UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20172019

o☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number: 0-24796

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

(Exact name of registrant as specified in its charter)

|

| | | | |

BERMUDABermuda | | | 98-0438382 |

(State or other jurisdiction of incorporation or organizationorganization) | | | (I.R.S. Employer Identification No.) |

| | | | | |

| O'Hara House, | | | |

3 Bermudiana Road, Hamilton, Bermuda | | | HM 08 |

| Hamilton, | Bermuda | | | (Zip Code) |

| (Address of principal executive offices) | | (Zip Code) | |

Registrant's telephone number, including area code: (441) 296-1431

|

| | |

Title of each class | | Name of each exchange on which registered |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| CLASS A COMMON STOCK, $0.08 PAR VALUE | CETV | NASDAQ Global Select Market Prague Stock Exchange |

| | | |

Securities registered pursuant to Section 12(g) of the Act: |

UNIT WARRANTS TO PURCHASE SHARES OF CLASS A COMMON STOCK | | None. |

Indicate by check mark if the registrant is a well knownwell-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐No ☒

Indicate by check mark whether registrant: (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for each shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405)is not contained herein, and will not be contained, to the best of the registrants knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer”, “large accelerated filer” or “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | | |

Large accelerated filer ☐ Filer | ☐ | | | Accelerated filer ☒Filer | ☒ |

Non-accelerated filer ☐Filer | ☐ | | | Smaller reporting company☐ | ☐ |

| | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act) Yes £☐ No T☒

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 20172019 (based on the closing price of US$ 4.004.36 of the registrant's Class A Common Stock, as reported by the NASDAQ Global Select Market on June 30, 2017)2019) was US$ 250.0383.6 million.

Number of shares of Class A Common Stock outstanding as of February 5, 2018: 145,498,4884, 2020: 253,607,026

DOCUMENTS INCORPORATED BY REFERENCE

|

| | |

| Document | | Location in 10-K in Which Document is Incorporated |

Registrant's Proxy Statement for the 20182020 Annual General Meeting of Shareholders | | Part III |

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

FORM 10-K

For the year ended December 31, 20172019

|

| | | |

| TABLE OF CONTENTS | Page |

| | |

| PART I | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| PART II | |

| | | | |

| | | |

| | | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| PART III | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| PART IV | |

| | | | |

| | | | |

| |

| | | | |

| | | | |

I. Forward-looking Statements

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 22E of the Securities Exchange Act of 1934 (the "Exchange Act"), including those relating to our capital needs, business strategy, expectations and intentions. Statements that use the terms “believe”, “anticipate”, “trend”, “expect”, “plan”, “estimate”, “forecast”, “should”, “intend” and similar expressions of a future or forward-looking nature identify forward-looking statements for purposes of the U.S. federal securities laws or otherwise. In particular, information appearing under the sections entitled "Business," "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" includes forward looking-statements. For these statements and all other forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are inherently subject to risks and uncertainties, many of which cannot be predicted with accuracy or are otherwise beyond our control and some of which might not even be anticipated. Forward-looking statements reflect our current views with respect to future events and because our business is subject to such risks and uncertainties, actual results, our strategic plan, our financial position, results of operations and cash flows could differ materially from those described in or contemplated by the forward-looking statements contained in this report.

Important factors that contribute to such risks include, but are not limited to, those factors set forth under "Risk Factors” as well as the following: the effect of the proposed Merger on our business; the risks that the closing conditions to the proposed Merger may not be satisfied or that necessary governmental approvals are not obtained or are obtained with conditions; the impact of any failure to complete the proposed Merger on our business; the effect of changes in global and regional economic conditions and the extent, timing and durationincluding as a result of the recovery in our markets;quantitative easing program implemented by the European Central Bank; the economic, political and monetary impacts of Brexit; levels of television advertising spending and the rate of development of the advertising markets in the countries in which we operate; our ability to refinance our existing indebtedness; the extent to which our debt service obligations and covenants may restrict our business; our exposure to additional tax liabilities as well as liabilities resulting from regulatory or legal proceedings initiated against us; our ability to refinance our existing indebtedness; our success in continuing our initiatives to diversify and enhance our revenue streams; our ability to make cost-effective investments in our television businesses, including investments in programming; our ability to develop and acquire necessary programming and attract audiences; our ability to consummate the Divestment Transaction; and changes in the political and regulatory environments where we operate and in the application of relevant laws and regulations. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with other cautionary statements that are included in this report. All forward-looking statements speak only as of the date of this report. We undertake no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by law.

Defined Terms

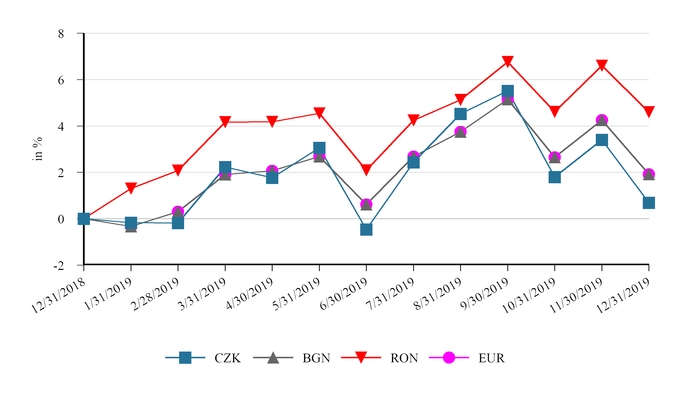

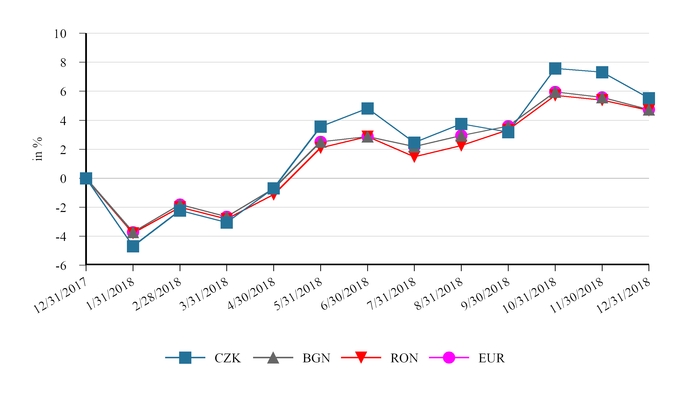

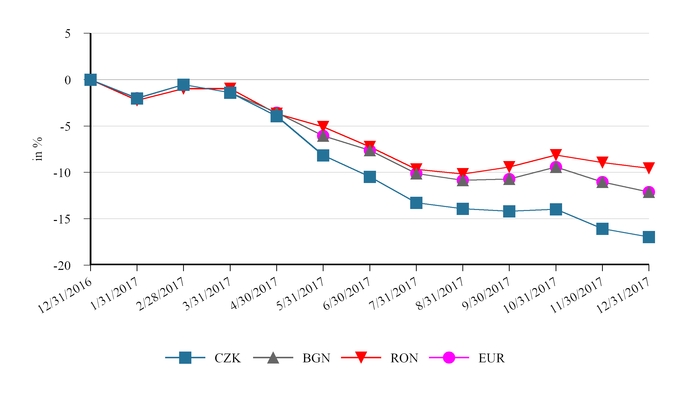

Unless the context otherwise requires, references in this report to the “Company”"Company", “CME”"CME", “we”"we", “us”"us" or “our”"our" refer to Central European Media Enterprises Ltd. (“("CME Ltd.”") or CME Ltd. and its consolidated subsidiaries listed in Exhibit 21.01 hereto. Unless otherwise noted, all statistical and financial information presented in this report has been converted into U.S. dollars using period-end exchange rates or average rates where applicable. All references in this report to “US$”"US$" or “dollars”"dollars" are to U.S. dollars, all references to “BGN”"BGN" are to Bulgarian leva, all references to “CZK”"CZK" are to Czech koruna, all references to “RON”"RON" are to the New Romanian lei and all references to “Euro”"Euro" or “EUR”"EUR" are to the European Union Euro. The exchange rates as at December 31, 20172019 used in this report are US$/BGN 1.63;1.74; US$/CZK 21.29;22.62; US$/RON 3.89;4.26; and US$/EUR 0.83.0.89.

The following defined terms are used in this Annual Report on Form 10-K:

| |

| • | "2019 Euro Loan" refers to our floating rate senior unsecured term credit facility guaranteed by Warner Media (as defined below), dated as of November 14, 2014, as amended on March 9, 2015, February 19, 2016, June 22, 2017 and February 5, 2018 which was repaid in full on July 31, 2018; |

| |

| • | "2021 Euro Loan" refers to our floating rate senior unsecured term credit facility due November 1, 2021, guaranteed by Warner Media, dated as of September 30, 2015, as amended on February 19, 2016, June 22, 2017 and April 25, 2018; |

| |

| • | "2023 Euro Loan" refers to our floating rate senior unsecured term credit facility due April 26, 2023, entered into by CME BV (as defined below), guaranteed by Warner Media and CME Ltd., dated as of February 19, 2016, as amended on June 22, 2017 and April 25, 2018; |

| |

| • | "Euro Loans" refers collectively to the 2019 Euro Loan (when outstanding), 2021 Euro Loan and 2023 Euro Loan; |

| |

| • | "2023 Revolving Credit Facility" refers to our revolving credit facility due April 26, 2023, dated as of May 2, 2014, as amended and restated as of February 19, 2016, and as further amended and restated on April 25, 2018; |

| |

| • | "Guarantee Fees" refers to amounts accrued and payable to Warner Media as consideration for Warner Media's guarantees of the Euro Loans; |

| |

| • | "Reimbursement Agreement" refers to our reimbursement agreement with Warner Media which provides that we will reimburse Warner Media for any amounts paid by them under any guarantee or through any loan purchase right exercised by Warner Media, dated as of November 14, 2014, as amended and restated on February 19, 2016, and as further amended and restated on April 25, 2018; |

| |

| • | "CME BV" refers to CME Media Enterprises B.V., our 100% owned subsidiary; |

| |

| • | "AT&T" refers to AT&T, Inc. |

| |

| • | "TW Investor" refers to Time Warner Media Holdings B.V., a wholly owned subsidiary of Warner Media; |

| |

| • | "Warner Media" refers to Warner Media, LLC. (formerly Time Warner, Inc.), a wholly owned subsidiary of AT&T. |

| |

| • | "Merger" refers to the merger of Merger Sub (as defined below) with and into the Company pursuant to the Merger Agreement (as defined below); |

| |

| • | "Merger Agreement" refers to the agreement and plan of merger dated October 27, 2019 by and among the Company, Parent (as defined below) and Merger Sub (as defined below); |

"2015 Convertible Notes" refers to our 5.0% senior convertible notes due November 2015, redeemed in November 2015;Index"2017 PIK Notes" refers to our 15.0% senior secured notes due 2017, redeemed in April 2016;

"2017 Term Loan" refers to our 15.0% term loan facility due 2017, repaid in April 2016;

"2018 Euro Term Loan" refers to our floating rate senior unsecured term credit facility guaranteed by Time Warner, dated as of November 14, 2014 and amended on March 9, 2015, February 19, 2016, June 22, 2017 and February 5, 2018 which matures on May 1, 2019 (see Part II, Item 8, Note 24, "Subsequent Events" for further information);

"2019 Euro Term Loan" refers to our floating rate senior unsecured term credit facility due 2019 guaranteed by Time Warner, dated as of September 30, 2015 and amended on February 19, 2016 and June 22, 2017;

"2021 Euro Term Loan" refers to our floating rate senior unsecured term credit facility due 2021 entered into by CME BV (as defined below), guaranteed by Time Warner and CME Ltd., dated as of February 19, 2016 and amended on June 22, 2017;

"Euro Term Loans" refers collectively to the 2018 Euro Term Loan, 2019 Euro Term Loan and 2021 Euro Term Loan;

"2021 Revolving Credit Facility" refers to our amended and restated revolving credit facility dated as of February 28, 2014, as amended and restated as of November 14, 2014, further amended and restated on February 19, 2016 and amended on June 22, 2017;

"Divestment Transaction" refers to the framework agreement dated July 9, 2017 with Slovenia Broadband S.à r.l. for the sale of our Croatia and Slovenia operations (see Part II, Item 8, Note 3, "Discontinued Operations and Assets Held for Sale" for further information)

"Guarantee Fees" refers to amounts accrued and payable to Time Warner as consideration for Time Warner's guarantees of the Euro Term Loans;

"Reimbursement Agreement" refers to an agreement with Time Warner which provides that we will reimburse Time Warner for any amounts paid by them under any guarantee or through any loan purchase right exercised by Time Warner, dated as of November 14, 2014, amended and restated on February 19, 2016 and amended on March 2, 2017 and June 22, 2017;

"CME BV" refers to CME Media Enterprises B.V., our 100% owned subsidiary;

"CME NV" refers to Central European Media Enterprises N.V., our 100% owned subsidiary;

"Time Warner" refers to Time Warner Inc.; and

"TW Investor" refers to Time Warner Media Holdings B.V.

| |

| • | "Merger Sub" refers TV Bermuda Ltd., a Bermuda exempted company limited by shares and a wholly-owned subsidiary of Parent (as defined below); |

| |

| • | "Parent" refers TV Bidco B.V., a Netherlands private limited liability company; and |

| |

| • | "PPF" refers PPF Group N.V., a Netherlands public limited liability company. |

PART I

ITEM 1. BUSINESS

Central European Media Enterprises Ltd., a Bermuda company limited by shares, is a media and entertainment company operating in Central and Eastern Europe. Our assets are held through a series of Dutch and Curaçao holding companies.company. We manage our business on a geographical basis, with fourfive operating segments, Bulgaria, the Czech Republic, Romania, and the Slovak Republic and Slovenia, which are also our reportable segments and our main operating countries. We own 94% of our Bulgaria operations and 100% of our companies in our remaining countries.

On July 9, 2017, we entered into a framework agreement with Slovenia Broadband S.à r.l., a wholly owned subsidiary of United Group B.V., relating to the sale of our Croatia and Slovenia operations. Accordingly, these operations are classified as held for sale and they are presented as discontinued operations for all periods in this report; and the discussion below relates to our continuing operations in the four remaining operating segments. See Part II, Item 8, Note 3, "Discontinued Operations and Assets Held for Sale" for further information.

Our main operating countries are members of the European Union (the “EU”"EU"). However, as emerging economies, they have adopted Western-style democratic forms of government and have economic structures, political and legal systems, systems ofand corporate governance and business practices that continue to evolve. As the economies of our operating countries converge with more developed nations and their economic and commercial infrastructures continue to develop,mature, we believe the business risks of operating in these countries will continue to decline.

Merger

On October 27, 2019, the Company entered into the Merger Agreement with Parent and Merger Sub. Parent and Merger Sub are affiliates of PPF. Pursuant to the Merger Agreement, Merger Sub will merge with and into the Company, with the Company continuing as the surviving company in the Merger as a wholly-owned subsidiary of Parent.

The closing of the proposed Merger is subject to several conditions, including, but not limited to, the requisite vote of the Company’s shareholders in favor of the Merger Agreement and the proposed Merger, the receipt of certain competition and other regulatory approvals, compliance with covenants and agreements in the Merger Agreement (subject to certain materiality qualifications), and the absence of any governmental order prohibiting completion of the proposed Merger. A special general meeting of shareholders of the Company will be held on February 27, 2020, where shareholders will be asked to vote on a proposal to approve the Merger Agreement, the related statutory merger agreement and the Merger contemplated under such agreements.

Under the Merger Agreement, at the effective time of the Merger (the “Effective Time”), without any action required by the Company, Parent, Merger Sub or any shareholder of the Company or any other person, each Class A Share issued and outstanding immediately prior to the Effective Time will be canceled and cease to exist automatically and each such Class A Share (other than shares owned by the Company, Parent, Merger Sub or any of their respective direct or indirect wholly-owned subsidiaries, in each case not held on behalf of third parties) will be converted into the right to receive $4.58 in cash.

Under the Merger Agreement, at the Effective Time, without any action required by the Company, Parent, Merger Sub or any shareholder of the Company or any other person, the Series A Preferred Share issued and outstanding immediately prior to the Effective Time will be canceled and cease to exist automatically and will be converted into the right to receive the $32,900,000 in cash, without interest, and each Series B Preferred Share issued and outstanding immediately prior to the Effective Time will be canceled and cease to exist automatically and will be converted into the right to receive the $1,630.875 in cash, without interest; provided that, among other things, any conversion of the Series A Preferred Share or any Series B Preferred Shares into Class A Shares on or after October 27, 2019 will be deemed to be null and void.

For further details on the proposed Merger, refer to Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

Operating Strategy

We operate market leading television networks in each of these fourfive countries, broadcasting a total of 2630 television channels to more than 40approximately 45 million people living in the region. Each segment also develops and produces content for their television channels.channels and digital properties. We generate advertising revenues in our country operations primarily through entering intofrom agreements with advertisers, advertising agencies and sponsors to place advertising on the television channels and websites that we operate. We generate additional revenues by collecting fees from cable, direct-to-home (“DTH”("DTH") and internet protocol television ("IPTV") operators for carriage of our channels.

Our strategy is to maintain or increase our audience leadership in each of our operating countries and to pursue sales strategies designed to maximize our revenues in order to provide additional financial resources to invest in popular local content. We have built our audience leadership in each of our markets by operating a multi-channel business model with a diversified portfolio of television channels which appeal to a broad audience.

Content that consistently generates high audience shares is crucial to maintaining the success of each of our country operations. While content acquired from the Hollywood studios remains popular, our audiences increasingly demand content that is produced in their local language and reflects their society, attitudes and culture. We believe developing and producing local content is key to being successful in prime time and supporting market-leading television channels, particularly in prime time, and that maintaining a regular stream of popular local content at the lowest possible cost is operationally importanta key strength over the long term.

As the distribution platforms in our region develop and become more diversified, our television channels and digital content will increasingly reach viewers through new distribution offerings such as internet TV and smarton mobile devices. We offer viewers the choice of watching premiumour television content through a seriesvariety of portals,platforms, including through Voyo, our subscription video-on-demand service, and advertising supported catch-up services on our websites. Additionally, we operate a portfolio of digital media products that complement our news programming and other television station-related brands.

Sales

We generate advertising revenues primarily through entering into agreements with advertisers, advertising agencies and sponsors to place advertising on our television channels.

Our main unit of inventory is the commercial gross rating point (“GRP”("GRP"), a measure of the number of people watching television when an advertisement is aired. We generally contract with a client to provide an agreed number of GRPs for an agreed price (“cost per point” or ��CPP”"CPP"). The CPP varies depending on the season and time of day during which the advertisement is aired, the volume of GRPs purchased, requests for special positioning of the advertisement, the demographic group that the advertisement is targeting and other factors. Much less frequently, and usually only for small niche channels, we may sell on a fixed spot basis where an advertisement is placed at an agreed time for a negotiated price that is independent of the number of viewers. The CPP varies depending on the season and time of day the advertisement is aired, the volume of GRPs purchased, requests for special positioning of the advertisement, the demographic group that the advertisement is targeting and other factors. Our larger advertising customers generally commit to specified amounts of advertising on an annual basis, which sets the pricing for a minimum volume of GRPs.

We operate our television networks based on a business model of audience leadership, brand strength and popular local content. Our sales strategy is to maximize the monetization of our advertising time by leveraging our high brand power and applying an optimal mix of pricing and sell-out rate. The effectiveness of our sales strategy is measured by our share of the television advertising market, which represents the proportion of our television advertising revenues compared to the total television advertising market.

We also generate additionala growing proportion of revenues by collecting carriage fees from cable, satellite and IPTV operators for broadcasting our television channels. This fee revenue is generally based on the number of subscribers to offerings from these operators that include our channels.

Programming

Our programming strategy in each country is tailored to match the expectations of key audience demographics by scheduling and marketing an optimal mix of programs in a cost effective manner. The programming that we provide drives our audience shares and ratings (see "Audience Share, Ratings and Ratings"Competition" below) and consists of locally-produced news, current affairs, fiction, and reality and entertainment shows as well as acquired foreign movies, series and sports programming.

We focus our programming investments on securing leading audience share positions during prime time, where the majority of advertising revenues are delivered,derived, and improving our cost efficiency through optimizing the programming mix and limiting the cost of programming scheduled off-prime time while maintaining all day audience shares.

Audience Share, Ratings and RatingsCompetition

Audience share represents the viewers watching a channel inas a proportion toof the total audience watching television at thethat time. Ratings represent the number of people watching a channel in proportion to the total population. Audience share and ratings information are measured in each market by independent agencies using peoplemeters, which measure audiences for different demographics and subgeographies of the population throughout the day. Our channels schedule programming intended to attract audiences within specific target demographics that we believe will be attractive to advertisers.advertisers and television distributors. The tables below provide a comparison of all day and prime time audience shares for 20172019 in the target demographic of each of our leading channels to the primary channels of our main competitors.

Bulgaria

We operate one general entertainment channel, BTV, and five other channels, BTV CINEMA, BTV COMEDY, BTV ACTION, BTV LADY and RING.

| | | Target Demographic | | Channel | | Ownership | | All day audience share | | Prime time audience share | | Channel | | Ownership | | All day audience share | | Prime time audience share |

| | | 2017 | | 2016 | | 2017 | | 2016 | | 2019 | | 2018 | | 2019 | | 2018 |

| 18-49 | | BTV | | CME | | 31.8% | | 30.5% | | 34.8% | | 33.6% | | BTV | | CME | | 27.3% | | 29.7% | | 31.6% | | 32.4% |

| | | NOVA TV | | MTG | | 16.7% | | 19.2% | | 18.5% | | 21.1% | | NOVA TV | | Advance Media Group | | 20.8% | | 17.7% | | 22.7% | | 19.3% |

| | | BNT 1 | | Public television | | 6.0% | | 7.0% | | 7.4% | | 8.9% | | BNT 1 | | Public television | | 5.7% | | 6.6% | | 7.1% | | 8.9% |

| | | |

Source: GARB

The combined all day and prime time audience shares of our Bulgaria operations in 20172019 were 41.9%38.0% and 45.3%41.9%, respectively.

Czech Republic

We operate one general entertainment channel, TV NOVA, and seven other channels, NOVA 2, NOVA CINEMA, NOVA SPORT 1, NOVA SPORT 2, NOVA ACTION, NOVA GOLD and NOVA INTERNATIONAL, a general entertainment channel broadcasting in the Slovak Republic.

| | | Target Demographic | | Channel | | Ownership | | All day audience share | | Prime time audience share | | Channel | | Ownership | | All day audience share | | Prime time audience share |

| | | 2017 | | 2016 | | 2017 | | 2016 | | 2019 | | 2018 | | 2019 | | 2018 |

| 15-54 | | TV NOVA | | CME | | 23.7% | | 23.7% | | 27.9% | | 28.2% | | TV NOVA | | CME | | 23.0% | | 22.4% | | 27.0% | | 25.8% |

| | | Prima | | MTG / GME | | 10.7% | | 10.8% | | 13.5% | | 13.2% | | Prima | | GME | | 11.1% | | 10.8% | | 13.3% | | 13.1% |

| | | CT 1 | | Public television | | 12.2% | | 12.3% | | 14.1% | | 14.7% | | CT 1 | | Public television | | 13.3% | | 12.8% | | 15.8% | | 15.5% |

| | | |

Source: ATO - Nielsen Admosphere; Mediaresearch

The combined all day and prime time audience shares of our Czech Republic operations in 2017,2019, excluding NOVA SPORT 1, NOVA SPORT 2 and NOVA INTERNATIONAL, were 36.9%34.8% and 39.3%36.9%, respectively.

Romania

We operate one general entertainment channel, PRO TV, and sevensix other channels, PRO 2, (formerly ACASA), PRO X, (formerly SPORT.RO), PRO GOLD, (formerly ACASA GOLD), PRO CINEMA, PRO TV INTERNATIONAL, MTV ROMANIA, as well as PRO TV CHISINAU, a general entertainment channel broadcasting in Moldova.

| | | Target Demographic | | Channel | | Ownership | | All day audience share | | Prime time audience share | | Channel | | Ownership | | All day audience share | | Prime time audience share |

| | | 2017 | | 2016 | | 2017 | | 2016 | | 2019 | | 2018 | | 2019 | | 2018 |

| 18-49 Urban | | PRO TV | | CME | | 23.3% | | 20.6% | | 27.0% | | 25.0% | | PRO TV | | CME | | 22.5% | | 22.5% | | 25.5% | | 24.7% |

| | | Antena 1 | | Intact group | | 14.9% | | 15.7% | | 15.9% | | 15.9% | | Antena 1 | | Intact group | | 14.6% | | 14.5% | | 15.9% | | 15.6% |

| | | TVR 1 | | Public television | | 1.4% | | 1.3% | | 1.5% | | 1.5% | | TVR 1 | | Public television | | 1.3% | | 2.2% | | 1.3% | | 2.7% |

| | | |

Source: Kantar Media

The combined all day and prime time audience shares of our Romania operations in 2017,2019, excluding PRO TV INTERNATIONAL and PRO TV CHISINAU, were 26.3% and ACASA IN MOLDOVA (which ceased broadcasting in October 2017) were 27.4% and 30.3%29.5%, respectively.

Slovak Republic

We operate one general entertainment channel, TV MARKIZA, and three other channels, DOMA, DAJTO and MARKIZA INTERNATIONAL, a general entertainment channel broadcasting in the Czech Republic.

| | | Target Demographic | | Channel | | Ownership | | All day audience share | | Prime time audience share | | Channel | | Ownership | | All day audience share | | Prime time audience share |

| | | 2017 | | 2016 | | 2017 | | 2016 | | 2019 | | 2018 | | 2019 | | 2018 |

| 12-54 | | TV MARKIZA | | CME | | 19.5% | | 22.2% | | 20.3% | | 23.3% | | TV MARKIZA | | CME | | 21.2% | | 21.3% | | 22.3% | | 21.8% |

| | | TV JOJ | | J&T Media Enterprises | | 16.5% | | 15.4% | | 20.2% | | 18.8% | | TV JOJ | | J&T Media Enterprises | | 14.5% | | 13.9% | | 18.3% | | 17.7% |

| | | Jednotka | | Public Television | | 8.6% | | 8.0% | | 10.8% | | 9.7% | | Jednotka | | Public Television | | 8.2% | | 8.4% | | 10.1% | | 10.2% |

| | | |

Source: PMT/ TNS SK

The combined all day and prime time audience shares of our Slovak Republic operations in 2017,2019, excluding MARKIZA INTERNATIONAL, were 27.0%28.4% and 28.3%29.7%, respectively.

Slovenia

We operate two general entertainment channels, POP TV and KANAL A, and three other channels, KINO, BRIO and OTO.

|

| | | | | | | | | | | | |

| Target Demographic | | Channel | | Ownership | | All day audience share | | Prime time audience share |

| | | | | | | 2019 | | 2018 | | 2019 | | 2018 |

| 18-54 | | POP TV | | CME | | 20.6% | | 21.0% | | 31.6% | | 32.8% |

| | | Planet TV | | TSmedia | | 5.2% | | 5.4% | | 6.3% | | 6.8% |

| | | SLO 1 | | Public Television | | 9.2% | | 9.1% | | 10.1% | | 9.9% |

| | | | | | | | | | | | | |

Source: AGB Nielsen Media Research

The combined all day and prime time audience shares of our Slovenia operations in 2019 were 39.0% and 49.9%, respectively.

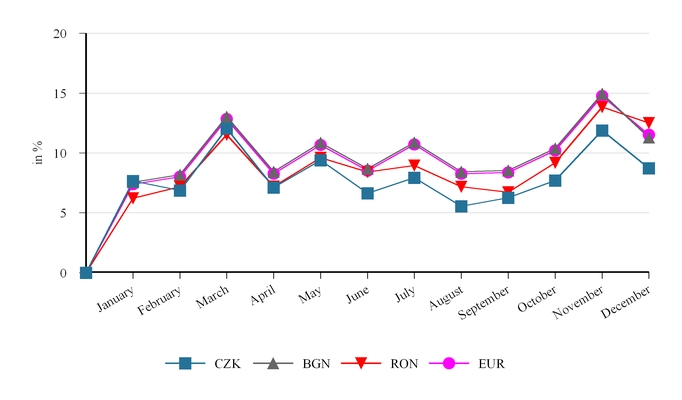

Seasonality

We experience seasonality, with advertising sales tending to be highest during the fourth quarter of each calendar year due to the holiday season, and lowest during the third quarter of each calendar year due to the summer vacation period (typically July and August). Our non-advertising sales are not affected by seasonality.

Regulation of Television Broadcasting

Television broadcasting in each of the countries in which we operate is regulated by a governmental authority or agency. In this report, we refer to such agencies individually as a “Media Council”"Media Council" and collectively as “Media Councils”"Media Councils". Media Councils generally supervise broadcasters and their compliance with national broadcasting legislation, as well as control access to the available frequencies through licensing regimes.

Programming and Advertising Regulation

Our main operating countries are member states of the EU, and as such, our broadcast operations in such countries are subject to relevant EU legislation relating to media.

The EU Audiovisual Media Services Directive (the “AVMS Directive”"AVMS Directive"), which came into force in March 2010, and provides the legal framework for audiovisual media services generally in the EU. On November 6, 2018, the European Council adopted amendments to the AVMS Directive, which formally entered into force on December 18, 2018. European Member States, including the territories in which CME operates, have until September 19, 2020, to transpose the amendments to the AVMS Directive into national legislation. The original AVMS Directive remains in force until new legislation incorporating the amendments to the AVMS Directive (described below) are implemented in the countries in which we operate. The AVMS Directive covers both linear (i.e., broadcasting) and non-linear (e.g., video-on-demand and catch-up) transmissions of audiovisual media services, with the latter subject to significantly less stringent regulation. Among other things, the AVMS Directive requires broadcasters to comply with rules related to, but not limited to, program content, advertising content and quotas, product placement, sponsorship, teleshopping, the protection of minors, accessibility by persons with a visual or hearing disability, and minimum quotas with respect to “European works”"European works" (defined as originating from an EU member state or a signatory to the Council of Europe's Convention on Transfrontier Television as well as being written and produced mainly by residents of the EU or Council of Europe member states or pursuant to co-production agreements between such states and other countries). In addition, the AVMS Directive requires that at least 10% of either broadcast time or programming budget is dedicated to programs made by European producers who are independent of broadcasters. News, sports, games, advertising, teletext services and teleshopping are excluded from the calculation of these quotas. In respect of advertising, the AVMS Directive currently provides that the proportion of television advertising spots and teleshopping spots within a givenany hour of broadcasting shall not exceed 20% (what is commonly referred to as the ‘12 minute per hour rule’). The current AVMS Directive does not otherwise restrict when programming may be interrupted by advertising in linear broadcasting, except in the case of films and news programming (where programming may be interrupted once every thirty minutes or more) and children’s programming (where the same restriction applies providing that the program is greater than thirty minutes) and religious programming (where no advertising or teleshopping shall be inserted). Under the current AVMS Directive, there is also a general prohibition on product placement, is prohibited subject to certain exceptions (for example it is permitted in films and series, sports programs and light entertainment programs) and providing that the use of product placement is not ‘unduly’ prominent, is not promotional and is appropriately identified to viewers. Legislation implementing

The amendments to the AVMS Directive has been adopted across our operating countries.

On May 25, 2016, the European Commission adopted a proposal to amend the AVMS Directive. As proposed, the legislation liberalizes manyliberalize some of the AVMS Directive requirements including,and extend some rules that currently apply to broadcasters to video-on-demand services (such as program content, advertising content, and quotas and prominence requirements for example,European works). The amendments also introduce more stringent rules related to the protection of minors as well as bringing video-sharing platforms that target audiences in the EU (such as YouTube, Facebook, Instagram) within its the scope.

In respect of hourly advertising, limits, product placement, teleshopping and sponsorship. The proposal is subject to consultation, review by the European Commission committees and a vote by the European Parliament in order to be adopted. Following adoption, any amendments to the AVMS Directive would then needprovide greater flexibility to linear broadcasters on the timing of advertising so that the share of television commercials and teleshopping spots between 6am and 6pm and between 6pm and midnight may not exceed 20% of the total broadcasting time in each respective time slot (rather than the 20% hourly limit that currently exists). This means that broadcasters are able to allocate up to 144 minutes of advertising in total during the period between 6am and 6pm, and 72 minutes in total between 6pm and midnight, with no specific restrictions on the amount of advertising between midnight and 6am. The amendments to the AVMS Directive permit product placement in all audiovisual media services except in news and current affairs programs, consumer affairs programs, religious programs and children’s programs while maintaining the requirements that the use of product placement is not unduly prominent, is not promotional and is appropriately identified to viewers and imposing restrictions on the type of products which may be implemented by our operating countries.placed (e.g., no cigarettes or alcohol). In addition, the amended AVMS Directive imposes a ban on advertising, sponsorship and product placement of electronic cigarettes in any audiovisual service.

In respect of the protection of minors, the amended AVMS Directive imposes a ban on teleshopping during the broadcast of children’s programs, provides Member States with the option of banning the sponsorship of children’s programs, and limits the uses of personal data of children.

Under the amendments to the AVMS Directive, Member States also have the option of imposing on their audiovisual service providers (including broadcasters and video-on-demand services providers whose operations target their service to an audience within a different Member State) a financial contribution towards the European production of Europeans works). There is also a requirement that broadcasters and other audiovisual service providers ensure that at least 30% of their video-on-demand service catalog is dedicated to European works and that such works are given due prominence.

Please see below for more detailed information on programming and advertising regulations that impact our channels.

Bulgaria: In Bulgaria, privately owned broadcasters are permitted to broadcast advertising for up to 12 minutes per hour. The public broadcaster, BNT, which is financed through a compulsory television license fee and by the government, is restricted to broadcasting advertising for four minutes per hour and no more than 15 minutes per day, of which only five minutes may be in prime time. There are also restrictions on the frequency of advertising breaks (for example, news and children's programs shorter than 30 minutes cannot be interrupted). These restrictions apply to both publicly and privately ownedprivately-owned broadcasters. Further restrictions relate to advertising content, including a ban on tobacco advertising and restrictions on alcohol advertising, regulations on medical products advertising and regulations on advertising targeted at children or during children's programming. In addition, members of the news department of our channels are prohibited from appearing in advertisements. Our channels in Bulgaria are required to comply with several restrictions on programming, including regulations on the origin of programming. These channels must ensure that 50% of a channel's total annual broadcast time consists of EU- or locally-produced programming and 12% of such broadcast time consists of programming produced by independent producers in the EU. News, sports, games and teleshopping programs, as well as advertising and teletext services, are excluded from these restrictions.

Czech Republic: Privately owned broadcasters in the Czech Republic are permitted to broadcast advertising for up to 12 minutes per hour. In September 2011, legislation was implemented in the Czech Republic which restricts the amount of advertising that may be shown on channels of the public broadcaster, CT. Pursuant to the regulation, no advertising may be shown on the public channels CT 1 and CT 24, while the channels CT 2 and CT 4 may show a limited amount of advertising.advertising up to 0.5% of the total daily broadcasting time on each channel, of which only 6 minutes per hour may be in prime time. No advertising may be shown on the other public TV channels, except where broadcasting an advertisement is a necessary condition for the acquisition of rights to broadcast cultural or sport events on such public channels. Where such broadcasting advertisement conditions apply, the same limitations on advertising time applicable to CT 2 and CT 4 shall apply to any advertising on the other public TV channels. Also included in the legislation is the requirement that national private broadcasters must contribute annually to a Czech cinematography fund in an amount equal to 2% of their net advertising revenues. We are entitled to apply for financing from the fund. In the Czech Republic, all broadcasters are restricted with respect to the frequency of advertising breaks during and between programs, as well as being subject to restrictions that relate to advertising content, including a ban on tobacco advertising and limitations on advertisements of alcoholic beverages, pharmaceuticals, firearms and munitions.

Romania: Privately owned broadcasters in Romania are permitted to broadcast advertising and direct sales advertising for up to 12 minutes per hour. There are also restrictions on the frequency of advertising breaks (for example, news and children's programs shorter than 30 minutes cannot be interrupted). Broadcasters are also required that from the total broadcasting time (except for the time allocated to news, sports events, games, advertising and teleshopping) (a) at least 50% must be European-origin audio-visual works and (b) at least 10% (or, alternatively, at least 10% of their programming budget) must be European audio-visual works produced by independent producers. The public broadcaster, TVR, is restricted to broadcasting advertising for eight minutes per hour and only between programs. Further restrictions relate to advertising content, including a ban on tobacco advertising and restrictions on alcohol advertising, and regulations on advertising targeted at children or during children's programming. In addition, news anchors of all channels are prohibited from appearing in advertisements and teleshopping programming. A new Audiovisual Code was enacted in March 2017 providing additional safeguards in connection with the protection of minors and privacy rights.

Slovak Republic: Privately owned broadcasters in the Slovak Republic are permitted to broadcast advertising for up to 12 minutes per hour but not for more than 20% of their total daily broadcast time. Since January 2013,2020, the public broadcaster RTVS, which is financed through a compulsory license fee, can broadcast advertising for up to 0.5% of its total broadcast time on a given calendar day (up to 2.5% of total broadcast time including teleshopping programming), but between 7:00 p.m. and 10:00 p.m. may broadcast only eight minutes of advertising per hour. The restriction regarding total broadcast advertising time does not apply to the broadcasting of advertising in direct connection with the broadcasting of a sporting or cultural event, in which the broadcasting of advertising is a necessary condition for the acquisition of rights to broadcast such event. The broadcasting of advertising in direct connection with the broadcasting of a sporting or cultural event cannot exceed 15% of the daily total broadcast time. There are also restrictions on the frequency of advertising breaks during and between programs. RTVSThe public broadcaster is not permitted to broadcast advertising breaks during programs. There are also restrictions that relate to advertising content, including a ban on tobacco, pharmaceuticals, firearms and munitions advertising and a ban on advertisements of alcoholic beverages (excluding beer and wine) between 6:00 a.m. and 10:00 p.m. Our operations in the Slovak Republic are also required to comply with several restrictions on programming, including regulations on the origin of programming. These include the requirement that 50% of the station's monthly broadcast time must be European-origin audio-visual works and at least 10% of a station's monthly broadcast time must be European audio-visual works produced by independent producers, at least 10% of which must be broadcast within five years of production. National private broadcasters must also contribute annually to an audiovisual fund in the amount equal to 2% of their net advertising revenues and public broadcasters must contribute annually to the audiovisual fund in the amount equal to 5% of its net advertising revenue. Both public and private broadcasters are entitled to apply for financing from the fund.

Slovenia: Privately owned broadcasters in Slovenia are allowed to broadcast advertising for up to 12 minutes in any hour. The public broadcaster, SLO, which is financed through a compulsory television license fee and commercial activities, is allowed to broadcast advertising for up to 10 minutes per hour, but is only permitted up to seven minutes per hour between the hours of 6:00 p.m. and 11:00 p.m. There are also restrictions on the frequency of advertising breaks during programs and restrictions that relate to advertising content, including restrictions on food advertising during children's programming and a ban on tobacco advertising and a prohibition on the advertising of any alcoholic beverages from 7:00 a.m. to 9:30 p.m. and generally for alcoholic beverages with an alcoholic content of more than 15%. Our Slovenian operations are required to comply with several restrictions on programming, including regulations on the origin of programming. These include the requirement that 20% of a station's daily programming consist of locally produced programming, of which at least 60 minutes must be broadcast between 6:00 p.m. and 10:00 p.m. In addition, 50% of our niche channels' annual broadcast time must be European-origin audio-visual works and at least 10% of such stations' annual broadcast time must be European audio-visual works produced by independent producers.

Licensing Regulation

The license granting and renewal process in our operating countries varies by jurisdiction and by type of broadcast permitted by the license (i.e., terrestrial, cable, satellite). Depending on the country, terrestrial licenses may be valid for an unlimited time period, may be renewed automatically upon application or may require a more lengthy renewal procedure, such as a tender process. Generally cable and satellite licenses are granted or renewed upon application. We expect all of our licenses will continue to be renewed or new licenses to be granted as required to continue to operate our business. All of the countries in which we operate have transitioned from analog to digital terrestrial broadcasting and we have obtained digital licenses where requested. In January 2017, we ceased terrestrial distribution of our channels in the Slovak Republic and Slovenia, and channels are now available exclusively on cable, satellite and IPTV platforms. We will apply for additional digital licenses where such applications are prudent and permissible. Please see below for more detailed information on licenses for our channels.

Bulgaria: BTV operates pursuant to a national digital terrestrial license issued by the Council for Electronic Media, the Bulgarian Media Council, that expires in July 2024. BTV ACTION broadcasts pursuant to a national cable and satellite registration that is valid for an indefinite time period and also has a digital terrestrial license that expires in January 2025 which is not currently in use. BTV CINEMA, BTV COMEDY, RING and BTV LADY, as well as BTV, each broadcast pursuant to a national cable and satellite registration that is valid for an indefinite time period.

Czech Republic: Our channels in the Czech Republic operate under a variety of licenses granted by the Czech Republic Media Council, The Council for Radio and Television Broadcasting. TV NOVA broadcasts under a national terrestrial license that expires in January 2025. TV NOVA may also broadcast pursuant to a satellite license that expires in December 2020. NOVA CINEMA broadcasts pursuant to a national terrestrial digital license that expires in September 2023. NOVA CINEMA also broadcasts via satellite pursuant to a license that is valid until November 2019.October 2031. NOVA SPORT 1 broadcasts pursuant to a license that allows for both satellite and cable transmission that expires in October 2020. NOVA SPORT 2 broadcasts pursuant to a satellite license that expires in August 2027. In addition, NOVA SPORT 1 and NOVA SPORT 2 each have a license that permits internet transmission which expires in August 2027. NOVA ACTION broadcasts pursuant to a satellite license that expires in July 2024, and a national terrestrial license that expires in September 2023. NOVA 2 broadcasts pursuant to a national terrestrial license that expires in December 2024 and a satellite license that expires in February 2025. NOVA GOLD broadcasts pursuant to a national terrestrial license and a satellite license that each expire in February 2025. In addition, each channel has a license that permits internet transmission that expires in June 2030, other than NOVA SPORT 1 and NOVA SPORT2 which expires in August 2027. NOVA INTERNATIONAL broadcasts pursuant to a license that permits internet transmission which expires in January 2028.

Romania: PRO TV broadcasts pursuant to a national satellite license granted by the Romanian Media Council, the National Audio-Visual Council, that expires in May 2023. PRO 2 broadcasts pursuant to a national satellite license that expires in January 2025. PRO GOLD broadcasts pursuant to a national satellite license that expires in April 2021. PRO CINEMA broadcasts pursuant to a national satellite license that expires in April 2022. PRO X broadcasts pursuant to a national satellite license that expires in July 2021. MTV ROMANIA broadcasts pursuant to a national satellite license that expires in April 2018 and PRO TV INTERNATIONAL broadcasts pursuant to a national satellite license that expires in May 2018.2027. PRO TV also broadcasts through the electronic communications networks pursuant to a series of local licenses and PRO 2 broadcasts in high-definition pursuant to a written consent from the Media Council.national cable license that expires in September 2024. PRO 2 also broadcasts in high-definition pursuant to a national cable license that expires in October 2028. PRO X also broadcasts in high-definition pursuant to a national cable license that expires in October 2028. PRO TV CHISINAU broadcasts pursuant to a cable license granted by the Audio-Visual Coordinating Council of the Republic of Moldova (the "AVCC") that expires in November 2023. In September 2017 we applied to the AVCC to discontinue the ACASA IN MOLDOVA channel from October 2017.

Slovak Republic: TV MARKIZA, DOMA and DAJTO each broadcast pursuant to a national license for digital broadcasting granted by the Council for Broadcasting and Retransmission, the Media Council of the Slovak Republic, which is valid for an indefinite period. MARKIZA INTERNATIONAL is broadcast pursuant to the license granted to TV MARKIZA.

Slovenia: Our Slovenian channels POP TV, KANAL A, KINO, BRIO and OTO each have licenses granted by the Agency for Communication Networks and Services of the Republic of Slovenia and the Ministry of Culture, that allow for broadcasting on any platform, including digital, cable and satellite. These licenses are valid for an indefinite time period.

OTHER INFORMATION

Employees

As of December 31, 20172019, we had a total of approximately 2,2002,550 employees (including contractors).

Corporate Information

CME Ltd. was incorporated in 1994 under the laws of Bermuda. Our registered offices are located at O'Hara House, 3 Bermudiana Road, Hamilton HM 08, Bermuda, and our telephone number is +1-441-296-1431. Communications can also be sent c/o CME Media Services Ltd. at Krizeneckeho nam. 1078/5, 152 00 Praha 5, Czech Republic, telephone number +420-242-465-605. CME's Class A common stock is listed on the NASDAQ Global Select Market and the Prague Stock Exchange under the ticker symbol “CETV”.

Available Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Sections 13(a) or 15(d) of the Exchange Act are available on our website, free of charge, as soon as reasonably practicable after the reports are electronically filed with or furnished to the SEC. These reports together with press releases, public conference calls, webcasts and posts to the "Investors" section of our website are available at www.cme.net and we encourage investors to use our website. The information contained on our website is not included as a part of, or incorporated by reference into, this Report.

Financial Information by Operating Segment and by Geographical Area

For financial information by operating segment and geographic area, see Part II, Item 8, Note 20, "Segment Data".

ITEM 1A RISK FACTORSRisk Factors

This report and the following discussion of risk factors contain forward-looking statements as discussed on page 1 of this report. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks and uncertainties described below and elsewhere in this report. These risks and uncertainties are not the only ones we may face. Additional risks and uncertainties of which we are not aware, or that we currently deem immaterial, may also become important factors that affect our financial condition, results of operations and cash flows.

Risks Relating to Our Financial Position

Changes in global or regional economic conditions may adversely affect our financial position and results of operations.

The results of our operations depend heavily on advertising revenue, and demand for advertising is affected by general economic conditions in the region and globally. Our markets have experienced overall growth in real GDP (as adjusted for inflation) and advertising spending since 2014;over the last several years; however, we cannot predict if the current growth trends will continue in the future. Analyst estimates for 2020 of real GDP in the countries in which we operate forecast a slower rate of growth overall compared to 2019. Recessions or periods of low or negative growth in the region or globally in the future may cause a deterioration of general economic conditions in one or more of our markets, which would have an adverse economic impact on our advertising revenues. The United States has imposed tariffs on certain products from many of its trading partners, including Europe and China, and has previously threatened to impose additional tariffs on cars and auto part exports from Europe. Such tariffs could have a significant adverse impact on the economies of our countries of operation. Additionally, a slowdown in China resulting from existing tariffs on Chinese products may have an adverse impact on the global economy, which may ultimately reduce demand for European exports and the rate of GDP growth in the countries in which we operate. Other factors that may affect general economic conditions in our markets include defaults by sovereigns or systemically important companies, austerity programs, natural disasters, acts of terrorism, civil or military conflicts or general political instability and responses to it, any of which may also reduce advertising spending. In addition, although we believe the advertising spend per capita of the countries in which we operate and advertising intensity (the ratio of total advertising spend per capita to nominal GDP per capita) will eventually converge with developed markets in Europe, such convergence may not occur in the time frame we expect, or at all. Any of these developments would have a significant negative effect on our financial position, results of operations and cash flows.

Changes to the quantitative easing program implemented by the European Central Bank ("ECB") and the impact on the region of the United Kingdom’s exit from the European Union (“EU”) may adversely affect our financial position and results of operations.

The ECB embarked upon quantitative easing in 2015 to address economic softness and a slowdown in growth of consumer prices in the Eurozone. The ECB also created funding and stability mechanisms to provide liquidity and financial assistance to Eurozone member states and financial institutions. Economic growth in recent years in the Eurozone including strong growth in 2017, has been helped by the ECB’s quantitative easing program. Citingprogram which was recalibrated in January 2018. Although the ECB, citing improved economic conditions, ended its original quantitative easing program at the ECB has announced that from Januaryend of December 2018, it will be reducingresumed its quantitative easing program from a ratein November 2019. While the duration of EUR 60 billion a month to EUR 30 billion a month for an initial nine-month period. The ECB may decide to take further steps to reduce or exitthe current quantitative easing program is not known, the cessation of quantitative easing in the future. The tapering of quantitative easingfuture may adversely impact future growth in Eurozone countries, including the countries in which we operate, in whichand would negatively impact our business.

Our financial position and results of operations may be adversely affected as a result of the United Kingdom’s decision to end its membership in the European Union.

The United Kingdom is in the process of negotiating its exit from the European Union (generally referred to as “Brexit”). On March 29, 2017,January 31, 2020, the United Kingdom formally initiatedleft the processEuropean Union; however, it will remain in the single market and be subject to leave the EU, commonly referred to as "Brexit", triggeringEU’s rules and regulations during a two-yeartransition period to finalize the terms for its leaving the EU.ending December 31, 2020. It is expected that economic conditions in the EU will be impacted by Brexit. WhileThe impact on our business from a result of Brexit will depend, in part, on the outcome of tariff, trade, regulatory and other negotiations during this transition period and on the ultimate manner and terms of the U.K.’s withdrawal from the EU. Given the ongoing uncertainty over the final terms of Brexit to be negotiated during the transition period, the overall economic impact of Brexit on the EU and the Euro iscontinues to be difficult to estimate at present,as decisions to conserve cash and reduce spending by consumers and businesses in the United Kingdom would have a negative impact on economic growth rates in the United Kingdom and, to a lesser extent, in the EU, in particular those countries that are significant exporters to the United Kingdom. There is also significant uncertainty regarding the terms on which the United Kingdom will leave the EU, and it is expected that a more protracted process to set those terms would have a more prolonged economic impact. In addition, if other countries seek to leave the EU, that would increase uncertainty in the region, which may have a further negative impact on investment and economic growth rates. Furthermore, the departure of the United Kingdom from the EU may further affect the budgetary contributions and allocations among the EU member states in the medium term, including the countries in which we operate, which arehave historically been net recipients of EU funding. Economic uncertainty caused by Brexit or other instability in the EU resulting from Brexit could cause significant volatility in EU markets and reduce economic growth rates in the countries in which we operate, which would negatively impact the demand for advertising and consequently our business.financial position, results of operations and cash flows.

Our operating results will be adversely affected if we cannot generate strong advertising sales.

We generate the majority of our revenues from the sale of advertising airtime on our television channels. While we have implemented pricing strategies to increase sales and television advertising spending, the success of these strategies has varied from market to market and continues to be challenged by pressure from advertisers and discounting by competitors. In addition to advertising pricing, other factors that may affect our advertising sales include general economic conditions (described above), competition from other broadcasters and operators of other distribution platforms, changes in programming strategy, changes in distribution strategy, our ability to secure distribution on cable, satellite or IPTV operators, our channels’ technical reach, technological developments relating to media and broadcasting, seasonal trends in the advertising market, changing audience preferences and in how and when people view content and the accompanying advertising, increased competition for the leisure time of audiences and shifts in population and other demographics. Our advertising revenues also depend on our ability to maintain audience ratings and to generate GRPs. This requires us to have a distribution strategy that reaches a significant audience as well as to maintain investments in programming at a sufficient level to continue to attract audiences. Changes in the distribution of our channels, such as our decision to cease broadcasting on DTTdigital terrestrial television ("DTT") in the Slovak Republic and Slovenia in 2017, may reduce the number of people who can view our channels, which may negatively impact our audience share and GRPs generated. Furthermore, significant or sustained reductions in investments in programming or other operating costs in response to reduced advertising revenues had and, if repeated, may have an adverse impact on our television viewing levels. Reductions in advertising spending in our markets and resistance to price increases as well as competition for ratings from broadcasters seeking to attract similar audiences may have an adverse impact on our ability to maintain our advertising sales. A failure to maintain and increase advertising sales could have a material adverse effect on our financial position, results of operations and cash flows.

Our debt service obligations and covenants may restrict our ability to conduct our operations.

We have significant debt service obligations under the Euro Term Loans as well as the 2021 Revolving Credit Facility (when drawn), including the Guarantee Fees to Time Warner as consideration for its guarantees of the Euro Term Loans (collectively, the "TW Guarantees"). Although a portion of the Guarantee Fees in respect of each of the Euro Term Loans can be non-cash pay at our option, accruing such fees will further increase the amounts to be repaid at the maturity of these facilities. In addition, if the Divestment Transaction does not close, the warrants are not exercised in full or cash flows from operations do not meet our forecasts, we would not be able to reduce our indebtedness as planned and would continue to bear higher average borrowing costs on our senior debt and pay more interest and Guarantee Fees. As a result of our debt service obligations and covenants contained in the related loan agreements, we are restricted under the Reimbursement Agreement and the 2021 Revolving Credit Facility (when drawn) in the manner in which our business is conducted, including but not limited to our ability to obtain additional debt financing to refinance existing indebtedness or to fund future working capital, capital expenditures, business opportunities or other corporate requirements. We may have a proportionally higher level of debt and debt service obligations than our competitors, which may put us at a competitive disadvantage by limiting our flexibility in planning for, or reacting to, changes in our business, economic conditions or our industry. For additional information regarding the Reimbursement Agreement, the 2021 Revolving Credit Facility and the TW Guarantees, see Part II, Item 8, Note 5, "Long-term Debt and Other Financing Arrangements".

We may be unable to repay or refinance our existing indebtedness and may not be able to obtain favorable refinancing terms.

We have a substantial amount of indebtedness. Under the Reimbursement Agreement and the 2021 Revolving Credit Facility (when drawn), we can incur only limited amounts of additional indebtedness, other than indebtedness incurred to refinance existing indebtedness. In addition, pursuant to the Reimbursement Agreement, the all-in rates on each of the Euro Term Loans increase to a maximum of 10.0% (or 3.5% above the then-current all-in rate, if lower), on the date that is 180 days following a change of control of CME Ltd. (as defined therein); and pursuant to the 2021 Revolving Credit Facility, all commitments terminate following a change of control (as defined therein) and the interest rate on amounts outstanding increases to 13% on the date that is 180 days following such change of control. We intend to repay the 2018 Euro Term Loan at or prior to maturity on May 1, 2019 with cash flows from operations and the expected proceeds from the Divestment Transaction or if the Divestment Transaction does not close, the expected proceeds from warrant exercises. In the event the Divestment Transaction doesproposed Merger is not close, the warrants are not exercised in full or cash flows from operations do not meet our forecasts,completed, we would be required to refinance the 2018 Euro Term Loan in whole or in part. Pursuant to the Reimbursement Agreement, all commitments under the 2021 Revolving Credit Facility terminate on the refinancing of any Euro Term Loan. We face the risk that we will not be able to renew, repay or refinance our indebtedness when due, or that the terms of any renewal or refinancing will not be on better terms than those of such indebtedness being refinanced. Furthermore, pursuant to the Reimbursement Agreement, the all-in rates on each of the Euro Loans increase to a maximum of 10.0% (or 3.5% above the then-current all-in rate, if lower), on the date that is 365 days following a change of control of CME Ltd. (as defined therein); and pursuant to the 2023 Revolving Credit Facility, all commitments terminate following a change of control (as defined therein) and the interest rate on amounts outstanding increases to 10% plus LIBOR or 9% plus the alternate base rate on the date that is 365 days following such change of control. In the event we are not able to refinance our indebtedness, we might be forced to dispose of assets on disadvantageous terms or reduce or suspend operations, any of which would materially and adversely affect our financial condition, results of operations and cash flows.

IfOur debt service obligations and covenants may restrict our ability to conduct our operations.

We have debt service obligations under the Divestment Transaction failsEuro Loans as well as the 2023 Revolving Credit Facility (when drawn), including the Guarantee Fees to complete or is terminated,Warner Media as consideration for its guarantees of the Euro Loans (collectively, the "WM Guarantees"). In addition, if our financial performance does not meet our forecasts, we may need to find alternative sources of funds to repay certainbear higher average borrowing costs on our senior debt and pay more interest and Guarantee Fees. As a result of our indebtedness

On July 9, 2017,debt service obligations and covenants contained in the related loan agreements, we entered into a framework agreement (the “Framework Agreement”) with Slovenia Broadband S.à r.l. (the "Purchaser"), a wholly owned subsidiary of United Group B.V., relatingare restricted under the Reimbursement Agreement and the 2023 Revolving Credit Facility (when drawn) in the manner in which our business is conducted, including but not limited to the sale of our Croatia and Slovenia operations for cash consideration of EUR 230.0 million (approximately US$ 275.8 million), subjectability to customaryobtain additional debt financing to refinance existing indebtedness or to fund future working capital, adjustments (the "Divestment Transaction"). The closing ofcapital expenditures, business opportunities or other corporate requirements, which may limit our flexibility in planning for, or reacting to, changes in our business, economic conditions or our industry. For additional information regarding the Divestment Transaction is subject to obtaining regulatory approvals and other customary closing conditions. On November 15, 2017 the Croatian Agency for Electronic Media ("CAEM") published a decision that the acquisition by the Purchaser is not permitted under the Croatian Act on Electronic Media due to certain cross ownership restrictions that CAEM believes to be applicable to the Divestment Transaction. Following the sale by the United Group of certain assets in Croatia to address this cross ownership restriction, the Purchaser has reapplied for approval from CAEM. Under the terms of the FrameworkReimbursement Agreement, the Purchaser has the right to extend the closing date of the transaction until March 31, 2018 (the "Long Stop Date"). There is no guarantee that the CAEM regulatory approval or any other regulatory approvals will be obtained by the Long Stop Date. In the event the required regulatory approvals are not obtained by the Long Stop Date or the parties have not otherwise agreed to extend that date, both we2023 Revolving Credit Facility and the Purchaser have the right to terminate the Framework Agreement on notice to the other party. If the Divestment Transaction does not close or is terminated, we would not be able to repay indebtedness we planned to repay with expected proceeds of the Divestment TransactionWM Guarantees, see Part II, Item 8, Note 4, "Long-term Debt and would need to find alternative sources of funds to repay such indebtedness (see "We may be unable to refinance our existing indebtedness and may not be able to obtain favourable refinancing terms" above)Other Financing Arrangements".

We may be subject to changes in tax rates and exposure to additional tax liabilities.

We are subject to taxes in a number of foreign jurisdictions, including in respect of our operations as well as capital transactions undertaken by us. We are subject to regular review and audit by tax authorities, and in the ordinary course of our business there are transactions and calculations where the ultimate tax determination is unknown. Significant judgment is required in determining our provision for taxes. The final determination of our tax liabilities resulting from tax audits, related proceedings or otherwise could be materially different from our tax provisions. Economic and political pressures to increase receipts in various jurisdictions may make taxation and tax rates subject to significant change and the satisfactory resolution of any tax disputes more difficult. The occurrence of any of these events could have a material adverse effect on our financial position, results of operations and cash flows.

A default by us in connection with our obligations under our outstanding indebtedness could result in our inability to continue to conduct our business.

Pursuant to the Reimbursement Agreement and the 20212023 Revolving Credit Facility, we pledged all of the shares of CME NV and of CME BV, which together ownowns all of our interests in our operating subsidiaries, in favor of Time Warner Media as security for this indebtedness. If we or these subsidiariesCME BV were to default under the terms of any of the relevant agreements, Time Warner Media would have the ability to sell all or a portion of the assets pledged to it in order to pay amounts outstanding under such debt instruments. This could result in our inability to conduct our business.

Fluctuations in exchange rates may continue to adversely affect our results of operations.

Our reporting currency is the dollar and CME Ltd.'s functional currency is the Euro. Our consolidated revenues and costs are divided across a range of European currencies. In 2017, the weakening of the dollar had a positive impact on reported revenues when translated from the functional currencies of our operations. Any future strengthening of the dollar will have a negative impact on our reported revenues. Furthermore, fluctuations in exchange rates may negatively impact programming costs. While local programming is generally purchased in local currencies, a significant portion of our content costs relates to foreign programming purchased pursuant to dollar-denominated agreements. If the dollar appreciates against the functional currencies of our operating segments, the cost of acquiring such content would be adversely affected, which could have a material adverse effect on our results of operations and cash flows.

Our strategies to enhance our carriage fees and diversify our revenues may not be successful.

We are focused on creating additional revenue streams from our broadcast operations as well as increasing revenues generated from television advertising, which is how we generate most of our revenues. Our main efforts with respect to this strategy are on increasing carriage fees from cable, satellite and IPTV operators for carriage of our channels as well as continuing to seek improvements in advertising pricing. Agreements with operators generally have a term of one or more years, at which time agreements must be renewed. There can be no assurance that we will be successful in renewing carriage fee agreements on similar or better terms. During negotiations to implement our carriage fees strategy in prior years, some cable and satellite operators suspended the broadcast of our channels, which negatively affected the reach and audience shares of those operations and, as a result, advertising revenues. There is a risk that operators may refuse to carry our channels while carriage fee negotiations are ongoing, which would temporarily reduce the reach of those channels and may result in clients withdrawing advertising from our channels. The occurrence of any of these events may have an adverse impact on our financial position, results of operations and cash flows. If we are ineffective in negotiations with carriers or in achieving further carriage fee increases, our profitability will continue to be dependent primarily on television advertising revenues, which increases the importance placed on our ability to improve advertising pricing and generate advertising revenues. In addition to carriage fees, we are also working to build-out our offerings of advertising video-on-demand products and other opportunities for advertising online. There can be no assurances that our revenue diversification initiatives will ultimately be successful, and if unsuccessful, this may have an adverse impact on our financial position, results of operations and cash flows.

A downgrading of our corporate credit ratings may adversely affect our ability to raise additional financing.

Moody’s Investors Service rates our corporate credit as B2B1 with a positive outlook. Standard & Poor’s rates our corporate credit B+ currently on CreditWatch(on watch with developingnegative implications due to the Divestment Transaction.proposed Merger). Our ratings show each agency's opinion of our financial strength, operating performance and ability to meet our debt obligations as they become due.due, as well as the proposed Merger. These ratings take into account the particular emphasis the ratings agencies place on metrics such as leverage ratio and cash flow, which they use as measurements of a company's liquidity and financial strength. They also reflect an emphasis placed by the ratings agencies on a track record ofthe historically strong financial support from Time Warner.Warner Media. We may be subject to downgrades if our operating performance deteriorates or we fail to maintain adequate levels of liquidity. In addition, our ratings may be downgraded if the agencies form a view that material support from Time Warner is not as strong, or the strategic importance of CME to Time Warner is not as significant as it has been in the past. In the event our corporate credit ratings are lowered by the rating agencies, we may not be able to refinance our existing indebtedness or raise new indebtedness that may be permitted under the Reimbursement Agreement and the 20212023 Revolving Credit Facility (when drawn), and we will have to pay higher interest rates, all of which would have an adverse effect on our financial position, results of operations and cash flows.

If our goodwill, other intangible assets and long-lived assets become impaired, we may be required to record significant charges to earnings.

We review our long-lived assets for impairment when events or changes in circumstances indicate the carrying amount may not be recoverable. Goodwill and indefinite-lived intangible assets are required to be assessed for impairment at least annually. Factors that may be considered a change in circumstances indicating that the carrying amount of our goodwill, indefinite-lived intangible assets or long-lived assets may not be recoverable include slower growth rates in our markets, reduced expected future cash flows, increased country risk premium as a result of political uncertainty and a decline in stock price and market capitalization. We consider available current information when calculating our impairment charge. If there are indicators of impairment, our long-term cash flow forecasts for our operations deteriorate or discount rates increase, we may be required to recognize additional impairment charges in later periods. See Part II, Item 8, Note 4,3, "Goodwill and Intangible Assets" for the carrying amounts of goodwill in each of our reporting units.

Risks Relating to Our Operations