UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the year ended December 31, 20202023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-36373

TRINET GROUP, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | |

| Delaware | | 95-3359658 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| One Park Place, | Suite 600 | | |

| Dublin, | CA | | 94568 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (510) 352-5000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock par value $0.000025 per share | TNET | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ |

| | | | | | |

| Smaller reporting company | ☐ | Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ☐ No ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on The New York Stock Exchange on June 30, 2020,2023, was $2.5$3.6 billion.

The number of shares of Registrant’s Common Stock outstanding as of February 9, 20218, 2024 was 65,990,673.50,567,866.

Portions of the Registrant’s Definitive Proxy Statement to be issued in connection with its Annual Meeting of Stockholders, scheduled to be held on May 27, 2021,23, 2024, are incorporated by reference into Part III of this Form 10-K.

TRINET GROUP, INC.

Form 10-K - Annual Report

For the Year Ended December 31, 20202023

TABLE OF CONTENTS

| | | | | | | | |

| Form 10-K Cross Reference | Page |

| | |

| Part I, Item 1. | |

| Part I, Item 1A. | |

| Part I, Item 1B. | |

| Part I, Item 1C | |

| Part I, Item 2. | |

| Part I, Item 3. | |

| Part I, Item 4. | |

| Part II, Item 5. | |

| | |

| Part II, Item 7. | |

| Part II, Item 7A. | |

| Part II, Item 8. | |

| | |

| | |

| | |

| | |

| | |

| Part II, Item 9. | |

| Part II, Item 9A. | |

| Part II, Item 9B. | |

| Part II, Item 9C. | |

| Part III, Item 10. | |

| Part III, Item 11. | |

| Part III, Item 12. | |

| Part III, Item 13. | |

| Part III, Item 14. | |

| Part IV, Item 15. | |

| Part IV, Item 16. | |

| | |

Glossary of Acronyms and Abbreviations

Acronyms and abbreviations are used throughout this report, particularly in Part I, Item 1. Business; Part I, Item 1A. Risk Factors; Part II, Item 7. MD&A; Part II, Item 7A. Quantitative and Qualitative Disclosures About Market Risk and Part II, Item 8. Financial Statements and Supplementary Data.

| | | | | | |

AB52018 Term Loan | Assembly Bill 5Our $425 million term loan A executed in June 2018 and repaid in 2021 | |

| 2021 Credits | Our announced 2021 credits, which provided eligible clients with discretionary credits, subject to certain predefined conditions. | |

| 2022 Credits | Includes both of our announced 2022 credits, each of which provides eligible clients with discretionary credits, subject to certain predefined conditions. | |

| 2021 Credit Agreement | Our credit agreement dated February 26, 2021, as amended, supplemented or modified from time to time, most recently August 16, 2023. | |

| 2021 Revolver | Our $700 million revolving line of credit included in our 2021 Credit Agreement | |

| 2029 Notes | Our $500 million senior unsecured notes maturing in March 2029 | |

| 2031 Notes | Our $400 million senior unsecured notes maturing in August 2031 | |

| | |

| ACA | The Patient Protection and Affordable Care Act | |

| ACH | Automated Clearinghouse Transaction | |

| AFS | Available-for-sale | |

| ARPA | American Rescue Plan Act | |

| ASC | Accounting standards codificationStandards Codification | |

| ASO | Administrative Services Organization | |

| ASU | Accounting standards updateStandards Update | |

| CARES Act | Coronavirus Aid Relief and Economic Security Act | |

| CCPA | California Consumer Privacy Act | |

| CEO | Chief Executive Officer | |

| CIRT | Cybersecurity Incident Response Team | |

| CFO | Chief Financial Officer | |

| | |

| COBRA | Consolidated Omnibus Budget Reconciliation Act | |

| Colleague | TriNet's internal employee (as distinguished from WSEs and HRIS Users) | |

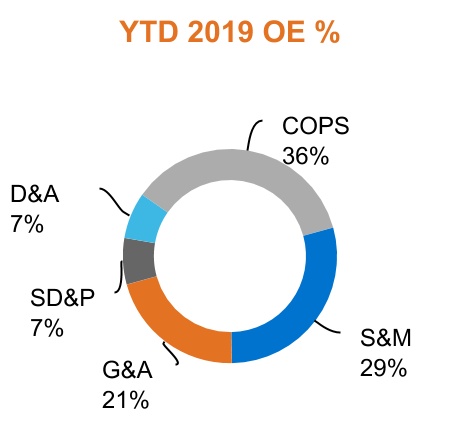

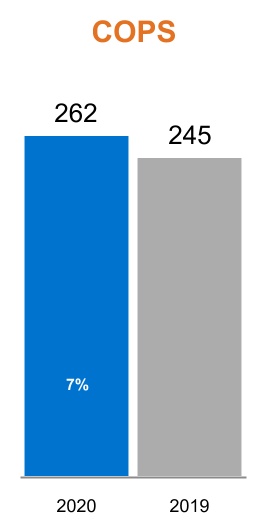

| COPS | Cost of providing services | |

| | |

| COVID-19 | Novel coronavirus | |

| CPRA | California Privacy Rights Act | |

| CSO | Chief Security Officer | |

| D&A | Depreciation and amortization expenses | |

| DOL | U.S. Department of Labor | |

| EBITDA | Earnings before interest expense, taxes, depreciation and amortization of intangible assets | |

| EPLI | Employment Practices Liability Insurance | |

| EPS | Earnings Per Share | |

| ERISA | Employee Retirement Income Security Act | |

ESACERM | Employer Services Assurance CorporationEnterprise Risk Management | |

| ERP | Enterprise Resource Planning | |

| | |

| ESPP | Employee stock purchase plan | |

| ETR | Effective tax rate | |

| FASB | Financial Accounting Standards Board | |

| FFCRA | Families First Coronavirus Response Act | |

| FLSA | Fair Labor Standards Act | |

| G&A | General and administrative | |

| GAAP | Generally Accepted Accounting Principles in the United States | |

| HCM | Human capital management | |

| HIPAA | Health Insurance Portability and Accountability Act | |

| | | | | | |

| HITECH Act | Health Information Technology for Economic and Clinical Health Act | |

| HR | Human Resources | |

| HRIS | Human resources information system | |

| HRIS User | A client employee who is a user of our HR Platform (for example, employees of a TriNet Zenefits client) | |

| IBNP | Incurred but not yet paid | |

| IBNR | Incurred but not yet reported | |

| ICR | Insurance cost ratio | |

| IGP | Indemnity Guarantee Payment | |

| IRC | Incident Review Committee | |

| IRCF | Integrated Risk and Control Framework | |

| IRM | Information Risk Management | |

| IRS | Internal Revenue Service | |

| ICR | Insurance cost ratio | |

| ISR | Insurance service revenues | |

| | |

| LDF | Loss development factor | |

| LIBOR | London Inter-bank Offered Rate | |

| MCT | Medical cost trend | |

| MD&A | Management's Discussion and Analysis of Financial Condition and Results of Operations |

| | | | | |

NIMMEWA | Net Insurance Margin |

NISRMultiple Employer Welfare Arrangement | | Net Insurance Service Revenues

NSR | Net service revenues |

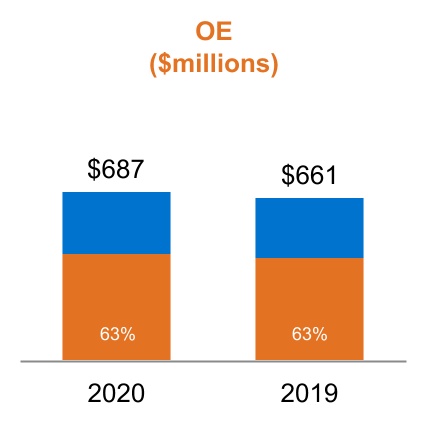

| OE | Operating expenses | |

| OMS | Open Market Solutions offering that includes Broker Select and Broker Flex offerings | |

| PCAOB | Public Company Accounting Oversight Board | |

| PEO | Professional Employer Organization | |

| PFC | Payroll funds collected | |

| PHI | Protected Health Information | |

| PPP | Paycheck Protection Program, a loan program administered by the SBA |

| PPPFA | Paycheck Protection Program Flexibility Act |

| PSR | Professional service revenues | |

| R&D | Research and Development | |

| Recovery Credit | ProgramOur 2020 Recovery Credit to provide eligible clients with one-time reductions against fees for future services | |

| Recovery Credits | Collectively, our Recovery Credit, 2021 Credits, and 2022 Credits | |

| Reg FD | Regulation Fair Disclosure | |

| ROU | Right-of-use | |

| RSA | Restricted Stock Award | |

| RSU | Restricted Stock Unit | |

| SBA | U.S. Small Business Administration | |

| SBC | Stock Based Compensation | |

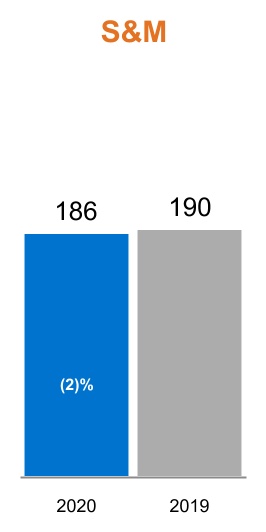

| S&M | Sales and marketing | |

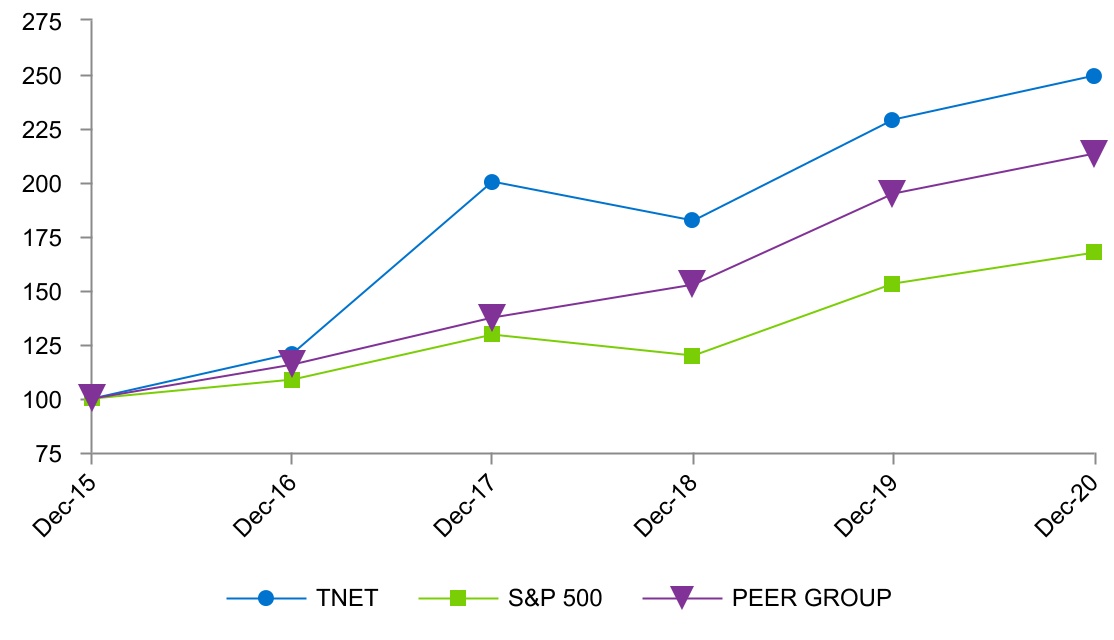

S&P 500 | Standard and& Poor's 500 Stock Index | |

| SD&P | Systems development and programming | |

| SEC | U.S. Securities and Exchange Commission | |

| SMB | Small and medium-size business | |

| | |

| TCJA | Tax Cuts and Jobs Act | |

| TriNet Clarus R+D | Clarus R+D Solutions, LLC | |

| U.S. | United States | |

| | |

| | |

| WSE | WorksiteA worksite employee who is co-employed by, or otherwise receiving services from a TriNet PEO | |

| YTD | Year to date | |

| Zenefits | YourPeople, Inc. and its subsidiaries | |

Cautionary Note Regarding Forward-Looking Statements

For purposes of this Annual Report on Form 10-K (Form 10-K), the terms “TriNet,” “the Company,” “we,” “us” and “our” refer to TriNet Group, Inc., and its subsidiaries. This Form 10-K contains statements that are not historical in nature, are predictive in nature, or that depend upon or refer to future events or conditions or otherwise contain forward-looking statements within the meaning of Section 21 of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements are often identified by the use of words such as, but not limited to, “ability,” “anticipate,” “believe,” “can,” “continue,” “could,” “design,” “estimate,” “expect,” “forecast,” “hope,” “impact,” “intend,” “may,” “outlook,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “strategy,” “target,” “value,” “will,” “would” and similar expressions or variations intended to identify forward-looking statements. Examples of forward-looking statements include, among others, TriNet’s expectations regarding: market response to new support, service and product offerings, including our Enrich, Broker Select and tax credit products; our ability to successfully diversify our overall service and technology offerings to support SMBs throughout their lifecycle; our plans and ability to grow our client base; the impact of the COVID-19 pandemic; the impact of COVID-19 regulationsthat stopping our discretionary credit program may have on client loyalty and government programs;attrition; the impact of our Recovery Creditongoing efforts to ensure that our billing practices best match the expectations of our customers and the impact on our WSE count; the impact of our TriNet PeopleForce conference; our expectations regarding medical utilization rates by our WSEs and the impact of inflation on our insurance costs; the effect that our stock repurchase program and its suitability for generating client loyalty and retention;will have on our ability to modify or develop service offerings to assist clients affected by COVID-19;business; the impact of our vertical approach; our ability to leverage our scale and industry HR experience to deliver vertical servicefocused offerings; the growthimpact of our client base; planned improvements to our technology platform;platform and HRIS software and whether they will meet the needs of our current clients and attract new ones; the implementation of our ERP system and its impact on our internal financial controls and operations; our ability to driveimprove operating efficiencies and improve the client experience;efficiencies; the impact of our client service initiatives;initiatives and whether they enhance client experience and satisfaction; our continued ability to provide access to a broad range of benefit programs on a cost-effective basis; our expectations regarding the volume and severity of insurance claims and insurance claim trends; the impacteffectiveness of COVID-19 on claims;our risk strategies for, and management of, workers' compensation, health benefit insurance costs and deductibles, and EPLI risk; the metrics that may be indicators of future financial performance; the relative value of our benefit offerings versus those SMBs can independently obtain; the impact that our benefit offerings have for SMBs seeking to attract and retain employees; the principal competitive drivers in our market; our plans to retaingrow net new clients and manage client attrition; our investment strategy and its impact on our ability to generate future interest income, net income, and Adjusted EBITDA; seasonal trends and their impact on our business and the impact of COVID-19 on those trends;business; fluctuations in the period-to-period timing of when we incur certain operating expenses; the estimates and assumptions we use to prepare our financial statements; our belief we can meet our present and reasonably foreseeable cash needs and future commitments through existing liquid assets and continuing cash flows from corporate operating activities; and other expectations, outlooks and forecasts on our future business, operational and financial performance.

Important factors that could cause actual results, level of activity, performance or achievements to differ materially from those expressed or implied by these forward-looking statements are discussed above and throughout this Form 10-K, including under Part I, Item 1A. Risk Factors, and Part II, Item 7. MD&A, and in the other periodic filings we make with the SEC, and including risk factors associated with: the economic, health and business disruption caused by the COVID-19 pandemic; the impact of the COVID-19 pandemic on our clients and prospects, insurance costs and operations; the impact of the COVID-19 pandemic on the laws and regulations that impact our industry and clients; our ability to mitigate the business risks we face as a co-employer; our ability to manage unexpected changes in workers’ compensation and health insurance claims and costs by worksite employees;WSEs; our ability to mitigate the unique business risks we face as a co-employer; the effects of volatility in the financial and economic environment on the businesses that make up our client base,base; loss of clients for reasons beyond our control and the concentrationshort-term contracts we typically use with our clients; the impact of regional or industry-specific economic and health factors on our clients in certain geographies and industries;operations; the impact of failures or limitations in the business systems and centers we rely upon; the impact of discontinuing our Recovery Credit program; adversediscretionary credits on our business and client loyalty and retention; changes in our insurance coverage or our relationships with key insurance carriers; our ability to improve our services and technology to satisfy client and regulatory requirements and meet the expectations of our clients and manage client attrition;expectations; our ability to effectively integrate businesses we have acquired or may acquire in the future; our ability to effectively manage and improve our operational processes;effectiveness and resiliency; our ability to attract and retain qualified personnel; the effects of increased competition and our ability to compete effectively; the impact on our business of cyber-attacks, breaches, disclosures and security breaches;other data-related incidents; our ability to secureprotect against and remediate cyber-attacks, breaches, disclosures and other data-related incidents, whether intentional or inadvertent and whether attributable to us or our information technology infrastructure and our confidential, sensitive and personal information;service providers; our ability to comply with constantly evolving data privacy and security laws; our ability to manage changes in, uncertainty regarding, or adverse application of the complex laws and regulations that govern our business; changing laws and regulations governing health insurance and employee benefits; our ability to be recognized as an employer of worksite employees and for our benefits plans to satisfy all requirements under federal and state regulations; changes in the laws and regulations that govern what it means to be an employer, employee or independent contractor; the impact of new and changing laws regarding

remote work; our ability to comply with the laws and regulationslicensing requirements that govern PEOs and other similar industries;our solutions; the outcome of existing and future legal and tax proceedings; fluctuation in our results of operationoperations and stock price due to factors outside of our control, such as the volume and severity of our workers’ compensation and health insurance claims and the amount and timing of our insurance costs, operating expenses and capital expenditure requirements;control; our ability to comply with the restrictions of our credit facility and meet our debt obligations; and the impact of concentrated ownership in our stock.stock by Atairos and other large stockholders. Any of these factors could cause our actual results to differ materially from our anticipated results.

Forward-looking statements are not guarantees of future performance, but are based on management’s expectations as of the date of this Form 10-K and assumptions that are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from our current expectations and any past results, performance or achievements. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

The information provided in this Form 10-K is based upon the facts and circumstances known atas of the date of this time,Form 10-K, and any forward-looking statements made by us in this Form 10-K speak only as of the date of this Form 10-K. We undertake no obligation to revise or update any of the information provided in this Form 10-K, except as required by law.

Part II, Item 7.The MD&A of this Form 10-K includes references to our performance measures presented in conformity with GAAP and other non-GAAP financial measures that we use to manage our business, to make planning decisions, to allocate resources and to use as performance measures in our executive compensation plans. Refer to the Non-GAAP Financial Measures in Part II, Item 7. within our MD&A for definitions and reconciliations from GAAP measures.Website Disclosures

We use our website (www.trinet.com) to announce material non-public information to the public and to comply with our disclosure obligations under Regulation Fair Disclosure (Reg FD). We also use our website to communicate with the public about our Company, our services, and other matters. Our SEC filings, press releases and recent public conference calls and webcasts can also be found on our website. The information we post on our website could be deemed to be material information under Reg FD. We encourage investors and others interested in our Company to review the information we post on our website. Information contained in or accessible through our website is not a part of this report.

PART I

Item 1. Business

TriNet is a leading provider of comprehensive and flexible HCM solutions designed to address a wide range of SMB needs as they change over time. Our flexible HCM solutions free SMBs from HR complexities and empower SMBs to focus on what matters most - growing their business and enabling their people.

TriNet offers access to human capital expertise, payroll services, employee benefits, and employmentpayroll, risk mitigation and compliance, all enabled by industry leading technology capabilities. TriNet's suite of products also includes services for SMBs. and software-based solutions to help streamline workflows by connecting HR, benefits, payroll, time and attendance, and employee engagement. Clients can use our industry tailored PEO services and technology platform to receive the full benefit of our HCM services enabling their WSEs to participate in our TriNet-sponsored employee benefit plans. Clients can alternatively choose to use our self-directed, cloud-based HRIS software solution and add HR services such as payroll and access to benefits management as needed. By providing PEO and HRIS services, we believe that we can support a wider range of SMBs and create a pipeline of HRIS clients that may be able to benefit from and transition to TriNet’s higher-touch PEO services at future points in their business lifecycle. In order to better serve TriNet’s customers throughout their business lifecycle, we are investing in our technology platform so that it can accommodate both PEO and HRIS customers.

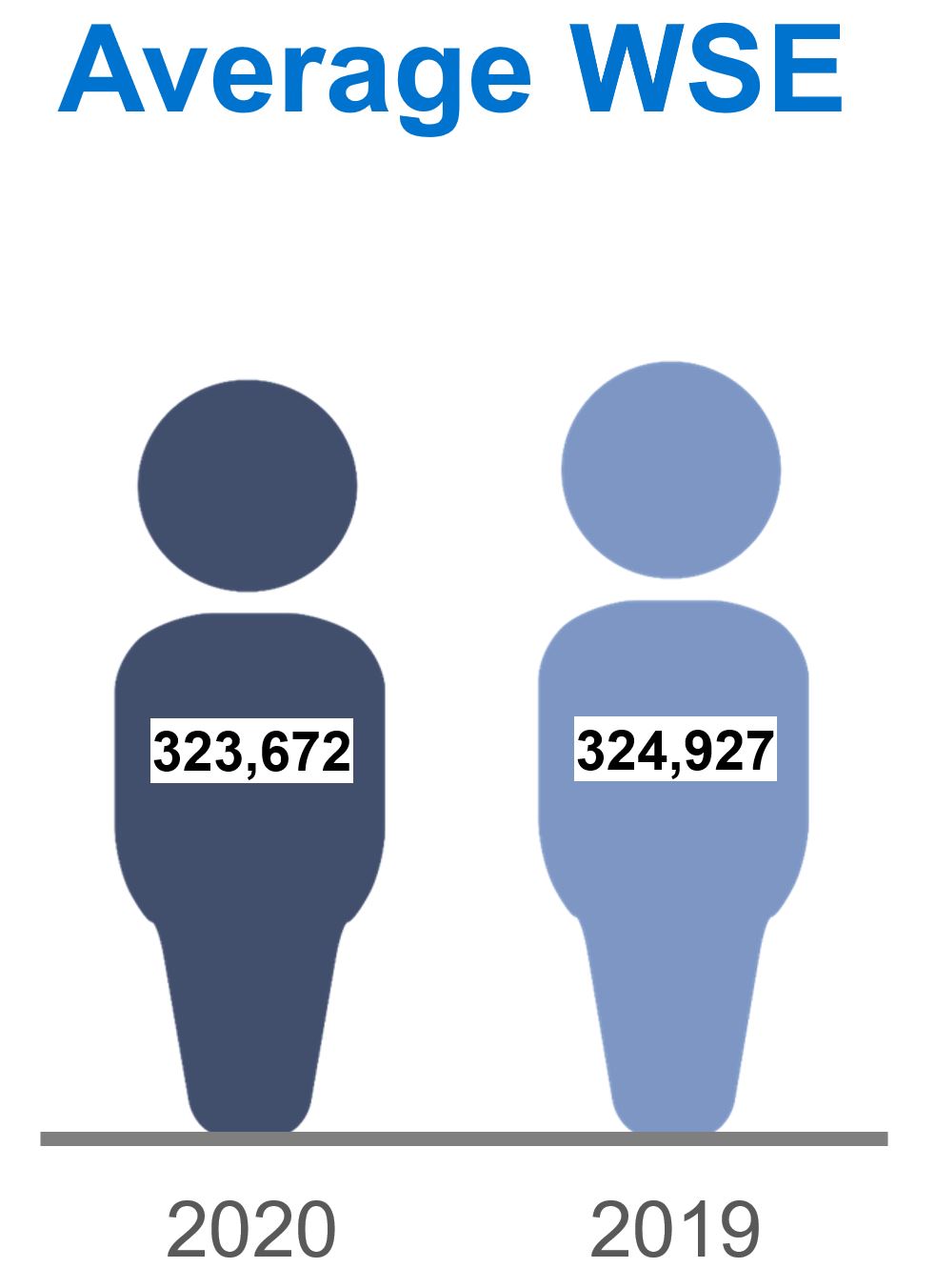

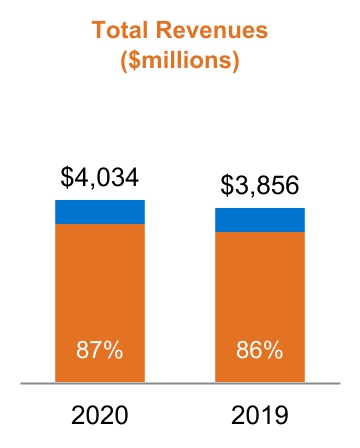

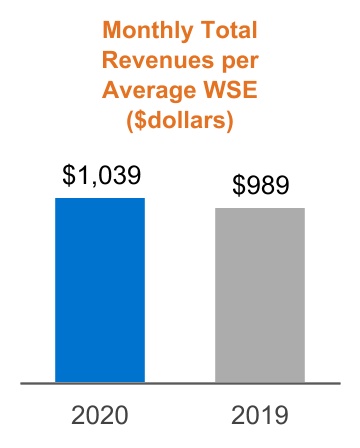

Since our founding in 1988, TriNet has served, and continues to serve, thousands of SMBs. In 2020,2023, we processed $44.9$72 billion in payroll and payroll taxes for our clients and ended the year with approximately 17,70022,600 clients, 347,500 WSEs and 331,900 WSEs,200,800 HRIS Users primarily in the U.S.

Our ServicesService Models

To free SMBs from HR complexities, weWe deliver a comprehensive suite of HCM services that help our clients administer and manage various HR-related needs and functions, such as compensation, and benefits, payroll processing, tax credit support, employee data, health insurance, and workers' compensation, EPLI and other employment risk mitigation programs, employee performance management and training, on-boarding and off-boarding, and other transactional HR needs using our PEO and HRIS technology platformplatforms and HR,our HCM, benefits and compliance expertise.

We empower SMBs to focusdeliver our services through two primary models, higher-touch PEO services and our more self-directed HRIS services.

PEO Services

TriNet has historically focused almost exclusively on what mattersthe PEO business and PEO services remain our core business. Our PEO services offer clients our most - growing their business.

complete HCM solution generally including all of the services described below. We leverage our scale and industry HR experience to deliver our PEO service offerings tailored for SMBs in specific industry verticals. We believe our vertical approach is a key differentiator for us and creates additional value for our clients thanks to service offerings that are tailored to addressby addressing their industry-specific HR needs. We offer six industry-tailored vertical PEO services: TriNet Financial Services, TriNet Life Sciences, TriNet Main Street, TriNet Nonprofit, TriNet Professional Services, and TriNet Technology.

HRIS Services

Our HRIS services primarily consists of our self-directed, cloud-based HRIS software solution which allows clients to manage their HR needs and the option to add tools such as payroll processing and benefits management to provide HCM solutions that flex dynamically over time based on the needs of our clients. Our HRIS services do not include access to our co-employment services, or access to our TriNet sponsored health benefit plans. However, these services can also include tax credit support via our TriNet Clarus R+D team, additional cloud-based software integrations and incremental administrative services.

Our Services

Our comprehensive HR solutions include the following capabilities:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| HR CONSULTING EXPERTISE | | BENEFIT

OPTIONS | | PAYROLL SERVICES | | RISK MITIGATION | | TECHNOLOGY

PLATFORM |

| | | | | | | | |

HR

HR Consulting ExpertiseWe use the collective knowledge and experience of our teams of HR, benefits, payroll, risk management and compliance professionals to help our PEO and HRIS clients manage many of the administrative, regulatory and practical requirements associated with being employers. These professionalsWe do this by incorporating our knowledge and experience into our services and our services helptechnology platforms and by making our professionals available to consult with clients addresson a variety of client HR needs, including consulting on talent management, retention and terminations, benefits enrollment, immigration and visas, payroll tax credits, labor lawemployment compliance and regulatory developments and many other industry-specific and general HR topics. Depending on their needs, our clients, WSEs and WSEsHRIS Users have access to varying levels of service and support from our professionals, ranging from call center support for basic questions, to pooled HR resources, to onsite consulting and services.resources. Our professionals also provide additional specialized HR consulting and services upon request.

Benefit Options

Benefit OptionsWeIn our PEO business, we utilize our scale to provide our clients and WSEs access to a broad range of TriNet-sponsored employee benefit and insurance programs with choice and at costs that we believe most of our clients would be unable to obtain on their own. We believe that our TriNet-sponsored programs help our PEO clients compete for talent against larger businesses. Our benefit and insurance programs are designed to comply with federal, state and local regulations, and our benefit and insurance service offerings include plan selection and administration, enrollment management, leave management, plan document distribution and WSE and client communications.

Under ourthese benefit and insurance programs, we pay third-party insurance carriers for WSE insurance benefits and reimburse insurance carriers or third-party administrators for claims payments within our insurance deductible layer, where applicable.

We sponsor and administer several employee benefit plans for our WSEs through a broad range of carriers, including group health, dental, vision, short- and long-term disability, and life insurance as an employer plan sponsor under Section 3(5) of ERISA. We also provide for other benefit programs to be made available to WSEs, including flexible spending accounts, health savings accounts, retirement benefits, COBRA benefits, supplemental insurance, commuter benefits, home insurance, critical illness insurance, accident insurance, hospital indemnity, pet insurance, and auto insurance. For further discussion of our insurance programs, including policies where we reimburse our carriers for certain amounts relating to claims, refer to Note 1 in Part II, Item 8. Financial Statements and Supplementary Data, of this Form 10-K. We also offer PEO clients the option to obtain their own client-sponsored benefits through our OMS product family. Our OMS clients receive PEO services like HR, payroll, payroll tax, and risk management from TriNet while sponsoring their own health benefits obtained through a broker.

Our HRIS clients use our HRIS software solution to manage their own selected group health plans. For our HRIS clients, we provide access to benefit programs for HRIS Users where we are not an employer plan sponsor under ERISA, such as flexible spending accounts, health savings accounts, retirement benefits, COBRA benefits, supplemental insurance, commuter benefits, critical illness insurance, accident insurance, and hospital indemnity.

Payroll Services

Payroll ServicesWe help our PEO and HRIS clients manage all aspects of their employee compensation by providing multi-state payroll processing, tax administration and tax credit services and other payroll-related services, such as time and attendance management, time off and overtime tracking, and expense management solutions. Our clients, WSEs, and WSEsHRIS Users can access payroll and tax information using our various online and mobile tools. Our payroll tax administration and tax credit services include calculating, withholding, remitting and reporting certain federal, state and local payroll and unemployment taxes on behalf of clients, WSEs, and WSEs.HRIS Users. While all of our PEO clients receive payroll and payroll tax administration tax services, our HRIS clients can choose whether to manage these services themselves.

Through TriNet Clarus R+D, we also help SMBs take advantage of federal and state payroll tax credits, particularly PATH Act R&D tax credits, one of the largest payroll tax incentives available to US businesses. TriNet Clarus R+D uses a proprietary software solution and payroll tax experts to support clients and help them determine their tax credits. SMBs do not need to use TriNet’s PEO or HRIS services to use TriNet Clarus R+D's tax credit services.

Risk Mitigation

Risk MitigationWe monitor employment-related legal and regulatory developments at the federal, state, and local levels to help our PEO and HRIS clients comply with employment laws and mitigate many of the risks associated with being an employer. We provide HR guidance on employment laws and regulations, includingsuch as those relating to minimum wage, unemployment insurance, family and medical leave and anti-discrimination. WeFor our PEO clients, we also ensure that our TriNet-sponsored benefit plans comply with applicable laws and regulations, like the ACA, reducing this compliance burden to our clients.

WeOur PEO services provide fully-insured workers' compensation insurance coverage for our clients and WSEs through insurance policies that we negotiate with our third-party insurance carriers. We manage the deductible risk that we assume in connection with these policies by being selective in the types of businesses that we take on as new clients, and by monitoring claims data and the performance of our carriers and third-party claims management service providers. In addition, we advise clients on workers’ compensation best practices, including by performing workplace assessment consultations and assisting with client efforts to identify conditions or practices that might lead to employee injuries.

We also provide EPLI coverage for our PEO clients through an insurance policiespolicy that we obtain from a third-party EPLI carrier. These policies provideThis policy provides coverage for certain claims that arise in the course of the employment relationship, such as discrimination, harassment, and certain other employee claims, with a per-claim retention amount. The retention amount under this policy, which functions like a deductible, is allocated on a pre-determined basis between the client and TriNet. Our professionals assist our clients in implementing HR best practices to help avoid and reduce the cost of employment-related liabilities. Litigation defense is conducted by ourOur preferred outside employment law firms.firms defend covered EPLI claims.

Technology Platform

Technology PlatformWe currently use separate technology platforms for our PEO and HRIS clients. Our PEO technology platform includes online and mobile tools that allow our clients and WSEs to store, view, and manage HR information and administer a variety of HR transactions, such as payroll processing, tax administration, tax credits, employee onboarding and termination, employee performance, time and attendance, compensation reporting, expense management, and benefits enrollment and administration. Our online tools also incorporate workforce analytics, allowing PEO clients to generate HR, data, payroll, total compensation and other custom reports.

Our HRIS software allows our HRIS clients to manage most of the same functions as our PEO technology platform and it is optimized to provide HRIS clients with customizable and flexible reporting tools and analytics to fit specific client needs. Our TriNet Clarus R+D tax credit services use a proprietary cloud-based software platform to simplify and support various state and federal tax credits for SMBs.

Our PEO Co-Employment Model

WeOur PEO services operate using a co-employment model, under which employment-related responsibilities are allocated by contract between us and our PEO clients. ThisThe co-employment model allows WSEs to receive the full benefit of our services, including providing WSEs with access to TriNet-sponsored employee benefit plan offerings. Each of our PEO clients enters into a client service agreement with us that defines the suite of services and benefits to be provided by us, the fees payable to us, and the division of responsibilities between us and our clients as co-employers. WSEs also separately acknowledge the co-employment relationship and the allocation of employment-related responsibilities between TriNet and our clients.the client co-employer. The division of responsibilities under our client service agreements is typically as follows:

TriNet Responsibilities

We generally assume responsibility for, and manage certain risks associated with:

•payments of salaries, wages and certain other compensation to WSEs from our own bank accounts (based on client reports and payments), including the processing of garnishment and wage deduction orders,

•reporting of wages, withholding and deposit of associated payroll taxes as the employer of record,

•provision and maintenance of workers' compensation insurance and workers' compensation claims processing,

•access to, and administration of, group health, welfare, and retirement benefits to WSEs under TriNet-sponsored benefit plans,

•compliance with applicable law for certain TriNet-sponsored employee benefits offered to WSEs,

•administration of unemployment claims and post-employment COBRA benefits, and

•provision of various HR policies and agreements, including employee handbooks and worksite employee agreements describing the co-employment relationship.

Client Responsibilities

Our clients are responsible for employment-related responsibilities that we do not specifically assume, generally including:

•day-to-day management of their worksites and WSEs,

•compliance with laws associated with the classification of employees as exempt or non-exempt, such as overtime pay and minimum wage law compliance,

•accurate and timely reporting to TriNet of compensation and deduction information, including information relating to hours worked, rates of pay, salaries, wages and other compensation, and work locations,

•accurate and timely reporting to TriNet of information relating to workplace injuries, employee hires and termination, and certain other information relevant to TriNet’s services,

•provision and administration of any employee benefits not provided by TriNet, such as equity incentive plans,

•compliance with all laws and regulations applicable to the clients' workplace and business, including work eligibility laws, laws relating to workplace safety or the environment, laws relating to family and medical leave, laws pertaining to employee organizing efforts and collective bargaining and employee termination notice requirements,

•payment of TriNet invoices, which include salary, wages and other relevant compensation to WSEs and applicable employment taxes and service fees, and

•all other matters for which TriNet does not assume responsibility under the client service agreement, such as intellectual property ownership and protection and liability for products produced and services provided by the client company to its own clients.

As a result of our co-employment relationships for PEO services, we are liable for payment of salary, wages and certain other compensation to the WSEs as reported and paid to us by theour client, and we are responsible for providing specified employee benefits to such persons to the extent provided in each client service agreement and under federal and state law. In most instances, clients are required to remit payment prior to the applicable payroll date by wire transfer or ACH.

WeFor our PEO services, we also assume responsibility for payment and liability for the withholding and remittance of federal and state income and employment taxes with respect to salaries, wages and certain other compensation paid to WSEs, although we reserve the right to seek recourse against our clients for any liabilities arising out of their conduct. We perform these functions as the statutory employer for federal employment tax purposes, since our clients transfer legal control over these payroll functions to us. The laws that govern the payment of salaries, wages and related payroll taxes for our WSEs are complex and the various federal, state and local laws that govern such payments can vary significantly. Based on applicable law in any jurisdiction, we or our client may be held ultimately liable for those obligations if we fail to remit taxes.

Our HRIS services do not involve co-employment, and this reduces the responsibility and liability that we assume when providing these services. For example, while our software may facilitate payroll processing for HRIS clients, TriNet is not the employer of record and acts only in a software provider role. HRIS clients generally remain responsible for, among other things, payroll funding, workers’ compensation insurance, obtaining and administering group health, welfare and retirement benefits, administering unemployment claims, and in some cases payroll tax reporting. The higher level of responsibility that our PEOs assume, and risks that our PEOs manage, for our PEO clients is a key differentiator between our PEO and HRIS services.

Market Trends and Developments Affecting Our Business in 20202023

The COVID-19 pandemic wasU.S. economy grew modestly during 2023 with unemployment remaining low while inflation began to abate over the most significant development we faced in 2020. COVID-19 related stay-at-home mandates and social distancing practices resulted in a nationwide economic slowdown and an unprecedented disruption to the businesses of our clients, the PEO industry and our business.year. We observed the following PEO industry trends in 2020 as a result of the COVID-19 pandemic:2023:

•SMB Economic DistressPerformance. Over any year, SMBs generally suffered,experience staffing changes, either resulting in a net increase or decrease in staffing. In 2023 the extent of net staffing increases differed significantly based on industry and we expect they will continue to suffer, from headcount freezes, furloughsgeographic region. Our clients experienced significant staffing reductions in the technology sector, and terminations, partial or complete business shutdowns, as well as reduced budgets and liquidity issues.reductions in the professional services sector, while staffing levels in other industries remained stable. Overall in 2023, our SMB clients still increased their staffing, however the increase was significantly lower overall than historic trends.

•IncreasedContinued Insurance Cost Variability and Volatility. The volumeIn 2023, we experienced increased health benefits utilization and inflation in health costs. We believe this occurred in part due to market-wide pharmaceutical price increases, as well as the impact of medical claims, including COVID-19 testingrising wages and treatmentother costs changed. We observed significant fluctuationswhich led to increased costs associated with contract renewals between health insurers and health care providers. These higher costs over the year were and continue to be reflected in the use of medical services, particularly in the second quarter of 2020, as enrollees deferred or cancelled elective procedures and outpatient medical, dental and vision services.2023 health claims.

•NewTax Credit Backlogs. Many of the key economic assistance programs that SMBs relied on during the COVID-19 pandemic have now expired, including the Employee Retention Tax Credit (ERTC). Although these programs have expired, processing backlogs and a temporary halt in September 2023 in processing new ERTC claims at the IRS have resulted in many SMBs, including some of our clients, continuing to wait to receive their tax credits. In many cases, SMBs still participated in these programs retroactively via payroll tax filing amendments. The regulatory uncertainty surrounding the end date for the filing of ERTC claims and its impact on our PEO clients in particular exacerbates this trend and its impact.

•Interest Rates. The same rise in interest rates that is contributing to lower overall hiring among our SMB clients also contributed to higher interest income we receive on our cash deposits and higher interest expense on our debt. While the Federal Reserve's last increase to the Federal Funds Rate was in the middle of 2023, the impacts of the higher rates continue to contribute to our earnings, as well as contributed to higher interest costs as we issued debt and borrowed on our credit line in August and September of 2023.

•Privacy Laws and Regulations. We have seen increased focus at every level of government inside and outside of the United States on regulating the collection, storage, use, retention, security, disclosure, transfer and other processing of confidential, sensitive and personal information, as well as the growing use of artificial intelligence. As the patchwork of laws becomes increasingly complex, we expect the effort and cost of complying with all of the requirements to also increase and the likelihood of compliance failures to rise.

•PEO Benefit Plan Legislation. We saw an increase in state efforts to regulate PEO health plans. For example, new legislation and proposed rules in New lawsMexico seek to prevent WSEs of small group employers from participating in PEO-sponsored large group market health plans, with the exception for plans the PEOs register as MEWAs under state law. State regulations on PEO health plans can limit our options for providing TriNet sponsored benefits to our PEO clients or eliminate those benefits entirely, so we devote substantial time and programs were passedresources to assist SMBsmonitor and their employees during the COVID-19 pandemic, including the federal FFCRA and CARES Act and PPPFA business loan, employment, and tax assistance programs, and various state and local labor, employment and tax assistance programs.respond to these developments. We expect legislative efforts to help SMBs and employees to continue and we will need to continue to create or redesign our services to provide support for as many of these programs as possible.see similar legislative and regulatory efforts across the country.

Our Technology and Service Development Efforts

We continued to make significant investments in our PEO and HRIS technology platform with projectsplatforms. These investments are intended to provide our usersclients, WSEs, and HRIS Users with improvedenhanced functionality, ease of use, HR management options, security and security.an optimized user experience. We intend to continue to investmaking these and other similar investments in our technology platform to improve its functionality, ease of use, security2024 and the overall user experience for our clients and WSEs.beyond. We believe the continued investment in and improvement ofimproving our technology platform will drive operating efficiencies and improve client retention and satisfaction over the long termterm.

In 2023, we began combining our PEO and HRIS technology platform into a single modern cloud-based platform that can support all of our customers with a technology that enables more self-service capabilities. By creating these new cloud-based services we are able to invest in common services that can benefit both our PEO and HRIS customers. These cloud services are easier to deploy, modify and maintain which will allow us, over time, to achieve faster time to market. The first services on this next generation cloud-based platform went live in 2023 and as we continue to bring more innovation to our entire customer base we expect that our investment and prioritization in this area will increase. We believe this will enable us to service SMBs throughout a larger portion of their lifecycle. Additionally, our TriNet Clarus R+D cloud-based software platform allows us to serve our existing SMB clients and to serve SMBs that are not currently a client of our PEO or HRIS services with tax credit support services. The services we provide through our HRIS and TriNet Clarus R+D software platforms create a potential pipeline of SMB clients that may benefit from, and transition to, TriNet’s higher-touch PEO services at future points in their lifecycle.

In 2023 TriNet moved all of our applications, computing and storage to the cloud in a multi-cloud strategy which enabled the shutdown of all on-premise data centers. We believe this cloud migration will enable TriNet to deploy solutions quickly and manage costs effectively by taking advantage of the ability to expand or change with our growing needs while allowing our colleagues to focus on high value activities in support of our customers. This strategy is aligned with our sustainability goals to reduce waste and improve our client experience.

In April 2020, we created our Recovery Credit program to assist in the economic recovery of our existing clients and enhance our ability to retain these clients. Eligible clients receive one-time reductions against fees for future services, accounted for as a discount, to be received over the following 12 months. The ultimate amount of the Recovery Credit eligible clients will receive is dependent on our future performance and is subject to a limit on the total amount. Our Recovery Credit program is designed to promote client loyalty, incentivize client retention, and to differentiate TriNet from its peers in the PEO industry and in other competing HR services industries.

In March 2020, the FFCRA and the CARES Act were signed into law, creating several important funding and payroll tax incentive programs for SMBs, including PPP, mandatory employee leave requirements, payroll tax deferral and tax credit programs and other employment- and employment tax-related incentives. The PPPFA was signed into law in June 2020, modifying and expanding the original PPP. The appropriations package passed in December 2020 further expanded the availability of some of the employee leave and tax credit programs available to SMBs and their employees during 2021 as well as the PPP. These developments required us to create new services, or redesign our existing services, to support these programs.

To engage with our clients and SMBs virtually we launched our COVID-19 Preparedness Center, which provides ongoing and timely webinars, information, resources and offerings to clients and other SMBs to help them navigate the rapidly changing and complex COVID-19 business landscape. In the fourth quarter of 2020 we hosted the first annual TriNet PeopleForce, our virtual client and prospect conference, where we provided insights, thought leadership and recommendations for the challenges they face.energy consumption.

Our Clients and Geographies

Our clients are distributed across a variety of industries, including technology, professional services, financial services, life sciences, not-for-profit, property management, retail, manufacturing, and hospitality.industries. We generally support these different clients using our industry-tailored vertical approach.suite of HCM offerings. Our PEO clients generally execute annual service contracts with us that automatically renew. In most cases, our PEO clients may cancel these contracts with 30 days' notice to us and we may cancel these contracts with 30 days' notice.notice to our clients. Our HRIS clients execute contracts with monthly or annual terms and clients can typically cancel these contracts with 30 days’ notice to us. In some cases, our clients may incur fees associated with early termination.

Our top five PEO markets are California, New York, Florida, Texas and Massachusetts, which account for approximately 64% of our total WSEs for the year ended December 31, 2023. Nearly all of our revenues are generated within the United States and its territories and substantially all our long-lived assets are located in the United States.

Our Competitors

We face competition from:

•PEOs that compete directly with us,

•HRHRIS software providers that compete directly with us,

•payroll processing agents and information systems departmentsother HCM services providers that do not use a PEO model,

•HR and personnel of companies that administer employee benefits, payroll and HR for their companies in-house,

•providers of certain endpoint HR services, including payroll, employee benefits, business process outsourcers with high-volume transaction and administrative capabilities, and other third-party administrators, and

•insurance brokers who allow third-party HR systems to integrate with their technology platform.

PEO services remain our core business and other PEOs continue to represent our most significant competition. Our PEO service competitors include large PEOs such as the TotalSource unit of Automatic Data Processing, Inc., the

PEO operations of Paychex, Inc. and Insperity, Inc., as well as numerous specialized and smaller PEOs and similar HR service providers with PEO operations.

Our HRIS service competitors include software and HCM service providers such as Rippling, Gusto, Automatic Data Processing, Inc. and Bamboo in addition to smaller national and local providers.

Our tax credit services face competition from large CPA firms, such as PwC, Ernst &Young, Moss Adams, and KPMG and smaller software companies and CPA firms, such as alliantgroup, Ardius, Cherry Bekaert and Eide Bailly.

We believe that a key reason why our PEO services are attractive to many SMBs in partis because of our ability to provide access to a broad range of TriNet-sponsored workers'workers compensation, health insurance and other benefits programs on a cost-effective basis. We compete with insurance brokers and other providers of insurance and benefits coverage, and our PEO offerings must be priced competitively with those provided by these competitors in order for us to attract and retain our clients.

We believe that we also compete based upon the breadthOur PEO clients are typically looking for high-touch HR compliance and depthservices support, TriNet sponsored employee benefits, TriNet responsibility for processing payroll and payroll taxes, and access to EPLI claims support and other substantial HR services. By contrast, many of our benefit plans, vertical market expertise, total costHRIS clients are looking for more self-directed, focused and less expensive HRIS services. We do not co-employ our HRIS Users and do not provide TriNet sponsored health benefits, workers’ compensation, or EPLI coverage. As a result, our HRIS services competes with services provided by a wider array of service, brand awarenessHCM companies and reputation, ability to innovate and respond to client needs rapidly, access to online and mobile solutions, and subject matter expertise. We believe that we are competitive across these factors. HRIS providers outside of the PEO industry.

For additional information about our competition, please refer to Part I, Item 1A. Risk Factors, of this Form 10-K, under the heading – "We must continue to work to improve our services to meet the expectations of our clients and regulators, or we may lose our clients and materially harm our business".

Our Sales and Marketing Organizations

We sell our solutions primarily online and through our direct sales organization. We have aligned our PEO sales organization by industry vertical with the goal of growing profitable market share in our targeted industries. ThisOur PEO vertical approach deepens our network of relationships and gives us an understanding of the unique HR needs facing SMBs in those industries. Our sales representatives are supported by marketing, lead generation efforts, and referral sources and networks. While the COVID-19 pandemic made it difficult to engage with prospects face-to-face, theWe increasingly use of technology and remote communication tools created new opportunities for us to engage with customers and prospects virtually.

We typically sponsor and participate in associations and events around the country to promote our PEO and HRIS services and we also utilize these forums to target specific vertical and geographic markets. We responded to the unique challenges posed by the COVID-19 pandemic by shifting to virtual events, such asEvents include our 20204th TriNet PeopleForce conference, and by providing informational webinars periodically throughout the year on a wide variety of COVID-19 and business topics relevant to our SMB prospects and clients. We also generate sales opportunities, and promote brand awareness, client retention, and build our reputation as HCM thought leaders, within key industry verticals, through marketing alliances and other indirect channels, such as accounting firms, venture capital firms, incubators, insurance brokers, and vertical market industry associations. Additionally, we utilize digital marketing programs, including digital advertising, search and email marketing, to create awareness and interest in all of our services.

Our marketing and corporate communications organization is charged with driving overall brand awareness, managing lead generation, creating and managing our website and other online properties, creating content for all marketing and communication channels. Includingchannels including our outbound and inbound marketing efforts, media relations, and managing our sponsorships, major marketing events, and internal and external communications. SMBs are increasingly using digital tools like tele-presence and web engagements and we work to engage with SMBs in these ways. In 20202023, we continued to use numerous digital channels for engagement, including conversational marketing enhancements on our website. Our marketing team also focused on strategic marketing, communications via social media, branding initiatives, and crisis communication plans, in part by augmenting our comprehensive company re-brandingbrand campaign, Incredible Starts Here, with our marketing campaign, People Matter, that included an omni channelomni-channel initiatives using social media, digital, television, radio and out-of-home media.

The Laws and Regulations that Affect Our Business

Our business operates in a complex legal and regulatory environment due to a myriad of federal, state and local laws and regulations that impact our business. Below is a summary of what we believe are the most important legal and regulatory issues forspecific to our business. For additional information on the impact of these and other laws and regulations on our business and results of operations, refer to Part I, Item 1A. Risk Factors, of this Form 10-K, under the heading - "Legal and Compliance Risks". Employer Status under ERISA and State Laws

WeAs part of our PEO services, we sponsor our employee benefit plan offerings as the employer of our WSEs under the Internal Revenue Code of 1986, as amended (the Code)"Code"), ERISA and applicable state law. The multipleterm “employer” has different definitions of “employer”for different purposes under both the Code and ERISA, and for most purposes are not clear and most are defined in part byinterpreted under complex multi-factor tests under common law. As an employer of WSEs, we must manage our benefit plans in accordance with ERISA requirements, which can impact how we fulfill plan obligations, how we price services, the features of our benefit plans, and how we administer and operate our plans. We believe we manage our benefit plans in accordance with ERISA requirements and that we are an “employer”employer of our WSEs in the U.S. under the Code, and the employer of our WSEs in the U.S. for the purposes of ERISA, as well as qualifying as an employer under various state laws, but this status could be subject to challenge by various regulators. We believe that our benefit plans are exempt from many state regulations under ERISA, but our position could be challenged by state regulators or as a result of new laws, regulations, agency guidance, audits or caselaw at the federal and state levels. For additional information on our state and federal employer status and itsthe ERISA and other state requirements that apply to us and their collective impact on our business and results of operations, refer to Part I, Item 1A. Risk Factors, of this Form 10-K, under the heading - "If we are not recognized as an employer of worksite employees, and if our benefit plans are deemed to not satisfy plan requirements, under federal and state regulations, we and our clients could be adversely impacted".Health Insurance and Health Care Reform

Our sponsored employee health and welfare offerings are an important component of the services that we provide. The future of health care reform continues to evolve in the U.S. For example, the passage of the ACA in 2010 implemented sweeping health care reforms with staggered effective dates from 2010 through 2022, and many provisions in the ACA are still requiresubject to the issuance of additional guidance from the DOL, the IRS, the U.S. Department of Health and Human Services and various U.S. states. Passage of the TCJA in 2017 eliminated the individual mandate tax penalty under the ACA beginning in 2019, while retaining employer ACA mandate obligations. States have developed, and will continue to develop, varying approaches to state-based health exchanges and mandates. Further significant changes to health care statutes, regulations and policy at the federal, state and local levels could occur in 20212024 and beyond, including the potential further modification or amendment of the ACA, and we may need to adapt the manner in which we conduct our business as a result of any such changes. For additional information on the ACAhealth care reform and its impact on our business and results of operations, refer to Part I, Item 1A. Risk Factors, of this Form 10-K, under the heading - "Changing laws and regulations governing health insurance and other traditional employee benefits at the federal, state and local level could negatively affect our business".

Data Privacy and Security Regulations

We collect, store, use, retain, disclose, transfer and otherwise process a significant amount of confidential, sensitive and personal information from and about our actual and potential clients, WSEs, HRIS Users and corporate employees,colleagues, and we are subject to a variety of federal, state and foreigninternational laws, rules, and regulations in connection with such activities. As a sponsor of employee benefit plans, we also have access to certain protected health information (PHI) of our WSEs and corporate employees.colleagues. Management of PHI is subject to several regulations at the federal level, including HIPAA and the HITECH Act. HIPAA contains restrictions and health data privacy, security and breach notification requirements with respect to the use and disclosure of PHI. Further, there are penalties and fines for HIPAA violations. Because TriNet sponsored health plans are covered entities under HIPAA, we are required to comply with HIPAA's portability, privacy, and security requirements. We are also subject, among other applicable federal laws, rules and regulations, to the rules and regulations promulgated under the authority of the Federal Trade Commission. The U.S. Congress has considered, but not yet passed, several comprehensiveWe expect that the federal government’s approach to data privacy bills over the past few years, such as the CONSENT Act, which was intended to be similar to the landmark 2018 European Union General Data Protection Regulation. We expect federal data privacy laws toand security rules and regulations will continue to evolve.evolve in the coming years.

At the state and local level, there is increased focus on regulating the collection, storage, use, retention, security, disclosure, transfer and other processing of confidential, sensitive and personal information. In recent years, many states have proposed or enacted new laws or amended existing laws and we have seen significant changesexpect them to datacontinue to do so in the future. As the state privacy regulations acrosslaws becomes increasingly complex, we expect the U.S., including the enactmentcost and effort of complying with all of the California Consumer Privacy Act of 2018 (CCPA), which went into effect in January 2020. The CCPA increases privacy rights for California residentsrequirements to increase and imposes obligations on companies that process their personal information, including an obligation to provide certain new disclosures to such residents. The CCPA provides for civil penalties for violations, as well as a private right of action for certain data breaches that result in the loss of personal information. This private right of action may increase the likelihood of compliance failures to rise. Lack of uniformity of laws and risks associated with, data breach litigation. The CCPA was amended in September 2018regulations, which we expect will increase as various states and October 2019, and further amendments may be enacted. In November 2020, California approved the California Privacy Rights Act (CPRA), which creates a new privacy oversight agency and further amends the CCPA to provide additional rights to consumers to access, edit and control the sale and sharing of personal information. The provisions of the CPRA go into effect in January 2023.

New legislation proposed or enacted in Illinois, Massachusetts, New Jersey, New York, Rhode Island, Washington and other states, including a proposed right to privacy amendment to the Vermont Constitution, impose, or has the potential to impose, additional obligations on companies that collect , store, use, retain, disclose, transfer and otherwise process confidential, sensitive and personal information, and will continue to shape thecountries enact data privacy environment nationally. In addition,laws, creates significant legal complexities for companies like TriNet that operate nationwide and in India and Canada. Also, all 50 U.S. states, the District of Columbia, Guam, Puerto Rico, the Virgin Islands and Canada have enacted data breach notification laws that may require us to notify WSEs, HRIS Users, clients, employees,colleagues, third parties or regulators in the event of unauthorized access to or disclosure of personal or confidential information. Complying with existing and new data privacy and security regulations could cause us to incur substantial costs or require us to change our business practices in a manner adverse to our business. Any failure to comply with existing and new data privacy and security regulations could result in significant penalties, damage our reputation and otherwise have a material adverse effect on our business. For additional information on the privacy and security of the confidential, sensitive and personal information and PHI we possess and the potential impact to our business if we fail to protect such information, refer to Part I, Item 1C. Cybersecurity and each of the risk factors included in Part I, Item 1A. Risk Factors, of this Form 10-K, under the heading - "Data"Data Privacy and Security Risks".PEO Licensing Laws

Nearly all states have adopted laws and regulations for licensing, registration, certification or recognition of PEOs and the IRS has implemented a voluntary federal certification program for PEOs. We expect states without such laws and regulations to adopt them in the future. While these laws and regulations can vary widely, most regulators monitor the financial health and other relevant business information of PEOs on an annual or quarterly basis. In some cases, these laws and regulations codify and clarify the co-employment relationship for certain payroll, unemployment, workers' compensation and other employment-related purposes or require specific client contractual terms and/or WSE disclosures. We believe we comply in all material respects with the applicable PEO laws and regulations in each state and jurisdiction in which we operate.provide PEO services.

Every state regulates insurance practices conducted within their jurisdiction. While we do not broker insurance, certain of our PEO and HRIS services involve assisting our clients in obtaining and managing employee benefits. We partner with brokers to provide these services and have elected to obtain state insurance licenses as a result. As each state’s licensing requirements differ, maintaining current licenses is complex and we are subject to insurance audits, investigations and fines if we fail to comply with insurance license requirements.

Other state regulatory authorities impose licensing requirements on companies involved in the transmission of cash, such as banks, and other money transmitters. We do not believe that our current activities require any such licenses, but we and others in our industry have received inquiries from regulatory authorities in the past and could receive them in the future.

For additional information on the impact of licensing laws, refer to Part I, Item 1A. Risk Factors, of this Form 10-K, under the heading "If we do not comply with our regulatory license requirements, or if we are deemed to be operating in various non-PEO licensed industries without the required licenses, we and our clients could be adversely impacted".

Payroll andTaxes, Unemployment Taxes and Payroll Tax Credits

We must also comply with the federal and state payroll tax and unemployment tax requirements that apply where our clients are located. Tax reform efforts, and other payroll tax changes, at the federal, state and local level can impact our payroll tax reporting obligations for our clients and the services we can provide. State unemployment tax rates vary by state based in part on prior years’ compensationtotal wages, unemployment taxes paid and unemployment claims experience and may also vary based on the overall claims experience of a PEO.PEO in states in which we are required to report and pay unemployment taxes using one of our accounts and rates. As a result, depending on where client WSEs perform services for our clients, are located, the fees we charge PEO clients for unemployment taxes can be higher or lower than a client could obtain alone.without use of a PEO. In some cases, taxing authorities can retroactively increase the unemployment taxes we pay can also be retroactively increased to cover deficiencies in the unemployment tax funds. We also rely on our clients to accurately reportinform us of the work and residence locations for their work locationsWSEs and HRIS Users, and inaccurate reporting,information, whether due to remote work from home policies during the COVID-19 pandemic or otherwise, can impact our payroll tax obligations and the obligations of our clients, WSEs and WSEs.HRIS Users.

We have seen a growing trend, particularly at the federal level, of using payroll tax credits, deferrals and other related payroll tax programs as a mechanism for incentivizing SMB development and economic recovery. These programs are popular because they allow SMBs, which often have business income tax losses, to realize benefits via payroll tax reductions, rather than business income tax reductions. As a result, many of our SMB clients require that we support these programs. Examples of these programs include the federal 2015 PATH Act, CARES Act and FFCRA Act. The PATH Act allows SMBs to use R&D tax credits submitted on the SMB’s business income tax return to reduce certain payroll taxes. The CARES Act and FFCRA Act introduced payroll tax credits and employer Social Security deferral programs that allowed SMBs to receive payroll tax reductions and refunds or to defer the employer portion of Social Security based on qualifications and employment practices.

We act as the employer of record for federal payroll tax reporting for our PEO clients. This means that we file client tax credit claims, and pass the associated tax credit refunds to our clients based on information supplied by our clients, which we do not control. These programs have generally not been designed with the PEO industry in mind and these programs are subject to broad agency interpretations given their complexity. While our clients are contractually responsible to us for their errors in tax credit submissions and for repaying us for all rejected tax credits under our service contracts, taxing authorities may still look to TriNet for repayment and we may not be able to effectively enforce or collect on these obligations. For additional information tax credit programs, and the risks they post to our operations, refer to Part I, Item 1A. Risk Factors, of this Form 10-K, under the heading - "Our business is subject to numerous complex laws, and changes in, uncertainty regarding, or adverse application of these laws could negatively affect our business." Other Employment Regulations

We must also comply with labor and employment laws, which can change frequently at the federal, state and local level. In particular for our PEO services, regulatory focus on the classification of employers, employees and independent contractors has the potential to significantly change how we and other PEOs operate and the services that we and other PEOs can provide to our clients and WSEs. States continue to consider, or have adopted, changing regulations or guidance around the definition of employers, employees and independent contractors and any change in these definitions may impact our ability to provide certain PEO and HRIS services to certain employers or employees.

We must also comply with state and federal rules and guidelines around both independent contractor and joint employer status. Standards for determining independent contractor and joint employer status vary from law to law and state to state, and changes to and new interpretations of these standards can limit the client workers to which we can provide services and increase the likelihood of claims that we are a joint employer of client WSEs or an employer of HRIS Users. For example, In January 2024, the DOL proposed a new rule for determining independent contractor status and in September 2019, California passed AB5, a lawAugust 2023, the DOL proposed new regulations that could potentially reclassify clientaddress the salary requirements for white collar minimum wage and overtime exemptions under the FLSA. Meanwhile, the NLRB also modified its own independent contractors as employees. In November 2020, California voters passed Proposition 22, which supersedes AB5 for certain types of contractors. Recently, the DOLtest in June 2023 and issued a new rule to make it easier to classify workers as independent contractors under federal law referenced below. Although the rule is scheduled to go into effect on March 8, 2021, the Biden administration and/or Congress may delay its effective date, change the rule, or quash it in its entirety. In January 2020, the DOL issued a new rule changing the definition ofstandard for determining whether two businesses are joint employer usedemployers under the Fair Labor Standards Act (FLSA) and potentially limiting businesses that are deemed to be joint employers. Since its issuanceNLRA in 2020, the rule has been struck down by a federal court, and that decision is currently on appeal.October 2023. We do not believe that we are a joint employer under any law or rule, or that these rule changes impact our status as a co-employer. However, laws regarding independent contractor and joint employer status can impact the new DOL rule, but the impacttypes of new regulations like these could lead to increased legal claims against us or our clients, increase our compliance costs, or require changes to howSMB workers we operate our businesscan service and the servicespotential liability that we provide tohave for the actions of our SMB clients and WSEs.their employees. For additional information, refer to Part I, Item 1A. Risk Factors, of this Form 10-K, under the heading - ""The definition of employers, employees and independent

contractors is evolving. Changes to the laws and regulations that govern what it means to be an employer or an employee may require us to make significant changes in our operations and may negatively affect our business".

Our Human Capital Resources

As of December 31, 2020,2023, we had approximately 331,900347,500 WSEs, 200,800 HRIS Users and 2,700 corporate employees, or3,600 colleagues.

Oversight and Management

At TriNet, we rally around a shared visionpower the success of improving humanity through businessSMBs by supporting their growth and innovation.enabling their people. Together, we strive to become the most trusted advisor to SMBs by harnessing the power of scale. We recognize the incredible opportunity that can only be realized by working together, with a shared view of how we support our clients, WSEs and WSEs.HRIS Users. This is illustrated in our core values:

•Lead with the customer - We are accessible, responsive and empowered to serve our customers. We are successful when our customers are successful.

•Stand together - We bring together diverse backgrounds, experiences and ideas to create better outcomes. We collaborate across boundaries, communicate openly and respect each other.

•Act with integrity - We are honest, transparent, ethical and fair. We take pride in always doing what’s right for our customers and colleagues.

•Make an impact - We act with purpose, are deliberate in our planning and quick in execution. We are accountable to each other and empowered to make decisions.

•Be incredible - We invest in the development of our colleagues. We push the boundaries of what's possible, lead the way and innovate to accomplish the extraordinary.

We regularly conduct surveys to seek feedback from our colleagues on a variety of topics, including confidence in company leadership, competitiveness of our compensation and benefits package, career growth opportunities and opportunities to improve the attractiveness of our company with existing and potential colleagues. The results are shared with our colleagues and reviewed by senior leadership, who analyze areas of progress or deterioration and prioritize actions and activities in response to this feedback to drive meaningful improvements in colleague engagement. Our corporate employeesNone of our colleagues are not covered by a collective bargaining agreement.

Attracting and Retaining Ourour Colleagues

We must attract, develop and retain highly motivated and qualified colleagues to continue to provide the services that our clients need, to achieve our strategic objectives, and to grow our business. We do this by:

•offering competitive compensation and benefits packages, including comprehensive health benefits and our 401(k) retirement savings plan, with an immediately vested employer match of up to 4% of cash compensation,

•supporting a pay for performance culture through the use of cash and equity incentives tied to the performance of our company and individual performance,

•offering an employee stock purchase planESPP that allows our colleagues to purchase our shares at a discount to market value, which fosters a stronger sense of ownership and aligns the interests of our colleagues with our stockholders,

•investing in the professional growth of our colleagues with tuition and continuing education reimbursement, wellbeing programs, and comprehensive training and development activities and opportunities both inside and outside of our company,

•creating and maintaining a diverse and inclusive colleague base by, for example, the use of colleague-led resource groups and by launching a new diversity and inclusion training curriculum for our colleagues, in 2020, and

•supporting workplace flexibility for our colleagues during the COVID-19 pandemic by adopting work-from-homeremote work policies, halting non-critical travel, and providing additional paid time off, employee assistance plans, and access to telemedicine services.