UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

forFor the fiscal year ended December 31, 20212023

ORor

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

forFor the transition period from to .

Commission file number: 1-13888

GRAFTECH INTERNATIONAL LTD.

(Exact name of registrant as specified in its charter)

Delaware 27-2496053

(State or other jurisdiction of (I.R.S. Employer

incorporation or organization) Identification Number)

982 Keynote Circle 44131

Brooklyn Heights, Ohio (Zip Code)44131

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (216) 676-2000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | EAF | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☒☐ No ☐☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer," “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐

Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant as of June 30, 20212023 was $2,365.0$970.6 million, based on the closing price of the registrant’s common stock as reported on the New York Stock Exchange as of the last business day of the registrant’s most recently completed second quarter.

On February 11, 2022, 263,255,7082, 2024, 256,831,870 shares of our common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement (the “Proxy Statement”) to be filed with the Securities and Exchange Commission relative to the registrant’s 20222024 Annual Meeting of Stockholders are incorporated by reference into Part III of this Report.

Table of Contents

| | | | | | | | |

| |

| |

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| |

| |

| Item 5. | | |

| | |

| | |

| Item 6. | | |

| Item 7. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 7A. | | |

| Item 8. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| |

| |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| |

| |

| Item 15. | | |

| Item 16. | | |

| | |

PART I

References herein to the "Company", "we", "our",“Company,” “GrafTech,” “we,” “our,” or "us"“us” refer collectively to GrafTech International Ltd. and its subsidiaries.

Presentation of Financial, Market and Industry Data

We present our financial information on a consolidated basis. Unless otherwise noted, when we refer to dollars, we mean U.S. dollars.

Certain market and industry data included in this Annual Report on Form 10-K for the year ended December 31, 20212023 (the “Annual Report” or “Report”) has been obtained from third-party sources that we believe to be reliable. Market estimates are calculated by using independent industry publications, government publications and third-party forecasts in conjunction with our assumptions about our markets. We cannot guarantee the accuracy or completeness of this market and market share data and have not independently verified it. None of the sources has consented to the disclosure or use of data in this Annual Report. While we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under the headings “Forward-Looking“Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in this Annual Report.

Cautionary Note Regarding Forward-Looking Statements

This Report may contain forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect our current views with respect to, among other things, financial projections, plans and objectives of management for future operations, and future economic performance. Examples of forward-looking statements include, among others, statements we make regarding future estimated revenuesvolume, pricing and volumes derived from our take-or-pay agreements with initial terms of three-to-five years ("LTA"), future pricing of short-term agreements and spot sales ("Non-LTA"),revenue, anticipated levels of capital expenditures and cost of goods sold, anticipated reduction in our costs resulting from our cost rationalization initiatives and one-time costs of implementation and guidance relating to earnings per shareadjusted EBITDA and adjusted EBITDA.free cash flow. You can identify these forward-looking statements by the use of forward-looking words such as “will,” “may,” “plan,” “estimate,” “project,” “believe,” “anticipate,” “expect,” “foresee,” “intend,” “should,” “would,” “could,” “target,” “goal,” “continue to,” “positioned to,” “are confident,” or the negative versions of those words or other comparable words. Any forward-looking statements contained in this Report are based upon our historical performance and on our current plans, estimates and expectations considering information currently available to us. The inclusion of this forward-looking information should not be regarded as a representation by us that the future plans, estimates, or expectations contemplated by us will be achieved. Our expectations and targets are not predictions of actual performance and historically our performance has deviated, often significantly, from our expectations and targets. These forward-looking statements are subject to various risks and uncertainties and assumptions relating to our operations, financial results, financial condition, business, prospects, growth strategy and liquidity. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. We believe that these factors include, but are not limited to:

•our dependence on the ultimate impact the COVID-19 pandemic has on our business, results of operations, financial condition and cash flows, including the duration and spread of any variants, the duration and scope of related government orders and restrictions, the impact on our employees,global steel industry generally and the disruptions and inefficiencieselectric arc furnace (“EAF”) steel industry in our supply chain;

•the possibility that we may be unable to implement our business strategies, including our ability to secure and maintain longer-term customer contracts, in an effective manner;particular;

•the cyclical nature of our business and the selling prices of our products, which may continue to decline in the future, and may lead to periods of reduced profitability and net losses in the future;

•the risks and uncertainties associated with litigation, arbitration, and like disputes, including disputes related to contractual commitments;

•the possibility that global graphite electrode overcapacity mayor adversely affect graphite electrode prices;

•our dependence on the global steel industry generally and the electric arc furnace steel industry in particular;impact liquidity;

•the sensitivity of our business and operating results to economic conditions, including any recession, and the possibility others may not be able to fulfill their obligations to us in a timely fashion or at all;

•the possibility that we may be unable to implement our business strategies in an effective manner;

•the possibility that global graphite electrode overcapacity may adversely affect graphite electrode prices;

•the competitiveness of the graphite electrode industry;

•our dependence on the supply of raw materials, including decant oil and petroleum needle coke, and energy, and disruptions in supply chains for these materials;

•our primary reliance on one facility in Monterrey, Mexico for the manufacturing of connecting pins;

•the availability and cost of electric power and natural gas, particularly in Europe;

•our manufacturing operations are subject to hazards;

•changes in, or more stringent enforcement of, health, safety and environmental regulations applicable to our manufacturing operations and facilities;

•the legal, compliance, economic, social and political risks associated with our substantial operations in multiple countries;

•the possibility that fluctuation of foreign currency exchange rates could materially harm our financial results;

•the possibility that our results of operations could further deteriorate if our manufacturing operations were substantially disrupted for an extended period, including as a result of equipment failure, climate change, regulatory issues, natural disasters, public health crises, such as the COVID-19a global pandemic, political crises or other catastrophic events;

•the risks and uncertainties associated with litigation, arbitration, and like disputes, including disputes related to contractual commitments;

•our dependence on third parties for certain construction, maintenance, engineering, transportation, warehousing and logistics services;

•the possibility that we are subject to information technology systems failures, cybersecurity attacks, network disruptions and breaches of data security;

•the possibility that we are unable to recruit or retain key management and plant operating personnel or successfully negotiate with the representatives of our employees, including labor unions;

•the sensitivity of goodwilllong-lived assets on our balance sheet to changes in the market;

•the possibility that we are subject to information technology systems failures, cybersecurity attacks, network disruptions and breaches of data security;

•our dependence on protecting our intellectual property and the possibility that third parties may claim that our products or processes infringe their intellectual property rights;

•the impact of inflation and our ability to mitigate the effect on our costs;

•the impact of macroeconomic and geopolitical events on our business, results of operations, financial condition and cash flows, and the disruptions and inefficiencies in our supply chain that may occur as a result of such events;

•the possibility that our indebtedness could limit our financial and operating activities or that our cash flows may not be sufficient to service our indebtedness;

•the possibility that restrictive covenantsrecent increases in our financing agreements could restrict or limit our operations;

•benchmark interest rates and the fact that any future borrowings under certain of our existing financing agreementsmay subject us to interest rate risk;

•the possibility that disruptions in or our ability to access the capital and credit markets could adversely affect our results of operations, cash flows and financial condition, or those of our customers and suppliers;

•the possibility that the market pricerestrictive covenants in our financing agreements could restrict or limit our operations;

•changes in, or more stringent enforcement of, health, safety and environmental regulations applicable to our common stock could be negatively affected by sales of substantial amounts of our common stock in the public markets, including by Brookfield Asset Management Inc.manufacturing operations and its affiliates;facilities; and

•the possibility that the cash dividends on our common stock, which are currently suspended, will remain suspended and we may not pay cash dividends on our common stock in the future; and

•the fact that our stockholders have the right to engage or invest in the same or similar businesses as us.future.

These factors should not be construed as exhaustive and should be read in conjunction with the risk factorsRisk Factors and other cautionary statements that are included in this Report. The forward-looking statements made in this Report relate only to events as of the date on which the statements are made. Except as required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual results may vary materially from what we may have expressed or implied by these forward-looking statements. We caution that you should not place undue reliance on any of our forward-looking statements. You should specifically consider the factors identified in this Report that could cause actual results to differ before making an investment decision to purchase our common stock. Furthermore, new risks and uncertainties arise from time to time, and it is impossible for us to predict those events or how they may affect us.

For a more complete discussion of these and other factors, see "Risk Factors"“Risk Factors” in Part I of this Report and "Management's“Management’s Discussion and Analysis of Financial Condition and Results of Operations"Operations” in Part II of this Report.

Item 1.Business

Our companyIntroduction

GrafTech International Ltd., founded in 1886 and incorporated in Delaware, is a leading manufacturer of high-quality graphite electrode products essential to the production of electric arc furnace ("EAF")EAF steel and other ferrous and non-ferrous metals. We believe that we have the mosta competitive portfolio of low-cost ultra-high power (“UHP”) graphite electrode manufacturing facilities, in the industry, including threewith some of the highest capacity facilities in the world. We have graphite electrode manufacturing facilities in Calais, France, Pamplona, Spain, Monterrey, Mexico and St. Marys, Pennsylvania. We are the only large scalelarge-scale graphite electrode producer that is substantially vertically integrated into petroleum needle coke, aour key raw material for graphite electrode manufacturing. This unique position provides us with competitive advantages in product quality and cost. Founded in 1886, we have over 135 years

Our only reportable segment, Industrial Materials, is comprised of experience in the researchtwo major product categories: graphite electrodes and development (“R&D”) of graphite- and carbon-based solutions, and our intellectual property portfolio is extensive. We currently have graphite electrode manufacturing facilities in Calais, France, Pamplona, Spain, Monterrey, Mexico and St. Marys, Pennsylvania. Our customers include major steel producers and other ferrous and non-ferrous metal producers in Europe, Russia and other Commonwealth of Independent States countries, the Middle East and Africa (collectively, “EMEA”), the Americas and Asia-Pacific (“APAC”), which sell their products into the automotive, construction, appliance, machinery, equipment and transportation industries.petroleum needle coke products. Our vision is to provide highly engineered graphite electrode products, services solutions and productssolutions to EAF operators. Based on the high-quality of our graphite electrodes, reliability of our petroleum needle coke supply and our excellent customer service, we believe that we are viewed as a preferred supplier to the global EAF steel producer market.

As of December 31, 2023, our stated production capacity was approximately 202 thousand metric tons (“MT”)1 through our primary manufacturing facilities in Calais, Pamplona and Monterrey. On February 14, 2024, the Company announced a cost rationalization and footprint optimization plan, in response to persistent softness in the commercial environment. This includes an indefinite suspension of production activities at our St. Marys facility, with the exception of graphite electrode and pin machining. We are also indefinitely idling certain assets within our remaining graphite electrode manufacturing footprint. As a result of these initiatives, beginning in 2024, our stated production capacity will be approximately 178 thousand MT1.

Our principal executive offices are located at 982 Keynote Circle, Brooklyn Heights, Ohio 44131 and our telephone number is (216) 676‑2000. Our website address is www.graftech.com. Information on, or accessible through, our website is not part of this Annual Report. We have included our website address only as an inactive textual reference and do not intend it to be an active link to our website.

Products and Raw Materials

Graphite Electrodes

Graphite electrodes are an industrial consumable product used primarily in EAF steel production, one of the two primary methods of steel production and the steelmaking technology used by all “mini‑mills.” Electrodes act as conductors of electricity in the furnace, generating sufficient heat to melt scrap metal, iron oreore-derived products or other raw materials used to produce steel or other metals. We estimate that, on average, the cost of graphite electrodes represents less than 5% of the total production cost of steel in a typical EAF, but they are essential to EAF steel production. Graphite electrodes are currently the only known commercially available products that have the high levels of electrical conductivity and the capability to sustain the high levels of heat generated in EAF steel production. As a result, EAF steel manufacturers require a reliable supply of high-quality graphite electrodes. Graphite electrodes are also used in steel refining in ladle furnaces and in other processes, such as the production of titanium dioxide, stainless steel, silicon metals and other ferrous and non‑ferrous metals.

With the growth of EAF steel production, graphite electrode production has become focused on the manufacturemanufacturing of UHP electrodes.electrodes, which have low electrical resistivity and strong durability to maximize efficient use of electricity in the EAF and minimize electrode consumption. The production of UHP electrodes requires an extensive proprietary manufacturing process and material science knowledge, including the use of higher quality needle coke blends. We primarily competemanufacture graphite electrodes ranging in size up to 30 inches (750 millimeters) in diameter, over 11 feet (3,400 millimeters) in length, and weighing as much as 5,900 pounds (2.6 MT). In 2024, we anticipate expanding our product offerings to include the addition of an 800-millimeter super-sized electrode to our portfolio to serve a small but growing segment of the UHP graphite electrode market.

Petroleum needle coke, We also manufacture corresponding sizes of graphite connecting pins, which are used by customers to connect and fasten graphite electrodes together in a crystalline form of carbon derived from decant oil, is the key raw material wecolumn for use in an EAF. For the past several years, all of our connecting pin production of graphite electrodes. We achieved substantial vertical integration with this critical raw material source throughwas performed at our acquisition of Seadrift Coke L.P. (“Seadrift”) in November 2010, significantly reducingMonterrey, Mexico facility. However, we recently added pin production capabilities at our reliance on other suppliers. The petroleum needle coke industry is highly concentrated. We believe Seadrift is one of the largest petroleum needle coke producers in the world. We also believe that the quality of Seadrift’s petroleum needle coke is superior for graphite electrode production compared to most of the petroleum needle coke available to our peers on the open market, allowing us to produce high-quality electrodes in a cost‑efficient manner. Additionally, we believe that this vertical integration provides a significant cost advantage relative to our competitors.

As a leading producer of graphite electrodes, we believe we are well-positioned to be a key provider to the EAF steel making industry. Our production capacity is approximately 200,000 metric tons ("MT")1 through our primary manufacturing facilities in Calais, France, Pamplona, Spain and Monterrey, Mexico. In 2021, we shifted graphitization and machining of a portion of semi-finished products from Monterrey to St. Marys, Pennsylvania, in order to improve environmental performance, production flexibility and overall cost efficiencies across the two facilities.

Graphite electrodes are an essential consumable in the EAF steel production process and require a long lead time to manufacture, and our strategic customers are highly focused on securing certainty of supply of reliable, high-quality graphite electrodes. We believe we are uniquely capable among graphite electrode producers to pursue our LTA contracting strategy due to our substantial vertical integration into petroleum needle coke production.

On August 15, 2015, we became an indirect wholly owned subsidiary of Brookfield Asset Management Inc. (together with its affiliates, "Brookfield"). In April 2018, we completed our initial public offering ("IPO"). Our common stock is listed

1 Production capacity reflects expected maximum production volume during the period through our Calais, Pamplona and Monterrey facilities depending on product mix and expected maintenance outage. Actual production may vary.

on the New York Stock Exchange ("NYSE") under the symbol “EAF.” Brookfield owned approximately 24%facility to provide alternative sources, if needed, for this critical component. The total manufacturing time of our common stock as of December 31, 2021.

Our executive offices are located at 982 Keynote Circle, Brooklyn Heights, Ohio 44131 and our telephone number is (216) 676‑2000. Our website address is www.graftech.com. Information on, or accessible through, our website is not part of this Annual Report. We have included our website address only as an inactive textual reference and do not intend it to be an active link to our website.

Competitive strengths

We are one of the largest producers of graphite electrodes in the world, accounting for approximately a quarter of global production capacity (excluding China), and we believe our strategically positioned global footprint provides us with competitive advantages.

We believe our facilities are among the most strategically located and lowest cost, large‑scaleUHP graphite electrode manufacturing plants in the world. Of the graphite electrode manufacturing facilities currently operating, we estimate that our three primary operating manufacturing facilities representand its associated connecting pin is, on average and except for special requests, approximately a quarter of estimated production capacity for graphite electrodes outside of China, making us a critical supplier to global EAF steel manufacturers. Our manufacturing facilities are located in the Americas and EMEA, providing us with access to reliable energy sources, logistical and freight advantages in sourcing raw materials and shipping our graphite electrodes to our customers compared to our competitors, and excellent visibility into the large North American and European EAF steelmaking markets. Our experience in producing graphite electrodes for a varied global customer base positions us to meet customer requirements across a range of product types and quality levels, including support and technical services, further distinguishing us from our competitors.six months.

We are a pure‑play provider of an essential consumable for EAF steel producers, the fastest‑growing sector of the steel industry.

According to the World Steel Association (“WSA”), since 2000, EAF steelmaking grew at an annual pace of approximately 2%, compared with 1% for steelmaking overall, excluding China. As a result of the increasing global availability of steel scrap and the more resilient, high‑variable cost and environmentally friendly EAF model, we expect EAF steel producers to continue to grow at a faster rate than blast oxygen furnace ("BOF") producers globally. Additionally, EAF steel producers are increasingly able to utilize higher quality scrap and iron units, their two primary raw materials, to produce higher quality steel grades and capture market share from BOF producers, while maintaining a favorable cost structure. The EAF method produces approximately 25% of the carbon dioxide (“CO2”) emissions of a BOF facility and does not require the smelting of virgin iron ore or the burning of coal. Additionally, as a result of significantly increased steel production in China since 2000, the supply of Chinese scrap is expected to increase substantially, which may result in lower scrap prices and provide the Chinese steel manufacturing industry with local scrap feedstock that was not historically available. We believe these trends will allow EAF steel producers to increase their market share and grow at a faster rate than BOF steel producers resulting in increasing demand for graphite electrodes.

We believe we have the industry’s most efficient production platform of high production capacity assets with substantial vertical integration.

From 2014 to 2016, we rationalized inefficient plants during the downturn and more recently completed a manufacturing footprint optimization program. We believe that the optimization of our graphite electrode plant network will continue to drive improved fixed cost absorption. Moreover, our Calais, Pamplona, Monterrey and St. Marys facilities each provides unique cost advantages given its scale and access to reliable energy sources.

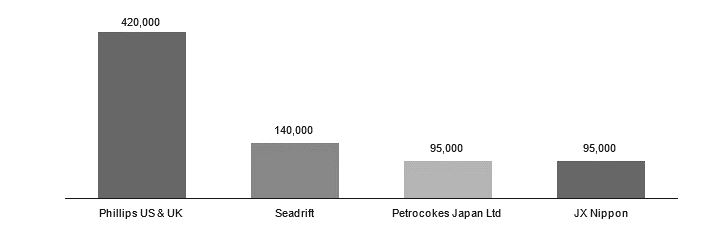

Seadrift provides a substantial portion of our petroleum needle coke supply needs internally at a competitive cost and allows us to maximize capacity utilization more efficiently than competitors, who may be more constrained by a limited or costly petroleum needle coke supply. Seadrift is one of only five petroleum needle coke facilities in the world outside of China, and we believe it is one of the largest petroleum needle coke producers in the world.

We are the only petroleum needle coke producer in the world specifically focused on the production of graphite electrodes.

Our production of petroleum needle coke specifically for graphite electrodes provides us the opportunity to produce super premium petroleum needle coke of the highest quality and allows us to tailor graphite electrodes for customer requirements. Seadrift has approximately 140,000 MT of petroleum needle coke production capacity, which we believe makes it one of the largest petroleum needle coke producers in the world. Sourcing the majority of our petroleum needle coke internally allows us to offer our customers certainty of supply, further enhancing our competitive position and supporting our LTA strategy. To align with our LTA profile, we have hedged the decant oil required to produce substantially all of the graphite electrodes sold under these contracts, providing us with substantial visibility into our raw material costs. We believe our use of petroleum needle coke is a further competitive advantage, as the use of pitch needle coke, an alternative raw material, results in longer bake times during graphite electrode production.

We provide highly engineered graphite electrode products and are competitively positioned to provide services and solutions to EAF operators.

We utilize our own R&D facility as well as process engineers located at plant sites to constantly work at process and product improvements. This work has yielded the development of new products, which have improved our competitive position. In addition, we believe that our ArchiTech Furnace Productivity System (“ArchiTech”) continues to provide a competitive advantage. ArchiTech, which has been installed at customer furnaces around the world, enables our engineers to work with our customers seamlessly to maximize the performance of their furnaces and provide real‑time diagnostics and troubleshooting. This remote functionality has been particularly helpful during the COVID-19 pandemic. We believe our customers value our high-quality products and customer service, which subsequently improves our commercial opportunities.

Our experienced executive leadership and general managers and flexible workforce have positioned us for future earnings growth.

Our seasoned leadership is committed to earnings growth. Our executive and manufacturing leadership have led manufacturing companies through many cycles and are focused on positioning us for profitable growth in any environment. We have undertaken strategic investments to increase our production capacity in a capital‑efficient manner while positively impacting our cost structure.

Graphite electrode industry

EAF steel producers are the primary consumers of graphite electrodes. The size of the electrodes used in EAF steel production varies depending on the size of the furnace, the size of the furnace’s electric transformer and the planned productivity of the furnace. In a typical furnace using alternating electric current and operating at a typical number of production cycles per day, three UHP graphite electrodes are fully consumed (requiring the addition of new electrodes), on average, every eight to ten operating hours. UHP graphite electrodes are consumed at a rate of approximately 1.7 kilograms per MT of steel production, on average, in EAF facilities.

The actual rate of consumption and addition of electrodes for a particular furnace depends primarily on the efficiency and productivity of the furnace. Therefore, demand for graphite electrodes is directly related to the amount and efficiency of EAF steel production. EAF steel production requires significant heat (as high as 5,000° F) to melt the raw materials, primarily scrap metal, in the furnace. Heat is generated as electricity (as much as 150,000 amps) passes through the electrodes and creates an electric arc between the electrodes and the raw materials.

Graphite Electrode Industry - Supply and Demand Trends

Supply trends

We estimate that as of the end of 2023, the graphite electrode industry globally (excluding China) had nameplate capacity to produce approximately 810 thousand MT of graphite electrodes. The industry is fairly consolidated, particularly outside of China. Thewith the five largest global (excluding China) producers in the industry, are Showa Denko K.K., GrafTech, Fangda Carbon New Material Technology Co. LTD,Resonac Holdings Corporation, HEG Limited, Tokai Carbon Co., Ltd. and Graphite India Limited.Limited, collectively, representing over 80% of global (excluding China) graphite electrode production capacity. As of December 31, 2023, our stated production capacity was approximately 202 thousand MT through our Calais, Pamplona and Monterrey facilities and represented approximately one-quarter of the global (excluding China) graphite electrode production capacity. On February 14, 2024, the Company announced a cost rationalization and footprint optimization plan, in response to persistent softness in the commercial environment. As a result, beginning in 2024, our stated production capacity will be approximately 178 thousand MT.

SupplyWe believe that no new graphite electrode production facilities have been built outside of China for several years.In recent years, additional production capacity has been generated by optimization and debottlenecking of existing assets and limited brownfield expansion.

We primarily compete in the UHP segment of the graphite electrode market. We estimate that, as of the end of 2023, global (excluding China) UHP graphite electrode capacity was approximately 690 thousand MT, or approximately 85% of the global (excluding China) graphite electrode capacity.

Although graphite electrode production capacity within China exceeds that of the rest of the world combined, the production landscape in China is fragmented, and the quality of Chinese graphite electrodes varies greatly. We estimate that as of the end of 2023, total production capacity within China for the UHP segment of graphite electrodes was approximately 825 thousand MT. However, we believe that a significant portion of the UHP electrodes produced in China do not meet the quality standards needed to be exported for use in the most demanding EAF applications. In addition, the imposition of customs duties and other tariffs in key EAF steelmaking regions, including the United States and the European Union (“EU”), have further limited the quantity of graphite electrodes exported from China.

Demand trends

We estimate that from 2014 to 2016, the industry closed or repurposed approximately 20% ofannual global production capacity outside of China, consisting of smaller, higher cost facilities. Based on our experience, high capacity manufacturing facilities can have a significant operating cost advantage as compared to low capacity manufacturing facilities, encouraging producers to consolidate facilities in order to reduce costs. The majority of the production capacity reduction was permanent due to the demolition, long-term environmental remediation and repurposing of most of these lower capacity facilities. These consolidation and production capacity reductions in the(excluding China) UHP graphite electrode industry, along withdemand has been approximately 660 thousand MT, on average, over the EAF steel industry’s recovery, lead us to believe that the graphite electrode industry will continue its long-term growth trajectory.

Demand trends

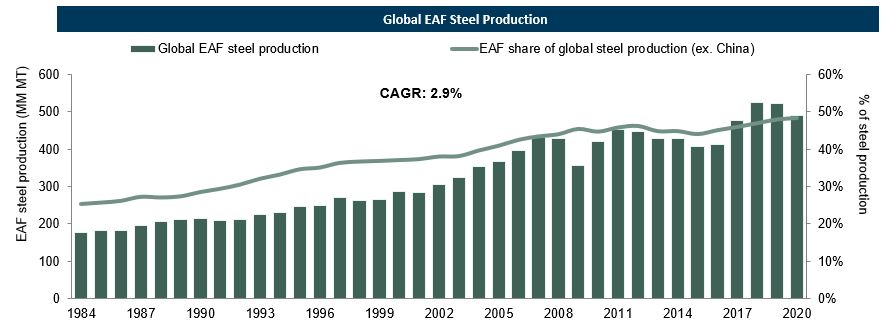

Ourpast three years. UHP graphite electrodes are primarily used in the EAF steelmaking process, and long-term global growth in that marketof EAF steel production has driven increased demand for graphite electrodes.electrodes over time. EAF steelmaking has historically been the fastest-growing segment of the global steel market. According to the WSA,World Steel Association (“WSA”), global (excluding China) EAF steel production grew at 2.9%a 2%-3% compound annual growth rate from 19842015 to 2020, while taking market share from other methods2022, the most recent year for which WSA has published such figures. This compares to a 1% compound annual growth rate for overall global (excluding China) steel production during this same period. As a result, the EAF method of steelmaking in most regionsaccounted for 49% of the world, outsideglobal (excluding China) steel production in 2022, compared to 44% in 2015, with share growth in nearly every region.

EAF steelmaking is more energy efficient and is advantaged in terms of China.its environmental footprint, compared to steel produced through the basic oxygen furnace (“BOF”) steelmaking model. According to the Steel Manufacturers Association (“SMA”), EAF steelmaking produces 75% fewer carbon dioxide emissions compared to BOF steelmaking. Further, SMA notes that the EAF process is a sustainable model for recycling scrap-based raw materials into new steel, which is 100% (and

infinitely) recyclable at the end of its useful life. In addition to these advantages, EAF steel producers benefit from their flexibility in sourcing iron units, being able to make steel from either scrap or alternative sources of iron, likesuch as direct reduced iron and hot briquetted iron, both made directly from iron ore. Most of the growth in EAF steelmaking has taken place in Western Europe

Reflecting these and North America, two regions with substantial amounts of scrap available for use in EAFs.

Source: World Steel Association

EAF Steel Production's Outlook

Since 2016, the EAF steel industry has grown at a 4.5% compound annual rate according to the WSA. This recovery has taken place since China began to restructure its steel industry, encouraging consolidation and shutting down excess capacity. China has also begun to implement environmental regulations to improve air quality impacted by CO2 emissions associated with the burning of coal in BOF steelmaking. Additionally, trade remedies in developed economies such as North America and Western Europe are protecting their domestic steel industries against imports from BOF-steel producing countries, which has resulted in a significant decrease in Chinese steel exports. According to China Customs and Baiinfo, Chinese steel exports declined from 112 million MT in 2015 to 67 million MT in 2021. This resulted in increased steel production outside of China, benefiting EAF steel production.

Weother competitive advantages, we believe there is a particular opportunity for EAF steelmaking to take further market share in China as well. China’s Ministry of Industry and Information Technology's current draft guidelines call for EAF steelmaking to constitute 15% of overall steel production by 2025, doubling its current share of output. If Chinese EAF steelmaking production capacity were to reach 15%, based on 2020 production levels, that would add 62 million MT of additional EAF steel production forwill continue to grow at a totalfaster rate than BOF steel production. Based on industry announcements of 160 million MT, compared to 2020planned incremental EAF capacity additions and factoring in further production increases at existing EAF steel productionplants, we estimate this could result in the next largest regionsglobal (excluding China) UHP graphite electrode demand growing at a compound annual growth rate of 86 million MT in Europe, 71 million MT in North America and 56 million MT in India, accordingapproximately 3% to WSA.4% through 2028.

Pricing trendsPetroleum Needle Coke

Pricing for graphite electrodes is determined through contract negotiations and spot transactions between producers and consumers. Pricing has historically been cyclical, reflecting the demand trends of the global EAF steelmaking industry and supply of graphite electrodes. Moreover, as petroleumPetroleum needle coke, represents a significant percentagecrystalline form of carbon derived from decant oil, is the key raw material cost of graphite electrodes, graphite electrodes have typically been priced at a spread to petroleum needle coke. Over the period from 2007 to 2021, the average graphite electrode spread over petroleum needle coke was approximately $3,600 per MT, on an inflation-adjusted basis using constant 2021 dollars. In tight demand markets, this spread has increased, resultingwe use in higher graphite electrode prices.

There is no widely accepted graphite electrode reference price. Historically, between 2007 and 2021, our weighted average realized price of graphite electrodes, excluding LTAs, was approximately $5,700 per MT (on an inflation-adjusted basis using constant 2021 dollars).

In 2019 and in 2020, market prices declined from the peaks of 2017 and 2018. The prices continued to decline into the first half of 2021 before starting to recover in the second half of the year. During the fourth quarter of 2021, our average price for non-LTA business was approximately $5,000 per MT, 10% higher than in the third quarter of 2021. The non-LTA sales price reflects a mix of annual agreements negotiated in the fourth quarter of the prior year, semi-annual and quarterly agreements negotiated earlier in the year along with spot agreements. There is a lag between the time we negotiate price for non-LTA sales and when our electrodes are delivered and recognized in revenue. We expect our first quarter 2022 non-LTA prices to increase 17 to 20% over the fourth quarter of 2021 as the price of annual and semi-annual agreements have now been reset to the current market conditions.

Needle coke industry

Introduction

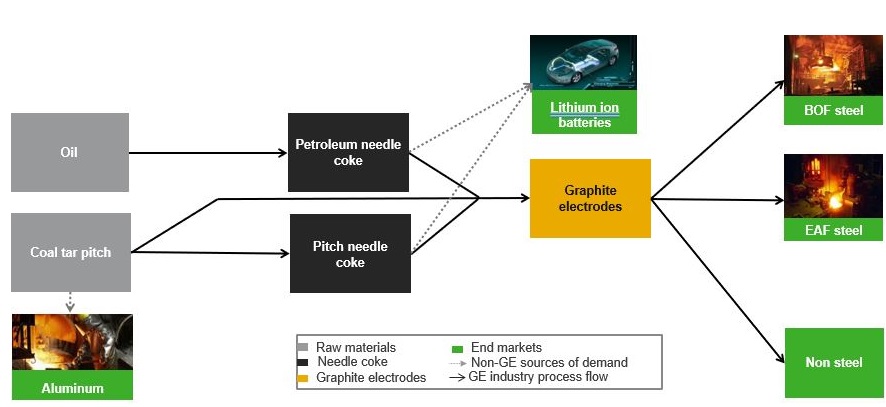

Needle coke is the primary raw material for the production of graphite electrodes used by EAF steelmakers and producers of stainless steel, silicon metals and other ferrous and non-ferrous metals, andelectrodes. It is also a primary raw material utilized in the production of synthetic graphite used in anodes for lithium-ion batteries used tothat power electric vehicles. Needle coke is derived from two carbon sources. vehicles (“EV”).

Petroleum needle coke is produced through a manufacturing process very similar to a refinery. The production process converts decant oil, a byproduct of the gasoline refining process, into petroleum needle coke and generally takes two to three months to produce.coke. Pitch needle coke, used principally by AsianChinese graphite electrode manufacturers, is made from coal tar pitch, a byproduct of coking metallurgical coal used in BOF steelmaking. For the production of our graphite electrodes, we prefer petroleum needle coke because of the meaningfully shorter bake and graphitizing time required, compared to graphite electrodes produced using pitch needle coke.

We are substantially vertically integrated into petroleum needle coke through our Seadrift facility (“Seadrift”), located in Port Lavaca, Texas, which provides the majority of our petroleum needle coke requirements used to produce our graphite electrodes and insulates us from rapid changes in the petroleum needle coke market. In addition, we believe the quality of Seadrift’s petroleum needle coke is superior for graphite electrode production compared to most of the petroleum needle coke available to our peers on the open market, allowing us to produce high-quality electrodes in a cost‑efficient manner. Seadrift sources all of its decant oil requirements from reputable U.S.-based suppliers. Seadrift has developed a well-diversified pool of suppliers, which we believe is sufficient to meet our needs.

Graphite electrode producers combine petroleum needle coke andand/or pitch needle coke with binders and other ingredients to form graphite electrodes. Petroleum needle coke and pitch needle coke, relative to other varieties of coke, are distinguished by their needle-like structure and their quality, which is measured by the presence of impurities, principally sulfur, nitrogen and ash. Petroleum needle coke and pitch needle coke are typically low in these impurities. Additionally, the needle-like structure of petroleum and pitch needle coke creates expansion along the length of the electrode, rather than the width, which reduces the likelihood of fractures. In order to minimize fractures caused by disproportionate expansion over the width of an electrode,

Petroleum Needle Coke Industry - Supply and minimize the effect of impurities, large-diameter graphite electrodes (18 inches to 32 inches) employed in high-intensity EAF applications are comprised almost exclusively of petroleum needle coke and pitch needle coke.Demand Trends

The process map below shows the raw materials required to make graphite electrodes, the various consumers of these raw materials, as well as the consumers of graphite electrodes.Supply Trends

Source: Management estimates

Previously, producers of petroleum needle coke typically agreed to supply petroleum needle coke in 12 month contracts; however, since 2017, producers of petroleum needle coke have typically used three to six month contracts. As a result, our competitors must continually renegotiate supply agreements in response to changing market conditions. We are substantially vertically integrated through our ownership of our Seadrift facility, which provides the majority of our needle coke requirements and insulates us from rapid changes in the needle coke market.

Market size and major producers

The needle coke industry is concentrated. We estimate that, Seadrift has approximately one-fifthas of the end of 2023, the petroleum needle coke productionindustry globally (excluding China) had capacity outside China.

Graphite electrode manufacturers preferto produce approximately 750 thousand MT of petroleum needle coke. The global (excluding China) industry is highly concentrated as it is comprised of four producers, Phillips 66, GrafTech (via Seadrift), Petrocokes Japan Ltd. (a subsidiary of Sumitomo Corporation) and ENEOS Holdings, Inc. Our Seadrift facility, with nameplate capacity to produce approximately 140 thousand MT of calcined petroleum needle coke, becauserepresents nearly one-fifth of the meaningfully longer bake and graphitizing time required for pitch needle coke. Additionally, the demand for petroleum needle coke in lithium-ion battery manufacturing is growing rapidly. Electric vehicle manufacturers prefer artificial graphite such as petroleum needle coke in lithium-ion batteries because of its greater energy density, providing batteries with longer driving ranges and longevity.

Estimated Petroleum needle coke industry production capacityglobal (excluding China) by company (MT)

Source: Management estimates

Industry trendsproduction capacity.

Petroleum needle coke production capacity outside of China has remained relatively flat for the last severalmany years due to the capital intensity, technical know-how and long permitting lead times required to build greenfield needle coke production facilities and the stringent regulatory process associated with building newfacilities.

Chinese petroleum needle coke production capacity. Furthermore,capacity is expected to grow significantly in the coming years, with a primary focus on serving the EV market, as China is currently the largest producer of EV batteries. Although this may provide sufficient capacity to meet global petroleum needle coke needs for the next several years, as demand from emerging non-Chinese EV battery producers continues to increase, we believe that brownfield expansion opportunitiesregional supply-demand imbalances will occur, particularly in developed countries are generally not available asNorth America and Europe, in the coming years.

Demand Trends

We estimate that global (excluding China) needle coke demand for use in UHP graphite electrode production has been approximately 550 thousand MT, on average, over the past three years with the majority being petroleum needle coke manufacturing iscoke. With demand for UHP graphite electrodes expected to increase at a continuous process with significant costs associated with shutting down and restarting facilities for maintenance or capital investment.compound annual growth rate of approximately 3% to 4%

through 2028 (see “Graphite Electrode” section above), we expect this to result in a similar increase in demand for needle coke used in graphite electrode production.

While the vast majority of petroleum needle coke produced globally (excluding China) is currently used in the production of graphite electrodes, theits use of needle coke in lithium-ion batteries for electric vehiclesthe EV market is growingexpected to grow with the increased production of these vehicles. According to the International Energy Agency ("IEA"), the global electric car fleet exceeded 10 million in 2020, as compared to 17,000 in 2010. The IEA projects that global annual sales of electric cars may range between 13 million and 20 million by 2025. Most electric vehiclesEVs rely on lithium-ion batteries as their key performance component. Some manufacturerscomponent, with graphite being the key material used for the carbon anode portion of the batteries. Although both natural and synthetic graphite are used in anodes for lithium-ion batteries, for electric vehicles useEV manufacturers prefer synthetic graphite, which is produced using needle coke, as a raw material for carbon anodes in their batteries due tobecause of its advantages in terms of charging rate and capacity. According to IEA,capacity, providing batteries with longer driving ranges and longevity.

Based on Benchmark Mineral Intelligence estimates for growth in battery pack capacityanodes, we estimate this could result in global needle coke demand for use in EV applications increasing at a 20% or more compound annual growth rate through 2028. While synthetic graphite can be produced from either petroleum needle coke or pitch needle coke, petroleum needle coke has been increasingsuperior characteristics for EV battery applications, as it does with graphite electrode applications. As a result, demand growth for petroleum needle coke for use in recent years andthe EV market is expected to continue. Based on IEA’s estimates for electric vehicle sales and battery pack size, and management estimates forbe higher than that of overall needle coke used in anodes, demand growth. As noted above, with North American and European EV manufacturers increasing focus on domestic sourcing of battery material needs, we believe that regional supply-demand imbalances will occur for petroleum needle coke from electric vehicles could grow significantly from over 100,000 MT in 2020 to over 650,000 MT in 2025.2the coming years.

Contracts and Customers

Our customers include major steel producers and other ferrous and non-ferrous metal producers in Europe, the Middle East and Africa (collectively, “EMEA”), the Americas, and Asia-Pacific (“APAC”), which sell their products primarily into the automotive, construction, appliance, machinery, equipment and transportation industries.

We sell our products under LTAs and under short-term purchase agreements, multi-year purchase agreements (which includes our take-or-pay agreements with initial term of three-to-five years (“LTAs”)) and spot sales.

Our short-term agreements are either annual, semi-annual or quarterly. We also sell electrodes underBecause of the long production time, the book building process is largely concentrated in the fourth quarter of each year for the annual short-term agreements as well as for the semi-annual agreements related to the first half of the upcoming year. Spot purchase orders are entered into with deliveries usually starting three or more months later. The price of our short-term agreements is determined through contract negotiations with our customers and is influenced by the then-prevailing price on spot purchase orders for limited quantitiesas well as the anticipated supply-demand situation at the time of the planned deliveries. There is a time.

The LTAs were entered intolag between the end of 2017time we negotiate prices for our short-term agreements and early 2019. As graphitewhen our electrodes are an essential consumabledelivered and recognized in revenue.

There is no widely accepted graphite electrode reference price. Pricing has historically been cyclical, reflecting the demand trends of the global EAF steel production processsteelmaking industry and require a long lead time to manufacture, we believe our strategic customers are highly focused on securing certainty of supply of reliable, high-quality graphite electrodes.

We believe we are uniquely capable among graphite electrode producers to pursue our LTA contracting strategy due to our substantial vertical integration into petroleum needle coke production. All of our petroleum needle coke production is used internally and is not sold to external customers. Demand for petroleum needle coke increased due to an increased demand for

2 Source: IEA Global Electric Vehicle Outlook 2020 for electric vehicle sales and battery pack capacity. This also assumes approximately 0.8 kilogram anode material per kilowatt-hour of battery pack capacity. Anode material is assumed to be approximately 50% synthetic and 50% natural graphite, with a yield of 50%.

graphite electrodes and the use of needle coke in lithium-ion batteries for electric vehicles. Consequently, we expect this limited availability of petroleum needle coke will restrict new graphite electrode production. Seadrift, our wholly-owned subsidiary acquired in 2010, provides the majority of our petroleum needle coke requirements and produces sufficient needle coke to supply substantially all of the graphite electrode production that we have contracted under our LTAs. We have also hedged the decant oil required to produce substantially all of the graphite electrodes sold under these contracts, providing us substantial visibility into our raw material costs.

Because the market price of graphite electrodes may be based, in part, on the current or forecasted costs of key raw materials, periods of raw material price volatility may have an impact on the market price. In particular, Moreover, as petroleum needle coke represents a significant percentage of the raw material cost of graphite electrodes, graphite electrodes have typically been priced at a spread to petroleum needle coke. Over the period from 2004 to 2023, the average graphite electrode spread over petroleum needle coke was approximately $3,900 per MT, on an inflation-adjusted basis using constant 2023 dollars. In tight demand markets, this spread has increased, resulting in higher graphite electrode prices. Historically, between 2004 and 2023, our weighted-average realized price of graphite electrodes, has historically been influenced byexcluding volume sold under LTAs, was approximately $6,000 per MT, on an inflation-adjusted basis using constant 2023 dollars.

Our LTAs were entered into between the priceend of petroleum needle coke. See “Risk Factors—Risks related to our business2017 and industry—Pricingearly 2019, which coincided with a period of elevated market prices for graphite electrodes has historically been cyclical, and the price ofelectrodes. As graphite electrodes may declineare an essential consumable in the future.” The fixed prices under our contracts prevent us from passing along changes related to our costsEAF steel production process, the LTAs provided certainty of raw materials to our customers. See “Risk Factors—Risks related to our business and industry—We are dependent on the supply of petroleum needle coke. Our results of operations could deteriorate if recent disruptionsreliable, high-quality graphite electrodes in the supply of petroleum needle coke continue or worsen for an extended period.” However, as described above, we believe our ability to source substantially all of our petroleum needle coke requirements for these contracts from our Seadrift facility and our hedging of our purchases of decant oil mitigates the impact of periodic shortages and price fluctuations of raw materials.

All of ourat-times volatile market. These LTAs have fixed prices. Within thisthe contract, framework, our customers are contractually bound to purchase the specified volume of product at the price under the contract. These fixed prices underSales from our LTAs represented 41%, 68% and 77% of our net sales in 2023, 2022 and 2021, respectively.

As our LTAs are nearing the end of their terms, our mix of business has shifted towards short-term purchase agreements and spot purchase orders (“non-LTAs”). We will continue to offer multi-year agreements, also known as electrode supply agreements, as an important part of our commercialization strategy and value proposition. Our substantial vertical integration into petroleum needle coke supports our ability to offer contracts also prevent us from passing along any changes related to the costs of raw materials to contract customers. As a result of the LTA obligation of the contracts, the customer must purchase the annual contracted volume (or annual volume within the specified range). In the event the customer does not take delivery of the annual volume specified in the contract, our contracts provide for a capacity payment equal to the product of the number of MTs short of the annual volume specified in the contract multiplied by the price under the contract for that contract year.

In addition to defining annual volumes and prices, these LTAs include significant termination payments (typically, 50% to 70% of remaining contracted revenue) and, in certain cases, parent guarantees and collateral arrangements to manage our customer credit risk. In most cases, the customer can terminate the contract unilaterally only: (i) upon certain bankruptcy events; (ii) if we materially breach certain anti-corruption legislation; (iii) if we are affected by a force majeure event that precludes the delivery of the agreed-to graphite electrodes for more than a six-month period; or (iv) if we fail to ship certain minimum levels during a specified period of time. The customer will also be able to temporarily suspend obligations under the contract due to a force majeure event, as will we, with the contract term being extended by a period equal to the duration of such suspension.

Our contracts providevarying durations, providing our customers with certain remedies inflexibility and surety of supply. However, we do not anticipate that multi-year agreements will make up the event that we are unable to deliver the contracted volumesmajority of graphite electrodes on a quarterly basis. Our substantially vertically integrated Seadrift plant is particularly important to our ability to provide our customers with a reliable supply of graphite electrodes. Therefore, the likelihood that we will fail to deliver the contracted volume is significantly reduced due to our substantial vertical integration. For a discussion of certain risks related to our LTA contracting initiative, see “Risk Factors—Risks related to our business and industry—We may be unable to implement our business strategies, including our initiative to secure and maintain LTAs, in an effective manner.”portfolio moving forward.

During the challenging market conditions in 2020, we were able to work with our customers to develop mutually beneficial solutions to their challenges, including volume commitments. We have negotiated LTA modifications with many of these customers. We also worked to preserve our rights under the LTAs in a few arbitrations that arose from some non-performance and other disputes during the year.

In addition to the LTAs, we continue to sell available volumes under annual, semi-annual, quarterly and spot purchase orders.

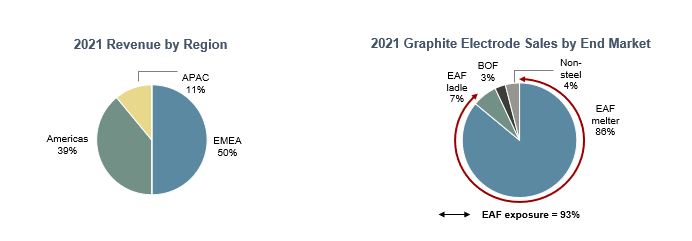

20212023 Revenue and production by region and end marketProduction By Region

Approximately 93%89% of our graphite electrodes were purchased by EAF steel producers in 2021.2023. The remaining portion is primarily used in various other ferrous and non-ferrous melting applications, fused materials, chemical processing, and alloy

metals. We sell our products in every major geographic region globally. Sales of our products to buyers outside the United States accounted for approximately 67%, 73% and 79% of net sales in both2023, 2022 and 2021, and 2020 and 77% in 2019.respectively. Overall, in 2021,2023, we generated 89% of our net sales from EMEA and the Americas.

The charts below show our revenue by region for 2023 and 2022: We believe our LTA contracting strategy provides us with cash flow visibility and has secured a high-quality customer base. We perform financial and credit reviews of all eligible potential customers prior to entering into these contracts. Less creditworthy customers are required to post a bank guarantee, letter of credit or significant cash prepayment. Sales from our LTAs represented 77% and 87% of our net sales in 2021 and 2020, respectively.

Sales and customer serviceCustomer Service

We differentiate and sell the value of our graphite electrodes primarily based on price, product quality and performance, delivery reliability and customer technical service.

We have a large customer technical service organization, with supporting application engineering and scientific groups and approximately 30 engineers and specialists around the world serving in this area. We believe that we are one of the industry leaders in providing value-added technical services to our customers.

Our direct sales force currently operates from 1113 sales offices located around the world. We sell our graphite electrodes primarily through our direct sales force, independent sales representatives, and distributors, all of whom are trained and experienced with our products.

We have customer technical service personnel based around the world to assist customers to maximize their production and minimize their costs. A portion of our engineers and technicians provide technical service and advice to key steel and other metals customers. These services relate to furnace applications and operation, as well as furnace upgrades to reduce energy consumption, improve raw material costs and increase output.

We believe we have a competitive advantage in offering customers ArchiTech® Furnace Productivity System 6.0 (“ArchiTech”), which we believe is an advanced support and technical service platform in the graphite electrode industry. ArchiTech, which has been installed in customer furnaces worldwide, enables our engineers to work with our customers seamlessly to maximize the performance of their furnaces and provide real-time diagnostics and troubleshooting. The arc furnace monitoring system team is continuously listening to our customers’ needs and develops new functionalities for the ArchiTech environment.

Distribution

We deploy various demand management and inventory management techniques to seek to ensure that we can meet our customers’ delivery requirements while still maximizing the capacity utilization of our production capacity. We can experience significant variation in our customers’ delivery requirements as their specific needs vary and change throughout the year. We generally seek to maintain appropriate inventory levels, taking into account these factors as well as the significant differences in manufacturing cycle times for graphite electrode products and our customers’ products.

Finished products are usually stored at our manufacturing facilities. Limited quantities of some finished products are also stored at local warehouses around the world to meet customer needs.

Facilities

We currently manufacture our graphite electrodes in three primary manufacturing facilities strategically located in the Americas and EMEA, two of the largest EAF steelmaking markets. Our locations allow us to serve our customers in the Americas and EMEA efficiently. Our production capacity is approximately 200,000 MT through our primary manufacturing

facilities in Calais, France, Pamplona, Spain, and Monterrey, Mexico3. In 2021, we shifted graphitization and machining of a portion of semi-finished products from Monterrey to St. Marys, Pennsylvania, in order to improve environmental performance, production flexibility and overall cost efficiencies across the two facilities. We believe that our business has the lowest manufacturing cost structure of all of our major competitors, primarily due to the large scale of our manufacturing facilities.

Our manufacturing facilities significantly benefit from their size and scale, work force flexibility, access to reliable sources of power and other key raw materials, and our substantial vertical integration with Seadrift. Our Calais, Pamplona, Monterrey and St. Marys facilities have access to reliable sources of electricity with essential logistical infrastructure in place, which is a significant element of our manufacturing costs. Our Seadrift facility currently produces the majority of our petroleum needle coke requirements for our graphite electrode production, allowing us to source our primary raw material internally and at cost, a significant advantage relative to our peers. Seadrift also produces sufficient needle coke to supply substantially all of the graphite electrode production that we have contracted under our LTAs.

Manufacturing

We manufacture graphite electrodes ranging in size up to 30 inches in diameter, over 11 feet in length, and weighing as much as 5,900 pounds (2.6 MT). The manufacturing process includes six main processes: screening of raw materials (needle coke) and blending with coal tar pitch followed by forming, or extrusion, of the electrode; baking the electrode; impregnating the electrode with a special pitch that improves strength; re-baking the electrode; graphitizing the electrode using electric resistance furnaces; and machining. The first baking process converts the pitch into hard coke. During the baking process, the electrode pitch volatiles are removed, leaving porosities inside. To improve graphite electrode quality, the electrode is then impregnated with additional coal tar pitch to fill the porosities and baked a second time. After impregnation and re-baking, the manufacturing process continues with graphitization as the electrodes are heated at 5,000° F in a special longitudinal furnace to convert the carbon into graphite. The graphitization cycle removes additional impurities and improves the electrodes’ key qualities: thermal and electrical conductivity, thermal shock resistance performance, lubricity, and abrasion resistance.

High-quality graphite electrodes have low electrical resistivity and strong durability. Resistivity is enhanced by removing impurities during the production process, while durability is determined by the coefficient of thermal expansion (“CTE”) of the raw material used to produce the graphite electrode. Lower CTE needle coke produces higher quality electrodes. UHP electrodes used in harsh EAF melter applications have low resistivity and low CTE to maximize efficient use of electricity in the EAF and minimize electrode consumption. The total manufacturing time of a graphite electrode and its associated connecting pin is on average approximately six months from needle coke production to customer delivery. We believe that the period of time required to produce a graphite electrode meaningfully constrains the ability of graphite electrode producers to react to real-time changes in steel market environments and acts as a barrier to entry.

Production of a graphite electrode begins with the production of either petroleum needle coke, our primary raw material, or pitch needle coke. Petroleum needle coke is produced through a manufacturing process very similar to a refinery. The production process converts decant oil, a byproduct of the gasoline refining process, into petroleum needle coke and generally takes two to three months to produce. Needle coke takes its name from the needle-like shape of the coke particles. We produce calcined petroleum needle coke at Seadrift. Seadrift is not dependent on any single refinery for decant oil. While Seadrift has purchased a substantial majority of its raw material inventory from a limited number of suppliers in recent years, we believe that there is a large supply of suitable decant oil in the United States available from a variety of sources. In addition, we use derivatives to hedge the decant oil required to produce substantially all of the graphite electrodes sold under our LTAs, providing us with substantial visibility into our raw material costs.

We purchase the electric power used in our manufacturing processes from local suppliers under contracts with pricing based on rate schedules or price indices. Our electricity costs can vary significantly depending on these rates and usage. Natural gas used in the baking and re-baking processes is purchased from local suppliers primarily under annual volume contracts with pricing based on various natural gas price indices.

Research and developmentDevelopment

We have over 135 years of experience in the research and development (“R&D&D”) of graphite- and carbon-based solutions. By focusing our management’s attention and R&D spending exclusively on the graphite electrode business, we have been able to improve the quality of our graphite electrodes, repositioning ourselvesmaintain our position as an industry leader and improvingimprove our relationships with strategic customers. Our focus on improving the quality of petroleum needle coke through R&D has led to our petroleum needle coke production at Seadrift being best-in-class for use in the manufacturing of highly durable UHP electrodes. Simultaneously, the R&D team helps to evaluate technology in adjacent markets where GrafTech may have technological advantages. We believe that the above strengths and capabilities provide us with a competitive advantage.

3 Production capacity reflects expected maximum production volume during the period depending on product mix and expected maintenance outage. Actual production may vary.

Intellectual propertyProperty

We believe that our intellectual property, consisting primarily of patents and proprietary know-how, provides us with competitive advantages and is important to our growth opportunities. Our intellectual property portfolio is extensive, with over 135approximately 100 U.S. and foreign patents and publishedpending patent applications.

We own, have the right to use or have obtained licenses for various trade names and trademarks used in our businesses. For example, the UCAR trademark is owned by Union Carbide Corporation ("(“Union Carbide"Carbide”) (which was acquired by Dow Chemical Company) and is licensed to us on a worldwide, exclusive and royalty-free basis until 2025.January 2035. This particular license automatically renews for successive 10 year10-year periods. It permits non-renewal by Union Carbide at the end of any renewal period upon five years’years notice of non-renewal.

We rely on patent, trademark, copyright and trade secret laws, as well as appropriate agreements to protect our intellectual property. Among other things, we seek to protect our proprietary know-how and information by requiring employees, consultants, strategic partners and others who have access to such proprietary information and know-how to enter into confidentiality or restricted use agreements.

Insurance

We maintain insurance against civil liabilities relating to personal injuries to third parties, for loss of or damage to property, for business interruptions and for certain environmental matters, that provides coverage, subject to the applicable coverage limits, deductibles and retentions, and exclusions, that we believe areis appropriate upon terms and conditions and for premiums that we consider fair and reasonable in the circumstances. There can be no assurance that we will not incur losses beyond the limits of or outside the coverage of our insurance.

Regulatory Matters

As a company with global operations, we are subject to the laws and regulations of the United States and the multiple foreign jurisdictions in which we operate or conduct business as well as the rules, reporting obligations and interpretations of all such requirements and obligations by various governing bodies, which may differ among jurisdictions. These include federal, state, local and foreign environmental laws and regulations, increasingly complex and changing laws and regulations enacted to protect business and personal data in the United States and other jurisdictions, including the European Union'sEU’s General Data Protection Regulation (“GDPR”), anti-corruption laws, import/export controls, anti-competition laws, U.S. securities laws and a variety of regulations including work-related and community safety laws. We believe we operate in compliance in all material respects with applicable laws and regulations, and maintaining compliance with them is not expected to materially affect our capital expenditures, earnings and competitive position. Estimates of future costs for compliance with U.S. and foreign environmental protection laws and regulations, and for environmental liabilities, are necessarily imprecise due to numerous uncertainties, including the impact of potential new laws and regulations, the availability and application of new and diverse technologies, the extent of insurance coverage, the potential discovery of contaminated properties, or the identification of new hazardous substance disposal sites at which we may be a potentially responsible party ("PRP"(“PRP”) and, in the case of sites subject to the Comprehensive Environmental Response, Compensation and Liability Act and similar state and foreign laws, the final determination of remedial requirements and the ultimate allocation of costs among the PRPs. Subject to the inherent imprecision in estimating such future costs, but taking into consideration our experience to date regarding environmental matters of a similar nature and facts currently known, we estimate that our costs and capital expenditures (in each case, before adjustment for inflation) for environmental protection regulatory compliance programs and for remedial response actions will not be material over the next several years. Furthermore, we establish accruals for environmental liabilities when it is probable that a liability has been or will be incurred, and the amount of the liability can be reasonably estimated. We adjust the accrual as

new remedial actions or other commitments are made, as well as when new information becomes available that changes the prior estimates previously made and we believe our existing accruals are reasonable.

Human Capital Resources

Employment

As of December 31, 2021,2023, we had 1,3531,249 employees (excluding contractors), 867758 of which were hourly employees. A total of 481435 employees were in Europe (including Russia), 573Mexico, 414 were in MexicoEurope and Brazil, two were in South Africa, 290the Middle East, 358 were in the United States, 37 were in Brazil and sevenfive were in the Asia Pacific region.

As of December 31, 2021,2023, approximately 557440 employees, or 41%,35% of our worldwide employees, were covered by collective bargaining or similar agreements that expire, or are subject to renegotiation, at various times through December 31, 2022.2024. We believe that, in general, our relationships with our employees'employees’ unions are good and that we will be able to renew or

extend our collective bargaining or similar agreements on reasonable terms as they expire. We have not had any material work stoppages or strikes initiated by our employees during the past decade.year.

The health and safety of our global team is a top priority and is a core value of the Company. Our comprehensive programs strive to achieve zero injuries and no harm done. Our total recordable incident rate in 2023 was 0.61 per 200,000 work hours, compared to 0.94 per 200,000 work hours in 2022. Our global Health, Safety and Environmental Protection ("(“HS&EP"&EP”) Policypolicy applies to all employees contractors, and visitors, and governs our actions and decisions every day. We also have a Code of Conduct and Ethics for Suppliers and Contractors that includes HS&EP guidelines required for doing business with GrafTech. GrafTech’s focus on HS&EP is a top priority for all employees. We have built risk recognition into our HS&EP programs. From pre-job planning, safety walks and inspections, planned job observations, or training employees on health and safety best practices, we strive to identify and mitigate risks. In the spirit of continuous improvement, regular inspections, internal reviews and corporate audits are conducted to foster compliance with our high standards.

Diversity and Inclusion

Diversity and inclusion are foundational to our culture, and all employees are expected to uphold these values in their day-to-day work. Our recruitment policies and hiring practices support our diversity and inclusion objectives. At both the corporate and site levels, we assign responsibilities for upholding policies, procedures, and practices for diverse and inclusive hiring and talent management. GrafTech affirms its position as an Equal Opportunity Employer and is committed to recruiting, employing, and promoting qualified veterans and disabled individuals, and we aim to ensure our people have equal opportunities related to job promotions, compensation and benefits, and personal development.