| ITEM 1. | BUSINESS |

In this document, please note the following:

references to “we”, “our”, “us”, the “Company” or “Mercer” mean Mercer International Inc. and its subsidiaries, unless the context clearly suggests otherwise, and references to “Mercer Inc.” mean Mercer International Inc. excluding its subsidiaries;

references to “ADMTs” mean air-dried metric tonnes;

references to “MW” mean megawatts and “MWh” mean megawatt hours; and

“€” refers to Euros, which is our reporting currency; “$” refers to U.S. dollars; and “C$” refers to Canadian dollars.

Due to rounding, numbers presented throughout this report may not add up precisely to totals we provide and percentages may not precisely reflect the absolute figures.

General We operate in the pulp business and are among the largest publicly traded producers of market northern bleached softwood kraft, or “NBSK”, pulp in the world. Mercer Inc. We are the sole isreorganized as a company under the laws of the State of Washington in 2006 from a Washington corporation and our shares ofbusiness trust. Its common stock areis quoted and listed for trading on the NASDAQ Global Market (MERC) and the Toronto Stock Exchange (MRI.U).We operate in the pulp business and are the second largest producer of market northern bleached softwood kraft, or “NBSK”, pulp in the world. kraft pulpNBSK producer, and the only significant producer of pulp for resale, known as “market pulp”, in Germany, which is the largest pulp import market in Europe. We also generate and sell a significant amount of surplus “green” energy to regional utilities. Our operations are located in Eastern Germany and Western Canada. We currently employ approximately 1,056 people at our German operations, 381 people at our Celgar mill in Western Canada and 18 people at our office in Vancouver, British Columbia, Canada.1,500 people. We operate three NBSK pulp mills with a consolidated annual production capacity of approximately 1.5 million ADMTs:

| • | Rosenthal | ||

| • | Celgar |

| • | Stendal mill. Our 74.9% owned subsidiary, Stendal, owns and operates the Stendal mill, a state-of-the-art, single-line, ISO 9001 and 14001 certified NBSK pulp mill that has an annual production capacity of approximately 650,000 ADMTs and 102 MW of electrical generation. The Stendal mill generated and exported 368,634 MWh of electricity in 2012, resulting in approximately €32.2 million in annual revenues. The Stendal mill is located near the town of Stendal, Germany, approximately 130 kilometers west of Berlin. |

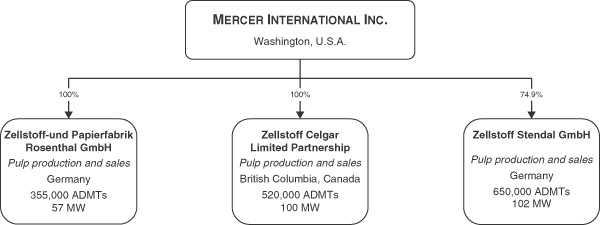

Organizational Chart

The following chart sets out our directly and indirectly owned principal operating subsidiaries, their jurisdictions of organization, their principal activities and their annual pulp production and electrical generation capacity:

History and Development of Business

We acquired our initialcommenced pulp and paper operations in 1993. Subsequently, we disposedwith the acquisition of our paper operations to focus our business on our core pulp operations.

5

We initially hadcurrently have a 63.6%74.9% ownership interest in StendalStendal. We, and over time, increased our interest to 74.9%.

In 2012, our Stendal mill commenced an approximate €40.0 million project, referred to as “Project Blue Mill”, which is designed to increase production and efficiency through debottlenecking initiatives including the installation of an additional 40 MW steam turbine at our Stendal mill. The debottlenecking which, among other things, requires the new turbine in order to enhance and efficiently utilize steam production, is designed to increase the mill’s annual pulp production capacity by 30,000 ADMTs. The new turbine is also expected to

initially produce an additional 109,000 MWh of surplus renewable energy for sale at premium pricing. Project Blue Mill is currently expected to be completed and start to generate power resources in or about September 2013.

A significant portion of the capital investments at our German mills, including the construction of the Stendal mill, were financed through government grants. Since 1999, our German mills have benefited from an aggregate €383.7€386.3 million in government grants. These grants reduce the cost basis of the assets purchased when the grants are received and are not reported in our income. See “- Capital Expenditures”.

In February 2005, we acquired the Celgar mill for $210.0 million of which $170.0 million was paid in cash and $40.0 million was paid in our shares, plus $16.0 million for the defined working capital of the mill. The Celgar mill was completely rebuilt in the early 1990s through a C$850.0 million modernization and expansion project, which transformed it into a modern and competitive producer.

Since its acquisition, we completed a C$28.0 millionhave effected several capital project which improved efficienciesprojects and reliability and, with other measures, increasedinitiatives at the Celgar mill’smill to increase its annual pulp production capacity to 500,000 ADMTs. In 2008, we commenced520,000 ADMTs and its production of “green” energy. This includes a new “green” energycapital project, at our Celgar mill, referred to as the “Celgar Energy Project”, to increasewhich was completed in September 2010 and increased the Celgar mill’s production of “green” energy and optimizeoptimized its power generation capacity. We are completing the project withcapacity, at an aggregate cost of approximately C$4064.9 million, inof which approximately C$48.0 million was financed by grants from the Canadian federal government and expect to complete the same in or about September 2010. See “- Capital Expenditures”.

6

Our competitive strengths include the following:

| • | Modern and Competitive Mills.We operate three large, modern, competitive NBSK pulp mills that produce high quality NBSK pulp, which is a premium grade of kraft pulp. | ||

| • | Stable Income Source from the Sale of Surplus Renewable | ||

| • | Leading Market Position.We are among the largest publicly traded NBSK market pulp producers in the world, which provides us increased presence and better industry information in the markets in which we operate and provides for close customer relationships with many large pulp consumers. |

| • | Strategic Locations and Customer | ||

| • | Advantageous Capital Investments and Financing.Our German mills are eligible to receive government grants in respect of qualifying capital investments. Over the last | ||

| • |

|

| • | Experienced Management Team.Our directors and senior managers have extensive experience in the pulp and forestry industries. We also have experienced managers at all of our mills. Our management has a proven track record of implementing new initiatives and capital projects in order to reduce costs throughout our operations as well as identifying and harnessing new revenue opportunities. |

Our corporate strategy is to create shareholder value by focusing on the expansion of our asset and earnings base.base through organic growth and acquisitions, primarily in Europe and North America. We pursue organic growth through active management and targeted capital expenditures to generate a high return by increasing pulp and energy production, reducing costs and improving efficiency. We seek to acquire interests in companies and assets in the pulp industry and related businesses where we can leverage our experience and expertise in adding value through a focused management approach. Key features of our strategy include:

| • |

|

| • | Reducing Volatility and Increasing the Stability of our Revenues by Maximizing Renewable Energy Realizations.We focus on the generation and sales of surplus renewable energy because there are minimal associated incremental costs and such sales are highly profitable and provide us with a stable income source unrelated to cyclical changes in pulp prices. In 2012, our mills sold a record 710,241 MWh of surplus electricity resulting in revenues of approximately €60.6 million, compared to 652,113 MWh and approximately €58.0 million in revenues in 2011. In 2012, we commenced Project Blue Mill to increase production and efficiency through debottlenecking initiatives and the installation of a 40 MW steam turbine at our Stendal mill. The new turbine is expected to initially produce an additional 109,000 MWh of surplus electricity. Based upon the current production levels of our mills, we expect to sell in excess of 740,000 MWh of surplus renewable energy in 2013. We continually explore and pursue initiatives to enhance our energy generation and sales in order to reduce volatility and increase our revenues from a stable source. |

| • | NBSK Market Pulp.We |

7

| • | ||

| ||

General Pulp is used in the production of paper, tissues and There are two We produce and paper relatedpaper-related products. Pulp is generally classified according to fiber type, the process used in its production and the degree to which it is bleached. Kraft pulp, a type of chemical pulp, is produced through a sulphate chemical process in which lignin, the component of wood which binds individual fibers, is dissolved in a chemical reaction. Chemically prepared pulp allows the wood’s fiber to retain its length and flexibility, resulting in stronger paper products. Kraft pulp can be bleached to increase its brightness. Kraft pulp is noted for its strength, brightness and absorption properties and is used to produce a variety of products, including lightweight publication grades of paper, tissues and paper relatedpaper-related products.The selling price of kraft pulp depends in part on the fiber used in the production process. primary speciesmain types of wood used as fiber:bleached kraft pulp, being softwood kraft made from coniferous trees and hardwood.hardwood kraft made from deciduous trees. Softwood species generally have long, flexible fibers which add strength to paper while fibers from species of hardwood contain shorter fibers which lend bulk and opacity. Generally, prices for softwood pulp are higher than for hardwood pulp. Most uses of market kraft pulp, including fine printing papers, coateduncoated magazine papers and various tissue products, utilize a mix of softwood and hardwood grades to optimize production and product qualities. In recent years, production of hardwood pulp, based on fast growing plantation fiber primarily from Asia and South America, has increased much more rapidly than that of softwood grades that have longer growth cycles. As a result of the growth in supply and lower costs, kraft pulp customers have substituted some of the pulp content in their products to hardwood pulp. Counteracting customers’ increased proportionate usage of hardwood pulp has been the requirement for strength characteristics in finished goods. Paper and tissue makers focus on higher machine speeds and lower basis weights for publishing papers which also require the strength characteristics of softwood pulp. We believe that the ability of kraft pulp users to continue to further substitute hardwood for softwood pulp is limited by such requirements.8

Most paper users of market kraft pulp use a mix of softwood and hardwood grades to optimize production and product qualities. In 2012, market kraft pulp consumption was approximately 53% hardwood kraft, 45% softwood kraft and the remainder comprised of sulphite and unbleached pulp. Over the last several years, production of hardwood pulp, based on fast growing plantation fiber primarily from Asia and South America, has increased much more rapidly than that of softwood grades that have longer growth cycles. Hardwood kraft generally has a cost advantage over softwood kraft as a result of lower fiber costs, higher wood yields and, for newer hardwood mills, economies of scale. As a result of this growth in supply and lower costs, kraft pulp customers have substituted some of the pulp content in their products to hardwood pulp. Counteracting customers’ increased usage of hardwood pulp has been the requirement for strength characteristics in finished goods. Paper and tissue makers focus on larger paper machines with higher speeds and lower basis weights for certain papers which require the strength characteristics of softwood pulp. Additionally, where paper products are lightweight or specialized, like direct mail, magazine paper or premium tissue, or where strength or absorbency are important, softwood kraft forms a significant proportion of the fiber used. As a result, we believe that the ability of kraft pulp users to continue to further substitute hardwood for softwood pulp is limited by such requirements.

Markets

We believe that over 125130 million ADMTs of kraftchemical pulp are converted annually into printing and writing papers, tissues, cartonboardscarton boards and other white grades of paper and paperboard around the world. We also believe that approximatelyover one third of this pulp is sold on the open market as market pulp, while the remainder is produced for internal purposes by integrated paper and paperboard manufacturers.

Demand for kraft pulp is cyclical in nature and is generally related to global and regional levels of economic activity. In 2008, overall global demand for all kraft pulp types, including softwood, was negatively impacted by the weak global economic conditions and global financial and credit turmoil the world began to experience in the second half of that year and which continued into the first half of 2009. Significant producer shutdowns and curtailments, along with strong demand from China, resulted in an improved supply-demand balance and increasedimproved prices in the second half of 2009.

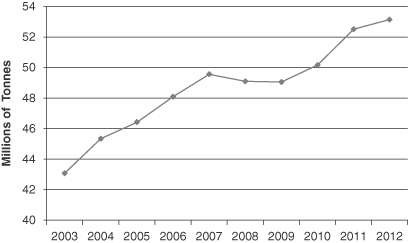

Between 19982003 and 20082012, worldwide demand for softwoodchemical market pulp grew at an average rate of approximately 2.3%2.0% annually. The following chart illustrates the global demand for chemical market pulp for the periods indicated:

Estimated Global Chemical Market Pulp Demand

Source: PPPC 2012

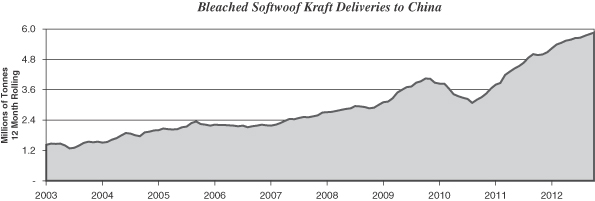

Since 2007, demand for softwood market pulp has grown in the emerging markets of Asia, Eastern Europe and Latin America. China in particular has experienced substantial growth and its demand forimports of softwood market pulp grew by approximately 12.2%14% per annum between 2003 and 2008.2012. China now accounts for approximately 23%26% of global bleached softwood kraft market pulp demand, compared to only 10.2%10% in 2003. Western Europe currently accounts for approximately 28%27% of global bleached softwood kraft market pulp demand. Within Europe, Eastern Europedemand, compared to approximately 38% in 2003.

The following chart sets forth industry-wide bleached softwood kraft delivery levels to China between 2003 to the present:

Source: PPPC 2012

Growth in NBSK pulp demand in China and other emerging markets has, experienced significantto a large extent, been driven by increased demand from tissue producers, as a result of economic growth with the region’sand rising income levels and living standards in such markets. These factors generally contribute to a greater demand for softwood market pulp increasingpersonal hygiene products in such regions. In China alone, two large tissue producers have publicly announced plans to add a total of 50 tissue paper machines at various sites by the end of 2015 to increase their annual tissue capacity by approximately 6% between 20072.3 million ADMTs. At this time there can be no assurance as to when and 2009.

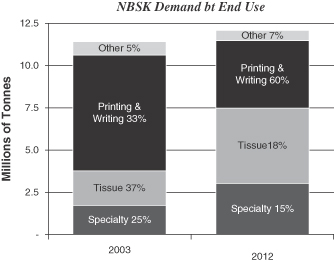

This has also led to an overall shift in demand for NBSK pulp, as demand from tissue producers has increased, while demand from printing and writing end uses has decreased. Between 2003 and 2012, NBSK pulp demand for tissue production increased by approximately 106% which has more than offset the secular decline in demand in printing and writing papers resulting from the rapid growth of digital media.

The following chart compares NBSK pulp demand by end use in each of 2003 and 2012:

Source: Brian McClay 2012 (end use) / Hawkins Wright 2012 (total demand)

A measure of demand for kraft pulp is the ratio obtained by dividing the worldwide demand of kraft pulp by the worldwide capacity for the production of kraft pulp, or the “demand/capacity ratio”. An increase in this ratio generally occurs when there is an increase in global and regional levels of economic activity. An increase in this ratio also generally indicates greater demand as consumption increases, which often results in rising kraft pulp prices and a reduction of inventories by producers and buyers. As prices continue to rise, producers continue to run at higher operating rates. However, an adverse change in global and regional levels of economic activity generally negatively affects demand for kraft pulp, often leading buyers to reduce their purchases and relyingrely on existing pulp inventories. As a result, producers run at lower operating rates by taking downtime to limit thebuild-up of their own inventories. The demand/capacity ratio for softwood kraft pulp was approximately 93%, 92% and 93% in 2012, 2011 and 2010, respectively.

A significant factor affecting our market is the amount of closures of old, high-cost capacity. Over the last seven years, several mills in North America, Finland, Sweden and Africa were indefinitely closed. Although some capacity was restarted in late 2009 approximately 89%and 2010 in 2008response to very high NBSK pulp prices, we believe the net effect of these closures and approximately 94%restarts is an estimated 3.4 million tonnes of capacity removed from the market since 2006. Further, in 2007.

We estimate that there were approximately 2.2 million ADMTsare aware of NBSK capacity of indefinite and permanent closures during 2009. Some of such capacity closures may potentially be restarted during periods of strong pulp markets and prices.

CompetitionNBSK Pulp Pricing

Pulp prices are highly cyclical. In general, kraft pulp is a globally traded commodity. Pricing and demand are influenced by the balance between supply and demand, as affected by global macroeconomic conditions, changes in consumption and capacity, the level of customer and producer inventories and fluctuations in exchange rates. As Northern Europe has historically been the world’s largest market and NBSK is the premium grade, the European NBSK market pricing is generally used as a benchmark price by the industry.

The average annual European list prices for NBSK pulp since 2000 have ranged from a low of approximately $447 per ADMT to a high of $1,030 per ADMT.

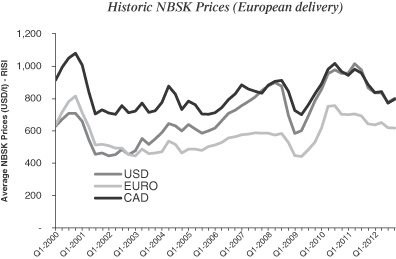

The following chart sets out the changes in list prices for NBSK pulp in Europe, as stated in U.S. dollars, Canadian dollars and Euros for the periods indicated:

Source: RISI pricing report.

In 2006, pulp prices increased steadily from approximately $600 per ADMT in Europe to $870 per ADMT at the end of 2007. These price increases resulted from increased demand and the closure of several pulp mills, particularly in North America, which reduced NBSK capacity. In the second half of 2008, list prices for NBSK pulp decreased markedly due to weak global economic conditions. As a result, list prices for NBSK pulp in Europe decreased from $900 per ADMT in mid-2008 to $635 per ADMT at the end of the year. Such pulp price weakness continued into early 2009, though commencing in mid-2009, pulp markets began to strengthen which led to improved prices. Strong demand from China, capacity closures and historically low global inventories for bleached softwood kraft pulp helped support upward price momentum. During the second half of 2009, several price increases raised European list prices by a total of $170 per ADMT to $800 per ADMT by year end. Such price increases were partially offset by the continued weakening of the U.S. dollar versus the Euro and Canadian dollar during the period.

In 2010, several increases lifted prices to record levels in the middle of the year and at the end of 2010 list prices were near historic highs of $950, $960 and $840 per ADMT in Europe, North America and China, respectively. Pulp prices remained strong in 2011, reaching record levels of $1,030 per ADMT in Europe and $1,035 and $920 per ADMT in North America and China, respectively. However, uncertainty concerning the economic situation in Europe, along with credit tightening in China in the last part of the year, caused pulp prices to drop to $825 per ADMT in Europe and $890 and $670 per ADMT in North America and China, respectively, by the end of the year. Economic uncertainty in Europe and China continued to dampen demand and NBSK pulp prices, which remained generally weak in 2012. Year-end list prices were approximately $810, $870 and $655 per ADMT in Europe, North America and China, respectively.

A producer’s net sales realizations are list prices, net of customer discounts, commissions and other selling concessions. While there are differences between NBSK list prices in Europe, North America and Asia, European prices are generally regarded as the global benchmark and pricing in other regions tends to follow European trends. The nature of the pricing structure in Asia is different in that, while quoted list prices tend to be lower than Europe, customer discounts and commissions tend to be lower resulting in net sales realizations that are generally similar to other markets.

The majority of market NBSK pulp is produced and sold by Canadian and Northern European producers, while the price of NBSK pulp is generally quoted in U.S. dollars. As a result, NBSK pricing is affected by fluctuations in the currency exchange rates for the U.S. dollar versus the Canadian dollar, the Euro and local currencies. NBSK pulp price increases during 2006, 2007 and the first half of 2008 were in large part offset by the weakening of the U.S. dollar. Similarly, the strengthening of the U.S. dollar against the Canadian dollar and the Euro towards the end of 2008 helped partially offset pulp price decreases caused by the deterioration in global economic conditions. The overall strengthening of the U.S. dollar against the Euro in 2010, and in particular in the first half of 2010, improved the operating margins of our German mills. Although the U.S. dollar weakened against the Euro for most of 2011, it strengthened at the end of 2011. Overall, the U.S. dollar was 8% stronger against the Euro in 2012 compared to 2011, partially offsetting pulp price decreases in 2012.

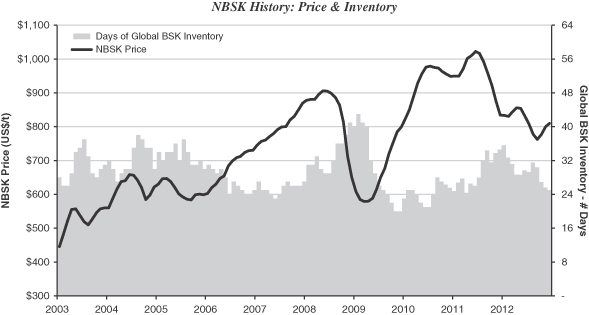

The global supply and demand balance for NBSK pulp is a key determinant in pulp pricing. The following chart sets forth changes in FOEX PIX index prices for NBSK pulp and global bleached softwood kraft inventory levels between 2003 to 2012:

Source: Factset FOEX PIX Pulp NBSK (prices) PPPC (inventories).

Competition

Pulp markets are large and highly competitive. Producers ranging from small independent manufacturers to large integrated companies produce pulp worldwide. Our pulp and customer services compete with similar products manufactured and distributed by others. While many factors influence our competitive position, particularly in weak economic times, a key factor is price. Other factors include service, quality and convenience of location. Some of our competitors are larger than we are in certain markets and have substantially greater financial resources. These resources may afford those competitors more purchasing power, increased financial flexibility, more capital resources for expansion and improvement and enable them to compete more effectively. Our key NBSK pulp competitors are principally located in Northern Europe and Canada.

9

10

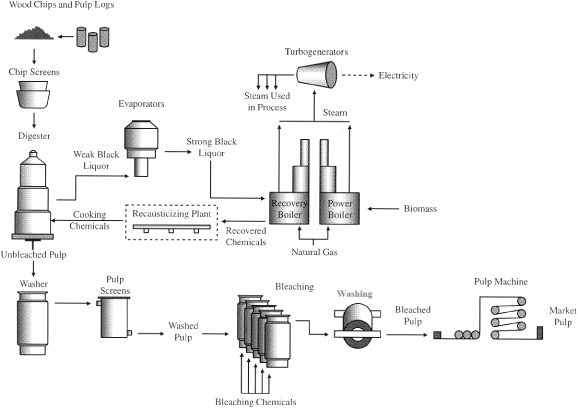

The following diagram provides a simplified description of the kraft pulp manufacturing process at our pulp mills:

11

In the initial processing stage, wood chips are screened to remove oversized chips and sawdust and are conveyed to a pressurized digester where they are heated and cooked with chemicals. This occurs in a continuous process at the Celgar and Rosenthal mills and in a batch process at the Stendal mill. This process softens and eventually dissolves the phenolic material called lignin that binds the fibers to each other in the wood.

Cooked pulp flows out of the digester and is washed and screened to remove most of the residual spent chemicals called black liquor, and partially cooked wood chips. The pulp then undergoes a series of bleaching stages where the brightness of the pulp is gradually increased. Finally, the bleached pulp is sent to the pulp machine where it is dried to achieve a dryness level of more than 90%. The pulp is then ready to be baled for shipment to customers.

A significant feature of kraft pulping technology is the recovery system, whereby chemicals used in the cooking process are captured and extracted for re-use, which reduces chemical costs and improves environmental performance. During the cooking stage, dissolved organic wood materials and used chemicals, collectively known as black liquor, are extracted from the digester. After undergoing an evaporation process, black liquor is burned in a recovery boiler. The chemical compounds of the black liquor are collected from the recovery boiler and are reconstituted into cooking chemicals used in the digesting stage through additional processing in the recausticizing plant.

The heat produced by the recovery boiler is used to generate high-pressure steam. Additional steam is generated by a power boiler through the combustion of biomass consisting of bark and other wood residuesresiduals from sawmills and our woodrooms and residue generated by the effluent treatment system. Additionally, during times of upset, we may use natural gas to generate steam. The steam produced by the recovery and power boilers is used to power a turbine generator to generate electricity, as well as to provide heat for the digesting and pulp drying processes.

We manufacture and sell NBSK pulp produced from The following table sets out our pulp production capacity and actual production by mill for the periods indicated: Rosenthal Celgar Stendal Total pulp production Rosenthal Mill.The Rosenthal mill is situated on a 220 acre site in the town of Blankenstein in the state of Thüringia, approximately 300 kilometers south of Berlin. The Saale river flows through the site of the mill. In late 1999, we completed a major capital project which converted the Rosenthal mill to the production of kraft pulp. It is a single line mill with a current annual production capacity of approximately 355,000 ADMTs of kraft pulp. The mill is self-sufficient in steam and electrical power. Some excess electrical power which is constantly generated is sold to the regional power grid. The facilities at the mill include: an approximately 315,000 square feet fiber storage area; debarking and chipping facilities for pulp logs; an approximately 300,000 square feet roundwood yard; a fiber line, which includes a Kamyr continuous digester and bleaching facilities; a pulp machine, which includes a dryer, a cutter and a baling line; an approximately 63,000 square feet finished goods storage area; a chemical recovery line, which includes a recovery boiler, evaporation plant, recausticizing plant and lime kiln; a fresh water plant; a wastewater treatment plant; and a power station with a turbine capable of producing 57 MW of electric power from steam produced by the recovery boiler and a power boiler. The kraft pulp produced at the Rosenthal mill is a long-fibered softwood pulp produced by a sulphate cooking process and manufactured primarily from wood chips and pulp logs. A number of factors beyond economic supply and demand have an impact on the market for chemical pulp, including requirements for pulp bleached without any chlorine compounds or without the use of chlorine gas. The Rosenthal mill has the capability of producing both “totally chlorine free” and “elemental chlorine free” pulp. Totally chlorine free pulp is bleached to a high brightness using oxygen, ozone and hydrogen peroxide as bleaching agents, whereas elemental chlorine free pulp is produced by substituting chlorine dioxide for chlorine gas in the bleaching process. This substitution virtually eliminates complex chloro-organic compounds from mill effluent. Kraft pulp is valued for its reinforcing role in mechanical printing papers and is sought after by producers of paper for the publishing industry, primarily for magazines and advertising materials. Kraft pulp is also an important ingredient for tissue manufacturing, and tissue demand tends to increase with living standards in developing countries. Kraft pulp produced for reinforcement fibers is considered the highest grade of kraft pulp and generally obtains the highest price. The Rosenthal mill produces pulp for reinforcement fibers to the specifications of certain of our customers. We believe that a number of our customers consider us their supplier of choice. Stendal Mill.The Stendal mill is situated on a 200 acre site owned by Stendal that is part of a larger 1,250 acre industrial park near the town of Stendal in the state of Saxony-Anhalt, approximately 300 kilometers north of the Rosenthal mill and 130 kilometers west of Berlin. The mill is adjacent to the Elbe river and has access to harbor facilities for water transportation. The mill is a single line mill with a current annual design production capacity of approximately 650,000 ADMTs of kraft pulp. The Stendal mill is self-sufficient in steam and electrical power. Some excess electrical power which is constantly being generated is sold to the regional power grid. The facilities at the an approximately 920,000 square feet fiber storage area; debarking and chipping facilities for pulp logs; a fiber line, which includes ten SuperBatch™ digesters and bleaching facilities; a pulp machine, which includes a dryer, a cutter and a baling line; an approximately 108,000 square feet finished goods storage area; a chemical recovery line, which includes a recovery boiler, evaporation plant, recausticizing plant and lime kiln; a fresh water plant; a wastewater treatment plant; and a power station with a turbine capable of producing approximately 102 MW of electric power from steam produced by the recovery boiler and a power boiler. Upon completion of Project Blue Mill, the mill will have two turbines and is expected to be able to produce 142 MW of electrical power. The kraft pulp produced at the Stendal mill is of a slightly different grade than the pulp produced at the Rosenthal mill as the mix of softwood fiber used is slightly different. This results in a complementary product more suitable for different end uses. The Stendal mill is capable of producing both totally chlorine free and elemental chlorine free pulp. Celgar Mill.The Celgar mill is situated on a 400 acre site near the city of Castlegar, British Columbia. The mill is located on the south bank of the Columbia River, approximately 600 kilometers east of the port city of Vancouver, British Columbia, and approximately 32 kilometers north of the Canada-U.S. border. The city of Seattle, Washington is approximately 650 kilometers southwest of Castlegar. It is a single line mill with a current annual production capacity of approximately 520,000 ADMTs of kraft pulp. Internal power generating capacity resulting from the completion of the Celgar Energy Project in 2010 enables the Celgar mill to be self-sufficient in electrical power and to sell surplus electricity. The facilities at the chip storage facilities with a capacity of 200,000 cubic meters of chips; a woodroom containing debarking and chipping equipment for pulp logs; a fiber line, which includes a dual vessel hydraulic digester, two stage oxygen delignification and a four stage bleach plant; two pulp machines, which each include a dryer, a cutter and a baling line; a chemical recovery line, which includes a recovery boiler, evaporation plant, recausticizing area and wastewater treatment system; and two turbines and generators capable of producing approximately 48 MW and 52 MW, respectively, of electric power from steam produced by the recovery boiler and a power boiler. The Celgar mill produces high-quality kraft pulp that is made from a unique blend of slow growing/long-fiber Western Canadian tree species. It is used in the manufacture of high-quality paper and tissue products. We believe the Celgar mill’s pulp is known for its excellent product characteristics, including tensile strength, wet strength and brightness. The Celgar mill is a long-established supplier to paper and tissue producers in Asia.wood chipswoodchips and pulp logs.logs at our three mills. Annual

Production

Capacity(1) Year Ended December 31, 2012 2011 2010 Pulp Production by Mill: (ADMTs) 355,000 337,959 344,389 324,194 520,000 490,018 488,007 502,107 650,000 640,298 621,281 599,985 1,525,000 1,468,275 1,453,677 1,426,286 (1) Capacity is the rated capacity of the plants for the year ended December 31, 2012. For more information aboutRosenthal mill see “Item 2 — Properties”.include: For more information aboutStendalCelgar mill see “Item 2 — Properties”.include: For more information about the facilities at the Celgar mill, see “Item 2 — Properties”.12

Our pulp mills are large scale bio-refineries that, produce bothin addition to pulp, andalso produce surplus “carbon neutral” or “green” energy. As part of the pulp production process our mills generate “green” energy using carbon-neutral biofuels such as black liquor and wood waste. Through the incineration of black liquorbiofuels in the recovery and power boilers, our mills produce sufficient steam to cover all of our steam requirements and generallyallow us to produce surplus energyelectricity which we sell to third party utilities.

Our surplus energy sales provide our mills with a new stable revenue source unrelated to pulp prices. Since our energy production is a by-product of our pulp production process, there are minimal incremental costs and our surplus energy sales are highly profitable. We believe that this revenue source from power sales gives our mills a competitive advantage over other older mills which do not have the equipment or capacity to produce and/or sell surplus power in a meaningful amount.

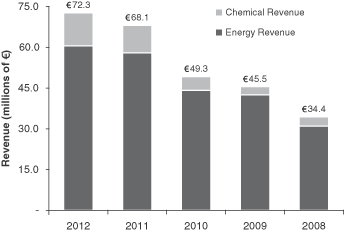

In 2012 and 2011, we sold 478,674710,241 MWh and 456,059652,113 MWh of surplus energy, respectively, and recorded revenues of €42.5€60.6 million and €31.0€58.0 million, respectively, from such energy sales.

The following table sets out our electricity generation and surplus energyelectricity sales for the last threefive years:

The following chart sets forth our consolidated revenues from electricity and Exports

Energy Project is completed, and based upon the current production levels of our mills, we currently expect to generate and sell between approximately 700,000 MWh and 750,000 MWh of surplus renewable energy per annum.

German Mills

Our Rosenthal and Stendal mills have participatedparticipate in a program established pursuant to Germany’sthe Renewable Energy Resources Act, or “Renewable Energy Act”. The Renewable Energy in Germany. Such Act, in existence since 2000, requires that public electric utilities give priority to electricity produced from renewable energy resourcessources by independent power producers and pay a fixed tariff for a period of 20 years. Previously, this legislation was only applicable to installments with a capacity of 20MW or less, effectively excluding our Rosenthal and Stendal mills. Subsequent amendments to the Renewable Energy Act have removed this restriction. Under the program, our German mills now sell their surplus energy to the local electricity grid at the rates stipulated by the Renewable Energy Act for biomass energy.

Since 2005, our German mills have also benefited from the sale of emission allowances under the European Union carbon emissions trading scheme,Carbon Emissions Trading Scheme, referred to as “EU ETS”. However, our participationeligibility for special tariffs under the Renewable Energy Act may in the future reducehas reduced the amount of emissions allowances granted to our German mills under the EU ETS.

13

In 2012, we commenced Project Blue Mill which is designed to increase the Stendal mill’s annual pulp production by 30,000 ADMTs and initially produce an additional 109,000 MWh of surplus renewable electricity. Project Blue Mill is eligible for €12.0 million of non-refundable government grants and the Stendal mill arranged a €17.0 million secured term debt facility, amortized over five-years, of which 80% will be government guaranteed. The balance of Project Blue Mill will be funded through operating cash flow of the Stendal mill and up to an aggregate of €6.5 million in pro rata shareholder loans from Mercer Inc. and its noncontrolling shareholder.

In 2012, we generated €11.6 million from the sale of tall oil, a by-product of our production process.

Celgar Mill

In mid-2008September 2010, we commencedcompleted the Celgar Energy Project at the Celgar mill to increase and optimize the mill’s production of “green” energy and optimize its power generation capacity.energy. The project includesincluded the installation of a 48 MW condensing turbine, which is expected to bringbrought the mill’s installed generating capacity up to 100 MW, and upgrades to the mill’s bark boiler and steam consuming facilities. In January 2009 theThe Celgar mill finalizedhas an electricity purchase agreement,Electricity Purchase Agreement with British Columbia Hydro and

Power Authority, referred to as the “EPA”“B.C. Hydro”, with B.C. Hydro, British Columbia’s primary public utility provider, for the sale of power generated from the Celgar Energy Project.such project. Under the EPA,Electricity Purchase Agreement, the Celgar mill is setagreed to supply a minimum of approximately 238,000 MWh of surplus electrical energy annually to the utility over a ten-year term.

In 2012, we entered into a non-repayable contribution agreement with NRCan whereby NRCan agreed to provide approximately C$40 million (€26.7 million) in grants towards certain costs associated with the Celgar Energy Project. In December 2009, we received an initial grantsold roughly 171,994 MWh of C$12.9 million from NRCan which was used to pay outstanding Celgar Energy Project costs.

and/or sell surplus power in a meaningful amount.

Our major costs of production are fiber, labor, fiber, energy and chemicals. Fiber, comprised of wood chips and pulp logs, is our most significant operating expense. Given the significance of fiber to our total operating expenses and our limited ability to control its costs, compared with our other operating costs, volatility in fiber costs can materially affect our margins and results of operations.

LaborFiber

Our mills are situated in regions which generally provide a relatively stable supply of fiber. The fiber consumed by our mills consists of wood chips produced by sawmills as a by-product of the sawmillingsawmill process and pulp logs. Wood chips are small pieces of wood used to make pulp and are either wood residuals from the sawmillingsawmill process or logs or pulp logs chipped especially for this purpose. Pulp logs consist of lower quality logs not used in the production of lumber. Wood chips and pulp logs are cyclical in both price and supply.

Generally, the cost of wood chips and pulp logs areis primarily affected by the supply and demand for lumber. Additionally, regional factors such as harvesting levels and weather conditions can also have a material effect on the supply, demand and price for fiber.

In Germany, since 2006, the price and supply of wood chips has been affected by increasing demand from alternative or renewable energy producers and government initiatives for carbon neutral energy. Declining energy

14

In April 2008, the Russian government raised tariffs on the export of sawmill and pulp wood to 25% from the 20% effective since July 2007.. A further increase to 80%, was initially scheduled for January 1, 2009 has beenbut was officially deferred twice now until late 2010. If and when implemented,Russia’s export tariff remained unchanged at 25% in 2011. In August 2012, Russia entered the additional tariff increase is expectedWorld Trade Organization, or “WTO”, and, due to reduceinclusion in the WTO, Russia has lowered its export of Russian woodtariffs to Europe, in particular to Scandinavian producers who importbetween 13% and 15%, which we believe has had a significant amount of their wood from Russia. This may put upward pressurepositive impact on pricing as such producers try to replace these volumes from other regions.

Offsetting some of the increases in demand for wood fiber have been initiatives in which we and other producers are participating to increase harvest levels in Germany, particularly from small private forest owners. We believe that Germany has the highest availability of softwood forests in Europe suitable for harvesting and manufacturing. PrivateWe believe private ownership of such forests is approximately 50%. Many of these forest ownership stakes are very small and have been harvested at rates much lower than their rate of growth. In early 2009, forest owners began to reduce their harvesting rates in response to slowing economies in Germany and elsewhere and the related weaker demand for pulp logs, forest owners reduced their harvesting rates slightly. While prices for pulp logs in Germany remained relatively low in the first half of 2009, further reductions in harvesting rates ledleading to an undersupply which resulted in increased fiber prices later in theduring that year. These same supply issues are expectedFiber prices continued to continue to cause pulp log prices to ease upwards in the early partincrease through most of 2010 and we expect this trend2011, driven by a weak lumber market, lower harvesting in central Germany and increased demand for wood from the energy sector for heating and other bio-energy purposes.

In 2012, fiber prices in Germany decreased by approximately 10%, mainly due to continue throughreduced demand for fiber from the first halfEuropean particle board industry and other regional residual fiber users and the start of 2010.

We believe we are the largest consumer of wood chips and pulp logs in Germany and often provide the best long-term economic outlet for the sale of wood chips in Eastern Germany. We coordinate the wood procurement activities for our German mills to reduce overall personnel and administrative costs, provide greater purchasing power and coordinate buying and trading activities. This coordination and integration of fiber flows also allows us to optimize transportation costs, and the species and fiber mix for both mills.

In 2009,2012, the Rosenthal mill consumed approximately 1.61.7 million cubic meters of fiber. Approximately 63% of such consumption was in the form of sawmill wood chips and approximately 37% was in the form of pulp logs. The wood chips for the Rosenthal mill are sourced from approximately 3227 sawmills located primarily in the states of Bavaria, Baden-Württemberg and Thüringia and are within a 300 kilometer radius of the Rosenthal mill. Within this radius, the Rosenthal mill is the largest consumer of wood chips. Given its location and size, the Rosenthal mill is often the best economic outlet for the sale of wood chips in the area. Approximately 81%75% of the fiber consumed by the Rosenthal mill is spruce and the remainder is pine. While fiber costs and supply are subject to cyclical changes largely in the sawmill industry, we expect that we will be able to continue to obtain an adequate supply of fiber on reasonably satisfactory terms for the Rosenthal mill due to its location and our long-term relationships with suppliers. We have not historically experienced any significant fiber supply interruptions at the Rosenthal mill.

Wood chips for the Rosenthal mill are normally sourced from sawmills under one year or quarterly supply contracts with fixed volumes, which providequarterly adjustments for price adjustments.market pricing. Substantially all of our chip supply is sourced from suppliers with which we have a long-standing relationship. We generally enter into annual contracts with such suppliers. Pulp logs are sourced from the state forest agencies in Thüringia, Saxony and Bavaria on a contract basis and partly from private holders on the same basis as wood chips. Like the wood chip supply arrangements, these contracts tend to be of less thanfor one-year terms with quarterly adjustments for market pricing. We organize the harvestingtransportation of pulp logs sourced from the state agencies in Thüringia, Saxony and Bavaria after discussions with the agencies regarding the quantities of pulp logs that we require.

In 2009,2012, the Stendal mill consumed approximately 3.13.3 million cubic meters of fiber. Approximately 20%24% of such fiber was in the form of sawmill wood chips and approximately 80%76% in the form of pulp logs. The core wood supply region for the Stendal mill includes most of the Northern part of Germany within an approximate 300 kilometer radius of the mill. We also purchase wood chips from Southwestern and Southern Germany. The fiber base in the wood supply area for the Stendal mill consisted of approximately 53%66% pine and 47%34% spruce

15

In 2009,2012, the Celgar mill consumed approximately 2.6 million cubic meters of fiber. Approximately 39%69% of such fiber was in the form of sawmill wood chips and the remaining 61%31% came from pulp logs processed through its woodroom or chipped by a third party. The source of fiber at the mill is characterized by a mixture of species (whitewoods and cedar) and the mill sources fiber from a number of Canadian and U.S. suppliers.

As a result of the cyclical decline in sawmill chip supply resulting from lower lumber production in British Columbia commencing in 2008, the Celgar mill increased its U.S. purchases of fiber, diversified its suppliers and, where possible, increased chip production through third party field chipping contracts and existing sawmill suppliers. In 2009, the Celgar mill upgraded its woodroom which, along with subsequent improvements during the year, increased its capacity to be able to process up to 50% of the mill’s fiber needs. The woodroom upgrades also increased the mill’s ability to process small diameter logs and facilitate an efficient flow of fiber. This has increased the overall volume of fiber being processed and helped mitigate increases in the price of fiber.

The Celgar mill has access to over 30approximately 25 different suppliers from Canada and the U.S., representing approximately 74%75% of its total annual fiber requirements. The Celgar mill’s woodroom suppliessupplied the remaining chips to meet25% of the Celgar mill’s fiber requirements.requirements in 2012. Chips are purchased in Canada and the U.S. in accordance with chip purchase agreements. Generally, pricing is reviewed and adjusted periodically to reflect market prices. Several One

of the longer-term contracts areis a so-called “evergreen” agreements,agreement, where the contract remains in effect until one of the parties elects to terminate. Termination requires a minimum of two and, in some cases, five years’ written notice. Certain non-evergreen long-term agreements provideAll other contracts are generally for renewal negotiations prior to expiry.

To secure the volume of pulp logs required by theits woodroom, the Celgar mill has entered into annual pulp log supply agreements, which can range from three-month to one-year terms, with a number of different suppliers, many of whom are also contract chip suppliers to the mill. All of the pulp log agreements can be terminated by either party for any reason, upon seven days’ written notice.

In 2012, our fiber costs at the Celgar mill were approximately 6% higher than in 2011, as a result of the impact of foreign exchange changes more than offsetting improved availability of wood chips.

EnergyLabor

Our labor costs are generally steady, with small overall increases due to inflation in wages and health care costs. Over the last three years, we have been able to largely offset such increases by increasing our efficiencies and production and streamlining operations.

Energy

Our energy is primarily generated from renewable carbon neutral sources, such as black liquor and wood waste. Our mills produce all of our steam requirements and generally generate excess energy which we sell to third party utilities. In 2009,2012, we generated 1,445,3321,704,058 MWh and we sold 478,674710,241 MWh of surplus energy. Once completed, the Celgar Energy Project is expected to generate a minimum of approximately 238,000 MWh of electricity. See also “- “—Generation and Sales of ‘Green’ Energy and Chemicals at our Mills”. We utilize fossil fuels, such as natural gas, in limited circumstances includingprimarily in our lime kilns and we use a limited amount forstart-up and shutdown operations. Additionally, from time to time, mill process disruptions occur and we consume small quantities of purchased electricity and fossil fuels to maintain operations. As a result, all of our mills are subject to fluctuations in the prices for fossil fuels.

16

Chemicals

Consolidated cash production costs per CashtonneADMT for our pulp mills are set out in the following table for the periods indicated: Years Ended December 31, 2009 2008 2007 (per ADMT) Fiber € 207 € 247 € 247 Labor 37 36 43 Chemicals 43 44 39 Energy 13 21 18 Other 42 43 46 Total cash production costs(1) € 342 € 391 € 393

| Year Ended December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

Cash Production Costs | (per ADMT) | |||||||||||

Fiber | € | 257 | € | 275 | € | 256 | ||||||

Labor | 47 | 43 | 42 | |||||||||

Chemicals | 49 | 46 | 41 | |||||||||

Energy | 19 | 20 | 20 | |||||||||

Other | 46 | 56 | 54 | |||||||||

|

|

|

|

|

| |||||||

Total cash production costs(1) | € | 418 | € | 440 | € | 413 | ||||||

|

|

|

|

|

| |||||||

| (1) | Cost of production per ADMT produced excluding depreciation. |

Our pulpThe distribution of our sales revenues by geographic area are set out in the following table for the periods indicated: Years Ended December 31, 2009 2008 2007 (in thousands) Germany € 154,323 € 198,340 € 198,575 China 146,613 131,412 159,553 Italy 44,616 56,487 50,177 Other European Union countries(1) 107,276 133,621 136,434 Other Asia 38,946 65,192 58,242 North America 68,213 78,718 66,229 Other countries 8,312 17,146 26,639 Total(2) € 568,299 € 680,916 € 695,849

| Year Ended December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

Revenues by Geographic Area | (in thousands) | |||||||||||

China | € | 230,007 | € | 234,654 | € | 196,022 | ||||||

Germany | 228,402 | 256,563 | 278,348 | |||||||||

Other European Union countries(1) | 168,616 | 175,937 | 182,246 | |||||||||

North America | 47,513 | 69,345 | 92,628 | |||||||||

Italy | 43,112 | 51,509 | 56,301 | |||||||||

Other Asia | 33,197 | 30,872 | 37,561 | |||||||||

Other countries | 1,632 | 823 | 1,503 | |||||||||

|

|

|

|

|

| |||||||

Total(2) | € | 752,479 | € | 819,703 | € | 844,609 | ||||||

|

|

|

|

|

| |||||||

| (1) | Not including Germany or Italy; includes new entrant countries to the European Union from their time of admission. |

| (2) | Excluding intercompany |

17

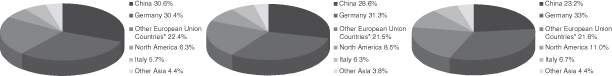

|  |  |

Year Ended December 31, 2012 | Year Ended December 31, 2011 | Year Ended December 31, 2010 | ||

| ||||

| * | Not including Germany or Italy; includes new entrant countries to the European Union from their time of admission. |

The distribution of our pulp sales by end customer are set out in the following table for the periods indicated:

| Year Ended December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| (in thousands of ADMTs) | ||||||||||||

Tissue | 576 | 602 | 610 | |||||||||

Specialty | 214 | 222 | 180 | |||||||||

Printing & Writing | 639 | 563 | 597 | |||||||||

Other | 44 | 41 | 42 | |||||||||

Our global sales and marketing group is responsible for conducting all sales and marketing of the pulp produced at our mills and currently has approximately 19 employees engaged full time in such activities. This group largely handles all European and North American sales directly. Sales to Asia are made directly or through commission agents overseen by our sales group. The global sales and marketing group handles sales to overapproximately 200 customers. We coordinate and integrate the sales and marketing activities of our German mills to realize on a number of synergies between them. These include reduced overall administrative and personnel costs and coordinated selling, marketing and transportation activities. We also coordinate sales from the Celgar mill with our German mills on a global basis, thereby providing our larger customers with seamless service across all major geographies. In marketing our pulp, we

seek to establish long-term relationships by providing a competitively priced, high-quality, consistent product and excellent service. In accordance with customary practice, we maintain long-standing relationships with our customers pursuant to which we periodically reach agreements on specific volumes and prices.

Our pulp sales are on customary industry terms. At December 31, 2009,2012, we had no material payment delinquencies. In 2009, 2008 and 2007,2012, one customer accounted for 11% of our pulp sales. In 2011, no single customer accounted for more than 10% of our pulp sales. OurIn 2010, one customer which purchased for several of its mills accounted for 11% of pulp sales. We do not believe our pulp sales are not dependent upon the activities of any single customer.

Approximately 54%, 58% and 55% of our sales were to tissue and specialty paper product manufacturers for the years ended December 31, 2012, 2011 and 2010, respectively. The balance of our sales for such periods was to other paper product manufacturers. Over the last five years, our sales to tissue and specialty paper product manufacturers have increased by over 15%. Generally such customers are not as sensitive to cyclical declines in demand caused by downturns in economic activity.

We transport our NBSK pulp generally by truck, rail and ocean carriers through third-party carriers. Our carrier contracts are generally from one to two years.

Our German mills are currently the only market kraft pulp producers in Germany, which is the largest import market for kraft pulp in Europe. We therefore have a competitive transportation cost advantage compared to NorscanCanadian and Northern European pulp producers when shipping to customers in Europe. Due to the location of our German mills, we are able to deliver pulp to many of our customers primarily by truck. Most trucks that deliver goods into Eastern Germany generally do not also haul goods out ofhave significant backhaul opportunities as the region as Eastern Germany is primarily an importer of goods. We are therefore frequently able to obtain relatively low back haulbackhaul freight rates for the delivery of our products to many of our customers. Since many of our customers are located within a 500 kilometer radius of our German mills, we can generally supply pulp to customers of these mills faster than our competitors because of the short distances between the mills and our customers.

The Celgar mill’s pulp is transported to customers by rail, truck and ocean carrier using strategically located third party warehouses to ensure timely delivery. The majority of Celgar’s pulp for overseas markets is initially delivered primarily by rail to the Port of Vancouver for shipment overseas by ocean carrier. Based in Western Canada, the Celgar mill is well positioned to service Asian customers. The majority of the Celgar mill’s pulp for domestic markets is shipped by rail to third party warehouses in the U.S. or directly to the customer.

In each of the three years ended December 31, 2009,2012, 2011 and 2010, outbound transportation costs comprised approximately 51%, 47% and 44%9% of our total consolidated cost of sales. Generally, in recent years, our transportation costs have increased due to increases in fuel costs and lower shipping capacity. As a result, we have taken initiatives to target sales were to tissue and specialty paper product manufacturers. The balance of our salesthe most “freight logical” customers for such periods was to other paper product manufacturers. Sales to tissue and specialty paper product manufacturers are a key focus for us, as they generally are not as sensitive to cyclical declines in demand caused by downturns in economic activity.

18

In 2009,2012, we continued with our capital investment programs designed to increase pulp and green energy production capacity, reduce costs and improve efficiency and environmental performance at our mills. The improvements made at our mills over the past six years have reduced operating costs and increased the competitive position of our facilities.

Total capital expenditures at our mills are set out in the Rosenthal mill in 2009, 2008 and 2007 were €9.1 million, €8.7 million and €5.2 million, respectively. following table for the periods indicated:

| Year Ended December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| (in thousands) | ||||||||||||

Rosenthal | € | 15,436 | € | 13,718 | € | 4,033 | ||||||

Stendal | € | 14,767 | € | 8,296 | € | 3,625 | ||||||

Celgar | € | 6,461 | € | 15,718 | € | 30,642 | ||||||

Capital investments at the Rosenthal mill in 20092012 related primarily to the mill’s recovery boiler upgrade, which we believe will reduce our wastewater fees, while, in 2011, they related primarily to the installation of a new chipper and 2008upgrades to the recovery process. In 2010, capital expenditures related mainly to the upgrade of a bleaching line. In addition, we initiatedline and a washer project at a total cost of approximately €2.5 million which will helphelped offset three years of wastewater fees that would otherwise be payable.

Capital investments at the Stendal mill in 20092012 related primarily to the commencement of Project Blue Mill. In 2011 and 2010, capital investments related mainly to relatively small projects designed to improve safety and environmental performance as well as improve the overall efficiency of the mill.

In 2012, the Stendal mill commenced Project Blue Mill to increase production and efficiency at the mill through debottlenecking initiatives, including the installation of an additional 40 MW steam turbine. Project Blue Mill is estimated to require approximately €40.0 million in capital expenditures over about 21 months, which will be primarily funded through €12.0 million of non-refundable German government grants and a new €17.0 million five-year amortizing secured term debt facility, of which 80% will be government guaranteed. The balance of Project Blue Mill will be funded through operating cash flow of the Stendal mill and up to an aggregate of €6.5 million in pro rata shareholder loans from Mercer Inc. and Stendal’s noncontrolling shareholder. Project Blue Mill is currently expected to be completed and start to generate electricity sales in or about September 2013. As of December 31, 2012, we had expended an aggregate €13.3 million on Project Blue Mill.

Certain of our capital investment programs in Germany were partially financed through government grants made available by German federal and state governments. Under legislation adopted by the federal and certain state governments of Germany, government grants are provided to qualifying businesses operating in Eastern Germany to finance capital investments. The grants are made to encourage investment and job creation. For example, the government grants received in connection with Project Blue Mill require us to maintain the employment of core employees for five years after completion of the project. Currently, grants are available for up to 15%30% of the cost of qualified investments. Previously, government grants were available for up to 35% of the cost of qualified investments, such as for the construction of our Stendal mill. These grants at the 35% of cost level required that at least one permanent job be created for each €500,000€0.5 million of capital investment eligible for such grants and that such jobs be maintained for a period of five years from the completion of the capital investment project. Generally, government grants are not repayable by a recipient unless it fails to complete the proposed capital investment or, if applicable, fails to create or maintain the requisite amount of jobs. In the case of such failure, the government is entitled to revoke the grants and seek repayment unless such failure resulted from material unforeseen market developments beyond the control of the recipient, wherein the government may refrain from reclaiming previous grants. Pursuant to such legislation in effect at the time, the Stendal mill received approximately €278.0 million of government grants. We believe that we are in compliance in all material respects with all of the terms and conditions governing the government grants we have received in Germany.

The following table sets out for the periods indicated the effect of these government grants on the recorded value of such assets in our consolidatedConsolidated Balance Sheets:

| As at December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| (in thousands) | ||||||||||||

Property, plant and equipment, gross amount less amortization | € | 1,085,593 | € | 1,112,639 | € | 1,144,759 | ||||||

Less: government grants less amortization | 276,715 | 291,665 | 297,992 | |||||||||

|

|

|

|

|

| |||||||

Property, plant and equipment, net (as shown on the Consolidated Balance Sheet) | € | 808,878 | € | 820,974 | € | 846,767 | ||||||

|

|

|

|

|

| |||||||

The following table sets forth the gross amount of all government grants we have received and capitalized in our balance sheets:

| As at December 31, | ||||||||||||

| 2009 | 2008 | 2007 | ||||||||||

| (in thousands) | ||||||||||||

| Properties, gross amount including government grants less amortization | € | 1,152,288 | € | 1,171,891 | € | 1,237,624 | ||||||

| Less: government grants less amortization | 283,730 | 290,187 | 304,366 | |||||||||

| Properties, net (as shown on consolidated balance sheets) | € | 868,558 | € | 881,704 | € | 933,258 | ||||||

| As at December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| (in thousands) | ||||||||||||

Government grants—gross | € | 431,580 | € | 429,946 | € | 419,891 | ||||||

Less: accumulated amortization | 154,865 | 138,281 | 121,889 | |||||||||

|

|

|

|

|

| |||||||

Government grants less accumulated amortization | € | 276,715 | € | 291,665 | € | 297,992 | ||||||

|

|

|

|

|

| |||||||

Qualifying capital investments at industrial facilities in Germany that reduce effluent discharges offset wastewater fees that would otherwise be required to be paid. For more information about our environmental capital expenditures, see “—Environmental”.

In 2012, capital expenditures at the Celgar mill includes a project to recover/recycle chemicals from the mill’s effluent, referred to as the “GAP Project”, while in 2009, 2008 and 2007 were €17.8 million, €12.1 million and €7.9 million, respectively. In 2009, capital2011 such expenditures related primarily to a project to improve the Celgar mill’s fiber line and oxygen delignification process, referred to as the “Oxygen Delignification Project” and the GAP Project. We completed the Celgar Energy Project and upgrades to the mill’s woodroom. We commenced the Celgar Energy Project as part of our continued focus on energy production and sales andin 2010 to increase the mill’s production of “green” energy and optimize its power generation capacity. The project is designed to be a high return capital project with an estimated cost of approximately €35.0 million. It includesC$64.7 million (€49.0 million) and included the installation of a second turbine generator with a design capacity of 48 MW.

In October 2009, as part of the GTP, the Canadian government, through NRCanNatural Resources Canada, referred to as “NRCan”, agreed to provide approximately C$57.7 million (€38.5 million) in credits towards the capital costs associated withto improve energy efficiency or effect environmental improvements at the Celgar mill, includingmill. Of the same, we used approximately C$46.8 million in connection with the Celgar Energy Project. Such credits when received, will reducereduced the cost basis of the assets purchased and arewere not

19

Excluding costs for the Celgar Energy Project to beprojects financed through government grants, under the GTP, our capital expenditures for all of our mills in 20102013 are expected to be approximately €6.3 million.

Our operations are subject to a wide range of environmental laws and regulations, dealing primarily with water, air and land pollution control. We devote significant management and financial resources to comply with all applicable environmental laws and regulations. Our total capital expenditures on environmental projects at our mills were approximately We believe we have obtained all required environmental permits, authorizations and approvals for our operations. We believe our operations are currently in substantial compliance with the requirements of all applicable environmental laws and regulations and our respective operating permits. Under German state environmental rules relating to effluent discharges, industrial users are required to pay wastewater fees based upon the amount of their effluent discharge. These rules also provide that an industrial user which undertakes environmental capital expenditures and lowers certain effluent discharges to prescribed levels may offset the amount of these expenditures against the wastewater fees that they would otherwise be required to pay. We estimate that the aggregate wastewater fees we saved in Environmental compliance is a priority for our operations. To ensure compliance with environmental laws and regulations, we regularly monitor emissions at our mills and periodically perform environmental audits of operational sites and procedures both with our internal personnel and outside consultants. These audits identify opportunities for improvement and allow us to take proactive measures at the mills as considered appropriate. The Rosenthal mill has a relatively modern biological wastewater treatment and oxygen bleaching facility. We have significantly reduced our levels of The Stendal mill The Celgar mill has been in substantial compliance with applicable environmental laws, regulations and permits.€9.5€9.3 million in 2009 (2008 — €4.9 million). In 2010, we expect environmental project related capital expenditures to be approximately €1.82012 (approximately €7.1 million primarily relating to a washer project at the Rosenthal mill.20092012 as a result of environmental capital expenditures and initiatives to reduce allowable emissions and discharges at our Stendal andmill was approximately €4.2 million. The estimated amount of accrued wastewater fees we expect to recover at our Rosenthal mills weremill is approximately €6.4€6.6 million. We expect that capitalCapital investment programs and other environmental initiatives at our German mills will mostly offset the wastewater fees that may bewere payable for 20102012 and 2011 andwe believe they will ensure that our operations continue in substantial compliance with prescribed standards.adsorbableabsorbable organic halogen discharge at the Rosenthal mill and we believe the Rosenthal mill’s adsorbableabsorbable organic halogen and chemical oxygen demand discharges are in compliance with the standards currently mandated by the German government.which commenced operations in September 2004, has beenis in substantial compliance with applicable environmental laws, regulations and permits. Management believes that, as the Stendal mill is astate-of-the-art facility, it will be able to continue to operate in compliance with the applicable environmental requirements.November 2008,2012, after a hearing, the Celgar mill sufferedwas required to pay C$30,000 as a fine and C$120,000 as a contribution to a conservation trust fund for environmental projects in respect of a minor 2008 spill of diluted weak black liquor intoin the nearby Columbia River. The spill was promptly reported by the mill to authorities at the time of occurrence and remediated. An environmental impact report prepared by independent consultants engaged by the mill concluded that the environmental impact of the spill was minimal. The spill was also investigated by federal and provincial environmental authorities and, in January 2009, the Celgar mill received a government directive requiring it to take a number of measures relating to the retention capacity of spill ponds. These measures have now been completedremediated to the satisfaction of the overseeing20

The Celgar mill operates two landfills, a newly commissioned site andone of which is an older site.site that the mill is in the process of decommissioning. The Celgar mill intends to decommission the old landfill and is developingcontinuing work on finalizing a closure plan for such site and then reviewing such plan with the CanadianBritish Columbia Ministry of Environment, or “MOE”. However, the MOE, in conjunction with the provincial pulp and paper industry, is in the process of developing a standard for landfill closures. In addition, theA portion of thethis older landfill owned by an adjacent sawmill continues to be active. Accordingly, the mill has not been able to move forward with the closure.is still being utilized. We currently believe we may receive regulatory approval for suchexpect to finalize our closure plan in 20102013 and commencereceive MOE approval for it in 2014. The actual closure activities thereafter. We currently estimateshall be effected pursuant to a timetable agreed to by the mill and the MOE. The cost of closing the landfill atis expected to be approximately €1.8 million but since the closure program for the old landfill has not been finalized or approved, there can be no assurance that the decommissioning of the old landfill will not exceed such cost estimate.

Future regulations or permits may place lower limits on allowable types of emissions, including air, water, waste and hazardous materials, and may increase the financial consequences of maintaining compliance with environmental laws and regulations or conducting remediation. Our ongoing monitoring and policies have enabled us to develop and implement effective measures to maintain emissions in substantial compliance with environmental laws and regulations to date in a cost-effective manner. However, there can be no assurances that this will be the case in the future.

There are So far, the potentialand/or perceived effects of climate change and social and governmental responses to it have created both business opportunities and the potential for negative consequences for our business. The focus on climate change has generated a substantial increase in demand and in legislative requirements for “carbon neutral” or “green” energy in both Europe and, increasingly, in North America. Pulp mills consume wood As part of their production process, our mills take wood These factors, along with governmental initiatives in respect of renewable or green energy legislation, have provided business opportunities for us to enhance our generation and sales of green energy We are constantly exploring other initiatives to enhance our generation and sales of surplus green Currently, there numerous differing scientific studies and opinions relating to the severity, extent and speed at which climate change is or may be occurring around the world.occurring. As a result, we are currently unable tocannot identify and predict all of the specific consequences of climate change on our business and operations.To date,residue,residuals, being wood chips and pulp logs, as the base raw material for itstheir production process. Wood chips are residueresiduals left over from lumber production and pulp logs are generally lower quality logs left over from logging that are unsuitable for the production of lumber.residueresiduals and process itthem through a digester where cellulose is separated from the wood to be used in pulp production and the remaining residue,residuals, called “black liquor”, is used for green energy production. As a result of their use of wood residueresiduals and because our mills generate combined heat and power, they are efficient producers of energy. This energy is carbon neutral and produced from a renewable source. Our relatively modern mills generate a substantial amount of energy that is surplus to their requirements.and to participate in the sale of emission allowances under the EU ETS. See “Generation and Sales of ‘Green’ Energyregional utilities. In early 2012 we commenced Project Blue Mill, a project at our Mills”.Currently,Stendal mill to install a new 40 MW steam turbine which we expect will initially produce an additional 109,000 MWh of surplus renewable electricity.energy.energy and chemical by-products. Other potential opportunities that may result from climate change include:

21the expansion of softwood forests and increased growth rates for such forests;

more intensive forestry practices and timber salvaging versus harvesting standing timber;

greater demand for sustainable energy and cellulosic biomass fuels; and

additional governmental incentives and/or legislative requirements to enhance biomass energy production.

At this time, we cannot predict which, if any, of these potential opportunities will be available to, or realized by, us or their economic effect on our business.

While all of the specific consequences to our business from climate controlchange are not yet predictable, the most visible potential negative consequence is that the focus on renewable energy will continue to create greater demand for the wood residuals or fiber that is consumed by our mills as part of their production process.

In Germany, since 2006, the price and supply of wood residuals have been affected by an increasing demand from alternative or renewable energy producers and governmental initiatives for carbon neutral energy. Over the long term, this non-traditional demand for fiber is expected to increase in Europe. Additionally, the growing interest and focus in British Columbia for renewable green energy is also expected to create additional competition for such fiber in that region over time. Such additional demand for wood residuals may increase the competition and prices for wood residuals over time. See “Operating Costs — “—Production Costs—Fiber”.

Governmental action or legislation may also have an important effect on the demand and prices for wood residuals. As governments pursue green energy initiatives, they risk creating incentives and demand for wood residuals from renewable energy producers that “cannibalizes” or adversely affects existing traditional users, such as lumber and pulp and paper producers. We are activelycontinually engaged in continuing dialogue with government to educate and try to ensure potential initiatives recognize the traditional and continuing role of our mills in the overall usage of forestry resources and the economies of local communities.

Other potential negative consequences from climate change over time that may affect our business include:

a greater susceptibility of northern softwood forest to disease, fire and insect infestation;

the disruption of transportation systems and power supply lines due to more severe storms;

the loss of fresh water transportation for logs and our finished goods inventories due to lower water levels;

decreases in quantity and quality of processed water for our mill operations;

the loss of northern softwood boreal forests in areas in sufficient proximity to our mills to competitively acquire fiber; and

lower harvest levels decreasing the supply of harvestable timber and, as a consequence, wood residuals.

We currently employ approximately Rosenthal, which employs approximately Stendal and its subsidiaries employ approximately We negotiated a five-year collective agreement in November 2012, effective May 1, 2012, with our hourly workers at the 1,4551,500 people. We have approximately 1,0561,044 employees working in our German operations, including our wood procurement, transportation and sales subsidiaries. In addition, there are approximately 1816 people workingemployed at the office we maintain in Vancouver, British Columbia, Canada. Celgar currently employs approximately 381443 people in its operations, the vast majority of which are unionized.444441 people, is bound by collective agreements negotiated with Industriegewerkschaft Bergbau, Chemie, Energie, or “IGBCE”, a national union that represents pulp and paper workers. In January 2009,December 2011, we successfully negotiated a new agreement with IGBCE substantially upon the same terms as the previous labor contract which expired at the end of 2008. Thiscontract. The new collective agreement provided for a one-time payment of €200 per employee, an approximately 2.3%3.0% wage increase in 2009.606597 people. Pursuant to the government grants and financing arranged in connection with theIn 2011, Stendal mill, we have agreed with German state authorities to maintain at least 580 jobs until September 2010. Stendal has not yet entered into anya seven-year collective agreementsagreement with IGBCE although it may do soeffective July 2011. Since, prior to entering into this collective agreement, Stendal’s employees had relatively lower wages compared to their peers at other German pulp mills, this agreement provided for an approximately 5.5% wage increase in 2012. The collective agreement provides for a further 2.5% minimum annual wage increase from 2013 to 2015. The collective agreement is scheduled to expire in 2018.future.22