SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

----------

FORM 10-K

|X|

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2004

2007

OR

|_|

FOR THE TRANSITION PERIOD FROM ___________________ TO _________.

COMMISSION FILE NUMBER

Commission File Number 0-26068

ACACIA RESEARCH CORPORATION

(Exact

(Exact name of registrant as specified in its charter)

DELAWARE 95-4405754

(State or other jurisdiction of (I.R.S. Employer

incorporation organization) Identification No.)

500 NEWPORT CENTER DRIVE, NEWPORT BEACH, CA 92660

(Address of principal executive offices) (Zip Code)

Registrant's

| DELAWARE | 95-4405754 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation organization) | Identification No.) |

| 500 NEWPORT CENTER DRIVE, NEWPORT BEACH, CA | 92660 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (949) 480-8300

Securities registered pursuant to Section 12(b) of the Act: NONE

| Title of Each Class | Name of Each Exchange on Which Registered |

| Acacia Research - Acacia Technologies Common Stock, $0.001 par value | The NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: ACACIA RESEARCH - ACACIA TECHNOLOGIES COMMON STOCK, $0.001 PAR VALUE

(TITLE OF CLASS)

ACACIA RESEARCH - COMBIMATRIX COMMON STOCK, $0.001 PAR VALUE

(TITLE OF CLASS)

----------

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to filing requirements for the past 90 days.

Yes |X|þ No [ ]

£

Indicate by check mark that disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant'sregistrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K |X|

10-K. þ

Indicate by check mark whether the Registrantregistrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ | Accelerated filer þ | |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes |X|¨ No [ ]

þ

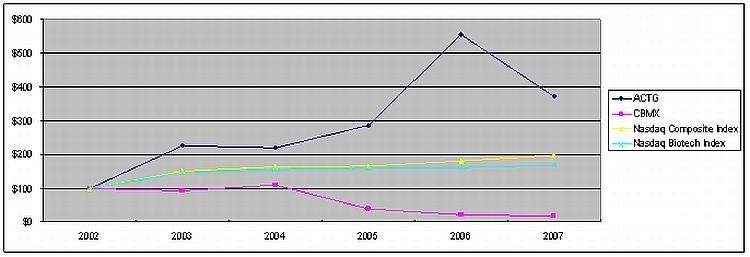

The aggregate market value of the registrant'sregistrant’s Acacia Research - Acacia Technologies common stock and Acacia Research - CombiMatrix common stock held by non-affiliates of the registrant, computed by reference to the last sales prices of such stocks reported on The Nasdaq Stock Market, as of June 30, 2004,29, 2007, was approximately $123,737,135 and $133,494,318, respectively.$458,295,628. (All executive officers and directors of the registrant are considered affiliates.)

As of March 9, 2005, 27,212,769February 25, 2008, 30,132,922 shares of Acacia Research-Acacia Technologies common stock were issued and outstanding. As of March 9, 2005,

31,200,496 shares of Acacia Research-CombiMatrix common stock were issued and

outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant'sregistrant’s definitive proxy statement for its Annual Meeting of Stockholders to be filed with the Commission within 120 days after the close of its fiscal year are incorporated by reference into Part III.

================================================================================

ACACIA RESEARCH CORPORATION

FORM 10-K ANNUAL REPORT

FISCAL YEAR ENDED DECEMBER 31, 2004

ACACIA RESEARCH CORPORATION

ITEM PAGE

- ---- ----

2007

TABLE OF CONTENTS

| Item | Page | ||

| PART I | |||

| 1. | Business | 1 | |

| 1A. | Risk Factors | 6 | |

| 1B. | Unresolved Staff Comments | 13 | |

| 2. | Properties | 13 | |

| 3. | Legal Proceedings | 13 | |

| 4. | Submission of Matters to a Vote of Security Holders | 13 | |

| PART II | |||

| 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer | ||

| Purchases of Equity Securities | 14 | ||

| 6. | Selected Financial Data | 17 | |

| 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 19 | |

| 7A. | Quantitative and Qualitative Disclosures About Market Risk | 29 | |

| 8. | Financial Statements and Supplementary Data | 29 | |

| 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 29 | |

| 9A. | Controls and Procedures | 29 | |

| 9B. | Other Information | 29 | |

| PART III | |||

| 10. | Directors, Executive Officers and Corporate Governance | 30 | |

| 11. | Executive Compensation | 30 | |

| 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 30 | |

| 13. | Certain Relationships and Related Transactions, and Director Independence | 30 | |

| 14. | Principal Accounting Fees and Services | 30 | |

| PART IV | |||

| 15. | Exhibits, Financial Statement Schedules | 31 | |

PART I

1. Business..................................................................1

2. Properties...............................................................22

3. Legal Proceedings.........................................................23

4. Submission of Matters to a Vote of Security Holders.......................23

PART II

5. Market for Registrant's Common Equity, Related Stockholder

Matters and Issuer Purchases of Equity Securities.........................24

6. Selected Financial Data...................................................26

7. Management's Discussion and Analysis of Financial Condition and

Results of Operations.....................................................30

7A. Quantitative and Qualitative Disclosures About Market Risk................53

8. Financial Statements and Supplementary Data...............................54

9. Changes in and Disagreements With Accountants on Accounting and

Financial Disclosure......................................................54

9A. Controls and Procedures...................................................54

9B. Other Information.........................................................54

PART III

10. Directors and Executive Officers of the Registrant........................55

11. Executive Compensation....................................................55

12. Security Ownership of Certain Beneficial Owners and Management............55

13. Certain Relationships and Related Transactions............................55

14. Principal Accounting Fees and Services....................................55

PART IV

15. Exhibits, Financial Statement Schedules...................................56

PART I

CAUTIONARY STATEMENT

This report contains forward-looking statements within the meaning of the "safe harbor"“safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Reference is made in particular to the description of our plans and objectives for future operations, assumptions underlying such plans and objectives, and other forward-looking statements included in this report. Such statements may be identified by the use of forward-looking terminology such as "may," "will," "expect," "believe," "estimate," "anticipate," "intend,"

"continue,"“may,” “will,” “expect,” “believe,” “estimate,” “anticipate,” “intend,” “continue,” or similar terms, variations of such terms or the negative of such terms. Such statements are based on management'smanagement’s current expectations and are subject to a number of factors and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. Such statements address future events and conditions concerning product development, capital expenditures, earnings, litigation, regulatory matters, markets for products and services, liquidity and capital resources and accounting matters. Actual results in each case could differ materially from those anticipated in such statements by reason of factors such as future economic conditions, changes in consumer demand, legislative, regulatory and competitive developments in markets in which we and our subsidiaries operate, and other circumstances affecting anticipated revenues and costs.costs, as more fully disclosed in our discussion of risk factors incorporated by reference in Item 1A. of Part I of this report. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Additional factors that could cause such results to differ materially from those described in the forward-looking statements are set forth in connection with the forward-looking statements.

As used in this Form 10-K, "we," "us"“we,” “us” and "our"“our” refer to Acacia Research Corporation andand/or its subsidiary companies.

ITEM 1. BUSINESS

OVERVIEW

Acacia Research Corporation is comprised of two operating groups.

COMBIMATRIX GROUP

Our life sciences business, referred to as the "CombiMatrix group," is

comprised of our wholly owned subsidiary, CombiMatrix Corporation and

CombiMatrix Corporation's wholly owned subsidiary, CombiMatrix K.K. The

CombiMatrix group is seeking to become a broadly diversified biotechnology

company, through the development of proprietary technologies and products in the

areas of drug development, genetic analysis, nanotechnology research, defense

and homeland security markets, as well as other potential markets where its

products could be utilized. Among the technologies being developed by the

CombiMatrix group are a platform technology to rapidly produce customizable

arrays, which are semiconductor-based tools for use in identifying and

determining the roles of genes, gene mutations and proteins. This technology has

a wide range of potential applications in the areas of genomics, proteomics,

biosensors, drug discovery, drug development, diagnostics, combinatorial

chemistry, material sciences and nanotechnology. Other technologies include

proprietary molecular synthesis and screening methods for the discovery of

potential new drugs.

ACACIA TECHNOLOGIES GROUP

Ouroperating subsidiaries. All intellectual property acquisition, development, licensing business, referred to as the "Acacia

Technologies group," develops, acquires, and licenses patented technologies. The

Acacia Technologies group owns and out-licenses a portfolio of pioneering U.S.

and foreign patents covering digital audio and video transmission and receiving

systems, commonly known as audio-on-demand, video-on-demand, and audio/video

streaming. The Acacia Technologies group's patented proprietary digital media

transmission, or DMT(R), technology enables the digitization, encryption,

storage, transmission, receipt and playback of digital content via several means

including cable TV, which includes digital ad insertion and video on demand

programming, satellite TV programming, the Internet, which includes distance

learning and other Internet programming involving digital audio/video content,

wireless delivery of video content, fiber-optic delivery of video content and

hotel in-room digital delivery of programming.

The Acacia Technologies group owned, and out-licensed to consumer

electronics manufacturers, patented technology known as the V-chip. The V-chip

technology was protectedenforcement activities are conducted solely by U.S. Patent No. 4,554,584, which expired in July

2003. The Acacia Technologies group concluded its V-chip licensing program in

August 2004 as discussed below.

1

On January 28, 2005, Acacia Global Acquisition Corporation, a newly formed

wholly owned subsidiarycertain of Acacia Research Corporation, acquiredCorporation’s wholly owned operating subsidiaries.

Item 1. BUSINESS

OVERVIEW

Acacia Research Corporation’s operating subsidiaries acquire, develop, license and enforce patented technologies. Our operating subsidiaries generate license fee revenues and related cash flows from the assetsgranting of Global Patent Holdings, LLC,licenses for the use of patented technologies that our operating subsidiaries own or Global Patent Holdings,control. Our operating subsidiaries assist patent owners with the prosecution and development of their patent portfolios, the protection of their patented inventions from unauthorized use, the generation of licensing revenue from users of their patented technologies and, if necessary, with the enforcement against unauthorized users of their patented technologies. Currently, on a privately held patent

holding company based in Northbrook, Illinois, which owned 11 patent licensing

companies. The acquisition givesconsolidated basis, our operating subsidiaries own or control the Acacia Technologies group ownership of

companies that control 27rights to 91 patent portfolios, which include 120 U.S. patents and certain foreign counterparts, and covercovering technologies used in a wide variety of industries, as set forth below.

The acquisition expandsindustries.

CombiMatrix Group Split-off Transaction and diversifiesRelated Discontinued Operations. In January 2006, Acacia Research Corporation’s board of directors approved a plan for its wholly owned subsidiary, CombiMatrix Corporation, the primary component of Acacia Technologies group's

revenue generating opportunitiesResearch Corporation’s CombiMatrix group, to become an independent public company. CombiMatrix Corporation’s registration statement on Form S-1 was declared effective by the Securities and acceleratesExchange Commission (“SEC”) on June 8, 2007. Following the executionredemption period required by Acacia Research Corporation’s Restated Certificate of Incorporation, on August 15, 2007 (the “Redemption Date”), CombiMatrix Corporation was split-off from Acacia Research Corporation through the redemption of all outstanding shares of Acacia Research-CombiMatrix common stock in exchange for the distribution of new shares of CombiMatrix Corporation common stock, on a pro-rata basis, to the holders of Acacia Research-CombiMatrix common stock on the Redemption Date (the “Split-off Transaction”). On the Redemption Date, every ten (10) shares of Acacia Research-CombiMatrix common stock outstanding on August 15, 2007, was redeemed for one (1) share of common stock of CombiMatrix Corporation. Subsequent to the Redemption Date, Acacia Research Corporation no longer owns any equity interests in CombiMatrix Corporation and the two companies operate independently of each other.

As a result of the Acacia

Technologies group's business strategySplit-off Transaction, we have disposed of acquiring, developing and licensing

patented technologies.our investment in CombiMatrix Corporation. Refer to Note 16 in10A to the accompanying Acacia Research Corporation consolidated financial statements, included elsewhere herein, for financial information relatedregarding presentation of the assets, liabilities, results of operations and cash flows for the CombiMatrix group as “Discontinued Operations,” for all periods presented, in accordance with guidance set forth in SFAS No. 144 “Accounting for the Impairment or Disposal of Long-Lived Assets” (“SFAS No. 144”).

1

Capital Structure

As a result of the Split-off Transaction, Acacia Research Corporation no longer owns any equity interests in CombiMatrix Corporation and the CombiMatrix group is no longer a business group of Acacia Research Corporation. Pursuant to ourthe terms of the Split-off Transaction, all outstanding shares of Acacia Research-CombiMatrix common stock were redeemed, and hence, all rights of holders of Acacia Research-CombiMatrix common stock ceased as of the Redemption Date, except for the right, upon the surrender to the exchange agent of shares of Acacia Research-CombiMatrix common stock, to receive new shares of CombiMatrix Corporation stock pursuant to the exchange ratio described above. Subsequent to the consummation of the Split-off Transaction, Acacia Research Corporation’s only class of common stock outstanding is its Acacia Research-Acacia Technologies common stock.

Prior to the Split-off Transaction, Acacia Research Corporation had two

segments.

RECAPITALIZATION AND MERGER TRANSACTIONS

On December 11, 2002, our stockholders voted in favor of a recapitalization

transaction, which became effective on December 13, 2002, whereby we created two

new classes of common stock called Acacia Research-CombiMatrix stock, or

AR-CombiMatrix stock, andoutstanding, its Acacia Research-Acacia Technologies common stock or(“AR-Acacia Technologies stock”) and its Acacia Research-CombiMatrix common stock (“AR-CombiMatrix stock”). AR-Acacia Technologies stock and divided our existing Acacia Research

Corporation common stock into shares of the two new classes of common stock.

AR-CombiMatrix stock iswas intended to reflect separately the performance of Acacia Research Corporation's CombiMatrixCorporation’s Acacia Technologies group. AR-Acacia TechnologiesAR-CombiMatrix stock iswas intended to reflect separately the performance of Acacia Research Corporation's

Acacia TechnologiesCorporation’s CombiMatrix group. Although the AR-CombiMatrix stock and the AR-Acacia Technologies stock areand the AR-CombiMatrix stock were intended to reflect the performance of our different business groups, they arewere both classes of common stock of Acacia Research Corporation and arewere not stock issued by the respective groups. As

Our Board of Directors has approved an amendment and restatement of our certificate of incorporation to remove reference to AR-CombiMatrix stock which was cancelled as a result holders of Acacia Research-Acaciathe redemption, to rename AR-Acacia Technologies stock as the only class of common stock, and Acacia

Research-CombiMatrixto provide that all 100,000,000 shares of AR-Acacia Technologies stock continuecurrently authorized may be issued as a single class of common stock. The amendment and restatement of our certificate of incorporation is subject to approval by the stockholders at the next annual meeting of stockholders, as further described in our proxy statement to be subject to all of the risks of an

investment in Acacia Research Corporation and all of its businesses, assets and

liabilities. The assets Acacia Research Corporation attributes to one group

could be subject to the liabilities of the other group. Included in the

CombiMatrix group and the Acacia Technologies group are certain wholly owned

subsidiaries that are not material, quantitatively or qualitatively, either

individually or in the aggregate, to either group, or to Acacia Research

Corporation as a whole.

On December 13, 2002, Acacia Research Corporation acquired the stockholder

interests in CombiMatrix Corporation not already owned by us (52% of the total

stockholder interests in CombiMatrix Corporation). The acquisition was

accomplished through a merger in which stockholders of CombiMatrix Corporation

other than Acacia Research Corporation received one share of the new

AR-CombiMatrix stock in exchange forfiled. If adopted, each share of CombiMatrix Corporation

common stock that they owned immediately priorwill be entitled to one vote and the merger.

OTHER

relative voting strength of the common stock will be equal notwithstanding the trading price of the common stock.

Other

Acacia Research Corporation, a Delaware corporation, was originally incorporated in California in January 1993 and reincorporated in Delaware in December 1999. Our website address is www.acaciaresearch.com.www.acaciaresearch.com. We make our filings with the Securities and Exchange Commission, or SEC, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, available free of charge on our website as soon as reasonably practicable after we file these reports. In addition, we post the following information on our website:

o our corporate code of conduct, board of directors - code of conduct

and fraud policy;

o charters for our audit committee, nominating and corporate governance

committee, disclosure committee and compensation committee;

| · | our corporate code of conduct, our board of directors – code of conduct and our fraud policy; |

| · | charters for our audit committee, nominating and corporate governance committee, disclosure committee and compensation committee; |

The public may read and copy any materials that Acacia Research Corporation files with the SEC at the SEC'sSEC’s Public Reference Room at 450 Fifth Street N.W., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also, the SEC maintains an Internet website that contains reports, proxy and information statements, and other information regarding issuers, including the Acacia Research Corporation, that file electronically with the SEC. The public can obtain any documents that Acacia Research Corporation files with the SEC at http://www.sec.gov.

www.sec.gov.

2

BUSINESS GROUPS

COMBIMATRIX GROUP

(A DIVISION OF ACACIA RESEARCH CORPORATION)

BUSINESS

The CombiMatrix group is comprised

Intellectual Property Licensing Business

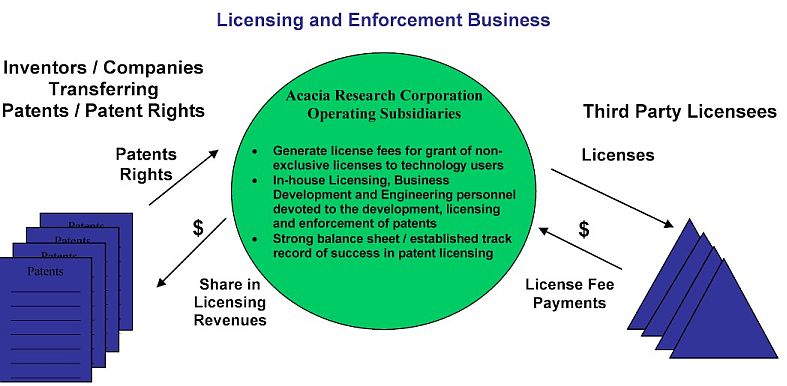

Acacia Research Corporation’s operating subsidiaries acquire, develop, license and enforce patented technologies. Our operating subsidiaries generate license fee revenues and related cash flows from the granting of licenses for the use of patented technologies that our operating subsidiaries own or control. Our operating subsidiaries assist patent owners with the prosecution and development of their patent portfolios, the protection of their patented inventions from unauthorized use, the generation of licensing revenue from users of their patented technologies and, if necessary, with the enforcement against unauthorized users of their patented technologies. Currently, on a consolidated basis, our operating subsidiaries own or control the rights to 91 patent portfolios, which include U.S. patents and certain foreign counterparts, covering technologies used in a wide variety of industries. Our operating subsidiaries have established a track record of licensing success with more than 540 license agreements executed to date. Our professional staff includes in-house patent attorneys, licensing executives, engineers and business development executives.

Our clients are primarily individual inventors and small companies who have limited resources and/or expertise to effectively address the unauthorized use of their patented technologies, and also include large companies seeking to effectively and efficiently monetize their portfolio of patented technologies. In a typical client arrangement, our operating subsidiary will acquire a patent portfolio, or acquire rights to a patent portfolio, with our clients receiving an upfront payment for the purchase of the patent portfolio or patent portfolio rights, or receiving a percentage of our operating subsidiaries net recoveries from the licensing and enforcement of the patent portfolio, or a combination of the two.

In January 2005, our wholly owned subsidiary, CombiMatrix Corporation and CombiMatrix Corporation's wholly owned subsidiary,

CombiMatrix K.K. The CombiMatrix group is seeking to become a broadly

diversified biotechnology company, through the development of proprietary

technologies and products in the areas of drug development, genetic analysis,

nanotechnology research, defense and homeland security markets, as well as other

potential markets where its products could be utilized. Among the technologies

being developed by the CombiMatrix group are a platform technology to rapidly

produce customizable arrays, which are semiconductor-based tools for use in

identifying and determining the roles of genes, gene mutations and proteins.

This technology has a wide range of potential applications in the areas of

genomics, proteomics, biosensors, drug discovery, drug development, diagnostics,

combinatorial chemistry, material sciences and nanotechnology. Other

technologies include proprietary molecular synthesis and screening methods for

the discovery of potential new drugs.

TECHNOLOGIES

SEMICONDUCTOR BASED ARRAY

The CombiMatrix group's semiconductor based array technology enables the

rapid, parallel synthesis, immobilization and detection of molecules and

materials at discrete electrodes on a semiconductor chip. These chips, also

known as microelectrode arrays, are used in multiple applications in the areas

described above. The CombiMatrix group's technology integrates semiconductor

micro fabrication, proprietary software, chemistry and hardware into systems

that it believes will enable it, its customers and its partners to design and

fabricate arrays for biological, diagnostic, material sciences and

nanotechnology applications, typically within a few days. The CombiMatrix

group's system should enable researchers to conduct rapid, iterative experiments

in each of these fields.

For biological applications, the CombiMatrix group believes that its

customizable arrays will enable users to reduce the time and costs associated

with the discovery and development of pharmaceutical products. Although there

are numerous applications of the CombiMatrix group's arrays in life sciences

research, each depend on the synthesis, immobilization or detection of molecules

at discrete sites on the array. Some specific applications include studies of

genetic expression in cellular systems, genotyping and mutation analysis,

synthesis of nucleic acid drugs, and others.

Utilizing this array technology, the CombiMatrix group is engaged in four

strategic business areas:

o The development, manufacture and sale of research tools and services

to life sciences researchers

o The discovery of drugs based on the mechanism of ribonucleic acid

inhibition, or RNAi, and other approaches

o The development, manufacture and sale of biosensor systems and

technology for national defense and homeland security

o The development of tools for applications in nanotechnology and

materials science.

ELECTROCHEMICAL SYNTHESIS OF MOLECULES

The CombiMatrix group is utilizing its expertise in electrochemistry to

synthesize novel compounds, which can be screened in binding and cellular assays

to determine their potential as new drugs. The types of molecules that can be

synthesized electrochemically from precursors using various approaches,

proprietary to the CombiMatrix group, include organic compounds, nucleic acids,

peptides and others. These molecules can then be utilized in biochemical and

cellular screens to determine if they have appropriate potency to be considered

for downstream pre-clinical and clinical drug development.

3

POTENTIAL DRUG COMPOUNDS

Through its minority investment in Leuchemix, Inc., the CombiMatrix group

has access to proprietary compounds that have been shown to be cytotoxic towards

certain cancers in vitro and in vivo. Many of these compounds were discovered

through combinatorial chemistry, natural product chemistry and certain cellular

screening assays. Leuchemix, Inc. has access to state of the art laboratories

and equipment, which includes flow cytometry, molecular biology and cell culture

facilities. In addition, Leuchemix, Inc. has access to a bank of over 150

primary leukemia specimens and a panel of 15 leukemia and lymphoma cell lines as

well as several xenogenic animal model systems.

MARKET OVERVIEW

The markets for the CombiMatrix group's products include pharmaceutical and

biotechnology markets (also referred to as life sciences), national defense and

homeland security applications and the emerging markets for nanotechnology and

new materials. In the future, if the CombiMatrix group is successful in

developing approved drugs either internally or through its investments in

companies such as Leuchemix, Inc., the CombiMatrix group's market opportunities

will expand to include pharmacies, physicians, hospitals, patients and other

consumers of therapeutics. At this time, the majority of the CombiMatrix group's

efforts are focused on the life sciences and national defense markets.

GENERAL OVERVIEW OF LIFE SCIENCES AND PHARMACEUTICAL INDUSTRIES

The pharmaceutical and biotechnology industries are faced with increasing

costs and risks of failure in the drug discovery, development and

commercialization process. According to industry statistics, the time required

to commercialize a new drug averages 15 years. Declining research and

development productivity, rising costs of commercialization, increasing

reimbursement influence and shorter exclusivity periods have driven up the cost

to develop each successful compound to $1.7 billion according to recent industry

data. Only one compound now reaches the market for every thirteen discovered and

placed in preclinical trials, compared to one for every eight between 1995 and

2000. The pharmaceutical and biotechnology industries are working to reduce

their costs and risks of failure by turning to new technologies to help identify

deficiencies in drug candidates as early as possible in the process so that drug

discovery and development become more efficient and cost-effective.

Additionally, with vast amounts of genomic data becoming available for use in

the development of therapeutics and diagnostic tests, they are searching for

ways to expedite their analysis of available genomic data so that they can be

the first to bring new therapeutics and diagnostic tests to market.

DRUG DISCOVERY AND DEVELOPMENT

The discovery and development of new drugs for a particular disease

typically involves several steps. First, researchers identify a target for

therapeutic intervention, such as a protein or gene, that is either directly

involved in the disease or lies in a biochemical pathway leading to the disease.

The next step is to identify chemical compounds that interact with and modulate

the target's activity to inhibit or prevent the disease. Promising compounds

advance to subsequent stages, which include animal trials followed by human

trials.

Recent advances, including the sequencing of the human genome, have led to

the use of genomics in choosing and validating the targets for drug development.

This process begins with the discovery and identification of genes within the

genome and the functions of these genes in regulating biological processes and

disease. This information is used to assess the value of a particular gene or

its protein product as a target for drug discovery. According to industry

statistics, pharmaceutical and biotechnology companies worldwide spent

approximately $62.0 billion on drug research and development during 2003.

GENES AND PROTEINS

The human body is composed of billions of cells each containing DNA that

encodes the basic instructions for cellular function. The complete set of an

individual's DNA is called the genome, and is organized into 23 pairs of

chromosomes, which are further divided into smaller regions called genes. Each

gene is composed of a strand of four types of nucleotide bases, referred to as

A, C, G and T. The bases of one DNA strand bind to the bases of the other strand

in a specific fashion to form base pairs: the base A always binds with the base

T and the base G always binds with the base C.

The human genome has approximately 3.0 billion nucleotides and their

precise order is known as the DNA sequence. When a gene is turned on, or

expressed, the genetic information encoded in the DNA is copied to a specific

type of RNA, called messenger RNA, or mRNA. The mRNA provides instructions for

the synthesis of proteins. Proteins direct cellular function, the development of

individual traits and are involved in many diseases. Abnormal variations in the

sequence of a gene or in the level of gene expression can interfere with the

normal physiology of particular cells and lead to a disease, a predisposition to

a disease or an adverse response to drugs.

4

GENE EXPRESSION PROFILING

Gene expression profiling is the process of determining which genes are

active in a specific cell or group of cells and is accomplished by measuring

mRNA, the intermediary between genes and proteins. By comparing gene expression

patterns between cells from normal tissue and cells from diseased tissue,

researchers may identify specific genes or groups of genes that play a role in

the presence of disease. Studies of this type, used in drug discovery, require

monitoring thousands, and preferably tens of thousands, of mRNAs in large

numbers of samples. As the correlation between gene expression patterns and

specific diseases is determined, the CombiMatrix group believes that gene

expression profiling will have an increasingly important role as a diagnostic

tool. Diagnostic use of expression profiling tools is anticipated to grow

rapidly with the combination of the sequencing of various genomes and the

availability of more cost-effective technologies.

GENETIC VARIATION AND MUTATIONS

Genetic variation is also due to polymorphisms (mutations) in genomes,

although functional variations may also arise from differences in the way genes

are expressed in a given cell, as well as the timing and levels of their

expression.

The most common form of genetic variation occurs as a result of a

difference in a single nucleotide in the DNA sequence, commonly referred to as a

single nucleotide polymorphism, or SNP. The human genome is estimated to contain

between three and six million SNPs. By screening for polymorphisms, researchers

seek to correlate variability in the sequence of genes with a specific disease.

SNPs are believed to be associated with a large number of human diseases,

although most SNPs are believed to be benign and not to be associated with

disease. Determining which SNPs may be related to a disease is a complex process

requiring investigation of a vast number of SNPs. A SNP association study might

require testing for 200,000 possible SNPs in 1,000 patients. Although only a few

hundred of these SNPs might be clinically relevant, 200 million genotyping

tests, or assays, might be required to complete a study. Using currently

available technologies, this scale of SNP genotyping is both impractical and

prohibitively expensive.

While in some cases one SNP will be responsible for medically important

effects, it is now believed that the genetic component of most major diseases is

associated with a combination of SNPs. As a result, the scientific community has

recognized the importance of investigating combinations of many SNPs in an

attempt to discover medically valuable information. In order to understand how

genetic variation causes disease, researchers must compare gene sequence

polymorphisms, or conduct SNP genotyping, from healthy and diseased individuals.

Researchers may also compare gene expression patterns, or perform gene

expression profiling, from healthy and diseased tissues.

PROTEOMICS

Proteomics is the process of determining which proteins are present in

cells, how they interact with one another and how they are correlated with

genomic variation. This process is useful in drug discovery and diagnostics

because most drugs target proteins that play a role in the existence or

development of a disease.

CURRENT TECHNOLOGIES

Despite the recent sequencing of the human genome, scientists have a

limited understanding of the function of genes, how they interact with each

other, how they modulate disease, and how they correlate with protein

translation and function. Additionally, the role of specific mutations is poorly

understood.

Traditional technologies for analyzing genetic or protein variation and

function generally perform experiments individually, or serially, and often

require relatively large sample volumes, adding significantly to the cost of

conducting experiments. Arrays were developed to overcome the limitations of

traditional technologies and enable the parallel evaluation of large numbers of

genes.

An array is a collection of miniaturized test sites arranged in a manner

that permits many tests to be performed simultaneously, or in parallel, in order

to achieve higher throughput. The average size of test sites in an array and the

spacing between them defines the array's density. Higher density increases

parallel processing throughput. In addition to increasing the throughput, higher

density reduces the required volume for the sample being tested, and thereby

lowers costs. Currently, the principal commercially available ways to produce

arrays include mechanical deposition, bead immobilization, inkjet printing and

photolithography.

While current array technologies have revolutionized drug discovery and

development, the CombiMatrix group believes that it's advanced array technology

provides characteristics, including flexibility, superior cost metrics, and

performance which address certain needs of the life sciences market which are

not addressed by conventional arrays.

5

THE COMBIMATRIX SOLUTION

The CombiMatrix group believes that its system will have advantages over

other existing technologies because it is being designed to be a cost-effective,

fast, flexible, customizable alternative to existing analytical tools designed

for similar purposes. Researchers using the CombiMatrix group's system should be

able to design and order custom arrays, conduct their tests, analyze the

results, and reorder additional arrays incorporating modified test parameters,

all within a few days. The CombiMatrix group believes that its system will offer

several important advantages over competing products. These advantages arise

from a unique approach to fabricating the arrays utilizing a proprietary

electrochemical synthesis method on an array of microelectrodes that have been

fabricated on a silicon device.

GENETIC ANALYSIS PRODUCTS AND SERVICES

The CombiMatrix group's technology represents a significant advance over

existing array technologies and other platforms for combinatorial chemistry. The

first application of the technology that the CombiMatrix group is pursuing is in

the field of genomics, where it is developing an array for the analysis of DNA.

The CombiMatrix group believes that this technology may be applied to the fields

of genetic analysis and disease management.

CUSTOMARRAY(TM)

The CombiMatrix group's product for genetic studies is marketed under the

trade name CustomArray(TM). CustomArray(TM) is a highly flexible custom

oligonucleotide array that addresses researchers' specific requirements for

high-performance arrays that can interrogate small sets of target genes or whole

genomes at a low cost. CustomArrays currently come in two formats: the

lower-density CustomArray(TM) 902, and the medium-density CustomArray(TM) 12K.

The CustomArray(TM) 902 enables an analysis of roughly 1,000 genes, and the

CustomArray(TM) 12K enables analysis of up to 12,000 genes.

CustomArray(TM) is an advanced tool used to understand gene expression by

measuring mRNA activity within a cell type or groups of cells, enabling

researchers to understand disease, predisposition to disease, drug response and

drug development. CustomArray(TM) can also be used as a SNP genotyping tool

providing statistics on the effect of a SNP or groups of SNPs, giving rise to

data that is important in diagnostic testing. Because of the product's

flexibility, researchers have utilized and are evaluating the use of

CustomArrays for other applications such as gene assembly, sequencing, protein

translation and others.

ON-LINE ORDER PROCESSING AND SOFTWARE TOOLS

CustomArrays are designed and ordered through the CombiMatrix group's

on-line ordering process. Customers are able to utilize a number of tools to

design and order their arrays through an on-line interface via the World Wide

Web. Some of the tools available to the customers are referred to as the

CustomArray(TM) content software application suite of tools for designing and

ordering arrays.

The content software application provides a suite of sophisticated tools

that customers can use to design a custom array specific to their experimental

needs. This application allows the customer to submit a list of genes and/or

genomic sequences to the CombiMatrix group's probe design system. This design

process produces probe sequences optimal to the customer's requirements.

Customers also have the flexibility to re-design their array at anytime.

When the customer has finished designing their arrays using the CombiMatrix

group's proprietary software tools, the arrays may be ordered using the

e-commerce section of the CustomArray(TM) web site. Arrays are then manufactured

using our proprietary oligonucleotide synthesis technology to the specific

design requirements of the customer's order. The CombiMatrix group's proprietary

DNA synthesis technology enables product turnaround time of typically just a few

days. After production, each array is put through a rigorous quality control

process. To our knowledge, the CombiMatrix group is the only array company that

quality checks every single feature on each array produced prior to shipment.

DESIGN-ON-DEMAND(TM)

The CombiMatrix group has also launched a service known as

Design-on-Demand(TM) for its arrays. Through this service, customers can work

one-on-one with our staff of bioinformatic experts to assist them with designing

their arrays to meet their specific project goals. Customers can also access our

Design-on-Demand(TM) catalog of over 1,400 pre-designed genome arrays available

for ordering.

6

HOMELAND SECURITY AND DEFENSE APPLICATIONS

Through U.S. government funding, the CombiMatrix group's array technology

is being developed to simultaneously detect toxins, viruses, and bacteria using

either genomic analysis or antigen-antibody experiments, or assays. The ability

to conduct over 12,000 individual assays simultaneously means that the

CombiMatrix group's array can be configured to detect many biothreat agents of

interest to the U.S. Department of Defense and Department of Homeland Security

within hours and with a high degree of certainty that surpasses current

technologies. The CombiMatrix group's goal is that these systems will eventually

be portable and ultimately be completely automated.

The CombiMatrix group's technology can simultaneously identify hundreds of

different microbes (including viruses), determine their ability to cause

disease, and discover their characteristics, such as antibiotic resistance.

Working with academia, industry, and government laboratories, the CombiMatrix

group is developing assays, arrays and bioinformatics for quickly identifying

human, animal, and plant pathogens in a single-assay format. This format and

single test eliminates the need for a different test for each disease or threat

and eliminates the time lost in developing a new test for each new disease or

threat. For disease-control agencies, it simplifies the process, reduces costs,

and allows more rapid identification and reaction, all in an environment where

increased time can equate to increased illness and loss of lives.

This program is enabled by the characteristic of the CombiMatrix group's

array technology, which allows the binding reactions to be measured through

electrochemical means instead of optical methods. Though optical detection has

been successful in many applications and our other products utilize these

methods, we feel that electrochemical detection techniques have the potential to

be far superior. By eliminating the need for light sources, optical components,

their corresponding mechanical requirements as well as their power requirements,

we feel that we will be able to build detection systems that will be less

expensive, smaller, lighter and portable. In addition, certain technical

characteristics of electrochemical detection on the arrays may enable higher

sensitivity, better dynamic range and superior reproducibility in measurements.

Though the initial focus of our Government-funded development program is a

product for military and homeland security markets, the core technology being

developed will be applicable to products in the life sciences and human

healthcare markets as well.

DRUG DISCOVERY

The CombiMatrix group has initiated both internally focused and externally

focused programs to utilize its arrays to discover nucleic acid drugs, based on

the recently discovered mechanism known as RNAi (Ribonucleic Acid interference).

This field is often referred to as siRNA (small interfering Ribonucleic Acid) or

gene silencing.

The underlying principle in this field is that an appropriately

designed, double-stranded sequence of RNA can effectively shut down the

operation of a particular gene. If this inhibition cures a disease or alleviates

its symptoms, these RNA molecules can potentially become effective therapeutics.

The process of drug discovery utilizing the RNAi mechanism involves multiple

steps, the first of which is the design and synthesis of potential RNAi

sequences. The CombiMatrix group believes that its expertise in nucleic acid

design and synthesis on its semiconductor-based arrays provides a significant

advantage in discovery.

The CombiMatrix group has chosen to initially focus its integrated RNAi

discovery program on viral diseases for the following reasons:

o Viral infections affect millions of individuals throughout the world

each year

o There are relatively few effective anti-viral medications

o Most emerging diseases are viruses such as SARS and West Nile Virus

o The basis of infection is through transfer of viral genetic material

o Complete viral genomic sequences have recently been made available

o The CombiMatrix group's approach is suited to viral research because

it attempts to thwart a virus by building a cocktail of drugs to

target multiple genes or all the genes of a virus

o It is believed that an RNAi effect is already operating when the body

battles viral infections

7

NANOTECHNOLOGY

The CombiMatrix group has also entered into development programs to use its

arrays for the discovery of nano-structured materials. In analogy to the study

of genes and proteins in parallel using a highly-customizable array, the

CombiMatrix group will develop a system, which enables researchers to perform

combinatorial materials discovery work in a rapid, cost effective manner.

THE COMBIMATRIX GROUP'S STRATEGY

FOCUSING ON HIGH-GROWTH MARKETS

The CombiMatrix group's goal is to provide customers and partners with

tools in their discovery efforts as well as to perform discovery itself.

The CombiMatrix group will focus on markets that it believes are growing

rapidly and where it believes it has a competitive advantage. The first of these

markets are for gene expression, mutation analysis, and other applications for

the development of drugs and diagnostic products. Other markets include protein

analysis, homeland security and military applications, anti-viral drug

development nanotechnology and material sciences.

PARTNERING WITH MULTIPLE COMPANIES TO EXPAND MARKET OPPORTUNITY

The CombiMatrix group plans to pursue multiple relationships to facilitate

the expansion of its array technologies and to exploit large and diverse

markets. The CombiMatrix group expects to enter into relationships and

collaborations to gain access to complementary technologies, distribution

channels, manufacturing infrastructure and information content. The CombiMatrix

group intends to structure relationships that maximize its research and

development efforts with the strong distribution and manufacturing capabilities

of its customers and any entities with which the CombiMatrix group has joint

development efforts.

MAJOR STRATEGIC ALLIANCES

The CombiMatrix group intends to rapidly commercialize its array technology

for gene expression profiling through its own sales and marketing efforts. In

addition, the CombiMatrix group has had agreements with several strategic

partners, such as Roche Diagnostics GmbH, or Roche, to jointly develop its

technology. For example, Roche contributed extensive expertise in the areas of

instrument and reagent development, and offers a large and experienced worldwide

sales and marketing team. The CombiMatrix group believes that the combination of

its array technology with Roche's leadership position in the genetic analysis

and diagnostic markets will enable it to capture a significant portion of the

gene expression profiling and molecular diagnostic markets.

The CombiMatrix group has been awarded several U.S. government grants and

contracts to develop its electrochemical detection system for the detection of

biological threat agents. Though these programs initially focused on product

development for military and homeland security applications, the CombiMatrix

group believes that the core technology being developed will be applicable to

products in the life sciences and human healthcare markets as well.

The CombiMatrix group has also entered into a design, fabrication and

manufacturing relationship with Toppan Printing of Japan, or Toppan, and Furuno

Electronic Co., or Furuno, for the development and manufacture of new designs of

its electrochemical detection arrays and bench-top array synthesizers,

respectively.

In addition to these relationships, the CombiMatrix group has entered into

additional relationships and plans on establishing other relationships for

multiple applications of its technology.

EXPANDING TECHNOLOGIES INTO MULTIPLE PRODUCT LINES

The CombiMatrix group intends to utilize the flexibility of its

semiconductor based array technologies to develop multiple product lines. In

addition to providing new sources of revenue, it believes these product lines

will further its goal of establishing its array technology as the industry

standard for array-based analysis.

8

STRENGTHENING TECHNOLOGICAL LEADERSHIP

The CombiMatrix group plans to continue advancing its proprietary

technologies through its internal research efforts, collaborations with industry

leaders and strategic licensing. The CombiMatrix group may also pursue

acquisitions of complementary technologies and leverage its technologies into

other value-added businesses.

PROTECTING AND STRENGTHENING INTELLECTUAL PROPERTY

Through the CombiMatrix Corporation's four patents issued in the United

States and three corresponding patents granted in Europe, Australia and Taiwan,

its 59 patent applications pending in the United States, Europe and elsewhere

and its trade secrets, the CombiMatrix group believes it has suitable

intellectual property protection for its proprietary technologies in those

markets where it operates and where a market for its products and services

exists. The CombiMatrix group plans to build its intellectual property portfolio

through internal research efforts, collaborations with industry leaders,

strategic licensing and possible acquisitions of complementary technologies. The

CombiMatrix group also plans to pursue patent protection for downstream products

created using its proprietary products.

REGULATORY MATTERS

The CombiMatrix group sells array products to the pharmaceutical,

biotechnology and academic communities for research applications as well as

non-life sciences customers. In addition, its drug development efforts are early

stage. Therefore, its initial products do not require approval from, or be

regulated by, the FDA, as a manufacturer nor are they subject to the FDA's

current good manufacturing practice, or cGMP, regulations. Additionally, the

CombiMatrix group's initial products are not subject to certain reagent

regulations promulgated by the FDA. However, the manufacture, marketing and sale

of certain products and services for most clinical or diagnostic applications

will be subject to extensive government regulation as medical devices in the

United States by the FDA and in other countries by corresponding foreign

regulatory authorities.

SUBSIDIARIES

Prior to July 11, 2003, CombiMatrix K.K., a majority-owned subsidiary of

CombiMatrix Corporation, was operating under a joint venture agreement with

Marubeni Japan, or Marubeni, one of Japan's leading trading companies. The

primary purpose of the joint venture was to focus on development and licensing

opportunities for CombiMatrix Corporation's array technology with academic,

pharmaceutical and biotechnology organizations in the Japanese market. Marubeni

held a 10% minority interests in the joint venture. On July 11, 2003, Acacia

Research Corporation purchased the outstanding minority interests in CombiMatrix

K.K. from Marubeni. Acacia Research Corporation issued 200,000 shares of its

AR-CombiMatrix stock to Marubeni in exchange for Marubeni's 10% minority

interests in CombiMatrix K.K. This increase in ownership interest has been

attributed to the CombiMatrix group.

Prior to July 2, 2003, CombiMatrix Corporation owned 87% of Advanced

Material Sciences, which in turn holds an exclusive license for CombiMatrix

Corporation's array synthesis technology for the development and discovery of

advanced electronic materials for such purposes as fuel cell catalysts. In

consideration for this exclusive license, CombiMatrix Corporation will share in

the revenues earned by Advanced Material Sciences for commercialization of these

discoveries based on CombiMatrix Corporation's array technology. The term of

this arrangement is 20 years. On July 2, 2003, Acacia Research Corporation

increased its consolidated ownership interest in Advanced Material Sciences to

99% by acquiring 1,774,750 shares of Advanced Material Sciences common stock in

exchange for 295,790 shares of AR-CombiMatrix stock. This increased ownership

interest has been attributed to the CombiMatrix group.

MARKETING AND DISTRIBUTION

During 2004, the CombiMatrix group launched its CustomArray(TM) products

and is currently selling these products directly and through distributors to

customers in the United States, Australia, New Zealand and Japan. Where

appropriate, the CombiMatrix group will continue to market and sell its products

directly or through distribution arrangements and/or through other strategic

alliances.

In July 2001, CombiMatrix Corporation entered into non-exclusive worldwide

license, supply, research and development agreements with Roche. These

agreements were amended in September 2002, primarily to grant Roche

manufacturing rights with respect to the products under development in return

for additional cash consideration under the agreements. The revised agreements

also made minor modifications to terms of the agreements involving matters such

as milestones, payments and technical specifications, none of which were

considered to be material. Such minor modifications are a standard part of the

research and development process and in our experience are routinely made in

development agreements.

9

In March 2004, the agreements were modified to indicate that CombiMatrix

Corporation had completed all phases of its research and development commitments

to Roche.

Since the inception of our relationship with Roche, CombiMatrix Corporation

has engaged in a continuous process of monitoring and reevaluating the terms of

the agreements, and have amended the agreements in several respects to establish

more meaningful goals, milestones and timelines. The agreements are

non-exclusive with respect to CombiMatrix Corporation's core technology, meaning

that CombiMatrix Corporation remains free to license its core technology to

third parties for applications in the genomics, proteomics and other fields. The

agreements contain exclusivity or co-exclusivity provisions only with respect to

the specific products being co-developed for, and partially funded by, Roche

pursuant to the agreements.

Under the terms of the agreements, it is contemplated that Roche will

co-develop, use, manufacture, market and distribute CombiMatrix Corporation's

array and related technology for rapid production of customizable arrays. The

agreements provide for minimum payments by Roche to CombiMatrix Corporation over

the first three years after product launch, including milestone achievements,

payments for products, royalties and future research and development projects.

Nevertheless, because our agreements with Roche contain provisions that would

allow Roche to terminate the agreements, the future payments by Roche to

CombiMatrix Corporation might never be realized. Since July 2001, CombiMatrix

Corporation has received approximately $26.6 million in cash payments from Roche

from July 2001 through December 31, 2003. The CombiMatrix group has not received

any additional payments from Roche since December 31, 2003.

MANUFACTURING AND CUSTOMIZATION

The CombiMatrix group is developing automated, computer-directed

manufacturing processes for the synthesis of sequences of DNA, RNA, peptides or

small molecules on its arrays. Certain portions of its manufacturing, such as

semiconductor fabrication and processing, will be outsourced to subcontractors,

while the steps involving synthesis of biological materials and quality control

of its products will be conducted by the CombiMatrix group.

Substantially all of the components and raw materials used in the

manufacture of the CombiMatrix group's products, including semiconductors and

reagents, are currently provided from a limited number of sources or in some

cases from a single source. Although the CombiMatrix group believes that

alternative sources for those components and raw materials are available, any

supply interruption in a sole-sourced component or raw material might result in

up to a several-month production delay and materially harm the CombiMatrix

group's ability to manufacture products until a new source of supply, if any,

could be located and qualified. In addition, an uncorrected impurity or

supplier's variation in a raw material, either unknown to the CombiMatrix group

or incompatible with its manufacturing process, could have a material adverse

effect on its ability to manufacture products. The CombiMatrix group may be

unable to find a sufficient alternative supply channel in a reasonable time

period, or on commercially reasonable terms, if at all. The CombiMatrix group

utilizes non-standard semiconductor manufacturing processes to fabricate the

electrode array that is a key aspect of the array structure. Although the

CombiMatrix group has a supply agreement in place with the semiconductor wafer

manufacturer to ensure availability of the raw materials, it does not guarantee

a permanent supply. These non-standard processes are not widely available and it

may be difficult or expensive to obtain sufficient quantities of semiconductor

wafers if the current manufacturer changes or discontinues its manufacturing

production capability.

PATENTS AND LICENSES

CombiMatrix Corporation continues to build its intellectual property

portfolio to protect its product in those markets where it operates and where a

market for its products and services exists. In the United States, CombiMatrix

Corporation has been issued four United States patents. Three of the United

States patents (U.S. Patent No. 6,093,302 expiration date January 5, 2018; U.S.

Patent No. 6,280,595 expiration date September 10, 2019 and U.S. Patent No.

6,444,111 expiration date October 13, 2019) protect CombiMatrix Corporation's

core technology relating to methods for electrochemical synthesis of arrays. The

fourth United States Patent (U.S. Patent No. 6,456,942 expiration date January

25, 2020) describes and claims a network infrastructure for custom array

synthesis and analysis. Corresponding CombiMatrix Corporation core patents

describing and claiming methods for electrochemical synthesis of arrays have

been issued in Europe (entire EU), Australia and Taiwan and are pending in the

remaining major industrialized markets. In total, CombiMatrix Corporation has 59

patent applications pending in the Unites States, Europe and elsewhere.

The CombiMatrix group seeks to protect its corporate identity with

trademarks and service marks. In addition, its trademark strategy includes

protecting the identity and goodwill associated with its biological array

processor products. The CombiMatrix group purchases chemical reagents from

suppliers who are licensed under appropriate patent rights. It is the

CombiMatrix group's policy to obtain licenses from patent holders if needed to

practice its chemical processes.

10

The CombiMatrix group's success will depend, in part, upon its ability to

obtain patents and maintain adequate protection of its intellectual property in

the United States and other countries. If it does not protect its intellectual

property adequately, competitors may be able to use its technologies and thereby

erode any competitive advantage that the CombiMatrix group may have. The laws of

some foreign countries do not protect proprietary rights to the same extent as

the laws of the United States, and many companies have encountered significant

problems in protecting their proprietary rights abroad. These problems can be

caused by the absence of rules and methods for defending intellectual property

rights.

The patent positions of companies developing tools and drugs for the

biotechnology and pharmaceutical industries, including the CombiMatrix group's

patent position, generally are uncertain and involve complex legal and factual

questions. The CombiMatrix group will be able to protect its proprietary rights

from unauthorized use by third parties only to the extent that its proprietary

technologies are covered by valid and enforceable patents or are effectively

maintained as trade secrets. The CombiMatrix group's existing patent and any

future patents it obtains may not be sufficiently broad to prevent others from

practicing its technologies or from developing competing products. There also is

risk that others may independently develop similar or alternative technologies

or design around its patented technologies. In addition, others may challenge or

invalidate the CombiMatrix group's patents, or its patents may fail to provide

it with any competitive advantage. Enforcing its intellectual property rights

may be difficult, costly and time consuming, and ultimately may not be

successful.

The CombiMatrix group also relies upon trade secret protection for its

confidential and proprietary information. It seeks to protect its proprietary

information by entering into confidentiality and invention disclosure and

transfer agreements with employees, collaborators and consultants. These

measures, however, may not provide adequate protection for the CombiMatrix

group's trade secrets or other proprietary information. Employees, collaborators

or consultants may still disclose its proprietary information, and the

CombiMatrix group may not be able to meaningfully protect its trade secrets. In

addition, others may independently develop substantially equivalent proprietary

information or techniques or otherwise gain access to its trade secrets.

The CombiMatrix group cannot assure you that any of its patent applications

will result in the issuance of any additional patents, that its patent

applications will have priority of invention or filing date over similar rights

of others, or that, if issued, any of its patents will offer protection against

its competitors. Additionally, the CombiMatrix group cannot assure you that any

patent issued to it will not be challenged, invalidated or circumvented in the

future or that the intellectual property rights it has created will provide a

competitive advantage. Litigation may be necessary to enforce its intellectual

property rights or to determine the enforceability, scope of protection or

validity of the intellectual property rights of others.

COMPETITION

The CombiMatrix group expects to encounter competition in the area of

business opportunities from other entities having similar business objectives.

Many of these potential competitors possess greater financial, technical, human

and other resources than does the CombiMatrix group. The CombiMatrix group

anticipates that it will face increased competition in the future as new

companies enter the market and advanced technologies become available. In the

life sciences industry, many competitors have more experience in research and

development than the CombiMatrix group. Technological advances or entirely

different approaches developed by one or more of its competitors could render

the CombiMatrix group's processes obsolete or uneconomical. The existing

approaches of competitors or new approaches or technology developed by

competitors may be more effective than those developed by the CombiMatrix group.

The CombiMatrix group is aware of other companies or companies with

divisions that have, or are developing, technologies for the SNP genotyping,

gene expression profiling and proteomic markets. The CombiMatrix group believes

that its primary competitors will be Affymetrix, Inc., Agilent Technologies,

Inc., Becton, Dickinson and Company, Ciphergen Biosystems, Inc., Gene Logic

Inc., Illumina, Inc., Johnson & Johnson, Nanogen, Inc., Orchid Biosciences,

Inc., Applera Corporation, Roche Diagnostics GmbH and Sequenom, Inc. However,

the CombiMatrix group's market is rapidly changing, and the CombiMatrix group

expects to face additional competition from new market entrants, new product

developments and consolidation of its existing competitors. Many of the

CombiMatrix group's competitors have existing strategic relationships with major

pharmaceutical and biotechnology companies, greater commercial experience and

substantially greater financial and personnel resources than it does. The

CombiMatrix group expects new competitors to emerge and the intensity of

competition to increase in the future.

RESEARCH, DEVELOPMENT AND ENGINEERING

The CombiMatrix group's research and development expenses, excluding

non-cash stock compensation charges and acquired in-process research and

development charges, were $7.2 million (including Department of Defense related

research and development expenses of $2.0 million), $8.1 million and $18.2

million during 2004, 2003 and 2002, respectively. Research and development

11

related non-cash stock compensation charges were $91,000, $466,000 and $1.9

million during 2004, 2003 and 2002, respectively and acquired in-process

research and development charges were $17.2 million in 2002. The CombiMatrix

group intends to invest in its proprietary technologies through internal

development and, to the extent available, licensing of third-party technologies

to increase and improve other characteristics of its products. The CombiMatrix

group also plans to continue to invest in improving the cost-effectiveness of

its products through further automation and improved information technologies.

The CombiMatrix group's future research and development efforts may involve

research conducted by the CombiMatrix group, collaborations with other

researchers and the acquisition of chemistries and other technologies developed

by universities and other academic institutions.

The CombiMatrix group is developing a variety of life sciences and non-life

sciences products and services. Potential customers for these products operate

in industries characterized by rapid technological development. The CombiMatrix

group believes that its future success will depend in large part on its ability

to continue to enhance its existing products and services and to develop other

products and services, which complement existing ones. In order to respond to

rapidly changing competitive and technological conditions, the CombiMatrix group

expects to continue to incur significant research and development expenses

during the initial development phase of new products and services, as well as on

an ongoing basis.

GOVERNMENT GRANTS AND CONTRACTS

Government grants and contracts have allowed the CombiMatrix group to fund

certain internal scientific programs and exploratory research. The CombiMatrix

group retains ownership of all intellectual property and commercial rights

generated during these projects. The United States government, however, retains

a non-exclusive, non-transferable, paid-up license to practice the inventions

made with federal funds pursuant to applicable statutes and regulations. The

CombiMatrix group does not believe that the retained license will have any

impact on its ability to market its products. The CombiMatrix group does not

need government approval to enter into collaborations or other relationships

with third parties.

The CombiMatrix group has been awarded several grants from the federal

government in connection with its biological array processor technology since

it's inception. Most recently, in March of 2004, the CombiMatrix group was

awarded a two-year, $5.9 million contract with the Department of Defense to

further the development of the CombiMatrix group's array technology for the

detection of biological threat agents. Under the terms of the contract, the

CombiMatrix group will be reimbursed on a periodic basis for actual costs

incurred to perform its obligations, plus a fixed fee, of up to $5.9 million.

The CombiMatrix group will continue to pursue grants and contracts that

complement its research and development efforts.

RECENT ACTIVITIES

Significant milestones for the CombiMatrix group during 2004 include the

following:

GENETIC ANALYSIS PRODUCTS AND SERVICES

o In March 2004, the CombiMatrix group launched the CustomArray(TM) DNA

Microarray platform, its first commercially-available array product,

to the worldwide research marketplace. This platform offers

researchers the ability to order fully customizable arrays on demand

in any quantity they choose. CustomArrays(TM) are produced on a

standard slide format, a configuration that is most familiar to

researchers. The commercial launch of CustomArray(TM) also provides

the marketplace with full access to the CombiMatrix group's suite of

software applications, including array design and submission, online

ordering and extraction of experimental results.

o In June 2004, the CombiMatrix group entered into a co-marketing

relationship with Axon Instruments, Inc. and in July, the CombiMatrix

group entered into a co-marketing agreement with Strand Genomics.

o In July 2004, the CombiMatrix group launched the CustomArray(TM)12K

DNA expression array, offering researchers the ability to order a

fully customizable array with more than 12,000 sites.

CustomArray(TM)12K and related products enable researchers to study

any combination of genes from any genome on a single chip. Also in

July 2004, the CombiMatrix group made available to researchers new

CustomArrays(TM) for Human Drug Metabolism, Human Toxicology, and a

Core 67 Cancer Array.

o In August 2004, the CombiMatrix group entered into a multi-year

collaborative strategic alliance with Furuno Electric Company, Ltd.

("Furuno") to design, engineer and build CombiMatrix Corporation's

Bench-Top DNA Microarray Synthesizer for CustomArray(TM) formatted

arrays. Under the terms of the agreement, Furuno paid CombiMatrix

Corporation an upfront fee of $1,000,000 and will make additional

development and milestone payments in the future, in accordance with

the agreement.

12

o In December 2004, the CombiMatrix group launched Design-on-Demand(TM)

Arrays, which provides the marketplace with a comprehensive catalog of

microarray expression products for microbial, eukaryotic, and viral

genomes. These arrays offer scientists an affordable and flexible tool

to conduct whole-genome expression studies on a wide range of

organisms, including Influenza, HIV, Anthrax, and SARS coronavirus.

HOMELAND SECURITY AND DEFENSE APPLICATIONS

o In March 2004, the CombiMatrix group executed a two-year, $5.9 million

contract with the Department of Defense to further the development of

the CombiMatrix group's microarray technology for the detection of

biological threat agents. Additionally, In July 2004, the CombiMatrix

group announced that it will receive an additional $2.3 million from a

Department of Defense appropriations bill passed by Congress.

o In October 2004, the CombiMatrix group and Science Applications

International Corporation (SAIC) announced a collaboration to develop

arrays for the identification of multiple bio-threat organisms. The

intent of the collaboration is to leverage each company's respective

Department of Defense funding in order to expedite the development and

testing of new identification and diagnostic assays and products

against conventional bio-threat agents and emerging and genetically

engineered pathogens.

DRUG DISCOVERY

o In January 2004, the CombiMatrix group made the first commercially

available microarray designed for the H5N1 influenza A virus ("bird

flu"). The World Health Organization appealed on January 27, 2004 for

technical assistance and expert advice to help stop the threat to

humans and agriculture posed by bird flu virus. The CombiMatrix group

utilized its proprietary probe-design software and ability to rapidly

synthesize novel DNA arrays to respond within two days.

o During 2004, the CombiMatrix group entered into a number of

collaborations in the field of drug discovery and development,

including collaborations with: 1) Washington University in St. Louis

to develop a system for the synthesis of libraries of diverse,

non-nucleic acid molecules; 2) Professor Bonaventura Clotet, M.D.,

Ph.D., of the Retrovirology Laboratory irsiCaixa, to conduct the

initial efficacy screening of pooled siRNA compounds against the

hepatitis C virus; 3) Dr. Ulrich Melcher, Department of Biochemistry

and Molecular Biology and Dr. Alexander C. Lai, Department of