Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Common Stock, par value $0.001 per share |

| The Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrantRegistrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒☒

Indicate by check mark if the registrantRegistrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒☒

Indicate by check mark whether the registrant:Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrantRegistrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ NO ☐☒ No ☐

Indicate by check mark whether the registrantRegistrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrantRegistrant was required to submit such files). Yes ☒ No ☐☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrantRegistrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐☐No No ☒☒

BasedThe aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant as of June 30, 2023 was $10.3 million, based on the closing price of the registrant’s common stock on the last business day of the registrant’s most recently completed second fiscal quarter, which was June 30, 2021, the aggregate market value of its common stock (based on a closing price of $11.65 per share on June 30, 2021 as reported on the Nasdaq Capital Market) held by non-affiliates was approximately $110,386,092.

As of March 17, 2022, the registrant had 10,829,749shares of common stock $0.001 par value per share, issued and outstanding.on The Nasdaq Capital Market on June 30, 2023.

The number of shares of Registrant’s Common Stock outstanding as of March 18, 2024 was 10,962,460.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for its 20222024 Annual Meeting of Stockholders, which the registrant intends to file with the Securities and Exchange Commission not later than 120 days after the registrant’s fiscal year ended December 31, 2021,2023, are incorporated by reference into Part III of this Annual Report on Form 10-K.

Yumanity Therapeutics, Inc.

Table of Contents

Index

Page | ||

1 | ||

Item 1. |

| |

Item 1A. |

| |

Item 1B. |

| |

Item 1C. | 92 | |

Item 2. |

| |

Item 3. |

| |

Item 4. |

| |

PART II | ||

Item 5. |

| |

Item 6. |

| |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

Item 7A. |

| |

Item 8. |

| |

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

Item 9A. |

| |

Item 9B. |

| |

Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

PART III | ||

Item 10. |

| |

Item 11. |

| |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

Item 13. | Certain Relationships and Related Transactions, and Director Independence |

|

Item 14. |

| |

PART IV | ||

Item 15. |

| |

Item 16. |

| |

| ||

i

EXPLANATORY NOTE

On December 22, 2020, Proteostasis16, 2022, Yumanity Therapeutics, Inc. (“Proteostasis”Yumanity”) completed its previously announced merger transaction with Yumanity,Kineta Operating, Inc. (formerly Yumanity Therapeutics,Kineta, Inc.) (“Private Kineta”) in accordance with the terms of the Agreement and Plan of Merger, and Reorganization, dated as of August 22, 2020,June 5, 2022, as amended on November 6, 2020December 5, 2022 (the “Merger Agreement”), by and among PangolinYumanity, Private Kineta and Yacht Merger Sub, Inc., a wholly-owned subsidiary of ProteostasisYumanity (“Merger Sub”), Yumanity Holdings, LLC (“Holdings”) and Yumanity, Inc., pursuant to which Merger Sub merged with and into Yumanity, Inc.,Private Kineta, with Yumanity, Inc.Private Kineta surviving such merger as a wholly ownedwholly-owned subsidiary of ProteostasisYumanity (the “Merger”). Immediately prior to the effective time ofThe surviving corporation from the Merger Holdingssubsequently merged with and into Yumanity, Inc. and Yumanity, Inc. continued to exist asKineta Operating, LLC, with Kineta Operating, LLC being the surviving corporation. On December 22, 2020,16, 2022, in connection with, and prior to the completion of, the Merger, ProteostasisYumanity effected a 1-for-201-for-7 reverse stock split of its common stock (the “Reverse Stock Split”). Immediately following the Merger, ProteostasisYumanity changed its name to “Yumanity Therapeutics,“Kineta, Inc.”

Unless the context otherwise requires, references to the “Company,” “Yumanity,“Kineta,” the “combined organization,” “we,” “our” or “us” in this reportAnnual Report on Form 10-K refer to HoldingsPrivate Kineta and its subsidiarysubsidiaries prior to completion of the Merger and to Yumanity Therapeutics,Kineta, Inc. and its subsidiarysubsidiaries after completion of the Merger. In addition, references to “Proteostasis” or “PTI”“Yumanity” refer to the registrant prior to the completion of

the Merger.

For accounting purposes, the

The Merger was treatedhas been accounted for as an “asset acquisition” undera reverse merger and asset acquisition in accordance with U.S. generally accepted accounting principles in(“U.S. GAAP”). Under this method of accounting, Private Kineta was deemed to be the United States (“GAAP”) and Yumanity was considered the acquirer. Accordingly, Yumanity’s historical results of operations will replace the Proteostasis historical results of operationsaccounting acquirer for all periods prior to the Merger and, for all periods following the Merger, the results of operations of the combined organization will be included in the Company’s financial statements.reporting purposes. Following the Merger, the business conducted by YumanityPrivate Kineta became ourthe Company’s primary business.

Except as otherwise noted, references to “common stock” in this report refer to common stock, $0.001 par value per share, of the Company.

iiCAUTIONARY STATEMENT

SummaryIn February 2024, the Company initiated a process to explore a range of strategic alternatives to maximize shareholder value. Potential strategic alternatives that may be evaluated include sale of assets of the Material Risks Associated with Our Business

We are subject to various risks associated with our businesses and industries. These risks include the following:

The summary risk factors described above should be read together with the text of the full risk factors below, in the section entitled “Risk Factors” in Part I, Item 1A. and the other information set forth in this Annual Report on Form 10-K, including our consolidated financial statements and the related notes, as well as in other documents that we file with the U.S. Securities and Exchange Commission. The risks summarized above or described in full below are not the only risks that we face. Additional risks and uncertainties not precisely known to us, or that we currently deem to be immaterial may also materially adversely affect our business, financial condition, results of operations and future growth prospects.US Bankruptcy Code.

iii

CAUTIONARYKineta, Inc. cautions that trading in the Company’s securities is highly speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the actual value realized, if any, by holders of the Company’s securities. Accordingly, the Company urges extreme caution with respect to existing and future investments in its securities.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-lookingcertain statements that constitute “forward-looking statements” within the meaning of Section 27A of the U.S. Private Securities Litigation Reform Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. In some cases, you can identify these forward-looking statements by the use of terms such as “expect,” “will,” “continue,” “believe,” “estimate,” “aim,” “project,” “intend,” “should,” “is to be,” or similar expressions, and variations or negatives of these words, but the absence of these words does not mean that involve substantial risks and uncertainties.a statement is not forward-looking. All statements other than statements of historical fact containedare statements that could be deemed forward-looking statements. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to differ materially from results expressed or implied in this Annual Report including statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans and objectives of management, areon Form 10-K. The following factors, among others, could cause actual results to differ materially from those described in these forward-looking statements. The words “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would,” or the negative of these words or other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

The forward-looking statements in this Annual Report include, among other things, statements about:statements:

1

iv

We may not actually achieve the plans, intentions or expectations disclosed in our

The forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements includedcontained in this Annual Report particularly inon Form 10-K and the “Risk Factors” section,documents incorporated herein by reference are based on our current expectations and beliefs concerning future developments and their potential effects on our business. There can be no assurance that future developments affecting our business will be those that we believe couldhave anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or eventsperformance to differbe materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the forward-looking statementscaption “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K and under similar headings in the documents that we make. are incorporated by reference herein.

2

Moreover, we operate in a very competitive and rapidly changing environment. New risk factorsrisks and uncertainties may emerge from time to time and it is not possible for managementus to predict all such risk factors, and uncertainties. Ournor can we assess the effect of all such risk factors on our business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements do not reflectstatements. Should one or more of these risks or uncertainties materialize, or should any of the potential impact of any future acquisitions, mergers, dispositions, collaborations, joint ventures, or investments weassumptions prove incorrect, actual results may make or enter into.vary in material respects from those projected in these forward-looking statements.

You should read this Annual Report and the documents that we file with the Securities and Exchange Commission with the understanding that our actual future results may be materially different from what we expect. The forward-looking statements containedmade by us in this Annual Report are madeon Form 10-K and the documents incorporated herein by reference speak only as of the date of this Annual Report,such statement. Except to the extent required under the federal securities laws and rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”), we do not assumedisclaim any obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. In light of these risks and uncertainties, there is no assurance that the events or results suggested by the forward-looking statements will in fact occur, and you should not place undue reliance on these forward-looking statements.

Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.law, you are advised to consult any additional disclosures we make in the documents that we file with the SEC.

v

3

PART I

All brand names or trademarks appearing in this report are the property of their respective owners. Except where the context otherwise requires or where otherwise indicated, the terms “we,” “us,” “our,” “our company,” “the company,” and “our business” refer to Yumanity Therapeutics, Inc. and its consolidated subsidiary.

ITEMItem 1. BUSINESSBusiness.

Overview

On February 29, 2024, Kineta announced that it had completed a review of its business, including the status of its programs, resources and

capabilities. Following this review, Kineta determined that it would implement a significant corporate restructuring to substantially reduce expenses and preserve cash. The restructuring includes a reduction in its workforce by approximately 64% and the termination of enrollment of new patients in its ongoing VISTA-101 Phase 1/2 clinical trial evaluating KVA12123 in patients with advanced solid tumors. Patients currently enrolled in the trial will be permitted to continue to participate. The Company made this decision, in part, because certain investors have indicated they will not be able to fulfill their contractual obligation to consummate the Private Placement (as defined below). Kineta has initiated a process to explore a range of strategic alternatives to maximize shareholder value. Potential strategic alternatives that may be evaluated include sale of assets of the Company, a sale of the Company, licensing of assets, a merger, liquidation or other strategic action. There is no set timetable for this process, and there can be no assurance that this strategic review process will result in the pursuit of any transaction or that any transaction, if pursued, will be completed. Additionally, there can be no assurances that any particular course of action, business arrangement or transaction, or series of transactions, will be pursued, successfully consummated, or lead to increased stockholder value. If the strategic process is unsuccessful, the Company's Board may decide to pursue a liquidation or obtain relief under the US Bankruptcy Code. In the event of such liquidation, bankruptcy case, or other wind-down event, holders of the Company's securities will likely suffer a total loss of their investment.

Kineta is a clinical-stage biotechnology company with a mission to develop next-generation immunotherapies that transform patients’ lives. Kineta has leveraged its expertise in innate immunity and is focused on discovering and developing potentially differentiated immunotherapies that address the mechanisms of cancer immune resistance:

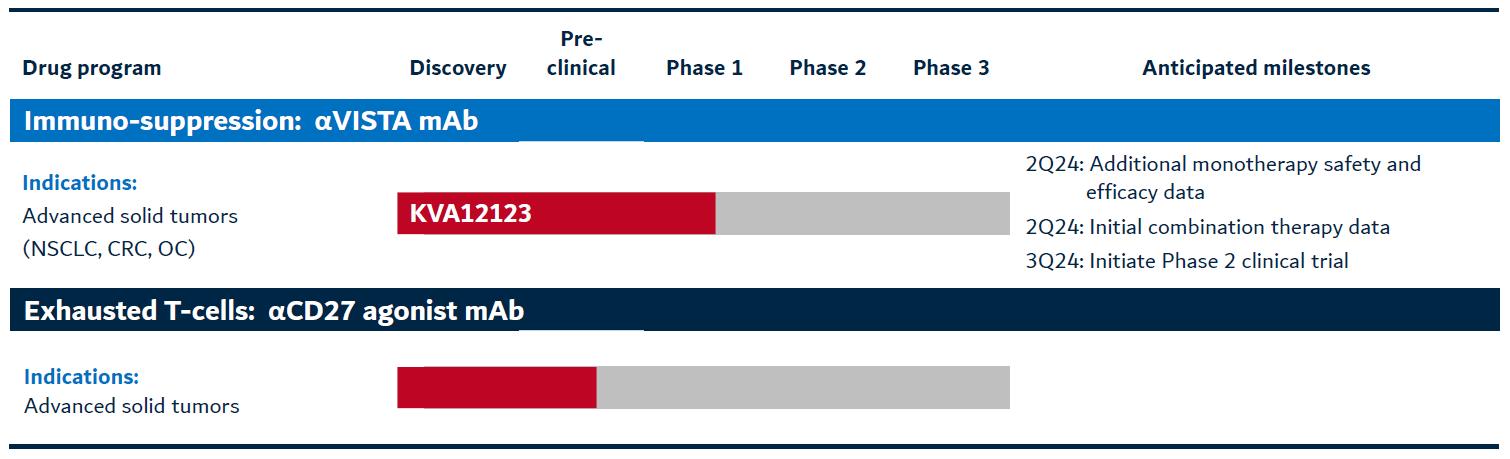

Kineta’s pipeline of potentially next-generation immunotherapies includes (i) KVA12123, a monoclonal antibody (“mAb”), immunotherapy targeting VISTA (V-domain Ig suppressor of T cell activation) and (ii) an anti-CD27 agonist mAb immunotherapy. These novel immunotherapies have the potential to address disease areas with unmet medical needs and significant commercial potential.

KVA12123 is a VISTA blocking immunotherapy in development as an intravenous infusion dosed every two weeks. Kineta dosed the first patient in a Phase 1/2 clinical trial of KVA12123 in the United States in April 2023. The ongoing Phase 1/2 clinical study is designed to evaluate KVA12123 as a monotherapy and in combination with the immune checkpoint inhibitor pembrolizumab in patients with advanced solid tumors. Initial monotherapy safety, pharmacokinetic and biomarker data were presented at the Society for Immunotherapy of Cancer’s (SITC) annual meeting in November 2023. KVA12123 was designed to be a differentiated VISTA blocking immunotherapy to address the problem of immunosuppression in the tumor microenvironment (“TME”). It is a fully human engineered IgG1 monoclonal antibody that binds to VISTA through a unique epitope and across neutral and acidic pHs. KVA12123 may be an effective immunotherapy for many types of cancer, including non-small cell lung cancer (“NSCLC”), colorectal cancer (“CRC”), ovarian cancer (“OC”), renal cell carcinoma (“RCC”) and head and neck squamous cell carcinoma (“HNSCC”). These indications represent a significant unmet medical need with a large worldwide commercial opportunity for KVA12123.

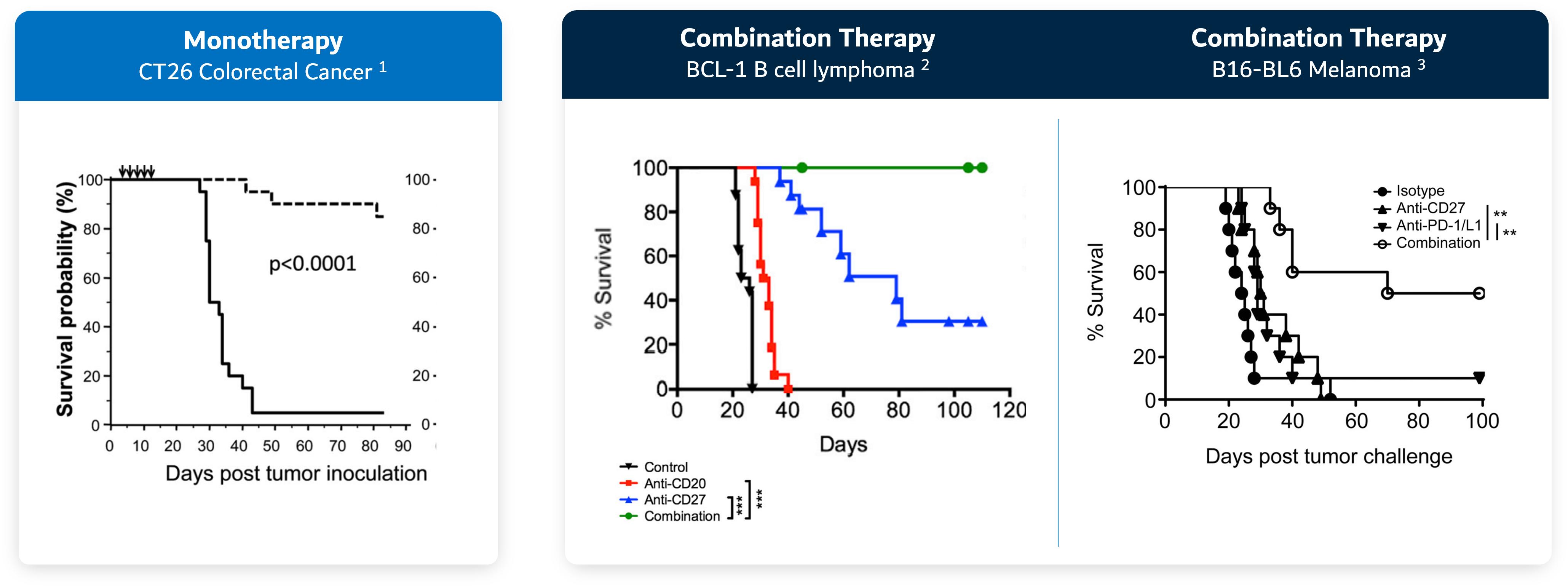

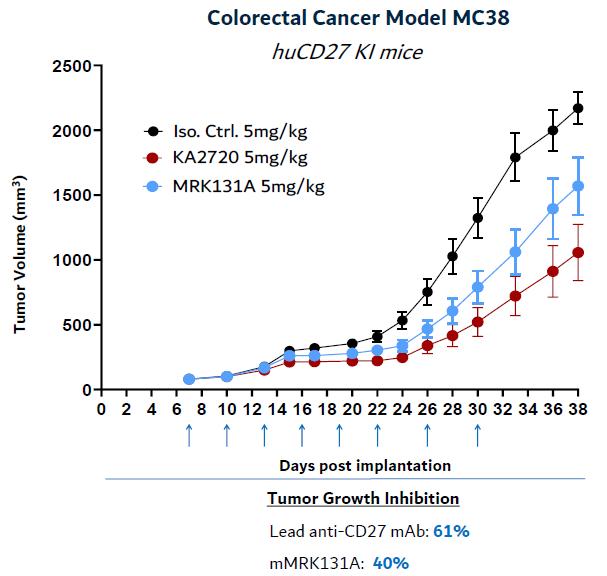

Kineta is also developing an anti-CD27 agonist mAb immunotherapy to address the problem of exhausted T cells. The nominated lead candidate is a fully human mAb that demonstrates nanomolar (“nM”) binding affinity to CD27 in humans. In preclinical studies,Kineta’s lead anti-CD27 candidate demonstrated antitumor efficacy as a single agent and in combination with other immunotherapies in multiple solid and hematological preclinical tumor models. CD27 is a clinically validated target that may be an effective immunotherapy for advanced solid tumors including RCC, CRC and OC. Kineta continues to conduct preclinical studies to optimize its lead anti-CD27 agonist mAb clinical candidate and to evaluate it in combination with other checkpoint inhibitors.

According to Market Data Forecast, the immuno-oncology market generated sales of approximately $111 billion in 2023 and is forecast to reach $201 billion in 2028. If Kineta successfully completes the clinical trial program for KVA12123 and if Kineta subsequently obtains regulatory approval for KVA12123, Kineta will focus on initial target indications in NSCLC, CRC and OC. Initially the clinical development of KVA12123 will be as a second-line therapy in these indications. These three cancer therapy segments represent a forecasted $48 billion market opportunity in 2027 according to GlobalData.

Kineta is a leader in the field of innate immunity and is focused on developing potentially differentiated immunotherapies. With KVA12123 in clinical development and the lead anti-CD27 agonist mAb in preclinical development, Kineta believes it is positioned to achieve multiple value-driving catalysts. Kineta has assembled an experienced management team, a seasoned research and clinical team, an immuno-oncology focused scientific advisory board, and a leading intellectual property position to advance its pipeline of potential novel immunotherapies for cancer patients.

Kineta’s Strategy

Kineta’s immediate strategy is to continue its process to explore strategic alternatives.

4

Kineta has initiated a process to explore a range of strategic alternatives to maximize shareholder value. Potential strategic alternatives that may be evaluated include a sale or merger of the Company, the sale of all or a portion of the Company’s assets and/or intellectual property, or securing additional financing or partnerships that would enable further development of our programs. There can be no assurance that this strategic review process will result in the Company pursing any transaction or that any transaction, if pursed, will be completed. If the strategic process is unsuccessful, the Company's Board may decide to pursue a liquidation or obtain relief under the US Bankruptcy Code.

Overview

We are a biopharmaceutical company focused on the discovery and development of innovative, disease-modifying therapies for neurodegenerative diseases. Neurodegenerative diseases cause a progressive loss of structure and function in the brain, leaving patients with devastating damageKineta’s mission is to their nervous system and widespread functional impairment. Although treatments may help relieve some of the physical or mental symptoms associated with neurodegenerative diseases, few of the currently available therapies slow or stop the continued loss of neurons, resulting in a critical unmet need. We are specificallydevelop next-generation immunotherapies that transform patients’ lives. Kineta is focused on developing fully human antibodies that address the mechanisms of cancer immune resistance. Kineta is a leader in developing fully human antibody drugs directed against novel therapies to treat devastating conditions, either with large or orphan disease markets, such as Parkinson’s disease, dementia with Lewy bodies, multiple system atrophy, or MSA, amyotrophic lateral sclerosis, or ALS (also known as Lou Gehrig’s disease),innate immune targets. Kineta’s focus on innate immunity differentiates it from other immuno-oncology companies that are primarily focused on adaptive immunity and frontotemporal lobar dementia, or FTLD.T cell focused therapies.

Neurodegenerative diseases exertThe key element of Kineta’s strategy to achieve this mission is to advance the clinical development of Kineta’s lead product candidates. Kineta’s most advanced drug candidate, KVA12123, is a heavy societal burden worldwide and represent one of the largest global healthcare challenges of our time. With an increasingly aging population, diseases affecting the brain and central nervous system are rising in prevalence, with overwhelming personal and economic consequences that exact a toll on patients, caregivers and treatment providers. The rising prevalence of neurodegenerative disease and a lack of disease-modifying treatments has resultedpotentially differentiated VISTA blocking immunotherapy currently being tested in a significant and growing unmet medical need. It is estimated that more than 60 million people worldwide suffer from neurodegenerative diseases, which is expected to almost double every 20 years. Global costsPhase 1/2 clinical trial. Kineta’s IND application for treating these diseases are greater than $1 trillion annually.

In February 2022, we announced that we are exploring strategic alternatives to enhance shareholder value and engaged H.C. Wainwright as our exclusive financial advisor to assist in this process. No timetable has been established for the completion of this process, and we do not expect to disclose developments unless and until the Board of Directors has concluded that disclosure is appropriate or required.

In February we also began implementation of a strategic restructuring with the objective of preserving capital. As part of the restructuring, we are eliminating approximately 60% of its workforce and took other actions, including reducing our office and laboratory space, to reduce expenditures.

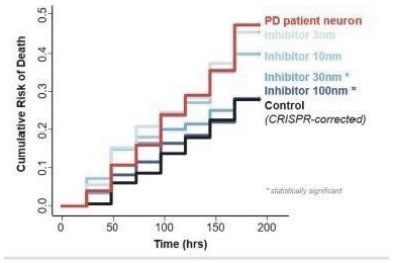

Our lead program, YTX-7739, is in development for the potential treatment and disease modification of Parkinson’s disease. YTX-7739 targets an enzyme known as stearoyl-CoA desaturase, or SCD. Inhibition of SCD in multiple cellular systems, including patient-derived neurons, as well as in a novel mouse model of Parkinson’s disease, has been demonstrated to reverse the toxicity of misfolded alpha-synuclein, or α-synuclein, a protein strongly associated with Parkinson’s disease.

In January 2022,KVA12123 was accepted by the U.S. Food and Drug Administration (FDA), placed a partial clinical hold on multidose clinical trials of YTX-7739. The partial clinical hold suspends initiation of multiple dose clinical trials(the “FDA”) in the U.S. until the FDA’s concerns have been addressed. We anticipate working closely with the FDA to adequately address their concerns. The FDA’s action has not impacted our on-going multidose clinical trial in Europe and is permitting our planned single dose formulation clinical trial to proceed.

On November 10, 2021, we announced the top-line results of2022. Kineta initiated a Phase 1b clinical trial of YTX-77391 dose escalation study with KVA12123 as a monotherapy and in combination with pembrolizumab in patients with mild-to-moderate Parkinson’s disease, which assessedadvanced solid tumors in the safety, tolerability and pharmacokinetics and pharmacodynamicsfourth quarter of YTX-7739. The Phase 1b2022. Initial data from this clinical trial was a randomized, placebo-controlled, double-blind multi dose study to investigate the safety, tolerability, pharmacokinetics and pharmacodynamics of YTX-7739. Data were reported from 20 patients with mild-to-moderate Parkinson’s disease. Patients received once-daily oral doses of YTX-7739 (20 mg or placebo) for 28 days. YTX-7739 was shown to inhibit its primary target, SCD, an enzyme whose inhibition has been closely linked to neuronal survival and improved motor function in a Parkinson’s disease model.

After 28 days of treatment, the 20 mg dose given once-daily reduced the fatty acid desaturation index (FA-DI), a biomarker of SCD inhibition, by approximately 20%-40%, the range expected to be clinically relevant based on preclinical studies. Target engagementreleased in the cerebrospinal fluid suggested that YTX-7739 crossed the blood-brain barrier. Additionally, the PK/PD profilefourth quarter of YTX-7739 was consistent with previous2023. Kineta is also conducting preclinical studies and we believe informs dose selection for future studies.its lead anti-CD27 agonist mAb immunotherapy.

YTX-7739 was generally well toleratedUnmet medical needs for cancer patients

With improvements in screening and early diagnosis, cancer patient survival has increased considerably, since tumors that are detected and treated early with surgery, conventional chemotherapy or radiation therapy can often be cured. However, for patients who are diagnosed with more advanced or difficult to treat tumors, conventional therapies are often ineffective, and the chance of long-term survival is seriously reduced.

The discovery of novel immune checkpoint inhibitors (“CPIs”) targeting the B7/CD28 family of proteins, including programmed cell-death protein 1 (“PD1”), programmed death-ligand 1 (“PD-L1”) and cytotoxic T lymphocyte associated protein 4 (“CTLA4”) has completely revolutionized cancer treatment. These new immunotherapies provide hope for patients with advanced tumors to achieve long-term remission after treatment.

However promising the existing CPIs are in treating certain clinical indications, several key deficiencies of this approach have become apparent during clinical development and post-marketing use:

Addressing the major challenges with increased Parkinson’s symptoms, 2 patients with lower back pain, 1 patient with headache, 1 patient with myalgia, 1 patient with insomnia, 1 patient withcurrent cancer therapy

1There remains a significant unmet need to improve overall and long-term survival for cancer patients, especially those diagnosed with later stage cancers. New innovations and enhancements to the currently available therapies are urgently needed to address the treatment gaps.

Kineta is developing next-generation immunotherapies to address the major challenges with current cancer treatments. Kineta aims to improve outcomes for cancer patients by solving the major problems of cancer immune resistance.

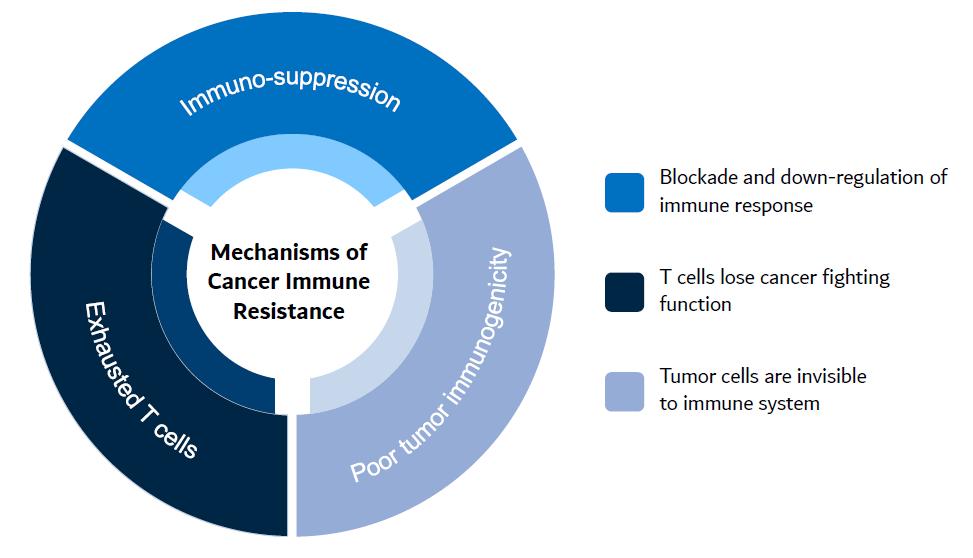

Kineta’s development approach involves first exploring the main mechanisms of cancer resistance to existing therapies, including CPIs. Kineta focuses on the importance of the innate immune response to achieve a complete adaptive immune response. Kineta has identified that colder, less inflamed and more difficult to treat tumors have three characteristics that Kineta believes can be addressed by its pipeline. Figure 1 below represents the three major mechanisms of cancer immune resistance to therapies that Kineta’s pipeline is designed to address.

ligament strain,5

Figure 1. The major challenges with current cancer therapies

Kineta’s Product Candidate Pipeline

Kineta is devoted to the discovery and development of fully human monoclonal antibodies that target novel innate immune regulators. Kineta is developing two novel innate immune-targeted therapies that may address advanced solid tumors:

Figure 2. Kineta’s pipeline

KVA12123: VISTA blocking immunotherapy

KVA12123 is designed to be a differentiated VISTA blocking immunotherapy to address the problem of immunosuppression in the TME. KVA12123 is a VISTA blocking immunotherapy in development as an infusion dosed every two weeks. The drug is being evaluated in an ongoing Phase 1/2 clinical trial as a monotherapy and in combination with pembrolizumab in patients with advanced solid tumors. Through the combination of unique epitope binding and an optimized IgG1 Fc region, KVA12123 demonstrates strong monotherapy tumor growth inhibition in preclinical models without evidence of cytokine release syndrome (“CRS”) in clinical trial participants. KVA12123 also exhibits an excellent safety profile in initial clinical trial cohorts. KVA12123 has been shown to de-risk the VISTA target and provides a novel approach to address the problem of immunosuppression in the TME with a mechanism of action that is differentiated and complementary to T cell focused therapies. KVA12123 may be an effective immunotherapy for many types of cancer including NSCLC, CRC, OC, RCC and HNSCC.

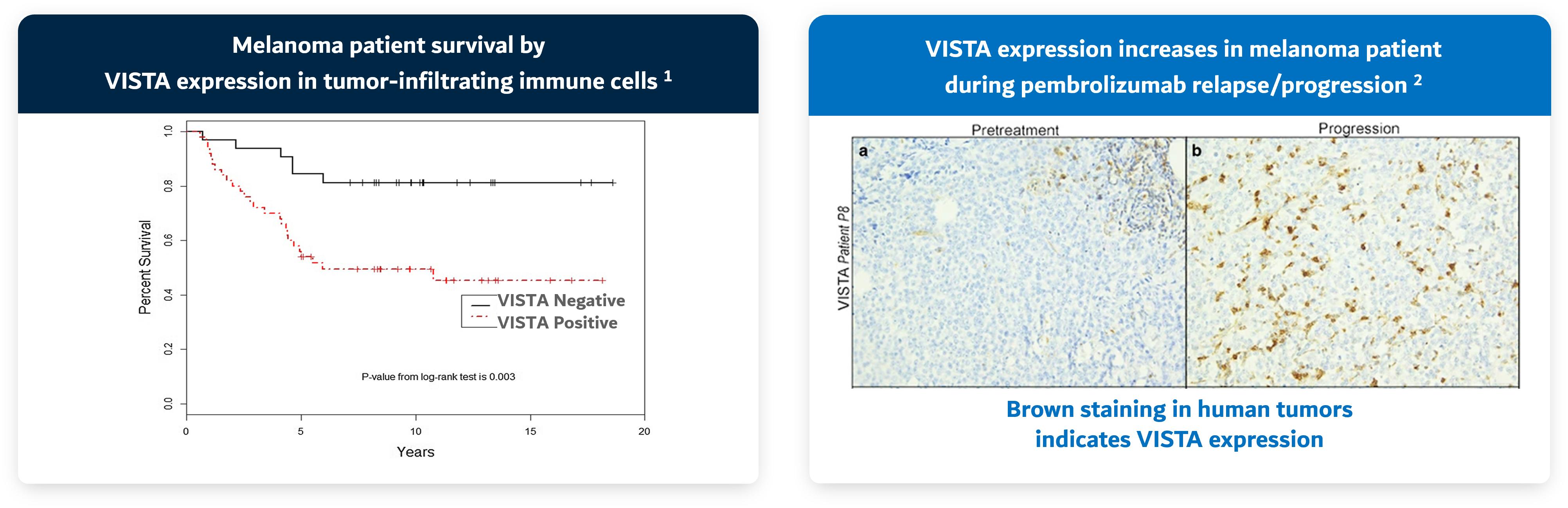

VISTA (V-domain Ig suppressor of T cell activation) is a negative immune checkpoint that suppresses T cell function in a variety of solid tumors. High VISTA expression in tumor correlates with poor survival in cancer patients and has been associated with a lack of response to other immune checkpoint inhibitors. Blocking VISTA induces an efficient polyfunctional immune response to address immunosuppression and drives anti-tumor responses.

There is a strong clinical rationale for targeting VISTA with an antibody immunotherapy. The innate immune target VISTA is highly expressed in

6

NSCLC, OC, colon cancer, melanoma, pancreatic cancer and gastric cancer and correlates with poor outcomes in cancer patients. VISTA is also up-regulated after CPI therapy (e.g., Keytruda®) and is associated with treatment failure (Figure 3).

Figure 3. VISTA expression is associated with poor overall survival and treatment failure with CPI

Sources: 1. Kuklinski et al. 2018; 2. Kakavand et al. 2017

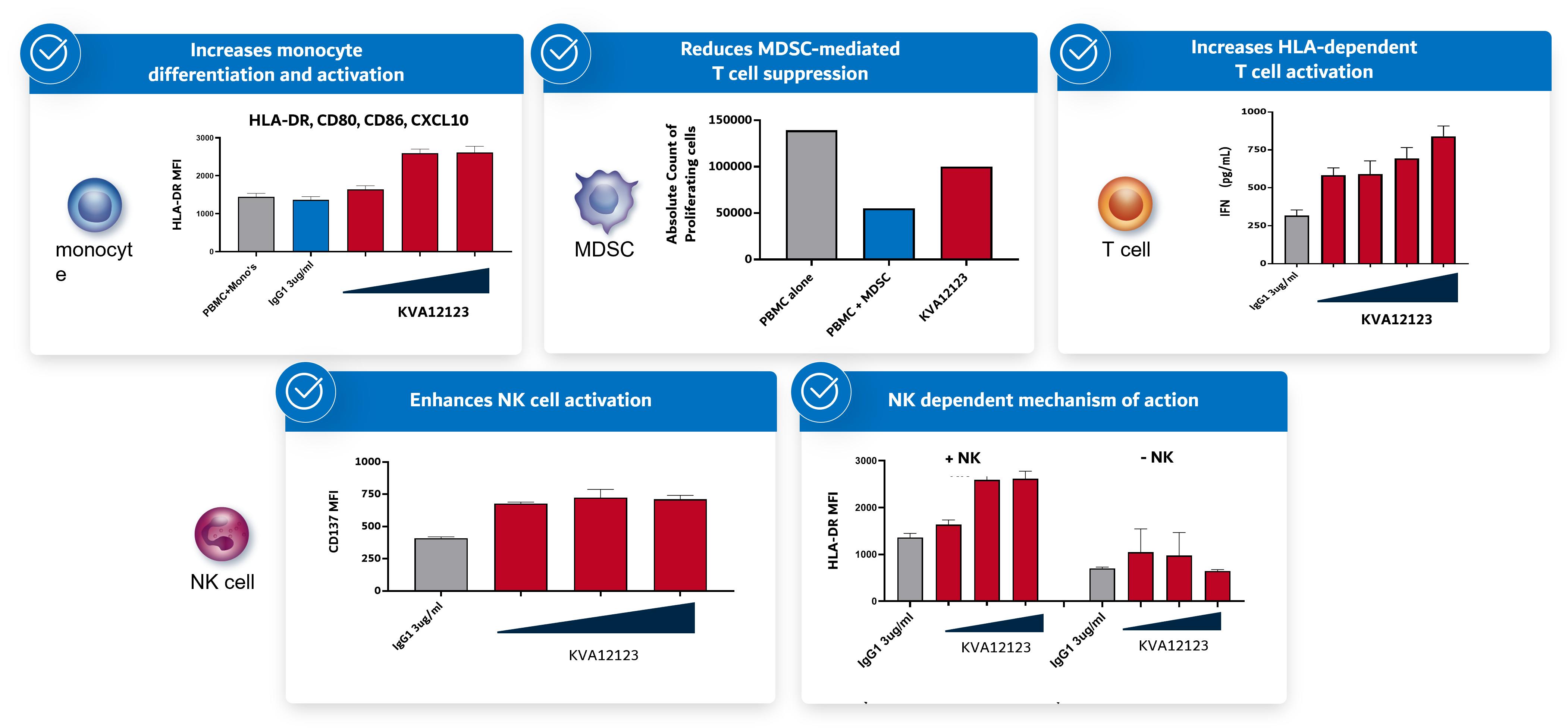

Blocking VISTA drives an efficient polyfunctional immune response to turn cold tumors hot. VISTA is a novel immuno-oncology target due to its unique expression and activity. First, high VISTA expression on immunosuppressive myeloid cells (tumor associated macrophages and myeloid-derived suppressor cells (MDSCs)) is consistent across tumor types, making it a relevant target across multiple types of cancer. Re-programmed myeloid cells can drive tumor inflammation. VISTA-blockade decreases immune suppression and provides single agent tumor growth inhibition and also improves efficacy of T cell focused therapies like anti-PD(L)1 and anti-CTLA4.

Second, blocking VISTA induces activation of dendritic cells and natural killer (“NK”) cells and ultimately proliferation and infiltration of T cells into the tumor. The combination of myeloid, NK and T cell responses can reverse immunosuppression and drive anti-tumor activity. While many immuno-oncology targets address either T cell or myeloid functions, VISTA has the potential to regulate both.

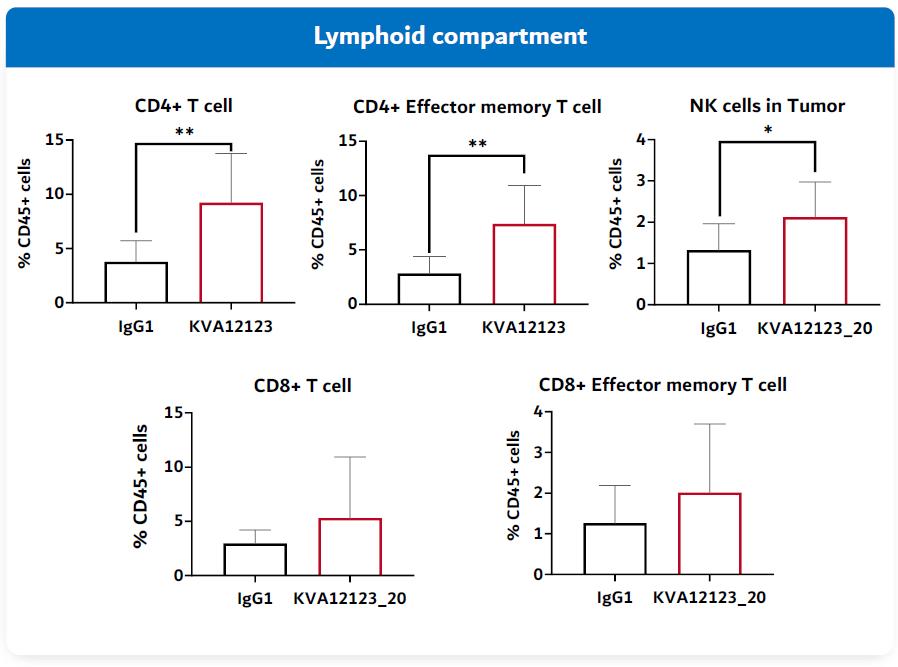

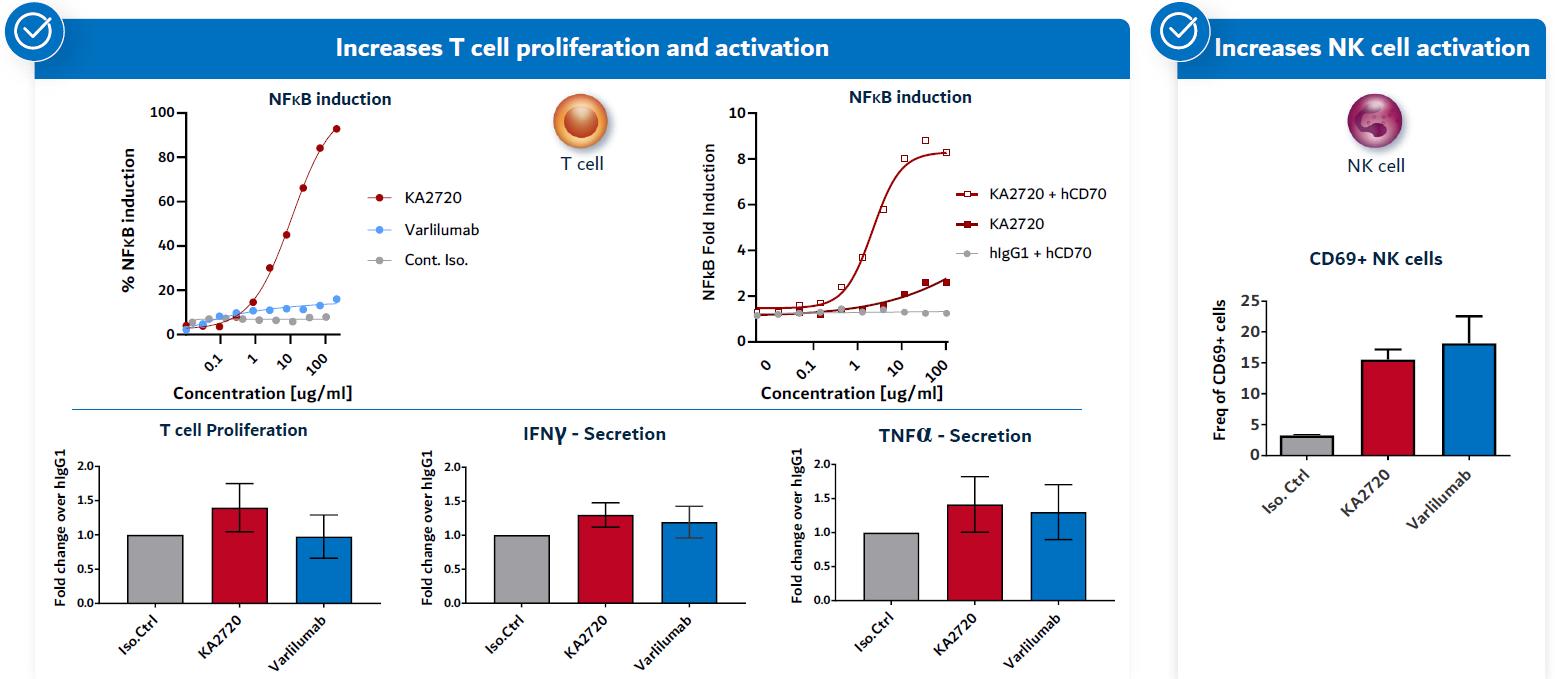

KVA12123 has demonstrated activity on important innate and adaptive immune cells (Figure 4) present in the TME in preclinical assays (in vitro).

Figure 4. Blocking VISTA with KVA12123 activates both innate and adaptive immune cells

Additionally, KVA12123 drives an integrated innate and adaptive anti-tumor immune response in tumor models like MB49 bladder tumor (ex vivo).

Figure 5. Blocking VISTA with KVA12123 drives anti-tumor responses in MB49 model

7

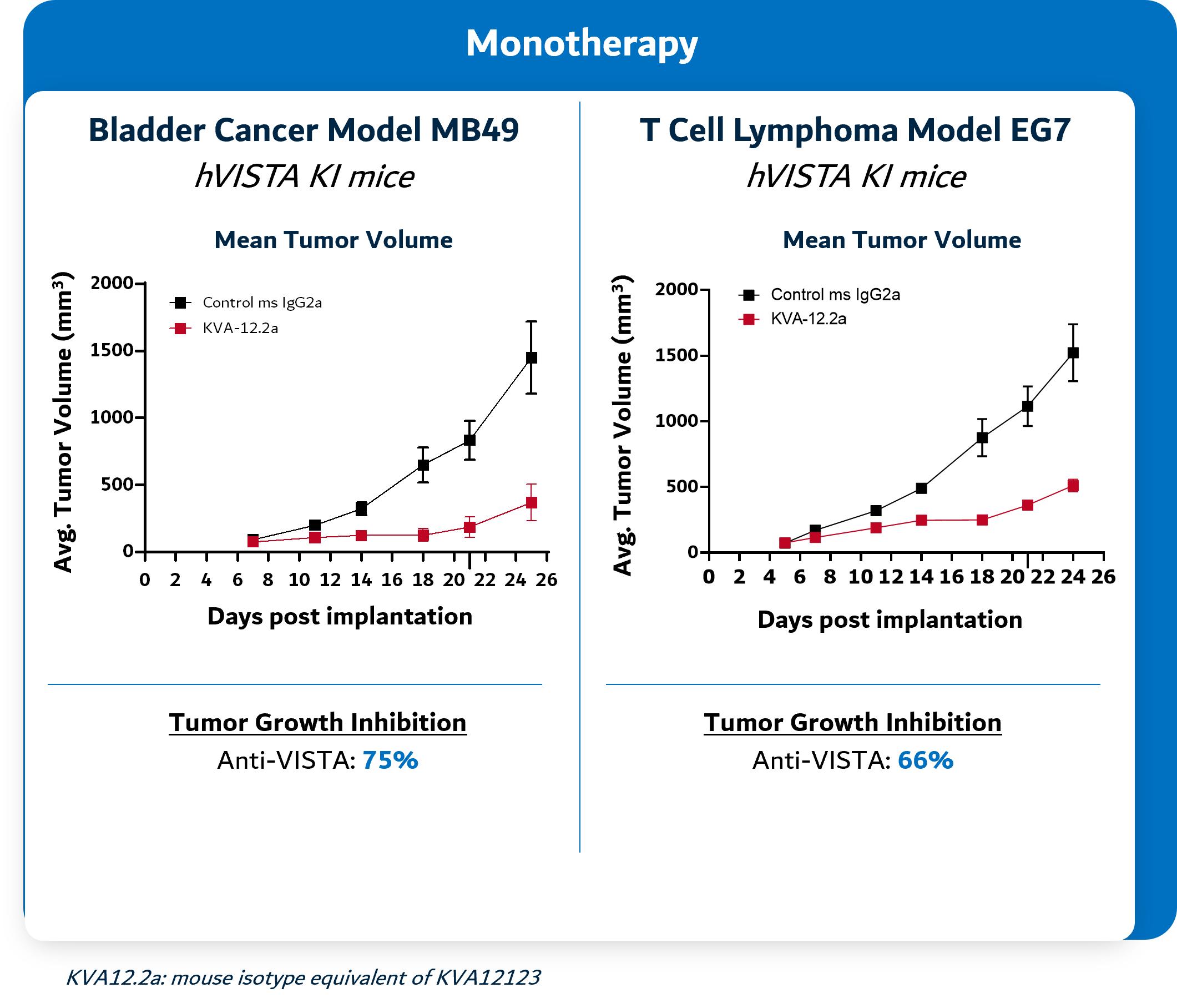

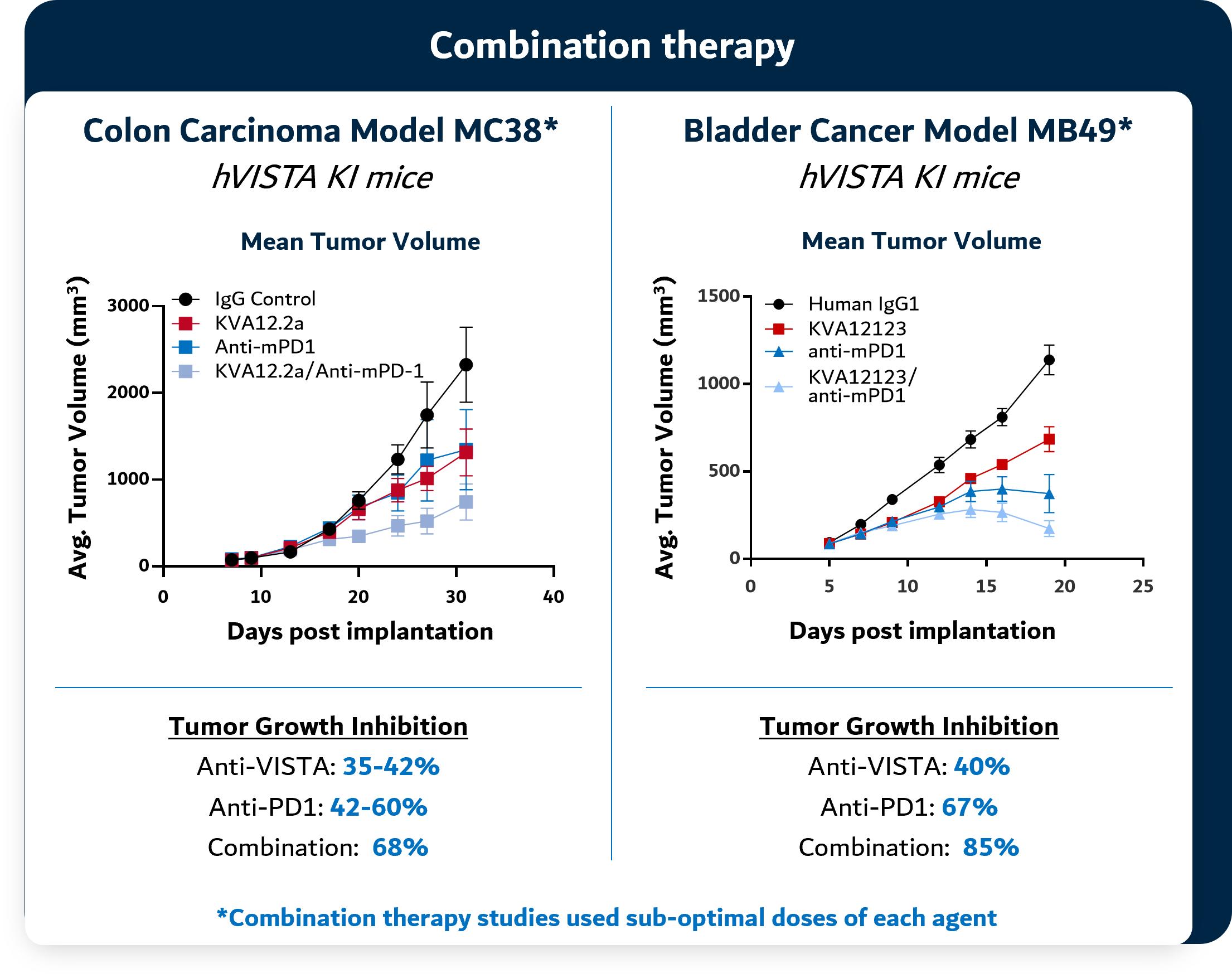

In preclinical models, KVA12123 has been observed to show strong single agent tumor growth inhibition in poorly immunogenic “cold tumors” models and complementary tumor growth inhibition when dosed in combination with CPIs like PD-1 or CTLA-4 as shown in Figure 6 below. Studies in preclinical tumor models demonstrate the tumor growth inhibition of Kineta’s anti-VISTA antibody as a single agent in bladder cancer, T cell lymphoma and colon cancer models. In combination studies, Kineta’s anti-VISTA antibody acts synergistically in combination with anti-PD-1 therapy to inhibit tumor growth in preclinical colon cancer and bladder cancer models.

8

Figure 6. KVA12123 demonstrates single agent tumor growth inhibition and in combination with PD-1 in preclinical models

Source: Kineta data

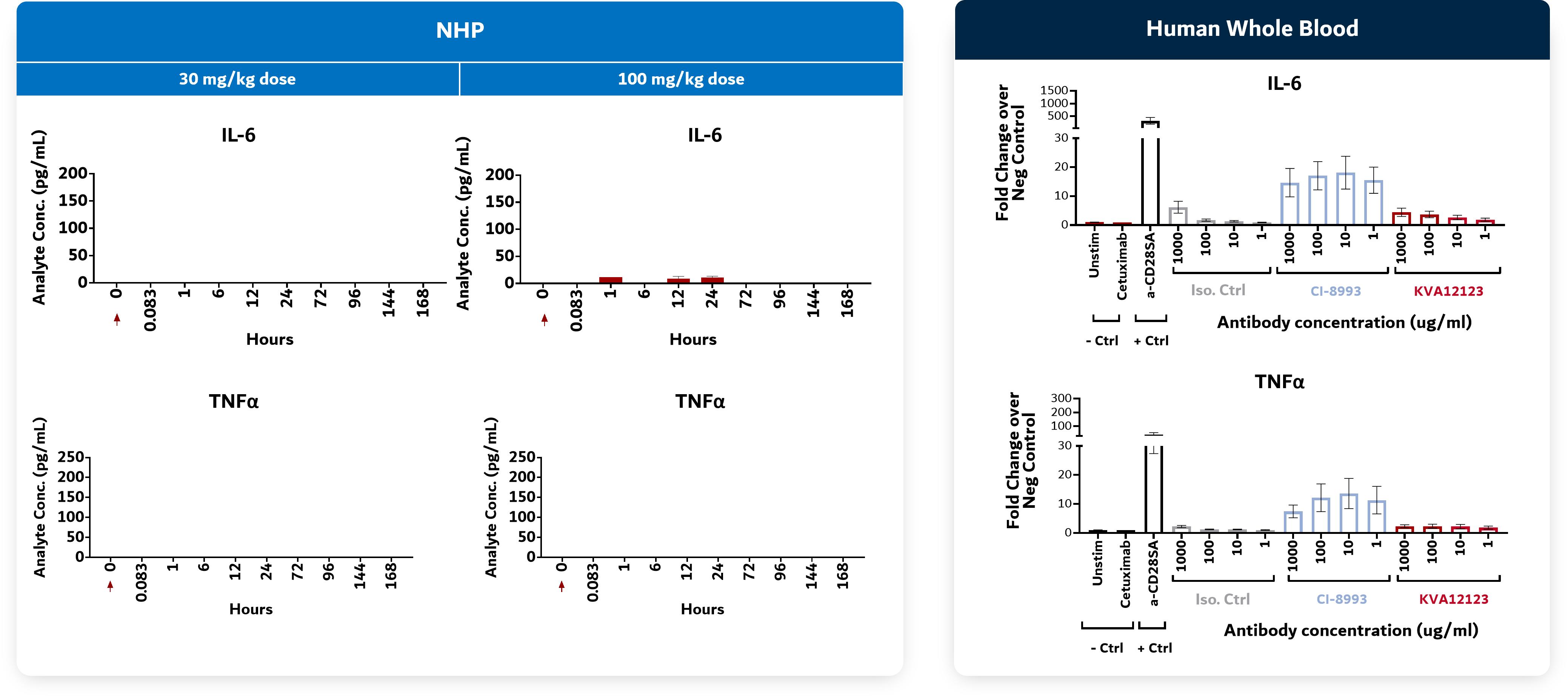

Kineta has completed multiple, single and repeat-dose toxicology studies in non-human primates (“NHP”) with doses of KVA12123 up to 100 mg/kg (>100-fold safety margin over target human exposure). KVA12123 was observed to be well-tolerated in NHP toxicology studies with no mortality, no overt clinical signs or weight loss, no treatment-related findings and no change in CRS-associated cytokine levels (IL6 or TNFα). IL6 and TNFα are indicators of CRS.

9

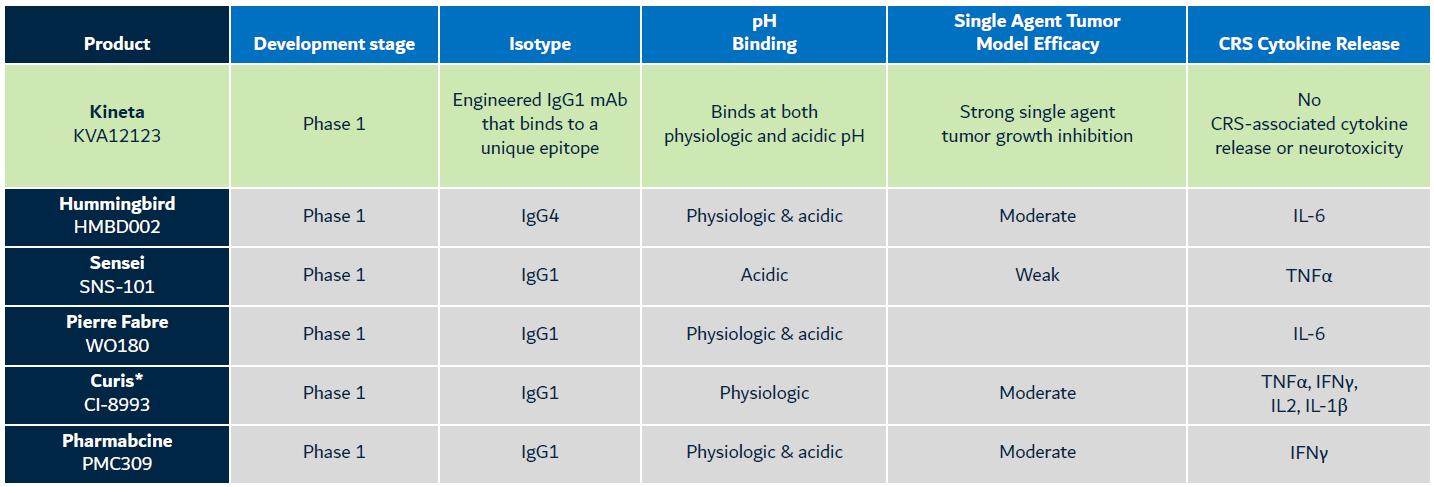

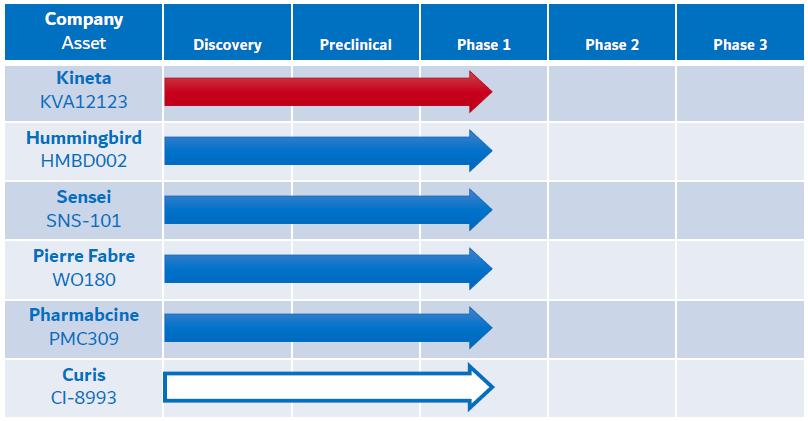

KVA12123 Competitive Differentiation

The competitive landscape for VISTA blocking immunotherapies includes six primary companies (Kineta, Inc., Curis, Inc., Pierre Fabre Laboratories, Hummingbird Bioscience Pte. Ltd., PharmAbcine, Inc. and Sensei Biotherapeutics, Inc.) with assets in Phase 1 clinical development. Other discovery stage assets have been announced by Apexigen, Inc. and Five Prime Therapeutics (acquired by Amgen Inc.)/Bristol Myers Squibb Company (“BMS”). See Figure 7 below for more information on competitive products in development.

Kineta is developing a VISTA blocking immunotherapy that is designed to be differentiated from competitive products by the following:

Figure 7. KVA12123: Differentiated VISTA blocking immunotherapy

Other discovery stage programs: Apexigen and Five Prime Therapeutics/BMS. Empty cells indicate no public data available

* Curis announced 11/9/2022: “Concentrating its resources to focus on and accelerate emavusertib”, the company’s lead asset and “deprioritization of other programs” (CI-8993)

Kineta believes that KVA12123 may be differentiated as the only antibody in its class with strong single-agent tumor growth inhibition in the absence of cytokine-mediate toxicity.

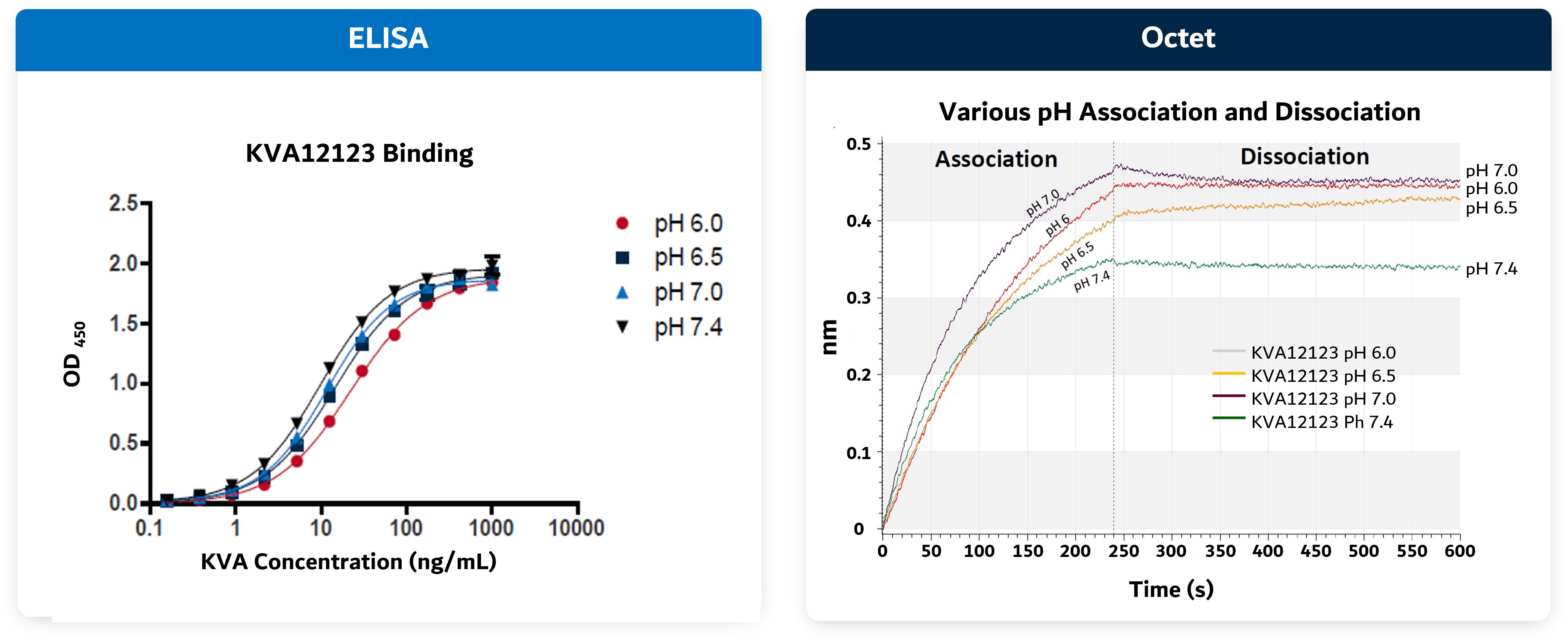

Figure 8. KVA12123 binds at physiologic and acidic pH

Source: Kineta data

10

Figure 9. KVA12123: No CRS-associated cytokine release seen in preclinical models in NHP toxicology and in human whole blood studies

Source: Kineta data

Clinical rationale for KVA12123

Kineta is developing KVA12123 in large clinical and commercial indications where existing CPIs perform poorly, there is a high unmet medical need and VISTA expression in the TME is high. Clinical applications for KVA12123 are primarily focused on solid tumors with high levels of VISTA expression. KVA12123 may be an effective immunotherapy for many types of cancer, including NSCLC, CRC, OC, RCC and HNSCC and other “cold” difficult-to-treat solid tumors. The lead commercial and clinical indications for KVA12123 are NSCLC, CRC and OC based on the following clinical rationale.

Non-small cell lung cancer (NSCLC)

NSCLC is the leading cause of cancer-related mortality in the United States with more than 200,000 newly diagnosed cases each year. NSCLC accounts for about 85% of all diagnosed cases, and about 70% of newly diagnosed NSCLC is already locally advanced or metastatic. For NSCLC that has spread regionally, five-year relative survival rates are 35%. For NSCLC that has spread to distant locations in the body at the time of diagnosis, five-year survival rates are only 7%. More than half of all newly diagnosed NSCLC patients die within one year.

Current treatment options for advanced NSCLC include chemotherapy with cytotoxic combinations (cisplatin and carboplatin plus paclitaxel, gemcitabine, docetaxel, vinorelbine, irinotecan, protein-bound paclitaxel or pemetrexed), EGFR (epidermal growth factor receptor) tyrosine kinase inhibitors, monoclonal antibodies, and anaplastic lymphoma kinase (“ALK”) inhibitors for ALK-rearranged tumors. Targeted therapies overall show modest increases in progression-free survival (“PFS”) and overall survival (“OS”) relative to chemotherapy alone. Only 1 to 2% of lung adenocarcinomas are BRAF V600E positive, 1% of NSCLC have a ROS1 rearrangement, less than 0.5% have an nRTK (non-receptor tyrosine kinase) fusion and less than 2% have an RET fusion, making most of these additional approved targeted therapies of no benefit to most patients.

Keytruda®, Tecentriq®, Imfinzi® and Libtayo®, all targeting PD-(L)1, have been approved for first-line treatment of advanced NSCLC in combination with chemotherapy. The combination of Opdivo® and Yervoy® has also been approved in first line advanced indications. However, CR rates in this setting are low (less than 5%) and median PFS is increased by only two to seven months over conventional chemotherapy alone. In advanced NSCLC that has progressed following initial treatment, PFS and objective responses are even lower. Imfinzi® is also approved as consolidation therapy following chemoradiation therapy, Tecentriq® and Opdivo® are approved in the adjuvant setting, and Opdivo® is approved in the neoadjuvant setting.

Taken together, the above analysis shows that there is a large population of NSCLC patients globally with advanced, refractory disease that could benefit from novel immunotherapy.

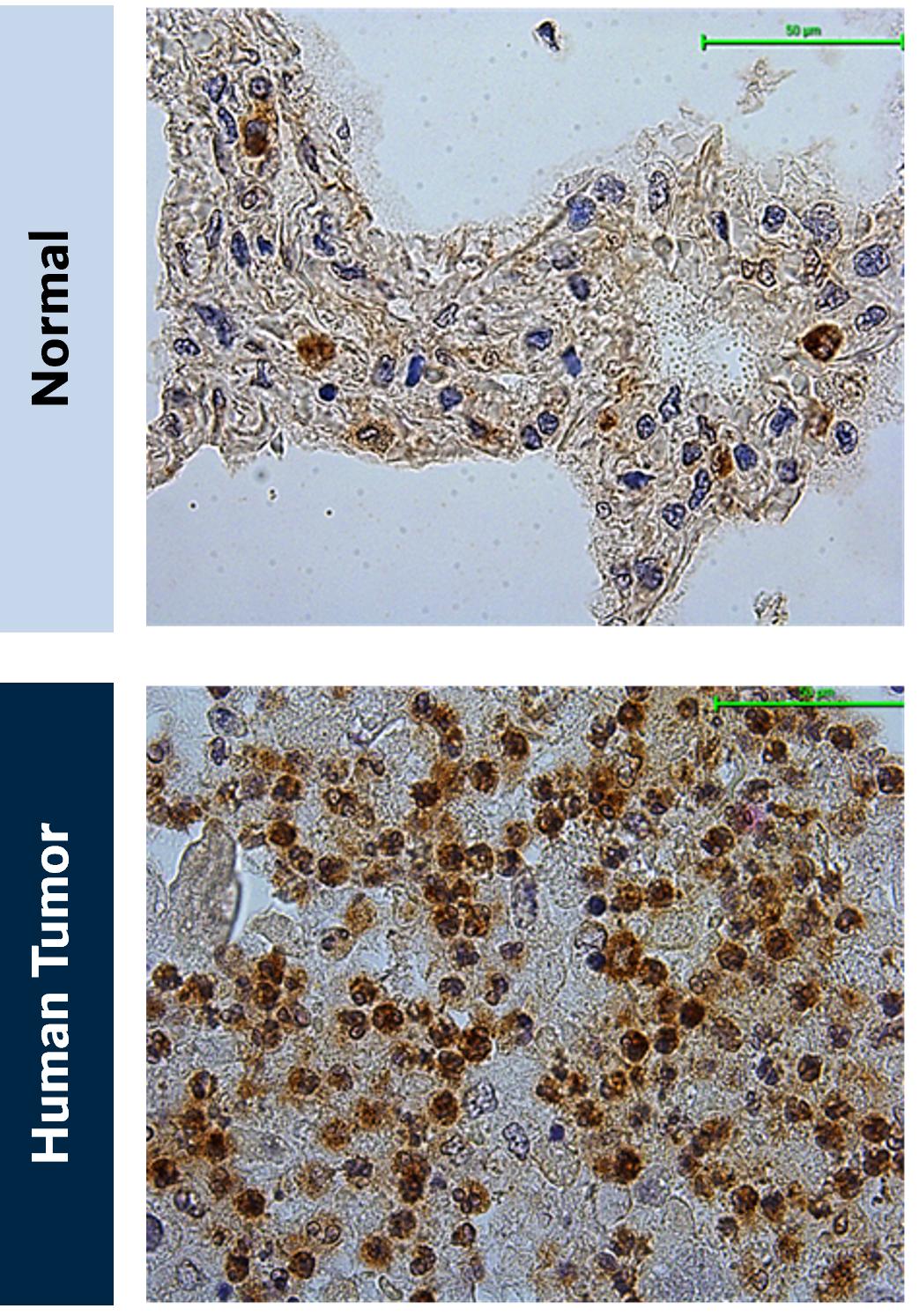

The microenvironment in NSCLC is dominated by immunosuppressive innate immune cells, especially neutrophils and macrophages, making this colder tumor a candidate for treatment with KVA12123. Kineta has conducted immuno-histochemical analysis of VISTA expression on immune cell populations in NSCLC and found high levels in several NSCLC histologies (Figure 10).

11

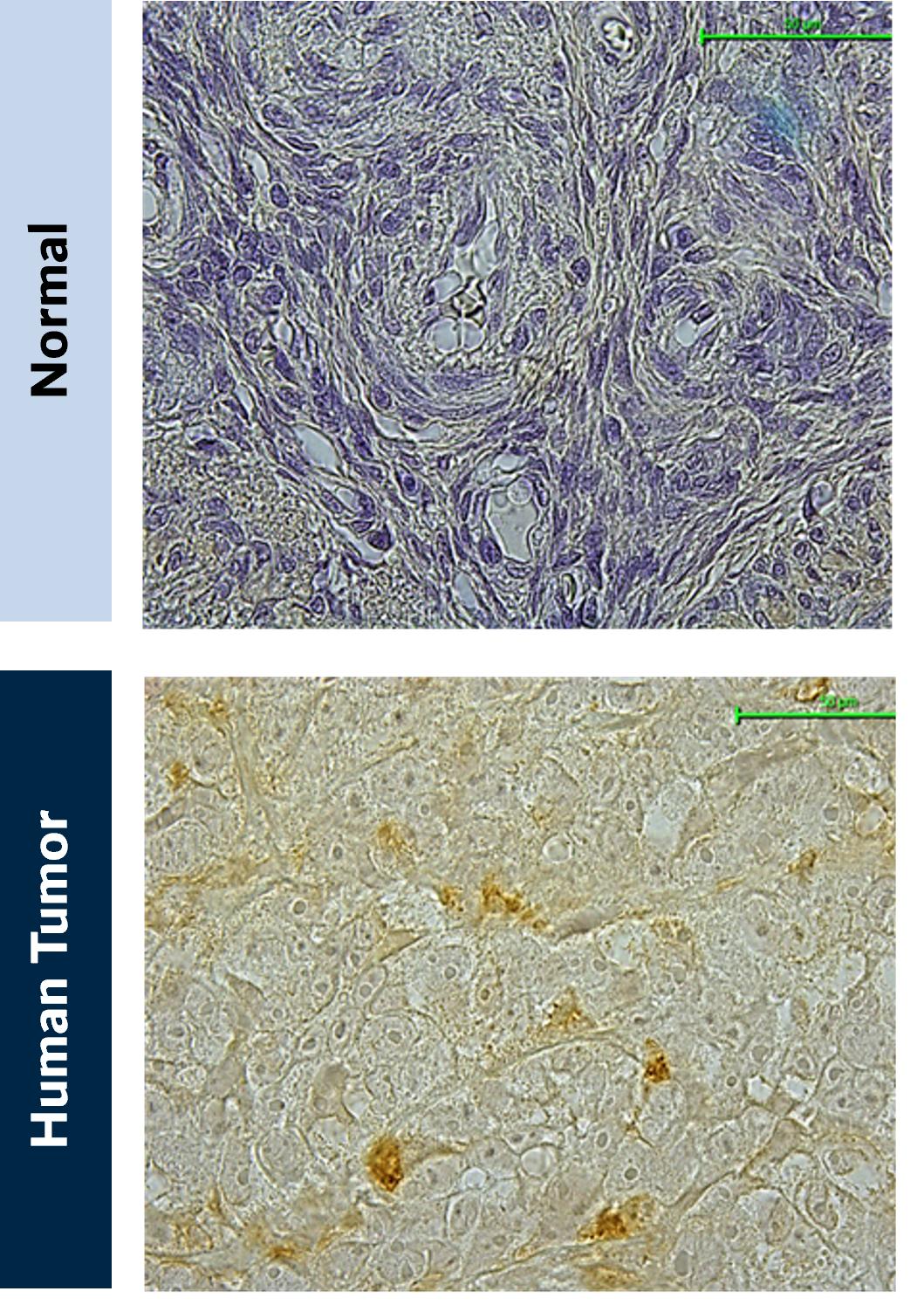

Figure 10. VISTA expression in NSCLC. (A) Normal lung tissue and (B) NSCLC lung cancer tissue stained for VISTA expression (brown)

Source: Kineta data

Colorectal cancer (CRC)

More than 150,000 patients in the U.S. each year are diagnosed with CRC, and more than 50,000 deaths are attributed to the disease. In advanced and metastatic CRC, five-year survival rates are only 14%. The mainstay of treatment for CRC that is detected early is surgical resection. However, patients diagnosed with locally or regionally advanced disease can benefit from adjuvant chemotherapy, in addition to surgical resection. About 22% of patients are initially diagnosed with advanced or metastatic disease. For these patients, and for patients with recurrent disease, chemotherapy and targeted therapy result in only very slight increases in PFS and OS. Radiation therapy has no proven benefit in CRC. Keytruda®, Yervoy® and Opdivo® are approved for the treatment of mismatch repair deficient or microsatellite unstable/microsatellite instability-high tumors, but this accounts for only 4% of CRC patients.

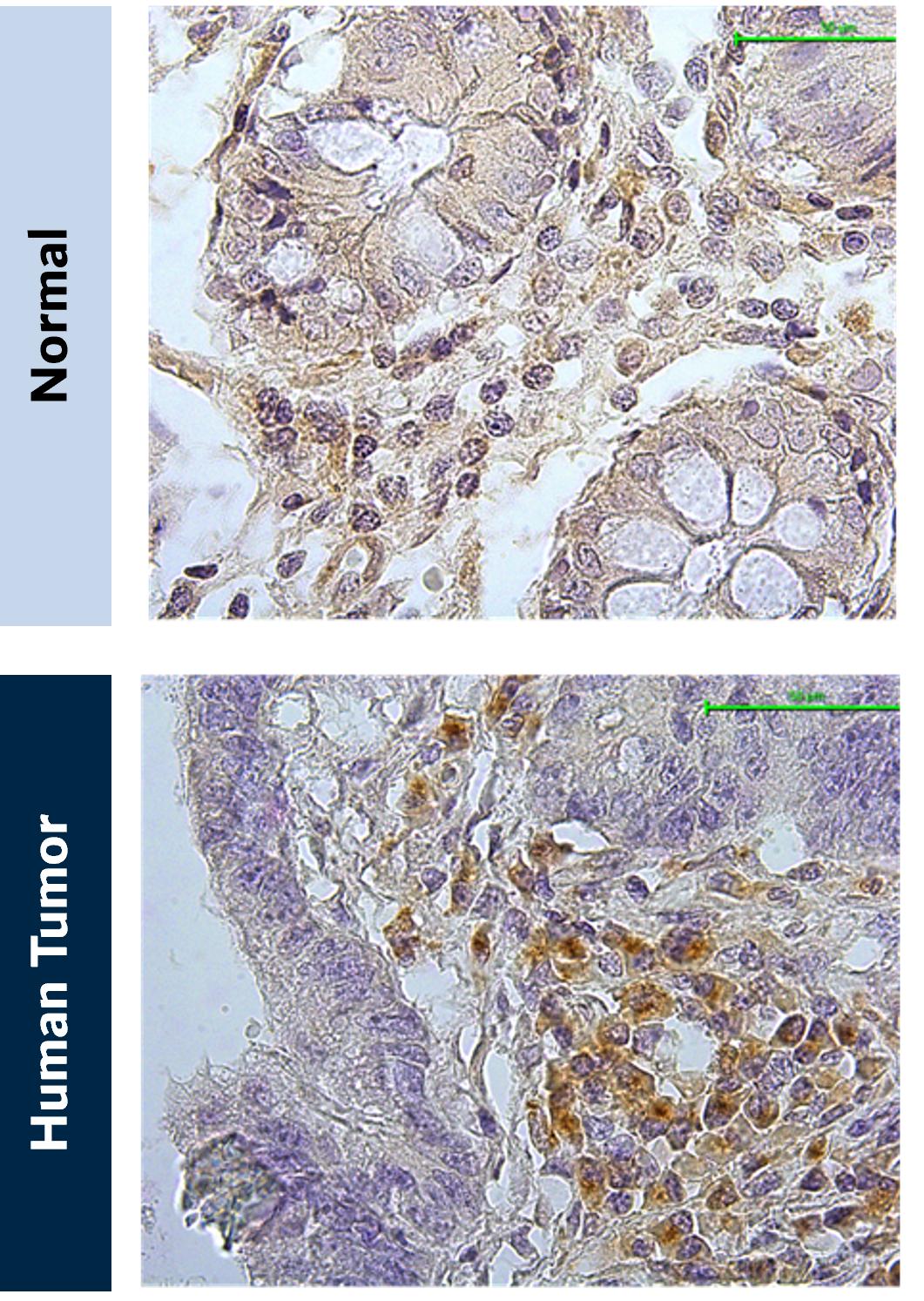

Like NSCLC, CRC is characterized by many VISTA positive innate immune cells and presents an excellent clinical indication for KVA12123 (Figure 11).

12

Figure 11. VISTA expression in CRC. (A) Normal colon tissue and (B) colorectal cancer tissue stained for VISTA expression (brown)

Source: Kineta data

Ovarian cancer (OC)

A small number of mostly gynecological cancers express VISTA on tumor cells and on infiltrating immune cells. One example is OC, where tumor cells express high levels of VISTA (Figure 12). More than 60% of OC cases are diagnosed at an advanced stage of disease, and five-year survival rates for these patients are less than 50%. Platinum/taxane combination chemotherapy is widely used in this indication, with modest improvements in PFS and OS. OC represents a third potential clinical indication for KVA12123.

13

Figure 12. VISTA expression in ovarian cancer. (A) Normal ovarian tissue and (B) ovarian cancer tissue stained for VISTA expression (brown)

Source: Kineta data

VISTA-101 Clinical Trial (VISTA-101)

Kineta announced dosing of the first patient with vaccination complication. OneKVA12123 as a monotherapy in the VISTA-101 trial in April 2023. The ongoing Phase 1/2 clinical study of KVA12123 has continued to enroll monotherapy cohorts and dosed the first patient in combination with pembrolizumab in October 2023.

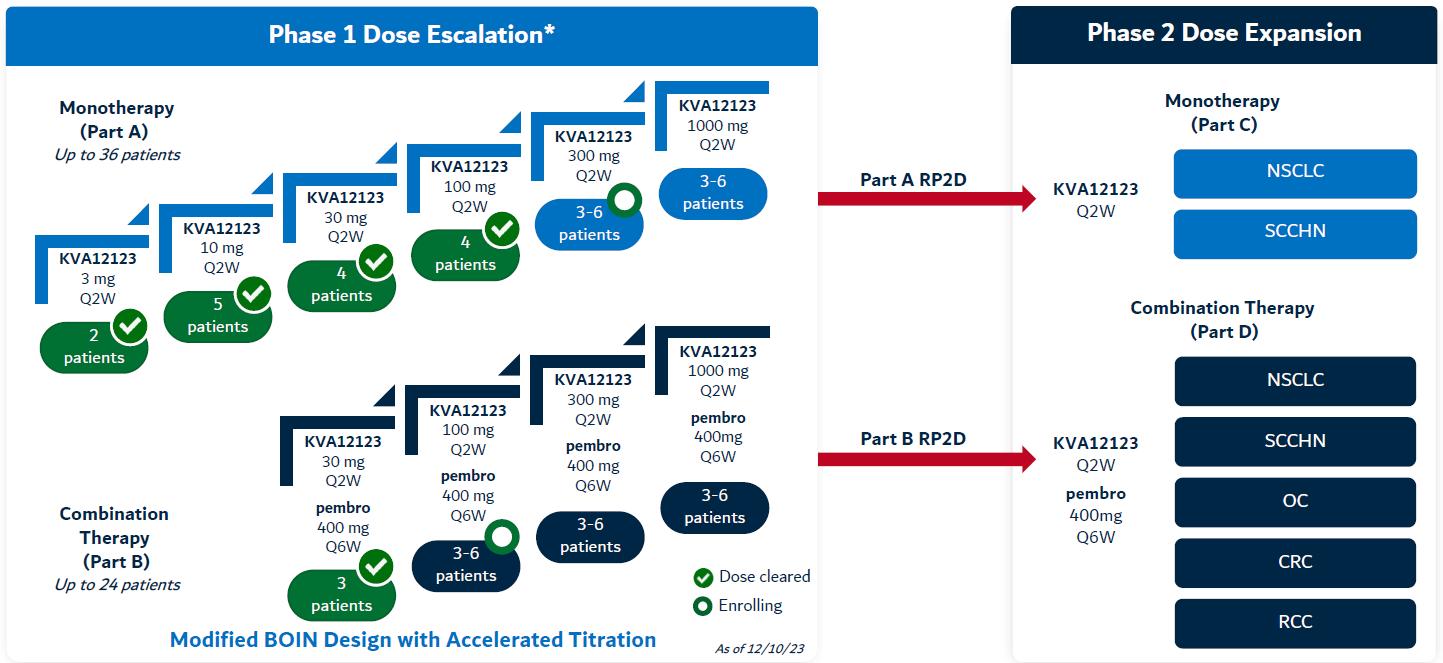

VISTA-101 is a first-in-human (FIH), Phase 1/2, open-label, multicenter, dose escalation, and dose expansion study designed to evaluate the safety, tolerability, pharmacokinetics (“PK”), immunogenicity, and tumor response of the investigational drug KVA12123 as a monotherapy and in combination with pembrolizumab in adults with relapsed or refractory advanced solid tumors.

The study is being conducted in 4 parts: Parts A, B, C and D. Parts A and B focus on placebo had moderate worseningdose escalation. Parts A (single-agent KVA12123) and B (KVA12123 + pembrolizumab) comprise up to 6 and 4 dose escalation cohorts, respectively, each treating 1-6 participants, to characterize the safety, tolerability, pharmacodynamics (“PD”), PK and preliminary tumor responses of tremorsstudy interventions.

Parts C and Parkinsonism,D will focus on dose expansion. Parts C (single-agent KVA12123) and D (KVA12123 + pembrolizumab) will comprise up to 7 disease-specific dose expansion cohorts (2 for Part C and 5 for Part D), which ledwill commence at the recommended Phase 2 dose (“RP2D”) to discontinuation. AEs occurringfurther characterize the safety, tolerability, PD, PK, and preliminary tumor response of KVA12123 as a monotherapy and in combination with pembrolizumab. Part C and Part D will enroll patients with specific tumor types including NSCLC, SCCHN, OC, CRC and RCC as determined in Parts A and B.

14

Figure 13. KVA12123 Phase 1/Phase 2 dose escalation study design

VISTA-101 study objectives

VISTA-101 study objectives are outlined below:

Primary objectives

Secondary objectives

Exploratory Objectives

Clinical sites

Kineta has engaged seven well-known research sites to conduct the Phase 1 arm of VISTA-101 across the United States only (Figure 14). Three additional sites will be added as the study advances to the Phase 2 dose expansion cohorts.

15

Figure 14. VISTA-101 clinical trial sites

Clinical collaboration with Merck

Kineta has entered into a clinical trial collaboration and supply agreement with Merck (known as MSD outside the U.S. and Canada). Under this collaboration, Kineta will evaluate the safety, tolerability, PK and anti-tumor activity of KVA12123, its novel anti-VISTA monoclonal antibody, alone and in combination with KEYTRUDA® (pembrolizumab), Merck’s anti-PD-1 therapy, in patients with advanced solid tumors.

Kineta is conducting a Phase 1/2 clinical study evaluating KVA12123 as a single agent and in combination with KEYTRUDA® in patients with advanced solid tumors. The objectives of the study are to evaluate the safety, tolerability, PK and anti-tumor responses of KVA12123 as a monotherapy and in combination with KEYTRUDA® with initial clinical data released in the fourth quarter of 2023. Kineta is responsible for conducting this study.

Initial VISTA-101 Clinical Data

Kineta presented initial KVA12123 monotherapy clinical data from VISTA-101 at a higher percentagethe Society for Immunotherapy of Cancer’s (SITC) 38th Annual Meeting in 2 or more patients administered YTX-7739 compared to placebo were procedural pain, myalgia, dry eye, hyperbilirubinemia, hypoesthesia, lower back pain, and constipation. AEs occurring at a higher percentage with placebo included orthostatic hypotension, headache, tremor, fatigue and dizziness.November 2023.

As expected, after only 28 days of dosing, there were no statistically significant differences in clinical assessments (Unified Parkinson's Disease Rating Scale Part III (UPDRS III), Montreal Cognitive Assessment (MoCA)) or most exploratory biomarkers. Quantitative electroencephalogram (qEEG) assessments ofJanuary 31, 2024, the effect of YTX-7739 on brain activity were completed in a subset of 8Phase 1/2 VISTA-101 trial enrolled 15 patients and demonstrated a statistically significant change compared to baseline, suggestive of a potential improvement in synaptic function.

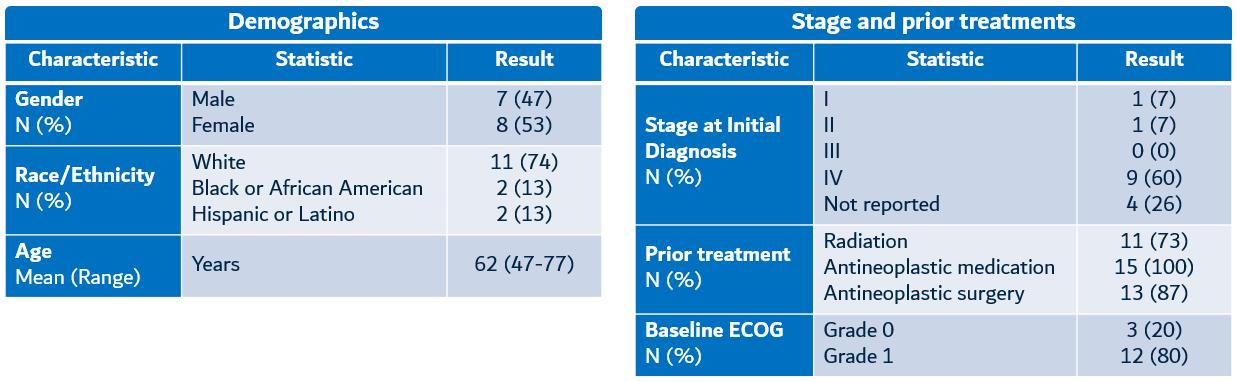

At the center of our scientific foundation is our drug discovery engine, which is based on technology licensed from the Whitehead Institute, an affiliate of the Massachusetts Institute of Technology. This core technology, combined with investments and advancements by us, is designed to enable rapid screening to identify product candidates with the potential to modify disease by overcoming toxicity in disease-causing gene networks. Toxicity in many neurodegenerative diseases results from an aberrant accumulation of misfolded proteinsadvanced solid tumors in the brain. We leverage our proprietary discovery engine to identifyfirst four monotherapy dose-escalation cohorts, where subjects received either 3, 10, 30 or 100mg of KVA12123 by intravenous infusion every two weeks, and screen novel drug targets3 patients in the first combination therapy cohort, where subjects received 30 mg of KVA12123 Q2W and drug molecules for their ability to protect nerve cells from toxicity arising from misfolded proteins. To date, we have identified over twenty targets, most400 mg of which have not previously been linked to neurodegenerative diseases.pembrolizumab Q6W. Patients enrolled in VISTA-101 monotherapy arm ranged in gender, ethnicity and age (Figure 15). Patients were heavily pretreated with multiple prior lines of therapy including chemotherapy, radiation and immunotherapy.

Figure 15. VISTA-101 baseline patient characteristics

16

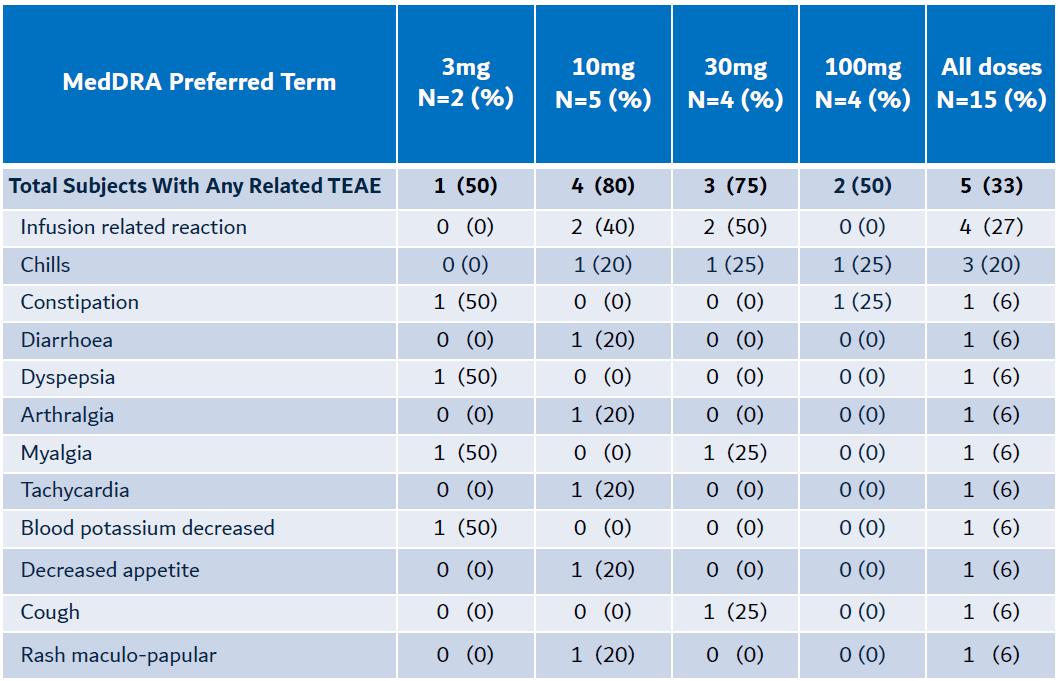

Safety

Evaluating the safety and tolerability of KVA12123 is one of the primary objectives of VISTA-101. As of January 31, 2024, 15 patients were dosed in the first four monotherapy cohorts. KVA12123 was well tolerated at all doses and no dose limiting toxicities (“DLT”) were observed. All KVA12123 treatment emergent adverse events were grades 1-2.

Figure 16: VISTA-101 KVA12123 was well tolerated in 3, 10, 30 and 100 mg monotherapy cohorts

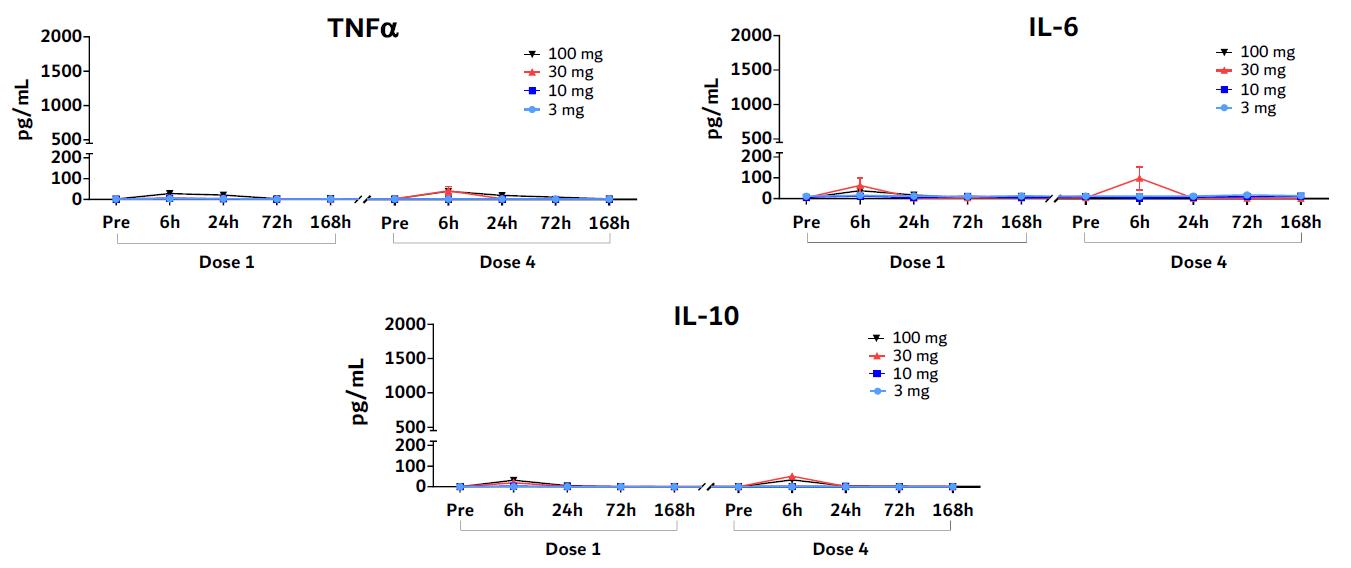

Furthermore, no evidence of CRS or associated cytokines including IL-6, TNFα & IL-10 were detected at any of the dose levels.

17

Figure 17. VISTA-101 No CRS-related cytokine induction observed

Pharmacokinetics (PK) and Receptor Occupancy (RO)

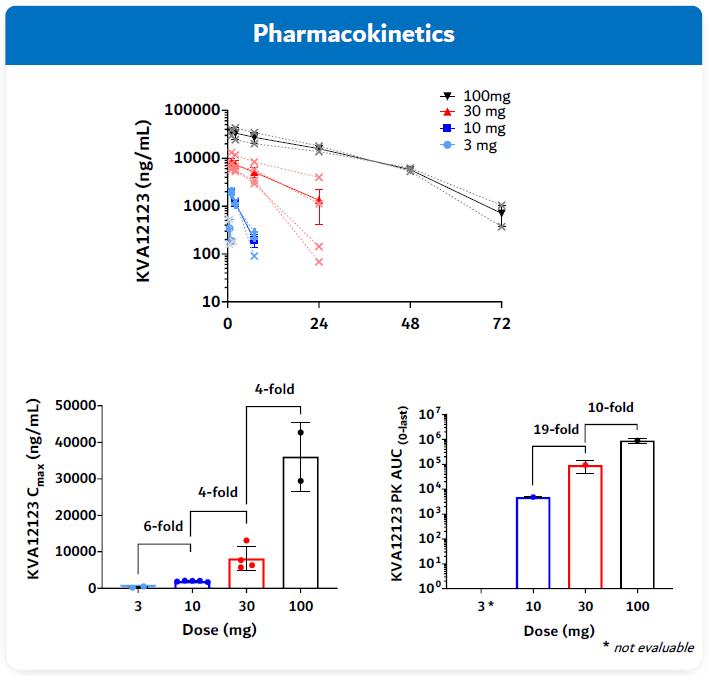

PK is the study of how the body interacts with KVA12123 for the entire duration of exposure after administration. KVA12123 exhibited a greater than dose-proportional pharmacokinetic profile in drug exposure across all evaluated doses, consistent with target-mediated drug disposition at lower doses.

Figure 18. VISTA-101 KVA12123 Pharmacokinetics

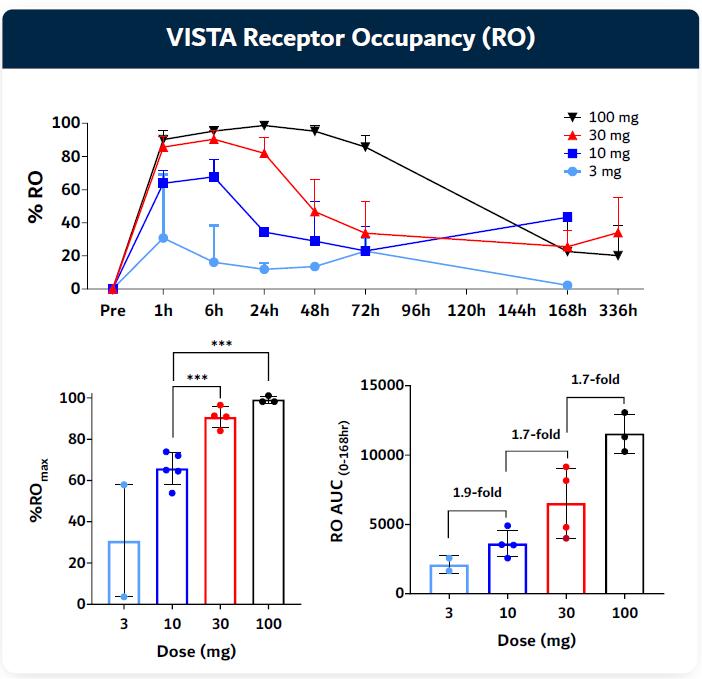

To guide the recommended phase 2 dose decision, Kineta developed a proprietary assay to evaluate VISTA receptor occupancy (“RO”) on immune cells from patients treated with KVA12123. This is an important metric for evaluating how well KVA12123 is blocking the VISTA target. KVA12123 achieved a greater than 90% VISTA RO at the 30 mg dose indicating that KVA12123 may be approaching an optimal clinical dose.

18

Figure 19. VISTA-101 KVA12123 VISTA receptor occupancy

Biomarkers

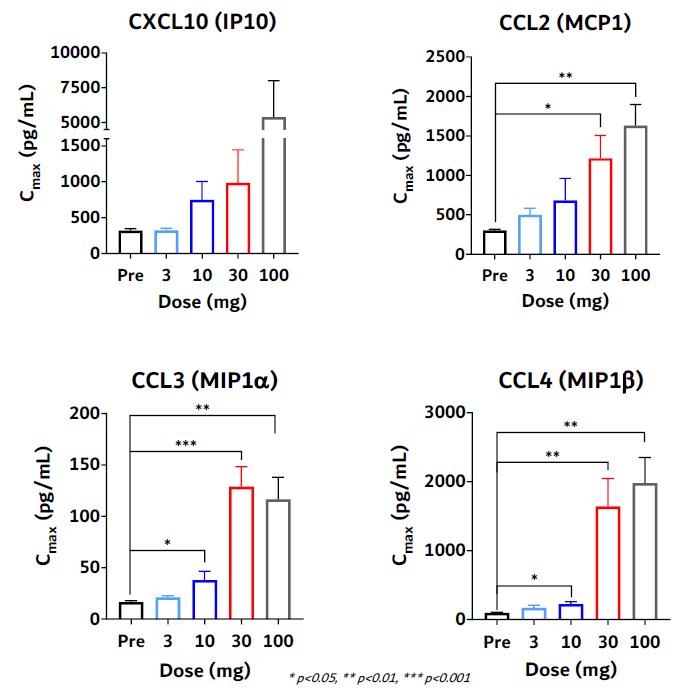

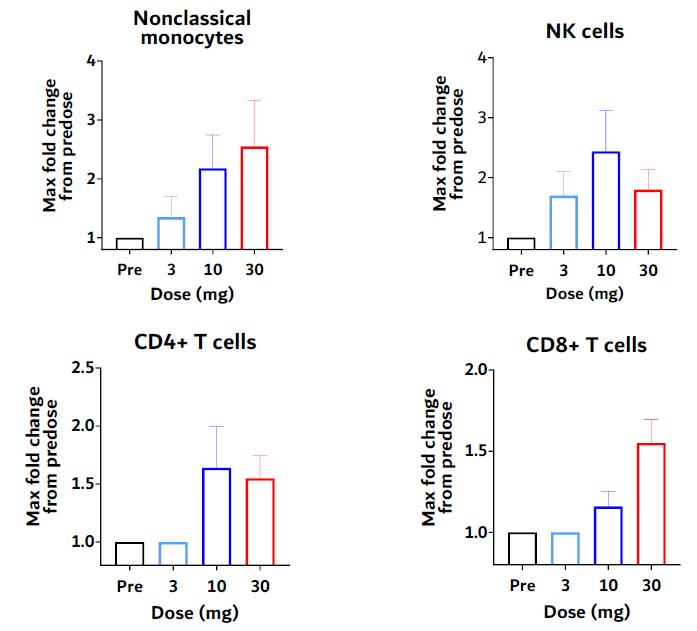

In drug development and clinical trials, biomarkers may be useful to identify patient populations for a study, monitor therapeutic response and identify side effects. KVA12123 demonstrated dose-proportional on-target biomarker immune responses involved in anti-tumor activity. KVA12123 demonstrated significant efficacy-related, dose-dependent cytokine induction of CXCL10, CCL2 (MCP1), CCL3 (MIP1α) and CCL4 (MIP1β), which are involved in immune cell activation and recruitment to the TME (Figure 19). Additionally, increases in anti-tumor immune cell subpopulations including nonclassical monocytes, NK cells, CD4+ T cells and CD8+ T cells were observed during treatment (Figure 20).

19

Figure 20. VISTA-101 KVA12123 pro-inflammatory biomarkers

Figure 21. VISTA-101 KVA12123 immune cell responses

KVA12123 demonstrated induction of pro-inflammatory myeloid derived cytokines/chemokines involved in immune cell activation and recruitment in the TME. Changes in these key biomarkers and immune cell populations are indicative of the anti-tumor effects of blocking VISTA that is

20

consistent with data from preclinical models (NHP and KO mice). These data validate their use as potential biomarker of VISTA target engagement with KVA12123.

VISTA-101 Initial Monotherapy Data Summary

Safety

Pharmacokinetics (PK) and Receptor Occupancy (RO)

Biomarkers

Development timeline

The ongoing VISTA-101 clinical trial is currently enrolling patients in both monotherapy and combination therapy arms of the study. Initial monotherapy data was presented at SITC in November 2023. Additional monotherapy safety and efficacy data as well as initial combination therapy data are anticipated in the second quarter of 2020, we secured2024. The Company anticipates a strategic research and development collaboration in ALS and FTLD with Merck Sharp & Dohme Corp., or Merck, with upfront and potential milestone payments of up to $530 million plus royalties.

Neurodegenerative Disease Market and Challenges

Many factors, including too few disease-relevant biological hypotheses, the inherent complexity of the brain, and high patient heterogeneity, have led to a graveyard of failed approaches over the last several decades and have produced few approved disease-modifying therapies for neurodegenerative diseases to date.

We believe this is about to change. Recent scientific and technological advances include the improved understanding of the disease-relevant biology, innovative target discovery technologies, potentially better predictive animal models, new imaging approaches and identification of new biomarkers. These advances have ignited a renewed focus and commitment to neurodegenerative disease research and development, and we are one of the companies at the forefront of this emerging revolution.

Clinical study of neurodegenerative disease and evaluation of potential therapeutics has faced several hurdles. A primary consideration is the genetic heterogeneity of neurodegenerative diseases and subsequent variations in the disease biology in patients with similar clinical diagnoses. We believe this degree of heterogeneity is far greater than previously appreciated and is likely due to a unique combination of genetic and environmental factors which have important implications for development of therapies and their appropriate use by individual patients. We believe there is a need for a larger and more accurate set of biomarkers to aid in diagnosis as well as monitoring disease progression and treatment response in trials. Damage to brain cells early in the disease course and prior to the onset of symptoms presents further challenges for the design of clinical trials, as patients enrolling in clinical trials are typically selected based on expression of disease symptoms when significant damage to brain cells has already occurred. For example, increasingly sophisticated imaging studies have demonstrated that patients have lost at least 40% to 60% of dopaminergic neuronal integrity before qualifying for a diagnosis of Parkinson’s disease, indicating damage to brain cells begins long, often decades, before clinical symptoms manifest. As a result, many previous clinical trials in neurodegenerative disease included patients at a stage of the disease beyond which progression could no longer be modified. Thus, clinical trials would optimally be performed in patient populations that are at an early enough stage where potential disease-modifying therapies have an opportunity to preserve existing brain cells and function. Approaches to early diagnosis remain a focus in the neurodegenerative clinical research field.

In Parkinson’s disease, the cornerstone of pharmacological therapy for the past several decades has focused on either temporarily replenishing dopamine or mimicking the action of dopamine such asmeeting with the dopamine precursor levodopa. Levodopa, which is very helpful to patients in managing some of the motor symptoms of the disease, does not alter disease progression. Certain disease-modifying molecules are currently being investigated in early clinical trials for the potential of removing or reducing levels of α-synuclein. These programs, however, are predominantly focused on the development of antibodies. Therapeutic antibodies are large molecules that are administered systemically, and as such have significant challenges crossing the blood brain barrier and penetrating into the brain, which is the target tissue for neurodegenerative diseases. Even if some limited amount of antibody can penetrate into the brain, antibodies face a further challenge. α-Synuclein functions within cells to facilitate vesicle trafficking, however when α-synuclein misfolds it is thought to have an increased propensity to aggregate and disrupt multiple critical processes inside the cell. The ultimate expression of this pathology is the formation of Lewy bodies within neurons, which are a hallmark of dystrophic and degenerating cells. Therapeutics that target pathological processes within cells would be expected to prevent this toxic progression. α-Synuclein can also be secreted by neurons, and although the function is unclear, this results in α-synuclein outside of cells. It is this

2

population that would be a target for antibody therapeutics which are generally believed to interact with protein extracellularly, or outside the cell. We believe antibodies therefore have less access to α-synuclein, and recently, two antibody drug candidates that target α-synuclein failed to meet primary clinical endpoints in Phase 2 trials. By contrast, we are developing small molecules that our yeast platform pre-selects by design to cross the blood brain barrier and diffuse into the cell where α-synuclein causes cellular toxicity and damage. YTX-7739 targets the enzyme SCD, the inhibition of which has been shown to help overcome the toxicity of α-synuclein and promote protection of neurons.

Our Approach

Our approach is to unlock the path to new therapies by addressing the fundamental and persistent barriers in neurodegeneration research: the poor understanding of disease mechanisms and lack of new biological targets. We believe that programs focused on novel drug targets, which are grounded in an improved understanding of disease biology, will enable a higher likelihood of success in developing disease-modifying therapies.

Our discovery engine is built upon core enabling technology that we exclusively license from the Whitehead Institute, an affiliate of the Massachusetts Institute of Technology. The core discovery technologies were created in the laboratory of our co-founder, Dr. Susan Lindquist. Dr. Lindquist and senior scientists from her team integrated multiple technology platforms to create a drug discovery engine designed to reliably generate new insights into fundamental mechanisms of neurodegenerative disease, and also reveal new potential drug targets and drug molecules that address neurodegeneration in a range of different ways, many of which were previously unknown.

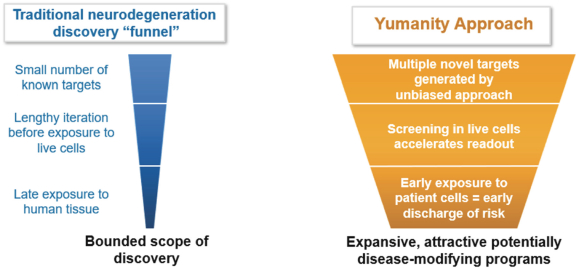

The discovery engine is centered on the key insight that protein misfolding, a phenomenon at the root of virtually all neurodegenerative diseases, can be modeled in yeast cells. These yeast models are then screened against large chemical libraries using high throughput technology, selecting for chemical hits that protect cells from the toxicities created by the misfolded human disease-relevant proteins. The biological targets and pathways for these protective molecules are then uncovered using a series of chemical genetic techniques. Our technology also allows for screening yeast collections that have individual genes deleted, such that, when rescue is observed, it can be inferred that the gene that was deleted in that yeast strain is involved in ameliorating the toxicity of the misfolded human disease-relevant protein. Since the only modification to the original yeast system was the introduction of the culprit misfolding proteins, any molecule or gene deletion that can protect cells from the resultant toxicity is of interest. The discovery of protective molecules and biological targets, especially when previously unknown, can reveal new or untapped areas for study. We believe that the complement and overlap between the small molecule and genetic rescue screens have the potential to create a powerful network of interlinked biological processes that can further identify previously unknown therapeutic targets. We explore these cell-protective discoveries from the yeast system for translation to human disease-relevant cells using informatics and cutting-edge stem cell and iPSC experimental techniques. The discovery engine is designed to ultimately output novel programs: molecules with novel biological targets that can then be progressed through the standard preclinical drug development processes.

We believe our proprietary discovery engine has the potential to dramatically expand the knowledge around the complex biology of neurodegeneration, and further allows initiation of discovery programs outside of the traditional, limited set of hypotheses that exist today. Screening for hits in a living yeast system can save time by providing a biological-relevant readout sooner than some of the more typical practice of starting in non-live, test tube systems. Additionally, shared features between yeast cell membranes and the blood brain barrier, such as comparable membrane permeability, polarity, and drug pumps for removal of non-native compounds, mean that molecules that can permeate a yeast cell to effect intracellular rescue may also be likely to penetrate the blood brain barrier. Furthermore, our molecules have been tested in diseased human cells ex-vivo at the beginning rather thanFDA at the end of preclinical development. We believe that successPhase 1 and initiating the Phase 2 arms of VISTA-101 in this setting confers increased confidence in programs compared to the more traditional paradigmthird quarter of multiple rounds of animal studies before any actual testing in human tissues.2024.

3Potentially Large Commercial Opportunity for KVA12123

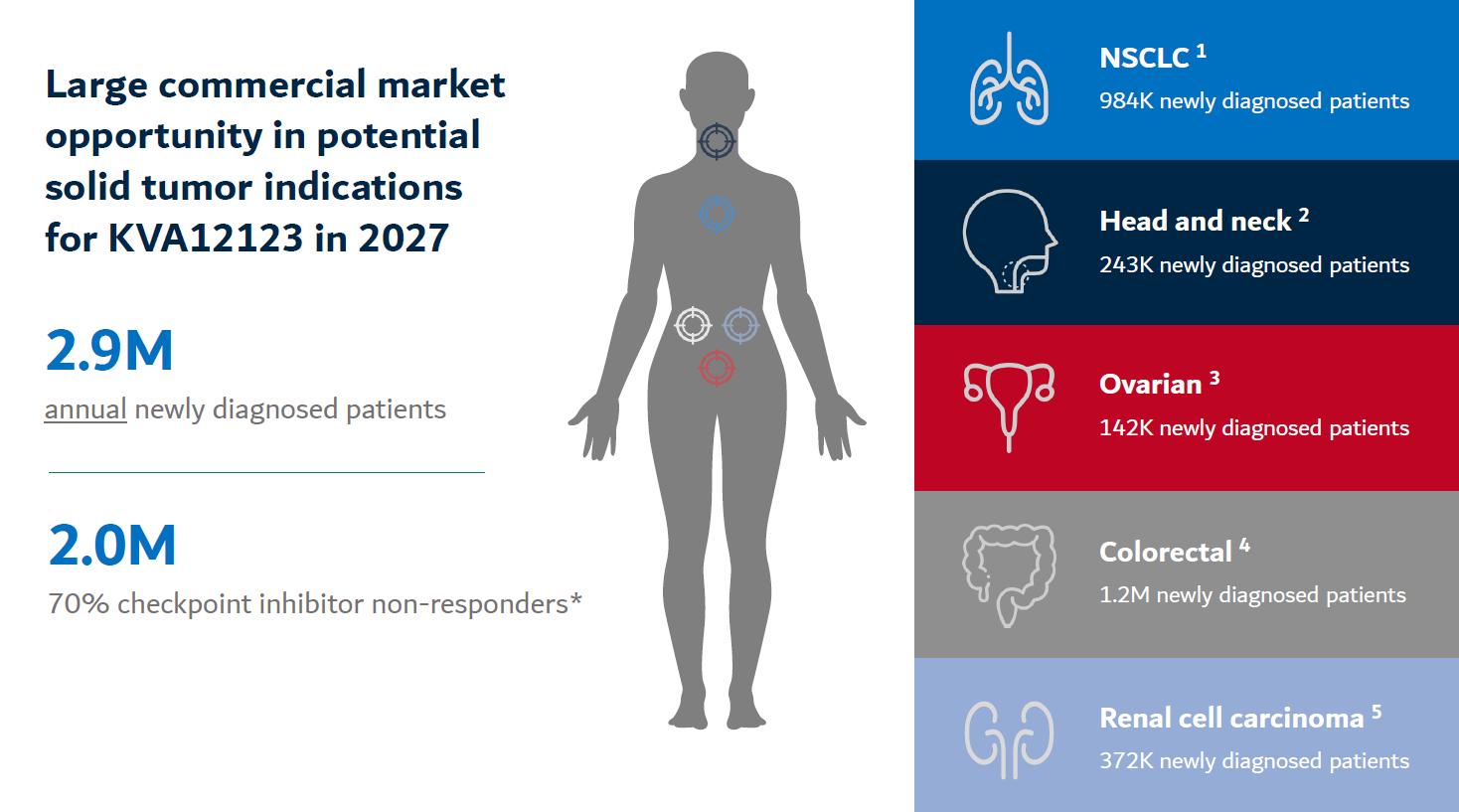

Based on the strong clinical rationale and commercial opportunity, Kineta has identified NSCLC, SCCHN, OC, CRC and RCC as potential initial indications for KVA12123. Data from the Phase 1 / 2 clinical trial will more fully inform the indications to initially pursue for regulatory approval.

Key DifferentiatorsThe projected new annual patients worldwide for each of Our Discovery Enginethese initial indications in 2027 totals 984,000 for NSCLC, 243,000 for SCCHN, 142,000 for OC, 1.2 million for CRC and 372,000 for RCC, based on reports from GlobalData. In total, these five initial indications represent an estimated 2.9 million annual new patient opportunity (Figure 21). Improving survival for CPI non-responders remains a critical unmet need that affects ~70% of cancer patients representing 2.0 million patients annually who could be an ideal candidate for treatment with KVA12123.

If Kineta successfully completes the clinical trial program for KVA12123 and if Kineta subsequently obtains regulatory approval for KVA12123, Kineta will focus on initial target indications in NSCLC, CRC and OC as potential commercial opportunities with significant unmet needs. Clinical development of KVA12123 will be initially as a second-line therapy in these indications. The projected therapeutic market size in 2027 for each of these initial indications totals $31.8 billion for NSCLC, $10.3 billion for CRC and $5.9 billion for OC, based on reports from GlobalData. In total, these three initial cancer indications represent an estimated $48 billion market opportunity for KVA12123.

We

21

Figure 22. Large commercial opportunity in initial indications in solid tumors for KVA12123

Source: GlobalData: Global Drug Forecast and Market Analysis to 2028 (1. NSCLC, 2. SCCHN, 3. OC 4. CRC and 5. RCC)

Anti-CD27 agonist mAb immunotherapy

Kineta is developing an anti-CD27 agonist mAb immunotherapy to address the problem of exhausted T cells in the TME. It has been recently demonstrated that it is very difficult to reverse T cell exhaustion. As an alternative approach, Kineta is developing an agonist antibody to a receptor (CD27) present on naïve T cells circulating outside the tumor. Anti-CD27 monoclonal antibodies activate and induce the maturation and migration of naïve T cells. CD27 activation also drives the diversification of the T cell repertoire, lowering the activation threshold of T cells against low affinity tumor antigens. Recent data also suggests that an agonist anti-CD27 antibody can activate important innate immune cell populations like NK cells and inflammatory myeloid cells. These cells contribute to an effective anti-tumor response, especially in CPI-resistant patients.

Recent publications have leveragedalso demonstrated that anti-CD27 agonist antibodies can drive tumor growth inhibition as a monotherapy and in combination with CPIs.

Figure 23. Activating CD27 demonstrates tumor growth inhibition as a monotherapy and in combination with CPIs

Source: 1. He et al. J. Immunol 2013 2. Turaj et al. Cancer Cell 20173. Buchan et al. Clin. Cancer Research 2018

Kineta has identified a lead candidate out of a diverse set of anti-CD27 agonist antibody sequences. The lead candidate is a fully human monoclonal antibody that has been observed to show nM binding affinity to CD27 in humans. Kineta plans to develop the powerdrug as an intravenous infusion.

22

In in vitro studies, Kineta’s lead candidate antibodies demonstrate robust agonist activation of our discovery engineT cells and NK cells demonstrating the ability to generatepotentiate new anti-tumor responses (Figure 23).

Figure 24. CD27 T cell and NK cell activation

Source: Kineta data

In preclinical tumor models, Kineta’s anti-CD27 agonist lead mAb has shown strong tumor growth inhibition as a robust portfolio of promising novel drug targetsmonotherapy and molecules. We then prioritize the most promising targets to accelerate drug discovery programs and advance compounds intoin combination with other checkpoint inhibitors in preclinical and ultimately clinical development. To date, this approach has already uncovered over twenty novel targets, pathways, mechanisms, and molecules that we believe have the potential to ameliorate the fundamental cellular toxicities associated with neurodegenerative diseases.tumor models.

Discovered targets may mature into programs as they advance through the discovery process. YTX-7739, our lead program, targets the enzyme SCD, one of the early targets identified and validated in our discovery engine and is being studied for the treatment of Parkinson’s disease. We are also developing lead compounds and validating two targets that are advancing through a research collaboration with Merck. Other targets for multiple potential indications are at varying stages of the discovery process.

Our PipelineFigure 25. Lead anti-CD27 agonist mAb demonstrates monotherapy and combination therapy growth inhibition in MC38 preclinical model

All of our therapeutic candidates are small molecules

Source: Kineta data

Kineta is developing a novel anti-CD27 agonist mAb immunotherapy for advanced solid tumors including RCC, OC and are optimizedCRC.

23

Strategic Partnerships

KVA12123

Kineta has entered into a clinical trial collaboration and formulated for oral delivery. We own both development and commercialization rights to YTX-7739 and all other targets except for our research collaborationsupply agreement with Merck who has licensed these potential programs(known as MSD outside the U.S. and Canada). Under this collaboration, Kineta will conduct IND-enabling toxicologyevaluate the safety, tolerability, PK and safety pharmacology, clinical development,anti-tumor activity of KVA12123, its novel anti-VISTA monoclonal antibody, as a monotherapy and commercialization.

YTX-7739 is a novel small molecule for the potential treatment of Parkinson’s disease and related disorders of α-synuclein. The program that resulted in this lead compound was the first prioritized output program of our discovery engine. YTX-7739 is designed to ameliorate the consequences of α-synuclein toxicity in human cells that results in cellular dysfunction, specifically disruptionscombination with the directed movement, or trafficking, of proteins or lipid-bound vesicles within cells. YTX-7739 targets the enzyme SCD, that catalyzes a reaction in the lipid metabolism pathway.

α-Synuclein is a protein that is a prominent constituent of Lewy bodies, the abnormal protein aggregates that are the pathological hallmarks of Parkinson’s disease, dementia with Lewy bodies, MSA and other neurological disorders known collectively as “synucleinopathies”. Current treatments for Parkinson’s disease manage the early motor symptoms of the disease. The goal of our differentiated and potentially disease-modifying approach with YTX-7739 is to block the intracellular toxicity associated with α-synuclein misfolding and aggregation to allow the cell to continue to function normally, and to slow or possibly even halt the progressive degenerative consequences of the disease.

On November 10, 2021, we announced the top-line results from our Phase 1b clinical trial of YTX-7739KEYTRUDA® (pembrolizumab), Merck’s anti-PD-1 therapy, in patients with mild-to-moderate Parkinson’s disease.advanced solid tumors.

Effective October 14, 2022, Kineta entered into a Clinical Trial Collaboration and Supply Agreement (the “CTCSA”) with MSD International Business GmbH (“Merck”) to evaluate KVA12123 as a monotherapy and in combination KEYTRUDA® (pembrolizumab), Merck’s anti-PD-1 therapy, in patients with advanced solid tumors. Pursuant to the terms of the CTCSA, each party retains its intellectual property rights, but all joint clinical data and joint inventions shall be jointly owned by the parties. Each party shall bear its own costs related to manufacturing and supply of its compound, as well as be responsible for its own internal costs and expenses to support the clinical trial. During the term of the CTCSA and for a specified period thereafter, either party shall have the option to propose an amendment to the CTCSA or to negotiate a new agreement to conduct a subsequent study. The parties shall negotiate the terms of such amendment or new agreement in good faith.

Unless terminated earlier by either party, the CTCSA will continue in full force and effect until Kineta delivers Merck final versions of the study results memorandum and final report. Either party may terminate the CTCSA upon an uncured material breach by the other party, for reasons related to patient safety, in the event of certain regulatory actions or if development of such party’s compound is discontinued for certain reasons. If the CTCSA is terminated, Kineta is obligated to return or destroy the unused supply of pembrolizumab to Merck.

Kineta is conducting a Phase 1b1/2 clinical trial wasstudy evaluating KVA12123 as a randomized, placebo-controlled, double-blind multi dosesingle agent and in combination with KEYTRUDA® in patients with advanced solid tumors. The objectives of the study are to investigateevaluate the safety, tolerability, pharmacokinetics and pharmacodynamicsanti-tumor responses of YTX-7739. Data were reportedKVA12123 as a monotherapy and in combination with KEYTRUDA® with initial clinical data presented in the fourth quarter of 2023. Kineta is responsible for conducting this study, which was initiated in the fourth quarter of 2022.

In-License Agreements

License Agreement with GigaGen, Inc.-VISTA

In August 2020, Kineta entered into an Option and License Agreement with GigaGen, Inc. (“GigaGen”), which was amended in November 2020 and May 2023 (such agreement, as amended, the “VISTA Agreement”) to in-license certain intellectual property and antibodies for the VISTA/KVA12123 drug program. Pursuant to the terms of the VISTA Agreement, GigaGen granted Kineta an exclusive (even as to GigaGen) world-wide license, with the right to grant sublicenses to research, develop, make, have made, use, have used, offer for sale, sell, have sold, distribute, import, have imported, export and have exported and otherwise exploit the licensed antibodies and licensed products. Upon Kineta’s exercise of the option, Kineta made an upfront payment of cash to GigaGen and issued Kineta equity to GigaGen. In December 2020, Kineta exercised its exclusive option to GigaGen’s intellectual property rights to develop, manufacture and commercialize six antibodies and derivatives identified by GigaGen that target VISTA and subsequently made a cash payment of $400,000 and issued 7,818 shares of common stock to GigaGen per the terms of the VISTA Agreement. In May 2023, Kineta achieved initiation of the Phase 1 clinical trial milestone and incurred $500,000 in fees to Gigagen per the terms of the VISTA Agreement. From inception of the VISTA Agreement through December 31, 2023, Kineta has incurred $1.3 million of expense to GigaGen for the license to certain antibodies and development antibodies.

Under the VISTA Agreement, GigaGen is eligible to receive approximately $20.4 million in development and regulatory milestone payments and up to $8.0 million in sales milestone payments. In addition, GigaGen is eligible to receive low single-digit royalty percentages based on net sales. Kineta is responsible (with input from 20 patients with mild-to-moderate Parkinson’s disease. Patients received once-daily oral dosesGigaGen) for the preparation, filing, prosecution and maintenance of YTX-7739 (20 mg or placebo)all patents and patent applications, and all associated costs.

The VISTA Agreement shall remain in effect on a licensed product-by-licensed product and country-by-country basis, until the expiration of the royalty term for 28 days. YTX-7739 was shown to inhibit its primary target, SCD, an enzyme whose inhibition has been closely linked to neuronal survival and improved motor functiona licensed product in a Parkinson’s disease model.country, which, based on the expiration of the last-to-expire valid claim of the two current patent applications (without any patent term adjustment or extensions) would be February 2042 and March 2044, respectively. Kineta may terminate the VISTA Agreement with 30 days’ written notice to GigaGen. Either party has the right to terminate the VISTA Agreement upon a material breach of the other party that is not cured within 90 days after the breaching party receives written notice of such breach from the non-breaching party.

After 28 days of treatment, the 20 mg dose given once-daily reduced the fatty acid desaturation index (FA-DI), a biomarker of SCD inhibition, by approximately 20%-40%, the range expected to be clinically relevant based on preclinical studies. Target engagement inLicense Agreement with GigaGen, Inc.-CD27

4

In June 2021, Kineta entered into an Option and License Agreement with GigaGen, as amended in July 2022, December 2022, May 2023 and December 2023 (such agreement, as amended, the cerebrospinal fluid suggested“CD27 Agreement”) to in-license certain intellectual property rights and antibodies for the CD27 drug program. Pursuant to the terms of the CD27 Agreement, GigaGen granted Kineta an exclusive (even as to GigaGen) world-wide license, with the right to grant sublicenses to research, develop, make, have made, use, have used, offer for sale, sell, have sold, distribute, import, have imported, export and have exported and otherwise exploit the licensed antibodies and licensed products. Upon Kineta’s exercise of the option, Kineta made an upfront payment of cash to GigaGen and issued shares of common stock to GigaGen. From inception of the CD27 Agreement through December 31, 2023, Kineta has incurred $80,000 of expense to GigaGen to maintain its rights to exercise its license to certain antibodies and development antibodies. In January 2024, Kineta exercised its exclusive option to GigaGen’s intellectual property rights to develop, manufacture and commercialize antibodies and derivatives identified by GigaGen that YTX-7739 crossedtarget CD27 and subsequently incurred license fees of $100,000 and issued 91,240 shares of common stock to GigaGen per the blood-brain barrier. Additionally,terms of the PK/PD profile of YTX-7739 was consistent with previous studies and we believe informs dose selection for future studies.CD27 Agreement.

YTX-7739 was generally well tolerated with

24

Under the CD27 Agreement, GigaGen is eligible to receive approximately $20.4 million in development and regulatory milestone payments and up to $11.0 million in sales milestone payments. In addition, GigaGen is eligible to receive low single-digit royalty percentages based on net sales. Kineta is responsible (with input from GigaGen) for the preparation, filing, prosecution and maintenance of all treatment emergent adverse events being mild to moderate in severity. There were no serious adverse events. Moderate AEs in the active treatment group consisted of 2 patients with increased Parkinson’s symptoms, 2 patients with lower back pain, 1 patient with headache, 1 patient with myalgia, 1 patient with insomnia, 1 patient with ligament strain,patents and 1 patient with vaccination complication. One patient on placebo had moderate worsening of tremorspatent applications, and Parkinsonism, which led to discontinuation. AEs occurring at a higher percentage in 2 or more patients administered YTX-7739 compared to placebo were procedural pain, myalgia, dry eye, hyperbilirubinemia, hypesthesia, lower back pain, and constipation. AEs occurring at a higher percentage with placebo included orthostatic hypotension, headache, tremor, fatigue and dizziness.all associated costs.

As expected, after only 28 days of dosing, there were no statistically significant differencesThe CD27 Agreement shall remain in clinical assessments (UPDRS III, MoCA) or most exploratory biomarkers. Additionally, qEEG assessmentseffect on a licensed product-by-licensed product and country-by-country basis, until the expiration of the effect of YTX-7739 on brain activity were completedroyalty term for a licensed product in a subsetcountry. Kineta may terminate the CD27 Agreement with 30 days’ written notice to GigaGen. Either party has the right to terminate the CD27 Agreement upon a material breach of 8 patients and demonstrated a statistically significant change compared to baseline, suggestivethe other party that is not cured within 90 days after the breaching party receives written notice of a potential improvement in synaptic function. We plan to further validatesuch breach from the role of this diagnostic marker in future clinical studies.non-breaching party.

Out-License Agreements

Merck & Co., Inc.

In January 2022, the U.S Food and Drug Administration (FDA) placed a partial clinical hold on multidose clinical trials of YTX-7739. The partial clinical hold suspends initiation of multiple dose clinical trials in the U.S. until the FDA’s questions have been addressed. The FDA has not halted all clinical programming and is permitting our planned single dose clinical trial to proceed. We anticipates working closelyconnection with the FDAMerger, Kineta became the successor in interest to adequately address their concerns. While we work to address the FDA’s concerns, we have paused our planned window-of-opportunity clinical study of YTX-7739 in glioblastoma multiforme patients and exploration of additional indications.