UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20212023

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to |

Commission File Number 001-39735

The Beachbody Company, Inc.

(Exact name of Registrant as specified in its Charter)

Delaware | 85-3222090 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

400 Continental Blvd, Suite 400, El Segundo, California | 90245 |

(Address of principal executive offices) | (Zip Code) |

(310) 883-9000

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A Common Stock, par value $0.0001 per share |

|

|

|

| The New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files.files). Yes ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large“large accelerated filer," "accelerated” “accelerated filer," "smaller” “smaller reporting company,"” and "emerging“emerging growth company"company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☒ Accelerated filer ☐

Non-accelerated filer ☐ Smaller reporting company ☐☒

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based on the closing price reported on the New York Stock Exchange for June 30, 2021,2023, was $1,067,431,33157,754,248.

There were 168,996,7644,101,895 shares of registrant’s Class A Common Stock, par value $0.0001 per share, and 141,250,3102,729,003 shares of the registrant’s Class X Common Stock, par value $0.0001 per share, outstanding as of February 23, 2022.March 3, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

Parts of the registrant’s definitive proxy statement for the 20222024 Annual Meeting of Stockholders to be filed pursuant to Regulation 14A under the Securities Exchange Act of 1934 are incorporated by reference in Part III of this Annual Report on Form 10-K.

Table of Contents

Page | ||

PART I | ||

Item 1. | 3 | |

Item 1A. |

| |

Item 1B. |

| |

Item 1C. | 44 | |

Item 2. |

| |

Item 3. |

| |

Item 4. |

| |

PART II | ||

Item 5. |

| |

Item 6. |

| |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

Item 7A. |

| |

Item 8. |

| |

Item 9. | Changes in and Disagreements |

|

Item 9A. |

| |

Item 9B. |

| |

Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

PART III | ||

Item 10. |

| |

Item 11. |

| |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

Item 13. | Certain Relationships and Related Transactions, and Director Independence |

|

Item 14. |

| |

PART IV | ||

Item 15. |

| |

Item 16. |

|

1

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”), including statements about and the financial condition, results of operations, earnings outlook and prospects of the Company.The Beachbody Company, Inc. (the “Company,” "BODi", “we,” “us,” “our” or similar terms). Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on our current expectations as applicable and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to the following:

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by management prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

You should not place undue reliance upon our forward-looking statements.

Except to the extent required by applicable law or regulation, we undertake no obligation to update these forward-looking statements to reflect events or circumstances after the date of this Report or to reflect the occurrence of unanticipated events.

2

PART I

Item 1. Business.

We are a leading subscription health and wellness platformcompany providing fitness, nutrition and stress-reducing programs to our customers. With over 2.51.3 million digital subscriptions and 0.30.2 million nutritional subscriptions as of December 31, 2023, we believe our ability to offer solutions in both the global fitness market and the global nutrition market under one platform positions us as the leading holistic health and wellness solution. We have a 23-year25-year track record of creating innovative exercise, nutrition and stress-reducing content that have improved the lives of millions of customers. We make fitness entertaining, approachable, effective and convenient, while fostering social connections that encourage customers to live healthier and more fulfilling lives.

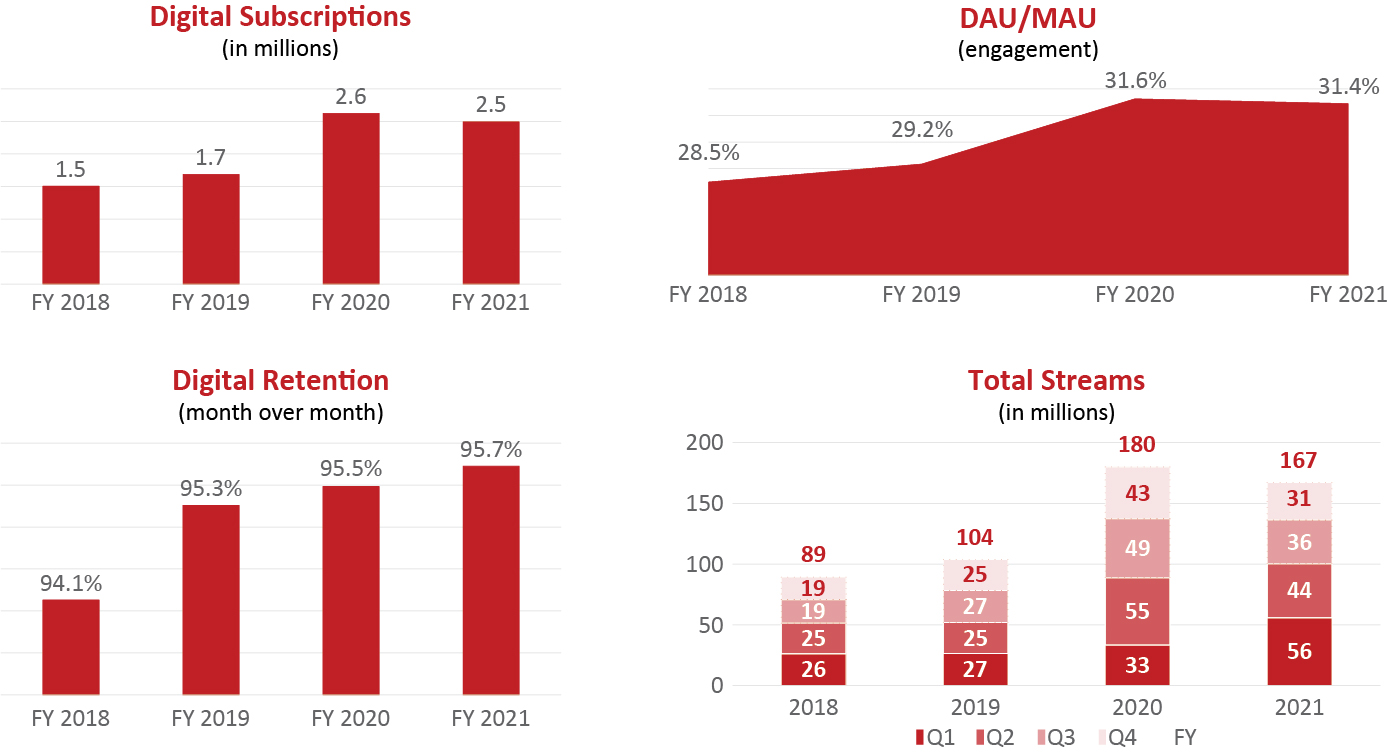

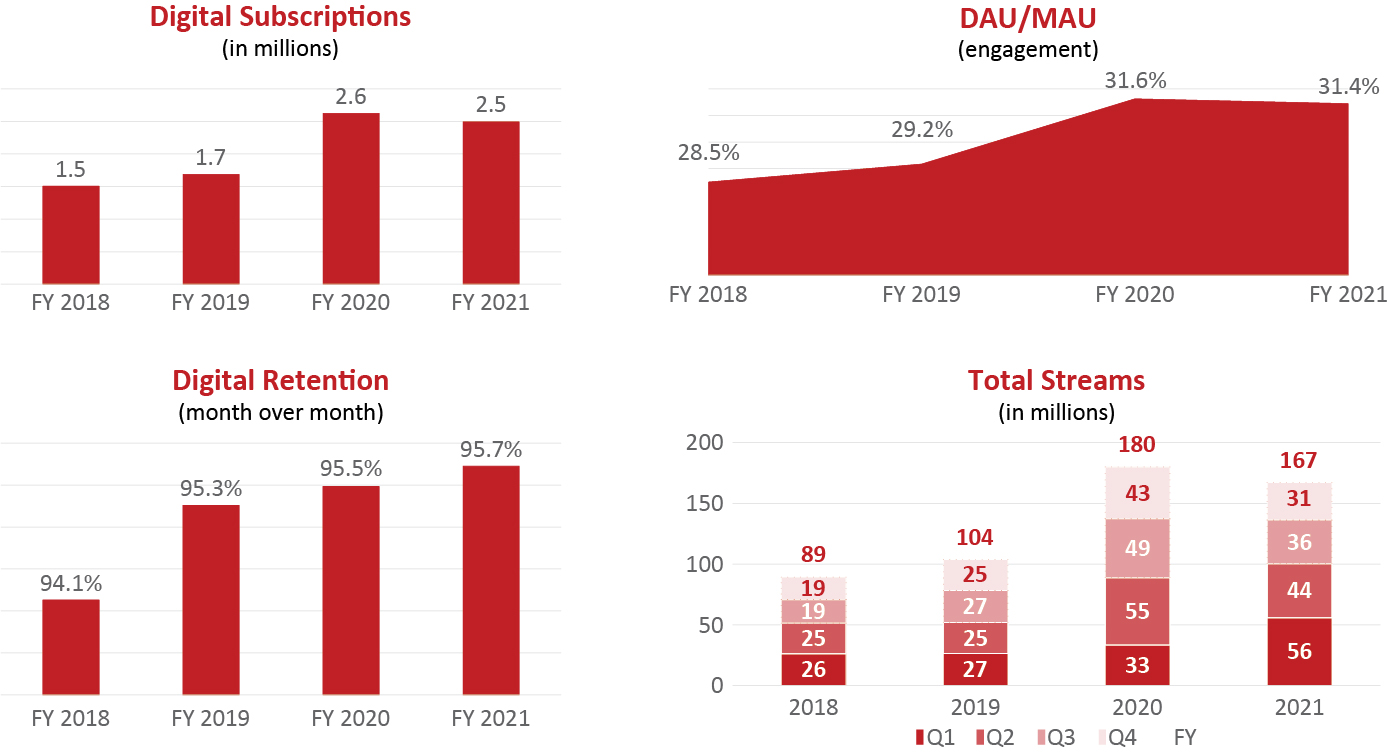

We are a results-oriented company at the intersection of wellness, technology and media. We developed one of the original fitness digital streaming platforms with an extensive library of content containing over 116134 complete workoutstreaming programs and 4,570approximately 9,000 unique streaming workouts.videos. We measure the success of our library by customer engagement indicators including a metric that divides daily active users by monthly active users (“DAU/MAU”) and “streams” by our subscribers over the respective periods. While the measure of a digital stream may vary across companies, we define streams and total streams as the stream of a video for at least 25% of its length during a given period. In 2021,2023, our DAU/MAU averaged 31.4%31.3%. In 2021, 20202023 and 2019,2022, our subscribers viewed streams totaling 167 million, 18098.2 million and 104120.5 million streams, respectively. We also measure our success by month over month retention rates of our digital subscribers, which was approximately 95.7%96.0% for the year ended December 31, 2021.2023.

Driven by our commitment to help people achieve their goals and lead healthy, fulfilling lives, we have built or acquired digital platforms to engage with our customers such as Beachbody On Demand (“BOD”), Beachbody On Demand Interactive (“BODi”), Beachbody Bike (also known as Myx) and Openfit.BODi Bike. Prior to July 2022, fitness programs were also available on the Openfit digital platform. Our BOD digital platforms includeplatform includes an extensive library with highhigh-quality production value and creatively diverse fitness contentcontent. BOD, and our premium and interactive digital platform, BODi, in addition to an annual subscription, also have monthly, 3-month and 6-month membership prices. In addition, we also have promotional offers which at a price point as low as $9.99 per month or $99.00 pertimes include membership options for greater than one year. InDuring 2022, we will also consolidatecompleted the consolidation of our Openfit streaming fitness offering onto our singleinto both Beachbody platform (BOD)platforms to enhance our value proposition to all customers and simplify our go-to-market strategy. Starting in March 2023, BODi also includes a new form of fitness programming called BODi Blocks, and the new mindset content.

The BOD + BODi annual subscription price was reduced to $179, from $298 in September 2022 to appeal to a larger audience. In 2023, we enhanced our BODi platform by improving the digital experience for search and discovery, which resulted in being named the "Best Workout and Fitness App" for 2023 by CNN Underscored. It also integrates a layer of personal development and mindset content. The combination of fitness, nutrition, and mindset makes the BODi platform a complete solution to support the whole person and help them achieve positive “Health Esteem.”

Our premium nutrition products help make meal planning and healthy weight loss achievable without deprivation. Simplicity and proven strategies are at the core of what we do, and many of our brands, including Shakeology, Beachbody Performance, BEACHBAR and Ladder,Bevvy, have been designed with formulae and ingredients that have been

3

clinically tested to help our customers achieve their goals. By leveraging consumer insights such as which content subscribers are engaging with, we are able to make targeted recommendations to them that support improved results.

3

In late 2023, we added GrowthDay, a subscription-based personal development application ("app") to the BODi Health Esteem ecosystem which the BODi Partners network can sell to prospective customers. This product is offered by GrowthDay and we receive a portion of the revenue for selling our customers access to this app. Additionally, GrowthDay content appears in the Mindset section of our BODi app.

We have also built a social commerce platform with incentives to invite people to participate in groups and thusto increase our customer base, inspiring participants to achieve their goals which in turn generates cash flow that can be used to accelerate our digital and international expansion. This platform includes hundreds of thousandsour network of micro influencers or Coaches,whom we refer to as "Partners", who help customers start and maintain a fitness and nutrition program through positive reinforcement, accountability, and a proprietary online support community. The Partners pay a monthly subscription fee to access our Partner office tools, which provide training, sales enablement, and reporting capabilities.

In late 2023, we launched an initiative that we call "the BODi Growth Game Plan" which is designed to help Partners improve the overall productivity of their teams, as they assist current and potential customers achieve an improvement in their Health Esteem. We also implemented results oriented compensation incentives for our Partners beginning January 1, 2024, which will reward high performance, especially for new Partners, and aligns the overall compensation structure with generating profitable revenues.

Our revenue is primarily generated from the sale of digital subscriptions and nutritional products that are often bundled together. We also generate revenue selling the Beachbody Bike (also known as Myx).BODi Bike. We believe there are future revenue and customer retention opportunities that can be generated through our enhanced BODi offering, new nutritional bundles, and connected devices that offer digital subscriptions, and future international expansion and opportunistic acquisitions.subscriptions.

Our Product Offerings and Economic Model

Digital Subscriptions

Our digital subscriptions include BOD and a live interactive premium subscription, BODi, launched in beta version in the fourth quarter of 2015, and Openfit, launched in 2019.late 2021. The subscriptions are renewed on a monthly, quarterly, semi-annual or annual basis and include unlimited access to an extensive library of live and on-demand fitness and nutrition content. WeIn addition, we also have promotional offers which at times include membership options for greater than one year. Prior to July 2022, we also offered a subscription service to the Openfit digital platform. In March 2023, we launched a live interactive premium subscription tier,an improved BODi in late 2021.experience and began migrating all BOD-only members to BODi on their renewal dates, all BOD-only members will be migrated to BODi by March 31, 2024.

Our digital platforms provide a one-stop-shop for all types of fitness and nutrition content, with world famous brands such as P90X, Insanity, 21 Day Fix, 80 Day Obsession, Morning Meltdown 100, LIIFT4, Unstress meditations,Meditations, Portion Fix, 4 Weeks of Focus, Sure Thing, and others. The BODBODi platform gives users access to comprehensive, highly produced, and creatively diverse fitness content with dynamic trainers. We had over 2.51.3 million digital subscriberssubscriptions as of December 31, 2021, who have2023, which provide access to 4,570approximately 9,000 unique fitness, nutrition, mindfulness and recovery videos that can be accessed anywhere. BODBODi content is available on the web as well as the Beachbody Bike touchscreen, iOS, Android, Roku, AppleTV,Apple TV, Fire TV and Chromecast.

Leveraging the power of celebrity, mass social influence, story and live interactivity, Openfit is a digital streaming platform for people who want to make the commitment to change their Our offerings deliver both fitness and nutrition habits for the long term with the gratification of aligning that commitment with celebritiesnutritional content, and influencers they admire and love to watch. Celebrity-influence is combined with live small group training supervised by a team of certified trainers offering real time feedback, motivation and professional instruction. Complemented by the acquisition of Ladder, which originally formulated its products to the specifications of founders LeBron James and Arnold Schwarzenegger, Openfit provides an original and exciting digital fitness and wellness resource with its own exclusive library ofpersonal development mindset content. Openfit content can be streamed via iOS, Android, FireTV, Chromecast, Roku and AppleTV.

Digital subscriptions also help generate sales of our nutritional products, which are often sold together as bundles.

Nutritional Products

Our nutritional products include Shakeology, Beachbody Performance supplements, BEACHBARs and Bevvy supplements and others. As part of our mission to be a total health and wellness solution for our consumers, our nutritional products are formulated and manufactured to high quality standards and complement our fitness and device offerings. Our research and development team rigorously assesses and develops new nutritional products that are in line with customer goals, satisfies a continuum of customer demand, and increases subscriptions and customer lifetime revenue. Shakeology,, our premium nutrition shake,superfood health mix, is clinically shown to help reduce cravings and promote healthy weight loss and formulated to help support healthy digestion and provide healthy energy with its proprietary formula of superfoods, phytonutrients, enzymes, fiber and protein, with no artificial sweeteners, flavors, colors or preservatives.

4

Beachbody Performance supplements include our pre-workout Energize,, Hydrate,, post-workout Recover and protein supplement Recharge. These products were createdRecharge. In 2022, we launched First Thing and Last Thing, a comprehensive mind-body solution formulated with clinically effective key ingredients to meet different needs than Shakeology, which is a once-a-day premium nutrition shake that helps supplement a healthy diet.help support the immune system, nourish brain health, defend against stress, and encourage better sleep.

BEACHBARs are low-sugar snack bars available in three flavors, made with ingredients to help satisfy cravings without undermining our customers’ fitness and weight loss goals. We continue to research and develop additional nutritional products, and currently provide a variety of other nutritional supplements including collagen, fiber and greens “boosts.”

4

Connected Fitness Products

Our digital subscription offerings are complemented by our entrance into connected fitness through theproducts acquired from Myx Fitness acquisition in June 2021. The BeachbodyBODi Bike (also known as Myx) ismay be equipped with a unique swivel touch screen that enables users to engage with content beyond the indoor cycling experience and encourages broader cross-training, incorporating resistance training and yoga for a more holistic fitness experience and healthier results.

We believe a connected bike is a perfect fit and important genre for the BeachbodyBODi ecosystem with its focus on heartrate-based zone training, and together with Beachbody’sBODi’s digital subscription offerings and nutritional products, will bringbrings together a comprehensive at-home solution that provides personalization, live coaching, celebrity rides, nutritional supplements and healthy meal-planning.

We provide BeachbodyBOD and OpenfitBODi content through the bike's swivel touch screen. We plan to offer the Beachbodyfitness content and supplements together with the bike through BOD subscribersBODi subscriptions and Coaches,through our network as well as via direct-to-consumer marketing channels.

The BeachbodyBODi Bike is manufactured using commercial-grade equipment and includesmay include a 21.5” 360-degree swivel screen. In the United States, the standard package price is $1,399 and includes a Polar heart rate monitor with free delivery and set up. The “Plus”Additionally, we offer a “BODi Bike Studio” package price is $1,599,which bundles a 3-year subscription to BODi with special promotional offers from time to time.a bike and accessories for $1,625. In late 2023, we began offering a BODi bike without the 360-degree swivel screen which can be connected with customer's personal devices (e.g., phone, watch or tablet) for $499.

Implementing a “One Brand” Strategy

During 2022, we will consolidateconsolidated our streaming fitness and nutrition offerings into a single Beachbody platform and marketbegan marketing our connected fitness bike under the Beachbody brand. We believe the addition of prior Openfit products and talent into BOD’s alreadythe BOD and BODi extensive on-demand library will strengthenstrengthened the Beachbody ecosystem, enhanceenhanced our value proposition to all our customers and partners,Partners, and simplifysimplified our go-to-market strategy. It also helps us leverage the scale of our content creation, technology investments, and marketing.

Our Value Proposition

Our holistic approach to health and wellness provides the consumer with tools to succeedachieve positive health esteem at a lower cost than most traditional gyms or fitness studios and nutrition/weight loss plans.

Our business model is characterized by developing compelling fitness, nutrition, and nutrition programsmindset content and products that are designed to providehelp subscribers achieve their goals and feel good about themselves in the subscriber with results.process. This in turn attracts additional customers who see those resultsexperiences on social media. These consumers then become advocates for the company,Company, which helps attract and retain new and existing consumers. This “virtuous cycle” of content, customer success, and new customer acquisition drives subscriber growth and recurring revenue opportunities.

Our monthlyannual connected fitness subscription atof $179 equates to an average monthly price of $29.00$15.00 during 2023, which is less expensive than most monthly gym memberships, a fraction of the price of a personal training session, and less than the cost of one individual cycling class at a boutique studio. Boutique studio fitness classes typically cost between $25.00 and $45.00 per person per class and follow a strict schedule whereas our monthly connected fitness subscription covers the household of up to five people and offers unlimited use, anytime, anywhere. Our on-demand library featurefeatures classes, spanning five to 60 minutes, which provide our customers with flexibility and convenience.

For our bike,BODi Bike Studio, which bundles a BODi Bike, a 3-year subscription to BODi, and accessories, we offer attractive 0% APR financing programs to qualified customers through a third-party financing partner who bears the risk of loss

5

associated with the amount financed, which allow qualified customers to pay in monthly installments of as low as $28$50 for 4836 months. These financing programs have successfully broadened the base of customers by attracting consumers from a wider spectrum of ages and income levels.

Our nutritional products come in varying sizes and prices and are often bundled with digital content offerings. OneAn example of our most popular packagesa bundled package is the BODBODi and Shakeology Total Solution Pack, which is priced at $160$99 per month and comes with a one-monthtwenty serving supply of Shakeology and an annual BODa monthly BODi membership.

BODi's approach to Health Esteem is designed to help people feel good as they create sustainable healthy habits. We have the lifestyle solutions for individuals focused on weight loss, including a broad array of structured, step by step fitness and nutrition programs, plus personal development and mindset tools.

Our Economic Model

Our Beachbody offerings provide accessprimary model is selling directly to consumers. We attract new customer sign ups through three go-to-market models: 1) a proprietary network of Partners that earns commissions on their sales, 2) contact with current and past customers by emails or through our marketplacesocial media followers and 3) direct response marketing media.

Our Partner network drives the majority of Coaches, which are people who have signed up to use Beachbody’s products and organize groups on our proprietary social platform, BODgroups. On this platform, Coachesrevenues. Partners earn a share of the revenue generated by promoting our products and helping our customers succeed. They also earn additional bonuses for expanding this social networkour customer base by building teams of Coaches. This marketplace, called Team Beachbody, is made upPartners. The Partners are BODi’s equivalent of hundreds of thousands of Coaches and Preferred Customers who receive a 25% discount

5

on their purchases for personal use or, for Coaches, whogig workforce. In the year ended December 31, 2023 the Partners typically receivereceived a 25% commission on orders they generategenerated through their efforts. The Partner commission was reduced to 20% effective January 3, 2024. We also have a “Preferred Customer” program, which entitled them in the year ending December 31, 2023 to up to a 25% discount on certain purchases in return for paying a monthly subscription fee. The Preferred Customer discount was reduced to 20% effective December 1, 2023.

We also sellleverage our digital subscription products, nutritional productssuper trainers and connected fitness products direct to consumer throughother influencers in our Beachbodymarketing creative, as well as their social media following. We have arrangements with the influencers where they earn financial incentives for engaging customers and Openfit platforms. On Openfit, many of our influencers receive a commission on digital subscriptions or nutritional products that they help sell, however there is no commission paid on any subscriptions that are not sold through the social channels of these influencers.getting new customer sign ups.

Competition

We operate in the competitive and highly fragmented health and wellness market in which, given the holistic nature of our business, we face significant competition from multiple industry segments. WithinThe overall market opportunity remains large as 74% of U.S. adults are considered overweight according to the Centers for Disease Control and Prevention. A consumer's fitness weprofile may range from a very active gym member with multiple online platform subscriptions to an infrequent user with a single subscription. We want to help consumers achieve their health objectives by offering an engaging platform with healthy nutrition solutions.

We face significant competition from providers of at-home fitness solutions, including connected fitness equipment, digital fitness apps, and content, on-demand fitness offerings, and health andother wellness apps. We also face competition from weight management, dietary and nutritional supplement providers, and are sensitive to the introduction of new products or weight management plans, including various prescription drugs.

The recent emergence of the GLP -1 weight loss drugs have generated a considerable amount of attention. We are encouraged about treatments that can help some of the 74% of Americans that are overweight or obese, but we also recognize that a chemical solution is only a single step towards sustaining a healthy lifestyle and does nothing to improve skeletal muscle mass which is critical to health and functioning. It is important that people supplement these weight loss drugs with healthier lifestyle choices, including fitness and nutrition. BODi’s approach to Health Esteem helps people feel good as they create sustainable healthy habits.

We are also subject to significant competition in attracting CoachesPartners from other social commerce platforms, including those that market fitness solutions, weight management products and dietary and nutritional supplements. Our ability to remain competitive depends on our success in delivering results for our customers, maintaining our community, retaining CoachesPartners through attractive compensation plans, and continuing to offer a vast content library as well as an attractive product portfolio.

Our competitors may develop, or have already developed, products, features, content, services, or technologies that are similar to ours or that achieve greater acceptance, may undertake more successful product development efforts, create more compelling marketing campaigns, or may adopt more aggressive pricing policies. Our competitors may develop or acquire, or have already developed or acquired, intellectual property rights that significantly limit or

6

prevent our ability to compete effectively in the public marketplace. In addition, our competitors may have significantly greater resources than us, allowing them to identify and capitalize more efficiently upon opportunities in new markets and consumer preferences and trends, quickly transition and adapt their products and services, devote greater resources to marketing and advertising, or be better positioned to withstand substantial price competition. If we are not able to compete effectively against our competitors, they may acquire and engage customers or generate revenue at the expense of our efforts, which could have an adverse effect on our business, financial condition, and operating results.

Manufacturing

We rely on contract manufacturers to manufacture our nutritional products, bikes and related equipment. Our contract manufacturers can schedule and purchase supplies independently or from our suppliers, according to contractual parameters. Nutritional ingredients are sourced according to our specifications from our approved suppliers. Outsourcing allows us to operate an asset-light business model and focus our efforts on innovation, sales and marketing. Our contract manufacturers are regularly audited by third parties and in the case of nutritionals, they are also audited by our Quality Assurance department and comply with our rigorous Quality Assurance Protocols (“QAP”s) and specifications as well as follow industry good manufacturing practices (“GMP”s) and food safety guidelines. We believe our contract manufacturers have the capacity to meet our current and near-term supply needs. We monitor capacity and performance of our manufacturing partners and will qualify alternate suppliers as needed. We receive finished products from our contract manufacturers, which includes all packaging and ingredients used, as well as an agreed-upon charge for each item produced.

To mitigate against the risks related to a single source of supply, we qualify alternative suppliers and manufacturers when possible, and develop contingency plans for responding to disruptions, including maintaining adequate inventory of products.

Storage and Distribution

We outsource the storage and distribution of finished goods to third-party logistics companies, with facilities geographically dispersed to help optimize shipping times to our customer base. In the United States, our nutrition and other products are currently distributed from Groveport, Ohio or Ontario, California and shipped to U.S.-basedUnited States-based customers principally through FedEx or the U.S. Postal Service. In Canada, our nutrition and other products are

6

distributed from Ontario,Oshawa, Canada to customers via a third-party specialty shipper. In Europe, our products are distributed from Daventry,Northampton, UK to customers via a European transport provider. Usual delivery time is approximately five to seven days.

Our connected fitness products are currently distributed mainly from separate distribution centers in California, New Jersey, Illinois, and Georgia and shipped to U.S.-based customers principally through XPOGXO Logistics covering the entire United States.States and Canada.

Utilizing multiple partners from geographically-distributed locations enhances our geographic reach and allows us to further scale our distribution system and maintain flexibility, while reducing order fulfillment time and shipping costs. With our commitment to our customer-first approach, we will continue to invest to strengthen our operations’ coverage in locations we identify as strategic and cost-effective delivery markets throughout the United States, Canada, Europe, and in new international regions.

Intellectual Property

We believe our success, competitive advantages, and growth prospects depend in part upon our ability to develop and protect our content, technology, and intellectual property rights. We rely upon a combination of patents, trademarks, trade secrets, copyrights, confidentiality agreements, contractual commitments and other legal rights to establish and protect our brands and intellectual property rights throughout the world. For example, we file for and register our trademarks and monitor third party trademarks worldwide and we have developed a robust enforcement program to protect our brands/trademarks, domains, and copyrights to protect our intellectual property rights on various platforms including the web, borders/customs, e‑commerce and social channels to protect our brands, videos, DVDs and DVD kits, clothing, and accessories which have been and continue to be counterfeited. WeAs of December 31, 2023, we have over 3,000 registered trademarks, 172over 200 registered copyrights and four patents (including 1418 patents pending).

7

To minimize intellectual property infringement and counterfeiting, our team monitors domains, websites, eCommerce sites, social channels, distributors and other third parties through a third-party platform that monitors eBay, Amazon, Mercado Libre, YouTube, Vimeo, Instagram, Gumtree, Kijiji, Mercari and other platforms and sites in the U.S. and worldwide to identify third parties who purport to sell our products including DVDs and videos. Additionally, we enter into agreements with our commercial partners, supply-chainsupply chain vendors, employees and consultants to control access to, and clarify ownership of, our intellectual property and proprietary information.

Government Regulation

We are subject to many varying laws and regulations in the United States, Canada, the United Kingdom (the "UK"), the European Union (the "EU") and throughout the world, including those related to data privacy, data protection, data breach notification, content regulation, foods and dietary supplements, imports and exports, intellectual property, consumer protection, e-commerce, multi-level marketing, advertising, messaging, rights of publicity, health and safety, employment and labor, product liability, accessibility, competition, and taxation. These laws often require companies to implement specific information security controls to protect certain types of information, such as personal data, “special categories of personal data” or health data. While we strive to comply and remain compliant with each of these laws and regulations, they are constantly evolving and may be interpreted, applied, created, or amended in a manner that could require a change to our current compliance footprint, or harm our current or future business and operations. In addition, it is possible that certain governments may seek to block or limit our products and services or otherwise impose other restrictions that may affect the accessibility or usability of any or all of our products and services for an extended period of time or indefinitely.

With respect to data privacy and protection laws and regulations, in the European Union,EU, the General Data Protection Regulation, (the “GDPR”), became effective in 2018. The GDPR is intended to create a single legal framework for privacy rights that applies across all EU member states, including France, which is currently the only country in the EU in which we operate. The GDPR created more stringent operational requirements for controllers and processors of personal data, including, for example, requiring enhanced disclosures to data subjects about how personal data is processed (including information about the profiling of individuals and automated individual decision-making), limiting retention periods of personal data, requiring mandatory data breach notification, and requiring additional policies and procedures to comply with the accountability principle under the GDPR. Similarly, other jurisdictions are instituting privacy and data security laws, rules, and regulations, which could increase our risk and compliance costs. As a result of Brexit, for example, we will need to continue compliance with the UK Data Protection Act of 2018 for privacy rights across the United Kingdom, the legal requirements of which largely follow the GDPR.

7

We are also subject to laws, rules, and regulations regarding cross-border transfers of personal data, including laws relating to the transfer of personal data outside the European Economic Area, (“EEA”), and the United Kingdom.UK. We rely on transfer mechanisms permitted under these laws, including the standard contract clauses and intracompany data transfer agreements, which mechanisms have been subject to regulatory and judicial scrutiny. If these existing mechanisms for transferring personal data from the EEA, the United Kingdom, or other jurisdictions are unavailable, we may be unable to transfer personal data of employees or customers in those regions to the United States.

In addition to European data privacy rules, we are subject to privacy laws in the U.S. and Canada, including the most comprehensiveCalifornia Privacy Rights Act and strictest of which is the California Consumer Privacy Act (“CCPA”(collectively, “California Privacy Laws”). The CCPA requiresCalifornia Privacy Laws require us to provide clear notice to consumers about what data is collected about them, honor requests to opt-out of the sale or sharing of their personal data and comply with certain requests related to their personal data, such as the right to access or delete their personal data. We will also be subject to the new California Privacy Rights Act (“CPRA”) which will take effect on January 1, 2023. The CPRA expands California’s consumer privacy law and builds upon the CCPA.

Additionally, along with our contract manufacturers, distributors and ingredients and packaging suppliers, we are subject to laws and regulations related to our food and nutritional products. In the United States, the federal agencies governing the manufacture, distribution and advertising of our products include, among others, the Federal Trade Commission, the Food and Drug Administration ("FDA"), the United States Department of Agriculture (“USDA”), the U.S. Environmental Protection Agency and similar state and local agencies. Under various statutes, these agencies, among other things, prescribe the requirements and establish the standards for labeling, manufacturing, quality, and safety and regulate marketing and advertising to consumers. Certain of these agencies, in certain circumstances, must not only enforce regulations that apply to our food and nutritional products, but also review the manufacturing processes and facilities used to produce these products to ensure compliance with applicable regulations in the United States.

8

We may also be subject to increasing levels of regulation with respect to environmental, social and governance ("ESG") matters. For example, the SEC and the State of California, have adopted, or are considering rules to require companies to provide significantly expanded climate related disclosures, which may require us to incur additional costs to comply, including the implementation of significant additional internal controls processes and procedures.

We are also subject to laws and regulations regarding automatically renewing subscriber products and services as well as the status and determination of independent contractor status for our distributors, affiliates and influencers. Any changes in the laws, regulations or interpretations of these laws, or increased enforcement of such laws and/or regulations, could adversely affect our ability to retain customers, promote sales, and harm our financial condition and operating performance.

Seasonality

Historically, we have experienced higher sales in the first and second quarters of the fiscal year compared to other quarters, due in large part to seasonal holiday demand, New Year’s resolutions, and cold weather. We also have historically incurred higher selling and marketing expenses during these periods. For example, in the year ended December 31, 2023, our first and second quarters combined represented 53% of revenue and 54% of our selling and marketing expenses.

Human Capital

Mission and Values

Like our brand, product and content offerings, our culture is dynamic, unique, and framed by our expansive vision and passion for community, collaboration, and success. For our people, the purpose and function of our culture is clear, and operates as a shared language of values and as a way of getting things done that permeates through the many areas in which we operate as a company. Our culture is shaped by our Core Purpose: to help people achieve their goals and lead healthy, fulfilling lives. Our Core Purpose informs what we do, the products we develop, the people we hire and the business decisions we make, which helps us collaborate and interact with candor, passion and heart.

In furthering our Core Purpose, we employ the following business tenets, among others, in the way we operate:

8

Our Culture

To foster these values, we have committed to promote a culture that is professional, collaborative and informal.supportive. We are an inclusive group comprised of bright and talented people who are highly skilled and collaborative, who work hard and are relentless about seizing opportunities and solving problems. We assess our culture and listen to our workforce through periodic employee engagement surveys. Our workplace policies are informed by the feedback we receive from our employees. We are an equal opportunity employer, with all qualified applicants receiving consideration for employment without regard to race, color, religion, sex, sexual orientation, gender identity or expression, national origin, disability or protected veteran status. Throughout our organization, including our Board of Directors (the “Board”), we are committed to equality and fostering a diverse and inclusive culture.

Team Member Total Rewards

9

We offeraim to provide team members a competitive total rewards program that includes competitive salaries and a broad range of sponsored benefits such as a 401 (k) plan with a Company match, healthcare and compensation packages, includinginsurance benefits, parental leave, health and wellness offerings, product discounts, life insurance,paid time off and learning and development opportunities.opportunities, which we believe are competitive with others in our industry.

We are committed to fair and equal pay, respecting all people and all beliefs, and creating a positive social impact.

Employees

We are extremely proud of our team which embodies a diverse mix of backgrounds, industries, and levels of experience. We are a remote-first workplace, and as of December 31, 20212023, we employed 1,021582 full-time individuals,individuals. Our team members primarily workingwork remotely, but also across our El Segundo, California, New York City, New York, Provo, UtahVan Nuys, California and Harpenden, United Kingdom locations. We do not have any material collective bargaining agreements and consider relations with our employees to be good.

Web Site Access to Our Periodic SEC ReportsAvailable Information

The reports we file with the Securities and Exchange Commission (“SEC”), including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and proxy materials, including any amendments, are available free of charge on our website at www.thebeachbodycompany.com as soon as reasonably practicable after we electronically file such material with or furnish it to the SEC. The SEC also maintains a website (www.sec.gov) containing reports, proxy and information statements, and other information that we file with the SEC. Our Code of Ethics and Conduct and the Charters of our Audit Committee, Nominating and Corporate Governance Committee, and Compensation Committee are available on our website at www.thebeachbodycompany.com under the “investors”“Investors” section. Copies of the information identified above may be obtained without charge from us by writing to The Beachbody Company, Inc., 400 Continental Blvd., Suite 400, El Segundo, CA 90245, Attention: Corporate Secretary.Unless expressly noted, the information on our website, including our investor relations website, or any other website is not incorporated by reference in this Annual Report on Form 10-K and should not be considered part of this Annual Report on Form 10-K or any other filing we make with the SEC.

Item 1A. Risk Factors.

Investing in our common stocksecurities involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this Annual Report on Form 10-K, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the accompanying notes and the information contained in our other public filings before deciding whether to invest in shares of our common stock. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of or that we deem immaterial may also become important factors that adversely affect our business. If any of the following risks occur, our business, financial condition, operating results, and future prospects could be materially and adversely affected. In that event, the market price of our common stock could decline, and you could lose part or all of your investment.

Summary of Risk Factors

Risks Related to Our Business and Industry

910

Risks Related to Our Indebtedness

Risks Related to Expansion

Risks Related to Our Personnel

Risks Related to Data and Information Systems

11

Risks Related to Laws and Regulations

10

Risk Factors

Risks Related to Our Business and Industry

If we are unable to anticipate and satisfy consumer preferences and shifting views of health, fitness and nutrition, our business may be adversely affected.

The fitness industry is highly susceptible to changes in consumer preferences. Our success depends on our ability to anticipate and satisfy consumer preferences relating to health, fitness and nutrition. Our business is, and all of our workouts and products are, subject to changing consumer preferences that cannot be predicted with certainty. Consumers’ preferences for health and fitness services and products, including the technology through which they consume these services and products, could shift rapidly to offerings different from what we offer, and we may be unable to anticipate and respond to such shifts in consumer preferences. It is also possible that competitors could introduce new products, services and/or technologies that negatively impact consumer preference for our workouts and products. In addition, developments or shifts in research or public opinion on the types of workouts and products we provide could negatively impact our business. Even if we are successful in anticipating consumer preferences, our ability to adequately react to and address those preferences will in part depend upon our continued ability to develop and introduce innovative, high-quality health and fitness services. Our failure to effectively introduce new health and fitness services that are accepted by consumers could result in a decrease in revenue, which could have a material adverse effect on our financial condition and adversely impact our business.

If we are unable to sustain pricing levels for our products and services, our business could be adversely affected.

If we are unable to sustain pricing levels for our products and services, including our nutritional products, digital services and connected fitness products, whether due to competitive pressure or otherwise, our revenue and gross margins could be significantly reduced. In particular, we may not be able to increase prices to offset the impact of inflation on our costs. Further, our decisions around the development of new ancillary products and services are grounded in assumptions about eventual pricing levels. If there is price compression in the market after these decisions are made, it could have a negative effect on our business.

Our success depends on our ability to maintain the value and reputation of our brands.

We believe that our brands are important to attracting and retaining customers. Maintaining, protecting, and enhancing our brands depends largely on the success of our marketing efforts, ability to provide consistent, high-quality products, services, features, content, and support, and our ability to successfully secure, maintain, and defend our rights to use our trademarks, logos and other intellectual property important to our brands. We believe that the importance of our brands will increase as competition further intensifies and brand promotion activities may require substantial expenditures. Our brands could be harmed if we fail to achieve these objectives or if our public image were to be tarnished by negative publicity. Unfavorable publicity about us, including our products, services, technology, subscriber service, content, personnel, industry, distribution and/or marketing channel, and suppliers could diminish confidence in, and the use of, our products and services. Such negative publicity also could have an adverse effect on

12

the size, engagement and loyalty of our customer base and result in decreased revenue, which could have an adverse effect on our business, financial condition, and operating results.

The perception of the effects of our nutritional products may change over time, which could reduce customer demand.

A substantial portion of our revenues is derived from our Shakeology line of products. We believe that these nutritional products have, or are perceived to have, positive effects on health, and compete in a market that relies on innovation and evolving consumer preferences. However, the nutritional industry is subject to changing consumer trends, demands and preferences. Additionally, the science underlying nutritious foods and dietary supplements is constantly evolving. Therefore, products once considered healthy may over time become disfavored by consumers or no longer be perceived as healthy. Trends within the food industry change often and our failure to anticipate, identify or react to changes in these trends could, among other things, lead to reduced consumer demand and spending reductions, and

11

could adversely impact our business, financial condition and results of operations. Additionally, ingredients used in our products may become negatively perceived by consumers, resulting in reformulation of existing products to remove such ingredients, which may negatively affect taste or other qualities. Factors that may affect consumer perception of nutritional products include dietary trends and attention to different nutritional aspects of foods, concerns regarding the health effects of specific ingredients and nutrients, trends away from specific ingredients in products and increasing awareness of the environmental and social effects of product production. For example, conflicting scientific information on what constitutes good nutrition, diet trends and other weight loss trends may also adversely affect our business from time to time. Our success depends, in part, on our ability to anticipate the tastes and dietary habits of consumers and other consumer trends and to offer nutritional products that appeal to their needs and preferences on a timely and affordable basis. Failure to do so could have a material adverse effect on our financial condition and adversely impact our business.

We rely on consumer discretionary spending, which may be adversely affected by economic downturns and other macroeconomic conditions or trends.

Our business and operating results are subject to global economic conditions and their impact on consumer discretionary spending. Some of the factors that may negatively influence consumer spending include high levels of unemployment, higher consumer debt levels, reductions in net worth, declines in asset values and related market uncertainty, home foreclosures and reductions in home values, fluctuating interest rates and credit availability, fluctuating fuel and other energy costs, fluctuating commodity prices and general uncertainty regarding the overall future of the political and economic environment. Consumer purchases of discretionary items generally decline during periods of economic uncertainty, when disposable income is reduced or when there is a reduction in consumer confidence. If consumer purchases of subscriptions and products decline, our revenue may be adversely affected.

For example, the outbreak of COVID-19 has negatively affected economic conditions regionally as well as globally and has caused a reduction in consumer spending. Continued efforts to contain the effect of the virus have included travel restrictions and restrictions on public gatherings. Many businesses continue to limit non-essential travel and in-person events to reduce instances of employees and others being exposed to large public gatherings, and governments across the globe continue to restrict business and personal activities and strongly encouraged, instituted orders or otherwise restricted individuals from leaving their home. These efforts have led to an increase in at-home gyms and workouts which has in turn led to an increase in our consumers, a trend which may be negatively impacted as commercial and office gyms continue to reopen. The ultimate severity of the coronavirus outbreak and distribution and vaccine inoculation results are uncertain at this time and therefore we cannot predict the full impact it may have on our end markets or operations; however, the effect on our results could be material and adverse. Any significant or prolonged decrease in consumer spending on fitness or nutritional products could adversely affect the demand for our offerings, reducing our cash flows and revenues, and thereby materially harming our business, financial condition, results of operations and prospects.

Further, COVID-19 has had a significant impact on the fitness sector and has increased demand for home fitness solutions as gyms across the country have either been shuttered by government orders or abandoned by members uncertain of their safety in those facilities. While we cannot predict the long-term impact on consumer behavior, we believe that a significant percentage of gym goers do not plan to return to the gym even after widespread distribution of the COVID-19 vaccine. The adoption of at-home connected fitness by the broad market consumer has been accelerated by the pandemic. In addition, COVID-19 has had an adverse impact on global supply chains, resulting in an increased uncertainty in shipping lead times as well as increased import and logistics costs. However, if a significant percentage of consumers return to the gym and do not continue at-home fitness, or consumer sentiment shifts from prioritizing health and fitness, or import and logistics costs continue to increase, our business, financial condition, results of operations and prospects may be adversely affected.

Adverse publicity associated with our products, ingredients or network marketing program, or those of similar companies, could adversely affect our business.

The size of our distributor base and the results of our operations may be significantly affected by the perception of our company and similar companies. This perception is dependent upon opinions concerning:

13

12

Adverse publicity concerning any actual or purported failure of our Company or our distributors to comply with applicable laws and regulations regarding product claims and advertising, good manufacturing practices, the regulation of our network marketing business, the licensing of our products for sale in our target markets, or other aspects of our business, whether or not resulting in enforcement actions or the imposition of penalties, could have an adverse effect on the goodwill of our Company and could negatively affect our ability to attract, motivate and retain distributors, which would have a material adverse effect on our ability to generate revenue. We cannot ensure that all distributors will comply with applicable legal requirements relating to the advertising, sale, labeling, licensing or distribution of our products or promotion of the income opportunity.

In addition, our distributors’ and consumers’ perception of the safety and quality of our products and ingredients as well as similar products and ingredients distributed by other companies can be significantly influenced by national media attention, publicized scientific research or findings, widespread product liability claims and other publicity concerning our products or ingredients or similar products and ingredients distributed by other companies. Adverse publicity, whether or not accurate or resulting from consumers’ use or misuse of our products, that associates consumption of our products or ingredients or any similar products or ingredients with illness or other adverse effects, questions the benefits of our or similar products or claims that any such products are ineffective, inappropriately labeled or have inaccurate instructions as to their use, could have a material adverse effect on our reputation or the market demand for our products.

We may not successfully execute or achieve the expected benefits of our strategic alignment initiativeinitiatives and other cost-saving measures we may take in the future, and our efforts may result in further actions and/or additional asset impairment charges and adversely affect our business.

In the first quarter of 2022, we implemented a strategic alignment initiative, which primarily includes shifting to a single technology and marketing platform business model during calendar yearBeginning in early 2022 and undertakingcontinuing in 2023, we executed cost reduction activities intended to streamline the business and strategically align operations, including multiple reductions in our headcount. Our strategic alignment initiative isinitiatives were intended to address the short-term health of our business as well as our long-term objectives and is based on our current estimates, assumptions and forecasts, which are subject to known and unknown risks and uncertainties, including whether we have targeted the appropriate areas for our cost-saving efforts and at the appropriate scale, and whether, if required in the future, we will be able to appropriately target any additional areas for our cost-saving efforts. As such, the actions we intendintended to take under the strategic alignment initiativeinitiatives and that we may decide to take in the future may not be successful in yielding our intended results and may not appropriately address either or both of the short-term and long-term strategy for our business. Additionally, implementation of the strategic alignment initiativeinitiatives and any other cost-saving initiatives may be costly and disruptive to our business, the expected costs and charges may be greater than we have forecasted, and the estimated cost savings may be lower than we have forecasted. In addition, our initiatives could result in personnel attrition beyond our planned reductions in headcount or reduce employee morale, which could in turn adversely impact productivity, including through a loss of continuity, loss of accumulated knowledge and/or inefficiency during transitional periods, or our ability to attract highly skilled employees. Unfavorable publicity about us or any of our strategic initiatives, including our strategic alignment initiative,initiatives, could result in reputation harm and could diminish confidence in, and the use of, our products and services. The strategic alignment initiative hasinitiatives have required, and may continue to require, a significant amount of management’s and other employees’ time and focus, which may divert attention from effectively operating and growing our business. We also cannot assure you that it will impact our ability to achieve or maintain profitability.

Our marketing strategy relies on the use of social media platforms and any negative publicity on such social media platforms may adversely affect the public perception of our brand, and changing terms or conditions or ways in which advertisers use their platforms may adversely affect our ability to engage with customers, both of which in turn could have a material and adverse effect on our business, results of operations and financial condition. In addition, our use of social media could subject us to fines or other penalties.

We rely on social media marketing through various social media platforms, such as Instagram, YouTube and Facebook, as a means to engage with our existing customers as well as attract new customers. Existing and new customers alike interact with the brand both organically, through posts by the BeachbodyBODi community, as well as through distributors via their own social media accounts. While the use of social media platforms allows us access to a broad audience of consumers and other interested persons, our use of, and reliance on, social media as a key marketing tool

14

exposes us to significant risk of widespread negative publicity. Social media users generally have the

13

ability to post information to social media platforms without filters or checks on accuracy of the content posted. Information concerning the Company or its many brands may be posted on such platforms at any time. Such information may be adverse to our interests or may be inaccurate, each of which can harm our reputation and value of our brands. The harm may be immediate without affording us an opportunity for redress or correction. In addition, social media platforms provide users with access to such a broad audience that collective action against our products and offerings, such as boycotts, can be more easily organized. If such actions were organized, we could suffer reputational damage. Social media platforms may be used to attack us, our information security systems, including through use of spam, spyware, ransomware, phishing and social engineering, viruses, worms, malware, distributed denial of service attacks, password attacks, “Man in the Middle” attacks, cybersquatting, impersonation of employees or officers, abuse of comments and message boards, fake reviews, doxing and swatting. As such, the dissemination of information on social media platforms and other online platforms could materially and adversely affect our business, results of operations and financial condition, regardless of the information’s accuracy.

Our reliance on social media platforms for advertising also subjects us to the risk that any change to the platforms’ algorithms, terms and conditions and/or ways in which advertisers may advertise on their platforms may adversely affect our ability to effectively engage with customers and sell our products, which in turn could have a material and adverse effect on our business, results of operations and financial condition.

In addition, our use of social media platforms as a marketing tool could also subject us to fines or other penalties. As laws and regulations, including those from the Federal Trade Commission, State Attorneys General, and other enforcement agencies rapidly evolve to govern the use of these platforms, the failure by us, our distributors, influencers, or other third parties acting at our direction to abide by applicable laws and regulations in the use of these platforms could materially and adversely impact our business, results of operations and financial condition or subject us to fines or other penalties.

We may be unable to attract and retain customers, which would materially and adversely affect our business, results of operations and financial condition.

The success of our business depends on our ability to attract and retain customers. Our marketing efforts may not be successful in attracting customers, and membership levels may materially decline over time. Customers may cancel their membership at any time. In addition, we experience attrition, and we must continually engage existing customers and attract new customers in order to maintain membership levels. Some of the factors that could lead to a decline in membership levels include, among other factors:

Any decrease in our average fees or higher membership costs may materially and adversely impact our results of operations and financial condition. Additionally, further expansion into international markets may create new challenges in attracting and retaining customers that we may not successfully address, as these markets carry unique risks as discussed below. As a result of these factors, we cannot be certain that our membership levels will be adequate to maintain or permit the expansion of our operations. A decline in membership levels would have an adverse effect on our business, results of operations and financial condition.

1415

Our customers use their connected fitness products and fitness accessories to track and record their workouts. If our products fail to provide accurate metrics and data to our customers, our brand and reputation could be harmed, and we may be unable to retain our customers.

Our customers use their connected fitness products and fitness accessories to track and record certain metrics related to their workouts. Examples of metrics tracked on our platform currently include heartrate and calories burned. These metrics assist our customers in tracking their fitness journeys and understanding the effectiveness of their workouts. We anticipate introducing new metrics and features in the future. If the software used in our connected fitness products or on our platform malfunctions and fails to accurately track, display, or record customers workouts and metrics, we could face claims alleging that our products and services do not operate as advertised. Such reports and claims could result in negative publicity, product liability claims, and, in some cases, may require us to expend time and resources to refute such claims and defend against potential litigation. If our products and services fail to provide accurate metrics and data to our customers, or if there are reports or claims of inaccurate metrics and data or claims of inaccuracy regarding the overall health benefits of our products and services in the future, we may become the subject of negative publicity, litigation, regulatory proceedings, and warranty claims, and our brand, operating results, and business could be harmed.

Our business relies on sales of a few key products.

Our digital platforms which provide recurring subscription revenue also provide a significant portion of our revenue, accounting for approximately 42%49% of revenue for the year ended December 31, 2021.2023. Our nutrition products also constitute a significant portion of our revenue, accounting for approximately 47% of revenue for the year ended December 31, 2023 and Shakeology, our premium nutrition shake, alsospecifically constitutes a significant portion of our revenue, accounting for approximately 30%20% of revenue for the year ended December 31, 2021.2023. If consumer demand for these products decreases significantly or we cease offering these products without a suitable replacement, our operations could be materially adversely affected. Despite these efforts, our financial performance currently remains dependent on a few products. Any significant diminished consumer interest in these products would adversely affect our business. We could also experience adverse financial consequences if we fail to sustain market interest in our BeachbodyBODi Bike business, (also known as Myx), which accounted for approximately 5%4% of revenue for the year ended December 31, 2021.2023. We may not be able to develop successful new products or implement successful enhancements to existing products. Any products that we do develop or enhance may not generate sufficient revenue to justify the cost of developing and marketing these products.

We operate in highly competitive markets and we may be unable to compete successfully against existing and future competitors.

Our products and services are offered in a highly competitive market. We face significant competition in every aspect of our business, including at-home fitness equipment and content, fitness clubs, nutritional products, dietary supplements, and health and wellness apps. Moreover, we expect the competition in our market to intensify in the future as new and existing competitors introduce new or enhanced products and services that compete with ours.

Our competitors may develop, or have already developed, products, features, content, services, or technologies that are similar to ours or that achieve greater acceptance, may undertake more successful product development efforts, create more compelling employment opportunities, or marketing campaigns, or may adopt more aggressive pricing policies. Our competitors may develop or acquire, or have already developed or acquired, intellectual property rights that significantly limit or prevent our ability to compete effectively in the public marketplace. In addition, our competitors may have significantly greater resources than us, allowing them to identify and capitalize more efficiently upon opportunities in new markets and consumer preferences and trends, quickly transition and adapt their products and services, devote greater resources to marketing, advertising and research and development, or be better positioned to withstand substantial price competition. If we are not able to compete effectively against our competitors, they may acquire and engage customers or generate revenue at the expense of our efforts, which could have an adverse effect on our business, financial condition, and operating results. The business of marketing nutritional products is highly competitive and sensitive to the introduction of new products, including various prescription drugs, which may rapidly capture a significant share of the market. These market segments include numerous manufacturers, distributors, marketers, retailers and physicians that actively compete for the business of consumers both in the United States and abroad. In addition, we anticipate that we will be subject to increasing competition in the future from large electronic commerce sellers. Some of these competitors have significantly greater financial, technical, product development, marketing and sales resources, greater name recognition, larger established subscriber bases, and better-developed distribution channels than we do. Our present or future competitors may be able to develop products that are

16

comparable or superior to those we offer, adapt more quickly than we do to new technologies, evolving industry trends and standards or subscriber requirements, or devote greater resources to the development, promotion and sale of their

15

products than we do. Accordingly, we may not be able to compete effectively in our markets and competition may intensify.

We are also subject to competition for the recruitment of distributors from other organizations, including those that market nutritional products, dietary and nutritional supplements, and personal care products as well as other types of products. Our ability to remain competitive depends, in part, on our success in recruiting and retaining CoachesPartners through an attractive compensation plan, the maintenance of an attractive product portfolio, and other incentives. We cannot ensure that our programs for recruitment and retention efforts will be successful.successful, or that we will be able to continue to offer the same compensation plans to our Partners. We have recently changed the compensation plans for our Partners and such changes, and any future changes, may have an adverse effect on our relationships with our current Partners or our ability to recruit new Partners.

We compete with other direct selling organizations, some of which have longer operating histories and higher visibility, name recognition and financial resources. The Company competes for new CoachesPartners on the basis of the culture, premium quality products and compensation plan. We envision the entry of many more direct selling organizations into the marketplace as this channel of distribution expands. There can be no assurance that the Company will be able to successfully meet the challenges posed by increased competition.

We also compete for the time, attention and commitment of our independent distributor force. Given that the pool of individuals interested in the business opportunities presented by direct selling tends to be limited in each market, the potential pool of distributors for our products is reduced to the extent other companies successfully recruit these individuals into their businesses. Although we believe that we offer an attractive business opportunity, there can be no assurance that other companies will not be able to recruit our existing distributors or deplete the pool of potential distributors in a given market.

We have limited control over our suppliers, manufacturers, and logistics providers, which may subject us to significant risks, including the potential inability to produce or obtain quality products on a timely basis or in sufficient quantity in order to meet demand.

We have limited control over our suppliers, manufacturers, and logistics providers, which subjects us to risks, such as the following:

17

16

We also rely on our logistics providers, including last mile warehouse and delivery providers, to complete deliveries to customers. If any of these independent contractors do not perform their obligations or meet the expectations of us or our customers, our reputation and business could suffer.

The occurrence of any of these risks, especially during seasons of peak demand, could cause us to experience a significant disruption in our ability to produce and deliver our products to our customers.

The failure or inability of our contract manufacturers to comply with the specifications and requirements of our products could result in a product recall, which could adversely affect our reputation and subject us to significant liability should the consumption of any of our products cause or be claimed to cause illness or physical harm.

We sell nutritional products for human consumption, which involves risks such as product contamination or spoilage, product tampering, other adulteration, mislabeling and misbranding. We also sell stationary bikes. All of our products are manufactured by independent third-party contract manufacturers. In addition, we do not own a warehouse facility, instead it is managed for us by a third party. Under certain circumstances, we may be required to, or may voluntarily, recall or withdraw products.

A widespread recall or withdrawal of any of our products may negatively and significantly impact our sales and profitability for a period of time and could result in significant losses depending on the costs of the recall, destruction of product inventory, reduction in product availability, and reaction of competitors and consumers. We may also be subject to claims or lawsuits, including class actions lawsuits (which could significantly increase any adverse settlements or rulings), resulting in liability for actual or claimed injuries, illness or death. Any of these events could adversely affect our business, financial condition and results of operations. Even if a product liability claim or lawsuit is unsuccessful or is not fully pursued, the negative publicity surrounding any assertion that our products caused illness or physical harm could adversely affect our reputation with existing and potential consumers and its corporate and brand image. Moreover, claims or liabilities of this sort might not be covered by insurance or by any rights of indemnity or contribution that we may have against others. We maintain product liability and product recall insurance in an amount that we believe to be adequate. However, we may incur claims or liabilities for which it is not insured or that exceed the amount of its insurance coverage. A product liability judgment against us or a product recall could adversely affect our business, financial condition and results of operations.

If any of our products are unacceptable to us or our customers, our business could be harmed.

We have occasionally received, and may in the future continue to receive, shipments of products that fail to comply with our technical specifications or that fail to conform to our quality control standards. We have also received, and may in the future continue to receive, products that either meet our technical specifications but that are nonetheless unacceptable to us, or products that are otherwise unacceptable to us or our customers. Under these circumstances, unless we are able to obtain replacement products in a timely manner, we risk the loss of net revenue resulting from the inability to sell those products and related increased administrative and shipping costs. Additionally, if the unacceptability of our products is not discovered until after such products are purchased by our customers or riders, they could lose confidence in the quality of our products and our results of operations could suffer and our business could be harmed.

Our products and services may be affected from time to time by design and manufacturing defects that could adversely affect our business and result in harm to our reputation.