UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE YEAR ENDED DECEMBER 31, 20122013

COMMISSION FILE NUMBER 000-27467

ERF WIRELESS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 000-27467 | 76-0196431 | ||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

2911 SOUTH SHORE BOULEVARD, SUITE 100, LEAGUE CITY, TEXAS 77573

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code:(281) 538-2101

Securities registered under Section 12(b) of the Exchange Act:

None.

Securities registered under Section 12(g) of the Exchange Act:

$.001 PAR VALUE COMMON STOCK

Check whether the issuer is not required to file report pursuant to Section 13

or 15(d) of the Exchange Acto

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes¨ Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes¨ Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to filing requirements for the past 90 days. Yesx No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding twelve months (or for such shorter period that the registrant was required to submit and post such files). Yesx No¨

Indicate by check mark that disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer¨ | Accelerated filero | |

| Non-accelerated filer¨ (Do not check if a smaller reporting company) | Smaller reporting companyx |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).Yes. Yes¨ Nox

As of June 30, 20122013 the aggregate market value of the shares of common stock held by non-affiliates (based on the closing price of $1.28$200.00 per share for the common stock as quoted on that date) was approximately $3,758,852.$5,122,852.

As of MarchApril 15, 2013,2014, the Company had outstanding 7,688,2621,001,743 shares of its $.001 par value common stock.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| ITEM | ||||

| NUMBER | CAPTION | PAGE | ||

| PART I | ||||

| ITEM 1. | Business | |||

| ITEM 1A. | Risk Factors | |||

| ITEM 1B. | Unresolved Staff Comments | |||

| ITEM 2. | Properties | |||

| ITEM 3. | Legal Proceedings | |||

| ITEM 4. | ||||

| PART II | ||||

| ITEM 5. | Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |||

| ITEM 6. | Selected Financial Data | |||

| ITEM 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |||

| ITEM 7A. | Quantitative and Qualitative Disclosures About Market Risk | |||

| ITEM 8. | Financial Statements and Supplementary Data | |||

| ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 63 | ||

| ITEM 9A. | Controls and Procedures | 63 | ||

| ITEM 9B. | Other Information | |||

| PART III | ||||

| ITEM 10. | Directors, Executive Officers and Corporate Governance | 64 | ||

| ITEM 11. | Executive Compensation | |||

| ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||

| ITEM 13. | Certain Relationships and Related Transactions, and Director Independence | |||

| ITEM 14. | Principal Accountant Fees and Services | |||

| PART IV | ||||

| ITEM 15. | Exhibits and Financial Statement Schedules | |||

| i |

FORWARD LOOKING STATEMENTS

Except for the historical information and discussions contained herein, statements contained in this Annual Report on Form 10-K, may constitute forward-looking statements. These statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially, as discussed elsewhere in the ERF Wireless, Inc. ("Company" or "ERF"), filings with the U.S. Securities and Exchange Commission ("SEC"). The statements contained in this document that are not purely historical are forward-looking statements including without limitation statements regarding our expectations, beliefs, intentions or strategies regarding our business. This Annual Report on Form 10-K includes forward-looking statements about our business including, but not limited to, the level of our expenditures and savings for various expense items and our liquidity in future periods. We may identify these statements by the use of words such as "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "might," "plan," "potential," "predict," "project," "should," "will," "would" and other similar expressions. All forward-looking statements included in this document are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements, except as may otherwise be required by law. Our actual results could differ materially from those anticipated in these forward-looking statements.

ITEM 1. BUSINESS

The Company

We are a leading provider of wireless broadband access solutions for the energy industry. Our primary business strategy is to develop and provide a long-term terrestrial wireless broadband solution for the exploration, drilling, and production sectors of the energy industry in rural and remote locations in North America that lack existing communications infrastructure. We offer our oil and gas customers a comprehensive and integrated package of wellsite information technology (“IT”) communications services, including high-speed low-latency terrestrial broadband connectivity utilizing both licensed and unlicensed spectrum, VOIPvoice over Internet Protocol (VOIP) telephone, facsimile service, wireless intercom systems, computer and other IT equipment rental, IT support services, and video security solutions.

Wireless broadband Internet systems consist of a radio transceiver that sends a signal on a combination of radio channels to other transceivers, categorized based upon the wireless technology utilized, and transmitted through licensed or unlicensed spectrum. We use a combination of WiMAX (“Worldwide interoperability for Microwave Access”) wireless broadband as well as other relevant wireless technology solutions to service our customers.

Our current focus is to expand our network in the middle-United States region, including Texas, Oklahoma, Arkansas, New Mexico, Louisiana, Colorado, Kansas, North Dakota, and Montana.Louisiana. The delivery of terrestrial broadband wireless directly to the wellsite is the primary benefit of our service - we believe the primary reason why our services are currently in demand throughout the remote oil and gas regions of North America. We have acquired 15 wireless broadband networks over eight years, built seven additional wireless networks, and contracted with 11 other wireless networks to create, what we believe to be, the largest North American terrestrial wireless network coverage- in excess of 450,000 square miles- in important oil and gas regions. We have combined our terrestrial wireless coverage with a fleet of more than 130 MBT’smobile broadband trailers being referred to as “MBT’s”, that are deployed by our field technicians to a drilling pad that provides a symmetrical 1.5Mb/s wireless circuit back to one of our fixed towers up to twenty five miles away, depending on the local terrain -providing wireless access anywhere within our coverage area. We are paid a daily rate for delivering this circuit to the wellsite while the well is being drilled. The terrestrial wireless solution offers a distinct advantage, in addition to the increased bandwidth, over the traditional very small aperture terminal, or VSAT, communications solution in that a VSAT adds almost one second of delay to the communications path (“latency”) while terrestrial broadband has no more than sixty thousands of a second of latency. Many of the current remote software programs utilized by oil and gas companies require less than one tenth of a second of latency to function properly. Once the drilling process has been completed our technicians reverse the deployment process and move our MBT’s along with the drilling rig to our customer’s next drilling site. We are paid on an hourly rate for the move, since distances can vary from only a few miles to hundreds of miles. Once our technician arrives at the new wellsite, the process is repeated. Some of our MBT’s have been following the same drilling rig for years. We believe that this low latency “nomadic” delivery solution, when combined with our provision of a technician at the wellsite within four hours of being notified of any issues anywhere in our North American service territory, affords us a competitive advantage and should allow us to expand our market share going forward.

While our focus is on providing broadband connectivity to the drilling sector of the oil and gas industry, we also provide wireless broadband services to a broad range of other residential and enterprise customers including banking, healthcare, and educational customers utilizing the same wireless network assets and personnel used in our oil and gas services business.

Corporate Information

We were incorporated in the State of Nevada in June 2004. Our principal executive offices are located at 2911 South Shore Blvd., Suite 100, League City, Texas 77573, and our telephone number is (281) 538-2101.We maintain web sites at www.erfwireless.com, www.energybroadband.com and www.erfwireless.net. The information on, or that may be accessed through, our websites are not incorporated by reference into this filing and should not be considered a part of this filing.

On October 1, 2013, shareholders of the Company holding approximately 98.5% of the Company’s voting stock (the “Majority Shareholders”), as of September 24, 2013 (the “Record Date”), consented in writing to, among other things, an amendment to the Company’s Articles of Incorporation to effect one or a series of forward or reverse splits (the “Stock Splits”) of the Company’s common stock only for the express purpose, if required, in connection with obtaining a listing on a national securities exchange. The Stock Splits were required to be at a ratio of not less than 2 and not greater than 400 with the exact ratio to be set within such range at the discretion of the Board of Directors, without further approval or authorization of the Company’s shareholders, provided that such Stock Splits were required to be effected no later than October 1, 2014 (the “Shareholder Approval”). Neither the (i) number of authorized shares or the par value of the shares of the Company’s common stock nor (ii) number of authorized, issued and outstanding, or any associated conversion ratio of the shares of Series A Preferred Stock were to be changed in connection with any such Stock Split.

| 1 |

Effective December 2, 2013, the Board of Directors of the Company, consistent with the Shareholder Approval for the Stock Splits, approved a reverse stock split in a ratio of 1:400 (the “Reverse Stock Split”) and the filing of a Certificate of Amendment (the “Amendment”) to effect such Reverse Stock Split with the secretary of state of Nevada, which amendment was filed on December 12, 2013, provided that such Amendment, pursuant to its terms, did not go effective with the State of Nevada until December 17, 2013. The Board of Directors also approved the rounding of fractional shares remaining after the Reverse Stock Split to the nearest whole share on a per shareholder basis, provided that any shareholders holding over ten (10) shares, but less than ninety-nine (99) shares after the Reverse Stock Split would have their shares automatically rounded up to 100 shares (the “Rounding”). The Reverse Stock Split became effective with FINRA and in the marketplace on December 18, 2013 (the “Effective Date”).

As a result of the Reverse Stock Split, the Company’s issued and outstanding shares of common stock decreased from approximately 34.2 million pre-Reverse Stock Split shares to approximately 85,452 post-Reverse Stock Split shares prior to effecting the Rounding described above.

Unless otherwise stated or the context would require otherwise, the effects of the Reverse Stock Split have been retroactively reflected throughout this report.

The Company owns 100% of the common stock of the following subsidiaries: (i) Wireless Bundled Services, Inc., a Texas corporation (“WBS”); (ii) Enterprise Network Services, Inc., a Texas corporation (“ENS”); and (iii) Wireless Messaging Services, Inc., a Texas corporation (“WMS”). In September 2011, we declared a stock dividend to our shareholders consisting of 5% of the existing common stock in Energy Broadband, Inc. (“EBI”) our then wholly owned subsidiary. The dividend resulted in the issuance to each common and preferred shareholder of record as of September 30, 2011, for each 200 shares of our common stock, including Series A Preferred Stock convertible into 200 common shares, (i) 100 shares of EBI common stock, (ii) one three-year warrant to purchase 100 shares of EBI common stock at a price of $4.00 per share, and (iii) a second three-year warrant to purchase 100 shares of EBI at a price of $6.00 per share. During the year ended 2012, we distributed 725,611 shares of EBI common stock to our shareholders (the “EBI Dividend”). As a result, as of December 31, 2012,2013, we owned 96.37% of EBI common stock and our shareholders owned an aggregate of 3.63% of EBI common stock. The Company intendsexpects to issue the remaining portion ofstock dividends in 2014. No stock dividends were issued during the dividend to its shareholders as soon as practicable.year ended December 31, 2013.

Our Industries

Oil and Gas Industry

As demand for energy produced in North America continues to grow, we believe that exploration and production will continue to move further away from civilization and into more remote environments. In particular, the recent discovery of certain new extraction techniques such as “fracking” has opened up multiple oil and gas shale regions in extremely remote areas of North America. As a result, oil and gas companies have been forced to change the way they communicate. One such approach is to achieve a “digital oilfield.” In a digital oilfield, new technologies such as process digitization, real time data collection, and intelligent controls are combined to improve recovery, accelerate production, reduce downtime, and reduce the number of on-site engineers and geologists required to oversee the operation. At the heart of a digital oilfield is a reliable, low latency, cost-effective means of communication. Oil and gas companies have historically relied on cellular and satellite communication to transmit data from the well site to the home office but these very remote locations are typically not within range of cellular communication and satellite communication suffers from extremely high latency - a delay of almost one second in data transmission. High latency can interrupt the fluency of voice communications and make machine to machine communications complex, ineffective and unreliable. Currently, we believe that the terrestrial wireless broadband network we offer in these remote areas is the only fully viable solution.

In addition to the increased rate of utilization by oil and gas companies of our low latency, terrestrial wireless broadband communications service, our business growth is also driven by the increased level of oil and gas drilling activities in North America, particularly in shale plays in Eagle Ford and Bakken.Cline Shale formations. We believe the following economic factors will positively impact our business strategy in the near future:

| · | The continued need for higher bandwidth, low latency communications to support the digital oilfield. This need is continually driven by the more bandwidth intensive software being developed by the major oil and gas service providers. We believe that the traditional satellite communications |

| · | Increased oil drilling activity and sustained higher oil prices. The average West Texas Intermediate oil price has increased |

| · | Favorable domestic natural gas drilling outlook. Domestic natural gas exploration and production companies are trending toward development of unconventional natural gas basins such as shale. These basins are known for large inventories of drilling locations and wells with high initial decline rates. These high initial decline rates typically result in more wells drilled over time in order to maintain production and lease positions. As producers gain experience in the nation’s shale gas plays, the efficiency of their drilling operations has improved immensely. Today, operators sink wells at a much quicker pace and have optimized their drilling and hydraulic fracturing techniques to maximize output.We believe these factors should result in high levels of domestic natural gas drilling activity, in particular in the Eagle Ford Shale and |

As a result of the above factors, we expect that there will continue to be a tight supply of, and high demand for, natural gas and oil in North America in the near future. We believe these trends will continue to support high levels of drilling activity which should equate to increased demand for our services.

Banking/Healthcare/Education

Many rural areas of the United States that need point-to-point broadband communications do not have any alternative other than to lease these services from the local telephone company. Because of the rural nature of these leased services, there is very little competition and thus higher than average pricing in many locations. We have developed a wireless model for replacing these leased wireline circuits with terrestrial wireless circuits that are typically owned by the customer and monitored and maintained by us. In particular, for the regional banking industry, we utilize our already owned terrestrial wireless networks to build fixed point-to-point spur networks from our towers to the individual bank branch locations up to twenty-five miles away. The banks typically purchase these spur networks and pay us to build the networks. In addition, we provide our patented security device CryptoVueTMCryptoVue™ to satisfy the regulatory requirements of a bank using a wireless network outside of the bank’s physical location. These new bank networks allow a bank to communicate voice and data among their various branches as well as the parent bank. Following the construction and commissioning of a bank network, we typically enter into a long term monitoring and maintenance contract with the bank. The advantage that the bank receives, in addition to higher transmission speeds, is a reduction of their communication costs as compared to leasing such services from the telephone company. To date we have constructed four such banking networks that serve almost one hundred branch locations across Texas and Louisiana.

The healthcare and educational application of our wireless technology is very similar to the banking model, except that we typically own the spur networks and the security requirements are not as stringent as compared to banks. Over the past five years we have completed such networks for four large school districts in Texas and are serving threefive healthcare facilities, most located in the State of Texas.

Commercial and Residential Wireless Broadband

The rural areas of the United States have not historically enjoyed the advantages of broadband that is now available in most urban areas. Currently many rural areas still receive their Internet service by way of a dial up telephone connection, a local cable company, or if they live near a more urban region, by DSL. Even though they are connected to the Internet they cannot enjoy its advantages because their connection speed is limited in bandwidth. For those who want or need an increased bandwidth offered by broadband, the only viable and economic solution is to purchase wireless broadband. The costs associated with providing connectivity these customers are directly related to the number of customers per square mile, and as a result, the margins for rural commercial and residential broadband can be quite small even when delivered in a wireless fashion. We have, however, been able to utilize our existing networks shared with oil and gas customers, banks, healthcare, and educational entities to also deliver wireless broadband to customers in these rural areas. We currently have approximately 3,2523,000 residential and commercial customers producing approximately $200,000 per month of recurring revenue while sharing our rural networks with our banking/healthcare/educational/ and oil and gas customers.

| 3 |

Our Services

Oil & Gas Industry Wireless Bandwidth and Related Support Services.Through our oil and gas industry division, we provide a wide range of wireless Internet bandwidth connectivity service solutions as well as a number of related products and services, which include the following:

| · | Nomadic terrestrial wireless broadband circuit connectivity to the wellsite:the term “nomadic” refers to our ability to provide portable trailer mounted fifty foot erectable communication |

| · | Wellsite communications equipment rental: rental of computers, printers, fax machines, monitors, and similar communications equipment directly to the wellsite customers. |

| · | Wellsite IT supportservices: software and driver loading, computer problem resolution, and IT troubleshooting. |

| · | Wellsite IT services over broadband: IT support services to allow wellsite customers to operate remote software and data solutions over the broadband connection. |

| · | Network monitoring and maintenance: monitoring of various customer devices over the broadband network and troubleshooting either remotely or in person at the wellsite. |

| · | Layer 2 secure communications connectivity products rental and services: secure Internet protocol layer 2 routing of customer circuits to improve security and reliability of broadband connection. |

| · | Fixed site terrestrial wireless broadband connectivity: wireless broadband circuit connectivity directly from our fixed network towers to customer fixed sites such as remote field offices. |

| · | Network design and construction: design of wireless networks for customers for implementation anywhere in the world. Implementation of our network designs for customers anywhere in North America. |

| · | Production field SCADA (supervisory control and data acquisition): connection of our fixed tower wireless networks via wireless circuits directly to oil and gas customer production fields to monitor and control the production process. |

| · | Midstream communications, monitoring, and security: connection of our fixed tower wireless networks via wireless circuits directly to gathering and transport pipeline facilities for monitoring and security purposes. |

In fiscal 20122013 and 2011,2012, these products and services resulted in revenues of $4,642,000$4,311,000 and $2,713,000$4,642,000 respectively, comprising 64%60% of our revenues in 20122013 and 51%63% of our revenues in 2011.2012.

Enterprise-Level Wireless Bandwidth Product and Services Through our enterprise network services division we provide a wide range of terrestrial wireless Internet bandwidth service solutions and related products to the regional banking, healthcare, and educational sectors primarily in the rural areas of North America within our existing coverage areas, including:

| · | Turnkey design and implementation of custom Internet wireless bandwidth solutions, including long-term maintenance and network monitoring; |

| · | Reselling arrangements, under which banks may sell wireless broadband services to private entities, cities, municipalities, and private citizens in specific coverage areas; and |

| · | Secure connectivity using our patented |

In fiscal 20122013 and 2011,2012, these products and services resulted in revenues of $380,000$404,000 and $407,000$380,000 respectively, comprising 6% of our revenues in 2013 and 5% of our revenues in 2012 and 8% of our revenues in 2011.2012.

Commercial and Residential Wireless Bandwidth, Products and Services Through our commercial and residential wireless bundled services division we provide a full range of terrestrial wireless Internet connectivity service solutions and products to commercial businesses and residential customers using our existing wireless networks. These services include high-speed Internet, VOIP service, network monitoring and maintenance, and video service. The bulk of our current commercial and residential customer base reside in Texas and Louisiana.

In fiscal 20122013 and 2011,2012, these products and services resulted in revenues of $2,283,000$2,441,000 and $2,178,000$2,306,000 respectively, comprising 34% of our revenues in 2013 and 31% of our revenues in 2012 and 41% of our revenues in 2011.2012.

| 4 |

Our Business Strategy

We intend to continue to build upon our market position in the areas in which we operate by offering an integrated and comprehensive package of services that will allow us to provide our oil and gas customers with wellsite IT communications services required throughout their drilling locations. We intend to continue to supplement our wellsite communications business with our enterprise, commercial and residential bandwidth delivery to maximize the return from our investment in network infrastructure throughout the regions in which we operate. We view the incremental steps in achieving this to include the following:

| · | Deploying our suite of communications services across existing North American land-based oil and gas operating areas. We believe that our existing terrestrial wireless networks combined with our nomadic wellsite bandwidth delivery system using our advanced fleet of 130 MBTs |

| · | Extend our oil and gas operations into new geographic areas.We intend to apply our expertise in wellsite communications services in markets where we currently do not operate and which provide an attractive platform for future growth. We believe our customers will continue to find value in our ability to provide services across multiple operating regions. We intend to continue to improve the ease with which our clients can use our services from one wellsite location to the next by expanding our service teams of field technicians that provide this service. We expect to support our customers’ entry into other new active drilling regions that are currently developing in the major oil shale regions of North America by introducing our service offerings in those regions. In addition, we intend to expand into new geographic areas where market conditions are favorable in order to attract new customers. Our major criteria for choosing new expansion regions are the availability of sufficient drilling rig density to justify the financial cost of building or acquiring the network. |

| · | Broaden the suite of services we provide.We have established what we believe to be solid working relationships with our oil and gas and enterprise customers, which we believe will allow us to work closely with our customers to define newservice offerings such as security, custom circuit configurations, and redundant communication configurations that meet specific customer needs in the areas where we operate. |

| · | Focus on service quality, business performance and safety. Our management team is responsible for assessing our service quality, performance and safety compliance and coordinates with our field offices to help ensure that our quality and performance metrics and safety standards are met at every level of our organization. |

| · | Continue to pursue strategic expansion opportunities to acquire coverage.We believe that the markets in which we operate remain fragmented and that there are consolidation opportunities within these markets. We completed 15 acquisitions between 2006 and 2010 and intend to continue pursuing strategic acquisitions which add to the scope and quality of our service portfolio. While our primary focus is to expand through organic growth, we intend to continue to evaluate the expansion of our coverage area through acquisitions. In evaluating such acquisitions, we consider a number of factors, including enhancing our current service offerings, geographic diversification, synergies with existing operations, and financial performance and acquisition costs taking into account all of our wireless customer base. As of the date hereof, we have not identified any particular acquisition candidate. |

| · | Capitalize on regional experience. One component of our acquisition and growth strategy is to acquire assets located in strategic operating areas for all of our wireless customers, but especially for our oil and gas customers, that include personnel with strong local leadership and regional experience. We believe that by having the administrative functions previously performed at the regional level centralized in and handled by our corporate office, we believe we have enhanced our controls environment and enabled our local management to focus on our customers, our employees and the effective management and deployment of our assets. |

Our Competitive Strengths

We believe our operations benefit from a number of competitive strengths addressed below:

| · | Extensive breadth of communications services throughout the wellsite life-cycle. We provide a broad array of wellsite broadband communications and IT services throughout each phase of the land-based drilling and production process. We believe this breadth of service strengthens our relationships with our customers and allows us to identify and cross-sell additional services. Our service offering starts with the exploration phase before any drilling when the oil and gas customers are using a variety of data producing devices to determine the best drilling locations. Our service continues with the delivery of our nomadic terrestrial wireless circuit delivery during the drilling process. In addition, during the drilling process we also provide computer, monitor, printer, fax, router, cellular repeater, and wireless intercom equipment rental as well as standard IT consulting services at the wellsite. After the drilling is completed there is another requirement for a nomadic wireless circuit and other services when crews return to the wellsite for the completions phase. Finally, after the well is producing there is a long-term communications need for monitoring and control. |

| 5 |

| · | Extensive geographic footprint in the oil and gas industry with a strong regional and local presence. Our regional operations are located in some of the most active onshore oil and natural gas drilling regions of the United States, including South Texas, the Texas Panhandle, |

| · | Leveraged to drilling activity. We believe that favorable supply and demand fundamentals will maintain the current level of drilling for oil and natural gas for the foreseeable future. Efforts to maintain current levels of production will, in turn, necessitate continued drilling, which should sustain demand for our services. In addition, as wellsite activities become more automated, and thus data intensive, we expect that the data being generated will continue to grow and will require low latency bandwidth to meet a customer’s requirements. Terrestrial based solutions currently address this need, and we believe we have the largest such wireless network in North America covering oil and gas drilling regions. |

| · | Experienced management team with proven track record and control environment. Our senior management team has extensive experience in the wireless communications industry and also has sound oil and natural gas industry experience. We believe that this background provides our management team with an in-depth understanding of our customers’ needs and enhances our ability to deliver customer driven solutions. While our primary emphasis is to focus on organic growth by the deployment of MBTs to provide nomadic coverage, our management also has substantial experience in identifying, completing and integrating acquisitions to acquire wireless coverage and, since our inception, we have acquired 15 businesses. We have also implemented a standardized control environment that includes accounting, safety, environmental and maintenance processes and controls. Our integrated systems allow us to monitor operating performance, maintain financial, accounting and asset management controls, integrate acquisitions, prepare timely financial reports and manage contractual risk. In addition, our control environment provides transparency for our management team to track regional and project level performance and reliability and frees our local personnel to focus on customer service and performance. |

Overview of our Divisions

We operate in the following areas of North America:

| 6 |

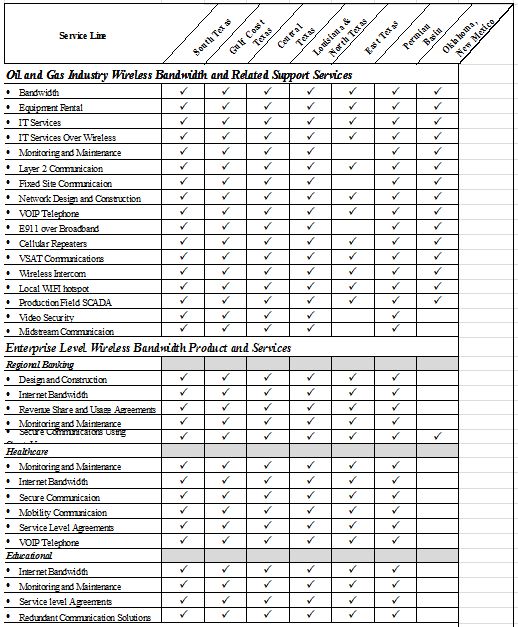

We manage our business through three major divisions: oil and gas services division, enterprise network services division, and wireless bundled services division. The following matrix illustrates the various products and services we provide throughout all of our different service regions from the three major divisions of our company:

| 7 |

Our revenues from our operating segments for the fiscal years ended December 31, 20122013 and 20112012 are set forth below.

| ($ in thousands) | Fiscal Year Ended December 31, | Fiscal Year Ended December 31, | ||||||||||||||||||||||||||||||||||||||||||||||

| Business Segment | 2012 | % of Total | 2011 | % of Total | $ Change | % Change | 2013 | % of Total | 2012 | % of Total | $ Change | % Change | ||||||||||||||||||||||||||||||||||||

| Energy Broadband, Inc. | $ | 4,642 | 64% | $ | 2,713 | 51% | $ | 1,929 | 71% | $ | 4,311 | 60% | $ | 4,642 | 63% | $ | (331 | ) | -7% | |||||||||||||||||||||||||||||

| Wireless Bundled Services | 2,283 | 31% | 2,178 | 41% | 105 | 5% | 2,441 | �� | 34% | 2,306 | 32% | 135 | 6% | |||||||||||||||||||||||||||||||||||

| Enterprise Network Services | 380 | 5% | 407 | 8% | (27 | ) | -7% | 404 | 6% | 380 | 5% | 24 | 6% | |||||||||||||||||||||||||||||||||||

| Wireless Messaging Services | 23 | 0% | 22 | 0% | 1 | 5% | ||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 7,328 | 100% | $ | 5,320 | 100% | $ | 2,008 | 38% | $ | 7,156 | 100% | $ | 7,328 | 100% | $ | (172 | ) | -2% | |||||||||||||||||||||||||||||

Sales and Marketing

Our sales and marketing activities are generally performed through local operations in each geographic region. We believe our local field sales personnel understand basic issues and customer operating procedures and, therefore, can effectively target marketing activities. We also have a corporate sales office located in our League City, Texas headquarters that supplements our field sales efforts and focuses on large accounts and selling our complementary services.

Operating Risks and Insurance

Our operations are subject to a limited number of hazards inherent in the land based oil and natural gas industry. Our enterprise, commercial, and residential customers present operating risks similar to those found in many business environments of the communications industry. We maintain industry standard insurance in amounts that we believe to be adequate.

Third Party Suppliers

We procure substantially all of the equipment we use to provide our terrestrial broadband services from third-party suppliers pursuant to multi-year agreements. The equipment we procure consists of commercial off-the-shelf components, which management believes could be obtained from other third-parties on commercially reasonable terms in the event that supply from our current suppliers is interrupted. Our suppliers generally warrant the products distributed by us and allow returns of defective products, including those that have been returned to us by our customers. We do not independently warrant the products that our suppliers distribute, but we do provide warranty services on behalf of the suppliers if and when required.

Competition

We operate in competitive markets with low barriers to entry. To compete successfully in those markets, a company must provide high-quality, reliable services that meet the specific needs of our customers at competitive prices. In the oil and gas industry division, our terrestrial broadband communications competes primarily with the traditional VSAT communications that are provided by a wide range of other providers. With respect to our enterprise network service division and our commercial and residential bundled service division, we compete mainly with the more established telephone and cable companies.

TheThe oil and gas remote communications services industry is highly competitive. We expect competition in the markets that we serve to continue, increase and change, consistent with recent industry consolidation and introductions of new 4G LTE technologies. We face varying degrees of competition from a wide variety of companies, including new potential entrants from providers to adjacent vertical markets and from forward integration by some of our suppliers deeper in the industry value chain, since successful service and system development is not necessarily dependent upon substantial financial resources.

Our primary North American competitors in upstream oil and gas include Harris CapRock Communiations,Communications, RigNet, Inmarsat plc’s Inmarsat Solutions, Stallion Oilfield Services, Datacom, Digital Networks and Sound & Cellular marketed under the brand Drillcom. The VSAT industry sector has experienced consolidation with Harris Corporation’s acquisitions of CapRock Communications, Inc. and Schlumberger Ltd’s Global Connectivity Services division. More recently, 4G LTE start-up companies including Infrastructure Networks and Texas Energy Networks have acquired spectrum assets and begun constructing 4G LTE networks in certain oil and gas territories. In addition, there are a range of regional providers serving smaller customers. Specifically in North America, we also face competition from drilling instrumentation providers, living-quarters companies, and other pure-play providers that have a similar operating strategy.

Our oil and gas customers generally choose their provider(s) based on the quality and reliability of the service and the ability to restore service quickly when there is an outage. Pricing and breadth of service offerings is also a factor. The oil and gas industry depends on maximum reliability, quality and continuity of products and service. Established relationships with customers and proven performance serve as significant barriers to entry. Our competitive advantage over traditional VSAT providers that have dominated the industry historically results from being able to provide a T-1 equivalent 1.5Mb circuit with a service level agreement of less than 70 milliseconds of latency as compared to 600-700 milliseconds latency for VSAT providers. This increased speed and lower latency allows for better dependability of voice transmissions and quality as well as enabling utilization of the oil and gas operators drilling and measurement applications on a real-time basis.

| 8 |

For our non-oil and gas operations, the Internet services industry is extremely competitive. We compete for revenues with multiple companies providing Internet services on a nationwide basis, discount ISPs (Internet service providers) and smaller regional ISPs. We also compete with companies that provide Internet access via narrowband and broadband technologies, such as Internet access providers, cable companies and telephone companies, most of which offer the same Internet connectivity services. While there is still significant competition, we are utilizing a strategy of focusing on marketing to underserved geographic areas –areas with less competition or technically inferior services available that also contain oil and gas exploration and drilling operations. We believe residential Internet competition in these areas is generally from locally owned wireless broadband operators who lack the operating scale and monitoring systems. These operators often have significantly higher prices or inefficient operations. These local wireless broadband operators offer little competition for our oil and gas customers since they are generally not equipped, financially or otherwise, to offer the required service.

Finally we believe that the principal competitive factors in the market areas that we serve are quality of service, low latency, reputation for safety and technical expertise, availability and price. While we attempt to be price competitive, we believe that many of our customers select our services based primarily on our professional, reliable and comprehensive provision of services in each of our service areas and the experience of our service professionals who deliver those services.

Safety Program

In the wellsite support services industry, an important competitive factor in establishing and maintaining long-term customer relationships is having an experienced and skilled work force. In recent years, many of our larger customers have placed an emphasis not only on pricing, but also on safety records and quality management systems of contractors. We believe that these factors will gain further importance in the future. We plan to apply adequate resources toward employee safety and quality management training programs.

Intellectual Property, Proprietary Rights and Licenses

With respect to our Internet services, we believe that our success is more dependent upon technical, marketing and customer service expertise than upon our proprietary rights. With respect to our enterprise network services division, we have been issued three patents and we have two patent applications pending on our CryptoVueTMCryptoVue™ technology. The abstract of the patent application filing included the secure, triple-controlled system for data over a network, which protects against data theft or alteration by one or more ("e.g., two") corrupt insiders working together with outsiders. A combination of dual-control tamper-resistant routers, physical hardware keys and encryption keys enforces what we believe to be best practice security protocols with thorough auditing. A remote monitoring center provides a third level of control along with remote auditing and detailed change-control alerts. We can provide no assurance that the remaining two patents will be issued.

All spectrum in the US and generally internationally is controlled by each country's equivalent of the Federal Communications Commission (“FCC”). In some cases and some countries portions of the spectrum are set aside for general use such as license-free networks. Part of the spectrum in most countries is controlled for military use, public safety and commercial services. Only the entities so entitled may use the frequency bands they have rights to. We currently operate in all bands of the unlicensed spectrum, and have licensed spectrum in the 3.65 gigahertz, 6.6 gigahertz, and 11 gigahertz bands.

Although we believe our products and services are unique and do not infringe upon the proprietary rights of others, there is no assurance that infringement claims will not be brought against us in the future. Any such claim could result in costly litigation or have a material adverse effect on our business, operating results and financial condition.

Governmental Regulation

Our wireless Internet access products currently operate in a combination of licensed and unlicensed spectrums. We provide Internet access, in part, using telecommunications services provided by third-party carriers. Terms, conditions and prices for telecommunications services are subject to economic regulation by state and federal agencies. As an Internet access provider, we are not currently subject to direct economic regulation by the FCC Federal Communications Commission (FCC) or any state regulatory body, other than the type and scope of regulation that is applicable to businesses generally. In April 1998, the FCC reaffirmed that Internet access providers should be classified as unregulated "information service providers" rather than regulated "telecommunications providers" under the terms of the 1996 Telecommunications Act (the "1996 Act"). As a result, we are not subject to federal regulations applicable to telephone companies and similar carriers merely because we provide our services using telecommunications services provided by third-party carriers. To date, no state has attempted to exercise economic regulation over Internet access providers.

| 9 |

Governmental regulatory approaches and policies to Internet access providers and others that use the Internet to facilitate data and communication transmissions are continuing to develop and, in the future, we could be exposed to regulation by the FCC or other federal agencies or by state regulatory agencies or bodies. In this regard, the FCC has expressed an intention to consider whether to regulate providers of voice and fax services that employ the Internet, or IP, switching as "telecommunications providers," even though Internet access itself would not be regulated. The FCC is also considering whether providers of Internet-based telephone services should be required to contribute to the universal service fund, which subsidizes telephone service for rural and low-income consumers, or should pay carrier access charges on the same basis as applicable to regulated telecommunications providers. To the extent that we engage in the provision of Internet or Internet protocol-based telephony or fax services, we may become subject to regulations promulgated by the FCC or states with respect to such activities. We cannot assure you that these regulations, if adopted, would not adversely affect our ability to offer certain enhanced business services in the future. Due to the increasing popularity and use of the Internet by broad segments of the population, it is possible that laws and regulations may be adopted with respect to the Internet pertaining to content of Web sites, privacy, pricing, encryption standards, consumer protection, electronic commerce, taxation, and copyright infringement and other intellectual property issues. No one is able to predict the effect, if any, that any future regulatory changes or developments may have on the demand for our Internet access or other Internet-related services. Changes in the regulatory environment relating to the Internet access industry, including the enactment of laws or promulgation of regulations that directly or indirectly affect the costs of telecommunications access or that increase the likelihood or scope of competition from national or regional telephone companies, could materially and adversely affect our business, operating results and financial condition.

The FCC has granted direct broadcast satellite (“DBS”) and multi-channel, multi-point distribution service (“MMDS”) operator rights on a national basis similar to the mandatory access provided to franchise cable operators in some state and local jurisdictions. The FCC has adopted rules prohibiting homeowners associations, manufactured housing parks and state and local governments from imposing any restriction on a property owner that impairs the owner's installation, maintenance or use of DBS and MMDS antennas one meter or less in diameter or diagonal measurement. We do not believe our business will be significantly impacted by these rights.

Certain wireless broadband services are subject to regulation by the FCC. At the federal level, the FCC has jurisdiction over wireless transmissions over the electromagnetic spectrum, all interstate and foreign telecommunications services, and many aspects of intrastate telecommunications. State and municipalities also may regulate many aspects of intrastate telecommunications. Broadband Internet-related regulatory policies are continuing to develop and it is possible that our services could be subject to additional regulations in the future. The extent of regulations and their impact on its business and its ability to compete are currently unknown.

Due to the increasing popularity and use of the Internet, it is possible that additional laws, regulations or legal precedent may be adopted with respect to the Internet, covering issues such as content, privacy, pricing, unsolicited email, encryption standards, consumer protection, electronic commerce, taxation, copyright infringement and other intellectual property issues. We cannot predict the impact, if any, that any future legal or regulatory changes or developments may have on our business, prospects, financial condition and results of operations. Changes in the legal or regulatory environment relating to the Internet access industry, including changes that directly or indirectly affect telecommunication costs or increase the likelihood or scope of competition from regional telephone companies, cable operators or others, could have a material adverse effect on its business, financial condition and results of operations.

We are also subject to the requirements of the federal Occupational Safety and Health Act (“OSHA”) and comparable state statutes that regulate the protection of the health and safety of workers. In addition, the OSHA hazard communication standard requires that information be maintained about hazardous materials used or produced in operations and that this information be provided to employees, state and local government authorities and citizens. We believe that our operations are in substantial compliance with the OSHA requirements, including general industry standards, record keeping requirements, and monitoring of occupational exposure to regulated substances.

Employees

As of December 31, 2012,2013, we employed 7059 people, 4433 of which were sales, general and administrative employees located in our Houston headquarters, and 26 of which were field workers and others employed in regional operations. Approximately 44%51% of our employees are on salary and 56%49% of our employees are employed on an hourly basis. Our future success will depend in part on our ability to attract, retain and motivate qualified personnel. We are not a party to any collective bargaining agreements, and we consider our relations with our employees to be satisfactory.

Customers

In our oil and gas division, we serve numerous major and independent oil and natural gas companies, operators and drilling contractors that are active in our core areas of operations. None of our oil and gas industry customers have long-term contracts, as all arrangements are terminable upon 30 daysdays’ notice or less. As of December 31, 2012,2013, we have in excess of 2567 customers and during the year ended December 31, 20122013 and 2011,2012, we had two customers that accounted for 10% or more of our revenues, and one customer that accounted for 10% or more of our revenues, respectively.

| 10 |

In our enterprise network services division,we service four major regional banking organizations with banking locations covering much of western and central Louisiana and western Texas. In addition, we service four major school districts in Texas as well as five hospitals and numerous clinics mainly located in Texas. Most of these contracts are one-year or more in duration. For the years ended December 31, 2013 and 2012, and 2011, we had nodid not have any customers in the division that accounted for 10% or more of our revenues.

In our wireless bundles servicesdivision we service approximately 3,2523,000 individual commercial and residential customers with most of these customers currently being located in Texas. None accounted for 10% or more of our revenues during the fiscal years ended December 31, 20122013 and 2011.2012. All of these customers are subject to contractual arrangements terminable upon 30-days30-days’ notice.

Research and Development

During the two previous fiscal years we have not incurred research and development cost and do not anticipate incurring any such costs in the current fiscal year.

Patents, trademarks, licenses

The company has three issued patents on its CryptoVue bank network routing device and operates this product in customer networks both in Texas and Louisiana. The company also maintains a number of registered trademarks and utilizes these trademarks in product literature and markings. The company also utilized numerous FCC licensed frequencies throughout its networks in multiple states.

ITEM 1A. RISK FACTORS

Risks Related to Our Business

We have a history of significant losses, expect future losses and cannot assure you that we will achieve profitability.

We have experienced net losses and negative cash flows from operating activities since inception and we expect such losses and negative cash flows to continue in the foreseeable future. As of December 31, 20122013 and 2011,2012, we had a working capital deficit of $2,460,000,$4,500,000 and working capital of $170,000,$2,460,000, respectively, and stockholders’ deficit of $2,915,000$6,989,000 and $2,091,000,$2,915,000, respectively. For the years ended December 31, 20122013 and 2011,2012, we incurred net losses attributable to ERF Wireless, Inc. of $7,264,000, and $4,814,000, and $3,379,000.respectively. As of December 31, 2012,2013, we had an aggregate accumulated deficit of $56,012,000.$63,276,000. We cannot guarantee that we will achieve sufficient revenues for profitability. Even if we achieve profitability, we cannot guarantee that we can sustain or increase profitability on a quarterly or annual basis in the future.

We have a limited cash and liquidity position and may need to raise additional funds to fund operations.

As of December 31, 2012,2013, we had cash and cash equivalent balances of $118,000,$42,000, a working capital deficit of $2,460,000,$4,500,000, total liabilities of $9,186,000$12,061,000 including notes payable, debt and capital leases in the aggregate amount of $6,328,000,$8,914,000, of which $1,527,000$3,435,000 matures on or prior to December 31, 2013.2014. Revenues generated from our operations are not presently sufficient to sustain our operations. There can be no assurance that additional funds will be available when needed from any source or, if available, will be available on favorable terms, or terms that are acceptable to us. We may be required to pursue sources of additional capital through various means, including debt or equity financings. Future financings through equity investments are likely to be dilutive to existing stockholders. Also, the terms of securities we may issue in future capital transactions may be more favorable for our new investors. Newly issued securities may include preferences, superior voting rights, the issuance of warrants or other derivative securities, and the issuances of incentive awards under equity employee incentive plans, which may have additional dilutive effects. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition. Our ability to obtain needed financing may be impaired by such factors as the capital markets and our history of losses, which could impact the availability or cost of future financings. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs, even to the extent that we reduce our operations accordingly, we may be required to cease operations.

We have incurred significant indebtedness and a default of the terms of our significant debt obligations may subject us to the risk of foreclosure on certain of our assets.

As of December 31, 2012,2013, we had current liabilities of $4,385,000$6,582,000 that included $1,527,000$3,435,000 of notes payable and current portion of long-term debt, $1,226,000$1,299,000 of accounts payable, $1,120,000$1,158,000 of accrued expenses, $20,000$13,000 deferred revenue and $492,000$677,000 of non-cash derivative liabilities. As of December 31, 2012,2013, we had long-term debt outstanding in the amount of $3,168,000$4,281,000 on our unsecured Angus Capital Partners, a related party line of credit, bearing interest at a rate of 12%3% per annum and maturing December 30, 2015, and $1,384,00031, 2017, $1,024,000 owed on our debt agreement with Dakota Capital Fund, LLC, a $2.0 million, with an option for an additional $1,000,000 of funding, secured equipment credit facility, bearing interest at a rate of 18% per annum and maturing March 31, 2016, and long-term capital leases of $174,000 payable to various capital lease agreements, bearing interest rates ranging from 6.75% to 42% per annum and maturing from September 30, 2014 to July 31, 2016.

| 11 |

Subsequent to December 31, 2012,2013, the investor financing agreement was modified in January 2014, extending the maturity date to April 15, 2014. Both parties have renegotiated the subset interest rate from .5% interest per day on a 360 day calendar year to 12% rate per annum retroactive to March 23, 2013. The Company entered intoalso agreed to additional consideration of 5,000 shares of Series A Preferred Stock to be issued as long as the note remains unpaid and a three-month unsecured credit facility with$50,000 penalty to be added to principal in January 2014.

Subsequent to December 31, 2013, TCA Global Credit Master Fund, effective March 25, 2014, has agreed to restructure the loan agreement and extend the maturity date to November 15th, 2014. The Company in consideration has agreed to a financial institution, under which the lender, at its option, may advance up$75,000 restructuring fee to $500,000be added to the Company. The Company borrowed $100,000 undersum of the facility, which was repaid onprincipal balance including a $40,791 interest charge to be paid in March 12, 2013. Additionally, on March 5, 2013, the Company issued a six month convertible secured promissory note in the original principal amount of $650,000 and original issue discount and prepaid interest of $141,500.2014 nd nominal legal fees.

Our level of indebtedness increases the possibility that we may be unable to generate cash sufficient to pay, when due, the principal of, interest on or other amounts due in respect of the indebtedness. Our indebtedness, combined with other financial obligations and contractual commitments, could:

| · | make it more difficult for us to satisfy our obligations with respect to the indebtedness and any failure to comply with the obligations under any of our debt instruments, including restrictive covenants, could result in events of default under the loan agreements and instruments governing the indebtedness; |

| · | require us to dedicate a substantial portion of our cash flow from operations to payments on indebtedness, thereby reducing funds available for working capital, capital expenditures, acquisitions, research and development and other corporate purposes; |

| · | increase our vulnerability to adverse economic and industry conditions, which could place us at a competitive disadvantage compared to competitors that have relatively less indebtedness; |

| · | limit our flexibility in planning for, or reacting to, changes in business and the industry in which we operate; and |

| · | limit our ability to borrow additional funds, or to dispose of assets to raise funds, if needed, for working capital, capital expenditures, acquisitions, research and development and other corporate purposes. |

Some of our existing debt involves variable rate debt, thus exposing us to risk of fluctuations in interest rates. In addition, as of December 31, 2012,2013, certain operating assets, and furniture are pledged as collateral on outstanding notes andcapital leases. The occurrence of an event of default under any of our obligations might subject us to foreclosure by the lenders to the extent necessary to repay any amounts due. If a foreclosure were to occur on our assets, it would likely have a material adverse effect on our business, prospects, financial condition and results of operation.

We may incur significant additional indebtedness in the future. If we incur a substantial amount of additional indebtedness, the related risks that we face could become more significant. Additionally, the terms of any future debt that we may incur may impose requirements or restrictions that further affect our financial and operating flexibility or subject us to other events of default.

During 20122013 and 2011,2012, a majority of our revenue was generated from short-term agreements and we expect that these arrangements will continue for the foreseeable future.

For the year ended December 31, 20122013 and 2011,2012, the majority of our revenues resulted from short-term, terminable-at-will, arrangements. We had two customers that provided revenue in excess of 10% (32% and 12% of the gross sales during 2012the year ended December 31, 2013) and one customertwo customers that accounted for revenues in excess of 10% (42% and 13% of the gross sales during 2011.the year ended December 31, 2012). We expect that for the foreseeable future a majority of our revenue will continue to be earned pursuant to short-term terminable-at-will, arrangements with our customers. There is no assurance that our customers will continue to conduct business with us in the future, the failure of which could have a material adverse effect on our business, prospects, financial condition and results of operation.

We may be adversely affected by our dependence on network infrastructure, telecommunications providers and other vendors.

We may experience problems with the installation, maintenance and pricing of our communications network, and delays in equipment delivery orloss of our equipment suppliers could impair the quality of our services and any growth. If our network infrastructure is disrupted, we may lose customers or incur additional liabilities. We may experience interruptions in service as a result of fire, natural disasters, power loss, or the accidental or intentional actions of service users, and others. Although we have implemented disaster recovery, security and service continuity protection measures, including the physical protection of our offices and equipment, we cannot guarantee that such measures are sufficient to avoid future interruptions of service or losses of data.

| 12 |

We may not be able to increase our customer base at the expected rate, which is dependent upon our growth strategies.

In order to become profitableand obtain consistent positive operating cash flow, we need to both retain existing customers and continue to add new customers. We may encounter difficulties, including but not limited to

| · | we may not retain customers for a variety of reasons, including competition from other providers, existing customers electing to develop their own services, and customers going out of business; |

| · | we may not succeed in adding customers if our sales and marketing plan is unsuccessful. As part of our growthstrategy, |

| · | we compete with other companies for acquisition opportunities and cannot make assurances that we will be able tosuccessfully negotiate future acquisitions or strategic alliances; |

| · | we often use a combination of cash, debt, and common stock as consideration for our acquisitions, and futureacquisition targets may not agree to accept the form(s) of consideration offered; and |

| · | we may not be able to acquire companies or their assets at prices that are consistent with our strategy. |

While our current business plan is to expand primarily through organic growth, we plan to effect acquisitions of broadband coverage if and when necessary. Consummating acquisitions could also result in the incurrence of additional debt and related interest expense, aswell as unforeseen contingent liabilities, all of which could have a material adverse effect on our business, prospects, financial condition and results of operations.

If our security measures are breached, or if our services are subject to attacks that degrade or deny the ability of customers to access our network, our products and services may be perceived as not being secure and customers may curtail or stop using our services, and we may incur significant legal and financial exposure.

Concerns about the security of information transmitted through the use of our services and the privacy of users may inhibit our growth. With respect to our enterprise customers, we rely upon our CryptoVueTMCryptoVue™ technology as well as an Internet protocol layer “2” device to provide secure transmissions of certain customer information and various firewall systems to protect our databases and computer systems. Security breaches at our enterprise customer installations could expose us to litigation and potential liability. Our security measures may be breached due to the actions of outside parties, employee error, malfeasance, security flaws in the third party products or services that we rely upon or otherwise, and, as a result, an unauthorized party may obtain access to our data or data transferred over our network. Additionally, outside parties may attempt to fraudulently induce employees to disclose sensitive information in order to gain access to our enterprise customers’ data or data transferred over our network. Because the techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently and often are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. If an actual or perceived breach of our security occurs, the market perception of the effectiveness of our security measures, such as the CryptoVueTMCryptoVue™ technology, could be harmed and we could lose customers.

We may be subject to significant liability for our technology.

If our technology contains defects, we may be subject to significant liability claims from subscribers and other users of our technology and incur significant unexpected expenses or lost revenues. Our technology is complex and may contain undetected errors or failures. We also have exposure to significant liability claims from our customers because our technology is designed to provide critical communications services. Our product liability insurance and contractual limitations in our customer agreements may not cover all potential claims resulting from a defect in our technology. Failure of our technology to perform satisfactorily could cause us to lose revenue, as well as to experience delay in or loss of market acceptance and sales, product returns, diversion of research and development resources, injury to our reputation or increased service and warranty costs.

Our current services may become obsolete due to the highly competitive and continued advancement of the communications industry. Larger service providers may provide services at lower costs.

Intense competition in the Internet services market and inherent limitations in existing technology may negatively affect the number of our subscribers. Competition in the market for Internet technology services is intense, and we expect the level of competition to intensify in the future. The market for Internet services and technology is characterized by rapid change, evolving industry standards and frequent introductions of new technological developments. These new standards and developments could make our existing or future services obsolete. Many of our current and potential competitors have longer operating histories, greater brand name recognition, larger subscriber bases and substantially greater financial, technical, marketing and other resources than we have. Therefore, they may be able to respond more quickly than we can respond to new or changing opportunities, technologies, standards or subscriber requirements. Our effort to keep pace with the introduction of new standards and technological developments and effectively compete with larger service providers could result in additional costs or the effort could prove difficult or impossible. The failure to keep pace with these changes and to continue to enhance and improve the responsiveness, functionality and features of our services could harm our ability to attract and retain users, which could lead to a loss of revenues.

| 13 |

Interruption or failure of our networks, which in certain rural markets are often subject to severe weather such as hurricanes,lightning storms or tornados, could impair our ability to provide our services, which could damage our reputation and harm operating results.

We provide our services in remote areas of North America, including the Gulf coast, which are more prone to severe weather such as hurricanes, lightning storms and tornados. Any disruption in our services arising from these or other natural disasters or catastrophic events including wildfires and other fires, excessive rain, terrorist attacks and wars, could disrupt the continued operation of our networks and have a material adverse effect on our business, prospects, results of operation and financial condition.

Although we believe our insurance coverage is adequate to address the variety of potential liabilities we face, our insurance coverage is subject to deductibles and coverage limits. Upon an occurrence of a significant natural disaster, or manmade problems such as computer viruses, civil war, terrorism, blackout or disruptions to the economies of the United States and other countries, such coverage may not be adequate or continue to be available at commercially reasonable rates and terms. In the event of a major disaster affecting one or more of our sites, our operations could be significantly disrupted, delayed or prevented for the time required to transfer production, repair, rebuild or replace the affected site. This time frame could be lengthy, and result in significant expenses for repair and related costs.

We may not be able to successfully upgrade our existing network infrastructure.

If the number of customers using our network and the complexity of our services increase, we will require more infrastructure, network and customer service resources tomaintain the quality of our services. We may experience quality deficiencies, cost overruns and delays in implementing network improvements and expansion, in maintenance and upgrade projects, including slower than anticipated technology migrations. If we do not implement necessary developments and network upgrades successfully, or if it experiences inefficiencies, operational failures, or unforeseen costs during implementation, we may lose customers or incur additional liabilities.

We compete with many companies that are larger and better capitalized than us, and we expect such competition to continue. An inability to overcome competition from alternative communication systems could adversely affect our results of operations.

We face competition from many entities with significantly greater financial resources, well-established brand names and larger customer bases. The internetInternet services market is extremely competitive in every segment including competing technologies such as VSAT and long-term evolution (marketed as 4G LTE). We may become subject to price competition for our services as companies seek to enter our industry or current competitors attempt to gain market share.We expect competition to intensify in the future and expect significant competition from traditional and new telecommunications companies primarily consisting of cable modem, Internet, DSL, microwave, mobile and satellite data providers. For example, the performance and coverage area of our wireless systems are dependent on certain factors that are outside of our control, including features of the environment inwhich the systems are deployed, such as the amount of clutter (natural terrain features and man-made obstructions) and the radio frequency available. Depending on specific customer needs, these obstacles may make our technology less competitive in comparison with other technologies and make other technologies less expensive or more suitable. Our business may also compete in the future with products and services based on other wireless technologies and other technologies that have yet to be developed. If we are unable to make or keep our services competitively priced and attain a larger market share in the markets in which we compete, our levels of sales and our ability to achieve profitability may suffer.

To the extent we elect to enter into marketing or reseller agreements with third parties to expand our network, and our dependence on such relationships may adversely affect our business.

Our business strategy for increasing the size of our networks may depend on our ability to enter into marketing or reseller agreements with other companies, similar to our exclusive reseller agreements withSchlumberger Technology Corporation and Schlumberger Canada Limited entered into in 2009.companies. Supporting diligence activities conducted by potential partners and negotiating the financial and other terms of these agreements are long and complex processes with uncertain results. Even if we are successful entering into one or more marketing or reseller agreements, such arrangements can involve greater uncertainty for us, as we may have limited or no control over certain aspects of the programs. We may determine that continuing the relationships under the terms provided is not in our best interest, and we may terminate the agreements. Similarly, these third parties could delay or terminate their agreements with us, further delaying the execution of our business plan.

| 14 |

In addition, we could have disputes with our marketing and reselling partners, such as the interpretation of terms in our agreements. For example, we are currently involved in arbitration proceedings withSchlumberger Technology Corporation and Schlumberger Canada Limited, where we are pursuing a breach of contract claim relating to the minimum purchase requirements under the 2009 reseller agreements. This pending action, and any such future disagreements with our partners, could lead to delays in the execution of our business plan or could result in time-consuming and expensive litigation or arbitration, which may not be resolved in our favor.

The ongoing weakness in the global economic environment may have significant effects on our customers and suppliers that could result in material adverse effects on our business, prospects, financial condition and results of operations.

Notwithstanding the increased potential for economic recovery, the ongoing weakness in the global economic environment – which has included, among other things, significant reductions in available capital and liquidity from banks and other providers of credit, substantial reductions and/or fluctuations in equity and currency values worldwide, significant decreases in consumer confidence and consumer and business spending, high rates of unemployment and concerns that the worldwide economy may continue to experience significant challenges – may materially adversely affect our customers’ access to capital or willingness to spend capital on our products, and/or their levels of cash liquidity with which to pay for our products. In addition, our suppliers’ access to capital and liquidity may continue to be affected, which may in turn adversely impact their ability to maintain inventories, production levels, and/or product quality, or cause them to raise prices or lower production levels, or result in their ceasing operation.

Future acquisitions could prove difficult to integrate, disrupt our business, dilute stockholder value and strain our resources.

We have completed 15 acquisitions since 2004, and we plan to continue to engage in strategic acquisitions that further expand our wireless broadband footprint and coverage areas in key oil and gas markets.The structure of our acquisitions and investments involve numerous risks, including:

| · | difficulties inintegrating operations, technologies, services, accounting and personnel; |

| · | difficulties insupporting current customers of our acquired companies; |

| · | ability tomaintain sufficient internal controls; |

| · | diversion offinancial and management resources from existing operations; |

| · | if wefinance acquisitions by issuing convertible debt or equity securities, our existing stockholders may be diluted,which dilution could adversely affect the market price of our stock; |

| · | assumption of contingent liabilities; |

| · | recording of goodwill and other intangible assets, which are subject to potential impairments in the future that could harm ouroperating results; and |

| · | inability togenerate sufficient revenues to offset acquisition or investment costs. |