The financial section of the FedEx Corporation (“FedEx”) Annual Report on Form 10-K (“Annual Report”) consists of the following Management’s Discussion and Analysis of Results of Operations and Financial Condition (“MD&A”), the Consolidated Financial Statements and the notes to the Consolidated Financial Statements, and Other Financial Information, all of which include information about our significant accounting policies, practices and the transactions that underlie our financial results. The following MD&A describes the principal factors affecting the results of operations, liquidity, capital resources, contractual cash obligations and the critical accounting estimates of FedEx. The discussion in the financial section should be read in conjunction with the other sections of this Annual Report, particularly “Item 1: Business” and our detailed discussion of risk factors included in this MD&A.

ORGANIZATION OF INFORMATION

Our MD&A is composed of three major sections: Results of Operations, Financial Condition and Critical Accounting Estimates. These sections include the following information:

Results of Operationsoperations includes an overview of our consolidated 20112013 results compared to 2010,2012, and 20102012 results compared to 2009.2011. This section also includes a discussion of key actions and events that impacted our results, as well as our outlook for 2012.2014.

The overview is followed by a financial summary and analysis (including a discussion of both historical operating results and our outlook for 2012)2014) for each of our reportable transportation segments.

Our financial condition is reviewed through an analysis of key elements of our liquidity, capital resources and contractual cash obligations, including a discussion of our cash flows and our financial commitments.

Critical accounting estimates discusses those financial statement elements that we believe are important to understanding certain of the material judgments and assumptions incorporated in our reported financial results.

We conclude with a discussion of risks and uncertainties that may impact our financial and operating results.

DESCRIPTION OF BUSINESS

We provide a broad portfolio of transportation, e-commerce and business services through companies competing collectively, operating independently and managed collaboratively, under the respected FedEx brand. Our primary operating companies are Federal Express Corporation (“FedEx Express”), the world’s largest express transportation company; FedEx Ground Package System, Inc. (“FedEx Ground”), a leading North American provider of small-package ground delivery services; and FedEx Freight, Inc. (“FedEx Freight”), a leading U.S.North American provider of less-than-truckload (“LTL”) freight services. These companies represent our major service lines and, along with FedEx Corporate Services, Inc. (“FedEx Services”), form the core of our reportable segments. Our FedEx Services segment provides sales, marketing, and information technology, communications and back-office support to our transportation segments. In addition, the FedEx Services segment provides customers with retail access to FedEx Express and FedEx Ground shipping services through FedEx Office and Print Services, Inc. (“FedEx Office”) and provides customer service, technical support and billing and collection services through FedEx TechConnect, Inc. (“FedEx TechConnect”). See “Reportable Segments” for further discussion and refer to “Item 1: Business” for a more detailed description of each of our operating companies.

36

the overall customer demand for our various services;services based on macro-economic factors and the global economy;

the volumes of transportation services provided through our networks, primarily measured by our average daily volume and shipment weight;

the mix of services purchased by our customers;

the prices we obtain for our services, primarily measured by yield (revenue per package or pound or revenue per hundredweight for LTL freight shipments);

our ability to manage our cost structure (capital expenditures and operating expenses) to match shifting volume levels; and

the timing and amount of fluctuations in fuel prices and our ability to recover incremental fuel costs through our fuel surcharges.

The majority of our operating expenses are directly impacted by revenue and volume levels. Accordingly, we expect these operating expenses to fluctuate on a year-over-year basis consistent with the change in revenues and volumes. Therefore, the discussion of operating expense captions focuses on the key drivers and trends impacting expenses other than changes in revenues and volume.

Except as otherwise specified, references to years indicate our fiscal year ended May 31, 20112013 or ended May 31 of the year referenced and comparisons are to the prior year. References to our transportation segments include, collectively, our FedEx Express, FedEx Ground and FedEx Freight segments.

CONSOLIDATED RESULTS

The following table compares summary operating results (dollars in millions, except per share amounts) for the years ended May 31:

| Percent Change | ||||||||||||||||||||

| 2011(1) | 2010 | 2009(2) | 2011/2010 | 2010/2009 | ||||||||||||||||

| Revenues | $ | 39,304 | $ | 34,734 | $ | 35,497 | 13 | (2 | ) | |||||||||||

| Operating income | 2,378 | 1,998 | 747 | 19 | 167 | |||||||||||||||

| Operating margin | 6.1 | % | 5.8 | % | 2.1 | % | 30 | bp | 370 | bp | ||||||||||

| Net income | $ | 1,452 | $ | 1,184 | $ | 98 | 23 | NM | ||||||||||||

| Diluted earnings per share | $ | 4.57 | $ | 3.76 | $ | 0.31 | 22 | NM | ||||||||||||

| Percent Change | ||||||||||||||||||||

| 2013(1) | 2012(2) | 2011(3) | 2013/2012 | 2012/2011 | ||||||||||||||||

Revenues | $ | 44,287 | $ | 42,680 | $ | 39,304 | 4 | 9 | ||||||||||||

Operating income | 2,551 | 3,186 | 2,378 | (20 | ) | 34 | ||||||||||||||

Operating margin | 5.8 | % | 7.5 | % | 6.1 | % | (17 | 0)bp | 14 | 0bp | ||||||||||

Net income | $ | 1,561 | $ | 2,032 | $ | 1,452 | (23 | ) | 40 | |||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Diluted earnings per share | $ | 4.91 | $ | 6.41 | $ | 4.57 | (23 | ) | 40 | |||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| (1) | Operating expenses include $560 million for business realignment costs and a $100 million impairment charge resulting from the decision to retire ten aircraft and related engines at FedEx Express. |

| (2) | Operating expenses include an impairment charge of $134 million resulting from the decision to retire 24 aircraft and related engines at FedEx Express and the reversal of a $66 million legal reserve which was initially recorded in 2011 at FedEx Express. |

| (3) | Operating expenses include $133 million in costs associated with the combination of our FedEx Freight and FedEx National LTL operations, effective January 30, 2011, and a $66 million legal reserve | |

37

| Revenues | Operating Income | |||||||||||||||||||||||||||||||

| Dollar Change | Percent Change | Dollar Change | Percent Change | |||||||||||||||||||||||||||||

| 2011/ | 2010/ | 2011/ | 2010/ | 2011/ | 2010/ | 2011/ | 2010/ | |||||||||||||||||||||||||

| 2010 | 2009 | 2010 | 2009 | 2010 | 2009 | 2010 | 2009 | |||||||||||||||||||||||||

FedEx Express segment(1) | $ | 3,026 | $ | (809 | ) | 14 | (4 | ) | $ | 101 | $ | 333 | 9 | 42 | ||||||||||||||||||

| FedEx Ground segment | 1,046 | 392 | 14 | 6 | 301 | 217 | 29 | 27 | ||||||||||||||||||||||||

FedEx Freight segment(2) | 590 | (94 | ) | 14 | (2 | ) | (22 | ) | (109 | ) | (14 | ) | (248 | ) | ||||||||||||||||||

FedEx Services segment(3) | (86 | ) | (207 | ) | (5 | ) | (10 | ) | — | 810 | — | 100 | ||||||||||||||||||||

| Other and eliminations | (6 | ) | (45 | ) | NM | NM | — | — | — | — | ||||||||||||||||||||||

| $ | 4,570 | $ | (763 | ) | 13 | (2 | ) | $ | 380 | $ | 1,251 | 19 | 167 | |||||||||||||||||||

| Revenues | Operating Income | |||||||||||||||||||||||||||||||

| Dollar Change | Percent Change | Dollar Change | Percent Change | |||||||||||||||||||||||||||||

| 2013/ 2012 | 2012/ 2011 | 2013/ 2012 | 2012/ 2011 | 2013/ 2012 | 2012/ 2011 | 2013/ 2012 | 2012/ 2011 | |||||||||||||||||||||||||

FedEx Express segment(1) | $ | 656 | $ | 1,934 | 2 | 8 | $ | (705 | ) | $ | 32 | (56 | ) | 3 | ||||||||||||||||||

FedEx Ground segment(2) | 1,005 | 1,088 | 10 | 13 | 24 | 439 | 1 | 33 | ||||||||||||||||||||||||

FedEx Freight segment(3) | 119 | 371 | 2 | 8 | 46 | 337 | 28 | 193 | ||||||||||||||||||||||||

FedEx Services segment | (91 | ) | (13 | ) | (5 | ) | (1 | ) | — | — | — | — | ||||||||||||||||||||

Other and eliminations | (82 | ) | (4 | ) | NM | NM | — | — | — | — | ||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

| $ | 1,607 | $ | 3,376 | 4 | 9 | $ | (635 | ) | $ | 808 | (20 | ) | 34 | |||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

| (1) | FedEx Express segment |

| (2) | FedEx Ground segment 2013 operating expenses include |

| (3) | FedEx Freight segment 2013 operating expenses include $50 million | |

| of direct and allocated business realignment costs. Additionally, FedEx Freight segment 2011 operating expenses include $133 million in costs associated with the combination of our FedEx Freight and FedEx National LTL operations, effective January 30, | ||

-41-

Overview

Our results for 20112013 reflect a significant impact of certain charges (described below), which negatively impacted our earnings by $1.31 per diluted share. Beyond these factors, our results for 2013 benefited from the momentumstrong performance of improved global economic conditionsFedEx Ground, which continued to grow market share, and strongongoing profit improvement at FedEx Freight. However, a decline in profitability was experienced at our FedEx Express segment resulting from ongoing shifts in demand forfrom our priority international services to economy international services which drove yield growthcould not be fully offset by network cost and volume increasescapacity reductions in 2013.

Our 2013 results include business realignment costs of $560 million, primarily related to our voluntary cash buyout program (see “Business Realignment, Impairment and Other Charges” for additional information). Furthermore, in May 2013, we made the decision to retire from service 10 aircraft and related engines, which resulted in a noncash asset impairment charge of $100 million.

In addition, actions in 2012 at FedEx Express related to fleet modernization resulted in the accelerated retirement of certain aircraft which negatively impacted our 2013 results by $69 million due to additional depreciation recorded for the shortened lives of the aircraft.

Our 2012 revenues, operating income and operating margins reflected the exceptional performance of our FedEx Ground segment, improved profitability at FedEx Freight and increased yields across all our transportation segments duringoperating segments. Our results significantly benefited in 2012 from the timing lag that exists between when fuel prices change and when indexed fuel surcharges automatically adjust. Our 2012 results included the reversal of a $66 million legal reserve initially recorded in 2011 particularly in FedEx International Priority (“IP”) package shipmentsand an aircraft impairment charge of $134 million at FedEx Express. Our FedEx Ground segment continued its exceptional performance, increasing volume, yield and operating margins. The FedEx Freight segment returned to profitability in the fourth quarter of 2011 primarily due to higher LTL yield. All of our transportation segments benefited from our yield management initiatives in 2011. Despite the strength in our businesses and significantly improved results, we incurred increased retirement plans and medical costs, higher aircraft maintenance expenses, higher costs associated with the restoration of compensation programs curtailed during the recession and one-time costs associated with the combination of our LTL operations (described below) during 2011.

| 2011 | ||||

| Severance | $ | 40 | ||

| Lease terminations | 20 | |||

| Asset impairments | 29 | |||

| Impairment and other charges | 89 | |||

| Other program costs | 44 | |||

| Total program costs | $ | 133 | ||

38��

-42-

39

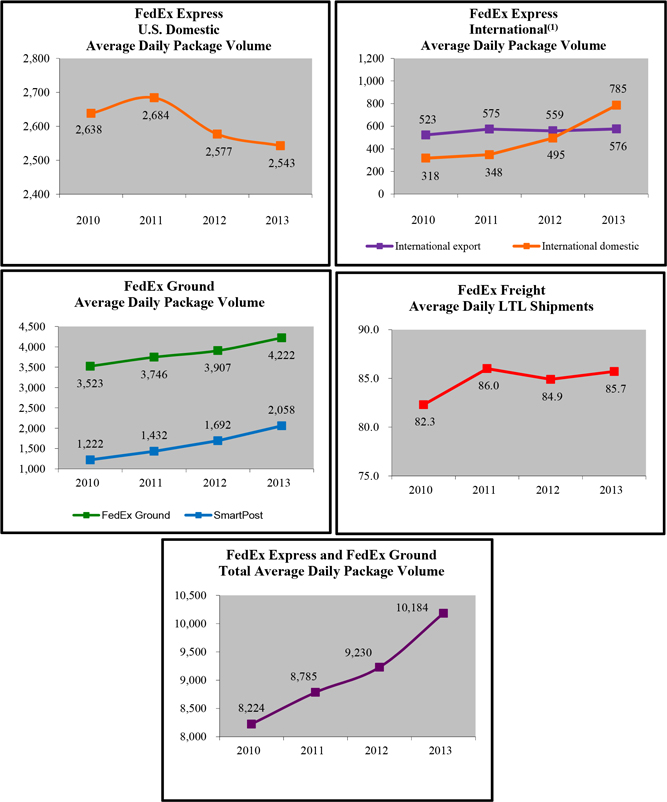

| (1) | International domestic average daily package volume includes our international intra-country express operations, including acquisitions in India (February 2011), Mexico (July 2011), Poland (June 2012), France (July 2012) and Brazil (July 2012). |

-43-

Revenue

Revenues increased 13% during 20114% in 2013 primarily driven by increases in international domestic revenue at FedEx Express and volume growth at FedEx Ground. At FedEx Ground, revenues increased 10% in 2013 primarily due to volume growth from market share gains. At FedEx Express, revenues increased 2% due to increases in international domestic revenues from recent acquisitions and growth in our freight-forwarding business at FedEx Trade Networks. Base revenue growth at FedEx Express in 2013 was constrained by global economic conditions as shifts in demand from our priority international services to our economy international services and lower rates resulted in declines in international export package yields. At FedEx Freight, revenues increased 2% as a result of higher yield and average daily LTL shipments.

During 2012, revenues increased 9% due to yield increases and volume growth across all our transportation segments. Yields improved due to higher fuel surcharges and increased base rates under our yield improvement programs, including our dimensional pricing changes for package shipments effective January 1, 2011. At FedEx Express, revenues increased 14%8% in 20112012 led by IP volume growth in Asia, as well ashigher U.S. domestic and IPinternational export package yield increases. At theyields. However, U.S. domestic package and international export package volumes declined due to weakening global economic conditions. Revenues increased 13% during 2012 at our FedEx Ground segment revenues increased 14% in 2011 due to continued volume growth driven by market share gainshigher yields and yield growth at both FedEx Ground and FedEx SmartPost.strong demand for all our major services. At FedEx Freight, yield increasesrevenues increased 8% during 2012 due to our yield management programs and higher LTL fuel surcharges, and higher average daily LTL volumes led to a 14% increase in revenues in 2011.

40

The following tables compare operating expenses expressed as dollar amounts (in millions) and as a percent of revenue for the years ended May 31:

| 2011 | 2010 | 2009 | ||||||||||

| Operating expenses: | ||||||||||||

| Salaries and employee benefits | $ | 15,276 | $ | 14,027 | $ | 13,767 | ||||||

| Purchased transportation | 5,674 | 4,728 | 4,534 | |||||||||

| Rentals and landing fees | 2,462 | 2,359 | 2,429 | |||||||||

| Depreciation and amortization | 1,973 | 1,958 | 1,975 | |||||||||

| Fuel | 4,151 | 3,106 | 3,811 | |||||||||

| Maintenance and repairs | 1,979 | 1,715 | 1,898 | |||||||||

| Impairment and other charges | 89 | (1) | 18 | 1,204 | (2) | |||||||

| Other | 5,322 | (3) | 4,825 | 5,132 | ||||||||

| Total operating expenses | $ | 36,926 | $ | 32,736 | $ | 34,750 | ||||||

| 2013 | 2012 | 2011 | ||||||||||

Operating expenses: | ||||||||||||

Salaries and employee benefits | $ | 16,570 | $ | 16,099 | $ | 15,276 | ||||||

Purchased transportation | 7,272 | 6,335 | 5,674 | |||||||||

Rentals and landing fees | 2,521 | 2,487 | 2,462 | |||||||||

Depreciation and amortization | 2,386 | 2,113 | 1,973 | |||||||||

Fuel | 4,746 | 4,956 | 4,151 | |||||||||

Maintenance and repairs | 1,909 | 1,980 | 1,979 | |||||||||

Business realignment, impairment and other charges | 660 | (1) | 134 | (2) | 89 | (3) | ||||||

Other (4) | 5,672 | 5,390 | 5,322 | |||||||||

|

|

|

|

|

| |||||||

Total operating expenses | $ | 41,736 | $ | 39,494 | $ | 36,926 | ||||||

|

|

|

|

|

| |||||||

| Percent of Revenue | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

Operating expenses: | ||||||||||||

Salaries and employee benefits | 37.4 | % | 37.7 | % | 38.9 | % | ||||||

Purchased transportation | 16.4 | 14.9 | 14.4 | |||||||||

Rentals and landing fees | 5.7 | 5.8 | 6.3 | |||||||||

Depreciation and amortization | 5.4 | 5.0 | 5.0 | |||||||||

Fuel | 10.7 | 11.6 | 10.6 | |||||||||

Maintenance and repairs | 4.3 | 4.6 | 5.0 | |||||||||

Business realignment, impairment and other charges | 1.5 | (1) | 0.3 | (2) | 0.2 | (3) | ||||||

Other (4) | 12.8 | 12.6 | 13.5 | |||||||||

|

|

|

|

|

| |||||||

Total operating expenses | 94.2 | 92.5 | 93.9 | |||||||||

|

|

|

|

|

| |||||||

Operating margin | 5.8 | % | 7.5 | % | 6.1 | % | ||||||

|

|

|

|

|

| |||||||

| (1) | Includes predominantly severance costs associated with our voluntary buyout program and charges resulting from the decision to retire 10 aircraft and related engines at FedEx Express. |

| (2) | Represents charges resulting from the decision to retire 24 aircraft and related engines at FedEx Express. |

| (3) | Represents charges associated with the combination of our FedEx Freight and FedEx National LTL operations effective January 30, 2011. |

Includes | ||

41

| Percent of Revenue | ||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| Operating expenses: | ||||||||||||

| Salaries and employee benefits | 38.9 | % | 40.4 | % | 38.8 | % | ||||||

| Purchased transportation | 14.4 | 13.6 | 12.8 | |||||||||

| Rentals and landing fees | 6.3 | 6.8 | 6.8 | |||||||||

| Depreciation and amortization | 5.0 | 5.6 | 5.6 | |||||||||

| Fuel | 10.6 | 8.9 | 10.7 | |||||||||

| Maintenance and repairs | 5.0 | 4.9 | 5.3 | |||||||||

| Impairment and other charges | 0.2 | 0.1 | 3.4 | |||||||||

| Other | 13.5 | 13.9 | 14.5 | |||||||||

| Total operating expenses | 93.9 | 94.2 | 97.9 | |||||||||

| Operating margin | 6.1 | % | 5.8 | % | 2.1 | % | ||||||

Purchased transportation increased 20%15% in 20112013 due to volume growth higher fuel surcharges and higher rates paid to our independent contractors at FedEx Ground, as well as costs associated withrecent international business acquisitions and the expansion of our freight forwarding business at FedEx Trade Networks. MaintenanceSalaries and repairs expensebenefits increased 15%3% in 20112013 primarily due to an increaseincreases in maintenance events, as a result of timing,pension and higher utilization of our fleet drivengroup health insurance costs, partially offset by lower incentive compensation accruals. Other expenses increased volumes. Other operating expense increased 10%5% in 2013 primarily due to volume-the impact of business acquisitions and weather-related expenses.

-45-

The following graph for our transportation segments shows our average cost of jet and vehicle fuel per gallon for the years ended May 31:

42

Our analysis considers the estimated impact of the reduction in fuel surcharges included in the base rates charged for FedEx Express and FedEx Ground services. However, this analysis does not consider the negative effects that fuel surcharge levels may have on our business, including reduced demand and shifts by our customers to lower-yielding services. While fluctuations in fuel surcharge rates can be significant from period to period, fuel surcharges represent one of the many individual components of our pricing structure that impact our overall revenue and yield. Additional components include the mix of services sold, the base price and extra service charges we obtain for these services and the level of pricing discounts offered. In order to provide information about the impact of fuel surcharges on the trendstrend in revenue and yield growth, we have included the comparative fuel surcharge rates in effect for 2011, 20102013, 2012 and 20092011 in the accompanying discussions of each of our transportation segments.

In 2012, operating income increased 34% and operating margin increased in 2010 primarily as a result of the inclusion in 2009 of the impairment140 basis points driven by higher yields across all our transportation segments due to higher fuel surcharges and other charges described above. Volume increases at our package businesses, particularly in higher-margin IP package and freight services at FedEx Express,yield management programs. Our results also benefited our 2010 results. Additionally, wesignificantly benefited in 20102012 from several actions implementedthe timing lag that exists between when fuel prices change and when indexed fuel surcharges automatically adjust. FedEx Ground segment operating income increased $439 million in 2009 to lower2012 driven by higher yields and strong demand for all our cost structure, including reducing base salaries, optimizingmajor services. At our networks by adjusting routes and equipment types, permanently and temporarily idling certain equipment and consolidating facilities; however, these benefits were partially offset by increased costs in 2010 associated with our variable incentive compensation programs. An operating loss at the FedEx Freight segment, operating income increased $337 million due to continued weaknesshigher LTL yield and efficiencies gained from the combination of our LTL operations in the LTL freight market constrained the earnings increase.

Salaries and repairs expense decreased 10%benefits increased 5% in 20102012 primarily due to the timing of maintenance events. Other operating expense decreased 6% in 2010 due to actions to control spendinghigher incentive compensation costs and the inclusion in the prior yearfull reinstatement of higher self-insurance reserve requirements at FedEx Ground.401(k) company-matching contributions effective January 1, 2011. Purchased transportation costs increased 4%12% in 20102012 due to increasedvolume growth and higher fuel surcharges at FedEx Ground, costs associated with the expansion of our freight forwarding business at FedEx Trade Networks and higher utilization of third-party transportation providers associated primarily with our LTL freight service as a result of higher shipment volumes.

Fuel expense increased 19% during 2012 primarily due to price per gallon of fuel and fuel consumption, as we lowered flight hours and improved route efficiencies.increases. Based on a static analysis of the net impact to operating income of year-over-year changes in fuel prices compared to year-over-year changes in fuel surcharges, fuel had a significant negative impact to operating incomesurcharges significantly exceeded incremental fuel costs in 2010.

-46-

Other Income and Expense

Interest expense increased $7$30 million during 2011in 2013 primarily due to a decreasereduction in capitalized interest and increased interest expense from 2013 debt issuances. Other expense increased in 2013 driven by foreign currency translation due to global currency volatility. Interest expense decreased $34 million in 2012 due to debt maturities, an increase in capitalized interest related to the timing of construction projects and progress payments on aircraft purchases. Interest expense decreased $6 million during 2010 due to increased capitalized interest primarily related to progress payments on aircraft purchases. Interest income decreased $18 million during 2010 primarily due topurchases and lower interest rates and invested balances. Other expense increased $22 million during 2010 primarily due to higher amortization of financing fees and foreign currency losses.

Income Taxes

Our effective tax rate was 36.4% in 2013, 35.3% in 2012 and 35.9% in 2011, 37.5% in 2010 and 85.6% in 2009.2011. Our 20112012 rate was lower thanfavorably impacted by the conclusion of the Internal Revenue Service (“IRS”) audit of our 2010 rate primarily due to increased permanently reinvested foreign earnings and a lower state2007-2009 consolidated income tax rate driven principally by favorable audit and legislative developments. In 2011, ourreturns. Our permanent reinvestment strategy with respect to unremitted earnings of our foreign subsidiaries provided a 1.3%1.2% benefit to our 2013 effective tax rate. Our total permanently reinvested foreign earnings were $640 million$1.3 billion at the end of 20112013 and $325 million$1.0 billion at the end of 2010. Our 2009 rate was significantly impacted by goodwill impairment charges that were not deductible for income tax purposes.

2012.

43

The components of the provision for federal income taxes for the years ended May 31 were as follows (in millions):

| 2011 | 2010 | 2009 | ||||||||||

| Current | $ | 79 | $ | 36 | $ | (35 | ) | |||||

| Deferred | 485 | 408 | 327 | |||||||||

| Total Federal Provision | $ | 564 | $ | 444 | $ | 292 | ||||||

| 2013 | 2012 | 2011 | ||||||||||

Current | $ | 512 | $ | (120 | ) | $ | 79 | |||||

Deferred | 175 | 947 | 485 | |||||||||

|

|

|

|

|

| |||||||

Total Federal Provision | $ | 687 | $ | 827 | $ | 564 | ||||||

|

|

|

|

|

| |||||||

For 2012,2014, we expect our effective tax rate to be in the range of 36.0% to 38.0%between 36.5% and 37.0%. The actual rate, however, will depend on a number of factors, including the amount and source of operating income.

Additional information on income taxes, including our effective tax rate reconciliation, and liabilities for uncertain tax positions and our global tax profile can be found in Note 1112 of the accompanying consolidated financial statements.

-47-

Business Acquisitions

During 2013, we expanded the international service offerings of FedEx Express by completing the following business acquisitions:

Rapidão Cometa Logística e Transporte S.A., a Brazilian transportation and logistics company, for $398 million in cash from operations on July 4, 2012

TATEX, a French express transportation company, for $55 million in cash from operations on July 3, 2012

Opek Sp. z o.o., a Polish domestic express package delivery company, for $54 million in cash from operations on June 13, 2012

These acquisitions give us more robust transportation networks within these countries and added capabilities in these important international markets. See Note 3 of the accompanying consolidated financial statements for further discussion of these acquisitions.

In 2012, we completed our acquisition of Servicios Nacionales Mupa, S.A. de C.V. (MultiPack), a Mexican domestic express package delivery company, for $128 million in cash from operations on July 25, 2011. In 2011, FedEx Expresswe completed the acquisition of the Indian logistics, distribution and express businesses of AFL Pvt. Ltd. and its affiliate Unifreight India Pvt. Ltd. for $96 million in cash. cash from operations on February 22, 2011.

The financial results of thethese acquired businesses are included in the FedEx Express segment from the date of acquisition and were not material, individually or in the aggregate, to our results of operations orand therefore, pro forma financial condition.information has not been presented. Substantially all of the purchase price in each of these acquisitions was allocated to goodwill.

On December 15, 2010, FedEx entered into an agreementJune 20, 2013, we signed agreements to acquire Servicios Nacionales Mupa, S.A. de C.V. (MultiPack), a Mexican domestic express package delivery company. Thisthe businesses operated by our current service provider Supaswift (Pty) Ltd. in five countries in Southern Africa. The acquisition will be funded with cash from operations and is expected to be completed duringin the first quartersecond half of 2012,2014, subject to customary closing conditions. The financial results of the acquired companybusinesses will be included in the FedEx Express segment from the date of acquisition and will be immaterial to our 2014 results.

Business Realignment, Impairment and Other Charges

During 2013, we announced profit improvement programs primarily through initiatives at FedEx Express and FedEx Services that include the following:

Cost reductions in selling, general and administrative functions through headcount reductions, streamlining of processes and elimination of less essential work, as well as deriving greater value from strategic sourcing

Modernization of our aircraft fleet, transformation of the U.S. domestic operations and international profit improvements at FedEx Express

Improved efficiencies and lower costs of information technology at FedEx Services

During 2013, we conducted a program to offer voluntary cash buyouts to eligible U.S.-based employees in certain staff functions. The voluntary buyout program includes voluntary severance payments and funding to healthcare reimbursement accounts, with the voluntary severance calculated based on four weeks of gross base salary for every year of FedEx service up to a maximum payment of two years of pay. This program was completed in the fourth quarter and approximately 3,600 employees have left or will be voluntarily leaving the company by the end of 2014. Eligible employees are scheduled to vacate positions in phases to ensure a smooth transition in the impacted functions so that we maintain service levels to our customers. Of the total population leaving the

-48-

company, approximately 40% of the employees vacated positions on May 31, 2013. An additional 35% will depart throughout 2014 and approximately 25% of this population will remain until May 31, 2014. Costs of the benefits provided under the voluntary program were recognized as special termination benefits in the period that eligible employees accepted their offers.

We incurred costs of $560 million ($353 million, net of tax, or $1.11 per diluted share) during 2013 associated with our business realignment activities. These costs related primarily to severance for employees who accepted voluntary buyouts in the third and fourth quarters of 2013. Payments will be made at the time of departure. Approximately $180 million was paid under this program during 2013. The cost of the buyout program is included in the caption “Business realignment, impairment and other charges” in our consolidated statements of income. Also included in that caption are other external costs directly attributable to our business realignment activities, such as professional fees.

In addition, actions in 2012 results.

In May 2013, we made the decision to retire from service two Airbus A310-200 aircraft and four related engines, three Airbus A310-300 aircraft and two related engines, and five Boeing MD10-10 aircraft and 15 related engines. As a consequence of this decision, a noncash impairment charge of $100 million ($63 million, net of tax, or $0.20 per diluted share) was recorded in the fourth quarter. The decision to retire these importantaircraft, which were temporarily idled and not in revenue service, aligns with the plans of FedEx Express to modernize its aircraft fleet and improve its global markets.

In May 2012, we retired from service 24 aircraft and related engines, the majority of which were temporarily idled and not in revenue service. As a consequence of this decision, a noncash impairment charge of $134 million ($84 million, net of tax, or $0.26 per diluted share) was recorded in the fourth quarter of 2012.

See the “Long-lived Assets” section of our “Critical Accounting Estimates” for a discussion of our accounting for aircraft retirement decisions.

Outlook

We expectanticipate revenue and earnings growth in 2014 driven by the continued strong performance of our FedEx Ground and FedEx Freight businesses and improving performance at FedEx Express. Our expected results for 2014 will be constrained by moderate growth in the global economy combinedand continued challenges from the demand shift trend from our priority international services to our economy international services. In response to these trends, we will be evaluating additional capacity reductions and other actions in 2014. During 2014 we will incur incremental costs to transform our information technology operations at FedEx Services in connection with ongoing yieldour profit improvement actions,programs, which will increase the costs allocated to driveour transportation segments. In May 2013, in conjunction with the retirement of aircraft, FedEx Express shortened the depreciable lives of 76 aircraft and related engines. As a significantresult of this decision and the 2012 decision to shorten the depreciable lives of 54 aircraft, we expect to incur additional year-over-year accelerated depreciation expense of $74 million in 2014. However, lower pension expense in 2014 will positively impact our operating results.

In addition to continued profit improvements in the base businesses at FedEx Ground and FedEx Freight, our profit improvement programs announced in earnings in 2012. Results2013 are targeting annual profitability improvement of $1.6 billion at FedEx Express driven by international services,the end of 2016 (from the full year 2013 base business). Collectively, these initiatives are expected to beincrease margins, improve cash flows and increase our competitiveness. However, the primary driveramount of earnings growth during 2012. In addition, we expect our FedEx Freight segment to be profitable throughout 2012 and anticipate our FedEx Ground segment to continue to grow significantly. However, our outlook is dependent on continued strengthening in global economic conditions,benefit ultimately realized will vary depending upon future customer demand, particularly in industrial production, the pace of which is uncertain due to several factors, including the impact of higher fuel prices on demand.for priority international services. We expect growth in international trade to substantially outpace growth in the U.S. domestic economy, and our unmatched global network is uniquely positioned to service customer needs in this sector. While cost headwinds in pension plans and maintenance and repairs are expected to abate, we expect higher incentive compensation expense asbegin realizing a result of higher earnings and higher expenses related to the full restorationportion of the company-matching contributions onbenefits of these programs in 2014; however, the majority of the benefits, including those from our 401(k) programs.

44

Our outlook is dependent upon a stable pricing environment for fuel, as volatility in fuel prices impacts our fuel surcharge levels, fuel expense and demand for our services. Historically, our fuel surcharges have largely offset incremental fuel costs; however, volatility in fuel costs may impact earnings because adjustments to our fuel surcharges lag changes in actual fuel prices paid. Therefore, the trailing impact of adjustments to our fuel surcharges can significantly affect our earnings either positively or negatively in the short-term.

As described in Note 1718 of the accompanying consolidated financial statements and the “Independent Contractor Matters”Model” section of our FedEx Ground segment MD&A, we are involved in a number of lawsuits and other proceedings that challenge the status of FedEx Ground’s owner-operators as independent contractors. FedEx Ground anticipates continuing changes to its relationships with its contractors.owner-operators. The nature, timing and amount of any changes are dependent on the outcome of numerous future events. We cannot reasonably estimate the potential impact of any such changes or a meaningful range of potential outcomes, although they could be material. However, we do not believe that any such changes will impair our ability to operate and profitably grow our FedEx Ground business.

See “Risk Factors” for a discussion of these and other potential risks and uncertainties that could materially affect our future performance.

Seasonality of Business

Our businesses are cyclical in nature, as seasonal fluctuations affect volumes, revenues and earnings. Historically, the U.S. express package business experiences an increase in volumes in late November and December. International business, particularly in the Asia-to-U.S. market, peaks in October and November in advance of the U.S. holiday sales season. Our first and third fiscal quarters, because they are summer vacation and post winter-holiday seasons, have historically experienced lower volumes relative to other periods. Normally, the fall is the busiest shipping period for FedEx Ground, while late December, June and July are the slowest periods. For FedEx Freight, the spring and fall are the busiest periods and the latter part of December January andthrough February areis the slowest periods.period. For FedEx Office, the summer months are normally the slowest periods. Shipment levels, operating costs and earnings for each of our companies can also be adversely affected by inclement weather, particularly the impact of severe winter weather in our third fiscal quarter.

New accounting rules and disclosure requirements can significantly impact our reported results and the comparability of our financial statements. New accounting

On June 1, 2012, we adopted the authoritative guidance that has impacted our financial statements can be found in Note 2 of the accompanying consolidated financial statements.

-50-

In February 2013, the FASB issued new guidance requiring additional information about reclassification adjustments out of comprehensive income, including changes in comprehensive income balances by component and significant items reclassified out of comprehensive income. This new standard is effective for our fiscal year ending May 31, 2013.

In May 2013, the FASB issued a revised exposure draft outlining proposed changes to the accounting for leases. Under the revised exposure draft, the recognition, measurement and presentation of expenses and cash flows arising from a lease would depend primarily on whether the lessee is expected to consume more than an insignificant portion of the economic benefits embedded in the underlying asset. A right-of-use asset and a liability to make lease payments will be recognized on the balance sheet for all leases (except short-term leases). The enactment of this proposal will have a significant impact on our accounting and financial reporting. The FASB has not yet proposed an effective date of this proposal.

We believe there isthat no additionalother new accounting guidance was adopted but not yet effectiveor issued during 2013 that is relevant to the readers of our financial statements. However, there are numerous new proposals under development which, if and when enacted, may have a significant impact on our financial reporting.

45

FedEx Express, FedEx Ground and FedEx Freight represent our major service lines and, along with FedEx Services, form the core of our reportable segments. Our reportable segments include the following businesses:

| FedEx Express Segment | ||

FedEx Express (express transportation) | ||

FedEx Trade Networks | ||

| (air and ocean freight forwarding and customs brokerage) FedEx SupplyChain Systems (logistics services) | ||

| FedEx Ground Segment | ||

FedEx Ground (small-package ground delivery) | ||

FedEx SmartPost (small-parcel consolidator) | ||

| FedEx Freight Segment | ||

FedEx Freight (LTL freight transportation) | ||

FedEx Custom Critical (time-critical transportation) | ||

| FedEx Services Segment | ||

FedEx Services (sales, marketing, | ||

FedEx TechConnect (customer service, technical support, billings and collections) | ||

FedEx Office (document and business services and package acceptance) | ||

The FedEx Services segment operates combined sales, marketing, administrative and information technology functions in shared services operations that support our transportation businesses and allow us to obtain synergies from the combination of these functions. For the international regions of FedEx Express, some of these functions are performed on a regional basis by FedEx Express and reported in the FedEx Express segment in their natural expense line items. The FedEx Services segment includes: FedEx Services, which provides sales, marketing, and information technology, communications and back-office support to our other companies; FedEx TechConnect, which is responsible for customer service, technical support, billings and collections for U.S. customers of our major business units; and FedEx Office, which provides an array of document and business services and retail access to our customers for our package transportation businesses. Effective September 1, 2009, FedEx SupplyChain Systems, formerly included in the FedEx Services reporting segment, was realigned to become part of the FedEx Express reporting segment. Prior year amounts have not been reclassified to conform to the current year segment presentation because these reclassifications are immaterial.

-51-

The FedEx Services segment provides direct and indirect support to our transportation businesses, and we allocate all of the net operating costs of the FedEx Services segment (including the net operating results of FedEx Office) to reflect the full cost of operating our transportation businesses in the results of those segments. Within the FedEx Services segment allocation, the net operating results of FedEx Office, which are an immaterial component of our allocations, are allocated to FedEx Express and FedEx Ground. The allocations of net operating costs are based on metrics such as relative revenues or estimated services provided. We believe these allocations approximate the net cost of providing these functions. We review and evaluate the performance of our transportation segments based on operating income (inclusive of FedEx Services segment allocations). For the FedEx Services segment, performance is evaluated based on the impact of its total allocated net operating costs on our transportation segments.

The operating expenses line item “Intercompany charges” on the accompanying unaudited financial summaries of our transportation segments reflects the allocations from the FedEx Services segment to the respective transportation segments. The “Intercompany charges” caption also includes charges and credits for administrative services provided between operating companies and certain other costs such as corporate management fees related to services received for general corporate oversight, including executive officers and certain legal and finance functions. We believe these allocations approximate the net cost of providing these functions.

46

Certain FedEx operating companies provide transportation and related services for other FedEx companies outside their reportable segment. Billings for such services are based on negotiated rates, which we believe approximate fair value, and are reflected as revenues of the billing segment. These rates are adjusted from time to time based on market conditions. Such intersegment revenues and expenses are eliminated in our consolidated results and are not separately identified in the following segment information, because the amounts are not material.

47

FedEx Express offers a wide range of U.S. domestic and international shipping services for delivery of packages and freight including priority services, which provide time-definite delivery within one, two or three business days worldwide, and deferred or economy services, which provide time-definite delivery within five business days worldwide. The following tables compare revenues, operating expenses, operating expenses as a percent of revenue, operating income and operating margin (dollars in millions) for the years ended May 31:

| Percent Change | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2011/2010 | 2010/2009 | ||||||||||||||||

| Revenues: | ||||||||||||||||||||

| Package: | ||||||||||||||||||||

| U.S. overnight box | $ | 6,128 | $ | 5,602 | $ | 6,074 | 9 | (8 | ) | |||||||||||

| U.S. overnight envelope | 1,736 | 1,640 | 1,855 | 6 | (12 | ) | ||||||||||||||

| U.S. deferred | 2,805 | 2,589 | 2,789 | 8 | (7 | ) | ||||||||||||||

| Total U.S. domestic package revenue | 10,669 | 9,831 | 10,718 | 9 | (8 | ) | ||||||||||||||

| International priority | 8,228 | 7,087 | 6,978 | 16 | 2 | |||||||||||||||

International domestic (1) | 653 | 578 | 565 | 13 | 2 | |||||||||||||||

| Total package revenue | 19,550 | 17,496 | 18,261 | 12 | (4 | ) | ||||||||||||||

| Freight: | ||||||||||||||||||||

| U.S. | 2,188 | 1,980 | 2,165 | 11 | (9 | ) | ||||||||||||||

| International priority | 1,722 | 1,303 | 1,104 | 32 | 18 | |||||||||||||||

| International airfreight | 283 | 251 | 369 | 13 | (32 | ) | ||||||||||||||

| Total freight revenue | 4,193 | 3,534 | 3,638 | 19 | (3 | ) | ||||||||||||||

Other (2) | 838 | 525 | 465 | 60 | 13 | |||||||||||||||

| Total revenues | 24,581 | 21,555 | 22,364 | 14 | (4 | ) | ||||||||||||||

| Operating expenses: | ||||||||||||||||||||

| Salaries and employee benefits | 9,183 | 8,402 | 8,217 | 9 | 2 | |||||||||||||||

| Purchased transportation | 1,573 | 1,177 | 1,112 | 34 | 6 | |||||||||||||||

| Rentals and landing fees | 1,672 | 1,577 | 1,613 | 6 | (2 | ) | ||||||||||||||

| Depreciation and amortization | 1,059 | 1,016 | 961 | 4 | 6 | |||||||||||||||

| Fuel | 3,553 | 2,651 | 3,281 | 34 | (19 | ) | ||||||||||||||

| Maintenance and repairs | 1,353 | 1,131 | 1,351 | 20 | (16 | ) | ||||||||||||||

| Impairment and other charges | — | — | 260 | (3) | — | NM | ||||||||||||||

| Intercompany charges | 2,043 | 1,940 | 2,103 | 5 | (8 | ) | ||||||||||||||

| Other | 2,917 | (4) | 2,534 | 2,672 | 15 | (5 | ) | |||||||||||||

| Total operating expenses | 23,353 | 20,428 | 21,570 | 14 | (5 | ) | ||||||||||||||

| Operating income | $ | 1,228 | $ | 1,127 | $ | 794 | 9 | 42 | ||||||||||||

| Operating margin | 5.0 | % | 5.2 | % | 3.6 | % | (20 | )bp | 160 | bp | ||||||||||

| Percent Change | ||||||||||||||||||||

| 2013 | 2012 | 2011 | 2013/2012 | 2012/2011 | ||||||||||||||||

Revenues: | ||||||||||||||||||||

Package: | ||||||||||||||||||||

U.S. overnight box | $ | 6,513 | $ | 6,546 | $ | 6,128 | (1 | ) | 7 | |||||||||||

U.S. overnight envelope | 1,705 | 1,747 | 1,736 | (2 | ) | 1 | ||||||||||||||

U.S. deferred | 3,020 | 3,001 | 2,805 | 1 | 7 | |||||||||||||||

|

|

|

|

|

| |||||||||||||||

Total U.S. domestic package revenue | 11,238 | 11,294 | 10,669 | — | 6 | |||||||||||||||

International priority | 6,586 | 6,849 | 6,760 | (4 | ) | 1 | ||||||||||||||

International economy | 2,046 | 1,859 | 1,468 | 10 | 27 | |||||||||||||||

|

|

|

|

|

| |||||||||||||||

Total international export package revenue | 8,632 | 8,708 | 8,228 | (1 | ) | 6 | ||||||||||||||

International domestic (1) | 1,398 | 853 | 653 | 64 | 31 | |||||||||||||||

|

|

|

|

|

| |||||||||||||||

Total package revenue | 21,268 | 20,855 | 19,550 | 2 | 7 | |||||||||||||||

Freight: | ||||||||||||||||||||

U.S. | 2,562 | 2,498 | 2,188 | 3 | 14 | |||||||||||||||

International priority | 1,678 | 1,827 | 1,722 | (8 | ) | 6 | ||||||||||||||

International airfreight | 276 | 307 | 283 | (10 | ) | 8 | ||||||||||||||

|

|

|

|

|

| |||||||||||||||

Total freight revenue | 4,516 | 4,632 | 4,193 | (3 | ) | 10 | ||||||||||||||

Other (2) | 1,387 | 1,028 | 838 | 35 | 23 | |||||||||||||||

|

|

|

|

|

| |||||||||||||||

Total revenues | 27,171 | 26,515 | 24,581 | 2 | 8 | |||||||||||||||

Operating expenses: | ||||||||||||||||||||

Salaries and employee benefits | 10,045 | 9,657 | 9,183 | 4 | 5 | |||||||||||||||

Purchased transportation | 2,331 | 1,828 | 1,573 | 28 | 16 | |||||||||||||||

Rentals and landing fees | 1,684 | 1,680 | 1,672 | — | — | |||||||||||||||

Depreciation and amortization | 1,350 | 1,169 | 1,059 | 15 | 10 | |||||||||||||||

Fuel | 4,130 | 4,304 | 3,553 | (4 | ) | 21 | ||||||||||||||

Maintenance and repairs | 1,244 | 1,332 | 1,353 | (7 | ) | (2 | ) | |||||||||||||

Business realignment, impairment and other charges (3) | 243 | 134 | — | NM | NM | |||||||||||||||

Intercompany charges (4) | 2,379 | 2,193 | 2,043 | 8 | 7 | |||||||||||||||

Other (5) | 3,210 | 2,958 | 2,917 | 9 | 1 | |||||||||||||||

|

|

|

|

|

| |||||||||||||||

Total operating expenses | 26,616 | 25,255 | 23,353 | 5 | 8 | |||||||||||||||

|

|

|

|

|

| |||||||||||||||

Operating income | $ | 555 | $ | 1,260 | $ | 1,228 | (56 | ) | 3 | |||||||||||

|

|

|

|

|

| |||||||||||||||

Operating margin (6) | 2.0 | % | 4.8 | % | 5.0 | % | (280 | )bp | (20 | )bp | ||||||||||

-53-

| Percent of Revenue | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

Operating expenses: | ||||||||||||

Salaries and employee benefits | 37.0 | % | 36.4 | % | 37.4 | % | ||||||

Purchased transportation | 8.6 | 6.9 | 6.4 | |||||||||

Rentals and landing fees | 6.2 | 6.3 | 6.8 | |||||||||

Depreciation and amortization | 5.0 | 4.4 | 4.3 | |||||||||

Fuel | 15.2 | 16.2 | 14.4 | |||||||||

Maintenance and repairs | 4.6 | 5.0 | 5.5 | |||||||||

Business realignment, impairment and other charges (3) | 0.9 | 0.5 | — | |||||||||

Intercompany charges (4) | 8.7 | 8.3 | 8.3 | |||||||||

Other (5) | 11.8 | 11.2 | 11.9 | |||||||||

|

|

|

|

|

| |||||||

Total operating expenses | 98.0 | 95.2 | 95.0 | |||||||||

|

| �� |

|

|

|

| ||||||

Operating margin (6) | 2.0 | % | 4.8 | % | 5.0 | % | ||||||

|

|

|

|

|

| |||||||

| (1) | International domestic revenues include our international intra-country |

| (2) | Includes FedEx Trade Networks and |

| (3) | 2013 includes $143 million of predominantly severance costs associated with |

| (4) | Includes allocations of $262 million in 2013 for business realignment costs. |

| (5) | Includes the 2012 reversal of a $66 million legal reserve |

| (6) | The direct and indirect charges described in notes (3) and (4) above reduced 2013 operating margin by 190 basis points. The charges and credit described in notes (3) and (5) above reduced 2012 operating margin by 20 basis points. |

48

-54-

| Percent of Revenue | ||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| Operating expenses: | ||||||||||||

| Salaries and employee benefits | 37.4 | % | 39.0 | % | 36.7 | % | ||||||

| Purchased transportation | 6.4 | 5.5 | 5.0 | |||||||||

| Rentals and landing fees | 6.8 | 7.3 | 7.2 | |||||||||

| Depreciation and amortization | 4.3 | 4.7 | 4.3 | |||||||||

| Fuel | 14.4 | 12.3 | 14.7 | |||||||||

| Maintenance and repairs | 5.5 | 5.2 | 6.0 | |||||||||

| Impairment and other charges | — | — | 1.2 | (1) | ||||||||

| Intercompany charges | 8.3 | 9.0 | 9.4 | |||||||||

| Other | 11.9 | (2) | 11.8 | 11.9 | ||||||||

| Total operating expenses | 95.0 | 94.8 | 96.4 | |||||||||

| Operating margin | 5.0 | % | 5.2 | % | 3.6 | % | ||||||

| Percent Change | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2011/2010 | 2010/2009 | ||||||||||||||||

Package Statistics(1) | ||||||||||||||||||||

| Average daily package volume (ADV): | ||||||||||||||||||||

| U.S. overnight box | 1,184 | 1,157 | 1,127 | 2 | 3 | |||||||||||||||

| U.S. overnight envelope | 627 | 614 | 627 | 2 | (2 | ) | ||||||||||||||

| U.S. deferred | 873 | 867 | 849 | 1 | 2 | |||||||||||||||

| Total U.S. domestic ADV | 2,684 | 2,638 | 2,603 | 2 | 1 | |||||||||||||||

| International priority | 575 | 523 | 475 | 10 | 10 | |||||||||||||||

International domestic(2) | 348 | 318 | 298 | 9 | 7 | |||||||||||||||

| Total ADV | 3,607 | 3,479 | 3,376 | 4 | 3 | |||||||||||||||

| Revenue per package (yield): | ||||||||||||||||||||

| U.S. overnight box | $ | 20.29 | $ | 19.00 | $ | 21.21 | 7 | (10 | ) | |||||||||||

| U.S. overnight envelope | 10.86 | 10.47 | 11.65 | 4 | (10 | ) | ||||||||||||||

| U.S. deferred | 12.60 | 11.70 | 12.94 | 8 | (10 | ) | ||||||||||||||

| U.S. domestic composite | 15.59 | 14.61 | 16.21 | 7 | (10 | ) | ||||||||||||||

| International priority | 56.08 | 53.10 | 57.81 | 6 | (8 | ) | ||||||||||||||

International domestic(2) | 7.38 | 7.14 | 7.50 | 3 | (5 | ) | ||||||||||||||

| Composite package yield | 21.25 | 19.72 | 21.30 | 8 | (7 | ) | ||||||||||||||

Freight Statistics(1) | ||||||||||||||||||||

| Average daily freight pounds: | ||||||||||||||||||||

| U.S. | 7,340 | 7,141 | 7,287 | 3 | (2 | ) | ||||||||||||||

| International priority | 3,184 | 2,544 | 1,959 | 25 | 30 | |||||||||||||||

| International airfreight | 1,235 | 1,222 | 1,475 | 1 | (17 | ) | ||||||||||||||

Total average daily freight pounds | 11,759 | 10,907 | 10,721 | 8 | 2 | |||||||||||||||

| �� | ||||||||||||||||||||

| Revenue per pound (yield): | ||||||||||||||||||||

| U.S. | $ | 1.17 | $ | 1.09 | $ | 1.17 | 7 | (7 | ) | |||||||||||

| International priority | 2.12 | 2.01 | 2.22 | 5 | (9 | ) | ||||||||||||||

| International airfreight | 0.90 | 0.81 | 0.99 | 11 | (18 | ) | ||||||||||||||

| Composite freight yield | 1.40 | 1.27 | 1.34 | 10 | (5 | ) | ||||||||||||||

| Percent Change | ||||||||||||||||||||

| 2013 | 2012 | 2011 | 2013/2012 | 2012/2011 | ||||||||||||||||

Package Statistics (1) | ||||||||||||||||||||

Average daily package volume (ADV): | ||||||||||||||||||||

U.S. overnight box | 1,134 | 1,146 | 1,184 | (1 | ) | (3 | ) | |||||||||||||

U.S. overnight envelope | 574 | 586 | 627 | (2 | ) | (7 | ) | |||||||||||||

U.S. deferred | 835 | 845 | 873 | (1 | ) | (3 | ) | |||||||||||||

|

|

|

|

|

| |||||||||||||||

Total U.S. domestic ADV | 2,543 | 2,577 | 2,684 | (1 | ) | (4 | ) | |||||||||||||

International priority | 421 | 421 | 459 | — | (8 | ) | ||||||||||||||

International economy | 155 | 138 | 116 | 12 | 19 | |||||||||||||||

|

|

|

|

|

| |||||||||||||||

Total international export ADV | 576 | 559 | 575 | 3 | (3 | ) | ||||||||||||||

International domestic (2) | 785 | 495 | 348 | 59 | 42 | |||||||||||||||

|

|

|

|

|

| |||||||||||||||

Total ADV | 3,904 | 3,631 | 3,607 | 8 | 1 | |||||||||||||||

|

|

|

|

|

| |||||||||||||||

Revenue per package (yield): | ||||||||||||||||||||

U.S. overnight box | $ | 22.52 | $ | 22.31 | $ | 20.29 | 1 | 10 | ||||||||||||

U.S. overnight envelope | 11.66 | 11.65 | 10.86 | — | 7 | |||||||||||||||

U.S. deferred | 14.18 | 13.87 | 12.60 | 2 | 10 | |||||||||||||||

U.S. domestic composite | 17.33 | 17.12 | 15.59 | 1 | 10 | |||||||||||||||

International priority | 61.28 | 63.47 | 57.68 | (3 | ) | 10 | ||||||||||||||

International economy | 51.77 | 52.77 | 49.76 | (2 | ) | 6 | ||||||||||||||

International export composite | 58.72 | 60.83 | 56.08 | (3 | ) | 8 | ||||||||||||||

International domestic (2) | 6.99 | 6.74 | 7.38 | 4 | (9 | ) | ||||||||||||||

Composite package yield | 21.36 | 22.44 | 21.25 | (5 | ) | 6 | ||||||||||||||

Freight Statistics (1) | ||||||||||||||||||||

Average daily freight pounds: | ||||||||||||||||||||

U.S. | 7,612 | 7,487 | 7,340 | 2 | 2 | |||||||||||||||

International priority | 3,048 | 3,303 | 3,184 | (8 | ) | 4 | ||||||||||||||

International airfreight | 1,066 | 1,171 | 1,235 | (9 | ) | (5 | ) | |||||||||||||

|

|

|

|

|

| |||||||||||||||

Total average daily freight pounds | 11,726 | 11,961 | 11,759 | (2 | ) | 2 | ||||||||||||||

|

|

|

|

|

| |||||||||||||||

Revenue per pound (yield): | ||||||||||||||||||||

U.S. | $ | 1.32 | $ | 1.30 | $ | 1.17 | 2 | 11 | ||||||||||||

International priority | 2.16 | 2.16 | 2.12 | — | 2 | |||||||||||||||

International airfreight | 1.01 | 1.02 | 0.90 | (1 | ) | 13 | ||||||||||||||

Composite freight yield | 1.51 | 1.51 | 1.40 | — | 8 | |||||||||||||||

| (1) | Package and freight statistics include only the operations of FedEx Express. |

| (2) | International domestic statistics include our international intra-country |

49

FedEx Express segment revenues increased 14%2% in 20112013 primarily due to the impact of new business acquisitions and growth in our freight-forwarding business at FedEx Trade Networks. Core revenue growth was constrained by global economic conditions as revenue growth from higher international export volume was offset by decreased yields due to shifts in demand from our priority international services to our economy international services, as well as lower rates. In 2013, international domestic revenues increased 64% due to recent acquisitions in Brazil, France and Poland. International export revenues were down in 2013 as revenue per package decreased 3% due to the demand shift to our lower-yielding economy services and lower rates, while volume increased 3% driven by higherour economy services. A decrease in U.S. domestic package volumes more than offset an increase in U.S. domestic package yield, resulting in slightly lower U.S. domestic package revenues in 2013. Total average daily freight pounds decreased 2% in 2013 due to weakness in economic global conditions.

-55-

FedEx Express segment revenues increased 8% in 2012 primarily due to an increase in U.S. domestic and international export package yields, partially offset by decreases in U.S. domestic and international export package volumes. In 2011, IP package volume increased 10% led by volume growth from Asia, Europe and the U.S. FedEx Express2012, U.S. domestic package yields increased 7%10% due to higher fuel surcharges rate increases and increased package weights. IPrate per pound. International export package yields increased 6%8% in 2012 due to higher fuel surcharges, increased package weights and favorable exchange rates. IP freight pounds increased 25% ledrate per pound. Continued softness in the global economy resulted in decreased demand for our U.S. domestic and international export package services in 2012. International export revenue growth was negatively impacted by volumea lower-yielding mix of services, consisting of growth in Europe.

Our fuel surcharges are indexed to the spot price for jet fuel. Using this index, the U.S. domestic and outbound fuel surcharge and the international fuel surcharges ranged as follows for the years ended May 31:

| 2011 | 2010 | 2009 | ||||||||||

| U.S. Domestic and Outbound Fuel Surcharge: | ||||||||||||

| Low | 7.00 | % | 1.00 | % | — | % | ||||||

| High | 15.50 | 8.50 | 34.50 | |||||||||

| Weighted-average | 9.77 | 6.20 | 17.45 | |||||||||

| International Fuel Surcharges: | ||||||||||||

| Low | 7.00 | 1.00 | — | |||||||||

| High | 21.00 | 13.50 | 34.50 | |||||||||

| Weighted-average | 12.36 | 9.47 | 16.75 | |||||||||

| 2013 | 2012 | 2011 | ||||||||||

U.S. Domestic and Outbound Fuel Surcharge: | ||||||||||||

Low | 10.00 | % | 11.50 | % | 7.00 | % | ||||||

High | 14.50 | 16.50 | 15.50 | |||||||||

Weighted-average | 11.84 | 14.23 | 9.77 | |||||||||

International Fuel Surcharges: | ||||||||||||

Low | 12.00 | 13.50 | 7.00 | |||||||||

High | 20.50 | 23.00 | 21.00 | |||||||||

Weighted-average | 17.02 | 17.45 | 12.36 | |||||||||

In both January 2011,2013 and 2012, we implemented a 5.9% average list price increase onfor FedEx Express U.S. domestic, U.S. export and U.S. outbound express package and freight shipments and made various changes to other surcharges,import services, while we lowered our fuel surcharge index by two percentage points. In January 2010, we implemented a 5.9% average list price increase on FedEx Express U.S. domestic and U.S. outbound express package and freight shipments and made various changes to other surcharges, while we lowered our fuel surcharge index by two percentage points.

FedEx Express Segment Operating Income

FedEx Express segment operating income increased in 2011 due to yieldresults were negatively impacted by $405 million of costs associated with our business realignment program, both directly and volume growth, particularly in our higher-margin IP package services, although operating margin was down slightly. Higher revenues in 2011through intercompany allocations. Additionally, results for 2013 were partially offset by higher retirement plans and medical expenses, increased aircraft maintenance costs, the reinstatement of certain employee compensation programs, and the negative impact of severe weather during the second half of the year. Results in 2011 were also negatively impacted by a $66$100 million impairment charge as a result of the decision to retire 10 aircraft and related engines from service. FedEx Express incurred $69 million in year-over-year incremental depreciation costs in 2013 due to the decision in 2012 to accelerate the retirement of certain aircraft. Operating income and operating margin also decreased in 2013 due to the demand shift toward lower-yielding international services. Operating comparisons were also impacted by an aircraft impairment charge in 2012 and a legal reserve associated with the ATA Airlines lawsuit (see Note 17 of the accompanying consolidated financial statements).

Purchased transportation costs increased 34%28% in 20112013 due to recent business acquisitions and costs associated with the expansion of our freight forwarding business at FedEx Trade NetworksNetworks. Salaries and IP packagebenefits increased 4% in 2013 due to recent acquisitions and freight volume growth.higher pension costs, partially offset by lower incentive compensation accruals. Other operating expenses increased 15%9% due to volume-related expensesthe impact of recent business acquisitions and the ATA Airlinesnegative year-over-year comparison of the legal reserve. Maintenancereserve accrual reversal in 2012. Depreciation and repairsamortization expense increased 20%15% in 2011 primarily due to an increase in aircraft maintenance expenses2013 as a result of timingaircraft recently placed into service and accelerated depreciation due to the shortened life of certain aircraft.

FedEx Express aircraft maintenance and repairs costs are largely driven by aircraft utilization and required periodic maintenance events. When newer aircraft are introduced into our operating fleet, less maintenance costs are incurred. As a part of our fleet modernization program, FedEx Express has retired older, less efficient aircraft prior to required periodic maintenance events and higher utilization of our fleet driven by increased volumes.

has introduced newly manufactured aircraft into the fleet. As a result, a decrease in maintenance and repairs costs was experienced in 2013 and 2012.

50

-56-

FedEx Express segment operating income and operating margin increased during 2010 due to volume growth, particularly3% in higher-margin IP package and freight services. Reductions in network operating costs driven by lower flight hours and improved route efficiencies, as well as other actions to control spending, positively impacted our results for 2010. Our 2010 year-over-year results were also positively impacted by a $260 million charge in 2009 for aircraft-related asset impairments and other charges primarily associated with aircraft-related lease and contract termination costs and employee severance.

Salaries and employee benefits increased 5% in 2012 due to higher incentive compensation accruals and the full reinstatement of 401(k) company-matching contributions effective January 1, 2011. Purchased transportation costs increased 6%16% in 2010 primarily2012 due to higher air transportation volume and costs inassociated with the expansion of our freight forwarding business at FedEx Trade Networks. Depreciation expenseNetworks, business acquisitions in India and Mexico and higher utilization of third-party transportation providers, primarily in Europe. Intercompany charges increased 6%7% in 2010 primarily2012 due to the addition of 21 aircraft placed into service during the year. Intercompany charges decreased 8%higher allocated variable incentive compensation expenses.

Fuel costs increased 21% in 2010 primarily2012 due to lower allocated information technology costs and lower net operating costs at FedEx Office.

FedEx Express Segment Outlook

We expect revenue growthrevenues and earnings to increase at FedEx Express during 2014 due to be driven by continuedslight growth in our international services aspackage and international economic conditions are expecteddomestic services. In addition, we expect operating income to improve at a faster rate than in the U.S. We also anticipate improvement in both domestic and international yields through ongoing yield management initiatives.

Capital expenditures at FedEx Express are expected to increase in 20122014 driven by replacement vehiclean increase in aircraft investment. We will continue to modernize our aircraft fleet at FedEx Express during 2014 by adding newer aircraft that are more reliable, fuel-efficient and equipment purchases. technologically advanced, and retiring older, less-efficient aircraft. Due to the accelerated retirement of certain aircraft and related engines to aid in modernizing our fleet and improving our global network, we expect an additional $74 million in year-over-year depreciation expense in 2014.

In 2012, capital expenditures will also include continued investmentsApril 2013, FedEx Express was selected as the sole awardee of the recent U.S. Postal Service air cargo solicitation, representing the majority of the United States Postal Service’s (“USPS”) air linehaul traffic. This new seven year agreement begins on October 1, 2013. The agreement provides reduced rates for the new B777FUSPS versus the prior FedEx Express agreement and B757 aircraft. These aircraft capital expenditures are necessary to achieve significant long-term operating savings and to support projected long-term international volume growth.

51

FedEx Ground service offerings include day-certain service delivery to businesses in the U.S. and Canada and to nearly 100% of U.S. residences. FedEx SmartPost consolidates high-volume, low-weight, less time-sensitive business-to-consumer packages and utilizes the USPS for final delivery. The following tables compare revenues, operating expenses, operating expenses as a percent of revenue, operating income and operating margin (dollars in millions) and selected package statistics (in thousands, except yield amounts) for the years ended May 31:

| Percent Change | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2011/2010 | 2010/2009 | ||||||||||||||||

| Revenues: | ||||||||||||||||||||

| FedEx Ground | $ | 7,855 | $ | 6,958 | $ | 6,670 | 13 | 4 | ||||||||||||

| FedEx SmartPost | 630 | 481 | 377 | 31 | 28 | |||||||||||||||

| Total revenues | 8,485 | 7,439 | 7,047 | 14 | 6 | |||||||||||||||

| Operating expenses: | ||||||||||||||||||||

| Salaries and employee benefits | 1,282 | 1,158 | 1,102 | 11 | 5 | |||||||||||||||

| Purchased transportation | 3,431 | 2,966 | 2,918 | 16 | 2 | |||||||||||||||

| Rentals | 263 | 244 | 222 | 8 | 10 | |||||||||||||||

| Depreciation and amortization | 337 | 334 | 337 | 1 | (1 | ) | ||||||||||||||

| Fuel | 12 | 8 | 9 | 50 | (11 | ) | ||||||||||||||

| Maintenance and repairs | 169 | 166 | 147 | 2 | 13 | |||||||||||||||

| Intercompany charges | 897 | 795 | 710 | 13 | 12 | |||||||||||||||

| Other | 769 | 744 | 795 | 3 | (6 | ) | ||||||||||||||

| Total operating expenses | 7,160 | 6,415 | 6,240 | 12 | 3 | |||||||||||||||

| Operating income | $ | 1,325 | $ | 1,024 | $ | 807 | 29 | 27 | ||||||||||||

| Operating margin | 15.6 | % | 13.8 | % | 11.5 | % | 180 | bp | 230 | bp | ||||||||||

| Average daily package volume: | ||||||||||||||||||||

| FedEx Ground | 3,746 | 3,523 | 3,404 | 6 | 3 | |||||||||||||||

| FedEx SmartPost | 1,432 | 1,222 | 827 | 17 | 48 | |||||||||||||||

| Revenue per package (yield): | ||||||||||||||||||||

| FedEx Ground | $ | 8.17 | $ | 7.73 | $ | 7.70 | 6 | — | ||||||||||||

| FedEx SmartPost | $ | 1.72 | $ | 1.56 | $ | 1.81 | 10 | (14 | ) | |||||||||||

| Percent of Revenue | ||||||||||||||||||||

| 2011 | 2010 | 2009 | ||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||

| Salaries and employee benefits | 15.1 | % | 15.5 | % | 15.6 | % | ||||||||||||||

| Purchased transportation | 40.4 | 39.9 | 41.4 | |||||||||||||||||

| Rentals | 3.1 | 3.3 | 3.1 | |||||||||||||||||

| Depreciation and amortization | 4.0 | 4.5 | 4.8 | |||||||||||||||||

| Fuel | 0.1 | 0.1 | 0.1 | |||||||||||||||||

| Maintenance and repairs | 2.0 | 2.2 | 2.1 | |||||||||||||||||

| Intercompany charges | 10.6 | 10.7 | 10.1 | |||||||||||||||||

| Other | 9.1 | 10.0 | 11.3 | |||||||||||||||||

| Total operating expenses | 84.4 | 86.2 | 88.5 | |||||||||||||||||

| Operating margin | 15.6 | % | 13.8 | % | 11.5 | % | ||||||||||||||

| Percent Change | ||||||||||||||||||||

| 2013 | 2012 | 2011 | 2013/2012 | 2012/2011 | ||||||||||||||||

Revenues: | ||||||||||||||||||||

FedEx Ground | $ | 9,652 | $ | 8,791 | $ | 7,855 | 10 | 12 | ||||||||||||

FedEx SmartPost | 926 | 782 | 630 | 18 | 24 | |||||||||||||||

|

|

|

|

|

| |||||||||||||||

Total revenues | 10,578 | 9,573 | 8,485 | 10 | 13 | |||||||||||||||

Operating expenses: | ||||||||||||||||||||

Salaries and employee benefits | 1,586 | 1,451 | 1,282 | 9 | 13 | |||||||||||||||

Purchased transportation | 4,191 | 3,762 | 3,431 | 11 | 10 | |||||||||||||||

Rentals | 331 | 284 | 263 | 17 | 8 | |||||||||||||||

Depreciation and amortization | 434 | 389 | 337 | 12 | 15 | |||||||||||||||

Fuel | 17 | 14 | 12 | 21 | 17 | |||||||||||||||

Maintenance and repairs | 190 | 176 | 169 | 8 | 4 | |||||||||||||||

Intercompany charges(1) | 1,148 | 978 | 897 | 17 | 9 | |||||||||||||||

Other | 893 | 755 | 769 | 18 | (2 | ) | ||||||||||||||

|

|

|

|

|

| |||||||||||||||

Total operating expenses | 8,790 | 7,809 | 7,160 | 13 | 9 | |||||||||||||||

|

|

|

|

|

| |||||||||||||||

Operating income | $ | 1,788 | $ | 1,764 | $ | 1,325 | 1 | 33 | ||||||||||||

|

|

|

|

|

| |||||||||||||||

Operating margin(1) | 16.9 | % | 18.4 | % | 15.6 | % | (150 | )bp | 280 | bp | ||||||||||

Average daily package volume: | ||||||||||||||||||||

FedEx Ground | 4,222 | 3,907 | 3,746 | 8 | 4 | |||||||||||||||

FedEx SmartPost | 2,058 | 1,692 | 1,432 | 22 | 18 | |||||||||||||||

Revenue per package (yield): | ||||||||||||||||||||

FedEx Ground | $ | 8.94 | $ | 8.77 | $ | 8.17 | 2 | 7 | ||||||||||||

FedEx SmartPost | $ | 1.77 | $ | 1.81 | $ | 1.72 | (2 | ) | 5 | |||||||||||

| Percent of Revenue | ||||||||||||||||||||

| 2013 | 2012 | 2011 | ||||||||||||||||||

Operating expenses: | ||||||||||||||||||||

Salaries and employee benefits | 15.0 | % | 15.2 | % | 15.1 | % | ||||||||||||||

Purchased transportation | 39.6 | 39.3 | 40.4 | |||||||||||||||||

Rentals | 3.1 | 3.0 | 3.1 | |||||||||||||||||

Depreciation and amortization | 4.1 | 4.1 | 4.0 | |||||||||||||||||

Fuel | 0.2 | 0.1 | 0.1 | |||||||||||||||||

Maintenance and repairs | 1.8 | 1.8 | 2.0 | |||||||||||||||||

Intercompany charges(1) | 10.9 | 10.2 | 10.6 | |||||||||||||||||

Other | 8.4 | 7.9 | 9.1 | |||||||||||||||||

|

|

|

|

|

| |||||||||||||||

Total operating expenses | 83.1 | 81.6 | 84.4 | |||||||||||||||||

|

|

|

|

|

| |||||||||||||||

Operating margin(1) | 16.9 | % | 18.4 | % | 15.6 | % | ||||||||||||||

|

|

|

|

|

| |||||||||||||||

| (1) | Includes allocations of $105 million in 2013 for business realignment costs which reduced operating margin by 100 basis points. |

52

FedEx Ground segment revenues increased 14%10% during 20112013 due to volume and yield increases at both FedEx Ground and FedEx SmartPost.

FedEx Ground average daily package volume increased 6%8% during 20112013 due to market share gains from continued growth in our commercial business and our FedEx Home Delivery service. The 6%service and increases in our commercial business. FedEx Ground yield improvementincreased 2% in 2013 primarily due to increased rates and higher residential surcharge revenue, partially offset by lower fuel surcharges and package weights.

FedEx SmartPost average daily volume grew 22% during 2013 primarily as a result of growth in e-commerce. Yields at FedEx SmartPost decreased 2% during 2013 primarily due to higher postage costs, partially offset by increased rates. FedEx SmartPost yield represents the amount charged to customers net of postage paid to the USPS.

During 2012, FedEx Ground segment revenues increased 13% due to yield and volume growth at both FedEx Ground and FedEx SmartPost.

FedEx Ground yields increased 7% during 2011 was2012 primarily due to rate increases, higher fuel surcharges and higher extra service revenue, particularlyrevenue. Average daily package volume increased 4% at FedEx Ground in residential surcharges.

At FedEx SmartPost, averageyields increased 5% in 2012 primarily due to higher fuel surcharges and increased rates, partially offset by an unfavorable service mix. Average daily volume grew 17% during 2011 primarilyincreased 18% at FedEx SmartPost in 2012 as a result of growth in e-commerce business, gains in market share and the introduction of new service offerings. Yields increased 10% during 2011 primarily due to growth in higher yielding services, improved fuel surcharges and lower postage costs as a result of increased deliveries to United States Postal Service (“USPS”) final destination facilities.

The FedEx Ground fuel surcharge is based on a rounded average of the national U.S. on-highway average price for a gallon of diesel fuel, as published by the Department of Energy. Our fuel surcharge ranged as follows for the years ended May 31:

| 2011 | 2010 | 2009 | ||||||||||

| Low | 5.50 | % | 2.75 | % | 2.25 | % | ||||||

| High | 8.50 | 5.50 | 10.50 | |||||||||

| Weighted-average | 6.20 | 4.23 | 6.61 | |||||||||

| 2013 | 2012 | 2011 | ||||||||||

Low | 6.50 | % | 7.50 | % | 5.50 | % | ||||||

High | 8.50 | 9.50 | 8.50 | |||||||||

Weighted-average | 7.60 | 8.46 | 6.20 | |||||||||

In January 2011, we implemented a 4.9% list price increase for2013 and 2012, FedEx Ground and FedEx Home Delivery services.implemented a 4.9% average list price increase. The full average rate increase of 5.9% was partially offset by adjusting the fuel price threshold at which the fuel surcharge begins, reducing the fuel surcharge by one percentage point. Additional changes were made to other FedEx Ground surcharges and FedEx SmartPost rates. In January 2010, we implemented a 4.9% average list price increase and made various changes to other surcharges, including modifying the fuel surcharge table, on FedEx Ground shipments.

FedEx Ground Segment Operating Income

FedEx Ground segment operating income increased 29% and operating margin increased 180 basis points due to improved yield and higher volume resulting from market share growth. We have realized a higher retention of our annual rate increase this year as more customers recognize the competitive advantage that we maintain across many shipping lanes in the U.S. We have also improved our customers’ experience by dramatically reducing our package loss and damage claims while maintaining exceptional service levels. Purchased transportation costs increased 16% in 20111% during 2013 primarily due to volume growth and higher fuelyields. However, operating margin decreased as the benefit of higher volume and revenue per package was more than offset by intercompany charges of $105 million associated with the business realignment program and a favorable self-insurance true-up in the prior year. Purchased transportation costs increased 11% in 2013 primarily as a result of volume growth and higher rates paid to our independent contractors. Other operating expenses increased 18% primarily due to a favorable self-insurance true-up in the prior year and higher legal expenses in the current year. Salaries and employee benefits expense increased 11%9% in 20112013 primarily due primarily to increased staffing at to support volume growth.

-59-

FedEx Ground segment operating income increased 33% and operating margin increased 280 basis points during 2012 primarily due to higher yields and volume growth. FedEx SmartPostGround has continued to shorten transit times throughout 2012 by accelerating various lanes throughout the U.S. and Canada, while maintaining consistently high on-time service. Purchased transportation costs increased 10% in 2012 primarily as a result of volume growth and higher fuel surcharges. Salaries and employee benefits increased 13% primarily due to increased staffing to support volume growth and higher pension and medical costs.incentive compensation accruals. Intercompany charges increased 9% in 20112012 primarily due to higher allocated information technology costs.

53