|  |

|  |

| U.S. Bank lapel pin signifying This year, we At U.S. Bancorp, we value and recognize the expertise and energy of our employees, especially their commitment to providing outstanding customer service and contributing to the corporation’s financial results. Each employee wears a our customer service guarantee. will acknowledge employees’ milestone service anniversaries with special gemstone lapel pins for service at five, 10, 15, 20 and 25 years. |

c o r p o r a t ep r o f i l e

U.S. Bancorp, headquartered in Minneapolis, is the 8th largest financial services holding company in the United States with total assets exceeding $189 billion at year-end 2003.

Through U.S. Bank® and other subsidiaries, U.S. Bancorp serves 11.6 million customers, primarily through 2,243 full-service branch offices in 24 states. Customers also access their accounts and conduct all or part of their banking transactions through 4,425 U.S. Bank ATMs, U.S. Bank Internet Banking and telephone banking. In addition, a network of specialized U.S. Bancorp offices and representatives across the nation serves customers inside and outside our 24-state footprint through comprehensive product sets that meet the financial needs of customers beyond basic core banking. Backed by expertise and advanced technology, these sophisticated U.S. Bancorp products and services include large corporate services, payment services, private banking, personal and institutional trust services, corporate trust services, specialized large-scale government banking services, mortgage, commercial credit vehicles, and financial and asset management services.

Major lines of business provided by U.S. Bancorp through U.S. Bank and other subsidiaries include Consumer Banking; Payment Services; Private Client, Trust & Asset Management; and Wholesale Banking. U.S. Bank is home of the exclusive U.S. Bank Five Star Service Guarantee.

At year-end 2004 | ||||

U.S. BANCORP AT A GLANCE | ||||

| Ranking | ||||

| Asset size | $ | |||

| Deposits | $ | |||

| $ | ||||

| Earnings per share (diluted) | $ | |||

| Return on average assets | ||||

| Return on average equity | ||||

| Tangible common equity | ||||

| Efficiency ratio | ||||

| Customers | ||||

| Primary banking region | 24 states | |||

| Bank branches | ||||

| ATMs | ||||

| NYSE symbol | USB | |||

| 2 | ||||

| 3 | ||||

| 4 |

in Action U.S. Bancorp employees deliver on our promise to provide the outstanding service our customers expect and deserve. | ||||||

| 6 | ||||||

| Business Mix We help our customers achieve their financial goals by offering an extensive scope of strategic services through specialized lines of business. | 10 | ||||

| Initiatives for Success We are increasing our ability to provide the highest quality service and the most innova- tive products through new investments and initiatives for future growth and service. | 14 |

| 64 | ||||||||

| 68 | ||||||||

| 105 | ||||||||

| 108 | ||||||||

| 110 | ||||||||

| 111 | ||||||||

| 114 | ||||||||

| 121 | ||||||||

| 124 | ||||||||

| 125 | ||||||||

| inside back cover | ||||||||

| | ||||||||

| | ||||||||

| Statement Re: Computation of Ratio of Earnings to Fixed Charges | ||||||||

| Subsidiaries of the Registrant | ||||||||

| Consent of Ernst & Young LLP | ||||||||

| Consent of PricewaterhouseCoopers LLP | ||||||||

| Certification of CEO Pursuant to Rule 13a-14(a) | ||||||||

| Certification of CFO Pursuant to Rule 13a-14(a) | ||||||||

| Certification of CEO and CFO Pursuant to | ||||||||

Statements in this report regarding U.S. Bancorp’s business which are not historical facts are “forward-looking statements” that involve risks and uncertainties. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see the “Forward-Looking Statements” disclosure on page 17 of this report.

CORPORATE PROFILE

U.S. Bancorp, headquartered in Minneapolis, is the 6th largest financial holding company in the United States, with total assets exceeding $195 billion at year-end 2004. U.S. Bancorp, the parent company of U.S. Bank, serves 13.1 million customers and operates 2,370 branch offices in 24 states. U.S. Bancorp customers also access their accounts through 4,620 U.S. Bank ATMs, U.S. Bank Internet Banking and telephone banking. A network of specialized U.S. Bancorp offices across the nation, inside and outside our 24-state footprint, provides a comprehensive

line of banking, brokerage, insurance, investment, mortgage, trust and payment services products to consumers, businesses, governments and institutions.

Major lines of business provided by U.S. Bancorp through U.S. Bank and other subsidiaries include Wholesale Banking; Payment Services; Private Client, Trust & Asset Management; and Consumer Banking. U.S. Bank is home of the exclusive Five Star Service Guarantee. Visit U.S. Bancorp on the web at usbank.com.

U.S. BANCORP1

g r a p h sSELECTED FINANCIAL HIGHLIGHTSo fs e l e c t e df i n a n c i a lh i g h l i g h t s

(a) | Dividends per share have not been restated for the 2001 Firstar/USBM merger. | ||

(b) | Computed as noninterest expense divided by the sum of net interest income on a taxable-equivalent basis and noninterest income excluding securities gains (losses), net. |

2U.S. BANCORP

FINANCIAL SUMMARY

| Year Ended December 31 | 2004 | 2003 | ||||||||||||||||||

| (Dollars and Shares in Millions, Except Per Share Data) | 2004 | 2003 | 2002 | v 2003 | v 2002 | |||||||||||||||

| Total net revenue (taxable-equivalent basis) | $ | 12,659.1 | $ | 12,530.5 | $ | 12,057.9 | 1.0 | % | 3.9 | % | ||||||||||

| Noninterest expense | 5,784.5 | 5,596.9 | 5,740.5 | 3.4 | (2.5 | ) | ||||||||||||||

| Provision for credit losses | 669.6 | 1,254.0 | 1,349.0 | |||||||||||||||||

| Income taxes and taxable-equivalent adjustments | 2,038.2 | 1,969.5 | 1,740.4 | |||||||||||||||||

| Income from continuing operations | 4,166.8 | 3,710.1 | 3,228.0 | 12.3 | 14.9 | |||||||||||||||

| Discontinued operations (after-tax) | — | 22.5 | (22.7 | ) | ||||||||||||||||

| Cumulative effect of accounting change (after-tax) | — | — | (37.2 | ) | ||||||||||||||||

| Net income | $ | 4,166.8 | $ | 3,732.6 | $ | 3,168.1 | 11.6 | 17.8 | ||||||||||||

Per Common Share | ||||||||||||||||||||

| Earnings per share from continuing operations | $ | 2.21 | $ | 1.93 | $ | 1.68 | 14.5 | % | 14.9 | % | ||||||||||

| Diluted earnings per share from continuing operations | 2.18 | 1.92 | 1.68 | 13.5 | 14.3 | |||||||||||||||

| Earnings per share | 2.21 | 1.94 | 1.65 | 13.9 | 17.6 | |||||||||||||||

| Diluted earnings per share | 2.18 | 1.93 | 1.65 | 13.0 | 17.0 | |||||||||||||||

| Dividends declared per share | 1.020 | .855 | .780 | 19.3 | 9.6 | |||||||||||||||

| Book value per share | 10.52 | 10.01 | 9.62 | 5.1 | 4.1 | |||||||||||||||

| Market value per share | 31.32 | 29.78 | 21.22 | 5.2 | 40.3 | |||||||||||||||

| Average common shares outstanding | 1,887.1 | 1,923.7 | 1,916.0 | (1.9 | ) | .4 | ||||||||||||||

| Average diluted common shares outstanding | 1,912.9 | 1,936.2 | 1,924.8 | (1.2 | ) | .6 | ||||||||||||||

Financial Ratios | ||||||||||||||||||||

| Return on average assets | 2.17 | % | 1.99 | % | 1.84 | % | ||||||||||||||

| Return on average equity | 21.4 | 19.2 | 18.3 | |||||||||||||||||

| Net interest margin (taxable-equivalent basis) | 4.25 | 4.49 | 4.65 | |||||||||||||||||

| Efficiency ratio | 45.3 | 45.6 | 48.8 | |||||||||||||||||

Average Balances | ||||||||||||||||||||

| Loans | $ | 122,141 | $ | 118,362 | $ | 114,453 | 3.2 | % | 3.4 | % | ||||||||||

| Investment securities | 43,009 | 37,248 | 28,829 | 15.5 | 29.2 | |||||||||||||||

| Earning assets | 168,123 | 160,808 | 147,410 | 4.5 | 9.1 | |||||||||||||||

| Assets | 191,593 | 187,630 | 171,948 | 2.1 | 9.1 | |||||||||||||||

| Deposits | 116,222 | 116,553 | 105,124 | (.3 | ) | 10.9 | ||||||||||||||

| Shareholders’ equity | 19,459 | 19,393 | 17,273 | .3 | 12.3 | |||||||||||||||

Period End Balances | ||||||||||||||||||||

| Loans | $ | 126,315 | $ | 118,235 | $ | 116,251 | 6.8 | % | 1.7 | % | ||||||||||

| Allowance for credit losses | 2,269 | 2,369 | 2,422 | (4.2 | ) | (2.2 | ) | |||||||||||||

| Investment securities | 41,481 | 43,334 | 28,488 | (4.3 | ) | 52.1 | ||||||||||||||

| Assets | 195,104 | 189,471 | 180,027 | 3.0 | 5.2 | |||||||||||||||

| Deposits | 120,741 | 119,052 | 115,534 | 1.4 | 3.0 | |||||||||||||||

| Shareholders’ equity | 19,539 | 19,242 | 18,436 | 1.5 | 4.4 | |||||||||||||||

| Regulatory capital ratios | ||||||||||||||||||||

| Tangible common equity | 6.4 | % | 6.5 | % | 5.7 | % | ||||||||||||||

| Tier 1 capital | 8.6 | 9.1 | 8.0 | |||||||||||||||||

| Total risk-based capital | 13.1 | 13.6 | 12.4 | |||||||||||||||||

| Leverage | 7.9 | 8.0 | 7.7 | |||||||||||||||||

U.S. BANCORP3

| LETTER TO SHAREHOLDERS 2004 was a year that it all came together for U.S. Bancorp. Service quality levels have never been higher. Financial results are strong and lead the industry in key measurements. All lines of business are contributing to revenue and growth. |

Fellow Shareholders:

I am pleased to tell you that in 2004, U.S. Bancorp achieved its goals for the year and delivered on its promises to you.

STRONG FINANCIAL RESULTS WITH A

FOCUS ON REVENUE GROWTH

During the coming year, we will act to sustain those successes. Revenue growth is our primary focus, particularly net interest income from improved commercial lending results. Our consumer lending business continues to grow, and we have made a number of changes surrounding our commercial banking and small business banking lines of business to increase commercial loan growth. We saw middle market commercial loan balances move upward in fourth quarter 2004.

We are very disciplined in our acquisitions, focusing only on those which will enhance revenue growth, create operating scale, build a more profitable business line or strengthen a critical competitive advantage. This strategy has proved very successful, most notably in our payments business, which reported 10.6 percent net revenue growth in 2004.

Our capital position remains strong, and we repurchased 93.8 million shares during 2004.

INVESTING FOR GROWTH AND SERVICE

We continue to support our pledge of guaranteed high levels of customer service. Investments in delivery and operational systems allowed us to unify systems, simplify procedures, streamline processes and increase the ease of numerous customer transactions and communications. These investments improved customer service and increased customer satisfaction and loyalty, contributing significantly to our ability to attract and retain customers. We have also improved hiring and training practices, and service quality is an integral part of our employees’ performance evaluation and incentive programs.

RATING AGENCIES VIEW

U.S. BANK FAVORABLY

4U.S. BANCORP

upgrade was Moody’s view that the corporation’s business model will generate strong profitability, and the consistency of that profitability performance is supported by improving risk management and maintenance of very good liquidity.

We were also pleased that on September 27, 2004, Fitch’s rating agency upgraded U.S. Bank’s ratings. Long- and short-term senior debt at the holding company, U.S. Bancorp, were upgraded to AA- and F1+, respectively, from A+ and F1, respectively. The long-term ratings of its subsidiary bank, U.S. Bank National Association, were upgraded to AA from AA-. The main driver behind the upgrade was Fitch’s view of the corporation’s solid net interest margin, diverse sources of non-interest income, disciplined expense management and improved asset quality.

The debt ratings established for U.S. Bank by Moody’s, Standard and Poor’s, and Fitch reflect the ratings agencies’ recognition of the strong, consistent financial performance of the company and the quality of the balance sheet.

U.S. BANCORP IS A CORPORATION

BUILT ON INTEGRITY

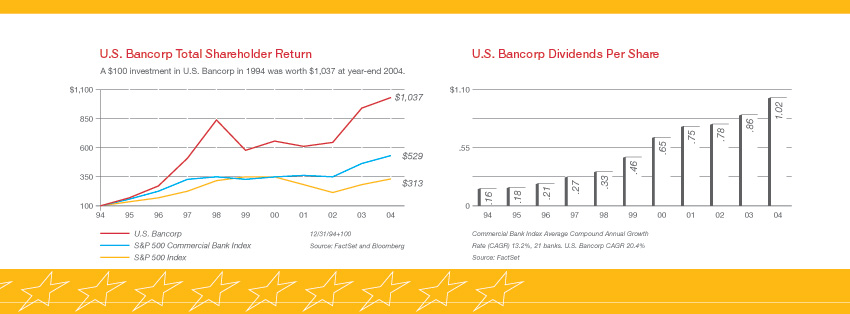

CREATING SHAREHOLDER VALUE

IS OUR PRIORITY

This corporation has paid a cash dividend for 142 consecutive years, and we have increased the dividend for 33 consecutive years. That long-time record of dividend increases earned U.S. Bancorp the designation of one of the S&P’s 58 “Dividend Aristocrats.” Only nine other issues have paid a dividend longer than U.S. Bancorp, which first paid a dividend in 1863.

We manage this corporation to increase the value of your investment in U.S. Bancorp. It’s the reason we come to work each day.

Sincerely,

Jerry A. Grundhofer

Chairman and Chief Executive Officer

U.S. Bancorp

February 28, 2005

U.S. BANCORP5

| FIVE STAR SERVICE IN ACTION THE VALUES OF FIVE STAR SERVICE Take Ownership Make it Personal Add Value to Every Interaction Make Customer Courtesy Common Share Knowledge SHE TAKES OWNERSHIP. May Li, Manager Factoria Office, Bellevue, WA When Terrie Nixdorff needed help obtaining a debit card after experiencing an unsettling fraud situation, May Li stepped right in. With unyielding determination and extensive follow-through, May Li ensured that Terrie's situation was completely resolved. 6 U.S. BANCORP |

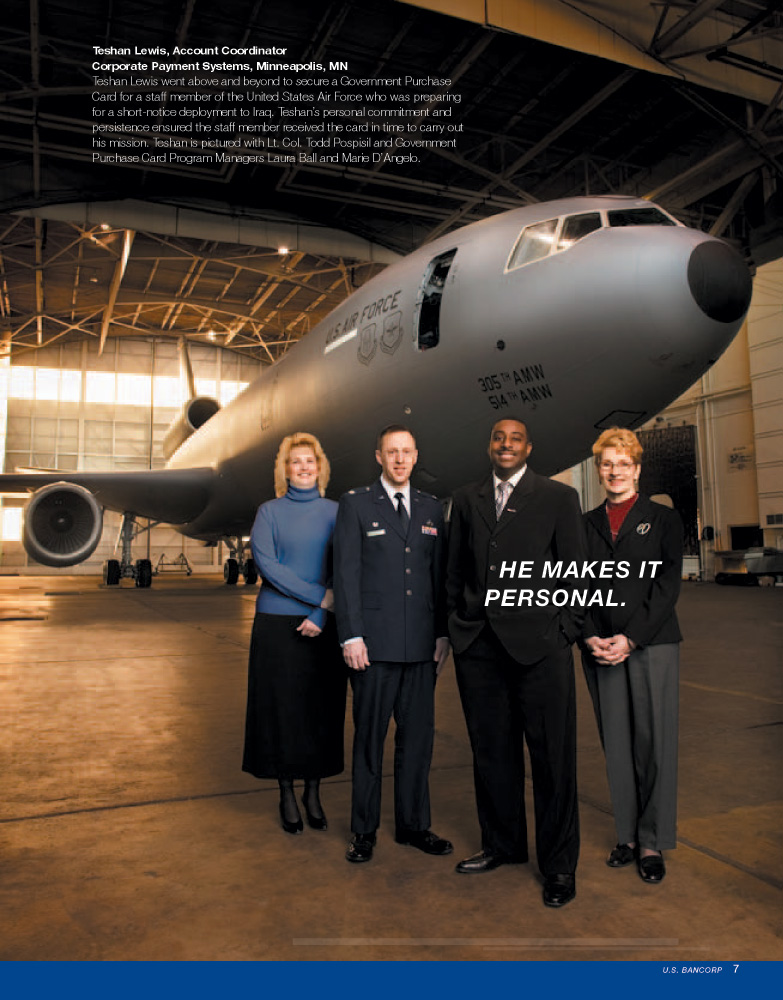

| Teshan Lewis, Account Coordinator Corporate Payment Systems, Minneapolis, MN Teshan Lewis went above and beyond to secure a Government Purchase Card for a staff member of the United States Air Force who was preparing for a short-notice deployment to Iraq. Teshan's personal commitment and persistence ensured the staff member received the card in time to carry out his mission. Teshan is pictured with Lt. Col. Todd Pospisil and Government Purchase Card Program Managers Laura Ball and Marie D'Angelo. HE MAKES IT PERSONAL. |

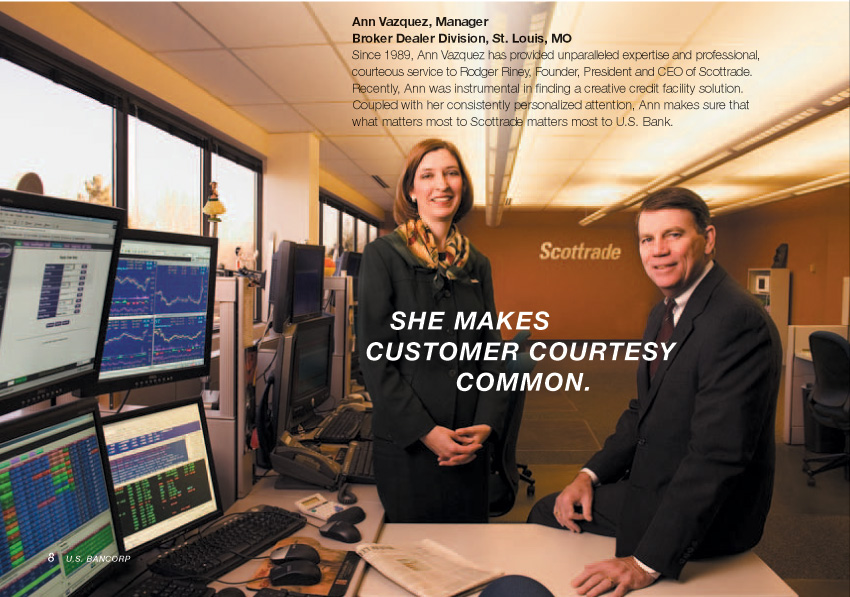

| SHE ADDS VALUE. Pam Paley, Relationship Manager The Private Client Group, Cincinnati, OH Pam Paley partners with Frederic H. Mayerson, Chairman and Managing General Partner of The Walnut Group, a diversified private equity investment company. Pam adds value to every interaction by consistently finding the right specialized, competitive products and services designed to meet the needs of The Walnut Group's principals. Ann Vazquez, Manager Broker Dealer Division, St. Louis, MO Since 1989, Ann Vazquez has provided unparalleled expertise and professional, courteous service to Rodger Riney, Founder, President and CEO of Scottrade. Recently, Ann was instrumental in finding a creative credit facility solution. Coupled with her consistently personalized attention, Ann makes sure that what matters most to Scottrade matters most to U.S. Bank. SHE MAKES CUSTOMER COURTESY COMMON. |

| Andrew Eberhardy, Project Manager Elan Financial Services, Milwaukee, WI Andrew Eberhardy's skilled support made all the difference to Oregon-based Umpqua Bank during a recent credit card portfolio conversion. Drawing on his vast knowledge of conversion processes, Andrew offered Umpqua flexible, efficient and reliable options to guarantee their satisfaction. Andrew is pictured with Susie McEuin and Laura Schaeffer of Umpqua. HE SHARES HIS KNOWLEDGE. |

| ADVANTAGEOUS BUSINESS MIX 13.1 million customers rely on U.S. Bancorp as their financial partner. From a simple personal checking account to sophisticated corporate transactions, U.S. Bancorp has the products and services, the talent, the technologies and the expertise to help our customers achieve their goals. |

f i n a n c i a lWHOLESALE

s u m m a r yBANKING

With relationship managers who understand the companies, the markets and the industries of our commercial, corporate and correspondent customers, no bank brings more to the table than U.S. Bank.

| Year Ended December 31 | 2003 | 2002 | ||||||||||||||||||

| (Dollars and Shares in Millions, Except Per Share Data) | 2003 | 2002 | 2001 | v 2002 | v 2001 | |||||||||||||||

| Total net revenue (taxable-equivalent basis) | $ | 12,530.5 | $ | 12,057.9 | $ | 11,074.6 | 3.9 | % | 8.9 | % | ||||||||||

| Noninterest expense | 5,596.9 | 5,740.5 | 6,149.0 | (2.5 | ) | (6.6 | ) | |||||||||||||

| Provision for credit losses | 1,254.0 | 1,349.0 | 2,528.8 | |||||||||||||||||

| Income taxes and taxable-equivalent adjustments | 1,969.5 | 1,740.4 | 872.8 | |||||||||||||||||

| Income from continuing operations | $ | 3,710.1 | $ | 3,228.0 | $ | 1,524.0 | 14.9 | 111.8 | ||||||||||||

| Discontinued operations (after-tax) | 22.5 | (22.7 | ) | (45.2 | ) | |||||||||||||||

| Cumulative effect of accounting change (after-tax) | — | (37.2 | ) | — | ||||||||||||||||

| Net income | $ | 3,732.6 | $ | 3,168.1 | $ | 1,478.8 | 17.8 | 114.2 | ||||||||||||

Per Common Share | ||||||||||||||||||||

| Earnings per share from continuing operations | $ | 1.93 | $ | 1.68 | $ | .79 | 14.9 | % | 112.7 | % | ||||||||||

| Diluted earnings per share from continuing operations | 1.92 | 1.68 | .79 | 14.3 | 112.7 | |||||||||||||||

| Earnings per share | 1.94 | 1.65 | .77 | 17.6 | 114.3 | |||||||||||||||

| Diluted earnings per share | 1.93 | 1.65 | .76 | 17.0 | 117.1 | |||||||||||||||

| Dividends declared per share | .855 | .780 | .750 | 9.6 | 4.0 | |||||||||||||||

| Book value per share | 10.01 | 9.62 | 8.58 | 4.1 | 12.1 | |||||||||||||||

| Market value per share | 29.78 | 21.22 | 20.93 | 40.3 | 1.4 | |||||||||||||||

| Average shares outstanding | 1,923.7 | 1,916.0 | 1,927.9 | .4 | (.6 | ) | ||||||||||||||

| Average diluted shares outstanding | 1,936.2 | 1,924.8 | 1,940.3 | .6 | (.8 | ) | ||||||||||||||

Financial Ratios | ||||||||||||||||||||

| Return on average assets | 1.99 | % | 1.84 | % | .89 | % | ||||||||||||||

| Return on average equity | 19.2 | 18.3 | 9.0 | |||||||||||||||||

| Net interest margin (taxable-equivalent basis) | 4.49 | 4.65 | 4.46 | |||||||||||||||||

| Efficiency ratio | 45.6 | 48.8 | 57.2 | |||||||||||||||||

Average Balances | ||||||||||||||||||||

| Loans | $ | 118,362 | $ | 114,453 | $ | 118,177 | 3.4 | % | (3.2 | )% | ||||||||||

| Investment securities | 37,248 | 28,829 | 21,916 | 29.2 | 31.5 | |||||||||||||||

| Earning assets | 160,808 | 147,410 | 143,501 | 9.1 | 2.7 | |||||||||||||||

| Assets | 187,630 | 171,948 | 165,944 | 9.1 | 3.6 | |||||||||||||||

| Deposits | 116,553 | 105,124 | 104,956 | 10.9 | .2 | |||||||||||||||

| Total shareholders’ equity | 19,393 | 17,273 | 16,426 | 12.3 | 5.2 | |||||||||||||||

Period End Balances | ||||||||||||||||||||

| Loans | $ | 118,235 | $ | 116,251 | $ | 114,405 | 1.7 | % | 1.6 | % | ||||||||||

| Allowance for credit losses | 2,369 | 2,422 | 2,457 | (2.2 | ) | (1.4 | ) | |||||||||||||

| Investment securities | 43,334 | 28,488 | 26,608 | 52.1 | 7.1 | |||||||||||||||

| Assets | 189,286 | 180,027 | 171,390 | 5.1 | 5.0 | |||||||||||||||

| Deposits | 119,052 | 115,534 | 105,219 | 3.0 | 9.8 | |||||||||||||||

| Total shareholders’ equity | 19,242 | 18,436 | 16,745 | 4.4 | 10.1 | |||||||||||||||

| Regulatory capital ratios | ||||||||||||||||||||

| Tangible common equity | 6.5 | % | 5.7 | % | 5.9 | % | ||||||||||||||

| Tier 1 capital | 9.1 | 8.0 | 7.8 | |||||||||||||||||

| Total risk-based capital | 13.6 | 12.4 | 11.9 | |||||||||||||||||

| Leverage | 8.0 | 7.7 | 7.9 | |||||||||||||||||

Whether it’s finding the right financing and capital for growth and expansion, accelerating receivables, expediting transactions, managing employee benefits programs or structuring transactions to finance foreign trade, U.S. Bank has the business solutions that build businesses and futures.

After several years of lackluster demand, in 2004 we saw an increase, albeit modest, in commercial and corporate lending, particularly in the areas of commercial and industrial lending and commercial real estate. Economic trends across most markets are positive overall and we expect to see continued improvement in 2005. Interest rates, while rising, are affordable, and companies appear more ready than at any time in the past several years to invest in their businesses.

Significant changes within our organization position us well to be more visible and active in every market, with more streamlined procedures and more competitive pricing. These changes augment the high level of customer service and industry expertise already provided to our customers.

KEY BUSINESS UNITS

• | Middle Market Commercial Banking | |

• | Commercial Real Estate | |

• | Corporate Banking | |

• | Correspondent Banking | |

• | Dealer Commercial Services | |

• | Equipment Leasing | |

• | Foreign Exchange | |

• | Government Banking | |

• | International Banking | |

• | Specialized Industries | |

• | Specialized Lending | |

• | Treasury Management |

10U.S. BANCORP

PAYMENT

SERVICES

U.S. Bancorp is a recognized leader in the rapidly growing payments business, with customers ranging from individual credit and debit cardholders and ATM users to local and global merchants, fleet enterprises and multinational corporations with complex payment and payment processing needs.

KEY BUSINESS UNITS

•Corporate Payment Systems |

•Merchant Payment Services |

•NOVA Information Systems, Inc. |

•Retail Payment Solutions (card services) |

•Transaction Services |

We provide innovative card-based programs, internet-based reporting tools, fully integrated payment solutions and electronic payments settlement answers across the country and around the world.

Payment Services is a higher growth, higher return line of business for U.S. Bancorp. We will continue to invest in the technology, acquisitions, product development and sales promotion needed to support its continued growth.

There is strong momentum in merchant processing, especially related to our new NOVA processing capabilities in Europe. Both our retail payments and corporate payments businesses are focusing on the expansion of existing relationships with current

customers. Additionally, corporate payment products and merchant processing can provide valuable benefits to middle market and small business companies, and we are increasing penetration of those customer segments for payments and processing services.

We are also investing in the hardware and technology to expand and enhance our network of U.S. Bank ATMs. Our newest generation of ATMs are among the most highly functional in the industry, with vivid, striking graphics and transaction screens and customization capabilities so that customers’ transactions are faster, easier and individualized.

THE PRIVATE CLIENT GROUP,

TRUST & ASSET MANAGEMENT

U.S. Bancorp understands what it takes to build, manage and preserve our clients’ wealth. From sensitive and personalized family financial management and estate planning to sophisticated corporate trust transactions to expert advice on investments, we prepare clients for today’s realities and tomorrow’s goals.

KEY BUSINESS UNITS

•The Private Client Group |

•Corporate Trust Services |

•Institutional Trust & Custody |

•U.S. Bancorp Asset Management, Inc. |

•U.S. Bancorp Fund Services, LLC |

The Private Client Group works with affluent individuals and families, professional service corporations and non-profit organizations as a bank within a bank, providing tailored programs to meet specialized needs. Recognizing that many more U.S. Bank customers could benefit from the financial planning, investment management, personal trust and private banking expertise of The Private Client Group, this group is building stronger bank-wide partnerships with other U.S. Bank lines of business to identify Private Client Group referral opportunities.

Built on our strong technology platform and superior management, Corporate Trust Services is leveraging its distribution and scale following our two most recent acquisitions. We reported to you last year about our acquisition of the State Street corporate trust business, and in June 2004 we completed the acquisition of National City’s corporate trust division, a transaction that brought

the bank $34 billion in assets under administration and 3,800 corporate clients throughout the Midwest. It is our sixth corporate trust acquisition since 1999, reflecting our approach of acquisitions to grow revenue and businesses capable of competing with anyone.

U.S. Bancorp Asset Management, Inc., a subsidiary of U.S. Bank National Association, serves as the investment advisor to the First American Funds. It provides investment management services to individuals and institutions including corporations, foundations, pension funds, public funds, and retirement plans. The firm has offices in 24 states. Asset Management distribution is expanding through increased penetration of the Institutional Market and third-party distribution. In 2004, U.S. Bancorp Asset Management launched two new mutual funds—the First American Inflation Protected Securities Fund and the First American U.S. Treasury Money Market Fund. A retirement (R) share class was also added to a number of funds in the fund family.

CONSUMER

BANKING

Our customers want convenience, accessibility, quality products and outstanding service. Our distribution channels—full-service banking offices, ATMs, telephone banking, and internet banking—deliver the deposit, credit, mortgage, investment and insurance products that support the goals and visions of personal and small business customers.

Business momentum in Consumer Banking is strong, and we continue to invest in technologies and initiatives that enhance distribution and deliver on customer expectations.

Customer satisfaction remains our top priority, and new Consumer Banking product initiatives are positively impacting customer satisfaction. Enhancements to internet banking on usbank.com, again ranked number one by Speer and Associates, provide even greater flexibility, customization and functionality.

Significant investment in innovative image technology enables U.S. Bank Internet Banking customers to instantly view more than 3.5 million check and deposit slip images per month on their computer screens. A wide range of operational procedures have also been simplified and streamlined.

KEY BUSINESS UNITS

•24-Hour Banking & | •Investments and | |||||

| Financial Sales | Insurance | |||||

| • | Business Equipment Finance | • | Metropolitan Branch Banking | |||

| • | Community Banking | • | Small Business Banking | |||

| • | Consumer Lending | • | SBA Division | |||

| • | Home Mortgage | • | Workplace and Student Banking | |||

| • | In-store and Corporate | |||||

| On-site Banking | ||||||

We continue to expand our unique Checking That Pays® rewards program, which gives customers who use their U.S. Bank Visa® Check Card the choice of four different reward options. In 2004, U.S. Bank rewarded customers more than $26 million in annual cash rebates, five times the $5 million rewarded in 2000.

| OUR IN-STORE BANKING NETWORK CONTINUES TO GROW |

| Our in-store branch network—the third largest in the industry—delivers all the access of traditional branches to our customers inside grocery and convenience stores. Building on the tremendous success of this lower cost distribution channel, last year U.S. Bank began a major expansion of in-store branches in fast-growing markets such as Arizona, California, Nevada and Utah. These new branches continue to exceed expectations for profitability. |

| In 2003, we opened six new Nashville Publix and 32 new Safeway, Vons, Smith’s, Pak N Save and Pavilion branches, plus additional branches with other valued partners. We continued to grow in 2004, opening 112 new in-store branches. By the end of 2005, U.S. Bank will have opened 185 new in-store branches as part of the newest expansion initiative, for a total overall of 478 in-store branches in 19 states. |

| INITIATIVES FOR SUCCESS |

| INVESTING |

| IN OUR COMPANY FOR GROWTH AND SERVICE Increasing our ability to provide better customer service, offer new customer options, and develop and deliver new products keeps us ahead of the curve and ahead of the competition. |

MARKET PENETRATION

In Consumer Banking, we have improved our automated capability to identify product recommendation and customer service opportunities at the individual customer level so we can provide more personalized service and recommend the most appropriate products.

In Corporate Payment Systems, we are dedicating resources to build middle market relationships. We have redesigned and simplified processes, applications and contracts and have been pursuing new client categories among companies with annual sales between $20 and $500 million. Our new One Card for the middle market combines the best features from our corporate and purchasing cards into one easy-to-manage program.

NOVA’s new Electronic Check Service processing streamlines check acceptance and mitigates risk for our customers so they can accept checks as safely and easily as card payment alternatives.

Gift card industry sales reached $45 billion in 2003 and are forecast to double by 2007. NOVA’s growing gift card program meets the needs of merchants in a cost-effective manner, and NOVA gift cards are processed using the same point-of-sale systems used for credit and debit card processing, further controlling costs.

14U.S. BANCORP

The Private Client Group has several initiatives in progress which leverage the franchise to develop new client relationships. Our focus is on building stronger internal partnerships with other U.S. Bancorp lines of business. We recognize that many customers already doing business with U.S. Bank could benefit from the comprehensive and specialized expertise of our Financial Planning, Private Banking, Personal Trust, Investment and Insurance experts in The Private Client Group.

Retail Payment Solutions has increased penetration of personal and small business checking account customers with U.S. Bank-branded credit and debit cards by investing in sales and training opportunities with our expanded branch network.

services. SinglePointSM allows business customers to access information and reports, initiate and manage ACH transactions and wires, view check and deposit images and manage check fraud programs at one source.

We have upgraded and image-enabled key lockbox sites for both wholesale and retail payment processing, and introduced a suite of check conversion products and services including On-Site Electronic Deposit and Electronic Cash Letter.

Institutional Trust has launched Health Savings Accounts (HSA) to client companies. HSAs are tax-exempt trust or custodial accounts to be used exclusively for future medical expenses. Similar to IRAs, they are special tax-sheltered savings accounts for medical bills for those employees who qualify.

| Our new generation of ATMs integrates customization and information delivery with ATM transactions. Customers will have access to personalized messages, customized “fast cash” preferences, and more. These ATMs provide a faster, easier to use, and more personal experience. |

| We are leveraging our expertise in Commercial Real Estate financing and capitalizing on an improving economy by opening new Commercial Real Estate offices in Phoenix, Dallas and Washington, D.C. Offering our clients greater investment choice, The Private Client Group launched Mutual Fund Open Architecture in 2004, allowing clients to access investments that complement our proprietary funds. We will continue to strategically expand Open Architecture. Retail Payment Solutions successfully entered the affinity debit and credit card market in June 2004. With a potential partner base of 7,000 or more across the country, growth prospects are excellent. U.S. Bancorp’s Elan Financial Services division now offers prepaid card processing for its financial institution clients, providing the ability for these clients to offer payroll cards and to offer or purchase gifts cards. MARKET DEVELOPMENT Our Asset Management business is performance driven, and on this foundation, we have created investment products attractive not only to our own investors, but also products that will be competitive and attractive in third party retail and institutional distribution. We will expand into these new distribution channels in 2005. U.S. Bancorp Fund Services (USBFS), long a recognized administrator for U.S.-based mutual funds, is gaining name recognition and reputation as a third party outsourcing administrator in the alternative investment industry as well. USBFS has made investments in the specialized technology and accounting systems to support servicing both the simple and complex investments held by hedge funds. NOVA continues its merchant processing expansion in Europe through its EuroConex business, headquartered in Ireland. Growing through acquisitions and alliances, EuroConex now supports more than 100,000 merchants across eight European countries. As a specialized business with notable competitive advantages, and one that benefits from economies of scale, we see considerable potential for further European expansion. NOVA also launched a Canadian merchant processing product in October 2004. We anticipate that many current U.S. customers will consolidate their U.S. and Canadian merchant processing with NOVA and that Canadian merchants will switch from fragmented processing systems to NOVA as a single source of top-rated processing and customer service. |

FORWARD-LOOKING STATEMENTSThis Annual Report and Form 10-K contains forward-looking statements. Statements that are not historical or current facts, including statements about beliefs and expectations, are forward-looking statements. These statements often include the words “may,” “could,” “would,” “should,” “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” “potentially,” “probably,” “projects,” “outlook” or similar expressions. These forward-looking statements cover, among other things, anticipated future revenue and expenses and the future prospects of U.S. Bancorp. Forward-looking statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated, including the following, in addition to those contained in U.S. Bancorp’s reports on file with the SEC: (i) general economic or industry conditions could be less favorable than expected, resulting in a deterioration in credit quality, a change in the allowance for credit losses, or a reduced demand for credit or fee-based products and services; (ii) changes in the domestic interest rate environment could reduce net interest income and could increase credit losses; (iii) inflation, changes in securities market conditions and monetary fluctuations could adversely affect the value or credit quality of our assets, or the availability and terms of funding necessary to meet our liquidity needs; (iv) changes in the extensive laws, regulations and policies governing financial services companies could alter our business environment or affect operations; (v) the potential need to adapt to industry changes in information technology systems, on which we are highly dependent, could present operational issues or require significant capital spending; (vi) competitive pressures could intensify and affect our profitability, including as a result of continued industry consolidation, the increased availability of financial services from non-banks, technological developments or bank regulatory reform; (vii) changes in consumer spending and savings habits could adversely affect our results of operations; (viii) changes in the financial performance and condition of our borrowers could negatively affect repayment of such borrowers’ loans; (ix) acquisitions may not produce revenue enhancements or cost savings at levels or within time frames originally anticipated, or may result in unforeseen integration difficulties; (x) capital investments in our businesses may not produce expected growth in earnings anticipated at the time of the expenditure; and (xi) acts or threats of terrorism, and/or political and military actions taken by the U.S. or other governments in response to acts or threats of terrorism or otherwise could adversely affect general economic or industry conditions. Forward-looking statements speak only as of the date they are made, and U.S. Bancorp undertakes no obligation to update them in light of new information or future events.

U.S. BANCORP17

“We are pleased to tell you that in 2003, we reported record earnings and also achieved the financial results to which we had committed.”MANAGEMENT’S DISCUSSION AND ANALYSIS

f e l l o ws h a r e h o l d e r s :

Strong financial results. U.S. Bancorp delivered strong financial results in 2003, the culmination of five years of transformation and integration, during which we forged a company uniquely positioned to generate consistent earnings and revenue growth.

Growing U.S. Bancorp. With virtually all integration and merger-related activities behind us, we are now focused solely on growing U.S. Bancorp by leveraging the breadth and depth of the powerful franchise we have built. Our five-year transformation allowed us to gain access to high-growth markets, to solidify strong regional positions and to build a national platform. During our integration process, we accelerated our cost control leadership. We are now extending that cost and execution leadership, as well as making significant strategic investments in our highest-potential businesses, and reaffirming our focus on delivering high-quality service.

Achieving our goals to build a stronger corporation. I am pleased to tell you that U.S. Bancorp accomplished the performance, credit quality and other goals we had previously committed to achieving. We met financial objectives — in particular, revenue growth, expense management, net interest margin and earnings per share.

In addition, and perhaps most importantly, we continue to show improvement in overall credit quality, a direct result of all we have done in the past two years to reduce this corporation’s risk profile. We also completed the spin-off of Piper Jaffray, further reducing risk and volatility in our business. Finally, we began a major expansion of our distribution channels in fast-growing markets within our franchise through the previously announced in-store branch partnerships with Safeway/Vons, Smith’s and Publix.

140 years of creating value for shareholders. We have targeted returning 80 percent of our earnings to shareholders through a combination of dividends and share repurchases.

The 17 percent common stock dividend increase approved by our Board of Directors and announced in December 2003 is a continuation of a long history of paying significant dividends, as well as a reflection of the Board’s confidence in this corporation’s future success.

U.S. Bancorp, through its predecessor companies, has increased its dividend in each of the past 32 years and has paid a dividend for 140 consecutive years.

In addition to the common stock dividend discussed above, as part of the December 2003 spin-off of Piper Jaffray, U.S. Bancorp distributed common shares of the new Piper Jaffray Companies in the form of a special dividend to eligible U.S. Bancorp shareholders.

Also in December 2003, our Board of Directors approved authorization to repurchase 150 million shares of outstanding U.S. Bancorp common stock during the next two years.

These specific steps were undertaken to increase the value of your shares; in addition, we manage this corporation with the long-term value of your investment as our paramount objective. It’s the reason we come to work each day.

Sincerely,

Jerry A. GrundhoferChairman, President and Chief Executive OfficerU.S. BancorpFebruary 27, 2004

c o r p o r a t eg o v e r n a n c e

Good corporate governance promotes ethical business practices, demands meticulous accounting policies and procedures and includes a structure with effective checks and balances. Corporate governance is vital to the continued success of U.S. Bancorp and the entire financial services industry. Our ethical standards have rewarded us with an enviable reputation in today’s marketplace — a marketplace where trust is hard to earn. Our shareholders, customers, communities and employees demand — and deserve — to do business with companies they can trust. U.S. Bancorp operates with uncompromising honesty and integrity. Our Board of Directors has had a Corporate Governance Committee for many years. We have implemented Corporate Governance Guidelines in response to today’s heightened concern. Our Corporate Governance Guidelines are available for you to view on our Internet web site at usbank.com. Following are some of the important elements of our Corporate Governance practices.

Independent oversight. Each of our Audit Committee, Compensation Committee and Governance Committee is composed entirely of independent outside directors. In fact, following our annual meeting, our Chairman, President and Chief Executive Officer will be the only member of our Board of Directors who is not independent. In addition, our Board of Directors and the committees of the Board meet in “executive session” without management in attendance at every meeting. The presiding director at every executive session of the Board is an independent director. The Board and each committee also have express authority to engage outside advisors to provide additional independent expertise for their deliberations.

Board of Directors’ focus on U.S. Bancorp.To ensure that our directors are able to focus effectively on our business, we limit the number of other public company boards a director may serve on to three. The Chairman, President and Chief Executive Officer of U.S. Bancorp serves on only two other public company boards. Audit Committee members may serve on no more than three other public company audit committees, and the chairman of the Audit Committee serves on no other audit committees.

Board of Directors’ knowledge and expertise.All of our directors are skilled business leaders. Directors are encouraged to attend continuing director education seminars in order to keep a sharp focus on current good governance practices. In addition, the Board and each committee may use outside advisors to add expertise on specific issues. Our directors have full and

unrestricted access to our management and employees. Additionally, key members of management attend Board meetings from time to time to present information about the results, plans and operations of their business segments. The Board and each committee perform annual self-evaluations in order to assess their performance and to ensure that the Board and committee structure is providing effective oversight of corporate management. You may review the charters of each of our Board committees on our Internet web site at usbank.com.

Management’s ownership commitment. We understand clearly that U.S. Bancorp shareholders are the primary beneficiaries of management’s actions. All U.S. Bancorp executive officers and directors own shares of company stock, and in order to tightly align management’s interests with those of our shareholders, we have established stock ownership guidelines for our executive officers.

Disclosure controls.We have established rigorous procedures to ensure that we provide complete and accurate disclosure in our publicly filed documents. We have also established a telephone hotline for employees to anonymously submit any concern they may have regarding corporate controls or ethical breaches. Management investigates all complaints and directs to our Audit Committee any issues relating to concerns about our financial statements or public disclosures.

U.S. Bancorp Code of Ethics and Business Conduct.Each year, we reiterate the vital importance of our Code of Ethics and Business Conduct. The Code applies to directors, officers and all employees, who must certify annually their compliance with the standards of the Code. The content of the Code is based not solely on what we have the right to do, but, even more importantly, on what is the right thing to do. Our standards are higher than any legal minimum because our business is built on trust. You may review our Code of Ethics and Business Conduct on our Internet web site at usbank.com.

Communications with our Board of Directors.Shareholders can communicate with our Board of Directors by sending a letter addressed to the Board of Directors, the independent outside directors or specified individual directors, to:

The Office of the Corporate SecretaryU.S. Bancorp800 Nicollet MallMinneapolis, MN 55402

s e r v i c ee x c e l l e n c e

Great service is more than our goal; it’s the way we do business. Every U.S. Bancorp employee in every U.S. Bancorp line of business is committed to providing responsive, prompt and helpful service - every transaction, every relationship, every day. And our exclusive Five Star Service Guarantee backs up our promise to deliver the outstanding service our customers expect and deserve.

Five Star Service Guarantee ensures highest level of service. Exceptional service is the single most important thing U.S. Bank offers our customers. We make a promise to deliver the highest level of customer service and we boldly back up this pledge with the U.S. Bank Five Star Service Guarantee, which ensures the core service standards most important to our customers — such as availability, accuracy, timeliness and responsiveness — are met and exceeded. Every U.S. Bank customer is covered by one or more guarantees. If we fall short in keeping our service guarantees, and our customer tells us they did not get the service they expected and deserved, we pay the customer for the inconvenience.

Taking ownership of our business one employee at a time. Each line of business has developed and adapted its own Five Star Service Guarantee, defining the quality standards that are expected and demanded of every employee — standards that are based on meeting the diverse financial needs of all our customers. U.S. Bank has created an environment in which employees understand how their individual service and sales performance contributes to revenue growth and

shareholder value. It is an environment where employees take ownership of their business, where they are held accountable for the company’s success and where they are compensated for measurable performance results.

Service is foundation of success.U.S. Bank employees are recognized and rewarded for their outstanding service. Our Pay for Performance compensation program rewards employees financially and personally for their achievements in meeting service and sales goals and for their contributions to company earnings. Customized line of business incentive programs drive employees to generate revenue while fulfilling customers’ needs. Each quarter, 20 selected employees who exemplify our high service standards are inducted into the prestigious Circle of Service Excellence.

The Service Advantage puts customers at center of everything we do.To deepen our commitment to superior service, in 2003, we launched The Service Advantage, an innovative internal initiative designed to increase customer access and convenience; simplify customer issue solutions; make quality service central to hiring, orientation and training; and improve the common customer experience. Our Service Council is the driving force behind The Service Advantage; it is comprised of senior managers from every line of business who identify areas of improvement, analyze customer satisfaction measurements and implement resolutions that create greater customer satisfaction and loyalty. We are enhancing existing and creating new internal service techniques and processes, as well, so that our frontline employees have the tools and support they need to better meet customer expectations. By the end of first quarter 2004, every U.S. Bank employee will have received personalized training on the core principles of The Service Advantage.

Cacique® is the #1 selling brand of Hispanic-style cheeses and creams in the world. For over three decades, the family owned and operated company has produced authentic cheeses, creams and chorizos, growing from a small, abandoned facility to one of the world’s most sophisticated cheese manufacturing facilities. Cacique is committed to quality, heritage and tradition, sharing this legacy with the community through a long history of philanthropy, including Fighting Diabetes Together, a recent collaboration with City of Hope®. U.S. Bank Commercial Banking partners with Cacique to provide flexible, competitive products to meet the financial needs of this unique company.

U.S. Bancorp meets the diverse financial needs of our customers by providing innovative, creative answers through specialized lines of business. Across 24 states and beyond, our experienced bankers share ideas, best practices, capabilities and cross-sell opportunities, supported by advanced technology and operating systems. The results are competitive benefits for our customers and competitive advantages for U.S. Bancorp.

l i n e so fb u s i n e s s

KEY BUSINESS UNITS

Wholesale Banking offers strategic lending, depository, treasury management and other financial services to middle market, large corporate, financial institution and public sector customers. Experienced, accessible relationship managers serve as our customers’ link to all the products, credit, support and resources that the extensive scope of U.S. Bancorp provides.

S U C C E S S E S

|

KEY BUSINESS UNITS

Our uniquePayment Servicesbusiness specializes in credit and debit cards, commercial card services, business-to-business payment and ATM and merchant processing. Customized products delivered through leading-edge technology channels equip consumers, small businesses, merchants of every size, government entities, large corporations, financial institutions and co-brand partners with the most advanced payment services tools available.

S U C C E S S E S

KEY BUSINESS UNITS

Private Client, Trust & Asset Managementmeets diverse wealth management needs through best-in-class personal trust, corporate trust, institutional trust and custody, private banking, financial advisory, investment management and mutual fund and alternative investment product services. Expert advisers and relationship managers offering sophisticated knowledge and personalized service give U.S. Bank a competitive advantage.

S U C C E S S E S

Our industry-leadingConsumer Bankingdelivers a full range of products and services to the broad consumer market and small businesses through full-service banking offices, ATMs, telephone customer service and telesales, online banking and direct mail. A disciplined sales culture, optimal distribution channel convenience and a mandate for quality service are the hallmarks of Consumer Banking.

S U C C E S S E S

KEY BUSINESS UNITS

U.S. Bancorp strategically invests in the distribution channels, lines of business and markets with high potential for growth. These investments take full advantage of the existing resources, capabilities and national platforms we have built, enhancing our core geography and increasing customer convenience with moderate expenditure and low risk to the company.

i n v e s t i n gi nd i s t r i b u t i o na n ds c a l e

Distribution channels deliver anytime access. Our distribution channels — including 2,243 branch banking offices in 24 states, 4,425 U.S. Bank ATMs, 24-hour call center service, U.S. Bank Internet Banking and specialized trust, brokerage and home mortgage offices — form the foundation of our powerful presence in many of the country’s high-growth, diversified markets. Our growing branch network operates in three strategically segmented formats. Community Banking delivers our full range of products and services in smaller, non-urban communities through the local office. Metropolitan Banking serves branch customers in larger and urban locations as a separate line of business through partnerships with all businesses of the bank. Our highly successful In-store Banking operates branches inside grocery stores, colleges and universities, workplaces, retirement centers and other high-traffic locations.

Expanding in-store banking office distribution.In 2003, we began a major expansion of our in-store network — the third largest in the country — by partnering with supermarket retailers Safeway Inc., Publix and Smith’s Food & Drug Stores. Beginning with six new Nashville Publix branches in 2003, by the end of 2004, U.S. Bank will have opened 15 new Smith’s in-store branches in Utah, and by the end of 2005 we will have opened a total of 163 new full-service in-store locations in Safeway and Vons stores throughout California, Arizona and Nevada.

Strategic investments solidify our position in high-growth markets and businesses.In 2003, U.S. Bank completed system conversions resulting from the 2002 purchase and deposit assumption of 57 Bay View Bank branches in California. This transaction strengthened the U.S. Bank geographic footprint in California, adding to existing U.S. Bank branches to create an integrated network offering complete coverage of the fast-growing Greater Bay area- San Francisco, San Jose, Alameda County, Contra Costa County, Santa Rosa, Vallejo-Fairfield-Sonoma and Santa Cruz.

In 2003, U.S. Bank also completed system conversions resulting from the purchase of State Street Corporate Trust in 2002. This transaction strongly complemented our existing corporate trust business, making U.S. Bank the leading corporate trust provider in New England in addition to our current lead status in the Northwest, West and Central regions of the country.

With over thirty-five years of experience, Millennium Development Corp. has invested in and developed a wide variety of real estate projects ranging from agricultural land to office buildings to shopping centers. As an equity participant in each project, Millennium Development Corp. is committed to preserving capital and producing an attractive return on investment. For more than 10 years, U.S. Bank Small Business Banking has provided the cash flow management, credit and financing resources that support Millennium Development’s business vision.

a t t r a c t i v eb u s i n e s sm i x

The sports, educational and cultural programs of the Mathews-Dickey Boys’ & Girls’ Club in St. Louis instill “The Three R’s: Respect, Restraint & Responsibility” within more than 40,000 deserving young men and women each year. In 1982, President Ronald Reagan recognized the Club’s neighbor-helping neighbor concept by declaring it a model for the country. Numerous other government, media, sports and civic luminaries have applauded the 44-year-old organization’s impact in keeping more than one million youth on the fields, in the classroom and off the streets. We’ve enjoyed a successful relationship with Mathews-Dickey, a long-time client of the U.S. Bank Private Client Group. We are proud to manage the Endowment Fund for Mathews- Dickey to support its youth-enrichment programs for years to come.

U.S. Bancorp serves multiple customer segments in our 24-state footprint through a broad, attractive business mix with scale, resulting in competitive advantages, operating economies, reduced risk, diversified revenue streams and a wide range of ways to satisfy every customer.

U.S. Bancorp has a very attractive growth franchise.Our core regional businesses operate in our 24-state footprint and benefit from the geographic density of our banking locations and franchise support in terms of cross-sell, crossservicing and back-office support. Our top-performing regional businesses, combined with our specialized national-scale businesses, create a diversified and advantaged revenue mix of both spread and fee income from discrete sources. With challenge, opportunity, risk and reward spread across all geographic markets and a wide range of customer and business segments, we are positioned to capitalize on a recovering economy, while tolerating individual market or industry weaknesses.

Improving business unit trends. We see strong business momentum in Consumer Banking; we opened nearly a quarter of a million more checking accounts than were closed in 2003. A checking account is our retail customers’ primary link to U.S. Bank and is the basis for our 11.7 percent compound annual growth rate in branch-generated average low-cost core deposits. More importantly, checking is the starting point for expanded consumer relationships, reflected in a 12 percent compound annual growth rate in branch-generated average retail loans. Small business loans and branch-based investment product fee income also showed double-digit growth rates.

Our investment in distribution in high-growth markets continues, most particularly our current in-store branch expansion and our extension of mortgage banking origination capabilities in western markets.

In our Wholesale Banking business, the timing of commercial loan growth is still uncertain; however, we expect credit improvement trends to continue, a key driver of future growth. Along with loan generation, our relationship managers are putting renewed focus on providing appropriate supplementary services and deposit products to our commercial customers.

Improving equity markets are driving growth in our Private Client, Trust & Asset Management business units, as are outstanding service and our exceptional personal attention to each customer. Deposits, total loans and noninterest income are on upward trends. We strive to increase the level and breadth of services we provide to corporate executives, business owners, legal and healthcare professionals, professional athletes and non-profit organizations with their specialized and complex financial needs. Private Client Group earns an increasing share of wallet through expert investment management, financial planning, personal trust and private banking services. Institutional investment needs are met with high-performing securities lending, equity, fixed income and cash products.

Revenue byBusiness Segment

15.1% Metropolitan Banking11.9% Community Banking10.3% Retail Payment Solutions 6.7% Corporate Banking 6.2% NOVA Information Systems 5.5% Middle Market Banking 4.9% Mortgage Banking 4.3% Consumer Lending 3.9% Private Client Group 3.4% Commercial Real Estate 2.5% Corporate Trust 2.0% Government Banking 1.9% Asset Management 1.9% Corporate Payment Systems 1.1% Institutional Trust .7% Fund Services

DiversifiedRegional Businesses

Consumer Banking

Institutional Trust

Middle Market Banking

Private Client Group

With top-ranked payment services, expertise in highly specialized businesses, advanced technological capabilities and financial products and services not limited by location, U.S. Bancorp has built a national standing in a number of high-growth businesses.

h i g h — v a l u en a t i o n a lb u s i n e s s e s

Lockheed Martin Corporation, the world’s premier advanced technology systems integrator, has partnered with U.S. Bank Corporate Payment Systems for ten years, adopting a full range of Corporate Payment Systems services, including corporate travel card and purchasing card programs. As a result of U.S. Bank Corporate Payment Systems’ flexibility and client-focus, Lockheed Martin recently extended its purchasing card commitment with a new five-year contract

Connie Mearkle (left), Assistant Treasurer,and Molly Chung (right), Director,Global Treasury OperationsLockheed Martin CorporationBethesda, MD

Payment Services is a high-value, growth business without boundaries.U.S. Bank has developed innovative payment services to meet the rapidly expanding needs of consumers, businesses, financial institutions, government entities and millions of merchants throughout the world. This line of business has unlimited potential, and we utilize our expertise, technology and reputation for service to seize a growing share of business within this burgeoning arena.

We are the Number 3 merchant processor (NOVA), the Number 1 Visa commercial card issuer, the Number 2 small business card issuer, the Number 7 Visa and MasterCard® consumer card issuer, the Number 2 bank-owned ATM network, the Number 2 universal fleet card (Voyager) and the Number 2 freight payment provider (PowerTrack®).

Through NOVA Information Systems, recognized for superlative customer service and technical proficiency, ourMerchant Processingbusiness ranks third in the nation and serves more than 600,000 merchant locations in the United States and in Europe. We continue to expand this business through penetration of the U.S. Bank customer base of merchants and through ongoing activities, backed by the full resources of U.S. Bancorp, to gain additional merchant customers.

OurRetail Payment Solutions business is unique among large issuers in that we build this business in large part on relationship-based efforts among our retail and small business customers, among our growing network of correspondent financial institutions and with a star-studded roster of co-brand partners. There is enormous potential in the further penetration of our existing customer base and in our ability to stay at the leading edge of new product introductions.

Corporate Payment Systems is at the forefront of payment providers, using leading technology and expertise to automate the entire payment continuum for commercial buyers and sellers. Card solutions like One Card, Corporate Card, Purchasing Card and Fleet Card provide flexible solutions for classic payables, while PowerTrack adds increased control and sophisticated pre-payment audits for complex business-to-business procurement processes.

With a compelling investment in the industry’s best technology, ourTransaction Services is the hub of electronic payments transactions for all U.S. Bancorp ATMs, as well as ATMs, credit and debit cards, merchant processing, and the electronic funds transfer network gateway for other financial institutions, through Elan Financial Services. With expertise, technology, economy of scale and existing potential still within our markets, this is a full-service, start-to-finish business with growth expectation.

Diverse U.S. Bancorp national businesses serve customers coast to coast. U.S. Bank is a leading financial resource for local and state government, political sub-divisions and the federal government through ourGovernment Banking business. We are one of the largest tax payment processors for the U.S. Government, and we provide a wide range of financial services for the Department of Defense, as well as web and lockbox collection services for the U.S. Department of Homeland Security.Mortgage Banking originates loans in all 50 states. We are targeting becoming a Top 10 mortgage provider through expanded sales efforts nationally and also the extension of our Mortgage Banking as a primary line of business into our western markets.

With expertise to support the nation’s largest corporations, specialized industries and our middle market customers,Corporate Banking provides services to meet the most complex transactional, credit, financial management, international financing and exchange, and risk mitigation needs. We are also a national leader in treasury management services. Our relationship-based model succeeds on the experience of our managers, the economies of scope and scale derived from our size and geography and our commitment to cost management. As the leading provider of municipal trust services and a top provider of corporate, escrow and structured finance services,Corporate Trust Services brings an unrelenting commitment to exceeding expectations by providing the right solutions at the right time for customers nationwide.

U.S. Bancorp Asset Management leverages the multiple distribution channels and broad geographic range of U.S. Bank to deliver the First American family of mutual funds, which encompasses a full range of equity and fixed income investment strategies. We are a performance-driven culture of expanding non-proprietary distribution, and we continue to promote U.S. Bancorp Asset Management to prospective customers nationwide.

NationalBusinesses

c o m m u n i t yp a r t n e r s h i p s

Our commitment to helping build strong communities begins with local market leadership and dedicated community involvement. U.S. Bancorp and our employees are committed to giving and volunteerism in the markets we serve. We make this investment proudly, promoting powerful partnerships and fostering economic development in communities, small and large, across the country.

Creating stronger communities for a stronger company. U.S. Bancorp is not just part of the community — we’re a partner in all the communities we serve across the country. Working with people, businesses and non-profit organizations in these local markets, we assist with economic, educational and cultural development. As an active partner, U.S. Bancorp provides superior, competitive products and services to every customer we serve, while offering customized financial solutions to customers and businesses who need assistance overcoming challenging financial situations. By helping to create strong, vibrant communities, U.S. Bancorp is building a healthy marketplace for our company - one community at a time.

Sponsorships support quality of life.The enduring vitality of a community is ultimately in the hands of its artists, athletes, performers, scholars, musicians and the institutions that train, educate, nurture and promote them. We extend sponsorship support to a variety of music, arts, sports and education programs, in addition to many other civic and cultural activities. From county fairs to the performing arts to professional, minor league, collegiate and high school sports, U.S. Bancorp supports a diverse range of opportunities and interests of our customers.

Empowering local leaders. To meet the unique needs of the communities we serve, local leaders are empowered with the autonomy to customize all the resources of U.S. Bancorp for their individual markets. Coupled with the valuable insight of local market leaders, local boards provide further knowledge, expertise and insight into each community’s businesses, industries and important causes. Together, this leadership team is equipped with the first-hand knowledge needed to make strategic pricing and business development decisions that strengthen both U.S. Bancorp and the community.

Investing in our employees. The U.S. Bancorp Development Network promotes the personal and professional development of our employees by enhancing leadership, management and communication skills; organizing networking opportunities; providing community involvement opportunities; and encouraging and capitalizing on the diversity of our employees. The Development Network is composed of 42 geographically based chapters, which share these objectives and fulfill the program’s mission by organizing professional and community service activities, such as financial and leadership seminars for employees, mentoring opportunities, charitable fundraising drives and more.

U.S. Bank gives “Back 2 Schools in Minnesota.” U.S. Bank is investing nearly $500,000 in programs that support Minnesota teachers, high schools and students during the 2003-2004 school year. Designed to enrich student learning, recognize outstanding high school students and assist school athletic programs, Back 2 Schools is part of the ongoing investment U.S. Bank makes in Minnesota schools. Cynthia Welsh, teacher at Cloquet High School, has developed an interactive science discovery class using the funds she received from a U.S. Bank Back 2 Schools grant. Cynthia and her students collaborate with the Fond du Lac Band of Lake Superior Chippewa and other local scientists conducting environmental research that benefits the entire community.

OVERVIEW

In 2003,2004, U.S. Bancorp and its subsidiaries (the “Company”) achieved each of the goals outlined for the year despite challenging economic conditions in early 2003.continued to demonstrate its financial strength and shareholder focus. We began the year with several specific financial objectives. The first goal was toa focus on organic revenue growth. In 2003,While growth in net interest income has been challenging for the Company’sbanking industry due to rising interest rates and sluggish commercial loan growth, the Company experienced strong growth in its fee-based revenues, particularly in payment processing services. The Company generated fee-based revenue growth of 3.911.0 percent included 3.7 percentin 2004. By year-end, commercial loan balances also displayed encouraging trends as the Company experienced its first year-over-year growth in quarterly average balances since mid-2001. Retail loans continued to display strong growth in 2004. In 2005, the Company will continue to focus on revenue from baselinegrowth driven by disciplined strategic business productsinitiatives, customer service and services.an emphasis on payment processing, retail banking and commercial lending. The second goal was to continue improving our operating leverage. During 2003, our efficiency ratio improved to 45.6 percent compared with 48.8 percent in 2002. Third, the Company was determined to continue improving its credit quality and reduceof our loan portfolios. During the overall risk profile of the organization. Nonperformingyear nonperforming assets have declined 16.434.8 percent from a year ago and total net charge-offs decreased to 1.06.63 percent of average loans outstanding in 20032004, compared with 1.201.06 percent in 2002. Finally, despite2003. By year end 2004, the challengescredit risk profile of 2003, the Company had improved to pre-2001 levels. In 2005, the Company will continue to focus on credit quality and minimizing volatility of credit-related losses. Finally, effectively managing costs is always desiresa goal for the Company. During 2004, our efficiency ratio (the ratio of noninterest expense to grow revenues faster than expenses.taxable-equivalent net revenue excluding net securities gains or losses) improved to 45.3 percent, compared with 45.6 percent in 2003, and continues to be a leader in the banking industry. The Company’s results for 20032004 reflect the achievement of this objective.these operating objectives and help to position the Company to achieve its long-term goal of 10 percent or greater growth in earnings per diluted share.

Earnings SummaryThe Company reported net income of $3.7$4.2 billion in 2003,2004, or $2.18 per diluted share, compared with $3.7 billion, or $1.93 per diluted share, compared with $3.2 billion, or $1.65in 2003. The 13.0 percent increase in earnings per diluted share principally reflected growth in 2002.fee-based revenues and lower credit costs. Return on average assets and return on average equity were 2.17 percent and 21.4 percent, respectively, in 2004, compared with returns of 1.99 percent and 19.2 percent, respectively, in 2003, compared with returns of 1.84 percent and 18.3 percent, respectively, in 2002.2003. Net income in 2003 included after-tax income from discontinued operations of $22.5 million, or $.01 per diluted share, compared with an after-tax loss of $22.7 million, or $.01 per diluted share, in 2002. Included in net income for 2002 was an after-tax goodwill impairment charge of $37.2 million, or $.02 per diluted share, primarily related to the purchase of a transportation leasing company in 1998 by the equipment leasing business. This charge was taken at the time of adopting new accounting standards related to goodwill and other intangible assets and was recognized as a “cumulative effect of accounting change” in the income statement. Refer to Note 2 of the Notes to Consolidated Financial Statements for further discussion of the impact of changes in accounting principles.share.

changes in interest rates and related prepayments. Refer to “Merger and Restructuring-Related Items” for further discussion on merger and restructuring-related items and the related earnings impact.

| Table 1 | Selected Financial Data |

| Year Ended December 31 | Year Ended December 31 | Year Ended December 31 | ||||||||||||||||||||||||||||||||||||||||

| (Dollars and Shares in Millions, Except Per Share Data) | (Dollars and Shares in Millions, Except Per Share Data) | 2003 | 2002 | 2001 | 2000 | 1999 | (Dollars and Shares in Millions, Except Per Share Data) | 2004 | 2003 | 2002 | 2001 | 2000 | ||||||||||||||||||||||||||||||

Condensed Income Statement | Condensed Income Statement | Condensed Income Statement | ||||||||||||||||||||||||||||||||||||||||

| Net interest income (taxable-equivalent basis) (a) | Net interest income (taxable-equivalent basis) (a) | $ | 7,217.5 | $ | 6,847.2 | $ | 6,405.2 | $ | 6,072.4 | $ | 5,875.7 | Net interest income (taxable-equivalent basis) (a) | $ | 7,139.9 | $ | 7,217.5 | $ | 6,847.2 | $ | 6,405.2 | $ | 6,072.4 | ||||||||||||||||||||

| Noninterest income | Noninterest income | 5,068.2 | 4,910.8 | 4,340.3 | 3,958.9 | 3,501.9 | Noninterest income | 5,624.1 | 5,068.2 | 4,910.8 | 4,340.3 | 3,958.9 | ||||||||||||||||||||||||||||||

| Securities gains, net | 244.8 | 299.9 | 329.1 | 8.1 | 13.2 | |||||||||||||||||||||||||||||||||||||

| Securities gains (losses), net | Securities gains (losses), net | (104.9 | ) | 244.8 | 299.9 | 329.1 | 8.1 | |||||||||||||||||||||||||||||||||||

| Total net revenue | 12,530.5 | 12,057.9 | 11,074.6 | 10,039.4 | 9,390.8 | Total net revenue | 12,659.1 | 12,530.5 | 12,057.9 | 11,074.6 | 10,039.4 | |||||||||||||||||||||||||||||||

| Noninterest expense | Noninterest expense | 5,596.9 | 5,740.5 | 6,149.0 | 4,982.9 | 5,131.8 | Noninterest expense | 5,784.5 | 5,596.9 | 5,740.5 | 6,149.0 | 4,982.9 | ||||||||||||||||||||||||||||||

| Provision for credit losses | Provision for credit losses | 1,254.0 | 1,349.0 | 2,528.8 | 828.0 | 646.0 | Provision for credit losses | 669.6 | 1,254.0 | 1,349.0 | 2,528.8 | 828.0 | ||||||||||||||||||||||||||||||

| Income from continuing operations before taxes | 5,679.6 | 4,968.4 | 2,396.8 | 4,228.5 | 3,613.0 | Income from continuing operations before taxes | 6,205.0 | 5,679.6 | 4,968.4 | 2,396.8 | 4,228.5 | |||||||||||||||||||||||||||||||

| Taxable-equivalent adjustment | Taxable-equivalent adjustment | 28.2 | 32.9 | 54.5 | 82.0 | 94.2 | Taxable-equivalent adjustment | 28.6 | 28.2 | 32.9 | 54.5 | 82.0 | ||||||||||||||||||||||||||||||

| Applicable income taxes | Applicable income taxes | 1,941.3 | 1,707.5 | 818.3 | 1,422.0 | 1,296.3 | Applicable income taxes | 2,009.6 | 1,941.3 | 1,707.5 | 818.3 | 1,422.0 | ||||||||||||||||||||||||||||||

| Income from continuing operations | 3,710.1 | 3,228.0 | 1,524.0 | 2,724.5 | 2,222.5 | Income from continuing operations | 4,166.8 | 3,710.1 | 3,228.0 | 1,524.0 | 2,724.5 | |||||||||||||||||||||||||||||||

| Discontinued operations (after-tax) | Discontinued operations (after-tax) | 22.5 | (22.7 | ) | (45.2 | ) | 27.6 | 17.9 | Discontinued operations (after-tax) | — | 22.5 | (22.7 | ) | (45.2 | ) | 27.6 | ||||||||||||||||||||||||||

| Cumulative effect of accounting change (after-tax) | Cumulative effect of accounting change (after-tax) | — | (37.2 | ) | — | — | — | Cumulative effect of accounting change (after-tax) | — | — | (37.2 | ) | — | — | ||||||||||||||||||||||||||||

| Net income | $ | 3,732.6 | $ | 3,168.1 | $ | 1,478.8 | $ | 2,752.1 | $ | 2,240.4 | Net income | $ | 4,166.8 | $ | 3,732.6 | $ | 3,168.1 | $ | 1,478.8 | $ | 2,752.1 | |||||||||||||||||||||

Per Common Share | Per Common Share | Per Common Share | ||||||||||||||||||||||||||||||||||||||||

| Earnings per share from continuing operations | Earnings per share from continuing operations | $ | 1.93 | $ | 1.68 | $ | .79 | $ | 1.43 | $ | 1.16 | Earnings per share from continuing operations | $ | 2.21 | $ | 1.93 | $ | 1.68 | $ | .79 | $ | 1.43 | ||||||||||||||||||||

| Diluted earnings per share from continuing operations | Diluted earnings per share from continuing operations | 1.92 | 1.68 | .79 | 1.42 | 1.15 | Diluted earnings per share from continuing operations | 2.18 | 1.92 | 1.68 | .79 | 1.42 | ||||||||||||||||||||||||||||||

| Earnings per share | Earnings per share | 1.94 | 1.65 | .77 | 1.44 | 1.17 | Earnings per share | 2.21 | 1.94 | 1.65 | .77 | 1.44 | ||||||||||||||||||||||||||||||

| Diluted earnings per share | Diluted earnings per share | 1.93 | 1.65 | .76 | 1.43 | 1.16 | Diluted earnings per share | 2.18 | 1.93 | 1.65 | .76 | 1.43 | ||||||||||||||||||||||||||||||

| Dividends declared per share (b) | Dividends declared per share (b) | .855 | .780 | .750 | .650 | .460 | Dividends declared per share (b) | 1.020 | .855 | .780 | .750 | .650 | ||||||||||||||||||||||||||||||

| Book value per share | Book value per share | 10.01 | 9.62 | 8.58 | 8.06 | 7.29 | Book value per share | 10.52 | 10.01 | 9.62 | 8.58 | 8.06 | ||||||||||||||||||||||||||||||

| Market value per share | Market value per share | 29.78 | 21.22 | 20.93 | 23.25 | 21.13 | Market value per share | 31.32 | 29.78 | 21.22 | 20.93 | 23.25 | ||||||||||||||||||||||||||||||

| Average shares outstanding | 1,923.7 | 1,916.0 | 1,927.9 | 1,906.0 | 1,907.8 | |||||||||||||||||||||||||||||||||||||

| Average diluted shares outstanding | 1,936.2 | 1,924.8 | 1,940.3 | 1,918.5 | 1,930.0 | |||||||||||||||||||||||||||||||||||||

| Average common shares outstanding | Average common shares outstanding | 1,887.1 | 1,923.7 | 1,916.0 | 1,927.9 | 1,906.0 | ||||||||||||||||||||||||||||||||||||

| Average diluted common shares outstanding | Average diluted common shares outstanding | 1,912.9 | 1,936.2 | 1,924.8 | 1,940.3 | 1,918.5 | ||||||||||||||||||||||||||||||||||||

Financial Ratios | Financial Ratios | Financial Ratios | ||||||||||||||||||||||||||||||||||||||||

| Return on average assets | Return on average assets | 1.99 | % | 1.84 | % | .89 | % | 1.74 | % | 1.49 | % | Return on average assets | 2.17 | % | 1.99 | % | 1.84 | % | .89 | % | 1.74 | % | ||||||||||||||||||||