PART I

In this document, please note the following:

references to “we”, “our”, “us”, the “Company” or “Mercer” mean Mercer International Inc. and its subsidiaries, unless the context clearly suggests otherwise, and references to “Mercer Inc.” mean Mercer International Inc. excluding its subsidiaries;

references to “ADMTs” mean air-dried metric tonnes;

| | |

| • | references to “we”, “our”, “us”, the “Company” or “Mercer” mean Mercer International Inc. and its subsidiaries, unless the context clearly suggests otherwise, and references to “Mercer Inc.” mean Mercer International Inc. excluding its subsidiaries; |

|

| • | references to “ADMTs” mean air-dried metric tonnes; |

|

| • | references to “MW” mean megawatts and “MWh” mean megawatt hours; |

|

| • | information is provided as of December 31, 2010, unless otherwise stated or the context clearly suggests otherwise; |

|

| • | all references to monetary amounts are to “Euros”, the lawful currency adopted by most members of the European Union, unless otherwise stated; and |

|

| • | “€” refers to Euros; “$” refers to U.S. dollars; and “C$” refers to Canadian dollars. |

references to “MW” mean megawatts and “MWh” mean megawatt hours; and

all references to “$” shall mean U.S. dollars, which is our reporting currency, unless otherwise stated; “€” refers to Euros; and “C$” refers to Canadian dollars.

Due to rounding, numbers presented throughout this report may not add up precisely to totals we provide and percentages may not precisely reflect the absolute figures.

The Company

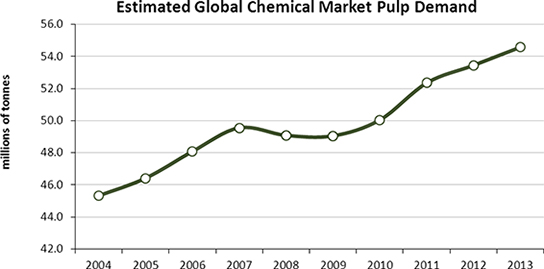

Mercer Inc. is a Washington corporation and our shares of common stock are quoted and listed for trading on the NASDAQ Global Market (MERC) and the Toronto Stock Exchange (MRI.U).

We operate in the pulp business and are among the largest publicly traded producerproducers of market northern bleached softwood kraft, or “NBSK”, pulp in the world. Mercer Inc. reorganized as a corporation under the laws of the State of Washington in 2006 from a Washington business trust. Its common stock is quoted and listed for trading on the NASDAQ Global Select Market (MERC) and the Toronto Stock Exchange (MRI.U).

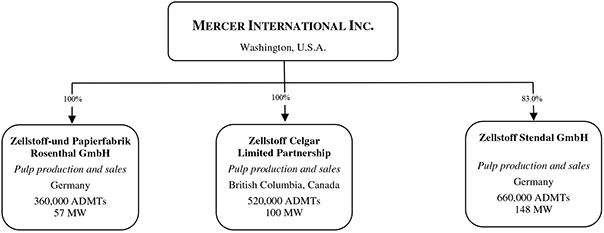

We are the sole kraft pulpNBSK producer, and the only significant producer of pulp for resale, known as “market pulp”, in Germany, which is the largest pulp import market in Europe. We also generate and sell a significant amount of surplus “green” energy to regional utilities. Our operations are located in Eastern Germany and Western Canada. We currently employ approximately 1,052 people at our German operations, 422 people at our Celgar mill in Western Canada and 17 people at our office in Vancouver, British Columbia, Canada.1,460 people. We operate three NBSK pulp mills with a consolidated annual production capacity of approximately 1.5 million ADMTs:

| | |

| | • | | Rosenthal mill.mill. Our wholly-owned subsidiary, Rosenthal, owns and operates the Rosenthal mill, a modern, efficient ISO 9001, 14001 and 1400150001 certified NBSK pulp mill that has a currentan annual pulp production capacity of approximately 330,000 ADMTs. Additionally, the360,000 ADMTs and 57 MW of electrical generation. The Rosenthal mill is a significant producer of “green” energygenerated and exported 123,309178,295 MWh of electricity in 2010.2013, resulting in approximately $21.5 million in annual revenues. The Rosenthal mill is located nearin the town of Blankenstein, Germany, approximately 300 kilometers south of Berlin. |

|

| | • | | Celgar mill.mill. Our wholly-owned subsidiary, Celgar, owns and operates the Celgar mill, a modern, efficient ISO 9001 and 14001 certified NBSK pulp mill with an annual pulp production capacity of approximately 520,000 ADMTs.ADMTs and 100 MW of electrical generation. The Celgar mill also produces “green” energygenerated and exported 70,923127,729 MWh of electricity in 2010. At the end of September of 2010, Celgar completed a new “green” energy project, referred to as the “Celgar Energy Project”, that is expected to increase surplus energy sales by over 238,000 MWh annually and generate2013, resulting in approximately C$20 to C$25$12.3 million of additional high-margin revenue per annum.in annual revenues. The Celgar mill is located near the city of Castlegar, British Columbia, Canada, approximately 600 kilometers east of Vancouver, British Columbia, Canada. |

|

| | • | | Stendal mill.mill. Our 74.9%83.0% owned subsidiary, Stendal, owns and operates the Stendal mill, astate-of-the-art, single-line, ISO 9001 and 14001 certified NBSK pulp mill that has an annual pulp production capacity of approximately 645,000 ADMTs. Additionally, the660,000 ADMTs and 148 MW of electrical generation. The Stendal mill is a significant producer of “green” energygenerated and exported 325,773393,027 MWh of electricity in 2010.2013, resulting in approximately $45.6 million in annual revenues. The Stendal mill is located near the town of Stendal, Germany, approximately 130 kilometers west of Berlin. |

5

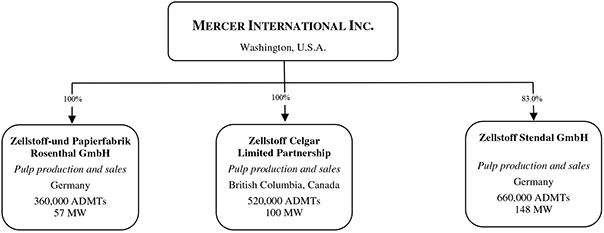

Organizational Chart

The following chart sets out our directly and indirectly owned principal operating subsidiaries, their jurisdictions of organization, their principal activities and their principal activities:

annual pulp production and electrical generation capacity:

History and Development of Business

We acquired our initialIn 1994, we commenced pulp and paper operations in 1993. Subsequently, we disposedwith the acquisition of our paper operations to focus our business on our core pulp operations.

Rosenthal mill. In late 1999, we completed a major capital project which, among other things, converted the Rosenthalthat mill to the production of kraft pulp from sulphite pulp, increased its annual production capacity reduced costs and improved efficiencies. The aggregate cost of this project was approximately €361.0$385.7 million, of which approximately €102.0$100.8 million was financed through government grants. Subsequent minor capital investments and efficiency improvements have reduced emissions and energy costs and increased the Rosenthal mill’s annual production capacity to approximately 330,000360,000 ADMTs.

In September 2004, we completed construction of the Stendal mill at an aggregate cost of approximately €1.0$1.1 billion. The Stendal mill is one of the largest NBSK pulp mills in Europe. The Stendal mill was financed through a combination of government grants totaling approximately €275.0$332.0 million, low-cost, long-term project debt which is largely severally guaranteed by the federal government and a state government in Germany, and equity contributions.

We initially had a 63.6% ownership interest in Stendal and, over time, increased our interest to 74.9%83.0%.

We Stendal and itsStendal’s noncontrolling shareholder are parties to a shareholders’ agreement dated August 26, 2002, as amended, to govern our respective interests in Stendal. The agreement contains terms and conditions customary for these types of agreements, including restrictions on transfers of share capital and shareholder loans other than to affiliates, rights of first refusal on share and shareholder loan transfers, pre-emptive rights and piggyback rights on dispositions of our interest. The shareholders are not obligated to fund any further equity capital contributions to the project. The shareholders’ agreement provides that Stendal’s managing directors are appointed by holders of a simple majority of its share capital. Further, shareholder decisions, other than those mandated by law or for the provision of financial assistance to a shareholder, are determined by a simple majority of Stendal’s share capital.

In December 2013, our Stendal mill completed a $49.3 million project, referred to as “Project Blue Mill”, which was designed to increase production and efficiency through debottlenecking initiatives including the installation of an additional 46 MW steam turbine at our Stendal mill. The debottlenecking which, among other things, required a new turbine in order to enhance and efficiently utilize steam production is designed to increase the mill’s annual pulp production capacity by 30,000 ADMTs. The new turbine is also expected to initially produce an additional 109,000 MWh of surplus renewable energy for sale at premium pricing.

A significant portion of the capital investments at our German mills, including the construction of the Stendal mill, were financed through government grants. Since 1999,1998, our German mills have benefited from an aggregate €384.7approximately $464.1 million in government grants. These grants reduce the cost basis of the assets purchased when the grants are received and are not reported in our income.

In February 2005, we acquired the Celgar mill for $210.0 million of which $170.0 million was paid in cash and $40.0 million was paid in our shares, plus $16.0 million for the defined working capital of the mill. The Celgar mill was completely rebuilt in the early 1990s through a C$850.0 million modernization and expansion project, which transformed it into a modern and competitive producer.

6

In 2007,Since its acquisition, we completed a C$28.0 millionhave effected several capital project which improved efficienciesprojects and reliability and, with other measures, increasedinitiatives at the Celgar mill’smill to increase its annual pulp production capacity to 500,000 ADMTs. In 2008, we commenced520,000 ADMTs and its production of “green” energy. This includes a capital project, referred to as the Celgar“Celgar Energy Project to increaseProject”, which was completed in September 2010 and increased the Celgar mill’s production of “green” energy and optimizeoptimized its power generation capacity. We completed the project at the end of September 2010capacity, at an aggregate cost of approximately C$64.9$60.6 million, of which approximately C$48.0$44.6 million was financed by grants from the Canadian federal government. See “— Capital Expenditures”. We have also increased the Celgar mill’s overall annual pulp production capacity to approximately 520,000 ADMTs through increased efficiencies.

Our Competitive Strengths

Our competitive strengths include the following:

| | |

| | • | | Modern and Competitive Mills.We operate three large, modern, competitive NBSK pulp mills that produce high qualityhigh-quality NBSK pulp, which is a premium grade of kraft pulp. We believe the relative age, production capacity and operating featureselectrical generation capacity of our mills provide us with certain manufacturing cost and other advantages over many of our competitors including lower maintenance capital expenditures.competitors. |

|

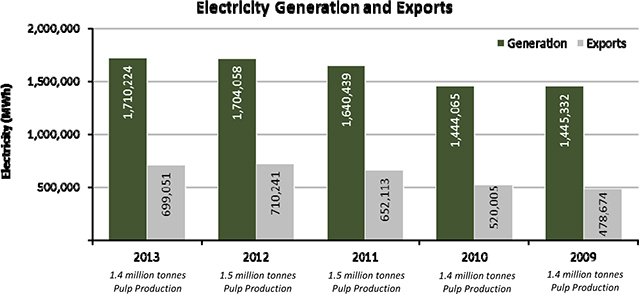

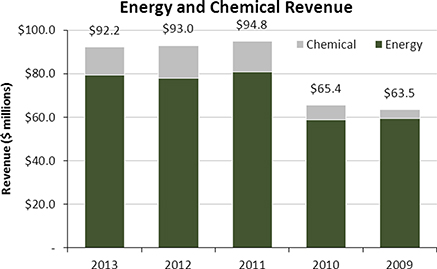

| | • | | Stable and Growing Income from Surplus Renewable Energy and Chemical Sales.Our modern mills generate electricity and steam in their boilers which is surplus to their operating requirements. Such energy is primarily produced from wood residuals which are a renewable carbon neutral source. All of our mills also generate and sell surplus energy to regional utilities. Our German mills benefit from special tariffs under Germany’sRenewable Energy Sources Act, referred to as the “Renewable Energy Act”, which provides for premium pricing. Our Celgar mill is party to a fixed electricity purchase agreement, referred to as the “Electricity Purchase Agreement”, with the regional public utility provider, for the sale of surplus power that runs until 2020. Our Stendal mill also produces tall oil as a chemical by-product which is sold to third parties. In 2013, our mills produced approximately 699,051 MWh of surplus renewable energy and generated approximately $92.2 million in revenues from energy and chemical sales. These sales provide us with a stable income unrelated to cyclical changes in pulp prices. In 2014, we expect our revenues from this source to increase as we completed the Blue Mill Project at our Stendal mill in December 2013, which is designed to produce an annual incremental 109,000 MWh of surplus energy. Additionally, in 2014, our Rosenthal mill is implementing a capital project to also produce and sell tall oil. We believe our generation and sale of surplus renewable “green” energy and chemicals provides us with a competitive energy advantage over less efficient mills. |

| • | | Leading Market Position. Mercer isWe are among the largest publicly traded NBSK market pulp producerproducers in the world, which provides us increased presence and better industry information in the markets in which we operate and provides for closestrong customer relationships with many large pulp consumers. |

|

| | • | Renewable Surplus Energy. Our modern mills generate electricity and steam in their boilers and are generally energy self-sufficient. Such energy is primarily produced from wood residuals which are a renewable carbon neutral source. All of our mills also generate surplus energy which we sell to third parties. Our Rosenthal and Stendal mills benefit from special tariffs under Germany’sRenewable Energy Resources Act, referred to as the “Renewable Energy Act” which provides for premium pricing and has materially increased their revenues from sales of surplus power. Additionally, our Celgar mill completed the Celgar Energy Project at the end of September 2010 and is party to an electricity purchase agreement, referred to as the “Electricity Purchase Agreement” with the British Columbia Hydro and Power Authority, or “B.C. Hydro”, British Columbia’s primary public utility provider, for the sale of surplus power for ten years. The Celgar Energy Project is expected to increase our consolidated total sales of surplus power by 238,000 MWh per annum to over 700,000 MWh per annum. We believe our generation and sale of surplus renewable “green” energy provides us with a competitive energy advantage over less efficient mills. |

|

| • | Strategic Locations and Customer Service.We are the only significant producer of market pulp in Germany, which is the largest pulp import market in Europe. Due to the proximity of our German mills to most of our European customers, we benefit from lower transportation costs relative to our major competitors. Our Celgar mill, located in Western Canada, is well situated to serve Asian and North American customers. We primarily work directly with customers to capitalize on our geographic diversity, coordinate sales and enhance customer relationships. We believe our ability to deliver high qualityhigh-quality pulp on a timely basis and our customer service makesmake us a preferred supplier for many customers. |

|

| | • | | Advantageous Capital Investments and Financing.Our German mills are eligible to receive government grants in respect of qualifying capital investments. Over the last eleven16 years, our German mills have benefited from approximately €384.7$464.1 million of such government grants. In addition, in October 2009, our Celgar mill qualified to receive C$57.7received approximately $55.6 million of creditsgrants under the Canadian government’s Pulp and Paper Green Transformation Program referred to asfund the “GTP”. TheseCelgar Energy Project and other smaller projects. All such grants reduce the cost basis of the assets purchased when the grants are received and are not reported in our income. Additionally, during the last eleventen years, capital investments at our German mills have reduced the amount of overall wastewater fees that would otherwise be payable by over €55.8$71.3 million. Further, our Stendal mill benefits from German governmental guarantees of its project financing, which permitted it to obtain better credit terms and lower interest costs than would otherwise have been available. TheStendal’s project debt, of Stendal which matures in 2017, currently bears interest at a substantially fixed rate of 5.28% per annum plus an applicable margin and is non-recourse to our other operations and Mercer Inc. |

7

| | |

| | • | | Proximity of Abundant Fiber Supply.Although fiber is cyclical in both price and supply, there is a significant amount of high-quality fiber within a close radius of each of our mills. This fiber supply, combined with our purchasing power and our current ability to meaningfully switch between whole logs chipped at our mills and sawmill residual chips, enables us to enter into contracts and arrangements which have generally provided us with a competitivesufficient fiber supply. |

|

| | • | | Experienced Management Team. Our directors and senior managers have extensive experience in the pulp and forestry industries. In particular, our Chief Executive Officer has over 16 years experience in the pulp industry and has guided the Company’s operations and development over that time. Our Chief Operating Officer and Chief Financial Officer each has over 30 years of industry experience. We also have experienced managers at all of our mills. Our management has a proven track record of implementing new initiatives and programscapital projects in order to reduce costs throughout our operations as well as identifying and harnessing new revenue opportunities. |

Corporate Strategy

Our corporate strategy is to create shareholder value by focusing on the expansion of our asset and earnings base.base through organic growth and acquisitions, primarily in Europe and North America. We pursue organic growth through active management and targeted capital expenditures to generate a high return by increasing pulp, energy and chemical production, reducing costs and improving efficiency. We are also conducting research to develop innovative new products based on other derivatives of the kraft pulping process. We seek to acquire interests in companies and assets in the pulp industry and related businesses where we can leverage our experience and expertise in adding value through a focused management approach. Key features of our strategy include:

| | |

| | • | | Focus on NBSK Market Pulp.Targeted Capital Expenditures.We focus on NBSK pulp because it is a premium grade kraft pulp and generally obtains the highest price relative to other kraft pulps. Although demand is cyclical, between 1998 and 2008, worldwide demand for softwood kraft market pulp grew at an average of approximately 2.3% per annum. We focus on servicing customers that produce high quality printing and writing paper grades and tissue producers. This allows us to benefit from our stable relationships with paper and tissue manufacturers in Europe and Asia as well as participate in strong growth markets such as China where we also have strong customer relationships. |

|

| • | Maximizing Renewable Energy Realizations. In 2010 and 2009, our mills generated 520,005 MWh and 478,674 MWh, respectively, of surplus energy, primarily from a renewable carbon-neutral source. We are developing other initiatives to increase our overall energy generation and the amount of and price for our surplus power sales. We completed the Celgar Energy Project at the end of September 2010. Based upon the current production levels of our mills and after giving effect to the planned generation from the Celgar Energy Project, we expect to generate and sell between 700,000 MWh and 750,000 MWh of surplus renewable energy per annum. We expect energy generation and sales to continue to be a key focus for our mills for the foreseeable future. |

|

| • | Enhancing Long-Term Sustainability/Growth. In connection with the global slowdown that commenced in 2008, we shifted our short-term focus to enhancing the long-term sustainability of our business. To this end, we have extended the maturity of senior debt and reduced our overall debt levels in order to maximize our long-term liquidity position. Although pulp prices improved significantly in 2010, we intend to continue our focus on cost reduction initiatives while strategically evaluating and pursuing internal, high return capital projects and growth opportunities in order to enhance cash flows and maximize shareholder value. |

|

| • | Operating and Maximizing Returns from our Modern, World-Class Mills. In order to keep our operating costs as low as possible, with a goal of generating positive cash flow in all market conditions, we operate three large modern pulp mills. Wemills as we believe these production facilities provide us with the best platform to be an efficient and competitive producer of high-quality NBSK pulp without the need for significant sustaining capital. Our modern mills are also generally net exporters of renewable energy. We are constantly reviewing opportunitiesseek to enhancemake targeted capital expenditures that increase the production and maximize the usageoperational efficiency of the strengthsmills, reduce costs and improve product quality. Over the last five years, we have invested approximately $200.0 million (including $73.0 million in associated government grants) in growth capital expenditures for capacity expansions and operational efficiencies. |

| • | | Increasing Stable Revenues from Renewable Energy and Chemical Sales.We focus on the generation and sales of surplus renewable energy and chemicals and, because there are minimal associated incremental costs, such sales are highly profitable and they provide us with a stable income source unrelated to cyclical changes in pulp prices. In 2013, our mills sold 699,051 MWh of surplus electricity resulting in revenues of approximately $79.4 million, compared to 710,241 MWh and approximately $78.0 million in revenues in 2012. In December 2013, our Stendal mill completed Project Blue Mill to increase production and efficiency through debottlenecking initiatives and the installation of a 46 MW steam turbine at the mill. The new turbine is expected to initially produce an additional 109,000 MWh of surplus electricity annually. Our Rosenthal mill is implementing a capital project in 2014 to produce and sell tall oil. Based upon the current production levels of our mills, including through increasedwe expect to sell in excess of 840,000 MWh of surplus renewable energy in 2014. We continually explore and pursue initiatives to enhance our energy and chemical generation production ofand sales in order to reduce volatility and increase our revenues from a stable source. |

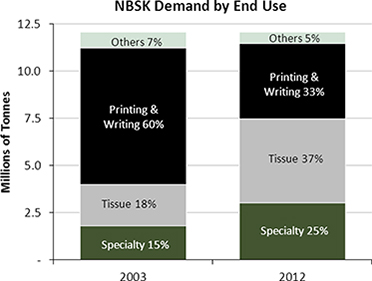

| • | | Focus on NBSK Market Pulp.We produce NBSK pulp because it is a premium grades ofgrade kraft pulp and other improvements, to capturegenerally obtains the highest returns available.price relative to other kraft pulps. Although demand is cyclical, between 2004 and 2013 overall worldwide demand for bleached softwood kraft market pulp grew at an average of approximately 2% per annum. We focus on customers that produce tissue, specialty papers and high-quality printing and writing paper grades. We believe the growth in demand from tissue and specialty paper customers, which utilize a significant proportion of NBSK pulp, has more than offset the secular decline in demand from printing and writing paper customers. This allows us to benefit from our long-term relationships with tissue and paper manufacturers in Europe and participate in strong growth markets in emerging countries such as China where there has been strong growth in tissue demand. |

8

| • | | Achieving Operational Excellence.Operating our mills reliably and at a competitive cost is important for our financial performance. In addition to our capital expenditure program, we continuously strive to develop maintenance systems and procedures that will improve the throughput of our products by increasing the reliability of our manufacturing processes. We also seek to reduce operating costs by better managing certain operating activities such as fiber procurement, sales, marketing and logistics activities. We believe that our continued focus on operational excellence should allow us to achieve improved profitability and cash flows. |

| • | | Strategic Opportunities.We believe there will be continuing change and consolidation in the pulp and paper industry as industry participants continually seek to lower costs, refocus their product lines and react to ever changing global market conditions. We take an opportunistic approach to opportunities that can expand our earnings or grow our business. |

The Pulp Industry

Pulp is used in the production of paper, tissues and paper-related products. Pulp is generally classified according to fiber type, the process used in its production and the degree to which it is bleached. Kraft pulp, a type of chemical pulp, is produced through a sulphate chemical process in which lignin, the component of wood which binds individual fibers, is dissolved in a chemical reaction. Chemically prepared pulp allows the wood’s fiber to retain its length and flexibility, resulting in stronger paper products. Kraft pulp can be bleached to increase its brightness. Kraft pulp is noted for its strength, brightness and absorption properties and is used to produce a variety of products, including lightweight publication grades of paper, tissues and other paper-related products.

The selling price of kraft pulp depends in part on the fiber used in the production process. There are two primary speciesmain types of wood used as fiber:bleached kraft pulp, being softwood kraft made from coniferous trees and hardwood.hardwood kraft made from deciduous trees. Softwood species generally have long, flexible fibers which add strength to paper while fibers from species of hardwood contain shorter fibers which lend bulk and opacity. Generally, list prices for softwood pulp are higher than list prices for hardwood pulp. Most uses of market kraft pulp, including fine printing papers, coated

We produce and uncoated magazine papers and various tissue products, utilize a mix of softwood and hardwood grades to optimize production and product qualities. In recent years, production of hardwood pulp, based on fast growing plantation fiber primarily from Asia and South America, has increased much more rapidly than that of softwood grades that have longer growth cycles. As a result of the growth in supply and lower costs, kraft pulp customers have substituted some of the pulp content in their products to hardwood pulp. Counteracting customers’ increased proportionate usage of hardwood pulp has been the requirement for strength characteristics in finished goods. Paper and tissue makers focus on higher machine speeds and lower basis weights for publishing papers which also require the strength characteristics of softwood pulp. We believe that the ability of kraft pulp users to continue to further substitute hardwood for softwood pulp is limited by such requirements.

sell NBSK pulp, which is a bleached kraft pulp manufactured using species of northern softwood and is considered a premium grade because of its strength. It generally obtains the highest price relative to other kraft pulps. Southern bleached softwood kraft pulp is kraft pulp manufactured using southern softwood species and does not possess the strength found in NBSK pulp. NBSK pulp is the sole pulp product of our mills.

Most paper users of market kraft pulp use a mix of softwood and hardwood grades to optimize production and product qualities. In 2013, market kraft pulp consumption was approximately 52% hardwood bleached kraft, 44% softwood bleached kraft and the remainder comprised of unbleached pulp. Over the last several years, production of hardwood pulp, based on fast growing plantation fiber primarily from Asia and South America, has increased much more rapidly than that of softwood grades that have longer growth cycles. Hardwood kraft generally has a cost advantage over softwood kraft as a result of lower fiber costs, higher wood yields and, for newer hardwood mills, economies of scale. As a result of this growth in supply and lower costs, kraft pulp customers have substituted some of the pulp content in their products to hardwood pulp.

Counteracting customers’ ability to substitute lower priced hardwood pulp for NBSK pulp is the requirement for strength and formation characteristics in finished goods. Paper and tissue makers focus on larger paper machines with higher speeds and lower basis weights for certain papers which require the strength characteristics of softwood pulp. Additionally, where paper products are lightweight or specialized, like direct mail, magazine paper or premium tissue, or where strength or absorbency are important, softwood kraft forms a significant proportion of the fiber used. As a result, we believe that the ability of kraft pulp users to further substitute hardwood for softwood pulp is limited by such requirements.

Kraft pulp can be made in different grades, with varying technical specifications, for different end uses. High-quality kraft pulp is valued for its reinforcing role in mechanical printing papers, while other grades of kraft pulp are used to produce lower priced grades of paper, including tissues and paper-related products.

We believe that over 125130 million ADMTs of kraftchemical pulp are converted annually into tissues, printing and writing papers, tissues, carton boards and other whitespecialty grades of paper and paperboard around the world. We also believe that approximatelyover one third of this pulp is sold on the open market as market pulp, while the remainder is produced for internal purposes by integrated paper and paperboard manufacturers.

Demand for kraft pulp is cyclical in nature and is generally related to global and regional levels of economic activity. In 2008, overall global demand for all kraft pulp types, including softwood, was negatively impacted by the weak global economic conditions and global financial and credit turmoil the world began to experience in the second half of that year and which continued into the first half of 2009. Significant producer shutdowns and curtailments, along with strong demand from China, resulted in an improved supply-demand balance and improved prices in the second half of 2009 through 2010.

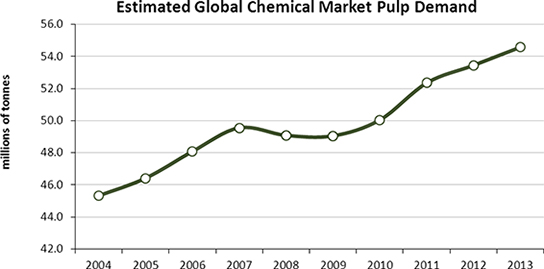

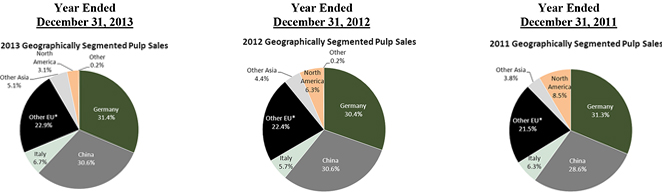

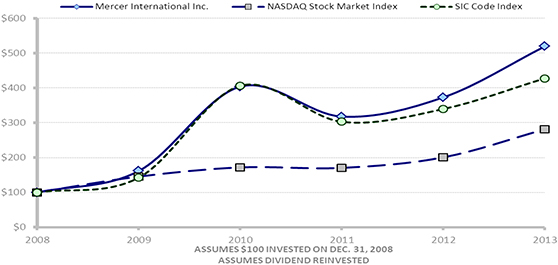

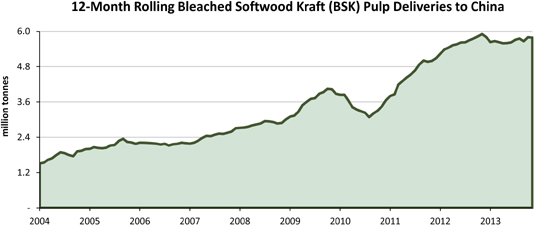

Although global pulp markets continued to strengthen in the first half of 2011, mainly driven by demand from Asia, economic uncertainty in Europe and credit tightening in China resulted in a decrease in demand and weaker pulp prices in the fourth quarter of 2011. In 2012, there was continued economic uncertainty in Europe and credit tightening in China in the first half of the year. Further, in the latter part of 2012, weak demand for paper in Europe resulted in some integrated producers curtailing their paper production and selling their pulp on the market, primarily in China. These factors negatively impacted demand and supply of pulp and resulted in generally weak pulp prices. In 2013, demand from China was stable throughout the year and supply was slightly under-balanced, which resulted in higher prices in 2013.Between 19982004 and 20082013, worldwide demand for softwoodchemical market pulp grew at an average rate of approximately 2.3%2% annually. DemandThe following chart illustrates the global demand for softwoodchemical market pulp was negatively impacted by weak global economic conditionsfor the periods indicated:

Two key macro-economic trends in 2009. However,worldwide NBSK pulp demand over the supply/last several years have been:

a significant increase in demand balance for softwood market pulp improvedfrom emerging markets, and in 2010, primarily due to strongparticular China, which has more than offset a decline in demand in China, the residual effectsmature markets of Europe, North America and Japan; and

partly related to the Chilean earthquake that affected millsforegoing, there has been a significant shift in that regiondemand by end use, as demand from tissue and specialty producers has increased markedly and offset the net closure of approximately 3.4 million tonnes of production capacity globally. secular decline in demand for printing and writing paper resulting from the rapid growth in digital media.

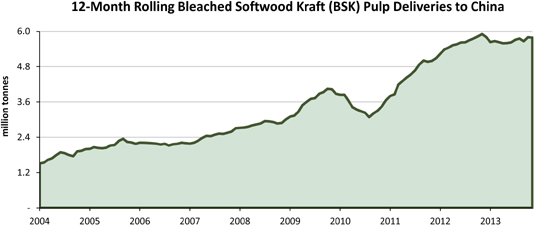

Since 2007, demand for chemical softwood market pulp has grown in the emerging markets of Asia, Eastern Europe and Latin America. China in particular has experienced substantial growth and its demand forimports of softwood market pulp grew by approximately 13.6%13% per annum between 2004 and 2009.2013. We believe the emerging markets now account for approximately 50% of total world demand. China now accounts for approximately 22%28% of global bleached softwood kraft market

9

pulp demand, compared to only 12% in 2004. Western Europe currently accounts for approximately 28%27% of global bleached softwood kraft market pulp demand.

demand, compared to approximately 38% in 2004. We believe the demand in the mature markets of Europe, North America and Japan in 2013 will have declined by approximately 2.5 million ADMTs from its peak in 2005.The following chart sets forth industry-wide bleached softwood kraft delivery levels to China for the periods indicated:

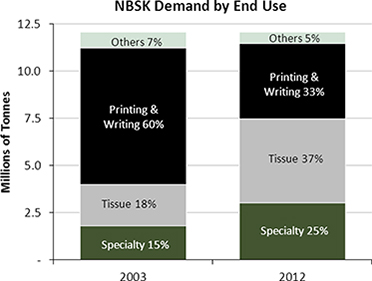

Growth in NBSK pulp demand in China and other emerging markets has, to a large extent, been driven by increased demand from tissue producers, as a result of economic growth and rising income levels and living standards in such markets. These factors generally contribute to a greater demand for personal hygiene products in such regions. In China alone, tissue producers have publicly announced plans to add a total of 132 tissue paper machines at various sites by the end of 2015 to increase their annual tissue capacity by approximately 4.9 million ADMTs. At this time there can be no assurance as to when and how much of such capacity expansion will be implemented.

This has also led to an overall shift in demand for NBSK pulp, as demand from tissue producers has increased, while demand from printing and writing end uses has decreased. Between 2004 and 2012 (the last year for which information is currently available), NBSK pulp demand for tissue production increased by approximately 106%.

The following chart compares NBSK pulp demand by end use in each of 2003 and 2012 (the latest year for which figures are currently available).

We believe 2013 NBSK demand by end use was generally consistent with the trend in the chart above.

A measure of demand for kraft pulp is the ratio obtained by dividing the worldwide demand of kraft pulp by the worldwide capacity for the production of kraft pulp, or the “demand/capacity ratio”. An increase in this ratio generally occurs when there is an increase in global and regional levels of economic activity. An increase in this ratio also generally indicates greater demand as consumption increases, which often results in rising kraft pulp prices and a reduction of inventories by producers and buyers. As prices continue to rise, producers continue to run at higher operating rates. However, an adverse change in global and regional levels of economic activity generally negatively affects demand for kraft pulp, often leading buyers to reduce their purchases and relyingrely on existing pulp inventories. As a result, producers run at lower operating rates by taking downtime to limit thebuild-up of their own inventories. The demand/capacity ratio for softwood kraft pulp was approximately 93%94%, 94% and 92% in 2010, approximately 91% in 20092013, 2012 and approximately 89% in 2008.

2011, respectively.A significant factor affecting our market is the amount of closures of old, high-cost capacity. InOver the four-year period from 2006 to 2009, we estimate approximately 5.3 million tonnes of predominantly NBSK capacity waslast several years, mills in North America, Finland and Sweden were permanently or indefinitely closed. In connection with the recent recovery of pulp prices, approximately 1.9 million tonnesAlthough some capacity was restarted in late 2009 and 2010. The2010 in response to very high NBSK pulp prices, we believe the overall net effect reduced NBSK pulp supply and positively impacted markets. Between 2011 and 2013, we believe approximately 1.5 million ADMTs of thesepulp capacity was idled or shut down through mill closures or curtailments. Further, in efforts to improve environmental and restartssafety standards, China has publicly stated that it will be reducing existing pulp and paper capacity in the near term by closing “old” mills, targeting a removal of 7.4 million ADMTs by the end of 2013. At this time, there can be no certainty as to the actual amount and timing of any such closures.

During the course of 2014, the supply of hardwood bleached kraft pulp production is an estimated 3.4projected to increase by approximately 2.1 million tonnesADMTs, primarily from South America. This increase in hardwood chemical production is, in large part, targeted at the growing demand for pulp by tissue makers, particularly in China. As a result of capacity removed from the market. generally lower prices for hardwood bleached pulp, this increase in supply could put downward pressure on NBSK pulp prices.

We are aware of only one plannednew NBSK mill in Russia which started up in 2013. The new mill provided a net incremental increase in annual pulp production capacity of approximately 490,000 ADMTs. Other than the foregoing, we are unaware of any new material NBSK pulp capacity that has been announced. However, certain integrated pulp and paper producers have the ability to discontinue paper production by idling their paper machines and selling their NBSK pulp production on the market, if market conditions, prices and trends warrant such actions. We believe that the absence of other plant expansion worldwide in the next few years, which we believeexpansions is due in part to fiber supply constraints and high capital costs.

CompetitionNBSK Pulp Pricing

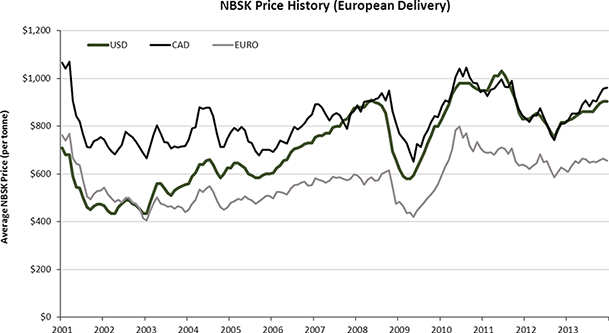

Pulp prices are highly cyclical. In general, kraft pulp is a globally traded commodity. Pricing and demand are influenced by the balance between supply and demand, as affected by global macroeconomic conditions, changes in consumption and capacity, the level of customer and producer inventories and fluctuations in exchange rates. As Northern Europe has historically been the world’s largest market and NBSK is the premium grade, the European NBSK market price is generally used as a benchmark price by the industry.

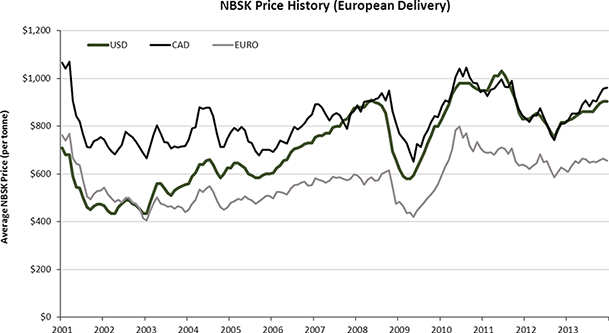

The average European list prices for NBSK pulp since 2000 have fluctuated between a low of approximately $447 per ADMT in 2002 to a high of $1,030 per ADMT in 2011.

The following chart sets out the changes in list prices for NBSK pulp in Europe, as stated in U.S. dollars, Canadian dollars and Euros for the periods indicated:

In 2006, pulp prices increased steadily from approximately $600 per ADMT in Europe to $870 per ADMT at the end of 2007. These price increases resulted from increased demand and the closure of several pulp mills, particularly in North America, which reduced NBSK capacity. In the second half of 2008, list prices for NBSK pulp decreased markedly due to weak global economic conditions. As a result, list prices for NBSK pulp in Europe decreased from $900 per ADMT in mid-2008 to $635 per ADMT at the end of the year. Such pulp price weakness continued into early 2009, though commencing in mid-2009, pulp markets began to strengthen which led to improved prices. Strong demand from China, capacity closures and historically low global inventories for bleached softwood kraft pulp helped support upward price momentum. During the second half of 2009, several price increases raised European list prices by a total of $170 per ADMT to $800 per ADMT by year end. Such price increases were partially offset by the continued weakening of the U.S. dollar versus the Euro and Canadian dollar during the period. In 2010, several increases lifted prices to record levels in the middle of the year and at the end of 2010 list prices were near historic highs of $950, $960 and $840 per ADMT in Europe, North America and China, respectively.

In 2011, pulp prices remained strong in the first half of the year, reaching record levels of $1,030 per ADMT in Europe and $1,035 and $920 per ADMT in North America and China, respectively. However, uncertainty concerning the economic situation in Europe, along with credit tightening in China in the last part of the year, caused pulp prices to drop sharply to $825 per ADMT in Europe and $890 and $670 per ADMT in North America and China, respectively, by the end of the year. Economic uncertainty in Europe and China continued to dampen demand and NBSK pulp prices, which remained generally weak in 2012. In 2012, year-end list prices were approximately $810, $870 and $655 per ADMT in Europe, North America and China, respectively. In 2013, demand from China was stable throughout the year and supply was slightly under-balanced, which resulted in higher year-end list prices of $905 per ADMT in Europe and $990 and $750 per ADMT in North America and China, respectively.

A producer’s net sales realizations are list prices, net of customer discounts, commissions and other selling concessions. While there are differences between NBSK list prices in Europe, North America and Asia, European prices are generally regarded as the global benchmark and pricing in other regions tends to follow European trends. The nature of the pricing structure in Asia is different in that, while quoted list prices tend to be lower than Europe, customer discounts and rebates are much lower resulting in net sales realizations that are generally similar to other markets.

The majority of market NBSK pulp is produced and sold by Canadian and Northern European producers, while the price of NBSK pulp is generally quoted in U.S. dollars. As a result, NBSK pricing is often affected by fluctuations in the currency exchange rates for the U.S. dollar versus the Canadian dollar, the Euro and local currencies. NBSK pulp price increases during 2006, 2007 and the first half of 2008 were in large part offset by the weakening of the U.S. dollar. Similarly, the strengthening of the U.S. dollar against the Canadian dollar and the Euro towards the end of 2008 helped partially offset pulp price decreases caused by the deterioration in global economic conditions. The overall strengthening of the U.S. dollar against the Euro in 2010, and in particular in the first half of 2010, improved the operating margins of our German mills. Although the U.S. dollar weakened against the Euro for most of 2011, it strengthened at the end of 2011. Overall, the U.S. dollar was 8% stronger against the Euro in 2012 compared to 2011, partially offsetting pulp price decreases in 2012. In 2013, the U.S. dollar was 3% weaker against the Euro, compared to 2012, which reduced the operating margins of our German mills.

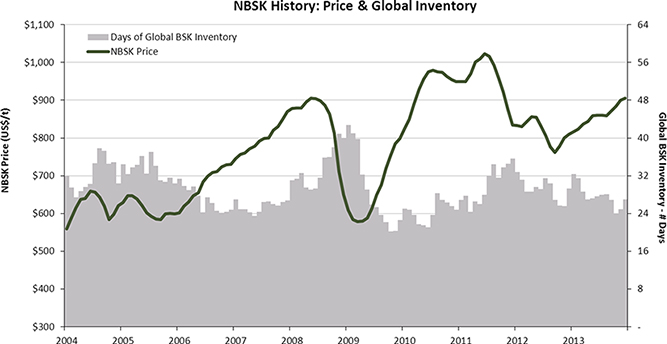

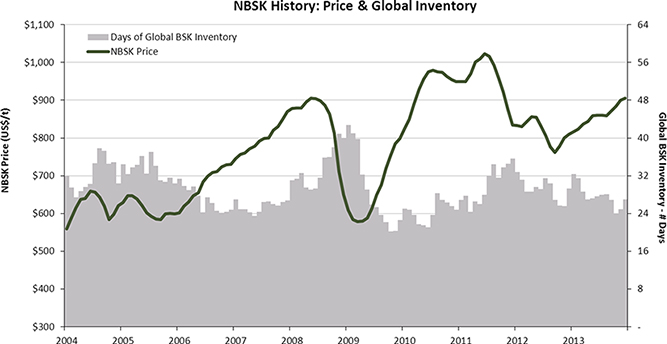

The global supply and demand balance for NBSK pulp is a key determinant in pulp pricing. Generally, we and other producers consider global NBSK pulp supply and demand to be evenly balanced when world inventory levels are at about 30 days’ supply.

The following chart sets forth changes in FOEX PIX Pulp index prices for NBSK pulp and global bleached softwood kraft inventory levels between 2004 and 2013:

Seasonality

We are exposed to fluctuations in quarterly sales volumes and expenses due to seasonal factors. These factors are common in the NBSK pulp industry. We generally have weaker pulp demand in Europe during the summer holiday months and in China in the period relating to its lunar new year. We typically have a seasonal build-up in raw material inventories in the early winter months as the mills build up their fiber supply for the winter when there is reduced availability.

Competition

Pulp markets are large and highly competitive. Producers ranging from small independent manufacturers to large integrated companies produce pulp worldwide. Our pulp and customer services compete with similar products manufactured and distributed by others. While many factors influence our competitive position, particularly in weak economic times, a key factor is price. Other factors include service, quality and convenience of location. Some of our competitors are larger than we are in certain markets and have substantially greater financial resources. These resources may afford those competitors more purchasing power, increased financial flexibility, more capital resources for expansion and improvement and enable them to compete more effectively. Our key NBSK pulp competitors are principally located in Northern Europe and Canada.

Pulp prices are highly cyclical. Global economic conditions, changes in production capacity, inventory levels, and currency exchange rates are the primary factors affecting NBSK pulp list prices. The average annual European list prices for NBSK pulp since 2000 have ranged from a low of approximately $447 per ADMT to a high of $980 per ADMT.

Starting in 2006, pulp prices increased steadily from approximately $600 per ADMT in Europe to $870 per ADMT at the end of 2007. These price increases resulted from the closure of several pulp mills, particularly in North America, which reduced NBSK capacity by approximately 1.3 million ADMTs, better demand and the general weakness of the U.S. dollar against the Euro and the Canadian dollar.

In the second half of 2008, list prices for NBSK pulp decreased markedly due to weak global economic conditions. As a result, list prices for NBSK pulp in Europe decreased from $900 per ADMT in mid-2008 to $635 per ADMT at the end of the year. Such price weakness continued into early 2009 as list prices in Europe fell to approximately $575 per ADMT. Commencing in mid-2009, pulp markets began to strengthen which led to improved prices. Strong demand from China, capacity closures and historically low global inventories for bleached softwood kraft pulp helped support upward price momentum. During the second half of 2009, several price increases raised European list prices by a total of $170 per ADMT to $800 per ADMT by year end. Such price increases were partially offset by the continued weakening of the U.S. dollar versus the Euro and Canadian dollar during the period. In December 2009, list prices for pulp were approximately $800 per ADMT in Europe, $830 per ADMT in North America and $700 per ADMT in China. In 2010, several increases lifted prices to record levels in the middle of the year and at the end of 2010 list prices were near historic highs of $950, $960 and $840 per ADMT

10

in Europe, North America and China, respectively. As pulp prices are highly cyclical, there can be no assurance that prices will not decline in the future.

A producer’s net sales realizations are list prices, net of customer discounts, commissions and other selling concessions. While there are differences between NBSK list prices in Europe, North America and Asia, European prices are generally regarded as the global benchmark and pricing in other regions tends to follow European trends. The nature of the pricing structure in Asia is different in that, while quoted list prices tend to be lower than Europe, customer discounts and commissions tend to be lower resulting in net sales realizations that are generally similar to other markets.

The majority of market NBSK pulp is produced and sold by Canadian and Scandinavian producers, while the price of NBSK pulp is generally quoted in U.S. dollars. As a result, NBSK pricing is affected by fluctuations in the currency exchange rates for the U.S. dollar versus the Canadian dollar, the Euro and local currencies. NBSK pulp price increases during 2006, 2007 and the first half of 2008 were in large part offset by the weakening of the U.S. dollar. Similarly, the strengthening of the U.S. dollar against the Canadian dollar and the Euro towards the end of 2008 helped slightly offset pulp price decreases caused by the deterioration in global economic conditions. The overall strengthening of the U.S. dollar against the Euro in 2010, and in particular in the first half of 2010, improved the operating margins of our German mills.

The following chart sets out the changes in list prices for NBSK pulp in Europe, as stated in U.S. dollars, Canadian dollars and Euros for the periods indicated.

Price Delivered to N. Europe (C$ and €equivalent indexed to 2000)

11

The Manufacturing Process

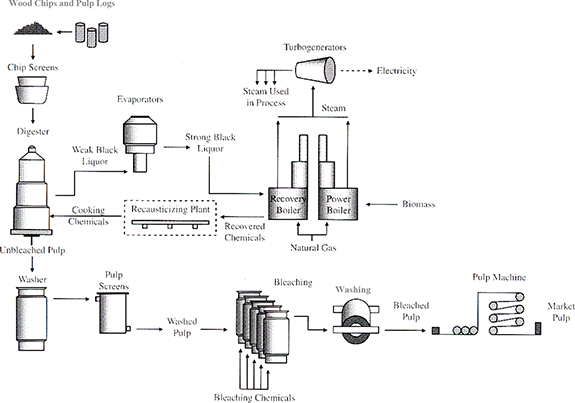

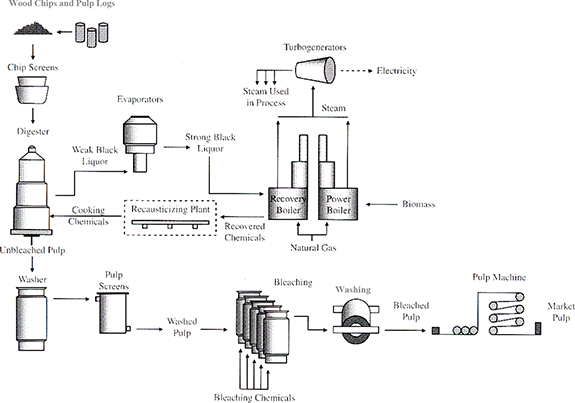

The following diagram provides a simplified description of the kraft pulp manufacturing process at our pulp mills:

In order to transform wood chips into kraft pulp, wood chips undergo a multi-step process involving the following principal stages: chip screening, digesting, pulp washing, screening, bleaching and drying.

In the initial processing stage, wood chips are screened to remove oversized chips and sawdust and are conveyed to a pressurized digester where they are heated and cooked with chemicals. This occurs in a continuous process at the Celgar and Rosenthal mills and in a batch process at the Stendal mill. This process softens and eventually dissolves the phenolic material called lignin that binds the fibers to each other in the wood.

Cooked pulp flows out of the digester and is washed and screened to remove most of the residual spent chemicals called black liquor, and partially cooked wood chips. The pulp then undergoes a series of bleaching stages where the brightness of the pulp is gradually increased. Finally, the bleached pulp is sent to the pulp machine where it is dried to achieve a dryness level of more thanapproximately 90%. The pulp is then ready to be baled for shipment to customers.

A significant feature of kraft pulping technology is the recovery system, whereby chemicals used in the cooking process are captured and extracted for re-use, which reduces chemical costs and improves environmental performance. During the cooking stage, dissolved organic wood materials and used chemicals, collectively known as black liquor, are extracted from the digester. After undergoing an evaporation process, black liquor is burned in a recovery boiler. The chemical compounds of the black liquor are collected from the recovery boiler and are reconstituted into cooking chemicals used in the digesting stage through additional processing in the recausticizing plant.

The heat produced by the recovery boiler is used to generate high-pressure steam. Additional steam is generated by a power boiler through the combustion of biomass consisting of bark and other wood residuesresiduals from sawmills and our woodrooms and residue generated by the effluent treatment system. Additionally, during times of

12

upset, we may use natural gas to generate steam. The steam produced by the recovery and power boilers is used to power a turbine generator to generate electricity, as well as to provide heat for the digesting and pulp drying processes.

Research and Development

We, along with other pulp producers both individually and through industry associations, are conducting research and development focused on developing innovative new products that are based on derivatives of the kraft pulping process. Currently these derivatives are focused in two broad categories:

the further refinement of materials contained in black liquor, the extractive chemical and lignin containing compounds that are a result of the kraft pulping process; and

the further refinement of cellulose materials that are currently the basis of NBSK kraft pulp.

We are engaged with several research partners to participate in and develop new innovative products. To date, one of the most well-developed of these projects is a cellulose derivative generally referred to in the industry as “cellulose filaments”. Cellulose filaments are the result of a new process that unbinds the individual filaments that make up a cellulose fiber. In northern softwoods, there are approximately 1,000 filaments making up a single fiber. The filaments resulting from this patented process are long, ribbon-like structures that have unique strength characteristics similar to other chemical derivatives, such as aramids. We believe that this material may have commercial potential in many applications, including strength enhancers, solution stabilizers and specialty solutions for numerous other industries.

We are part of an industry association that has made considerable progress in developing a particular manufacturing process. We, along with other member companies, including certain other NBSK producers, have license rights to further develop and market existing intellectual property registered under patent to our industry association. Further, such association, in conjunction with one of its member companies, is constructing a pilot production facility and we have access to its product for development purposes. While there remains much research and development to be done, we are encouraged enough to continue to expend resources to develop this technology, both individually and in joint development arrangements with third parties. We estimate expenditures totaling approximately $3.0 million over the next three years.

Such research and development is still at an early stage and there has been no commercialization of the research to date. We currently estimate it may take between three and five years before we can determine if product applications can be commercialized. However, there can be no assurance that such research and development will ever result in commercialization or the production or sales of any products by us at a profit or at all.

Our Mills and Product

We manufacture and sell NBSK pulp produced from wood chipswoodchips and pulp logs.logs at our three mills.

The following table sets out our pulp production capacity and actual production by mill for the periods indicated:

| | | | | | | | | | | | | | | | |

| | | Annual

Production

Capacity(1) | | | Year Ended December 31, | |

| | | | 2013 | | | 2012 | | | 2011 | |

Pulp Production by Mill: | | | | | (ADMTs) | |

Rosenthal | | | 360,000 | | | | 361,724 | | | | 337,959 | | | | 344,389 | |

Celgar | | | 520,000 | | | | 447,935 | | | | 490,018 | | | | 488,007 | |

Stendal | | | 660,000 | | | | 634,816 | | | | 640,298 | | | | 621,281 | |

| | | | | | | | | | | | | | | | |

Total pulp production | | | 1,540,000 | | | | 1,444,475 | | | | 1,468,275 | | | | 1,453,677 | |

| | | | | | | | | | | | | | | | |

| (1) | Capacity is the rated capacity of the plants for the year ended December 31, 2013. |

Rosenthal Mill.The Rosenthal mill is situated on a 220 acre site in the town of Blankenstein in the state of Thüringia, approximately 300 kilometers south of Berlin. The Saale river flows through the site of the mill. In late 1999, we completed a major capital project which converted the Rosenthal mill to the production of kraft pulp. It is a single line mill with a current annual production capacity of approximately 360,000 ADMTs of kraft pulp. The mill is self-sufficient in steam and electrical power. Some excess electrical power which is constantly generated is sold to the regional power grid. The facilities at the mill include:

an approximately 315,000 square feet fiber storage area;

debarking and chipping facilities for pulp logs;

an approximately 300,000 square feet roundwood yard;

a fiber line, which includes a Kamyr continuous digester and bleaching facilities;

a pulp machine, which includes a dryer, a cutter and a baling line;

an approximately 63,000 square feet finished goods storage area;

a chemical recovery line, which includes a recovery boiler, evaporation plant, recausticizing plant and lime kiln;

a fresh water plant;

a wastewater treatment plant; and

a power station with a turbine capable of producing 57 MW of electric power from steam produced by the recovery boiler and a power boiler.

The kraft pulp produced at the Rosenthal mill is a long-fibered softwood pulp produced by a sulphate cooking process and manufactured primarily from wood chips and pulp logs. A number of factors beyond economic supply and demand have an impact on the market for chemical pulp, including requirements for pulp bleached without any chlorine compounds or without the use of chlorine gas. The Rosenthal mill has the capability of producing both “totally chlorine free” and “elemental chlorine free” pulp. Totally chlorine free pulp is bleached to a high brightness using oxygen, ozone and hydrogen peroxide as bleaching agents, whereas elemental chlorine free pulp is produced by substituting chlorine dioxide for chlorine gas in the bleaching process. This substitution virtually eliminates complex chloro-organic compounds from mill effluent.

Kraft pulp is valued for its reinforcing role in mechanical printing papers and is sought after by producers of paper for the publishing industry, primarily for magazines and advertising materials. Kraft pulp is also an important ingredient for tissue manufacturing, and tissue demand tends to increase with living standards in developing countries. Kraft pulp produced for reinforcement fibers is considered the highest grade of kraft pulp and generally obtains the highest price. The Rosenthal mill produces pulp for reinforcement fibers to the specifications of certain of our customers. We believe that a number of our customers consider us their supplier of choice.

Stendal Mill.The Stendal mill is situated on a 200 acre site owned by Stendal that is part of a larger 1,250 acre industrial park near the town of Stendal in the state ofSaxony-Anhalt, approximately 300 kilometers north of the Rosenthal mill and 130 kilometers west of Berlin. The mill is adjacent to the Elbe river and has access to harbor facilities for water transportation. The mill is a single line mill with a current annual design production capacity of approximately 660,000 ADMTs of kraft pulp. The Stendal mill is self-sufficient in steam and electrical power. Some excess electrical power which is constantly being generated is sold to the regional power grid. The facilities at the mill include:

an approximately 920,000 square feet fiber storage area;

debarking and chipping facilities for pulp logs;

a fiber line, which includes ten SuperBatch™ digesters and bleaching facilities;

a pulp machine, which includes a dryer, a cutter and a baling line;

an approximately 108,000 square feet finished goods storage area;

a chemical recovery line, which includes a recovery boiler, evaporation plant, recausticizing plant and lime kiln;

a fresh water plant;

a wastewater treatment plant; and

a power station with two turbines capable of producing 148 MW of electrical power since the completion of Project Blue Mill in December 2013.

The kraft pulp produced at the Stendal mill is of a slightly different grade than the pulp produced at the Rosenthal mill as the mix of softwood fiber used is slightly different. This results in a complementary product more suitable for different end uses. The Stendal mill is capable of producing both totally chlorine free and elemental chlorine free pulp.

Celgar Mill.The Celgar mill is situated on a 400 acre site near the city of Castlegar, British Columbia. The mill is located on the south bank of the Columbia River, approximately 600 kilometers east of the port city of Vancouver, British Columbia, and approximately 32 kilometers north of theCanada-U.S. border. The city of Seattle, Washington is approximately 650 kilometers southwest of Castlegar. The Celgar mill is a single line mill with a current annual production capacity of approximately 520,000 ADMTs of kraft pulp. Internal power generating capacity resulting from the completion of the Celgar Energy Project in 2010 enables the Celgar mill to be self-sufficient in electrical power and to sell surplus electricity. The facilities at the Celgar mill include:

chip storage facilities with a capacity of 250,000 cubic meters of chips;

a woodroom containing debarking and chipping equipment for pulp logs;

a fiber line, which includes a dual vessel hydraulic digester, two stage oxygen delignification and a four stage bleach plant;

two pulp machines, which each include a dryer, a cutter and a baling line;

a chemical recovery line, which includes a recovery boiler, evaporation plant, recausticizing area and wastewater treatment system; and

two turbines and generators capable of producing approximately 48 MW and 52 MW, respectively, of electric power from steam produced by the recovery boiler and a power boiler.

The Celgar mill produces high-quality kraft pulp that is made from a unique blend of slow growing/long-fiber Western Canadian tree species. It is used in the manufacture of high-quality paper and tissue products. We believe the Celgar mill’s pulp is known for its excellent product characteristics, including tensile strength, wet strength and brightness. The Celgar mill is a long-established supplier to paper and tissue producers in Asia.

Generation and Sales of “Green” Energy and Chemicals at our Mills

Climate change concerns have caused a proliferation of renewable or “green” energy legislation, incentives and commercialization in both Europe and, increasingly, in North America. This has generated an increase in demand and legislated requirements for “carbon neutral” sources of energy supply. Our pulp mills are large scale bio-refineries that, produce bothin addition to pulp, andalso produce surplus “carbon neutral” or “green” energy. As part of the pulp production process our mills generate “green” energy using carbon-neutral biofuels such as black liquor and wood waste. Through the incineration of biofuels in the recovery and power boilers, our mills produce sufficient steam to cover all of our steam requirements and generallyallow us to produce surplus energyelectricity which we sell to third party utilities.

As a result, we have benefitted from “green” energy legislation, incentives and commercialization that has developed over the last few years in Europe and Canada. In

2010addition, in recent years we have applied considerable resources to increasing our capacity to produce and

2009, we sold 520,005 MWh and 478,674 MWh ofsell bio-chemicals, primarily tall oil for use in numerous applications including bio-fuels.Our surplus energy respectively, and recorded revenues of €44.2 million and €42.5 million, respectively, from such energy sales.chemical sales provide our mills with a new stable revenue source unrelated to pulp prices. Since our energy and chemical production is a by-productare by-products of our pulp production process, there are minimal incremental costs and our surplus energy and chemical sales are

13

The following table sets out for the periods indicated the effect of these government grants on the recorded value of such assets in our

consolidatedConsolidated Balance Sheets: | | | | | | | | | | | | |

| | | As at December 31, | |

| | | 2013 | | | 2012 | | | 2011 | |

| | | (in thousands) | |

Property, plant and equipment, gross amount less amortization | | $ | 1,403,990 | | | $ | 1,431,355 | | | $ | 1,443,315 | |

Less: government grants less amortization | | | 365,359 | | | | 364,849 | | | | 378,348 | |

| | | | | | | | | | | | |

Property, plant and equipment, net (as shown on the Consolidated Balance Sheet) | | $ | 1,038,631 | | | $ | 1,066,506 | | | $ | 1,064,967 | |

| | | | | | | | | | | | |

The following table sets forth the gross amount of all government grants we have received and capitalized in our balance sheets:

| | | | | | | | | | | | | |

| | | As at December 31, | |

| | | 2010 | | | 2009 | | | 2008 | |

| | | (in thousands) | |

| |

| Properties, gross amount including government grants less amortization | | € | 1,144,759 | | | € | 1,152,288 | | | € | 1,171,891 | |

| Less: government grants less amortization | | | 297,992 | | | | 283,730 | | | | 290,187 | |

| | | | | | | | | | | | | |

| Properties, net (as shown on consolidated balance sheets) | | € | 846,767 | | | € | 868,558 | | | € | 881,704 | |

| | | | | | | | | | | | | |

sheet, the associated amortization and the resulting net balance we include in our property, plant and equipment for the periods indicated: | | | | | | | | | | | | |

| | | As at December 31, | |

| | | 2013 | | | 2012 | | | 2011 | |

| | | (in thousands) | |

Government grants—gross | | $ | 600,158 | | | $ | 569,039 | | | $ | 557,726 | |

Less: Accumulated amortization | | | 234,799 | | | | 204,190 | | | | 179,378 | |

| | | | | | | | | | | | |

Government grants less accumulated amortization | | $ | 365,359 | | | $ | 364,849 | | | $ | 378,348 | |

| | | | | | | | | | | | |

Qualifying capital investments at industrial facilities in Germany that reduce effluent discharges offset wastewater fees that would otherwise be required to be paid. For more information about our environmental capital expenditures, see “—“– Environmental”.

TotalIn 2013, capital expenditures at the Celgar mill included maintenance projects, while in 2010, 2009 and 2008 were €30.6 million, €17.8 million and €12.1 million, respectively.2012 such expenditures included a project to recover/recycle chemicals from the mill’s effluent, referred to as the “GAP Project”. In 2010,2011, capital expenditures related primarily to the Celgar Energy Project. We implemented the Celgar Energy Project as part of our continued focus on energy production and sales and to increase the mill’s production of “green” energy and optimize its power generation capacity. The project was designed as a high return capital project at a cost of approximately C$64.9 million (€48.7 million). It included the installation of a second turbine generator with a design capacity of 48 MW.

In October 2009, as part of the GTP, the Canadian government through NRCan agreed to provide approximately C$57.7 million in credits towards the capital costs associated with the Celgar mill includingrelated to a project to improve the Celgar Energy Project. Such credits reduced the cost basis of the assets purchased and were not recorded in our income. The majority of the remaining credits not used for the Celgar Energy Project will be available for use by the Celgar mill on other qualifying projects until March 31, 2012. To be eligible for GTP credits, projects must meet certain energy efficiency or environmental improvement requirements. Specifically, we have applied to NRCan to utilize approximately C$9.7 million of our allocated GTP funding towards improving ourmill’s fiber line and oxygen delignification process at our Celgar mill. Once completed, we believe that this project, referred to as the “Oxygen Delignification Project”, should generate a high return for the mill while reducing Celgar’s chemical and energy costs through decreased consumption.

The Celgar Energy Project increased the mill’s installed generating capacity to 100 MW, and upgraded the mill’s bark boiler and steam facilities. process.In January 2009,2014, we commenced the Celgar mill finalizedimplementation of a new Enterprise Resource Planning, or “ERP”, solution to replace our existing business software applications at an estimated cost of $12.0 million. The project is designed to be completed in stages over the Electricity Purchase Agreement undernext three years. After considerable due diligence, we selected SAP, a global leader in the development of ERP solutions for medium to large sized international businesses.

The ERP installation will replace a suite of existing legacy systems which, itwhile functional, will sell electrical energy generated bybegin becoming obsolete in the Celgar Energy Projectnear future. The ERP solution introduces state of the art end to B.C. Hydro.

end business solutions that will provide automation for most aspects of our business including finance, payroll, inventory management, sales, fiber management, supply chain, business analytics and forecasting.To assist us through the implementation, we have engaged third party advisors with extensive experience in ERP implementations using contemporary systems implementation methodologies that will address not only the technical complexities of such an implementation but also assist with maintaining internal controls over financial reporting.

Excluding costs for projects financed through government grants, under the GTP, capital expenditures for all of our mills in 20112014 are expected to be approximately €24.1$40.0 million, comprised of principally of:

a tall oil plant, chip receiving project, wastewater reduction project and maintenance projects at the Rosenthal mill, aggregating approximately $16.0 million;

wastewater reduction projects at the Stendal mill and maintenance projects, aggregating approximately $8.6 million;

a chip screening project and maintenance projects at the Celgar mill, aggregating approximately $9.5 million; and

an array of small projects.ERP software implementation across the entire company, aggregating approximately $5.9 million.

Environmental

Our operations are subject to a wide range of environmental laws and regulations, dealing primarily with water, air and land pollution control. We devote significant management and financial resources to comply with all applicable environmental laws and regulations. Our total capital expenditures on environmental projects at our mills were approximately €2.5$1.9 million in 2010 (€9.52013, as compared to approximately $12.0 million in 2009). The Oxygen Delignification Project is intended2012 related primarily to generatethe Rosenthal mill’s recovery boiler upgrade. In 2014, capital expenditures for environmental improvements by reducing organic loading on the effluent treatment system.

projects are expected to be approximately $8.0 million.We believe we have obtained all required environmental permits, authorizations and approvals for our operations. We believe our operations are currently in substantialmaterial compliance with the requirements of all applicable environmental laws and regulations and our respective operating permits.

Under German state environmental rules relating to effluent discharges, industrial users are required to pay wastewater fees based upon the amount of their effluent discharge. These rules also provide that an industrial user which undertakes environmental capital expenditures and lowers certain effluent discharges to prescribed levels may offset the amount of these expenditures against the wastewater fees that they would otherwise be required to pay. We estimate that the aggregate amount of wastewater fees we saved in 20102013 as a result of environmental capital

20

expenditures and initiatives to reduce allowable emissions and discharges at our Stendal andmill was approximately $1.8 million. The estimated amount of accrued wastewater fees we expect to recover at our Rosenthal mills weremill is approximately €6.4$3.0 million. We expect that capitalCapital investment programs and other environmental initiatives at our German mills will mostly offset the wastewater fees that may bewere payable for 2010, 2011 and 20122013 and we believe they will ensure that our operations continue in substantial compliance with prescribed standards.

Environmental compliance is a priority for our operations. To ensure compliance with environmental laws and regulations, we regularly monitor emissions at our mills and periodically perform environmental audits of operational sites and procedures both with our internal personnel and outside consultants. These audits identify opportunities for improvement and allow us to take proactive measures at the mills as considered appropriate.

The Rosenthal mill has a relatively modern biological wastewater treatment and oxygen bleaching facility. We have significantly reduced our levels of absorbable organic halogen discharge at the Rosenthal mill and we believe the Rosenthal mill’s absorbable organic halogen and chemical oxygen demand discharges are in compliance with the standards currently mandated by the German government.

The Stendal mill, which commenced operations in September 2004, has been in substantial compliance with applicable environmental laws, regulations and permits. Management believes that, as the Stendal mill is astate-of-the-art facility, it will be able to continue to operate in compliance with the applicable environmental requirements.

The Celgar mill has been in substantial compliance with applicable environmental laws, regulations and permits.

In November 2008, the Celgar mill suffered a spill of diluted weak black liquor into the nearby Columbia River. The spill was promptly reported by the mill to authorities and remediated. An environmental impact report prepared by independent consultants engaged by the mill concluded that the environmental impact of the spill was minimal. The spill was also investigated by federal and provincial environmental authorities and, in January 2009, the Celgar mill received a government directive requiring it to take a number of measures relating to the retention capacity of spill ponds. These measures have now been completed to the satisfaction of the overseeing environmental authorities. However, in September 2009, the Celgar mill received a summons in connection with this spill for charges under the CanadianFisheries Actand the British ColumbiaEnvironmental Management Act, primarily relating to alleged effluent exceedances under the Celgar mill’s discharge permit. See “Legal Proceedings”.

The Celgar mill operates two landfills, a newly commissioned site andone of which is an older site.site that the mill is in the process of decommissioning. The Celgar mill intends to decommission the old landfill and is developingcontinuing work on finalizing a closure plan for such site and then reviewing such plan with the CanadianBritish Columbia Ministry of Environment, or “MOE”. However, the MOE, in conjunction with the provincial pulp and paper industry, is in the process of developing a standard for landfill closures. In addition, the portion of the landfill owned by an adjacent sawmill continuesWe expect to be active. Accordingly, the mill has not been able to move forward with the closure. We currently believe we may receive regulatory approval for suchfinalize our closure plan for the older landfill in 2011 and commence2014. The actual closure activities based onshall be effected pursuant to a timetable agreed to by both Celgarthe mill and the MOE. We currently estimate theThe cost of closing the landfill atis expected to be approximately €2.1 million but, since the closure program for the old landfill has not been finalized or approved, there can be no assurance that the decommissioning of the old landfill will not exceed such cost estimate.

$3.0 million.Future regulations or permits may place lower limits on allowable types of emissions, including air, water, waste and hazardous materials, and may increase the financial consequences of maintaining compliance with environmental laws and regulations or conducting remediation. Our ongoing monitoring and policies have enabled us to develop and implement effective measures to maintain emissions in substantial compliance with environmental laws and regulations to date in a cost-effective manner. However, there can be no assurances that this will be the case in the future.

Climate Change

Currently,As there are numerous differing scientific studies and opinions relating to the severity, extent and speed at which climate change is or may be occurring, around the world. As a result, we are currently unable tocannot identify and predict all of the specific consequences of climate change on our business and operations.

21

To date, the potentialand/oreffects and perceived effects of climate change and social and governmental responses to it have created both business opportunities and the potential for negative consequences for our business.

The focus on climate change has generated a substantial increase in demand and in legislative requirements for “carbon neutral” or “green” energy in both Europe and, increasingly, in North America. Pulp mills consume wood residue,residuals, being wood chips and pulp logs, as the base raw material for itstheir production process. Wood chips are residueresiduals left over from lumber production and pulp logs are generally lower quality logs left over from logging that are unsuitable for the production of lumber.

As part of their production process, our mills take wood residueresiduals and process itthem through a digester where cellulose is separated from the wood to be used in pulp production and the remaining residue,residuals, called “black liquor”, is used for green energy production. As a result of their use of wood residueresiduals and because our mills generate combined heat and power in a process known as cogeneration, they are efficient producers of energy. This energy is carbon neutral and produced from a renewable source. Our relatively modern mills generate a substantial amount of energy that is surplus to their operational requirements.

These factors, along with governmental initiatives in respect of renewable or green energy legislation, have provided business opportunities for us to enhance our generation and sales of green energy and to participate in the saleregional utilities. In December 2013, we completed Project Blue Mill, a project at our Stendal mill to install a new 46 MW steam turbine which we expect will initially produce an additional 109,000 MWh of emission allowances under the EU ETS.

Currently, wesurplus electricity annually.We are constantly exploring other initiatives to enhance our generation and sales of surplus green energy.energy and chemical by-products. Other potential opportunities that may result from climate change include:

the expansion of softwood forests and increased growth rates for such forests;

more intensive forestry practices and timber salvaging versus harvesting standing timber;

| | |

| • | increased growth rates for northern softwood forests due to greater atmospheric CO2 levels; |

|

| • | the expansion of softwood forests into less developed tundra areas; |

|

| • | more intensive forestry practices and timber salvaging versus harvesting standing timber; |

|

| • | greater demand for sustainable energy and cellulosic biomass fuels; and |

|

| • | governmental incentivesand/or legislative requirements to enhance biomass energy production and prices. |

greater demand for sustainable energy and cellulosic biomass fuels; and

additional governmental incentives and/or legislative requirements to enhance biomass energy production.

At this time, we cannot predict which, if any, of these potential opportunities will be available to or realized by us or their economic effect on our business.