UNITED STATES

SECURITIES AND EXCHANGE COMMISSION | x |

TANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| |

For the fiscal year ended March 31, 2009 2012 |

| |

OR |

| |

£ o

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from ___________ to ___________ |

| Commission File Number 000-28827 |

Commission File Number 000-28827

(Exact name of registrant as specified in its charter)

| FLORIDA | 65-0680967 |

FLORIDA

| 65-0680967

|

(State or other jurisdiction of | (IRS Employer |

incorporation or organization) | Identification No.) |

| |

1441 S.W. 29th Avenue, Pompano Beach, Florida 33069 |

(Address of principal executive offices) (Zip Code) |

|

Registrant’s telephone number, including area code: (954) 979-5995 |

|

Securities registered under Section 12(b) of the Act: |

|

Title of each class |

| Name of each exchange on which registered | |

| | | | |

| COMMON STOCK, $.001 PAR VALUE | | The NASDAQ Stock Market LLC (NASDAQ Global Select Market) | |

| | |

| Securities registered under Section 12(g) of the Act: | |

| | |

| NONE | |

___________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes£o NoSx

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes£o NoSx

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YesSx No£o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceeding12 months (or for such shorter period that the registrant was required to submit and post such files). Yes£x No£o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant'sregistrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Sx

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer”, “large accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one):

| | | | |

| Large accelerated filer | £

o | | Accelerated filer | S

x |

| Non-accelerated filer | £

o | | Smaller reporting company | £

|

(Do not check if smaller reporting company)

| | | | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes£o NoSx

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of September 30,

2008,2011, the last business day of the registrant’s most recently completed second fiscal quarter, was

$363,284,000$177.0 million based on the closing sales price of the registrant’s Common Stock on that date, as reported on the NASDAQ Global Select Market.

The number of shares of the registrant’s Common Stock outstanding as of

June 1, 2009May 28, 2012 was

22,722,803.

20,334,941.

DOCUMENTS INCORPORATED BY REFERENCE

Information to be set forth in our Proxy Statement relating to our

20092012 Annual Meeting of Stockholders to be held on July

31, 200927, 2012 is incorporated by reference in Items 10, 11, 12, 13, and 14 of Part III of this report.

2012 Annual Report on Form 10-K

TABLE OF CONTENTS

| | | | | Page |

PART I | | Page

| | 1 |

PART I

| Item 1. | | Business | | 1 |

| Item 1. Business1A. | 1

| Risk Factors | | 6 |

| Item 1A. Risk Factors

| 6

|

| Item 1B. | | Unresolved Staff Comments | | 11 |

| Item 2. Properties | | Properties | | 11 |

| Item 3. | | Legal Proceedings | | 11 |

| Item 4. Submission of Matters to a Vote of Security Holders | | Mine Safety Disclosures | | 11 |

| | | | | |

PART II | | | | 12 |

| Item 5. | | Market for Registrant'sRegistrant’s Common Equity, Related Stockholder

Matters and Issuer Purchases of Equity Securities | | 12 |

| Item 6. | | Selected Financial Data | | 15 |

| Item 7. | | Management’s Discussion and Analysis of Financial Condition

and Results of Operations | | 16 |

| Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | 24

| 23 |

| Item 8. | | Financial Statements and Supplementary Data | 25

| 24 |

| Item 9. | | Changes in and Disagreements With Accountants on Accounting

and Financial Disclosure | 48

| 44 |

| Item 9A. | | Controls and Procedures | 48

| 44 |

| Item 9B. | | Other Information | 48

| 44 |

| | | | | |

PART III | | 49

| | 45 |

| Item 10. | | Directors, Executive Officers, and Corporate Governance | 49

| 45 |

| Item 11. | | Executive Compensation | 49

| 45 |

| Item 12. | | Security Ownership of Certain Beneficial Owners and

Management and Related Stockholder Matters | 49

| 45 |

| Item 13. | | Certain Relationships and Related Transactions, and Director

Independence | 49

| 45 |

| Item 14. | | Principal Accountant Fees and Services | 49

| 45 |

| | | | | |

PART IV | | 50

| | 46 |

| Item 15. | | Exhibits, Financial Statement Schedules | 50

| 46 |

| | | | | |

SIGNATURES | | 51

47 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain information in this Annual Report on Form 10-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. You can identify these forward-looking statements by the words "believes," "intends," "expects," "may," "will," "should," "plan," "projects," "contemplates," "intends," "budgets," "predicts," "estimates," "anticipates,"“believes,” “intends,” “expects,” “may,” “will,” “should,” “plan,” “projects,” “contemplates,” “intends,” “budgets,” “predicts,” “estimates,” “anticipates,” or similar expressions. These statements are based on our beliefs, as well as assumptions we have used based upon information currently available to us. Because these statements reflect our current views concerning future events, these statements involve risks, uncertainties and assumptions. Actual future re sultsresults may differ significantly from the results discussed in the forward-looking statements. A reader, whether investing in our common stock or not, should not place undue reliance on these forward-looking statements, which apply only as of the date of this Annual Report.

When used in this Annual Report on Form 10-K, "PetMed“PetMed Express," "1-800-PetMeds,"” “1-800-PetMeds,” “PetMeds,” "PetMed,"“PetMed,” “PetMeds.com,” "PetMed“PetMed Express.com," "the” “the Company," "we," "our,"” “we,” “our,” and "us"“us” refer to PetMed Express, Inc. and our wholly-owned subsidiaries.

PetMed Express, Inc. and subsidiaries, d/b/a 1-800-PetMeds, is a leading nationwide pet pharmacy. The Company markets prescription and non-prescription pet medications, and other health products for dogs

cats, and

horsescats, direct to the consumer. The Company offers consumers an attractive alternative for obtaining pet medications in terms of convenience, price, and speed of delivery.

The Company markets its products through national television, online, and direct mail/print advertising campaigns, which aim to increase the recognition of the “1-800-PetMeds” brand name, and “PetMeds” family of trademarks, increase traffic on its website atwww.1800petmeds.com,acquire new customers, and maximize repeat purchases. Our fiscal year end is March 31, our executive offices are located at 1441 S.W. 29th Avenue, Pompano Beach, Florida 33069, and our telephone number is (954) 979-5995.

We offer a broad selection of products for dogs

cats, and

horses.cats. Our current product line contains approximately

750 skus.1200 SKUS. These products include a majority of the well-known brands of medication, such as Frontline Plus®, K9 Advantix®

, II, Advantage®

, II, Heartgard Plus®, Sentinel®, Interceptor®, Program®, Revolution®, Deramaxx®, and Rimadyl®. Generally, our prices are competitive with the prices for medications charged by veterinarians and retailers.

In March 2010, the Company started offering for sale additional pet supplies on our website, which are drop shipped to our customers by third parties. These pet supplies include: food, beds, crates, stairs, strollers, and other popular pet supplies.

We research new products, and regularly select new products or the latest generation of existing products to become part of our product selection. In addition, we also refine our current products to respond to changing consumer-purchasing habits. Our website is designed to give us the flexibility to change featured products or promotions. Our product line provides customers with a wide variety of selections across the most popular health categories for dogs

cats, and

horses.cats. Our current products include:

Non-Prescription Medications (OTC) and supplies: Flea and tick control products, bone and joint care products, vitamins, andtreats, nutritional supplements, hygiene products, and hygiene products.

supplies.

Prescription Medications (Rx): Heartworm preventatives, arthritis, thyroid, and arthritisdiabetes, pain medications, antibiotics, and other specialty medications, as well as generic substitutes.

The following table provides a breakdown of the percentage of our total sales by each category during the indicated periods:

| | | | | |

| Year Ended March 31, |

| 2009 | | 2008 | | 2007 |

Non-prescription medications | 68% | | 69% | | 70% |

Prescription medications | 31% | | 30% | | 29% |

Shipping and handling charges and other | 1% | | 1% | | 1% |

Total | 100% | | 100% | | 100% |

| | | Year Ended March 31, | |

| | | 2012 | | | 2011 | | | 2010 | |

Non-prescription medications and supplies | | | 59 | % | | | 61 | % | | | 64 | % |

| Prescription medications | | | 40 | % | | | 38 | % | | | 35 | % |

| Shipping and handling charges and other | | | 1 | % | | | 1 | % | | | 1 | % |

| Total | | | 100 | % | | | 100 | % | | | 100 | % |

We offer our products through three main sales channels: Internet through our website, telephone contact center through our toll-free number, and direct mail/print through 1-800-PetMeds catalogs, brochures, and postcards. We have designed our catalogs and website to provide a convenient, cost-effective, and informative shopping experience that encourages consumers to purchase products important for a pet’s health and quality of life. We believe that these multiple channels allow us to increase the visibility of our brand name and provide our customers with increased shopping flexibility and excellent service.

We seek to combine our product selection and pet health information with the shopping ease of the Internet to deliver a convenient and personalized shopping experience. Our website offers health and nutritional product selections for dogs

cats, and

horses,cats, and relevant editorial and easily obtainable or retrievable resource information. From our home page, customers can search our website for products and access resources on a variety of information on dogs

cats, and

horses.cats. Customers can shop at our website by category, product line,

individual product, or

individual product.symptom. We attracted approximately

1619.1 million visitors to our website during fiscal

2009,2012, approximately

12%13% of those visitors placed an order, and our website generated approximately

65%75% of our total sales for the same time period.

In February 2006, we began sponsorship of a website called "PetHealth101"“PetHealth101” which is located atwww.PetHealth101.com. In PetHealth101, pet owners have access to health information covering pets’ behavior and illnesses, and natural and pharmaceutical remedies specifically for a pet’s problems. During fiscal 2012, the PetHealth101 content was incorporated into our main website. The pet education content on our main website is continuallyperiodically updated with the latest research for pet owners.

Our customer care representatives receive and process inbound

and outbound customer calls,

facilitate our outbound campaigns around maximizing customers’ reorders, facilitate our live web chat, and process customer e-mails. Our telephone system is equipped with certain features including pop-up screens and call blending capabilities that give us the ability to efficiently utilize our customer care representatives’ time, providing excellent customer care, service, and support. Our customer care representatives receive a base salary and are rewarded with commissions for sales, and bonuses and other awards for achieving certain

quality goals.

The 1-800-PetMeds catalog is a full-color catalog that features our most popular products. The catalog is produced by a combination of in-house writers, production artists, and independent contractors. We mail catalogs, brochures, and postcards in response to requests generated from our advertising and as part of direct mail campaigns to our customers.

Approximately

2,500,0002.7 million customers have purchased from us within the last two years. We attracted approximately

802,000722,000 and

710,000645,000 new customers in fiscal

20092012 and

2008,2011, respectively. Our customers are located throughout the United States, with approximately 50% of customers residing in California, Florida,

Texas, New York,

Texas, Pennsylvania, Virginia,

Georgia, North Carolina, and New Jersey.

While ourOur primary focus has been on retail customers

we have also sold various non-prescription medications wholesale to a variety of businesses, including pet stores, groomers, and

traditional retailers in the

United States. For the fiscal year ended March 31, 2009, the majority of our sales were made to retail customers with less than 1% of our sales made to wholesale customers. The average

retail purchase was approximately

$82$76 for fiscal

20092012 compared to

$80$79 for fiscal

2008.

2011.The goal of our marketing strategy is to build brand recognition, increase customer traffic, add new customers, build strong customer loyalty, maximize reorders, and develop incremental revenue opportunities. We have an integrated marketing campaign that includes television advertising,

online marketing, direct mail/print and

e-mail, and online marketing.

e-mail.

Our television advertising is designed to build brand equity, create brand awareness, and generate initial purchases of products via the telephone and the Internet. We have used :30 and :15 second television commercials to attract new customer orders. Our television commercials typically focus on our ability to rapidly deliver to customers the same medications offered by veterinarians, but at reduced prices. We generally purchase advertising on national cable channels to target our key demographic group – women, ages 30 to 65. We believe that television advertising is particularly effective and instrumental in building brand awareness.

Our most current television commercial, airing nationally, speaks to pet owners about the savings and convenience of purchasing the same exact pet medications from 1-800-PetMeds, compared to purchasing the medications from a veterinarian. Direct Mail/Print and E-mail

We use direct mail/print and e-mail to acquire new customers and to remind our existing customers to reorder.

We supplement our traditional advertising with online advertising and marketing efforts. We make our brand available to Internet consumers by purchasing targeted keywords and achieving prominent placement on the top search engines and search engine networks, including Google, Microsoft Network,Bing™, and Yahoo.Yahoo®. We utilize Internet bannerdisplay and video advertisements, social media, and comparison shopping, and we are also members of the LinkShare Network, which is an affiliate program with merchant clients and affiliate websites. This network

Direct Mail/Print and E-mail

We use direct mail/print and e-mail to acquire new customers and to remind our existing customers to reorder.

Operations

Order Processing

Our website allows customers to easily browse and purchase all of our products online. Our website is designed to

developbe fast, secure, and

build a long-term, branded affiliate program ineasy to use with order

to increaseand shipping confirmations, and with online

sales and establish an Internet presence. The LinkShare Network enables us to establish link arrangements with other websites, as well as with portals and search engines.

Operations

Purchasing

We purchase our products from a variety of sources, including certain manufacturers, domestic distributors, and wholesalers. We have multiple suppliers for each of our products to obtain the lowest cost. There are currently three suppliers from whom we purchased approximately 50% of all products in fiscal 2009. We purchase the majority of our health and nutritional supplements directly from manufacturers. We believe having strong relationships with product manufacturers will ensure the availability of an adequate volume of products ordered by our customers, and will enable us to provide more and better product information. Historically, substantially all the major manufacturers of prescription and non-prescription medications have declined to sell these products to direct marketing companies, such as our Company. (See Risk Factors.) Part of our growth strategy includes develo ping direct relationships with the leading pharmaceutical manufacturers of the more popular prescription and non-prescription medications.

Order Processing

order tracking capabilities. We provide our customers with toll-free telephone access to our customer care representatives. Our call center generally operates from 8:00 AM to 11:00 PM, Monday through Thursday, 8:00 AM to 9:00 PM on Friday, 9:00 AM to 6:00 PM on Saturday, and 10:00 AM to 5:00 PM on Sunday, Eastern Time. The process of customers purchasing products from 1-800-PetMeds consists of a few simple steps. A customer first places a call to our toll-free telephone number or visits our website. The following information is needed to process prescription orders: general pet information, prescription information, and the veterinarian’s name and phone number. This information is entered into our computer system. Then our pharmacists and pharmacy technicians verify all prescriptions. The order process system checks for the verification for prescription medication orders and a valid payment method fo rfor all orders. An invoice is generated and printed in our fulfillment center, where items are picked, for shipping. The product(s) in the customer’s order areand then selected from the Company's inventory and

shipped via United States Postal Service, United Parcel Service,Federal Express, or Federal Express.UPS. Our customers enjoy the convenience of rapid home delivery, with approximately 75%80% of all orders being shipped within 24 hours of ordering. Our website allows customers to easily browse and purchase substantially all of our products online. Our website is designed to be fast, secure, and easy to use with order and shipping confirmations, and with online order tracking capabilities.

Warehousing and Shipping

We inventory our products and fill all customer orders from our corporate headquarters in Pompano Beach, Florida. We have an in-house fulfillment and distribution operation, which is used to manage the entire supply chain, beginning with the placement of the order, continuing through order processing, and then fulfilling and shipping of the product to the customer. We offer a variety of shipping options, including next day delivery. We ship to anywhere in the United States served by the United States Postal Service, United Parcel Service, or Federal Express. Priority orders are expedited in our fulfillment process. Our goal is to ship the products the same day that the order is received. For prescription medications, our goal is to ship the product immediately after the prescription has been authorized by the customer’s veterinarian.

Customer Care and Support

We believe that a high level of customer care and support is critical in retaining and expanding our customer base. Customer care representatives participate in ongoing training programs under the supervision of our training managers. These training sessions include a variety of topics such as product knowledge, computer usage, customer service tips, and the relationship between our Company and veterinarians. Our customer care representatives respond to customers’ e-mails and calls that are related to products, order status, prices, and shipping. Our customer care representatives also respond to customers through our live web chat. We believe our customer care representatives are a valuable source of feedback regarding customer satisfaction. Our customer returns and credits

averageaveraged approximately

1.5 %1.5% of total

sales.

sales for fiscal 2012.

Warehousing and Shipping

We inventory our products and fill most customer orders from our corporate headquarters in Pompano Beach, Florida. We have an in-house fulfillment and distribution operation, which is used to manage the entire supply chain, beginning with the placement of the order, continuing through order processing, and then fulfilling and shipping of the product to the customer. We offer a variety of shipping options, including next day delivery. We ship to anywhere in the United States served by the United States Postal Service, Federal Express, or UPS. Priority orders are expedited in our fulfillment process. Our goal is to ship the products the same day that the order is received. For prescription medications, our goal is to ship the product immediately after the prescription has been authorized by the customer’s veterinarian.

Purchasing

We purchase our products from a variety of sources, including certain manufacturers, domestic distributors, and wholesalers. There were four suppliers from whom we purchased approximately 50% of all products in fiscal 2012. We purchase the majority of our health and nutritional supplements directly from manufacturers. We believe having strong relationships with product manufacturers will ensure the availability of an adequate volume of products ordered by our customers, and will enable us to provide more and better product information. Historically, substantially all the major manufacturers of prescription and non-prescription medications have declined to sell these products to direct marketing companies, such as our Company. (See Risk Factors.) Part of our growth strategy includes developing direct relationships with the leading pharmaceutical manufacturers of the more popular prescription and non-prescription medications. In March 2010 Bayer started making their products available directly to pet specialty retailers and internet sites, including our Company.

We utilize integrated technologies in our call centers, e-commerce, order entry, and inventory control/fulfillment operations. Our systems are custom configured by the Company to optimize our computer telephone integration and mail-order processing. The systems are designed to maintain a large database of specialized information and process a large volume of orders efficiently and effectively. Our systems provide our customer care representatives, and our customers on our website, with real time product availability information and updated customer information to enhance our customer care. We also have an integrated direct connection for processing credit cards to ensure that a valid credit card number and authorization have been received at the same time our customer care representatives are on the phone with the customer or when a customer submits an order on our website. Our

informati oninformation systems provide our customer care representatives with records of all prior contact with a customer, including the customer’s address, phone number, e-mail address,

fax number, prescription information, order history, payment history, and notes.

The pet medications market is competitive and highly fragmented. Our competitors consist of veterinarians,

online and traditional

retailers, and other mail-order and online retailers of pet medications and other health products.retailers. We believe that the following are the principal competitive factors in our market:

·

Product selection and availability, including the availability of prescription and non-prescription medications;

·

Brand recognition;

·

Reliability and speed of delivery;

·

Personalized service and convenience;

·

Price; and

·

Quality of website content.

| ● | Product selection and availability, including the availability of prescription and non-prescription medications; |

| ● | Reliability and speed of delivery; |

| ● | Personalized service and convenience; |

| ● | Quality of website content. |

We compete with veterinarians for the sale of prescription and non-prescription pet medications and other health products. Many pet owners may prefer the convenience of purchasing their pet medications or other health products at the time of a veterinarian visit, or may be hesitant to offend their veterinarian by not purchasing these products from the veterinarian. In order to effectively compete with veterinarians, we must continue to educate pet owners about the service, convenience, and savings offered by our Company.

According to the American Pet Products Manufacturers Association, pet spending in the United States increased 5.3% to

$43.4$51.0 billion in

2008.2011. Pet supplies and medications represented

$10.3$11.8 billion, or

24%23% of the total spending on pets in the United States. The pet medication market that we participate in is estimated to be approximately

$3.6$4.0 billion, with veterinarians having the majority of the market share. The dog and cat population is approximately

163165 million, with approximately

63%62% of all households owning a pet.

We believe that the following are the main competitive strengths that differentiate 1-800-PetMeds from the competition:

·

“1-800-PetMeds” brand name;

·

Exceptional customer care and support;

·

Consumer benefit structure of savings and convenience; and

·

Licensed pharmacy to conduct business in 50 states.

| ● | Channel leader, in an estimated $4.0 billion industry; |

| ● | “1-800-PetMeds” brand name; |

| ● | Licensed pharmacy to conduct business in 50 states, and awarded Vet-VIPPSCM (Veterinary-Verified Internet Pharmacy Practice Site) accreditation by the National Association of Boards of Pharmacy®; |

| ● | Exceptional customer care and support |

We conduct our business under the trade name “1-800-PetMeds” and use a family of names all containing the term “PetMeds” or “PetMed” in some form. We believe this trade name, which is also our toll-free telephone number, and the “PetMeds” family of trademarks, have added significant value and are an important factor in the marketing of our products. We have also obtained the right to use and control the Internet addresseswww.1800petmeds.com, www.1888petmeds.com, www.petmedexpress.com,www.1888petmeds.com,www.petmedexpress.com,www.petmed.com, andwww.petmeds.com. We do not expect to lose the ability to use the Internet addresses; however, there can be no assur anceassurance in this regard and the loss of these addresses may have a material adverse effect on our financial position and results of operations. We are the exclusive owners of United States Trademark Registrations for “PetMed Express and Design®,” “1888PetMeds and Design®,” “1-800-PetMeds and Design®,” 1-800-PetMeds®,” and “PetMeds®.”

Dispensing prescription medications is governed at the state level by the

BoardBoards of Pharmacy, or similar regulatory agencies, of each state where prescription medications are dispensed. We are subject to regulation by the State of Florida and are licensed as a community pharmacy by the Florida Board of Pharmacy. Our current license is valid until February 28,

20112013, and prior to that date a renewal application will be submitted to the Board of Pharmacy. Our pharmacy practice is also licensed and/or regulated by 49 other state pharmacy boards and, with respect to our products, by other regulatory authorities including, but not necessarily limited to, the United States Food and Drug Administration (“FDA”) and the United States Environmental Protection Agency. As a licensed pharmacy in the State of Florida, we are subject to the Florida Pharmacy Act and regulations promulgated thereunder. To the extent that we are unable to maintain our license as a community pharmacy with the Florida Board of Pharmacy, or if we do not maintain the licenses granted by other state pharmacy boards, or if we become subject to actions by the FDA, or other enforcement regulators, our distribution of prescription medications to pet owners could cease, which could have a material adverse effect on our financial condition and results of operations.

We currently have

248207 full time employees, including:

143125 in customer care and marketing;

3433 in fulfillment and purchasing;

5835 in our pharmacy; 4 in information technology;

43 in administrative positions; and

57 in management. None of our employees are represented by a labor union, or governed by any collective bargaining agreements. We consider relations with our employees to be satisfactory.

We file annual, quarterly, and current reports, proxy statements, and other information with the Securities and Exchange Commission ("SEC"(“SEC”). Our SEC filings, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) of the Exchange Act are available to the public free of charge over the Internet aton our website atwww.1800petmeds.com or at the SEC'sSEC’s web site atwww.sec.gov. Our SEC filings will be available through our website as soon as reasonably practicable after we have electronically filed or furnished them to the SEC. Information contained on our website is not incorporated by reference into this annual report on Form 10-K.

5

You may also read and copy any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Room 1580, Washington D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330 or on the Internet atwww.sec.gov/info/edgar/prrrules.htm. The Company’s Code of Business Conduct and Ethics and the charters for each of our committees of the Board of Directors may be found in our 2004 Proxy which was filed on June 30, 2004. You may also obtain a copy of our Code of Business Conduct and Ethics and the charters for each of our committees of the Board of Directors free of charge by contacting investor relations at 1-800-738-6337.

You should carefully consider the risks and uncertainties described below, and all the other information included in this Annual Report on Form 10-K before you decide to invest in our common stock. Any of the following risks could materially adversely affect our business, financial condition, or operating results and could result in a loss of your investment.

We may inadvertently fail to comply with various state regulations covering the dispensing of prescription pet medications which may subject us to reprimands, sanctions, probations, fines, suspensions, or the loss of one or more of our pharmacy licenses. The sale and delivery of prescription pet medications is generally governed by state laws and state regulations. Since our pharmacy is located in the State of Florida, the Company is governed by the laws and regulations of the State of Florida. Each prescription pet medication sale we make is likely also to be covered by the laws of the state where the customer is located. The laws and regulations relating to the sale and delivery of prescription pet medications vary from state to state, but generally require that prescription pet medications be dispensed with the authorization from a prescribing veterinarian. To the extent that we are unable to maintain our license as a community pharmacy with the Florida Board of Pharmacy, or if we do not maintain the licenses granted by other state boards, or if we become subject to actions by the FDA, or other enforcement regulators, our distribution of

pr escriptionprescription medications to pet owners could cease, which could have a material adverse effect on our operations.

The Company is a party to routine litigation and administrative complaints incidental to its business. Management does not believe that the resolution of any or all of such routine litigation and administrative complaints is likely to have a material adverse effect on the Company’s financial condition or results of operations. While we make every effort to fully comply with all applicable state rules, laws, and regulations, from time to time we have been the subject of administrative complaints regarding the authorization of prescriptions prior to shipment. We cannot assure you that we will not continue to be the subject of administrative complaints in the future. We cannot guarantee you that we will not be subject to reprimands, sanctions, probations, or fines, or that one or more of our pharmacy licenses will not be suspended or revoked. If we were unable to maintain our license

a sas a community pharmacy in the State of Florida, or if we are not granted licensure in a state that begins to require licensure, or if one or more of the licenses granted by other state boards should be suspended or revoked, our ability to continue to sell prescription medications and to continue our business as it is presently conducted could be in jeopardy.

We currently purchase a portion of our prescription and non-prescription medications from third party distributors and we are not an authorized distributor of these products. We do not have any guaranteed supply of medications at any pre-established prices.

The majority of our sales were attributable to sales of prescription and non-prescription medications. Historically, substantially all the major pharmaceutical manufacturers have declined to sell prescription and non-prescription pet medications directly to us. In order to assure a supply of these products, we purchase medications from various secondary sources, including a variety of domestic distributors. Our business strategy includes seeking to establish direct purchasing arrangements with major pet pharmaceutical manufacturing companies. If we are not successful in achieving this goal, we will continue to rely upon secondary sources.

We cannot guarantee that if we continue to purchase prescription and non-prescription pet medications from secondary sources that we will be able to purchase an adequate supply to meet our customers’ demands, or that we will be able to purchase these products at competitive prices. As these products represent a significant portion of our sales, our failure to fill customer orders for these products could adversely impact our sales. If we are forced to pay higher prices for these products to ensure an adequate supply, we cannot guarantee that we will be able to pass along to our customers any increases in the prices we pay for these medications. This inability to pass along increased prices could materially adversely affect our financial condition and results of operations.

Our failure to properly manage our inventory may result in excessive inventory carrying costs, or inadequate supply of products, which could materially adversely affect our financial condition and results of operations.

Our current product line contains approximately

7501200 SKUs. A significant portion of our sales is attributable to products representing approximately 90

SKUs.SKUs, including the most popular flea and tick, and heartworm preventative brands. We need to properly manage our inventory to provide an adequate supply of these products and avoid excessive inventory of the products representing the balance of the SKUs. We generally place orders for products with our suppliers based upon our internal estimates of the amounts of inventory we will need to fill future orders. These estimates may be significantly different from the actual orders we receive.

In the event that subsequent orders fall short of original estimates, we may be left with excess inventory. Significant excess inventory could result in price discounts and increased inventory carrying costs. Similarly, if we fail to have an adequate supply of some SKUs, we may lose sales opportunities. We cannot guarantee that we will maintain appropriate inventory levels. Any failure on our part to maintain appropriate inventory levels may have a material adverse effect on our financial condition and results of operations.

Resistance from veterinarians to authorize prescriptions, or attempts/efforts on their part to discourage pet owners to purchase from internet mail-order pharmacies could cause our sales to decrease and could materially adversely affect our financial condition and results of operations.

Since we began our operations some veterinarians have resisted providing our customers with a copy of their pet’s prescription or authorizing the prescription to our pharmacy staff, thereby effectively preventing us from filling such prescriptions under state law. We have also been informed by customers and consumers that veterinarians have tried to discourage pet owners from purchasing from internet mail-order pharmacies. Sales of prescription medications represented approximately

31%40% of our sales for the fiscal year. Although veterinarians in some states are required by law to provide a pet owner with a prescription if medically appropriate, if the number of veterinarians who refuse to authorize prescriptions should increase, or if veterinarians are successful in discouraging pet owners from purchasing from internet mail-order pharmacies, our sales could decrease and our financial condition

a ndand results of operations may be materially adversely affected.

Significant portions of our sales are made to residents of

nineeight states. If we should lose our pharmacy license in one or more of these states, our financial condition and results of operations would be materially adversely affected.

While we ship pet medications to customers in all 50 states, approximately 50% of our sales for the fiscal year ended March 31,

20092012 were made to customers located in the states of California, Florida,

Texas, New York,

Texas, Pennsylvania, Virginia,

Georgia, North Carolina, and New Jersey. If for any reason our license to operate a pharmacy in one or more of those states should be suspended or revoked, or if it is not granted or renewed, our ability to sell prescription medications to residents of those states would cease and our financial condition and results of operations in future periods would be materially adversely affected.

We face significant competition from veterinarians and online and traditional retailers and may not be able to compete profitably with them.

We compete directly and indirectly with veterinarians for the sale of pet medications and other health products. Veterinarians hold a competitive advantage over us because many pet owners may find it more convenient or preferable to purchase these products directly from their veterinarians at the time of an office visit. We also compete directly and indirectly with both online and traditional

retailers of pet medications and health and nutritional supplements.retailers. Both online and traditional retailers may hold a competitive advantage over us because of longer operating histories, established brand names, greater resources, and/or an established customer base. Online retailers may have a competitive advantage over us because of established affiliate relationships to drive traffic to their website. Traditional retailers may hold a competitive advantage over us because pet owners may prefer to purchase these products from a store instead of online or through catalog or telephone methods. In order to effectively compete in the future, we may be required to offer promotions and other incentives, which may result in lower operating margins

orand adversely affect the results of operations.

We also face a significant challenge from our competitors forming alliances with each other, such as those between online and traditional retailers. These relationships may enable both their retail and online stores to negotiate better pricing and better terms from suppliers by aggregating the demand for products and negotiating volume discounts, which could be a competitive disadvantage to us.

The content of our website could expose us to various kinds of liability, which, if prosecuted successfully, could negatively impact our business.

Because we post product and pet health information and other content on our website, we face potential liability for negligence, copyright infringement, patent infringement, trademark infringement, defamation, and/or other claims based on the nature and content of the materials we post. Various claims have been brought, and sometimes successfully prosecuted, against Internet content distributors. We could be exposed to liability with respect to the unauthorized duplication of content or unauthorized use of other parties’ proprietary technology.

Although we maintain general liability insurance, our insurance may not cover potential claims of this type, or may not be adequate to indemnify us for all liability that may be imposed. Any imposition of liability that is not covered by insurance, or is in excess of insurance coverage, could materially adversely affect our financial condition and results of operations.

We may not be able to protect our intellectual property rights, and/or we may be found to infringe on the proprietary rights of others.

We rely on a combination of trademarks, trade secrets, copyright laws, and contractual restrictions to protect our intellectual property rights. These afford only limited protection. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy our non-prescription private label generic equivalents, when and if developed, as well as aspects of our sales formats, or to obtain and use information that we regard as proprietary, including the technology used to operate our website and our content, and our trademarks. Litigation or proceedings before the United States Patent and Trademark Office or other bodies may be necessary in the future to enforce our intellectual property rights, to protect our trade secrets and domain names,

andor to determine the validity and scope of the proprietary rights of others. Any litigation or adverse proceeding could result in substantial costs and diversion of resources, and could seriously harm our business and operating results.

Third parties may also claim infringement by us with respect to past, current, or future technologies. We expect that participants in our market will be increasingly involved in infringement claims as the number of services and competitors in our industry segment grows. Any claim, whether meritorious or not, could be time-consuming, result in costly litigation, cause service upgrade delays, or require us to enter into royalty or licensing agreements. These royalty or licensing agreements might not be available on terms acceptable to us or at all.

If we are unable to protect our Internet addresses or to prevent others from using Internet addresses that are confusingly similar, our business may be adversely impacted.

Our Internet addresses,www.1800petmeds.com, www.1888petmeds.com, www.petmedexpress.com, www.1888petmeds.com,www.petmedexpress.com,www.petmed.com, andwww.petmeds.comare critical to our brand recognition and our overall success. If we are unable to protect these Internet addresses, our competitors could capitalize on our brand recognition. We are aware of substantiallyThere may be similar Internet addressesusedaddresses used by competitors. Governmental agencies and their designees generally regulate the acquisition and maintenance of Internet addresses. The regulation of Internet addresses in the United States and in foreign countries has changed, and may undergo further change in the near future. Further more,Furthermore, the relationship between regulations governing Internet addresses and laws protecting trademarks and similar proprietary rights is unclear. Therefore, we may not be able to protect our own Internet addresses, or prevent third parties from acquiring Internet addresses that are confusingly similar to, infringe upon, or otherwise decrease the value of our Internet addresses.

Since all of our operations are housed in a single location, we are more susceptible to business interruption in the event of damage to or disruptions in our facility.

Our headquarters and distribution center are located in two buildings in

one location in South Florida, and

allmost of our shipments of products to our customers are made from this sole distribution center. We have no present plans to establish any additional distribution centers or offices. Because we consolidate our operations in one location, we are more susceptible to power and equipment failures, and business interruptions in the event of fires, floods, and other natural disasters than if we had additional locations. Furthermore, because we are located in South Florida, which is a hurricane-sensitive area, we are particularly susceptible to the risk of damage to, or total destruction of, our headquarters and distribution center and surrounding transportation infrastructure caused by a hurricane. We cannot assure you that we are adequately insured to cover the amount of any losses relating to any of these

pot entialpotential events, business interruptions resulting from damage to or destruction of our headquarters and distribution center, or power and equipment failures relating to our call center or websites, or interruptions or disruptions to major transportation infrastructure, or other events that do not occur on our premises. The

occurrence of one or more of these events could adversely impact our ability to generate revenues in future periods.

A portion of our sales are seasonal and our

Our operating results are difficult to predict and may

fluctuate.

fluctuate, and a portion of our sales are seasonal.

Factors that may cause our operating results to fluctuate include:

| ● | Our ability to obtain new customers at a reasonable cost, retain existing customers, or encourage reorders; |

| ● | Our ability to increase the number of visitors to our website, or our ability to convert visitors to our website into customers; |

| ● | The mix of medications and other pet products sold by us; |

| ● | Our ability to manage inventory levels or obtain an adequate supply of products; |

| ● | Our ability to adequately maintain, upgrade, and develop our website, the systems that we use to process customers’ orders and payments, or our computer network; |

| ● | Increased competition within our market niche; |

| ● | New products introduced to the market, including generics; |

| ● | Increases in the cost of advertising; |

| ● | The amount and timing of operating costs and capital expenditures relating to expansion of our product line or operations; |

| ● | Disruption of our toll-free telephone service, technical difficulties, or systems and Internet outages or slowdowns; and |

| ● | Unfavorable general economic trends. |

Because our operating results are difficult to predict, we believe that quarter-to-quarter comparisons of our operating results are not a good indication of our future performance. The majority of our product sales are affected by the seasons, due to the seasonality of mainly heartworm, and flea and tick medications. For the quarters ended June 30,

2008,2011, September 30,

2008,2011, December 31,

2008,2011, and March 31,

2009,2012, Company sales were 31%,

27%24%,

20%21%, and

22%24%, respectively. In addition to the seasonality of our sales, our annual and quarterly operating results have fluctuated in the past and may fluctuate significantly in the future due to a variety of factors, many of which are out of our control.

Factors that may cause our operating results to fluctuate include:

·

Our ability to obtain new customers at a reasonable cost, retain existing customers, or encourage reorders;

·

Our ability to increase the number of visitors to our website, or our ability to convert visitors to our website into customers;

·

The mix of medications and other pet products sold by us;

·

Our ability to manage inventory levels or obtain an adequate supply of products;

·

Our ability to adequately maintain, upgrade, and develop our website, the systems that we use to process customers’ orders and payments, or our computer network;

·

Increased competition within our market niche;

·

Price competition;

·

Increases in the cost of advertising;

·

The amount and timing of operating costs and capital expenditures relating to expansion of our product line or operations; and

·

Disruption of our toll-free telephone service, technical difficulties, or systems and Internet outages or slowdowns.

Any change in one or more of these factors could materially adversely affect our financial condition and results of operations in future periods.

Our stock price fluctuates from time to time and may fall below expectations of securities analysts and investors, and could subject us to litigation, which may result in you suffering a loss on your investment.

The market price of our common stock may fluctuate significantly in response to a number of factors, many of which are out of our control. These factors include: quarterly variations in operating results; changes in accounting treatments or principles; announcements by us or our competitors of new products and services offerings; significant contracts, acquisitions, or strategic relationships; additions or departures of key personnel; any future sales of our common stock or other securities; stock market price and volume fluctuations of publicly-traded companies; and general political, economic, and market conditions.

In some future quarter our operating results may fall below the expectations of securities analysts and investors, which could result in a decrease in the trading price of our common stock. In the past, securities class action litigation has often been brought against a company following periods of volatility in the market price of its securities. We may be the target of similar litigation in the future. Securities litigation could result in substantial costs and divert

management'smanagement’s attention and resources, which could seriously harm our business and operating results.

We may issue additional shares of preferred stock that could defer a change of control or dilute the interests of our common stockholders. Our charter documents could defer a takeover effort which could inhibit your ability to receive an acquisition premium for your shares.

Our charter permits our Board of Directors to issue up to

5,000,0005.0 million shares of preferred stock without stockholder approval. Currently there are 2,500 shares of our Convertible Preferred Stock issued and outstanding. This leaves

4,997,500a little less than 5.0 million shares of preferred stock available for issuance at the discretion of our Board of Directors. These shares, if issued, could contain dividend, liquidation, conversion, voting, or other rights which could adversely affect the rights of our common stockholders and which could also be utilized, under some circumstances, as a method of discouraging, delaying, or preventing a change in control. Provisions of our articles of incorporation, bylaws and Florida law could make it more difficult for a third party to acquire us, even if many of our stockholders believe it is in their best interest.

9

Our investments in auction rate securities are subject to risks which may adversely affect our liquidity.

At March 31, 2009, the Company had $14,650,000 (par) invested in auction rate securities (“ARS”) which were classified as long term investments in our financial statements as of March 31, 2009. Our ARS investments are not mortgage-backed based but are municipal-based and the securities underlying the ARS are currently rated AAA, the highest rating available by a rating agency. Our ARS consist of closed-end fund preferred ARS, whose interest rates are reset, typically every seven to twenty-eight days. Liquidity for our ARS historically has been provided by an auction process which has allowed us the opportunity to sell the securities at each auction date, and for those securities not sold, resets the applicable interest rate every seven or twenty-eight days. Although auctions had been successful for periods immediately subsequent to February 2008, recently auctions for our ARS ha ve failed which therefore has eliminated our ability to sell these securities through the standard auction process. Currently there is no liquid market for these securities. There is no assurance that future auctions in our ARS will succeed. An auction failure means that the parties wishing to sell their securities cannot be matched with an adequate volume of buyers. In the event that there is a failed auction the indenture governing the security requires the issuer to pay interest at a contractually defined rate which may or may not correspond to market rates for other types of similar short-term instruments. Our securities for which auctions have failed will continue to accrue interest at the contractual rate and be subject to the auction process every seven or twenty-eight days until the auction succeeds, the issuer redeems the securities, or the security matures. As a result, our ability to liquidate our investment in these securities and use the cash proceeds in the near term may be limited.

The fair value of our ARS investments was determined based on quoted market prices at the reporting date for those instruments in fiscal 2008, and in fiscal 2009 the fair value was based upon a valuation assessment by an outside third party. As of March 31, 2009, the Company held $14,650,000 (par) in ARS, which were classified as long term investments and the Company recorded an unrealized impairment loss of $219,750, in the fourth quarter of fiscal 2009, within accumulated other comprehensive income (loss), based upon an assessment of the fair value of these ARS. The $219,750 impairment was recorded as temporary due to the fact that the Company has both the ability and intent to hold these securities until anticipated recovery or maturity. However, it could take until the final maturity or issuer refinancing of the underlying debt for us to realize the recorded value of our investments in these sec urities. If the issuers of our ARS are unable to successfully close future auctions or redeem or refinance the securities and their credit ratings deteriorate, we may in the future be required to record an additional impairment charge on these investments, or may need to sell these securities on a secondary market. Although we believe we will be able to liquidate our investments in these securities without any significant loss, the timing and financial impact of such an outcome is uncertain. Based on our expected cash expenditures, our cash and cash equivalents balance, and other potential sources of cash, we do not anticipate that the potential lack of liquidity of these investments in the near term will adversely affect our ability to execute our current business plan.

The United States Environmental Protection Agency (“EPA”) has

issued an advisory regarding increased scrutiny ofannounced its intention to increase restrictions on flea and tick

control products

for pets.and to caution consumers to use these products with extra care. The Company’s sales and profits in future periods could be adversely impacted if sales for these products decline.

The EPA is intensifying its evaluationtaking a series of actions to increase the safety of spot-on pesticide products for flea and tick control due to recent increases in the number of reported adverse reactions in pets treated with these products,for cats and has issued a an advisory.dogs. In 2008 the EPA received 44,000 complaints about certain “spot-on” pest prevention products, including some flea and tick control products that the Company currently sells. The complaints reported adverse reactions ranging from mild effects such as skin irritations to more serious effects such as seizures and, in some cases, death of the pet. While,Since that time, the EPA has statedreceived additional information from the pet spot-on pesticide registrants and others and began an intensive evaluation of these products. Among immediate actions that its main objective with the advisoryEPA is going to simply advise consumerspursue are: requiring manufacturers of spot-on pesticide products to improve labeling, making instructions clearer to prevent product misuse; requiring more precise label instructions to ensure proper dosage per pet weight; requiring clear markings to differentiate between dog and pet owners to exercise caution when using thesecat products, and to ensure that product instructions are followed carefullydisallowing similar brand names for dog and correctly, therecat products. There can be no assurances that this advisoryaction by the EPA will not adversely affect our f uturefuture sales and profits.

profits. A failure of our information systems or any security breach or unauthorized disclosure of confidential information could have a material adverse effect on our business.

Our business is dependent upon the efficient operation of our information systems. In particular, we rely on our information systems to effectively manage our business model strategy, with tools to track and manage sales, inventory, marketing, customer service efforts, the preparation of our consolidated financial and operating data, credit card information, and customer information. The failure of our information systems to perform as designed or the failure to maintain and enhance or protect the integrity of these systems could disrupt our business operations, impact sales and the results of operations, expose us to customer or third-party claims, or result in adverse publicity. Additionally, we collect, process, and retain sensitive and confidential customer information in the normal course of our business. Despite the security measures we have in place and any additional measures we may implement in the future, our facilities and systems, and those of our third-party service providers, could be vulnerable to security breaches, computer viruses, lost or misplaced data, programming errors, human errors, acts of vandalism, or other events. Any security breach or event resulting in the misappropriation, loss, or other unauthorized disclosure of confidential information, whether by us directly or our third-party service providers, could damage our reputation, expose us to the risks of litigation and liability, disrupt our business, or otherwise affect our results of operations.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None

Our facilities, including our principal executive offices, are located at 1441 S.W. 29th Avenue and 2900 Gateway Drive, Pompano Beach, Florida 33069. The Company leases its 50,00065,300 square foot executive offices, and warehouse facility and its 15,300 square foot customer service and pharmacy contact centers under a non-cancelable operating lease, through May 31, 2012.2015. The Company is responsible for certain maintenance costs, taxes, and insurance under this lease. The future minimum annual lease payments are as follows: $702,000$767,000 for fiscal 2010, $723,0002013, $784,000 for fiscal 2011, $745,0002014, $794,000 for fiscal 2012,2015, and $125,000$133,000 for fiscal 2013.2016, a lease payment total of $2.5 million. Rent expense was $745,000, $724,000, and $703,000 for the years ended March 31, 2012, 2011 and 2010, respectively. We believe that our facilities are sufficient for our current needs and are in good condition in all material respects.

ITEM 3. LEGAL PROCEEDINGS

In October 2009, the Company was notified that it was named as a defendant in a multi-defendant lawsuit, filed in the United States District Court for the Eastern District of Texas, Marshall Division, seeking declaratory, injunctive, and monetary relief styled Charles E. Hill & Associates, Inc. v. ABT Electronics, Inc., et al, Cause No. 2:09-CV-313. The lawsuit alleges that the Company is infringing on patents related to electronic catalog systems. From the outset, the vendor that provides the Company with the Internet software had been defending and indemnifying the Company. However, effective February 15, 2011, the company that acquired this vendor declined to provide any further indemnification of the Company. On October 5, 2011, the parties engaged in court-ordered mediation, which was unsuccessful. Without admitting any liability or wrongdoing, and with no finding or admission as to the merit or lack of merit of any claim or defense asserted in connection with the litigation, in May 2012, the Company entered into a licensing agreement, for a confidential amount, and a Stipulation of Dismissal was filed with the Court, dismissing the lawsuit against the Company.

The Company has settled complaints that had been filed with various states’ pharmacy boards in the past. There can be no assurances made that other states will not attempt to take similar actions against the Company in the future. The Company initiates litigation to protect its trade or service marks. There can be no assurance that the Company will be successful in protecting its trade or service marks. Legal costs related to the above matters are expensed as incurred.

ITEM 4.

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERSNo matter was submitted to a vote of our stockholders during the fourth quarter of the fiscal year ended March 31, 2009.

MINE SAFETY DISCLOSURESNot applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock, par value $.001 per share, began trading publicly in 1997.

Our common stock is

currently traded on the NASDAQ Global Select Market (“NASDAQ”) under the symbol “PETS.” The prices set forth below reflect the range of high and low closing sale prices per share in each of the quarters of fiscal

20092012 and

20082011 as reported by the NASDAQ.

These prices represent quotations among dealers without adjustments for retail mark-ups, markdowns, or commissions, and may not represent actual transactions.

| | |

Fiscal 2009: | High | Low |

First Quarter | $14.00 | $10.96 |

Second Quarter | $15.90 | $12.21 |

Third Quarter | $19.00 | $13.02 |

Fourth Quarter | $18.29 | $13.26 |

| | |

Fiscal 2008: | High | Low |

First Quarter | $13.60 | $10.78 |

Second Quarter | $15.98 | $12.88 |

Third Quarter | $15.07 | $11.99 |

Fourth Quarter | $13.47 | $10.45 |

| | Fiscal 2012: | | High | | | Low | |

| | First Quarter | | $ | 15.89 | | | $ | 11.53 | |

| | Second Quarter | | $ | 12.28 | | | $ | 8.91 | |

| | Third Quarter | | $ | 10.55 | | | $ | 8.57 | |

| | Fourth Quarter | | $ | 12.72 | | | $ | 10.17 | |

| | | | | | | | | | |

| | Fiscal 2011: | | High | | | Low | |

| | First Quarter | | $ | 24.50 | | | $ | 17.34 | |

| | Second Quarter | | $ | 18.45 | | | $ | 15.45 | |

| | Third Quarter | | $ | 18.80 | | | $ | 15.21 | |

| | Fourth Quarter | | $ | 17.89 | | | $ | 14.39 | |

There were

8988 holders of record of our common stock at May

31, 2009,28, 2012, and

we estimate there were approximately 12,000

of our holders are “street name” or beneficial

stockholders on that date.

holders, whose shares are held by banks, brokers, or other financial institutions.

Dividend Policy

The Company has never paid cash dividends

On August 3, 2009, the Company’s Board of Directors declared its first quarterly dividend of $0.10 per share on its common stock. We presently intendOn August 2, 2010, the Company’s Board of Directors increased the quarterly dividend to retain$0.125 per share, and then on January 27, 2012, the Company’s Board of Directors increased the quarterly dividend to $0.15 per share. The Company intends to continue to pay regular quarterly dividends; however the declaration and payment of future earningsdividends is discretionary and will be subject to financea determination by the expansionBoard of Directors each quarter following its review of the Company’s financial performance.

During fiscal 2012, our business. Our futureBoard of Directors declared the following dividends:

| | | | Per Share | | | | Total Amount | | |

| | Declaration Date | | Dividend | | Record Date | | (In thousands) | | Payment Date |

| | May 6, 2011 | | $ | 0.125 | | May 16, 2011 | | $ | 2,782 | | May 27, 2011 |

| | July 29, 2011 | | $ | 0.125 | | August 12, 2011 | | $ | 2,626 | | August 26, 2011 |

| | October 28, 2011 | | $ | 0.125 | | November 11, 2011 | | $ | 2,542 | | November 25, 2011 |

| | January 27, 2012 | | $ | 0.150 | | February 10, 2012 | | $ | 3,051 | | February 24, 2012 |

On May 4, 2012, the Company’s Board of Directors declared a quarterly dividend

policy will dependof $0.15 per share on

our earnings, capital requirements, expansion plans, financial condition, and other relevant factors.

Securities Authorized for Issuance under Equity Compensation Plans

its common stock. The following table sets forth securities authorized for issuance under equity compensation plans, including individual compensation arrangements, by us under our 1998 Stock Option Plan, 2006 Employee Equity Compensation Restricted Stock Plan, and 2006 Outside Director Equity Compensation Restricted Stock Plan as$3.1 million dividend was paid on May 25, 2012, to shareholders of March 31, 2009:

| | | | | | | |

EQUITY COMPENSATION PLAN INFORMATION |

| | | | | | | |

| | Number of securities | | | | | |

| | to be issued upon | | Weighted average | | | |

| | exercise of outstanding | | exercise price of | | Number of securities | |

| | options, warrants | | outstanding options, | | remaining available | |

Plan category | | and rights | | warrants and rights | | for future issuance | |

| | | | | | | |

1998 Stock Option Plan (1) | | 147,914 | | $7.27 | | - | |

| | | | | | | |

2006 Employee Restricted Stock Plan | 247,609 | | - | | 752,391 | |

| | | | | | | |

2006 Director Restricted Stock Plan | | 68,000 | | - | | 132,000 | |

| | | | | | | |

Total | | 463,523 | | | | 884,391 | |

(1) The 1998 Stock Option Plan expiredrecord at the close of business on July 31, 2008.

May 14, 2012.

On November 8, 2006, the

Company announced that theCompany’s Board of Directors

authorized theapproved a share repurchase

plan of up to

$20,000,000 of the Company’s common stock.$20.0 million. On October 31, 2008,

November 1, 2010, and August 1, 2011, the Company’s Board of Directors approved a second,

third, and fourth share repurchase

program of up to $20,000,000. Thisplan, respectively, each for an additional $20.0 million. The repurchase plan is intended to be implemented through purchases made from time to time in either the open market or through private transactions at the

Company'sCompany’s discretion, subject to market conditions and other factors, in accordance with Securities and Exchange Commission requirements.

There can be no assurances as to the precise number of shares that will be repurchased under the share repurchase plan, and the Company may discontinue the share repurchase plan at any time subject to compliance with applicable regulatory requirements. Shares purchased pursuant to the share repurchase plan will either be retiredcancelled or held in the Company'sCompany’s treasury. Any share repurchase would reduce our available cash.

During fiscal

2009 we2012 the Company repurchased approximately

1,347,0002.1 million shares of

ourthe Company’s outstanding common stock for approximately

$18,448,000,$23.7 million, averaging approximately

$13.70$11.36 per share. As of March 31, 2012, the Company had approximately $14.0 million remaining under the Company’s share repurchase plan. During fiscal 2011 the Company repurchased approximately 791,000 shares of the Company’s outstanding common stock for approximately $12.2 million, averaging approximately $15.47 per share. All shares repurchased in fiscal

20092012 and 2011 were subsequently retired.

The table below provides information with respect to purchases by the Company of shares of common stock during the three months ended March 31, 2009:

| | | | | | | | | | |

Month / Year | | Total Number of Shares Purchased | | Average Price Paid Per Share | | Total Number of Shares Purchased as Part of Publicly Announced Program | | Approximate Dollar Value of Shares That May Yet Be Purchased Under the Program |

| | | | | | | | |

January 2009

(January 1, 2009 to January 31, 2009) | | 180,617 | | $ | 14.72 | | 180,617 | | $ | 18,964,580 |

| | | | | | | | | | |

February 2009

(February 1, 2009 to February 28, 2009) | | 541,228 | | $ | 14.02 | | 541,228 | | $ | 11,378,394 |

| | | | | | | | | | |

March 2009

(March 1, 2009 to March 31, 2009) | | 106,700 | | $ | 13.37 | | 106,700 | | $ | 9,951,739 |

Since the inception of the share repurchase plan, approximately 2,299,0005.2 million shares have been repurchased under the plan for approximately $30,048,000, and$66.0 million, averaging approximately $9,952,000 remains$12.75 per share, with approximately $14.0 million remaining available for repurchase, as of June 1, 2009.

May 28, 2012.

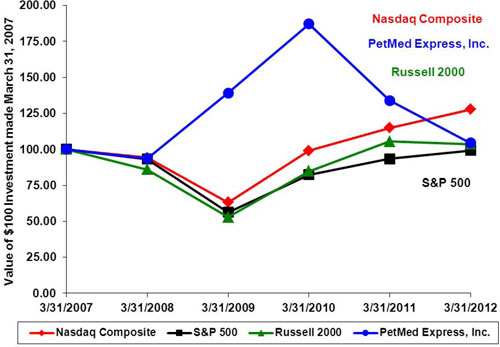

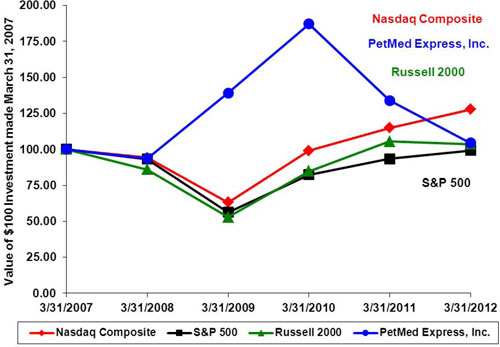

Set forth below is a graph comparing the five year cumulative performance of our Common Stock with the Standard & Poor’s Composite-500 Stock Index (the “S&P 500”), the Nasdaq Composite, and the Russell 2000, from March 31,

20042007 to March 31,

2009.2012. The graph assumes that $100 was invested on March 31,

20042007 in each of our Common Stock, the S&P 500, the Nasdaq Composite, and the Russell 2000 and that all dividends were reinvested. The performance graph and related information below shall not be deemed “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that we specifically incorporate it by reference into such filing.

Performance graph data:

| | | | | | |

| Fiscal Year Ended March 31, |

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 |

Nasdaq Composite | 100.00 | 100.25 | 117.33 | 121.43 | 114.29 | 76.65 |

S&P 500 | 100.00 | 104.83 | 114.98 | 126.16 | 117.45 | 70.85 |

Russell 2000 | 100.00 | 104.19 | 129.62 | 135.64 | 116.54 | 71.61 |

PetMed Express, Inc. | 100.00 | 67.36 | 161.55 | 107.73 | 100.82 | 149.82 |

| | | Fiscal Year Ended March 31, | |

| | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

| Nasdaq Composite | | | 100.00 | | | | 94.11 | | | | 63.12 | | | | 99.02 | | | | 114.84 | | | | 127.66 | |

| S&P 500 | | | 100.00 | | | | 93.09 | | | | 56.15 | | | | 82.30 | | | | 93.31 | | | | 99.13 | |

| Russell 2000 | | | 100.00 | | | | 85.92 | | | | 52.80 | | | | 84.75 | | | | 105.35 | | | | 103.70 | |

| PetMed Express, Inc. | | | 100.00 | | | | 93.59 | | | | 139.07 | | | | 187.09 | | | | 133.84 | | | | 104.47 | |

Securities Authorized for Issuance under Equity Compensation Plans

The following table sets forth securities authorized for issuance under equity compensation plans, including individual compensation arrangements, by us under our 2006 Employee Equity Compensation Restricted Stock Plan and 2006 Outside Director Equity Compensation Restricted Stock Plan as of March 31, 2012:

| EQUITY COMPENSATION PLAN INFORMATION | |

| (In thousands, except for per share amounts) | |

| | | Number of securities | | | | | | Number of securities | |

| | | to be issued upon | | | Weighted average | | | remaining available | |

| | | exercise of outstanding | | | exercise price of | | | for future issuance | |

| | | options, warrants | | | outstanding options, | | | under equity | |

| Plan category | | and rights | | | warrants and rights | | | compensation plans | |

| | | | | | | | | | |

| 2006 Employee Restricted Stock Plan | | | 542 | | | | - | | | | 458 | |

| | | | | | | | | | | | | |

| 2006 Director Restricted Stock Plan | | | 152 | | | | - | | | | 48 | |

| | | | | | | | | | | | | |

| Total | | | 694 | | | | | | | | 506 | |

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data should be read together with "Management's“Management’s Discussion and Analysis of Financial Condition and Results of Operations,"” the Consolidated Financial Statements and notes thereto, and other financial information included elsewhere in this Annual Report on Form 10-K. The Consolidated Statements of Income data set forth below for the fiscal years ended March 31, 2009, 2008,2012, 2011, and 20072010 and the Consolidated Balance Sheet data as of March 31, 20092012 and 20082011 have been derived from our audited Consolidated Financial Statements which are included elsewhere in this Annual Report on Form 10-K. The Consolidated Statements of Income data set forth below for the fiscal years ended March 31, 20062009 and 20052008 and the Consolidated Balance Sheet data as of March 31, 2007, 20062010, 2009 and 20052008 have been derived from our audited Consolidated Financial Statements which are not included in this A nnualAnnual Report on Form 10-K. CONSOLIDATED STATEMENTS OF INCOME DATA

(In thousands, except for per share amounts)

| | | Fiscal Year Ended March 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | | | | | | | | | | | | | | |

| Sales | | $ | 238,250 | | | $ | 231,642 | | | $ | 238,266 | | | $ | 219,412 | | | $ | 188,336 | |

| Cost of sales | | | 158,085 | | | | 147,686 | | | | 146,405 | | | | 134,085 | | | | 114,122 | |

| Gross profit | | | 80,165 | | | | 83,956 | | | | 91,861 | | | | 85,328 | | | | 74,214 | |

| Operating expenses | | | 54,143 | | | | 50,932 | | | | 51,319 | | | | 51,127 | | | | 46,218 | |

| Net income | | | 16,659 | | | | 20,871 | | | | 26,002 | | | | 22,976 | | | | 20,022 | |

| Net income per common share: | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 0.81 | | | | 0.93 | | | | 1.15 | | | | 0.99 | | | | 0.83 | |

| Diluted | | | 0.80 | | | | 0.92 | | | | 1.14 | | | | 0.98 | | | | 0.82 | |

Weighted average number of common shares outstanding: | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 20,613 | | | | 22,514 | | | | 22,617 | | | | 23,306 | | | | 24,088 | |

| Diluted | | | 20,708 | | | | 22,643 | | | | 22,746 | | | | 23,482 | | | | 24,299 | |

Cash dividends declared per common share | | | 0.525 | | | | 0.475 | | | | 0.300 | | | | - | | | | - | |

CONSOLIDATED BALANCE SHEET DATA DATA

(In thousands)

| | | March 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | | | | | | | | | | | | | | |

| Working capital | | $ | 78,216 | | | $ | 80,643 | | | $ | 79,412 | | | $ | 54,630 | | | $ | 38,804 | |

| Total assets | | | 91,064 | | | | 106,287 | | | | 104,170 | | | | 81,963 | | | | 73,455 | |

| Total liabilities | | | 9,883 | | | | 9,282 | | | | 7,313 | | | | 6,995 | | | | 6,421 | |

| Shareholders’ equity | | | 81,181 | | | | 97,005 | | | | 96,857 | | | | 74,968 | | | | 67,034 | |

NON FINANCIAL DATA (UNAUDITED) | | | | | | | | | | |

STATEMENTS OF INCOME |

| |

| Fiscal Year Ended March 31, |

| 2009 | 2008 | 2007 | 2006 | 2005 |

| | | | | |

Sales | $ | 219,412,247 | $ | 188,336,469 | $ | 162,246,407 | $ | 137,583,155 | $ | 108,357,747 |

Cost of sales | | 134,084,680 | | 114,122,433 | | 97,680,238 | | 83,244,366 | | 64,700,002 |

Gross profit | | 85,327,567 | | 74,214,036 | | 64,566,169 | | 54,338,789 | | 43,657,745 |

Operating expenses | | 51,126,582 | | 46,218,424 | | 43,066,144 | | 36,193,545 | | 31,156,119 |

Net income | | 22,976,411 | | 20,022,231 | | 14,443,502 | | 12,063,514 | | 8,010,370 |