UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 20022004

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period Fromto

Commission File Number 001-13533

NOVASTAR FINANCIAL, INC.

(Exact nameName of registrantRegistrant as specifiedSpecified in its charter)Charter)

| Maryland | 74-2830661 | |

(State or

| (I.R.S. Employer Identification No.) | |

8140 Ward Parkway, Suite 300, Kansas City, MO | 64114 | |

(Address of | (Zip Code) | |

Registrant’s telephone number, including area code:Telephone Number, Including Area Code: (816) 237-7000

Securities registered pursuantRegistered Pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, $0.01 par value | New York Stock Exchange |

Securities registered pursuantRegistered Pursuant to Section 12(g) of the Act:

None

None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is an accelerated filer (as defined in Exchange Act Rule 12b-2). Yes x No ¨

The aggregate market value of voting stock held by non-affiliates of the registrant as of March 12, 2003June 30, 2004 was approximately $351,842,695$948,751,931 as reported by the New York Stock Exchange Composite Transactions on such date.

The number of shares of the Registrant’s Common Stock outstanding on March 12, 200311, 2005 was 10,502,767.27,860,629.

Documents incorporatedIncorporated by referenceReference

Items 10, 11, 12, 13 and 1314 of Part III are incorporated by reference to the NovaStar Financial, Inc. definitive proxy statement to shareholders, which will be filed with the Commission no later than 120 days after December 31, 2002.2004.

FORM 10-K

For the Fiscal Year Ended December 31, 20022004

TABLE OF CONTENTS

Item 1. | 2 | |||

Item 2. | 13 | |||

Item 3. |

| |||

Item 4. |

| |||

Item 5. |

| |||

Item 6. |

| |||

Item 7. | 18 | |||

Item 7A. |

| 46 | ||

Item 8. |

| |||

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 85 | ||

Item 9A. |

| 85 | ||

Item 9B. | Other Information | 87 | ||

Item 10. |

| |||

Item 11. |

| |||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

| ||

Item 13. |

| |||

Item 14. |

| |||

| ||||

Item 15. | Exhibits and Financial |

| ||

Overview

We are a Maryland corporation formed on September 13, 1996 as an investora specialty finance company that originates, purchases, invests in mortgage assets, with a focus on non-conforming mortgageand services residential nonconforming loans. We also originate single-family non-conforming loansoperate through three separate but inter-related units—mortgage lending and loan servicing, mortgage portfolio management and branch operations. We offer a wide range of mortgage loan products to borrowers, commonly referred to as “nonconforming borrowers,” who generally do not satisfy the credit, collateral, documentation or other underwriting standards prescribed by conventional mortgage lenders and loan buyers, including United States of America government-sponsored entities such as Fannie Mae or Freddie Mac. We retain significant interests in the namenonconforming loans we originate and purchase through our mortgage securities investment portfolio. Through our servicing platform, we then service all of NovaStar Mortgage, Inc. (NovaStar Mortgage) andthe loans we retain interests in, in order to better manage retail brokers operatingthe credit performance of those loans.

We have elected to be taxed as a real estate investment trust, or REIT, under the name NovaStar Home Mortgage, Inc. (NovaStar Home)Internal Revenue Code of 1986, as amended (Code). NovaStar Mortgage and NovaStar Home are our subsidiaries.

Management believes the tax-advantaged structure of a real estate investment trust (REIT)REIT maximizes the after-tax returns from mortgage assets. We must meet numerous rules established by the Internal Revenue Service (IRS) to retain our status as a REIT. In summary, they require us to:

As long as we maintain our REIT status, distributions to stockholders will generally be deductible by us for income tax purposes. This deduction effectively eliminates corporateREIT level income taxes. Management believes it has and will continue to meet the requirements to maintain our REIT status.

Mortgage Portfolio Management

Earnings from our portfolio of mortgage loans and securities generate a substantial portion of our earnings. Gross interest income was $224.0 million, $170.4 million and $107.1 million in the three years ended December 31, 2004, 2003 and 2002, respectively. Net interest income before credit losses/recoveries from the portfolio was $171.4 million, $130.1 million and $79.4 million in the three years ended December 31, 2004, 2003 and 2002, respectively. See our discussion of interest income under the heading “Results of Operations” and “Net Interest Income”. See Note 15 to our consolidated financial statements for a summary of operating results and total assets for mortgage portfolio management.

A significant risk to our operations, relating to our portfolio management, is the risk that interest rates on our assets will not adjust at the same times or amounts that rates on our liabilities adjust. Many of the loans in our portfolio have fixed rates of interest for a period of time ranging from 2 to 30 years. Our funding costs are generally not constant or fixed. We use derivative instruments to mitigate the risk of our cost of funding increasing or decreasing at a faster rate than the interest on the loans (both those on the balance sheet and those that serve as collateral for mortgage securities – available-for-sale).

In Reviewcertain circumstances, because we enter into interest rate agreements that do not meet the hedging criteria set forth in accounting principles generally accepted in the United States of America, we are required to record the change in the value of derivatives as a component of earnings even though they may reduce our interest rate risk. In times where short-term rates rise or drop significantly, the value of our agreements will increase or decrease, respectively. As a result, we recognized losses on these derivatives of $8.9 million, $30.8 million and $36.8 million in 2004, 2003 and 2002, respectively.

Mortgage Lending and Loan Servicing

The mortgage lending operation is significant to our financial results as it produces the loans that ultimately collateralize the mortgage securities – available-for-sale that we hold in our portfolio. During 2002,2004, we originated $2.8and purchased $8.4 billion in nonconforming mortgage loans, compared to $1.3 billionthe majority of which were retained in 2001. Non-conformingour servicing portfolio and serve as collateral for our securities. The loans we originate and purchase are primarily sold, througheither in securitization transactions completed by NovaStar Mortgage. Includedor in netoutright sales to third parties. We recognized gains on sales of mortgage assets fortotaling $145.0 million, $144.0 million and $53.3 million during the yearthree years ended December 31, 2004, 2003 and 2002, are $47.9 million in gains recognized inrespectively. In securitization transactions securitizingaccounted for as sales, we retain interest-only, prepayment penalty, overcollateralization and other subordinated securities, along with the right to service the loans. See Note 15 to our consolidated financial statements for a summary of operating results and total of $1.6 billion in loans. In addition, we sold $346.1 million in loans, including conforming loans, to unrelated third partiesassets for cash, recognizing gains of $6.2 million.mortgage lending and loan servicing.

Our wholly-owned subsidiary, NovaStar Mortgage, retains the servicing rights to loans securitized. During 2002 the loan-servicing portfolio increased from $2.0 billion to $3.7 billion.

During 2002, we increased our branches from 123 in 32 states to 216 in 35 states. While the branch is free to broker loans for any approved investor, many of the loans produced by our branches are funded by NovaStar Mortgage. This arrangement serves to reduce our overall cost of lendingInc., originates and provides for enhanced fee income.

We have obtained committed financing facilities to fund our mortgage loan operations. As of December 31, 2002, combined lending arrangements under these agreements totaled $1.4 billion. Cash and availability under these committed facilities was $80.1 million.

During the year ended December 31, 2002, we recorded net income of $48.8 million, $4.50 per diluted share. Our operating results are discussed further under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this annual report.

Lending Operations

Following is a diagram of thepurchases primarily nonconforming, industry in which we operate and our loan production during 2002 (in thousands). Following the diagram is further description of our business.

(A) The portion of loans that NovaStar has not securitized as of December 31, 2002 is included in our mortgage loans held-for-sale.

Mortgage Lending

We originate conforming and non-conformingsingle-family residential mortgage loans. We simultaneously enter a commitment agreement to sell our conforming loans at the time the loan is originated. Conforming loans are sold to independent mortgage lenders or to government agencies.

In our non-conformingnonconforming lending operations, we lend to individuals who generally do not qualify for agency/conventional lending programs because of a lack of available documentation or previous credit difficulties, butdifficulties. These types of borrowers are generally have substantial equity in their homes. Often,willing to pay higher mortgage loan origination fees and interest rates than those charged by conventional lending sources. Because these are individuals or families who have built high-rate consumer debt and are attempting toborrowers typically use the equity in their homeproceeds of the mortgage loans to consolidate debt and lower their total monthly payments.to finance home improvements, education and other consumer needs, loan volume is generally less dependent on general levels of interest rates or home sales and therefore less cyclical than conventional mortgage lending.

Our nationwide loan origination network includes wholesale loan brokers, correspondent institutions and direct to consumer operations. We have developed a nationwide network of wholesale loan brokers and mortgage lenders who submit mortgage loans to us. Except for NovaStar Home Mortgage brokers described below, these brokers and mortgage lenders are independent from any of the NovaStar entities. Our sales force, which includes 249 account executives in 39 states, develops and maintains relationships with athis network of independent retail brokers. In 1997Our correspondent origination channel consists of a network of institutions from which we purchase nonconforming mortgage loans on a bulk or flow basis. Our direct to consumer origination channel consists of call centers, which use telemarketing and in much of 1998, we retained ourinternet loan lead sources to originate mortgage loans. Since 1998, we have operated as a seller of whole loans to independent third parties. Two primary avenues were used for selling mortgage loans: 1) directly to independent, third parties for cash and 2) through securitization transactions that are treated for tax and accounting purposes as loan sales.

We underwrite, process, fund and service the non-conformingnonconforming mortgage loans sourced through our broker network.network in centralized facilities. Further details regarding the loan originations are discussed under the “Mortgage Originations”Loans” section of “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

A significant risk to our mortgage lending operations is liquidity risk – the risk that we will not have financing facilities and cash available to fund and hold loans prior to their sale or securitization. We maintain committed lending facilities with large banking and investment institutions to reduce this risk. On a short-term basis, we finance mortgage loans using warehouse lines of credit and repurchase agreements. In addition, we have access to facilities secured by our mortgage securities.securities – available-for-sale. Details regarding available financing arrangements and amounts outstanding under those arrangements are included in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 57 to the consolidated financial statements.

For long-term financing,funding, we fundpool our mortgage loans usingand issue asset-backed bonds (ABB). Primary bonds—bonds – AAA through BBB rated—rated – are issued to the public. We retain the interest only bonds andinterest-only, prepayment penalty, bonds, which are AAA rated.overcollateralization and other subordinated bonds. We also retain the right to service the mortgage loans and retain non-rated, subordinated interests.loans. Prior to 1999, our ABB transactions were executed and designed to meet accounting rules that resulted in securitizations being treated as financing transactions. The mortgage loans and related debt continue to be presented on our consolidated balance sheets, and no gain iswas recorded. Beginning in 1999, our securitization transactions have been structured to qualify as sales for accounting and income tax purposes. The loans and related bond liability are not recorded in our consolidated financial statements. We do, however, record the value of the securities and servicing rights we retain. Details regarding ABBs we issued can be found in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in Notes 3 and 5Note 7 to our consolidated financial statements.

Loan Servicing

Loan servicing remains a critical part of our business operation. In the opinion of management, maintaining contact with our borrowers is critical in managing credit risk and in borrower retention. Non-conformingNonconforming borrowers are more prone to late payments and are more likely to default on their obligations than conventional borrowers. By servicing our loans, we strive to identify problems with borrowers early and take quick action to address problems. Borrowers may be motivated to refinance their mortgage loans either by improving their personal credit or due to a decrease in interest rates. By keeping in close touch with borrowers, we can provide them with information about company products to enticeencourage them to refinance with us. Mortgage servicing yields fee income for us in the form of fees paid by the borrowers for normal customer service and processing fees. In addition we receive contractual fees approximating 0.50% of the outstanding balance and rights to future cash flows arising after the investors in the securitization trusts have received the return for which they contracted. We recognized $41.5 million, $21.1 million and $10.0 million in loan servicing fee income from the securitization trusts during the three years ended December 31, 2004, 2003 and 2002, respectively. See also “Mortgage Loan Servicing” under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for further discussion and analysis of the servicing operations.

Loan Brokering by BranchesBranch Operations

In 1999, we opened our retail mortgage broker business operating under the name NovaStar Home Mortgage.Mortgage, Inc. (“NHMI”). Prior to 2004, many of these NHMI branches were supported by LLC’s operating under LLC agreements where we owned a minority interest in the LLC and the branch manager was the majority interest holder. In December 2003, we decided to terminate the LLC’s effective January 1, 2004. As of January 1, 2004, continuing branches that formerly operated under LLC agreements became operating units of NHMI and their financial results are included in the consolidated financial statements. See Note 14 to our consolidated financial statements for further discussion. Branch offices offer conforming and non-conformingnonconforming loans to potential borrowers. Loans are brokered for approved investors, including NovaStar Mortgage. The NHMI branches must adhere to a strict setare considered departmental functions of established policies regarding their operations. Net incomeNHMI under which the branch manager (department head) is an employee of NHMI and receives compensation based on the profitability of the branch is returned(department) as bonus compensation. See Note 15 to our consolidated financial statements for a summary of operating results and total assets for our branches.

We routinely close branches and branch managers voluntarily terminate their employment with us, which generally results in the branch’s closure. As the demand for conforming loans declined significantly during 2004, many branches were not able to produce sufficient fees to meet operating expense demands. As a result of these conditions, a significant number of branch managers voluntarily terminated employment with us. We have also terminated many branches when loan production results were substandard. In these terminations, the branch “owner/manager.” Administrative functions, including accounting, payroll and human resources, investor relationsall operations are eliminated. Note 14 to our consolidated financial statements provides detail regarding the impact of the discontinued operations and licensing, are conducted bymodifications to our central corporate office staff. As of December 31, 2002 we have 216 active branches in 35 states.branch program.

The branch business provides an additional source for mortgage loan originations that, in most cases, we will eventually sell, either in securitizations or in outright sales to third parties. During 2004 and 2003, our branches brokered $3.7 billion and $6.4 billion, respectively, in nonconforming loans, of which we funded $1.7 billion and $1.2 billion, respectively.

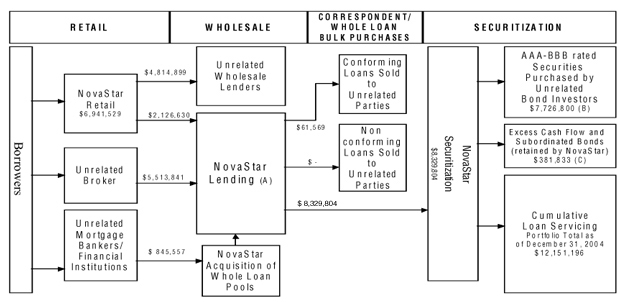

Following is a diagram of the industry in which we operate and our loan production including nonconforming and conforming during 2004 (in thousands).

| (A) | A portion of the loans securitized or sold to unrelated parties as of December 31, 2004 were originated prior to 2004, but due to timing were not yet securitized or sold at the end of 2003. Loans originated and purchased in 2004 that we have not securitized or sold to unrelated parties as of December 31, 2004 are included in our mortgage loans held-for-sale |

| (B) | The AAA-BBB rated securities related to NMFT Series 2004-1, 2004-2, 2004-3 and 2004-4 were purchased by bond investors during 2004. |

| (C) | The excess cash flow and subordinated bonds retained by NovaStar includes the securitization transactions that occurred during 2004 for NMFT Series 2003-4, 2004-1, 2004-2, 2004-3 and 2004-4. |

Market in Which NovaStar Operates and Competes

We face intense competition in the business of originating, purchasing, selling and securitizing mortgage loans. The number of market participants is believed to be well in excess of 100 companies who originate non-conforming loans and hundreds of companies originating conformingpurchase nonconforming loans. No single participant holds a dominant share of the lending market. In addition to other residential mortgage REITs, weWe compete for borrowers with consumer finance companies, conventional mortgage bankers, commercial banks, credit unions, thrift institutions and thrift institutions.other independent wholesale mortgage lenders. Our principal competition in the business of holding mortgage loans and mortgage securities – available-for-sale are life insurance companies, institutional investors such as mutual funds and pension funds, other well-capitalized publicly-owned mortgage lenders and certain other mortgage acquisition companies structured as REITs. Many of these competitors are substantially larger than we are and have considerably greater financial resources than we do.

Competition among industry participants can take many forms, including convenience in obtaining a loan, amount and term of the loan, customer service, marketing/distribution channels, loan origination fees and interest rates. To the extent any competitor significantly expands their activities in the non-conformingnonconforming and subprime market, we could be materially adversely affected.

One of our key competitive strengths is our employees and the level of service they are able to provide our borrowers. We service our non-conformingnonconforming loans and, in doing so, we are able to stay in close contact with our borrowers and identify potential problems early. During 2002, the branches brokered $2.6 billion in residential mortgage loans. While the branches are free to broker loans for any approved investor, frequently NovaStar Mortgage is the lender for the branch loans. This integrated relationship adds another competitive advantage for us.

In addition, regulated mortgage lenders, such as savings and loans and banks, are subject to regulatory review and must pay for the costs incurred by the regulator in their examinations. We incur no such regulation fees or costs and are, therefore, competitively advantaged.

We are also competitively successfulbelieve we compete successfully due to our:

Risk Management

Management recognizes the following primary risks associated with the business and industry in which it operates.

Credit Risk

Credit risk is the risk that we will not fully collect the principal we have invested in mortgage loans or securities. Non-conforming mortgage loans comprise substantially our entire mortgage loan portfolio and serve as collateral for our mortgage securities. Our non-conforming borrowers include individuals who do not qualify for agency/conventional lending programs because of a lack of available documentation or previous credit difficulties, but have considerable equity in their homes. Often, they are individuals or families who have built up high-rate consumer debt and are attempting to use the equity in their home to consolidate debt and reduce the amount of money it takes to service their monthly debt obligations. Our underwriting guidelines are intended to evaluate the credit history of the potential borrower, the capacity and willingness of the borrower to repay the loan, and the adequacy of the collateral securing the loan.

Underwriting staff work under the supervision of our Chief Credit Officer. Underwriters are given approval authority only after their work has been reviewed for a period of at least two weeks. Thereafter, the Chief Credit Officer re-evaluates the authority levels of all underwriting personnel on an ongoing basis. All loans in excess of $350,000 currently require the approval of an underwriting supervisor. Our Chief Credit Officer or our President must approve loans in excess of $500,000.

The underwriting guidelines take into consideration the number of times the potential borrower has recently been late on a mortgage payment and whether that payment was 30, 60 or 90 days past due. Delinquency on consumer/revolving debt is also considered. Discharged bankruptcy filings are allowed under all credit ratings, however, to obtain an “A” or “B” grade, the borrower must have at least a one-year seasoning on a discharged Chapter 13 filing and two years for a Chapter 7 filing. The credit grade that is assigned to the borrower is a reflection of the borrower’s historical credit and the loan-to-value determined by the amount of documentation the borrower could produce to support income. Maximum loan-to-value ratios for each credit grade depend on the level of income documentation provided by the potential borrower. In some instances, when the borrower exhibits strong compensating factors, exceptions to the underwriting guidelines may be approved.

Key to our successful underwriting process is the use of NovaStarIS®. NovaStarIS® is the second generation of our proprietary automated underwriting system. IS provides more consistency in underwriting loans and allows underwriting personnel to focus more of their time on loans that are not initially accepted by the IS system.

Table 1 of “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sets forth our mortgage loan portfolio by credit grade, all of which are non-conforming.

A tool for managing credit risk is to diversify the markets in which we originate and own mortgage loans. Presented in Table 2 of “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of this annual report is a breakdown of the geographic diversification our loans. Detail regarding loan delinquencies and loans charged off are disclosed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” Table 3 and Note 2 to the “Financial Statements and Supplementary Data”.

We have purchased mortgage insurance on many of the loans that are held in our portfolio—on the balance sheet and those that serve as collateral for our mortgage securities. Our mortgage insurance provides for coverage to a loan-to-value of 50-55%, which serves to substantially limit our exposure to credit risk. The use of mortgage insurance is discussed under “Premiums for Mortgage Loan Insurance” in “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

Prepayment Risk

The majority of our securities are “interest-only” in nature. These securities represent the net cash flow—interest income—on the underlying loans in excess of the cost to finance the loans. When borrowers repay the principal on their mortgage loans early, the effect is to shorten the period over which interest is earned, and therefore, reduce the cash flow and yield on our securities.

We mitigate prepayment risk by originating loans that are originated with a penalty if the borrower repays the loan in the early months of the loan’s life. For the majority of our loans, a prepayment penalty is charged equal

to 80% of six months interest on the principal balance that is to be paid in full. Table 5 of “Management’s Discussion and Analysis of Financial Condition and Results of Operations” is a summary of the loans originated by NovaStar Mortgage demonstrating the nature of prepayment penalties. As of December 31, 2002, 73% of our loans had a prepayment penalty. Of the loans that serve as collateral for our mortgage securities, 82% had prepayment penalties as of December 31, 2002. During 2002, 76% of the loans we originated had prepayment penalties. Table 5 of “Management’s Discussion and Analysis of Financial Condition and Results of Operations” details prepayment speeds.

Liquidity/Funding Risk

See the “Liquidity and Capital Resources” section of “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for a discussion of liquidity risks and resources available to us.

Interest Rate/Market Risk

Our investment policy sets the following general goals:

(1) Maintain the net interest margin between assets and liabilities, and

(2) Diminish the effect of changes in interest rate levels on our market value

Loan Price Volatility. Under our current mode of operation, we depend heavily on the market for wholesale non-conforming mortgage loans. To conserve capital, we may sell loans we originate. Financial results will depend, in part, on the ability to find purchasers for the loans at prices that cover origination expenses. Exposure to loan price volatility is reduced as we acquire and retain mortgage loans.

Interest Rate Risk. When interest rates on our assets do not adjust at the same rates as our liabilities or when the assets have fixed rates and the liabilities are adjusting, future earnings potential is affected. We express this interest rate risk as the risk that the market value of assets will increase or decrease at different rates than that of the liabilities. Expressed another way, this is the risk that net asset value will experience an adverse change when interest rates change. We assess the risk based on the change in market values given increases and decreases in interest rates. We also assess the risk based on the impact to net income in changing interest rate environments.

Management primarily uses financing sources where the interest rate resets frequently. As of December 31, 2002,2004, borrowings under all financing arrangements adjust daily or monthly. On the other hand, very few of the mortgage assets we own adjust on a monthly or daily basis. Most of the mortgage loans contain features where their rates are fixed for some period of time and then adjust frequently thereafter. For example, one of our loan products is the “2/28” loan. This loan is fixed for its first two years and then adjusts every six months thereafter.

While short-term borrowing rates are low and long-term asset rates are high, this portfolio structure produces good results. However, if short-term interest rates rise rapidly, earning potential is significantly affected and impairments may be incurred, as the asset rate resets would lag the borrowing rate resets.

Interest Rate Sensitivity Analysis.To assess interest sensitivity as an indication of exposure to interest rate risk, management relies on models of financial information in a variety of interest rate scenarios. Using these models, the fair value and interest rate sensitivity of each financial instrument, or groups of similar instruments is estimated, and then aggregated to form a comprehensive picture of the risk characteristics of the balance sheet. The risks are analyzed on both an income anda market value basis.

The following are summariestable summarizes management’s estimates of the analysis.changes in market value our same mortgage assets and interest rate agreements assuming interest rates were 100 and 200 basis points, or 1 and 2 percent higher and lower. The cumulative change in market value represents the change in market value of mortgage assets, net of the change in market value of interest rate agreements. The change in market value, due to a change in interest rates, of the liabilities on our balance sheet which finance our mortgage assets is insignificant.

Interest Rate Sensitivity-IncomeSensitivity - Market Value

(dollars in thousands)

Basis Point Increase (Decrease) in Interest Rate (A) | ||||||||||||||||||

(200) (C) | (100) | Base | 100 | 200 | ||||||||||||||

As of December 31, 2002: | ||||||||||||||||||

Interest margin | N/A | $ | 168,379 |

| $ | 150,150 |

| $ | 130,828 |

| $ | 109,984 |

| |||||

Expense from interest rate agreements | N/A |

| (42,284 | ) |

| (32,949 | ) |

| (20,573 | ) |

| (6,060 | ) | |||||

Net interest income | N/A | $ | 126,095 |

| $ | 117,201 |

| $ | 110,255 |

| $ | 103,924 |

| |||||

Percent change in net interest income from base | N/A |

| 7.6 | % |

| — |

|

| (5.9 | )% |

| (11.3 | )% | |||||

Percent change of capital (B) | N/A |

| 4.9 | % |

| — |

|

| (3.8 | )% |

| (7.2 | )% | |||||

As of December 31, 2001: | ||||||||||||||||||

Interest margin | N/A | $ | 97,837 |

| $ | 83,300 |

| $ | 67,797 |

| $ | 55,007 |

| |||||

Expense from interest rate agreements | N/A |

| (21,647 | ) |

| (14,636 | ) |

| (7,624 | ) |

| (612 | ) | |||||

Net interest income | N/A | $ | 76,190 |

| $ | 68,664 |

| $ | 60,173 |

| $ | 54,395 |

| |||||

Percent change in net interest income from base | N/A |

| 11.0 | % |

| — |

|

| (12.4 | )% |

| (20.8 | )% | |||||

Percent change of capital (B) | N/A |

| 5.8 | % |

| — |

|

| (6.5 | )% |

| (11.0 | )% | |||||

| Basis Point Increase (Decrease) in Interest Rate (A) | |||||||||||||||

| (200) (C) | (100) | 100 | 200 | ||||||||||||

As of December 31, 2004: | |||||||||||||||

Change in market values of: | |||||||||||||||

Assets | 70,438 | $ | 33,198 | $ | (34,045 | ) | $ | (72,840 | ) | ||||||

Interest rate agreements | (54,085 | ) | (28,046 | ) | 27,832 | 55,113 | |||||||||

Cumulative change in market value | 16,353 | $ | 5,152 | $ | (6,213 | ) | $ | (17,727 | ) | ||||||

Percent change of market value portfolio equity (B) | 3.3 | % | 1.0 | % | (1.3 | )% | (3.6 | )% | |||||||

As of December 31, 2003: | |||||||||||||||

Change in market values of: | |||||||||||||||

Assets | N/A | $ | 34,499 | $ | (65,216 | ) | $ | (144,343 | ) | ||||||

Interest rate agreements | N/A | (31,250 | ) | 34,073 | 69,497 | ||||||||||

Cumulative change in market value | N/A | $ | 3,249 | $ | (31,143 | ) | $ | (74,846 | ) | ||||||

Percent change of market value portfolio equity (B) | N/A | 1.0 | % | (9.1 | )% | (21.9 | )% | ||||||||

| (A) |

Interest Rate Sensitivity—Market Value

(dollars in thousands)

Basis Point Increase (Decrease) in Interest Rate (A) | ||||||||||||||

(200) (C) | (100) | 100 | 200 | |||||||||||

As of December 31, 2002: | ||||||||||||||

Change in market values of: | ||||||||||||||

Assets | N/A | $ | 16,449 |

| $ | (49,343 | ) | $ | (119,232 | ) | ||||

Liabilities | N/A |

| (2,311 | ) |

| 2,451 |

|

| 4,969 |

| ||||

Interest rate agreements | N/A |

| (36,249 | ) |

| 37,930 |

|

| 76,873 |

| ||||

Cumulative change in market value | N/A | $ | (22,111 | ) | $ | (8,962 | ) | $ | (37,390 | ) | ||||

Percent change of market value portfolio equity (B) | N/A |

| 10.9 | % |

| (4.4 | )% |

| (18.4 | )% | ||||

As of December 31, 2001: | ||||||||||||||

Change in market values of: | ||||||||||||||

Assets | N/A | $ | 13,158 |

| $ | (28,771 | ) | $ | (67,162 | ) | ||||

Liabilities | N/A |

| (2,245 | ) |

| 2,382 |

|

| 6,414 |

| ||||

Interest rate agreements | N/A |

| (15,505 | ) |

| 15,218 |

|

| 30,236 |

| ||||

Cumulative change in market value | N/A | $ | (4,592 | ) | $ | (11,171 | ) | $ | (30,512 | ) | ||||

Percent change of market value portfolio equity (B) | N/A |

| 3.0 | % |

| (7.3 | )% |

| (19.8 | )% | ||||

| Change in market value of assets |

| (B) | Total change in estimated market value as a percent of market value portfolio equity as of December 31. |

| (C) | A decrease in interest rates by 200 basis points (2%) would imply |

Interest Rate Sensitivity Analysis. The values under the heading “Base” are management’s estimates of spread income for assets, liabilities and interest rate agreements on December 31, 2002 and 2001. The values under the headings “100”, “200”, “(100)” and “(200)” are management’s estimates of the income and change in market value of those same assets, liabilities and interest rate agreements assuming that interest rates were 100 and 200 basis points, or 1 and 2 percent higher and lower. The cumulative change in income or market value represents the change in income or market value of assets, net of the change in income or market value of liabilities and interest rate agreements.

The interest sensitivity analysis is prepared monthly. If the analysis demonstrates that a 100 basis point shift, up or down, in interest rates would result in a 25% or more cumulative decrease in income from base, or a 10% cumulative decrease in market value from base, policy requires management to adjust the portfolio by adding or removing interest rate cap or swap agreements. The Board of Directors reviews and approves our interest rate sensitivity and hedged position quarterly. Although management also evaluates the portfolio using interest rate increases and decreases less than and greater than one percent, management focuses on the one percent increase.

Assumptions Used in Interest Rate Sensitivity Analysis.Management uses a variety of estimates and assumptions in determining the income and market value of assets, liabilities and interest rate agreements. The estimates and assumptions have a significant impact on the results of the interest rate sensitivity analysis, the results of which are shown as of December 31, 2002.

Management’s analysis for assessing interest rate sensitivity on its mortgage loans relies significantly on estimates for prepayment speeds. A prepayment model has been internally developed based upon four main factors:

Generally speaking, when market interest rates decline, borrowers are more likely to refinance their mortgages. The higher the interest rate a borrower currently has on his or her mortgage the more incentive he or she has to refinance the mortgage when rates decline. In addition, the higher the credit grade, the more incentive there is to refinance when credit ratings improve. When a borrower has a low loan-to-value ratio, he or she is more likely to do a “cash-out” refinance. Each of these factors increases the chance for higher prepayment speeds during the term of the loan. On the other hand, prepayment penalties serve to mitigate the risk that loans will prepay because the penalty is a deterrent to refinancing.

These factors are weighted based on management’s experience and an evaluation of the important trends observed in the non-conforming mortgage origination industry. Actual results may differ from the estimates and assumptions used in the model and the projected results as shown in the sensitivity analyses.

Projected prepayment rates in each interest rate scenario start at a prepayment speed less than 5% in month one and increase to a long-term prepayment speed in nine to 18 months, to account for the seasoning of the loans. The long-term prepayment speed ranges from 20% to 40% and depends on the characteristics of the loan which include type of product (ARM or fixed rate), note rate, credit grade, loan to value, gross margin, weighted average maturity and lifetime and periodic caps and floors. This prepayment curve is also multiplied by a factor of 60% on average for periods when a prepayment penalty is in effect on the loan. Prepayment assumptions are also multiplied by a factor of greater than 100% during periods around rate resets and prepayment penalty expirations. These assumptions change with levels of interest rates. The actual historical speeds experienced on our loans shown in Table 5 of “Management’s Discussion and Analysis” are weighted average speeds of all loans in each deal.

As discussed above, actual prepayment rates on loans that have been held in portfolio for shorter periods are slower than long term prepayment rates used in the interest rate sensitivity analysis. Also, as pools of loans held in portfolio season, the actual prepayment rates are more consistent with the long term prepayment rates used in the interest sensitivity analysis.

Hedging.In order to address a mismatch of interest rate indices and adjustment periods on our assets and liabilities, the hedging section of the investment policy is followed, as approved by the Board. Specifically, the interest rate risk management program is formulated with the intent to offset the potential adverse effects resulting from rate adjustment limitations on mortgage assets and the differences between interest rate adjustment indices and interest rate adjustment periods of adjustable-rate mortgage loans and related borrowings.

We use interest rate cap and swap contracts to mitigate the risk of the cost of variable rate liabilities increasing at a faster rate than the earnings on assets during a period of rising rates. In this way, management intends generally to hedge as much of the interest rate risk as determined to be in our best interest, given the cost and risk of hedging transactions and the need to maintain REIT status.

We seek to build a balance sheet and undertake an interest rate risk management program that is likely, in management’s view, to enable us to maintain an equity liquidation value sufficient to maintain operations given a variety of potentially adverse circumstances. Accordingly, the hedging program addresses both income preservation, as discussed in the first part of this section, and capital preservation concerns.

Interest rate cap agreements are legal contracts between us and a third partythird-party firm or “counter-party”“counterparty”. The counter-partycounterparty agrees to make payments to us in the future should the one- or three-monthone-month LIBOR interest rate rise above the strike rate specified in the contract. We make either quarterly or monthly premium payments or have chosen to pay the premiums at the beginning to the counterparties under contract. Each contract has either a fixed or amortizing notional face amount on which the interest is computed, and a set term to maturity. When the referenced LIBOR interest rate rises above the contractual strike rate, we earn cap income. Payments on an annualized basis equal the contractual notional face

amount times the difference between actual LIBOR and the strike rate. Interest rate swaps have similar characteristics. However, interest rate swap agreements allow us to pay a fixed rate of interest while receiving a rate that adjusts with one-month LIBOR.

The following table summarizes the key contractual terms associated with our interest rate risk management contracts. Substantially all of the pay-fixed swaps and interest rate caps are indexed to one-month LIBOR.

We have determined the following estimated net fair value amounts by using available market information and valuation methodologies we deem appropriate as of December 31, 2004.

Interest Rate Risk Management Contracts

(dollars in thousands)

| Maturity Range | |||||||||||||||||||

Net Fair Value | Total Notional Amount | 2005 | 2006 | 2007 | |||||||||||||||

Pay-fixed swaps: | |||||||||||||||||||

Contractual maturity | $ | 6,143 | $ | 1,350,000 | $ | 285,000 | $ | 840,000 | $ | 225,000 | |||||||||

Weighted average pay rate | 3.0 | % | 2.4 | % | 3.1 | % | 3.5 | % | |||||||||||

Weighted average receive rate | 2.4 | % | (A | ) | (A | ) | (A | ) | |||||||||||

Interest rate caps: | |||||||||||||||||||

Contractual maturity | $ | 5,819 | $ | 650,000 | $ | 450,000 | $ | 200,000 | $ | — | |||||||||

Weighted average strike rate | 1.7 | % | 1.6 | % | 2.0 | % | — | ||||||||||||

| (A) | The pay-fixed swaps receive rate is indexed to one-month and three-month LIBOR. |

Liquidity/Funding Risk

Mortgage lending requires significant cash to fund loan originations and purchases. Our warehouse lending arrangements, including repurchase agreements, support the mortgage lending operation. Our warehouse mortgage lenders allow us to borrow between 98% and 100% of the outstanding principal. Funding for the difference – generally 2% of the principal - must come from cash on hand. If we are unable to obtain sufficient cash resources, we may not be able to operate our mortgage lending (banking) segment.

We are currently dependent upon a limited number of primary credit facilities for funding of our mortgage loan originations and acquisitions. Any failure to renew or obtain adequate funding under these financing arrangements could harm our lending operations and our overall performance. An increase in the cost of financing in excess of any change in the income derived from our mortgage assets could also harm our earnings and reduce the cash available for distributions to our stockholders. In October 1998, the subprime mortgage loan market faced a liquidity crisis with respect to the availability of short-term borrowings from major lenders and long-term borrowings through securitization. At that time, we faced significant liquidity constraints that harmed our business and our profitability. We can provide no assurance that those adverse circumstances will not recur.

We use repurchase agreements to finance the acquisition of mortgage assets in the short-term. In a repurchase agreement, we sell an asset and agree to repurchase the same asset at some period in the future. Generally, the repurchase agreements we entered into stipulate that we must repurchase the asset in 30 days. For financial accounting purposes, these arrangements are treated as secured financings. We retain the assets on our balance sheet and record an obligation to repurchase the asset. For our repurchase agreements secured by mortgage loans, the amount we may borrow is generally 98% of the mortgage loan market value. For our repurchase agreements secured by mortgage securities, the amount we may borrow is generally 75% of the mortgage securities market value. When asset market values decrease, we are required to repay the margin, or difference in market value. To the extent the market values of assets financed with repurchase agreements decline rapidly, we will be required to meet cash margin calls. If cash is unavailable, we may default on our obligations under the applicable repurchase agreement. In that event, the lender retains the right to liquidate the collateral we provided to it to settle the amount due from us.

We are dependent on the securitization market for the sale of our loans because we securitize loans directly and many of our whole loan buyers purchase our loans with the intention to securitize. The securitization market is dependent upon a number of factors, including general economic conditions, conditions in the securities market generally and conditions in the asset-backed securities market specifically. In addition, poor performance of our previously securitized loans could harm our access to the securitization market. Accordingly, a decline in the securitization market, the ability to obtain attractive terms or a change in the market’s demand for our loans could have a material adverse effect on our results of operations, financial condition and business prospects.

See the “Liquidity and Capital Resources” section of “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for further discussion of liquidity risks and resources available to us.

Credit Risk

Credit risk is the risk that we will not fully collect the principal we have invested in mortgage loans or securities. Nonconforming mortgage loans comprise substantially our entire mortgage loan portfolio and serve as collateral for our mortgage securities – available-for-sale. Our nonconforming borrowers include individuals who do not qualify for agency/conventional lending programs because of a lack of conventional documentation or previous credit difficulties, but have considerable equity in their homes. Often, they are individuals or families who have built up high-rate consumer debt and are attempting to use the equity in their home to consolidate debt and reduce the amount of money it takes to service their monthly debt obligations. Our underwriting guidelines are intended to evaluate the credit history of the potential borrower, the capacity and willingness of the borrower to repay the loan, and the adequacy of the collateral securing the loan.

Underwriting staff work under the credit policies established by our Chief Credit Officer. Underwriters are given approval authority only after their work has been reviewed for a period of time. Thereafter, the Chief Credit Officer re-evaluates the authority levels of all underwriting personnel on an ongoing basis. All loans in excess of $350,000 currently require the approval of an underwriting supervisor. Our Chief Credit Officer or our President must approve loans in excess of $1,000,000.

The underwriting guidelines take into consideration the number of times the potential borrower has recently been late on a mortgage payment and whether that payment was 30, 60 or 90 days past due. Factors such as FICO score, bankruptcy and foreclosure filings, debt-to-income ratio, and loan-to-value ratio are also considered. The credit grade that is assigned to the borrower is a reflection of the borrower’s historical credit and the loan-to-value determined by the amount of documentation the borrower could produce to support income. Maximum loan-to-value ratios for each credit grade depend on the level of income documentation provided by the potential borrower. In some instances, when the borrower exhibits strong compensating factors, exceptions to the underwriting guidelines may be approved.

Key to our successful underwriting process is the use of NovaStarIS®. NovaStarIS® is the second generation of our proprietary automated underwriting system. IS provides more consistency in underwriting loans and allows underwriting personnel to focus more of their time on loans that are not initially accepted by the IS system.

Our mortgage loan portfolio by credit grade, all of which are nonconforming can be accessed via our website at www.novastarmortgage.com.

A tool for managing credit risk is to diversify the markets in which we originate, purchase and own mortgage loans. Presented via our website at www.novastarmortgage.com is a breakdown of the geographic diversification of our loans. Details regarding loans charged off are disclosed in Note 2 to our consolidated financial statements.

We have purchased mortgage insurance on many of the loans that are held in our portfolio – on the balance sheet and those that serve as collateral for our mortgage securities – available-for-sale. The use of mortgage insurance is discussed under “Premiums for Mortgage Loan Insurance” in “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

Prepayment Risk

Generally speaking, when market interest rates decline, borrowers are more likely to refinance their mortgages. The higher the interest rate a borrower currently has on his or her mortgage the more incentive he or she has to refinance the mortgage when rates decline. In addition, the higher the credit grade, the more incentive there is to refinance when credit ratings improve. When a borrower has a low loan-to-value ratio, he or she is more likely to do a “cash-out” refinance. Each of these factors increases the chance for higher prepayment speeds during the term of the loan.

The majority of our securities are “interest-only” in nature. These securities represent the net cash flow – interest income – on the underlying loans in excess of the cost to finance the loans. When borrowers repay the principal on their mortgage loans early, the effect is to shorten the period over which interest is earned, and therefore, reduce the cash flow and yield on our securities.

We mitigate prepayment risk by originating and purchasing loans that include a penalty if the borrower repays the loan in the early months of the loan’s life. For the majority of our loans, a prepayment penalty is charged equal to 80% of six months interest on the principal balance that is to be paid in full. As of December 31, 2004, 73% of our securitized loans had a prepayment penalty. These loans serve as collateral for our mortgage securities – available-for-sale. As of December 31, 2004, 65% of our mortgage loans - held-for-sale had a prepayment penalty, which serve as collateral for our short-term borrowings. During 2004, 72% of the loans we originated and purchased had prepayment penalties.

Regulatory Risk

As a mortgage lender, we are subject to many laws and regulations. Any failure to comply with these rules and their interpretations or with any future interpretations or judicial decisions could harm our profitability or cause a change in the way we do business. For example, several lawsuits have been filed challenging types of payments made by mortgage lenders to mortgage brokers. Similarly, in our branch operations, we allow our branch managers considerable autonomy, which could result in our facing greater exposure to third-party claims if our compliance programs are not strictly adhered to.

Several states and cities are considering or have passed laws, regulations or ordinances aimed at curbing predatory lending practices. The federal government is also considering legislative and regulatory proposals in this regard. In general, these proposals involve lowering the existing federal Homeownership and Equity Protection Act thresholds for defining a “high-cost” loan, and establishing enhanced protections and remedies for borrowers who receive such loans. Passage of these laws and rules could reduce our loan origination volume. In addition, many whole loan buyers may elect not to purchase any loan labeled as a “high cost” loan under any local, state or federal law or regulation. Rating agencies likewise may refuse to rate securities backed by such loans. Accordingly, these laws and rules could severely restrict the secondary market for a significant portion of our loan production. This would effectively preclude us from continuing to originate loans either in jurisdictions unacceptable to the rating agencies or otherwise within newly defined thresholds and could have a material adverse effect on our business.

Recently enacted and effective laws, regulations and standards relating to corporate governance and disclosure requirements applicable to public companies, including the Sarbanes-Oxley Act of 2002, new Securities and Exchange Commission regulations and New York Stock Exchange rules have increased the costs of corporate governance, reporting and disclosure practices. These costs may increase in the future due to our continuing implementation of compliance programs mandated by these requirements. In addition, these new laws, rules and regulations create new legal bases for administrative enforcement and civil and criminal proceedings against us in case of non-compliance, thereby increasing our risks of liability and potential sanctions.

Other Risk Factors

Although management considers the risk components set forth above to be its primary business risks, the following are other risks that should be considered by our investors. Further information regarding these risks is included in our registration statements filed with the Commission.

| Changes in interest rates may |

| Interest rate fluctuations may |

| • | Failure to hedge effectively against interest rate changes may |

| • | Mortgage insurers may not pay claims resulting in increased credit losses or may in the future change their pricing or underwriting guidelines. |

serviced or has been |

| • |

| • | Changes in accounting standards might cause us to alter the way we structure or account for securitizations. Changes could be made to current accounting standards which would limit the types of transactions eligible for gain on sale treatment. These changes could cause us to alter the way we either structure or account for securitizations. |

| • | We face loss exposure due to the underlying real estate.A substantial portion of our mortgage assets |

| • |

| • | Loans made to |

| • | Current loan performance data may not be indicative of future results. |

| • | Market factors may limit our ability to acquire mortgage assets at yields that are favorable relative to borrowing costs. Despite |

| • | Intense competition in the |

| • |

| • |

Restrictions on ownership of capital stock may inhibit market activity and the resulting opportunity for holders of our capital stock |

inhibit market activity and the resulting opportunity for the holders of our |

| • |

Federal Income Tax Consequences

General. We believe we have complied, and intend to comply in the future, with the requirements for qualification as a REIT under the Code. To the extent that we qualify as a REIT for federal income tax purposes, we generally will not be subject to federal income tax on the amount of income or gain that is distributed to shareholders. However, origination and broker operations are conducted through NovaStar Mortgage and NovaStar Home Mortgage, which are owned by NFI Holding—Holding – a taxable REIT subsidiary.subsidiary (TRS). Consequently, all of the taxable income of NFI Holding is subject to federal and state corporate income taxes. In general, a TRS may hold assets that a REIT cannot hold directly and generally may engage in any real estate or non-real estate related business. However, special rules do apply to certain activities between a REIT and its TRS. For example, a TRS will be subject to earnings stripping limitations on the deductibility of interest paid to its REIT. In addition, a REIT will be subject to a 100% excise tax on certain excess amounts to ensure that (i) tenants who pay a TRS for services are charged an arm’s-length amount by the TRS, (ii) fees paid to a REIT by its TRS are reflected at fair market value and (iii) interest paid by a TRS to its REIT is commercially reasonable.

The REIT rules generally require that a REIT invest primarily in real estate related assets, its activities be passive rather than active and it distribute annually to its shareholders substantially all of its taxable income. We could be subject to a number of taxes if we failed to satisfy those rules or if we acquired certain types of income-producing real property through foreclosure. Although no complete assurance can be given, we do not expect that we will be subject to material amounts of such taxes.

Failure to satisfy certain Code requirements could cause loss of REIT status. If we fail to qualify as a REIT for any taxable year, we would be subject to federal income tax (including any applicable minimum tax) at regular corporate rates and would not receive deductions for dividends paid to shareholders. As a result, the amount of after-tax earnings available for distribution to shareholders would decrease substantially. While we intend to operate in a manner that will enable itus to qualify as a REIT in future taxable years, there can be no certainty that such intention will be realized. Loss of REIT status would reduce the amount of any distributions by taxes due, but the character of such distributions for tax purposes should be unaffected.

Qualification as a REIT. Qualification as a REIT requires that we satisfy a variety of tests relating to income, assets, distributions and ownership. The significant tests are summarized below. We will make available more detailed information regarding our compliance with the REIT rules upon request.

Sources of Income. We must satisfy two tests with respect to the sources of income: the 75% income test, and the 95% income test. The 75% income test requires that we derive at least 75% of gross income, excluding gross income from prohibited transactions, from certain passive real estate-related sources. Management believes that income qualified for both of the income tests during 2002.

activities. In order to satisfy the 95% income test, at least an additional 20%95% of gross income formust be derived from the taxable year must consist either of income that qualifies undersame sources as the 75% income test or from dividends or interest from any source. Management believes that we were in compliance with both of the income tests for the 2004 and interest.2003 calendar years.

Nature and Diversification of Assets. As of the last day of each calendar quarter, we must meet threesix requirements under the two asset tests. Under the 75% of assets test, at least 75% of the value of our total assets must represent cash or cash items (including receivables), government securities or real estate assets. Under the 10% asset25% assets test, no more than 25% of our total assets can be represented by securities, other than government securities, stock of a qualified REIT subsidiary, and securities that qualify as real estate assets under the 75% assets test (collectively “75% Securities”). Additionally, under the 25% assets test, no more than 20% of the value of our total assets can be represented by securities of one or more taxable REIT subsidiaries and no more than 5% of the value of our total assets can be represented by the securities of a single issuer, excluding 75% Securities. Furthermore, we may not own more than 10% of the total voting power or the total value of the outstanding securities of any single non-governmentalone issuer, if these securities do not qualify under theexcluding 75% asset test. There is an exception for electing corporations of which we own at least 35% of the outstanding securities. We intend to make this election. Under the 5% asset test, ownership of any stocks or securities that do not qualify under the 75% asset test must be limited, in respect of any single non-governmental issuer, to an amount not greater than 5% of the value of our total assets. The definition of security for this purpose includes financial contracts and instruments that we acquire in the normal course of business.Securities.

If we inadvertently fail to satisfy one or more of the asset tests at the end of a calendar quarter, such failure would not cause us to lose our REIT status. We could still could avoid disqualification by eliminating any discrepancy within 30 days after the close of the calendar quarter in which the discrepancy arose. Management believes that we compliedare in compliance with all of the requirements of both asset tests for all quarters during 2002.2004 and 2003.

Ownership of Common Stock. Our capital stock must be held by a minimum of 100 persons for at least 335 days of each year. In addition, at all times during the second half of each taxable year, no more than 50% in value of our capital stock may be owned directly or indirectly by 5 or fewer individuals. We use the calendar year as our taxable year for income tax purposes. The Code requires us to send annual information questionnaires to specified shareholders in order to assure compliance with the ownership tests. Management believes that we have complied with these stock ownership tests for 2002.2004 and 2003.

Distributions. We must distribute at least 90% of our taxable income and any after-tax net income from certain types of foreclosure property less any non-cash income. No distributions are required in periods in which there is no income.

Taxable Income. We use the calendar year for both tax and financial reporting purposes. However, there may be differences between taxable income and income computed in accordance with accounting principles generally accepted in the United States of America (GAAP). These differences primarily arise from timing and character differences in the recognition of revenue and expense and gains and losses for tax and GAAP purposes. Additionally, taxable income does not include the taxable income of our taxable subsidiary, although the subsidiary’s operating results are included in our GAAP results.

Personnel

As of December 31, 2002,2004, we employed 9443,502 people. Of these, 8771,738 were employed in our wholesale lending and servicing operations and the remainder in ourmortgage portfolio management and administrative functions.mortgage lending and loan servicing operations. Our branches employed 1,3011,721 people as of December 31, 2002.2004. The remaining employees were employed in our branch administrative functions.

Available Information

A copy of the filings we have made with the Securities and Exchange Commission (SEC) may be obtained on our website (www.novastarmortgage.com), through the website of the SEC (www.sec.gov) or by contacting us directly. Our investor relations contact information follows.

Investor Relations

8140 Ward Parkway, Suite 300

Kansas City, MO 64114

816.237.7000

Email: ir@novastar1.com

Our executive, administrative and loan servicing offices are located in Kansas City, Missouri, and consist of approximately 65,000200,000 square feet of leased office space. The lease agreements on the premises expire in January 2009.2011. The current annual rent for these offices is approximately $1.3$4.1 million.

We lease office space for our mortgage lending operations in Orange County, California,Lake Forest, California; Independence, Ohio,Ohio; Richfield, Ohio; Troy, Michigan,Michigan; Columbia, Maryland and Vienna, Virginia. Currently, these offices consist of approximately 52,000255,000 square feet. The leases on the premises expire from January 20042005 through April 2005,May 2012, and the current annual rent is approximately $1.6$4.1 million.

We occasionally become involvedSince April 2004, a number of substantially similar class action lawsuits have been filed and consolidated into a single action in litigation arisingUnited States District Court for the Western District of Missouri. The consolidated complaint names as defendants the Company and three of its executive officers and generally alleges that the defendants made public statements that were misleading for failing to disclose certain regulatory and licensing matters. The plaintiffs purport to have brought this consolidated action on behalf of all persons who purchased the Company’s common stock (and sellers of put options on the Company’s stock) during the period October 29, 2003 through April 8, 2004. The Company believes that these claims are without merit and intends to vigorously defend against them.

In the wake of the securities class action, the Company has also been named as a nominal defendant in several derivative actions brought against certain of the Company’s officers and directors in Missouri and Maryland. The complaints in these actions generally claim that the defendants are liable to the Company for failing to monitor corporate affairs so as to ensure compliance with applicable state licensing and regulatory requirements.

In July 2004, an employee of NHMI filed a class and collective action lawsuit against NHMI and NovaStar Mortgage, Inc. (“NMI”) in the normal courseCalifornia superior Court for the County of business. ManagementLos Angeles. Subsequently, NHMI and NMI removed the matter to the United States District court for the Central District of California. The plaintiff brought this class and collective action on behalf of herself and all past and present employees of NHMI and NMI who were employed since May 1, 2000 in the capacity generally described as Loan Officer. The plaintiff alleged that NHMI and NMI failed to pay her and the members of the class she purported to represent overtime premium and minimum wage as required by the Fair Labor Standards Act and California state laws for the period commencing May 1, 2000. In January 2005, the plaintiff and NHMI agreed upon a nationwide settlement in the nominal amount of $3.1 million on behalf of a class of all NHMI Loan Officers nationwide. The settlement, which is subject to court approval, covers all minimum wage and overtime claims going back to July 30, 2001, and includes the dismissal with prejudice of the claims against NMI. Since not all class members will elect to be part of the settlement, the Company estimated the probable obligation related to the settlement to be in a range of $1.3 million to $1.7 million. In accordance with SFAS No. 5,Accounting for Contingencies, the Company recorded a charge to earnings of $1.3 million in 2004.

In addition to those matters listed above, the Company is currently party to various other legal proceedings and claims. While management, including internal counsel, currently believes that any liability with respect to such legal actions,the ultimate outcome of these proceedings and claims, individually orand in the aggregate, will not have a material adverse effect on itsthe Company’s financial positioncondition or results of operations.operations, litigation is subject to inherent uncertainties. If an unfavorable ruling were to occur, there exists the possibility of a material adverse impact on the results of operations for the period in which the ruling occurs.

In April 2004, the Company also received notice of an informal inquiry from the Securities & Exchange Commission requesting that it provide various documents relating to its business. The Company has been cooperating fully with the Commission’s inquiry.

Item 4.Submission of Matters to a Vote of Security Holders

None

Item 5.a.Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Price of and Dividends on the Registrant’s Common and Preferred Equity and Related Stockholder Matters. The common stock of NovaStar Financial, Inc (“NFI”) is traded on the NYSE under the symbol “NFI”. Our Series C Cumulative Redeemable Perpetual Preferred Stock is traded on the NYSE under the symbol “NFI-PC”. The following table sets forth, for the periods indicated, the high and low sales prices per share of common stock on the NYSE and the cash dividends paid or payable per share of capital stock.

Common Stock Prices | Cash Dividends (A) | ||||||||||||||

High | Low | Class of Stock | Declared | Paid or Payable | Amount Per Share | ||||||||||

1/1/00 to 3/31/00 | $ | 4.38 | $ | 3.13 | Preferred | 4/26/00 | 5/10/00 | $ | 0.12 | ||||||

4/1/00 to 6/30/00 |

| 4.19 |

| 2.88 | Preferred | 7/26/00 | 8/10/00 |

| 0.12 | ||||||

7/1/00 to 9/30/00 |

| 4.06 |

| 2.88 | Preferred | 10/25/00 | 11/10/00 |

| 0.12 | ||||||

10/1/00 to 12/31/00 |

| 4.31 |

| 3.56 | Preferred | 12/20/00 | 1/10/01 |

| 0.12 | ||||||

1/1/01 to 3/31/01 |

| 6.20 |

| 3.75 | Preferred | 4/27/01 | 5/10/01 |

| 0.12 | ||||||

4/1/01 to 6/30/01 |

| 8.50 |

| 5.55 | Preferred and Common | 7/26/01 | 8/10/01 |

| 0.13 | ||||||

7/1/01 to 9/30/01 |

| 11.80 |

| 8.05 | Preferred and Common | 10/25/01 | 11/10/01 |

| 0.36 | ||||||

10/1/01 to 12/31/01 |

| 18.10 |

| 10.35 | Preferred Common | 12/19/01 12/19/01 | 1/10/02 1/14/02 |

| 0.47 0.47 | ||||||

1/1/02 to 3/31/02 |

| 19.50 |

| 15.00 | Common (B) | 4/23/02 | 5/7/02 |

| 0.80 | ||||||

4/1/02 to 6/30/02 |

| 35.75 |

| 18.90 | Common | 7/24/02 | 8/6/02 |

| 0.90 | ||||||

7/1/02 to 9/30/02 |

| 35.49 |

| 19.00 | Common | 10/15/02 | 11/7/02 |

| 1.00 | ||||||

10/1/02 to 12/31/02 |

| 32.80 |

| 18.01 | Common | 12/18/02 | 1/15/03 |

| 1.60 | ||||||

Common Stock Prices | Cash Dividends | ||||||||||||||

| High | Low | Class of Stock | Declared | Paid or Payable | Amount Per Share | ||||||||||

1/1/03 to 3/31/03 | $ | 18.10 | $ | 13.90 | Common Common | 1/29/03 4/22/03 | 2/11/03 5/15/03 | $ | 0.17 1.13 | ||||||

4/1/03 to 6/30/03 | 30.50 | 17.15 | Common | 7/30/03 | 8/20/03 | 1.25 | |||||||||

7/1/03 to 9/30/03 | 37.75 | 24.25 | Common | 10/29/03 | 11/19/03 | 1.25 | |||||||||

10/1/03 to 12/31/03 | 45.80 | 28.63 | Common | 12/17/03 | 1/6/04 | 1.25 | |||||||||

1/1/04 to 3/31/04 | 70.32 | 42.50 | Preferred Common | 1/28/04 4/28/04 | 3/31/04 5/26/04 | | 0.43 1.35 | ||||||||

4/1/04 to 6/30/04 | 66.59 | 28.75 | Preferred Common | 4/28/04 7/28/04 | 6/30/04 8/26/04 | | 0.56 1.35 | ||||||||

7/1/04 to 9/30/04 | 48.69 | 37.29 | Preferred Common | 7/28/04 10/28/04 | 9/30/04 11/22/04 | | 0.56 1.40 | ||||||||

10/1/04 to 12/31/04 | 58.04 | 40.19 | Preferred Common | 10/28/04 12/22/04 | 12/31/04 1/14/05 | | 0.56 2.65 | ||||||||

As of March 12, 2003, more than 9,00011, 2005, approximately 27,000 stockholders held our 10,502,76727,860,629 shares of common stock as provided by third partythird-party brokers and transfer agent reports.

We intend to make distributions to stockholders of all or substantially all of taxable income in each year, subject to certain adjustments, so as to qualify for the tax benefits accorded to a REIT under the Code. All distributions will be made at the discretion of the Board of Directors and will depend on earnings, financial condition, maintenance of REIT status and other factors as the Board of Directors may deem relevant.

b.Recent Sales of Unregistered Securities

Securities. None.

c.Filings with the Securities and Exchange Commission

A copyPurchase of Equity Securities by the filings we have made with the Securities and Exchange Commission (SEC) may be obtained on our website (www.novastaris.com), through the website of the SEC (www.sec.gov) or by contacting us directly. Our investor relations contact information follows.Issuer.

Investor RelationsIssuer Purchases of Equity Securities

8140 Ward Parkway, Suite 300

Kansas City, MO 64114

816.237.7000

Email: ir@novastar1.com(dollars in thousands)

Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Approximate Dollar that May Yet Be Purchased Under the Plans or Programs (A) | ||||||

October 1, 2004 – October 31, 2004 | — | — | — | $ | 1,020 | ||||

November 1, 2004 – November 30, 2004 | — | — | — | $ | 1,020 | ||||

December 1, 2004 – December 31, 2004 | — | — | — | $ | 1,020 | ||||

| (A) | Current report on Form 8-K was filed on October 2, 2000 announcing that the Board of Directors authorized the company to repurchase its common shares, bringing the total authorization to $9 million. |

Item 6.Selected Consolidated Financial and Other Data

The following selected consolidated financial data areis derived from our audited consolidated financial statements for the periods presented and should be read in conjunction with the more detailed information therein and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this annual report. Operating results are not necessarily indicative of future performance.

Selected Consolidated Financial and Other Data

(dollars in thousands, except per share amounts)

For the Year Ended December 31, | ||||||||||||||||||||

2002 (A) | 2001 (A) | 2000 | 1999 | 1998 | ||||||||||||||||

Consolidated Statement of Operations Data | ||||||||||||||||||||

Interest income | $ | 107,143 |

| $ | 57,904 |

| $ | 47,627 |

| $ | 66,713 |

| $ | 100,747 |

| |||||

Interest expense |

| 38,596 |

|

| 28,588 |

|

| 34,696 |

|

| 46,758 |

|

| 80,794 |

| |||||

Net interest income before provision for credit losses |

| 68,547 |

|

| 29,316 |

|

| 12,931 |

|

| 19,955 |

|

| 19,953 |

| |||||

Provision for credit losses |

| (432 | ) |

| 3,608 |

|

| 5,449 |

|

| 22,078 |

|

| 7,430 |

| |||||

Gains (losses) on sales of mortgage assets |

| 53,305 |

|

| 37,347 |

|

| (826 | ) |

| 351 |

|

| (14,962 | ) | |||||

Losses on derivative instruments |

| (25,973 | ) |

| (2,731 | ) | ||||||||||||||

General and administrative expenses |

| 84,594 |

|

| 46,505 |

|

| 3,017 |

|

| 3,590 |

|

| 4,379 |

| |||||

Equity in net income (loss)—NFI Holding |

| 1,123 |

|

| 88 |

|

| (2,984 | ) | |||||||||||

Income (loss) before cumulative effect of change in accounting principle |

| 48,761 |

|

| 34,014 |

|

| 5,626 |

|

| (7,092 | ) |

| (21,821 | ) | |||||

Cumulative effect of change in accounting principle (B) |

| (1,706 | ) | |||||||||||||||||

Net income (loss) |

| 48,761 |

|

| 32,308 |

|

| 5,626 |

|

| (7,092 | ) |

| (21,821 | ) | |||||

Basic income (loss) per share | $ | 4.70 |

| $ | 3.22 |

| $ | 0.51 |

| $ | (1.08 | ) | $ | (2.71 | ) | |||||

Diluted income (loss) per share | $ | 4.50 |

| $ | 3.02 |

| $ | 0.50 |

| $ | (1.08 | ) | $ | (2.71 | ) | |||||

As of December 31, | ||||||||||||||||||||

2002 (A) | 2001 (A) | 2000 | 1999 | 1998 | ||||||||||||||||

Consolidated Balance Sheet Data | ||||||||||||||||||||

Mortgage Assets: | ||||||||||||||||||||

Mortgage loans | $ | 1,133,509 |

| $ | 365,560 |

| $ | 375,927 |

| $ | 620,406 |

| $ | 945,798 |

| |||||

Mortgage securities |

| 178,879 |

|

| 71,584 |

|

| 46,650 |

|

| 6,775 |

|

| — |

| |||||

Total assets |

| 1,452,497 |

|

| 512,380 |

|

| 494,482 |

|

| 689,427 |

|

| 997,754 |

| |||||

Borrowings |

| 1,225,228 |

|

| 362,398 |

|

| 382,437 |

|

| 586,868 |

|

| 891,944 |

| |||||

Stockholders’ equity |

| 183,257 |

|

| 129,997 |

|

| 107,919 |

|

| 100,161 |

|

| 82,808 |

| |||||

For the Year Ended December 31, | ||||||||||||||||||||

2002 | 2001 | 2000 | 1999 | 1998 | ||||||||||||||||

Other Data | ||||||||||||||||||||

Loans originated, principal | $ | 2,781,539 |

| $ | 1,333,366 |

| $ | 719,341 |

| $ | 452,554 |

| $ | 878,871 |

| |||||

Branches, end of year |

| 216 |

|

| 123 |

|

| 63 |

|

| 1 |

|

| — |

| |||||

Loans brokered through branches | $ | 2,622,950 |