QuickLinks-- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2000

[_] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

2002

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to ____________

Commission file number:0-26642

-------

MYRIAD GENETICS, INC.

(Exact

(Exact name of registrant as specified in its charter)

Delaware 87-0494517

--------- ----------

(State or other jurisdiction (I.R.S. Employer Identification No.)

of incorporation or organization)

320 Wakara Way, Salt Lake City, UT 84108

- ---------------------------------- -----

(Address of principal executive offices) (Zip Code)

| Delaware (State or other jurisdiction of incorporation or organization) | 87-0494517 (I.R.S. Employer Identification No.) | |

320 Wakara Way, Salt Lake City, UT (Address of principal executive offices) | 84108 (Zip Code) |

Registrant's telephone number, including area code:(801) 584-3600

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, $.01 Par Value Per Share

(Title

Preferred Share Purchase Rights

(Title of Class)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ X ]ý No [_]o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [_]o

The aggregate market value of the registrant's voting stock held by non-

affiliatesnon-affiliates of the registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) on September 1, 20002, 2002 was $1,621,749,204,$392,025,303, based on the last sale price as reported by The Nasdaq Stock Market.

As of September 1, 200018, 2002 the registrant had 22,269,64023,835,056 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents (or parts thereof) are incorporated by reference into the following parts of this Form 10-K: Certain information required in Part III of this Annual Report on Form 10-K is incorporated from the Registrant's Proxy Statement for the Annual Meeting of Stockholders to be held on November 17, 2000.

1

Overview

We are a leader inleading biopharmaceutical company focused on the usedevelopment and marketing of gene-based medicine to develop novel therapeutic and molecular diagnosticpredictive medicine products. We are focused on the emerging

field of proteomics, which involves establishing the relationship between

protein function and particular diseases by identifying disease-specific

proteins. We employhave developed a varietynumber of proprietary proteomic technologies which permit us to discover

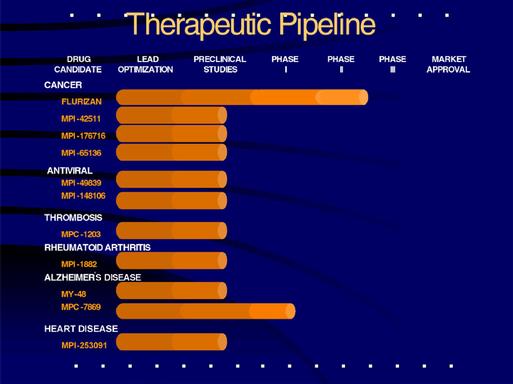

important diseaseidentify genes, their related proteins and the biological pathways they form. We use this information to better understand the role these genes and their related proteins play in the onset and progression of human disease. We operate two wholly owned subsidiaries, Myriad Pharmaceuticals, Inc. and Myriad Genetic Laboratories, Inc., to commercialize our therapeutic and predictive medicine discoveries. Myriad Pharmaceuticals, Inc. develops and intends to market novel therapeutic products. Myriad Genetic Laboratories, Inc. focuses on the development and marketing of predictive medicine products that assess an individual's risk of developing a specific disease.

Myriad researchers have integrated these

technologies using powerful bioinformaticsmade important discoveries in the fields of cancer, viral diseases such as AIDS, and robotics systemsacute thrombosis. These discoveries point to conductnovel disease pathways and have paved the way for the development of new drugs. Additionally, our research efforts on a high-throughput basis. This integrated proteomics platform

has enabled us to identify numerous proteinspipeline of drug targets offers therapeutic opportunities for the treatment of diseases such as promising targets for new

proprietary drugsheart disease, rheumatoid arthritis, Alzheimer's disease and molecular diagnostic tests.

Using our proprietary technologies, weother central nervous system disorders. We have identified 22871 drug targets to date. We have delivered 13also established an extensive portfolio of drug candidates that are under development at Myriad. Fifteen of these drug targets tocandidates are in pre-clinical testing. Flurizan™, our strategic partners based

on our discoverylead therapeutic product for the treatment of genes involved in breast cancer, brain cancer, prostate cancer, heart disease, dementia and other disorders.is currently in a large, multi-center human clinical trial. We have received total

payments from our seven current strategic partners in excessalso recently submitted an Investigational New Drug (IND) application for the evaluation of $100 million.R-flurbiprofen (MPC-7869) for the treatment of Alzheimer's disease. We will receive additional milestone and royalty payments if our strategic partners

develop and commercialize drugs from the thirteen targets we have delivered to

them. Our current partners include Bayer Corporation, Eli Lilly and Company,

Hitachi Ltd., Hoffmann-LaRoche Inc., Pharmacia Corporation, Novartis

Corporation, Schering-Plough Corporation and Schering AG. We have also

established a portfolio of nine new drug targets that we have retained for our

own small molecule drug development program. We expectintend to independently develop test and, commercialize small molecule therapeutics from drug targets selected

fromsubject to regulatory approval, market our internal portfolio,therapeutic products, particularly in the area of cancer. Outside of the

oncology area, we will seek to enter into future strategic partnerships for the

clinical development of many of these targets.cancer and infectious diseases.

We also focus on developing, marketing and selling products used for

predictive medicine and personalized medicine. We have developed and commercialized twofive innovative molecular diagnostic tests, one ofpredictive medicine products: BRACAnalysis®, which is used for analyzingto assess a woman's risk of developing breast and ovarian cancer, susceptibilityCOLARIS™ and the otherCOLARIS AP™, which are used to determine a person's risk of developing colon cancer, MELARIS®, which is used to determine a person's risk of developing malignant melanoma, and CardiaRisk®, which is used for therapeutic management of hypertensive patients. In August 2000, we announced

the future launch of a predictive medicine test for hereditary colon cancer and

uterine cancer. We market these products using our own internal 106 person sales force in the United States and we have entered into marketing collaborations with other organizations in the United Kingdom, Ireland,Austria, Brazil, Canada, Germany, Japan, and Japan.Switzerland. Revenues from these proprietary tests, which we analyze in our CLIA approved laboratory,products grew approximately 70%57% from the prior year to $8.8$26.8 million in the fiscal year ended June 30, 2000.2002.

We believe that the future of medicine lies in the creation of new classes of drugs that prevent disease from occurring or progressing and that treat the cause, not just the symptoms, of the disease. In addition, we believe that advances in the emerging field of molecular diagnosticspredictive medicine will improve our ability to determine which patients are subject to a greater risk of developing these diseases and who therefore should receive these new preventativepreventive medicines.

Industry Background

We have devoted substantially all of our resources to maintaining our research and development programs, undertaking drug discovery and development, and operating our predictive medicine business. Our revenues have consisted primarily of sales of predictive medicine products and research payments received pursuant to collaborative agreements, upfront fees, and milestone payments. We have yet to attain profitability and, for the year ended June 30, 2002, we had a net loss of $14.0 million and as of June 30, 2002 had an accumulated deficit of $73.8 million.

We have formed strategic alliances with 12 major pharmaceutical or multinational companies including Abbott Laboratories, Bayer Corporation, E.I. du Pont de Nemours and Company (DuPont),

2

Eli Lilly and Company, Hitachi Ltd., Hoffmann-LaRoche Inc., Novartis Corporation, Oracle Corporation, Pharmacia Corporation, Schering AG, Schering-Plough Corporation, and Torrey Mesa Research Institute, a subsidiary of Syngenta. We intend to enter into additional collaborative relationships to discover genes, proteins, protein networks, and drug targets associated with common diseases as well as to continue to fund internal research projects. However, we may be unable to enter into additional collaborative relationships on terms acceptable to us.

In April 2001, we announced the formation of Myriad Proteomics, Inc., a new venture with Hitachi, Ltd. and Gene-Based Drug DevelopmentOracle Corporation to map the human proteome. Myriad Proteomics, which is 49 percent owned by the Company, intends to develop and market a proprietary map of the human proteome to pharmaceutical and biotechnology companies for therapeutic and diagnostic product development.

We expect to incur losses for at least the next several years, primarily due to expansion of our drug discovery and development efforts, expansion of our research and development programs, launch of new predictive medicine products, and expansion of our facilities. Additionally, we expect to incur substantial sales, marketing and other expenses in connection with building our pharmaceutical and predictive medicine businesses. We expect that losses will fluctuate from quarter to quarter and that such fluctuations may be substantial.

Business Strategy

Understanding the cause of a disease at the level of genes, proteins and biological pathways can be very helpful in determining how best to treat the disease. Historically, technologies used to discover treatments for the symptoms of diseases have been less effective against complex diseases that arise through a combination of genetic and environmental factors, such as cancer and heart disease. In order to treat complex diseases effectively, it is imperative to understand how the body uses its genetic information, how genetic mutationsthe disruption of important biological pathways can lead to disease, and how drugs can be developed to prevent, halt or reverse disease progression. As the scientific community learnswe learn more about the genetic basis of disease, we believe that the current methods of drug developmentwe will be revolutionized.

2

The majority of diseases are treated by modifying the activities of biological pathways through drugs that interact with the proteins produced by

the genes in affected cells and tissues. The quest for safer and more effective treatments for a wider range of diseases has led pharmaceutical companiesus to employ genomics and proteomics in theirour drug discovery and development programs.

Modern gene-based

Gene-based small molecule drug discovery and development programs at Myriad typically involve the following steps:

Target Discovery. Target discovery involves identifying genes and their proteins related to disease susceptibility, onset or progression. A better understanding of some diseases has resulted from the identification of disease-

relateddisease-related proteins and the subsequent understanding of their function.

Protein Function and Biological Pathway Determination. Proteins control virtually all cellular processes, including important disease processes. The determination of a protein's function clarifiesand clarifying the role of a protein in the biological pathway of a disease.disease, leads to the identification of key regulators in that pathway or drug target.

Target Validation. After identifying aan important disease-related protein, the decision must be made as to whether the protein can be a drug target. If a

protein is not qualified to serve as a target other proteins in the same

disease pathway can be examined as potential targets. A protein target that is

identified must be validated to confirm that the potential targetit is at a control point in a disease-related pathway and that a drug which interacts with the target is expected to have a beneficial effect. If through the validation process a protein is not qualified to serve as a drug target, other proteins in the same disease pathway can be examined as potential targets.

Assay Development and High-Throughput Screening. A specific assay must be developed for each validated drug target to identify compounds that inhibit or activate athe specific protein. To identify

3

potential drugs, a target is tested through high-throughput screening against a chemically diverse library, usually comprised of hundredsmillions of different small molecule compounds. The screening process frequently produces several compounds that interact with the identified drug target.

Drug Development. Compounds that may be suitable for development into potential drugs undergo selection and optimization. Once selected, the compound is optimized by synthesizing and testing a series of closely related compounds. Based on expected activity, safety and bioavailability, the most promising leads are selected. If the disease results from the loss of function of a specific protein, protein replacement therapy may represent an attractive alternative. Following optimization, lead compounds and protein therapeutics enter into preclinicalpre-clinical testing to establish their efficacy and safety in animals. If preclinicalpre-clinical tests are successful, candidate drugs enter clinical trials to determine their efficacy and safety in humans.

Predictive and Personalized Medicine

PredictiveMedicine. In predictive medicine identifies those individuals at risk for the

development of specific diseases, and guides the healthcare management of those

predisposed individuals to delay the onset or prevent the occurrence of specific

diseases. Once a predisposed individual is identified, that individual can make

more informed decisions in selecting the most appropriate surveillance measures

for prevention, and therapy. Personalized medicine establishes a genetic

response profile to drug therapy for specific individuals. Knowing how a patient

will likely respond to particular drugs may decrease the occurrence of adverse

side effects from medications while improving their effectiveness, possibly

leading to better outcomes and lower overall healthcare costs. Both predictive

and personalized medicine are of interest to healthcare payors who seek to lower

costs and improve the effectiveness of medical care.

Molecular Diagnostics. Molecular diagnostics is the analysis ofwe analyze genes and their proteins to predict individuals' risks for developing diseases and their responses to specific treatments. Armed with this risk assessment information, individuals can increase surveillance and take preventive action to prevent or delay the onset of disease. As drugs are developed and approved for use, knowledge about side effects and efficacy in specific individuals emerges. Using this pharmacogenomic knowledge, personal genetic profiles can be developed to predict responses of individuals to drugs.

Our Business Strategy

We believe that the future of medicine lies in the creation of new classes of drugs that are safer and more effective; drugs that not only treat disease but that also prevent disease from occurring. We also believe that the emerging field of predictive medicine will revolutionize the practice of medicine by identifying an individual's risk of developing diseases later in life.

Our business strategy is to understand the relationship between proteins and diseases in order to develop the next generation of therapeutic and molecular diagnosticpredictive medicine products. Through our proprietary technologies, we are 3

molecular diagnosticpredictive medicine products. Our business strategy includes the following key elements:

. Expand

- •

- Use our

proprietary proteomic databases.technologies to discover important disease genes and proteins, understand their functions and identify lead compounds. Wewill continueplan to expand ourexisting genetic and medical databases in Utah and Quebec. Theseproprietarydatabases not only enable us to accelerate our gene discovery efforts, they are also useful in target validation, pharmacogenomics and disease association studies. . Discover important disease genes, understand their function and identify lead compounds. We will expand ProNet(R), our proprietary proteomic technology,technologies to uncover additional disease pathways, discover functions for many of the proteins in these pathways and identify high quality drug targets. In addition, we will continue to employ ourProTrap(TM)high-throughput screening technologyfor high- throughput screeningin order to rapidlydevelop assays for our high throughput screening platform.identify novel small molecule drugs. We believe this will result in the identification of numerous lead compounds for potential drug development.. Selectively developBased on the specific characteristics of our drug targets, we will augment our small molecule drug development capability with protein replacement therapy and antibody therapy. - •

- Develop and commercialize therapeutic products. We intend to take selected compounds, particularly in the

areaareas of cancer and infectious diseases such as AIDS, through the clinical developmentprocess.process ourselves. We are focusing oncancerthese diseases due to the large unmet need for effective and less toxic drugs, and the oftentimes shorter and less expensive clinical trials resulting from the potential for fast track status that the U.S. Food and Drug Administration, or FDA, has typically afforded novelcancer drugs.drugs in these areas. Additionally, we will be able to leverage the expertise of our existing oncology sales force in the marketing ofthesenovel cancertherapies. .therapies and intend to expand our existing sales force to address the AIDS market as well. - •

- Grow and expand our predictive medicine business. We plan continue to increase the domestic and foreign market penetration of our existing predictive medicine products and create additional products to capitalize on the emerging areas of predictive medicine.

- •

- Capitalize on our strategic alliances with major pharmaceutical companies.We expect to maintain

and expandour strategic alliances focused on the discovery of novel drug targets.Moreover, as we identify and develop lead compounds, we plan to partner many of these compounds with major pharmaceutical companies prior to pursuing human clinical trials.This will shift much of the

4

financial risk associated with later

stage drug development to our partners, while permitting us to benefit from our partners' drug development expertise and marketing strength.

. Grow and expand our molecular diagnostic business. We will continue to

increase the domestic and foreign market penetration of our existing

molecular diagnostic tests and create additional tests to capitalize on

the emerging areas of predictive and personalized medicine.

Our Integrated Proteomic PlatformSet of Technologies

We have developed and integrated a powerful set of proteomic technologies

and databases that enable us to discover genes of commercial importance and understand their role in disease pathways. Our technology platform provides the basisknowledge to develop therapeutic and molecular diagnosticpredictive medicine products, based on a vastly improved understanding of the genetic basis of disease. Our proteomic

platform consists of the following key elements.

Genetic and Medical Databases

Our genetic databases, which are based on distinct populations, provide us

with a unique competitive advantage because they enable us to correlate the

inheritance of gene mutations through multiple generations with the occurrence

of disease. We have created an extensive computerized genealogical database

whose ancestries are centered on the pioneer families of Utah. This population

is valuable for genetic research because of its Northern European ancestry,

its large families, and its profound interest in recording its genealogy.

Information from this population, such as medical records, DNA samples,

genealogy and other health-related data, has been identified by our

researchers and collaborators and assembled into our computerized genealogy

database. This database has allowed us to discover genes involved in breast

cancer, ovarian cancer, melanoma, brain cancer, prostate cancer, heart

disease, and diabetes.

4

We have linked our database of Utah families to a disease registry from

Intermountain Health Care, which operates 40 hospitals and clinics in the

western United States. This information includes data such as laboratory tests,

prescription medications, drug allergies, surgical procedures and patient

criteria.

We have recently augmented this genetic medical information of the Utah

population by developing databases of individuals with specific diseases in

Quebec. This genetically isolated population complements the Utah population and

further strengthens our ability to more rapidly identify disease-causing genes.

A database of affected individuals from Quebec, a population that is twice as

old as Utah allows us to quickly identify important disease-causing genes. We

have worldwide exclusive rights and access to the Utah and Quebec databases.

Our high-throughput sequencing and mutation screening systems use a

robotics platform and bioinformatics software custom designed by our scientists

and software engineers. This integrated system has been expanded to incorporate

the introduction of a large number of genes and research populations, permitting

the rapid comparison of novel mutations in candidate genes between individuals

with diseases and healthy individuals drawn from the same population. This high-

throughput, automated system enables us to rapidly detect genes, which are

highly correlated with disease, and in many instances can be shown to be causal.

ProNet(R) Database

We believe that because virtually all cellular processes are controlled by proteins, including important disease processes, knowledge of protein interactions and functions can be extremely valuable in the identification of novel drug targets for therapeutic development. In order to determine the function of genes and their role in disease pathways, we use our proprietary ProNet(R) technologyProNet® and ProSpec™ technologies. These technologies enable us to develop our ProNet(R) database ofidentify human proteins, to discover the other proteins with which they interact and to improve our understanding of their involvement in important disease pathways. Each protein and its interacting partners form a network, which reads like a map, positioning the protein in the disease pathway and tracing the protein's role in that pathway.

Using our ProNet(R) technology,high-throughput proteomic technologies, we screen target proteins throughwith our proprietary libraries constructed from a variety of different tissues and organs, such as heart, brain, kidney, liver, breast and prostate. We have constructed over 1533 proprietary libraries each containing approximately 10 million protein fragments. We apply our proprietary automation and robotic capabilities to the protein search process to allow high-throughput processing of protein interactions. Our current capacity allows us to identify over 100hundreds of protein interactions each day. Every new interaction is entered into our

ProNet(R) database.

We believe that ProNet(R) provides aProNet® and ProSpec™ provide significant opportunityopportunities to identify and develop novel drug targets by:

.

- •

- discovering new proteins in the disease pathways;

. - •

- discovering functions for

manynovel proteins;. - •

- identifying new functions for known proteins;

. - •

- identifying proteins involved in critical interactions along the pathway; and

. - •

- selecting high quality drug

discoverytargets from disease pathways.Our clients access these data through secure Internet connections. We have created the following three types of ProNet(R) databases: . Proprietary ProNet(R) databases for specific pharmaceutical company clients. These databases address specific diseases and disease pathways of strategic importance to our pharmaceutical partners. Specific drug targets are selected by our partners for their proprietary drug discovery research. . Main ProNet(R) database of proteins and biological pathways, which contains proprietary interactions that we have discovered. These interactions are distinct from those identified for client companies. 5. ProNet(R) Online database of protein-protein interactions from the public domain. We use this database as a marketing tool and it is freely available to the public through the Internet at www.myriad- pronet.com. ProTrap(TM) Technology

We have developed a newproprietary drug screening technology platform called ProTrap(TM). The

ProTrap(TM) technologyProTrap™ which allows us quickly and cost effectively to build high-

throughputhigh-throughput drug screens using a yeast-based system. We believe that yeast-based screens offer a number of distinct cost and time advantages in comparison to the more commonly used mammalian or cell-free screens. Yeast are inexpensive and easy to grow and yeast screens can be run onthrough our liquid handling robots.robotics platform.

In the ProTrap(TM)ProTrap™ system, yeast are manipulated genetically so that they produce a human or viral protein. When the protein is produced in one of a variety of proprietary yeast strains, it causes the strain to change in a way that can be easily detected. Therefore, when a small molecular weight compound inhibits or activates the protein, a further change in the characteristics of the yeast strain is easily detectable.identified. The drug discovery screens are designed to be run in parallel, such that each screen controls for false positives in other screens. The result is greater efficiency and a higher screening throughput. Our ProTrap(TM)Additionally, our ProTrap™ technology has a wide variety of other potential

applications and can bebeen extended to complement our other target validation technologies by determining the functions of proteins. It complements ProNet(R)

by quickly finding new disease gene pathways. Finally, it can also determine the biological activity of a mutant proteinproteins that may have utility in pharmacogenomics.

Bioinformatics

Our high-throughput sequencing and Roboticsscreening systems use a robotics platform and bioinformatics software custom designed by our scientists and software engineers. This integrated system has been

5

expanded to incorporate the introduction of a large number of genes and research populations, permitting the rapid comparison of novel mutations in candidate genes between individuals with diseases and healthy individuals drawn from the same population. This high-throughput, automated system enables us to rapidly detect genes and proteins, which are highly correlated with disease, and in many instances can be shown to be causal.

The gene and drug discovery process generates vast amounts of information. Accordingly, we have designed proprietary bioinformatics systems, which provide significant analytical and data management capabilities. Our systems are based on integrated, protocol-driven database management software, which is used to track experiments and collect relevant data. In addition, we have developed a proprietary laboratory information management system. This system has the advantages of simplicity of design, ease of maintenance, and speed of development. To date, we have used our information management systemsoftware for our high-throughput systems for protein analysis, genotyping, genomic sequencing, mutation screening and compound screening. This has been of fundamental importance in sample tracking and quality assessment and quality control. We believe our strength in bioinformatics provides us with a substantial competitive advantage.

We employ state-of-the-art robotics platforms in all of our high-throughput systems. We use the same robotics software and hardware development and

maintenance teams to ensure efficiency throughout our operations. We operate

flexible robotics systems in our research and molecular diagnostics laboratories

and high-throughput robotics systems in our sequencing and drug screening

laboratories. Each of our robotics systems is connected continually in a real time interface with our proprietary laboratory information management system to maintain a high degree of precision in sample tracking. Our robotics systems have been designed to ensure that the sample volumes used for each of the applications are kept at minimum levels to maintain reagent cost savings in each of our operations. The high level of automation as well as the concerted effort in optimizing biochemistry and reducing reagent volumes allows us to produce data at a very competitive cost in the industry.

Therapeutic Product Development

The pharmaceutical industry has been successful in developing medicines to treat the symptoms of disease. However, as the current generation of compounds nears the end of its patent protection, the industry has begun to

6

some of those compounds in the oncology

areathese drug candidates through human clinical trials. If we developFor those therapeutic products in the area of cancer, then given the concentrated nature of the oncology market, we would be able to leverage the marketing efforts of our existing oncology sales force. OutsideGiven the concentrated nature of the oncology area,AIDS market, we intend to partner these lead compounds with

major pharmaceutical companies.expand our sales force to address this market ourselves.

We formed Myriad Pharmaceuticals, our wholly owned subsidiary, to use our proprietary proteomics technologies to discover and develop novel therapeutic products. We believe that our ProNet(R) database of important disease pathwaystechnology provides us with a significant advantage in drug discovery because it enables us to generate a large number of potential drug targets. Once these targets have been identified, our ProTrap(TM) technology enables us towe can rapidly screen a large number of these drug targets against our library of small molecule compounds. This integrated platform enables us to pursue a rapid and cost effective approach to identifying potentially valuable drug candidates

In contrast to the drug discovery model employed by much of the

biotechnology industry, which screens relatively few drug targets against large

libraries of compounds, we are able to screen large numbers of protein targets

against our diverse library of compounds and rigorously select those candidates

we believe to be the most promising. To date, we have 22 drug targets in

development. Of these 22, we have licensed 13 to our strategic partners for

further development and we have retained nine for internal development. Our

current in house drug discovery efforts target cancer, AIDS and rheumatoid

arthritis. In addition, we are exploring the biology around genes that we

believe are involved in a variety of disease areas, including arteriosclerosis,

chronic pain, chronic obstructive pulmonary disease and sleep disorders, and

have selected 110 proteins for further evaluation using our ProNet(R)

technology.

High-Throughput Screeningcandidates.

Our high-throughput screening is highly automated, using robot workstations and a proprietary computerized management system that monitors each step of the process, confirms that each step has been performed to eliminate operator errors and automatically correlates results with compound identity and drug target. Current capacity is approximately 3650 million screening data points per year.

We also build mammalian cell secondary assays to evaluate the initial compounds arising from the primary drug discovery screens. To date, we have completed the evaluation of these assays for colon

6

cancer, other solid tumors, AIDS and inflammatory diseases and have developed protocols to evaluate the mammalian toxicity of all compounds found in our drug discovery screens. We are exploring the biology around genes that we believe are involved in a variety of disease areas, including arteriosclerosis, chronic pain, chronic obstructive pulmonary disease and sleep disorders, and have selected 1,356 proteins for further evaluation using our ProNet® technology.

To date, we have discovered 871 drug targets. We have built drug discovery screens for eachmany of our nine proprietary drug targets and all nine have been runare screening them against our compound library.own library of 200,000 small molecule weight compounds. We have identified a number of proprietarynumerous candidate drug compounds from our drug discovery screens, including drug candidates for colon cancer, heart disease, rheumatoid arthritis, Alzheimer's disease, HCV, HBV, acute thrombosis, and HIV targets, which satisfy the initial criteria of showing selectivity for one molecular target without obvious toxicity. Furthermore, the compounds have been shown to display a good dose response curve, showing increased activity at higher concentrations and decreased activity at lower concentrations.

We have built mammalian cell15 drug candidates currently under development in pre-clinical studies. Flurizan™, our lead therapeutic product for the treatment of prostate cancer, is currently in a large, multi-center human clinical trial. We also recently submitted an Investigational New Drug (IND) application for the evaluation of R-flurbiprofen for the treatment of Alzheimer's disease. The following table outlines the status of our major drug development programs:

Flurizan: Candidate Drug for Prostate Cancer. Flurizan is a novel drug for the treatment of prostate cancer and is our most advanced therapeutic program. It has completed a phase II human clinical trial. In animal models of cancer, Flurizan demonstrated marked anti-tumor and anti-metastatic activity, significantly reducing the incidence of primary and secondary assaysprostate tumors. In humans, the drug was well tolerated in normal healthy subjects and in advanced prostate cancer patients who have relapsed. The drug has good bioavailability and would be given in pill form, once a day. Among relapsing prostate cancer patients, the level of prostate specific antigen (PSA) increases dramatically. After Flurizan was given to evaluate the initial

compounds arising from the primary drug discovery screens. To date, we have

completed the construction of severala group of these assayspatients, 52% experienced a reduction in the growth rate

7

of their PSA levels. Flurizan holds promise as an effective, safe drug for colon cancer, other

solid tumors, HIV and inflammatory diseases and have developed protocols to

evaluate the mammalian toxicity of all compounds found in our drug discovery

screens. We are currently working to build secondary screens for the remainder

of our drug targets.

MPI-42511 Candidate Therapeutic Compound for Colon Cancer

Our lead therapeutic development program addresses the treatment and prevention of colorectalprostate cancer. Based uponFour patents have issued on the drug.

MPI-176716: Candidate drug for Solid Tumors, Leukemia and Lymphoma. MPI-176716 is a novel small- molecule drug that inhibits an important step in the pathway controlling programmed cell death. As a result, most dividing cancer cell types tested to date are sensitive to this drug. We expect this drug candidate to address solid tumors as well as leukemia and lymphomas. These cancers account for an expected 1.3 million cases in 2001, according to the American Cancer Society. Drugs that have the potential to treat a common underlying mechanism of cancer have broad application to the treatment of disease and therefore, a very large market potential worldwide. Our cancer drug is in preclinical testing and if successful we plan to enter human clinical trials in cancer patients.

MPI-49839: Candidate Drug for AIDS. Our novel drug, MPI-49839, represents a new approach to the treatment of AIDS. The concept behind the drug may enable the creation of an entirely new class of therapeutics. The drug is distinct from the protease inhibitors and reverse-transcriptase inhibitors, which are the current generation of AIDS drugs, or fusion and integrase inhibitors, which are other classes of anti-HIV drugs being studied. Our anti-HIV drug is especially exciting in that it has the potential to improve on these current treatments for AIDS. With the evolution of multi-drug resistant strains of the virus comes an increased need for therapies that act through different mechanisms. Although current drugs have been quite successful in improving survival for AIDS patients, the drugs do not eliminate the virus, thus drug therapy becomes a life-long commitment. Researchers at the University of California recently estimated that an alarming 42% of HIV-infected individuals will be resistant to the current generation of drugs by 2005. The ability to establish long-term suppression of viral activity requires new drugs that are more impervious to viral resistance. Novel approaches such as Myriad's may well provide that extended therapeutic benefit to patients. MPI-49839 is in pre-clinical studies, and if successful, we plan to enter human clinical trials in AIDS patients.

MPI-42511: Candidate Drug for Colon Cancer. MPI-42511 is a novel small-molecule drug that inhibits a key regulator of a cancer pathway that is involved in 95% of all cases of colon cancer. Our scientists employed a rapid, high-throughput two-tier screening procedure to discover this potential colon cancer pathway

developed withdrug. Initially, we screened our ProNet technology, we identified a novel drug target, built

and implemented a high-throughput drug discovery screen that resulted inlibrary of small molecules for their ability to inhibit the

discovery of a small molecule compound. The compound, MPI-42511, showed

selectivity for the target both in the initial screen and in a human cell line

assay. Subsequently, we have demonstrated the anti-colon cancer activity of the compound against a

7

variety ofdrug target. We isolated several candidates, which were subsequently screened for the ability to specifically kill human colon cancer cells without harming normal cells. These compounds provide the potential to prevent unchecked cell lines. A rangegrowth during the progression of chemical analogues of MPI-

42511 have been generatedcolon cancer. The lead drug is now in pre-clinical evaluation, and evaluated for optimal drug characteristicsif successful, we plan to enter human clinical trials in colon cancer models. Pre-clinicalpatients.

MPC-1203: Candidate Drug for Acute Thrombosis. MPC-1203 is a proprietary recombinant form of the human protein, anti-thrombin III. Anti-thrombin III plays a critical role in helping to maintain the flow of blood by inhibiting clot formation. It is a circulating plasma protein that is produced in the liver. Following severe trauma or major surgery, this essential protein is degraded by enzymes, and can no longer prevent the blood from clotting. Our proprietary form effectively resists degradation by these enzymes, which are released during inflammatory events. By resisting inactivation, MPC-1203 remains in circulation, available to carry out its function in the body. Blood clotting is a major concern following orthopedic surgery such as hip replacement surgery, open heart surgery and other critical trauma to the body. Clotting of the blood is also a cause of organ failure and death following sepsis and cancer. MPC-1203 is the subject of two United States patent applications and eight foreign patent applications. Our protein drug is in pre-clinical testing, and if successful, we plan to enter human clinical trials.

MPC-7869: Candidate Drug for Alzheimer's Disease. We recently submitted an Investigational New Drug (IND) application to the FDA for the evaluation of MPC-7869 (R-flurbiprofen) in the treatment and prevention of Alzheimer's disease. In our Phase I human clinical trial, which has now been cleared

8

by the FDA for initiation, we intend to establish the safety profile and dosing regimens of MPC-7869 in healthy elderly volunteers. Alzheimer's disease is a degenerative neurological condition affecting up to 20% of all people aged 80 or older, with an estimated 4 million cases in the United States alone. Current approved treatments, such as acetylcholinesterase inhibitors, temporarily mitigate symptoms without meaningfully impacting progression of the underlying disease. Alzheimer's disease is marked by progressive cognitive decline and by the accumulation of amyloid plaques and neurofibrillary tangles in the brain. The major structural component of these plaques is amyloid beta protein, specifically Amyloid beta-42 (Ab42). Many researchers now believe that Ab42 plays an important role in the onset of Alzheimer's disease. Preclinical studies performed with MPI-42511NIH funding, at Mayo Clinic Jacksonville and UCSD have demonstrated that R-flurbiprofen substantially lowers the levels of Ab42 in colon cancer model

organisms have been initiated.

Candidate Therapeutic Compound for AIDSboth human cell lines and in animal models of Alzheimer's disease. We have established a substantial development programbelieve MPC-7869 holds promise as an effective, safe drug for the treatment and prevention of the Human Immunodeficiency Virus (HIV). The program was initiated from the

discovery, using ProNet(R), of an intriguing protein interaction between the HIV

virus and the human host cell. A high-throughput screen was constructed and has

identified compounds that showed selectivity against the target. The target is

neither of the protease inhibitor nor reverse-transcriptase inhibitor class and

thus represents the potential for novel drug therapy as the two common currently

prescribed drugs become less effective through increased viral resistance. These

compounds are now being further evaluated for their activity against the virus.

Molecular Diagnostics

We are committed to the development and marketing of novel molecular

diagnostic products for the emerging market opportunities of predictive medicine

and personalized medicine.Alzheimer's disease.

Predictive Medicine Products

Predictive medicine determines whichidentifies those individuals are at risk for the development of specific diseases, and guides the healthcare management of those predisposed individuals to delay the onset or prevent the occurrence of specific diseases. ThisOnce a predisposed individual is identified, that individual can make more informed decisions in selecting the most appropriate surveillance measures and therapeutic course of action. Because predictive medicine guides the healthcare management of those predisposed individuals, this allows healthcare resources to be focused on individuals who have the greatest need and may reduce waste in the healthcare system. Personalized medicine establishes an individual's genetic response

profile to a specific drug. Knowing how individual patients are likely to

respond to a particular drug may lead to more effective choice of medication,

reduced adverse side effects and lower overall healthcare costs.

Through our wholly owned subsidiary, Myriad Genetic Laboratories, we have

established a central molecular diagnostics facilityare committed to provide genetic

information services worldwide to healthcare providers.the development and marketing of novel products for the emerging market opportunities of predictive medicine. We have also developed a

clinical database of information on genetic mutations of each gene discovered,

including the frequency of occurrence in different ethnic population groups and

the clinical effect of these mutations. From these mutations we can identify an

individual's genetic predisposition to disease. Through our database of

mutations we can provide healthcare professionals with detailed genetic

information regarding the risk profile of these different ethnic groups. We also provide educational and support services to physicians and healthcare professionals as part of our genetic informationpredictive medicine business. The molecular

diagnostic testspredictive medicine products we have developed and currently market are not subject to FDA approval, but are subject to oversight and approval byunder the Clinical Laboratory Improvement Amendments, or CLIA. We have obtained all approvals required by CLIA.

Our strategy is to first introduce molecular diagnosticpredictive medicine products in the United States, and then to make them available worldwide through strategic marketing partnerships abroad. We have developed three molecular diagnosticfive predictive medicine products, BRACAnalysis(R)BRACAnalysis®, COLARIS™ and CardiaRisk(R)COLARIS AP®, that weMELARIS®, and CardiaRisk®. We are currently marketing these products in the United States directly through our own 106 person oncology sales force, as well as through a partnership with Laboratory Corporation of America Holdings (LabCorp). Through our partnership with LabCorp we intend to make our predictive medicine products broadly available to primary care physicians throughout the United States. LabCorp is our exclusive sales and COLARIS(TM), which

willdistribution partner, marketing the products through its 600-person U.S. sales force to more than 200,000 of LabCorp's physician customers. All of Myriad's predictive medicine products are included in this agreement.

9

The potential international market for our predictive medicine products is estimated to be launchedat least twice the size of the United States market. After introducing predictive medicine products in the fall of 2000.United States, we plan to introduce our products in foreign markets primarily through strategic marketing partners. We arehave completed marketing agreements with MDS Laboratory Services in the process of developing

additional molecular diagnostic tests for genetic susceptibility to prostate

cancerCanada, Falco Biosystems, Ltd. in Japan, Bioscientia, Ltd. in Germany, Austria and melanoma.

BRACAnalysis(R)Switzerland, and Laboratorio Fleury in Brazil.

BRACAnalysis®: Predictive Medicine Product for Breast and Ovarian Cancer

SusceptibilityCancer. It is estimated that each year, approximately 180,000203,500 women in the United States are diagnosed with breast cancer each year and approximately 25,00023,300 women are diagnosed with ovarian cancer annually.cancer. Each year in the United States, an estimated 43,00039,600 women will die from breast cancer, which has the second highest cancer mortality rate among women, and an estimated 14,50013,900 women will die of ovarian cancer. We reported the discovery of the BRCA1 breast and ovarian cancer

predisposing gene in the October 7, 1994, issue of the journal Science, and in

December 1995, announced the discovery of the complete sequence of BRCA2 breast

cancer gene, as reported in the journal Nature Genetics. BRCA1 and BRCA2 appear to be responsible for approximately 84% of the early onset hereditary breast cancer and approximately 90% of hereditary ovarian cancer. Hereditary breast

cancer is believed to account for approximately 10% of all cases of breast cancer. A study of women in the United States published in the American Journal of Human Genetics indicates that a woman with a BRCA1 mutation has an 86% risk of

8

BRACAnalysis(R),

BRACAnalysis® is a comprehensive analysis of the BRCA1 and BRCA2 genes for determining a woman's susceptibility to breast and ovarian cancer. BRACAnalysis(R)BRACAnalysis® provides important information that we believe will help the patient and her physician make better informed lifestyle, surveillance, chemoprevention and treatment decisions. The price perfor the test is currently $2,580$2,760 and is covered by most health maintenance organizations and health insurance providers in the United States. CardiaRisk(R)We have nine issued United States patents covering BRACAnalysis®.

COLARIS™: Predictive Medicine Product for Colon Cancer and Uterine Cancer. Colorectal cancer is the second leading cause of cancer deaths in the United States, with approximately 148,300 new cases expected to be diagnosed in the year 2002. Familial forms of colorectal cancer were estimated in 1997 to account for 10% to 30% of all cases according to the American Society of Clinical Oncologists. The health care management considerations in these hereditary syndromes are similar to those for breast and ovarian cancer at-risk individuals. Individuals who carry a mutation in one of the two colon cancer genes have a greater than 80% lifetime risk of developing colon cancer and women have a 60% life time chance of developing uterine cancer. Highly effective preventive measures include colonoscopy and the removal of precancerous polyps. To illustrate the predictive medicine value of molecular testing in colorectal cancer syndromes, it has been shown that individuals who carry gene mutations can lower their risk of developing cancer by more than 50% with appropriate preventive and surveillance measures.

COLARIS™ is a comprehensive analysis of the MLH1 and MSH2 genes for determining a person's risk of developing colon cancer or uterine cancer. COLARIS™ provides important information that we believe will help in the surveillance and possible prevention of colon cancer. The price for the test is $1,950 and is covered by most health maintenance organizations and health insurance providers in the United States.

COLARIS AP™: Predictive Medicine Product for Colon Cancer. In May 2002 we introduced our fifth predictive medicine product for genetic susceptibility to colon cancer. COLARIS AP™ detects mutations in the APC gene, which cause a colon polyp-forming syndrome known as familial adenomatous polyposis (FAP), and a more common variation of the syndrome known as attenuated FAP (aFAP). FAP may be responsible for as much as 20% of hereditary colorectal cancer, and aFAP

10

may underlie as much as 20% of all colon cancer cases. There are an estimated 32,000 possible cases of FAP and aFAP each year in the United States. Our other colon cancer product is COLARIS™, a predictive medicine test for hereditary colon cancer that is not associated with significant polyp formation. Together, COLARIS™ and COLARIS AP™ may account for approximately 90% of all hereditary colon cancer syndromes. The price for the test is $1,685 and is covered by most health maintenance organizations and health insurance providers in the United States.

MELARIS™: Predictive Medicine Product for Melanoma. In September 2001 we introduced our fourth predictive medicine product for genetic susceptibility to malignant melanoma, a deadly form of skin cancer. The incidence of melanoma, a malignant form of skin cancer, has increased approximately 4% per year since the early 1970's and is the second fastest growing cancer in the United States. This year 53,600 Americans are expected to be diagnosed with melanoma, according to the American Cancer Society. We discovered that mutations in the p16 gene are involved in cancer and can be inherited and predispose individuals to melanoma, as reported in the September 1994 issue of the journalNature Genetics. Melanoma is lethal within five years in 86% of cases where it has spread to another site in the body. However, when melanoma is diagnosed at an early stage, fewer than 10% of patients die within five years. We believe that approximately 10% of melanoma cases are hereditary.

MELARIS™, which assesses a person's risk of developing melanoma, provides important information that we believe will be useful in the surveillance and prevention of melanoma. Melanoma can be prevented through appropriate screening and a specific threshold of action for mutation carriers, in which precancerous lesions are removed before cancer can develop. We have six issued United States patents covering MELARIS™. The price for the test is $745 and is covered by most health maintenance organizations and health insurance providers in the United States.

CardiaRisk®: Personalized Medicine Product for Hypertension ManagementHypertension. Approximately 50 million people in the United States are hypertensive. Hypertension has a significant genetic component and is a major risk factor for cardiovascular disease, kidney failure and stroke. The angiotensinogen gene, or AGT gene, is believed to be involved in the salt-dependent form of hypertension, which accounts for approximately 35% of all hypertension. Therapy for these patients includes the use of a low-salt diet, other dietary regimens, and numerous drug therapies to control blood pressure. Results of a recent study of 1,509 patients by the National Institutes of Health showed that of all patients placed on a low-salt diet, only patients with the AGT mutation achieved a significant reduction in blood pressure over the three-year course of the study. Patients in this study with the variant form of the AGT gene were also found to be 42% more likely to experience hypertension earlier in life and more severely.

CardiaRisk(R)

CardiaRisk® identifies individuals likely to respond to specific high blood pressure therapies by screening for mutations of the AGT gene. Mutations

of this gene determine a patient's potential reaction to different courses of

therapy for hypertension. Using CardiaRisk(R)CardiaRisk® to help predict the specific therapies and drugs to which a patient will respond may improve patient compliance, reduce adverse side effects and decrease overall healthcare costs. CardiaRisk(R)CardiaRisk® is a fully automated test that we perform using DNA extracted from a patient's blood sample. The cost for the test is $295$315 and it is not currently reimbursed by health insurance. We believe CardiaRisk(R)CardiaRisk® is one of the first commercially available personalized medicine products. COLARIS(TM): Predicitve Medicine for Hereditary Colon Cancer and Uterine Cancer

We announced in August 2000 the launch of COLARIS(TM), a molecular

diagnostic test for genetic susceptibility to colorectal and uterine cancer.

Colorectal cancer is the second leading cause of cancer deaths in thehave six issued United States with 130,200 new cases expected to be diagnosed in the year 2000.

Familial forms of colorectal cancer were estimated in 1997 to account for 10% to

30% of all cases according to the American Society of Clinical Oncologists. The

molecular diagnostic considerations in these hereditary syndromes are similar to

those necessary for breast and ovarian cancer at-risk individuals, which we have

already commercialized. To illustrate the predictive medicine value of molecular

testing in colorectal cancer syndromes, it has been shown that individuals who

carry gene mutations can lower their risk of developing cancer by more than 50%

with appropriate surveillance measures.

Predictive Medicine Tests under Development

Prostate Cancer. We are preparing to introduce a molecular diagnostic test

for prostate cancer in calendar year 2001, based upon our discovery of the HPC2

prostate cancer gene. Prostate cancer is diagnosed in approximately 180,000 men

each year in the United States. According to the American Cancer Society, over

31,000 men will die of the disease in 2000, making it the second most common

cause of cancer death in men. Early diagnosis is effective in increasing the

survival for patients with prostate cancer. Diagnosis at the local and regional

stages is associated with a five-year survival rate approaching 100%, although

survival rates for more advanced tumors decline rapidly. Tests such as PSA have

had a positive effect on survival with prostate cancer, and serial PSA

determinations among patients identified as high risk from a molecular

diagnostic test offer potential for early diagnosis with longer

9

survival. Recent genetic studies suggest that approximately 10% of prostate

cancer is due to hereditary predisposition.

Melanoma. We are planning to introduce a molecular diagnostic test for

genetic susceptibility to melanoma in calendar year 2001. The incidence of

melanoma, a malignant form of skin cancer, has increased approximately 4% per

year since the early 1970's. In the year 2000, approximately 44,000 Americans

will be diagnosed with melanoma, according to the journal Science. We discovered

that mutations in the p16 gene are involved in cancer and can be inherited and

predispose individuals to melanoma, as reported in the September 1994 issue of

the journal Nature Genetics. Melanoma is lethal within five years in 86% of

cases where it has spread to another site in the body. However, when melanoma is

diagnosed at an early stage, fewer than 10% of patients die within five years.

We believe that approximately 10% of melanoma cases are hereditary. We have

substantial expertise in the genetic analysis of melanoma and have begun to

identify important disease-predisposing p16 mutations.

Sales and Marketing

We are currently marketing BRACAnalysis(R) and CardiaRisk(R), and we expect

to market other diagnostic products, including COLARIS(TM), in the United States

directly through our own direct sales force. The potential international market

for our molecular diagnostic products is estimated to be at least twice the size

of the United States market. After introducing molecular diagnostic products in

the United States, we plan to introduce our products in foreign markets

primarily through strategic marketing partners. We have recently completed

marketing agreements with the following foreign marketing partners:

Partner Territory

------- ---------

Falco Biosystems, Ltd. Japan

MDS Laboratory Services Canada

Rosgen Ltd. United Kingdom and Ireland

patents covering CardiaRisk®.

Strategic Alliances

In order to limit the financial risks associated with the development of therapeutic products, including costs associated with related clinical trials of such drugs, our strategy is to enter into alliances with corporate partners who assume such risks and other assorted financial costs. In addition to our current strategic alliances, we are actively pursuing other partners in areas that we believe may enhance our ability to develop and exploit our technology. The

financial structure of ourIn fiscal year 2002 we entered into three new strategic alliances varies with each agreementAbbott Laboratories, Pharmacia Corporation, and may include research payments, equity investments, milestone payments, upfront

payments, license fees, subscription fees, option payments,E.I. du Pont de Nemours and royalty payments

or profit sharing.

Events that trigger milestone payments to us may include:

. the discovery of a gene or protein;

. the determination of the function of a gene or protein;

. the identification of a lead compound;

. the filing of an investigational new drug application with the FDA;

. the commencement of Phase III clinical trials; and

. the submission of a new drug application with the FDA.Company.

11

We are dependent on each strategic partner to commercialize the therapeutic products identified during our collaboration. If our partner commercializes the product, we will receive a royalty on sales of the product or share in the profits derived from sales of the drug. If any of our strategic partners cease efforts to commercialize any 10

We have formed strategic alliances with 12 major pharmaceutical or multinational companies including Abbott Laboratories, Bayer Corporation, E.I. du Pont de Nemours and Company (DuPont), Eli Lilly and Company. In August 1992, we entered into a Research

Collaboration and License Agreement with Eli Lilly and its former subsidiary,

Hybritech Incorporated, under which Eli Lilly and Hybritech made an equity

investment in us, and provided funding over a three-year period to support our

research and development program to discover the BRCA1 gene. The total equity

investment, research funding and potential milestone payments under this

collaboration may provide us with up to $4,000,000. In addition, we may also

receive future milestone payments and future royalty payments on therapeutic and

diagnostic product sales. The research portion of this collaboration was

concluded successfully on schedule in August 1995.Company, Hitachi Ltd., Hoffmann-LaRoche Inc., Novartis Corporation. In April 1995, we commenced a five-year

collaborative research and development arrangement with Novartis Corporation.

The total equity investment, research funding and potential milestone payments

under this collaboration may provide us with up to $60,000,000. The research

effort focused on the discovery of genes and drug targets involved in the field

of cardiovascular disease. The research phase of the Novartis collaboration

concluded successfully on schedule in April 2000. In March 1998, we announced

that Novartis had licensed the therapeutic rights to the CHD1 heart disease

gene, triggering a milestone payment to us. In addition, we may receive future

royalty payments on therapeutic products sold by Novartis.

Bayer Corporation. In September 1995, we commenced a five-year

collaborative research and development arrangement with Bayer Corporation. The

total equity investment, research funding and potential milestone payments under

this collaboration may provide us with up to $71,000,000. In November 1997 and

again in December 1998, we announced expansions of our collaborative research

and development arrangement with Bayer. The expanded collaboration may provide

us with additional research funding and potential milestone payments of up to

$137,000,000. We are entitled to receive royalties from sales of therapeutic

products commercialized by Bayer.

Schering-Plough Corporation. In April 1997, we commenced a three-year

collaborative research and development arrangement with Schering-Plough

Corporation. The total equity investment, research funding, license fees and

potential milestone payments under this collaboration may provide us with up to

$60,000,000. The research phase of the Schering-Plough collaboration concluded

successfully on schedule in April 2000. In October 1997, we announced that

Schering had licensed the therapeutic rights to the MMAC1 cancer gene. In March

1998, we demonstrated the tumor-suppressor activity of the MMAC1 gene. Each

event triggered milestone payments from Schering to us. In May 2000, we

announced that Schering had licensed the therapeutic rights to the HPC2 prostate

cancer gene, triggering a milestone payment to us. In addition, we may receive

future royalty payments on therapeutic products sold by Schering-Plough.

Schering AG. In October 1998, we entered into a five-year collaboration

withCorporation, Oracle Corporation, Pharmacia Corporation, Schering AG, to utilize ProNet(R) for drug discoverySchering-Plough Corporation, and development. Under

the agreement, we will have an option to co-promote all new therapeutic products

in North America and receive 50 percentTorrey Mesa Research Institute, a subsidiary of the profits from North American sales

of all new drugs discovered with ProNet(R). The total research funding, license

fees, subscription fees, option payments and potential milestone payments under

this collaboration may provide us with up to $51,000,000. If we choose to co-

promote a drug developed by Schering AG as a 50 percent partner, we are required

to pay funds to Schering AG to establish equal ownership. In October 1999, we

announced the expansion of our collaboration with Schering AG to include

research in the field of cardiovascular disease.

Pharmacia Corporation. In November 1998, we entered into a 15 month

collaboration with Pharmacia Corporation (formerly Monsanto Company) to utilize

ProNet(R) for drug discovery and development. In December 1999, Pharmacia

exercised its option to extend the research term for an additional 12 months and

exercised its option to expand the research funding. The total research funding,

option payments, license fees and potential milestone payments under this

collaboration may provide us with up to $28,000,000. In addition, we are

entitled to receive royalties from sales of therapeutic products commercialized

by Pharmacia.

Novartis Agricultural Discovery Institute, Inc. In July 1999, we entered

into a two-year collaboration and license agreement with the Novartis

Agricultural Discovery Institute, Inc. ("NADII"). The genomic collaboration

will focus on the discovery of the genetic structure of cereal crops. The total

funding under this collaboration is

11

expected to provide us with up to $33,500,000. Upon completion, we and NADII

intend to jointly offer commercial access to the genomic databases and share

equally in any resulting proceeds.

Hoffmann-LaRoche Inc. In December 1999, we entered into a 12 month

collaboration with Hoffmann-LaRoche Inc. to utilize ProNet(R) for drug discovery

and development in the area of cardiovascular disease. The total research

funding, license fees and potential milestone payments under this collaboration

may provide us with up to $13,000,000. In addition, we are entitled to receive

royalties from sales of therapeutic products commercialized by Roche.

Hitachi Ltd. In May 2000, we entered into a three year strategic alliance

with Hitachi Ltd. Under the terms of the agreement, we will work with Hitachi

to exploit the ProNet(R) technology together in Japan and Hitachi will establish

a designated ProNet(R) facility to expedite the discovery of novel protein-

protein interactions for Japanese customers. Total payments under this

collaboration are expected to provide us with $26,000,000. In addition, we are

entitled to receive royalties from sales of therapeutic products commercialized

by Hitachi.Syngenta.

We intend to enter into additional collaborative relationships with other corporate partners to locate and sequence genes and proteins, to discover protein networks associated with other common diseases, and to identify lead compounds which may be developed into commercial therapeutic products by those partners.

Patents and Proprietary Rights

We intend to seek patent protection in the United States and major foreign jurisdictions for the genes, we discover, mutations and products of the genes and

related processes,proteins, protein interactions, antibodies, drug targets, drug compounds, transgenic animals, technology related methods and processes and other inventions which we believe are patentable and where we believe our interests would be best served by seeking patent protection. We also intend to seek patent protection or rely upon trade secret rights to protect certain other technologies which may be used in discovering and characterizing new genes and proteins and which may be used in the development of novel diagnosticpredictive medicine and therapeutic products. To protect our trade secrets and other proprietary information, we require that our employees and consultants enter into confidentiality and invention assignment agreements. TheseHowever, those confidentiality and invention assignment agreements may not provide us with adequate protection. In addition, any such patents may not issue, and the breadth or the degree of protection of any claims of such patents may not afford us with significant protection.

We own or have licensed rights to 2899 issued patents and numerous patent applications in the United States as well as numerousand foreign patent

applications relating to genes, proteins, and protein interactions associated

with cancer, heart disease, neurological disease and hypertension, processes for

identifying and sequencing genes, and other related gene discovery technologies.countries. However, any patent applications which we have filed or will file or to which we have licensed or will license rights may not issue, and patents that do issue may not contain commercially valuable claims. In addition, any patents issued to us or our licensors may not afford meaningful protection for our technology or products or may be subsequently circumvented, invalidated or narrowed.

Our processes and potential products may also conflict with patents which have been or may be granted to competitors, academic institutions or others. As the biotechnology industry expands and more patents are issued, the risk increases that our processes and potential products may give rise to interferences filed by others in the U.S. Patent and Trademark Office, or to claims of patent infringement by other companies, institutions or individuals. These entities or persons could bring legal actions against us claiming damages and seeking to enjoin clinical testing, manufacturing and marketing of the related product or process. If any of these actions are successful, in addition to any potential liability for damages, we could be required to cease the infringing activity or obtain a license in order to continue to manufacture or market the relevant product or process. We may not prevail in any such action and any license required under any such patent may not be made available on acceptable terms, if at all.

Our failure to obtain a license to any technology that we may require to commercialize our technologies or potential products could have a material adverse effect on our business. There is also considerable pressure on academic institutions to publish discoveries in the genetic field.genomic and proteomic fields. Such a publication by an academic collaborator of ours prior to the filing date of our

12

application, if it covers a genediscovery claimed in the application, may preclude the patent from issuing or the filing of foreign patent applications, or if a patent was issued, may invalidate the patent.

12

We also rely upon unpatented proprietary technology, and in the future may determine in some cases that our interests would be better served by reliance on trade secrets or confidentiality agreements rather than patents or licenses. These include some of our positional cloning, protein interaction, roboticsgenomic, proteomic, robotic and bioinformaticsbioinformatic technologies. We may not be able to protect our rights to such unpatented proprietary technology and others may independently develop substantially equivalent technologies. If we are unable to obtain strong proprietary rights to our processes or products after obtaining regulatory clearance, competitors may be able to market competing processes and products.

Others may obtain patents having claims which cover aspects of our products or processes which are necessary for or useful to the development, use or manufacture of our services or products. Should any other group obtain patent protection with respect to our discoveries, our commercialization of molecular

diagnostic servicespredictive medicine products and potential therapeutic products could be limited or prohibited.

In addition, we are a party to various license agreements which give us the rights to use certain technology in our research, development and testing processes. We may not be able to continue to license this technology on commercially reasonable terms, if at all. Our failure to maintain rights to this technology could have a material adverse effect on our business.

Competition

Competition is intense in our existing and potential markets. Our competitors in the United States and abroad are numerous and include, among others, major pharmaceutical and diagnostic companies, specialized biotechnology firms, universities and other research institutions. Many of our potential competitors have considerably greater financial, technical, marketing and other resources than we do. We expect competition to intensify in the fields in which we are involved as technical advances occur in these fields and become more widely known.

We expect to encounter significant competition with respect to any drugs that may be developed using our technologies. Companies that complete clinical trials, obtain required regulatory approvals and commence commercial sales of therapeutic products prior to us may achieve a significant competitive advantage. We may not be able to develop such products successfully and we may not obtain patents covering such products that provide protection against competitors. Moreover, competitors may succeed in developing therapeutic products that circumvent our products, our competitors may succeed in developing technologies or products that are more effective than those developed by us or that would render our technologies or products less competitive or obsolete.

The technologies for discovering genes that predispose persons to major diseases and approaches for commercializing those discoveries are new and rapidly evolving. Rapid technological developments could result in our potential services, products, or processes becoming obsolete before we recover a significant portion of our related research and development costs and associated capital expenditures. Our competitors in the United States and abroad are numerous and

include, among others, major pharmaceutical and diagnostic companies,

specialized biotechnology firms, universities and other research institutions.

Many of our potential competitors have considerably greater financial,

technical, marketing and other resources than we do, which may allow these

competitors to discover important genes before we can. If we do not discover additional disease-predisposing genes, characterize their functions, develop genetic testspredictive medicine products and related information services based on such discoveries, obtain regulatory and other approvals, and launch such services or products before our competitors, we could be adversely affected. Moreover, any molecular diagnostic

testspredictive medicine products that we may develop could be made obsolete by less expensive or more effective tests or methods that may be developed in the future. We expect

competition to intensify in the fields in which we are involved as technical

advances occur in these fields and become more widely known.

We also expect to encounter significant competition with respect to any

drugs that may be developed using our technologies. Companies that complete

clinical trials, obtain required regulatory approvals and commence commercial

sales of therapeutic products prior to us or our collaborative partners may

achieve a significant competitive advantage. We and our collaborative partners

may not be able to develop such products successfully and we may not obtain

patents covering such products that provide protection against competitors.

Moreover, competitors may succeed in developing therapeutic products that

circumvent our products, our competitors may succeed in developing technologies

or products that are more effective than those developed by us and our

collaborative partners or that would render our and our competitors'

technologies or products less competitive or obsolete.

Governmental Regulation

Regulation by governmental authorities in the United States and foreign countries is a significant factor in the development, manufacture and marketing of our proposed products and services and in our ongoing research and development activities. The therapeutic products and molecular diagnostic testspredictive medicine

13