Our research and development organization is responsible for the design, development, testing and certification of our data and information management software applications. As of March 31, 2011,2012, we had 326348 employees in our research and development group, of which 105115 are located at our Hyderabad, India development center. In April 2012, we opened a new product development center in Bangalore, India, which increases our existing presence in India. Our engineering efforts support product development across all major operating systems, databases, applications and network storage devices. A substantial amount of our development effort goes into certification, integration and support of our applications to ensure interoperability with our strategic partners’ hardware and software products. We have also made substantial investments in the automation of our product test and quality assurance laboratories. We spent $37.0$39.9 million on research and development activities in fiscal 2012, $37.0 million in fiscal 2011 and $33.4 million in fiscal 2010 and $30.7 million in fiscal 2009.

Competition

The data storage management market is intensely competitive, highly fragmented and characterized by rapidly changing technology and evolving standards. We currently compete with other providers of data and information management software as well as large storage hardware manufacturers that have developed or acquired their own data and information management software products. These manufacturers have the resources and capabilities to develop their own data and information management software applications, and many have been making acquisitions and broadening their efforts to include broader data and information management and storage products. These manufacturers and/or our other current and potential competitors may establish cooperative relationships among themselves or with third parties, creating new competitors or alliances. Large operating system and application vendors, including Microsoft, have introduced products or functionality that includes some of the same functions offered by our software applications. In the future, further development by these vendors could cause some features of our software applications to become redundant.

The following are our primary competitors in the data and information management software applications market, each of which has one or more products that compete with a part of or our entire software suite:

EMC;

Hewlett-Packard;

IBM; and

Symantec.

The principal competitive factors in our industry include product functionality, product performance, product integration, platform coverage, ability to scale, price, worldwide sales infrastructure, global technical support, name recognition and reputation. The ability of major system vendors to bundle hardware and software solutions is also a significant competitive factor in our industry. Although many of our competitors have greater resources, a larger installed customer base and greater name recognition, we believe we compete favorably on the basis of these competitive factors.

Our unique product architecture is one of the primary reasons why we compete so successfully. Whereas other competitive solutions in the market are based on multiple, disparate products, our modular offering is based on a single, unified, underlying code base resulting in favorable efficiencies in functionality, integration, scalability and support. Our focused approach to data and information management and our ability to respond to customer feedback also drives the functionality and features of our products, which we believe lead the industry in terms of performance and usability, as evidenced by numerous industry awards we have received in the past 12 months such as the 2011 Windows IT Pro Editors’ Best Back Software Product Silver Award; 2011 Midsize Enterprise Summit West Inovations Award; 2011 Microsoft Server Platform Partner of the Year; 2011 Storage Magazine’s Deduplication Product of the Year; Microsoft Best of Tech-Ed 2011 Backup and Recovery Award; 2011 Gartner Magic Quadrant for Enterprise Disk-Based Backup and Recovery; 2011 DCIG Best in Class Virtual Server Backup Software; 2011 Info-Tech Research Group’s Champion for Enterprise Backup Software; the 2010 Storage Magazine/SearchStorage.com Quality Awards for Enterprise-class Backup and Recovery software; and 20102011 Gartner Magic Quadrant for Enterprise Information Archiving.

12

Some of our competitors have greater financial resources and may have the ability to offer their products at lower prices than ours. In addition, some of our competitors have greater name recognition than us, which could provide them a competitive advantage at some customers. Some of our competitors also have longer operating histories, have substantially greater technical, sales, marketing and other global resources than we do, as well as a larger installed customer base and broader product offerings, including hardware. As a result, these competitors can devote greater resources to the development, promotion, sale and support of their products than we can.

Intellectual Property and Proprietary Rights

Our success and ability to compete depend on our continued development and protection of our proprietary software and other technologies. We rely primarily on a combination of trade secret, patent, copyright and trademark laws, as well as contractual provisions, to establish and protect our intellectual property rights. We provide our software to customers pursuant to license agreements that impose restrictions on use. These license agreements are primarily in the form of shrink-wrap or click-wrap licenses, which are not negotiated with or signed by our end-user customers. These measures may afford only limited protection of our intellectual property and proprietary rights associated with our software. We also enter into confidentiality agreements with employees and consultants involved in product development. We routinely require our employees, customers and potential business partners to enter into confidentiality agreements before we disclose any sensitive aspects of our software, technology or business plans.

As of March 31, 2011,2012, we had 118162 issued patents and 174172 pending patent applications in the United States, as well as 5557 issued patents in foreign countries and 7683 pending foreign patent applications. Pending patent

applications may receive unfavorable examination and are not guaranteed allowance as issued patents. We may elect to abandon or otherwise not pursue prosecution of certain pending patent applications due to patent examination results, economic considerations, strategic concerns or other factors. We will continue to assess appropriate occasions to seek patent and other intellectual property protection for innovative aspects of our technology that we believe provide us a significant competitive advantage.

Despite our efforts to protect our trade secrets and proprietary rights through patents and license and confidentiality agreements, unauthorized parties may still attempt to copy or otherwise obtain and use our software and technology. In addition, we intend to expand our international operations and effective patent, copyright, trademark and trade secret protection may not be available or may be limited in foreign countries. If we fail to protect our intellectual property and other proprietary rights, our business could be harmed.

We currently resell certain software from Microsoft, including Microsoft SQL Server, used in conjunction with our software applications pursuant to an independent software vendor royalty license and distribution agreement that we have and plan to continue renewing annually. We also currently resell certain other software from Microsoft, including Windows Pre-installation Environment software, used in conjunction with our software applications, pursuant to an agreement with Microsoft that expires May 31, 2012. We have entered into and expect to enter into agreements with additional third parties to license their technology for use with our software applications.

Some of the products or technologies acquired, licensed or developed by us may incorporate so-called “open source” software and we may incorporate open source software into other products in the future. The use of such open source software may ultimately subject some products to unintended conditions, which may negatively affect our business, financial condition, operating results, cash flow and ability to commercialize our products or technologies.

From time to time, we are participants or members of various industry standard-setting organizations or other industry technical organizations. Our participation or membership in such organizations may, in some circumstances, require us to enter into royalty or licensing agreements with third parties regarding our intellectual property under terms established by those organizations, which we may find unfavorable.

13

Employees

As of March 31, 2011,2012, we had 1,2681,437 employees worldwide, including 362422 in sales and marketing, 326348 in research and development, 136147 in general and administration and 444520 in customer services and support. None of our employees are represented by a labor union. We have never experienced a work stoppage and believe our relationship with our employees is good.

Executive Officers of the Registrant

The following table presents information with respect to our executive officers as of May 15, 2011:

Name | Age | Position | ||||

N. Robert Hammer | ||||||

| Chairman, President and Chief Executive Officer | ||||||

Alan G. Bunte | Executive Vice President and Chief Operating Officer | |||||

Louis F. Miceli | Senior Vice President and Chief Financial Officer | |||||

Ron Miiller | Senior Vice President of Worldwide Sales | |||||

David West | Senior Vice President, Marketing and Business Development | |||||

N. Robert Hammerhas served as our Chairman, President and Chief Executive Officer since March 1998. Mr. Hammer was also a venture partner from 1997 until December 2003 of the Sprout Group, the venture capital arm of Credit Suisse’s asset management business. Prior to joining the Sprout Group, Mr. Hammer served as the chairman, president and chief executive officer of Norand Corporation, a portable computer systems manufacturer, from 1988 until its acquisition by Western Atlas, Inc. in 1997. Mr. Hammer led Norand following its leveraged buy-out from Pioneer Hi-Bred International, Inc. and through its initial public offering in 1993. Prior to joining Norand, Mr. Hammer also served as chairman, president and chief executive officer of publicly-held Telequest Corporation from 1987 until 1988 and of privately-held Material Progress Corporation from 1982 until 1987. Prior to joining Material Progress Corporation, Mr. Hammer spent 15 years in various sales, marketing and management positions with Celanese Corporation, rising to the level of vice president and general manager of the structural composites materials business. Mr. Hammer obtained his bachelor’s degree and master’s degree in business administration from Columbia University.

Alan G. Buntehas served as our Executive Vice President and Chief Operating Officer since October 2003 and served as our senior vice president from December 1999 until October 2003. Since January 2008, Mr. Bunte has also served as a director of CommVault. Prior to joining our company, Mr. Bunte was with Norand Corporation from 1986 to January 1998, serving as its senior vice president of planning and business development from 1991 to January 1998. Mr. Bunte obtained his bachelor’s and master’s degrees in business administration from the University of Iowa.

Louis F. Micelihas served as our Senior Vice President and Chief Financial Officer since April 2011. Prior to his current role, Mr. Miceli served as our Vice President and Chief Financial Officer from April 1997 to March 2011. Mr. Miceli has over 30 years of experience in various finance capacities for several high-technology companies. Prior to joining our company, Mr. Miceli served as chief financial officer of University Hospital, part of the University of Medicine and Dentistry of New Jersey (UMDNJ), from 1994 until 1997 and as the corporate controller of UMDNJ from 1992 until 1994. Prior to joining UMDNJ, Mr. Miceli served as the chief financial officer of Syntrex, Inc., a word processing software and hardware manufacturer, from 1985 until 1992, and as its controller from 1980 until 1985. Mr. Miceli began his career as a staff auditor at Ernst & Ernst LLP (currently Ernst &Young LLP), where he served five years. Mr. Miceli obtained his bachelor’s degree,cum laude, in accounting from Seton Hall University and is a certified public accountant in the State of New Jersey.

Ron Miillerhas served as our Senior Vice President of Worldwide Sales since April 2011. Prior to his current role, Mr. Miiller served as our Vice President of Sales, Americas from January 2005 to March 2011 and as our Central Region Sales Manager from March 2000 to December 2004. Prior to joining our company, Mr. Miiller served as Director, Central Region Sales for Softworks, Inc., an EMC company, from March 1997 through March 2000, and prior to that Mr. Miiller was with Moore Corporation, a diversified print and electronic communications company from 1989 through March 1997 in various leadership roles. Mr. Miiller received his bachelor of science degree in marketing from Ball State University in 1989.

14

September 2005 to March 2011 and Vice President, Business Development from August 2000 to September 2005. Prior to joining our company, Mr. West served as a director of strategic alliances from April 1999 to July 2000 and vice president of storage solutions in July 2000 at Legato Systems, Inc., which was subsequently acquired by EMC Corporation. Prior to joining Legato Systems, Mr. West served as vice president of sales at Intelliguard Software, Inc., which was also subsequently acquired by EMC Corporation, from 1990 to April 1999. Mr. West obtained his bachelor’s degree in electrical engineering from Villanova University.

| Item 1A. | Risk Factors |

You should consider each of the following factors as well as the other information in this Annual Report in evaluating our business and our prospects. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently consider immaterial may also impair our business operations. If any of the following risks actually occurs, our business and financial results could be harmed. In that case, the trading price of our common stock could decline. You should also refer to the other information set forth in this Annual Report, including our financial statements and the related notes.

Risks Related to Our Business

Our industry is intensely competitive, and most of our competitors have greater financial, technical and sales and marketing resources and larger installed customer bases than we do, which could enable them to compete more effectively than we do.

The data and information management software market is intensely competitive, highly fragmented and characterized by rapidly changing technology and evolving standards, changing customer requirements and frequent new product introductions. Competitors vary in size and in the scope and breadth of the products and services offered. Our primary competitors include CA, Inc., EMC, Hewlett-Packard, IBM and Symantec Corporation.

The principal competitive factors in our industry include product functionality, product integration, platform coverage, ability to scale, price, worldwide sales infrastructure, global technical support, name recognition and reputation. The ability of major system vendors to bundle hardware and software solutions is also a significant competitive factor in our industry. If we are unable to address these competitive factors, our competitive position could weaken and we could experience a decline in revenues that could adversely affect our business.

Most of our current and potential competitors have longer operating histories and have substantially greater financial, technical, sales, marketing and other resources than we do, as well as larger installed customer bases, greater name recognition and broader product offerings, including hardware. These competitors can devote greater resources to the development, promotion, sale and support of their products than we can and have the ability to bundle their hardware and software products in a combined offering. As a result, these competitors may be able to respond more quickly to new or emerging technologies and changes in customer requirements.

15

Our current and potential competitors may establish cooperative relationships among themselves or with third parties. If so, new competitors or alliances that include our competitors may emerge that could acquire significant market share. In addition, large operating system and application vendors, such as Microsoft Corporation, as well as some hardware manufacturers, have introduced products or functionality that includes some of the same functions offered by our software applications. In the future, further development by these vendors could cause our software applications and services to become redundant, which could seriously harm our sales, results of operations and financial condition.

New competitors entering our markets can have a negative impact on our competitive positioning. In addition, we expect to encounter new competitors as we enter new markets. Furthermore, many of our existing competitors are broadening their operating systems platform coverage. We also expect increased competition from original equipment manufacturers, including those we partner with, and from systems and network management companies, especially those that have historically focused on the mainframe computer market and have been making acquisitions and broadening their efforts to include data and information management and storage products. We expect that competition will increase as a result of future software industry consolidation. Increased competition could harm our business by causing, among other things, price reductions of our products, reduced profitability and loss of market share.

We may not be able to respond to rapid technological changes with new software applications and services offerings, which could have a material adverse effect on our sales and profitability.

The markets for our software applications are characterized by rapid technological changes, changing customer needs, frequent new software product introductions and evolving industry standards. The introduction of software applications embodying new technologies and the emergence of new industry standards could make our existing and future software applications obsolete and unmarketable. As a result, we may not be able to accurately predict the lifecycle of our software applications, and they may become obsolete before we receive the amount of revenues that we anticipate from them. If any of the foregoing events were to occur, our ability to retain or increase market share in the data and information management software market could be materially adversely affected.

We devote significant resources to the development of new products and the enhancement of existing products. To be successful, we need to anticipate, develop and introduce new software applications and services on a timely and cost-effective basis that keep pace with technological developments and emerging industry standards and that address the increasingly sophisticated needs of our customers. We may fail to develop and market software applications and services that respond to technological changes or evolving industry standards, experience difficulties that could delay or prevent the successful development, introduction and marketing of these applications and services or fail to develop applications and services that adequately meet the requirements of the marketplace or achieve market acceptance. Our failure to develop and market such applications and services on a timely basis, or at all, could have a material adverse effect on our sales and profitability.

Volatility in the global economy could adversely impact our continued growth, results of operations and our ability to forecast future business.

As our business has expanded globally, we have become increasingly subject to the risks arising from adverse changes in domestic and global economic and political conditions. TheUncertainty in the macroeconomic environment and associated global economic conditions have been volatileresulted in volatility in credit, equity, particularly with respect to the European sovereign debt markets and potential ramifications of the recent fiscal yearsU.S. debt issues and have resultedbudget concerns. These global economic conditions can result in slower economic activity, decreased consumer confidence, reduced corporate profits and capital spending, adverse business conditions and liquidity concerns. There has also been increased volatility in foreign exchange markets. We believe that our sales and results of operations were impacted by these economic factors. These factors make it difficult for our customers, our vendors and us to accurately forecast and plan future business activities. In addition, these factors could cause customers to slow or defer spending on our software and services products, which would delay and lengthen sales cycles and negatively affect our results of operations. We cannot predictThough current macroeconomic conditions appear to be stabilizing, if such conditions deteriorate or if the timing or durationpace of any economic slowdown or the timing or strength of a subsequent economic recovery on either a worldwide basisis slower or more uneven, our results of operations could be adversely affected, we may not be able to sustain the growth rates we have experienced recently, and we could fail to meet the expectations of stock analysts and investors, which could cause the price of our common stock to decline.

We continue to invest in our industry.

business in the Asia-Pacific and Europe, Middle East, and Africa (“EMEA”) regions. There are significant risks with overseas investments and growth prospects in these regions can be

16

uncertain. Increased volatility or further declines in the European credit, equity and foreign currency markets could cause delays in or cancellations of European orders. Deterioration of economic conditions in the countries in which we do business could also cause slower or impaired collections on accounts receivable. In addition, we could experience delays in the payment obligations of our worldwide resellers if they experience weakness in the end-user market, which would increase our credit risk exposure and harm our financial condition.

We rely significantly on our value-added resellers, systems integrators and corporate resellers, which we collectively refer to as resellers, for the marketing and distribution of our software applications and services. Resellers are our most significant distribution channel. However, our agreements with resellers are generally not exclusive, are generally renewable annually, generallytypically do not contain minimum sales requirements and in many cases may be terminated by either party without cause. Many of our resellers carry software applications that are competitive with ours. These resellers may give a higher priority to other software applications, including those of our competitors, or may not continue to carry our software applications at all. If a number of resellers were to discontinue or reduce the sales of our products, or were to promote our competitors’ products in lieu of our own, it would have a material adverse effect on our future revenues. Events or occurrences of this nature could seriously harm our sales and results of operations. If we fail to manage our resellers successfully, there may be conflicts between resellers, or they could fail to perform as we anticipate, which could reduce our sales. In addition, we expect that a significant portion of our sales growth will depend upon our ability to identify and attract new reseller partners. We believe that ourOur competitors also use reseller arrangements. Our competitorsarrangements and may be more successful in attracting reseller partners and could enter into exclusive relationships with resellers that make it difficult to expand our reseller network. Any failure on our part to maintain and/or expand our network of resellers could impair our ability to grow revenues in the future.

Some of our resellers possess significant resources and advanced technical abilities. These resellers, particularly our corporate resellers, may, either independently or jointly with our competitors, develop and market software applicationsproducts and related services that compete with our offerings. If this were to occur, these resellers might discontinue marketing and distributing our software applications and services. In addition, these resellers would have an advantage over us when marketing their competing software applicationsproducts and related services because of their existing customer relationships. The occurrence of any of these events could have a material adverse effect on our revenues and results of operations.

In addition, we have distribution agreements covering our North American commercial markets and our U.S. Federal Government market with Arrow Enterprise Computing Solutions, Inc. (“Arrow”), a subsidiary of Arrow Electronics, Inc., and Avnet Technology Solutions (“Avent”Avnet”), a subsidiary of Avnet, Inc. Pursuant to these distribution agreements, these distributors primary role is to enable a more efficient and effective distribution channel for our products and services by managing our reseller partners and leveraging their own industry experience. Many of our North American resellers have been transitioned to either Arrow or Avnet. Sales through our distribution agreement with Arrow accounted for approximately 25%26% of our total revenues for fiscal 20112012 and approximately 24%25% for fiscal 2010.2011. Arrow accounted for a total of approximately 32%30% of our accounts receivable balance as of March 31, 20112012 as a result of our reseller agreement. Avnet’s total revenue contribution was not material for fiscal 20112012 and 20102011 and its accounts receivable balance was not material as of March 31, 2011.2012. If Arrow or Avnet were to discontinue or reduce the sales of our products or if our agreement with Arrow or Avnet was terminated, and if we were unable to take back the management of our reseller channel or find another North American distributor to replace Arrow or Avnet, then it could have a material adverse effect on our future revenues.

Sales through Dell as a result of our reseller agreement and as well as our original equipment manufacturer agreement, which is discussed below, accounted for approximately 22% of total revenues for fiscal 2012 and

23% of total revenues for fiscal 2011 and approximately 24% of total revenues for fiscal 2010.2011. Dell also accounted for a total of approximately 25% of our accounts receivable balance as of March 31, 2011.2012. If we were to see an impairment of our receivable balance from Dell, it could have a significant adverse effect on our results of operations.

Our original equipment manufacturer agreements are primarily with Dell, and Hitachi Data Systems.Systems and NetApp. Our original equipment manufacturers sell our software applications and in some cases incorporate our data and information management software into systems that they sell. A material portion of our revenues is generated through these arrangements. However, we have no control over the shipping dates or volumes of systems these original equipment manufacturers ship and they have no obligation to ship systems incorporating our software applications. They also have no obligation to recommend or offer our software applications exclusively or at all, and they have no minimum sales requirements and can terminate our relationship at any time. These original equipment manufacturers also could choose to develop their own data and information management software internally and incorporate those products into their systems instead of our software applications. The original equipment manufacturers that we do business with also compete with one another. If one of our original equipment manufacturer partners views our arrangement with another original equipment manufacturer as competing with its products, it may decide to stop doing business with us. Any material decrease in the volume of sales generated by original equipment manufacturers we do business with, as a result of these factors or otherwise, wouldcould have a material adverse effect on our revenues and results of operations in future periods. Sales through our original equipment manufacturer agreements accounted for approximately 12% of our total revenues for fiscal 2012 and 10% of our total revenues for both fiscal 2011 and fiscal 2010.

2011.

17

Our outstanding accounts receivables are generally not secured. In addition, our standard terms and conditions permit payment within a specified number of days following the receipt of our product. During the recent volatile economic downturn,conditions certain of our customers and resellers have faced or may face liquidity concerns which could result in our customers or resellers not to bebeing able to satisfy their payment obligations to us, which would have a material adverse effect on our financial condition, operating results and cash flows. While we have procedures to monitor and limit exposure to credit risk on our receivables and have not suffered any material losses to date, there can be no assurance such procedures will continue to effectively limit our credit risk and avoid future losses.

We may experience a decline in revenues or volatility in our quarterly operating results, which may adversely affect the market price of our common stock.

We cannot predict our future quarterly revenues or operating results with certainty because of many factors outside of our control. A significant revenue or profit decline, lowered forecasts or volatility in our operating results could cause the market price of our common stock to decline substantially. Factors that could affect our revenues and operating results include the following:

the unpredictability of the timing and magnitude of orders for our software applications, particularly software transactions greater than $100,000 — in recent fiscal years, a majority of our quarterly revenues was earned and recorded near the end of each quarter;

the possibility that our customers may cancel, defer or limit purchases as a result of reduced information technology budgets;

the possibility that our customers may defer purchases of our software applications in anticipation of new software applications or updates from us or our competitors;

the ability of our original equipment manufacturers and resellers to meet their sales objectives;

market acceptance of our new applications and enhancements;

our ability to control expenses;

changes in our pricing and distribution terms or those of our competitors; and

the demands on our management, sales force and services infrastructure as a result of the introduction of new software applications or updates.

Our expense levels are relatively fixed and are based, in part, on our expectations of our future revenues. If revenue levels fall below our expectations and we are profitable at the time, our net income would decrease because only a small portion of our expenses varies with our revenues. Therefore, any significant decline in revenues for any period could have an immediate adverse impact on our results of operations for that period. We believe that period-to-period comparisons of our results of operations should not be relied upon as an indication of future performance. In addition, our results of operations could be below expectations of public market analysts and investors in future periods, which would likely cause the market price of our common stock to decline.

We encounter long sales and implementation cycles, particularly for our larger customers, which could have an adverse effect on the size, timing and predictability of our revenues.

Potential or existing customers, particularly larger enterprise customers, generally commit significant resources to an evaluation of available software and require us to expend substantial time, effort and money educating them as to the value of our software and services. Sales of our core software products to these larger customers often require an extensive education and marketing effort.

18

our customers’ budgetary constraints;

the timing of our customers’ budget cycles and approval processes;

our customers’ willingness to replace their current software solutions;

our need to educate potential customers about the uses and benefits of our products and services; and

the timing of the expiration of our customers’ current license agreements or outsourcing agreements for similar services.

If our sales cycles lengthen unexpectedly, they could adversely affect the timing of our revenues or increase costs, which may cause fluctuations in our quarterly revenues and results of operations. Finally, if we are unsuccessful in closing sales it could have a material adverse effect on the size, timing and predictability of our revenues.

We depend on growth in the data and information management software market, and lack of growth or contraction in this market or could have a material adverse effect on our sales and financial condition.

Demand for data and information management software is linked to growth in the amount of data generated and stored, demand for data retention and management (whether as a result of regulatory requirements or otherwise) and demand for and adoption of new storage devices and networking technologies. Because our software applications are concentrated within the data and information management software market, if the demand for storage devices, storage software applications, storage capacity or storage networking devices declines, our sales, profitability and financial condition would be materially adversely affected. Segments of the computer and software industry have in the past experienced significant economic downturns. The occurrence of any of these factors in the data and information management software market could materially adversely affect our sales, profitability and financial condition.

Furthermore, the data and information management software market is dynamic and evolving. Our future financial performance will depend in large part on continued growth in the number of organizations adopting data and information management software for their computing environments. The market for data and information management software may not continue to grow at historic rates, or at all. If this market fails to grow or grows more slowly than we currently anticipate, our sales and profitability could be adversely affected.

Our software applications are complex and may contain undetected errors, which could adversely affect not only our software applications’ performance but also our reputation and the acceptance of our software applications in the market.

Software applications as complex as those we offer contain undetected errors or failures, especially when products are first introduced or new versions are released. Despite extensive testing by us and by our customers, we have in the past discovered errors in our software applications and will do so in the future. As a result of past discovered errors, we experienced delays and lost revenues while we corrected those software applications. In addition, customers in the past have brought to our attention “bugs” in our software created by the customers’ unique operating environments, which are often characterized by a wide variety of both standard and non-standard configurations that make pre-release testing very difficult and time consuming. Although we have been able to fix these software bugs in the past, we may not always be able to do so. Our software products may also be subject to intentional attacks by viruses that seek to take advantage of these bugs, errors or other weaknesses. Any of these events may result in the loss of, or delay in, market acceptance of our software applications and services, which would seriously harm our sales, results of operations and financial condition.

Furthermore, we believe that our reputation and name recognition are critical factors in our ability to compete and generate additional sales. Promotion and enhancement of our name will depend largely on our success in continuing to provide effective software applications and services. The occurrence of errors in our software applications or the detection of bugs by our customers may damage our reputation in the market and our relationships with our existing customers, and as a result, we may be unable to attract or retain customers.

In addition, because our software applications are used to manage data that is often critical to our customers, they may have a greater sensitivity to defects in our products than to defects in other, less critical, applications. As a result, the licensing and support of our software applications involve the risk of product liability claims. AnyOur license agreements with our customers typically contain provisions designed to limit our exposure to potential product liability insurance we carryclaims. However, the limitation of liability provisions contained in our license agreements vary and may not be sufficienteffective as a result of existing or future national, federal, state, or local laws or ordinances or unfavorable judicial decisions. Although we have not experienced any material product liability claims to date, the sale and support of our products entail the risk of such claims, which could be substantial in light of the use of our products in enterprise-wide environments. In addition, our insurance against product liability may not be adequate to cover our losses resulting from product liabilityall potential claims. The successful assertion of one or more large claims against us could have a material adverse effect on our financial condition.

19

Most of our maintenance agreements are for a one year term. As the end of the annual period approaches, we pursue the renewal of the agreement with the customer. Historically, maintenance renewals have represented a significant portion of our total revenue. Because of this characteristic of our business, if our customers choose not to renew their maintenance and support agreements with us on beneficial terms, or at all, our business, operating results and financial condition could be harmed.

We develop software applications that interoperate with operating systems and hardware developed by others, and if the developers of those operating systems and hardware do not cooperate with us or we are unable to devote the necessary resources so that our applications interoperate with those systems, our software development efforts may be delayed or foreclosed and our business and results of operations may be adversely affected.

Our software applications operate primarily on the Windows, UNIX, Linux and Novell Netware operating systems and the hardware devices of numerous manufacturers. When new or updated versions of these operating systems and hardware devices are introduced, it is often necessary for us to develop updated versions of our software applications so that they interoperate properly with these systems and devices. We may not accomplish these development efforts quickly or cost-effectively, and it is not clear what the relative growth rates of these operating systems and hardware will be. These development efforts require the cooperation of the developers of the operating systems and hardware, substantial capital investment and the devotion of substantial employee resources. For some operating systems, we must obtain some proprietary application program interfaces from the owner in order to develop software applications that interoperate with the operating system. Operating system owners have no obligation to assist in these development efforts. If they do not provide us with assistance or the necessary proprietary application program interfaces on a timely basis, we may experience delays or be unable to expand our software applications into other areas.

We may not receive significant revenues from our current research and development efforts for up to several years, if at all.

Developing software is expensive, and the investment in product development may involve a long payback cycle. Our research and development expenses were $39.9 million, or 10% of our total revenues in fiscal 2012, $37.0 million, or approximately 12% of our total revenues in fiscal 2011 and $33.4 million, or 12% of our total revenues in fiscal 2010. Our future plans include significant investments in software research and development and related product opportunities. We believe that we must continue to dedicate a significant amount of resources to our research and development efforts to maintain our competitive position. However, we may not recognize significant revenues from these investments for up toseveral years, if at all.

The loss of key personnel or the failure to attract and retain highly qualified personnel could have an adverse effect on our business.

Our future performance depends on the continued service of our key technical, sales, services and management personnel. We rely on our executive officers and senior management to execute our existing business operations and identify and pursue new growth opportunities. The loss of key employees could result in significant disruptions to our business, and the integration and training of replacement personnel could be time consuming, cause additional disruptions to our business and be unsuccessful. We do not carry key person life insurance covering any of our employees.

20

Furthermore, in the past, we have experienced higher levels of turnover in our sales force compared to other employee groups in our company. Increases in the turnover rate of our sales force may affect our ability to generate license revenue growth. Although we have hired replacements in our sales force and are continuing to hire additional sales personnel to grow our business, we sometimes experience lower productivity from newly hired sales personnel for a period up to twelve months. In addition, we periodically make adjustments to our sales organization in response to a variety of internal and external factors, such as market opportunities, competitive threats, product introductions or enhancements and sales performance. Such adjustments could be temporarily disruptive and result in reduced productivity.

The volatility of our stock price may from time to time adversely affect our ability to attract or retain employees. If we are unable to hire or retain qualified employees across our organization, or conversely, if we fail to manage employee performance or reduce staffing levels when required by market conditions, our personnel costs would be excessive and our business and profitability could be adversely affected.

Our international sales and operations are subject to factors that could have an adverse effect on our results of operations.

We have significant sales and services operations outside the United States, and derive a substantial portion of our revenues from these operations. We also plan to continue to expand our international operations. We generated approximately 39% of our revenues from outside the United States in both fiscal 20112012 and approximately 38% in fiscal 2010.2011. Accordingly, international sales increased 22%27% in fiscal 20112012 compared to fiscal 2010.2011. Expansion of our international operations will require a significant amount of attention from our management and substantial financial resources and might require us to add qualified management in these markets.

In addition to facing risks similar to the risks faced by our domestic operations, our international operations are also subject to risks related to the differing legal, political, social and regulatory requirements and economic conditions of many countries, including:

difficulties in staffing and managing our international operations;

foreign countries may impose additional withholding taxes or otherwise tax our foreign income, impose tariffs or adopt other restrictions on foreign trade or investment, including currency exchange controls;

difficulties in coordinating the activities of our geographically dispersed and culturally diverse operations;

general economic conditions in the countries in which we operate, including seasonal reductions in business activity in the summer months in Europe and in other periods in other countries, could have an adverse effect on our earnings from operations in those countries;

imposition of, or unexpected adverse changes in, foreign laws or regulatory requirements may occur, including those pertaining to export restrictions, trade and employment restrictions and intellectual property protections;

longer payment cycles for sales in foreign countries and difficulties in collecting accounts receivable;

competition from local suppliers;

greater risk of a failure of our employees to comply with both U.S. and foreign laws, including antitrust regulations, the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act of 2010, and any trade regulations ensuring fair trade practices;

costs and delays associated with developing software in multiple languages; and

political unrest, war or acts of terrorism.

Our business in emerging markets requires us to respond to rapid changes in market conditions in those markets. Our overall success in international markets depends, in part, upon our ability to succeed in differing legal, regulatory, economic, social and political conditions. We may not continue to succeed in developing and implementing policies and strategies that will be effective in each location where we do business. Furthermore, the occurrence of any of the foregoing factors may have a material adverse effect on our business and results of operations.

We may experience fluctuations in foreign currency exchange rates that could adversely impact our results of operations.

Our international sales are generally denominated in foreign currencies, and this revenue could be materially affected by currency fluctuations. Our primary exposures are to fluctuations in exchange rates for the U.S. dollar

versus the Euro and, to a lesser extent, the Australian dollar, British pound sterling, Canadian dollar, Chinese yuan, Indian rupee, Korean won and Singapore dollar. Changes in currency exchange rates could adversely affect our reported revenues and could require us to reduce our prices to remain competitive in foreign markets, which could also have a material adverse effect on our results of operations. An unfavorable change in the exchange rate of foreign currencies against the U.S. dollar would result in lower revenues when translated into U.S. dollars, although operating expenditures would be lower as well. Historically, the effect of changes in foreign currency exchange rates on our revenues and operating expenses has not been material, although it may be in the future.

In recent fiscal years, we have selectively hedged our exposure to changes in foreign currency exchange rates on the balance sheet. In the future, we may enter into additional foreign currency-based hedging contracts to reduce our exposure to significant fluctuations in currency exchange rates on the balance sheet, although there can be no assurances that we will do so.

However, as our international operations grow, or if dramatic fluctuations in foreign currency exchange rates continue or increase or if our hedging strategies become ineffective, the effect of changes in the foreign currency exchange rates could become material to revenue, operating expenses, and income.

21

Our services include the assessment and design of solutions to meet our customers’ storage management requirements and the efficient installation and deployment of our software applications based on specified business objectives. Further, once our software applications are deployed, our customers depend on us to resolve issues relating to our software applications. A high level of service is critical for the successful marketing and sale of our software. If we or our partners do not effectively install or deploy our applications, or succeed in helping our customers quickly resolve post-deployment issues, it would adversely affect our ability to sell software products to existing customers and could harm our reputation with prospective customers. As a result, our failure to maintain high quality support and professional services would have a material adverse effect on our sales of software applications and results of operations.

Our services revenue produces lower gross margins than our software revenue, and an increase in services revenue relative to software revenue would harm our overall gross margins.

Our services revenue, which includes fees for customer support, assessment and design consulting, implementation and post-deployment services and training, has lower gross margins than our software revenue. An increase in the percentage of total revenues represented by services revenue would adversely affect our overall gross margins. The volume and profitability of services can depend in large part upon competitive pricing pressure on the rates that we can charge for our services; the complexity of our customers’ information technology environments and the existence of multiple non-integrated legacy databases;environments; the resources directed by our customers to their implementation projects; and the extent to which outside consulting organizations provide services directly to customers. Any erosion of our margins for our services revenue or any adverse change in the mix of our license versus services revenue would adversely affect our operating results.

Our abilityA portion of our revenue is generated by sales to sell to the U.S. Federal Government isgovernment entities, which are subject to uncertainties, which coulda number of challenges and risks.

Sales to U.S. and foreign federal, state, and local governmental agency end-customers have accounted for a material adverse effect onportion of our revenue, and we may in the future increase sales to government entities. However, government entities have recently announced reductions in, or experienced increased pressure to reduce spending. In particular, such measures have adversely affected European public sector transactions, and resultsthe recent U.S. debt issues and budget concerns may adversely impact future U.S. public sector transactions. Such budgetary constraints or shifts in spending priorities of operations.

government entities can be highly competitive, expensive and time consuming, often requiring significant upfront time and expense without any assurance that we will successfully sell our products to such governmental entity. Government entities may require contract terms that differ from our standard arrangements. Government contracts may require the government’s future funding commitments and our ability to maintainmaintenance of certain security clearances complyingfor facilities and employees which can entail administrative time and effort possibly resulting in additional costs and delays. In addition, government demand for our products may be more volatile as they are affected by public sector budgetary cycles, funding authorizations, and the potential for funding reductions or delays, making the time to close such transactions more difficult to predict. This risk is enhanced as the size of such sales to the government entities increases. If the use of our products expands to more sensitive, secure or mission critical uses by our government customers, we may be subject to increased scrutiny, potential reputational risk, or potential liability should our products fail to perform as expected or should we not comply with the Departmentterms of Defense and other agency requirements. Revenues derived from sales where the U.S. Federal Government was the end-user was approximately 8% in fiscal 2011 and approximately 9% in fiscal 2010. The future prospects for our business are also sensitive to changes in government policies and funding priorities. Changes in government policies or priorities, including funding levels through agency or program budget reductions by the U.S. Congresscontracts or government agencies, could materially adversely affectcontracting requirements.

Most of our abilitysales to government entities have been made indirectly through providers that sell our software applicationsproducts. Government entities may have contractual or other legal rights to the U.S. Federal Government, causingterminate contracts with our business prospectsproviders for convenience or due to suffer.

If we are unable to manage our growth, there could be a material adverse effect on our business, the quality of our products and services and our ability to retain key personnel.

We have experienced periods of growth in recent years. Our revenues increased 29% for fiscal 2012 compared to fiscal 2011 and also increased 16% for fiscal 2011 compared to fiscal 2010 and also increased 16% for fiscal 2010 compared to fiscal 2009.2010. The number of our customers increased significantly during these periods. Our growth has placed increased demands on our management and other resources and will continue to do so in the future. We may not be able to maintain or accelerate our current growth rate, manage our expanding operations effectively or achieve planned growth on a timely or profitable basis. Managing our growth effectively will involve, among other things:

continuing to retain, motivate and manage our existing employees and attract and integrate new employees;

continuing to provide a high level of services to an increasing number of customers;

22

developing new sales channels that broaden the distribution of our software applications and services; and

developing, implementing and improving our operational, financial, accounting and other internal systems and controls on a timely basis.

If we are unable to manage our growth effectively, there could be a material adverse effect on our ability to maintain or increase revenues and profitability, the quality of our data and information management software, the quality of our services offerings and our ability to retain key personnel. These factors could adversely affect our reputation in the market and our ability to generate future sales from new or existing customers.

We may be subject to information technology system failures, network disruptions and breaches in data security.

Information technology system failures, network disruptions and breaches of data security could disrupt our operations by causing delays or cancellation of customer orders, impeding the shipment of software products, negatively affecting our service offerings, preventing the processing transactions and reporting of financial results. Information technology system failures, network disruptions and breaches of data security could also

result in the unintentional disclosure of customer or our information as well as damage to our reputation. While management has taken steps to address these concerns by implementing sophisticated network security and internal control measures, there can be no assurance that a system failure or data security breach will not have a material adverse effect on our financial condition and operating results.

Protection of our intellectual property is limited, and any misuse of our intellectual property by others could materially adversely affect our sales and results of operations.

Our success depends significantly upon proprietary technology in our software, documentation and other written materials. To protect our proprietary rights, we rely on a combination of:

patents;

copyright and trademark laws;

trade secrets;

confidentiality procedures; and

contractual provisions.

These methods afford only limited protection. Despite this limited protection, any issued patent may not provide us with any competitive advantages or may be challenged by third parties, and the patents of others may seriously impede our ability to conduct our business. Further, our pending patent applications may not result in the issuance of patents, and any patents issued to us may not be timely or broad enough to protect our proprietary rights. We may also develop proprietary products or technologies that cannot be protected under patent law.

Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our software applications or to obtain and use information that we regard as proprietary. Policing unauthorized use of our software applications is difficult, and we expect software piracy to continue to be a persistent problem. In licensing our software applications, we typically rely on “shrink wrap” or “click wrap” licenses that are not signed by licensees. We may have difficulty enforcing these licenses in some jurisdictions. In addition, the laws of some foreign countries do not protect our proprietary rights to as great an extent as do the laws of the United States. Our attempts to protect our proprietary rights may not be adequate. Our competitors may independently develop similar technology, duplicate our software applications or design around patents issued to us or other intellectual property rights of ours. Litigation may be necessary in the future to enforce our intellectual property rights, protect our trade secrets or determine the validity and scope of the proprietary rights of others. Litigation could result in substantial costs and diversion of resources and management attention. In addition, from time to time we are participants or members of various industry standard-setting organizations or other industry technical organizations. Our participation or membership in such organizations may, in some circumstances, require us to enter into royalty or licensing agreements with third parties regarding our intellectual property under terms established by those organizations, which we may not find favorable.

In addition, many of our agreements with our customers and partners require us to indemnify them for certain intellectual property infringement claims against them, which would increase our costs as a result of defending such claims, and may require that we pay significant damages if there were an adverse ruling in any such claims. Furthermore, such customers and partners may discontinue the use of our products, services, and technologies, as a result of injunctions or otherwise, which could result in loss of revenues and adversely impact our business.

23

Due to the nature of our business, we may become subject to material claims of infringement by competitors and other third parties with respect to current or future software applications, trademarks or other proprietary

rights. We expect that software developers will increasingly be subject to infringement claims as the number of software applications and competitors in our industry segment grows and the functionality of software applications in different industry segments overlaps. Any such claims, whether meritorious or not, could be time-consuming, result in costly litigation, cause shipment delays or require us to enter into royalty or licensing agreements with third parties, which may not be available on terms that we deem acceptable, if at all. In addition, we may decide to settle a claim or action against us, which settlement could be costly. We may also be liable for any past infringement. If there is an adverse ruling against us in an infringement lawsuit, an injunction could be issued barring production or sale of any infringing product. It could also result in a damage award equal to a reasonable royalty or lost profits or, if there is a finding of willful infringement, treble damages. Any of these claims could disrupt our business and have a material adverse effect on our results of operations and financial condition.

In addition, we license and use software from third parties in our business. These third-party software licenses may not continue to be available to us on acceptable terms or at all, and may expose us to additional liability. This liability, or our inability to use any of this third-party software, could result in shipment delays or other disruptions in our business that could materially and adversely affect our operating results.

Our use of “open source” software could negatively affect our business and subjects us to possible litigation.

Some of the products or technologies acquired, licensed or developed by us may incorporate so-called “open source” software, and we may incorporate open source software into other products in the future. Such open source software is generally licensed by its authors or other third parties under open source licenses, including, for example, the GNU General Public License, the GNU Lesser General Public License, the Common Public License, “Apache-style” licenses, “Berkley Software Distribution or BSD-style” licenses and other open source licenses. We monitor our use of open source software to avoid subjecting our products to conditions we do not intend.intend, but these efforts may not be successful. Although we believe that we have complied with our obligations under the various applicable licenses for open source software that we use, there is little or no legal precedent governing the interpretation of many of the terms of certain of these licenses, and therefore the potential impact of these terms on our business is somewhat unknown and may result in unanticipated obligations regarding our products and technologies. The use of such open source software may ultimately subject some of our products to unintended conditions, which may negatively affect our business, financial condition, operating results, cash flow and ability to commercialize our products or technologies.

Some of these open source licenses may subject us to certain conditions, including requirements that we offer our products that use the open source software for no cost, that we make available source code for modifications or derivative works we create based upon, incorporating or using the open source software and/or that we license such modifications or derivative works under the terms of the particular open source license. If an author or other third-party that distributes such open source software were to allege that we had not complied with the conditions of one or more of these licenses, we could be required to incur significant legal expenses defending against such allegations. If our defenses were not successful, we could be enjoined from the distribution of our products that contained the open source software and required to make the source code for the open source software available to others, to grant third parties certain rights of further use of our software or to remove the open source software from our products, which could disrupt the distribution and sale of some of our products. In addition, if we combine our proprietary software with open source software in a certain manner, under some open source licenses we could be required to release the source code of our proprietary software. If an author or other third-party that distributes open source software were to obtain a judgment against us based on allegations that we had not complied with the terms of any such open source licenses, we could also be subject to liability for copyright infringement damages and breach of contract for our past distribution of such open source software.

Our effective tax rate is difficult to project, and changes in such tax rate or adverse results of tax examinations could adversely affect our operating results.

We are currently unablea United States-based multinational company subject to accurately predict whattax in multiple U.S. and foreign tax jurisdictions. Our results of operations would be adversely affected to the extent that our long-term effectivegeographical mix of

income becomes more weighted toward jurisdictions with higher tax rates willand would be favorably affected to the extent the relative geographic mix shifts to lower tax jurisdictions. Any change in our mix of earnings is dependent upon many factors and is therefore difficult to predict.

The process of determining our anticipated tax liabilities involves many calculations and estimates that are inherently complex and make the future.

Furthermore, our overall effective income tax rate and tax expenses may be affected by various factors in determining our worldwide provision for income taxes, andbusiness, including changes in the ordinary course of business, there are many transactions and calculations where the ultimate tax determination is uncertain. Our long-term effective tax rates could be adversely affected byour legal structure, changes in the geographic mix of earnings in countries with differing statutory tax rates;income and expenses, changes in tax laws and applicable accounting pronouncements and variations in the estimated and actual level of annual profits before income tax. For example, our effective tax rate has benefited from an existing U.S. research and development tax credit. If this tax credit is not renewed for 2012 or in the future, we would expect our effective tax rate to increase.

We also determine the need to record deferred tax liabilities and the recoverability of deferred tax assets. A valuation allowance is established to the extent recovery of deferred tax assets and liabilities; changes in tax laws;is not likely based on our ability to utilize net operating loss carryforwards and research tax credit carryforwards;estimation of future taxable income and other factors. Our judgments may be subject to audits or reviews by local tax authoritiesfactors in each of these jurisdictions, which could adversely affect our income tax provisions.jurisdiction. As of March 31, 2011,2012, we had net deferred tax assets of approximately $33.8$38.6 million, which were primarily related to federal and state research tax credit carryforwards, stock-based compensation and foreign net operating loss carryforwards. Consequently, our cash tax rate will be significantly lower than our effective tax rate for the next 12 months.though fiscal 2013 and into fiscal 2014. However, we expect our cash taxes to continue to increase as our cash tax rate approaches our effective tax rate.

24

Our cash and cash equivalents are highly liquid investments with original maturities of three months or less at the time of purchase. We maintain the cash and cash equivalents with major financial institutions. Deposits with these banks exceed the Federal Deposit Insurance Corporation (“FDIC”) insurance limits or similar limits in foreign jurisdictions. While we monitor daily the cash balances in the operating accounts and adjust the balances as appropriate, these balances could be impacted if one or more of the financial institutions with which we deposit fails or is subject to other adverse conditions in the financial or credit markets. To date, we have experienced no loss or lack of access to our invested cash or cash equivalents; however, we can provide no assurance that access to our invested cash and cash equivalents will not be impacted by adverse conditions in the financial and credit markets.

We cannot predict our future capital needs and we may be unable to obtain additional financing, which could have a material adverse effect on our business, results of operations and financial condition.

We may need to raise additional funds in the future in order to acquire complementary businesses, technologies, products or services. Any required additional financing may not be available on terms acceptable to us, or at all. If we raise additional funds by issuing equity securities, you may experience significant dilution of your ownership interest, and the newly-issued securities may have rights senior to those of the holders of our common stock. If we raise additional funds by obtaining loans from third parties, the terms of those financing arrangements may include negative covenants or other restrictions on our business that could impair our operational flexibility, and would also require us to fund additional interest expense. If additional financing is not available when required or is not available on acceptable terms, we may be unable to successfully develop or enhance our software and services through acquisitions in order to take advantage of business opportunities or

respond to competitive pressures, which could have a material adverse effect on our software and services offerings, revenues, results of operations and financial condition. We have no plans, nor are we currently considering any proposals or arrangements, written or otherwise, to acquire a business, technology, product or service.

Risks Relating to Ownership of Our Common Stock

The price of our common stock may be highly volatile and may decline regardless of our operating performance.

The market price of our common stock could be subject to significant fluctuations in response to:

variations in our quarterly or annual operating results;

changes in financial estimates, treatment of our tax assets or liabilities or investment recommendations by securities analysts following our business or our competitors;

the public’s response to our press releases, rumors, our other public announcements and our filings with the SEC;

changes in accounting standards, policies, guidance or interpretations or principles;

sales of common stock by our directors, officers and significant stockholders;

announcements of technological innovations or enhanced or new products by us or our competitors;

our failure to achieve operating results consistent with securities analysts’ projections;

the operating and stock price performance of other companies that investors may deem comparable to us;

broad market and industry factors; and

other events or factors, including those resulting from war, incidents of terrorism or responses to such events.

25

Future sales of our common stock, or the perception that such future sales may occur, may cause our stock price to decline and impair our ability to obtain capital through future stock offerings.

A substantial number of shares of our common stock are available for sale into the public market. The occurrence of such sales, or the perception that such sales could occur, could materially and adversely affect our stock price and could impair our ability to obtain capital through an offering of equity securities.

Certain provisions in our charter documents and agreements and Delaware law, as well as our stockholder rights plan, may inhibit potential acquisition bids for CommVault and prevent changes in our management.

Our certificate of incorporation and bylaws contain provisions that could depress the trading price of our common stock by acting to discourage, delay or prevent a change of control of our company or changes in management that our stockholders might deem advantageous. Specific provisions in our certificate of incorporation include:

our ability to issue preferred stock with terms that the Board of Directors may determine, without stockholder approval;

a classified board in which only a third of the total board members will be elected at each annual stockholder meeting;

advance notice requirements for stockholder proposals and nominations; and

limitations on convening stockholder meetings.

In addition to the provision described above, on November 13, 2008, our Board of Directors adopted a stockholders rights plan and declared a dividend distribution of one Right for each outstanding share of our common stock to shareholders of record on November 24, 2008. Each Right, when exercisable, entitles the registered holder to purchase from us one one-thousandth of a share of Series A Junior Participating Preferred Stock, par value $0.01 per share, at a purchase price of $80 per one one-thousandth of a share, subject to adjustment. The Rights may discourage a third-party from making an unsolicited proposal to acquire us, as exercise of the Rights would cause substantial dilution to such third-party attempting to acquire us.

As a result of the provisions in our certificate of incorporation and our stockholder rights plan, the price investors may be willing to pay in the future for shares of our common stock may be limited.

Also, we are subject to Section 203 of the Delaware General Corporation Law, which imposes certain restrictions on mergers and other business combinations between us and any holder of 15% or more of our common stock. Further, certain of our employment agreements and incentive plans provide for vesting of stock options and/or payments to be made to the employees there under if their employment is terminated in connection with a change of control, which could discourage, delay or prevent a merger or acquisition at a premium price.

We do not expect to pay any dividends in the foreseeable future.

We do not anticipate paying any cash dividends to holders of our common stock in the foreseeable future. Consequently, investors must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize any future gains on their investment. Investors seeking cash dividends should not purchase our common stock.

26

Although we currently believe our internal control over financial reporting is effective, the year. Our continued compliance with Section 404 will requireeffectiveness of our internal controls in future periods is subject to the risk that we incur substantial expenses and expend significant management time on compliance related issues.our controls may become inadequate or may not operate effectively. In future years, if we fail to timely complete this assessment, or if E&Your auditors cannot timely attest, there may be a loss of public confidence in our internal controls, the market price of our stock could decline and we could be subject to regulatory sanctions or investigations by the NASDAQ Stock Market, the Securities and Exchange Commission or other regulatory authorities, which would require additional financial and management resources. In addition, any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to timely meet our regulatory reporting obligations.

During the past few years, our organizational structure has increased in complexity due to compliance with tax regulations and tax accounting requirements and other regulatory and compliance requirements, including compliance with anti-corruption and anti-bribery laws such as the U.S. Foreign Corrupt Practices Act (the “FCPA”) and the UK Bribery Act of 2010 (the “UK Bribery Act”). Further, we have expanded our presence in the Asia-Pacific region, where business practices can differ from those in other regions of the world and can create internal control risks. We provide business practices training to our employees worldwide. Overall, the combination of increased structural complexity and the ever-increasing regulatory complexity make it more critical for us to attract and retain qualified and technically competent employees.

Item 1B. | Unresolved Staff Comments |

None.

Our principal administrative, sales, marketing, customer support and research and development facility is located at our headquarters in Oceanport, New Jersey. We currently occupy approximately 162,000 square feet of office space in the Oceanport facility under the terms of an operating lease expiring in July 2015. We believe that our current facility is adequate to meet our needs for at least the next 12 months. We believe that suitable additional facilities will be available as needed on commercially reasonable terms. In addition, we have offices in the United States in Arizona, California, Colorado, Connecticut, Florida, Georgia, Illinois, Massachusetts, Minnesota, New York, North Carolina, Ohio, Oregon, Pennsylvania, Tennessee, Texas, Virginia and Washington; and outside the United States in Kanata, Ontario; Toronto, Ontario; Calgary, Alberta; Montreal, Quebec; Vancouver, British Columbia; Reading, United Kingdom; Oberhausen, Germany; Utrecht, Netherlands; Milan, Italy; Madrid, Spain; Dubai; Moscow, Russia; Johannesburg, South Africa; Riyadh, Saudi Arabia; Beijing, China; Shanghai, China; Guangzhou, China; Chengdu, China; Sydney, Australia; Melbourne, Australia; Canberra, Australia; Auckland, New Zealand; Tokyo, Japan; Singapore; Mexico City, Mexico; Kuala Lumpar, Malaysia; Bangkok, Thailand; Sao Paulo, Brazil; Seoul, South Korea; Mumbai, India; Bangalore, India and Hyderabad, India.

From time to time, we are subject to claims in legal proceedings arising in the normal course of our business. We do not believe that we are currently party to any pending legal action that could reasonably be expected to have a material adverse effect on our business or operating results.

Item 4. |

Not Applicable.

PART II

27

Market for our Common Stock

Our common stock is listed and traded on The NASDAQ Global Market under the symbol “CVLT.” The following table sets forth, for the periods indicated, the high and the low closing sales prices of our common stock, as reported on The NASDAQ Global Market.

| Common Stock | ||||||||||||||||

| 2012 | 2011 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

First Quarter | $ | 44.45 | $ | 36.47 | $ | 23.96 | $ | 19.29 | ||||||||

Second Quarter | $ | 47.06 | $ | 31.22 | $ | 28.03 | $ | 17.80 | ||||||||

Third Quarter | $ | 50.54 | $ | 34.66 | $ | 31.41 | $ | 25.51 | ||||||||

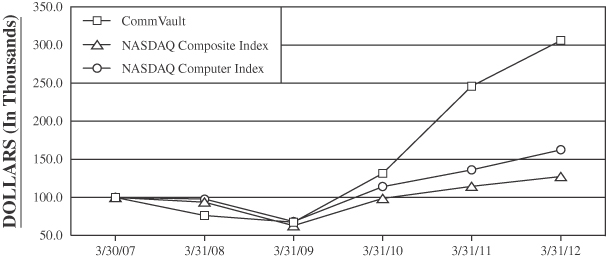

Fourth Quarter | $ | 54.71 | $ | 42.93 | $ | 40.94 | $ | 28.93 | ||||||||