John J. Goggins, Senior Vice President and General Counsel | Mr. Goggins has served as the Company’s Senior Vice President and General Counsel since October 1, 2000. Mr. Goggins joined Moody’s Investors Service, Inc. | ||

8

Linda S. Huber, 48 Executive Vice President and Chief Financial Officer | Ms. Huber has served as the Company’s Executive Vice President and Chief Financial Officer since May 2005. Prior thereto, she served as Executive Vice President and Chief Financial Officer at U.S. Trust Company, a subsidiary of Charles Schwab & Company, Inc., from 2003 to 2005. Prior to U.S. Trust, she was Managing Director at Freeman & Co. from 1998 through 2002. She served PepsiCo as Vice President of Corporate Strategy and Development from 1997 until 1998 and as Vice President and Assistant Treasurer from 1994 until 1997. She served as Vice President in the Energy Investment Banking Group at Bankers Trust Company from 1991 until 1994 and as an Associate in the Energy Group at First Boston Corporation from 1986 through 1990. She also held the rank of Captain in the U.S. Army where she served from 1980 to 1984. | ||

Joseph (Jay) McCabe, 56 Senior Vice President—Corporate Controller | Mr. McCabe has served as the Company’s Senior Vice President — Corporate Controller since December 2005. Mr. McCabe joined Moody’s in July 2004 as Vice President and Corporate Controller. Prior thereto, he served as | ||

Raymond W. McDaniel, Jr., Chairman and Chief | Mr. McDaniel has served as the Company’s Chairman and Chief Executive Officer since April 2005. Mr. McDaniel served as the Company’s President | ||

Perry Rotella, 43 Senior Vice President | Mr. | ||

9

| ITEM 1A. | RISK FACTORS |

The following risk factors and other information included in this annual report on Form 10-K should be carefully considered. The risks and uncertainties described below are not the only ones the Company faces. Additional risks and uncertainties not presently known to the Company or that the Company’s management currently deems minor or insignificant also may impair its business operations. If any of the following risks occur, Moody’s business, financial condition, operating results and cash flows could be materially adversely affected.

Changes in the Volume of Debt Securities Issued in Domestic and/or Global Capital Markets and Changes in Interest Rates and Other Volatility in the Financial Markets

Approximately 80% of Moody’s revenue in 2006 was derived from ratings, a significant portion of which was related to the issuance of credit-sensitive securities in the global capital markets. The Company anticipates that a substantial part of its business will continue to be dependent on the number and dollar volume of debt securities issued in the capital markets. Therefore, the Company’s results could be adversely affected by a reduction in the level of debt issuance.

Unfavorable financial or economic conditions that either reduce investor demand for debt securities or reduce issuers’ willingness or ability to issue such securities could reduce the number and dollar volume of debt issuance for which Moody’s provides ratings services. In addition, increases in interest rates or credit spreads, volatility in financial markets or the interest rate environment, significant regulatory, political or economic events, defaults of significant issuers and other market and economic factors may negatively impact the general level of debt issuance, the debt issuance plans of certain categories of borrowers, and/or the types of credit-sensitive products being offered. A sustained period of market decline or weakness could also have a material adverse effect on Moody’s business and financial results.

Possible Loss of Market Share or Revenue Through Competition or Regulation

The markets for credit ratings, research and credit risk management services are increasingly competitive. Moody’s competes on the basis of a number of factors, including quality of ratings, customer service, research, reputation, regulatory qualification, price, geographic scope, range of products and technological innovation. For example, a large investment grade default could impact the Company’s reputation and potentially lead to greater regulatory oversight. Moody’s faces competition from, among others, S&P, Fitch, DBRS, local rating agencies in a number of international jurisdictions and niche companies that provide ratings for particular types of financial products or issuers (such as A.M. Best Company, Inc., with respect to the insurance industry). Since Moody’s believes that some of its most significant challenges and opportunities will arise outside the U.S., it will have to compete with rating agencies that may have a stronger local presence or a longer operating history in those markets. These local providers or comparable competitors that may emerge in the future may receive support from local governments or other institutions that Moody’s does not receive.

Currently, Moody’s, S&P, Fitch, DBRS and A.M. Best Company, Inc. are designated as NRSROs by the SEC. In September 2006, the United States Congress passed into law the Credit Rating Agency Reform Act of 2006. As a direct result, the SEC is mandated to complete a rule-making process which implements the legislation (see “Regulation”, above, for further information) by June 2007. At present, Moody’s is unable to assess the impact of any regulatory changes that may result from the SEC’s rule-making process.

Introduction of Competing Products or Technologies by Other Companies

The markets for credit ratings, research and credit risk management services are competitive. The ability to provide innovative products and technologies that anticipate customers’ changing requirements and to utilize emerging technological trends is a key factor in maintaining market share. Competitors may develop quantitative methodologies or related services for assessing credit risk that customers and market participants may deem preferable, more cost-effective or more valuable than the credit risk assessment methods currently employed by Moody’s. Moody’s growth prospects could also be adversely affected by limitations of its information technologies that fail to provide adequate capacity and capabilities to meet increased demands of producing quality ratings and research products.

Increased Pricing Pressure from Competitors and/or Customers

In the credit rating, research and credit risk management markets, competition for customers and market share has spurred more aggressive tactics by some competitors in areas such as pricing and service. While Moody’s seeks to compete primarily on the basis of the quality of its products and service, if its pricing and services are not sufficiently competitive with its current and future competitors, Moody’s may lose market share.

10

Possible Loss of Key Employees to Investment or Commercial Banks or Elsewhere and Related Compensation Cost Pressures

Moody’s success depends in part upon recruiting and retaining highly skilled, experienced financial analysts and other professionals. Competition for qualified staff in the financial services industry is intense, and Moody’s ability to attract staff could be impaired if it is unable to offer competitive compensation and other incentives. Investment banks and other competitors for analyst talent may be able to offer higher compensation than Moody’s. Moody’s also may not be able to identify and hire employees in some markets outside the U.S. with the required experience or skills to perform sophisticated credit analysis. Moody’s may lose key employees due to other factors, such as catastrophes, that could lead to disruption of business operations. Moody’s ability to compete effectively will continue to depend, among other things, on its ability to attract new employees and to retain and motivate existing employees.

Exposure to Litigation Related to Moody’s Rating Opinions

Moody’s faces litigation from time to time from parties claiming damages relating to ratings actions. In addition, as Moody’s international business expands, these types of claims may increase because foreign jurisdictions may not have legal protections or liability standards comparable to those in the U.S. (such as protections for the expression of credit opinions as is provided by the First Amendment). These risks often may be difficult to assess or quantify and their existence and magnitude often remains unknown for substantial periods of time.

Potential Emergence of Government-Sponsored Credit Rating Agencies

When governments adopt regulations that require debt securities to be rated, establish criteria for credit ratings or authorize only certain entities to provide credit ratings, the competitive balance among rating agencies and the level of demand for ratings may be positively or negatively affected. Government-mandated ratings criteria may also have the effect of displacing objective assessments of creditworthiness. In these circumstances, debt issuers may be less likely to base their choice of rating agencies on criteria such as independence and credibility, and more likely to base their choice on their assumption as to which credit rating agency might provide a higher rating, which may negatively affect the Company.

Potential for New U.S., Foreign, State and Local Legislation and Regulations, Including Those Relating to Nationally Recognized Statistical Rating Organizations

In the United States and other countries, the laws and regulations applicable to credit ratings and rating agencies continue to evolve and are presently subject to review by a number of legislative or regulatory bodies, including the SEC in the United States and the CESR on behalf of the European Union. It is possible that such reviews could lead to greater oversight or regulation concerning the issuance of credit ratings or the activities of credit rating agencies. Such additional regulations could, potentially, increase the costs associated with the operation of a credit rating agency, alter the rating agencies’ communications with the issuers as part of the rating assignment process, increase the legal risk associated with the issuance of credit ratings, change the regulatory framework to which credit rating agencies are subject and/or affect the competitive environment in which credit rating agencies operate. A description of certain of the more recent regulatory initiatives in the United States and other countries is described above under the section entitled “Regulation” in Item 1. “Business”, of this Form 10-K. At present, Moody’s is unable to predict the regulatory changes that may result from ongoing reviews by the SEC or other regulatory bodies or the effect that any such changes may have on its business.

Exposure to Increased Risk from Multinational Operations

Moody’s maintains offices outside the U.S. and derives a significant portion of its revenue from sources outside the U.S. Operations in different countries expose Moody’s to a number of legal, economic and regulatory risks such as:

changes in legal and regulatory requirements affecting either Moody’s operations or its customers’ use of ratings

possible nationalization, expropriation, price controls and other restrictive governmental actions

restrictions on the ability to convert local currency into U.S. dollars

currency fluctuations

export and import restrictions, tariffs and other trade barriers

difficulty in staffing and managing offices as a result of, among other things, distance, travel, cultural differences and intense competition for trained personnel

longer payment cycles and problems in collecting receivables

11

political and economic instability

potentially adverse tax consequences

Any of these factors could have a material adverse effect on the business, financial condition and results of operations of the Company in the future.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

ITEM 2. PROPERTIES

The executive offices of Moody’s arecorporate headquarters is located at 99 Church Street, New York, New York, with approximately 441,000 square-feet. During the fourth quarter of 2006, the Company completed the sale of its corporate headquarters and is leasing back the building until the headquarters relocation is completed. On October 20, 2006, the Company entered into an operating lease agreement with 7 World Trade Center, LLC for 589,945 square-feet of an office building located at 7 World Trade Center at 250 Greenwich Street, New York, New York, which will serve as Moody’s new headquarters beginning in a 297,000-square-foot property owned by Moody’s.mid- to late 2007. As of December 31, 2006, Moody’s operations are alsowere conducted from 9 other15 U.S. offices and 2132 non-U.S. office locations, all of which are leased. These other properties are geographically distributed to meet operating and sales requirements worldwide. These properties are generally considered to be both suitable and adequate to meet current operating requirements and virtually all space is being utilized.

ITEM 3. LEGAL PROCEEDINGS

| ITEM 3. | LEGAL PROCEEDINGS |

From time to time, Moody’s is involved in legal and tax proceedings, claims and litigation that are incidental to the Company’s business, including claims based on ratings assigned by Moody’s. Moody’s is also subject to ongoing tax audits in the normal course of business. Management periodically assesses the Company’s liabilities and contingencies in connection with these matters based upon the latest information available. Moody’s discloses material pending legal proceedings, other than routine litigation incidental to Moody’s business, material proceedings known to be contemplated by governmental authorities, and other pending matters that it may determine to be appropriate. For those matters where it is both probable that a liability has been incurred and the probable amount of loss can be reasonably estimated, the Company believes it has recorded appropriate reserves in the consolidated financial statements and periodically adjusts these reserves as appropriate. In other instances, because of the uncertainties related to both the probable outcome andand/or the amount or range of loss, management is unable to make a reasonable estimate ofdoes not record a liability but discloses the contingency if any.significant. As additional information becomes available, the Company adjusts its assessments and estimates of such liabilities accordingly.

The discussion of the litigationlegal matters under the heading “Legacy Contingencies” underPart II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations”Operations—Contingencies”, commencing aton page 3428 of this annual report on Form 10-K, is incorporated into this Item 3 by reference.

Based on its review of the latest information available, in the opinion of management, the ultimate liability of the Company in connection with pending legal and tax proceedings, claims and litigation will not have a material adverse effect on Moody’s financial position, results of operations or cash flows, subject to the contingencies described in Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Operations—Contingencies”.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

During the fourth quarter of the fiscal year covered by this annual report on Form 10-K, no matter was submitted to a vote of security holders.

12

PART II

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Information in response to this Item is set forth under the captions “Common Stock Information” and “Dividends” in Item 7 of this annual report on Form 10-K.10-K, and under the caption “Equity Compensation Plan Information” in the Company’s definitive proxy statement for use in connection with its annual meeting of stockholders scheduled to be held on April 24, 2007, and is incorporated herein by reference.

MOODY’S PURCHASES OF EQUITY SECURITIES

For the Three Months Ended December 31, Period Total Number of Shares Purchased Average Price Paid per Share Total Number of Shares Purchased as Part of Publicly Announced Program Approximate Dollar Value of Shares That May yet be Purchased Under the Program (2) October 1 – 31 November 1 – 30 December 1 – 31 Total2004 971,702 (1) $ 63.44 971,479 $ 1,850.3 million 722,982 (1) 67.23 722,016 1,801.8 million 562,500 69.99 562,500 1,762.4 million 2,257,184 2,255,995 Total Number of SharesApproximate Dollar Value ofPurchased as Part ofShares that May Yet BeTotal Number ofAverage PricePublicly AnnouncedPurchased Under thePeriodShares PurchasedPaid per ShareProgramProgram (1)Includes the surrender to the Company of 223 and 966 shares in October 1 - 31———$547.7 millionand November, 1 - 30———$547.7 millionDecember 1 - 31———$547.7 millionTotal———respectively, of common stock to satisfy tax withholding obligations in connection with the vesting of restricted stock issued to employees.

| (2) | As of the last day of each of the months. On June 5, 2006, the Board of Directors authorized a $2 billion share repurchase program. There is no established expiration date for this authorization. During August 2006, the Company had completed its previous $1 billion share repurchase program, which had been authorized by the Board of Directors in October 2005. |

Since becoming a public company in October 2000 and through the end of 2004,December 31, 2006, Moody’s has repurchased 26.484.4 million shares at a total cost of $1.1$2.9 billion, including 13.038.6 million shares to offset issuances under employee stock-based compensation plans.

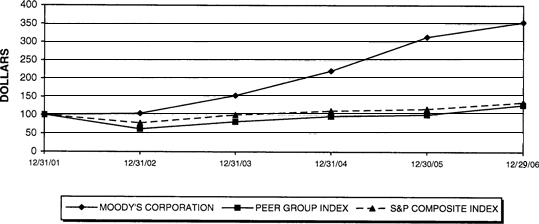

PERFORMANCE GRAPH

The following graph compares the total cumulative shareholder return of the Company to the performance of Standard & Poor’s Stock 500 Index (the “S&P 500”) and an index of performance peer group companies (the “Performance Peer Group”).

The Company does not believe there are any publicly traded companies that represent strict peers. However, each of the companies in the Performance Peer Group offers business information products in one or more segments of its business. The Performance Peer Group consists of Dow Jones & Company, Inc., The McGraw-Hill Companies, Pearson PLC, Reuters Group PLC, Thomson Corporation and Wolters Kluwer nv.

The comparison assumes that $100.00 was invested in the Company’s common stock plans.

(the “Common Stock”) and in each of the foregoing indices on December 31, 2001. The comparison also assumes the reinvestment of dividends, if any. The total return for the Common Stock was 254% during the performance period as compared with a total return during the same period of 35% for the S&P 500 and 27% for the Performance Peer Group.

COMPARISON OF CUMULATIVE TOTAL RETURN

SINCE DECEMBER 31, 2001

MOODY’S CORPORATION, S&P COMPOSITE INDEX AND PEER GROUP INDEX

| PERIOD ENDING | ||||||||||||

| 12/31/2001 | 12/31/2002 | 12/31/2003 | 12/31/2004 | 12/30/2005 | 12/29/2006 | |||||||

Moody's Corporation | 100.00 | 104.01 | 153.07 | 220.51 | 313.63 | 354.23 | ||||||

Peer Group Index | 100.00 | 61.80 | 81.57 | 96.18 | 100.97 | 127.43 | ||||||

S&P Composite Index | 100.00 | 77.90 | 100.25 | 111.15 | 116.61 | 135.03 | ||||||

The comparisons in the graph above are provided in response to disclosure requirements of the SEC and are not intended to forecast or be indicative of future performance of the Common Stock.

13

ITEM 6. SELECTED FINANCIAL DATA

| ITEM 6. | SELECTED FINANCIAL DATA |

The Company’s selected consolidated financial data should be read in conjunction with Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Moody’s Corporation consolidated financial statements and notes thereto.

| Year Ended December 31, | ||||||||||||||||||||

| amounts in millions, except per share data | 2004 | 2003 | 2002 | 2001 | 2000 (4) | |||||||||||||||

Results of operations (1) | ||||||||||||||||||||

| Revenue | $ | 1,438.3 | $ | 1,246.6 | $ | 1,023.3 | $ | 796.7 | $ | 602.3 | ||||||||||

| Expenses | 651.9 | 583.5 | 485.2 | 398.2 | 313.8 | |||||||||||||||

| Operating income | 786.4 | 663.1 | 538.1 | 398.5 | 288.5 | |||||||||||||||

| Non-operating expense, net (2) | (15.1 | ) | (6.7 | ) | (20.7 | ) | (16.6 | ) | (4.5 | ) | ||||||||||

| Income before provision for income taxes | 771.3 | 656.4 | 517.4 | 381.9 | 284.0 | |||||||||||||||

| Provision for income taxes | 346.2 | 292.5 | 228.5 | 169.7 | 125.5 | |||||||||||||||

| Net income | $ | 425.1 | $ | 363.9 | $ | 288.9 | $ | 212.2 | $ | 158.5 | ||||||||||

Earnings per share | ||||||||||||||||||||

| Basic | $ | 2.86 | $ | 2.44 | $ | 1.88 | $ | 1.35 | $ | 0.98 | ||||||||||

| Diluted | $ | 2.79 | $ | 2.39 | $ | 1.83 | $ | 1.32 | $ | 0.97 | ||||||||||

Weighted average shares outstanding | ||||||||||||||||||||

| Basic | 148.5 | 148.9 | 153.9 | 157.6 | 161.7 | |||||||||||||||

| Diluted | 152.3 | 152.3 | 157.5 | 160.2 | 163.0 | |||||||||||||||

Dividends declared per share | $ | 0.30 | $ | 0.18 | $ | 0.18 | $ | 0.18 | $ | 0.045 | ||||||||||

| As of December 31, | ||||||||||||||||||||

| 2004 | 2003 | 2002 | 2001 | 2000 (4) | ||||||||||||||||

Balance sheet data | ||||||||||||||||||||

| Total assets | $ | 1,376.0 | $ | 952.3 | $ | 630.8 | $ | 505.4 | $ | 398.3 | ||||||||||

| Long-term debt (3) | $ | — | $ | 300.0 | $ | 300.0 | $ | 300.0 | $ | 300.0 | ||||||||||

| Shareholders’ equity (deficit) | $ | 317.5 | $ | (32.1 | ) | $ | (327.0 | ) | $ | (304.1 | ) | $ | (282.5 | ) | ||||||

| Year Ended December 31, | ||||||||||||||||||||

amounts in millions, except per share data | 2006 | 2005 | 2004 | 2003 | 2002 (1) | |||||||||||||||

Results of operations | ||||||||||||||||||||

Revenue | $ | 2,037.1 | $ | 1,731.6 | $ | 1,438.3 | $ | 1,246.6 | $ | 1,023.3 | ||||||||||

Expenses, excluding gain on sale of building | 938.2 | 792.0 | 651.9 | 583.5 | 485.2 | |||||||||||||||

Gain on sale of building (2) | (160.6 | ) | — | — | — | — | ||||||||||||||

Operating income | 1,259.5 | 939.6 | 786.4 | 663.1 | 538.1 | |||||||||||||||

Non-operating income (expense), net (3) | 1.0 | (4.9 | ) | (15.1 | ) | (6.7 | ) | (20.7 | ) | |||||||||||

Income before provision for income taxes | 1,260.5 | 934.7 | 771.3 | 656.4 | 517.4 | |||||||||||||||

Provision for income taxes | 506.6 | 373.9 | 346.2 | 292.5 | 228.5 | |||||||||||||||

Net income | $ | 753.9 | $ | 560.8 | $ | 425.1 | $ | 363.9 | $ | 288.9 | ||||||||||

Earnings per share (4) | ||||||||||||||||||||

Basic | $ | 2.65 | $ | 1.88 | $ | 1.43 | $ | 1.22 | $ | 0.94 | ||||||||||

Diluted | $ | 2.58 | $ | 1.84 | $ | 1.40 | $ | 1.19 | $ | 0.92 | ||||||||||

Weighted average shares outstanding (4) | ||||||||||||||||||||

Basic | 284.2 | 297.7 | 297.0 | 297.8 | 307.8 | |||||||||||||||

Diluted | 291.9 | 305.6 | 304.7 | 304.6 | 315.0 | |||||||||||||||

Dividends declared per share | $ | 0.29 | $ | 0.24 | $ | 0.15 | $ | 0.11 | $ | 0.09 | ||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| 2006 | 2005 | 2004 | 2003 | 2002 | ||||||||||||||||

Balance sheet data | ||||||||||||||||||||

Total assets | $ | 1,497.7 | $ | 1,457.2 | $ | 1,389.3 | $ | 959.9 | $ | 633.7 | ||||||||||

Long-term debt (5) | $ | 300.0 | $ | 300.0 | $ | — | $ | 300.0 | $ | 300.0 | ||||||||||

Shareholders’ equity (deficit) | $ | 167.4 | $ | 309.4 | $ | 317.5 | $ | (32.1 | ) | $ | (327.0 | ) | ||||||||

| (1) | The 2002 results of operations include revenue of $42.1 million, expenses of $42.8 million and an operating loss of $0.7 million related to KMV, which was acquired in April 2002. | |

| (2) | During the fourth quarter of 2006, the Company completed the sale of its corporate headquarters located at 99 Church Street, New York, New York. The sale resulted in a gain of $160.6 million. |

| (3) |

| (4) | Prior period earnings per share and weighted average shares outstanding have been adjusted to reflect the May 2005 2-for-1 stock split. |

14

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

This discussion and analysis of financial condition and results of operations should be read in conjunction with the Moody’s Corporation consolidated financial statements and notes thereto included elsewhere in this annual report on Form 10-K.

This Management’s Discussion and Analysis of Financial Condition and Results of Operations contains Forward-Looking Statements. See “Forward-Looking Statements” commencing on page 4131 and “Additional Factors That May Affect Future Results”Item 1A. “Risk Factors” commencing on page 3010 for a discussion of uncertainties, risks and other factors associated with these statements.

The Company

Except where otherwise indicated, the terms “Moody’s” and the “Company” refer to Moody’s Corporation and its subsidiaries. Moody’s is a provider of (i) credit ratings, research and analysis covering fixed-income securities, other debt instruments and securitiesthe entities that issue such instruments in the global capital markets, and a provider of quantitative credit assessment services, credit training services, and (ii) quantitative credit processrisk assessment products and services and credit processing software tofor banks, corporations and other financial institutions.investors in credit-sensitive assets. Moody’s operates in two reportable segments: Moody’s Investors Service and Moody’s KMV.

Moody’s Investors Service publishes rating opinions on a broad range of credit obligors and credit obligations issued in domestic and international markets, including various corporate and governmental obligations, structured finance securities and commercial paper programs. It also publishes investor-oriented credit information, research and economic commentary, including in-depth research on major debt issuers, industry studies, special comments and credit opinion handbooks.

The Moody’s KMV business consists of the combined businesses of KMV LLC and KMV Corporation (“KMV”), acquired in April 2002, and Moody’s Risk Management Services. Moody’s KMV develops and distributes quantitative credit risk assessment products and services and credit processing software for banks, corporations and investors in credit-sensitive assets, credit training services and credit process software.assets.

The Company operated as part of The Dun & Bradstreet Corporation (“Old D&B”) until September 30, 2000 (the “Distribution Date”), when Old D&B separated into two publicly traded companies — Moody’s Corporation and The New D&B Corporation (“New D&B”). At that time, Old D&B distributed to its shareholders shares of New D&B stock. New D&B comprised the business of Old D&B’s Dun & Bradstreet operating company (the “D&B Business”). The remaining business of Old D&B consisted solely of the business of providing ratings and related research and credit risk management services (the “Moody’s Business”) and was renamed “Moody’s Corporation”. The method by which Old D&B distributed to its shareholders its shares of New D&B stock is hereinafter referred to as the “2000 Distribution”.

Critical Accounting Estimates

Moody’s discussion and analysis of its financial condition and results of operations are based on the Company’s consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires Moody’s to make estimates and judgments that affect reported amounts of assets and liabilities and related disclosures of contingent assets and liabilities at the dates of the financial statements and revenue and expenses during the reporting periods. These estimates are based on historical experience and on other assumptions that are believed to be reasonable under the circumstances. On an ongoing basis, Moody’s evaluates its estimates, including those related to revenue recognition, accounts receivable allowances, contingencies, goodwill and intangible assets, pension and other post-retirement benefits and stock-based compensation. Actual results may differ from these estimates under different assumptions or conditions. The following accounting estimates are considered critical because they are particularly dependent on management’s judgment about matters that are uncertain at the time the accounting estimates are made and changes to those estimates could have a material impact on the Company’s consolidated results of operations or financial condition.

15

Revenue Recognition

In recognizing revenue related to ratings, Moody’s uses judgments to allocate billed revenue between ratings and the future monitoring of ratings in cases where the Company does not charge ongoing monitoring fees for a particular issuer. These judgments are not dependent on the outcome of future uncertainties, but rather relate to allocating revenue across accounting periods. In such cases, the Company defers portions of rating fees that it estimates will be attributed to future monitoring activities and recognizes the deferred revenue ratably over the estimated monitoring periods.

The portion of the revenue to be deferred is determined based on annualupon a number of factors, including the estimated fair market value of the monitoring feesservices charged for similar securities or issuers and the level of monitoring effort required for a type of security or issuer.issuers. The estimated monitoring period over which the deferred revenue will be recognized is determined based on factors such as the frequency of issuance by the issuers and theestimated lives of the rated securities. Currently, the estimated monitoring periods range from threeone year to ten years. At December 31, 20042006, 2005 and 2003,2004, deferred revenue included approximately $30$47 million, $36 million and $26$30 million, respectively, related to such deferred monitoring fees.

15

Additionally, in the case of commercial mortgage-backed securities, issuers can elect to pay the monitoring fees upfront. These fees are deferred and recognized over the future monitoring period which is determined based on the lives of the rated securities. Currently, the monitoring periods range from five to 46 years. At December 31, 2006, 2005 and 2004, deferred revenue related to commercial mortgage-backed securities was approximately $62 million, $50 million and $37 million, respectively.

Moody’s estimates revenue for ratings of commercial paper for which, in addition to a fixed annual monitoring fee, issuers are billed quarterly based on amounts outstanding. Related revenue is accrued each quarter based on estimated amounts outstanding and is billed subsequently when actual data is available. The estimate is determined based on the issuers’ most recent reported quarterly data. At December 31, 20042006, 2005 and 2003,2004, accounts receivable included approximately $29$34 million, $31 million and $26$29 million, respectively, related to accrued commercial paper revenue. Historically, the Company has not had material differences between the estimated revenue and the actual billings.

Accounts Receivable Allowance

Moody’s records as reductions of revenue provisions for estimated future adjustments to customer billings based on historical experience and current conditions. Such provisions are reflected as additions to the accounts receivable allowance. Adjustments to and write-offs of accounts receivable are charged against the allowance. Moody’s evaluates its accounts receivable by reviewing and assessing historical collection and adjustment experience and the current status of customer accounts. Moody’s also considers the economic environment of the customers, both from an industry and geographic perspective, in evaluating the need for allowances. Based on its reviews, Moody’s establishes or adjusts allowances, for specific customers and the accounts receivable balance as a whole, as considered appropriate. This process involves a high degree of judgment and estimation and frequently involvescould involve significant dollar amounts. Accordingly, Moody’s results of operations can be affected by adjustments to the allowance. Management believes that the allowance for uncollectible accounts is adequate to cover anticipated adjustments and write-offs under current conditions. However, significant changes in any of the above-noted factors, or actual write-offs or adjustments that differ from the estimated amounts could result in allowancesrevenue adjustments that are greater or less than Moody’s estimates. In each of 20042006, 2005 and 2003,2004, the Company reducedadjusted its provision rates and its allowances to reflect its current estimate of the appropriate level of accounts receivable allowance.

Contingencies

Accounting for contingencies, including those matters described in the “Contingencies” section of this Management’s“Management’s Discussion and Analysis,Analysis”, commencing on page 28 is highly subjective and requires the use of judgments and estimates in assessing their magnitude and likely outcome. In many cases, the outcomes of such matters will be determined by third parties, including governmental or judicial bodies. The provisions made in the consolidated financial statements, as well as the related disclosures, represent management’s best estimates of the then current status of such matters and their potential outcome based on a review of the facts and in consultation with outside legal counsel where deemed appropriate.The Company regularly reviews contingencies and as additional information becomes available may, in the future, adjust the provisions made in respect thereof. Since the potential exposure on many of these matters is material, and it is possible that these matters could be resolved in amounts that are greater than the Company has reserved, their resolution could have a material adverse effect on Moody’s future reported results and financial position. In addition, potential cash outlays related to the resolution of these exposures could be material.

16

For the years ended December 31, 20042006, 2005 and 2003,2004, the provision for income taxes reflected credits of $2.4 million, $8.8 million and charges of $30.0 million and $16.2$30 million, respectively, due to increasechanges in the Company’s reserves for legacy income tax exposures that were assumed by Moody’s in connection with its separation from The Dun & Bradstreet CorporationOld D&B in October 2000. These tax matters are discussed under “Legacy Tax Matters” below.

Goodwill and Other Intangible Assets

Moody’s evaluates its goodwill for impairment annually or more frequently if impairment indicators arise in accordance with Statement of Financial Accounting Standards (“SFAS”) No. 142, “Goodwill and Other Intangible Assets”. Moody’s goodwill balance is material ($131.7 million at December 31, 2004), and theThe evaluation of the carrying value of goodwill requires that the Company make important assumptions and judgments about future operating results and cash flows as well as terminal values and discount rates. In estimating future operating results and cash flows, Moody’s considers internal budgets and strategic plans, expected long-term growth rates, and the effects of external factors and market conditions. If actual future operating results and cash flows or external conditions differ from the Company’s judgments, or if changes in assumed terminal values or discount rates are made, an impairment charge may be necessary to reduce the carrying value of goodwill, which charge could be material to the Company’s financial position and results of operations. Amortizable intangible assets are reviewed for recoverability whenever events or changes in circumstances indicate that the carrying amount may not be recoverable.

16

Pension and Other Post-Retirement Benefits

The expenses, assets, liabilities and obligations that Moody’s reports for pension and other post-retirement benefits are dependent on many assumptions concerning the outcome of future events and circumstances. These assumptions include the following:

•

future compensation increases, based on the Company’s long-term actual experience and future outlook

• discount rates, based on current yields on high grade corporate long-term bonds

• long-term return on pension plan assets, based on historical portfolio results and the expected future average annual return for each major asset class within the plan’s portfolio (which is principally comprised of equity and fixed-income investments)

future healthcare cost trends, based on historical market data, near-term outlooks and assessments of likely long-term trends

discount rates, based on current yields on high-grade corporate long-term bonds

The discount rate selected to measure the present value of the Company’s benefit obligations as of December 31, 2006 was derived using a cash flow matching method whereby the Company compares the plans’ projected payment obligations by year with the corresponding yield on the Citibank Pension Discount Curve. The cash flows are then discounted to their present value and an overall discount rate is determined.

Moody’s major assumptions vary by plan and assumptions used are set forth in Note 10 to the consolidated financial statements. In determining suchthese assumptions, the Company consults with outside actuaries and other advisors whereas deemed appropriate. In accordance with relevant accounting standards, if actual results differ from the Company’s assumptions, such differences are deferred and amortized over the estimated future working life of the plan participants. While the Company believes that the assumptions used in its calculations are reasonable, differences in actual experience or changes in assumptions could have a significant effect on the expenses, assets and liabilities related to the Company’s pension and other post-retirement benefits.

When actual plan experience differs from the assumptions used, actuarial gains or losses arise. To the extent the total outstanding gain or loss exceeds a corridor threshold as defined in SFAS No. 87, “Employers’ Accounting for Pensions” (“SFAS No. 87”), the excess is subject to amortization in annual expense over the estimated average future working lifetime of active plan participants. For Moody’s pension and other post-retirement benefit plans, the total losses as of December 31, 2006 which have not been recognized in annual expense are $ 41.0 million and Moody’s expects to recognize $2.2 million of actuarial losses in 2007 annual net periodic benefit expense.

For Moody’s funded pension plan, the differences between the expected long-term rate of return assumption and actual experience could also affect the net periodic pension expense. As permitted under SFAS No. 87, the Company spreads the impact of asset experience over a five-year period for purposes of calculating the market related value of assets which is used in determining the expected return on assets component of annual expense and in calculating the total unrecognized gain or loss subject to amortization. As of December 31, 2006, the Company has an unrecognized asset gain of $7.8 million, of which $3.3 million will be recognized in the market related value of assets which is used to calculate the expected return on assets component in 2008 expense.

The table below shows the estimated effect that a one percentage pointpercentage-point decrease in each of these assumptions will have on Moody’s 20052007 operating income (dollars in millions). These effects have been calculated using the Company’s current projections of 20052007 assets, liabilities, obligations and expenses related to pension and other post-retirement plans, which could change as updated data becomes available.

| Estimated Impact on | ||||||||

| Assumption Used for | 2005 Operating Income | |||||||

| 2005 | (Decrease)/Increase | |||||||

| Discount Rate | 5.90 | % | $ | (3.9 | ) | |||

| Weighted Average Assumed Compensation Growth Rate | 4.00 | % | $ | 1.2 | ||||

| Assumed Long-Term Rate of Return on Pension Assets | 8.35 | % | $ | (1.0 | ) | |||

17

Assumption Used for 2007 | Estimated Impact on 2007 Operating Income (Decrease)/Increase | |||||

Discount Rate* | 5.90% / 5.80% | $ | (5.3 | ) | ||

Weighted Average Assumed Compensation Growth Rate | 4.00% | $ | 1.8 | |||

Assumed Long-Term Rate of Return on Pension Assets | 8.35% | $ | (1.1 | ) | ||

| * | Discount rates of 5.90% and 5.80% are used for pension plans and other post-retirement plans, respectively. |

A one percentage-point increase in assumed healthcare cost trend rates will not affect 2007 projected expenses. Based on our current projections, the Company estimates that expenses related to pension and post-retirement plans will be approximately $13

17

$14.4 million in 20052007 compared with $8$14.9 million in 2004.2006. The expected expense increasedecrease in 20052007 reflects the effects of higher discount rates, higher plan asset gains and lower amortization of actuarial losses, which are partially offset by normal growth in plan liabilities, as well as amortization of actuarial losses due to differences between past actuarial assumptions and actual plan experience, and assumption changes adopted as of December 31, 2004.liabilities.

Stock-Based Compensation

On January 1, 2006, the Company adopted, under the modified prospective application method, the fair value method of accounting for stock-based compensation under Statement of Financial Accounting Standards (“SFAS”) No. 123 (Revised 2004) “Share-Based Payment” (“SFAS No. 123R”). Under this pronouncement, companies are required to record compensation expense for all share-based payment award transactions granted to employees based on the fair value of the equity instrument at the time of grant. This includes shares issued under employee stock purchase plans, stock options, restricted stock and stock appreciation rights. Previously, on January 1, 2003, the Company adopted, on a prospective basis, the fair value method of accounting for stock-based compensation under the provisions of SFAS No. 123, “Accounting for Stock-Based Compensation”, as amended by SFAS No. 148, “Accounting for Stock-Based Compensation - Transition and Disclosure — an Amendment of FASB Statement No. 123”. Therefore, employee stock options granted on and after January 1, 2003 are being expensed by the Company over the option vesting period, based on the estimatedThe fair value of theeach option award is estimated on the date of grant. The estimated fair value is calculated based on agrant using the Black-Scholes option pricing model usingthat uses assumptions and estimates that the Company believes are reasonable. Some of the assumptions and estimates, such as share price volatility and expected option holding period, are based in part on Moody’s experience during the period since becoming a public company, which is limited. The use of different assumptions and estimates in the Black-Scholes option pricing model could produce materially different estimated fair values for option awards and related expense to be recognized over the option vesting period.expense.

An increase in the following assumptions would have had the following estimated effect on operating income in 20042006 (dollars in millions):

| Estimated Impact on | ||||||||||

| Amount of Increase in | Operating Income in 2004 | |||||||||

| Assumption Used | Assumption | (Decrease)/Increase | ||||||||

| Expected Dividend Yield | 2003 grants | 0.41% | 0.10% | $0.2 | ||||||

| 2004 grants | 0.46% | |||||||||

| Expected Share Price Volatility | 2003 and 2004 grants | 30% | 5% | ($2.5) | ||||||

| Expected Option Holding Period | 2003 and 2004 grants | 5.0 years | 1.0 year | ($2.3) | ||||||

| Assumption Used | Increase in Assumption | Estimated Impact on Operating Income in 2006 Increase/(Decrease) | ||||||||

Average Expected Dividend Yield | 2002 -2006 grants | 0.41% -0.52% | 0.10% | $ | 0.6 | |||||

Average Expected Share Price Volatility | 2002 -2006 grants | 23% -30% | 5% | $ | (4.9 | ) | ||||

Expected Option Holding Period | 2002 -2006 grants | 4.5 –6.0 years | 1.0 year | $ | (4.2 | ) | ||||

Other Estimates

In addition, there are other accounting estimates within Moody’s consolidated financial statements, including recoverability of deferred tax assets, anticipated dividend distributions from non-U.S. subsidiaries realizability of long-lived and intangible assets and valuation of investments in affiliates. Management believes the current assumptions and other considerations used to estimate amounts reflected in Moody’s consolidated financial statements are appropriate. However, if actual experience differs from the assumptions and other considerations used in estimating amounts reflected in Moody’s consolidated financial statements, the resulting changes could have a material adverse effect on Moody’s consolidated results of operations or financial condition.

See Note 2 to the consolidated financial statements for further information on key accounting policies that impact Moody’s.

Operating Segments

Prior to 2002, the Company operated in one reportable business segment – Ratings, which accounted for approximately 90% of the Company’s total revenue. With the April 2002 acquisition of KMV and its combination with Moody’s Risk Management Services to form Moody’s KMV, Moody’s now operates in two reportable business segments: Moody’s Investors Service and Moody’s KMV. Accordingly, in the second quarter of 2002, the

18

Company restated its segment information for prior periods to conform to the current presentation. In order to provide additional information relating to Moody’s operating results, the discussion below includes information analyzing operating results as if the acquisition of KMV had been consummated as of January 1, 2002. This information is presented in a manner consistent with SFAS No. 141, “Business Combinations”, and is described in more detail in Note 5 to the consolidated financial statements.

The Moody’s Investors Service business consists of four rating groups — structured finance, corporate finance, financial institutions and sovereign risk, and public finance — that generate revenue principally from the assignment of (i) credit ratings on issuers and issues of fixed-income obligors and instrumentsobligations in the debt markets, and (ii) research, which primarily generates revenue from the sale of investor-oriented credit information, and research, principally produced by the rating groups.groups, and economic commentary. For presentation purposes, Europe represents Europe, the Middle East and Africa and public finance represents U.S. public finance. Given the dominance of Moody’s Investors Service to Moody’s overall results, the Company does not separately measure or report corporate expenses, nor are theysuch expenses allocated tobetween the Company’s business segments. Accordingly, all corporate expenses are included in operating income of the Moody’s Investors Service segment and none have been allocated to the Moody’s KMV segment.

The Moody’s KMV business develops and distributes quantitative credit risk assessment products and services and credit processing software for banks, corporations and investors in credit-sensitive assets, credit training servicesassets.

In February 2005, Moody’s Board of Directors declared a two-for-one stock split to be effected as a special stock distribution of one share of common stock for each share of the Company’s common stock outstanding, subject to stockholder approval of a charter amendment to increase the Company’s authorized common shares from 400 million shares to 1 billion shares. At the Company’s Annual Meeting on April 26, 2005, Moody’s stockholders approved the charter amendment. As a result,

18

stockholders of record as of the close of business on May 4, 2005 received one additional share of common stock for each share of the Company’s common stock held on that date (the “Stock Split”). Such additional shares were distributed on May 18, 2005. All prior period share and credit process software.per share information has been restated to reflect the Stock Split.

Certain prior year amounts have been reclassified to conform to the current presentation.

Results of Operations

Year Ended December 31, 20042006 Compared With Year Ended December 31, 20032005

Total Company Results

Moody’s revenue for 2004in 2006 was $1,438.3$2,037.1 million, an increase of $191.7$305.5 million or 15.4%17.6% from $1,246.6$1,731.6 million for 2003.the same period of 2005. Moody’s achieved strong revenue growth above the rate of the overall corporation in a number of business sectors. U.S.global structured finance, was the largest contributor to year over year growth, primarily due to residential mortgage backed and home equity loan securities. Research experienced robust growth in all geographies. U.S. corporate finance growth was primarily due to revenue related toand research, and below the ratings of bank credit facilities and high yield issues. Globalcorporate rate in financial institutions contributed to growth as well, most notablyand MKMV, with a decline in the U.S. insurance and real estate sectors and the U.S. and European banking sectors.revenue from public finance.

Revenue in the United States was $911.2$1,277.8 million for 2004,in 2006, an increase of $115.9$192.4 million or 14.6%17.7% from $795.3$1,085.4 million for 2003.in 2005. Approximately $52 million80% of this increasethe U.S. growth was due to growth in structured finance. The U.S. residential mortgage backed and home equity sector was the largest contributor, driven by the favorable interest rate environmentstructured finance and a strong housing market. In addition, over $26 million of Moody’s U.S. revenue growth was contributed by corporate finance, primarily reflecting strong activity in the ratings ofissuance across most structured asset classes as well as corporate bonds and bank credit facilities and high yield bonds. The U.S. research business contributed about $20 million of growth. Theloans. Research, financial institutions and MKMV businesses contributed approximately $15 million and $8 million, respectively, to Moody’s United Statesyear-over-year growth . Public finance revenue in the U.S. declined by approximately $5 million year-to-year, mainly due to a 6% decline in dollar issuance in the municipal bond market.as well.

Moody’s international revenue was $527.1$759.3 million in 2004,2006, an increase of $75.8$113.1 million or 16.8%17.5% from $451.3$646.2 million in 2003. Foreign currency translation accounted for approximately $21 million of reported international revenue growth. Reported2005. International ratings revenue grew approximately $45$91 million versus the prior year, with about $27 million of that growth coming from structured finance. Europe contributed approximately 80%84% of the growth in international structured finance. Financial institutions andEurope where credit derivatives, corporate finance, commercial mortgage-backed and residential mortgage-backed sectors were primary drivers of growth. European research and MKMV contributed approximately $13 million and $6 million, respectively, to revenue growth. Researchgrowth as well. Foreign currency translation positively impacted international revenue growth ofby approximately $23 million was primarily in Europe. MKMV contributed approximately $8 million of revenue growth outside the U.S.$1 million.

Moody’s operating, selling, general and administrative expenses of $617.8$898.7 million in 20042006 were $66.9$141.9 million or 12.1% greater18.8% more than $550.9$756.8 million in 2003.2005. Compensation and benefits continue to be Moody’s largest expense, accounting for approximately two-thirds$103 million in growth from prior year. Moody’s average global staffing of

19

total expenses in 2004 and 2003. Moody’s increased its overall staffing by over 175 people, or 8%, more than 3,100 employees during 2004the year ended December 31, 2006 was approximately 15% higher than during the same prior year period. This increase includes hiring to support continuedbusiness growth mainly in the business.U.S. and European ratings businesses. The table below shows Moody’s staffing at year-end 20042006 compared with year-end 2003.

| December 31, 2004 | December 31, 2003 | |||||||||||||||||||||||

| United States | International | Total | United States | International | Total | |||||||||||||||||||

| Moody’s Investors Service | 1,350 | 709 | 2,059 | 1,258 | 655 | 1,913 | ||||||||||||||||||

| Moody’s KMV | 343 | 75 | 418 | 318 | 69 | 387 | ||||||||||||||||||

| Total | 1,693 | 784 | 2,477 | 1,576 | 724 | 2,300 | ||||||||||||||||||

| December 31, 2006 | December 31, 2005 | |||||||||||

| United States | International | Total | United States | International | Total | |||||||

Moody’s Investors Service | 1,843 | 1,106 | 2,949 | 1,600 | 919 | 2,519 | ||||||

Moody’s KMV | 304 | 97 | 401 | 303 | 74 | 377 | ||||||

Total | 2,147 | 1,203 | 3,350 | 1,903 | 993 | 2,896 | ||||||

Operating expenses were $ 375.4$539.4 million in 2004,2006, an increase of $28.1$86.5 million or 8%19.1% from $347.3$452.9 million in 2003.2005. The largest contributor to this increase was growth in compensation and benefits expense of $25$76 million, reflecting compensation increases, increased staffing and higher stock-based compensation expense. Moody’s global staffing reflected hiring primarily in the specialist teams that support Moody’s Enhanced Analysis Initiative, in several of Moody’s U.S. and internationalEuropean ratings businesses and at Moody’s KMV.to support business growth. Stock-based compensation expense increased $12.3$16.3 million year-over-year due, in part, to the final year of phasing in of expense over the current four-year equity plan vesting period and the effects of a higher share price on the value of the 2006 equity grants versus 2005, offset by additional expense recorded in the first quarter of 2005 related to the accelerated expensing of equity grants for employees at or near retirement eligibility. Expenses for 2005 included $3.2 million for the settlement of certain pension obligations.

Selling, general and administrative expenses were $359.3 million in 2006, an increase of $55.4 million or 18.2% from $303.9 million in 2005. Year-over-year expense increases included growth in compensation and benefits of $27 million, reflecting compensation increases, increased staffing in technology support and finance functions and $6.0 million related to stock-based compensation as discussed above. Additional 2006 expenses included increased rent and occupancy costs of approximately $12 million to support business expansion and costs associated with Moody’s new corporate headquarters. Expenses for 2005 included a charge of $9.4 million for the settlement of sales tax matters related to Moody’s operations in Japan from 2000 through June 30, 2005, which was a result of a tax audit by Japanese taxing authorities that was completed in the second quarter of 2005.

19

Operating income of $1,259.5 million in 2006, which included a 160.6 million gain on the sale of Moody’s corporate headquarters building in the fourth quarter of 2006, rose $319.9 million or 34.0% from $939.6 million in 2005. Excluding the gain on sale, operating income increased 17%. The effects of foreign currency translation reduced year-over-year growth in operating income by approximately $3 million. Moody’s operating margin for 2006 was 61.8% compared to 54.3% in 2005. The gain on the sale of the building increased the 2006 margin by approximately 790 basis points.

Moody’s reported $1.0 million of interest and other non-operating income (expense), net in 2006 compared with ($4.9) million in 2005. Interest expense was $15.2 million in 2006 and $21.0 million in 2005. The amounts included $14.9 million and $20.9 million of interest expense on Moody’s $300 million of notes payable for 2006 and 2005, respectively. Interest income was $18.2 million in 2006 compared to $26.0 million in 2005. The decrease was attributed to the liquidation of investment portfolios to finance share repurchases. Foreign exchange losses were immaterial in 2006 compared to $8.2 million in 2005. The year-over-year change was primarily due to the British pound and euro appreciating to the U.S. dollar.

Moody’s effective tax rate was 40.2% in 2006 compared to 40.0% in 2005. The 2006 and 2005 effective tax rates were reduced by benefits of $2.4 million and $8.8 million, respectively, related to legacy income tax matters, see “Contingencies – Legacy Tax Matters” below for further information. Additionally, Moody’s recognized a tax benefit of approximately $3 million related to additional foreign tax credits in the fourth quarter of 2006 and a tax benefit of $3.6 million in 2005 related to the repatriation of foreign earnings under the American Jobs Creation Act of 2004. The 2006 rate was also favorably impacted by approximately 30 basis points due to the settlement of state tax audits.

Net income was $753.9 million in 2006, an increase of $193.1 million or 34.4% from $560.8 million in 2005. Basic and diluted earnings per share for 2006 were $2.65 and $2.58, respectively, compared to basic and diluted earnings per share of $1.88 and $1.84, respectively, for 2005. Excluding the gain on sale, 2006 net income was $659.8 million, an increase of $99.0 million or 17.7%. Additionally, the gain contributed $0.33 and $0.32 relating to full year basic and diluted earnings per share, respectively.

Segment Results

Moody’s Investors Service

Revenue at Moody’s Investors Service in 2006 was $1,894.3 million, up $294.0 million or 18.4% from $1,600.3 million in 2005. Ratings revenue accounted for $250.6 million of growth with increased revenue in global structured finance, corporate finance and financial institutions and sovereign risk offsetting a decline in public finance. Double-digit growth in research also contributed to the increase in revenue. Foreign currency translation positively impacted revenue growth by approximately $1 million. Price increases also contributed to year-over-year growth in revenue.

Structured finance revenue was $886.7 million in 2006, an increase of $171.3 million or 23.9% from $715.4 million in the same period of 2005. Approximately $109 million of the increase was in the U.S., with the collateralized debt and commercial mortgage-backed sectors contributing about 96% of the U.S. increase. Year-over-year issuance of collateralized loan obligations and cash flow resecuritizations grew, in part, to the increased “repackaging” of securitized assets such as consumer asset-backed and mortgage-backed securities, as well as bank loans in collateralized debt obligations. Strong growth in commercial real estate collateralized debt obligation issuance was a key driver of overall commercial mortgage-backed issuance. International structured finance revenue grew approximately $62 million year-over-year, with Europe contributing about $58 million, where credit derivatives, commercial mortgage-backed and residential mortgage-backed sectors totaled 92% of the European growth. Foreign currency translation for structured finance positively impacted international revenue growth by approximately $2 million.

Corporate finance revenue was $396.2 million in 2006, up $73.0 million or 22.6% from $323.2 million in 2005. Revenue in the U.S. increased approximately 22% principally due to issuance related growth in bank loan and corporate bond ratings revenue. Investment grade bond issuance increased approximately 17% and high yield bond issuance increased approximately 43%, primarily due to significant mergers and acquisitions, leveraged buyouts and second lien loan activity. International corporate finance revenue increased approximately $28 million or about 24% due largely to increased corporate bond issuance and non-issuance related ratings fees in Europe. Price increases also contributed to year-over-year growth in global corporate finance revenue.

Revenue in the financial institutions and sovereign risk group was $266.8 million in 2006, an increase of $12.2 million or 4.8% from $254.6 million in 2005. In the U.S., revenue grew approximately $11 million, principally due to strength in insurance and real estate sectors. Internationally, revenue increased $1.5 million compared to the prior year period.

Public finance revenue was $85.9 million in 2006, a decrease of $5.9 million or 6.4% from $91.8 million in 2005. Dollar volume issuance in the municipal bond market declined compared to 2005, primarily due to lower refinancing activity.

20

Research revenue of $258.7 million in 2006 was $43.4 million or 20.2% higher than $215.3 million in 2005. Revenue grew by approximately $28 million in the U.S. and about $15 million internationally, with Europe accounting for approximately 41% of international growth. Research and analytics services accounted for approximately $17 million of global revenue growth primarily from credit research on the corporate finance, financial institutions and the structured finance related businesses. Revenue from the licensing of Moody’s information to financial customers for internal use and redistribution was approximately $57 million in 2006, an increase of approximately $8 million, or about 17% higher than the prior year.

Moody’s Investors Service operating, selling, general and administrative expenses, including corporate expenses, were $789.1 million in 2006, an increase of $143.7 million or 22.3% from $645.4 million in 2005. The largest contributor to 2006 expenses was growth in compensation and benefits of approximately $110 million reflecting compensation increases, increased staffing primarily in the U.S. and European ratings businesses and higher stock-based compensation expense of $21.4 million. Furthermore, expenses in 2006 included increased rent and occupancy costs of approximately $11 million to support business expansion and costs associated with Moody’s new corporate headquarters. Additional increases were due to increased information technology investment spending of approximately $8 million offset by a decrease of approximately $6 million in legal fees. Expenses for 2005 included a charge of $9.4 million for the settlement of sales tax matters related to Moody’s operations in Japan from 2000 through June 30, 2005, which was a result of a tax audit by Japanese taxing authorities that was completed in the second quarter of 2005. Additionally, expenses in 2005 included $3.2 million for the settlement of certain pension obligations. Foreign currency translation contributed approximately $4 million to year-to-year growth in reported expenses.

Moody’s Investors Service operating income of $1,242.9 million in 2006 was up $306.6 million or 32.7% from $936.3 million in 2005, which included a $160.6 million gain on the sale of Moody’s corporate headquarters building in the fourth quarter of 2006. Excluding the gain, operating income increased 15.6%. The effects of foreign currency translation reduced year-to-year growth in operating income by approximately $3 million.

Moody’s KMV

MKMV revenue of $142.8 million in 2006 was $11.5 million or 8.8% more than the same period in 2005. MKMV’s revenue growth reflected increased demand for credit decision-making software and software related maintenance services, which grew approximately 10% or $2.7 million compared to 2005. Growth in subscriptions revenue related to credit risk assessment products grew approximately 5% or $4.9 million compared to prior year and risk services revenue increased approximately $4 million or about 36% compared to prior year. In 2006, international MKMV revenue accounted for 56% of its global revenue.

MKMV’s operating, selling, general and administrative expenses were $109.6 million in 2006, a decrease of $1.8 million or 1.6% from $111.4 million in 2005. The 2006 expenses include a total of $3.5 million due to training and recruitment, sales and marketing expenses. Additionally, 2006 expenses include a $2.2 million charge recorded in connection with a non-income tax matter. The 2005 expenses included approximately $7 million related to severance costs, the write-off of capitalized software development and a liability for unpaid overtime due to certain employees. MKMV operating income was $16.6 million for 2006 compared with $3.3 million in 2005. Currency translation did not have a significant year-to-year impact on MKMV results.

Year Ended December 31, 2005 Compared With Year Ended December 31, 2004

Total Company Results

Moody’s revenue for 2005 was $1,731.6 million, an increase of $293.3 million or 20.4% from $1,438.3 million during 2004. Moody’s achieved strong revenue growth in several business sectors, including global structured finance, financial institutions and research, international corporate finance and U.S. public finance.

Revenue in the United States was $1,085.4 million for 2005, an increase of $174.2 million or 19.1% from $911.2 million in 2004. Approximately 85% of the U.S. growth was driven by structured finance and research, reflecting strong issuance across all structured asset classes and continued demand for core research products. U.S. financial institutions, public finance and corporate finance contributed to year-to-year growth as well.

Moody’s international revenue was $646.2 million in 2005, an increase of $119.1 million or 22.6% from $527.1 million in 2004. International ratings revenue grew approximately $86 million versus the prior year, with approximately 77% of the growth related to Europe of which financial institutions contributed approximately $31 million of revenue growth primarily due to increased issuance and new ratings relationships. European structured finance, research and corporate finance contributed to growth as well. Favorable foreign currency translation accounted for approximately $7 million of reported international revenue growth.

21

Moody’s operating, selling, general and administrative expenses of $756.8 million in 2005 were $139.0 million or 22.5% greater than $617.8 million in 2004. Compensation and benefits continue to be Moody’s largest expense, accounting for more than 70% of total expenses in 2005 and 2004. Moody’s average global staffing of approximately 2,700 employees during the year ended December 31, 2005 was approximately 12% higher than during the same prior year period. This increase includes approximately 100 people due to the acquisition of Economy.com in November 2005 and hiring to support business growth mainly in the U.S. and European ratings businesses. The table below shows Moody’s staffing at year-end 2005 compared with year-end 2004.

| December 31, 2005 | December 31, 2004 | |||||||||||

| United States | International | Total | United States | International | Total | |||||||

Moody’s Investors Service | 1,600 | 919 | 2,519 | 1,358 | 761 | 2,119 | ||||||

Moody’s KMV | 303 | 74 | 377 | 329 | 68 | 397 | ||||||

Total | 1,903 | 993 | 2,896 | 1,687 | 829 | 2,516 | ||||||

Operating expenses were $452.9 million in 2005, an increase of $77.5 million or 20.6% from $375.4 million in 2004. The largest contributor to this increase was growth in compensation and benefits expense of $62.7 million, reflecting compensation increases, increased staffing, higher stock-based compensation expense and $3.2 million for the settlement of certain pension obligations. Moody’s global staffing reflected the acquisition of Economy.com in November 2005 and hiring primarily in the U.S. and European ratings businesses to support business growth. Stock-based compensation expense increased $18.7 million year-to-year. As more fully discussed in NoteNotes 2 and 11 to the consolidated financial statements, the Company adopted the fair value method provisions of SFAS No. 123 prospectively beginning on January 1, 2003. The year-to-year increase in expense principally reflects the phasing in of expense over the current four-year equity plan vesting period as annual equity grants are made, as well as the effecteffects of a higher share price on the value of the 2005 equity grants versus 2004, and additional expense recorded in the first quarter of 2005 related to the accelerated expensing of equity grants.grants for employees at or near retirement eligibility. Outside service fees increased by approximately $7 million of which approximately $6 million relates to information technology investment spending.

Selling, general and administrative (“SG&A”) expenses were $303.9 million in 2005, an increase of $61.5 million or 25.4% from $242.4 million in 2004, an increase of $38.8 million or 19% from $203.6 million in 2003.2004. Year-to-year expense increases included growth in compensation and benefits of $24$29.4 million, reflecting compensation increases, increased staffing in finance and $4.7technology support functions and $8.3 million related to stock-based compensation as discussed above. Additional increases were due to higher rent and occupancy costsAdditionally, as a result of approximately $4a tax audit by Japanese taxing authorities that was completed in the second quarter of 2005, expenses for 2005 included a charge of $9.4 million to support business expansion, and higher professional services costs, including spendingfor the settlement of approximately $5 millionsales tax matters related to Sarbanes-Oxley compliance.Moody’s operations in Japan from 2000 through June 30, 2005. Outside service fees increased by approximately $6 million of which approximately $3 million relates to information technology investment spending and about $2 million relates to legal fees.

Operating income of $939.6 million in 2005 rose $153.2 million, or 19.5% from $786.4 million in 2004 rose $123.3 million or 18.6% from $663.1 million in 2003. Foreign2004. Favorable foreign currency translation contributed approximately $6 million to operating income growth. Moody’s operating margin for 20042005 was 54.7%54.3% compared to 53.2%54.7% in 2003. The increase in margin principally reflected better-than-expected revenue growth.2004.

Moody’s reported $15.1$4.9 million of interest and other non-operating expense, net in 20042005 compared with $6.7$15.1 million in 2003. The 2003 amount included a gain of $13.6 million on an insurance recovery related to the September 11th tragedy, as discussed in Note 18 to the consolidated financial statements.2004. Interest expense was $21.0 million in 2005 and $23.0 million in 2004 and $23.5 million in 2003.2004. The amounts in both periods included $20.9 million and $22.8 million of interest expense on Moody’s $300 million of private placement debt.notes payable for 2005 and 2004, respectively. Interest income was $26.0 million in 2005 compared to $6.8 million in 2004 compared to $1.7 million in 2003.2004. The increase was due to a higher average investment balance as well as an increase in the weighted average yield. Foreign exchange (losses)/gains were ($8.2) million and $1.9 million in 2005 and $2.2 million in 2004, respectively. The year-over-year change was primarily due to the appreciation of the U.S. dollar versus the British pound and 2003, respectively.the euro.

Moody’s effective tax rate was 40.0% in 2005 compared to 44.9% in 2004 compared to 44.6% in 2003.2004. The 2004 and 2003 effective tax rates included charges aggregating approximately$8.8 million in credits and $30.0 million and $16.2 million, respectively, for increasesin charges due to changes in reserves in 2005 and 2004, respectively, related to legacy income tax exposures that were assumed by Moody’s in connection with its separation from The Dun & Bradstreet CorporationOld D&B in October 2000 (see Contingencies“Contingencies – Legacy Tax Matters,Matters”, below). Additionally, Moody’s recognized a tax benefit of $3.6 million in 2005 related to the repatriation of foreign earnings under the American Jobs Creation Act of 2004.

Net income was $560.8 million in 2005, an increase of $135.7 million or 31.9% from $425.1 million in 2004, an increase of $61.2 million or 16.8% from $363.9 million in 2003.2004. Basic and diluted earnings per share for 20042005 were $2.86$1.88 and $2.79,$1.84, respectively, compared to basic and diluted earnings per share of $2.44$1.43 and $2.39,$1.40, respectively, for 2003.2004.

20

22

Segment Results

Moody’s Investors Service

Revenue at Moody’s Investors Service revenue for 20042005 was $1,310.7$1,600.3 million, up $176.0$282.8 million or 15.5%21.5% from $1,134.7$1,317.5 million in 2003.2004. Ratings revenue accounted for $241.2 million of growth with approximately 80% of that growth coming from global structured finance and European financial institutions. Good growth was achieved in a number of ratings sectors as well as in research. Foreign currency translation contributed approximately $21 million to reported revenue growth, reflecting the depreciation of the U.S. dollar, mainly versus the Euro. Price increases also contributed to year-to-year growth in reported revenue.

Structured finance revenue was $538.6 million for 2004, an increase of $78.0 million or 16.9% from $460.6 million in the same period of 2003. Approximately $51 million of this increase was in the United States, with the residential mortgage and home equity sector contributing nearly $34 million of this amount. In this sector, growth was driven by increases in mortgage lending and home equity loans due to low interest rates, a strong housing market, and gains in market coverage. Good growth was also achieved in U.S. revenue from ratings of collateralized debt obligations (where the count of issues was up approximately 27% versus the prior year) and ratings of commercial mortgage backed securities (driven by record market issuance). International structured finance revenue grew approximately $27 million; about 80% of the growth was attributable to Europe, with growth in all asset classes. Foreign currency translation contributed approximately $9 million to year-to-year growth in global structured finance revenue. Price increases also contributed to year-to-year growth.

Corporate finance revenue was $311.5 million in 2004, up $32.7 million or 11.7% from $278.8 million in 2003. Revenue grew by approximately $26 million in the United States, reflecting strong growth in ratings of speculative-grade bonds as well as syndicated bank loans and other areas not related to public debt issuance. Price increases also contributed to revenue growth in this sector. These positive impacts were partially offset by the effects of a year-to-year decline in issuance of investment grade securities in the U.S. markets. International corporate finance revenue grew approximately $6 million, with roughly one-half of the growth attributed to foreign currency translation. Underlying revenue growth primarily reflected higher issuance volumes in Asia outside of Japan and Australia. Issuance in Europe was weak compared to 2003. Speculative grade issuance was strong, but investment grade issuance declined year-to-year as improved corporate profitability reduced borrowing needs and mergers and acquisitions remained weak.

Revenue in the financial institutions and sovereign risk group was $208.9 million for 2004, an increase of $27.7 million or 15.3% from $181.2 million in 2003. In the U.S., revenue grew $15 million year-to-year, principally reflecting refinancings in the real estate sector, new relationships in the insurance sector, and strong banking issuance as interest rate spreads tightened. Revenue from outside the U.S. grew approximately $13 million over the prior year, primarily in Europe. European growth reflected modest increases in issuance volumes, primarily in the banking sector, and good growth from new rating relationships. Foreign currency translation contributed approximately $3 million to revenue growth.

Public finance revenue was $82.2 million for 2004, a decrease of $5.0 million or 5.7% from $87.2 million in 2003. Dollar issuance in the municipal bond market declined 6% versus the same period in 2003, reflecting higher borrowing costs, a reduced pool of debt that was refunded and reduced borrowing needs due to strengthened tax receipts.

Research revenue of $169.5 million for 2004 was $42.6 million or 33.6% higher than the $126.9 million reported in 2003. Revenue grew by approximately $20 million in the U.S. and $16 million in Europe. The strong performance reflected growth in licensing of Moody’s information to financial customers for internal use and redistribution, sales of new products to existing clients and new clients. Foreign currency translation also contributed approximately $6 million to year-to-year growth in reported revenue.

Moody’s Investors Service operating, selling, general and administrative expenses, including corporate expenses, were $513.7 million in 2004, an increase of $51.5 million or 11.1% from $462.2 million in 2003. Compensation and benefits expense accounted for $37 million of the expense growth. This increase included $15.0 million related to stock-based compensation, as discussed above. The growth also reflected compensation increases and staffing

21

growth in many areas, including the specialist teams that support Moody’s Enhanced Analysis Initiative. Additionally, rent and occupancy costs increased approximately $5 million due to business expansion. Year-to-year expense growth also includes higher professional services costs. Foreign currency translation contributed approximately $14 million to year-to-year growth in reported expenses. Depreciation and amortization expense was $16.9 million in 2004 versus $15.4 million in 2003.

Moody’s Investors Service operating income of $780.1 million in 2004 was up $123.0 million or 18.7% from $657.1 million in 2003. Foreign currency translation contributed approximately $7 million to the year-to-year growth in operating income.

Moody’s KMV