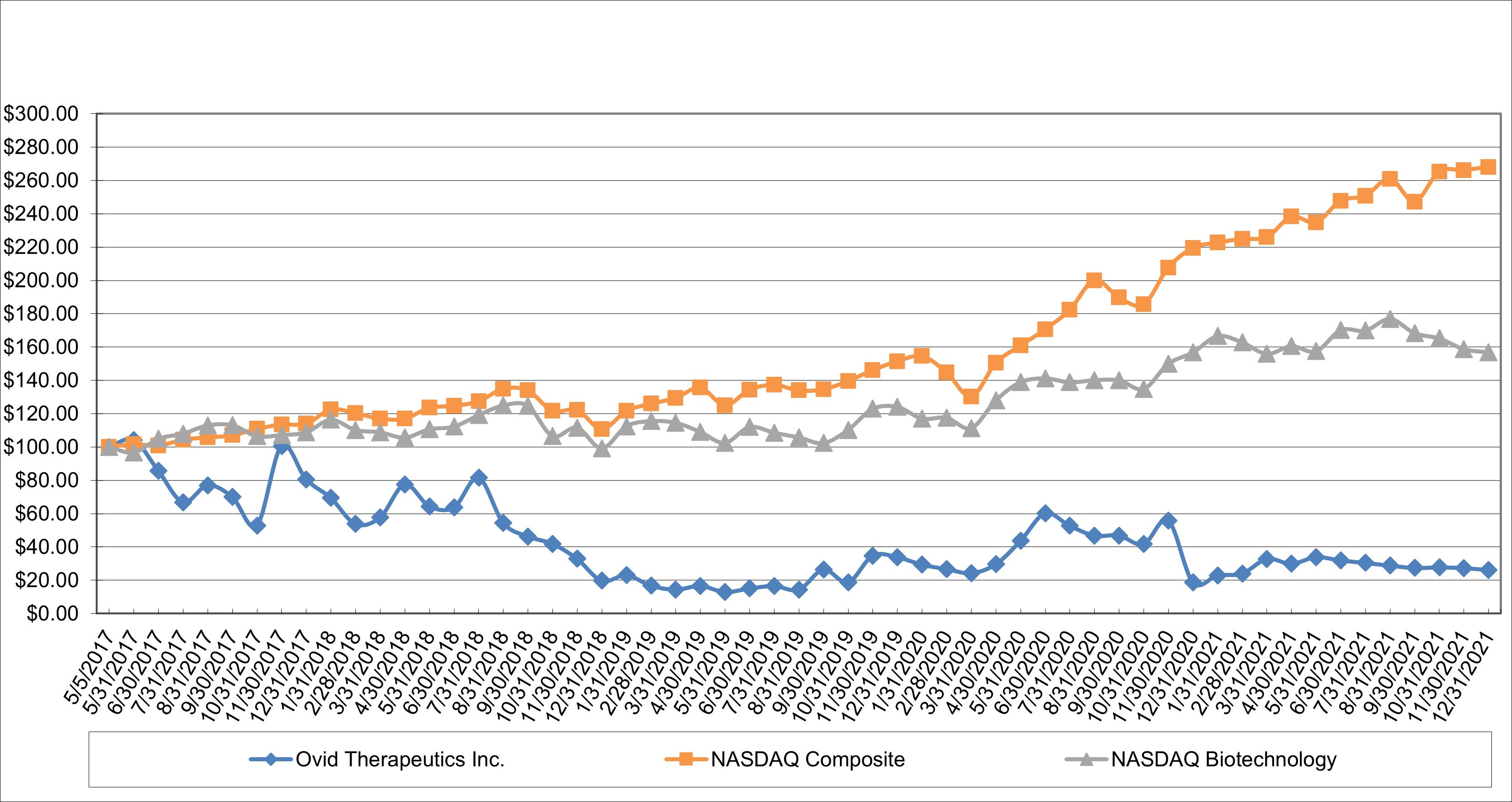

441 Ninth Avenue, 14th Floor Title of each class Name of each exchange on which registered Common Stock, par value $0.001 per share OVID The Nasdaq Stock Market LLC x o o Large Accelerated Filer o Accelerated Filer Non-accelerated Filer x Smaller Reporting Company x Emerging growth company o Portions of the registrant’s definitive proxy statement for its trademarks and trade names referred to, including logos, artwork and other visual displays, may appear without the ® or potential small molecule neurotherapeutics. the long-term future of treating genetic epilepsies and neurological disorders. Accordingly, we engage in appropriately scaled, early-stage research programs with certain collaborators, including Gensaic, Inc., formerly M13 Therapeutics, Inc. (“Gensaic”), a next-generation gene therapy developer. In June 2023, the Healx for OV329 Patent Rights. Patents, and, upon commercialization of any such products, will be required to pay to Northwestern a tiered royalty on net sales of such products by the Company, its affiliates or sublicensees, at percentages in the low to mid-single-digits, subject to standard reductions and offsets. Our royalty obligations continue on a product-by-product and country-by-country basis until the later of the expiration of the last-to-expire valid claim in a licensed patent covering the applicable product in such country and As it relates to OV888 (GV101), we believe Neurelis Inc. is our most direct competitor. application should be approved and under what conditions. The FDA is not bound by the recommendations of an advisory committee, but it considers such recommendations carefully when making decisions. Biden administration’s October 2022 executive order, on February 14, 2023, HHS released a report outlining three new models for testing by the CMS Innovation Center which will be evaluated on their ability to lower the cost of drugs, promote accessibility, and improve quality of care. It is unclear whether the models will be utilized in any health reform measures in the future. Further, on December 7, 2023, the Biden administration announced an initiative to control the price of prescription drugs through the use of march-in rights under the Bayh-Dole Act. On December 8, 2023, the National Institute of Standards and Technology published for comment a Draft Interagency Guidance Framework for Considering the Exercise of March-In Rights which for the first time includes the price of a product as one factor an agency can use when deciding to exercise march-in rights. While march-in rights have not previously been exercised, it is uncertain if that will continue under the new framework. As of December 31, have received LEED Platinum certification. business strategy. limited. ability to generate revenue from drug sales depends heavily on our, or any current or future collaborators’, success in the following areas, including but not limited to: the United States. Failure to obtain regulatory approval in the United States or other jurisdictions would prevent us from commercializing and marketing our current and future drug candidates. are a number of large pharmaceutical and biotechnology companies that currently market and sell drugs or are pursuing the development of drug candidates for the treatment of the indications that we are pursuing. Potential competitors also include academic institutions, government agencies and other public and private research organizations that conduct research, seek patent protection and establish collaborative arrangements for research, development, manufacturing and commercialization. Pursuant to the Ligand Agreement, Ligand will receive a 13% portion of the royalties and milestones owed to us pursuant to the RLT Agreement. amount of reimbursement to be provided for any drug candidates that we develop will be made on a payor-by-payor basis. One third-party payor’s determination to provide coverage for a drug does not assure that other payors will also provide coverage, and adequate reimbursement, for the drug. Additionally, a third-party payor’s decision to provide coverage for a therapy does not imply that an adequate reimbursement rate will be approved. Each third-party payor determines whether or not it will provide coverage for a therapy, what amount it will pay the manufacturer for the therapy, and on what tier of its formulary it will be placed. The position on a third-party payor’s list of covered drugs, or formulary, generally determines the co-payment that a patient will need to make to obtain the therapy and can strongly influence the adoption of such therapy by patients and physicians. Patients who are prescribed treatments for their conditions and providers prescribing such services generally rely on third-party payors to reimburse all or part of the associated healthcare costs. Patients are unlikely to use our drugs unless coverage is provided and reimbursement is adequate to cover a significant portion of the cost of our drugs. System (“MIPS”). Under both APMs and MIPS, performance data collected each performance year will affect Medicare payments in later years, including potentially reducing payments. research and development partnerships or similar agreements. We seek to protect our proprietary technology in part by entering into confidentiality agreements and, if applicable, material transfer agreements, consulting agreements or other similar agreements with our advisors, employees, third-party contractors and consultants prior to beginning research or disclosing proprietary information. These agreements typically limit the rights of the third parties to use or disclose our confidential information, including our trade secrets. Despite the contractual provisions employed when working with third parties, the need to share trade secrets and other confidential information increases the risk that such trade secrets become known by our competitors, are inadvertently incorporated into the technology of others, or are disclosed or used in violation of these agreements. Given that our proprietary position is based, in part, on our know-how and trade secrets, a competitor’s discovery of our trade secrets or other unauthorized use or disclosure could have an adverse effect on our business and results of operations. our results of operations. Additionally, we do not currently maintain “key person” life insurance on the lives of our executives or any of our employees. levels of persistence, sophistication and intensity, and are also being conducted by sophisticated and organized groups and individuals with a wide range of motives (including, but not limited to, industrial espionage) and expertise, including organized criminal groups, “hacktivists,” nation states and others. a ransomware attack, but we may be unwilling or unable to make such payments due to, for example, applicable laws or regulations prohibiting such payments. obligations. security laws, we may be bound by other contractual obligations related to data privacy and security, and our efforts to comply with such obligations may not be successful. We also publish privacy policies, marketing materials, and other statements regarding data privacy and security and if these policies, materials, or statements are found to be deficient, lacking in transparency, deceptive, unfair, or misrepresentative of our practices, we may be subject to investigation, enforcement actions by regulators, or other adverse consequences. If we fail to maintain an effective system of internal control over financial reporting in the future, we may not be able to accurately report our financial condition, results of operations or cash flows, which may adversely affect investor confidence in us and, as a result, the value of our common stock. report on internal control over financial reporting issued by our independent registered public accounting firm in this Annual Report on Form 10-K for the fiscal year ended December 31, 2023. dilutive. business. disagree. current management by making it more difficult for stockholders to replace members of our board of directors. Among other things, these provisions: General Corporation Law (the “DGCL”), which may discourage, delay or prevent someone from acquiring us or merging with us whether or not it is desired by or beneficial to our stockholders. Under the DGCL, a corporation may not, in general, engage in a business combination with any holder of 15% or more of its capital stock unless the holder has held the stock for three years or, among other things, the board of directors has approved the transaction. Any provision of our amended and restated certificate of incorporation or amended and restated bylaws or Delaware law that has the effect of delaying or deterring a change of control could limit the opportunity for our stockholders to receive a premium for their shares of our common stock and could also affect the price that some investors are willing to pay for our common stock. Sales of a substantial number of shares of our common stock in the public market could cause the market price of our common stock to drop significantly. intellectual property rights; complying with applicable regulatory requirements. 2022 Year Ended Year Ended December 31, December 31, 2021 2020 Change $ (in thousands) Revenue: License and other revenue $ 12,383 $ 12,617 $ (234 ) License revenue - related party 196,000 - 196,000 Total revenue 208,383 12,617 195,766 Operating expenses: Research and development 46,940 63,417 (16,477 ) General and administrative 37,234 30,631 6,603 Total operating expenses 84,174 94,048 (9,874 ) Income (loss) from operations 124,209 (81,431 ) 205,640 Other (expense) income, net (46 ) 395 (441 ) Income (loss) before provision for income taxes 124,163 (81,036 ) 205,199 Provision for income taxes 1,329 - 1,329 Net income (loss) $ 122,834 $ (81,036 ) $ 203,871 Year Ended Year Ended December 31, December 31, 2021 2020 Change $ (in thousands) Preclinical and development expenses $ 30,386 $ 43,612 $ (13,226 ) Payroll and payroll-related expenses 13,454 15,439 (1,985 ) Other expenses 3,101 4,366 (1,265 ) Total research and development $ 46,940 $ 63,417 $ (16,476 ) Year Ended Year Ended December 31, December 31, 2021 2020 Change $ (in thousands) Payroll and payroll-related expenses $ 14,008 $ 13,390 $ 618 Legal and professional fees 17,071 13,824 3,247 General office expenses 6,154 3,417 2,737 Total general and administrative $ 37,234 $ 30,631 $ 6,603 unrealized loss on long-term equity investments. issuance of this Annual Report on Form 10-K. negatively affect our See “Risk Factors” for additional risks associated with our capital requirements. Year Ended Year Ended December 31, December 31, 2021 2020 (in thousands) Net cash provided by (used in): Operating activities $ 118,612 $ (51,584 ) Investing activities (1,821 ) 34,648 Financing activities 904 47,072 Net increase in cash, cash equivalents, and restricted cash $ 117,694 $ 30,137 changes. in U.S. treasury funds. employee stock purchase plan. and Policies royalty agreements. reduced disclosure obligations regarding executive compensation arrangements; and 2023. year ended December 31, 2023. NOTE has not declared any dividends. No dividends on the common stock shall be declared and paid unless dividends on the provides for the grant of performance On January 1, 2024, an additional 3,534,600 shares were reserved for issuance under the 2017 Plan. months, respectively under the 2017 Plan and 6 months under the 2014 Plan.. stock prices. awards recognized. $9.3 million and $11.5 million as of December 31, The Company’s stock-based compensation expense was recognized in operating expenses as follows: For the Year Ended December 31, 2021 2020 Research and development $ 1,679,183 $ 2,779,758 General and administrative 3,375,274 4,745,596 Total $ 5,054,457 $ 7,525,354 For the Year Ended December 31, 2021 2020 Stock options $ 4,970,670 $ 7,372,381 Employee Stock Purchase Plan 83,787 152,973 Total $ 5,054,457 $ 7,525,354 For the Year Ended December 31, 2021 2020 Weighted Weighted Volatility 84.38 % 81.48 % Expected term in years 6.03 5.88 Dividend rate 0.00 % 0.00 % Risk-free interest rate 0.90 % 0.58 % Fair value of option on grant date $ 2.50 $ 2.62 The fair value of nonemployee options granted and remeasured during the years ended December 31, For the Year Ended December 31, 2021 2020 Weighted Weighted Volatility 80.43 % 74.37 % Expected term in years 6.23 5.64 Dividend rate 0.00 % 0.00 % Risk-free interest rate 1.03 % 2.32 % Fair value of option on grant date $ 2.49 $ 1.18 Weighted Weighted Average Average Remaining Aggregate Number of Exercise Contractual Intrinsic Shares Price Life in Years Value Options Outstanding at December 31, 2019 7,405,295 $ 5.82 8.01 $ 4,488,930 Vested and exercisable at December 31, 2019 3,296,547 $ 7.93 6.53 $ 356,443 Granted 3,583,160 3.93 9.68 Exercised (165,384 ) 1.82 Forfeited (415,526 ) 5.00 Options Outstanding December 31, 2020 10,403,420 $ 5.26 7.59 $ 652,438 Vested and exercisable at December 31, 2020 5,395,658 $ 6.45 6.13 $ 445,599 Granted 2,045,913 3.53 9.47 Exercised (288,525 ) 2.36 Forfeited (1,384,050 ) 4.08 Options Outstanding December 31, 2021 10,776,758 $ 4.97 6.07 $ 2,389,890 Vested and exercisable at December 31, 2021 6,188,200 $ 5.98 4.63 $ 1,531,907 last ownership change. The tax effects of temporary differences that gave rise to significant portions of the deferred tax assets and liabilities were as follows: December 31, 2021 2020 Deferred tax assets/liabilities: Net operating loss carryovers 49,086,998 $ 74,064,673 Research and development tax credits 2,422,331 5,458,004 Share-based compensation 4,663,578 4,978,370 Accrued compensation (28,243 ) 514,316 Depreciation (51,920 ) (29,760 ) Charitable contributions 87,672 87,120 Intangible assets 7,121,484 4,742,031 Total gross deferred tax assets/liabilities 63,301,900 89,814,754 Valuation allowance (63,301,900 ) (89,814,754 ) Net deferred tax assets (liabilities) $ 0 $ 0 December 31, 2021 2020 Federal income tax benefit at statutory rate 21.00 (21.00 ) State income tax, net of federal benefit (1) 1.05 6.15 Permanent items 0.53 0.75 Change in valuation allowance (21.39 ) 16.72 Research and development tax credits (1.05 ) (2.64 ) Other 0.93 0.02 Effective income tax (benefit) expense rate 1.07 % 0.00 % (1) Inclusive of $5.8 million deferred tax benefit due to change in apportionment Patent Rights. The Company is developing OV329 under this agreement. contingencies are expensed as incurred. The Company is not currently involved in any legal matters arising in the normal course of business. AGREEMENTS year ended December 31, 2023. During the year ended December 31, The For the Year Ended December 31, 2021 2020 Net income (loss) $ 122,834,584 $ (81,035,576 ) Net income attributable to participating securities (2,997,344 ) - Net income (loss) attributable to common stockholders $ 119,839,261 $ (81,035,576 ) For the Year Ended December 31, 2021 2020 Basic and Diluted Net income (loss) attributable to common stockholders $ 119,839,261 $ (81,035,576 ) Weighted average common shares outstanding used in 67,479,403 58,451,293 Weighted average common shares outstanding used in 68,067,992 58,451,293 Net income (loss) per share, basic $ 1.78 $ (1.39 ) Net income (loss) per share, diluted $ 1.76 $ (1.39 ) ☒x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 19342021OR☐o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934Delaware 2834 46-5270895 Delaware283446-52708951460 Broadway, Suite 15021, New York10036(646) 10001Indicatendicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ Noo ☒No ☐ o No ☒xYesx ☒ No ☐Yesx ☒ No ☐☐☒☐☒☒☒oYes ☐ No ¨☒If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨☐o No ☒x2021,2023, the last day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the Common Stock held by non-affiliates of the registrant was approximately $217.2$191.1 million based on the closing price of the registrant’s common stock on June 30, 2021.2023. The calculation excludes shares of the registrant’s common stock held by current executive officers, directors and stockholders that the registrant has concluded are affiliates of the registrant. This determination of affiliate status is not a determination for other purposes.10, 2022,5, 2024, there were 70,373,16270,709,857 shares of common stock outstanding.20222024 Annual Meeting of Stockholders, which the registrant intends to file pursuant to Regulation 14A with the Securities and Exchange Commission not later than 120 days after the registrant’s fiscal year ended December 31, 2021,2023, are incorporated by reference into Part III of this Annual Report on Form 10-K.istatementsour expectations regarding government and third-party payor coverage and reimbursement;COVID-19 pandemic and its effectsimpact of geopolitical tensions, including war or the perception that hostilities may be imminent, adverse global economic conditions, terrorism, natural disasters or public health crises on our operations, access to capital, research and development and clinical trials and potential disruption in the operations and business of third-party manufacturers, contract research organizations, or CROs, other service providers,third parties and collaborators with whom we conduct business;our expectations regarding government and third-party payor coverage and reimbursement;•our ability to compete in the markets we serve;•the impact of government laws and regulations;•developments relating to our competitors and our industry; and•subsidiaries.subsidiary. This Annual Report on Form 10-K also contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience,1TM™ symbols, but such references are not intended to indicate, in any way, that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.2committedthat is dedicated to developing medicines that transformmeaningfully improving the lives of people affected by certain epilepsies and seizure-related disorders.brain conditions with seizure symptoms. We believe that addressing these epilepsiesdisorders represents a substantial scientific, medical and seizure-related disorders represent an attractive area for drug development ascommercial opportunity. Over the last decade, scientific understanding of the underlying biology of neuronal hyperexcitability and the related pathophysiology of epilepsy and many neurological disorders has grown meaningfullyimproved. This understanding of disease, coupled with advances in preclinical research tools, is improving the predictive potential of translational research, and thereby, may increase the probability of successful clinical development of anti-seizure medicines (“ASMs”). Emerging science also indicates that addressing the underlying causes of hyperexcitability may have therapeutic applications in broad neurological disease well beyond epilepsy.few100 years, and today represents a substantial number of epilepsy patients continue to experience breakthrough seizures that can cause enduring damage to the brain. Individuals who suffer from rare forms of refractory epilepsies may experience persistent seizure rates ranging from 50 - 90%. The seizures they suffer can have a devastating impact both upon patients and their families, by triggering permanent motor, cognitive and developmental delays, as well as epileptogenesis, which is a cascade of seizures begetting more seizures. Some patients with developmental epileptic encephalopathies experience even greater rates of refractory seizures that are resistant to drug therapy.commercial opportunity.scientific advancements have set the stage for a potential era of neurotherapeutics, which we believe will be led by ASMs.aim to identify, discover and develop novel therapeutics based onbelieve that major developments in the rapid increase in scientific understanding of the rolebiology of geneticsthese diseases means that key areas of unmet need, including many epilepsies and key biological pathways relevantseizure disorders, are now addressable and offer significant medical potential. Our team has proven expertise in understanding MoAs that underlie seizures and shaping potential therapies to diseasestreat rare epilepsies and disorders with seizures. Specifically, we have built a pipeline focused on treating the extrinsic or intrinsic causes of neuronal hyperexcitability. This know-how affords us an ability to build Ovid in a manner focused on delivering successive, novel medicines for epilepsies and seizure-related neurological conditions.brain. development and subsequent repurchase of our rights to soticlestat by Takeda. In 2017, we in-licensed a 50% stake in soticlestat for $26.0 million, and further invested $57.0 million in designing and executing soticlestat’s early and mid-stage clinical trials. In 2021, following encouraging Phase 2 findings, which we delivered six months ahead of schedule, we entered into a Royalty, License and Termination Agreement (“RLT Agreement”) through which we sold back our rights to soticlestat to Takeda. The RLT Agreement provided us with $196.0 million paid in Q1 2021 and, if soticlestat is approved and successfully commercialized, we are eligible to receive up to $660.0 million in sales and regulatory milestone payments and low double-digits up to 20% of potential net sales-based tiered royalty payments. The RLT Agreement provides us with a potential stream of non-dilutive capital. The funds received from this transaction have enabled us to invest in and secure what we believe is a world-leading pipeline during a period when we believe the cost of capital would have been unduly expensive. In 2023, we sold a 13% stake in the royalty, regulatory and commercial milestone payments that we are eligible to receive under the RLT Agreement to Ligand Pharmaceuticals Incorporated (“Ligand”) for $30.0 million.knowledgesubject-matter expertise in seizures and neurological conditions. This includes epileptologists, physicians, academic scientists, commercial and biopharmaceutical industry leaders. In total, we have five individuals with M.D. degrees and 13 professionals with Ph.D. degrees specializing in the sciences. Our operational and commercial leaders have extensive experience fostering market access and sales for leading neurological medicines. In total, our team’s collective professional experience has involved the successful development or commercial launch of raremore than 25 CNS medicines, including several epilepsy products.diseases, howconditions, including seizures and epilepsies.themthe heterogeneous causes of seizures. Accordingly, our pipeline seeks to curate and how to identify the clinically meaningful endpoints required for developmentdevelop a unique set of compounds that can be effective by itself and/or can provide the necessary intervention to impact multiple mechanisms. We believe this approach has the potential to provide the basis of a modern differentiated and leading epilepsy franchise. Core tenets of our approach include a focus on:these conditions. As a resultsynthetic methodology, formulation technology, generative artificial intelligence and biology target research have unlocked more opportunities for innovative and creative medicines. The compounds we seek to develop are brain-permeable and are designed to modulate specific biological targets. We seek to take advantage of this knowledge,the versatility small molecules have to offer in terms of manufacturing, chemistry, and dosing to potentially deliver novel and next-generation medicines that will make meaningful improvements in the lives of patients.have developedpursue directly or indirectly modulate hyperexcitability. These targets are associated with regulating inherent intracellular excitatory/inhibitory balance within neurons.programstractable seizure types. Similarly, many ASMs were later proven to have clinical efficacy in other neurological conditions. Simply put, effective therapeutic outcomes in highly pharmaco-resistant indications often bodes well for treating broader neuropathologies.demonstratedmedicines that are well tolerated and exhibit few DDIs. In addition, we strive to impact the broader symptomatology of disease, including for example, the measurement of behavior and communication change. model by progressing compounds through to late-stage development. Our strategy focuses initially on evaluating our investigational medicines for pathways and targets impacting rare diseases, andbrain conditions. If effective in rare disease, our intent is to explore expanding on that may also have therapeutic relevance forsuccess to broader conditions of the brain. We are executing on our strategybrain for which the MoA may hold therapeutic relevance. Accordingly, in the future, we expect to build this pipeline by discovering, in-licensing and collaborating with leading biopharmaceutical companies and academic institutions.Our Focus: Epilepsies and Rare Neurological DisordersNeurological disorders have a devastating impact on patients and their families. Patients suffering from rare disorders of the brain often require extensive care, and go largely underserved by impactful therapeutics. We believe that there are at least 100 neurological disorders, epileptic encephalopathies and other related rare neurological disorders that we may be able to target. Theseextend our knowledge and drug programs to other neurological conditions. This approach is supported by research indicating that more than ten ASMs are used in treatment of other (non-epilepsy) neurological diseases today.characterized by seizures and degenerationeither uniquely (1) expressed in the developmentCNS, such as: CH24 and functioningKCC2 co-transporters or (2) over-expressed in a pathological state, such as ROCK and GABA-AT.brain. Due to a historical overwhelming preferencemost difficult organs in the body to treat, in part due to the challenge of penetrating the BBB. Ovid’s drug industry to develop medicines for broader neurological indications, manydevelopment programs include potential small molecule therapies that demonstrate penetration of these disorders have no approved therapies. As a result, recent scientific advancements have been overlooked, which we believe presents us with an opportunity to pursue these indications. These reasons include:•Potential to affect seizures and disease progression. We are focusing primarily on pediatric disorders that are typically characterized by epilepsy-related symptoms and seizures. Today, it is estimated that as many as 30-40% of patients treated for epilepsies continue to experience seizures; signifying that additional effective treatment options are needed. We believe that our therapeutic candidates may be able to meaningfully reduce harmful seizures, address symptoms, and potentially alter the progression of disease, especially if they can be administered early in life.BBB.High penetrance linking genetic defect to disorder pathology.Clinically translatable preclinical models Some rare neurological disorders have a genetic origin and typically have a strong correlation, or penetrance, between the presence of a gene and the manifestation of the corresponding disease pathology. As a result, we believe in those cases we can develop drug candidates that will be efficacious in patients with a given genetic profile.•Predictive genetic and other models.. Recent advances in genetics enable us to employ predictive in vitro and in vivo genetic models of certain ofspecific brain diseases. We believe these disorders. Thesepredictive models will allow us to evaluate and observe a drug candidate’s potential activity prior to initiation of clinicalhuman trials. ThroughApplying these models, we believe we will be able to select the most relevant clinicalindication and seizure endpoints for our trialsstudies and increase the potential for clinical success.Overlapping pathophysiologyClear primary endpoints and symptoms.scales Neurological. We primarily focus on disorders that are often characterized by a numberepilepsy-related symptoms and seizures. Many seizure types afford clear observable endpoints and biomarkers that help capture and measure evidence of overlappingthe clinical impact of our drug candidates. Our team of development experts has extensive experience designing scales to measure other symptoms that are common among seizure-disorders, such as seizures, sleep disturbances,cognitive declines, movement deficiencies and behavioral manifestations. We believe these commonalities will enable us to employ clinical endpoints that may be translatable from one disorder to another,These skills support our desire and ability to develop drugsmedicines that may provide a clinical benefit across multiple indications.aspects of patient health.EarlyTrial design enables early observation of proof-of-concept. By employing clinicalsurrogate biomarkers and endpoints that are highly relevant and are designed to detect meaningful clinical benefits, we anticipate that many of our studies may provide early proof-of-conceptPOC in clinical development.development, thereby directing the use of our capital to projects with higher probability of later-stage success.theseepilepsies and brain disorders have increasing access to diagnostics and genetic testing. Additionally, many are avid users of social media, tothrough which they learn new insights about thetheir conditions and share relevant information and experiences. We conduct patient disease community outreach and activities on digital platforms to efficiently identify new patients for our clinical trials, raise disease awareness and help connect with patients and caregivers.The Ovid StrategyWe believe that the sciencemedicine underlying discoveryDisciplined Business Developmentof new drugsefforts in collaboration with external leaders in the field and academic collaborators; and (2) business development activities to partner assets that have promising potential in and outside our chosen therapeutic areas.the brain has changed fundamentally over the last decade.laboratory facilities. We identify compounds with what we believe that major developmentsis untapped value sitting in other organizations’ pipelines and look to in-license or enter into collaborative agreements to secure such assets and advance clinical development. This strategy directs our efforts where we excel at creating value, which is specifically shaping translational and clinical-stage development in our understandingtherapeutic area. An integral part of our process is establishing collaborations with academic research centers to support translational expertise for our programs, including the biologyStephen Moss Lab of these diseases means3that key areasNeuropharmacology at Tufts University.unmet need are now addressable and offer tremendous medical and economic opportunity.our compounds in non-core indications or extend regional market rights outside the United States. We believe that we now have a deep understandingare well positioned to execute on our business development strategy due to the extensive experience and networks of the mechanismsour management team. Collectively, our senior management has transacted hundreds of in-licensing deals and collaborations.underlie seizureswe hope will create new possibilities and many brain disorders. This know-how offers an opportunity to build our company in a manner deeply focused on delivering novel medicines to address these medically important needs. We plan to focus our efforts in the areas ofmore good days for people living with rare epilepsies and then progressively, as science and medicine evolve, we expect to apply our knowledge to larger indications.Our strategy is to pursue drug discovery and development for epilepsies and rare central nervous system (CNS) disorders in a manner that is scientifically driven, patient focused and is coupled with an integrated and discipled approach to research, clinical development, and business development. Our team has significant experience and understanding of these epilepsies, seizure related disorders, and rare neurological conditions, and we continue build insight into the way the different molecular mechanisms and pathways underlying these disorders impact the symptoms patients suffer. We have set out to be a leader in the field, and have developed a differentiated pipeline containing three novel mechanisms of action to target different causes of epilepsies and seizures. Our team’s knowledge of epilepsy disease biology and pathology, now contributes to our pursuit of additional relevant genetic targets and molecular pathways that are the cause of seizures. We are pursuing therapeutic assets for epilepsies, seizure related disorders, and rare neurological disorders and seek to leverage those learnings in accelerated development programs. If successfully developed and marketed in rare conditions, we intend to explore our assets for broader neurologic indications. Our cohesive focus in epilepsies and seizures reinforces our belief that we have the potential to develop and produce multiple novel medicines, and thereby succeed in our mission.Scientifically DrivenWe take a scientifically driven approach to identify promising drug candidates for our pipeline. We are building our portfolio based on the existence of known biological rationales, including a focus on epilepsies, seizure-related disorders and neurological disorders that are associated with validated targets, genetic linkages and clear endpoints, such as seizures, for study in clinical trials. We use our deep understanding of neurology and epilepsies to identify differentiated mechanisms of action for initial drug candidates. As we advance our drug candidates into and through the clinical evaluation, we are building on the emerging body of scientific and clinical insights developed by us and others in the biopharmaceutical industry to target important disease pathways of the brain. As we evaluate data from previous and ongoing preclinical studies and clinical trials, we intend to refine and improve our scientific approach and apply these insights to continue to build our current and prospective pipeline programs and clinical trials.In particular, our approach is driven by the following scientific principles:•pursue epilepsy-related disorders and rare neurological conditions for which significant therapeutic need persists•identify the genetic origin of the disorder, when possible;•target biological pathways or genes for which proof-of-concept has been established via in vitro or animal models;•focus on the mechanisms that cause the pathology of the disorder that generate the symptoms that we can target; and which may hold relevance for development of therapeutics for broader neurologic conditions in the future;•develop understanding of gene expression and link to pathophysiology;•target optimal mechanism of action for drug candidates; and•seek clear endpoints and biomarkers, if possible, to help demonstrate evidence of the clinical impact of our drug candidates.Patient FocusedWe are developing product candidatesbrain conditions. For example, we believe havethat our therapeutic candidates may be able to meaningfully reduce harmful seizures, mitigate burdensome symptoms, and potentially slow down the potential to transform the livesunderlying progression of individuals affected by epilepsies and related neurological disorders. disease.rare condition that carries serious morbiditiesrisk of morbidity and requires extensive and specialized involvement from the patients’ families, caregivers, and physicians and from patient advocacy groups.efficient clinical trialspatients,patient communities, caregivers, families, disease foundations and key opinion leaders, to better understand the history of these disorders, raise awareness, identify patients and facilitate enrollment of clinical trials;patientsthe patient communities and their physicians and caregivers; and4Research and Development Coupled with Business Developmenthave builtare focused on delivering long-term value for shareholders. Our financial strategy seeks to apply our capital in a broadfocused manner to advance a differentiated pipeline of potential drug candidatesneurotherapeutics, which we believe may generate multiple value-creating milestones from data and ultimately, commercial sales.treat epilepsies, seizure related disorders, and related neurological disorders. Our current pipeline isfund Ovid's operations into the resultfirst half of two complementary efforts: 1) internal research and development efforts2026. To achieve this cash runway, in collaboration with external leadersOctober 2023, we sold 13% of our interest in the fieldmilestones and academic collaborators; and 2) focused business development to in-license or partner assets. Central to our internal process has been collaborations that we form with world-leading academic research centers such as Columbia University and the University of Connecticut to augment target discovery and early biology. Overall, our goal is to develop a cohesive and diversified pipeline with multiple, novel mechanisms that leverage our strong capabilities in this area and provide a sustainable pipeline for years to come.We are building a specialized, scalable and robust infrastructure that we believe will make us a leader in our chosen area and potentially a partner of choice for leading biopharmaceutical companies that wish to pursue valuable drug candidates or research platforms in epilepsies and seizures. This infrastructure spans the critical domains of discovery, delivery and development. We believeroyalties that we are particularly well positioned eligibleexecutereceive from soticlestat's potential approval and commercialization to Ligand for $30.0 million. We retain 87% interest in soticlestat's regulatory and commercial milestones and royalties on sales if the drug is successfully approved and commercialized by Takeda. These future payments may contribute to funding our operations and business development strategy becauseactivities. For additional information, see the description of both the extensive network of our management teamLigand Agreement below under the heading “License and experience delivering valued partnerships with companies including Takeda, LundbeckCollaboration Agreements – 2023 Ligand Pharmaceuticals Milestones and AstraZeneca.OurRoyalties Monetization.”two drug candidates (gaboxadol and soticlestat) from pre-clinical proof of concept and either through pivotal trials or to the initiation of pivotal trials, whether by us or our collaborators.POC into human clinical trials. Today, we are one of the few epilepsy-focused biopharma companies withthat has researched and developed three noveldistinct MoAs to target seizures and one of the only clinical development programs to evaluate a highly selective ROCK2 inhibitor for neurological disease. We believe this pipeline of potential first-in-class or potential best-in-class mechanisms differentiates us and provides the basis of action for epilepsy within its pipeline. This is critical given that as many as 30 - 40 percentan attractive franchise of patients treated for epilepsy continue to experience seizures.the status and mechanism of action of our drug candidates:

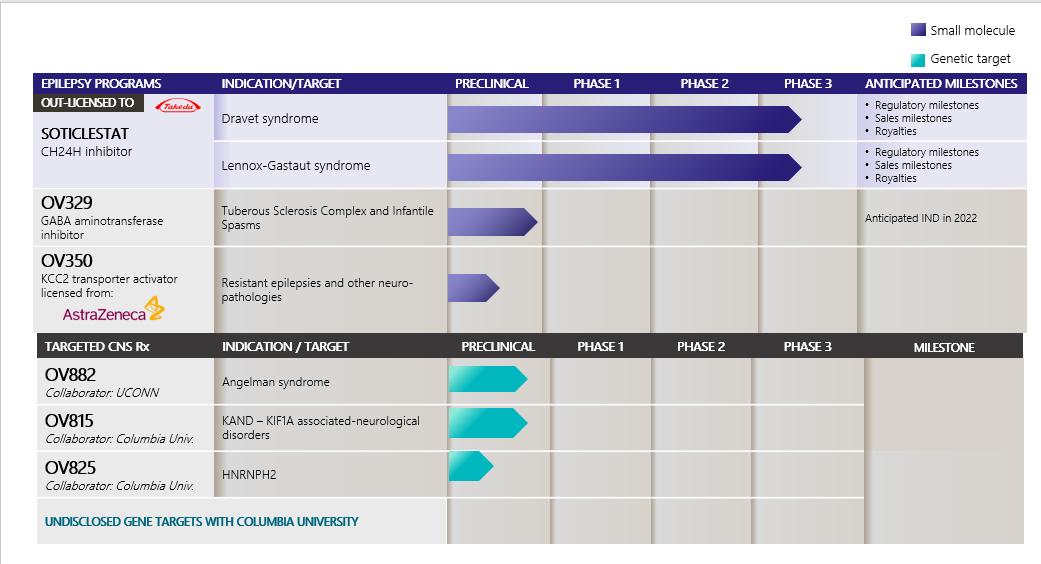

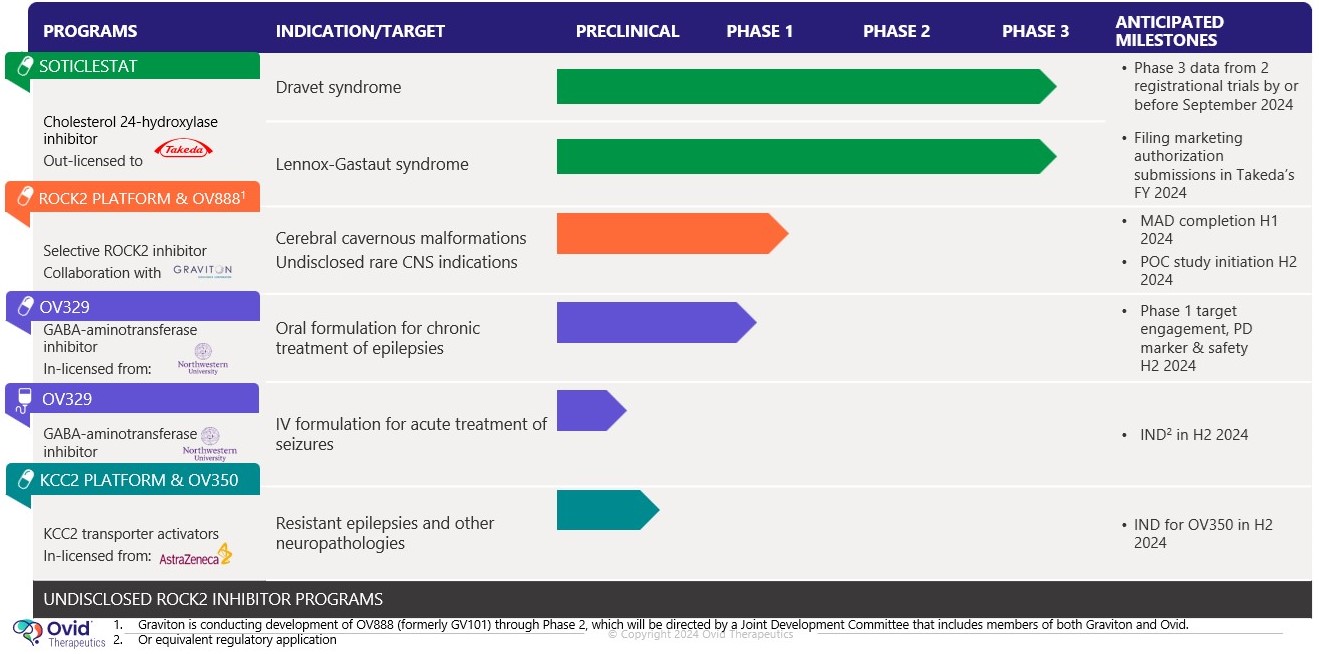

Internal ProgramsOV329OV329 (GABA aminotransferase inhibitor) iscandidate programs and their development status, MoA, and anticipated near-term milestones:

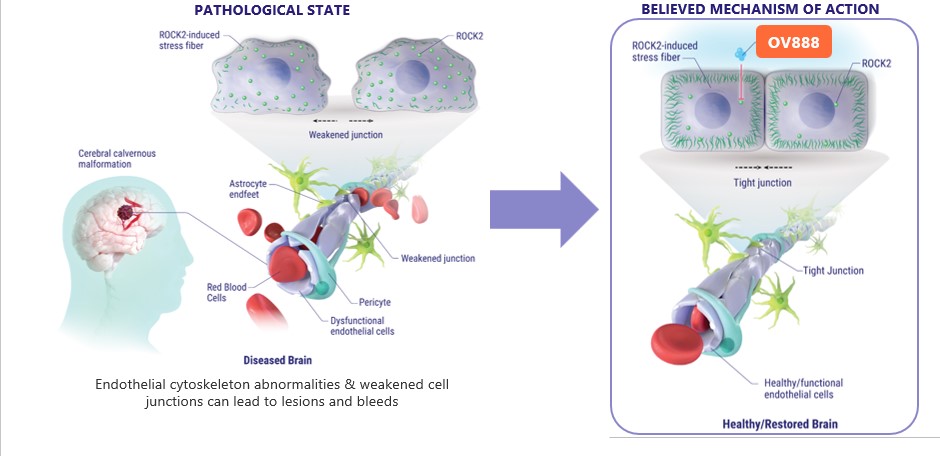

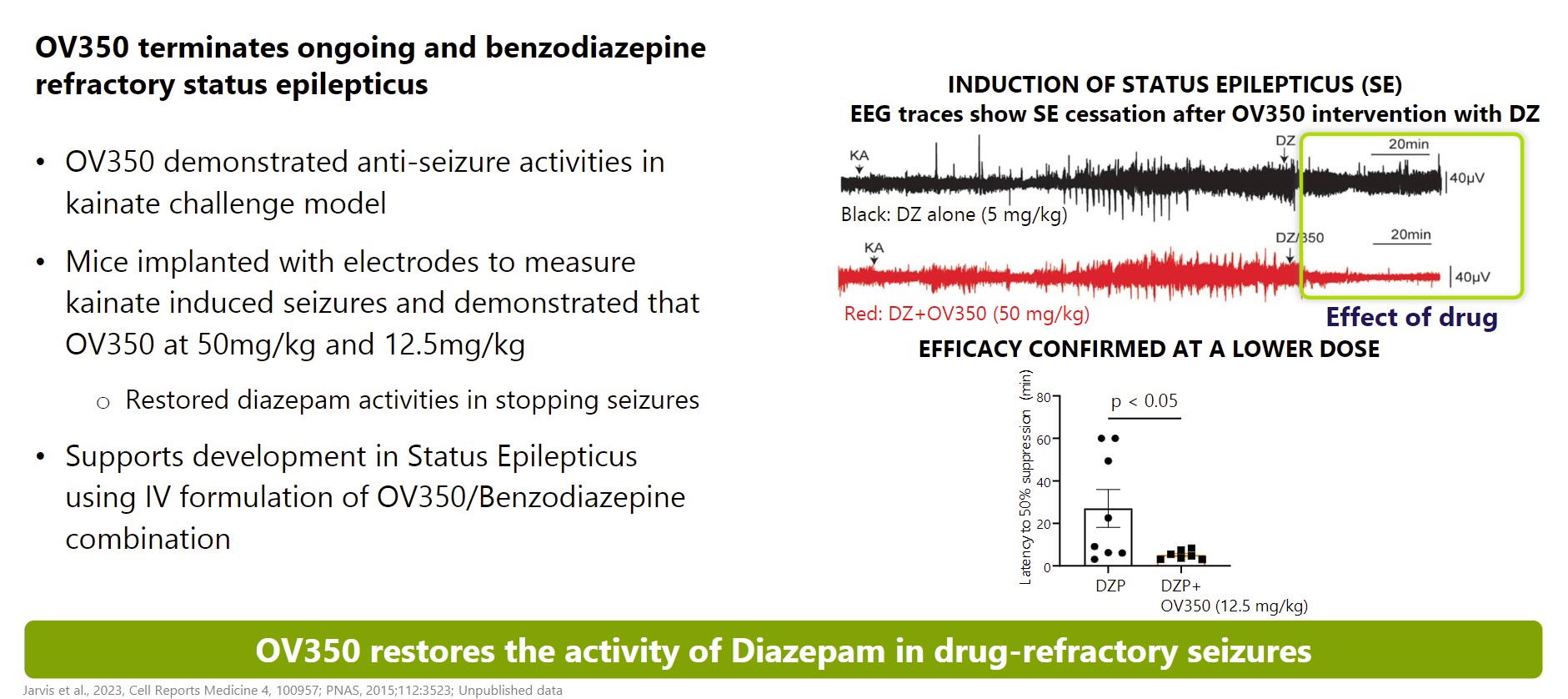

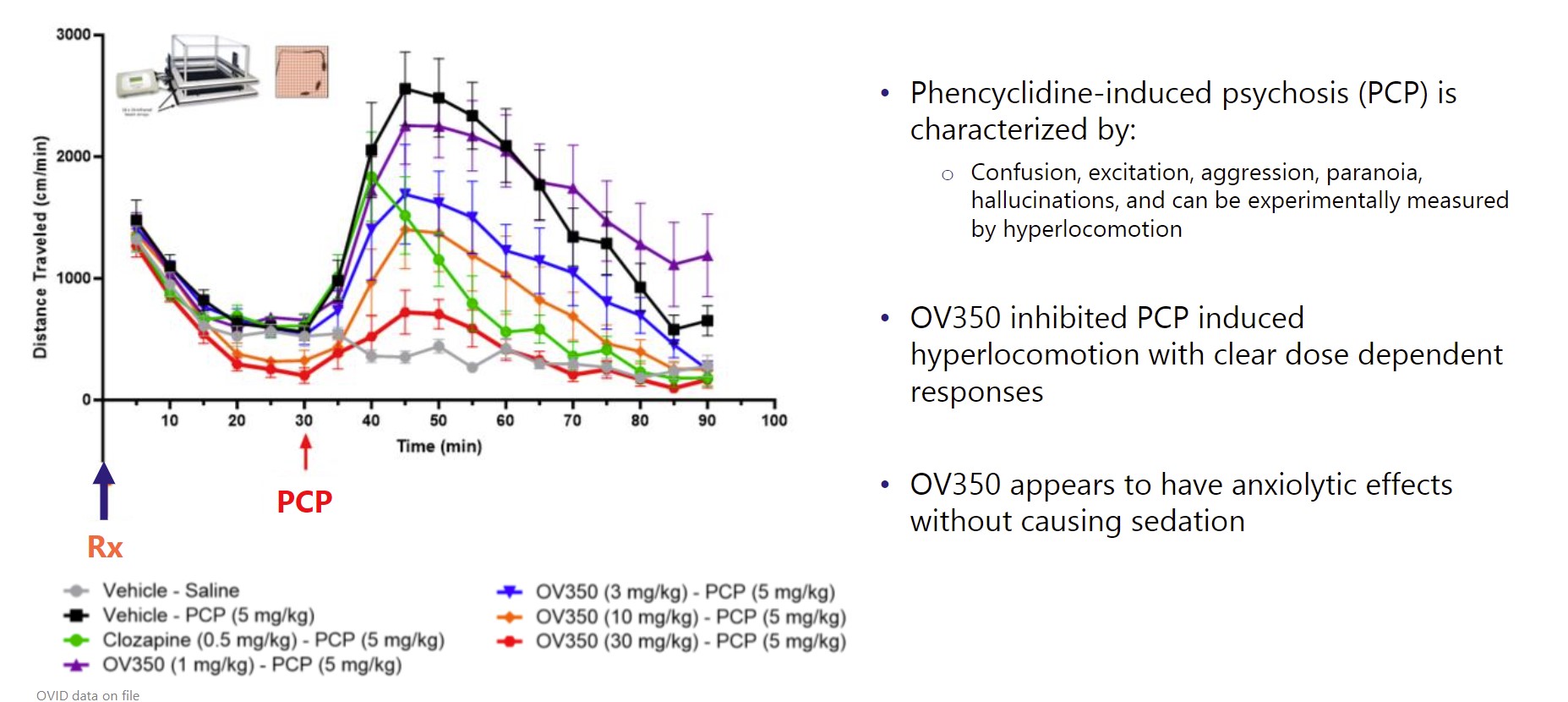

next-generation GABA aminotransferasenovel CH24 inhibitor being developed by us for the potential treatment of seizures associatedpatients with Tuberous Sclerosis Complexresistant epilepsies, following our role in its successful early and Infantile Spasms. We expect to file an IND for OV329 in 2022. OV329 functions by substantially reducing the activity of GABA aminotransferase (GABA-AT), a key enzyme responsible for the degradation of the brain’s major inhibitory neurotransmitter, GABA. OV329 leads to increased concentrations of GABA by inhibiting its metabolism. Given that epilepsy is characterized by excessive neuronal excitation, the increased levels of GABA may suppress this excitatory signaling and may reduce seizures. If successful, we anticipate OV329 could be used to treat seizures associated with Tuberous Sclerosis Complex and Infantile Spasms and we are currently assessing this approach in the pre-clinical setting. If the5safety and efficacy profile of the product is appropriate we will consider lifecycle management in epilepsy in other areas. In December 2016, we entered into a license agreement with Northwestern University, or Northwestern, pursuant to which Northwestern granted us an exclusive, worldwide license to patent rights in certain inventions, or the Northwestern Patent Rights, which relate to a specific compound and related methods of use for such compound, along with certain Know-How related to the practice of the inventions claimed in the Northwestern Patents.OV350OV350 is a small molecule that directly activates the KCC2 transporter, which is an important channel in seizure control. Ovid licensed OV350 and a library of associated compounds (previously AZ8333) from AstraZeneca in December 2021 to complement our growing pipeline of potential medicines with novel mechanisms of action for treating epilepsies.mid-stage development program. We believe itsoticlestat has the potential to bebecome a first-in-class direct activatormedicine targeting the metabolism of cholesterol in the KCC2 channel. Extensive academic literature indicates thatbrain. It has been shown to gradually reduce inflammation in the KCC2 transporter is an essential channel to maintaining homeostasis within neurons, thereby contributing to seizure control. In vivo studies illustrated that KCC2 activity leads to reduced seizure sensitivity and seizure-induced mortality. Pre-clinical mechanistic studies have also demonstrated that OV350 wasbrain as well tolerated and did not induce sedation.as indirectly acting on the N-methyl D-aspartate pathway. We believe OV350that this dual mechanism plays an important role in modulating excitatory signals involved in epilepsy, and thereby suppressing seizures.potential to be developed for multiple epilepsies and other CNS indications. Our initial efforts are focused on optimizing multiple potential formulations for OV350 and conducting animal models to inform our development plans. While we plan to develop the compound and seek initial approvals in rare epilepsies, if successful, and if the safety and efficacy profile of the product candidate is appropriate, we will consider lifecycle management in larger epilepsy indications.OV882OV882 is a short hairpin RNA (shRNA-551)RLT Agreement, we are evaluating aseligible to receive regulatory and commercial milestones payments of up to $660.0 million, in addition to potential net sales based tiered royalties of up to 20%. In 2023, we sold a potential disease-modifying gene therapy for Angelman syndrome. The most common cause of Angelman syndrome is the loss of functional UBE3A protein due to a defect13% stake in the maternal copyroyalty, regulatory and commercial milestone payments that we are eligible to receive under the RLT Agreement to Ligand for $30.0 million. Royalty payments are eligible on net sales across all regions and all future indications. The future milestones payments do not include an initial upfront payment that we received from Takeda in March 2021 of the UBE3A gene. Our aim is to develop a disease-modifying noncoding RNA vector that reduces expression of UBE3A-antisense and restores UBE3A expression via the paternal gene copy. We are$196.0 million. early stages of our research with OV882, but benefit from robust natural history and baseline data for a prior clinical trial we conducted with gaboxadol in Angelman's syndrome. From these prior programs, Ovid has deep knowledge of the Angelman's condition and retains ownership of baseline data from clinical trials with approximately 100 Angelman's patients. These proprietary insights will aid our OV882 program, which is being conducted in collaboration with the University of Connecticut School of Medicine.OV815 and OV825 - Columbia University ProgramIn June 2020, we began a strategic research collaboration with Columbia University Irving Medical Center, or Columbia, to advance genetic based therapies for a range of rare neurological conditions, complementary of our pipeline. This collaboration provides us with the potential to expand our future drug development portfolio and impact individuals living with rare genetic neurological conditions by working closely with the Precision Medicine Resource in the Irving Institute at Columbia. Our first research program with Columbia is OV815 and focuses on the kinesin-family of proteins and KIF1A-associated neurological disorder (KAND), under this research and translational development alliance, Columbia will align its expertise in rare disease genetics and deep clinical understanding of rare neurological diseases with our discovery, translational, and clinical development expertise in neurodevelopmental disorders and rare epilepsies.Soticlestat: Continued interest via Out-Licensing Agreement with Takeda PharmaceuticalsBackgroundIn January 2017 we entered intoas a license and collaboration agreement withbetween us and Takeda orfor rare epilepsies. Under this original agreement, Ovid held a 50% ownership stake in soticlestat and Takeda retained the Takeda collaboration agreement, to develop and commercialize soticlestat, which culminated inremaining 50%. Following a successful Phase 2 development program. Onprogram led by us, in March 29, 2021, we entered into a royalty, license and termination agreement, or the Takeda License and Termination Agreement, with Takeda.RLT Agreement. Under the terms of the Takeda License and TerminationRLT Agreement, we terminated the Takedaour original collaboration agreement with Takeda, and Takeda subsequently secured an exclusive license and intellectual property rights to repurchase our 50% global share in soticlestat. Takeda secured an exclusive license of soticlestat and our relevant intellectual property rights inIn exchange, for an upfront payment, development and commercial milestone payments, and royalties. Takeda has since assumed all responsibility for, and costs of, both development and commercialization of soticlestat.In March 2021, we received an upfront payment of $196 million$196.0 million. In addition, if soticlestat achieves regulatory approval, and is successfully commercialized, we are eligible to receive up to an additional $660$660.0 million in development, regulatory and sales milestones. In addition, if soticlestat achieves regulatory approval, we will receivecommercial milestone payments and potential tiered royalties on net sales of soticlestat at percentages ranging from the low double-digits up to 20%, subject to standard reductions in certain circumstances. Royalties are payable on a country-by-country and product-by-product basis during the period beginning on the date of the first commercial sale of such product in such country and ending on the later to occur of the expiration of patent rights covering the product in such country andcountry.specified anniversaryresult of such first commercial sale. The Takeda collaborationthis agreement, will remain in effect until Takeda’s cessation of commercialization of soticlestat.6Following the out-licensing of soticlestat to Takeda, Takeda initiated two pivotal, phase three programs for soticlestat, which are referred to as SKYWAY for LGS and SKYLINE for DS. SKYWAY applies the use of Major Motor Drop Seizures as an endpoint which it believes will more accurately reflect soticlestat's effectiveness in reducing seizures in LGS. It is anticipated that Takeda will have data from these Phase 3 programs in the first half of 2023 and will seek regulatory decisions by March 2024. Takeda has reported it is preparing for a multi-regional launch of soticlestat. The United States Food and Drug Administration, or the FDA, has granted orphan drug designation for soticlestat and China has granted it Breakthrough Status for the treatment of DS and LGS.Soticlestat - MechanismSoticlestat is a potential first-in-class inhibitor of cholesterol 24 hydroxylase (CH24H), which may modulate the excitatory signals involved in epilepsy, and thereby suppress seizures. The investigational soticlestat program began as a joint development collaboration between Ovid and Takeda for rare epilepsies. Following a successful Phase 2 development program led by us, we entered into a royalty, license and termination agreement with Takeda, or the Takeda License and Termination Agreement, in March 2021 under which Takeda secured all of the global rights from Ovid to develop and commercialize soticlestat for the treatment of developmental and epileptic encephalopathies, including Dravet syndrome (DS)DS and Lennox Gastaux syndrome (LGS).LGS. In addition, Takeda has assumed responsibility for all development and commercialization costs associated with soticlestat. We have no ongoing costs or obligations.Takeda’s continuedthat the ROCK2 signaling pathway may be hyperactivated in multiple neurological diseases, including disorders involving vascular structures and nerve myelination diseases that can result in seizures, spasms and a variety of other symptoms. Despite this link, there has been limited clinical development of soticlestatROCK2 inhibitors due to challenges penetrating the BBB and the inherent challenge of avoiding inhibition of rho-associated coiled-coil-containing protein kinase 1, which can have unwanted side effects.

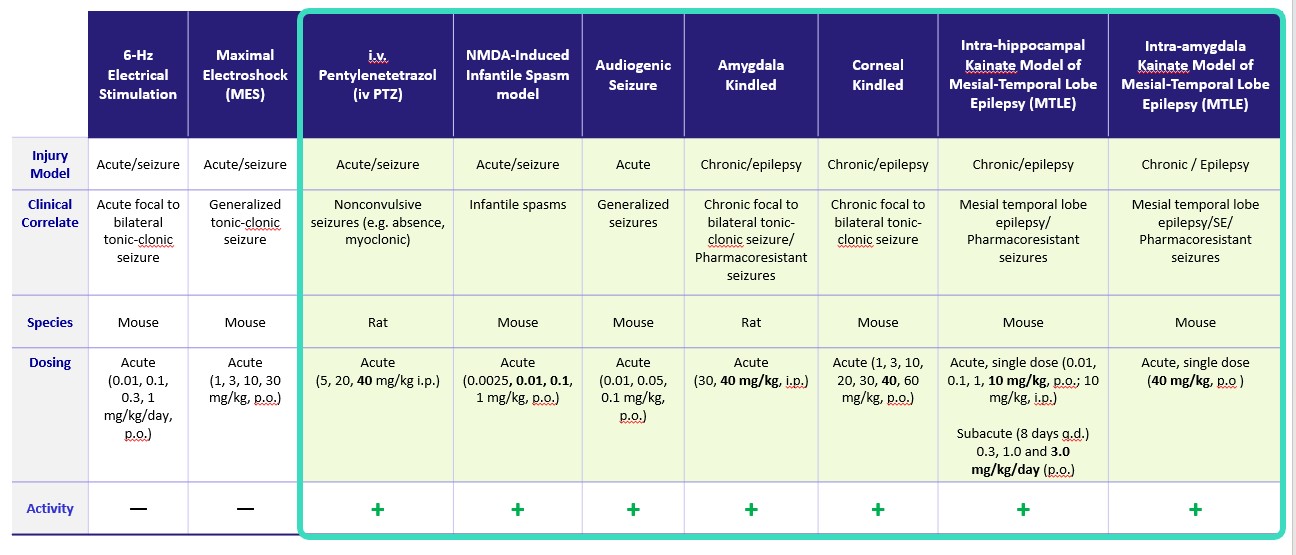

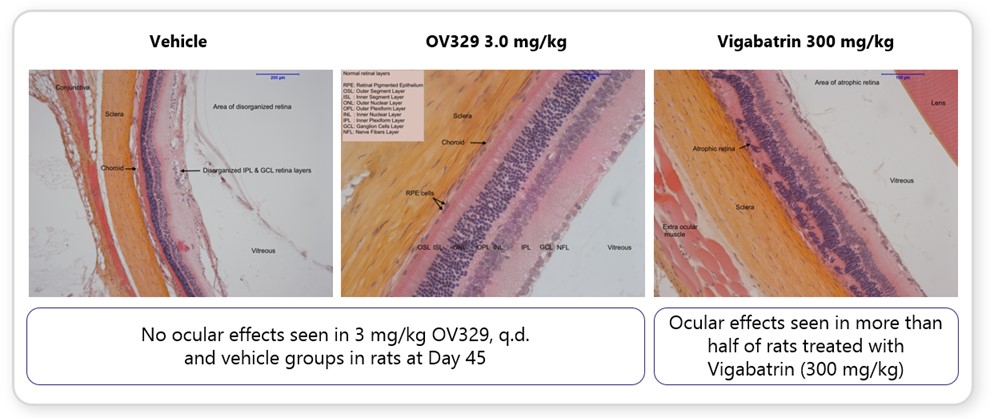

becomebe therapeutic in refractory and drug-resistant epilepsies such as seizures associated with tuberous sclerosis and refractory status epilepticus (“SE”).first-in-classvalidated drug target for seizures. Specifically, it works by substantially reducing the activity of GABA-AT, a key enzyme responsible for the degradation of the brain’s major inhibitory neurotransmitter, GABA. OV329 leads to increased concentrations of GABA by inhibiting its metabolism. Given that epilepsy is characterized by excessive neuronal excitation, the increased levels of GABA may suppress this excitatory signaling and only-in-class compound targetingmay reduce seizures.metabolismoral formulation has the potential to provide (in comparison to vigabatrin) preferred (lower) dosing. We believe that these preclinical data suggests that OV329 could allow for seizure reduction efficacy and improved tolerability in comparison to existing therapeutics.cholesterolOV329 (see Figure 3 below). These findings in both chronic and acute seizure models provide additional confidence about the therapeutic potential of OV329 in humans.

whichdamage and increased rates of mortality.