UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20062007

OR

OR

¨o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to_________to___________

Commission file number 0-23486

Commission file number 0-23486

NN, INC.

(Exact name of registrant as specified in its charter)

Delaware

| Delaware | | 62-1096725 | |

(State

| (State or other jurisdiction of incorporation or rganization)organization) | | (I.R.S. (I.R.S. Employer Identification No.)

|

2000 Waters Edge Drive

| |

| | | | |

| 2000 Waters Edge Drive | | 37604 | |

| Johnson City, Tennessee | 37604

| (Zip Code) | |

| (Address of principal executive offices) | (Zip Code)

| | |

Registrant’sRegistrant's telephone number, including area code: (423) 743-9151

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

| Name of each exchange on which registered | |

| Common Stock, par value $.01 | | The NASDAQ Stock Market LLC | |

Securities registered pursuant to Section 12(g) of the Act:

None

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’sregistrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a non-accelerated filer.smaller reporting company. See definition of “large accelerated filer,” “accelerated filerfiler” and large accelerated filer”“smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Smaller reporting Company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨No x

The aggregate market value of the voting stock held by non-affiliates of the registrant at June 30, 2006,2007, based on the closing price on the NASDAQ Stock Market LLC on that date was approximately $184,144,653.$176,899,780.

The number of shares of the registrant’sregistrant's common stock outstanding on March 12, 2007 2008 was 16,854,616.15,854,643.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement with respect to the 20072008 Annual Meeting of Stockholders are incorporated by reference in Part III of this Form 10-K.

Part

PART I

NN, Inc. manufactureshas three operating segments, the Metal Bearing Components Segment, the Plastic and suppliesRubber Components Segment, and the Precision Metal Components Segment. Within the Metal Bearing Components Segment, we manufacture and supply high precision bearing components, consisting of balls, cylindrical rollers, tapered rollers, seals, and plastic and metal retainers, for leading bearing manufacturers on a global basis. We are a leading independent manufacturer of precision steel bearing balls and rollers for the North American, European and EuropeanAsian markets. Our core business is the manufacture and saleIn 2007, Metal Bearing Components accounted for 72% of high quality, precision ball and roller bearing components including steel balls and rollers. In 2006, salestotal NN, Inc. sales. Sales of balls and rollers accounted for approximately 78%66% of the Company’sour total net sales with 58% and 20%48% of sales from balls and rollers, respectively.18% of sales from rollers. Sales of metal bearing retainers accounted for 6% of net sales and sales of precision molded plastic and rubber parts accounted for the remaining 16%.sales. See Note 13 of the Notes to Consolidated Financial Statements. In 1998, we began implementing a strategic plan designed to position us as a worldwide manufacturer and supplier of a broad line of bearing components and other precision plastic components. Through a series of acquisitions executed as part of that plan, we have built upon our strong core ball business and expanded our bearing component product offering. Today, we offer among the industry’s most complete line of commercially available bearing components. We emphasize engineered products that take advantage of our competencies in product design and tight tolerance manufacturing processes. Our bearing customers use our components in fully assembled ball and roller bearings, which serve a wide variety of industrial applications in the transportation, electrical, agricultural, construction, machinery, mining and aerospace markets. As used in this Annual Report on Form 10-K, the terms “NN”, “the Company”, “we”, “our”, or “us” mean NN, Inc. and its subsidiaries.

Within the Plastic and Rubber Components Segment, we manufacture high precision rubber seals and plastic retainers for leading bearing manufacturers on a global basis. In the fourth quarteraddition, we manufacture specialized plastic products including automotive components, electronic instrument cases and precision electronic connectors. We also manufacture rubber seals for use in various industrial applications. In 2007, plastics products accounted for 7% of 2005,net sales and rubber seals accounted for 5% of net sales.

In 2006, we developed a new five-year strategic business plan driven by perceived slower growth in the metal bearing components market and a need to create diversification in served customers and end markets. NN began to execute on this strategya new five year strategic business plan to leverage our competencies in 2006.precision metal products by creating an adjacent platform to bearing components which would broaden our reach into attractive end markets. As part of this new strategy, on November 30, 2006, we added a precision metal components product linePrecision Metal Components Segment through the acquisition of Whirlaway Corporation (“Whirlaway”) (see(See Note 2 of the Notes to Consolidated Financial Statements).Statements.) Whirlaway is a high precision metal components and assemblies manufacturer that supplies customers serving the air conditioning, appliance, automotive, commercial refrigeration and diesel engine industries. ThisOur entry into the precision metal components market is part of our new strategy to serve markets and customers we view as adjacent to bearing components that utilize our core manufacturing competencies. Management views this new product line as a new segment entitled "Precision Metal Components" and has retained Whirlaway management to run the segment.These products accounted for 16% of net sales in 2007.

For managerial and financial analysis purposes, management viewsThe three business segments are composed of the Company’s operation in three reporting segments: thefollowing manufacturing operations of Erwin, Tennessee and Mountain City, Tennessee, our plant in China, the European facilities of Kilkenny, Ireland; Eltmann, Germany; Pinerolo, Italy; Veenendaal, The Netherlands and Kysucke Nove Mesto, Slovakia (“operations:

Metal Bearing Components Segment”), the operations of Industrial Molding Corporation (“IMC”) and The Delta Rubber Company (“Delta”) (collectively “PlasticSegment

| · | Erwin, Tennessee Ball and Roller Plant (“Erwin Plant”) |

| · | Mountain City, Tennessee Ball Plant (“Mountain City Plant”) |

| · | Kilkenny, Ireland Ball Plant (“Kilkenny Plant”) |

| · | Eltmann, Germany Ball Plant (“Eltmann Plant”) |

| · | Pinerolo, Italy Ball Plant (“Pinerolo Plant”) |

| · | Veenendaal, The Netherlands Roller and Stamped Metal Parts Plant (“Veenendaal Plant”) |

| · | Kysucke Nove Mesto, Slovakia Ball Plant (“Kysucke Plant”) |

| · | Kunshan, China Ball Plant (“Kunshan Plant”) |

Plastic and Rubber Components Segment”), and beginning November 30, 2006, the operations of WhirlawaySegment

| · | Delta Rubber Company, Danielson, Connecticut Rubber Seal Plant (“Danielson Plant”) |

| · | Industrial Molding Corporation, Inc. Lubbock, Texas Plastic Injection Molding Plant (“Lubbock Plant”) |

Precision Metal Components Segment”). Segment

| · | Whirlaway Corporation, Wellington, Ohio Metal Components Plant 1 (“Wellington Plant 1”) |

| · | Whirlaway Corporation, Wellington, Ohio Metal Components Plant 2 (“Wellington Plant 2”) |

| · | Whirlaway Corporation, Hamilton, Ohio Metal Components Plant (“Hamilton Plant”) |

| · | Whirlaway Corporation, Tempe, Arizona Metal Components Plant, formerly known as Triumph LLC (“Tempe Plant”) |

Financial information about the segments is set forth in Note 13 of the Notes to Consolidated Financial Statements.

Recent Developments

On November 30, 2006, we purchased 100% of the stock of Whirlaway Corporation from its sole shareholder for approximately $45.6$43.0 million. Whirlaway manufactures precision metal components for the automotive and industrial end markets. Whirlaway operates three manufacturing plants in Ohio and one in Arizona.

In January 2007, we entered into a two year suppliersupply agreement with Schaeffler Group, (INA)our second largest customer, effective as of July 1, 2006 that replaced the agreement that expired on June 30, 2006.

In February 2006, we reached an informal agreement in principle to extend our supply agreementMay 2007, a new multi-year contract was signed with AB SKF, (“SKF”) until the end of 2006. The agreement would have expired on July 31, 2006. SKF is a global bearing manufacturer and our largest customer. We are currentlycustomer, to supply precision balls in discussionsEurope with SKFterms retroactive to formally extend the agreement through the end of 2009January 1, 2007 and expect conclusion during the first half of 2007.effective until December 31, 2009.

On October 7, 2005, we entered into an agreement with SNR Roulements (“SNR”) to purchase SNR’s entire internal precision ball producing equipment for approximately 5.2 million Euros ($6.2 million). SNR a division of Renault SA, France, is a global bearing manufacturer and supplier to the automotive, industrial and aerospace industries. As part of the transaction, we received a three -yearthree-year supply agreement for the present business existing at the time of the acquisition (approximately $8.0 million)million in annual revenue) and a five-year supply agreement to provide SNR with its annual ball requirements of theits former in-house production of approximately(approximately $9.0 million. The product will be supplied from our European existing precision ball operations.million in annual revenue).

During 2004, we formed a wholly owned subsidiary, NN Precision Bearing Products Company Co., Ltd, (“NN Asia)”. This subsidiary, which began production of precision balls during the fourth quarter of 2005, is located in the Kunshan Economic and Technology Development Zone, Jiangsu, The People’s Republic of China and is a component of our strategy to globally expand our manufacturing base. The costs incurred as a result of this start-up are included in our Metal Bearing Components Segment during the years ended December 31, 2005 and 2004.

Corporate Information

NN, originally organized in October 1980, is incorporated in Delaware. Our principal executive offices are located at 2000 Waters Edge Drive, Johnson City, Tennessee, and our telephone number is (423) 743-9151. Our web site address is www.nnbr.com. Information contained on our web site is not part of this Annual Report. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and related amendments thereto are available via a link to “SEC.gov” on our web site under “Investor Relations.”

Products

Metal Bearing Components Segment

Precision Steel Balls. At our Metal Bearing Components Segment facilities, we manufacture and sell high quality, precision steel balls in sizes ranging in diameter from 5/32 of an inch (3.969mm) to 2 ½ inches.inches (63.5mm). We produce and sell balls in grades ranging from grade 3 to grade 1000, according to international standards endorsed by the American Bearing Manufacturers Association. The grade number for a ball, in addition to defining allowable dimensional variation within production batches, indicates the degree of spherical precision of the ball; for example, grade 3 balls are manufactured to within three-millionths of an inch of roundness. Our steel balls are used primarily by manufacturers of anti-friction bearings where precise spherical, tolerance and surface finish accuracies are required. At the domestic locations, sales of steel balls accounted for approximately 80%77%, 87%,80% and 86%87% of net sales in 2007, 2006, 2005, and 20042005 respectively. At the European locations, sales of steel balls accounted for approximately 67%65%, 65%67%, and 68%65% of net sales in 2007, 2006 2005 and 2004,2005, respectively.

Steel Rollers. We manufacture tapered rollers at our Veenendaal Plant and cylindrical rollers at our Erwin Tennessee facility. Cylindrical rollers are normally defined by the combination of diameter and length.Plant. Most cylindrical rollers are made to specific customer requirements for diameter and length, so there is very little overlap of common cylindrical rollers matching two or more customers’ needs. The Company has experienced minimal roller product returns and does not have any customer acceptance clauses. Rollers are an alternative rolling element used instead of balls in anti-friction bearings that typically have heavier loading or different speed requirements. Our roller products are used primarily for applications similar to those of our precision steel ball product lines,line, plus certain non-bearing applications such as hydraulic pumps and motors. Cylindrical rollers accounted for approximately 4%, 4%, and 3% of net sales in each year of 2007, 2006, and 2005, and 2004, respectively. We manufacture tapered rollers at our Veenendaal, The Netherlands facility. These taperedTapered rollers are used in tapered roller bearings that are used in a variety of applications including automotive gearbox applications, automotive wheel bearings and a wide variety of industrial applications. Tapered rollers accounted for approximately 16%14%, 16% and 14%16% of net sales in 2007, 2006 2005 and 2004,2005, respectively.

Bearing Seals. AtMetal Retainers. We manufacture and sell precision metal retainers for ball and roller bearings used in a wide variety of industrial applications. Retainers are used to separate and space the rolling elements (balls or rollers) within a fully assembled bearing. We manufacture metal retainers at our Veenendaal Plant.

Plastic and Rubber Components Segment’sSegment

Bearing Seals. At our Danielson Connecticut facilities,Plant, we manufacture and sell a wide range of precision bearing seals produced through a variety of compression and injection molding processes and adhesion technologies to create rubber-to-metal bonded bearing seals. The seals are used in applications for automotive, industrial, agricultural, mining and aerospace markets.

Plastic Retainers.We manufacture and sell precision metal and plastic retainers for ball and roller bearings used in a wide variety of industrial applications. Retainers are used to separate and space the rolling elements (balls or rollers) within a fully assembled bearing. We manufacture plastic retainers at our Lubbock Texas facilities and metal retainers at our Veenendaal, The Netherlands facility.Plant.

Precision Plastic Components. Components. At our Plastic and Rubber Components Segment’s Lubbock Texas facilities,Plant, we also manufacture and sell a wide range of specialized plastic products including automotive under-the-hood components, electronic instrument cases and precision electronic connectors and lenses, as well as a variety of other specialized parts.

Precision Metal Components Segment

Precision Metal Components. Beginning with the purchase of Whirlaway Corporation on November 30, 2006, we began to sell a wide range of precision metal components. These components are manufactured at the three Whirlaway plants in Ohio and theone plant in Arizona. The precision metal components offered include fluid control components, fluid control assemblies, shafts, and other precision metal parts. The components are used in the following end markets: automotive brake/chassis, thermal air conditioning systems, commercial refrigeration, automotive engine, diesel engine fuel systems, other automotive, and other industrial applications.

Research and Development.

The amounts spent on research and development activities by us during each of the last three fiscal years are not material. Amounts spent areWe expensed amounts as incurred.

Customers

Our bearing component products are supplied primarily to bearing manufacturers for use in a broad range of industrial applications, including transportation, electrical, agricultural, construction, machinery, mining and aerospace. Additionally, we supply precision metal, rubber, and plastic components to automotive and industrial companies that are not used in bearing assemblies. We supply over 400approximately 500 customers; however, our top 10 customers account for approximately 81%75% of our revenue. Only twoone of these customers, SKF, and Schaeffler Group (INA), had sales levels that were 10% or greater of total net sales. In 2006, 30%2007, 33% of our products were sold to customers in North America, 59%51% to customers in Europe, and the remaining 11%16% to customers located throughout the rest of the world, primarily Asia.Asia and Latin America. Sales to various U.S. and foreign divisions of SKF accounted for approximately 46%40% of net sales in 2006 and sales to Schaeffler Group (INA) accounted for approximately 11% of net sales in 2006. None of our other customers accounted for more than 10% of our net sales in 2006.2007.

Certain customers have contracted to purchase all or a majority of their bearing component requirements from us, although only a few are contractually obligated to purchase any specific amounts. Certain agreements are in effect with some of our largest customers, which provide for targeted, annual price adjustmentsprices that may be offset by material cost fluctuations. We ordinarily ship our products directly to customers within 60 days, and in some cases, during the same calendar month, of the date on which a sales order is placed. Accordingly, we generally have an insignificant amount of open (backlog) orders from customers at month end. At the U.S. operations of our Metal Bearings Component Segment, we maintain a computerized, bar coded inventory management system with many of our major customers that enables us to determine on a day-to-day basis the amount of these components remaining in a customer’s inventory. When such inventories fall below certain levels, shipment of additional product is automatically triggered.shipped.

In 2006, the original six-year supply agreements for precision steel balls with SKF and Schaeffler Group (INA) expired. Prior to 2006, Schaeffler Group (INA) decided to in-source approximately one third of annual volume to its internal ball manufacturing facility in Germany, which during 2005 and 2006 resulted in a $9.0 million reduction in sales to Schaeffler Group (INA), or about 20% of our business with Schaeffler Group (INA). In January 2007, we entered into a new two-year agreement with Schaeffler Group (INA) effective as of July 1, 2006 providing for sales levels consistent with the indicated reduction in sales. A2006. In May 2007, a new multi-year formal agreementcontract was signed with SKF has not yet been signed. Into supply precision balls in Europe we continue to sell to SKF under an informal agreement matching thewith terms of the expired agreement. A new contract is still being negotiated and expected to be finalized in the first half of 2007, the terms of which will be retroactiveretroactively applied to January 1, 2007.2007 and effective until December 31, 2009.

In 2003, Veenendaalwe entered into a five-year supply agreement with SKF providing for the purchase of steel rollers and metal retainers manufactured at our Veenendaal facilityPlant in amounts and at prices that are subject to adjustment on an annual basis. The agreement contains provisions obligating Veenendaalus to maintain specified quality standards and comply with various ordering and delivery procedures, as well as other customary provisions. This agreement expires during 2008.2008 and we are in the process of negotiating a new multi-year agreement with SKF covering tapered rollers and metal retainers.

During 2006,2007, the Metal Bearing Components Segment sold products to more than 350approximately 400 customers located in 33 different countries. Approximately 88%89% of the net sales in 20062007 were to customers outside the United States. Approximately 71% of net sales in 20062007 were to customers within Europe. Sales to the top ten customers accounted for approximately 88%82% of the net sales in 2006.2007. Sales to SKF and Schaeffler Group (INA) accounted for approximately 55% and 13% of net sales of the segment in 2006, respectively. Sales to SKF and Schaeffler Group (INA) in Europe are made pursuant to the terms of supply agreements.2007.

During 2006,2007, the Plastic and Rubber Components Segment sold its products to over 70 customers located principally in 10 different countries.North America. Approximately 23%22% of the Plastic and Rubber Components SegmentSegment’s net sales were to customers outside the United States, almost all to customers in Mexico and Canada. Sales to the Segment’s top ten customers accounted for approximately 74% of the Segment’s net sales in 2007.

During 2007, the Precision Metal Components Segment sold its products to 16 customers located in 7 countries. Approximately 95% of all sales were to customers located within the United States. Sales to the segment’s top ten customers accounted for approximately 76%88% of the segment’s net sales in 2006.2007.

In both the foreign and domestic markets, the Companywe principally sells itssell our products directly to manufacturers and doesdo not sell significant amounts through distributors or dealers.

See Note 13 of the Notes to Consolidated Financial Statements and “Management’s"Management's Discussion and Analysis of Financial Condition and Results of Operations -- Results of Operations”Operations" for additional segmentSegment financial information.

The following table presents a breakdown of our net sales for fiscal years 2007, 2006 2005 and 2004:2005:

(In Thousands) | | 2007 | 2006 | 2005 |

| | 2006 | 2005 | 2004 | |

| | | |

| Metal Bearing Components Segment | $272,299 | $ 263,485 | $ 252,365 | $ 303,059 | $ 272,299 | $ 263,485 |

| Percentage of Total Sales | 82.4% | 82.0% | 83.0% | 72.0% | 82.4% | 82.0% |

| | | |

| Precision Metal Components Segment | 4,722 | -- | -- | 67,384 | 4,722 | -- |

| Percentage of Total Sales | 1.4% | -- | -- | 16.0% | 1.4% | -- |

| | | |

| Plastic and Rubber Components Segment | 53,304 | 57,902 | 51,724 | 50,851 | 53,304 | 57,902 |

| Percentage of Total Sales | 16.2% | 18.0% | 17.0% | 12.0% | 16.2% | 18.0% |

| | | |

| Total | $ 330,325 | $ 321,387 | $ 304,089 | $ 421,294 | $ 330,325 | $ 321,387 |

| | | |

Percentage of Total Sales | 100% | 100% |

The increase in value of Euro denominated sales resulted in net sales increasing $19.6 million in 2007 and $1.6 million in 2006 when converted to U.S. Dollars.

The Precision Metal Components Segment contains only one month of revenue in 2006. Based on pro-forma results, 2006 revenues would have been $77,713 or 19% of the total pro-forma sales. (See Note 2 of the Notes to Consolidated Financial Statements)

Sales and Marketing

A primary emphasis of our marketing strategy is to expand key customer relationships by offering high quality, high precision products with the value of a single supply chain partner for a wide variety of components. As a result, we have progressed toward integrating our sales organization on a global basis across all of our product lines. Within the Metal BearingsBearing Components Segment, our global sales organization includes eleven11 direct sales and fourteen15 customer service representatives. Due to the technical nature of many of our products, our engineers and manufacturing management personnel also provide technical sales support functions, while internal sales employees handle customer orders and other general sales support activities. For the Precision Metal Components Segment, the current sales structure consists of utilizing manufacturers’ representatives at key accounts supported by senior segment management and engineering involvement.

Ourbearing component Metal Bearing Component Segment marketing strategy focuses on increasing our outsourcing relationships with global bearing manufacturers that maintain captive bearing component manufacturing operations. Our marketing strategy for our precision plastic productsthe Plastic and precision metal componentsRubber Components Segment and the Precision Metal Components Segment is to offer custom manufactured, high quality, precision parts to niche markets with high value-added characteristics at competitive price levels. This strategy focuses on relationships with key customers that require the production of technically difficult parts and assemblies, enabling us to take advantage of our strengths in custom product development, tool design, and precision molding and machining processes.

Our arrangements with our domestic customers typically provide that payments are due within 30 days following the date of shipment of goods. With respect to foreign customers of our domestic business, payments generally are due within 90 to 120 days following the date of shipment in order to allow for additional freight time and customs clearance. For some customers that participate in our inventory management program, sales are recorded when the customer uses the product. See “Business"Business -- Customers”Customers" and “Management’s"Management's Discussion and Analysis of Financial Condition and Results of Operations -- Liquidity and Capital Resources.”"

Manufacturing Process

We have become a leading independent bearing component manufacturer through exceptional service and high quality manufacturing processes and are recognized throughout the industry as a low-cost producer. Because our ball and roller manufacturing processes incorporate the use of standardized tooling, load sizes, and process technology, we are able to produce large volumes of products while maintaining high quality standards.

The key to our low-cost, high quality production of seals and retainers is the incorporation of customized engineering into our manufacturing processes, metal to rubber bonding competency and experience with a broad range of engineered resins. This design process includes the testing and quality assessment of each product.

TheWithin the precision metal components industry continues to be challenged by rapid globalization. Our company iswe are well positioned in the marketplacemarket place by virtue of our focus on critical components and assemblies for highly engineered mechanical systems used in various durable goods.

Employees

As of December 31, 2006,2007, we employed a total of 2,2492,223 full-time employees. Our Metal Bearing Components Segment employed 282 workers283 in the U.S., 951 workers975 in Europe, and 54 workers80 in China, our Plastic and Rubber Components Segment employed 381 workers, and343, all in the U.S., our Precision Metal Components Segment employed 534, all in the U.S. In addition, there were 98 employees at the Company’sour corporate headquarters. Additionally on November 30, 2006, we added 572 full-time employees with the acquisition of Whirlaway. Of our total employment, 16%17% are management/staff employees and 84%83% are production employees. We believe we are able to attract and retain high quality employees because of our quality reputation, technical expertise, history of financial and operating stability, attractive employee benefit programs, and our progressive, employee-friendly working environment. The employees in the Eltmann Germany,Plant, Pinerolo Italy,Plant and Veenendaal The Netherlands plantsPlant are unionized. We have stronggood labor relations, and the Company haswe have never experienced any significant involuntary work stoppages. We consider our relations with our employees worldwide to be excellent.

We are currently in negotiationssigned a new agreement with the union representatives of our workers at our Eltmann Germany facilityPlant for significant contract revisions including loweringnew wage rates and increasingincreased working hours worked per week. We expect the negotiations to be complete in 2007.during February 2008.

Competition

The precision ball and roller and metal retainer industryMetal Bearing Components Segment of our business is intensely competitive. Our primary domestic competitor is Hoover Precision Products, Inc., a wholly owned USU.S. subsidiary of Tsubakimoto Precision Products Co. Ltd. Our primary foreign competitors are Amatsuji Steel Ball Manufacturing Company, Ltd. (Japan), a wholly owed division of NSK, and Tsubakimoto Precision Products Co. Ltd (Japan) and Jingsu General Ball and Roller (China.)(China).

We believe that competition within the precision ball, roller and metal retainer marketsMetal Bearing Components Segment is based principally on quality, price and the ability to consistently meet customer delivery requirements. Management believes that our competitive strengths are our precision manufacturing capabilities, our wide product assortment, offering capabilities, our reputation for consistent quality and reliability, and the productivity of our workforce.

The markets for the Plastic and Rubber Components Segment’s products are also intensely competitive. Since the plastic injection molding industry is currently very fragmented, IMCwe must compete with numerous companies in each of its marketing segments. Many of these companies have substantially greater financial resources than we do and many currently offer competing products nationally and internationally. IMC’sOur primary competitor in the plastic bearing retainer segment is Nakanishi Manufacturing Corporation. Domestically, Nypro, Inc. and Key Plastics are among the main competitors in the automotive market.

We believe that competition within the plastic injection molding industry is based principally on quality, price, design capabilities and speed of responsiveness and delivery. Management believes that IMC’sour competitive strengths are product development, tool design, fabrication, and tight tolerance molding processes. With these strengths, IMC haswe have built itsour reputation in the marketplace as a quality producer of technically difficult products.

While intensely competitive, the markets for Delta’sour rubber seal products are less fragmented than IMC’s.its plastic injection molding products. The bearing seal market is comprised of approximately six major competitors that range from small privately held companies to Fortune 500large global enterprises. Bearing seal manufacturers compete on design, service, quality and price. Delta’sOur primary competitors in the United StatesU.S. bearing seal market are Freudenburg-NOK, Chicago Rawhide Industries (an SKF subsidiary), Trostel, and Uchiyama.

In the Precision Metal Components Segment market, internal production of components by our customers can impact our business as the customers weigh the risk of outsourcing strategically critical components or producing them in-house. Our primary competitors are Linamar (Canada), Stanadyne, A. Berger, C&A Tool, American Turned Products Autocam and FCMP.Autocam. We generally win new business on the basis of our technical competence and our proven track record of successful product development.

Raw Materials

The primary raw material used in our core ball and roller business of the Metal Bearing Components Segment is 52100 Steel, which is high quality chromium steel. During 2006,2007, approximately 90% of the steel used by the segment was 52100 Steel in rod and wire form. Our other steel requirements include metal strips,strip, chrome rod and wire, and type S2 rock bit steel.

The Metal Bearing Components Segment locations purchase substantially all of their 52100 Steel requirements from mills in Europe and Japan and all of their metal stripsstrip requirements from European mills and traders. The principal suppliers of 52100 Steel in the U.S. are Daido Steel Inc. (America), Kobe Steel, America, Lucchini USA Inc. (affiliate of Ascometal France) and Ohio Star Forge Co. The principal supplier of 52100 Steel in Europe is Ascometal France (See Note 16 of the Notes to Consolidated Financial Statements), while the principal supplier of metal stripsstrip is Thyssen. Our other steel requirements are purchased principally from foreign steel manufacturers. There are a limited number of suppliers of the 52100 Steel that we use. We believe that if any of our current suppliers were unable to supply 52100 Steel to us, we would be able to obtain our 52100 Steel requirements from alternate sources. We are unable, however, to provide assurances that we would not face higher costs or production interruptions as a result of obtaining 52100 Steel from alternate sources.

We purchase steel on the basis of price and, more significantly, composition and quality. The pricing arrangements with our suppliers are typically subject to adjustment every three to six months in the U.S. and contractually adjusted on an annual basis within the European locations.locations for the base steel price and quarterly for surcharge adjustments for precision steel balls. In general, we do not enter into written supply agreements with suppliers or commit to maintain minimum monthly purchases of steel except for the supply arrangements between Ascometal and our Metal Bearing Components Segment (see Note 16 of the Notes to Consolidated Financial Statements).

Because 52100 Steel is principally produced by foreign manufacturers, the Company’sour operating results would be negatively affected in the event that the U.S. or European governments impose any significant quotas, tariffs or other duties or restrictions on the import of such steel, if the U.S. dollarDollar decreases in value relative to foreign currencies or if supplies available to us would significantly decrease. The relatively weak USU.S. Dollar is a factor for steel price increases since the suppliers’suppliers' base currencies are the Euro and Japanese Yen.

The price of steel stabilized during 2006. Previously our business wasMetal Bearing Components Segment is affected by upward price pressure on steel principally due to general increases in global demand and, more recently, due to China’s increased consumption of steel. This had thehas an impact of increasing steel prices we paidpay in procuring our steel in the form of higher unit prices and scrap surcharges. Our contracts with key customers allow us to pass a majority of thealong steel price increases on to those customers. However, for our European locations, material price changes are typically passed along with price adjustments in January of the following year. Starting in 2007, scrap surcharge inflation, a component of raw material cost, can be passed through quarterly. Until increases can be passed through to our customers, income from operations, net income and cash flow from operations can be adversely affected.as incurred.

For the Plastic and Rubber Components Segment, we base purchase decisions on price, quality and service. Generally, we do not enter into written supply contracts with our suppliers or commit to maintain minimum monthly purchases of resins.resins or rubber compounds. The pricing arrangements with our suppliers typically can be adjusted at anytime.

The primary raw materials used by IMCthe Plastic and Rubber Components Segment are engineering resins. Injectionengineered resins, injection grade nylon is utilized in bearing retainers, gears, automotive and other industrial products.proprietary rubber compounds. We purchase substantially all of our resin requirements from domestic manufacturers and suppliers. The majority of these suppliers are international companies with resin manufacutringmanufacturing facilities located throughout the world.

Delta uses We use certified vendors to provide a custom mix of proprietary rubber compounds. DeltaThis Segment also procures metal stampings from several domestic suppliers.

The Precision Metal Components Segment produces products from a wide variety of metals in various forms from various sources. Basic types include HRS, CRS,hot rolled steel, cold rolled steel, (both carbon and alloy) Stainless, Extruded Aluminum, Diecast Aluminum, Graystainless, extruded aluminum, diecast aluminum, gray and Ductile Iron Castings,ductile iron castings, and mechanical tubing. Some material is purchased directly under customer global contracts, some is consigned by the customer, and some is purchased directly from a mill.

Patents, Trademarks and Licenses

We do not own any U.S. or foreign patents, trademarks or licenses that are material to our business. We do rely on certain data and processes, including trade secrets and know-how, and the success of our business depends, to some extent, on such information remaining confidential. Each executive officer is subject to a non-competition and confidentiality agreement that seeks to protect this information.

Seasonal Nature of Business

Historically, due to a substantial portion of sales to European customers, seasonality has been a factor for our business in that some European customers typically reduce their production activities during the month of August.

Environmental Compliance

Our operations and products are subject to extensive federal, state and local regulatory requirements both domestically and abroad relating to pollution control and protection of the environment. We maintain a compliance program to assist in preventing and, if necessary, correcting environmental problems. TheIn the Metal Bearing Components Segment plants inthe Eltmann Germany;Plant, Kilkenny Ireland;Plant, and Pinerolo ItalyPlant are ISO 14000 certified and received the EPD (Environmental Product Declaration.) The Veenendaal The Netherlands plantPlant is also ISO 14000 certified. Based on information compiled to date, management believes that our current operations are in substantial compliance with applicable environmental laws and regulations, the violation of which would have a material adverse effect on our business and financial condition. The Company hasWe have assessed conditional asset retirement obligations and have found them to be immaterial to the consolidated financial statements. There can be no assurance,We cannot assure you, however, that currently unknown matters, new laws and regulations, or stricter interpretations of existing laws and regulations will not materially affect our business or operations in the future. More specifically, although we believe that we dispose of wastes in material compliance with applicable environmental laws and regulations, there can be no assurancewe cannot assure you that we will not incur significant liabilities in the future in connection with the clean-up of waste disposal sites. The Company maintainsWe maintain long-term environmental insurance covering the four manufacturing locations purchased with the Whirlaway acquisition.

Executive Officers of the Registrant

Our executive officers are:

Name | Age | Position |

| | | |

| Roderick R. Baty | 5354 | Chairman of the Board, Chief Executive Officer President and DirectorPresident |

| Frank T. Gentry, III | 5152 | Vice President -– General Manager U.S. Ball and Roller Division |

| Robert R. Sams | 4950 | Vice President -– Sales |

| James H. Dorton | 5051 | Vice President -– Corporate Development and Chief Financial Officer |

| William C. Kelly, Jr. | 4849 | Vice President -– Chief Administrative Officer, Secretary, and Treasurer |

| Nicola Trombetti | 4647 | Vice President -– Managing Director of NN Europe |

| Thomas G. Zupan | 5152 | Vice President -– President of Whirlaway Corporation |

David M. GilsonJames Anderson | 4243 | Vice President - Global Marketing |

James Anderson | 42 | Vice President -– Plastic and Rubber DivisionComponents and Precision Metal Components Divisions |

Set forth below is certain additional information with respect to each of our executive officers.

Roderick R. Baty was elected Chairman of the Board in September 2001 and continues to serve as Chief Executive Officer and President. He has served as President and Chief Executive Officer since July 1997. He joined NN in July 1995 as Vice President and Chief Financial Officer and was elected to the Board of Directors in 1995. Prior to joining NN, Mr. Baty served as President and Chief Operating Officer of Hoover Precision Products from 1990 until January 1995, and as Vice President and General Manager of Hoover Group from 1985 to 1990.

Frank T. Gentry, III, was appointed Vice President -– General Manager U.S. Ball and Roller Division in August 1995. Mr. Gentry joined NN in 1981 and held various manufacturing management positions within NN from 1981 to August 1995.

Robert R. Sams joined NN in 1996 as Plant Manager of the Mountain City, Tennessee facility. In 1997, Mr. Sams served as Managing Director of the Kilkenny facility and in 1999 was elected to the position of Vice President -– Sales. Prior to joining NN, Mr. Sams held various positions with Hoover Precision Products from 1980 to 1994 and as Vice President of Production for Blum, Inc. from 1994 to 1996.

James H. Dorton joined NN as Vice President of Corporate Development and Chief Financial Officer in June 2005. Prior to joining NN, Mr. Dorton served as Executive Vice President and Chief Financial Officer of Specialty Foods Group, Inc. from 2003 to 2004, Vice President Corporate Development and Strategy and Vice President -– Treasurer of Bowater Incorporated from 1996 to 2002 and as Treasurer of Intergraph Corporation from 1989 to 1996. Mr. Dorton is a Certified Public Accountant.

William C. Kelly, Jr. was named Vice President and Chief Administrative Officer in June 2005. In March 2003, Mr. Kelly was elected to serve as Chief Administrative Officer. In March 1999, he was elected Secretary of NN and still serves in that capacity as well as that of Treasurer. In February 1995, Mr. Kelly was elected Treasurer and Assistant Secretary. He joined NN in 1993 as Assistant Treasurer and Manager of Investor Relations. In July 1994, Mr. Kelly was elected to serve as NN’s Chief Accounting Officer, and served in that capacity through March 2003. Prior to joining NN, Mr. Kelly served from 1988 to 1993 as a Staff Accountant and as a Senior Auditor with the accounting firm of Price Waterhouse, LLP.

Nicola Trombetti was elected NN Europe Managing Director in June 2004 and was elected a Corporate Vice President in June 2005. Prior to being named NN Europe Managing Director he was Vice President and Director of Operations, NN Europe. He joined NN in September 2000 as Pinerolo Italy Plant Manager. Prior to joining NN Europe, Mr. Trombetti was Plant Director for Tekfor - Neumaier GmbH Group, a European-based steel component manufacturer for the auto industry. From 1996 to 1999 he was Manufacturing Manager and Plant Manager for SKF Group. He also spent seven years as a manufacturing manager for Pininfarina, an Italian-based car design, engineering, development and manufacturing company.

Thomas G. Zupan co-founded Whirlaway Corporation in 1973 with his father and began his career as a toolmaker. He gained further experience in every line business function including Engineering, Production Operations, Quality Assurance, H/R, Sales, Material Control, IS, and Finance as the company grew from owner operator to professionally managed. In 1991, Mr. Zupan became CEO and sole shareholder of Whirlaway Corporation.Whirlaway. Upon the sale of Whirlaway Corporation to NN November 30, 2006 Mr. Zupan was appointed Vice President - President of Whirlaway Corporation.

David M. Gilson joined NN in October 2006 as Vice President-Global Marketing. Prior to joining NN, Mr. Gilson held a variety of management positions for Ashland Specialty Chemical Company, a division of Ashland Inc. These positions included Business Manager, Ashland Chemical de Mexico, from 2000 until 2003, and Global Marketing Manager, from 2003 to 2006.

JamesJames. O. Anderson was appointed Vice President - PlasticsPresident-Plastics and Rubber Division in October 2006. In November, 2007, Mr. Anderson received additional responsibility for the Precision Metal Components Division in addition to the Plastic and Rubber Components Division. Mr. Anderson joined NN in January 2005 and served as the General Manager of Industrial Molding Corporation in Lubbock, Texas. Prior to joining NN, Mr. Anderson served for six years in the U. S.U.S. Army as an artillery officer and worked in various manufacturing roles with Dana Corporation and Accuma Corporation from 1996 to 2005.

Item 1A. Risk Factors

Cautionary Statements for Purposes of the “Safe Harbor”"Safe Harbor" Provisions of the Private Securities Litigation Reform Act of 1995

The Company wishesWe wish to caution readers that this report contains, and our future filings, by the Company, press releases and oral statements made by the Company’sour authorized representatives may contain, forward-looking statements that involve certain risks and uncertainties. Readers can identify these forward-looking statements by the use of such verbs as expects, anticipates, believes or similar verbs or conjugations of such verbs. The Company’sOur actual results could differ materially from those expressed in such forward-looking statements due to important factors bearing on the Company’sour business, many of which already have been discussed in this filing and in the Company’sour prior filings. The differences could be caused by a number of factors or combination of factors including, but not limited to, the risk factors described below.

You should carefully consider the following risks and uncertainties, and all other information contained in or incorporated by reference in this annual report on Form 10-K, before making an investment in our common stock. Any of the following risks could have a material adverse effect on our business, financial condition or operating results. In such case, the trading price of our common stock could decline and you may lose all or part of your investment.

The demand for our products is cyclical, which could adversely impact our revenues.

The end markets for fully assembled bearings and other industrial and automotive components are cyclical and tend to decline in response to overall declines in industrial and automotive production. As a result, the market for bearing components and precision metal, plastic, and rubber products is also cyclical and impacted by overall levels of industrial and automotive production. Our sales in the past have been negatively affected, and in the future will be negatively affected, by adverse conditions in the industrial and/or automotive production sectors of the economy or by adverse global or national economic conditions generally.

We depend on a very limited number of foreign sources for our primary raw material and are subject to risks of shortages and price fluctuation.

The steel that we use to manufacture precision balls and rollersour metal bearing components is of an extremely high quality and is available from a limited number of producers on a global basis. Due to quality constraints in the U.S. steel industry, we obtain substantially all of the steel used in our U.S. operations from overseas suppliers. In addition, we obtain most of the steel used in our European operations from a single European source. If we had to obtain steel from sources other than our current suppliers we could face higher prices and transportation costs, increased duties or taxes, and shortages of steel. Problems in obtaining steel, and particularly 52100 chrome steel, in the quantities that we require and on commercially reasonable terms, could increase our costs, adversely impacting our ability to operate our business efficiently and have a material adverse effect on our revenues and operating and financial results.

Increases in the market demand for steel can have the impact of increasing scrap surcharges we pay in procuring our steel in the form of higher unit prices and could adversely impact the availability of steel. Our contracts with key customers allow us to pass a majority of thealong steel price increases on to those customers. However, by contract, material price changes in any given year at our European operations are typically passed along with price adjustments in January of the following year. Until the current increases can be passed through to our customers, income from operations, net income and cash flow from operations can be adversely affected.as incurred.

We depend heavily on a relatively limited number of customers, and the loss of any major customer would have a material adverse effect on our business.

Sales to various U.S. and foreign divisions of SKF, which is one of the largest bearing manufacturers in the world, accounted for approximately 46%40% of consolidated net sales in 2006, and sales to Schaeffler Group (INA) accounted for approximately 11% of consolidated net sales in 2006. During 2006, our ten largest customers accounted for approximately 81% of our consolidated net sales.2007. No other customers accounted for more than 10% of sales. During 2007, our ten largest customers accounted for approximately 75% of our consolidated net sales. The loss of all or a substantial portion of sales to these customers would cause us to lose a substantial portion of our revenue and would lower our operating profit margin and cash flows from operations.

We operate in and sell products to customers outside the U.S. and are subject to several related risks.

Because we obtain a majority of our raw materials from overseas suppliers, actively participate in overseas manufacturing operations and sell to a large number of international customers, we face risks associated with the following:

| · | high tax rates that discourage the repatriation of funds to the U.S.; |

| · | the imposition of import or other duties or taxes; and |

| · | unstable governments or legal systems in countries in which our suppliers, manufacturing operations, and customers are located. |

We do not have a hedging program in place associated with consolidating the operating results of our foreign businesses into U.S. dollars.Dollars. An increase in the value of the U.S. dollarDollar and/or the Euro relative to other currencies may adversely affect our ability to compete with our foreign-based competitors for international, as well as domestic, sales. Also, a decline in the value of the Euro relative to the U.S. dollarDollar will negatively impact our consolidated financial results, which are denominated in U.S. dollars.Dollars.

In addition, due to the typical slower summer manufacturing season in Europe, we expect that revenues in the third fiscal quarter of each year will reflect lower sales than in the other quarters of the year.

Failure of our product could result in a product recall

The majority of our products go into bearings used in the automotive industry and other critical industrial manufacturing applications. A failure of our components could lead to a product recall. If a recall were to happen as a result of our components failing, we could bear a substantial part of the cost of correction. In addition to the cost of fixing the parts affected by the component, a recall could result in the loss of a portion of or all of customers’ business. To partially mitigate this risk, we carry some product recall insurance and have invested heavily in TS16949 and QS9000 quality programs.

The costs and difficulties of integrating acquired business could impede our future growth.

We cannot assure you that any future acquisition will enhance our financial performance. Acquiring companies involves inherent risk in the areas of environmental and legal issues, information technology, cultural and regulatory matters, product/supplier issues, and financial risk. Our ability to effectively integrate any future acquisitions will depend on, among other things, the adequacy of our implementation plans, the ability of our management to oversee and operate effectively the combined operations and our ability to achieve desired operating efficiencies and sales goals. The integration of any acquired businesses might cause us to incur unforeseen costs, which would lower our profit margin and future earnings and would prevent us from realizing the expected benefits of these acquisitions.

We may not be able to continue to make the acquisitions necessary for us to realize our future growth strategy.

Acquiring businesses that complement or expand our operations has been and continues to be an important element of our business strategy. This strategy calls for growth through acquisitions constituting the majority of our future growth objectives, with the remainder resulting from internal growth and increased market penetration. For recent acquisitions see Note 2 of the Notes to Consolidated Financial Statements. We cannot assure you that we will be successful in identifying attractive acquisition candidates or completing acquisitions on favorable terms in the future. In addition, we may borrow funds to acquire other businesses, increasing our interest expense and debt levels. Our inability to acquire businesses, or to operate them profitably once acquired, could have a material adverse effect on our business, financial position, results of operations and cash flows.

Our growth strategy depends in part on outsourcing, and if the industry trend toward outsourcing does not continue, our business could be adversely affected.

Our growth strategy depends in part on major bearing manufacturers continuing to outsource components, and expanding the number of components being outsourced. This requires manufacturers to depart significantly from their traditional methods of operations. If major bearing manufacturers do not continue to expand outsourcing efforts or determine to reduce their use of outsourcing, our ability to grow our business could be materially adversely affected.

Our market is highly competitive and many of our competitors have significant advantages that could adversely affect our business.

The global markets for bearing components, precision metal and precision plastic parts are highly competitive, with a majority of production represented by the captive production operations of certain large bearing manufacturers and the balance represented by independent manufacturers. Captive manufacturers make components for internal use and for sale to third parties. All of the captive manufacturers, and many independent manufacturers, are significantly larger and have greater resources than do we. Our competitors are continuously exploring and implementing improvements in technology and manufacturing processes in order to improve product quality, and our ability to remain competitive will depend, among other things, on whether we are able to keep pace with such quality improvements in a cost effective manner.

The production capacity we have added over the last several years has at times resulted in our having more capacity than we need, causing our operating costs to be higher than expected.

We have expanded our metal bearing components production facilities and capacity over the last several years. Our metal bearing component production facilities have not always operated at full capacity, and from time to time our results of operations have been adversely affected by the under-utilization of our production facilities. Under-utilization or inefficient utilization of our production facilities could be a risk in the future. We have recently undertaken steps to address a portion of the capacity risk. See Note 3 of the Notes to the Consolidated Financial Statements.

The price of our common stock may be volatile.

The market price of our common stock could be subject to significant fluctuations and may decline. Among the factors that could affect our stock price are:

| · | our operating and financial performance and prospects; |

11

| · | quarterly variations in the rate of growth of our financial indicators, such as earnings per share, net income and revenues; |

domestic and international economic, legal and regulatory factors unrelated to our performance; and

The| · | changes in revenue or earnings estimates or publication of research reports by analysts; |

| · | loss of any member of our senior management team; |

| · | speculation in the press or investment community; |

| · | strategic actions by us or our competitors, such as acquisitions or restructurings; |

| · | sales of our common stock by stockholders; |

| · | general market conditions; |

| · | domestic and international economic, legal and regulatory factors unrelated to our performance; and |

| · | loss of a major customer. |

The stock markets in general have experienced extreme volatility that has often been unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common stock. In addition, due to the market capitalization of our stock (less than $200 million), our stock tends to be more volatile than large capitalization stocks that comprise the Dow Jones Industrial Average or Standard and Poor’s 500 Index.

Provisions in our charter documents and Delaware law may inhibit a takeover, which could adversely affect the value of our common stock.

Our certificate of incorporation and bylaws, as well as Delaware corporate law, contain provisions that could delay or prevent a change of control or changes in our management that a stockholder might consider favorable and may prevent you from receiving a takeover premium for your shares. These provisions include, for example, a classified board of directors and the authorization of our board of directors to issue up to 5,000,000 preferred shares without a stockholder vote. In addition, our restated certificate of incorporation provides that stockholders may not call a special meeting.

We are a Delaware corporation subject to the provisions of Section 203 of the Delaware General Corporation Law, an anti-takeover law. Generally, this statute prohibits a publicly-held Delaware corporation from engaging in a business combination with an interested stockholder for a period of three years after the date of the transaction in which such person became an interested stockholder, unless the business combination is approved in a prescribed manner. A business combination includes a merger, asset sale or other transaction resulting in a financial benefit to the stockholder. We anticipate that the provisions of Section 203 may encourage parties interested in acquiring us to negotiate in advance with our board of directors, because the stockholder approval requirement would be avoided if a majority of the directors then in office approve either the business combination or the transaction that results in the stockholder becoming an interested stockholder.

These provisions apply even if the offer may be considered beneficial by some of our stockholders. If a change of control or change in management is delayed or prevented, the market price of our common stock could decline.

Item 1B. Unresolved Staff Comments

None

Item 2. Properties

Metal Bearing Components

The Metal Bearing Components Segment has eight manufacturing locations aroundplants for each of the world. The segment has two manufacturing facilities locatedcompany's segments are listed below. In addition, the company leases a portion of a small office building in Erwin,Johnson City, Tennessee and Mountain City, Tennessee. The Erwin and Mountain City plants currently have approximately 125,000 and 86,500 square feet of manufacturing space, respectively. The Erwin plant is located on a 12 acre tract of land owned by the Company and the Mountain City plant is located on an eight acre tract of land owned by the Company.which serves as our corporate headquarters.

| Metal Bearing Components Segment | | |

| | | |

| Manufacturing Operation | Country | Sq. Feet | Owned or Leased |

| Erwin Plant | U.S.A. | 125,000 | Owned |

| Mountain City Plant | U.S.A. | 86,400 | Owned |

| Kilkenny Plant | Ireland | 125,000 | Owned |

| Eltmann Plant | Germany | 175,000 | Leased |

| Pinerolo Plant | Italy | 330,000 | Owned |

| Kysucke Plant | Slovakia | 135,000 | Owned |

| Veenendaal Plant | The Netherlands | 159,000 | Owned |

| Kunshan Plant | China | 110,000 | Leased |

The Metal Bearing Components Segment has five manufacturing facilities in Europe. These are located in Kilkenny, Ireland; Eltmann Germany; Pinerolo, Italy and Kysucke Nove Mesto, Slovakia and Veenendaal, The Netherlands. The facilities currently have approximately 125,000, 175,000, 330,000, 135,000, and 159,000 square feet of manufacturing space, respectively. All of the facilities are owned by the Company, except for the Eltmann facility whichPlant is leased from the Schaeffler Group, (INA).

which is also a customer. The production facility in the People's Republic of ChinaKunshan Plant lease is leased and accounted for as a capital lease. The Company haslease and we have an option to purchase the facility at various points in the future. The facility has approximately 110,000 square feet of production and office space and is located on approximately 5 acres.

| Plastic and Rubber Components Segment | | |

| | | |

| Manufacturing Operation | Country | Sq. Feet | Owned or Leased |

| Danielson Plant | U.S.A. | 50,000 | Owned |

| Lubbock Plant | U.S.A. | 228,000 | Owned |

| Precision Metal Components Segment | | |

| | | |

| Manufacturing Operation | Country | Sq. Feet | Owned or Leased |

| Wellington Plant 1 | U.S.A. | 86,000 | Leased |

| Wellington Plant 2 | U.S.A. | 132,000 | Leased |

| Hamilton Plant | U.S.A. | 19,000 | Owned |

| Tempe Plant | U.S.A. | 140,000 | Leased |

Plastics and Rubber Components

IMC manufacturesThe Wellington Plants are leased from a wide range of plastic molded products through two facilities located in Lubbock, Texas. The Slaton facility, located on a six and one half acre tract of land ownedcompany controlled by the Company, contains approximately 193,000 square feetformer owner of manufacturing, warehouse and office space. The Cedar facilityWhirlaway Corporation, who is situated on a two and one half acre tractcurrently an officer of land which is also owned by the Company and contains approximately 35,000 square feet of manufacturing and warehouse space.NN, Inc.

Delta’s operations are located in two facilities on a 12 acre site in Danielson, Connecticut, owned by the Company. The two facilities encompass over 50,000 square feet of rubber seal manufacturing and administrative functions.

Precision Metal Components

Whirlaway operates at four locations, three in Ohio and one in Arizona. Two of the Ohio plants are in Wellington, Ohio with 86,000 square feet on 8 acres and 132,000 square feet on 10 acres. The other Ohio plant is in the Cincinnati area and has 19,000 square feet on 2 acres. The Arizona plant is in Tempe with 140,000 square feet on 8 acres. All of the locations are leased except for the Cincinnati location which is owned. For more information, please see “Management’s"Management's Discussion and Analysis of Financial Condition and Results of Operations -- Liquidity and Capital Resources.”"

On March 20, 2006, we, as well as numerous other parties, received correspondence from the Environmental Protection Agency (“EPA”) requesting information regarding a former waste recycling vendor which we previously used by us.used. The vendor has since ceased operations and the EPA is investigating the clean up of the site or sites used by the vendor. We have contributed to an escrow fund along with 42 other potentially responsible parties for the purpose of investigating and addressing the environmental issues at the facility. Our contribution to the account was twenty-three thousand dollars. A Remedial Investigation and Risk Assessment report funded by the escrow fund was submitted to the EPA in December 2007. As of the date of this report, we do not know whether we have any liability beyond the contribution to the escrow account mentioned earlier, related to this vendor’s actions, or estimatable range for any potential liability. We believe our contribution to the remediation of the site, if any, would be approximately 1.083% or less of the volume of waste sent to the facility and we assert that our waste was non-hazardous.

On June 20, 2007, we, as well as numerous other parties, received correspondence from the New York State Department of Environmental Conservation notifying us that we have been named as a potentially responsible party for the potential clean up of a former waste recycling facility. As of the date of this report, we estimate our maximum exposure to be ten thousand dollars. The maximum exposure is based on the amount of gallons we sent to the waste facility multiplied by the proposed charge per gallon as determined by the potentially responsible parties.

All other legal matters are of an ordinary and routine nature and are incidental to the operations of the Company.our operations. Management believes that such proceedings should not, individually or in the aggregate, have a material adverse effect on the Company’sour business or financial condition or on the results of operations.

No matters were submitted for a vote of stockholders during the fourth quarter of 2006.

Part II2007.

Part II

Item 5. Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Since our initial public offering in 1994, ourthe common stock has been traded on The NASDAQ Stock Market LLC (NASDAQ)(“NASDAQ”) under the trading symbol “NNBR.” Prior to such time there was no established market for ourthe common stock. As of March 13, 2007,12, 2008, there were approximately 2,5002,100 holders of our common stock.the Common Stock.

The following table sets forth the high and low closing sales prices of the common stock, as reported by NASDAQ, and the dividends paid per share on the common stock during each calendar quarter of 20062007 and 2005.2006.

| | Close Price | | | Close Price | |

| | | High | Low | Dividend |

| 2007 | | |

| First Quarter | | $ 13.27 | $ 11.40 | $ 0.08 |

| Second Quarter | | 12.78 | 11.65 | 0.08 |

| Third Quarter | | 12.51 | 9.00 | 0.08 |

| Fourth Quarter | | 10.67 | 8.07 | 0.08 |

| | High | | Low | | Dividend | |

2006 | | | | | | |

| First Quarter | $ 13.12 | | $ 10.77 | | $ 0.08 | $ 13.12 | $ 10.77 | $ 0.08 |

Second Quarter | 13.53 | | 11.92 | | 0.08 | 13.53 | 11.92 | 0.08 |

Third Quarter | 13.29 | | 11.11 | | 0.08 | 13.29 | 11.11 | 0.08 |

Fourth Quarter | 12.76 | | 10.55 | | 0.08 | 12.76 | 10.55 | 0.08 |

| | | | | | | |

2005 | | | | | | |

First Quarter | $ 13.01 | | $ 10.70 | | $ 0.08 | |

Second Quarter | 13.12 | | 11.62 | | 0.08 | |

Third Quarter | 13.58 | | 11.38 | | 0.08 | |

Fourth Quarter | 11.96 | | 9.87 | | 0.08 | |

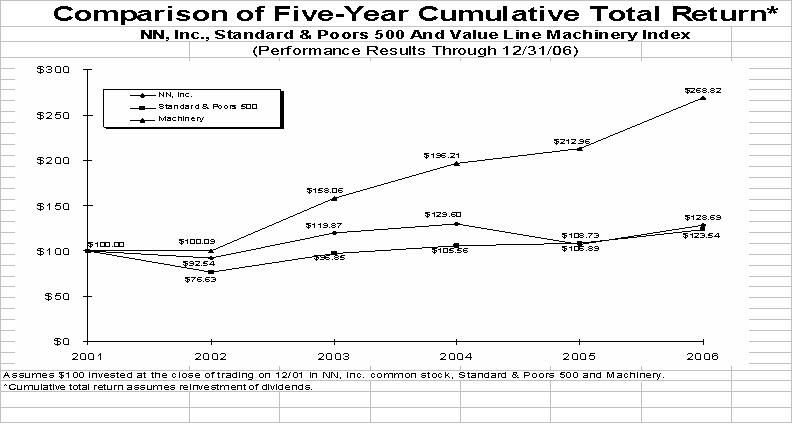

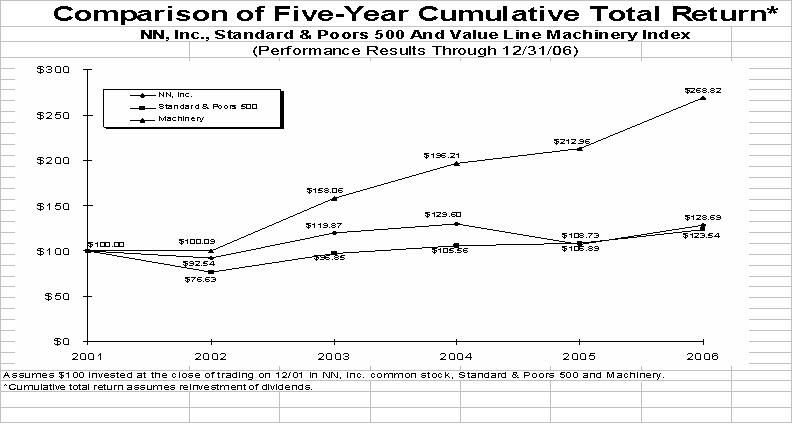

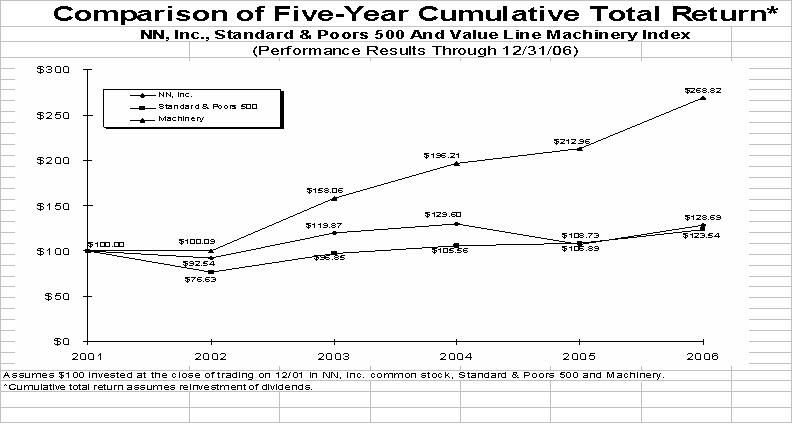

The following graph compares the cumulative total shareholder return on our common stock (consisting of stock price performance and reinvested dividends) from December 31, 20012002 with the cumulative total return (assuming reinvestment of all dividends) of (i) the Value Line Machinery Industry Stock Index ("Machinery ")(“Machinery”) and (ii) the Standard & Poor'sPoor’s 500 Stock Index, for the period December 31, 20012002 through December 31, 2006.2007. The Machinery index is an industry index comprised of 49 companies engaged in manufacturing of machinery and machine parts, a list of which is available from the company. The comparison assumes $100 was invested in our common stock and in each of the foregoing indices on December 31, 2001.2002. We cannot assure you that the performance of the common stock will continue in the future with the same or similar trend depicted on the graph.

| | Cumulative Return |

| | 12/31/2002 | 12/31/2003 | 12/31/2004 | 12/31/2005 | 12/31/2006 |

| NN, Inc. | 92.54 | 119.87 | 129.60 | 108.73 | 128.69 |

| Standard & Poors 500 | 76.63 | 96.85 | 105.56 | 106.89 | 123.54 |

| Machinery | 100.09 | 158.06 | 196.21 | 212.96 | 268.82 |

Comparison of Five-Year Cumulative Total Return*

NN, Inc., Standard & Poors 500 and Value Line Machinery Index

(Performance Results Through 12/31/07)

Assumes $100 invested at the close of trading on December 31, 2002 in NN, Inc. common stock, Standard & Poors 500 and Value Line Machinery Index.

Assumes $100 invested at the close of trading on December 31, 2002 in NN, Inc. common stock, Standard & Poors 500 and Value Line Machinery Index.

*Cumulative total return assumes reinvestment of dividends.

| | Cumulative Return |

| | 12/31/2003 | 12/31/2004 | 12/31/2005 | 12/31/2006 | 12/31/2007 |

| NN, Inc. | 129.54 | 140.06 | 115.51 | 139.07 | 108.57 |

| Standard & Poors 500 | 126.38 | 137.75 | 141.88 | 161.20 | 166.89 |

| Machinery | 157.91 | 196.03 | 212.77 | 268.57 | 382.73 |

The declaration and payment of dividends are subject to the sole discretion of our Board of Directors and depend upon our profitability, financial condition, capital needs, future prospects and other factors deemed relevant by the Board of Directors. The terms of our revolving credit facility restrict the payment of dividends by prohibiting us from declaring or paying any dividend if an event of default exists at the time of, or would occur as a result of, such declaration or payment. Additionally, the terms of our revolving credit facility restrict the declaration and payment of dividends in excess of certain amounts specified in the credit agreement in any fiscal year. For further description of our revolving credit facility, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources” below.

During the fourth quarter of 2006,2007, we repurchased 249,199699,838 shares of our common stock at a total cost of $2.7$6.6 million under our publicly announced $10$25 million repurchase plan authorized by the Board of Directors.

Issuer Purchases of Equity Securities |

Period | (a) Total Number of Shares (or Units) Purchased | (b) Average Price Paid per Share (or Unit) including commissions | (c) Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs | (d) Maximum Number (or Approximate Dollar Value) of Shares that May Yet Be Purchased Under the Plans or Programs |

| October 1 - October 31 | -- | -- | -- | $7,466,064 |

| November 1- November 30 | 217,961 | $10.97 | 217,961 | $5,073,962 |

| December 1 - December 31 | 31,238 | $11.17 | 31,238 | $4,724,854 |

Issuer Purchases of Equity Securities In the Fourth Quarter 2007 |

| Period | (a) Total Number of Shares (or Units) Purchased | (b) Average Price Paid per Share (or Unit) including commissions | (c) Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs | (d) Maximum Number (or Approximate Dollar Value) of Shares that May Yet Be Purchased Under the Plans or Programs |

| October 1 – October 31 | 216,684 | $10.06 | 216,684 | $21,816,042 |

| November 1 – November 30 | 233,319 | $ 9.24 | 233,319 | $19,660,332 |

| December 1 – December 31 | 249,835 | $ 8.87 | 249,835 | $17,444,402 |

For the full year of 2007, we repurchased 1,008,439 shares for a total amount of $9.7 million at an average price of $9.64 including commissions.

See Part III, Item 12 - "Security– “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters"Matters” of this 20062007 Annual Report on Form 10-K for information required by Item 201 (d) of regulation S-K.

The following selected financial data has been derived from the audited financial statements of the Company are qualified by reference to andCompany. The selected financial data should be read in conjunction with the consolidated financial statements and the Notes thereto included as Item 8. The data set forth below as of December 31, 2006, 2005, 2004, and 2003 and for the periods then ended has been derived from the consolidated financial statements of the Company which have been audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, whose report thereon is included as part of Item 8. The data below as of December 31, 2002 and for the period then ended has been derived from the consolidated financial statements of the Company, which have been audited by KPMG LLP, an independent registered public accounting firm. These historical results are not necessarily indicative of the results to be expected in the future. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

(In Thousands, Except Per Share Data)

| | Year ended December 31,

|

Operations” and the audited consolidated financial statements, including notes thereto.

| | 2006 | 2005 | 2004 | 2003 | 2002 |

Statement of Income Data: | | | | | |

| Net sales | $ 330,325 | $ 321,387 | $ 304,089 | $ 253,462 | $ 192,856 |

| Cost of products sold (exclusive of depreciation shown separately below) | 257,703 | 248,828 | 240,580 | 195,658 | 144,274 |

| Selling, general and administrative expenses | 30,008 | 29,073 | 29,755 | 21,700 | 17,134 |

| Depreciation and amortization | 17,492 | 16,331 | 16,133 | 13,691 | 11,212 |

| (Gain) loss on disposal of assets | (705) | (391) | 856 | (147) | (25) |

| Restructuring and impairment costs (income) | (65) | (342) | 2,398 | 2,490 | 1,277 |

| Income from operations | 25,892 | 27,888 | 14,367 | 20,070 | 18,984 |

| Interest expense | 3,983 | 3,777 | 4,029 | 3,392 | 2,451 |

| Other (income) loss | (1,048) | (653) | (853) | 99 | (462) |

| Income before provision for income taxes | 22,957 | 24,764 | 11,191 | 16,579 | 16,995 |

| Provision for income taxes | 8,522 | 9,752 | 4,089 | 5,726 | 6,457 |

Minority interest in income of consolidated Subsidiary | -- | -- | -- | 675 | 2,778 |

| Net income | $ 14,435 | $ 15,012 | $ 7,102 | $ 10,178 | $ 7,760 |

| | | | | | |

| Basic income per share: | | | | | |

| Net income | $ 0.84 | $ 0.88 | $ 0.42 | $ 0.64 | $ 0. 51 |

| | | | | | |

| Diluted income per share: | | | | | |

| Net income | $ 0.83 | $ 0.87 | $ 0.41 | $ 0.62 | $ 0.49 |

| | | | | | |

| Dividends declared | $ 0.32 | $ 0.32 | $ 0.32 | $ 0.32 | $ 0.32 |

Weighted average number of shares outstanding - Basic | 17,125 | 17,004 | 16,728 | 15,973 | 15,343 |

Weighted average number of shares outstanding - Diluted | 17,351 | 17,193 | 17,151 | 16,379 | 15,714 |

(In Thousands, Except Per Share Data) | 2006 | | 2005 | | 2004 | | 2003 | | 2002 |

Balance Sheet Data: | | | | | | | | | |

| Current assets | $ 125,864 | | $ 105,950 | | $ 108,440 | | $ 89,901 | | $ 61,412 |

| Current liabilities | 74,869 | | 64,839 | | 74,431 | | 64,176 | | 40,234 |

| Total assets | 342,701 | | 269,655 | | 288,342 | | 267,899 | | 195,215 |

| Long-term debt | 80,711 | | 57,900 | | 67,510 | | 69,752 | | 46,135 |

| Stockholders’ equity | 133,169 | | 116,074 | | 115,140 | | 106,468 | | 77,908 |

| (In Thousands, Except Per Share Data) | Year ended December 31, |

| | 2007 | 2006 | 2005 | 2004 | 2003 |

| Statement of Income Data: | | | | | |

| Net sales | $ 421,294 | $ 330,325 | $ 321,387 | $ 304,089 | $ 253,462 |

| Cost of products sold (exclusive of depreciation shown separately below) | 337,024 | 257,703 | 248,828 | 240,580 | 195,658 |

| Selling, general and administrative expenses | 36,473 | 30,008 | 29,073 | 29,755 | 21,700 |

| Depreciation and amortization | 22,996 | 17,492 | 16,331 | 16,133 | 13,691 |

| (Gain) loss on disposal of assets | (71) | (705) | (391) | 856 | (147) |

| Restructuring and impairment charges (income) | 13,636 | (65) | (342) | 2,398 | 2,490 |

| Income from operations | 11,236 | 25,892 | 27,888 | 14,367 | 20,070 |

| Interest expense | 6,373 | 3,983 | 3,777 | 4,029 | 3,392 |

| Other (income) expense | (386) | (1,048) | (653) | (853) | 99 |

| Income before provision for income taxes | 5,249 | 22,957 | 24,764 | 11,191 | 16,579 |

| Provision for income taxes | 6,422 | 8,522 | 9,752 | 4,089 | 5,726 |

Minority interest in income of consolidated subsidiary | -- | -- | -- | -- | 675 |

| Net income (loss) | $ (1,173) | $ 14,435 | $ 15,012 | $ 7,102 | $ 10,178 |

| | | | | | |

| Basic income per share: | | | | | |

| Net income (loss) | $ (0.07) | $ 0.84 | $ 0.88 | $ 0.42 | $ 0.64 |

| | | | | | |

| Diluted income per share: | | | | | |