UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

(X)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended December

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009

OR

( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

2013

Commission File No. Number: 333-148546

ELEMENTAL PROTECTIVE COATINGS CORP.

-------------------------------------------

(Exact

NSU RESOURCES INC F/K/A BIO-CARBON SOLUTIONS INTERNATIONAL INC. |

| (Exact name of registrant as specified in its charter) |

| NEVADA | 20-8248213 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

305 James Street

Ottawa, Ontario, Canada K1R 5M8

(Address of registrant as specified in its charter)

Nevada 20-8248213

- --------------------------------- ------------------------------------

(State or other jurisdiction (I.R.S. Employer Identification No.)

of incorporation or organization)

Water Park Place

20 Bay Street

Toronto, ON M5J2N8

- ---------------------------------------- ----------------

(Address of Principal Executive Office) Zip Code

principal executive offices, including zip code)

(613) 878 6552

(Registrant's telephone number, including Area Code: (646) 448-0197

area code)

Securities registered pursuant to Section 12(b) of the Act:

None

| Title of class | Name of each exchange on which registered | |

| Common Stock. $0.001 par value per share | None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ]

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. [ ]

Yes x No o

Indicate by check mark whether the registrantregistrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X]x No [ ]

Indicate by check mark whether the registrant has submitted electronically and

posted on it corporate Web site, if any, every Interactive Data File required to

be submitted and posted pursuant to Rule 405 of Regulation S-T (ss.232.405 of

this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit and post such files). Yes [X] No [ ]

o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer"filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. Large accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer [ ] Smaller reporting company [X]

(Do not check if a smaller

reporting company)

(Check one):

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o | Smaller Reporting Company | x |

| (Do not check if smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): [ X ]. Yes [ ]o No The aggregate market value of the voting stock held by non-affiliates of the

Company on June 30, 2009 was -0-. x

As of March 31, 2010,April 30, 2014 the CompanyRegistrant had 13,300,000 issued and156,311,131 outstanding shares of common stock. Documents incorporated

by reference: None

ITEM 1. BUSINESS

The Company was formed in January 2007 to provide elderly and hospitalized

personsCommon Stock with assistance in performing everyday tasks that, due to health

reasons, they were unable to perform. The Company never generated any revenue

and essentially abandoned its business plan in 2008. In July 2009,a par value of $0.001 per share.

INDEX

NSU RESOURCES INC

| PAGE NO | |||||

| PART I | |||||

| ITEM 1 | BUSINESS | 3 | |||

| ITEM 1A | RISK FACTORS | 9 | |||

| ITEM 1B | UNRESOLVED STAFF COMMENTS | 13 | |||

| ITEM 2 | PROPERTIES | 13 | |||

| ITEM 3 | LEGAL PROCEEDINGS | 13 | |||

| ITEM 4 | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS | 13 | |||

| PART II | |||||

| ITEM 5 | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 14 | |||

| ITEM 6 | SELECTED FINANCIAL DATA | 14 | |||

| ITEM 7 | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 15 | |||

| ITEM 7A | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 15 | |||

| ITEM 8 | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 15 | |||

| ITEM 9 | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 16 | |||

| ITEM 9A(T) | CONTROLS AND PROCEDURES | 16 | |||

| ITEM 9B | OTHER INFORMATION | 18 | |||

| PART III | |||||

| ITEM 10 | DIRECTORS AND EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 19 | |||

| ITEM 11 | EXECUTIVE COMPENSATION | 20 | |||

| ITEM 12 | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 21 | |||

| ITEM 13 | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 21 | |||

| ITEM 14 | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 22 | |||

| PART IV | |||||

| ITEM 15 | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | 23 | |||

| SIGNATURES | 24 | ||||

2

PART I.

Cautionary Note

This Annual Report on Form 10-K contains forward-looking statements within the Company's

directors approved a 10-1 forward stock split. Prior to the stock split there

were 5,630,000 outstanding sharesmeaning of common stock. Subsequent to the stock split

there were 56,300,000 outstanding shares of common stock. The stock split did

not affect the number of shares of common or preferred stock that the Company is

authorized to issue. In October 2009, Debbie Barnum, an officer and directorSection 27A of the Company sold 21,500,000 sharesSecurities Act of common stock to the Company for $100. On

that same date, Darin Barnum, also an officer1933 and director of the Company sold

21,500,000 shares of common stock to the Company for $100.

In November 2009, MSE Enviro-Tech Corp ("MSE") assigned to the Company the

rights to sell MSE's fire retardant products in the United States. In

consideration for the assignment of these rights, the Company issued MSE a

promissory note in the principal amount of $5,000,000.

The note bears interest at 6% per year, is unsecured, and is payable on

November 16, 2011. At the option of the holder, the note can be converted into

shares of the Company's common stock. The number of shares to be issued will be

determined by dividing the amount of the note to be converted by $0.25. In

November 2009, Gilles Trahan and Martin Baldwin were appointed directors of the

Company. Subsequent to these appointments, Ms. Barnum and Mr. Barnum resigned as

officers and directors of the Company. Mr. Trahan was then appointed as the

Company's President and Chief Executive Officer and Mr. Baldwin was appointed as

the Company's Secretary, Treasurer and Chief Financial Officer.

In connection with their resignations, Ms. Barnum sold her 3,500,000

remaining shares in the Company to Mr. Trahan and Mr. Barnum has sold his

3,500,000 remaining shares in the Company to Mr. Baldwin. In November 2009, in

accordance with Nevada Revised Statutes, the directors of the Company approved

an amendment to the Company's articles of incorporation changing the Company's

name from DBL Senior Care, Inc. to Elemental Protective Coatings Corp. On the

same day, the shareholders owning a majority of the Company's issued and

outstanding shares approved the amendment. The name change became effective on

the OTC Bulletin Board on January 21, 2010.

The Company plans to sell environmentally friendly, water-based products

that prevent materials from igniting and in doing so prevent fires from

spreading.

2

The Company is in the development stage and has not generated any revenue.

The Company needs capital to implement its business plan. The Company will

attempt to raise capital through the private sale of its common stock or other

securities.

General

As of March 31, 2010, the Company had two part time employees. The Company

does not have a website.

ITEM 2. DESCRIPTION OF PROPERTY

As of March 31, 2010 the Company did not own any tangible property.

ITEM 3. LEGAL PROCEEDINGS.

The Company is not involved in any legal proceedings and the Company does

not know of any legal proceedings which are threatened or contemplated. ITEM 4.

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

Not Applicable.

ITEM 5. MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT'S COMMON EQUITY AND

OTHER SHAREHOLDER MATTERS.

Between June 12, 2008 and January 21, 2010 the Company's common stock was

quoted on the OTC Bulletin Board under the symbol "DBLT". On January 21, 2010,

and in connection with the Company's name change, the Company's trading symbol

was changed to "EPRO". During the year ended December 31, 2009 the Company's

common stock did not trade.

Trades of the Company's common stock are subject to Rule 15g-9Section 21E of the Securities Exchange Act of 1934, which ruleare subject to a number of risks and uncertainties. All statements that are not historical facts are forward-looking statements, including statements about our business strategy, the effect of Generally Accepted Accounting Principles ("GAAP") pronouncements, uncertainty regarding our future operating results and our profitability, anticipated sources of funds and all plans, objectives, expectations and intentions and the statements regarding future potential revenue, gross margins and our prospects for fiscal 2009. These statements appear in a number of places and can be identified by the use of forward-looking terminology such as "may," "will," "should," "expect," "plan," "anticipate," "believe," "estimate," "predict," "future," "intend," or "certain" or the negative of these terms or other variations or comparable terminology, or by discussions of strategy.

Actual results may vary materially from those in such forward-looking statements as a result of various factors that are identified in "Item 1A.—Risk Factors" and elsewhere in this document. No assurance can be given that the risk factors described in this Annual Report on Form 10-K are all of the factors that could cause actual results to vary materially from the forward-looking statements. References in this Annual Report on Form 10-K to (i) the "Company," the "Registrant," "NSU Resources” "we," "our," “NOST,” and "us" refer to NSU Resources Inc.

Investors and security holders may obtain a free copy of the Annual Report on Form 10-K and other documents filed by NSU Resources Inc. with the Securities and Exchange Commission ("SEC") at the SEC's website at http://www.sec.gov. Free copies of the Annual Report on Form 10-K and other documents filed by NSU Resources, Inc. with the SEC may also be obtained from NSU Resources, Inc. by directing a request to NSU Resources, Inc., Attention: Dr. Luc C. Duchesne-103 Metig Street, Sault Ste Marie, Ontario, Canada P6A 2Z5.

General

NSU Resources Inc. (“The Company”) is a development stage company incorporated on January 17, 2007, under the laws of the State of Nevada. The principal offices are located at 305 James Street, Ontario, Canada K1R 5M8. The telephone number is (705) 253-0339. The Company has never declared bankruptcy, it has never been in receivership, and it has never been involved in any legal action or proceedings. Our fiscal year end is December 31.

Description of Business

The Company’s business plan and objective is to use its licensed intellectual property to provide services and capitalize on opportunities relating to renewable energy services, carbon trading, carbon sequestration, and other greenhouse gas emission control, offset and reduction programs worldwide.

Employees

Currently there are only two employees of the Company, whom also serve as directors of the Company; however, several other employees will be needed to implement the Company’s business plan.

Research and Development Expenditures

Since the time of our incorporation we have not incurred any research or development expenditures.

3

Business Strategy

NSU Resources, Inc. is a mineral exploration and carbon development company. Our mission is to become a vertically integrated provider of Rare Earth Elements using carbon solutions. We are targeting growth from the acquisition of mineral and carbon rights worldwide.

Our strategic growth plan:

| - | Develop proven NI 43-101 compliant ore inventories from high quality properties with potential for providing topside ore of good quality, have access to cost-effective energy sources, and easy access to qualified labor; |

| - | Develop and/or secure tenure on novel cost-effective and environmentally friendly methodologies for the extraction and purification of Rare Earth Elements; |

| - | Develop B2B relationships with users of Rare Earth Elements metals through the Company's extensive contacts in the renewable energy industry; |

| - | Apply the Company's technologies to ore extracted from other mining complexes; |

| - | Use cashflow from the sales of products to further develop the company's own mining projects; and, |

| - | Create carbon neutral solutions to the mining and renewable energy supply chain. |

From Q1-2012 to Q4-2013 NSU Resources, Inc will pursue expansion in the form of various acquisitions that are pertinent to its strategic vision for aggressive growth. Specific deliverables include and are not limited to:

1. The creation of a business plan for the exploitation of Rare Earth Elements from its 4,200 acres of rare earth claims in the Cobequid Fault Area of Nova Scotia, Canada. Said claims are adjacent to or in the vicinity of claims or exploration projects by other mineral exploration companies in the Cobequid Highlands. Reports of the occurrence of Rare Earth Elements have been made with the Nova Scotia Ministry of Natural Resources by exploration companies in the vicinity. Rare Earth Elements are experiencing rapidly increasing demand for use in green technologies from consumer electronics, electric and hybrid vehicles and power storage for alternative energy sources such as wind and solar. For example, the emergence of third generation solar cells with multispectral capabilities and with >40% efficiencies will create significant growth possibilities for the industry. Companies with Rare Earth Elements are re-emerging as a strategic investment opportunity. The first wave started in early 2010 when China began rationing its export of Rare Earth Elements, which led to the emergence of junior miners in the Rare Earths Elements industry.

2. The completion and proving of its technology for the extraction of rare earth minerals using a combination of methodologies that were first developed for the purification of rare chemicals from living tissues. The most exciting aspect on the discovery of Rare Earth Ore minerals in the Cobiquid fault area is the ratio between Heavy Rare Earth Ores (HREO) to the Light Rare Earth Ores (LREO). This is especially significant considering the much greater market value of HREO as compared to LREO. In almost all analyses of the closely related site of Debert Lake the ratio was near or greater than 50% (From Sears 2011). The high levels of HREO over LREO suggests that a mining venture might be economically feasible, provided the costs of ore extraction are in line with the costs of competing mines. The company plans to adapt, prove and patent its unique rare earth extraction process for the ores specifically found in the Cobequid Highlands of Nova Scotia.

3. The demonstration of carbon neutral approaches for the mining sector despite the current lackluster interest in carbon trading schemes, indicates there is still regional interest in Cap and Trade, for example through the Western Climate Initiative. This will permit the Company to augment the yield from Rare Earth Element extraction projects and other mining projects.

The Company was initiated as a provider of carbon offset development solutions (accounting, measuring, reporting, verification and registration) to:

| · | Companies with the need to model, monitor and report their carbon footprints; |

| · | Companies that emit greenhouse gases and are seeking cost-effective carbon offsets—see below the extensive lists of potential greenhouse gases emitters that are subjected to reporting and cap-and-trade regulations; and, |

| · | Landowners in search of expertise to develop the carbon potential of their properties. |

4

In November 2011, the Company acquired a License for a process for the extraction of rare earths elements. This approach is based on the combination of methodologies that combine plant extraction protocols and carbon neutral approaches.

In November 2010, management of the Company identified the need to pursue carbon opportunities because of international and North American markets in the carbon economy. Namely, carbon offsets are identified registered and/or traded through a number of methodologies/venues (see below) and can be either voluntary or mandated. For example, in Europe, large emitters are subjected to the European Emissions Trading System which is a result of the EU entering into the Kyoto Protocol. In North America, 7 states of the USA and 4 Canadian provinces are members of the Western Climate Initiative. Of these, regulated cap and trade systems are taking place in California and British Columbia. The Company plans to generate revenues from the exploitation of its two licenses: the Lacey Holdings which it entered into on November 4, 2010 and the 1776739 License which it entered into on January 14, 2011.

| 1. | The Company’s Lacey Holdings license permits us to calculate carbon offsets from the business activities of emitters, which we see as a significant consulting activity. For example, under the Western Climate Initiative (WCI), California’s large industrial entities, including refineries, cement plants, and chemical plants, must report on their emissions starting in 2012 if they emit more than 25,000 MT CO2e per year. Likewise CO2 suppliers are covered entities to the extent that they supply more than 25,000 tons of CO2 per year. Electricity suppliers and generators are also covered entities during the initial phase of the Program. All importers of electricity. Importers of electricity include both retail providers and marketers that import electricity into the WCI region. |

| 2. | Any supplier that within the WCI region distributes transportation fuels in quantities that when combusted would emit 10,000 metric tons CO2e per year or more, in any calendar year starting in 2010. |

| 3. | Any supplier that distributes, within the WCI region, residential, commercial, and industrial fuels in quantities that when combusted would emit 10,000 metric tons CO2e per year or more, in any calendar year starting in 2010. |

The technology acquired from Lacey Holdings can be offered to various consulting clients, for example, in assessing the life cycle analysis of different biomass options for the displacement of coal: assessing the carbon footprint of wood biomass, emissions from the combustions municipal solid refuse, emissions from forested, aquatic or agricultural ecosystems or methane emission from coal beds. This technology is derived from a number of scholarly papers that have been authored or co-authored by Dr Luc C Duchesne who is a director of the Company and Director of Ontario 1776729 which is referenced in this section under a separate license agreement. The following is a selected list of scholarly papers which served in the construction of the intellectual property underlying the Lacey Holdings License: 1. WETZEL, S., L. C. DUCHESNE and M. LAPORTE. 2007. Bioproducts from Canada’s forests: new partnerships in the bioeconomy. Springer. 2. ZASADA, J.C., C.W. SLAUGHTER, L.C. DUCHESNE and A.G. GORDON. 1997. Ecological considerations for the North American Boreal forest. International Institute for Applied Systems Analysis, Laxenburg Austria. Pub. No. IR-97-024. 3. LAPORTE, M.F., L. C. DUCHESNE and S. WETZEL. 2003. Effect of rainfall patterns on soil surface CO2 efflux, soil moisture, soil temperature and plant growth in a grassland ecosystem of northern Ontario, Canada: implications for climate change. Biomed Central Ecology, 2: 10-16. 4. TROFYMOW, J.A., T.R. MOORE, B. TITUS, C. PRESCOTT, I. MORRISON, M. SILTANEN, S. SMITH, J. FYLES, R. WEIN, C. CAMIRE. L.C. DUCHESNE, L. KOZAK, M. KRANANBETTER and S. VISSER. 2002. Rates of litter decomposition over six years in Canadian forests: Influence of litter quality and climate. Canadian Journal of Forest Research, 32: 789-804. 5. LAPORTE, M., L.C. DUCHESNE and I. K. MORRISON. 2002. Effect of clearcutting, selection cutting, shelterwood cutting and micro-sites on soil respiration in a tolerant hardwood ecosystem of northern Ontario. Forest Ecology and Management, 174: 565-575. 6. DUCHESNE, L.C. and D.W. LARSON. 1989. Cellulose and the evolution of plant life. Bioscience, 39: 238-241. 7. PRESTON, C.M., J.A. TROFYMOW and L.C. DUCHESNE. 2000. Variability in litter quality and its relationship to litter decay in Canadian forests. Canadian Journal of Botany, 78: 1269-1287. 8. DUCHESNE, L.C. and S. WETZEL. 2000. Effect of clear-cutting, prescribed burning and scarification on litter decomposition in an Eastern Ontario jack pine (Pinus banksiana) ecosystem. International Journal of Wildland Fire, 9:195-201. 9. MOORE, T.J., J. A. TROFYMOW, B. TAYLOR, C. PRESCOTT, C. CAMIRE, L.C. DUCHESNE, J. FYLES, L. KOZAK, M. KRANABETTER, I. MORRISON, M. SILTANEN, S. SMITH, B. TITUS, S. VISSER, R. WEIN and S. ZOLTAI. 1999. Litter decomposition rates in Canadian forests. Global Change Biology, 5: 75-82.

5

The Lacey Holdings Licence was originally purchased from Dr. Duchesne by Lacey Holdings Inc. which is a private company owned exclusively by Mr Christopher Skinner. Mr. Wilkes, as CEO of Elemental Protective Coatings, while scoping business potential for the Company, identified the Lacey Holdings license as a business opportunity. Furthermore, as management delved into the carbon market and with the emergence of supporting cap-and-trade legislation in California, it became evident that engaging in carbon development projects also offered new business opportunities. Consequently, the Company improved its business plan and made the acquisition of the 1776729 License which permits a greater offering of services than the Lacey Holdings Inc. license. Mr. Duchesne is not a shareholder or a director of Lacey Holdings or related to the only shareholder, officer or director of Lacey Holdings Inc. There is no relationship between Lacey Holdings, the directors of the Company or its management.

Whereas the Lacey Holdings License permits to measure carbon emissions, the 1776729 License agreement permits to develop carbon offset credits for the purpose of taking advantage of recent developments showing that the regulated carbon market is emerging in North America despite the lack of support by the United States Government and the Canadian Government who refuse to ratify the Kyoto Protocol, states and provincial jurisdictions are actively engaged in Cap-and-Trade efforts through the Western Climate Initiative (WCI).

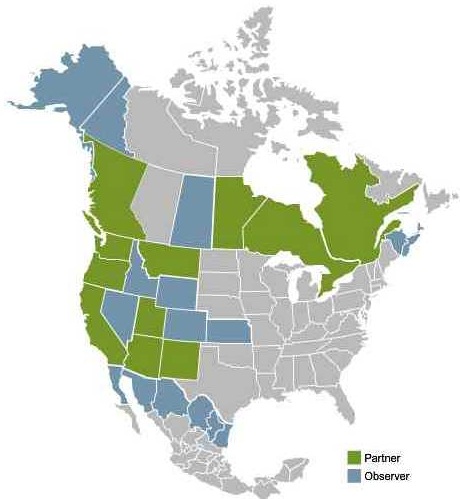

The WCI Partner jurisdictions have developed a comprehensive strategy to reduce regional GHG emissions to 15 percent below 2005 levels by 2020. The figure below shows that 4 Canadian provinces (British Columbia, Manitoba, Ontario and Quebec) and 7 states in the USA (Washington, Oregon, California, Arizona, New Mexico, Montana, Utah) are members of the Western Climate Initiative. In addition 16 States/provinces of Canada, the USA and Mexico enjoy observer status in the Western Climate Initiative, which means they are interested but undecided as of yet.

| In Canada, British Columbia spearheads Cap-and-Trade efforts. In November 2010, British Columbia posted its Draft Protocol for Forest Carbon Sequestration from Forests making it the most advanced jurisdiction member of the WCI in Canada. British Columbia is the first Canadian province with a Cap-and-Trade legislation. In the USA, California spearheads the efforts of Cap-and-Trade under the Western Climate Initiative with numerous protocols and methodologies published under The Climate Action Reserve registry. In December 2010, California, a member of the Western Climate Initiative, legislated that carbon offsets from forests are a part of its Cap-and-Trade system. California produces roughly 1.4 percent of the worlds, and 6.2 percent of the total U.S. greenhouse gases. This has two significant consequences that create a business case for the development of carbon credits from Canadian forests: |

6

1. Under the Western Climate Initiative, credits can be traded between province and member state –see insert from www.westernclimateinitiative.org/component/remository/general/program-design/Design-Summary/ page 6:

1. The WCI Cap-and-Trade Program will be composed of the individual jurisdictions’ cap-and-trade programs implemented through state and provincial regulations. Each WCI Partner jurisdiction implementing the cap-and-trade program design will issue “emission allowances” to meet its jurisdiction-specific emissions goal. The total number of available allowances serves as the “cap” on emissions. The allowances can be bought and sold (“traded”). A regional allowance market is created by the Partner jurisdictions recognizing one another’s allowances for compliance. Through this recognition, the emissions allowances issued by each jurisdiction will be usable throughout the jurisdictions for compliance purposes. We note that carbon offset vary in quality as reviewed in “FOREST CARBON OFFSETS: A Scorecard for Evaluating Project Quality” by Julie L. Beane, John M. Hagan, Andrew A. Whitman, John S. Gunn, 2008; and Manomet Center for Conservation Sciences, #MCCS NCI 2008, which heightens the needs for a rigorous approach to the development of carbon offsets from forests.

Management feels that it might be difficult for California emitters to meet their regulated carbon requirements without having to purchase carbon offsets from Canada. According to the Climate Action Reserve’s projections, the projects currently under approval have just under 30 million tons of credits in the pipeline through 2014 that could be used in the California program. Yet the demand for total reduction requirements is projected to exceed 230 million tons between 2012 through 2020 in California alone. Of these, 8% are allowable from forests. The Company believes that emitters will attempt to fill the offset supply gap which will create greater demand pressure on the price point of carbon and also stimulate carbon forest sequestration projects from other jurisdictions of the WCI.

More precisely the 1776729 License provides the Company with the means to engage in carbon development as the license is based on: (1) Knowledge of and/or relationships with technology providers in various manufacturing sectors who own technologies that can be used by carbon emitters to meet emission reduction requirements; (2) Knowledge of and/or relationships with land owners in various countries with interests in providing land bases for the development of biological sequestration offset credits to meet emission reduction requirements; (3) Knowledge of and/or relationships with financial institutions with interest in providing capital for the development of carbon sequestration tools or implementation of novel technologies to meet emissions reduction requirements; and, (4) Knowledge of and/or relationships with purchasers of carbon offsets. 1776729 is a holding company which owns licensed intellectual property from GSN Dreamworks Inc., which is solely owned by our President and CEO Luc Duchesne.

The Company does not currently engage in any business activities that may provide immediate cash flow. We expect to incur expenses without generating any material revenues for the foreseeable future. We anticipate the need to raise funds to support our operations for the next 12 months. We have not identified any sources of additional funding for our continued operations, nor have we committed to a plan for funding if our current assets prove inadequate. During the next 12 months we anticipate incurring costs related to:

pursuing business opportunities to obtain engagements from clients for the use of our licensed technology;

preparing our financial statements and having them reviewed and audited; and

preparing and filing of Exchange Act reports.

We do not anticipate that we will be able to meet these costs without securing additional cash to be loaned by, or invested in us by our stockholders, management or other investors. Management has funded operations thus far but there is no guaranty that management will be able support operations definitely.

7

1. The creation of a business plan from the exploitation of rare earth minerals from its 4,200 acres of rare earth claims in the Cobequid Fault Area of Nova Scotia, Canada. Said claims are adjacent and in the vicinity of claims by other mineral exploration companies in the Cobequid Highlands and reports of rare earths have been made with Nova Scotia Ministry of Natural Resources by exploration companies in the vicinity. Rare Earth Metals are experiencing rapidly increasing demand for use in green technologies from consumer electronics to electric and hybrid vehicles to power storage for alternative energy sources such as wind and solar. For example the emergence of third generation solar cells with multispectral capabilities and with 40% efficiencies will create significant growth possibilities for the industry. Companies with Rare Earth Elements (REE) are re-emerging as a strategic investment opportunity. The first wave started in early 2010 when China began rationing its export of REE, which led to the emergence of junior miners in the REE industry. The next wave of opportunity in the REE industry is predicated on companies being able to process and purify mineral deposits through the development of leading-edge extraction technologies. As such, REE companies now have to straddle mineral exploitation and R & D. With the strong and proven expertise of our management team we have positioned the company to meet this unique challenge.

2. The completion and proving of its technology for the extraction of rare earth minerals using a combination of methodologies that were first developed for the purification of rare chemicals from living tissues. The most exciting aspect on the discovery of Rare Earth Ore minerals in the Cobiquid fault area is the ratio between Heavy Rare Earth Ores (HREO) to the Light Rare Earth Ores (LREO). This is especially significant considering the much greater market value of HREO as compared to LREO. In almost all analyses of the closely related site of Debert Lake the ratio was near or greater than 50% (From Sears 2011). The high levels of HREO over LREO suggests that that a mining venture might be economically feasible, provided the costs of ore extraction are in line with the costs of competing mines. Indeed HREO are of greater commercial values than LREO.

3. The demonstration of carbon neutral approaches for the mining sector. Despite the current lack of global interest in carbon trading schemes, there exist regional interest in Cap and Trade, for example through the Western Climate Initiative. This will permit to augment the yield from rare earth extraction projects and other mining projects. We intend to create strategic alliances with technology providers for adapting various energy saving or carbon sequestration technologies to permit greater economic yields for the mining sector. When licensed such technologies and approaches will be applicable to the mining industry in general.

Investors must be aware that we have not begun significant operations and we have not generated any revenue. We currently have minimal funds available and in order to continue our business plan we must raise additional proceeds. We will likely be required to borrow proceeds from a shareholder in order to pay expenses associated with filing this report. We cannot provide any guarantee that we will be successful in securing adequate proceeds in the future and failure to do so would result in a complete loss of any investment made into the Company.

Competitive Business Conditions

Carbon trading is a commercial activity that is regulated by specific jurisdictions pursuant to regional legislation or can be voluntary. When regulated (Eg. Europe and Western Climate Initiative), governments compel polluters to reduce their greenhouse gas emissions through technological improvements or through the purchase of carbon offsets (carbon credits). It is an identified risk factor that new legislation may arise in certain jurisdictions that may render the Company’s business plan and knowledge obsolete with respect to carbon credits. With respect to the voluntary trade of carbon credits, there is a significant risk that certain voluntary purchasers of carbon credits may elect to cease the purchase of carbon credits for various reasons that are inherent to their business plans, or because of changing economic, political contexts or other conditions that cannot be controlled by the management of the Company.

Patents and Trademarks

We have no patents or trademarks.

Governmental Regulation

See “Competitive Business Conditions.”

8

Reports to Security Holders

We file our quarterly and annual report with the Securities and Exchange Commission (SEC), which the public may view and copy at the Public Reference Room at 100 F Street, N.E. Washington D.C. 20549. SEC filings, including supplemental schedule and exhibits, can also be accessed free of charge through the SEC website www.sec.gov.

| ITEM 1A | RISK FACTORS |

Factors Affecting Future Operating Results

This Annual Report on Form 10-K contains forward-looking statements concerning our future programs, expenses, revenue, liquidity and cash needs as well as our plans and strategies. These forward-looking statements are based on current expectations and we assume no obligation to update this information, except as required by applicable laws and regulations. Numerous factors could cause actual results to differ significantly from the results described in these forward-looking statements, including the following risk factors.

Because our auditors have issued a going concern opinion, there is substantial uncertainty we will continue activities in which case you could lose your investment.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue as an ongoing business for the next twelve months. As such we may have to cease activities and you could lose your investment.

We currently do not have adequate funds to cover the costs associated with maintaining our status as a Reporting Company.

The Company currently has no cash available. This amount will not be enough to pay the legal, accounting, and filing fees that is required to maintain our status as a reporting company, which is currently estimated at $20,000 for fiscal year 2014. If we can no longer be a reporting company our common stock would no longer be eligible for quotation on the Over-the-Counter Bulletin Board. This would result in there being no public market for an investor to trade our common stock and any investment made would be lost in its entirety.

We lack an operating history and have losses which we expect to continue into the future. As a result, we may have to suspend or cease activities, which would result in a complete loss of any investment made into the Company.

We were incorporated on January 17, 2007 and we have not started our proposed business activities or realized any revenues. We have no operating history upon which an evaluation of our future success or failure can be made. As of December 31, 2013 our net loss since inception is $2,418,899. Based upon current plans, we expect to incur operating losses in future periods. Failure to generate revenues will cause us to suspend or cease activities.

If we are able to complete financing through the sale of additional shares of our common stock in the future, then shareholders will experience dilution.

The most likely source of future financing presently available to us is through the sale of shares of our common stock. Any sale of common stock will result in dilution of equity ownership to existing shareholders. This means that if we sell shares of our common stock, more shares will be outstanding and each existing shareholder will own a smaller percentage of the shares then outstanding. To raise additional capital we may have to issue additional shares, which may substantially dilute the interests of existing shareholders. Alternatively, we may have to borrow large sums, and assume debt obligations that require us to make substantial interest and capital payments.

9

Because there is currently a limited public trading market for our common stock, you may not be able to resell your stock.

Although our common stock is quoted on the Over-the-Counter Bulletin Board (OTCBB) the market is limited. If a market does not develop there would be no central place, such as stock exchange or electronic trading system to resell your shares.

Because our securities are subject to penny stock rules, you may have difficulty reselling your shares.

Our shares are penny stocks are covered by, and subject to, section 15(g) of the Securities Exchange Act of 1934 which imposes certainadditional sales practice requirements on broker/dealers who sell the Company's securities subject toincluding the rule to persons other than

established customersdelivery of a standardized disclosure document; disclosure and accredited investors.confirmation of quotation prices; disclosure of compensation the broker/dealer receives; and, furnishing monthly account statements. For transactions covered bysales of our securities, the rule, brokers/dealersbroker/dealer must make a special suitability determination and receive from its customer a written agreement prior to making a sale. The imposition of the foregoing additional sales practices could adversely affect a shareholder's ability to dispose of his stock.

We are subject to the requirements of section 404 of the Sarbanes-Oxley Act. If we are unable to timely comply with section 404 or if the costs related to compliance are significant, our profitability, stock price and results of operations and financial condition could be materially adversely affected.

We are required to comply with the provisions of Section 404 of the Sarbanes-Oxley Act of 2002, which require us to maintain an ongoing evaluation and integration of the internal controls of our business. We were required to document and test our internal controls and certify that we are responsible for maintaining an adequate system of internal control procedures for the year ended December 31, 2013

We evaluated our existing controls for the year ended December 31, 2013. Our Chief Executive Officer identified material weaknesses, specifically a poor segregation of duties, in our internal control over financial reporting and determined that we did not maintain effective internal control over financial reporting as of December 31, 2013. The identified material weaknesses did not result in material audit adjustments to our 2013 financial statements; however, uncured material weaknesses could negatively impact our financial statements for subsequent years.

In addition, a material weakness in the effectiveness of our internal controls over financial reporting could result in an increased chance of fraud and the loss of customers, reduce our ability to obtain financing and require additional expenditures to comply with these requirements, each of which could have a material adverse effect on our business, results of operations and financial condition.

Further, we believe that the out-of-pocket costs, the diversion of management’s attention from running the day-to-day operations and operational changes caused by the need to comply with the requirements of Section 404 of the Sarbanes-Oxley Act could be significant. If the time and costs associated with such compliance exceed our current expectations, our results of operations could be adversely affected.

There may be conflicts of interest between our management and our non-management stockholders.

Conflicts of interest create the risk that management may have an incentive to act adversely to the interests of other investors. A conflict of interest may arise between our management's personal financial interests and the fiduciary duty to our stockholders. Further, our management's own financial interests may at some point compromise their fiduciary duty to our stockholders. Luc Duchesne and Robert Williams, who are the Company’s sole officers and a majority of its directors, continue to be involved in businesses that operate and commercialize technologies that are similar or related to the Company’s, although those businesses exploit and seek to exploit different applications and opportunities. In addition, although it is anticipated that these individuals will spend significant time and effort developing our business, it is possible that they will be exposed to business or employment opportunities that would conflict with the interests of the Company, or cause them to reduce their efforts on the Company’s behalf or to entirely cease working with the Company. If we and any other businesses with which our officers are involved wish to take advantage of the same opportunity, then the officer and director that is affiliated with both companies would abstain from voting upon the opportunity.

10

Future success is highly dependent on the ability of management to further develop and implement a business plan, and secure customers.

The nature of our operations is highly speculative and there is a consequent risk of loss of your investment. The success of our activities will depend on the availability of finances, opportunities relating to carbon trading, offset and reduction regimes, greenhouse gas emission reduction programs, government regulations and economic conditions in the forestry and timber industries. As we have no operating history or revenue and only minimal assets, there is a risk that we will be unable to consummate a business combination. The Company has had no recent operating history and no revenues or earnings from operations since inception. We have no significant assets or financial resources. We will, in all likelihood, sustain operating expenses without realizing significant revenues for the foreseeable future, at least until the market opportunities for the Company’s services and technology develops and the demand for our services becomes more proven and regular. This will likely result in our incurring net operating losses for the foreseeable future. We cannot assure that our business will develop as hoped, or that it will become profitable.

Our business may have no revenues for the foreseeable future.

We are a development stage company and have had no revenues from operations. Although the technologies offer potential, we may not realize any revenues unless and until we successfully develop a revenue stream from the use of existing licenses.

We may issue more shares to raise additional capital, and permit the development of the Company’s business.

As a result, the shareholdings of current shareholders may be diluted. Our Articles of Incorporation authorizes the issuance of a maximum of 275,000,000 shares of common stock. We may issue additional shares from time to time to raise the capital that we anticipate will be required to further develop our business. Any share issuance would be subject to compliance with applicable securities laws and subject to that limitation, unless our Articles of Incorporation are amended with approval of our stockholders. This may result in substantial dilution in the percentage of our common stock held by our then existing stockholders. Moreover, the common stock issued from time to time may be valued on an arbitrary or non-arm’s-length basis by our management, resulting in an additional reduction in the percentage of common stock held by our then existing stockholders. Our Board of Directors has the power to issue any or all of such authorized but unissued shares without stockholder approval. To the extent that additional shares of common stock or preferred stock are issued, dilution to the interests of our stockholders will occur and the rights of the holders of common stock might be materially and adversely affected.

There is limited public market for our Common Stock, and we have never paid dividends on our Common Stock.

There is limited public trading market for our common stock which is listed on OTCQB: NOST and none is expected to develop until our business develops further. Additionally, we have never paid dividends on our common stock and do not presently intend to pay any dividends in the foreseeable future. We anticipate that any funds available for payment of dividends will be re-invested into the Company to further its business strategy. Moreover, a significant number of unregistered securities may not become traded. Pursuant to the Securities Act of 1933, as amended (the “Securities Act”) and any other applicable securities laws or regulations these restrictions will limit the ability of our stockholders to liquidate their investment.

Carbon trading may become obsolete.

Carbon trading is a commercial activity that is either regulated by specific jurisdictions pursuant to regional legislation, or can be voluntary. When regulated (Eg. Europe and Western Climate Initiative), governments compel polluters to reduce their greenhouse gas emissions through technological improvements or through the purchase of carbon offsets (carbon credits). It is an identified risk factor that new legislation may arise in certain jurisdictions that may render the Company’s business plan and knowledge obsolete with respect to carbon credits. With respect to the voluntary trade of carbon credits, there is a significant risk that certain voluntary purchasers of carbon credits may elect to cease the securitiespurchase of carbon credits for various reasons that are inherent to their business plans, or because of changing economic, political contexts or other conditions that cannot be controlled by the management of the Company.

11

Mineral claims may prove non commercial

Although we have acquired options to mineral rights for properties in Nova Scotia, there is a possibility that the claims do not contain ores of commercial values either because of non-economical mineral content, inability to secure financing, inability to secure permitting, inability to extract the minerals economically or any combination of these factors acting in concert.

Limited Operating History; Need for Additional Capital.

Although the Company draws on the expertise on the principals who have been operating private businesses in the renewable energy and receiveforestry sectors, there is no pertinent historical financial information for the purchaser's written agreementCompany upon which to base an evaluation of our performance. Our assets and business have not yet generated substantial or recurring revenues. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources and possible cost overruns due to price and cost increases in services. We will require additional financing to cover costs that we expect to incur over the next twelve months. We believe that debt financing will not be an alternative for funding our operations as we do not have tangible assets to secure any debt financing. We anticipate that additional funding will be in the form of equity financing from the sale of our common stock or other securities. However, we cannot provide any assurance that we will be able to raise sufficient funding from the sale of our common stock to fund our plan of operations. In the absence of such financing, we will not be able to continue and our business plan will fail.

Our common stock is subject to the transaction prior to sale. "penny stock" rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The Securities and Exchange Commission also has adopted certain rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that regulate broker/dealer practices in connection with transactions inare applicable to "penny stocks". Penny stocks generally areFor the purposes relevant to us, a “penny stock” is any equity securities withsecurity that has a market price of less than $5.00 (otherper share or has an exercise or conversion price of less than securities registered on$5.00 per share, subject to certain national securities

exchangesexceptions. For any transaction involving a penny stock, unless exempt, the rules require:

| · | that a broker or dealer approve a person's account for transactions in penny stocks; |

| · | the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased; and |

| · | that a broker or dealer provide certain detailed market information about the market for the applicable company’s securities. |

In order to approve a person's account for transactions involving penny stocks, the broker or quoted ondealer must:

(1) obtain financial information, investment experience and investment objectives of the NASDAQ system, providedperson; and

(2) make a reasonable determination that current price and volume

information with respect tothe proposed transactions in penny stocks are suitable for that security is provided byperson and that the exchangeperson has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

12

The broker or system). The penny stock rules require a broker/ dealer must also deliver, prior to aany transaction in a penny stock, not otherwise exempt from the rules, to deliver a standardized risk disclosure documentschedule prepared by the Commission that provides

information about penny stocks and the nature and level of risks inSEC relating to the penny stock market. The broker/dealer alsomarket, which, in highlight form:

| · | sets forth the basis on which the broker or dealer made the suitability determination; and |

| · | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Following a transaction, monthly statements must provide the customer with current bid

3

and offer quotationsbe sent disclosing recent price information for the penny stock, the compensation of the broker/dealer

and its salesperson in the transaction, and monthly account statements showing

the market value of each penny stock held in the customer's account. The bidaccount and offer quotations, andinformation on the broker/dealer and salesperson compensation

information, mustlimited market in penny stocks.

Generally, brokers may be givenless willing to execute transactions in securities subject to the customer orally or in writing prior"penny stock" rules. This may make it more difficult for investors to effecting the transaction and must be given to the customer in writing before or

with the customer's confirmation. These disclosure requirements may have the

effectdispose of reducing the level of trading activity in the secondary market for the

Company's common stock.

As of March 31, 2010, the Company had 13,300,000 outstanding shares ofour common stock and 30 shareholdersdepress the market value of record.

Holdersour stock.

There are additional risks of investing in penny stocks whether in public offerings or in secondary trading, relating to commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions.

| TEM 1B | UNRESOLVED STAFF COMMENTS |

None

We do not own any property; the principal offices are located at 305 James Street, Ottawa, Ontario K1R 5M8. The telephone number is (705) 253-0039. The website is www.nsuresources.com.

| ITEM 3 | LEGAL PROCEEDINGS. |

NSU Resources Inc. is not currently a party to any legal proceedings.

| ITEM 4 | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

None

13

| MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Our common stock is quoted on the Over-the-Counter Bulletin Board (OTCBB) under the ticker symbol NOST. The stock trades are entitledlimited and sporadic; there is no established public trading market for our common stock.

Dividends

We did not declare or pay dividends during the Fiscal Year 2013 and do not anticipate declaring or paying dividends in fiscal year 2014.

Securities Authorized for Issuance under Equity Compensation Plans

There is no stock option on place for the company.

Recent Sales of Unregistered Securities

There was no sale of unregistered securities in 2013.

Securities issued in 2013

None.

Summary of Financial Data

| December 31, 2013 | December 31, 2012 | |||||||

| Revenues | $ | - | $ | 5,792 | ||||

| Operating Expenses | $ | 4,895 | $ | 10,455 | ||||

| Earnings (Loss) | $ | (4,895 | ) | $ | (4,669 | ) | ||

| Total Assets | $ | 800 | $ | - | ||||

| Liabilities | $ | 79,374 | $ | 73,679 | ||||

| Stockholders’ Deficit | $ | (78,574 | ) | $ | (73,679 | ) | ||

14

The following discussion is intended to receive dividends as may be

declared byassist in the Boardunderstanding and assessment of Directors. The Company's Board of Directors is not

restricted from paying any dividends but is not obligated to declare a dividend.

No dividends have ever been declaredsignificant changes and it is not anticipated that dividends

will ever be paid.

In October 2009, the Company purchased 43,000,000 shares of its common

stock from two former officers in a private transaction. These shares were

subsequently cancelled. In November 2009, the two former officers collectively

sold 7,000,000 shares of the Company's common stocktrends related to the Company's current

officers. See Item 1results of operations and financial condition of NSU Resources Inc. This discussion and analysis should be read in conjunction with our financial statements and notes thereto included elsewhere in this reportAnnual Report on Form 10-K for further information. With the exception

of the foregoing, during thefiscal year ended December 31, 2009, none2013.

Critical Accounting Policies

The preparation of our consolidated financial statements and notes thereto requires management to make estimates and assumptions that affect the amounts and disclosures reported within those financial statements. On an ongoing basis, management evaluates its estimates, including those related to revenue recognition, contingencies, litigation and income taxes. Management bases its estimates and judgments on historical experiences and on various other factors believed to be reasonable under the circumstances. Actual results under circumstances and conditions different than those assumed could result in differences from the estimated amounts in the financial statements. There have been no material changes to these policies during fiscal 2013.

Plan of Operations

Liquidity and Capital Resources. At the end of fiscal year 2013 we had no cash on hand and we had liabilities of $79,374. We must secure additional funds in order to continue our business. We were required to secure a loan to pay expenses relating to filing this report including legal, accounting and filing fees and may be required to secure additional financing to fund future filings. We believe that we will be able to obtain this loan from a current shareholder of the Company's

officersCompany; however we cannot provide any assurance that we will be able to raise additional proceeds or directors, nor any of its principal shareholders, purchased any

shares of the Company's common stock from third parties in a private transaction

or as a result of purchasessecure additional loans in the open market.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

PLAN OF OPERATION

The Company was incorporated in January 2007. The Companyfuture to cover our expenses related to maintaining our reporting company status (estimated at $20,000 for fiscal year 2014). Furthermore, there is inno guarantee we will receive the development stage and as of March 31, 2010 has never generatedrequired financing to complete our business strategies; we cannot provide any revenue.

Since its inception,assurance that future financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our operations. If we are unable to accomplish raising adequate funds then it would be likely that any investment made into the Company has financedwould be lost in its operations throughentirety.

Results of Operations. We have generated minimal revenues since inception, including $0 and $5,792 during the

private sale of its common stock. The Company does not have any commitments or

arrangements from any person to provide the Company with any additional capital.

See Item 1 of this report for information concerning the Company's plan of

operation.

See Note 2 to the financial statements included as part of this report for

a description of the Company's accounting policies and recent accounting

pronouncements.

4

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK

Not applicable.

ITEM 8. FINANCIAL STATEMENTS

See the financial statements attached to this report.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS.

On July 20, 2009, the Company, through and with the approval of its Board

of Directors, dismissed Moore & Associates, Chartered as its independent

registered public accounting firm. The reports of Moore & Associates on the

financial statements of the Company for the two years ended December 31, 2008

did not contain an adverse opinion or disclaimer of opinion nor were the reports

qualified or modified as2013 and 2012. Additionally, we continue to uncertainty, audit scope or accounting principles.

However, the reports of Moore & Associates for those fiscal years were qualifiedincur administrative costs related to becoming compliant with respect to uncertainty as to the Company's ability to continuefiling requirements as a going

concern.

Duringpublic issuer. Such administrative costs totaled $4,895 and $10,455 during the Company's two fiscal years ended December 31, 20082013 and the

subsequent interim period ended July 20, 2009, there were no disagreements2012. Since inception we have incurred a loss of $2,418,999 of which $2,127,000 is attributable to impairment losses on assets acquired for common stock.

Off-Balance Sheet Arrangements. None

| ITEM 7A | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK. |

We do not currently hold any market risk sensitive instruments entered into for hedging transaction risks related to foreign currencies. In addition, we have not entered into any transactions with Moore & Associates on any matter of accounting principles or practices,derivative financial statement disclosure, or auditing scope or procedure, which

disagreements, if not resolved to Moore & Associates satisfaction, would have

caused them to refer to such disagreements in their reports.

On July 23, 2009, the Company hired De Joya Griffith & Company, LLC, as

its independent registered public accounting firm. Prior to hiring De Joya

Griffith & Company, the Company did not consult with De Joya Griffith & Company

regarding the application of accounting principles to a specific completed or

contemplated transaction or regarding the type of audit opinion that might be

rendered by De Joya Griffith & Company on the Company'sinstruments for trading purposes.

Our financial statements appear beginning on page F-1, immediately following the signature page of this report.

15

None

Disclosure Controls and De Joya Griffith & Company did not provide any written or oral advice that

was an important factor considered by the Company in reaching a decision as to

any accounting, auditing or financial reporting issue.

ITEM 9A. CONTROLS AND PROCEDURES

The Company maintains a systemProcedures

Management of NSU Resources Inc. is responsible for maintaining disclosure controls and procedures that are designed to ensure that information required to be disclosed in the reports filedthat the Company files or submittedsubmits under the Securities Exchange Act of 1934 as amended ("1934 Act"(the “Exchange Act”), is recorded, processed, summarized and reported within the time periods specified in the SEC'sSecurities and Exchange Commission’s rules and formsforms.

In addition, the disclosure controls and toprocedures must ensure that such information required to be disclosed by the

Company in the reports that it files or submits under the 1934 Act, is accumulated and communicated to the Company'sCompany’s management, including its PrincipalChief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure. Asfinancial and other required disclosures.

At the end of December 31, 2009, the Company's

Principal Executive and Financial Officer evaluatedperiod covered by this report, an evaluation of the effectiveness of the

design and operation of the Company'sour disclosure controls and procedures.procedures (as defined in Rules 13(a)-15(e) and 15(d)-15(e) of the Securities Exchange Act of 1934 (the “Exchange Act”)) was carried out under the supervision and with the participation of our Principal Executive Officer, Principal Financial and Accounting Officer, Luc C. Duchesne. Based on thathis evaluation the Company's Principal Executiveof our disclosure controls and Financial Officerprocedures, he concluded that during the Company'speriod covered by this report, such disclosure controls and procedures were effective.

Management'snot effective to detect the inappropriate application of US GAAP standards. This was due to deficiencies that existed in the design or operation of our internal control over financial reporting that adversely affected our disclosure controls and that may be considered to be “material weaknesses.”

The Company will continue to create and refine a structure in which critical accounting policies and estimates are identified, and together with other complex areas, are subject to multiple reviews by accounting personnel. In addition, the Company will enhance and test our year-end financial close process. Additionally, the Company’s management will increase its review of our disclosure controls and procedures. Finally, we plan to designate individuals responsible for identifying reportable developments. We believe these actions will remediate the material weakness by focusing additional attention and resources in our internal accounting functions. However, the material weakness will not be considered remediated until the applicable remedial controls operate for a sufficient period of time and management has concluded, through testing, that these controls are operating effectively.

Management’s Annual Report on Internal Control over Financial Reporting

5

The Company's

Our management is responsible for establishing and maintaining adequate internal control over financial reporting and for the assessment of the

effectiveness of internal control overour financial reporting. As defined by the

Securities and Exchange Commission, internalInternal control over financial reporting is a process designed by, or under the supervision of the Company's principal

executive officer and principal financial officer and implemented by the

Company's Board of Directors, management and other personnel, to provide reasonable assurance to our management and board of directors regarding the reliability of financial reporting and the preparation of the Company's financial statements for external purposes in accordance with U.S. generally accepted accounting principles. Our internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that in reasonable detail accurately and fairly reflect our transactions; (ii) provide reasonable assurance that transactions are recorded as necessary for preparation of our financial statements; (iii) provide reasonable assurance that receipts and expenditures of company assets are made in accordance with management authorization; and (iv) provide reasonable assurance that unauthorized acquisition, use or disposition of company assets that could have a material effect on our financial statements would be prevented or detected on a timely basis.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions may occur or that the degree of compliance with the policies or procedures may deteriorate.

The Company's management evaluated

16

Management assessed the effectiveness of itsour internal control over financial reporting as of December 31, 20092013. This assessment is based on the criteria establishedfor effective internal control described in Internal Control -— Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission, or the COSO Framework.

Management'sCommission. Based on its assessment, included an evaluation of the design of the Company'smanagement concluded that our internal control over financial reporting and testing of the operational

effectiveness of those controls.

Based on this evaluation, the Company's management concluded that the

Company's internal control over financial reporting was effective as of December 31, 2009.

There2013 was no changenot effective in the Company'sspecific areas described in the “Disclosure Controls and Procedures” section above and as specifically described in the paragraphs below.

As of December 31, 2013 the Principal Executive Officer/Principal Financial Officer identified the following specific material weaknesses in the Company’s internal controlcontrols over its financial reporting processes:

• Policies and Procedures for the Financial Close and Reporting Process — Currently there are no policies or procedures that occurred duringclearly define the quarter endedroles in the financial close and reporting process. The various roles and responsibilities related to this process should be defined, documented, updated and communicated. Failure to have such policies and procedures in place amounts to a material weakness to the Company’s internal controls over its financial reporting processes.

• Representative with Financial Expertise — For the year ending December 31, 20092013, the Company did not have a representative with the requisite knowledge and expertise to review the financial statements and disclosures at a sufficient level to monitor the financial statements and disclosures of the Company. Failure to have a representative with such knowledge and expertise amounts to a material weakness to the Company’s internal controls over its financial reporting processes.

• Adequacy of Accounting Systems at Meeting Company Needs — The accounting system in place at the time of the assessment lacks the ability to provide high quality financial statements from within the system, and there were no procedures in place or built into the system to ensure that all relevant information is secure, identified, captured, processed, and reported within the accounting system. Failure to have an adequate accounting system with procedures to ensure the information is secure and accurately recorded and reported amounts to a material weakness to the Company’s internal controls over its financial reporting processes.

• Segregation of Duties — Management has materially affected, or is reasonably likelyidentified a significant general lack of definition and segregation of duties throughout the financial reporting processes. Due to materially affect, the Company'spervasive nature of this issue, the lack of adequate definition and segregation of duties amounts to a material weakness to the Company’s internal controls over its financial reporting processes.

In light of the foregoing, once we have the adequate funds, management plans to develop the following additional procedures to help address these material weaknesses:

• NSU Resources Inc. will create and refine a structure in which critical accounting policies and estimates are identified, and together with other complex areas, are subject to multiple reviews by accounting personnel. In addition, we plan to enhance and test our month-end and year-end financial close process. Additionally, our audit committee will increase its review of our disclosure controls and procedures. We also intend to develop and implement policies and procedures for the financial close and reporting process, such as identifying the roles, responsibilities, methodologies, and review/approval process. We believe these actions will remediate the material weaknesses by focusing additional attention and resources in our internal accounting functions. However, the material weaknesses will not be considered remediated until the applicable remedial controls operate for a sufficient period of time and management has concluded, through testing, that these controls are operating effectively.

17

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management'sManagement’s report was not subject to attestation by the Company's

independentour registered public accounting firm pursuant to temporary rules of the SECSecurities and Exchange Commission that permit the Companyus to provide only management'smanagement’s report on internal

control in this annual report.

ITEM 9B. OTHER INFORMATION

Not applicable.

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

Name Age Position

Gilles Trahan 38 President, Chief Executive Officer

This report shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section, and a Director.

6

Martin Baldwin 44 Secretary, Treasurer, Chief Financial Officer

and a Director.

The directorsis not incorporated by reference into any filing of the Company, servewhether made before or after the date hereof, regardless of any general incorporation language in such capacityfiling.

Changes in Internal Controls

There have been no changes in our internal control over financial reporting that occurred during our fiscal year ended December 31, 2013 that have materially affected, or are reasonable likely to materially affect, our internal control over financial reporting.

| ITEM 9B | OTHER INFORMATION. |

None.

18

PART III

NSU Resources Inc.’s executive officers and directors and their respective age as of December 31, 2013 are as follows:

Directors:

| Name of Director | Age | |

| Luc C. Duchesne | 52 | |

| Robert Williams | 50 |

Executive Officer:

| Name of Officer | Age | Office | ||

| Luc C. Duchesne | 52 | President, CFO, CEO | ||

| Robert Williams | 50 | Chief Technology Officer |

The term of office for each director is one year, or until the next annual meeting of the Company's shareholdersshareholders.

Biographical Information

Set forth below is a brief description of the background and business experience of our officers and director for the past year.

Luc Duchesne (52), for the past five years, has been President and CEO of Forest BioProducts Inc, a consulting firm in forestry dealing with resource development. Forest BioProducts is owned in majority by Grid Cloud Solutions, Inc. (OTC Pinksheets: GRDC) a publicly trading technology and consulting company in the renewable energy sector, where Mr. Duchesne holds the positions of Director and Chief Technology Officer. He has also been president and CEO of SITTM Technologies Inc, a private biodiesel technology and brokerage firm until their successors have been duly

electedFebruary 17, 2011 when it was acquired by MSE Envirotech Corp (OTC Pinksheets: MEVT); and qualified. The officersof GSN Dreamworks Inc. (a related party), a private research and development firm involved in opportunities relating to carbon stocks and natural resources.

From 2004 to 2006 Mr. Duchesne was fully engaged in forestry consulting, acting as CEO of Forest BioProducts, providing various services to clients seeking economic opportunities from the exploitation of non-timber values from forest ecosystems such as bioenergy, biomass, pharmaceuticals and nutraceuticals. These activities were reduced to 20% of his time when he took the position of CEO of SITTM Technologies Inc, in 2006. SITTM Technologies Inc. is a privately owned corporation involved in the manufacturing and sales of biodiesel and value added products from fatty acid methyl esters. This took up 60% of his time. He was president of GSN Dreamworks from 2006 continuing until June 2010 when he became CEO of BioCarbon Systems International. From June 2010 to December 2010 he was CEO and director of Bio-Carbon Systems International Inc. He is currently engaged in the full time management of the Company servewith an effort of at least 40 hours per week.

19

Mr. Duchesne holds a PhD in plant biochemistry from the discretionUniversity of Guelph, a M.Sc. in Forest Sciences from the University of Toronto (1985) and a B.Sc. in Forest Engineering from Laval University (1983). He has authored or co-authored 85 peer-reviewed scientific articles, book chapters or books. He has developed algorithms and other knowledge relating to carbon stocks and the assessment of the Company's directors. The Company does not compensate any person for actingamount of carbon stock found in various natural ecosystems. That intellectual property can be used to validate carbon stocks in the context of carbon trading regimes. Mr. Duchesne was appointed as a director

The principal occupation of the Company's officers and directors during

the past several years is as follows:

Mr. Trahan has been an officer and director of the Company since November,

2009. Since August 2008in large part because of his academic training with respect to forestry matters, his training and experience in the forestry sector, his prior experience as an entrepreneur, and his specific knowledge and understanding of the intellectual property to be exploited by the Company and the business opportunities in which that technology could be applied. Mr. TrahanDuchesne anticipates that over the next six months he will devote approximately 160 hours per month to the business of the Company.

Robert Williams (50) received his degree in Chemistry from Acadia University in Nova Scotia (1984) and his Ph.D. from the University of Guelph (1989). Throughout his career he has been the Chief Executive Officer and a

director of MSE Enviro-Tech Corp. Between 2002 and the time he joined MSE

Enviro-Tech, Mr. Trahan was the Chief Executive Officer and President of Geneva

Bancorp Inc. where he was involved in international financial consulting and

investment banking. Between 1998 and 2002 Mr. Trahan was the Chief Executive

Officer and a Directordevelopment of Symphony Telecom, Inc. Since October 2008, Mr. Trahan

has also been a director of Atlantic Wind & Solar, Inc.

Mr. Baldwin has been an officer and director of the Company since November,

2009. Since April 2009 Mr. Baldwin has been a Director of MSE Enviro-Tech Corp.

Between July 2008 and April 2009 Mr. Baldwin was a Director with the

International Money Market Department at the Bank of Nova Scotia in Toronto.

Between August 2002 and June 2008 Mr. Baldwin was the Assistant General