UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 20162018

Commission file number 1-12383

Rockwell Automation, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 25-1797617 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

| | | |

1201 South 2nd Street | | |

| Milwaukee, Wisconsin | | 53204 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code:

+1 (414) 382-2000

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of each class | | Name of each exchange on which registered |

| | | |

| Common Stock, $1 Par Value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

| Large Accelerated Filer | ☑ | | Accelerated Filer | ☐ | |

| Non-accelerated Filer | ☐ | | Non-accelerated Filer Smaller Reporting Company

| ☐ | |

| | Smaller reporting company

| | Emerging Growth Company | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of registrant’s voting stock held by non-affiliates of registrant on March 31, 201629, 2018 was approximately $14.7 billion.$21.7 billion.

128,229,158120,684,079 shares of registrant’s Common Stock, par value $1 per share, were outstanding on October 31, 2016.2018.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information contained in the Proxy Statement for the Annual Meeting of Shareowners of registrant to be held on February 7, 20175, 2019 is incorporated by reference into Part III hereof.

PART I

FORWARD-LOOKING STATEMENTS

This Annual Report contains statements (including certain projections and business trends) that are “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Words such as “believe”, “estimate”, “project”, “plan”, “expect”, “anticipate”, “will”, “intend” and other similar expressions may identify forward-looking statements. Actual results may differ materially from those projected as a result of certain risks and uncertainties, many of which are beyond our control, including but not limited to:

macroeconomic factors, including global and regional business conditions, the availability and cost of capital, commodity prices, the cyclical nature of our customers’ capital spending, sovereign debt concerns and currency exchange rates;

laws, regulations and governmental policies affecting our activities in the countries where we do business;

business, including those related to tariffs, taxation, and trade controls;the successful development of advanced technologies and demand for and market acceptance of new and existing hardware and software products;

the availability and price of components and materials;

the successful execution of our cost productivity initiatives;

the availability, effectiveness and security of our information technology systems;

competitive hardware and software products, solutions and services and pricing pressures, and our ability to provide high quality products, solutions and services;

disruptions to our distribution channels or the failure of distributors to develop and maintain capabilities to sell our products;

a disruption of our business due to natural disasters, pandemics, acts of war, strikes, terrorism, social unrest or other causes;

our ability to manage and mitigate the risk related to security vulnerabilities and breaches of our products, solutions and services;

intellectual property infringement claims by others and the ability to protect our intellectual property;

the uncertainty of claims by taxing authorities in the various jurisdictions where we do business;

our ability to attract, develop, and retain qualified personnel;

our ability to manage costs related to employee retirement and health care benefits;

the uncertainties of litigation, including liabilities related to the safety and security of the hardware and software products, solutions and services we sell;

our ability to manage and mitigate the risks associated with our solutions and services businesses;

a disruption to our distribution channels;

the availability and price of components and materials;

the successful integration and management of acquired businesses;

businesses and technologies;risks associated with our investment in common stock of PTC Inc., including the successful executionpotential for volatility in our reported quarterly earnings associated with changes in the market value of such stock;

our cost productivity initiatives;ability to manage costs related to employee retirement and health care benefits; and

other risks and uncertainties, including but not limited to those detailed from time to time in our Securities and Exchange Commission (SEC) filings.

These forward-looking statements reflect our beliefs as of the date of filing this report. We undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. See Item 1A. Risk Factors for more information.

Item 1. Business

General

Rockwell Automation, Inc. ("(“Rockwell Automation"Automation” or "the Company"the “Company”), a leader in industrial automation and information, makes its customers more productive and the world more sustainable. Our hardware and software products, solutions and services are designed to meet our customers’ needs to reduce total cost of ownership, maximize asset utilization, improve time to market and reduce enterprise business risk.

The Company continues the business founded as the Allen-Bradley Company in 1903. The privately-owned Allen-Bradley Company was a leading North American manufacturer of industrial automation equipment when the former Rockwell International Corporation (RIC) purchased it in 1985.

The Company was incorporated in Delaware in connection with a tax-free reorganization completed on December 6, 1996, pursuant to which we divested our former aerospace and defense businesses (the A&D Business) to The Boeing Company (Boeing). In the

reorganization, RIC contributed all of its businesses, other than the A&D Business, to the Company and distributed all capital stock of the Company to RIC’s shareowners. Boeing then acquired RIC. RIC was incorporated in 1928.

As used herein, the terms “we”, “us”, “our”, “Rockwell Automation” or the “Company” include subsidiaries and predecessors unless the context indicates otherwise. Information included in this Annual Report on Form 10-K refers to our continuing businesses unless otherwise indicated.

Whenever an Item of this Annual Report on Form 10-K refers to information in our Proxy Statement for our Annual Meeting of Shareowners to be held on February 7, 20175, 2019 (the Proxy Statement), or to information under specific captions in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A), or in Item 8. Financial Statements and Supplementary Data (the Financial Statements), the information is incorporated in that Item by reference. All date references to years and quarters refer to our fiscal year and quarters unless otherwise stated.

Operating Segments

We have two operating segments: Architecture & Software and Control Products & Solutions. In 2016, our total sales were $5.88 billion. Our Architecture & Software operating segment recorded sales of $2.64 billion (45 percent of our total sales) in 2016. Our Control Products & Solutions operating segment recorded sales of $3.24 billion (55 percent of our total sales) in 2016.

Our Architecture & Software operating segment is headquartered in Mayfield Heights, Ohio, and our Control Products & Solutions operating segment is headquartered in Milwaukee, Wisconsin. Both operating segments share a common sales organization and supply chain and conduct business globally. Major markets served by both segments consist of consumer industries, including food and beverage, home and personal care and life sciences; transportation, including automotive and tire; and heavy industries, including oil and gas, mining, metals, and metals.

Additional information with respect to our operating segments, including a description of our operating segments and their contributions to sales and operating earnings for each of the three years ended September 30, 2016, 2015 and 2014 is contained in Note 15 in the Financial Statements and under the caption Results of Operations in MD&A.chemicals.

Geographic Information

In 2016, sales to customersWe do business in more than 80 countries around the United States accounted for 55 percent of our total sales. Outside the United States, we sell in every region.world. The largest sales outside the United States on a country-of-destination basis are in China, Canada, Mexico, Italy, the United Kingdom, Germany, and Brazil. See Item 1A. Risk Factors for a discussion of risks associated with our operations outside the United States. Sales and property information by major geographic area for each of the past three years is contained in Note 15 in the Financial Statements.global operations.

Competition

Our competitors range from large diversified corporations that may also have business interests outside of industrial automation to smaller companies that specialize in nicheoffer a limited portfolio of industrial automation products, solutions and services. Factors that influence our competitive position include the breadth of our product portfolio and scope of solutions, technology differentiation, domain expertise, installed base, distribution network, quality of hardware and software products, solutions and services, global presence and price. Major competitors of both segments include Siemens AG, ABB Ltd, Schneider Electric SA, Emerson Electric Co., Mitsubishi Electric Corp. and Honeywell International Inc.

Distribution

In most countries, we sell primarily through independent distributors in conjunction with our direct sales force. In other countries, we sell through a combination of our direct sales force and to a lesser extent, through independent distributors. Approximately 7075 percent of our global sales are through independent distributors. Sales to our largest distributor in 20162018, 20152017 and 20142016 were approximately 10 percent of our total sales.

Research and Development

Our research and development spending for the years ended September 30, 2016, 2015 and 2014 was $319.3 million, $307.3 million and $290.1 million, respectively. Customer-sponsored research and development was not significant in 2016, 2015 or 2014.

Employees

At September 30, 2016,2018, we had approximately 22,00023,000 employees. Approximately 8,5008,600 were employed in the United States.

Raw Materials

We purchase a wide range of equipment, components, finished products and materials used in our business. The raw materials essential to the manufacture of our products generally are available at competitive prices. We have a broad base of suppliers and subcontractors. We depend upon the ability of our suppliers and subcontractors to meet performance and quality specifications and delivery schedules. See Item 1A. Risk Factors for a discussion of risks associated with our reliance on third party suppliers.

Backlog

Our total order backlog consists of (in millions):

| | | | | September 30, | | September 30, |

| | | 2016 | | 2015 | | 2018 | | 2017 |

| Architecture & Software | | $ | 185.8 |

| | $ | 165.1 |

| | $ | 215.7 |

| | $ | 205.1 |

|

| Control Products & Solutions | | 1,024.6 |

| | 999.5 |

| | 1,196.3 |

| | 1,091.6 |

|

| | | $ | 1,210.4 |

|

| $ | 1,164.6 |

| | $ | 1,412.0 |

|

| $ | 1,296.7 |

|

Backlog is not necessarily indicative of results of operations for future periods due to the short-cycle nature of most of our sales activities. Backlog orders scheduled for shipment beyond 20172019 were approximately $199$232 million as of September 30, 2016.2018.

Environmental Protection Requirements

Information about the effect of compliance with environmental protection requirements and resolution of environmental claims is contained in Note 1415 in the Financial Statements. See Item 1A. Risk Factors for a discussion of risks associated with liabilities and costs related to environmental remediation.

Patents, Licenses and Trademarks

We own or license numerous patents and patent applications related to our hardware and software products and operations. While in the aggregate our patents and licenses are important in the operation of our business, we do not believe that loss or termination of any one of them would materially affect our business or financial condition. Various claims of patent infringement and requests for patent indemnification have been made to us. We believe that none of these claims or requests will have a material adverse effect on our financial condition. See Item 1A. Risk Factors for a discussion of risks associated with our intellectual property.

The Company’s name and its registered trademark “Rockwell Automation®” and other trademarks such as “Allen-Bradley®”, “A-B®” and “PlantPAx® Process Automation System™System™” are important to both of our business segments. In addition, we own other important trademarks that we use, such as “PowerFlex®” for our AC drives, and “Rockwell Software®” and “FactoryTalk®” for our software offerings.

Seasonality

Our business segments are not subject to significant seasonality. However, the calendarization of our results can vary and may be affected by the seasonal spending patterns of our customers due to their annual budgeting processes and their working schedules.

Available Information

We maintain a website at http:https://www.rockwellautomation.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to such reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (the Exchange Act), as well as our annual reportreports to shareowners and Section 16 reports on Forms 3, 4 and 5, are available free of charge on this site through the "Investors"“Investors” link as soon as reasonably practicable after we file or furnish these reports with the SEC. All reports we file with the SEC are also available free of charge via EDGAR through the SEC’s website at http:https://www.sec.gov. Our Guidelines on Corporate Governance and charters for our Board committees are also available on our website. The information contained on and linked from our website is not incorporated by reference into this Annual Report on Form 10-K.

Item 1A. Risk Factors

In the ordinary course of our business, we face various strategic, operating, compliance and financial risks. These risks could have an impact on our business, financial condition, operating results and cash flows. Our most significant risks are set forth below and elsewhere in this Annual Report on Form 10-K.

Our Enterprise Risk Management (ERM) process seeks to identify and address significant risks. Our ERM process usesassesses, manages, and monitors risks consistent with the integrated risk framework in Internal Control — Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) to assess, manage and monitor risks.. We believe that risk-taking is an inherent aspect of the pursuit of our growth and performance strategy. Our goal is to manage risks prudently rather than avoidingavoid risks. We can mitigate risks and their impact on the Company only to a limited extent.

A team of senior executives prioritizes identified risks and assigns an executive to address each major identified risk area and lead action plans to manage risks. Our Board of Directors provides oversight of the ERM process and reviews significant identified risks. The Audit Committee of the Board of Directors also reviews significant financial risk exposures and the steps management has taken to monitor and manage them. Our other Board committees also play a role in risk management, as set forth in their respective charters.

Our goal is to proactively manage risks in a structured approach in conjunction with strategic planning, with the intent to preserve and enhance shareowner value. However, the risks set forth below and elsewhere in this Annual Report on Form 10-K and other risks and uncertainties could adversely affect us and cause our results to vary materially from recent results or from our anticipated future results and could adversely affect us.results.

Adverse changes in business or industry conditions and volatility and disruption of the capital and credit markets may result in decreases in our sales and profitability.

We are subject to macroeconomic cycles and when recessions occur, we may experience reduced, canceled or delayed orders, payment delays or defaults, supply chain disruptions or other factors as a result of the economic challenges faced by our customers, prospective customers and suppliers.

Demand for our hardware and software products is sensitive to changes in levels of industrial production and the financial performance of major industries that we serve. As economic activity slows, credit markets tighten, or sovereign debt concerns linger,arise, companies tend to reduce their levels of capital spending, which could result in decreased demand for our products.

Our ability to access the credit markets and the costs of borrowing are affected by the strength of our credit rating and current market conditions. If our access to credit, including the commercial paper market, is adversely affected by a change in market conditions or otherwise, our cost of borrowings may increase or our ability to fund operations may be reduced.

We sell to customers around the world and are subject to the risks of doing business in many countries.

We do business in more than 80 countries around the world. Approximately 45 percent of our sales in 20162018 were to customers outside the U.S. In addition, many of our manufacturing operations, suppliers and employees are located in many places around the world. The future success of our business depends in large part on growth in our sales in non-U.S. markets. Our global operations are subject to numerous financial, legal and operating risks, such as political and economic instability; prevalence of corruption in certain countries; enforcement of contract and intellectual property rightsrights; and compliance with existing and future laws, regulations and policies, including those related to exports, imports, tariffs, embargoes and other trade restrictions, investments, taxation, trade controls, product content and performance, employment and repatriation of earnings. In addition, we are affected by changes in foreign currency exchange rates, inflation rates and interest rates.

New legislative and regulatory actions could adversely affect our business.

Legislative and regulatory action The occurrence or consequences of these risks may be taken in the various countries and other jurisdictions where wemake it more difficult to operate that may affect our business activities in these countries or may otherwiseand increase our costs, to do business. For example, we are increasingly required to comply with various environmentalwhich could decrease our profitability and other material, product, certification and labeling laws and regulations. Our customers may also be required to comply with such legislative and regulatory requirements. These requirements could increase our costs and could potentially have an adverse effect on our ability to ship our products into certain jurisdictions. Changes in these requirements could impact demand for our products, solutions and services.

financial condition.

An inability to respond to changes in customer preferences could result in decreased demand for our products.

Our success depends in part on our ability to anticipate and offer hardware and software products that appeal to the changing needs and preferences of our customers in the various markets we serve. Developing new hardware and software products requires high levels of innovation, and the development process is often lengthy and costly. If we are not able to anticipate, identify, develop and market products that respond to changes in customer preferences and emerging technological and broader industry trends, demand for our products could decline.

We rely on suppliers to provide equipment, components and services.

Our business requires that we buy equipment, components and services including finished products, electronic components and commodities. Our reliance on suppliers involves certain risks, including:

poor quality or an insecure supply chain, which could adversely affect the reliability and reputation of our hardware and software products;

changes in the cost of these purchases due to inflation, exchange rate fluctuations, taxes, tariffs, embargoes and other trade restrictions, commodity market volatility or other factors that affect our suppliers;

intellectual property risks such as challenges to ownership of rights or alleged infringement by suppliers; and

shortages of components, commodities or other materials, which could adversely affect our manufacturing efficiencies and ability to make timely delivery of our products, solutions and services.

Any of these uncertainties could adversely affect our profitability and ability to compete. We also maintain several single-source supplier relationships, because either alternative sources are not available or the relationship is advantageous due to performance, quality, support, delivery, capacity, or price considerations. Unavailability of, or delivery delays for single-source components or products could adversely affect our ability to ship the related products in a timely manner. The effect of unavailability or delivery delays would be more severe if associated with our higher volume and more profitable products. Even where substitute sources of supply are available, qualifying alternative suppliers and establishing reliable supplies could cost more or result in delays and a loss of sales.

Failures or security breaches of our products, connected services, manufacturing environment, supply chain, or information technology systems could have an adverse effect on our business.

We rely heavily on information technology (IT) both in our hardware and software products, solutions and services for customers, manufacturing environment, and in our enterprise IT infrastructure in orderinfrastructure. Despite the implementation of security measures, our IT systems are vulnerable to achieve our business objectives. Government agencies and security experts have warned about growing risks ofunauthorized access by nation states, hackers, cyber-criminals, malicious insiders, and other actors targeting every type of IT system including industrial control systems such as those we sell and service and corporate enterprise IT systems. These actorswho may engage in fraud, theft of confidential or proprietary information, or sabotage. These systems could be compromised by malware (including ransomware), cyber attacks, and sabotage.other events, ranging from widespread, non-targeted, global cyber threats to targeted advanced persistent threats. Given that our hardware and software products and services are used in critical infrastructure, these threats could indicate increased risk for our products, services, manufacturing, and IT infrastructure. Recent global cyber attacks have been perpetuated by compromising software updates in widely-used software products, increasing the risk that vulnerabilities or malicious content could be inserted into our products. In some cases, malware attacks were spread throughout the supply chain, moving from one company to the next via authorized network connections.

Our hardware and software products, solutions, and services are used by our direct and indirect customers in applications that may be subject to information theft, tampering, or sabotage. Among other industries, our products, solutions and services are often employed in the control of critical infrastructure. Careless or malicious actors could cause a customer’s process to be disrupted or could cause equipment to operate in an improper manner that could result in harm to people or property. While we continue to improve the security attributes of our hardware and software products, solutions and services, we can reduce risk, not eliminate it. To a significant extent, the security of our customers’ systems depends on how those systems are designed, installed, protected, configured, updated and monitored, allmuch of which are typically outside our control.

Our business uses development, engineering, manufacturing, sales, accounting, support and IT resources on a dispersed, global basis.basis for a wide variety of functions including development, engineering, manufacturing, sales, accounting, and human resources. Our vendors, partners, employees and customers have access to, and share, information across multiple locations via various digital technologies. In addition, we rely on partners and vendors for a wide range of outsourced activities.activities, including cloud providers, are part of our internal IT infrastructure and our commercial offerings. Secure connectivity is important to these ongoing operations. Also, our partners and vendors frequently have access to our confidential information as well as confidential information about our customers, employees, and others. We design our security architecture to reduce the risk that a compromise of our partners’ infrastructure, for example a cloud platform, could lead to a compromise of our internal systems or customer networks, but this risk cannot be eliminated and vulnerabilities at third parties could result in unknown risk exposure to our business.

The current cyber threat environment indicates increased risk for all companies, including those in industrial automation and information. Like other global companies, we have experienced cyber threats and incidents, although none have been material or had a material adverse effect on our business or financial condition. Our information security efforts, under the leadership of our Chief Information Security Officer and Chief Product Security Officer, with the support of the entire management team, include major programs designed to address security governance, product security, identification of critical assets,and protection of critical assets, the human element/insider risk, third-party relationshipsrisk, and cyber defense operations. We believe these measures reduce, but cannot eliminate, the risk of an information

security incident.

Any significant security incidents could have an adverse impact on sales, harm our reputation and cause us to incur legal liability and increased costs to address such events and related security concerns.

There are inherent risks in our solutions and services businesses.

Risks inherent in the sale of solutions and services include assuming greater responsibility for successfully delivering projects that meet a particular customer specification, including defining and controlling contract scope, efficiently executing projects, and managing the performance and quality of our subcontractors and suppliers. If we are unable to manage and mitigate these risks, we could incur cost overruns, liabilities and other losses that would adversely affect our results of operations.

New legislative and regulatory actions could adversely affect our business.

Legislative and regulatory action may be taken in the various countries and other jurisdictions where we operate that may affect our business activities in these countries or may otherwise increase our costs to do business. For example, we are increasingly required to comply with various environmental and other material, product, certification and labeling laws and regulations. Our customers may also be required to comply with such legislative and regulatory requirements. These requirements could increase our costs and could potentially have an adverse effect on our ability to do business in certain jurisdictions. Changes in these requirements could impact demand for our hardware and software products, solutions and services. Compliance with increasing privacy regulation, such as the European Union's General Data Protection Regulation (GDPR), could increase our operating costs as part of our efforts to protect and safeguard our sensitive data and personal information. Failure to maintain information privacy could result in legal liability or reputational harm.

Our industry is highly competitive.

We face strong competition in all of our market segments in several significant respects. We compete based on breadth and scope of our hardware and software product portfolio and solution and service offerings, technology differentiation, the domain expertise of our employees and partners, product performance, quality of our hardware and software products, solutions and services, knowledge of integrated systems and applications that address our customers’ business challenges, pricing, delivery and customer service. The relative importance of these factors differs across the geographic markets and product areas that we serve.serve and across our market segments. We seek to maintain acceptable pricing levels across and within geographic markets by continually developing advanced technologies for new hardware and software products and product enhancements and offering complete solutions for our customers’ business problems. In addition, we continue to drive productivity to reduce our cost structure. If we fail to achieve our objectives, to keep pace with technological changes, or to provide high quality hardware and software products, solutions and services, we may lose business or experience price erosion and correspondingly lower sales and margins. We expect the level of competition to remain high in the future, which could limit our ability to maintain or increase our market share or profitability.

We rely on our distribution channel for a substantial portion of our sales.

our sales are through distributors. In certain other countries, the majority of our sales are also through a limited number of distributors. We depend on the capabilities and competencies of our distributors to sell our hardware and software products and services and deliver value to our customers. Disruptions to our existing distribution channel or the failure of distributors to maintain and develop the appropriate capabilities to sell our hardware and software products and services could adversely affect our sales. A disruption could result from the sale of a distributor to a competitor, financial instability of a distributor or other events.

We face the potential harms of natural disasters, pandemics, acts of war, terrorism, international conflicts or other disruptions to our operations.

Our business depends on the movement of people and goods around the world. Natural disasters, pandemics, acts or threats of war or terrorism, international conflicts, power outages, fires, explosions, equipment failures, sabotage, political instability and the actions taken by governments could cause damage to or disrupt our business operations, our suppliers or our customers, and could create economic instability. Disruptions to our IT infrastructure from system failures, shutdowns, power outages, telecommunication or utility failures, and other events, including disruptions at third party IT and other service providers, could also interfere with or disrupt our operations. Although it is not possible to predict such events or their consequences, these events could decrease demand for our hardware and software products, solutions or services, increase our costs, or make it difficult or impossible for us to deliver products.products, solutions or services.

Intellectual property infringement claims of others and the inability to protect our intellectual property rights could harm our business and our customers.

Others may assert intellectual property infringement claims against us or our customers. We frequently provide a limited intellectual property indemnity in connection with our terms and conditions of sale to our customers and in other types of contracts with third parties. Indemnification payments and legal expenses to defend claims could be costly.

In addition, we own the rights to many patents, trademarks, brand names and trade names that are important to our business. The inability to enforce our intellectual property rights may have an adverse effect on our results of operations. Expenses related to enforcing our intellectual property rights could be significant.

Claims from taxing authorities could have an adverse effect on our income tax expense and financial position.condition.

We conduct business in many countries, which requires us to interpret and comply with the income tax laws and rulings in each of those taxing jurisdictions. Due to the ambiguity of tax laws among those jurisdictions as well as the uncertainty of how underlying facts may be construed, our estimates of income tax liabilities may differ from actual payments or assessments. We must successfully defend any claims from taxing authorities to avoid an adverse effect on our operating results and financial position.condition.

Our business success depends on attracting, developing, and retaining highly qualified personnel.

Our success depends in part on the efforts and abilities of our management team and key employees. Their skills, experience and industry knowledge significantly benefit our operations and performance. Difficulty attracting, developing, and retaining members of our management team and key employees, including employees with the necessary technological expertise, could have a negative effect on our business, operating results and financial condition.

Increasing employee benefit costs could have a negative effect on our operating results and financial condition.

One important aspect of attracting and retaining qualified personnel is continuing to offer competitive employee retirement and health care benefits. The expenses we record for our pension and other postretirement benefit pension plans depend on factors such as changes in market interest rates, the value of plan assets, mortality assumptions and health care trend rates. Significant unfavorable changes in these factors would increase our expenses. Expenses related to employer-funded health care benefits depend on health care cost inflation. An inability to control costs related to employee and retiree benefits could negatively impact our operating results and financial condition.

Potential liabilities and costs from litigation (including asbestos claims and environmental remediation) could reduce our profitability.

Various lawsuits, claims and proceedings have been or may be asserted against us relating to the conduct of our business, including those pertaining to the safety and security of the hardware and software products, solutions and services we sell, employment, contract matters, and environmental remediation.

We have been named as a defendant in lawsuits alleging personal injury as a result of exposure to asbestos that was used in certain of our products many years ago. Our products may also be used in hazardous industrial activities, which could result in product liability claims. The uncertainties of litigation (including asbestos claims) and the uncertainties related to the collection of insurance coverageproceeds make it difficult to predict the ultimate resolution.

Our operations are subject to various environmental regulations that are concerned with human health, the limitation and control of emissions and discharges into the air, ground, and waters,water, the quality of air and bodies of water, and the handling, use and disposal of specified substances. Our financial responsibility to clean up contaminated property or for natural resource damages may extend to previously owned or used properties, waterways and properties owned by unrelated companies or individuals, as well as properties that we currently own and use, regardless of whether the contamination is attributable to prior owners. We have been named as a potentially responsible party at cleanup sites and may be so named in the future, and the costs associated with these current and future sites may be significant.

We have, from time to time, divested certain of our businesses. In connection with these divestitures, certain lawsuits, claims and proceedings may be instituted or asserted against us related to the period that we owned the businesses, either because we agreed to retain certain liabilities related to these periods or because such liabilities fall upon us by operation of law. In some instances, the divested business has assumed the liabilities; however, it is possible that we might be responsible for satisfying those liabilities if the divested business is unable to do so.

A disruption

Failure to our distribution channel could reduce our sales.

In the United Statesidentify, manage, complete, and Canada, approximately 90 percent of our sales are through distributors. In certain other countries, the majority of our sales are also through a limited number of distributors. While we maintain the right to appoint new distributors, any unplanned disruption to our existing distribution channel couldintegrate acquisitions and technology investments may adversely affect our sales. A disruption could resultbusiness.

As part of our strategy, we may pursue acquisitions of or investment opportunities in businesses as well as the purchase of technology from third parties. In order to be successful with these transactions, we must identify attractive acquisition or investment opportunities, successfully complete the sale of a distributor to a competitor, financial instability of a distributor or other events.

We rely on suppliers to provide equipment, componentstransaction, and services.

Our business requires that we buy equipment, components and services including finished products, electronic components and commoditiesmanage post-closing matters, such as copper, aluminumintegration of the acquired business or technology. We may not be able to identify or complete beneficial acquisition or transaction opportunities given the intense competition for them. Even if we successfully identify and steel. Our reliance on suppliers involves certain risks, including:

poor quality or an insecure supply chain, which could adversely affect the reliability and reputation of our products;

changes in the cost of these purchases duecomplete such transactions, we may not be able to inflation, exchange rates, commodity market volatility or other factors;

intellectual property risks such as ownership of rights or alleged infringement by suppliers;

information security risks associated with providing confidential information to suppliers; and

shortages of components, commodities or other materials, which could adversely affect our manufacturing efficiencies and ability to make timely delivery.

Any of these uncertainties could adversely affect our profitability and ability to compete. We also maintain several single-source supplier relationships, because either alternative sources are not available or the relationship is advantageous due to performance, quality, support, delivery, capacity or price considerations. Unavailability or delivery delays of single-source components or products could adversely affect our ability to ship the related products in a timely manner. The effect of unavailability or delivery delays would be more severe if associated with our higher volume and more profitable products. Even where substitute sources of supply are available, qualifying the alternate suppliers and establishing reliable supplies could cost more or could result in delays and a loss of sales.

Risks associated with acquisitions could have an adverse effect on us.

We have acquired, and will continue to acquire, businesses in an effort to enhance shareowner value. Acquisitions involvesuccessfully address risks and uncertainties inherent in such transactions, including:

difficulties in integrating the acquired business,purchased operations, technologies, products or services, retaining the acquired business’ customers and achieving the expected benefits of the acquisition, such as sales increases, access to technologies, cost savings and increases in geographic or product presence, in the desired time frames;

loss of key employees of the acquired business;

legal and compliance issues;

difficulties implementing and maintaining consistent standards, controls, procedures, policies and information systems; and

diversion of management’s attention from other business concerns.

Future acquisitions and technology investments could result in debt, dilution, liabilities, increased interest expense, restructuring charges, and impairment and amortization expenses related to intangible assets.

We own common stock in PTC Inc. and are exposed to the volatility, liquidity and other risks inherent in holding that stock.

We own common stock of PTC Inc. (PTC), a Nasdaq-listed company, that we acquired for an aggregate purchase price of approximately $1.0 billion. We present this investment on our Consolidated Balance Sheet at its fair value at the end of each reporting period, less a valuation adjustment pending registration of our shares of PTC common stock (Shares) under the Securities Act of 1933, as amended, which, per a registration rights agreement entered into with PTC, must occur no later than July 19, 2019. The fair value of the Shares is subject to fluctuation in the future due to the volatility of the stock market, changes in general economic conditions, and the performance of PTC. We will recognize all changes in the fair value of the Shares (whether realized or unrealized) as gains or losses in our Consolidated Statement of Operations. Accordingly, changes in the fair value of the Shares can materially impact the earnings we report, which introduces volatility in our earnings that is not associated with the results of our business operations. In particular, significant declines in the fair value of the Shares would produce significant declines in our reported earnings.

While there is an established trading market for shares of PTC common stock, there are limitations on our ability to dispose of some or all of the Shares should we wish to reduce our investment. Until approximately July 19, 2021, we are subject to contractual restrictions on our ability to transfer the Shares, subject to certain exceptions. In addition, we are subject to certain restrictions on our ability to transfer the Shares under the securities laws. Further, the reported value of our Shares does not necessarily reflect their lowest current market price. If we were forced to sell some or all the Shares in the market, there can be no assurance that we will be able to sell them at prices equivalent to the value of the Shares that we have reported on our Consolidated Balance Sheet, and we may be forced to sell them at significantly lower prices.

Finally, our equity position in PTC is a minority position which exposes us to further risk as we are not able to exert control over PTC.

Increasing employee benefit costs could have a negative effect on our operating results and financial condition.

One important aspect of attracting and retaining qualified personnel is continuing to offer competitive employee retirement and health care benefits. The expenses we record for our pension and other postretirement benefit plans depend on factors such as changes in market interest rates, the value of plan assets, mortality assumptions and healthcare trend rates. Significant unfavorable changes in these factors would increase our expenses. Expenses related to employer-funded healthcare benefits depend on laws and regulations, which could change, as well as healthcare cost inflation. An inability to control costs related to employee and retiree benefits could negatively impact our operating results and financial condition.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

We operate manufacturing facilities in the United States and multiple other countries. Manufacturing space occupied approximately 3.43.3 million square feet, of which 3836 percent was in the United States and Canada. Our global headquarters are located in Milwaukee, Wisconsin in a facility that we own. We lease the remaining facilities noted below. Most of our facilities are shared by operations in both segments and may be used for multiple purposes such as administrative, manufacturing, warehousing and / or distribution.

The following table sets forth information regarding our headquarter locations as of September 30, 20162018.:

|

| | | |

| | | |

| Location | | Segment/Region |

| | | |

| Milwaukee, Wisconsin, United States | | Global Headquarters and Control Products & Solutions |

| Mayfield Heights, Ohio, United States | | Architecture & Software |

| Cambridge, Canada | | Canada |

| Capelle, Netherlands / Diegem, Belgium | | Europe, Middle East and Africa |

| Hong Kong | | Asia Pacific |

| Weston, Florida, United States | | Latin America |

| | | |

The following table sets forth information regarding the manufacturing square footage of our principal manufacturing locations as of September 30, 2016.2018: |

| | | |

| Location | | Manufacturing Square Footage |

| | | |

| Monterrey, Mexico | | 637,000630,000 |

|

| Aarau, Switzerland | | 284,000 |

|

| Twinsburg, Ohio, United States | | 257,000 |

|

| Mequon, Wisconsin, United States | | 240,000 |

|

| Tecate, Mexico | | 221,000 |

|

| Cambridge, Canada | | 216,000 |

|

| Shanghai, China | | 196,000176,000 |

|

| Richland Center, Wisconsin, United States | | 166,000 |

|

| Harbin, China | | 162,000 |

|

Singapore | | 139,000 |

|

| Katowice, Poland | | 138,000 |

|

Tecate, Mexico | | 135,000 |

|

| Ladysmith, Wisconsin, United States | | 124,000 |

|

Richland Center, Wisconsin, United States | | 124,000130,000 |

|

| Jundiai, Brazil | | 115,000 |

|

| Singapore | | 74,000 |

|

There are no major encumbrances (other than financing arrangements, which in the aggregate are not significant) on any of our plants or equipment. In our opinion, our properties have been well maintained, are in sound operating condition and contain all equipment and facilities necessary to operate at present levels.

Item 3. Legal Proceedings

The information required by this Item is contained in Note 1415 in the Financial Statements within the section entitled Other Matters.

Item 4.Mine Safety Disclosures

Not applicable.

Item 4A. Executive Officers of the Company

The name, age, office and position held with the Company and principal occupations and employment during the past five years of each of the executive officers of the Company as of October 31, 2016November 1, 2018 are:

|

| | |

| | |

| Name, Office and Position, and Principal Occupations and Employment | Age |

| | |

Blake D. Moret — Chairman of the Board since January 1, 2018, and President and Chief Executive Officer since July 1, 2016; previously Senior Vice President previously | 53 |

|

Kenneth M. Champa — Senior Vice President since July 1, 2016; previously Vice President, Finance, Control Products and Solutions and (from March 2015) Operations and Engineering Services

| 6255 |

|

Sujeet Chand — Senior Vice President and Chief Technology Officer | 5860 |

|

Theodore D. Crandall — Senior Vice President since February 7, 2017; previously Senior Vice President and Chief Financial Officer | 6163 |

|

David M. Dorgan — Vice President and Controller | 5254 |

|

Steven W. Etzel — Vice President and Treasurer | 5658 |

|

Douglas M. HagermanElik I. Fooks — Senior Vice President since March 16, 2017; previously Vice President and General Manager, Sensing, Safety, and Connectivity Business

| 67 |

|

Patrick P. Goris — Senior Vice President and Chief Financial Officer since February 7, 2017; previously Vice President, Finance, Architecture and Software and (from 2013-2015) Operations and Engineering Services, and (from July 2015) Vice President, Investor Relations | 47 |

|

Rebecca W. House — Senior Vice President, General Counsel and Secretary since January 3, 2017; previously Assistant General Counsel, Operations and Compliance, and Assistant Secretary at Harley-Davidson, Inc. (motorcycle manufacturer) | 5545 |

|

Frank C. Kulaszewicz — Senior Vice President | 5254 |

|

Michael Laszkiewicz — Senior Vice President, Operations and Engineering Services since July 2, 2018; previously Vice President and General Manager, Power Control Business | 58 |

|

John P. McDermott — Senior Vice President | 5860 |

|

John M. Miller — Vice President and Chief Intellectual Property Counsel | 4951 |

|

Robert B. Murphy — Senior Vice President, Connected Enterprise Consulting since July 2, 2018; previously Senior Vice President, Operations and Engineering Services since(from May 2, 2016;2016 - July 2018) and Vice President, Manufacturing Operations previously | 5759 |

|

Susan J. SchmittChristopher Nardecchia — Senior Vice President Human Resourcesand Chief Information Officer since November 1, 2017; previously Vice President and Chief Information Officer, Global Operations and Supply Chain, Amgen, Inc. (biopharmaceutical company)

| 56 |

|

Francis S. Wlodarczyk — Senior Vice President since July 2, 2018; previously Vice President, Control and Visualization Business (from 2014 - 2018) and Director, Product Businesses, EMEA | 53 |

|

There are no family relationships, as defined by applicable SEC rules, between any of the above executive officers and any other executive officer or director of the Company. No officer of the Company was selected pursuant to any arrangement or understanding between the officer and any person other than the Company. All executive officers are elected annually.

PART II

Item 5. Market for the Company’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common stock, $1 par value, is listed on the New York Stock Exchange and trades under the symbol “ROK.” On October 31, 2016,2018, there were 18,20516,162 shareowners of record of our common stock.

The following table sets forth the high and low sales price of our common stock on the New York Stock Exchange-Composite Transactions reporting system during each quarter of our fiscal years ended September 30, 2016 and 2015:

|

| | | | | | | | | | | | | | | | |

| | | 2016 | | 2015 |

| Fiscal Quarters | | High | | Low | | High | | Low |

| First | | $ | 111.03 |

| | $ | 98.47 |

| | $ | 118.32 |

| | $ | 98.55 |

|

| Second | | 115.62 |

| | 87.53 |

| | 118.96 |

| | 102.31 |

|

| Third | | 120.60 |

| | 107.17 |

| | 127.05 |

| | 110.00 |

|

| Fourth | | 123.11 |

| | 110.89 |

| | 126.77 |

| | 99.00 |

|

We declare and pay dividends at the sole discretion of our Board of Directors. During 2016 we declared and paid aggregate cash dividends of $2.90 per common share. During the first quarter of fiscal 2016, we increased our quarterly dividend per common share 12 percent to 72.5 cents per common share effective with the dividend payable in December 2015 ($2.90 per common share annually). During 2015 we declared and paid aggregate cash dividends of $2.60 per common share.Company Purchases

The table below sets forth information with respect to purchases made by or on behalf of us of shares of our common stock during the three months ended September 30, 20162018:

|

| | | | | | | | | | | | | | |

| Period | | Total Number of Shares Purchased(1) | | Average Price Paid Per Share(2) | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | Maximum Approx. Dollar Value of Shares that may yet be Purchased Under the Plans or Programs(3) |

| July 1 – 31, 2016 | | 323,275 |

| | $ | 116.81 |

| | 323,275 |

| | $ | 1,037,423,371 |

|

| August 1 – 31, 2016 | | 462,436 |

| | 117.55 |

| | 460,000 |

| | 983,352,795 |

|

| September 1 – 30, 2016 | | 330,000 |

| | 116.09 |

| | 330,000 |

| | 945,043,797 |

|

| Total | | 1,115,711 |

| | 116.91 |

| | 1,113,275 |

| | |

|

| | | | | | | | | | | | | | |

| Period | | Total Number of Shares Purchased(1) | | Average Price Paid Per Share(2) | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | Maximum Approx. Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs(3) |

| July 1 – 31, 2018 | | 613,830 |

| | $ | 172.62 |

| | 613,830 |

| | $ | 398,070,077 |

|

| August 1 – 31, 2018 | | 781,516 |

| | 175.85 |

| | 780,961 |

| | 260,734,522 |

|

| September 1 – 30, 2018 | | 807,276 |

| | 188.69 |

| | 807,276 |

| | 1,108,405,220 |

|

| Total | | 2,202,622 |

| | 179.66 |

| | 2,202,067 |

| | |

| |

(1) | All of the shares purchased during the quarter ended September 30, 20162018 were acquired pursuant to the repurchase programs described in (3) below, except for 2,436555 shares that were acquired in August in connection with stock swap exercises of employee stock options. |

| |

(2) | Average price paid per share includes brokerage commissions. |

| |

(3) | On June 4, 2014,January 15, 2018, the Board of Directors authorized us to expend $1.0 billion to repurchase shares of our common stock. On AprilSeptember 6, 2016,2018, the Board of Directors authorized us to expend an additional $1.0 billion to repurchase shares of our common stock. Our repurchase programs allow us to repurchase shares at management's discretion or at our broker’s discretion pursuant to a share repurchase plan subject to price and volume parameters. |

Performance Graph

The following information is not deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934, as amended (Exchange Act) or to the liabilities of Section 18 of the Exchange Act, and will not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent the Company specifically incorporates it by reference into such a filing.

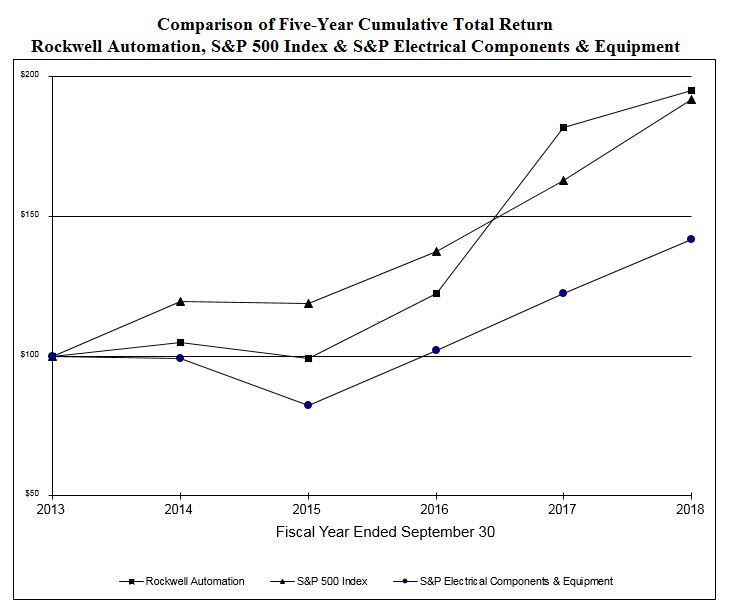

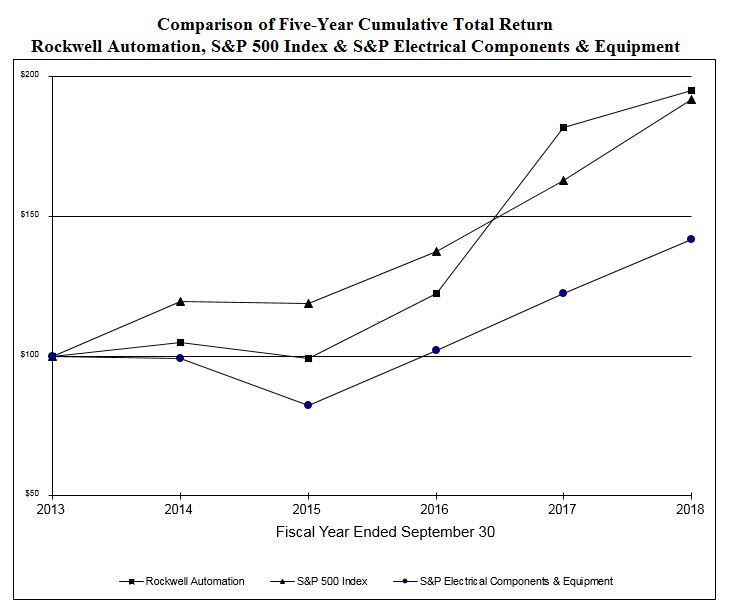

The following line graph compares the cumulative total shareowner return on our Common Stock against the cumulative total return of the S&P Composite-500 Stock Index and the S&P Electrical Components & Equipment (S&P Electrical C&E) Index for the period of five fiscal years from October 1, 2013 to September 30, 2018, assuming in each case a fixed investment of $100 at the respective closing prices on September 30, 2013 and reinvestment of all dividends.

The cumulative total returns on Rockwell Automation Common Stock and each index as of each September 30, 2013 through 2018 plotted in the above graph are as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | 2013 | | 2014 | | 2015 | | 2016 | | 2017 | | 2018 |

| Rockwell Automation* | $ | 100.00 |

| | $ | 104.76 |

| | $ | 99.00 |

| | $ | 122.54 |

| | $ | 182.04 |

| | $ | 195.23 |

|

| S&P 500 Index | 100.00 |

| | 119.73 |

| | 119.00 |

| | 137.36 |

| | 162.92 |

| | 192.10 |

|

| S&P Electrical Components & Equipment | 100.00 |

| | 99.35 |

| | 82.47 |

| | 102.01 |

| | 122.54 |

| | 141.96 |

|

| Cash dividends per common share | 1.98 |

| | 2.32 |

| | 2.60 |

| | 2.90 |

| | 3.04 |

| | 3.51 |

|

* Includes the reinvestment of all dividends in our Common Stock.

Item 6. Selected Financial Data

The following table sets forth selected consolidated financial data of our continuing operations. The data should be read in conjunction with MD&A and the Financial Statements. The selected financial data below has been derived from our audited consolidated financial statements.

| | | | | Year Ended September 30, | | Year Ended September 30, |

| | | 2016 | | 2015 | | 2014 | | 2013 | | 2012 | | 2018 | | 2017 | | 2016 | | 2015 | | 2014 |

| | | (in millions, except per share data) | | (in millions, except per share data) |

| Consolidated Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

| Sales | | $ | 5,879.5 |

| | $ | 6,307.9 |

| | $ | 6,623.5 |

| | $ | 6,351.9 |

| | $ | 6,259.4 |

| | $ | 6,666.0 |

| | $ | 6,311.3 |

| | $ | 5,879.5 |

| | $ | 6,307.9 |

| | $ | 6,623.5 |

|

| Interest expense | | 71.3 |

| | 63.7 |

| | 59.3 |

| | 60.9 |

| | 60.1 |

| | 73.0 |

| | 76.2 |

| | 71.3 |

| | 63.7 |

| | 59.3 |

|

Net income | | 729.7 |

| | 827.6 |

| | 826.8 |

| | 756.3 |

| | 737.0 |

| | 535.5 |

| | 825.7 |

| | 729.7 |

| | 827.6 |

| | 826.8 |

|

| Earnings per share: | | | | | | | | | | | | | | | | | | | | |

| Basic | | 5.60 |

| | 6.15 |

| | 5.98 |

| | 5.43 |

| | 5.20 |

| | 4.27 |

| | 6.42 |

| | 5.60 |

| | 6.15 |

| | 5.98 |

|

| Diluted | | 5.56 |

| | 6.09 |

| | 5.91 |

| | 5.36 |

| | 5.13 |

| | 4.21 |

| | 6.35 |

| | 5.56 |

| | 6.09 |

| | 5.91 |

|

| Cash dividends per share | | 2.90 |

| | 2.60 |

| | 2.32 |

| | 1.98 |

| | 1.745 |

| | 3.51 |

| | 3.04 |

| | 2.90 |

| | 2.60 |

| | 2.32 |

|

Consolidated Balance Sheet Data: (at end of period) | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 7,101.2 |

| | $ | 6,404.7 |

| | $ | 6,224.3 |

| | $ | 5,844.6 |

| | $ | 5,636.5 |

| | $ | 6,262.0 |

| | $ | 7,161.7 |

| | $ | 7,101.2 |

| | $ | 6,404.7 |

| | $ | 6,224.3 |

|

| Short-term debt | | 448.6 |

| | — |

| | 325.0 |

| | 179.0 |

| | 157.0 |

| |

| Short-term debt and current portion of long-term debt | | | 551.0 |

| | 600.4 |

| | 448.6 |

| | — |

| | 325.0 |

|

| Long-term debt | | 1,516.3 |

| | 1,500.9 |

| | 900.4 |

| | 905.1 |

| | 905.0 |

| | 1,225.2 |

| | 1,243.4 |

| | 1,516.3 |

| | 1,500.9 |

| | 900.4 |

|

| Shareowners’ equity | | 1,990.1 |

| | 2,256.8 |

| | 2,658.1 |

| | 2,585.5 |

| | 1,851.7 |

| | 1,617.5 |

| | 2,663.6 |

| | 1,990.1 |

| | 2,256.8 |

| | 2,658.1 |

|

| Other Data: | | | | | | | | | | | | | | | | | | | | |

| Capital expenditures | | $ | 116.9 |

| | $ | 122.9 |

| | $ | 141.0 |

| | $ | 146.2 |

| | $ | 139.6 |

| | $ | 125.5 |

| | $ | 141.7 |

| | $ | 116.9 |

| | $ | 122.9 |

| | $ | 141.0 |

|

| Depreciation | | 143.3 |

| | 133.1 |

| | 122.5 |

| | 113.8 |

| | 103.9 |

| | 136.4 |

| | 138.7 |

| | 143.3 |

| | 133.1 |

| | 122.5 |

|

| Intangible asset amortization | | 28.9 |

| | 29.4 |

| | 30.0 |

| | 31.4 |

| | 34.7 |

| | 28.2 |

| | 30.2 |

| | 28.9 |

| | 29.4 |

| | 30.0 |

|

| |

(1) | During the fourth quarter of fiscal 2017, we sold a product distribution business within our Control Products & Solutions segment. This business held no intellectual property and included products sold outside of our core channel and under different brands. We sold this business for approximately $94 million and recorded a pre-tax gain of $60.8 million, which is included within Other income (expense) in the Consolidated Statement of Operations. During fiscal 2018, we recorded a gain of $90 million due to a change in fair value of our investment in PTC, which is included within Other income (expense) in the Consolidated Statement of Operations. During fiscal 2018, we recorded charges of $538.3 million associated with the enactment of the Tax Cuts and Jobs Act of 2017 (the "Tax Act"). Refer to Notes 8 and 14 in the Condensed Consolidated Financial Statements for further information regarding our investment in PTC and the effect of the Tax Act, respectively on our financial condition and results of operations. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Results of Operations

Non-GAAP Measures

The following discussion includes organic sales, total segment operating earnings and margin, Adjusted Income, Adjusted EPS, Adjusted Effective Tax Rate and free cash flow, which are non-GAAP measures. See Supplemental Sales Information for a reconciliation of reported sales to organic sales and a discussion of why we believe this non-GAAP measure is useful to investors. See Results of Operations for a reconciliation of income before income taxes to total segment operating earnings and margin and a discussion of why we believe these non-GAAP measures are useful to investors. See Results of Operations for a reconciliation of income from continuing operations, diluted EPS from continuing operations and effective tax rate to Adjusted Income, Adjusted EPS and Adjusted Effective Tax Rate, respectively, and a discussion of why we believe these non-GAAP measures are useful to investors. See Financial Condition for a reconciliation of cash flows from operating activities to free cash flow and a discussion of why we believe this non-GAAP measure is useful to investors.

Overview

Rockwell Automation, Inc., a leader in industrial automation and information, makes its customers more productive and the world more sustainable. Overall demand for our hardware and software products, solutions and services is driven by:

investments in manufacturing, including upgrades, modifications and expansions of existing facilities or production lines and new facilities or production lines;

investments in basic materials production capacity, which may be related to commodity pricing levels;

our customers’ needs for faster time to market, lower total cost of ownership, improved asset utilization and optimization, and enterprise risk management;

our customers’ needs to continuously improve quality, safety and sustainability;

industry factors that include our customers’ new product introductions, demand for our customers’ products or services and the regulatory and competitive environments in which our customers operate;

levels of global industrial production and capacity utilization;

regional factors that include local political, social, regulatory and economic circumstances; and

the spending patterns of our customers due to their annual budgeting processes and their working schedules.

Long-term Strategy

Our strategy is to bring The Connected Enterprise to life. We integrate control and information across the enterprise to help industrial companies and their people be more productive. Our vision of being the most valued global provider of innovative industrial automation and information hardware and software products, solutions and services is supported by our growth and performance strategy, which seeks to:

achieve organic sales growth in excess of the automation market by expanding our served market and strengthening our competitive differentiation;

diversify our sales streams by broadening our portfolio of hardware and software products, solutions and services, expanding our global presence and serving a wider range of industries and applications;

grow market share by gaining new customers and by capturing a larger share of existing customers’ spending;

enhance our market access by building our channel capability and partner network;

acquire companies that serve as catalysts to organic growth by adding complementary technology, expanding our served market, or enhancing our domain expertise or market access;

deploy human and financial resources to strengthen our technology leadership and our intellectual capital business model;

continuously improve quality and customer experience; and

drive annual cost productivity.

By implementing the above strategy, we seek to achieve our long-term financial goals, including above-market organic sales growth, EPS growth above sales growth, return on invested capital in excess of 20 percent and free cash flow equal to about 100 percent of Adjusted Income. We expect acquisitions to add a percentage point or more per year to long-term sales growth.

Our customers face the challenge of remaining globally cost competitive and automation can help them achieve their productivity and sustainability objectives. Our value proposition is to help our customers reduce time to market, lower total cost of ownership, improve asset utilization and manage enterprise risks.

Differentiation through Technology Innovation and Domain Expertise

We seek a technology leadership position in industrial automation. We believe that our three platforms - integrated architecture, intelligent motor control and solutions and services - provide the foundation for a long-term sustainable competitive advantage.

Our integrated control and information architecture, with Logix at its core, is an important differentiator. We are the only automation provider that can support discrete, process, batch, safety, motion and power control on the same hardware platform with the same software programming environment. Our integrated architecture is scalable with standard open communications protocols making it easier for customers to implement it more cost effectively. Our software portfolio, combined with the software made available as a result of our strategic alliance with PTC, is the most comprehensive and flexible information platform in the industry.�� Through the combination of this technology and our domain expertise we help customers to achieve additional productivity benefits, such as reduced unplanned downtime, improved energy efficiency, higher quality and increased throughput yield.

Intelligent motor control is one of our core competencies and an important aspect of an automation system. These products and solutions enhance the availability, efficiency and safe operation of our customers' critical and most energy-intensive plant assets. Our intelligent motor control offering can be integrated seamlessly with the Logix architecture.

Domain expertise refers to the industry and application knowledge required to deliver solutions and services that support customers through the entire life cycle of their automation investment. The combination of industry-specific domain expertise of our people with our innovative technologies enables us to help our customers solve their manufacturing and business challenges.

Global Expansion

As the manufacturing world continues to expand, we must be able to meet our customers’ needs around the world. Approximately 60 percent of our employees and 45 percent of our sales are outside the U.S. We continue to expand our footprint in emerging markets.

As we expand in markets with considerable growth potential and shift our global footprint, we expect to continue to broaden the portfolio of hardware and software products, solutions and services that we provide to our customers in these regions. We have made significant investments to globalize our manufacturing, product development and customer-facing resources in order to be closer to our customers throughout the world. The emerging markets of Asia Pacific, including China and India, Latin America, Central and Eastern Europe and Africa are projected to be the fastest growing over the long term, due to higher levels of infrastructure investment and the growing middle-class population. We believe that increased demand for consumer products in these markets will lead to manufacturing investment and provide us with additional growth opportunities in the future.

Enhanced Market Access

Over the past decade, our investments in technology and globalization have enabled us to expand our addressed market to over $90 billion. Our process initiative has been the most important contributor to this expansion and remains our largest growth opportunity. Logix is the technology foundation that enabled us to become an industry leader for process applications. We complement that with a growing global network of engineers and partners to provide solutions to process customers.

OEMsOriginal Equipment Manufacturers (OEMs) represent another area of addressed market expansion and an important growth opportunity. To remain competitive, OEMs need to find the optimal balance of machine cost and performance while reducing their time to market. Our scalable integrated architecture and intelligent motor control offerings, along with design productivity tools and our motion and safety products, can assist OEMs in addressing these business needs.

We have developed a powerful network of channel partners, technology partners and commercial partners that act as amplifiers to our internal capabilities and enable us to serve our customers’ needs around the world.

Broad Range of Industries Served

We apply our knowledge of manufacturing applications to help customers solve their business challenges. We serve customers in a wide range of industries, including consumer products, resource-basedheavy industries and transportation.

Our consumer products customers are engaged in the food and beverage, home and personal care, and life sciences industries. These customers’ needs include new capacity, incremental capacity from existing facilities, flexible manufacturing and regulatory compliance. These customers operate in an environment where product innovation and time to market are critical factors.

We serve customers in resource-basedheavy industries, including oil and gas, mining, aggregates, cement, metals, energy, semiconductor, chemicals, pulp and paper and water/wastewater. Companies in theseresource-based industries typically invest in capacity expansion when commodity prices are relatively high and global demand for basic materials is increasing. In addition, there is ongoing investment in upgrades of aging automation systems and productivity.

In the transportation industry, factors such as geographic expansion, investment in new model introductions, including electric vehicles, and more flexible manufacturing technologies influence customers’ automation investment decisions. Our sales in transportation are primarily to automotive and tire manufacturers.

All of these industries also generate maintenance repair order (MRO) and ongoing services revenue related to the installed base.

Outsourcing and Sustainability Trends

Demand for our hardware and software products, solutions and services across all industries benefits from the outsourcing and sustainability needs of our customers. Customers increasingly desire to outsource engineering services to achieve a more flexible cost base. Our manufacturing application knowledge enables us to serve these customers globally.

We help our customers meet their sustainability needs pertaining to energy efficiency, environmental and safety goals. Customers across all industries are investing in more energy-efficient manufacturing processes and technologies, such as intelligent motor control, and energy efficientenergy-efficient solutions and services. In addition, environmental and safety objectives often spur customers to invest to ensure compliance and implement sustainable business practices.

Acquisitions and Investments

Our acquisition and investment strategy focuses on hardware and software products, solutions and services that will be catalytic to the organic growth of our core offerings.

In 2018, we made several investments, including in PTC. PTC is the leader in the Industrial Internet of Things and augmented reality. Our investment in and alliance with PTC will accelerate growth for both companies and enable us to be the partner of choice for customers around the world who want to transform their physical operations with digital technology. The result will be an unmatched integrated information solution that will enable customers to achieve increased productivity, heightened plant efficiency, reduced operational risk and better system interoperability.

In November 2017, we acquired Odos Imaging Limited, a Scottish technology company that provides three-dimensional, time-of-flight sensing systems for industrial imaging applications. This acquisition enables us to expand our existing capabilities by bringing 3-D time-of-flight sensor technology to industrial applications.

In September 2016, we acquired Maverick Technologies, a leading systems integrator. This acquisition significantly enhances our expertise in key process and batch applications that help our customers realize greater productivity and improved global competitiveness through process control and information management solutions.

In September 2016, we acquired Automation Control Products, a premier provider in centralized thin client, remote desktop and server management software. This acquisition strengthens our ability to provide our customers with visual display and software solutions to manage information and streamline workflows for a more connected manufacturing environment.

In March 2016, we acquired MagneMotion Inc., a leading manufacturer of intelligent conveying systems. This acquisition continues our strategy to build a portfolio of smart manufacturing technologies by expanding our existing capabilities in independent cart technology.

In October 2014, we acquired the assets of ESC Services, Inc., a global provider of lockout-tagout services and solutions. This acquisition enables our customers to increase their asset utilization and strengthen their enterprise risk management.

In January 2014, we acquired Jacobs Automation, a pioneer in intelligent track motion control technology. This technology improves performance across a wide range of packaging, material handling, and other applications for global machine builders.

In November 2013, we acquired vMonitor LLC and its affiliates, a global technology leader for wireless solutions in the oil and gas industry. This acquisition strengthens our ability to deliver end-to-end projects for the oil and gas sector and accelerates our development of similar process solutions and remote monitoring services for other industries globally.

We believe these acquisitions and investments will help us expand our served market and deliver value to our customers.

Continuous Improvement