Financial information relating to our international operations for the years ended December 31, 2008, 20072011, 2010 and 20062009 is incorporated by reference to “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA — Notes to Consolidated Financial Statements — Note 19”15”.

Executive Officers of the Registrant(1)

The following table sets forth certain information concerning our executive officers on March 14, 2012:

Name | Age | Position | ||

| Paul D. Arling | 49 | Chairman of the Board and Chief Executive Officer | ||

| Paul J.M. Bennett | 56 | Executive Vice President, Managing Director, Europe | ||

| Mark S. Kopaskie | 54 | Executive Vice President, General Manager U.S. Operations | ||

| Richard A. Firehammer, Jr. | 54 | Senior Vice President, General Counsel and Secretary | ||

| Bryan M. Hackworth | 42 | Senior Vice President and Chief Financial Officer |

| (1) | Included pursuant to Instruction 3 to Item 401(b) of Regulation S-K. |

Paul D. Arlingis our Chairman and Chief Executive Officer. He joined us in May 1996 as Chief Financial Officer and was named to our Board of Directors in August 1996. He was appointed President and COO in September 1998, was promoted to Chief Executive Officer in October 2000 and appointed as Chairman in July 2001. At the 2011Annual Meeting of Stockholders, Mr. Arling was re-elected as our Chairman to serve until the 2012 Annual Meeting of Stockholders. From 1993 through May 1996, he served in various capacities at pages 69–70.

Paul J.M. Bennettis www.uei.com. We make available freeour Executive Vice President and Managing Director, Europe. He was our Managing Director and Senior Vice President, Managing Director, Europe from July 1996 to December 2006. He was promoted to his current position in December 2006. Prior to joining us, he held various positions at Philips Consumer Electronics over a seven year period, first as Product Marketing Manager for the Accessories Product Group, initially set up to support Philip’s Audio division, and then as head of charge throughthat division.

Mark S. Kopaskieis our Executive Vice President and General Manager, U.S. Operations. He rejoined us in September 2006 as our Senior Vice President and General Manager, U.S. Operations and was promoted to his current position in December 2006. He was our Executive Vice President and Chief Operating Officer from 1995 to 1997. From 2003 until November 2005, Mr. Kopaskie was President and Chief Executive Officer of Packaging Advantage Corporation (PAC), a personal care and household products manufacturer, which was acquired by Marietta Corporation in November 2005. Following the websiteacquisition, he served as Senior Vice President, Business Development for Marietta Corporation. From 1997 to 2003, he held senior management positions at Birdair Inc., a world leader in the engineering, manufacturing, and construction of tensioned membrane structures, and OK International, a manufacturer and marketer of fluid dispensing equipment, solder and de-solder systems, and wire wrap products. Prior to joining us in 1995, Mr. Kopaskie was Senior Vice President of Operations at Mr. Coffee Inc.

Richard A. Firehammer, Jr., Esq.has been our annual report on Form 10-K,Senior Vice President since February 1999. He has been our quarterly reports on Form 10-Q,General Counsel since October 1993 and Secretary since February 1994. He was our current reports on Form 8-K and any amendmentsVice President from May 1997 until August 1998. He was outside counsel to these reports as soon as reasonably practical after we electronically file such reportsus from September 1998 until being rehired in February 1999. From November 1992 to September 1993, he was associated with the SecuritiesChicago, Illinois law firm, Shefsky & Froelich, Ltd. From 1987 to 1992, he was with the law firm, Vedder, Price, Kaufman & Kammholz in Chicago, Illinois.

Bryan M. Hackworthis our Senior Vice President and Exchange Commission. These reports may be found on our websiteChief Financial Officer. He was promoted to Chief Financial Officer in August 2006. Mr. Hackworth joined us in June 2004 as Corporate Controller and subsequently assumed the role of Chief Accounting Officer in May 2006. Before joining us in 2004, he spent five years at www.uei.com underMars, Inc., a privately held international manufacturer and distributor of consumer products and served in several financial and strategic roles (Controller — Ice Cream Division; Strategic Planning Manager for the caption “SEC Filings” onWHISKAS® Brand) and various other financial management positions. Prior to joining Mars Inc., Mr. Hackworth spent six years at Deloitte & Touche LLP as an auditor, specializing in the Investor page. Investors may also obtain copies of our SEC filings from the SEC website at www.sec.gov.

Forward Looking Statements

We caution that the following important factors, among others (including, but not limited to, factors discussed below in “ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS,” as well as those factors discussed elsewhere in this Annual Report on Form 10-K, or in our other reports filed from time to time with the Securities and Exchange Commission), may affect our actual results and may contribute to or cause our actual consolidated results to differ materially from those expressed in any of our forward-looking statements. The factors included here are not exhaustive. Further, any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for management to predict all such factors, nor can we assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Therefore, forward-looking statements should not be relied upon as a prediction of actual future results.

While we believe that the forward-looking statements made in this report are based on reasonable assumptions, the actual outcome of such statements is subject to a number of risks and uncertainties, including the failure of our markets to continue growing and expanding in the manner we anticipated; the failure of our customers to grow and expand as we anticipated; the effects of natural or other events beyond our control, including the effects aof political unrest, war or terrorist activities may have on us or the economy; the economic environment’s effect on us or our customers; the growth of, acceptance of and the demand for our products and technologies in various markets and geographical regions, including cable, satellite, consumer electronics, retail, digital media/technology, CEDIA, and interactive TV automotive, and cellular industries not materializing or growing as we believed; our inability to add profitable complementary products which are accepted by the marketplace; our inability to attract and retain quality workforce at adequate

levels in all regions of the world, and particularly Asia; our inability to continue to maintain our operating costs at acceptable levels through our cost containment efforts; our inability to realize tax benefits from various tax projects initiated from time to time; our inability to continue selling our products or licensing our technologies at higher or profitable margins; our inability to obtain orders or maintain our order volume with new and existing customers; the possible dilutive effect our stock incentive programs may have on our earnings per share and stock price; our inability to continue to obtain adequate quantities of component parts or secure adequate factory production capacity on a timely basis; and other factors listed from time to time in our press releases and filings with the Securities and Exchange Commission.

Risks Related to Doing Business in the People’s Republic of China

Changes in the policies of the People’s Republic of China (“PRC”) government may have a significant impact upon the business we may be able to conduct in the PRC and the profitability of such business.

Our business operations may be adversely affected by the current and future political environment in the PRC. The PRC has operated as a socialist state since the mid-1900s and is controlled by the PRC’s Communist Party. The Chinese government exerts substantial influence and control over the manner in which we must conduct our business activities. The PRC has only permitted provincial and local economic autonomy and private economic activities since 1988. The government of the PRC has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy, through regulation and state ownership. Our ability to operate in the PRC may be adversely affected by changes in Chinese laws and regulations, including those relating to taxation, labor and social insurance, import and export tariffs, raw materials, environmental regulations, land use rights, property and other matters. Under current leadership, the government of the PRC has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the government of the PRC will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

The PRC’s economy is in a transition from a planned economy to a market oriented economy subject to five-year and annual plans adopted by the government that set national economic development goals. Policies of the PRC government may have significant effects on the economic conditions of the PRC. The PRC government has confirmed that economic development will follow the model of a market economy. Under this direction, we believe that the PRC will continue to strengthen its economic and trading relationships with foreign countries and business development in the PRC will follow market forces. While we believe that this trend will continue, there can be no assurance that this will be the case.

A change in policies by the PRC government may adversely affect our interests by, among other factors: changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports or sources of supplies, or the expropriation or nationalization of private enterprises. Although the PRC government has been pursuing economic reform policies for more than two decades, there is no assurance that the government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting the PRC’s political, economic and social life.

The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. Any changes in such PRC laws and regulations may harm our business.

The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. The PRC’s legal system is a civil law system based on written statutes, in which decided legal cases have little value as precedents unlike the common law system prevalent in the United States. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to the laws and regulations governing our business, or the enforcement and performance of our arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy and criminal proceedings. The Chinese government has been developing a comprehensive system of commercial laws, and considerable progress has been made in introducing laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, labor and social insurance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited volume of published cases and judicial interpretation and their lack of force as precedents, interpretation and enforcement of these laws and regulations involve significant uncertainties. New laws and regulations that affect existing and proposed future businesses may also be applied

retroactively. We are considered a foreign person or foreign funded enterprise under PRC laws, and as a result, we are required to comply with PRC laws and regulations. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our businesses. If the relevant authorities find that we are in violation of PRC laws or regulations, they would have broad discretion in dealing with such a violation, including, without limitation:

levying fines;

10

revoking our business and other licenses;

requiring that we restructure our ownership or operations; and

requiring that we discontinue any portion or all of our business.

The fluctuation of the Chinese Yuan Renminbi may harm your investment.

Under Chinese monetary policy, the Chinese Yuan Renminbi is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. This policy, which was initiated during 2005, has resulted in an approximately 28.9% appreciation of the Chinese Yuan Renminbi against the U.S. dollar as of December 31, 2011. While the international reaction to the Chinese Yuan Renminbi revaluation has been positive, there remains significant international pressure on the PRC government to adopt an even more flexible currency policy, which could result in a further and more significant appreciation of the Chinese Yuan Renminbi against the U.S. dollar.

The PRC’s legal and judicial system may not adequately protect our business and operations and the rights of foreign investors.

The promulgation of new laws, changes to existing laws and the pre-emption of local regulations by national laws may adversely affect foreign investors. However, the trend of legislation since the amendment to the PRC’s Constitution has significantly enhanced the protection of foreign investment and allowed for more control by foreign parties of their investments in Chinese enterprises. There can be no assurance that a change in leadership, social or political disruption, or unforeseen circumstances affecting the PRC’s political, economic or social life, will not affect the PRC government’s ability to continue to support and pursue these reforms. Such a shift may have a material adverse effect on our business and prospects.

We faceAvailability of adequate workforce levels

Presently, the vast majority of workers at our PRC factories are obtained from third-party employment agencies. As the labor laws, social insurance and wage levels continue to mature and grow and the workers become more sophisticated, our costs to employ these and other workers in the PRC may grow beyond that anticipated by management. In addition, as the PRC market continues to open up and grow, with the advent of more companies opening plants and businesses in the PRC, we could experience an increase in competing for the same workers, resulting in either an inability to attract and retain an adequate number of qualified workers or an increase in our employment costs to obtain and retain these workers.

Expansion in the PRC

As our global business grows, we may decide to expand in China to meet demand. This would be dependent on our ability to locate suitable facilities to support this expansion, to obtain the necessary permits and funding, to attract and retain adequate levels of qualified workers, and to enter into a long term land lease that is common in the PRC.

Any recurrence of severe acute respiratory syndrome, or SARS, or other widespread public health problems, could harm our operations.

A renewed outbreak of SARS or other widespread public health problems (such as bird flu and swine flu) in the PRC could significantly harm our operations. Our operations may be impacted by a number of risks relatedhealth-related factors, including quarantines or closures of some of our offices that would adversely disrupt our operations. Any of the foregoing events or other unforeseen consequences of public health problems could significantly harm our operations.

Risks Related to the recent financial crisisRecent Financial Crisis and severe tighteningSevere Tightening in the global credit markets.Global Credit Markets

General economic conditions, both domestic and international, have an impact on our business and financial results. The ongoing global financial crisis affecting the banking system and financial markets has resulted in a severe tightening in the credit markets, a low level of liquidity in many financial markets, and extreme volatility in credit and equity markets. This financial crisis may impact our business in a number of ways, including:

Potential Defermentdeferment of Purchasespurchases and Ordersorders by Customers:customers

Uncertainty about current and future global economic conditions may cause consumers, businesses and governments to defer purchases in response to tighter credit, decreased cash availability and declining consumer confidence. Accordingly, future demand for our products may differ materially from our current expectations.

Customers’ Inabilityinability to Obtain Financingobtain financing to Make Purchasesmake purchases from Usus and/or Maintain Their Business:maintain their business

Some of our customers require substantial financing in order to fund their operations and make purchases from us. The inability of these customers to obtain sufficient credit to finance purchases of our products may adversely impact our financial results. In addition, if the financial crisis results in insolvencies for our customers, it may adversely impact our financial results.

Potential Impactimpact on Trade Receivables:trade receivables

Credit market conditions may slow our collection efforts as customers experience increased difficulty in obtaining requisite financing, leading to higher than normal accounts receivable balances and longer DSOs. This may result in greater expense associated with collection efforts and increased bad debt expense.

Negative Impactimpact from Increased Financial Pressuresincreased financial pressures on Third-Party Dealers, Distributorsthird-party dealers, distributors and Retailers:retailers

We make sales in certain regions of the world through third-party dealers, distributors and retailers. Although many of these third parties have significant operations and maintain access to available credit, others are smaller and more likely to be impacted by the significant decrease in available credit that has resulted from the current financial crisis. If credit pressures or other financial difficulties result in insolvency for these third parties and we are unable to successfully transition our end customers to purchase products from other third parties or from us directly, it may adversely impact our financial results.

Negative Impactimpact from Increased Financial Pressuresincreased financial pressures on Key Suppliers:key suppliers

Our ability to meet customers’ demands depends, in part, on our ability to obtain timely and adequate delivery of quality materials, parts and components from our suppliers. Certain of our components are available only from a single source or limited sources. If certain key suppliers were to become capacity constrained or insolvent as a result of the financial crisis, it may result in a reduction or interruption in supplies or a significant increase in the price of supplies and adversely impact our financial results. In addition, credit constraints at key suppliers may result in accelerated payment of accounts payable by us, impacting our cash flow.

Dependence upon Key Suppliers

During 2008, four sources,2011, Samsung provided $29.1 million, or 10.2%, of our total inventory purchases. During 2010, Samsung and Computime each provided over 10% of our total inventory purchases. Purchases from these suppliers collectively amounted to $67.0 million, or 34.2%, of our total inventory purchases in 2010. During 2009, Samsung, Computime, C.G. Development, Samsung and Samjin each provided over 10% of our total inventory purchases. Purchases from these suppliers collectively amounted to $135.5$147.8 million, or 73.1%77.4%, of total inventory purchases during 2008. During 2007, Computime, C.G. Development and Samsung, each provided over 10% of our total inventory purchases. Purchases from these suppliers collectively amounted to $100.7 million, representing 63.2% of total inventory purchases in 2007. During 2006, Computime, C.G. Development, Freescale and Jetta each provided over 10% of our total inventory purchases. Purchases from these suppliers collectively amounted to $82.6 million or 60.9% of our total inventory purchases in 2006.

Most of the components used in our products are available from multiple sources. However, we have elected to purchase integrated circuits, used principally in our wireless control products, from two sources, Freescale and Samsung.primarily three sources. To reduce our dependence on our integrated circuits suppliers we continually seek additional sources, such as our new relationship with Maxim.sources. We generally maintain inventories of our integrated chips,circuits, which may be used in part to mitigate, but not eliminate, delays resulting from supply interruptions.

We have identified alternative sources of supply for our integrated circuit, component parts, and finished goods needs; however, there can be no assurance that we will be able to continue to obtain these inventory purchases on a timely basis. Any extended interruption, shortage or termination in the supply of any of the components used in our products, or a reduction in their quality or reliability, or a significant increase in prices of components, would have an adverse effect on our operating results, financial position and cash flows.

Disruption of our supply chain could have an adverse effect on our business, financial condition and results of operations

Our ability, including manufacturing or distribution capabilities, and cash flows.

11

Even after our acquisition of the factories in the PRC, third-party manufacturers located in Asiathe PRC will continue to manufacture a majority of our products. Our arrangements with ourthese foreign manufacturers are subject to the risks of doing business abroad, such as tariffs, environmental and trade restrictions, intellectual property protection and enforcement, export license requirements, work stoppages, political and social instability, economic and labor conditions, foreign currency exchange rate fluctuations, changes in laws and policies (including fiscal policies), and other factors, which may have a material adverse effect on our business, results of operations and cash flows. We believe that the loss of any one or more of our manufacturers would not have a long-term material adverse effect on our business, results of operations and cash flows, because numerous other manufacturers are available to fulfill our requirements; however, the loss of any of our major manufacturers may adversely affect our business, operating results, financial condition and cash flows until alternative manufacturing arrangements are secured.

Potential Fluctuations in Quarterly Results

We may from time to time increase our operating expenses to fund greater levels of research and development, sales and marketing activities, development of new distribution channels, improvements in our operational and financial systems and development of our customer support capabilities, and to support our efforts to comply with various government regulations. To the extent such expenses precede or are not subsequently followed by increased revenues, our business, operating results, financial condition and cash flows will be adversely affected.

In addition, we may experience significant fluctuations in future quarterly operating results that may be caused by many other factors, including demand for our products, introduction or enhancement of products by us and our competitors, the loss or acquisition of any significant customers, market acceptance of new products, price reductions by us or our competitors, mix of distribution channels through which our products are sold, product or supply constraints, level of product returns, mix of customers and products sold, component pricing, mix of international and domestic revenues, foreign currency exchange rate fluctuations and general economic conditions. In addition, as a strategic response to changes in the competitive environment, we may from time to time make certain pricing or marketing decisions or acquisitions that may have a material adverse effect on our business, results of operations or financial condition. As a result, we believe period-to-period comparisons of our results of operations are not necessarily meaningful and should not be relied upon as an indication of future performance.

Due to all of the foregoing factors, it is possible that in some future quarters our operating results will be below the expectations of public market analysts and investors. If this happens the price of our common stock may be materially adversely affected.

Dependence on Consumer Preference

We are susceptible to fluctuations in our business based upon consumer demand for our products. In addition, we cannot guarantee that increases in demand for our products associated with increases in the deployment of new technology will continue. We believe that our success depends on our ability to anticipate, gauge and respond to fluctuations in consumer preferences. However, it is impossible to predict with complete accuracy the occurrence and effect of fluctuations in consumer demand over a product’s life cycle. Moreover, we caution that any growth in revenues that we achieve may be transitory and should not be relied upon as an indication of future performance.

Demand for Consumer Service and Support

We have continually provided domestic and international consumer service and support to our customers to add overall value and to help differentiate us from our competitors. We continually review our service and support group

12

In addition, certain of our products have more features and are more complex than others and therefore require more end-user technical support. In some instances, we rely on distributors or dealers to provide the initial level of technical support to the end-users. We provide the second level of technical support for bug fixes and other issues at no additional charge. Therefore, as the mix of our products includes more of these complex product lines, support costs may increase, which wouldmay have an adverse effect on our business, operating results, financial condition and cash flows.

Dependence Upon Timelyupon New Product Introduction

Our ability to remain competitive in the wireless control and AV accessory products market will depend considerably upon our ability to successfully identify new product opportunities, as well as develop and introduce these products and enhancements on a timely and cost effective basis. There can be no assurance that we will be successful at developing and marketing new products or enhancing our existing products, or that these new or enhanced products will achieve consumer acceptance and, if achieved, will sustain that acceptance. In addition, there can be no assurance that products developed by others will not render our products non-competitive or obsolete or that we will be able to obtain or maintain the rights to use proprietary technologies developed by others which are incorporated in our products. Any failure to anticipate or respond adequately to technological developments and customer requirements, or any significant delays in product development or introduction, may have a material adverse effect on our operating results, financial condition and cash flows.

In addition, the introduction of new products may require significant expenditures for research and development, tooling, manufacturing processes, inventory and marketing. In order to achieve high volume production of any new product, we may have to make substantial investments in inventory and expand our production capabilities.

Dependence on Major Customers

The economic strength and weakness of our worldwide customers affect our performance. We sell our wireless control products, AV accessory products, and proprietary technologies to private label customers,subscription broadcasters, original equipment manufacturers, and companies involved in the subscription broadcasting industry.private label customers. We also supply our products to our wholly owned, non-U.S. subsidiaries and to independent foreign distributors, who in turn distribute our products worldwide, with Europe Asia, South Africa, Australia, and ArgentinaAsia currently representing our principal foreign markets.

During the yearsyear ended December 31, 2008, 2007 and 2006,2011, we had sales to one customer, Comcast Communications Inc., that amountedSony and its sub-contractors and to more than 10% of our net sales for the year. In addition, in each of these years, we had sales to DirecTVDIRECTV and its sub-contractors, that when combined, each totaled 10% or more of our net sales. In each of the year ended December 31, 2010 and 2009, we had sales to DIRECTV and its sub-contractors and to Comcast and its sub-contractors, that when combined, each exceeded 10% of our net sales. The loss of eitherany of these customers or of any other key customer, either in the United States or abroad or our inability to maintain order volume with these customers, may have an adverse effect on our operating results, financial condition results of operations and cash flows.

Change in Warranty Claim Costs

We rely on third-party companies to service a large portion of our customer warranty claims. If the cost to service these warranty claims increases unexpectedly, or these outside services cease to be available, we may be required to increase our estimate of future claim costs, which may have a material adverse effect on our operating results, financial condition and cash flows.

Outsourced Labor

We employ a small number of personnel to develop and market additional products that are part of the Nevo®Nevo® platform as well as products that are based on the Zigbee®Zigbee®, Z-Wave®Z-Wave® and other radio frequency technology. Even after these hires, we continue to use outside resources to assist us in the development of these products. While we believe that such outside services shouldwill continue to be available to us, if they cease to be available, the

13

Competition

Competition with the wireless control industry is characterized by intense competition based primarily on product availability, price, speed of delivery, ability to tailor specific solutions to customer needs, quality, and depth of product lines. Our competition is fragmented across our products, and, accordingly, we do not compete with any one company across all product lines. We compete with a variety of entities, some of which have greater financial resources. Our ability to remain competitive in this industry depends in part on our ability to successfully identify new product opportunities, develop and introduce new products and enhancements on a timely and cost effective basis, as well as our ability to successfully identify and enter into strategic alliances with entities doing business within the industries we serve. There can be no assurance that our product offerings will be, and/or remain, competitive or that strategic alliances, if any, will achieve the type, extent, and amount of success or business that we expect them to achieve. The sales of our products and technology may not occur or grow in the manner we expect, and thus we may not recoup costs incurred in the research and development of these products as quickly as we expect, if at all.

Patents, Trademarks, and Copyrights

The procedures by which we identify, document and file for patent, trademark, and copyright protection are based solely on engineering and management judgment, with no assurance that a specific filing will be issued, or if issued, will deliver any lasting value to us. Because of the rapid innovation of products and technologies that is characteristic of our industry, there iscan be no assurance that rights granted under any patent will provide competitive advantages to us or will be adequate to safeguard and maintain our proprietary rights. Moreover, the laws of certain countries in which our products are or may be manufactured or sold may not offer protection on such products and associated intellectual property to the same extent that the U.S.United States legal system may offer.

In our opinion, our intellectual property holdings as well as our engineering, production, and marketing skills and the experience of our personnel are of equal importance to our market position. We further believe that none of our businesses are materially dependent upon any single patent, copyright, trademark, or trade secret.

Some of our products include or use technology and/or components of third parties. While it may be necessary in the future to seek or renew licenses relating to various aspects of such products, we believe that, based upon past experience and industry practice, such licenses generally may be obtained on commercially reasonable terms; however, there iscan be no guarantee that such licenses may be obtained on such terms or at all. Because of technological changes in the wireless and home control industry, current extensive patent coverage, and the rapid rate of issuance of new patents, it is possible certain components of our products and business methods may unknowingly infringe upon the patents of others.

Potential for Litigation

As is typical in our industry and for the nature and kind of business in which we are engaged, from time to time various claims, charges and litigation are asserted or commenced by third parties against us or by us against third parties, arising from or related to product liability, infringement of patent or other intellectual property rights, breach of warranty, contractual relations or employee relations. The amounts claimed may be substantial, but they may not bear any reasonable relationship to the merits of the claims or the extent of any real risk of court awards assessed against us or in our favor.

Risks of Conducting Business Internationally

Risks of doing business internationally may adversely affect our sales, operations, earnings and cash flows due to a variety of factors, including, but not limited to:

changes in a country or region’s economic or political conditions, including inflation, recession, interest rate fluctuations, forced political actions or elections, coops, and actual or anticipated military conflicts;

14

currency fluctuations affecting sales, particularly in the Euro, British Pound the Chinese Yuan Renminbi , Indian Rupee, Singapore dollar, and the Brazilian Real which contribute to variations in sales of products and services in impacted jurisdictions and also affect our reported results expressed in U.S. dollars;

currency fluctuations affecting costs, particularly the Euro, British Pound the Chinese Yuan Renminbi , Indian Rupee, Singapore dollar, and the Brazilian Real which contribute to variances in costs in impacted jurisdictions and also affect our reported results expressed in U.S. dollars;

longer accounts receivable cycles and financial instability among customers;

trade regulations and procedures and actions affecting production, pricing and marketing of products;

local labor conditions, customs, and regulations;

changes in the regulatory or legal environment;

differing technology standards or customer requirements;

import, export or other business licensing requirements or requirements related to making foreign direct investments, which may affect our ability to obtain favorable terms for components or lead to penalties or restrictions;

difficulties associated with repatriating cash generated or held abroad in a tax-efficient manner and changes in tax laws; and

fluctuations in freight costs and disruptions at important geographic points of exit and entry.

Effectiveness of Our Internal Control Over Financial Reporting

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, we are required to include in our Annual Report on Form 10-K our assessment of the effectiveness of our internal control over financial reporting. Furthermore, our independent registered public accounting firm is required to audit our internal control over financial reporting and separately report on whether it believes we maintain, in all material respects, effective internal control over financial reporting. Although we believe that we currently have adequate internal control procedures in place, we cannot be certain that future material changes to our internal control over financial reporting will be effective. If we cannot adequately maintain the effectiveness of our internal control over financial reporting, we mightmay be subject to sanctions or investigation by regulatory authorities, such as the Securities and Exchange Commission. Any such action may adversely affect our financial results and the market price of our common stock.

Changes in Generally Accepted Accounting Principles

Our financial statements are prepared in accordance with U.S. generally accepted accounting principles. These principles are subject to revision and interpretation by various governing bodies, including the FASB and the SEC. A change in current accounting standards or their interpretation may have a significant adverse effect on our operating results, financial condition and cash flows.

Unanticipated Changes in Tax Provisions or Income Tax Liabilities

We are subject to income taxes in the United States and numerous foreign jurisdictions. Our tax liabilities are affected by the amounts we charge for inventory and other items in intercompany transactions. From time to time, we are subject to tax audits in various jurisdictions. Tax authorities may disagree with our intercompany charges or other matters and assess additional taxes. We assess the likely outcomes of these audits in order to determine the appropriateness of the tax provision. However, there can be no assurance that we will accurately predict the

outcomes of these audits, and the actual outcomes of these audits may have a material impact on our financial condition, results of operations and cash flows. In addition, our effective tax rate in the future may be adversely affected by changes in the mix of earnings in countries with differing statutory tax rates, changes in the valuation of

15

Inability to Use Deferred Tax Assets

We have deferred tax assets that we may not be able to use under certain circumstances. If we are unable to generate sufficient future taxable income in certain jurisdictions, or if there is a significant change in the actual effective tax rates or a significant change in the time period within which the underlying temporary differences become taxable or deductible, we may be required to increase our valuation allowances against our deferred tax assets resulting in an increase in our effective tax rate and an adverse impact on our future operating results, financial condition and cash flows.

Environmental Matters

Many of our products are subject to various federal, state, local and international laws governing chemical substances in products, including laws regulating the manufacture and distribution of chemical substances and laws restricting the presence of certain substances in electronics products. With the passageIn addition, many of the European Union’s Restriction of Hazardous Substances Directive, which makesthese laws and regulations make producers of electrical goods responsible for collection, recycling, treatment and disposal of recovered products, similar restrictions in China effective March 2007 and the European Union’s Waste Electrical and Electronic Equipment Directive,products. As a result, we may face significant costs and liabilities in complying with these laws and any future laws and regulations or enforcement policies that may have a material adverse effect upon our capital expenditures, earnings oroperating results, financial condition.

Leased Property

We lease all of the properties used in our business. We can give no assurance that we will enter into new or renewal leases, or that, if entered into, the new lease terms will be similar to the existing terms or that the terms of any such new or renewal leases will not have a significant and material adverse effect on our operating results, financial condition and cash flows.

Technology Changes in Wireless Control

We currently derive substantial revenue from the sale of wireless remote controls based on infrared (“IR”)IR and RF technology. Other control technologies exist or may be developed that may compete with IR.this technology. In addition, we develop and maintain our own database of IR and RF codes. There are several competing IR and RF libraries offered by companies that we compete with in the marketplace. The advantage that we may have compared to our competitors is difficult to measure. IfIn addition, if other wireless control technology gains acceptance and starts to be integrated into home electronics devices currently controlled through our IR remote controllers, demand for our products may decrease, resulting in decreased revenue, earningsoperating results, financial condition, and cash flow.

Failure to Recruit, Hire, and Retain Key Personnel

Our ability to achieve growth in the future will depend, in part, on our success at recruiting, hiring, and retaining highly skilled engineering, managerial, operational, sales and marketing personnel. Our corporate office, includingIf our advance technology engineering group, is based in Southern California. The high cost of living in Southern California makes it difficult to attract talent from outside the regionsalary and may also put pressure on overall employment related expense. Additionally, our competitors seek to recruit and hire the same key personnel. Therefore, if webenefits fail to stay competitive in salary and benefits within the industry it may negatively impact our ability to hire and retain key personnel. The inability to recruit, hire, and retain qualified personnel in a timely manner, or the loss of any key personnel, may make it difficult to meet key objectives, such as timely and effective product introductions.

16

Even after our recent acquisition of the PRC factories, we will continue to rely on third-party manufacturers to build our universal wireless control products, based on our extensive IR code library and patented technology.products. Price is always an issue in winning and retaining business. If customers become increasingly price sensitive, new competition may arise from manufacturers who decide to go into direct competition with us or from current competitors who perform their own manufacturing. If such a trend develops, we may experience downward pressure on our pricing or lose sales, which may have a material adverse effect on our operating results, financial condition and cash flows.

Transportation Costs; Impact of Oil Prices

We ship products from our foreign manufacturers via ocean and air transport. It is sometimes difficult to forecast swings in demand or delays in production and, as a result, products may be shipped via air which is more costly than ocean shipments. Often, weWe typically cannot recover the increased cost of air freight from our customers. Additionally, tariffs and other export fees may be incurred to ship products from foreign manufacturers to the customer. The inability to predict swings in demand or delays in production may increase the cost of freight which may have a material adverse effect on our product margins.

In addition, we have an exposure to oil prices in two forms. The first is indue to the pricesuse of the oil-based materials that we use in our products, which are primarily the plastics and other components that we include in our finished products. The second is inproducts, the cost of delivery and freight, which would be passed on by the carriers that we use in the form of higher rates.rates, political unrest in oil producing countries that could cause a cessation of production and/or delivery of oil resulting in higher costs. We record freight-in as a cost of sales and freight-out in operating expenses. Rising oil prices may have an adverse effect on cost of sales and operating expenses.

Proprietary Technologies

We produce highly complex products that incorporate leading-edge technology, including hardware, firmware, and software. Firmware and software may contain bugs that canmay unexpectedly interfere with product operation. There can be no assurance that our testing programs will detect all defects in individual products or defects that may affect numerous shipments. The presence of defects may harm customer satisfaction, reduce sales opportunities, or increase returns. An inability to cure or repair such a defect may result in the failure of a product line, temporary or permanent withdrawal from a product or market, damage to our reputation, increased inventory costs, or product reengineering expenses, any of which may have a material impact on our revenues, marginsoperating results, financial condition and net income.

Strategic Business Transactions

We may, from time to time, pursue strategic alliances, joint ventures, business acquisitions, products or technologies (“strategic business transactions”) that complement or expand our existing operations, including those that may be material in size and scope. Strategic business transactions including our recent acquisition of patents, intellectual property and other assets from Zilog, involve many risks, including the diversion of management’s attention away from day-to-day operations. There is also the risk that we will not be able to successfully integrate the strategic business transaction with our operations, personnel, customer base, products or technologies. Such strategic business transactions may also have adverse short-term effects on our operating results, and may result in dilutive issuances of equity securities, the incurrence of debt, and the loss of key employees. In addition, these strategic business transactions are generally subject to specific accounting guidelines that may adversely affect our financial condition, results of operations and cash flow. For instance, business acquisitions must be accounted for as purchases and, because most technology-related acquisitions involve the purchase of significant intangible assets, these acquisitions

17

Growth Projections

Management has made the projections required for the preparation of financial statements in conformity with accounting principles generally accepted in the United States of America regarding future events and the financial performance of the company, including those involving:

the benefits the company expects as a result of the development and success of products and technologies, including new products and technologies;

the benefits expected by entering into emerging markets such as Asia and Brazil, without which, we may not be able to recover the costs we incur to enter into such markets;

the recently announced new contracts with new and existing customers and new market penetrations;

the expected continued growth in digital TVs, DVRs, PVRs and overall growth in the company’s industry; and

the effects we may experience due to the continued softness in worldwide markets driven by the current economic environment.

Actual events or results may be unfavorable to management’s projections, which wouldmay have a material adverse effect on our projected operating results, financial condition and cash flows.

We have no unresolved staff comments as ofon the filing date of filing this Form 10-K.

Our corporateglobal headquarters is located in Cypress, California. We utilize the following office facilities:

Location | Purpose or Use | Square Feet | Status | ||||||||

| Cypress, California(1) | Corporate headquarters, engineering, research and development | 34,080 | Leased, expires | ||||||||

| Twinsburg, Ohio | 21,509 | Leased, expires May | |||||||||

| 31,2014 | |||||||||||

| Enschede, Netherlands | 18,292 | Leased, expires September 30, 2013 | |||||||||

| Bangalore, India(2) | Engineering, research and development | 17,713 | Leased, expired January 31, 2012 | ||||||||

| San Mateo, California | Engineering, research and development | 4,785 | Leased, expires | ||||||||

| Hong Kong, PRC | Asian headquarters | 12,000 | |||||||||

| Leased, expires | |||||||||||

| Guangzhou, PRC(3) | Manufacturing facility | 710,203 | Land leased, expires June 30, 2044 | ||||||||

| Yangzhou, PRC(3) | Manufacturing facility | 1,204,697 | Land leased, expires July 31, 2055 | ||||||||

| Qinzhou, PRC(3) | Manufacturing facility under development | 980,646 | Land leased, expires January 31, 2017 | ||||||||

| Manaus, Brazil | Manufacturing facility | 21,709 | Leased, expires September 30, 2014 | ||||||||

| (1) | Our lease for the Cypress Corporate headquarters expires on July 31, 2012. We are currently investigating a renewal of this lease and other alternative facilities. |

| (2) | Our lease for the Bangalore office expired on January 31, 2012. We are currently paying on a month-to-month basis while we are negotiating a renewal. |

| (3) | Private ownership of land in mainland PRC is not allowed. All land in the PRC is owned by the government and cannot be sold to any individual or entity. These facilities were developed on land which we lease from the PRC government. |

In addition to the facilities listed above, we lease space in various international locations, primarily for use as sales offices.

We planbelieve we will obtain lease agreements under similar terms; however, there can be no assurance that we will receive similar terms or that any offer to renew our lease for the Hong Kong office which expires in November 2009. Furthermore, in order to support the growth of our company, during 2008 we completed renovations to expand our corporate headquarters.

See “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA — Notes to Consolidated Financial Statements — Note 13”12” for additional information regarding our obligations under leases.

18

We are subject to lawsuits arising out of the conduct of our business. The discussion of our litigation matters in “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA — Notes to Consolidated Financial Statements — Note 21” at page 7013” is incorporated by reference.

19

Not applicable.

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock trades on the NASDAQ Global Select Market under the symbol UEIC. The closing price of our common stock as reported by NASDAQ on March 11, 20099, 2012 was $16.32.$19.30. Our stockholders of record on March 11, 20099, 2012 numbered approximately 68.120. We have never paid cash dividends on our common stock, nor do we currently intend to pay any cash dividends on our common stock in the foreseeable future. We intend to retain our earnings, if any, for the future operation and expansion of our business. In addition, the terms of our revolving Credit Facility limit our ability to pay cash dividends on our common stock. For further information regarding our revolving Credit Facility see “ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS-Liquidity and Capital Resources” at pages 33–35 and “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA — Notes to Consolidated Financial Statements — Note 7” at page 56.

The following table sets forth, for the periods indicated, the high and low sale prices for our common stock, as reported by NASDAQ:

| 2008 | 2007 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| First Quarter | $ | 35.50 | $ | 18.04 | $ | 29.89 | $ | 19.25 | ||||||||

| Second Quarter | 28.20 | 20.67 | 38.09 | 26.66 | ||||||||||||

| Third Quarter | 27.99 | 19.02 | 39.33 | 25.20 | ||||||||||||

| Fourth Quarter | 26.49 | 12.33 | 38.50 | 31.29 | ||||||||||||

| 2011 | 2010 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

First Quarter | $ | 29.85 | $ | 25.11 | $ | 26.55 | $ | 20.25 | ||||||||

Second Quarter | 30.00 | 23.84 | 23.90 | 16.49 | ||||||||||||

Third Quarter | 25.71 | 14.20 | 20.93 | 16.12 | ||||||||||||

Fourth Quarter | 20.00 | 14.01 | 30.27 | 20.04 | ||||||||||||

Purchases of Equity Securities

The following table sets forth, for the fourth quarter, our total stock repurchases, average price paid per share and the maximum number of shares that may yet be purchased under our plans or programs:

| Total Number of | Maximum | |||||||||||||||

| Shares | Number of | |||||||||||||||

| Purchased | Shares that May | |||||||||||||||

| as Part of | Yet Be | |||||||||||||||

| Publicly | Purchased | |||||||||||||||

| Total Number of | Weighted Average | Announced | Under the | |||||||||||||

| Shares | Price Paid | Plans | Plans or | |||||||||||||

| Period | Purchased | per Share | or Programs | Programs | ||||||||||||

| 10/1/08 – 10/31/08 | 204,604 | $ | 25.04 | — | 313,782 | |||||||||||

| 11/1/08 – 11/30/08 | — | — | — | 313,782 | ||||||||||||

| 12/1/08 – 12/31/08 | — | — | — | 313,782 | ||||||||||||

| Total during fourth quarter | 204,604 | $ | 25.04 | — | ||||||||||||

Period | Total Number of Shares Purchased | Weighted Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs | ||||||||||||

10/1/2011 — 10/31/2011 | 11,460 | $ | 17.59 | 11,460 | 1,074,343 | |||||||||||

11/1/2011 — 11/30/2011 | 85 | 15.96 | 85 | 1,074,258 | ||||||||||||

12/1/2011 — 12/31/2011 | 4,348 | 15.95 | 4,348 | 1,069,910 | ||||||||||||

|

|

|

|

|

| |||||||||||

Total during fourth quarter | 15,893 | $ | 17.13 | 15,893 | 1,069,910 | |||||||||||

|

|

|

|

|

| |||||||||||

During the year ended December 31, 20062011, we repurchased 456,964 shares of our issued and outstanding common stock for $9.8 million under an ongoing and systematic program approved by our Board of Directors authorized the repurchase of 2.0 million shares of outstanding commonon February 11, 2010. We make stock under an ongoing systematic programrepurchases to manage the dilution created by shares issued under employeeour stock plans. Duringincentive plans or when we deem a repurchase is a good use of our cash and the year endedprice to be paid is at or below a threshold approved by our Board from time to time. On December 31, 2008,2011, we repurchased 1,118,318 shares for $26.7 million. As of December 31, 2008, we have 313,782had 69,910 shares available for repurchase under the program.

20

Information regarding our equity compensation plans, including both stockholder approved plans and plans not approved by stockholders, is incorporated by reference to “ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS” at pages 79–80, under the caption “Equity Compensation Plan Information” and “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA — Notes to Consolidated Financial Statements — Note 11” at pages 58–63,16” under the caption “Stock Incentive Plans.“Stock-Based Compensation.”

Performance Chart

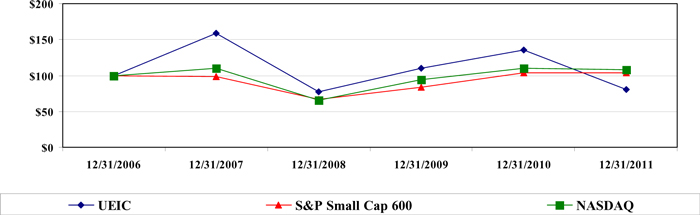

The following graph and table compares the cumulative total stockholder return with respect to our common stock versus the cumulative total return of our Peer Group Indexthe Standard & Poor’s Small Cap 600 (the “Peer Group Index”“S&P Small Cap 600”) and the NASDAQ Composite Index (the “NASDAQ Composite Index”) for the five (5) year period ended December 31, 2008.2011. The comparison assumes that $100

is invested on December 31, 20032006 in each of our common stock, the Peer Group IndexS&P Small Cap 600 and the NASDAQ Composite Index and that all dividends are reinvested. We have not paid any dividends and, therefore, our cumulative total return calculation is based solely upon stock price appreciation and not upon reinvestment of dividends. The graph and table depicts year-end values based on actual market value increases and decreases relative to the initial investment of $100, based on information provided for each calendar year by the NASDAQ Stock Market and the New York Stock Exchange.

The comparisons in the graph and table below are based on historical data and are not intended to forecast the possible future performance of our common stock.

Comparison of Stockholder Returns Amountof Universal Electronics Inc.,

the Peer Group Index(1),S&P Small Cap 600 and the NASDAQ Composite Index

| 12/31/2003 | 12/31/2004 | 12/31/2005 | 12/31/2006 | 12/31/2007 | 12/31/2008 | |||||||||||||||||||

| Universal Electronics Inc. | $ | 100 | $ | 138 | $ | 135 | $ | 165 | $ | 262 | $ | 127 | ||||||||||||

| Peer Group Index | $ | 100 | $ | 134 | $ | 133 | $ | 131 | $ | 102 | $ | 39 | ||||||||||||

| NASDAQ Composite Index | $ | 100 | $ | 109 | $ | 110 | $ | 121 | $ | 132 | $ | 79 | ||||||||||||

| 12/31/2006 | 12/31/2007 | 12/31/2008 | 12/31/2009 | 12/31/2010 | 12/31/2011 | |||||||||||||||||||

Universal Electronics Inc. | $ | 100 | $ | 159 | $ | 77 | $ | 110 | $ | 135 | $ | 81 | ||||||||||||

S&P Small Cap 600 | $ | 100 | $ | 99 | $ | 67 | $ | 83 | $ | 104 | $ | 104 | ||||||||||||

NASDAQ Composite Index | $ | 100 | $ | 110 | $ | 65 | $ | 94 | $ | 110 | $ | 108 | ||||||||||||

The information presented above is as of the end of each calendar year for the period December 31, 20032006 through 2008.2011. This information shallshould not be deemed to be “solicited“soliciting material” or to be “filed” with the Securities and Exchange Commission or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) nor shallshould this information be incorporated by reference into any prior or future filings under the Securities Act of 1933 or the Exchange Act, except to the extent that we specifically incorporate it by reference into a filing.

21

The information set forth below is not necessarily indicative of the results of future operations and should be read in conjunction with “ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS,” and the Consolidated Financial Statements and notes thereto included in “ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA,” of this Form 10-K, which are incorporated herein by reference, in order to further understand further the factors that may affect the comparability of the financial data presented below.

| Year Ended December 31, | ||||||||||||||||||||

| (in thousands, except per share data) | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

| Net sales | $ | 287,100 | $ | 272,680 | $ | 235,846 | $ | 181,349 | $ | 158,380 | ||||||||||

| Operating income | $ | 20,761 | $ | 26,451 | $ | 18,517 | $ | 11,677 | $ | 13,540 | ||||||||||

| Net income | $ | 15,806 | $ | 20,230 | $ | 13,520 | $ | 9,701 | $ | 9,114 | ||||||||||

| Earnings per share: | ||||||||||||||||||||

| Basic | $ | 1.13 | $ | 1.40 | $ | 0.98 | $ | 0.72 | $ | 0.67 | ||||||||||

| Diluted | $ | 1.09 | $ | 1.33 | $ | 0.94 | $ | 0.69 | $ | 0.65 | ||||||||||

| Shares used in calculating earnings per share: | ||||||||||||||||||||

| Basic | 14,015 | 14,410 | 13,818 | 13,462 | 13,567 | |||||||||||||||

| Diluted | 14,456 | 15,177 | 14,432 | 13,992 | 14,100 | |||||||||||||||

| Cash dividend declared per common share | — | — | — | — | — | |||||||||||||||

| Gross margin | 33.5 | % | 36.4 | % | 36.4 | % | 37.0 | % | 38.9 | % | ||||||||||

| Selling, general, administrative, research and development expenses as a % of net sales | 26.3 | % | 26.7 | % | 28.5 | % | 30.6 | % | 30.3 | % | ||||||||||

| Operating margin | 7.2 | % | 9.7 | % | 7.9 | % | 6.4 | % | 8.6 | % | ||||||||||

| Net income as a % of net sales | 5.5 | % | 7.4 | % | 5.7 | % | 5.4 | % | 5.8 | % | ||||||||||

| Return on average assets | 7.3 | % | 10.2 | % | 8.3 | % | 6.8 | % | 6.8 | % | ||||||||||

| Working capital | $ | 122,303 | $ | 140,330 | $ | 106,179 | $ | 77,201 | $ | 75,081 | ||||||||||

| Ratio of current assets to current liabilities | 3.0 | 4.0 | 3.4 | 2.8 | 3.1 | |||||||||||||||

| Total assets | $ | 217,555 | $ | 217,285 | $ | 178,608 | $ | 146,319 | $ | 140,400 | ||||||||||

| Cash and cash equivalents | $ | 75,238 | $ | 86,610 | $ | 66,075 | $ | 43,641 | $ | 42,472 | ||||||||||

| Long-term debt | — | — | — | — | — | |||||||||||||||

| Stockholders’ equity | $ | 153,353 | $ | 168,242 | $ | 134,217 | $ | 103,292 | $ | 103,881 | ||||||||||

Book value per share(a) | $ | 11.24 | $ | 11.55 | $ | 9.58 | $ | 7.63 | $ | 7.66 | ||||||||||

| Ratio of liabilities to liabilities and stockholders’ equity | 29.5 | % | 22.6 | % | 24.9 | % | 29.4 | % | 26.0 | % | ||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| (in thousands, except per share data) | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

Net sales | $ | 468,630 | $ | 331,780 | $ | 317,550 | $ | 287,100 | $ | 272,680 | ||||||||||

Operating income | $ | 26,576 | $ | 21,301 | $ | 21,947 | $ | 20,761 | $ | 26,451 | ||||||||||

Net income | $ | 19,946 | $ | 15,081 | $ | 14,675 | $ | 15,806 | $ | 20,230 | ||||||||||

Earnings per share: | ||||||||||||||||||||

Basic | $ | 1.34 | $ | 1.10 | $ | 1.07 | $ | 1.13 | $ | 1.40 | ||||||||||

Diluted | $ | 1.31 | $ | 1.07 | $ | 1.05 | $ | 1.09 | $ | 1.33 | ||||||||||

Shares used in calculating earnings per share: | ||||||||||||||||||||

Basic | 14,912 | 13,764 | 13,667 | 14,015 | 14,410 | |||||||||||||||

Diluted | 15,213 | 14,106 | 13,971 | 14,456 | 15,177 | |||||||||||||||

Cash dividend declared per common share | — | — | — | — | — | |||||||||||||||

Gross margin | 27.8 | % | 31.3 | % | 32.0 | % | 33.5 | % | 36.4 | % | ||||||||||

Selling, general, administrative, research and development expenses as a % of net sales | 19.5 | % | 24.9 | % | 25.1 | % | 26.3 | % | 26.7 | % | ||||||||||

Operating margin | 5.7 | % | 6.4 | % | 6.9 | % | 7.2 | % | 9.7 | % | ||||||||||

Net income as a % of net sales | 4.3 | % | 4.6 | % | 4.6 | % | 5.5 | % | 7.4 | % | ||||||||||

Return on average assets | 5.4 | % | 5.0 | % | 6.5 | % | 7.3 | % | 10.2 | % | ||||||||||

Working capital | $ | 84,761 | $ | 66,101 | $ | 127,086 | $ | 122,303 | $ | 140,330 | ||||||||||

Ratio of current assets to current liabilities | 1.7 | 1.4 | 3.1 | 3.0 | 4.0 | |||||||||||||||

Total assets | $ | 369,488 | $ | 372,533 | $ | 233,307 | $ | 217,555 | $ | 217,285 | ||||||||||

Cash and cash equivalents | $ | 29,372 | $ | 54,249 | $ | 29,016 | $ | 75,238 | $ | 86,610 | ||||||||||

Stockholders’ equity | $ | 229,989 | $ | 211,204 | $ | 169,730 | $ | 153,353 | $ | 168,242 | ||||||||||

Book value per share(a) | $ | 15.55 | $ | 14.13 | $ | 12.40 | $ | 11.24 | $ | 11.55 | ||||||||||

Ratio of liabilities to liabilities and stockholders’ equity | 37.8 | % | 43.3 | % | 27.3 | % | 29.5 | % | 22.6 | % | ||||||||||

| (a) | ||

Book value per share is defined as stockholders’ equity divided by common shares issued less treasury stock. |

The comparability of information between 20042011 and the otherprior years presented is affected by the acquisition of SimpleDevices Inc. inEnson during the fourth quarter of 2004.

The following discussion should be read in conjunction with the Consolidated Financial Statements and the related notes that appear elsewhere in this document.

Overview

We have developeddevelop and manufacture a broad line of pre-programmed universal wirelessremote control products, and audio-video accessories, and software that are marketed to enhance home entertainment systems. Our customers operate in the consumer electronics market and include subscription broadcasters, OEMs, MSOs (cable and satellite service providers), international retailers, CEDIA (Custom Electronic Design and Installation Association), U.S. retailers,custom installers, private labels, and companies in the computing industry. We also sell integrated circuits, on which our software and IR code database, or library, is embedded, to OEMs that manufacture wireless control devices, cable converters or satellite receivers for resale in their products. We believe that

Since our universal remote control database contains device codes that are capable of controlling virtually all infrared remote (“IR”) controlled TVs, VCRs, DVD players, cable converters, CD players, audio components and satellite receivers, as well as most other infrared remote controlled devices worldwide.

22

We operate as one business segment. We have twelvetwenty-four subsidiaries located in Argentina, Cayman Islands, France, Germany, Hong Kong (6), India, Italy, the Netherlands, Singapore, Spain, Brazil, British Virgin Islands (3), People’s Republic of China (4) and the United Kingdom.

To recap our results for 2008:2011:

Our net sales grew 41.2% to $468.6 million for 2011 from $331.8 million for 2010, due primarily to the acquisition of Enson during November 2010, which added $150.1 million of net sales during 2011.

Excluding Enson’s net sales, our 2011 net sales increased 3.8% to $318.6 million from $306.8 million for 2010. This is due primarily to the increase in net sales within the Latin America subscription broadcasting market and our acquisition of new domestic customers in our business category throughout 2011.

Our 2011 operating income increased 24.8% to $26.6 million for 2011 from $21.3 million for 2010. Our operating margin percentage decreased to 5.7% for 2011 from 6.4% for 2010 due primarily to the decrease in our gross margin percentage to 27.8% for 2011 from 31.3% for 2010. The decrease in our gross margin rate was due primarily to sales mix, as a higher percentage of our total sales were comprised of our lower-margin Business category. Partially offsetting the decrease in our gross margin percentage was a 2.8% improvement in operating expenses as a percentage of net sales for 2011 compared to 2010.

Our strategic business objectives for 20092012 include the following:

continue to develop industry-leading technologies and products with attractive gross margins in order to improve profitability;

further penetrate the growing Asian and Latin American subscription broadcasting markets;

acquire new customers in historically strong regions;

increase our share with existing customers;

increase the utilization of Enson’s factories by becoming less dependent on third party contract manufacturers;

place more operations, logistics, quality, program management, engineering, sales, and marketing personnel in the Asia region: and

Continue to seek acquisitions or strategic partners that complement and strengthen our existing business.

We intend for the following discussion of our financial condition and results of operations to provide information that will assist in understanding our consolidated financial statements, the changes in certain key items in those financial statements from period to period, and the primary factors that accounted for those changes, as well as how certain accounting principles, policies and estimates affect our consolidated financial statements.

Critical Accounting Policies and Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires us to make estimates and judgments that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. On an on-going basis, we evaluate our estimates and judgments, including those related to revenue recognition, allowance for sales returns and doubtful accounts, warranties, inventory valuation, business combination purchase price allocations, our review for impairment of long-lived assets, intangible assets and goodwill, income taxes and stock-based compensation expense. Actual results

23

An accounting policy is deemed to be critical if it requires an accounting estimate to be made based on assumptions about matters that are highly uncertain at the time the estimate is made, if different estimates reasonably may have been used, or if changes in the estimate that are reasonably likely to occur may materially impact the financial statements. Management believes the following critical accounting policies affect our more significant judgments and estimates used in the preparation of our consolidated financial statements.

Revenue recognition

We recognize revenue on the sale of products when deliverytitle of the goods has occurred,transferred, there is persuasive evidence of an arrangement (such as a purchase order from the customer), the sales price is fixed or determinable and collectability is reasonably assured.

We record a provision for estimated retail sales returns on retail product sales in the same period as the related revenues are recorded. These estimates are based on historical sales returns, analysis of credit memo data and other known factors.returns. The provision recorded for estimated sales returns and allowances is deducted from gross sales to arrive at net sales in the period the related revenue is recorded. These estimates are based on historical sales returns, analysis of credit memo data and other known factors. Actual returns and claims in any future period are inherently uncertain and thus may differ from our estimates. If actual or expected future returns and claims are significantly greater or lower than the reserves that we have established, we will record a reduction or increase to net revenues in the period in which we make such a determination. The allowance for sales returns balance at December 31, 20082011 and 2007 contained reserves for items returned prior to year-end, but that were not completely processed,2010 was $1.0 million and therefore not yet removed from the allowance for sales returns balance. We estimate that if these returns had been fully processed the allowance for sales returns balance would have been approximately $0.8$1.4 million, on December 31, 2008 and 2007. The value of these returned goods was included in our inventory balance at December 31, 2008 and 2007.

We accrue for discounts and rebates on product sales in the same period as the related revenues are recorded based on our current expectations, after considering historical experience. Changes in such accruals may be required if future rebates and incentives differ from our estimates. Rebates and incentives are recognized as a reduction of sales if distributed in cash or customer account credits. Rebates and incentives are recognized as cost of sales if we provide products or services for payment.

We maintain an allowance for doubtful accounts for estimated losses resulting from the inability of our customers to make payments for products sold or services rendered. The allowance for doubtful accounts is estimated based on a variety of factors, including credit reviews, historical experience, length of time receivables are past due, current economic trends and changes in customer payment behavior. Also,Our historical reserves have been sufficient to cover losses from uncollectible accounts. However, because we record specific provisions for individualcannot predict future changes in the financial stability of our customers, actual future losses from uncollectible accounts when we become awaremay differ from our estimates and may have a material effect on our consolidated financial position, results of a customer’soperations and cash flows. If the financial conditions of our customers deteriorate resulting in their inability to meet its financial obligationsmake payments, a larger allowance may be required resulting in a charge to us, such asselling, general, and administrative expense in the case of bankruptcy filings or deteriorationperiod in the customer’s operating results or financial position.which we make this determination. We increased our allowance for doubtful accounts byincurred $0.3 million, $0.9 million, and $0.4 million of bad debt expense in 20082011, 2010, and 2009, respectively, to reflect certain customer accounts where collection iswas highly uncertain in the current economic environment. If circumstances related to a customer change, our estimates of the recoverability of the receivables would be further adjusted, either upward or downward.

We have not made any material changes in our methodology for recognizing revenue during the past threefour fiscal years. We do not believe there is a reasonable likelihood that there will be a material change in the estimates or assumptions we use to recognize revenue. However, if actual results are not consistent with our estimates or assumptions, we may be exposed to losses or gains that may be material.

24

We warrant our products against defects in materials and workmanship arising during normal use. We service warranty claims directly through our customer service department or contracted third-party warranty repair facilities. Our warranty period rangesperiods range up to three years. We estimate and recognize product warranty costs, which are included in cost of sales, as we sell the related products. Warranty costs are forecasted based on the best available information, primarily historical claims experience and the expected cost per claim. The costs we have incurred to service warranty claims have been minimal. Historically, product defects have been less than 0.5% of the net units sold. As a result the balance of our reserve for estimated warranty costs is not significant.

We have not made any material changes in our warranty reserve methodology during the past three fiscal years. We do not believe there is a reasonable likelihood that there will be a material change in the estimates or assumptions we use to calculate the warranty reserve. However, actual claim costs may differ from the amounts estimated. If a significant product defect were to be discovered on a high volume product, our financial statements may be materially impacted. Historically, product defects have been less than 0.5% of the net units sold.

Inventories

Our inventories consist of primarily wireless remote control devicesdevice, component part, and the related component parts, including integrated circuits, andraw material inventories are valued at the lower of cost or market. Costmarket value. The approximate cost is determined using the first-in, first-out method.basis. We write-down our inventory for the estimated difference between the inventory’s approximate cost and its estimated market value based upon our best estimates about future demand andof market conditions.

We carry inventory in amounts necessary to satisfy our customers’ inventory requirements on a timely basis. We continually monitor our inventory status to control inventory levels and write-down any excess or obsolete inventories on hand. Our total excess and obsolete inventory reserve as ofon December 31, 20082011 and 20072010 was $1.5$3.4 million and $1.8$2.1 million, respectively, or 3.5%3.8% and 5.0%3.2% of total inventory. The decreaseincrease in our excess and obsolete reserve in 2008during 2011 was the result of $2.4$4.6 million of additional write-downs offset by $2.7$1.3 million of scrapping.sell-through, $2.0 million of scrapping and foreign currency translation effects. This compared to additional write-downs of $2.1$2.9 million of additional write-downs offset by $1.0 million of sell-through, $1.5 million of scrapping and scrapping of $2.5 million in 2007.

We have not made any material changes in the accounting methodology used to establish our excess and obsolete inventory reserve during the past three fiscal years. We do not believe there is a reasonable likelihood that there will be a material change in the future estimates or assumptions we useduse to calculate our excess and obsolete inventory reserve. If actual market conditions are less favorable than those projected by management, additional inventory write-downs may be required which may have a material impact on our financial statements. Such circumstances may include, but are not limited to, the development of new competing technology that impedes the marketability of our products or the occurrence of significant price decreases in our raw material or component parts, such as integrated circuits. Each percentage point change in the ratio of excess and obsolete inventory reserve to inventory would impact cost of sales by approximately $0.5$0.9 million.

Business Combinations

We are required to allocate the purchase price of acquired companies to the tangible and intangible assets and the liabilities assumed, as well as in-process research and development (“IPR&D”), based upon their estimated fair values. We engage independent third-party appraisal firms to assist us in determining the fair values of assets acquired and liabilities assumed. Such valuations require management to make significant fair value estimates and assumptions, especially with respect to intangible assets. Management estimates the fair value of certain intangible assets by utilizing the following (but not limited to):

future free cash flow from customer contracts, customer lists, distribution agreements, acquired developed technologies, trademarks, trade names and patents;