UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 30, 2012

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 0-1088

| KELLY SERVICES, INC. | ||

| (Exact name of registrant as specified in its charter) | ||

| Delaware | 38-1510762 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

999 West Big Beaver Road, Troy, Michigan |

| 48084 | ||

| ( | ( | |

| (248) 362-4444 | ||||

| (Registrant's telephone number, including area code) | ||||

| Title of each class | Name of each exchange on which registered | |

| Class A Common | NASDAQ Global Market | |

| Class B Common | NASDAQ Global Market | |

| Securities Registered Pursuant to Section 12(g) of the Act: None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes Yeso[ ] Noþ[X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes Yeso[ ] Noþ[X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes Yesþ[X] Noo[ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for shorter period that the registrant was required to submit and post such files). Yeso [X] Noo [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’sregistrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.þ[X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | |||||

| Non-accelerated filer | |||||||

| Smaller reporting company [ ] | |||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yeso [ ] Noþ [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $390,606,685.$373,723,242.

Registrant had 33,252,100 33,723,170 shares of Class A and 3,459,8853,452,585 of Class B common stock, par value $1.00, outstanding as of February 7, 2011.3, 2013.

Documents Incorporated by Reference

The proxy statement of the registrant with respect to its 20112013 Annual Meeting of Stockholders is incorporated by reference in Part III.

1

PART I

Unless the context otherwise requires, throughout this Annual Report on Form 10-K the words “Kelly,” “Kelly Services,” “the Company,” “we,” “us” and “our” refer to Kelly Services, Inc. and its consolidated subsidiaries.

History and Development of Business

Founded by William R. Kelly in 1946, Kelly ServicesServices® has developed innovative workforce solutions for customers in a variety of industries throughout our 64-year66-year history. Our range of solutions and geographic coverage has grown steadily over the years to match the expanding needs of our customers.

We have evolved from a United States-based company concentrating primarily on traditional office staffing into a global workforce solutions leader withoffering a full breadth of specialty businesses. We currently assign professional and technical employees in the fields of creative services, education, legal and health care—whileservices. While ranking as one of the world’s largest scientific staffing providers, andwe are also among the leaders in information technology, engineering and financial staffing.staffing, and we place professional and technical employees at all levels in law, healthcare, education and creative services. These specialty service linesservices complement our expertise in office services, contact center, light industrial and electronic assembly staffing. In additionAs the human capital arena has become more complex, we have also developed a suite of innovative solutions to staffing, we offer innovativehelp many of the world’s largest companies manage their supply of talent, management solutions for our customers including outsourcing, consulting, recruitment, career transition and vendor management services.

Geographic Breadth of Services

Headquartered in Troy, Michigan, we provide temporary employment for approximately 530,000560,000 employees annually to a variety of customers around the globe — globe—including more than 90 percent99 of theFortune500 100™ companies.

Kelly provides workforce solutions are provided to a diversified group of customers through offices in three regions: theAmericas, Europe, the Middle East, and Africa (“EMEA”),andAsia Pacific (“APAC”).

Description of Business Segments

Our operations are divided into seven principal business segments:Americas Commercial,Americas Professional and Technical(“Americas PT”), EMEA Commercial,EMEA Professional and Technical(“EMEA PT”),APAC Commercial,APAC Professional and Technical(“ (“APAC PT”)and the Outsourcing and Consulting Group(“OCG”).

Americas Commercial

Our Americas Commercial segment includes:Kellyspecialties include: Office, Services, offeringproviding trained employees who work infor word processing, data entry, clerical and as administrative support staff;KellyConnect,roles; Contact Center, providing staff for contact centers, technical support hotlines and telemarketing units;Kelly Educational Staffing, the first Education, supplying schools nationwide program supplying qualified substitute teachers;Kellywith instructional and non-instructional employees; Marketing, Services, includingproviding support staff for seminars, sales and trade shows;Kelly Electronic Assembly, Services, providing technicians to serve the technology, aerospaceassemblers, quality control inspectors and pharmaceutical industries;Kellytechnicians; and Light Industrial, Services, placing maintenance workers, material handlers and assemblers;KellySelect,assemblers. We also offer a temporary to full-timetemporary-to-hire service that provides both customers and temporary staff the opportunity to evaluate their relationship before making a full-time employment decision; andKellyDirect,decision, a permanentdirect-hire placement service used across all staffing business units.and vendor on-site management.

2

Americas PT

Our Americas PT segment includes a number of industry-specific specialty services:CGR/seven, placing employees in creative services positions;Kelly Science, providing all levels of scientists and scientific and clinical research workforce solutions; Engineering, Resources, supplying engineering professionals across all disciplines including aeronautical, chemical, civil/structural, electrical/instrumentation, environmental, industrial, mechanical, petroleum, pharmaceutical, quality and telecommunications;Kelly Financial Resources, Information Technology, placing IT specialists across all disciplines; Creative Services, placing creative talent in the spectrum of creative services positions; Finance and Accounting, serving the needs of corporate finance departments, accounting firms and financial institutions with professional personnel;Kellyall levels of financial professionals; Government, Solutions, providing a full spectrum of talent management solutions to the U.S. federal government;Kelly Healthcare, Resources, providing all levels of healthcare specialists and professionals for work in hospitals, ambulatory care centers, HMOsprofessionals; and other health insurance companies;Kelly IT Resources, placing information technology specialists across all IT disciplines;Kelly Law, Registry, placing legal professionals including attorneys, paralegals, contract administrators, compliance specialists and legal administrators; andKelly Scientific Resources, providing entry-level to Ph.D. professionals to a broad spectrum of scientific and clinical research industries.administrators. Our temporary-to-hire service,KellySelect, direct-hire placement service and permanent placement service,KellyDirect,vendor on-site management are also offered in this segment.

2

EMEA Commercial

Our EMEA Commercial segment provides a similar range of commercial staffing services as described for our Americas Commercial segment above, including:Kelly Office, Services,KellyConnect,Kelly Educational Staffing,Kelly Light Industrial ServicesContact Center andKellySelect. our temporary-to-hire service. Additional service areas of focus includeKelly Catering and Hospitality,providing chefs, porters and hospitality representatives; andKelly Industrial, supplying manual workers to semi-skilled professionals in a variety of trade, non-trade and operational positions.

EMEA PT

Our EMEA PT segment provides many of the same services as described for our Americas PT segment, including:Kelly Engineering, Resources, Kelly Financial Resources, KellyFinance and Accounting, Healthcare, Resources, Kelly IT ResourcesandKelly Scientific Resources. Science.

APAC Commercial

Our APAC Commercial segment offers a similar range of commercial staffing services as described for our Americas and EMEA Commercial segments above, through staffing solutions that include permanent placement, temporary staffing and temporary to full-time staffing and vendor on-site.staffing.

APAC PT

Our APAC PT segment provides many of the same services as described for our Americas and EMEA PT segments, including:Kelly Engineering, Resources, Kelly IT Resources and Kelly Scientific Resources.Science. Additional service areas includeKelly SelectionandKelly Executive(services in Australia and New Zealand only) which offerinclude mid- to senior-level search and selection to identifyfor leaders who help organizations grow, in core practice areas such as HR, Sales and Marketing, Finance, Procurement and General Management.

OCG delivers integrated talent management solutions configured to satisfy our customers’meet customer needs across multiple regions, skill sets and the entire spectrum of human resources. Using talent supply chain strategies, we help customers manage their contingent labor spend and gain access to service providers and quality talent at competitive rates and with minimized risk. Services in this segment include:Recruitment Process Outsourcing (“RPO”), offering end-to-end talent acquisition solutions, including customized recruitment projects;Contingent Workforce Outsourcing (“CWO”)(CWO), providing globally managed service solutions that integrate supplier and vendor management technology partners to optimize contingent workforce spend;Business Process Outsourcing (BPO), offering full staffing and operational management of non-core functions or departments; Recruitment Process Outsourcing (RPO), offering end-to-end talent acquisition solutions, including customized recruitment projects; Independent Contractor Solutions, delivering evaluation, classification and risk management services that enable safe access to this critical talent pool;Payroll Process Outsourcing (“PPO”)(PPO), providing centralized payroll processing solutions globally for our customers;Business Process Outsourcing (“BPO”), offering full staffing and operational management of non-core functions or departments;Career Transition & Organizational Effectiveness (CTO), offering a range of custom solutions to maintain effective operationsoutplacement services; and maximize employee motivation and performance in the wake of corporate restructurings; andExecutive Search, providing leadership in executive placement worldwide.in various regions throughout the world.

Financial information regarding our industry segments is included in the Segment Disclosures note to our consolidated financial statements presented in Part II, Item 8 of this report.

3

Business Objectives

Kelly’s philosophy is rooted in our conviction that we can and do make a difference on a daily basis—basis — for our customers, in the lives of our employees, in the local communities we serve and in our industry. Our vision is “To“to provide the world’s best workforce solutions.” We aspire to be a strategic business partner to our customers and strive to assist them in runningoperating efficient, profitable organizations. Our consultative approach to customer relationships leverages a collective expertise spanning more than 60 years of thought leadership, while Kelly solutions are customizable to benefit them on any scope or scale required.customers require.

As the use of contingent labor, consultants and independent contractors becomes more prevalent and critical to the ongoing success of our customer base—base, our core competencies are refined to help them realize their respective business objectives. Kelly offers a comprehensive array of outsourcing and consulting services, as well as world-class staffing on a temporary, temp-to-hiretemporary-to-hire and permanentdirect placement basis. Kelly will continue to deliver the strategic expertise our customers need to transform their workforce management challenges into opportunities.

3

Business Operations

Service Marks

We own numerous service marks that are registered with the United States Patent and Trademark

Office, the European Union Community Trademark Office and numerous individual country trademark

offices.

Office, the European Union Community Trademark Office and numerous individual country trademark

offices.

Seasonality

Our quarterly operating results are affected by the seasonality of our customers’ businesses. Demand for staffing services historically has been lower during the first and fourth quarters, in part as a result of holidays,quarter, and typically increases during the second and third quartersremainder of the year.

Working Capital

Our working capital requirements are primarily generated from temporary employee payroll and customer accounts receivable. Since receipts from customers generally lag payroll to temporary employees, working capital requirements increase substantially in periods of growth.

Customers

We are not dependent on any single customer or a limited segment of customers. In 2012, an estimated 49% of total Company revenue was attributed to 100 large customers. Our largest single customer accounted for approximately threefive percent of total revenue in 2010.2012.

Government Contracts

Although we conduct business under various federal, state, and local government contracts, they do not account for a significant portion of our business.

Competition

The worldwide temporary staffing industry is competitive and highly fragmented. In the United States, approximately 100 competitors operate nationally, and approximately 10,000 smaller companies compete in varying degrees at local levels. Additionally, several similar staffing companies compete globally. In 2010,2012, our largest competitors were Allegis Group, Adecco S.A,S.A., Manpower Inc., Robert Half International Inc., and Randstad Holding N.V. and SFN Group, Inc.

Key factors that influence our success are geographic coverage,quality of service, price, breadth of service, quality of service, and price.geographic coverage.

4

Quality of service is highly dependent on the availability of qualified, competent temporary employees, and our ability to recruit, screen, train, retain, and manage a pool of employees who match the skills required by particular customers. During an economic downturn, we must balance competitive pricing pressures with the need to retain a qualified workforce. Price competition in the staffing industry is intense—intense — particularly for office clerical and light industrial personnel—personnel — and pricing pressure from customers and competitors continues to be significant.

Breadth of service, or ability to manage staffing suppliers, has become more critical as customers seek “one-stop shopping” for all their staffing needs. Geographic presence is important, as temporary employees are generally unwilling to travel great distances for assignment, and customers prefer working with companies in their local market.

Environmental Concerns

Because we are involved in a service business, federal, state or local laws that regulate the discharge of materials into the environment do not materially impact us.

Employees

We employ approximately 1,100 people at our corporate headquarters in Troy, Michigan, and approximately 6,9007,000 staff members in our international network of branch offices. In 2010,2012, we assigned approximately 530,000560,000 temporary employees withto a variety of customers around the globe.

4

While services may be provided inside the facilities of customers, we remain the employer of record for our temporary employees. We retain responsibility for employee assignments, the employer’s share of all applicable payroll taxes and the administration of the employee’s share of these taxes.

Foreign Operations

For information regarding sales, earnings from operations and long-lived assets by domestic and foreign operations, please refer to the information presented in the Segment Disclosures note to our consolidated financial statements, presented in Part II, Item 8 of this report.

Access to Company Information

We electronically file our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports with the Securities and Exchange Commission (“SEC”). The public may read and copy any of the reports that are filed with the SEC at the SEC’s Public Reference Room at 100 F. Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet website at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically.

We make available, free of charge, through our Internet website, and by responding to requests addressed to our vice president of investor relations, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports. These reports are available as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. Our website address is: www.kellyservices.com. The information contained on our website, or on other websites linked to our website, is not part of this report.

5

ITEM 1A. RISK FACTORS.

We operate in a highly competitive industry with low barriers to entry and may be unable to compete successfully against existing or new competitors.

The worldwide staffing services market is highly competitive with limited barriers to entry. We compete in global, national, regional and local markets with full-service and specialized temporary staffing companies. While the majority of our competitors are significantly smaller than us, several competitors, including Allegis Group, Adecco S.A,S.A., Manpower Inc., Robert Half International Inc., and Randstad Holding N.V. and SFN Group, Inc., have substantial marketing and financial resources. In particular, Adecco S.A,S.A., Manpower Inc. and Randstad Holding N.V. are considerably larger than we are and, thus, have significantly more marketing and financial resources than we do. Additionally, the emergence of on-line staffing platforms may pose a competitive threat to our services which operate under a more traditional staffing business model. Price competition in the staffing industry is intense, particularly for the provision of office clerical and light industrial personnel. We expect that the level of competition will remain high, which could limit our ability to maintain or increase our market share or profitability.

5

The number of customers consolidating their staffing services purchases with a single provider or small group of providers continues to increase which, in some cases, may make it more difficult for us to obtain or retain customers. We also face the risk that our current or prospective customers may decide to provide similar services internally. As a result, there can be no assurance that we will not encounter increased competition in the future.

Our business is significantly affected by fluctuations in general economic conditions.

Demand for staffing services is significantly affected by the general level of economic activity and employment in the United States and the other countries in which we operate. When economic activity increases, temporary employees are often added before full-time employees are hired. As economic activity slows, however, many companies reduce their use of temporary employees before laying off full-time employees. Significant swings in economic activity historically have had a disproportionate impact on staffing industry volumes. We may also experience more competitive pricing pressure during periods of economic downturn. A substantial portion of our revenues and earnings are generated by our business operations in the United States. Any significant economic downturn in the United States or certain other countries in which we operate hascould have a material adverse effect on our business, financial condition and results of operations.

We may not achieve the intended effects of our business strategy.

Our business strategy focuses on improving profitability through scale and specialization, particularly with our professional and technical and OCG businesses. We have also implemented steps to increase our presenceoperating efficiency in theour commercial staffing markets, grow our higher margin specialty staffing and grow our outsourcing and consulting business. We plan to implementare implementing cost-efficient service delivery models to enable local teams to focus on profit-generating activities and relationships. If we are not successful or timely in achieving these objectives, our revenues, costs and overall profitability could be negatively affected. If we are unable to execute our business strategy effectively, our productivity and cost competitiveness could be negatively affected.

Our loss of major customers or the deterioration of their financial condition or prospects could have a material adverse effect on our business.

Our business strategy is focused on serving large corporate customers through high volume global service agreements. While our strategy is intended to enable us to increase our revenues and earnings from our major corporate customers, the strategy also exposes us to increased risks arising from the possible loss of major customer accounts. In addition, some of our customers are in industries, such as the automotive and manufacturing industries, that have experienced adverse business and financial conditions in recent years. The deterioration of the financial condition or business prospects of these customers could reduce their need for temporary employment services and result in a significant decrease in the revenues and earnings we derive from these customers. The bankruptcy of a major customer could have a material adverse impact on our ability to meet our working capital requirements.

6

Impairment charges relating to our goodwill and long-lived assets could adversely affect our results of operations.

We regularly monitor our goodwill and long-lived assets for impairment indicators. In conducting our goodwill impairment testing, we compare the fair value of each of our reporting units to the related net book value. In conducting our impairment analysis of long-lived assets, we compare the undiscounted cash flows expected to be generated from the long-lived assets to the related net book values. Changes in economic or operating conditions impacting our estimates and assumptions could result in the impairment of our goodwill or long-lived assets. In the event that we determine that our goodwill or long-lived assets are impaired, we may be required to record a significant non-cash charge to earnings that could adversely affect our results of operations.

6

Our customer contracts contain termination provisions that could decrease our future revenues and earnings.

Most of our customer contracts can be terminated by the customer on short notice without penalty. Our customers are, therefore, not contractually obligated to continue to do business with us in the future. This creates uncertainty with respect to the revenues and earnings we may recognize with respect to our customer contracts.

We depend on our ability to attract and retain qualified temporary personnel (employed directly by us or through a third-party supplier)suppliers).

We depend on our ability to attract qualified temporary personnel who possess the skills and experience necessary to meet the staffing requirements of our customers. We must continually evaluate our base of available qualified personnel to keep pace with changing customer needs. Competition for individuals with proven professional skills is intense, and demand for these individuals is expected to remain strong for the foreseeable future. There can be no assurance that qualified personnel will continue to be available in sufficient numbers and on terms of employment acceptable to us. Our success is substantially dependent on our ability to recruit and retain qualified temporary personnel.

We may be exposed to employment-related claims and losses, including class action lawsuits and collective actions, which could have a material adverse effect on our business.

We employ and assign personnel in the workplaces of other businesses. The risks of these activities include possible claims relating to:

| · | discrimination and harassment; |

| · | wrongful termination or retaliation; |

| · | violations of employment rights related to employment screening or privacy issues; |

| · | classification of employees including independent contractors; |

| · | employment of unauthorized workers; |

| · | violations of wage and hour requirements; |

| · | retroactive entitlement to employee benefits; |

| · | failure to comply with leave policy requirements; and |

| · | errors and omissions by our temporary employees, particularly for the actions of professionals such as attorneys, accountants and scientists. |

We are also subject to potential risks relating to misuse of customer proprietary information, misappropriation of funds, damage to customer facilities due to negligence of temporary employees, criminal activity and other similar claims. We may incur fines and other losses or negative publicity with respect to these problems. In addition, these claims may give rise to litigation, which could be time-consuming and expensive. In the U.S., and increasingly at the state and local level, and certain other countries in which we operate, new employment and labor laws and regulations have been proposed or adopted that may increase the potential exposure of employers to employment-related claims and litigation. There can be no assurance that the corporate policies we have in place to help reduce our exposure to these risks will be effective or that we will not experience losses as a result of these risks. ThereAlthough we maintain insurance in types and amounts we believe are appropriate in light of the aforementioned exposures, there can also be no assurance that thesuch insurance policies we have purchased to insure against certain risks will be adequate or that insurance coverage will remain available on reasonable terms or be sufficient in amount or scope of coverage.

Improper disclosure of sensitive or private information could result in liability and damage our reputation.

Our business involves the use, storage and transmission of information about full-time and temporary employees. Additionally, our employees may have access or exposure to customer data and systems, the misuse of which could result in legal liability. We are dependent on, and are ultimately responsible for, the security provisions of vendors who have custodial control of our data. We have established policies and procedures to help protect the security and privacy of this information. It is possible that our security controls over personal and other data and other practices we follow may not prevent the improper access to or disclosure of personally identifiable or otherwise confidential information. Such disclosure could harm our reputation and subject us to liability under our contracts and laws that protect personal data and confidential information, resulting in increased costs or loss of revenue. Further, data privacy is subject to frequently evolving rules and regulations, which sometimes conflict among the various jurisdictions and countries in which we provide services. Our failure to adhere to or successfully implement processes in response to changing regulatory requirements in this area could result in legal liability, additional compliance costs, missed business opportunities or damage to our reputation in the marketplace.

Unexpected changes in claim trends on our workers’ compensation and benefit plans may negatively impact our financial condition.

We self-insure, or otherwise bear financial responsibility for, a significant portion of expected losses under our workers’ compensation program and medical benefits claims. Unexpected changes in claim trends, including the severity and frequency of claims, actuarial estimates and medical cost inflation, could result in costs that are significantly different than initially reported. If future claims-related liabilities increase due to unforeseen circumstances, our costs could increase significantly. There can be no assurance that we will be able to increase the fees charged to our customers in a timely manner and in a sufficient amount to cover increased costs as a result of any changes in claims-related liabilities.

7

Failure to maintain specified financial covenants in our bank credit facilities, or credit market events beyond our control, could adversely restrict our financial and operating flexibility and subject us to other risks, including inadequaterisk of loss of access to liquidity.capital markets.

Our Bank Credit Facilitiesbank credit facilities contain covenants that require us to maintain specified financial ratios and satisfy other financial conditions. During 2010,2012, we met all of the covenant requirements. Our ability to continue to meet these financial covenants, particularly with respect to interest coverage (see Debt note in the footnotes to the consolidated financial statements), may not be assured. If we default under this or any other of these requirements, the lenders could declare all outstanding borrowings, accrued interest and fees to be due and payable or significantly increase the cost of the facility. In these circumstances, there can be no assurance that we would have sufficient liquidity to repay or refinance this indebtedness at favorable rates or at all. Events beyond our control could result in the failure of one or more of our banks, reducing our access to liquidity and potentially resulting in reduced financial and operating flexibility. If broader credit markets were to experience dislocation, our potential access to other funding sources would be limited.

8

Damage to our key data centers could affect our ability to sustain critical business applications.

Many business processes critical to our continued operation are housed in our data center situated within the corporate headquarters complex as well as regional data centers in Asia-Pacific and Europe. Those processes include, but are not limited to, payroll, customer reporting and order management. While we have taken steps to protect these operations, the loss of a data center would create a substantial risk of business interruption.

Our investment in our PeopleSoft payroll, billing and accounts receivable projectinformation technology projects may not yield itstheir intended results.

At the fourth quarterpresent time, we have a number of 2004, we commenced our PeopleSoft projectinformation technology projects in process or in the planning stages, including improvements to replace our payroll,applicant onboarding and tracking systems, order management, billing and accounts receivable information systems in the United States, Canada, Puerto Rico, the United Kingdom and Ireland. To date we have several modules in production including accounts receivable in all locations, payroll in Canada, payroll and billing in the United Kingdom and Ireland and general ledger in the U.S., Puerto Rico and Canada. We anticipate spending approximately $25 to $30 million from 2011 through 2014 to complete the PeopleSoft project.customer data analytics. Although the technology is intended to increase productivity and operating efficiencies, the PeopleSoft projectthese projects may not yield itstheir intended results. Any delays in completing, or an inability to successfully complete, thisthese technology initiativeinitiatives or an inability to achieve the anticipated efficiencies could adversely affect our operations, liquidity and financial condition. There is also a risk that if the remaining modules are not completed or the cost of completion is prohibitive, an impairment charge relating to all or a portion of the $5.5 million capitalized cost of the in-process modules as of January 2, 2011 could be required.

We are highly dependent on our senior management and the continued performance and productivity of our local management and field personnel.

We are highly dependent on the continued efforts of the members of our senior management. We are also highly dependent on the performance and productivity of our local management and field personnel. The loss of any of the members of our senior management may cause a significant disruption in our business. In addition, the loss of any of our local managers or field personnel may jeopardize existing customer relationships with businesses that use our services based on relationships with these individuals. The loss of the services of members of our senior management could have a material adverse effect on our business.

8

Our business is subject to extensive government regulation, which may restrict the types of employment services we are permitted to offer or result in additional or increased taxes, including payroll taxes, or other costs that reduce our revenues and earnings.

The temporary employment industry is heavily regulated in many of the countries in which we operate. Changes in laws or government regulations may result in prohibition or restriction of certain types of employment services we are permitted to offer or the imposition of new or additional benefit, licensing or tax requirements that could reduce our revenues and earnings. In particular, we are subject to state unemployment taxes in the U.S. which typically increase during periods of increased levels of unemployment. We also receive benefits, such as the work opportunity income tax credit in the U.S., that regularly expire and may not be reinstated. There can be no assurance that we will be able to increase the fees charged to our customers in a timely manner and in a sufficient amount to fully cover increased costs as a result of any changes in laws or government regulations. Any future changes in laws or government regulations, or interpretations thereof, may make it more difficult or expensive for us to provide staffing services and could have a material adverse effect on our business, financial condition and results of operations.

The net financial impact of recent U.S. healthcare legislation on our results of operations could be significant.

In March 2010, the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010 (collectively, the “Acts”) were signed into U.S. law. The Acts represent comprehensive healthcare reform legislation that, in addition to other provisions, will require that we provide affordable, minimum essential healthcare coverage to ourcertain temporary employees (and dependents) in the United States or incur penalties. Although we intend to billpass these costs on to our customers, there can be no assurance that we will be able to increase the fees chargedpricing to our customers in a sufficient amount to cover the increased costs. Additionally, since significant provisions of the Acts will not become effective until 2014, possible future changes to the Acts could significantly impact any estimates we develop during that period. While we are unable at this time to estimate the net impact of the Acts, we believe the net financial impact on our results of operations could be significant.

9

We conduct a significant portion of our operations outside of the United States and we are subject to risks relating to our international business activities, including fluctuations in currency exchange rates.

We conduct our business in allmost major staffing markets throughout the world. Our operations outside the United States are subject to risks inherent in international business activities, including:

| · | fluctuations in currency exchange rates; |

| · | varying economic and political conditions; |

| · | differences in cultures and business practices; |

| · | differences in employment and tax laws and regulations; |

| · | differences in accounting and reporting requirements; |

| · | differences in labor and market conditions; |

| · | changing and, in some cases, complex or ambiguous laws and regulations; and |

| · | litigation and claims. |

Our operations outside the United States are reported in the applicable local currencies and then translated into U.S. dollars at the applicable currency exchange rates for inclusion in our consolidated financial statements. Exchange rates for currencies of these countries may fluctuate in relation to the U.S. dollar and these fluctuations may have an adverse or favorable effect on our operating results when translating foreign currencies into U.S. dollars.

Our controlling stockholder exercises voting control over our company and has the ability to elect or remove from office all of our directors.

Terence E. Adderley, the Executive Chairman of our board of directors, and certain trusts with respect to which he acts as trustee or co-trustee, control approximately 93% of the outstanding shares of Kelly Class B common stock, which is the only class of our common stock entitled to voting rights. Mr. Adderley is therefore able to exercise voting control with respect to all matters requiring stockholder approval, including the election or removal from office of all members of our directors.the Board of Directors.

9

We are not subject to most of the listing standards that normally apply to companies whose shares are quoted on the NASDAQ Global Market.

Our Class A and Class B common stock are quoted on the NASDAQ Global Market. Under the listing standards of the NASDAQ Global Market, we are deemed to be a “controlled company” by virtue of the fact that Terence E. Adderley, the Executive Chairman of our board of directors, and certain trusts of which he acts as trustee or co-trustee have voting power with respect to more than fifty percent of our outstanding voting stock. A controlled company is not required to have a majority of its board of directors comprised of independent directors. Director nominees are not required to be selected or recommended for the board’s selection by a majority of independent directors or a nominations committee comprised solely of independent directors, nor do the NASDAQ Global Market listing standards require a controlled company to certify the adoption of a formal written charter or board resolution, as applicable, addressing the nominations process. A controlled company is also exempt from NASDAQ Global Market’s requirements regarding the determination of officer compensation by a majority of independent directors or a compensation committee comprised solely of independent directors. A controlled company is required to have an audit committee composed of at least three directors, who are independent as defined under the rules of both the Securities and Exchange Commission and the NASDAQ Global Market. The NASDAQ Global Market further requires that all members of the audit committee have the ability to read and understand fundamental financial statements and that at least one member of the audit committee possess financial sophistication. The independent directors must also meet at least twice a year in meetings at which only they are present.

We currently comply with certain of the listing standards of the NASDAQ Global Market that do not apply to controlled companies. Our compliance is voluntary, however, and there can be no assurance that we will continue to comply with these standards in the future.

10

Provisions in our certificate of incorporation and bylaws and Delaware law may delay or prevent an acquisition of our company.

Our restated certificate of incorporation and bylaws contain provisions that could make it harder for a third party to acquire us without the consent of our board of directors. For example, if a potential acquirer were to make a hostile bid for us, the acquirer would not be able to call a special meeting of stockholders to remove our board of directors or act by written consent without a meeting. The acquirer would also be required to provide advance notice of its proposal to replace directors at any annual meeting, and would not be able to cumulate votes at a meeting, which would require the acquirer to hold more shares to gain representation on the board of directors than if cumulative voting were permitted.

Our board of directors also has the ability to issue additional shares of common stock that could significantly dilute the ownership of a hostile acquirer. In addition, Section 203 of the Delaware General Corporation Law limits mergers and other business combination transactions involving 15 percent or greater stockholders of Delaware corporations unless certain board or stockholder approval requirements are satisfied. These provisions and other similar provisions make it more difficult for a third party to acquire us without negotiation.

Our board of directors could choose not to negotiate with an acquirer that it did not believe was in our strategic interests. If an acquirer is discouraged from offering to acquire us or prevented from successfully completing a hostile acquisition by these or other measures, our shareholders could lose the opportunity to sell their shares at a favorable price.

The holders of shares of our Class A common stock are not entitled to voting rights.

Under our certificate of incorporation, the holders of shares of our Class A common stock are not entitled to voting rights, except as otherwise required by Delaware law. As a result, Class A common stock holders do not have the right to vote for the election of directors or in connection with most other matters submitted for the vote of our stockholders.

10

Our stock price may be subject to significant volatility and could suffer a decline in value.

The market price of our common stock may be subject to significant volatility. We believe that many factors, including several which are beyond our control, have a significant effect on the market price of our common stock. These include:

| · | actual or anticipated variations in our quarterly operating results; |

| · | announcements of new services by us or our competitors; |

| · | announcements relating to strategic relationships or acquisitions; |

| · | changes in financial estimates by securities analysts; |

| · | changes in general economic conditions; |

| · | actual or anticipated changes in laws and government regulations; |

| · | changes in industry trends or conditions; and |

| · | sales of significant amounts of our common stock or other securities in the market. |

In addition, the stock market in general, and the NASDAQ Global Market in particular, have experienced significant price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of listed companies. These broad market and industry factors may seriously harm the market price of our common stock, regardless of our operating performance. In the past, securities class action litigation has often been instituted following periods of volatility in the market price of a company’s securities. A securities class action suit against us could result in substantial costs, potential liabilities and the diversion of our management’s attention and resources. Further, our operating results may be below the expectations of securities analysts or investors. In such event, the price of our common stock may decline.

11

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

We own our headquarters in Troy, Michigan, where corporate, subsidiary and divisional offices are currently located. The original headquarters building was purchased in 1977. Headquarters operations were expanded into additional buildings purchased in 1991, 1997 and 2001.

The combined usable floor space in the headquarters complex is approximately 350,000 square feet. Our buildings are in good condition and are currently adequate for their intended purpose and use. We also own undeveloped land in Troy and northern Oakland County, Michigan.

Branch office business is conducted in leased premises with the majority of leases being fixed for terms of generally three to five years in the United States and Canada and 5five to 10ten years outside the United States and Canada. We own virtually all of the office furniture and the equipment used in our corporate headquarters and branch offices.

11

During the second quarter of 2012, the Company is the subjectreceived final court approval of two pendinga settlement of a single class action, lawsuits. The two lawsuits, Fuller v. Kelly Services, Inc. and Kelly Home Care Services, Inc., pending in the Superior Court of California, Los Angeles, and Sullivan v. Kelly Services, Inc., pending in the U.S. District Court Southern District of California, both involve claimswhich involved a claim for monetary damages by current and former temporary employees working in the State of California.

The Fuller matter involves claims relatingwere related to alleged misclassification of personal attendants as exempt and not entitled to overtime compensation under state law and to alleged technical violations of a state law governing the content of employee pay stubs. On April 30, 2007,Recognized in discontinued operations in 2011 was a $1.2 million after tax charge relating to the Courtsettlement and in 2012 a $0.4 million after tax reduction in our estimate of costs to settle the Fuller case certified both plaintiff classes involved in the suit. In the third quarter of 2008, Kelly was granted a hearing date for its motions related to summary judgment on both certified claims. On March 13, 2009, the Court granted Kelly’s motion for decertification of the classes. Plaintiffs filed a petition for review on April 3, 2009 requesting the decertification ruling be overturned. Plaintiffs’ request was granted on May 17, 2010 and the suit was recertified as a class action. The Sullivan matter relates to claims by temporary workers for compensation while interviewing for assignments. On April 27, 2010, the Court in the Sullivan matter certified the lawsuit as a class action. The Company believes it has meritorious defenses in both lawsuits and will continue to vigorously defend itself during the litigation process.litigation.

The Company is also involvedcontinuously engaged in a number of other lawsuitslitigation arising in the ordinary course of its business, typically matters alleging employment discrimination, andalleging wage and hour matters.violations or enforcing the restrictive covenants in the Company’s employment agreements. While management does not expectthere is no expectation that any of these other matters towill have a material adverse effect on the Company’s results of operations, financial position or cash flows, litigation is always subject to inherent uncertaintiesuncertainty and the Company is not at this time able to reasonably predict the outcome of these matters. Itif any matter will be resolved in a manner that is reasonably possible that some matters could be decided unfavorablymaterially adverse to the Company and, if so, could have a material adverse impact on our consolidated financial statements. During 2010 and 2009, the Company reassessed its potential exposure from pending litigation and established additional reserves of $3.5 million and $4.4 million, respectively.Company.

12

Not applicable.

PART II

Market Information and Dividends

Our Class A and Class B common stock is traded on the NASDAQ Global Market under the symbols “KELYA” and “KELYB,” respectively. The high and low selling prices for our Class A common stock and Class B common stock as quoted by the NASDAQ Global Market and the dividends paid on the common stock for each quarterly period in the last two fiscal years are reported in the table below. Payments ofbelow. Our ability to pay dividends are restricted by theis subject to compliance with certain financial covenants contained in our short- and long-term debt facilities, as described in the Debt footnote to the consolidated financial statements.

| Per share amounts (in dollars) | ||||||||||||||||||||

| First | Second | Third | Fourth | |||||||||||||||||

| Quarter | Quarter | Quarter | Quarter | Year | ||||||||||||||||

2010 | ||||||||||||||||||||

| Class A common | ||||||||||||||||||||

| High | $ | 18.02 | $ | 18.93 | $ | 16.28 | $ | 20.29 | $ | 20.29 | ||||||||||

| Low | 11.80 | 12.80 | 10.07 | 11.70 | 10.07 | |||||||||||||||

| Class B common | ||||||||||||||||||||

| High | 17.56 | 18.54 | 14.40 | 20.90 | 20.90 | |||||||||||||||

| Low | 10.66 | 13.16 | 10.45 | 10.51 | 10.45 | |||||||||||||||

| Dividends | — | — | — | — | — | |||||||||||||||

2009 | ||||||||||||||||||||

| Class A common | ||||||||||||||||||||

| High | $ | 14.13 | $ | 12.99 | $ | 14.10 | $ | 13.69 | $ | 14.13 | ||||||||||

| Low | 6.11 | 7.68 | 10.39 | 10.01 | 6.11 | |||||||||||||||

| Class B common | ||||||||||||||||||||

| High | 14.50 | 11.65 | 14.12 | 14.99 | 14.99 | |||||||||||||||

| Low | 9.21 | 10.00 | 10.74 | 11.18 | 9.21 | |||||||||||||||

| Dividends | — | — | — | — | — | |||||||||||||||

| Per share amounts (in dollars) | ||||||||||||||||||||

| First | Second | Third | Fourth | |||||||||||||||||

| Quarter | Quarter | Quarter | Quarter | Year | ||||||||||||||||

| 2012 | ||||||||||||||||||||

| Class A common | ||||||||||||||||||||

| High | $ | 18.09 | $ | 16.25 | $ | 14.30 | $ | 15.90 | $ | 18.09 | ||||||||||

| Low | 13.75 | 11.30 | 11.26 | 12.40 | 11.26 | |||||||||||||||

| Class B common | ||||||||||||||||||||

| High | 17.40 | 18.02 | 14.47 | 15.50 | 18.02 | |||||||||||||||

| Low | 13.80 | 12.13 | 11.65 | 12.93 | 11.65 | |||||||||||||||

| Dividends | 0.05 | 0.05 | 0.05 | 0.05 | 0.20 | |||||||||||||||

| 2011 | ||||||||||||||||||||

| Class A common | ||||||||||||||||||||

| High | $ | 22.99 | $ | 21.41 | $ | 17.58 | $ | 17.00 | $ | 22.99 | ||||||||||

| Low | 17.50 | 14.61 | 10.95 | 10.77 | 10.77 | |||||||||||||||

| Class B common | ||||||||||||||||||||

| High | 22.99 | 21.30 | 16.70 | 17.12 | 22.99 | |||||||||||||||

| Low | 18.10 | 14.53 | 12.23 | 11.26 | 11.26 | |||||||||||||||

| Dividends | - | - | 0.05 | 0.05 | 0.10 | |||||||||||||||

Holders

The number of holders of record of our Class A and Class B common stock were 5,400approximately 8,600 and 410,300, respectively, as of February 7, 2011.3, 2013.

Recent Sales of Unregistered Securities

None.

13

13

Issuer Purchases of Equity Securities

| Maximum Number | ||||||||||||||||

| Total Number | (or Approximate | |||||||||||||||

| of Shares (or | Dollar Value) of | |||||||||||||||

| Total Number | Average | Units) Purchased | Shares (or Units) | |||||||||||||

| of Shares | Price Paid | as Part of Publicly | That May Yet Be | |||||||||||||

| (or Units) | per Share | Announced Plans | Purchased Under the | |||||||||||||

| Period | Purchased | (or Unit) | or Programs | Plans or Programs | ||||||||||||

| (in millions of dollars) | ||||||||||||||||

| October 4, 2010 through November 7, 2010 | 276 | $ | 14.24 | — | $ | — | ||||||||||

| November 8, 2010 through December 5, 2010 | — | — | — | — | ||||||||||||

| December 6, 2010 through January 2, 2011 | 6,961 | 18.80 | — | — | ||||||||||||

| Total | 7,237 | $ | 18.63 | — | ||||||||||||

| Maximum Number | ||||||||||||||||

| Total Number | (or Approximate | |||||||||||||||

| of Shares (or | Dollar Value) of | |||||||||||||||

| Total Number | Average | Units) Purchased | Shares (or Units) | |||||||||||||

| of Shares | Price Paid | as Part of Publicly | That May Yet Be | |||||||||||||

| (or Units) | per Share | Announced Plans | Purchased Under the | |||||||||||||

| Period | Purchased | (or Unit) | or Programs | Plans or Programs | ||||||||||||

| (in millions of dollars) | ||||||||||||||||

October 1, 2012 through November 4, 2012 | 280 | $ | 12.77 | - | $ | - | ||||||||||

November 5, 2012 through December 2, 2012 | 30,192 | 13.66 | - | - | ||||||||||||

December 3, 2012 through December 30, 2012 | - | - | - | - | ||||||||||||

| Total | 30,472 | $ | 13.65 | - | ||||||||||||

We may reacquire shares sold to cover taxes due upon the vesting of restricted stock held by employees. Accordingly, 7,23730,472 shares were reacquired during the Company’s fourth quarter.

14

14

Performance Graph

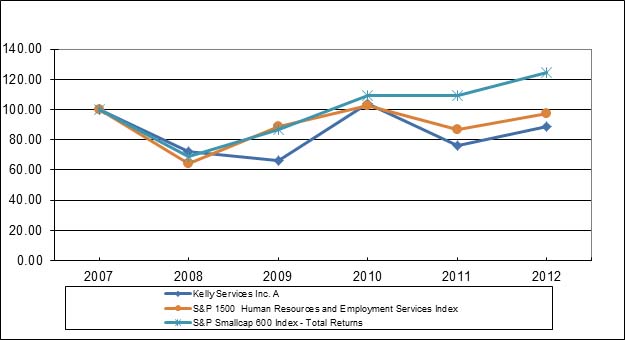

The following graph compares the cumulative total return of our Class A common stock with that of the S&P 600 SmallCap Index and the S&P 1500 Human Resources and Employment Services Index for the five years ended December 31, 2010.2012. The graph assumes an investment of $100 on December 31, 20052007 and that all dividends were reinvested.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

Assumes Initial Investment of $100

December 31, 2005 —2007 – December 31, 20102012

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |||||||||||||||||||

| Kelly Services, Inc. | $ | 100.00 | $ | 112.20 | $ | 73.91 | $ | 53.20 | $ | 48.78 | $ | 76.87 | ||||||||||||

| S&P SmallCap 600 Index | $ | 100.00 | $ | 115.11 | $ | 114.77 | $ | 79.10 | $ | 99.32 | $ | 125.45 | ||||||||||||

| S&P 1500 Human Resources and Employment Services Index | $ | 100.00 | $ | 119.59 | $ | 91.28 | $ | 58.72 | $ | 81.15 | $ | 93.87 | ||||||||||||

15

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |||||||||||||||||||

| Kelly Services, Inc. | $ | 100.00 | $ | 71.98 | $ | 66.00 | $ | 104.01 | $ | 76.20 | $ | 89.04 | ||||||||||||

| S&P SmallCap 600 Index | $ | 100.00 | $ | 68.92 | $ | 86.53 | $ | 109.31 | $ | 109.05 | $ | 124.41 | ||||||||||||

| S&P 1500 Human Resources and Employment Services Index | $ | 100.00 | $ | 64.34 | $ | 88.91 | $ | 102.84 | $ | 86.88 | $ | 97.38 | ||||||||||||

ITEM 6. SELECTED FINANCIAL DATA.

The following table summarizes selected financial information of Kelly Services, Inc. and its subsidiaries for each of the most recent five fiscal years. This table should be read in conjunction with the other financial information, including “Management’s"Management's Discussion and Analysis of Financial Condition and Results of Operations”Operations" and the consolidated financial statements included elsewhere in this report.

| (In millions except per share amounts) | 2010 (2) | 2009 (1,2) | 2008 (2) | 2007 | 2006 | |||||||||||||||

| Revenue from services | $ | 4,950.3 | $ | 4,314.8 | $ | 5,517.3 | $ | 5,667.6 | $ | 5,546.8 | ||||||||||

| Earnings (loss) from continuing operations | 26.1 | (105.1 | ) | (81.7 | ) | 53.7 | 56.8 | |||||||||||||

| Earnings (loss) from discontinued operations, net of tax (3) | — | 0.6 | (0.5 | ) | 7.3 | 6.7 | ||||||||||||||

| Net earnings (loss) | 26.1 | (104.5 | ) | (82.2 | ) | 61.0 | 63.5 | |||||||||||||

| Basic earnings (loss) per share: | ||||||||||||||||||||

| Earnings (loss) from continuing operations | 0.71 | (3.01 | ) | (2.35 | ) | 1.46 | 1.56 | |||||||||||||

| Earnings (loss) from discontinued operations | — | 0.02 | (0.02 | ) | 0.20 | 0.18 | ||||||||||||||

| Net earnings (loss) | 0.71 | (3.00 | ) | (2.37 | ) | 1.65 | 1.74 | |||||||||||||

| Diluted earnings (loss) per share: | ||||||||||||||||||||

| Earnings (loss) from continuing operations | 0.71 | (3.01 | ) | (2.35 | ) | 1.45 | 1.55 | |||||||||||||

| Earnings (loss) from discontinued operations | — | 0.02 | (0.02 | ) | 0.20 | 0.18 | ||||||||||||||

| Net earnings (loss) | 0.71 | (3.00 | ) | (2.37 | ) | 1.65 | 1.73 | |||||||||||||

| Dividends per share | ||||||||||||||||||||

| Classes A and B common | — | — | 0.54 | 0.52 | 0.45 | |||||||||||||||

| Working capital | 367.6 | 357.6 | 427.4 | 478.6 | 463.3 | |||||||||||||||

| Total assets | 1,368.4 | 1,312.5 | 1,457.3 | 1,574.0 | 1,469.4 | |||||||||||||||

| Total noncurrent liabilities | 153.6 | 205.3 | 203.8 | 200.5 | 142.6 | |||||||||||||||

| (In millions except per share amounts) | 2012 | 2011 | 2010 | 2009 (1) | 2008 | |||||||||||||||

| Revenue from services | $ | 5,450.5 | $ | 5,551.0 | $ | 4,950.3 | $ | 4,314.8 | $ | 5,517.3 | ||||||||||

| Earnings (loss) from continuing operations (2) | 49.7 | 64.9 | 26.1 | (105.1 | ) | (81.7 | ) | |||||||||||||

| Earnings (loss) from discontinued operations, net of tax (3) | 0.4 | (1.2 | ) | - | 0.6 | (0.5 | ) | |||||||||||||

| Net earnings (loss) | 50.1 | 63.7 | 26.1 | (104.5 | ) | (82.2 | ) | |||||||||||||

| Basic earnings (loss) per share: | ||||||||||||||||||||

| Earnings (loss) from continuing operations | 1.31 | 1.72 | 0.71 | (3.01 | ) | (2.35 | ) | |||||||||||||

| Earnings (loss) from discontinued operations | 0.01 | (0.03 | ) | - | 0.02 | (0.02 | ) | |||||||||||||

| Net earnings (loss) | 1.32 | 1.69 | 0.71 | (3.00 | ) | (2.37 | ) | |||||||||||||

| Diluted earnings (loss) per share: | ||||||||||||||||||||

| Earnings (loss) from continuing operations | 1.31 | 1.72 | 0.71 | (3.01 | ) | (2.35 | ) | |||||||||||||

| Earnings (loss) from discontinued operations | 0.01 | (0.03 | ) | - | 0.02 | (0.02 | ) | |||||||||||||

| Net earnings (loss) | 1.32 | 1.69 | 0.71 | (3.00 | ) | (2.37 | ) | |||||||||||||

| Dividends per share | ||||||||||||||||||||

| Classes A and B common | 0.20 | 0.10 | - | - | 0.54 | |||||||||||||||

| Working capital | 470.3 | 417.0 | 367.6 | 357.6 | 427.4 | |||||||||||||||

| Total assets | 1,635.7 | 1,541.7 | 1,368.4 | 1,312.5 | 1,457.3 | |||||||||||||||

| Total noncurrent liabilities | 172.4 | 168.3 | 153.6 | 205.3 | 203.8 | |||||||||||||||

| (1) | Fiscal year included 53 weeks. | |

| (2) | Included in results of continuing operations are asset impairments of $3.1 million in 2012, $2.0 million in 2010, $53.1 million in 2009 and $80.5 million in 2008. | |

| (3) | Discontinued Operations represent adjustments to assets and liabilities retained from the 2006 sale of |

16

16

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Executive Overview

The U.S.Staffing Industry

The worldwide staffing industry is competitive and global economies exhibited signs of slowly strengthening throughout 2010. Economic growth, coupled with the emergence of positive labor market trends, was favorable to the staffing industry.highly fragmented. In the U.S.,United States, approximately 100 competitors operate nationally, and approximately 10,000 smaller companies compete in varying degrees at local levels. Additionally, several similar staffing companies compete globally. Demand for temporary services is highly dependent on the overall strength of the global economy and labor markets. In periods of economic growth, demand for temporary employment penetration rate increased forservices generally increases, and the 15th consecutive monthneed to recruit, screen, train, retain and manage a pool of employees who match the skills required by particular customers becomes critical. Conversely, during an economic downturn, competitive pricing pressures can pose a threat to retaining a qualified temporary workforce. Accordingly, the on-going economic crisis in December to 1.7%, the highest level in over 21/2 years. More than 300,000 temporary jobs were addedEurozone and slow recovery from recession in the U.S. duringhas impacted all staffing firms over the last several years.

Our Business

Kelly Services is a global staffing company, providing innovative workforce solutions for customers in a variety of industries. Our staffing operations are divided into three regions, Americas, EMEA and APAC, with commercial and professional and technical staffing businesses in each region. As the human capital arena has become more complex, we have also developed a suite of innovative solutions within our global OCG Group. We are forging strategic relationships with our customers to help them manage their flexible workforces, through outsourcing, consulting, recruitment, career transition and vendor management services.

We earn revenues from the hourly sales of services by our temporary employees to customers, as a result of recruiting permanent employees for our customers, and through our outsourcing and consulting activities. Our working capital requirements are primarily generated from temporary employee payroll and customer accounts receivable. The nature of our business is such that trade accounts receivable are our most significant financial asset. Average days sales outstanding varies within and outside the U.S., but averages more than 50 days on a global basis. Since receipts from customers generally lag temporary employee payroll, working capital requirements increase substantially in periods of growth.

Our Strategy and Outlook

Our long-term strategic objective is to create shareholder value by delivering a competitive profit from the best workforce solutions and talent in the industry. We have set a long-term goal to achieve a competitive return on sales of 4%. To attain this, we are focused on the following key areas:

| · | Maintain our core strengths in commercial staffing and key markets; |

| · | Aggressively grow our professional and technical staffing; |

| · | Transform our OCG segment into a market-leading provider of talent supply chain management; |

| · | Capture permanent placement growth in selected specialties; and |

| · | Lower our costs through deployment of efficient service delivery models. |

In the face of economic uncertainty, softening demand, and declining revenue, we made progress in 2012, although at a pace slower than we had originally expected. During 2012, we:

| · | Maintained our competitive position in key global staffing markets; |

| · | Grew our professional and technical business by 3% year over year, despite a 2% decline in total revenue; |

| · | Increased our OCG revenue by 25% year over year and improved earnings from operations by over $11 million; |

| · | Increased permanent placement fees by 7% year over year; and |

| · | Reduced expenses by 1% in comparison to last year. |

We improved our return on sales by 30 basis points to 1.3%, although still far short of our long-term goal of 4.0%. In order to make significant progress against our long-term goal, we will need much stronger economic growth in order to leverage our business.

17

Looking ahead, although the U.S. unemployment rate is currently below 8%, overall job growth remains tepid, and U.S. temporary job growth is decelerating -- trends that are likely to continue in 2013. We expect that ongoing economic uncertainty in the U.S., fueled by the fiscal situation, will continue to constrain hiring in the near-term. In Europe, we do not anticipate any significant changes to the recessionary conditions that continue to take their toll on the labor market.

An additional challenge for us will be to meet the 2014 provisions of the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010 a growth of nearly 30% since(collectively, the low“Acts”). The Acts represent comprehensive health care reform legislation that, in addition to other provisions, will require that we offer affordable, minimum essential health care coverage to certain temporary employees (and dependents) in the United States or incur penalties. In order to comply with the Acts, Kelly intends to begin offering health care coverage in 2014 to all temporary employees eligible for coverage under the Acts.

At this point in September, 2009. While still shorttime, we are unable to estimate the costs of pre-recession levels,complying with the current environmentActs. Estimating the costs of complying with the Acts is encouragingdifficult due to a variety of factors associated with our temporary employee population, including: the number of employees who are eligible for coverage; the percentage of eligible employees who will enroll for health care coverage; the number of months during the following year that those employees who accept coverage remain an employee; determination of the appropriate employee contribution share for affordability purposes; the cost and availability of health care coverage that meets the Acts’ requirements; and the cost of implementation and ongoing administrative costs of compliance. Although we intend to pass ongoing costs on to our customers, there can be no assurance that we will be able to increase pricing to our customers in a sufficient amount to cover the increased costs, and the net financial impact on our results of operations could be significant.

Longer-term, we believe the trends in the staffing industry as employers seekare positive: companies are becoming more comfortable with the use of flexible staffing models; there is increasing acceptance of free agents and contractual employment by companies and candidates alike; and companies are searching for more comprehensive workforce management solutions. This shift in demand for contingent labor models. However, it will likely take several years for the overall labor marketplays to fully recover.our strengths and experience -- particularly serving large companies.

Financial Measures – Operating Margin and Constant Currency

Operating margin (earnings from continuing operations of $0.71 per diluted share, compared to a net loss of $3.01 per diluted share in 2009. Revenue, which declined significantly in 2009, increaseddivided by 15% during 2010, and our expense base continues to reflect the benefitrevenue from restructuring initiatives we undertook in 2009. However, our gross profit rate declined to 16.0% in 2010 from 16.3%services) in the prior year, reflecting changing business mixfollowing tables is a ratio used to measure the Company’s pricing strategy and related pressure on temporary margins.

17

18

Results of foreign exchange adjustments onOperations

2012 versus 2011

Total Company

(Dollars in millions)

| 2012 | 2011 | Change | CC Change | |||||||||||||

| Revenue from services | $ | 5,450.5 | $ | 5,551.0 | (1.8 | ) % | (0.2 | ) % | ||||||||

| Fee-based income | 148.2 | 138.0 | 7.3 | 10.1 | ||||||||||||

| Gross profit | 896.6 | 883.3 | 1.5 | 3.3 | ||||||||||||

SG&A expenses excluding restructuring charges | 822.1 | 822.8 | (0.1 | ) | ||||||||||||

| Restructuring charges | (0.9 | ) | 2.8 | (132.3 | ) | |||||||||||

| Total SG&A expenses | 821.2 | 825.6 | (0.6 | ) | 1.2 | |||||||||||

| Asset impairments | 3.1 | - | NM | |||||||||||||

| Earnings from operations | 72.3 | 57.7 | 25.3 | |||||||||||||

| Gross profit rate | 16.5 | % | 15.9 | % | 0.6 | pts. | ||||||||||

Expense rates (excluding restructuring charges): | ||||||||||||||||

| % of revenue | 15.1 | 14.8 | 0.3 | |||||||||||||

| % of gross profit | 91.7 | 93.2 | (1.5 | ) | ||||||||||||

| Operating margin | 1.3 | 1.0 | 0.3 | |||||||||||||

Total Company revenue from services for 2010 on a 53-week reported basis for 2009:

| Revenue from Services | ||||||||||||

| 2010 | 2009 | |||||||||||

| (52 Weeks) | (53 Weeks) | % Change | ||||||||||

| (In millions of dollars) | ||||||||||||

| Revenue from Services — Constant Currency: | ||||||||||||

| Americas Commercial | $ | 2,404.0 | $ | 1,980.3 | 21.4 | % | ||||||

| Americas PT | 887.3 | 792.6 | 12.0 | |||||||||

| Total Americas Commercial and PT — Constant Currency | 3,291.3 | 2,772.9 | 18.7 | |||||||||

| EMEA Commercial | 886.9 | 895.2 | (0.9 | ) | ||||||||

| EMEA PT | 151.4 | 141.9 | 6.7 | |||||||||

| Total EMEA Commercial and PT — Constant Currency | 1,038.3 | 1,037.1 | 0.1 | |||||||||

| APAC Commercial | 321.7 | 284.9 | 12.9 | |||||||||

| APAC PT | 29.6 | 25.4 | 16.8 | |||||||||

| Total APAC Commercial and PT — Constant Currency | 351.3 | 310.3 | 13.2 | |||||||||

| OCG — Constant Currency | 254.2 | 219.9 | 15.6 | |||||||||

| Less: Intersegment revenue | (29.0 | ) | (25.4 | ) | 14.2 | |||||||

| Total Revenue from Services — Constant Currency | 4,906.1 | 4,314.8 | 13.7 | |||||||||

| Foreign Currency Impact | 44.2 | |||||||||||

| Revenue from Services | $ | 4,950.3 | $ | 4,314.8 | 14.7 | % | ||||||

Compared to 2011, the gross profit rate decreased or remained flat in all business segments, with the exception of EMEA Commercialimproved by 60 basis points due to higher fee-based income and APAC PT. The decrease in thean improved temporary gross profit rate was caused by a reduction in our temporary margins, primarily within the Americas and APAC regions and the OCG businesses. Our average temporary margin continues to be impacted by shifts to a higher proportion of light industrial business compared to clerical, to large corporate customers compared to retail and, within OCG, to a higher proportion of the lower-margin PPO business. In addition, our temporary margins were impacted by higher state unemployment taxessegment. The improvement in the Americas to the extent not recovered through pricing. All of these items negatively impacting theAmericas’ temporary gross profit rate wereincluded the impact of lower workers’ compensation costs. We regularly update our estimates of open workers’ compensation claims. Due to favorable development of claims and payment data, we reduced our estimated costs of prior year workers’ compensation by $10 million for 2012. This compares to an adjustment reducing prior year workers’ compensation claims by $6 million for 2011.

Fee-based income, which is included in revenue from services, has a significant impact on gross profit rates. There are very low direct costs of services associated with fee-based income. Therefore, increases or decreases in fee-based income can have a disproportionate impact on gross profit rates.

Selling, general and administrative (“SG&A”) expenses excluding restructuring decreased slightly year over year. In the fourth quarter of 2012, we embarked on a restructuring program for certain of our EMEA operations in Italy, France and Ireland. The total net restructuring benefit in 2012 included $3 million of revisions of the estimated lease termination costs for previously closed EMEA Commercial branches, partially offset by $2 million of severance and lease termination costs for those EMEA Commercial branches which are in the favorable impact fromprocess of closing. We expect to spend approximately $0.5 million in the HIRE Act.first quarter of 2013 to complete the restructuring in EMEA. Restructuring costs in 2011 relate primarily to revisions of the estimated lease termination costs for previously closed EMEA Commercial branches.

In the fourth quarter of 2012, we made the decision to abandon our PeopleSoft billing system implementation in the U.S., Canada and Puerto Rico and, accordingly, recorded asset impairment charges of $3 million, representing previously capitalized costs associated with this project.

19

Income tax expense for 2012 was $19 million (27.8%), compared to a benefit of $7 million (-12.6%) for 2011. The 2012 income tax expense was impacted by the expiration of employment-related income tax credits, including the Hiring Incentives to Restore Employment (“HIRE”) Act retention credit, which allowswas unavailable in 2012, and the work opportunity credit, which was available in 2012 only for veterans and pre-2012 hires. Together, these income tax credits totaled $8 million in 2012, compared to $28 million in 2011. The work opportunity credit was retroactively reinstated on January 2, 2013, which will result in a first quarter 2013 tax benefit of $9 million that would have been recognized in 2012 if the law had been in effect at year-end 2012. In 2012, the Company closed income tax examinations relating to prior years, resulting in a $5 million benefit. During 2011, the Company determined that for tax reporting purposes, it was eligible for worthless stock deductions related to foreign subsidiaries, which provided U.S. federal and state benefits of $8 million in 2011.

Diluted earnings from continuing operations per share for 2012 were $1.31, as compared to $1.72 for 2011.

Earnings (loss) from discontinued operations for 2012 and 2011 represent adjustments to the estimated costs of litigation, net of tax, retained from the 2007 sale of the Kelly Home Care business unit.

Total Americas

(Dollars in millions)

| 2012 | 2011 | Change | CC Change | |||||||||||||

| Revenue from services | $ | 3,672.1 | $ | 3,643.7 | 0.8 | % | 1.3 | % | ||||||||

| Fee-based income | 30.2 | 25.3 | 19.0 | 20.3 | ||||||||||||

| Gross profit | 547.9 | 523.1 | 4.7 | 5.2 | ||||||||||||

| Total SG&A expenses | 405.8 | 396.4 | 2.4 | 3.0 | ||||||||||||

| Earnings from operations | 142.1 | 126.7 | 12.0 | |||||||||||||

| Gross profit rate | 14.9 | % | 14.4 | % | 0.5 | pts. | ||||||||||

| Expense rates: | ||||||||||||||||

| % of revenue | 11.1 | 10.9 | 0.2 | |||||||||||||

| % of gross profit | 74.1 | 75.8 | (1.7 | ) | ||||||||||||

| Operating margin | 3.9 | 3.5 | 0.4 | |||||||||||||

On an organic basis, excluding the Tradição acquisition in Brazil in late 2011, CC revenue decreased slightly. This was attributable to a 4% decrease in hours worked, partially offset by a 3% increase in average bill rates on a CC basis. During 2012, the PT segment revenue grew by 5%, while the Commercial segment revenue, excluding Tradição, declined 3%. The PT segment growth was fueled primarily by increases in hours and revenues in our engineering, IT and finance services. The decrease in Commercial segment revenue was driven primarily by decreases in light industrial and electronic assembly service lines, reflecting slowing demand as the year progressed, due to economic uncertainties. Americas represented 67% of total Company revenue in 2012 and 66% in 2011.

The increase in our gross profit rate was due to the combined effects of increased fee-based income, pricing increases and the decreases in workers’ compensation costs noted above. The year-over-year increase in total SG&A expenses is due to the costs associated with our Tradição operation. Total SG&A expenses without Tradição decreased slightly from last year.

20

Total EMEA

(Dollars in millions)

| 2012 | 2011 | Change | CC Change | |||||||||||||

| Revenue from services | $ | 1,022.9 | $ | 1,169.0 | (12.5 | ) % | (6.7 | ) % | ||||||||

| Fee-based income | 39.2 | 44.1 | (11.2 | ) | (5.5 | ) | ||||||||||

| Gross profit | 176.8 | 207.7 | (14.9 | ) | (9.2 | ) | ||||||||||

SG&A expenses excluding restructuring charges | 169.0 | 186.9 | (9.7 | ) | ||||||||||||

| Restructuring charges | (0.9 | ) | 2.8 | (132.3 | ) | |||||||||||

| Total SG&A expenses | 168.1 | 189.7 | (11.5 | ) | (6.0 | ) | ||||||||||

| Earnings from operations | 8.7 | 18.0 | (51.6 | ) | ||||||||||||

| Gross profit rate | 17.3 | % | 17.8 | % | (0.5 | ) pts. | ||||||||||

Expense rates (excluding restructuring charges): | ||||||||||||||||

| % of revenue | 16.5 | 16.0 | 0.5 | |||||||||||||

| % of gross profit | 95.6 | 90.1 | 5.5 | |||||||||||||

| Operating margin | 0.8 | 1.5 | (0.7 | ) | ||||||||||||