MOBIQUITY TECHNOLOGIES, INC.

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 20152016

COMMISSION FILE NUMBER: 000-51160

MOBIQUITY TECHNOLOGIES, INC.

(Exact name of Registrant as specified in its charter)

| New York | 11-3427886 |

(State of jurisdiction of incorporation or organization) | (I.R.S. Employee Identification Number) |

| 600 Old Country Road, STE 541, Garden City, NY | 11530 |

| (Address of principal executive offices) | (Zip Code) |

| Registrant's telephone number, including area code: | (516) 256-7766 |

| Securities registered pursuant to Section 12 (b) of the Act: | None |

| Securities registered pursuant to Section 12 (g) of the Act: | Common Stock, $.0001 Par Value |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o Nox

Check whether the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.o

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x Noo

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x Noo

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained in this form, and no disclosure will be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in part III of this Form 10-K or any amendment to this Form 10-K o.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company as defined by Rule 12b-2 of the Exchange Act: smaller reporting companyx.

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o Nox

As of June 30, 2015,2016 the number of shares of Common Stock held by non-affiliates was approximately 65,700,00071,175,872 shares based upon 74,700,56280,176,434 shares of Common Stock outstanding. The approximate market value based on the last sale (i.e. $.25$.10 per share as of June 30, 2015)2016) of the Company’s Common Stock was approximately $16,425.$7,117,587.

The number of shares outstanding of the Registrant’s Common Stock, as of March 26, 2016April 5,2017, was 79,125,928.185,201,768.

FORWARD-LOOKING STATEMENTS

We believe this annual report contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are subject to risks and uncertainties and are based on the beliefs and assumptions of our management, based on information currently available to our management. When we use words such as "believes," "expects," "anticipates," "intends," "plans," "estimates," "should," "likely" or similar expressions, we are making forward-looking statements. Forward-looking statements include information concerning our possible or assumed future results of operations set forth under "Business" and/or "Management's Discussion and Analysis of Financial Condition and Results of Operations." Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Our future results and stockholder values may differ materially from those expressed in the forward-looking statements. Many of the factors that will determine these results and values are beyond our ability to control or predict. Stockholders are cautioned not to put undue reliance on any forward-looking statements. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. For a discussion of some of the factors that may cause actual results to differ materially from those suggested by the forward-looking statements, please read carefully the information under "Risk Factors." In addition to the Risk Factors and other important factors discussed elsewhere in this annual report, you should understand that other risks and uncertainties and our public announcements and filings under the Securities Exchange Act of 1934, as amended could affect our future results and could cause results to differ materially from those suggested by the forward-looking statements.

As used in this Form 10-K, the terms “we,” “our,” “us,” “Mobiquity Technologies” or “the company” refer to Mobiquity Technologies and its subsidiaries, taken as a whole, unless the context otherwise requires it.

TABLE OF CONTENTS

Introduction

Mobiquity Technologies, Inc., incorporated under the laws of the State ofa New York owns and operates a national location-based mobile advertising network and have developed a consumer-focused proximity network which we believe is unlike any other in the United States. Our integrated suite of proprietary location based mobile advertising technologies allows clients to execute more personalized and contextually relevant experiences, driving brand awareness and incremental revenue in real-time.

Leveraging our agreements with Simon Property Group, Inc. (which we refer to herein as Simon or Simon Property), and Macerich Partnership, L.P. (which we refer to as “Macerich”corporation (the “Company”), is the number one and number three mall operators, respectively, in the U.S. in termsparent company of number of Class A properties, we have installed our location-based mobile advertising solutions in the common areas of approximately 295 retail destinations across the U.S. to create “smart malls” using Bluetooth-enabled iBeacon compatible technology. As part of our plan to expand our mall footprint into the common areas of other malls, we recently have also added 57 malls including 30 mallstwo operating by Rouse Properties TRS,subsidiaries; Mobiquity Networks, Inc. (“Rouse”(“Mobiquity Networks”) and 27 malls operated by Preit Services, LLC, which we will refer to as “PREIT.” In December 2015, we entered into an agreement with GGPLP REIT Services, LLC (which we refer to as “GGP”), the second largest mall operator, to install our Mobi-Beacons in approximately 120 malls scheduled for 2Q 2016. We plan to further expand our mall footprint into the common areas of other malls and outside of malls with additional synergistic venues that will allow for cross marketing opportunities, including venues such as stadiums, arenas, additional college campuses, airports and retail chains. For example, we have entered into an agreement with the New York State University at Stony Brook to deploy a mobile advertising network in their new arena. This type of installation will enable fan engagement, cross-marketing opportunities, sponsorship activation and create interactive event experiences. This is our first installation in the university market.

We operate through our wholly-owned subsidiaries, Ace Marketing & Promotions, Inc. (which we refer to as “Ace(“Ace Marketing”) and. The Company’s wholly-owned subsidiary, Mobiquity Networks Inc. has evolved and grown from a mobile advertising technology company focused on Driving Awareness and Foot-traffic throughout its indoor mall-based beacon network, into a next generation mobile location data and marketing company. Mobiquity Networks provides precise unique, at-scale location-based data and insights on consumer’s real world behavior and trends for use in marketing and research. With our combined data sets of shopping malls, premium outlets and cinemas beacon data, and first party location data via our advanced Software Development Kit (“SDK”) utilizing multiple geo-location technologies, Mobiquity Networks provides one of the most accurate and scaled solution for mobile data collection and analysis. Mobiquity Networks is seeking to create several new revenue streams from the mobile data collection and analysis, including, but not limited to; Push Notification Campaigns, Mobile Audiences & Segments, real-timeData Provision, Attribution Reporting and Custom Research. The Company is also attempting to reduce expenses by renegotiating certain Mall Developer Agreements.

Ace Marketing is our legacy marketing and promotions business which provides integrated marketing services to our commercial customers. While Ace Marketing currently represents substantially all of our revenue, we anticipate that activity from Ace Marketing will represent a diminishing portion of corporate revenue as our attention is now principally focused on developing and executing on opportunities in our Mobiquity Networks business.

We believe that our Mobiquity Networks business represents our greatest growth opportunity going forward.

Mobiquity Networks

Mobiquity Revenue Streams

Mobiquity Networks is seeking to create several new revenue streams from the mobile data collection and analysis, including, but not limited to; Push Notification Campaigns, Mobile Audiences and Segments, real-timeData Provision, Attribution Reporting and Custom Research as described below.

| 1 |

Push Notification Campaigns

Push notification campaigns are ideal for drive in-store traffic by reaching consumers before they decide where to shop and what to buy in malls and shopping center common areas.

Data collected with push notifications can:

| · | Increase your client’s revenue potential by driving in-store traffic; |

| · | Enable real time, location based in-app engagement; and |

| · | Enhance interaction by providing localized, relevant content. |

Mobile Audiences

Mobiquity’s Mobile Audiences enables advertisers to create specific audience segments based on user’s real world behaviors. With tracking of over 500 plus brands to understand consumer behavior and affinity, the platform provides unparalleled accuracy and precision due to the volume of user data points and our understanding of dwell time at locations.

Mobiquity Mobile Audiences:

| · | Retrieve over 600 existing geo-behavioral segments based on visitation to specific locations, chain and merchants; |

| · | Include event attendance, home/work locations and motion into your audiences; |

| · | Create custom or use standard audiences like: frequent store visitors, in-market auto buyers, consumers with homes in specific zips/DMAs; and |

| · | Are provided directly to client systems or via standard services. |

| 2 |

Location Data Feeds

Looking to substantially increase the number of unique devices on your own location data platform? Mobiquity’s Location Data Feed will provide clients with millions of first party unique devices and associated meta data to use with clients own places database.

With location data feeds, clients have access to:

| · | Location data from millions of devices; |

| · | Updates on client’s schedule which can be real-time, daily, monthly; and |

| · | Includes data on operating system, timestamp, latitude, longitude and more relevant data. |

Campaign Attribution

Mobiquity clients can now determine impact of its advertising campaigns on its in-store visits and store traffic patterns by leveraging our platform to collect and analyze location data for a clear view of how effectively client campaigns are in driving consumers to its stores.

With Mobiquity Mobile Audiences, clients can have real time information on:

| · | Footfall attribution; |

| · | Insights of daily conversion; |

| · | Insights on visit time and dwell time; and |

| · | Geographical and Audience analysis. |

| 3 |

Footfall, Audience & Path Reporting

Customized reports provide our clients with a deeper understanding of consumer behaviors, store location performance, new store site selection and marketing strategy.

Reports include:

| · | Visit analysis by time & trends by time of day, week and month; |

| · | Distance from home/work of store locations; |

| · | Performance, trends, and comparisons of store locations; |

| · | Dwell time and frequency comparisons by store locations; |

| · | Competitive analysis; |

| · | Locations visited before and after the desired points of interest(“POI”); and |

| · | Correlation between POIs visited and distance from key locations |

What Mobiquity Networks is about

Mobiquity Networks is a location data marketing and insights company. We provide accurate and precise location on millions of mobile devices to help marketers and researchers better find and understand their audiences. All of our data is first party supplied by our SDK installed within dozens of class "A" app partner's apps. First party data is considered the most valuable and accurate that can be collected from an SDK. All data provided by Mobiquity Networks is deterministic with a high degree of accuracy and precision.

Mobiquity Networks’ data is unique for the following reasons:

· Massive Scale: 15 million plus unique devices;

· Unique (exclusive) data from our owned & operated network of beacons in class “A” malls, shopping outlets and cinemas. In the united states, indoor locations represent approximately 30% of major retail locations;

· Data Density: 100 plus data points collected per user/day;

· Spatial Precision: 85% accurate within less than 30 feet;

· Verified Visits: frequency and dwell time in store utilized to determine real consumer visits;

· Diverse Data:found in dozens of mobile apps that utilize precise location; and

· Privacy Compliant: all user privacy is one hundred percent compliant and transparent.

Mobiquity Networks determines a location visit by utilizing all the location sensors built into a mobile device: GPS, Bluetooth, Wi-Fi and motion sensors. To be considered a verified visit a device must have triggered an enter location event (GPS, Wi-Fi, Bluetooth), had a set amount of accuracy to the location event and dwelled at the location for a set amount of time. A typical definition of a verified visit would be a device that was seen at a location in the last 30 days, dwelled at the location for a minimum of 10 minutes and had a high degree of accuracy.

| 4 |

Strategy

Mobiquity Networks derives its revenue utilizing the revenue streams mentioned above. All of the products used to derive revenue for the Company are reliant on the collection of data. To achieve management’s revenue goals moving forward, we have developed a strategy to increase the two main driving forces behind our data collection. One strategy is to increase the total number of users we see on a monthly basis (“MAU”), and the second strategy is to increase the total number of locations (Places) available to see our MAU’s visit over the same time period. We are currently seeing approximately 13,000,000 unique mobile devices by the MAU on a monthly basis and roughly 20,000,000 unique devices for the first 100 days of 2017. The ability to see and collect the data required from these unique devices comes from the installation of our proprietary Software Development Kit (SDK) into third party mobile applications (Apps). To continue to grow the total number of unique devices we can see on a monthly basis, we need to have our SDK installed in more third party Apps. We believe this business unit is well positioned asour unique offering to potential App partners gives us a resultcompetitive advantage over others in the industry. The task of partnering with third party Apps for installation of our early mover status, exclusive agreementsSDK is handled internally by our business development team.

As of March 31, 2017, we had approximately 200,000 Places in our proprietary Places database, and novel technology integrationthat number should increase to address a rapidly growing segment of the digital advertising market – location based mobile marketing. We expect that Mobiquity Networks will generate the majority of our revenueover 4,000,000 Places by the end of 2016 throughthe second quarter 2017, thus exponentially increasing the amount of data we collect. We have been able to steadily increase the number of locations available in our MOBI-Beacons Solutions, although no assurances can be given in this regard.

Mobiquity Hardware Solutions

Our current Mobiquity hardware solution is deployed in retail locations (and in the future may be deployed at other venues such as stadiums, arenas, college campuses and airports) to create the Mobiquity network. Our hardware solutions is identified by us as, Mobi-Beacons.

Mobi-Beacons, which utilize Bluetooth LE 4.0 technology, can dramatically enhance the in-app experiencePlaces database through the use of hyper accurate location event data. Our Mobi-Beacons have been developedboth open source and proprietary technologies. The task of growing our Places database is handled by our internal technology team. The Company currently utilizes both internal and outsourced resources to meet or exceed all iBeaconmarket and Eddystone standards. Our Mobi-Beacons have been deployed throughoutsell its product offerings. Management intends to hire additional sales personnel in the last three quarters of 2017 as working capital permits.

Agreements

Due to the evolution of the Mobiquity Network’s business model, our mall network system. Previously,agreements with the Company utilized Mobi-Units which utilized both Bluetooth and WiFi to communicate with all mobile devices. These devicesMall developers are no longer considered essential to our business operations as our Places data base has grown to approximately 4 million locations making malls a subset within our retail category. This is the major reason why we have allowed many of our mall developer contracts to be terminated by the other parties. We continue to have active agreements with Preit and Rousse malls on a revenue sharing basis covering an aggregate of 55 malls and an agreement with Simon Property malls covering about 195 malls, which agreement will expire no later than December 31, 2017. Since April 2016, this agreement is being financed through lines of credit totaling $2.7 million which lines of credit have been assigned to us by two stockholders in use.exchange for our common stock. See “Item 13.” This agreement is anticipated to be in default if the lines of credit are not reissued by us by the beginning of June 2017, unless a new agreement is entered into prior to that time. For a description of our prior mall agreements, reference is made to “Item 1” of our Form 10-k for the fiscal year ended December 31, 2015.

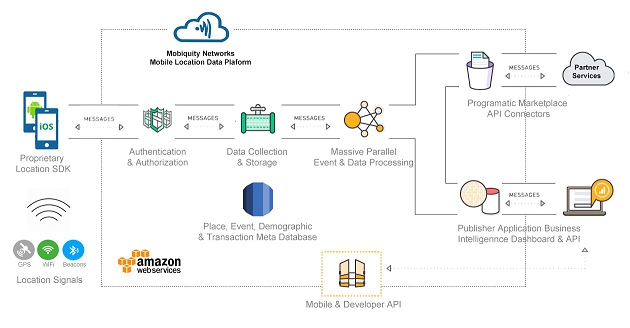

By embedding our SDK (Software Development Kit)We have entered into agreements with many third party app partners such as LiveRamp. LiveRamp is an app, we give an advertiser access to the beaconsAcxiom company, located in the network as well astechnology hub of San Francisco, delivering privacy-safe solutions to market and honoring the best practices of leading associations, including the Digital Advertising Alliance’s (DAA) ICON and App Choices programs, the Interactive Advertising Bureau, the Data & Marketing Association, and the Advertising Research Foundation. Through our agreement with LiveRamp, we have the ability to run targeted campaigns triggered at precise locations and times. Once they receive the data analytics frommake our dashboard, they’re armed with additional insights about their Shoppers and use the information for even more highly targeted campaigns on our own Mobile Ad Network but also when they run other campaigns through different channels like Online and email.Audiences Product available to nearly all buyers interested in such data.

| 5 |

Our Single IntegratedProprietary Technology Platform

Our Mobiquity Platform allowsNetworks has developed a highly accurate and scalable proprietary cloud based mobilelocation platform to allow millions of connected mobile devices to easily and securely log billions of events per day and receive timely user notifications in real-time.

The Mobiquity Networks’ platform analyzes a combination of raw GPS, Wi-Fi and iBeacon radio signals when collecting mobile data to identify user patterns in densely populated urban areas, and even inside stores or desired points of interest. This data is additionally analyzed and enriched with how often users visit specific locations, and how much time they spend at each location. The resulting combined contextual data ensures clients receive highly accurate insights into consumers’ offline behavior and purchase intent.

The Mobiquity Networks platform is hosted and managed on Amazon Web Service (AWS) and takes full advantage of open standards for processing, storage, security and big data technology. Specifically, the use of multiple sensory devices such as Bluetooth, Wi-Fi, Near Field CommunicationMobiquity Networks platform uses the following AWS services: EC2, Lambda, Kafka, Kinesis, S3, Storm, Spark, Machine Learning, RDS, Redshift, Elastic Map Reduction, CloudWatch, and Quick Response Codes in orderElastic Search Service with built-in Kibana integration.

Mobiquity Networks’ unique approach to engage with nearly 100% ofvalidating mobile device types. The platform also allows for plug-in solutions to be added to increase our service offeringslocation visits produces extremely precise and add complementary revenue streams. For example, in addition to our advertising network, numerous plug-ins can be added for services such as loyalty programs, indoor mapping and mobile payments. We have developed an online software platform that integrates the hardware and facilitates campaign management and reporting across the installed network. Our clients can use our network to deploy mobile ad campaigns simultaneously across multiple delivery methods, paying a fee per campaign delivered. Alternatively, clients can subscribe to our Location Signal Service to access real-time contextual beacon signals to drive localized in-app user activity. Management believes that no other competitive solution offers a platform that integrates the depth and range of mobile advertising tools combinedaccurate location data with a nationally deployed hardware network.its publisher application SDK.

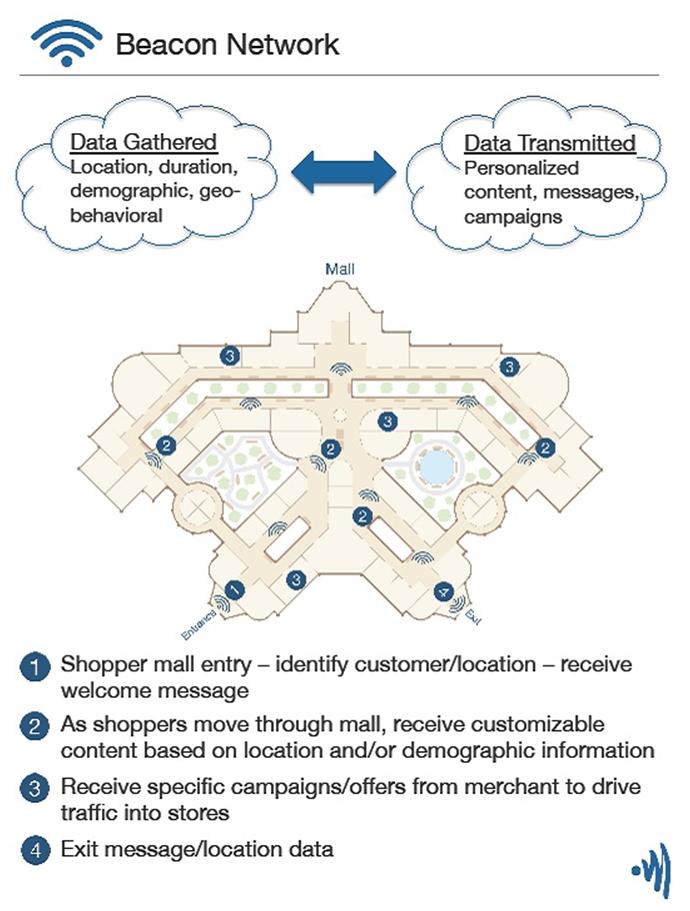

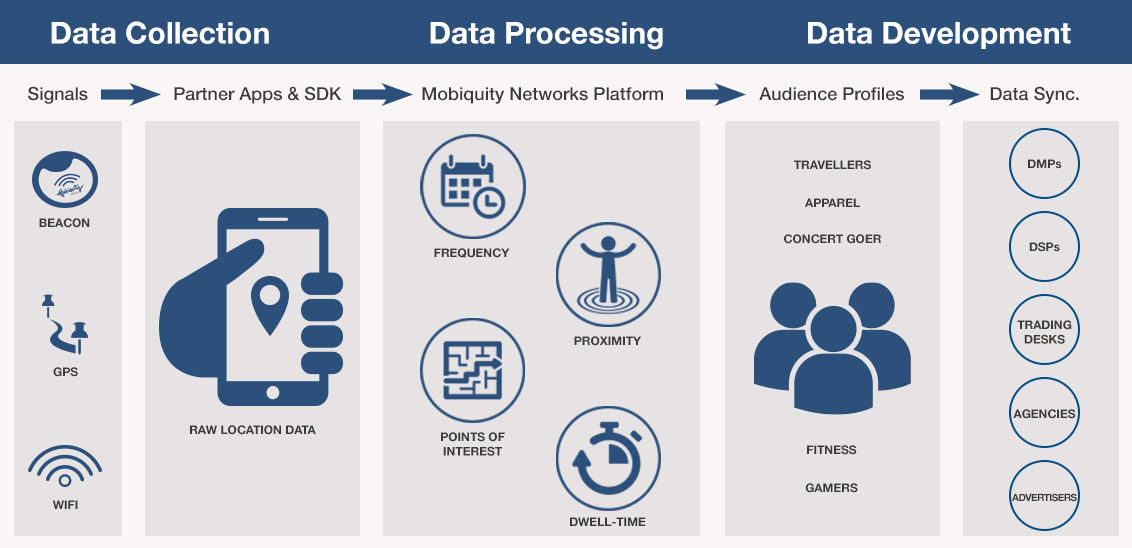

A diagram of our basic network architecture is as follows:

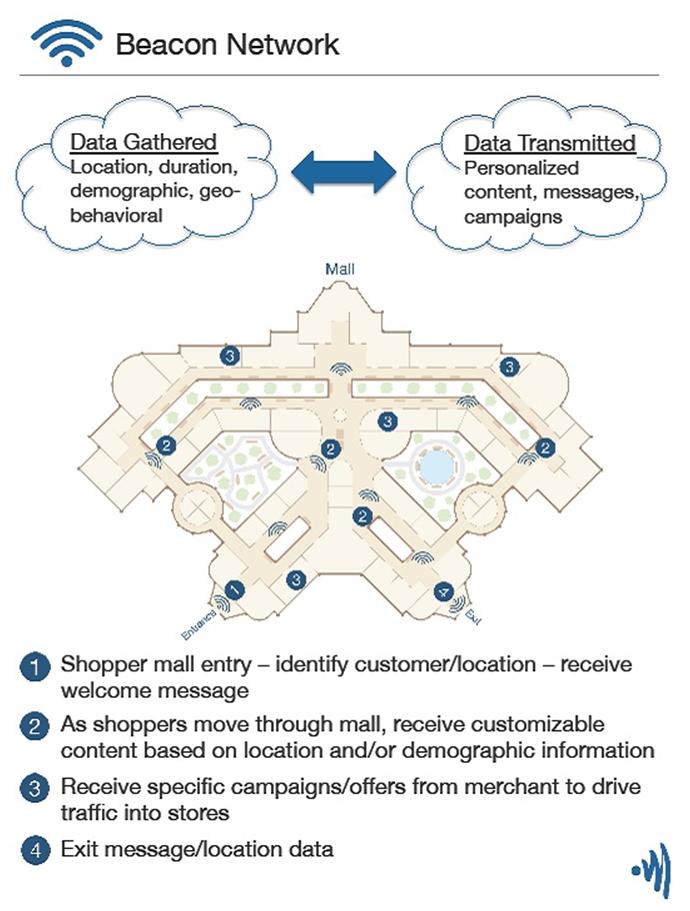

The following graphic depicts a typical mall-shopper engagement from our customers’ viewpoint:

| 6 |

OurThe Mobiquity Networks business monetizes its network by providing clients with Networks’ SDK for iOS and Android is a proprietary intelligent replacement for iOS CLLocationManager and the Android Location Manager technology. It provides all the existing location manager functionality plus adds the following benefits:

| · | advanced location technology capabilities (such as always-on location services, enhanced accuracy, lower battery drain, and others), |

| · | automatic venue recognition, |

| · | access to storefront and venue map database, and |

| · | a detailed location analytics |

Mobiquity Networks’ SDK enables partner publishers to our exclusive common-area beacon signals. By incorporating our software development kit (or SDK),add enhanced location capabilities, and therefore personalized experiences, to their mobile applications without the client app (or campaign-specific third party app) can access the beacon signals provided by our network, and leverage those signals plus the associated contextual information provided by our platform to trigger location-based campaign messaging. We plan to generate revenue several ways including by collecting a fee based on the delivery of our customer advertising campaigns, and licensing ourneed for location signals.expertise.

In order to expand our customer reach and potential app engagement, we have entered into agreements with numerous third party app publishers, including Moviefone, Snip-Snap The Coupons App and GeoOpons among others. In November 2014, we entered into a partnership agreement with Mobile Roadie, one of the largest mobile app and marketing platforms with clients in over 70 countries. By integrating the Mobiquity Networks SDK with the Mobile Roadie platform, Mobile Roadie clients will have the abilityhas assembled a comprehensive location database to add beacon campaignsconvert geographical coordinates to their existing mobile marketing applications, and will be able to leverage our public beacon network. Mobile Roadie has powered thousands of appsa physical address in the Apple App Storereal world. Mobiquity Networks built its own database because existing location databases did not have good enough data to resolve accurate places for user visits. This database includes the street level venue storefronts and Google Android Market. Mobile Roadie clients willentrance for businesses in the U.S., addresses, building polygons, venue polygons, and other related points of interest information. Currently this database has over 4 million locations and continues to be able to use their platform and our Mobi-Beacons to powerpopulated thereby improving the clients’ own private networks in their respective locations. Our relationship with Mobile Roadie and its client base potentially brings significant additional reach to our advertisers. Additionally, the context provided by our network gives shoppers more value as their app experiences are made more expansive and relevant as they shop. Each Mobile Roadie app can potentially be an advertiser or publisher on our network. We are in discussions with numerous other third party app developers including social media apps, retailer apps, entertainment apps, gaming apps and shopping apps. We will continue to attempt to enter into agreements with other app publishers, as the more apps containing our SDK integration, the greater chance of triggering a beacon engagementplatforms’ algorithm for which we get compensated by the advertiser.user visit accuracy.

Our Agreement with Mall Property Owners/ManagersUtilizing massively parallel cluster computing and IBMmachine learning algorithms and technology, Mobiquity Networks processes user dwell-time and frequency of visit data within iBeacons, Wi-Fi and GPS signals to segment highly targetable audiences for mobile marketing. This data processing provides valuable, actionable geo-behavioral data for advertisers and application publishers and made available through an automated platform.

Simon Properties

We entered into an initial agreement with Simon Property in April 2011. This agreement was amended in September 2013Figure 2 – Data Collection, Processing and July 2014Development

The Mobiquity Networks platform automatically synchronizes audience data to amongvarious Data Management Providers (DMP), Demand Side Providers (DSP), trading desks and other things, significantly expand the number of Simon mall properties covered by the agreement across the United States to up top 240 malls. Pursuant to our agreement with Simon, we currently have the right, on an exclusive basis, to install Bluetooth proximity marketing equipment to send information across the air space of the common areas of our Simon mall network, which includes approximately 195 current Simon malls and 45 former Simon malls sold in the first quarter of 2016 to another mall manager (collectively hereinafter referred to as the “Simon Malls”). Under a master agreement and related agreements between us and Simon, Simon is entitled to receive fees from us equal to a minimum fee plus the greater of a pre-set, per mall fee or a percentage of revenues derived from within the Simon mall network as well as certain commission fees based on revenues generated through Simon’s sales efforts. We believe that the revenue share in which Simon participates will exceed the minimum annual mall fees when revenues exceed approximately $14 million dollars. The agreement provides for Simon to adjust the number of malls subject to the agreement from time to time based upon changes inpartners using its beneficial ownership interest in the malls. Our agreement with Simon requires us to maintain letters of credit for each calendar year under the agreement represented by the minimum amount of fees due for such calendar year as well as certain levels of insurance. For 2015, the minimum fees of $2.7 million has been secured through two bank letters of credit, one of which was issued in the amount of $1,350,000 utilizing the funds of a non-affiliated stockholder and the second letter of credit was obtained in the same amount through the funds of Thomas Arnost, our Executive Chairman. In the event Simon draws down upon either letter of credit, we have until the next quarterly minimum payment due date (approximately 90 days) to obtain replacement letters of credit. Each person who secured our letters of credit has the opportunity to notify us that they wish to turn the cash funds securing the letters of credit over to us and to convert such funds into shares of our common stock. Also, each person who issued the letter of credit is receiving quarterly, while the letters of credit are outstanding, options to purchase 125,000 shares of common stock, exercisable at the prevailing market price per share on the date of grant and interest at the rate of 8% per annum on the monies that they have had to set aside in their bank accounts and are unable to have access to such monies. Our agreement with Simon expires on December 31, 2017. Our agreement with Simon is subject to earlier termination by either us or Simon only following a notice and cure period in the event of a material breach of the agreement.marketplace connection application programmer interfaces (API).

| 7 |

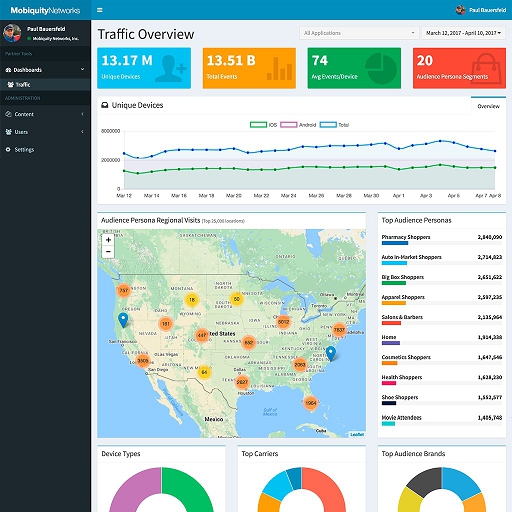

GGPPublishing partners are given access to a comprehensive dashboard to view mobile device traffic and audience segment information of their application user base. This information can be both viewed and access via API to incorporate into internal client systems.

In January 2016, we entered into a license agreement with GGP, with an effective date of November 20, 2015. Pursuant to our agreement with GGP, we shall install Mobi-Beacons to send information across the air space of the common areas of our GGP mall network, which will include approximately 120 malls across the United States. Our right to install our Mobi-Beacons to market and sell third party paid advertising in the interior common areas of these malls is exclusive, with defined limitations under the agreement. Under a license agreement between us and GGP currently covering about 120 malls, GGP is entitled to receive fees from us equal to a minimum fee plus the greater of a pre-set per mall fee or a percentage of revenues derived from within the GGP mall network as well as certain commission fees based on revenues generated through GGP’s sales efforts. We believe that the revenue share in which GGP participates will exceed the minimum annual mall fees if we generate revenues within the GGP network of approximately $10,000,000 million or more in a calendar year. The agreement also provides for GGP to adjust the number of malls subject to the agreement from time-to-time based upon changes in its beneficial ownership in the malls. Our agreement with GGP has a term of two years from April 1, 2016, but is subject to earlier termination with cause following a notice and cure period in the event of material breach of the agreement or operational failure.

Macerich

In April 2015, we entered into a license agreement with Macerich, which became effective June 2015. Pursuant to our agreement with Macerich, we have the right to install Mobi-Beacons to send information across the air space of the common areas of our Macerich mall network, which will include approximately 55 malls across the United States. Our right to install our Mobi-Beacons to market and sell third party paid advertising in the interior common areas of these malls is exclusive. Under a license agreement between us and Macerich currently covering 55 malls, Macerich is entitled to receive fees from us equal to a minimum fee plus the greater of a pre-set per mall fee or a percentage of revenues derived from within the Macerich mall network as well as certain commission fees based on revenues generated through Macerich’s sales efforts. We believe that the revenue share in which Macerich participates will exceed the minimum annual mall fees if we generate revenues within the Macerich network of approximately $3 million or more in a calendar year. The agreement also provides for Macerich to adjust the number of malls subject to the agreement from time-to-time based upon changes in its beneficial ownership in the malls. Our agreement with Macerich has a term of three years but is subject to earlier termination (i) with cause following a notice and cure period in the event of material breach of the agreement or (ii) without cause by Macerich after one year on 90 days’ prior written notice to us. In the event of termination of the agreement without cause, Macerich will reimburse us for certain out-of-pocket expenses.

IBM

In April 2015, we entered into a Joint Initiative Agreement with IBM and enrolled as an IBM Business Partner through IBM's PartnerWorld program. We are teaming with IBM to deliver jointly developed solutions for mall-based tenants, including retail clients. These solutions leverage the Mobiquity Networks beacon platform deployed exclusively in the common areas of our mall footprint across the United States, as well as our SDK which can be embedded within mall clients' mobile apps, to deliver relevant content in real time to shoppers' smart phones as they visit these malls. IBM has agreed to work with these clients to provide the analytics solutions needed to deliver personalized, one-on-one content to shoppers through our platform, and to help clients obtain insights from shopper transactions to drive improved customer experience and business performance. IBM services will also provide the integration capabilities needed to combine the Mobiquity Network platform in the mall common areas with the in-store server and network infrastructure, to optimize delivery of context-relevant content for the shopper. Together, our Joint Initiative Agreement with IBM can help their mall clients provide enhanced omni-channel marketing solutions and optimize business results. The agreement has an initial terms of two years and may be extended by agreement of the parties.

PREIT

Pursuant to a master agreement effective August, 2015, we entered into an agreement with PREIT pursuant to which we have the right to install our Mobi-Beacons to send information across the air space of the common areas of our PREIT mall network, which will include approximately 27 malls in select states in the United States. Our right to install our Mobi-Beacons to market and sell third party paid advertising in the interior common areas of these malls is exclusive. Under our agreement between us and PREIT, PREIT is entitled to an agreed upon revenue share over the four year term of the agreement. In the event the net revenue share as defined in the agreement is not attained for any measurement period, also as defined in the agreement, either party may terminate the agreement upon 90 days prior written notice. PREIT may also terminate the agreement if it determines that Mobiquity’s installed equipment is not adequate and/or provides a negative user experience for the visitors to the PREIT malls. The agreement also provides for PREIT to adjust the number of malls subject to the agreement from time-to-time based upon changes in its beneficial ownership in the malls.

Rouse

Pursuant to a master agreement entered into in 2015, we entered into an agreement with Rouse pursuant to which we have the right to install our Mobi-Beacons to send information across the air space of the common areas of our Rouse mall network, which will include approximately 30 malls in select states in the United States. Our right to install our Mobi-Beacons to market and sell third party paid advertising in the interior common areas of these malls is exclusive. Under our agreement between us and Rouse, Rouse is entitled to an agreed upon revenue share over the four-year term of the agreement. In the event the net revenue share as defined in the agreement is not attained for any measurement period, also as defined in the agreement, either party may terminate the agreement upon 90 days prior written notice. Either party may also terminate the agreement due to a material breach which is not cured within 30 days of written notice. Also, Rouse upon at least 60 days written notice to us prior to the end of the second contract year, may terminate the agreement with respect to any participating property for any reason at the end of the second contract year. The agreement also provides for Rouse to adjust the number of malls subject to the agreement from time-to-time based upon changes in its beneficial ownership in the malls.

The Mall Network

Through our agreement with Simon, we have installed our Mobi-Beacons in about 195 of Simon's malls and 45 former Simon malls across the United States. We have installed our Mobi-Beacons in about 55 of Macerich’s top malls 27 PREIT malls and 30 Rouse malls in select areas of the United States. We intend to install our Mobi-Beacons in about 120 GGP malls throughout the United States. Our agreements with Simon, Macerich and PREIT provide exclusive Bluetooth advertising rights in the common areas of each such malls. Our hardware solutions mesh together to create our network, which according to Simon, provides advertisers the opportunity to reach approximately 2.2 billion annual mall visits with mobile content and offers when they are most receptive to spending, while located in the Simon malls. The 2014 annual report for the International Council of Shopping Centers (ICSC) indicates that shoppers spend on average over $97 per shopping mall visit in 2013, which represents over $250 billion of annual spending. We believe our network provides advertisers the ability to influence a percentage of these shoppers who carry smartphones.

Mobiquity Advantages

We believe our agreements with Simon, GGP, Macerich, Rouse and PREIT potentially provide us with an advantage over our competitors as it gives us a national network. Our technology allows us the opportunity to reach nearly 100% of mobile device types by utilizing our Mobi-Beacons integrated into a single platform. Our platform monitors and reports hardware activity in real time, manages campaigns, delivers highly targeted content and provides third party access to our Mobiquity network through our licensing of software development kits and the integration of an application program interface. Specifically as it relates to our lead service offering – Location Signals and Campaign Management via Beacons – campaigns require an app that has integrated our software development kit (SDK) in order to engage with our network. The more apps that have integrated the Mobiquity SDK, the more opportunities to engage with mall shoppers in our network. We are carefully selecting app partners that have relevance to the mall shopping experience and to the mall shopper demographic. For example, the apps of retailers and brands are obvious partners. Additionally, we intend to partner with shopping apps such as coupon distribution platforms, and apps. We are in various stages of SDK integration with dozens of additional mobile app properties that represent tens of millions of active app users and in negotiations with various venues in regard to network expansion. Management believes that our ability to deliver a significant national audience via a single network is a significant advantage when creating app relationships.

Favorable Industry Trends

We believe the demand for location based mobile marketing services represents a large and growing market opportunity. Consumers are increasingly using smartphones and, according to a December 2014 report by IAB Mobile Marketing Center of Excellence, 88% of consumer mobile internet time is spent in apps where we expect to derive the majority of our revenue. According to the blog Asymco, a ComScore survey on U.S. smartphones shows that the smartphone penetration rate in the U.S. at the end of 2013 was approximately 62.5%, representing 149 million users and is expected to grow to 90% penetration or approximately 230 million users by December 2016.

Importantly, according to eMarketer, mobile ad spending grew 83% from 2013 to 2014 and the trend is expected to continue as the share of advertising spend on mobile is still disproportionately small relative to the amount of time spent by consumers on their mobile devices. A 2014 report by leading venture capital firm Kleiner Perkins reported that 20% of media time is spent on mobile however mobile represented only 4% of total advertising spending share.

Despite the growth in e-commerce, 90% of all purchases are still made in traditional brick and mortar stores according to A.T. Kearney, and 75% of Americans visit a mall at least once a month according to JCDecaux. Smartphone devices were estimated to influence $593 billion or 19% of in-store sales in 2013 and are expected to influence $4.5 trillion or 81% of in-store sales by 2018 according to a survey commissioned by Deloitte Consulting LLP. According to a 2014 Holiday Shopping Recap by Adobe Digital Index, 54% of marketers currently use or plan to use beacons in the next 12 to deliver location based content. Finally, BI Intelligence estimates that beacon triggered messages will influence $4.1 billion in store sales by the end of 2015, growing to $44.4 billion by the end of 2016.

We believe these trends will help drive demand for our Mobiquity Networks business as consumers increasingly engage with advertising content on their mobile devices and marketers seek to increase both the share of advertising dollars spent on mobile as well as the use of location technologies to personalize content delivered to consumers.

Our Strategy

Our goal is to enhance the shopper experience with retail customers by providing valuable and relevant content in real-time based on location. We achieve this goal by providing our customers (such as retailers, brands, and the entertainment industry) with a highly targeted form of mobile marketing engagement. Our platform enables interaction and advertising based on time, location and personalization to create the most effective campaigns/ experiences possible, in a way that is not possible without our network. We connect customers to brands in the retail space by increasing individual retail location app usage and driving foot traffic to such individual retail locations. We have deployed our Mobi-Beacons to expand the capability of the Mobiquity network in approximately 240 Simon and former Simon malls, 55 Macerich malls, 30 Rouse malls and 27 PREIT malls across the United States and intend to install the Mobi-Beacons in about 120 GGP malls by April 2016. As working capital permits, we intend to expand our sales and marketing human resource capability to focus on generating revenue over our network. Our sales and marketing team will be seeking to generate revenue over our network through five primary verticals:

We plan to expand on our current footprint into the common areas of other mall operations as well as outside of the malls with additional synergistic venues that will allow for cross marketing opportunities. Such venues include but are not limited to: stadiums, arenas, college campuses, airports and retail chains. The purpose of this type of expansion will be to create a unified network that will allow relevant beacon companies the opportunity to become part of the Mobiquity network. They may find it advantageous to become part of our network, so they will have the ability to drive traffic into their stores. In the future, we may also build a private advertising exchange system that would allow for programmatic buying where advertisers will be given permission to engage with shoppers through the Mobiquity network. Additionally, we plan to add other mobile services and plug-ins such as; loyalty programs, attribution, indoor mapping, security and mobile payments.

Sales and Marketing

As working capital permits, we intend to hire additional qualified sales and marketing personnel to generate revenue on our proximity mall network and to hire additional engineers, developers, computer and technology support personnel.

The key elements of our distribution and marketing strategy are as follows:

Our Proprietary TechnologyIntellectual Property

In March 2013, we formed Mobiquity Networks and Mobiquity Wireless in Spain. Mobiquity Wireless then acquired the assets of our then licensor, FuturLink. These assets include, without limitation, the FuturLink technology which consists of patent applications, source codes and trademark(s). The patent applications acquired related to the hardware and associated process for identifying and acquiring connections to mobile devices and the process for delivering select content to users on an opt-in basis. Additionally, significant “know how” was acquired with respect to managing remote hardware across a large physical network. As the technology owner, we will leverage the hardware and software included in our purchase to expand our mall-based footprint in the United States. We believe our acquisition of FuturLink’s technology and corresponding patent applications provided us with the flexibility and autonomy to improve, upgrade and integrate new ideas and cutting edge technologies into our then existing platform. This will allowhas allowed us to evolve as new technologies emerge. To date, we have published for four patents and two have onebeen approved.

We believe that our intellectual property is a valuable asset to us as we move forward with our technology platform. Since we acquired this technology, we have further developed our ability to manage large networks of hardware to include beacon technology. Additionally, we have expanded campaign management tools to optimize them to meet the demands of our customers. We believe our intellectual property gives us a lead in the industry with respect to the sophisticated management of large-scale network deployments and campaign management. We believe that most beacon providers focus on single-store applications and are not capable of managing beacons across multiple locations, much less manage a public network that will be accessed by multiple advertisers versus a single retailer. Our network-focused platform approach is a key selling tool when presenting our capabilities to property owners, such as mall developers, who understand the challenge associated with managing a large number of hardware solutions across hundreds of properties.

Governmental Regulations

Federal, state and international laws and regulations govern the collection, use, retention, sharing and security of data that we collect. We strive to comply with all applicable laws, regulations, self-regulatory requirements and legal obligations relating to privacy, data protection and consumer protection, including those relating to the use of data for marketing purposes. As we develop and provide solutions that address new market segments, we may become subject to additional laws and regulations, which could create unexpected liabilities for us, cause us to incur additional costs or restrict our operations. From time to time, we may be notified of or otherwise become aware of additional laws and regulations that governmental organizations or others may claim should be applicable to our business. Our failure to anticipate the application of these laws and regulations accurately, or other failure to comply, could create liability for us, result in adverse publicity or cause us to alter our business practices, which could cause our net revenues to decrease, our costs to increase or our business otherwise to be harmed. See “Risk Factors.”

We are subject to general business regulations and laws as well as regulations and laws specifically governing the Internet, e-commerce and m-commerce in a number of jurisdictions around the world. Existing and future regulations and laws could impede the growth of the Internet, e-commerce, m-commerce or other online services. These regulations and laws may involve taxation, tariffs, privacy and data security, anti-spam, data protection, content, copyrights, distribution, electronic contracts, electronic communications and consumer protection. It is not clear how existing laws and regulations governing issues such as property ownership, sales and other taxes, libel and personal privacy apply to the Internet as the vast majority of these laws and regulations were adopted prior to the advent of the Internet and do not contemplate or address the unique issues raised by the Internet, e-commerce or m-commerce. It is possible that general business regulations and laws, or those specifically governing the Internet, e-commerce or m-commerce may be interpreted and applied in a manner that is inconsistent from one jurisdiction to another and may conflict with other rules or our practices. See “Risk Factors. “

Integrated Marketing Company

Our subsidiary, Ace Marketing & Promotions, Inc. (or Ace Marketing), has historically represented substantially all of our operating revenues. Ace Marketing is an integrated marketing company focused on working with clients to grow their business. Ace Marketing’s core business is to provide a wide range of quality promotional products to a wide range of corporate, non-profit and educational clients. In addition, Ace Marketing offers brand analysis and development, website analysis and development, database analysis and building, and integrated marketing campaigns using: direct mail, email marketing, mobile marketing, promotional products and other mediums that help our clients connect with their customers and acquire new business.

Although the majority of Ace Marketing’s revenue is derived from the sale of promotional products, it is through the use of our four-step process supported by marketing technology platforms that allows us to attract and retain clients. The sale of promotional products alone can be considered a commodity business, so by offering our value-added services, we believe we have created a competitive advantage. We believe a client will be less likely to leave if we created their logo, built their website and/or appended their customer database.

| 9 |

Ace Marketing derives revenues from each of the following resources:

| Brand analysis and development. | ||

| Website analysis and development. | ||

| Database analysis and building. | ||

| Integrated marketing solutions. |

Substantially all of our resources and marketing efforts are dedicated toward deriving revenues from the operations of Mobiquity Networks.

Competition

We compete in the advertising technology and location-based mobile data, marketing and research business and in all other facets of our business against small, medium and large companies throughout the United States. Some examples include companies such as Gimbal, Shopkick, SwirlPlaced, PlaceIQ, Factual, xAd and Estimote.Foursquare. Although we can give no assurance that our business will be able to compete against other companies with greater experience and resources, we believe we have a competitive advantage with our mall network,proprietary Places Database, software and proprietary technology platform. As previously mentioned, we have the exclusive rights to provide Bluetooth advertisingmarketing services in the common area for Simon and othervarious shopping malls. This gives us the ability to compete with these other companies to provide in-store advertising, but they cannot compete with usindoor data based upon the exclusive rights in the common area of the malls as the mall operators prohibit the individual retail stores from sending proximity marketing signals and information beyond the perimeter of their retail store. . Our technology platform also allows us to integrate other companies’ beacons onto our network. This means that if a retailer has already purchased beacons from a competitor, we still have the ability to work with them by integrating their beacons into our network and delivering mobile marketing campaigns.such malls.

With respect to our integrated marketing subsidiary, while our competition in this business vertical is extensive, we believe that this industry is extremely fragmented and that there are no companies that dominate the market in which we operate. We compete within the industry on the basis of service, competitive prices, personal relationships and competitive commissions to our sales representatives to sell promotional products for us rather than our competitors. Competitors’ advantages over us may include better financing, greater experience, lower margins and better personal relationships than us.

Employees

We have approximately 3016 full time employees, including executive management, technical personnel, salespeople, and support staff employees. We also utilize several additional firms/persons who provide services to us on a non-exclusive basis as independent consultants.

| 10 |

Investing in our common stock involves a high degree of risk. Before deciding to invest in our company or deciding to maintain or increase your investment, you should consider carefully the risks and uncertainties described below, together with all information in this Form 10-K, including our consolidated financial statements and related notes. If one or more of the following risks are realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the market price for our common stock could decline and you may lose your investment.

Risks Relating To Our Business

We are dependent upon the immediate receipt of substantial additional financing to carry out our plan of operations and to meet our anticipated financial commitments over the next one year.Our auditors have expressed a substantial doubt of our ability to continue as a going concern.We are dependent upon the immediate receipt of substantial additional financing to carry out our plan of operations and to meet our anticipated financial commitments over the next one year, including, without limitation, maintaining the current technology and supporting staff, making minimum payments to our mall managers as required and making timely payments to our debt holders. The accompanying consolidated financial statements have been prepared assuming our company will continue as a going concern. Our continued existence is dependent upon our ability to obtain additional debt and/or equity financing to advance our mall network system and to develop a revenue stream resulting therefrom. We have incurred net losses for the years ending December 31, 2016, 2015 and 2014 of $10,701,503, $10,459,724 and 2013 of $10,459,724, $10,506,099, and $6,088,733, respectively. As of December 31, 2015,2016, we had an accumulated deficit of $40,471,590.$51,182,093. For the year ended December 31, 2015,2016, we have had negative cash flows from operating activities of $9,369,631.$5,929,852. These factors raise substantial doubt concerning our ability to continue as a going concern. We can provide no assurances that we will be successful in raising additional equity and/or debt financing on terms satisfactory to us, if at all, to remain a going concern.

We have a history of operating losses and may not in the future generate consistent revenues or profits.Since our inception, we have experienced a continued history of operating losses and an accumulated deficit of $40,471,590$51,182,093 at December 31, 2015.2016. We have incurred net losses for the years ending December 31, 2016, 2015 and 2014 of $10,710,503, $10,459,724 and 2013 of $10,459,724, $10,506,099, and $6,088,733, respectively. Our operating losses for the past several years are primarily attributable to the transformation of our company into an advertising technology corporation. Our Mobiquity Network subsidiary has no$65,932 in revenues from its operations for the year ended December 31, 2015.2016. We can provide no assurances that our operations will generate consistent or predictable revenue or be profitable in the future. This is particularly the case as we are shifting our business emphasis to focus on our Proximity MarketingMobiquity Network business.

We entered into convertible promissory notes in the aggregate amount of $1,600,000 which are shiftingsecured by all of our business fromassets. These notes have a current maturity dates beginning on August of 2017, but the noteholder has the right to call the note at any time, which could adversely affect our legacy marketingliquidity and promotion businesscapital resources. On March 31, 2017, we issued secured promissory notes in the aggregate amount of $1,100,000 to two non-affiliated investors and an additional $500,000 is expected to be issued in late April 2017. The maturity date of the notes is August through October 2017. The payment of these notes at maturity could come at a time when it would not be advantageous to us and could materially adversely affect our liquidity and capital resources. We can provide no assurances that we will be able to meet our obligations under these notes as they become due and payable.

We are focusing the majority of our attention on our Mobiquity Networks integrated suite of proprietary location-based mobile advertising technologies, the success of which cannot be assured. Further, our Mobiquity Networks’ business may be subject to quarterly fluctuations in its operating results due to the seasonality of mall-baseddata collection and analysis business.We operate through our wholly-owned subsidiaries, Ace Marketing & Promotions, Inc. and Mobiquity Networks, Inc. Ace Marketing is our legacy marketing and promotions business which provides integrated marketing services to our commercial customers. While Ace Marketing currently represents substantially all of our revenue, we anticipate that activity from Ace Marketing will represent a diminishing portion of corporate revenue as our attention is now principally focused on developing and executing on opportunities in our Mobiquity Networks business.We believe that our Mobiquity Networks business represents our growth opportunity going forward and that this business unit is positioned as a result of our early mover tatus and novel technology integration to address a growing segment of the digital advertising market – location based mobile marketing.forward. We expect that Mobiquity Networks will generate the majority of our revenue by the end of 2016,2017, although no assurances can be given in this regard. Further, we can provide no assurances that the implementation of our Mobiquity Networks’ business will meet our expectations in terms of generating a certain amount of revenue by a certain year. Also, the operating results of our Mobiquity Networks’ business may fluctuate quarterly due to the seasonality of mall-based businesses.

We did not receive any significant revenues from our new Mobiquity business in 20152016 and we cannot accurately predict the volume or timing of any future revenues.We may be unable to capture revenue from our new Mobiquity business and product offerings in the manner in which we anticipate and we may incur substantial expenses and devote significant management effort and expense in developing customer adoption of our Mobiquity solution, which may not result in revenue generation.anticipate. As such, we cannot accurately predict the volume or timing of any future revenues.

Our business may become dependent on our agreement with Simon Property, which agreement expires on December 31, 2017.In April 2011, we entered into our agreement with Simon Property, a leading mall developer, which agreement was amended first in September 2013 and secondly in July 2014. While substantially all of our operating revenues are currently derived from our Ace Marketing subsidiary, we could in the future become dependent upon our agreement with Simon Property to execute on the development of our Proximity Marketing business and to attempt to achieve profitable operations. We have signed an agreement with Simon Property to create Mobiquity Networks in about 195 of their current malls. This agreement expires on December 31, 2017. There is a risk that our agreement with Simon Property will not be extended beyond its original terms by Simon Property or that our operations will not be profitable. Also, our agreement with Simon Property requires us to maintain for each calendar year under said agreement the minimum amount of fees under irrevocable standby letters of credit. For 2015, a non-affiliated stockholder and Thomas Arnost, our Executive Chairman, each provided the necessary letters of credit totaling $2,700,000 with one-half coming from each party. Also, each person who issued the letter of credit is receiving quarterly, while the letters of credit are outstanding, options to purchase 125,000 shares of our common stock, exercisable at the prevailing market price per share on the date of grant and interest at the rate of 8% per annum on the monies that they have had to set aside in their bank accounts and are unable to have access as a result of the letters of credit. In the event Simon Property finds it necessary to draw down on the letter(s) of credit, an event which is expected to occur in April 2016 if substantial additional financing is not immediately obtained, we have until the next quarterly minimum payment due date (approximately 90 days) to obtain satisfactory replacement letters of credit. We can provide no assurance that we will be able to maintain the necessary letters of credit as required by the agreement. In the event of a default under our agreement with Simon Property, which is not cured within 30 days of notice of such breach, Simon Property may commence an action for damages or other appropriate relief and/or terminate the agreement. If we were to lose our agreement with Simon Property for these or any other reason, our business plan could be severely compromised, our business may suffer and our stock price could decrease significantly.

Our business may also become dependent upon our agreement with Macerich, which agreement expires in April 2018.In April 2015, we entered into an agreement with Macerich, a leading mall developer, which became effective June 2015. While substantially all of our operating revenues are currently derived from our Ace Marketing subsidiary, we could in the future become dependent upon our agreement with Macerich to execute on the development of our proximity marketing business and to attempt to achieve profitable operations. We signed an agreement with Macerich to create Mobiquity Networks in about 55 of their malls. There is a risk that our agreement with Macerich will not be extended beyond its original terms by Macerich or that our operations will not be profitable. Our agreement with Macerich has a term of three years expiring in April 2018, but is subject to earlier termination (i) with cause following a notice and cure period in the event of material breach of the agreement, (ii) in the event the Macerich mall properties are sold, or (iii) without cause by Macerich after one year. If we were to lose our agreement with Macerich, for these or any other reason, our business plan could be severely compromised, our business may suffer and our stock price could decrease significantly.

Our business may also become dependent upon our agreement with GGP, which agreement expires in April 2018.In December 2015, we entered into an agreement with GGP, a leading mall developer, which became effective November 2015. While substantially all of our operating revenues are currently derived from our Ace Marketing subsidiary, we could in the future become dependent upon our agreement with GGP to execute on the development of our proximity marketing business and to attempt to achieve profitable operations. We signed an agreement with GGP to create Mobiquity Networks in about 120 of their malls. There is a risk that our agreement with GGP will not be extended beyond its original terms by GGP or that our operations will not be profitable. Our agreement with GGP has a term of two years expiring in April 2018, but is subject to earlier termination with cause following a notice and cure period in the event of material breach of the agreement or an operational breach. If we were to lose our agreement with GGP, for these or any other reason, our business plan could be severely compromised, our business may suffer and our stock price could decrease significantly.

Our business may also become dependent upon our agreement with PREIT, which agreement expires in 2019.In 2015, we entered into an agreement with PREIT, a leading mall developer. While substantially all of our operating revenues are currently derived from our Ace Marketing subsidiary, we could in the future become dependent upon our agreement with PREIT to execute on the development of our proximity marketing business and to attempt to achieve profitable operations. We signed an agreement with PREIT to create Mobiquity Networks in about 27 of their malls. There is a risk that our agreement with PREIT will not be extended beyond its original terms by PREIT or that our operations will not be profitable. Our agreement with PREIT has a term of four years expiring in 2019, but is subject to earlier termination in the event of (i) a material breach of the agreement, (ii) in the event certain net revenue thresholds are not met for any measurement period, in each case as defined in the agreement, (iii) in the event of a sale of the mall premises, or (iv) if PREIT determines that our Mobi-Beacons or app is not adequate and/or otherwise provides a negative user experience for the visitors to the PREIT malls. If we were to lose our agreement with PREIT, for these or any other reason, our business plan could be severely compromised, our business may suffer and our stock price could decrease significantly.

Our business may also become dependent upon our agreement with Rouse, which agreement expires in 2019. In 2015, we entered into an agreement with Rouse, a leading mall developer. While substantially all of our operating revenues are currently derived from our Ace Marketing subsidiary, we could in the future become dependent upon our agreement with Rouse to execute on the development of our proximity marketing business and to attempt to achieve profitable operations. We signed an agreement with PREIT to create Mobiquity Networks in about 30 of their malls. There is a risk that our agreement with Rouse will not be extended beyond its original terms by Rouse or that our operations will not be profitable. Our agreement with Rouse has a term of four years expiring in 2019, but is subject to earlier termination in the event of (i) a material breach of the agreement, (ii) in the event certain net revenue thresholds are not met for any measurement period, in each case as defined in the agreement, (iii) in the event of a sale of the mall premises, or (iv) if Rouse elects to terminate the agreement at the end of year two of the contract. If we were to lose our agreement with Rouse, for these or any other reason, our business plan could be severely compromised, our business may suffer and our stock price could decrease significantly

We may be unable to realize the benefits of our agreement with IBM. In April 2015, we entered into a Joint Initiative Agreement with IBM and enrolled as an IBM Business Partner through IBM's PartnerWorld program. We are teaming with IBM to deliver jointly developed solutions for mall-based tenants, including retail clients. These solutions leverage the Mobiquity Networks beacon platform deployed exclusively in the common areas of our mall footprint across the United States, as well as our SDK which can be embedded within mall clients' mobile apps, to deliver relevant content in real time to shoppers' smart phones as they visit these malls. IBM has agreed to work with these clients to provide the analytics solutions needed to deliver personalized, one-on-one content to shoppers through Mobiquity's platform, and to help clients obtain insights from shopper transactions to drive improved customer experience and business performance. IBM services will also provide the integration capabilities needed to combine the Mobiquity Network platform in the mall common areas with the in-store server and network infrastructure, to optimize delivery of context-relevant content for the shopper. However, there is a risk that we may be unable to realize the benefits of this agreement, and a further risk that our agreement with IBM may not result in revenue generating or profitable operations of our company.

The reach of our Mobi-Beaconsbusiness is dependent upon our successful integration of our SDK into various mobilethird party applications (or apps) publishers to allow us to communicate with our targeted audience.collect and analyze data and create product offerings from the data collected.For us to create substantial revenues fromand expand our Mobi-Beacons,business model, we are dependent upon entering into agreements with mobile application publishers to expand our targeted audience similar to the agreements described under “Business – Our Single Integrated Platform,” Our Mobi-Beacons communicate with our SDK which will be embedded into apps pursuant to agreements we negotiate with appthird party publishers. The greater the number of publisher apps into which our SDK is embedded, the greater the chancenumber of triggering a beacon engagement for whichoriginal data we get compensated by advertisers.can collect and analyze. We currently have entered into agreements with a limited number of third party app publishers. There is a risk that we will be unable to expand our third party publisher network on terms satisfactory to us, or at all, and if we are unable to do so, our results of operations and overall business prospects would suffer.

The location-based mobile marketing industry is relatively new and our competition may become extensive.In 2008, we became an authorized distributor, provider and reseller in the United States of mobile advertising solutions, in the location-based mobile advertising industry. In March 2013, we purchased the mobile advertising technology from our licensor. In 2011, we started transforming our company into a location-based mobile mall marketing enterprise with the formation of our Mobiquity Networks subsidiary. Currently, we have not generated significant revenue from this new and unproven segment of our business as our proximity marketing revenues totaled $-0-, $149,500 and $162,500 for the years ended December 31, 2015, 2014 and 2013, respectively.business. While we intend to market our Mobiquity devices as a differentiatedproducts and advantageous mobile technology to attempt to capitalize on our location-based mobile mall network footprint, there is a risk that we will be unable to expand this business or generate substantial advertising revenues to support operations. Moreover,services, there is a risk that our location-based mobile mall networkdata collection and analysis will be unable to compete with large, medium and small competitors that are in (or may enter) the proximity marketing industry with substantially larger resources and management experience. If our Mobiquity technology is unsuccessful for any reason in the marketplace, our business would be substantially harmed.

We expect to derive substantially all of our future revenues from our principal technology, which leaves us subject to the risk of reliance on such technology. Further, our principal technology is subject to pending patent applications which could be rejected by the United States Patent and Trademark Office.We expect to derive substantially all of our future revenues from our Mobiquity location-based mobile advertising technology.Networks. As such, any factor adversely affecting our ability to offer and implement our solution to new customers, including regulatory issues, market acceptance, competition, performance and reliability, reputation, price competition and economic and market conditions, would likely harm our operating results.

If our Mobiquity technology fails to satisfy current or future customer requirements, we may be required to make significant expenditures to redesign the technology, and we may have insufficient resources to do so.Our Mobiquity technologyNetworks solution is designed to address an evolving marketplace and must comply with current and evolving customer requirements in order to gain market acceptance. There is a risk that we will not meet anticipated customer requirements or desires, including those of our key property licensor.desires. If we are required to redesign our technologies to address customer demands or otherwise modify our business model, we may incur significant unanticipated expenses and losses, and we may be left with insufficient resources to engage in such activities. If we are unable to redesign our technology, develop new technology or modify our business model to meet customer desires or any other customer requirements that may emerge, our operating results would be materially and adversely affected.

| 12 |

If we fail to respond quickly to technological developments, our service may become uncompetitive and obsolete.The location-based mobile advertisingdata collection and analysis market in which we plan to compete areis expected to experience rapid technology developments, changes in industry standards, changes in customer requirements and frequent new improvements. If we are unable to respond quickly to these developments, we may lose competitive position, and our technologies may become uncompetitive or obsolete, causing revenues and operating results to suffer. In order to compete, we may be required to develop or acquire new technology and improve our existing technology and processes on a schedule that keeps pace with technological developments. We must also be able to support a range of changing customer preferences. For instance, our shopping mall customers may have different requirements from universities or other users of our technology and solution, and thus we may be required to adopt our platform to accommodate the different customers. We cannot guarantee that we will be successful in any manner in these efforts.

We cannot predict our future capital needs and we may not be able to secure additional financing.Between January 2013 and December 2015,2016, we raised over $18$21 million in private equity and debt financing to support our transformation from an integrated marketing company to an advertisinga technology company. Since we might be unable to generate recurring or predictable revenue or cash flow to fund our operations, we will likely need to seek additional (perhaps substantial) equity or debt financing even following this offering to provide the capital required to maintain or expand our operations. We may also need additional funding for developing products and services, increasing our sales and marketing capabilities promoting brand identity, and acquiring complementary companies, technologies and assets, as well as for working capital requirements and other operating and general corporate purposes. We cannot predict our future capital needs with precision, and we may not be able to secure additional financing on terms satisfactory to us, if at all, which could lead to termination of our business.

When we elect to raise additional funds or additional funds are required, we may raise such funds from time to time through public or private equity offerings, debt financings or other financing alternatives. Additional equity or debt financing may not be available on acceptable terms, if at all. If we are unable to raise additional capital in sufficient amounts or on terms acceptable to us, we will be prevented from pursuing operational development and commercialization efforts and our ability to generate revenues and achieve or sustain profitability will be substantially harmed.

If we raise additional funds by issuing equity securities, our stockholders will experience dilution. Debt financing, if available, would result in increased fixed payment obligations and may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. Any debt financing or additional equity that we raise may contain terms, such as liquidation and other preferences, which are not favorable to us or our stockholders. If we raise additional funds through collaboration and licensing arrangements with third parties, it may be necessary to relinquish valuable rights to our technologies, future revenue streams or product candidates or to grant licenses on terms that may not be favorable to us. Should the financing we require to sustain our working capital needs be unavailable or prohibitively expensive when we require it, our business, operating results, financial condition and prospects could be materially and adversely affected and we may be unable to continue our operations. Failure to secure additional financing on favorable terms could have severe adverse consequences to us.