Use these links to rapidly review the documentCARREKER CORPORATION Index

Item 8. Financial Statements and Supplementary Data.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| (Mark One) | |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 31, | |

OR | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to | |

Commission file number 0-24201

CARREKER CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 75-1622836 (I.R.S. Employer Identification No.) | |

4055 Valley View Lane #1000 Dallas, Texas 75244 (Address of principal executive offices) | 75244 (Zip Code) |

Registrant's telephone number, including area code:(972) 458-1981

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

None

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

Common Stock, par value $0.01 per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one)

Large Accelerated Filer o Accelerated Filer ý Non-Accelerated Filer o

Indicate by check mark whether the registrant is an accelerated filera shell company (as defined in Rule 12b-2 of the Exchange Act Rule 12b-2)Act). Yes ýo No oý

The aggregate market value on July 31, 20042005 of the voting and non-voting common equity held by non-affiliates of the registrant was $202,239,992.$130,729,257.

Number ofThere were 25,328,615 shares of registrant'sour Common Stock, par value $0.01 per share, outstanding as of March 31, 2005: 24,859,5032006.

DOCUMENTS INCORPORATED BY REFERENCE

Selected portions of the registrant'sour definitive Proxy Statement for the 20052006 Annual Meeting of Stockholders are incorporated by reference into Part III hereof.

Index

| | | ||

|---|---|---|---|

| PART I: | |||

| Item 1. | Business | ||

| Item 1A. | Risk Factors | ||

| Item 1B. | Unresolved Staff Comments | ||

| Item 2. | Properties | ||

| Item 3. | Legal Proceedings | ||

| Item 4. | Submission of Matters to A Vote of Security Holders | ||

PART II: | |||

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | ||

| Item 6. | Selected Financial Data | ||

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | ||

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | ||

| Item 8. | Financial Statements and Supplementary Data | ||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | ||

| Item 9A. | Controls and Procedures | ||

| Item 9B. | Other Information | ||

PART III: | |||

| Item 10. | Directors and Executive Officers of the Registrant | ||

| Item 11. | Executive Compensation | ||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | ||

| Item 13. | Certain Relationships and Related Transactions | ||

| Item | Principal | ||

PART IV: | |||

| Item 15. | Exhibits and Financial Statement Schedules | ||

SIGNATURES | |||

Unless the context otherwise requires, the term "we," "us," "our," "Company," "Carreker," or "Carreker Corporation" when used in this Form 10-K ("Report") and in the Annual Report to the Stockholders refers to Carreker Corporation, a Delaware corporation organized in 1998, and its consolidated subsidiaries and predecessors. Our Internet Website address iswww.Carreker.com. www.Carreker.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to such reports are available, free of charge, on our Internet Website under "Investor Relations (IR)—SEC Filings" as soon as reasonably practicable after we file electronically such material with, or furnish it to, the United States Securities and Exchange Commission, or SEC. Information on our Internet Website does not constitute a part of this Report. This Report contains some forward-looking statements within the meaning of the federal securities laws. When used in this Report, the words "expects," "plans," "believes," "anticipating," "estimates," and similar expressions are intended to identify forward looking statements. Actual results and the timing of some events could differ materially from those projected in or contemplated by the forward looking statements due to a number of factors, including without limitation those set forth under "Forward Looking Statements and Risk"Risk Factors" below.

Our Business Focus

For the last 2728 years Carreker Corporation has designed, developed, sold and delivered payments-related software and consulting solutions to financial institutions and financial service providers. More recently, we have introduced a business process outsourcing solution to our customers. Our products and services address a broad spectrum of payment activities and are designed to help our clients enhance the performance of their payments businesses; improve operational efficiency in payments processing; enhance revenue and profitability from payments-oriented products and services; reduce losses associated with fraudulent payment transactions; facilitate compliance with risk-related laws and regulations; and/or maximize clients' customer income streams by aligning their customer interactions and products with customer needs.

We are organized into three primary operating divisions: Global Payments Technologies ("GPT"), Revenue Enhancement ("RevE") and Global Payments Consulting ("GPC"). These operating divisions are operated in discrete yet synergistic ways to bring value to our clients. In addition we have established As of January 31, 2006, Carreker employed a joint venture named Carretek LLC to address the payments outsourcing arena.total of 495 employees.

Products and Services

The products and services of our three primary operating divisions are described below in this sequence: Global Payments Technologies ("GPT"), Revenue Enhancement ("RevE") and, Global Payments Consulting ("GPC") and Carretek LLC ("Carretek").

Global Payments Technologies Solutions. Carreker's technology solutions help financial institutions address the needs of some critical payment services and delivery functions that impact overall operating revenues and costs and risk management. These functions include presentment of checks in paper and electronic form, identification and mitigation of fraudulent payments, handling irregular items such as checks returned unpaid (exceptions), maintaining a record of past transactions (archiving), responding to related customer inquiries (research), and correcting any errors that are discovered (adjustments). Global Payments Technologies ("GPT") solutions address these and other key functions in the context of improving operational efficiency and a gradual transition from paper to electronic-based payment systems. In addition,GPT offers Risk Management solutions that mitigate depository account risk through profiling and advanced analytics technology. GPT Risk solutions leverage transaction monitoring and filtering capabilities for AML and OFAC compliance. Finally, we offer technology solutions that optimize the inventory management of a bank's cash stock levels and logistical service requirements, including managing how much is needed, when it is needed and where it is needed. Our solutions reduce the amount of cash banks need to hold in reserve accounts and as cash-on-hand while ensuring a high level of customer service through timely replenishment of ATM cash supplies at minimal logistical services cost.

Specific solutions in the GPT group include:

| Solution | Description | Products Offered | ||

|---|---|---|---|---|

| Risk Solutions: | ||||

Fraud Mitigation and Anti-Money Laundering Compliance | Automated fraud detection and prevention solutions that reduce incidents of check fraud, deposit fraud, check kiting, and electronic fraud. Anti-money laundering solutions screen names and related data against industry blacklists, local high-risk lists and other customized databases. | FraudLink On-Us, FraudLink Deposit, FraudLink Deposit—Branch Access Option, Kite, FraudLink Positive Pay, FraudLink eTracker, FraudLink ACHeCK, FraudLink PC, | ||

Payment Solutions: | ||||

Management | Products that bring new efficiencies to back-office operations through leading-edge image, workflow, and RECO (character recognition) technologies. | Adjustments/Express, Exceptions/Express, Express Capture, Express Decision, Input/Express, Inbound Returns/Express, and All Transactions File | ||

Remittance and Payments Processing | Both host and client/server-based platforms for improved productivity in processing retail and wholesale remittance transactions for financial institutions and payments processing for a wide variety of cross-industry applications. | NeXGen Remittance | ||

Conventional Check Capture | An extensive array of enhancement products that add flexibility and usability to IBM's Check Processing Control System (CPCS) and the IBM 3890/XP series of Document Processors. | Conventional Capture Products, CPCS Enhancements Products, XP/Productivity Tools, Platform Emulation, NeXGen Settlement, NeXGen Balancing, and LTA (Large Table Access) | ||

Check Image Capture | Products and services related to the centralized and distributed capture, quality and inspection assurance, storage and delivery of check images. Distributed capture solutions come in web-based thin client and thick client. Distributed capture branch solution serves as core component to full bank branch image enablement. | ALS & CIMS Products (MVS, AIX, Windows), NeXGen Image Processor, Image Enhancement Products, Reject Repair, RECO Technology, Image POD, Image Delivery Products, Delivery Express QAS Image Inspector, NeXGen Capture, Source Capture Web, Source Capture Corporate and Source Capture Branch | ||

Check Image Archive Management | Comprehensive array of check image archive management products that may be tailored to a bank's unique requirements based on their operational environments and volumes. Carreker offers archive technology for both in-house solutions and shared outsource providers. | Check Image Archive-AIX, Check Image Archive-MVS, Check Image Archive Load | ||

Other Check Image Applications | An array of solutions that address revenue enhancement, risk reduction, and expense reduction issues through the application of image, workflow and RECO technologies. | Image Statements, CDRom Delivery, Input/Express, Express Capture, Payee Name Verification, and Amount Encoding Verification | ||

Receive Sentry and Trackpoint | ||||

eMetrics | Performance-measurement software suite that uses historical data to generate key performance indicators, item processing volume data, productivity statistics and quality control benchmarks. | Lumen, ProModel, eiMICR, eiStats, eiQuality, eiPerform | ||

Electronic Check Presentment and Image Exchange | Enables banks to transition from paper-based to electronic payment systems by automating key elements of the processing stream, creation of image replacement documents ("IRD") Aided by Check 21 legislation, these solutions are designed to reduce and eventually eliminate the movement of paper payments through the system, improving productivity, reducing errors, increasing customer satisfaction and reducing fraud. | ExchgLink, IRD Create, IRD Author, Image Inspector, CheckLink, CheckLink PC, Deposit Manager, Branch Truncation Manager and Cnotes | ||

Cash & Cash Logistic Solutions: | ||||

ATM Solutions | Advanced ATM monitoring and management, improving ATM availability and ensuring service levels are met. These solutions include an automated ATM monitoring and dispatching system for maximizing network availability; and a real-time Internet-based system for efficient handling of ATM service requests and responses. | eiManager, | ||

Cash Solutions | A product suite, now optimized through Web-based software solutions, that dramatically reduces the amount of cash banks, financial institutions and companies need to hold as cash-on-hand throughout vault, branch and ATM networks. These solutions also enable automation and standardization of the cash ordering process and optimization of transportation. Consulting solutions can drive further efficiency and automation in vault, branch and ATM operations. | iCom, ReserveLink, |

Revenue Enhancement. The Revenue Enhancement division includes two business units: RevE and Customer Value Enhancement ("CVE"RevE"), formerly known as EnAct. RevE is a highly specialized division that provides consulting services focused on tactical methods of increasing banks' fee income. The scope and depth of this practice has expanded throughout its 14 year history and now includes retail, small business, and commercial deposits, treasury management, consumer and commercial lending, credit card lending and trust and investment services. Our solutions involve developing strategies that enable our clients to take advantage of electronification trends, often gaining first mover advantages for our clients. In addition to developing strategies, our business model ensures that we continue to translate those strategies into tactical implementations with measurable revenue streams. Our client base has continued to expand with very high penetration rates in the markets in which we operate. Thus, we have experienced a trend of becoming longer term strategic partners with our clients.

Another component of our Revenue EnhancementRevE offering is our CVE solutions that includes EnActinclude software, proprietary sales management methodologies and sales training programs. Our CVE solutions assist financial institutions in leveraging central intelligence with local insight.insight, translating strategy into specific actions to achieve sustained organizational performance. This enables our clients to recognizeimprove their identification of those customers and prospects representing the greatest value or potential.potential, while aligning internal processes and behaviors with management's focus. Our approach is unique and complementary to many CRM investments that banks have made in recent years and is designed to focus their activities such that they can actually attain increased returns on these CRM investments.

Global Payments Consulting. Our Global Payments Consulting (GPC)("GPC") division helps financial institutions proactively plan, prepare and optimize for the regulatory, competitive and technological impacts affecting the financial payments environment. The division provides strategic planning, program management, specialized tools, business applications and implementation advisory services for financial institutions and otherspecialized payments clients. These planning and implementationThe focus areas for these services include:

The GPC division also contains the license, maintenance and services revenue of our for two product areas:

Outsourcing. Carretek LLC is a transformational business outsourcer for payment and transaction processing jointly owned by Carreker Corporation (51%) and Majesco Software Inc. (49%), the U.S. subsidiary of Mastek Limited, a leading Indian outsourcing company with global operations. Carretek was formed in fiscal 2003. While the venture has signed its first contract, it is still in the developmental phase and its results are contained in the Corporate-Unallocated business segment.

Carretek's mission is to enable financial institutions and their processors to realize the benefits of transformational offshore-centric outsourcing ("offshoring") of their business processes. The benefits to

clients could include reduction in operating costs, improvements in productivity, and enhancement of quality.

Initially, Carretek is focused on offshoring payments-related business processes. Through Carretek, financial institutions can leverage the global work force at this critical period when Check 21 and other payment electronification trends are pressuring financial institutions to reduce their payment per item costs beyond the power of traditional cost management practices. Carretek has designed and built specific product offerings targeted at payment and transaction processing functions for this express purpose. Within this area of expertise, the Carretek offering includes a flexible array of offshore outsourcing services to financial institutions.

The Carreker Solution

The products and services offered by our divisions are designed to address our clients' needs to adapt to an ever-changing landscape in the payments businesses for financial institutions. These solutions combine consulting and professional services with software applications to enable financial institutions to identifydesign and implement payment solutions, increase revenues, reduce costs and enhance delivery of customer services. The key characteristics of our solutions include:

Integrated and Consultative Approach. We combine our consulting expertise and software applications to serve as a single-source provider of fully-integrated payments solutions. This approach sets us apart from providers of partial solutions that require financial institutions to seek multiple solution providers and costly additional expertise or implementation services to attain a complete solution. By offering this integration, we can streamline the buying decisions, simplify the implementation efforts and accelerate results when compared to a multiple supplier approach.

Comprehensive Delivery Model. We deliver our software and consulting solutions in a variety of delivery models to meet our clients' specific needs. These delivery methods include strategic stand-alone consulting, traditional software licensing and associated consulting,professional services, third party web-hosting and licensing software for use by multiple banks in a shared operating environment. Our ability to deliver products and services in a variety of methods allows us to provide solutions to a wider range of clients.

Compelling Business Proposition for Clients. Our solutions reduce investment risk for our clients by increasing revenues or reducing costs in a concrete and measurable way and in a relatively short period of time. In addition, in appropriate circumstances, we value-price certain of our solutions, whereby we receive a percentage of the amount of additional revenues or reduced costs achieved by the customer. These arrangements allow banks to fund their investments in our solutions with the benefits derived from their implementation.

Broad Array of Services and Technology. We believe that ourOur offerings provide the broadesta broad footprint of solutions from a single supplier of payments solutions into the banking industry. This array of products enables us to provide a financial institution with a very targeted solution for a narrow area of its operations or to address a broad range of its operational requirements.

Carreker's direct market is the financial services industry. Within that huge sector, we focus mainly on large banks and mainly in the U.S. However, our market also includes:

At present, we serve all of the top 20 banks in the U.S., plus 75 of the next 100 banks, and many smaller banks. We also serve the six largest financial institutions in Canada, 75% of the largest banks in the UK, the four largest in the UK, the two largest in Ireland, the fivesix largest in Australia and New Zealand, and three of the four largest in South Africa. We have a smalleran emerging presence in other European and Latin American countries.

Most of the major bank processing companies are our clients, and we have alliance and/or reseller relationships with many of them to maximize distribution of our products and services.

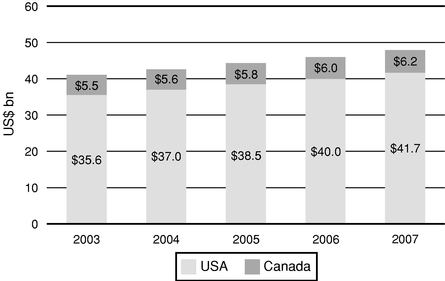

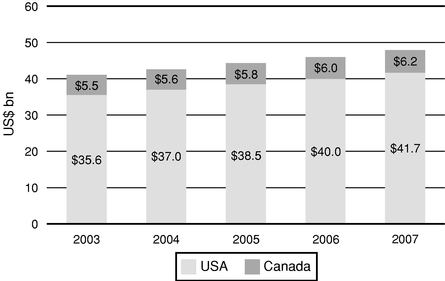

Banks are expected to continue spending heavily on Information Technology ("IT") this year. TowerGroupyear as indicated in the chart below.

IT Spending By North American Banks

Source: A North American Perspective: IT Spending at U.S. and Canadian Banks—Celent both forecast approximately a four percent increase. According to Celent, "Areas such as security, payments, multi-channel integration, and branch automation will be highlighted in 2005, as banks push towards increasing strategic investments in new technology."(February 2005)

Significant new regulatory, competitive, technological, human capital and behavioral forces are acting on the payments industry now in ways that seem likely to impact virtually all participants in this market space. The forces include the following:

Regulatory Change. There are a number of legislative and regulatory changes impacting the form, structure, process and controls around paper, electronic and currency-based financial payments. We believe financial institutions around the world will need to invest in the understanding, planning and implementation activities related to these changes. Three of the more important areas of legislative/regulatory changeschange to note are as follows:

credit risk and to introduce explicit treatment of operational risk. These changes will stipulate significant new capital and operational risk management requirements for banks. Whether in terms of new redundancy requirements for payments infrastructure or new business continuity practices for banks, we believe additional opportunities to leverage our technology and our operations consulting expertise may result from banks' efforts to achieve compliance.

Disintermediation of the Financial Institution.Institution Role in Payments. We believe the market share of financial institutions in the payments business has been declining over the last 20 years as new non-bank providers offer a competitive alternativealternatives to banks as financial intermediaries. We believe financialFinancial institutions are intimately aware of this trend and its implications on the positioning offor their client relationship,relationships, their value proposition,propositions, their revenues and their profits. We believe these financialFinancial institutions are and will be developing and executing strategies to protect and expand their market share of the payments business by investing in new value propositions, new products and new services in various payment arenas.

Convergence of Payment Vehicles. We believe that the front-end and the back-end of the presentment, processing and settlement aspects of the paper and electronic payment types will converge driven by customer demand and delivery efficiency. Although we believe the total number of payment transactions will increase for the foreseeable future, we believe paper-based payments will decline in number with the increase in electronic payments more than offsetting this decline. We believe over time the systems and operations infrastructure for payments, which is in silos today by payment type, will tend to converge and result in next generation payment technologies that will need to be developed. These technologies will be more real-time than traditional batch technologies. Straight through processing service offerings will be specifically tailored to communities of interest (e.g. casinos, healthcare or small retail) and payment related information services (e.g. loyalty programs and cross-sell programs) will be developed.

Mergers and Consolidations. Mergers and consolidations of financial institutions have been on the rise in the US recently. We believe these mergers will result in significant investments in business, system and operations integration for long-term shareholder value. We believe consulting and software solutions supporting the integration activities of the surviving financial institutions will be important offerings in the future.

Electronification. Technologies for electronification of check workflows continue to be refined and to gain further industry adoption. Many of our key customers are defining strategies now for the electronification of checks at the earliest point of receipt and for exchanging images between banks as a basis for financial settlement. Such practices would significantly reduce check-related operating expenses for banks and position banks to deliver more robust payment services to their customers. We believe we are positioned, through our broad suite of check imaging products, to benefit from the continued adoption of check imaging.

At the same time, practices are emerging for conversion of checks at the point of sale or at lockbox processing locations to alternative electronic payment types, such as ACH or debit transactions. In these cases, transactions are less likely to be processed through Carreker's current suite of technology solutions. We are developingcontinuing our development of enhancements to selected products that will address these electronic payment types.

As a third point, integration Integration between banks and the point of salepayment transaction or origination will increasingly lead to more real time verification and guarantee of transactions at the point of sale.payment

transactions. We are engaged now with key customers and partners in trying to define next-generation fraud mitigation solutions, and see this as an area of opportunity for technology growth.

Importance of Fraud/Risk Mitigation. We believe transaction fraud losses have continued to increase for financial institutions and their customers as electronic payment vehicles have grown in

availability and adoption. Further, we believe compliance costs and penalties for non-compliance with new regulations designed to mitigate global risks through controls on electronic and currency-based financial transactions will continue to increase. We believe significant investments in processes, procedures and technologies will continue to be made to detect and prevent fraud losses and improve compliance, while minimizing the intrusion of controls on customer activities.

Convergence of Payment Vehicles. We believe that the front-end and the back-end of the presentment, processing and settlement aspects of the paper and electronic payment types will converge, driven by customer demand and delivery efficiency. We believe paper-based payments will decline in number, and that the increase in electronic payments will more than offset this decline. We believe that over time the separate systems and operations for different payment types will tend to converge and result in next generation payment and synergistic technologies yet to be developed. These technologies will be more real-time than traditional batch technologies. Straight through processing service offerings will be specifically tailored to communities of interest (e.g. casinos, healthcare or small retail), and payment related information services (e.g. loyalty programs, spend management and cross-sell programs) will be developed.

Globalization of Payments Work. As the important work of processing payments becomes more electronic, the opportunities for financial institutions to leverage workforces around the world to achieve cost and quality advantages will proliferate.proliferate, and we have demonstrated expertise and success in this arena. We believe financial institutions will gradually at first, and more rapidly later, source and process components of their payments work in secure, low cost countries around the globe. We are already seeing a significant growth in the awareness of the importance of strategic sourcing and a lessening of the social and political obstacles to offshoring.

Customers

A majority of our revenues are generated from contracts with banks maintaining assets in excess of $5.0 billion. We currently provide services or products to each of the 20 largest banks in the United States,U.S., as measured by total assets by Sheshunoff Information Services. Our five largest customers accounted for approximately 31%36%, 28%31% and 34%28% of total revenues during the fiscal years ended January 31, 2006, 2005 2004 and 2003,2004, respectively. Wells Fargo accounted for approximately 13% of total revenues during the year ended January 31, 2006, and accounted for approximately 14% of total revenues during the year ended January 31, 2005. No single customer accounted for more than 10% of total revenues during the year ended January 31, 2004. U.S. Bank, N.A. accounted for approximately 10% of total revenues during the year ended January 31, 2003. Please see Note 11 of our Notes to Consolidated Financial Statements for further information about our non-U.S. customers.customers and markets.

Solutions Development

Our solutions development activities focus on identifying specific bank and end user needs and the shared needs of the banking industry, prototyping and developing promising applications, test marketing new products, developing sales strategies and coordinating distribution and on-going maintenance for each of our solutions. In certain instances, we have contracted with third party software development companies to develop our solutions.

We frequently receive customer requests for new services and/or software. We strive to develop solutions in response to these requests and historically have been able to partner with our customers and share some or all of the development costs. In addition to customer-funded solutions development,

we have invested significant amounts in solutions development, including expenditures (inclusive of amounts capitalized) of $10.4 million, $11.2 million, $8.5 million, and $11.4$8.5 million for research and development in the years ended January 31, 2006, 2005 2004 and 2003,2004, respectively. Further, some of our key product introductions have resulted from the adaptation of products developed for customers to address a wider market. In exchange for either a one-time payment and/or on-going royalties, we are often able to obtain the right to develop, enhance and market these modified products.

Technology

Our software products incorporate open systems architecture and protocols to provide scalability and functionality to interface with a bank's current and legacy systems. Our core proprietary technologies, for both our client/server and mainframe software products, are primarily directed at using a standard set of components, drivers, and application interfaces, andwhile leveraging the quality and productivity benefits of reusable component development.

Many of our newer products operate on Windows or Unix platforms, support industry-standard Web browsers such as Microsoft Internet Explorer and AOL Netscape, and databases such as Oracle, DB2, or SQL, and can be delivered as an Application Service Provider ("ASP") or standard packaged product.

We continue to enhance our second-generation computer systems, which are primarily IBM mainframe-based or client server applications, and use common computer tools to integrate the data from these computer programs into our new products.

Sales and Marketing

We have developed strong relationships with many senior bank executives as a result of our delivery of solutions to many of the largest banks in the United States for over 2728 years. As of January 31, 2005, we had 14We leverage an Account Relationship Managers who are responsiblemodel for managing our day-to-daylargest customer relationships with our customers. 13 are responsible forin North American bank relationships, and 1 is responsible for the International bank relationships.America. Our Account Relationship Managers' responsibilities include identifying customers' needs and assisting our business unit teams in presenting their solutions and concluding sales. Our Account Relationship Managers work closely with our executive officers, some of whom serve as Executive Relationship Managers to our customers. We also employ applicableleverage business segmentunit sales and technical sales support staff, who are familiar with our technology and who participate in opportunitiesspecific solutions to sell technology-based solutions.drive the bulk of the respective solutions sales process.

We derive a significant portion of our business through existing customers and customer referrals. In addition, we market our services through a variety of media, including:

AsBacklog

At the end of January 31,fiscal 2005, we employedour backlog was $63.6 million, including deferred revenues of $19.2 million. At the end of fiscal 2004, our backlog was $63.2 million, including deferred revenue of

$24.2 million. We do not believe that backlog is a marketing staffmeaningful indicator of 8 individuals, including graphics designers, writers, administrative coordinatorssales that can be expected for any period, and a Web master.there can be no assurance that backlog at any point in time will translate into revenue in any subsequent period.

Competition

We operate in a highly competitive and rapidly changing global marketplace and compete with a variety of organizations that offer products and services competitive with those we offer. In our consulting and revenue enhancement businesses our clients retain us on a non-exclusive basis. In addition, a client may choose to use its own resources rather than engage us for these consulting services. Our competitors in the consulting business space include strategic consulting firms and full-service consulting services, as well as niche consulting providers. Increasingly, the global information technology service firms are offering a full range of consulting services. Further, the niche financial institution processing companies are increasingly creating and offering consulting services as an additional value-added service to their IT processing offerings. In the Revenue Enhancement business our competitors are almost exclusively niche providers that are typically small and medium-sized private organizations. However, we also face competition from bank internal revenue enhancement departments. In our Carretek business line, we primarily compete against large global outsourcing providers and our customers' internally built and operated alternatives.

In our global payments technology business segment, our competitors are generally the global information technology service firms and the smaller niche application providers. In each of our major software product suites a range of competitors exists. The global IT services firms compete in some of our software product suites. At the same time, differing groups of application and niche application

competitors focus on one or more of our other product suites. Some of these competitors have significantly greater financial, technical, marketing and other resources than we do.

In addition to competing with a variety of third parties, we experience competition from our customers and potential customers when they develop, implement and maintain their own services and applications. In addition, customers or potential customers could enter into strategic relationships with one or more of our competitors to develop, market and sell competing services or products.

Government Regulation

Our primary customers are banks. Although the services we currently offer have not been subject to any material industry-specific government regulation, the banking industry is heavily regulated. Our products and services must allow our banking customers to comply with all applicable regulations, and as a result, we must understand the intricacies and application of many government regulations. The regulations most applicable to our provision of solutions to banks include regulations governing information and data security of customer accounts, establishing minimum reserve requirements, governing funds availability and the collection and return of checks, and establishing rights, liabilities and responsibilities of parties in electronic funds transfers. For example, some of our consulting services assist banks with minimizing their reserves while complying with requirements of the Board of Governors of the Federal Reserve System ("Federal Reserve"). In addition, the expedited availability and check return requirements imposed by funds availability regulations have increased fraud opportunities dramatically, and our Global Payments Technologies products and services address this concern while complying with such regulations.

While we are not directly subject to the federal orand state regulations specifically applicable to financial institutions, such as banks, thrifts and credit unions, the Federal Reserve, the Federal Deposit Insurance Corporation, the National Credit Union Administration, the Office of Thrift Supervision, the Office of the Comptroller of the Currency, and various state regulatory authorities typically assert the right to observe the operations of companies to which certain functions of financial institutions (such as data processing) are outsourced. These regulators may from time to time also claim the right to observe the operations of

companies like us that provide software and other products or services to financial institutions. In addition, financial institutions with whomwhich we do business may from time to timeoften require, by contract or otherwise, that evaluations of our internal controls be performed by independent auditors or by the financial institutions themselves.

Proprietary Rights

We rely upon a combination of patent, copyright, trademark and trade secret laws, including the use of confidentiality agreements with employees, independent contractors and third parties and physical security devices to protect our proprietary technology and information. We have a number of issued patents and registered trademarks and have filed applications for additional patents and trademarks in the United States. We defend our proprietary rights.

We enter into invention assignment and confidentiality agreements with our employees and independent contractors and confidentiality agreements with certain customers. We also limit access to the source codes for our software and other proprietary information. We believe that due to the rapid pace of innovation within the software industry, factors such as the technological and creative expertise of our personnel, the quality of our solutions, the quality of our technical support and training services and the frequency of release of technology enhancements are important to establishing and maintaining a technology leadership in addition to the various legal protections available for our technology.

We are not aware that we are infringing on any proprietary rights of third parties. We rely upon certain software that we license from third parties, including software that is integrated with our internally developed software and used in our solutions to perform key functions. We are not aware

that any third-partythird party software being re-sold by us is infringing upon proprietary rights of other third parties.parties and have proper indemnities in place to mitigate our risk.

Employees

As of January 31, 2005,2006, we had 541495 employees. Of theseThese employees 106 provided consultingare broken down into the following categories: Global Payments Technologies ("GPT") had 284 employees, Revenue Enhancement ("RevE") had 86 employees, Global Payments Consulting ("GPC") had 23 employees, Carretek had 2 U.S. based employees (along with 121 offshore personnel of Mastek Limited that perform services 212 provided technologyfor Carretek on a contract basis), Corporate Sales and implementation functions, 114 performed salesMarketing had 18 employees, and marketing, product management, customer relationsCorporate Staff which includes Executive Management, Legal, Finance and business development functionsAccounting, Human Resources, Facilities and 109 persons performed corporate, finance and administrative functions.IT had 82 employees. We have no unionized employees, and we believe that our employee relations are good.

Executive Officers of the Company

The following table sets forth information regarding the Company's current executive officers.

| Name | Age | Position | ||

|---|---|---|---|---|

| John D. Carreker, Jr. | Chairman of the Board, President, Chief Executive Officer and Director | |||

| Lisa K. Peterson | Executive Vice President, Treasurer and Chief Financial Officer | |||

| John D. Carreker III | Executive Vice President and President, Global Payments Technologies | |||

| Executive Vice President, | ||||

| Suzette L. Massie | Executive Vice President and President, Global Payments Consulting | |||

| Blake A. Williams | Executive Vice President and President, Revenue Enhancement | |||

John D. Carreker, Jr. has served as Chairman of the Board of Directors and Chief Executive Officer since the Company's formation in 1978. John D. Carreker, Jr. and James D. Carreker, a director of the company, are brothers. John D. Carreker III is the son of John D. Carreker, Jr.

Lisa K. Peterson has served as Executive Vice President, Treasurer and Chief Financial Officer since October 2003. From August 1999 to February 2003, Ms. Peterson served as Chief Financial and Administrative Officer for Monarch Dental Corporation, a dental group practice management company. Prior to that time, Ms. Peterson served as Chief Financial Officer for Viacom Retail Stores, Inc., a start-up division of Viacom, Inc. For the six years prior to that time, Ms. Peterson worked for Pearle Vision, Inc. in various capacities culminating in the position of Vice President and Controller.

John D. Carreker III has served as Executive Vice President and President, Global Payments Technologies since November 2002. Since June 1991, Mr. Carreker has served in various management positions with the Company. John D. Carreker III is the son of John D. Carreker, Jr. and the nephew of James D. Carreker.

Michael J. InmanJohn S. Davis has served as Executive Vice President, General Counsel and Secretary to the Company since June 2005. From June 2004 to June 2005, Mr. Davis was engaged in private legal practice. Prior to that time, he served as Senior Vice President and General Counsel of Relationship Management since September 2002Dave & Busters, Inc., a restaurant and entertainment company for three years, and as Vice President & General Counsel of Cameron Ashley Building Products, Inc., a corporate officer since December 2004.building products distributor, for seven years. Prior thereto, Mr. Inman has been with the Company for ten years in various management and consulting roles.Davis served as Associate General Counsel of Electronic Data Systems Corporation ("EDS"), a global information technology service company.

Suzette L. Massie has served as Executive Vice President and President, Global Payments Consulting since December 2004. ForDuring the last five years,year period prior to joining the Company, Ms. Massie was a partner with Accenture, a global management consulting company in the Financial Services practice focusing on Top 20 Banks in the U.S.

Robert M. Olson, Jr. has served as Executive Vice President since July 1998 and as President and CEO of Carretek since October 2004.

Blake A. Williams has served as Executive Vice President and President, Revenue Enhancement since November 2002. Mr. Williams has been with the Company for 14 years in various management and consulting roles.

Forward Looking Statements Statements in this Report and the Annual Report to the Stockholders that are not purely historical facts including statements about our expected future financial position, sales, results of operations, cash flows or backlog as well as other statements including words such as "anticipate," "believe," "plan," "estimate," "expect," "intend," "should," "could," "goal," "target," "designated," "on track," "comfortable with," "optimistic" and other similar expressions, constitute forward looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Actual results and the timing of some events could differ materially from those projected in or contemplated by the forward looking statements due to a number of factors, including, without limitation, those set forth below and elsewhere in this Report. Readers are cautioned not to place undue reliance on forward looking statements, for no assurances can be given with respect to any forward looking statements. In addition to the other information in this Report, the following factors, which may affect our current position and future prospects, should be considered carefully in evaluating us and an investment in our common stock. We desire to take advantage of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. Many of the following important factors discussed below have been discussed in our prior filings with the Securities and Exchange Commission. In addition to the other information in this report, readers should carefully consider that the following important factors, among others, in some cases have affected, and in the future could affect, our actual results and could cause our actual consolidated results of operations for the fiscal year ending January 31, 2007 (and the individual fiscal quarters therein) and beyond, to differ materially from those expressed in any forward-looking statements made by us, or on our behalf. Risks Related to Our Business Our performance depends on the banking industry, and any change in the banking industry's demand for our solutions could reduce our revenues and have a material adverse effect on our business. We derive substantially all of our revenues from solutions provided to banks and other participants in the banking industry. Accordingly, our future success significantly depends upon this industry's continued demand for our solutions. We believe that an important factor in our growth has been substantial changes in the banking industry in recent years, as manifested by continuing consolidation, regulatory change, technological innovation, the emergence of the Internet and other trends. If this environment of change were to slow, we could experience reduced demand for our solutions. In addition, the banking industry is sensitive to changes in economic conditions and is highly susceptible to unforeseen events, such as domestic or foreign political instability, recession, inflation or other adverse occurrences that may result in a significant decline in the utilization of bank services. Furthermore, due to concerns regarding data security and other factors, banks have been and may in the future be Our future success depends on our ability to develop and license new technologies and services to meet the changing needs of our current and future customers, and our inability to introduce new solutions could negatively impact our ability to do business and maintain our financial condition. We regularly undertake new projects and initiatives in order to meet the changing needs of our customers. In so doing, we invest substantial resources with no assurance of their ultimate success. We believe our future success will depend, in part, upon our ability to: There can be no assurance that future advances in technology will be beneficial to, or compatible with, our business or that we will be able to incorporate such advances into our business. In addition, keeping abreast of technological advances in our business may require substantial expenditures and lead-time. There can be no assurance that we will be successful in using new technologies, adapting our solutions to emerging industry standards or developing, introducing and marketing solution enhancements or new solutions, or that we will not experience difficulties that could delay or prevent the successful development, introduction or marketing of these solutions. If we incur increased costs or are unable, for technical or other reasons, to develop and introduce new solutions or enhancements of existing solutions in a timely manner in response to changing market conditions or customer requirements, our business, financial condition and results of operations could be materially and adversely affected. Our inability to respond to a decline in check volumes and to respond to rapid technological change or changes in industry standards could reduce our revenues and have a material adverse effect on our business. We have in the past derived a significant portion of our revenues from check related products and services. A decline in check volumes could have a material adverse effect on our business. If banks and merchants decide to use pricing incentives to further stimulate a decline in check usage, this decline in usage could accelerate. Our future success depends on our ability to leverage existing competencies to support emerging payments types, and to define and develop new solutions addressing those payment types. If we are unable to capitalize on these competencies to generate new revenues to offset any loss of revenues arising as a result of a decline in check usage or other changes in technology or industry standards, then our business could be adversely affected. Our quarterly operating results fluctuate and may not accurately predict our future performance. Additionally, our fixed costs may lead to operating results below analyst or investor expectations if our revenues are below anticipated levels, which could adversely affect the market price of our common stock. A significant percentage of our expenses, particularly personnel and facilities costs, are relatively fixed and based in part on anticipated revenue levels. In recent years, we experienced a decline in revenues with certain of our licensed software products and consulting offerings. A decline in revenues without a corresponding and timely reduction in expenses would negatively affect our business. Significant revenue shortfalls in any quarter may cause significant declines in operating results since we may be unable to reduce spending in a timely manner. Our quarterly results of operations have varied significantly and probably will continue to do so in the future as a result of a variety of factors, many of which are outside our control. These factors include: As a result of these factors, our quarterly revenues and operating results are difficult to forecast. It is possible that our future quarterly results of operations from time to time will not meet the expectations of securities analysts or investors, which could have a material adverse effect on the market price of our common stock. Our mix of products and services could have a significant effect on our results of operations and the market price of our common stock. The gross margins for our products and services vary considerably. If our mix of products and services in any given period does not match our expectations, our results of operations and the market price of our common stock could be significantly affected. Although a material portion of our revenue comes from annually renewable maintenance agreements, we do not typically enter into long-term agreements with our customers, which makes it more difficult to plan and efficiently allocate our resources, and any deferral, modification or cancellation of a customer project can adversely affect our operating results. We typically provide services to customers on a project-by-project basis without long-term agreements. When a customer defers, modifies or cancels a project, we must be able to rapidly re-deploy our personnel to other projects in order to minimize the under-utilization of our personnel and the resulting adverse impact on operating results. In addition, our operating expenses are relatively fixed and cannot be reduced on short notice to compensate for unanticipated variations in the number or size of projects in progress. As a result, any delay, modification or cancellation of a customer project, or any disruption of our business relationships with any of our significant customers or with a number of smaller customers could have a material adverse effect on our business, financial condition and results of operations. Additionally, if we do not successfully renew our maintenance agreements with our software customers, our business may be adversely affected. If a substantial number of our software customers declined to renew these agreements, our revenues and profits would be materially adversely affected, especially within the GPT business segment. Our future success significantly depends on the experience of our key personnel, and the loss of any one of them could impair our ability to do business. Our future success depends, in significant part, upon the continued services of John D. Carreker, Jr., our Chairman of the Board and Chief Executive Officer, as well as other executive officers and key personnel. The loss of services of Mr. Carreker or one or more of our other executive officers or key employees could have a material adverse effect on our business, financial condition and results of operations, and there can be no assurance that we will be able to retain our executive officers or key personnel. We do not maintain key-man life insurance covering any of our executive officers or other key personnel. We may be unable to fully benefit from our strategic alliances and acquisitions, which could negatively affect our business and hinder our ability to realize expected benefits. We regularly evaluate opportunities and may enter into strategic alliances, or make acquisitions of other businesses, product or technologies. Risks inherent in alliances may include, among others: Acquisitions involve numerous risks, including: There can be no assurance that we will be successful in identifying and entering into strategic alliances or making acquisitions, if at all, and any inability to do so could have a material adverse effect on our business, financial condition and results of operations. We expect that future acquisitions, if any, could provide for consideration to be paid in cash, shares of our common stock, or a combination of cash and our common stock. If the consideration for an acquisition transaction is paid in common stock, this could further dilute existing stockholders. Any impairment of a significant amount of goodwill or other assets resulting from an acquisition transaction could materially impact our operating results and financial condition. Our focus on providing business process outsourcing, or BPO, with a significant offshore component subjects us to risks associated with new markets, new competition, cross border and geopolitical risks and a dependence on Our BPO business model gives rise to numerous risks, particularly risks related to our dependence on third party providers operating in distant geographic regions and those associated with entering a new market with competitors who may have significantly more resources than we do. The success of our BPO model partially depends on the performance of our offshore third party service provider partner's parent company with whom we have contracted to provide BPO services to our clients. In addition, we have to compete on the basis of a number of factors including the attractiveness and breadth of the business strategy and services that we offer, pricing, technological innovation, quality of service, ability to invest in or acquire assets of potential customers, and our scale in certain industries or geographic regions. Because some of these factors are outside of our control and because many of our competitors may have greater financial resources, larger customer bases, and larger technical, sales and marketing resources, we cannot be sure that we will compete successfully against them in the future. If we fail to compete successfully against our competitors with respect to these or other factors, our BPO business, financial condition, and results of operations could be materially and adversely affected. There is competition in our industry for qualified banking professionals and technical and managerial personnel, and our failure to attract and retain these people could affect our ability to respond to banking and technological change and to increase our revenues. Our future success depends upon our continuing ability to attract and retain highly qualified banking, technical and managerial personnel. Competition for such personnel has at times caused difficulties in attracting the desired number of such individuals. Further, our employees have left us to work in-house with our customers and with our competitors. There can be no assurance that we will be able to attract or retain a sufficient number of highly qualified employees or independent contractors in the future. If we are unable to attract personnel in key positions, our business, financial condition and results of operations could be materially and adversely affected. A small number of customers accounts for a substantial portion of our business, so the loss of any one of them could have an adverse impact on our business and financial condition. Our five largest customers accounted for approximately have changed from period to period. However, a significant portion of our current revenues is derived from customers who were major customers in prior years, and we are therefore dependent to a significant degree on our ability to maintain our existing relationships with these customers. There can be no assurance that we will be successful in maintaining our existing customer relationships or in securing additional customers, and there can be no assurance that we can retain or increase the volume of business that we do with such customers. In particular, continuing consolidation within the banking industry may result in the loss of one or more significant customers and/or potential customers. Any failure by us to retain one or more of our large customers, maintain or increase the volume of business done for such customers or establish profitable relationships with additional customers could have a material adverse effect on our business, financial condition and results of operations. We face increased competition that could result in price reductions, fewer customer orders and loss of market share, any of which could materially and adversely affect our business. We compete with respond more quickly to new or emerging technologies and changes in customer requirements or to devote greater resources to the development, promotion and sale of their products than we can. Also, some of our current and potential competitors have greater name recognition and larger customer bases that such competitors could leverage to increase market share at our expense. We expect to face increased competition as other established and emerging companies enter the banking services market. Increased competition could result in price reductions, fewer customer orders and loss of market share, any of which could materially and adversely affect our business, financial condition and results of operations. There can be no assurance that we will be able to compete successfully against current or future competitors, and the failure to do so In addition to competing with a variety of third parties, we experience competition from our customers and potential customers. From time to time, these potential customers develop, implement and maintain their own services and applications for revenue enhancements, cost reductions and/or enhanced customer services, rather than purchasing services and related products from third parties. There can be no assurance that these customers or other potential customers will perceive sufficient value in our solutions to justify investing in them. In addition, customers or potential customers could enter into strategic relationships with one or more of our competitors to develop, market and sell competing services or products. Our inability to protect adequately our proprietary technology or to prevent its unauthorized use could divert our financial resources and cause significant expenditures, which could materially harm our business. Our success significantly depends upon our proprietary technology, intellectual property and information, including customer information. We rely upon a combination of patent, copyright, trademark and trade secret laws and confidentiality procedures to protect our proprietary technology and information. We have a number of issued patents and registered trademarks. We also limit customer use of our intellectual property by entering into license and other agreements which limit the customer's use of the intellectual property. There can be no assurance that the steps we have taken to protect our services and products are adequate to prevent misappropriation of our technology or that our competitors independently will not develop technologies that are substantially equivalent or superior to our technology. Furthermore, it is very difficult to police unauthorized use of our software due to the nature of software. Any such misappropriation of our proprietary technology or information or the development of competitive technologies could have a material adverse effect on our business, financial condition and results of operations. In addition, the laws of some countries in which our software is distributed do not protect our intellectual property rights to the same extent as the laws of the United States. For example, the laws of a number of foreign jurisdictions in which we license our software protect trademarks solely on the basis of the first to register. We currently do not possess any trademark registrations in foreign jurisdictions, although we do have copyright protection of our software under the provisions of various international conventions. Accordingly, intellectual property protection of our services and products may be ineffective in many foreign countries. In summary, there can be no assurance that the protection provided by the laws of the United States or such foreign jurisdictions will be sufficient to protect our proprietary technology or information. Infringement claims by third parties can subject us to substantial liability and expenses and can impair our ability to sell our solutions. We may need to litigate claims against third parties to enforce our intellectual property rights, protect our trade secrets, determine the validity and scope of the proprietary rights of others or defend against claims of infringement or invalidity. We may also be subject to claims from our customers for indemnification against third party claims for infringement or other similar claims. We may be required to incur significant costs in reaching a resolution to the asserted claims, or any other claims that may be asserted against us. We depend on third parties for some of our technology licenses, and if we cannot obtain satisfactory licenses our business could suffer. Some technology used in our current software and software in development includes technology licensed from third parties. These licenses generally require us to pay royalties and to fulfill confidentiality obligations. The termination of any such licenses, or the failure of the third party licensors to adequately maintain or update their products, could result in delays in our ability to implement solutions or in delays in the introduction of our new or enhanced solutions while we search for similar technology from alternative sources, if any, which could prove costly. Any need to implement alternative technology could prove to be very expensive for us, and any delay in solution implementation could result in a material adverse effect on the business, financial condition and results of our operations. It may also be necessary or desirable in the future to obtain additional licenses for use of We may face liability claims related to the use of our solutions and the defense of these claims could have a negative effect on our business, results of operations or financial condition. As a result of our suite of solutions that address critical functions of bank operations, we are exposed to possible liability claims from banks and their customers. Although we attempt to mitigate liability in our contracts and have not experienced any material liability claims to date, there can be no assurance that we will not become subject to such claims in the future. A liability claim against us could have a material adverse effect on our business, financial condition and results of operations. Our solutions at times in the past have been, and in the future may be, incompatible with the operating environments of our customers or inappropriate to address their needs, resulting in additional costs being incurred by us in rendering services to our customers. Further, like other software products, our software occasionally has contained undetected errors, or "bugs," which become apparent through use of the software. Because our new or enhanced software initially is installed at a limited number of sites and operated by a limited number of users, such errors and/or incompatibilities may not be detected for a number of months after delivery of the software. The foregoing errors in the past have resulted in the deployment of our personnel and funds to cure errors, occasionally resulting in cost overruns and delays in solutions development and enhancement. Moreover, solutions with substantial errors could be rejected by or result in damages to customers, which could have a material adverse effect on our business, financial condition and results of operations. There can be no assurance that errors or defects will not be discovered in the future, potentially causing delays in solution implementation or additional development costs such as requiring design modifications that could adversely affect our business, financial condition and results of operations. Information and data security requirements placed upon us by our customers necessitates investment and improvement in our information technology infrastructure and processes and a failure to adequately protect such information could adversely affect our business. Our business requires the storage and transmission of sensitive business information of our customers. Significant capital and investment in other resources is required to protect against the threat of security breaches or computer viruses, or to alleviate problems caused by breaches or viruses. To the extent that our activities or the activities of our customers require the storage and transmission of confidential information, such as banking records or credit information, security breaches and viruses could expose us to claims, litigation or other possible liabilities. We face risks in connection with the expansion of our international operations, which could have a negative impact on our business, financial condition and results of operations. We provide solutions to banks outside the United States, and a key component of our growth strategy is to broaden our international operations. In addition, our Some of our international sales are denominated in local currencies, and the impact of future exchange rate fluctuations on our financial condition and results of operations cannot be accurately predicted. There can be no assurance that fluctuations in currency exchange rates in the future will not have a material adverse effect on revenue from international sales and thus our business, financial condition and results of operations. Government regulation and legal uncertainties could force us to change our operations, which could have a material adverse effect on our ability to maintain our current Our primary customers are banks. Although the solutions that we currently offer have not been subject to any material, specific government regulation, the banking industry is regulated heavily, and we expect that such regulation will affect the relative demand for our solutions. While we are not directly subject to federal or state regulations specifically applicable to financial institutions, such as banks, thrifts and credit unions, the Federal Reserve, the Federal Deposit Insurance Corporation, the National Credit Union Administration, the Office of Thrift Supervision, the Office of the Comptroller of the Currency, and various state regulatory authorities typically assert the right to observe the operations of companies to which certain functions of financial institutions (such as data processing) are outsourced. These regulators may from time to time also claim the right to observe the operations of companies like us that provide software to financial institutions. In addition, financial institutions with whom we do business may from time to time require, by contract or otherwise, that evaluations of our internal controls be performed by independent auditors or by the financial institutions themselves. There can be no assurance that federal, state or foreign governmental authorities will not adopt new statutes or regulations, and any adoption of new Our intangible assets could become impaired and adversely affect our future results of operations and financial position. In June 2001, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 142,Goodwill and Other Intangible Assets ("SFAS 142"), effective for fiscal years beginning after December 15, 2001. Under SFAS 142, goodwill and intangible assets deemed to have indefinite lives will no longer be amortized but will be subject to annual impairment tests in accordance with the Statement. There can be no assurance that such tests will not result in a determination that these assets have been impaired. If at any time it is determined that an impairment has occurred, we will be required to reflect the impaired value as a charge resulting in a reduction in earnings in the quarter such impairment is identified and a corresponding reduction in our net asset value. We recorded a goodwill impairment charge of $46.0 million in the quarterly period ended January 31, 2003. The fair values used in this evaluation were estimated based upon the consideration of a number of fair value estimation techniques, including a discounted cash flow analysis and consideration of the market price of our stock. Goodwill that remains recorded at January 31, 2006 was $20.8 million. Declines in market conditions, increases in interest rates and changes in projections with respect to the Global Payments Technologies reporting unit in which goodwill is allocated could result in additional impairment charges in the future. In addition to the Goodwill discussed above, we have other intangible assets which are currently being amortized. These intangible assets are as follows: Declines in either current or projected demand for our software product offerings could result in non-cash impairment charges in the future. The ultimate realization of revenue from contracted sales, potential sales, backlog and deferred revenues cannot be predicted with a high degree of accuracy. From time to time management provides information regarding our contracted sales, potential sales and our backlog for contracted services, contracted contingent services, contracted licenses and contracted maintenance. Management also provides our expectations with regard to the realization of revenue from such contracted sales, potential sales and backlog. These expectations can be influenced by many factors, some of which are beyond our control, and include but are not limited to the following: The ultimate resolution of the class action lawsuit may have a material adverse effect on our business. Although we have reached an agreement to settle the shareholder class action lawsuit described under "Item 3. Legal Proceedings," we are unable to predict with certainty the final outcome of the lawsuit or the effect of the lawsuit on our financial results, our business or our management. Counsel for the plaintiffs and defendants have executed a stipulation of settlement, but the stipulation of settlement is subject to final court approval. At this time, there can be no assurance that the stipulation of settlement will receive final court approval. If this does not occur, the potential outcome or resolution of the class action lawsuit could include judgments against us or settlements that could require substantial payments by us. In addition, the timing of the final resolution of these matters is uncertain. We believe that a material adverse outcome with respect to the class action lawsuit could have a material adverse effect on our financial results, our business or our management. Risks Related to Our Common Stock Our stock price has fluctuated significantly, sometimes for reasons unrelated to our performance. Historically there has been significant volatility in the market price of our common stock, as well as in the market price of securities of many companies in the technology sector. We believe that factors such as quarterly fluctuations in financial results or announcements by us, our competitors, banks and other bank industry participants could cause the market price of our common stock to fluctuate substantially. Other factors which may have a significant impact on the market price of our common stock include, but are not limited to; changes in earnings estimates or recommendations by securities analysts and the outcome of the securities litigation (see "Item 3. Legal Proceedings.) In addition, the stock market may experience extreme price and volume fluctuations that often are unrelated to the operating performance of specific companies. Market fluctuations or perceptions regarding the banking industry and general economic or political conditions may adversely affect the market price of the common stock. Our Our certificate of incorporation and bylaws contain provisions that may have the effect of delaying, deterring or preventing a potential takeover of us, which potential investors in our We are subject to additional risks in light of the As described under "Management's Discussion and Analysis of Financial Tod V. Mongan has served as Senior Vice President and Secretary since December 2001 and as General Counsel to the Company since February 2001. For the five years prior to that time Mr. Mongan served as Senior Vice President, General Counsel, Secretary and Chief Administrative Officer for BancTec, Inc., a worldwide systems integration, manufacturing and services company.Forward Looking Statements and