch of Aurora® Surgiscope®, a proprietary surgical solution with integrated visualization and capabilities designed specifically for use in deep-seated brain lesions. We continue to gather clinical evidence using this same technology for early surgical intervention of ICH. We believe this technology offers the promise of transforming the standard of care in neurosurgery. In 2022, we launched the Aurora® Evacuator with Coagulation device in the U.S., designed to be used in conjunction with our well known, leading technologiesAurora Surgiscope to safely address and evacuate blood in dural repair, ultrasonic tissue ablation, intracranial pressure ("ICP") monitoring, hydrocephalus management, and cranial stabilization systems, while providing a rich research and development pipeline for growth.the brain caused by hemorrhagic stroke.

Rounding out the portfolio is a catalog of surgical headlamps and surgical instrumentation, as well as asset management software and support, and after-market service. With thousands of surgical instrument products, including specialty surgical instruments, we call on the central sterile processing unit of hospitals and acute care surgical centers. Additionally, through a strong U.S. distribution model, we can serve the needs of hundreds of physician, dentalmedical offices.

We also expanded our product offerings in 2021 with the launch of our new intracranial pressure ("ICP") monitoring system, CereLink® in the U.S. and veterinary offices.Europe and continued the global rollout in the first half of 2022. See additional discussion regarding certain matters with CereLinkunder "Item 1A. Risk Factors" under the heading Risks Related to our Regulatory Environment

5

and under "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations - General - FDA Matters" of this Annual Report on Form 10-K.

Our global commercial network includes clinical specialists, a large direct global sales force and strategic partnerships and distributors that serve hospitals, integrated health networks, group purchasing organizations, clinicians, surgery centers and health care providers.

Outside the U.S., we have a smallcombination of direct and indirect sales presence, primarilychannels in certain European countries, Australia, New Zealand, and Canada, and use distributors in other international markets to sell certain product lines.

This business segment also includes private-label sales of a broad set of our regenerative and wound care technologies. Our customers are other medical technology companies that sell to end markets primarily in orthopedics, spine, surgical and wound care.

COMPETITION

Our competitors for Codman Specialty SurgicalCSS are the Aesculap division of B. Braun Medical, Inc., Medtronic, Inc., Stryker Corporation, and Becton Dickinson and Company.Company, and B. Braun Medical, Inc. In addition, we compete with many smaller specialized companies and larger companies that do not otherwise focus on the offerings of Codman Specialty Surgical technologies. We rely on the depth and

breadth of our sales and marketing organization, our innovative technology,technologies, and our procurement and manufacturing operations to maintain our competitive position.

Our competition in Orthopedics and Tissue Technologiesfor TT includes the DePuy/Synthes business of Johnson & Johnson, ACell, Inc., Stryker Corporation, Wright Medical Group, N.V., Smith & Nephew plc, Organogenesis Holdings Inc., MiMedx Group, Inc., LifeCell Corporation, a subsidiary of Allergan PLC, Becton Dickinson and Zimmer Biomet Holdings,Company, and Axogen, Inc., as well as other major orthopedic We compete with many additional companies that carry a full line of small bone and joint fixation andwho partially participate in soft tissue products.

Our research and development activities focus on identifying unmet surgical needs and addressing those needs with innovative solutions and products. We apply our core competency in regenerative technology to innovate products for neurosurgical, wound applications, plastic surgery, and reconstructive surgery and we have extensive R&D development programs for our core platforms of electromechanical technologies. Additionally, we conduct products and clinical studies to generate efficacy and health economic evidence.

Regenerative Technologies.Integra was the first company to receive a FDA claim for regeneration of dermal tissue and is a world leader in regenerative technology. Because regenerative technology products represent a fast-growing, high-margin opportunity for us, we allocate a large portion of our research and development budget to these projects. Our regenerative technology development program applies our expertise in bioengineering to a range of biomaterials including natural materials such as purified collagen, intact human or animal tissues, honey as well as resorbable synthetic polymers with our DuraSorband DuraSealproduct lines. These unique product designs are used for neurosurgical and reconstructive surgical applications, as well as dermal regeneration, including the healing of chronic and acute wounds, tendon and nerve repair. Our regenerative

6

technology platform includes our legacy Integra® Dermal Regeneration Template ("IDRT") products and complementary technologies that we have acquired. Our collagen manufacturing capability, combined with our history of innovation, including our launch of NeuraGen 3D, provides us with strong platform technologies for multiple indications.

In 2020, we announced positive clinical and economic data on Integra® Bilayer Wound Matrix ("IBWM") in complex lower extremity reconstruction based on two retrospective studies recently published in Plastic and Reconstructive Surgery, the official journal of the American Society of Plastic Surgeons. As surgeons look for ways to efficiently and effectively repair and close wounds, IBWM helps address the efficiency needed in operating rooms by reducing both the operating time and costs to hospitals and patients. In 2021, we completed one of the largest diabetic foot ulcers ("DFU"), randomized controlled trials of the PriMatrix® Dermal Repair Scaffold for the management of DFU. This multi-center study enrolled more than 225 patients with chronic DFU's over the course of 12-week treatments and 4-week follow-up phases. The results of this study, which was published in the Journal of Wound Care, demonstrated that PriMatrix plus standard of care ("SOC") consisting of sharp debridement, infection elimination, use of dressings and offloading was significantly more likely to achieve complete wound closure compared with SOC alone, with a median number of one application of the product. Integra is currently pursuing pre-market approval for implant-based breast reconstruction with our Surgimend product. In 2022, we acquired SIA, which is also pursuing a pre-market approval for IBBR. By offering two distinct product solutions, we believe we have the opportunity to build a leading position in the market. We completed design control activities in 2022 for a Q1 2023 launch of Cytal and MicroMatrix in Europe and a pilot launch of the Cardion Pericardial Patch to gain clinical experience for finding a private label partner for that product.

Electromechanical Technologies and Instrumentation. Because our electromechanical products and instruments address significant needs in surgical procedures and limit uncertainty for surgeons, we continue to invest in approvals for new indications and next generation improvements to our market-leading products. We have several active programs focused on life cycle management and innovation for capital and disposable products in our portfolio. Our product development efforts are focused on core clinical applications in cerebrospinal fluid ("CSF") management, neuro-critical care monitoring, minimally invasive instruments and electrosurgery and ultrasonic medical technologies, as well as our ambition to transform the standard of care in neurosurgery with product advancements in MIS and ICH. Our lighting franchise is among the most dynamic in the industry.

We are focused on the development of core clinical applications in our electromechanical technologies portfolio. In 2022, we made progress to several enhancements to our CUSA Clarity Tissue Ablation System. The extended laparoscopic tip was launched in the U.S. to enhance laparoscopic liver procedures. In addition, a manufacturersingle-sided bone tip received 510(k) approval. Commercial launch is expected in the first quarter of 2023. We continue to update our CUSA Clarity platform by incorporating new ultrasonic handpiece and marketerintegrated electrosurgical capabilities. We continue to work with several instrument partners to bring new surgical instrument platforms to the market.

We are focused on the development of medical devices,core clinical applications in our electromechanical technologies portfolio. In June 2022, we launched the Neutus® EVD system, our first external ventricular drain (“EVD") in China. The Neutus EVD system is manufactured in China by Shanghai Haoju Medical Technology Co., Ltd. under an exclusive distribution arrangement. The device is used in the management of cerebrospinal fluid and therefore are subjectis highly complementary to extensive regulation byour Bactiseal® catheter and advanced intercranial pressure monitoring products.

In the third quarter of 2021, we launched our CereLink ICP Monitor System in the U.S. and Europe and continued the global rollout in the first half of 2022.On August 18, 2022, the Company, after consultation with the FDA the Center for Medicare Servicesand other regulatory authorities outside of the U.S. DepartmentUnited States, initiated an immediate voluntary global product removal of Health all CereLink® intracranial pressure monitors. See Item 1A. Risk Factors, under the heading Risks Related to our Regulatory Environment and Human Services, other federal governmental agenciesunder Item 7. General Management's Discussion and Analysis of Financial Condition and Results of Operations - FDA Matters of this Annual Report on Form 10-K for further discussion.

In 2022, we continued to advance the early-stage technology platforms we acquired in some jurisdictions, by state2019. Through the acquisition of Arkis Biosciences, Inc. ("Arkis") we added a platform technology, CerebroFlo® external ventricular drainage ("EVD"), catheter with Endexo® technology, a permanent additive designed to reduce the potential for catheter obstruction due to thrombus formation. The CerebroFlo EVD Catheter has demonstrated an average of 99% less thrombus accumulation onto its surface, in vitro, compared to a market leading EVD catheter. Our work to combine our bactiseal antimicrobial technology with the Endexo anti-occlusive technology obtained through our 2019 acquisition of Arkis continues to progress for both a silicone-based hydrocephalus and foreign governmental authorities. These regulations governEVD project.

In 2019, we also acquired Rebound Therapeutics Corporation ("Rebound Therapeutics"), a company that specialized in single-use medical device, known as Aurora Surgiscope, which is the introductiononly tubular retractor system designed for cranial surgery with an integrated access channel, camera and lighting. In the third quarter of new medical devices, the observance of certain standards with respect to the design, manufacture, testing, labeling, promotion and sales2021, we conducted a limited clinical launch of the devices,Aurora Surgiscope for use in minimally invasive neurosurgery as well as initiated a registry called MIRROR to collect data on early surgical intervention using this same technology platform for the maintenancetreatment of certain records,ICH. In 2022, we launched the ability to track devices, the reporting of potential product defects, the import and export of devices, and other matters.Aurora®

7

In November 2017, the FDA issued the final guidance document relatedgeneral, raw materials essential to human tissue titled, “Regulatory Considerationsour businesses are readily available from multiple sources. For reasons of quality assurance, availability, or cost effectiveness, certain components and raw materials are available only from a sole supplier. Our practice is to maintain sufficient inventory of components so that our production will not be significantly disrupted even if a particular component or material is not available for Human Cells, Tissues, and Cellular and Tissue-Based Products: Minimal Manipulation and Homologous Use” (the “HCT/P Final Guidance”). The HCT/P Final Guidance maintains the FDA’s position that products such as the company’s morselized amniotic membrane tissue-based products do not meet the criteria for regulation solely as HCT/Ps. In addition, the FDA articulated a risk-based approach to enforcement and, while some uses for amniotic membrane tissue-based products would have as much as thirty-six monthsperiod of enforcement discretion, other high risk uses could be subject to immediate enforcement action. The company does not believe the uses for its amniotic membrane tissue-based products fall into the high-risk category. As of February 21, 2020, the company has not received any further notice of enforcement action from the FDA regarding its morselized amniotic tissue-based products. Nonetheless, we can make no assurances that the FDA will continue to exercise its enforcement discretion with respect to the company’s morselized amniotic membrane tissue-based products, and any potential action of the FDA could have a financial impact regarding the sales of such products. The company has been considering and continues to consider regulatory approval pathways for its morselized amniotic membrane tissue-based products.time.

INTELLECTUAL PROPERTY

We seek patent and trademark protection for our key technology, products and product improvements, both in the U.S. and in selected foreign countries. When determined appropriate, we have enforced and plan to continue to enforce and defend our patent and trademark rights. In general, however, we do not rely solely on our patent and trademark estate to provide us with any significant competitive advantages as it relates to our existing product lines. We also rely upon trade secrets and continuing technological innovations to develop and maintain our competitive position. In an effort to protect our trade secrets, we have a policy of requiring our employees, consultants and advisors to execute proprietary information and invention assignment agreements upon commencement of employment or consulting relationships with us. These agreements also provide that all confidential information developed or made known to the individual during the course of their relationship with us must be kept confidential, except in specified circumstances.

AccuDrain®, AmnioExcel®, AmnioMatrixAquasonic®, BioDFactorAuragen®, Aurora® Surgiscope®, Bactiseal®, BioDFence®, BioDOptix®, BioDRestore™, BioguardBrainet®, BioMotion®, Bold®, Budde®, Buzz™, CadenceCereLink®, Capture™,CerebroFlo® EVD Catheter with Endexo® Technology, Codman®, Codman Accu-Flo®, Codman Bicol®, Codman®Certas®Plus, Codman® Hakim®Programmable valve, Codman Holter®, Codman ICP Express®, Codman Microsensor®, Codman VersaTru®, Codman VPV®, Contour-Flex®, Cranioplastic®,CRW®, CRW Precision™, Ctherm™, CUSA®, DigiFuseCytal®, DirectLink®, DuraGen®, DuraSeal®, First ChoiceDuraSorb®,, Hallu Gentrix®, HeliCote®, HeliPlug®, HeliTape®,, HeliMend®, Helistat®, Helitene®, Hermetic™, Hy-Tape®, Integra®, IntegraLink®, , IPP-ON®, Isocool®, Jarit®, Lead-Lok™, Licox®, LimiTorr™, Luxtec®, Mayfield®, MediHoneyMatriStem UBM™, MediHone®, MemoFix®y®, MicroFrance®, MicroMatrix®,Miltex®, MovementMischler™, MoniTorr ICP™, Natus®, NeuraGen®, NeuraWrap™, NuGripNicolet®, Omnigraft®, Omni-Tract®, OSV II®, Qwix®, Padgett®, Panta®, PriMatrix®, PyroSphere®Pureflow™, Q-Snor™, Redmond™, Revize™, Ruggles®, SafeGuardSignacreme®, Salto Talaris®, Subtalar MBA®, SurgiMend®, TCC-EZ®, TenoGlide®, Ti6®, Tibiaxys®, TissueMend®, Titan™ Ultra VS™, TruArchVersaTru®, Uni-CP®, Uni-Clip®, Xtrasorb®, zRIP™, and the Integra logo are some of the material trademarks of Integra LifeSciences Corporation and its subsidiaries. MAYFIELD® is a registered trademark of SM USA, Inc., and is used by Integra under license.

SEASONALITY

Revenues during our fourth quarter tend to be stronger than other quarters because many hospitals increase their purchases of our products during the fourth quarter to coincide with the end of their budget cycles in the U.S. In general, our first quarter usually has lower revenues than the preceding fourth quarter, the second and third quarters have higher revenues than the first quarter, and the fourth quarter revenues are the highest in the year. The main exceptions to this pattern occur because of material intervening acquisitions.acquisitions as well as impacts of the COVID-19 pandemic.

GOVERNMENT REGULATION AND COMPLIANCE

We are a manufacturer and marketer of medical devices and Human Tissue and Cell Based Products ("HCT/Ps") and therefore are subject to extensive regulation by the FDA, the Center for Medicare Services of the U.S. Department of Health and Human Services, other federal governmental agencies and, in some jurisdictions, by state and foreign governmental authorities. These regulations govern the introduction of new medical devices and HCT/Ps, the observance of certain standards with respect to the design, manufacture, testing, labeling, promotion and sales of the products, the maintenance of certain records, the ability to track devices, the reporting of potential product defects, the import and export of products, and other matters.

8

United States Food and Drug Administration

Our products are subject to extensive regulation particularly as to safety, efficacy and adherence to FDA Quality System Regulation, and related manufacturing standards. Medical device products are subject to rigorous FDA and other governmental agency regulations in the United States and similar regulations of foreign agencies abroad. The FDA regulates the design, development, research, preclinical and clinical testing, introduction, manufacture, advertising, labeling, packaging, marketing, distribution, import and export, and record keeping for such products, in order to ensure that medical products distributed in the United States are safe and effective for their intended use. In addition, the FDA is authorized to establish special controls to provide reasonable assurance of the safety and effectiveness of most devices. Non-compliance with applicable requirements can result in import detentions, fines, civil and administrative penalties, injunctions, suspensions or losses of regulatory approvals, recall or seizure of products, operating restrictions, refusal of the government to approve product export applications or allow us to enter into supply contracts, and criminal prosecution. The regulatory process for obtaining product approvals and clearances can be onerous and costly. The FDA requires, as a condition to marketing a medical device in the U.S., that we secure a Premarket Notification clearance pursuant to Section 510(k) of the Federal Food, Drug and Cosmetic Act (the "FD&C Act"), or an approved PMA application (or supplemental PMA application). Obtaining these approvals and clearances can take up to several years and may involve preclinical studies and clinical trials. The FDA also may require a post-approval clinical study as a condition of approval. To perform clinical trials for significant risk devices in the U.S. on an unapproved product, we are required to obtain an Investigational Device Exemption from the FDA. The FDA also may require a filing for approval prior to marketing products that are modifications of existing products or new indications for existing products. Moreover, after clearance/approval is given, if the product is shown to be hazardous or defective, the FDA and foreign regulatory agencies have the power to withdraw the clearance or approval, as the case may be, or require us to change the device, its manufacturing process or its labeling, to supply additional proof of its safety and effectiveness or to recall, repair, replace or refund the cost of the medical device. Because we currently export medical devices manufactured in the U.S. that have not been approved by the FDA for distribution in the U.S., we are required to obtain approval/registration in the country to which we are exporting and maintain certain records relating to exports and make these available to the FDA for inspection, if required.

Human Cells, Tissues and Cellular and Tissue-Based Products

Integra, through its wholly-owned subsidiary BioD LLC ("BioD"), is involved with the recovery, processing, storage, transportation and distribution of donated amniotic tissue. The FDA has specific regulations governing HCT/Ps. An HCT/P is a product containing, or consisting of, human cells or tissue intended for transplantation into a human patient. Examples of HCT/Ps include bone, ligament, skin and cornea.

Some HCT/Ps fall within the definition of a biological product, medical device or drug regulated under the FD&C Act. These biologic, device or drug HCT/Ps must comply both with the requirements exclusively applicable to HCT/Ps and, in addition, with requirements applicable to biologics, devices or drugs, including premarket clearance or approval from the FDA.

Section 361 of the Public Health Service Act ("Section 361") authorizes the FDA to issue regulations to prevent the introduction, transmission or spread of communicable disease. HCT/Ps regulated as “361” HCT/Ps are subject to requirements relating to registering facilities and listing products with the FDA, screening and testing for tissue donor eligibility, and Good Tissue Practices when processing, storing, labeling, and distributing HCT/Ps, including required labeling information, stringent record keeping, and adverse event reporting.

The American Association of Tissue Banks ("AATB") has issued operating standards for tissue banking. Compliance with these standards is a requirement in order to become an AATB-accredited tissue establishment. In addition, some states have their own tissue banking regulations. We are licensed or have permits for tissue banking in California, Delaware, Illinois, Maryland, New York, Oregon, and Tennessee. In Tennessee, we are registered with the FDA Center for Biological Evaluations and Research.

Procurement of certain human organs and tissue for transplantation is subject to the restrictions of the National Organ Transplant Act, which prohibits the transfer of certain human organs, including skin and related tissue for valuable consideration, but permits the reasonable payment associated with the removal, transportation, implantation, processing, preservation, quality control and storage of human tissue and skin. BioD is a registered Tissue Bank and is involved with the recovery, storage and transportation of donated human amniotic tissue.

On June 22, 2015, the FDA issued an Untitled Letter (the "Untitled Letter") alleging that BioD's morselized amniotic membrane tissue-based products do not meet the criteria for regulation as HCT/Ps solely under Section 361 and that, as a result, BioD would need a biologics license to lawfully market those morselized products. Since the issuance of the Untitled Letter, BioD and the Company has made known to the FDA their disagreement with the FDA’s assertion that certain products are more than minimally manipulated. The FDA has not changed its position that certain of the BioD acquired products are not eligible for marketing solely under Section 361. In July 2020, the FDA issued the final guidance document related to human tissue titled, “Regulatory Considerations for Human Cells, Tissues, and Cellular and Tissue-Based Products: Minimal Manipulation and Homologous Use” (the “2020 HCT/P Final Guidance”). The 2020 HCT/P Final Guidance document supersedes the November 2017 guidance by the same title.

9

The HCT/P Final Guidance maintains the FDA’s position that products such as the Company’s morselized amniotic membrane tissue-based products do not meet the criteria for regulation solely as HCT/Ps. In addition, in the November 2017 guidance, the FDA articulated a risk-based approach to enforcement and, while some uses for amniotic membrane tissue-based products would have as much as thirty-six months of enforcement discretion, other high risk uses could be subject to immediate enforcement action. The 2020 HCT/P Final Guidance maintained this approach and extended the discretionary enforcement period to May 31, 2021.

Considering the risk of enforcement action, the Company discontinued the manufacturing of all morselized amniotic membrane tissue-based products prior to May 31, 2021. We no longer distribute these products. As of December 31, 2022, the Company has not received any further notice of enforcement action from the FDA regarding its morselized amniotic membrane tissue-based products.

Medical Device Regulations

Unless an exemption applies, the FDA requires that a manufacturer introducing a new medical device or a new indication for use of an existing medical device obtain either a Section 510(k) premarket notification clearance or a PMA, before introducing it into the U.S. market. The type of marketing authorization is generally linked to the classification of the device. The FDA classifies medical devices into one of three classes (Class I, II or III) based on the degree of risk the FDA determines to be associated with a device and the level of regulatory control deemed necessary to ensure the device’s safety and effectiveness.

The process of obtaining a Section 510(k) clearance generally requires the submission of performance data and often clinical data, which in some cases can be extensive, to demonstrate that the device is “substantially equivalent” to a device that was on the market before 1976 or to a device that has been found by the FDA to be “substantially equivalent” to such a pre-1976 device, a predecessor device is referred to as “predicate device.” As a result, FDA clearance requirements may extend the development process for a considerable length of time. In addition, in some cases, the FDA may require additional review by an advisory panel, which can further lengthen the process. The PMA process, which is reserved for new devices that are not substantially equivalent to any predicate device and for high-risk devices or those that are used to support or sustain human life, may take several years and requires the submission of extensive performance and clinical information.

Medical devices can be marketed only for the indications for which they are cleared or approved. After a device has received 510(k) clearance for a specific intended use, any change or modification that significantly affects its safety or effectiveness, such as a significant change in the design, materials, method of manufacture or intended use, may require a new 510(k) clearance or PMA approval and payment of an FDA user fee. The determination as to whether or not a modification could significantly affect the device’s safety or effectiveness is initially left to the manufacturer using available FDA guidance; however, the FDA may review this determination to evaluate the regulatory status of the modified product at any time and may require the manufacturer to cease marketing and recall the modified device until 510(k) clearance or PMA approval is obtained. The manufacturer may also be subject to significant regulatory fines or penalties.

We also are required to register with the FDA as a medical device manufacturer and any devices we manufacture and distribute pursuant to clearance or approval by the FDA are subject to pervasive and continuing regulation by the FDA and certain state agencies. These include product listing and establishment registration requirements, which help facilitate FDA inspections and other regulatory actions, and our manufacturing sites are subject to periodic inspection by the FDA for compliance with the FDA's Quality System Regulations. These regulations require that we manufacture our products and maintain our documents in a prescribed manner with respect to design, manufacturing, testing and control activities. Further, we are required to comply with various FDA requirements and other legal requirements for labeling and promotion. If the FDA believes that a company is not in compliance with applicable regulations, it may issue a warning letter, institute proceedings to detain or seize products, issue a recall order, impose operating restrictions, enjoin future violations and assess civil penalties against that company, its officers or its employees and may recommend criminal prosecution to the U.S. Department of Justice. All Integra manufacturing facilities participate in the Medical Device Single Audit Program and are audited annually for compliance with the Quality System for US FDA, Canada, Australia, Brazil, and Japan.

Medical device regulations also are in effect in many of the countries in which we do business outside the U.S. In the European Economic Area ("EEA"), which is comprised of the 27 member states of the European Union plus Norway, Iceland and Liechtenstein, medical devices need to comply with specific requirements. These requirements were previously known as "Essential Requirements" under the former EU Medical Devices Directive (Council Directive 93/42/EEC, or MDD) and are now defined "General Safety and Performance Requirements (GSPR)" under the new EU Medical Devices Regulation (Regulation (EU) 2017/745, or "EU MDR"). Although the requirements set forth in the EU MDR are generally consistent with those laid out in the MDD (with a few exceptions), the EU MDR is intended, among other things, to establish a uniform, transparent, predictable and sustainable regulatory framework across the EEA for medical devices and ensure a high level of safety and health while supporting innovation. These laws range from comprehensive medical device approval and Quality System requirements for some or all of our medical device products to simpler requests for product data or certifications. Under the European Union Medical Device Directive, medical devices must meet the Medical Device Directive standards and receive

10

CE Mark Certification prior to marketing in the EEA. Although we continue to transition our certification profile to meet the new EU MDR requirements, these stricter regulations set forth in the EU MDR may pose additional challenges for Integra to continue marketing products in the EU as these regulations come into force. See “Item 1A. Risk Factors - We are subject to stringent domestic and foreign medical device regulations and oversight and any adverse action may adversely affect our ability to compete in the marketplace and our financial condition and business operations” of this Annual Report on Form 10-K.

CE Mark Certification requires a comprehensive quality system program, technical documentation, clinical evaluation and data on the product which are then reviewed, by a Notified Body. A Notified Body is an organization designated by the national governments of the EU member states to make independent judgments about whether a product complies with the requirements established by each CE marking directive. The Medical Device Directive, Medical Device Regulation, ISO 9000 series and ISO 13485 are recognized international quality standards that are designed to ensure that we develop and manufacture quality medical devices. Other countries are also instituting regulations regarding medical devices or interpreting and enforcing existing regulations more strictly. Compliance with these regulations requires extensive documentation and clinical reports for our products, revisions to labeling, and other requirements such as facility inspections to comply with the registration requirements. A recognized Notified Body audits our facilities annually to verify our compliance with the ISO 13485 Quality System standard.

Certain countries, as well as the EU, have issued regulations that govern products that contain materials derived from animal sources. Regulatory authorities are particularly concerned with materials infected with the agent that causes BSE. These regulations affect our dermal regeneration products, duraplasty products, hernia repair products, biomaterial products for the spine, nerve and tendon repair products and certain other products, all of which contain material derived from bovine tissue. Although we take great care to provide that our products are safe and free of agents that can cause disease, products that contain materials derived from animals, including our products, may become subject to additional regulation, or even be banned in certain countries, because of concern over the potential for prion transmission. Significant new regulations, a ban of our products, or a movement away from bovine-derived products because of an outbreak of BSE could have a material, adverse effect on our current business or our ability to expand our business. See “Item 1A. Risk Factors – Risks Related to our Regulatory Environment" of this Annual Report on Form 10-K.

Postmarket Requirements. After a device is cleared or approved for commercial distribution, numerous regulatory requirements apply. These include the FDA Quality System Regulations which cover the procedures and documentation of the design, testing, production, control, quality assurance, labeling, packaging, sterilization, storage and shipping of medical devices; the FDA's general prohibition against promoting products for unapproved or 'off-label' uses; the Medical Device Reporting regulation, which requires that manufacturers report to the FDA if their device may have caused or contributed to a death or serious injury or malfunctioned in a way that would likely cause or contribute to a death or serious injury if it were to recur; and the Reports of Corrections and Removals regulation, which require manufacturers to report recalls and field corrective actions to the FDA if initiated to reduce a risk to health posed by the device or to remedy a violation of the FD&C Act. Postmarket requirements are also followed globally where our products are registered and approved. These foreign jurisdictions have similar requirements to the FDA which include reporting requirements such as adverse events and recalls.

Other regulations

Anti-Bribery Laws. In the U.S., we are subject to laws and regulations pertaining to healthcare fraud and abuse, including anti-kickback laws and physician self-referral laws that regulate the means by which companies in the health care industry may market their products to hospitals and health care professionals and may compete by discounting the prices of their products. Similar anti-bribery laws exist in many of the countries in which we sell our products outside the U.S., as well as the United States Foreign Corrupt Practices Act (which addresses the activities of U.S. companies in foreign markets). Our products also are subject to regulation regarding reimbursement, and U.S. healthcare laws apply when a customer submits a claim for a product that is reimbursed under a federally funded healthcare program. These global laws require that we exercise care in designing our sales and marketing practices, including interactions with healthcare professionals, and customer discount arrangements. See “Item 1A. Risk Factors – We are exposed to a variety of risks relating to our international sales and operations” of this Annual Report on Form 10-K for further details.

Import-export. Our international operations subject us to laws regarding sanctioned countries, entities and persons, customs, and import-export. Among other things, these laws restrict, and in some cases can prevent, U.S. companies from directly or indirectly selling goods, technology or services to people or entities in certain countries. In addition, these laws require that we exercise care in our business dealings with entities in and from foreign countries.

Hazardous materials. Our research, development and manufacturing processes involve the controlled use of certain hazardous materials. We are subject to country-specific, federal, state and local laws and regulations governing the use, manufacture, storage, handling and disposal of these materials and certain waste products. We believe that our environmental, health and safety procedures for handling and disposing of these materials comply with the standards prescribed by the controlling laws and regulations. However, risk of accidental releases or injury from these materials is possible. These risks are managed to minimize or eliminate associated business impacts. In the event of this type of accident, we could be held liable for damages

11

and face a liability that could exceed our resources. We could be subject to a regulatory shutdown of a facility that could prevent the distribution and sale of products manufactured there for a significant period of time, and we could suffer a casualty loss that could require a shutdown of the facility in order to repair it, any of which could have a material, adverse effect on our business. Although we continuously strive to maintain full compliance with respect to all applicable global environmental, health and safety laws and regulations, we could incur substantial costs to fully comply with future laws and regulations, and our operations, business or assets may be negatively affected. Furthermore, global environmental, health and safety compliance is an ongoing process. Integra has compliance procedures in place for compliance with Employee Health & Safety laws, driven by a centrally led organizational structure that ensures proper implementation, which is essential to our overall business objectives.

In addition to the above regulations, we are, and may be, subject to regulation under country-specific federal and state laws, including, but not limited to, requirements regarding record keeping, and the maintenance of personal information, including personal health information. As a public Company, we are subject to the securities laws and regulations, including the Sarbanes-Oxley Act of 2002. We also are subject to other present and could be subject to possible future, local, state, federal and foreign regulations.

Third-Party Reimbursement. Healthcare providers that purchase medical devices generally rely on third-party payors, including, in the U.S., the Medicare and Medicaid programs and private payors, such as indemnity insurers, employer group health insurance programs and managed care plans, to reimburse all or part of the cost of the products. As a result, demand for our products is and will continue to be dependent in part on the coverage and reimbursement policies of these payors. The manner in which reimbursement is sought and obtained varies based upon the type of payor involved and the setting in which the product is furnished and utilized. Reimbursement from Medicare, Medicaid and other third-party payors may be subject to periodic adjustments as a result of legislative, regulatory and policy changes, as well as budgetary pressures. Possible reductions in, or eliminations of, coverage or reimbursement by third-party payors, or denial of, or provision of uneconomical reimbursement for new products may affect our customers' revenue and ability to purchase our products. Any changes in the healthcare regulatory, payment or enforcement landscape relative to our customers' healthcare services have the potential to significantly affect our operations and revenue.

Data Privacy and Cybersecurity Laws and Regulations. As a business with a significant global footprint, compliance with evolving regulations and standards in data privacy and cybersecurity (relating to the confidentiality and security of our information technology systems, products such as medical devices, and other services provided by us) may result in increased costs, lower revenue, new complexities in compliance, new challenges for competition, and the threat of increased regulatory enforcement activity. Our business relies on the secure electronic transmission, storage and hosting of sensitive information, including personal information, financial information, intellectual property, and other sensitive information related to our customers and workforce.

For example, in the U.S., the collection, maintenance, protection, use, transmission, disclosure and disposal of certain personal information and the security of medical devices are regulated at the U.S. federal and state, and industry levels. U.S. federal and state laws protect the confidentiality of certain patient health information, including patient medical records, and restrict the use and disclosure of patient health information by health care providers. For example, in the U.S. we are obligated to comply with the requirements of the Health Insurance and Portability Act of 1996, as amended by the Health Information Technology for Economic and Clinical Health Act of 2009 (collectively, “HIPPA”). Under HIPAA, the Department of Health and Human Services has issued regulations, including the HIPAA Privacy, Security and Breach Notification Rules, to protect the privacy and security of protected health information used or disclosed by covered entities including health care providers and their business associates, as well as covered subcontractors. HIPAA also regulates standardization of data content, codes and formats used in health care transactions and standardization of identifiers for health plans and providers. Penalties for violations of HIPAA regulations include significant civil and criminal penalties for each violation. In addition, the FDA has issued guidance advising manufacturers to take cybersecurity risks into account in product design for connected medical devices and systems, to assure that appropriate safeguards are in place to reduce the risk of unauthorized access or modification to medical devices that contain software and reduce the risk of introducing threats into hospital systems that are connected to such devices. The FDA also issued guidance on post market management of cyber security in medical devices.

Outside the U.S., we are impacted by the privacy and data security requirements at the international, national and regional level, and on an industry specific basis. Legal requirements in these countries relating to the collection, storage, handling and transfer of personal data and, potentially, intellectual property continue to evolve with increasingly strict enforcement regimes. In Europe, for example, we are subject to EU General Data Protection Regulation ("GDPR") which requires member states to impose minimum restrictions on the collection, use and transfer of personal data and includes, among other things, a requirement for prompt notice of data breaches to data subjects and supervisory authorities in certain circumstances and significant fines for non-compliance. The GDPR also requires companies processing personal data of individuals residing in the EU to comply with EU privacy and data protection rules.

12

Please refer to “Item 1A. Risk Factors – We are subject to requirements relating to information technology which could adversely affect our business” of this Annual Report on Form 10-K for additional discussion of the risks accompanying compliance with data privacy and cybersecurity laws and regulations.

These laws and regulations impact the ways in which we use and manage personal data, protected health information, and our information technology systems. They also impact our ability to move, store, and access data across geographic boundaries. Compliance with these requirements may require changes in business practices, complicate our operations, and add complexity and additional management and oversight needs. They also may complicate our clinical research activities, as well as product offerings that involve transmission or use of clinical data.

HUMAN CAPITAL

Workforce Demographics

As of December 31, 2022, we had approximately 3,722 regular full and part time employees and 874 contingent, subcontracted, and outsourced partners.

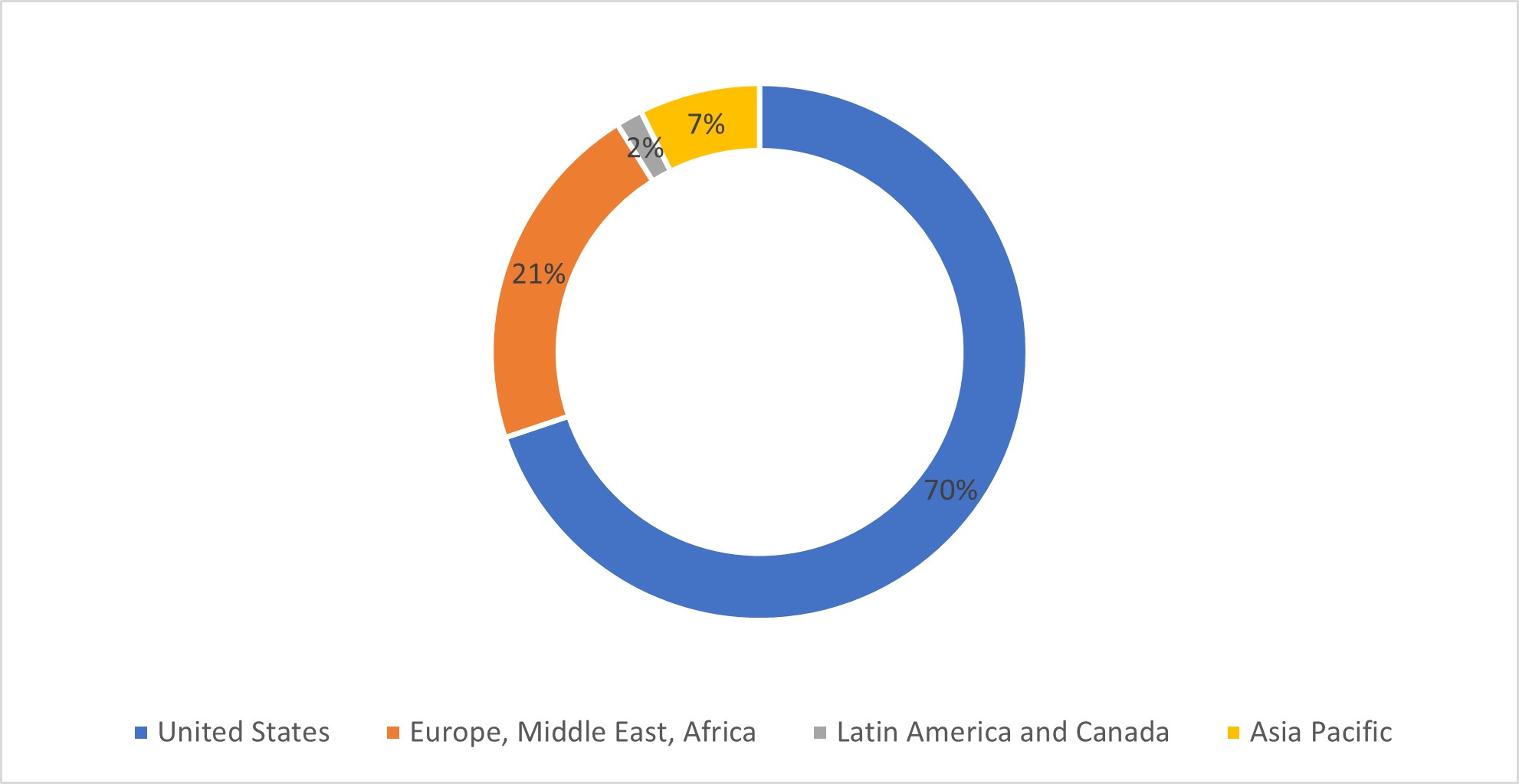

70% of our employees are located in the United States, 21% in Europe, 2% in Latin America and Canada and 7% in Asia Pacific which includes Australia and New Zealand.

Diversity and Inclusion

A diverse workforce and an inclusive culture and work environment is a business priority and a key to our long-term success. Our commitment to diversity and inclusion starts at the top with our Board of Directors and CEO. At all levels of the Company, we focus on attracting, retaining, and developing our diverse talent.

Leadership Commitment and Accountability

Executive leadership set diversity and inclusion goals for the Company on an annual basis. Advancing diversity and inclusion initiatives to build stronger teams has been a company-wide goal and the direct engagement of executive leadership in advancing diversity and inclusion initiatives helps to promote awareness throughout the Company.

Leadership Councils, Employee Resource Groups and External Partnerships

We are accountable to our diversity commitment through our leadership councils, employee resource groups, and external partnerships.

•The Women’s Leadership Council, established in 2017 and chaired by our President & Chief Executive Officer, Jan De Witte, is a results-oriented advisory group comprised of ten of our senior women leaders across Integra. The

13

specific charter of the Council is to work together to identify ways to continue to attract and retain female talent, advance the development of our women into leadership roles, increase the cultural awareness of the value of inclusion and diversity in our Company, and create specific development forums for our high performing women at Integra.

•Employee Resources Groups encourage a culture of awareness and inclusion, assist in the attraction and retention of diverse talent, and help colleagues develop leadership skills. Members of the Executive Leadership Team serve as sponsors for each of Integra’s employee resource groups. Integra currently has six Employee Resources Groups:

◦Women of Integra Networks (WIN) with 20+ chapters globally

◦African American Affinity Group

◦Veteran Employee Resource Group

◦Indian American Network

◦Asian American and Pacific Islander Network

◦Integra PRIDE (LGBTQ+ Employee Resource Group)

•We reinforce our commitment to diversity by partnering with other organizations focused on driving inclusion in the workplace including the CEO Action for Diversity & Inclusion, the largest CEO-driven business commitment to advance diversity and inclusion in the work place and Healthcare Businesswomen’s Association, an association dedicated to further the advancement and impact of women in the business of healthcare.

Promoting an inclusive culture through learning opportunities

To help drive our culture of inclusion, our colleagues participate in programs focused on how to manage bias, value differences, and develop inclusive leadership skills.

•Members of our executive leadership, senior management team, and larger scope leaders participated in a ½ day Microinequities training. The content includes understanding unconscious bias and microinequities, how to identify microinequities in day-to-day decisions and actions as leaders, and ways to mitigate microinequities on an individual and organizational level.

•In 2020, we launched two foundational programs to promote diversity and inclusion: Introduction to Managing Unconscious Bias, a course that creates awareness of unconscious biases in the workplaces and tools to build-bias breaking skills and Practicing Inclusion which examines what practicing inclusion in the workplace looks like. These trainings are now mandatory for all new Integra hires.

•We regularly provide educational content and resources to aid our colleagues as they build cultural competency and inclusive leadership skills

Gender Diversity

We believe that our company is stronger and will deliver strong operating results, when we build diverse teams and leverage broad perspectives to meet the needs of our shareholders, customers, colleagues, and communities we serve.

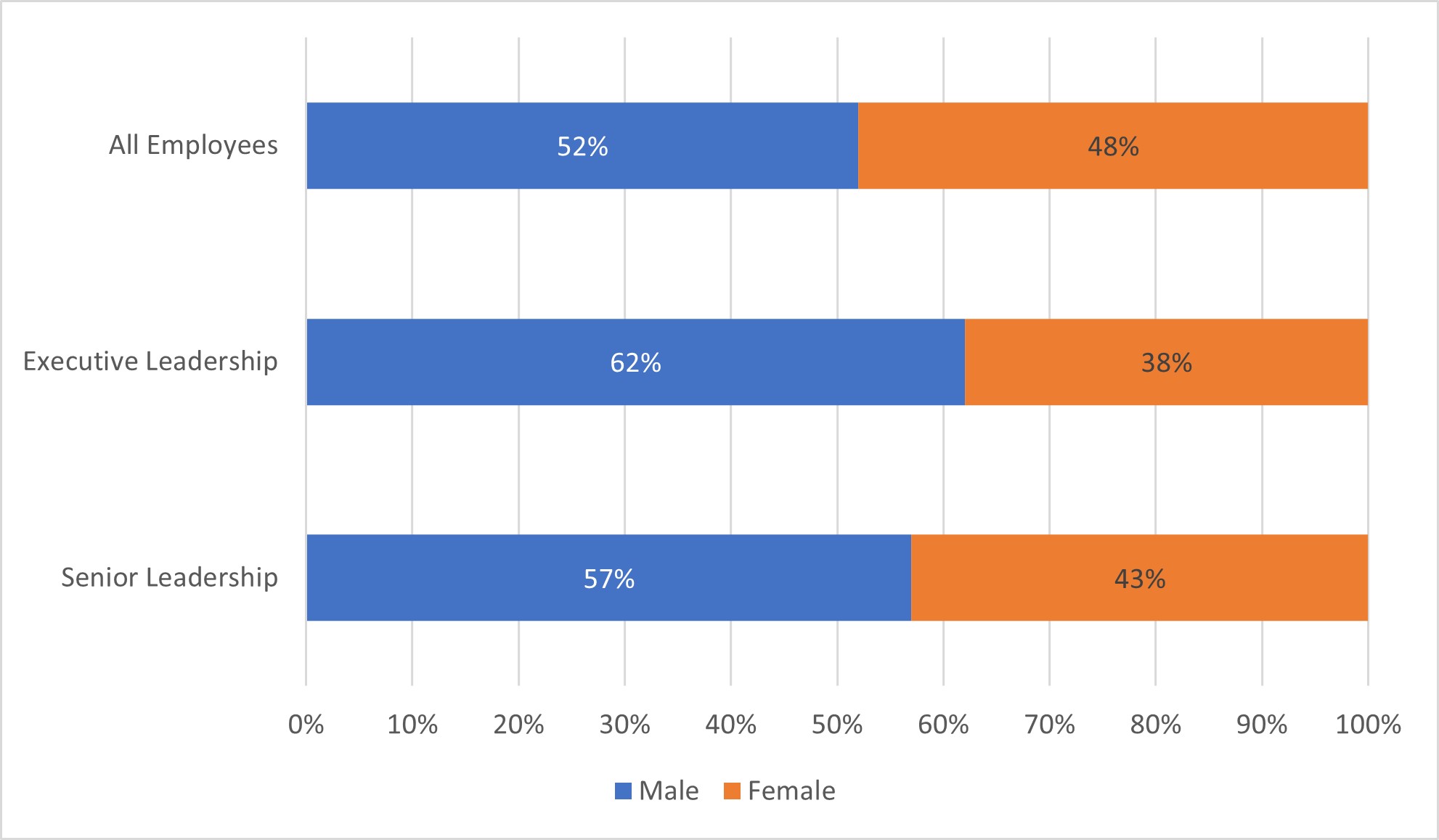

The breakout of our colleagues by gender:

48% of Integra’s overall population is female, 52% male. We continue to strive to ensure our diversity in our leadership ranks is representative of our overall population. Through mentorship, sponsorship, recruitment efforts, and development programs we look to continue to grow our population of females in leadership roles at Integra. Currently, 38% of our executive leaders and 43% of senior leaders (non-executive vice presidents) are female.

14

In partnership with Leadership Edge, a company founded by women leaders and dedicated to growing and mentoring women. Integra sponsors the Excel Women’s Leadership Program. The program is designed to accelerate the development and advancement of high potential, mid-career female leaders into senior leadership roles. The program has assisted in further building our pipeline of women leaders with 60% of the program’s graduates being promoted into roles with increased responsibility.

Compensation and Benefits

Our compensation philosophy is designed to reinforce and align with our mission, business strategy, and financial needs. We invest in the physical, emotional and financial well-being of our employees through our robust compensation and benefit programs. We provide market-competitive compensation and benefits based on benchmarking surveys we conduct regularly for all position levels against relevant peer companies. Our annual and long-term incentive packages are linked directly to business and individual performance, with a balance of short- and long-term financial and strategic objectives. We have an employee stock purchase plan. Eligibility for non-salary benefits such as salary continuance, life insurance, health insurance, and similar benefits, follows local regulations and practices.

Integra is a pay-for-performance company committed to fair pay. All compensation decisions are made without regard to personal characteristics such as, but not limited to, gender, race, color, national or ethnic origin, age, disability, sexual orientation, gender identity or expression, genetic information, religion, or veteran status. As part of our commitment to compensation equity, Integra regularly conducts a pay equity analysis, reviewing how our organization compensates employees against external and internal data in conjunction with the role and scope of each position and making adjustments if necessary.

Talent Development and Retention

We have comprehensive and effective human capital development programs in place because we believe that the personal success of our employees is critical to the overall success of our business. To build a diverse and talented organization, we have invested in honing our recruiting and hiring processes to attract top talent and engage new hires from the very beginning of their experience at Integra.

We offer a variety of opportunities for our employees to learn and grow. Continued learning and development is a critical component of employee job satisfaction, retention, and career advancement—and ultimately, a driver of business success. We encourage and promote experiential, collaborative, and formal learning programs. Employees are also encouraged to discuss with their managers the skills, training, and experience needed to grow and develop. In addition to several skills-based trainings

15

available (technical, sales, leadership ability) to all employees, managers may recommend external job-specific development programs to employees. These programs are paid for directly by Integra.

Employee Health and Safety:

Integra is committed to providing a safe environment for all employees and visitors. We rely on our environmental, health and safety management systems as well as entrusting our managers to oversee and ensure health and safety at their respective sites and foster a workplace culture to achieve that end. We implement our approach globally by our systems and support at regional and country levels from colleagues that implement proper safety protocols, identify and correct hazards, and remain safety conscious at all times. Managers are expected to enforce health and safety regulations, including compliance with applicable federal, state and local laws. Our Environmental Health and Safety ("EH&S") organizational structure incorporates both workplace EH&S coordinators and compliance teams. We have developed an Incident Procedure Policy and General Safety Rules that guide our colleagues to improve our workplace environment, improve safety, and reduce risk and costs.

Throughout the COVID-19 pandemic, we have placed a high priority on employee health, providing resources to support our workforce. At the outset of the pandemic, we sought to protect the health and safety of our employees unable to work remotely, including those in research and development, quality, manufacturing, distribution and sales roles. Such measures included the institution of robust hygiene practices, distribution of personal protective equipment, and the adoption of increased sanitation and social distancing protocols. We continue to actively monitor the COVID-19 pandemic and its variants and respond based on guidance from U.S. and global health organizations, relevant governmental guidance, and evolving practices.

Employee Engagement & Wellbeing

We regularly seek employee feedback and sentiment about our workplace through global engagement surveys conducted on a bi-annual basis. After each survey is complete, we share detailed results with senior management and all employees within each department. Each function or division appoints survey administrators who work with their respective teams to understand the feedback and establish action items. We believe this process enables us to monitor employee engagement and create a continuously improving, satisfying work environment for our employees.

We are committed to improving the quality of life of our employees and their families. Our health and wellbeing programs differ by country and typical benefits include comprehensive health insurance, disability coverage, workplace accommodations, parental leave and other leaves of absence based on health or life events (e.g., bereavement), employee assistance programs, fitness reimbursement, and flu shots. We also provide on-demand health advocates to help employees navigate the health insurance system, access to digital health solutions, a weight management program, smoking cessation assistance, a substance use disorder helpline, a diabetes health program and other similar programs to drive healthy behaviors and awareness.

FINANCIAL INFORMATION ABOUT GEOGRAPHIC AREAS

Financial information about our geographical areas is set forth in our financial statements Note 16, Segment and Geographic Information, to the Notes to Consolidated Financial Statements (Part IV, Item 15 of this Annual Report on Form 10-K).

AVAILABLE INFORMATION

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”Act"). In accordance with the Exchange Act, we file annual, quarterly and special reports, proxy statements and other information with the Securities and Exchange Commission, (the "SEC"("the SEC"). Our financial information may be viewed, including the information contained in this report, and other reports we file with the SEC, on the Internet, without charge as soon as reasonably practicable after we file them with the SEC, in the “SEC Filings” page of the Investor Relations section of our website at www.integralife.com. A copy may also be obtained for any of these reports, without charge, from our Investor Relations department, 1100 Campus Road, Princeton, NJ 08540. Alternatively, reports filed may be viewed or obtained with the SEC atthrough the SEC's website at www.sec.gov.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

We have made statements in this report, including statements under “Business” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” that constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, (the “Securities Act”("the Securities Act"), and Section 21E of the Exchange Act. These forward-looking statements are subject to a number of risks, uncertainties and assumptions about us including, among other things:

•the on-going and possible future effects of the COVID-19 pandemic and associated economic disruptions, including supply chain constraints and inflation, on our business, financial condition, results of operations and cash flows;

•general economic and business conditions, both nationally and in our international markets;markets, including the effect of the continuing worldwide macroeconomic uncertainty;

16

•our expectations and estimates concerning future financial performance, financing plans and the impact of competition;

•anticipated trends in our business;

•anticipated demand for our products, particularly capital equipment;

•our ability to produce regenerative-basedand deliver products in sufficient quantities to meet sales demands;

•our expectations concerning our ongoing restructuring, integration and manufacturing transfer and expansion activities;

•existing and future regulations affecting our business, and enforcement of those regulations;

•our failure to comply with the substantial regulation related to quality standards applicable to our manufacturing and quality processes could have an adverse effect on our business, financial condition, or results of operations;

•our ability to obtain additional debt and equity financing to fund capital expenditures, working capital requirements and acquisitions;

•physicians' willingness to adopt our recently launched and planned products, third-party payors' willingness to provide or continue reimbursement for any of our products and our ability to secure regulatory approval for products in development;

•initiatives launched by our competitors;

•our ability to protect our intellectual property, including trade secrets;

•our ability to complete acquisitions, integrate operations post-acquisition and maintain relationships with customers of acquired entities;

•our ability to remediate all matters identified in FDA observations and warning letters that we received or may receive; and

•other risk factors described in the section entitledItem 1A. "Risk Factors" in this report.Annual Report on Form 10-K.

Forward-looking statements can be identified by forward-looking words such as “believe,” “may,” “could,” “might,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “seek,” “plan,” “expect,” “should,” “would” and similar expressions in this report. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this report may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements.

ITEM 1A. RISK FACTORS

The continuing worldwide macroeconomic and geopolitical uncertainty may adversely affect our business and prospects.

Global economic disruptions, including the COVID-19 pandemic, have continued to impact the global supply chain, primarily through constraints on raw materials and electronic components. Additionally, we have observed a reduction in both inbound and outbound transportation capacity as a result of port closures and delays associated with the pandemic, which is causing longer lead times in receiving raw materials, as well as increased freight costs. These highly competitive and constrained supply chain conditions are increasing our cost of sales, which has and may continue to adversely impact our profitability. Given the ongoing uncertainty regarding the duration and extent of the COVID-19 pandemic, we are uncertain as to the duration and extent of constraint on our supply chain and are unable to predict the extent to which it will affect our global operations.

Continued concerns about the systemic impact of potential long-term and wide-spread recession and geopolitical issues, including the war in Ukraine, have contributed to increased market volatility and diminished expectations for economic growth in the world. Our Businessbusiness and results of operations have been and may continue to be adversely impacted by changes in macroeconomic conditions, including inflation, rising interest rates and the accessibility of capital markets. Uncertainty about global economic conditions may also cause decreased demand for our products and services and increased competition, which could result in lower sales volume and downward pressure on the prices for our products, longer sales cycles, and slower adoption of new technologies. A weakening of macroeconomic conditions may also adversely affect our suppliers, which could result in interruptions in supply.

Market acceptance of our medical products in the U.S. and other countries is dependent upon the medical equipment purchasing and procurement practices of our customers, patient need for our products and procedures and the reimbursement of patients' medical expenses by government healthcare programs and third-party payors. The continuing uncertainty surrounding global economic conditions and financial markets may cause the purchasers of medical equipment to decrease their procurement activities. Economic uncertainty, an increase in unemployment rates, as well as increasing health insurance premiums, co-payments and deductibles may adversely affect demand for our products and procedures. Furthermore, governments and other third-party payors around the world facing tightening budgets could move to further reduce the reimbursement rates or the scope of coverage offered, which could adversely affect sales of our products.

Public health crises, such as the COVID-19 pandemic, have had, and could in the future have, a negative effect on our business.

17

Our global operations and interactions with healthcare systems, providers and patients around the world expose us to risks associated with public health crises, including epidemics and pandemics such as COVID-19. In particular, the COVID-19 pandemic continues to cause significant volatility and uncertainty in the global and regional economies, leading to changes in consumer and business behavior, market fluctuations, materials and product shortages and restrictions on business and individual activities, all of which are materially impacting supply and demand in broad sectors of the world markets. Additionally, the COVID-19 pandemic, together with general macroeconomic conditions, have led to disruptions in the global supply chain, primarily through a lack of availability of raw materials and electronic components. We have experienced challenges associated with material and component availability for certain product lines, longer shipping and delivery times for raw materials and components, constrained logistics capacity related to the movement of our products, availability of skilled labor and increased costs of raw materials, components, labor, and freight and courier services. Regional COVID-19 case volumes (including those related to subsequent variants), actions taken by governmental authorities, private businesses and individuals, such as “shelter-in-place” orders and restrictions on travel and access to our customers or temporary closures of our facilities or the facilities of our suppliers, disruption and/or higher costs to the Company’s supply chain, staffing shortages in hospitals and labor constraints in our facilities, could further impact our gross margins and our ability to ship our products and supply our customers.

The emergence of new variants, vaccinations and public health measures are driving the pace of economic recovery unevenly in various regions. The direct and indirect disruptions caused by the pandemic and the responses of both governments and individuals could negatively impact the number of surgical and medical intervention procedures performed and have a material adverse effect on our business, financial condition, results of operations, or cash flows. The extent to which fear of exposure to or actual effects of COVID-19, new variants, disease outbreak, epidemic or a similar widespread health concern impacts our business will depend on future developments, which are highly uncertain and cannot be predicted with confidence, such as the speed and extent of geographic spread of the disease, the duration of the outbreak, travel restrictions, the efficacy of vaccination and treatment; impact on the U.S. and international healthcare systems, the U.S. economy and worldwide economy; the timing, scope and effectiveness of U.S. and international governmental response; and the impact on the health, well-being and productivity of our employees.

RISKS RELATING TO OUR BUSINESS

Our operating results may fluctuate.

Our operating results, including components of operating results such as gross margin and cost of product sales,operating expenses, may fluctuate from time to time, and such fluctuations could affect our stock price. Our operating results have fluctuated in the past and can be expected to fluctuatedo so from time to time in the future. Some of the factors that may cause these fluctuations include:

•economic conditions worldwide, which could affect the ability of hospitals and other customers to purchase our products and could result in a reduction in elective and non-reimbursed operative procedures;

•the impact of acquisitions, and our ability to integrate acquisitions;

•risks related to COVID-19 and other epidemics or similar widespread health concerns;

•expenditures for major initiatives, including acquired businesses and integrations thereof and restructuring;

•the timing of significant customer orders, which tend to increase in the fourth quarter to coincidecoinciding with the end of budget cycles for many hospitals;cycles;

•increased competition for a wide range of customers across all our product lines in the markets our products are sold;

•market acceptance of our existing products, as well as products in development;

•retention of current employees and recruiting of new employees in light of market competition for talent and relevant skills;

•the timing of regulatory approvals as well as changes in country-specific regulatory requirements;

•changes in the exchange rates of exchange between the U.S. dollar and otherforeign currencies of foreign countries in which we do business;

•changes in the variable interest rates of our debt instruments which could impact debt service requirements;

•potential backorders, lost sales and expenses incurred in connection with product recalls or field corrective actions;

•disruption of our operations and sales resulting from extreme weather conditions or natural disasters that damage our manufacturing, distribution, or distributioninfrastructure of those facilities, or the suppliers and service providers for those facilities, or the infrastructure in the locations of those facilities;

•our ability to manufacture and ship our products efficiently or in sufficient quantities to meet sales demands;

•changes in the cost or decreases in the supply of raw materials and services, including sterilization, energy, steel pyrocarbon and honey;

•the timing of our research and development expenditures;