Use these links to rapidly review the documentTABLE OF CONTENTS

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | |||

|---|---|---|---|

| ý | |||

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |||

OR | |||

| Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |||

For the transition period to

Commission File Number 001-32505

TRANSMONTAIGNE PARTNERS L.P.

(Exact name of registrant as specified in its charter)

| Delaware | 34-2037221 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Suite 3100, 1670 Broadway

Denver, Colorado 80202

(Address, including zip code, of principal executive offices)

(303) 626-8200

(Telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

|---|---|---|

| Common Limited Partner Units | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes /X/ý No / /o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. /X/ý

Indicate by check mark whether the registrantRegistrant is a large accelerated filer, an accelerated filer, (as definedor a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act Rule 12b-2) Yes / / No /X/Act. (Check one):

Large accelerated Filer o Accelerated Filer ý Non-accelerated Filer o

Indicate by check mark whether the registrantRegistrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes / /o No /X/ý

The aggregate market value of common limited partner units held by non-affiliates of the Registrant was $98,754,768.$120,601,600.

The aggregate market value was computed by reference to the last sale price ($26.0132.00 per common unit) of the Registrant's common limited partner units on the New York Stock Exchange on August 29, 2005.March 2, 2007.

The number of the registrant's common limited partner units outstanding on August 29, 2005March 2, 2007 was 3,972,500.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, and any amendments to such reports, will be available free of charge on our website atwww.transmontaignepartners.com under the heading "Unit holder"Unitholder Information" "SEC Filings" as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission.

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including the following:

Our business and results of operations are subject to risks and uncertainties, many of which are beyond our ability to control or predict. Because of these risks and uncertainties, actual results may differ materially from those expressed or implied by forward-looking statements, and investors are cautioned not to place undue reliance on such statements, which speak only as of the date thereof.

In addition to the specific risk Important factors, many of which are described in more detail in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—1A. Risk Factors," important factors that could cause actual results to differ materially from our expectations include, but are not limited to:

We do not intend to update these forward-looking statements except as required by law.

3

ITEMS 1 AND 2. BUSINESS AND PROPERTIES

TransMontaigne Partners L.P. is a publicly traded Delaware limited partnership formed in February 2005 by TransMontaigne Inc., but did not commence We commenced operations untilupon the closing of our initial public offering on May 27, 2005. Effective December 31, 2005, we changed our year end for financial and tax reporting purposes from June 30 to December 31. Our common units are traded on the New York Stock Exchange under the symbol "TLP." Our principal executive offices are located at 1670 Broadway, Denver, Colorado 80202; our telephone number is (303) 672-8200. Unless the context requires otherwise, references to "we," "us," "our," "TransMontaigne Partners," "Partners" or the "partnership" are intended to mean TransMontaigne Partners L.P., our subsidiarywholly-owned and controlled operating limited partnerships and their subsidiaries. References to TransMontaigne Inc. are intended to mean TransMontaigne Inc. and its subsidiaries other than TransMontaigne GP L.L.C., our general partner, TransMontaigne Partners and subsidiaries of TransMontaigne Partners.

We are a refined petroleum products terminaling and pipelinetransportation company with operations currentlyalong the Gulf Coast, in Florida, Southwest MissouriBrownsville, Texas, along the Mississippi and Northwest Arkansas.Ohio rivers and in the Midwest. We provide integrated terminaling, storage, pipelinetransportation and related services for companies engaged in the distribution and marketing of refined petroleum products and crude oil, including TransMontaigne Inc. We handle light refined products, such asheavy refined products, crude oil, chemicals and fertilizers. Light refined products include gasolines, distillates (including heating oil) and jet fuels, and heavy refined products such asinclude residual fuel oils and asphalt, and crude oil.

Our existing assets, often referred to as the "contributed assets," include:

asphalt. We do not purchase or market products that we handle or transport and, therefore,transport. Therefore, we do not have material direct exposure to changes in commodity prices, except for the value of product gains and losses arising from our terminaling services agreements with our customers.

We are controlled by our general partner, TransMontaigne GP L.L.C., which is a wholly-owned subsidiary of TransMontaigne Inc. Effective September 1, 2006, Morgan Stanley Capital Group Inc., which we refer to as Morgan Stanley Capital Group, acquired all of the issued and outstanding capital stock of TransMontaigne Inc. As a result, Morgan Stanley, which is the parent company of Morgan Stanley Capital Group, became the indirect owner of 100% of our general partner. The following diagram depicts our current organization and structure.

TransMontaigne Inc., formed in 1995, is a terminaling, distribution and marketing company that markets refined petroleum products to wholesalers, distributors, marketers and industrial and commercial end users throughout the United States, primarily in the Gulf Coast, East Coast and Midwest regions. TransMontaigne Inc. also provides supply chain management services to various customers throughout the United States. TransMontaigne Inc. relies on us to provide substantially all of the integrated terminaling services it requires to support its operations along the Gulf Coast, in Brownsville, Texas, along the Mississippi and Ohio rivers, and in the Midwest.

Morgan Stanley Capital Group is the principal commodities trading arm of Morgan Stanley. Morgan Stanley Capital Group is a leading global commodity trader involved in proprietary and counterparty-driven trading in numerous commodities markets including crude oil, refined petroleum products, natural gas and natural gas liquids, coal, electric power, base and precious metals and others. Morgan Stanley Capital Group engages in trading both physical commodities, like refined petroleum products that we handle in our terminals, and exchange or over-the-counter commodities derivative instruments. Morgan Stanley Capital Group has also made acquisitions, including the acquisition of TransMontaigne Inc., that complement Morgan Stanley's commodity trading activities.

Our existing facilities are located in four geographic regions, which we refer to as our Gulf Coast, Brownsville, River and Midwest facilities.

We were formed by On December 29, 2006, we acquired the River and Brownsville facilities from TransMontaigne Inc. to ownfor an aggregate purchase price of $135 million. We financed the acquisition of the River and operate certainBrownsville facilities through additional borrowings under our amended and restated senior secured credit agreement. The acquisition was approved by the conflicts committee of itsthe board of directors of our general partner.

On January 1, 2006, we acquired a refined product terminal and pipeline assets. In connection with our initial public offering the following transactions occurred:

4approximately $17.9 million.

Refined product terminaling and pipeline transportation companies, such as TransMontaigne Partners, facilitate the movement of refined products to consumers around the country. Consumption of refined products in the United States exceeds domestic production, which necessitates the importing

of refined products from other countries. Moreover, a substantial majority of the petroleum product refining that occurs in the United States is concentrated in the Gulf Coast region, which necessitates the transportation of domestic productionproduct to other areas, such as the East Coast, Florida, Midwest and West Coast regions of the country. Terminaling and pipeline transportation companies receive, store, blend, treat and distribute refined products, both domestic and imported, as they are transported from refineries to retailers and end-users.

Refining. Refineries in the Gulf Coast region refine crude oil into various "light oils" and "heavy oils." Light oils include gasolines and distillates, such as diesel fuels, heating oils and jet fuels. Heavy oils include residual fuel oils and asphalt. These products have various characteristics, such as sulfur content, octane level, Reid-vapor pressure and other chemical characteristics. Refined petroleum products of a specific grade and characteristics are substantially identical in composition from one refinery to another and are referred to as being "fungible." The refined products initially are stored at the refineries' own terminal facilities. The refineries owned by major oil companies then schedule for delivery some of their product output to satisfy their own retail delivery obligations, at branded gasoline stations, for example, and sell the remainder of their product output to independent marketing and distribution companies or traders, such as TransMontaigne Inc. and its independent supply partners,Morgan Stanley Capital Group, for resale. The major refineries typically prefer to sell their excess product to independent marketing and distribution companies rather than to other refineries and integrated oil companies, which are their primary competitors.

Transportation. For an independent distribution and marketing company, such as TransMontaigne Inc., to distribute product in the wholesale markets, it must first schedule that product for shipment by tankers or barges or on common carrier pipelines to a terminal.

Product reaches Florida primarily through marine terminals, as there are no interstate pipelines transporting refined products into the state. Product is transported to marine terminals, such as our Gulf Coast terminals and Baton Rouge, Louisiana dock facility, by tankers or barges. Because there are economies of scale in transporting products by vessel, marine terminals with larger storage capacities for various commodities have the ability to offer their customers lower per-barrel freight costs to a greater extent than do terminals with smaller storage capacities.

Product reaches inland terminals, such as our Mt. Vernon, Rogers and RogersOklahoma City terminals, by common carrier pipelines. Common carrier pipelines are pipelines with published tariffs that are regulated by the Federal Energy Regulatory Commission, or FERC, or state authorities. These pipelines ship product in batches, with each batch generally consisting of fungible product owned by several different companies. As a batch of product is shipped on a pipeline,

5

each terminal operator along the way draws the volume of fungible product that is scheduled for that facility as the batch passes in the pipeline. Consequently, each terminal operator must monitor the type of product in the common carrier pipeline to determine when to draw product scheduled for delivery to that terminal. In addition, both the common carrier pipeline and the terminal operator monitor the volume of product drawn to ensure that the amount scheduled for delivery at that location is actually received.

At both inland and marine terminals, the various refined petroleum products are segregated and stored in tanks. Because the characteristics of gasoline are required to be changed at least twice per year in many locations to meet government regulations, regular unleaded gasoline produced for winter cannot be stored in a tank together with regular unleaded gasoline produced for summer.

Delivery. Most terminals have a tanker truck loading facility commonly referred to as a "rack." Often, commercial and industrial end-users and independent retailers will rely on independent trucking companies to pick up product at the rack and transport it to the end-user or retailer at its location. Each truck holds an aggregate of approximately 8,000 gallons (approximately 190 barrels) of various products in different compartments. The driver will swipeswipes a magnetic card that identifies the customer purchasing the product, the carrier and the driver as well as the products to be pumped into the truck.

A computerized system electronically reviews the credentials of the carrier, including insurance and certain mandated certifications, the credit of the customer and confirms the customer is within product allocation limits. When all conditions are verified as being current and correct, the system authorizes the delivery of the product to the truck. As product is being loaded into the truck, additives are injected into products, including all gasolines, to conform to government specifications and individual customer requirements. If a truck is loading gasoline for retail sale by an independent gasoline station, generic additives will be added to the gasoline as it is loaded into the truck. If the gasoline is for delivery to a branded retail gasoline station, the proprietary additive compound of that particular retailer will be added to the gasoline as it is loaded. The type and amount of additive are electronically and mechanically controlled by equipment located at the truck loading rack. Approximately one to two gallons of additive are added toinjected into an 8,000 gallon truckload of gasoline.

At marine terminals, the product will be stored in tanks and may be delivered to tanker trucks over a rack in the same manner as at an inland terminal. Product also may be delivered to cruise ships and other vessels, known as bunkering, either at the dock, through a pipeline or truck, or by barge. Cruise ships typically purchase approximately 6,000 to 8,000 barrels, the equivalent of approximately 42 tanker truckloads, of product per refueling. Bunker fuel is a mixture of residual fuel oil and distillate. Each large vessel generally requires its own mixture of bunker fuel to match the distinct characteristics of that ship's engines and turbines. Because the mixture for each ship requires precision to mix and deliver, cruise ships often prefer to refuel in United States ports with experienced companies.

Our existing assetsterminal facilities are located in Florida, Southwest Missourithe United States along the Gulf Coast, in Brownsville, Texas, along the Mississippi and Northwest Arkansas.Ohio rivers and in the Midwest. We use our terminaling assetsfacilities to, among other things:

6

We derive revenues from our refined product terminals by charging fees for providing the following integrated terminaling and related services: throughput and additive injection fees based on the volume of product distributed at a standardcontracted rate per barrel, terminaling storage fees based on a per barrel of storage capacity per month, and ancillary services including heating and mixing of stored products, product transfer services, and product gains and losses arising from the terminaling services agreements with our customers. We generate revenues at the Razorback Pipeline by charging a tariff regulated by the FERC, based on the volume of product transported and the distance from the origin point to the delivery point. We also generate management fees associated with the bi-directional refined products pipeline that we manage and operate for PMI on a cost-plus basis.

TransMontaigne Inc. and Marathon Petroleum Company LLC, which we refer to as Marathon, are the principal customers at our Florida and Midwest facilities, TransMontaigne Inc. is our principal customer at our Midwest facilities and our principal customers at our Brownsville and River facilities

include: Valero Energy Corporation and its affiliates, which we refer to as Valero, Morgan Stanley Capital Group and PMI. Financial information for each reportable segment is included in Note 15 of the Notes to consolidated financial Statements in Item 8 of this annual report.

The locations and approximate aggregate active storage capacity at our terminal facilities as of December 31, 2006 are as follows:

| Locations | Active Storage Capacity (shell bbls) | ||||

|---|---|---|---|---|---|

| Gulf Coast Facilities | |||||

Florida | |||||

| Port Everglades Complex | |||||

| Port Everglades—North | 1,614,000 | ||||

| Port Everglades—South | 378,000 | (1) | |||

| Jacksonville | 271,000 | ||||

| Cape Canaveral | 727,000 | ||||

| Port Manatee | 1,385,000 | ||||

| Fisher Island | 672,000 | ||||

| Tampa | 496,000 | ||||

| Mobile, AL | 235,000 | ||||

| Gulf Coast Total | 5,778,000 | ||||

Midwest Facilities | |||||

| Rogers and Mt. Vernon (aggregate amounts) | 404,000 | ||||

| Oklahoma City | 157,000 | ||||

| Midwest Total | 561,000 | ||||

| Brownsville, Texas Terminal Complex | 2,215,000 | ||||

River Facilities | |||||

| Arkansas City, AR | 769,000 | ||||

| Evansville, IN | 218,000 | ||||

| New Albany, IN | 201,000 | ||||

| Greater Cincinnati, KY | 200,000 | ||||

| Henderson, KY | 133,000 | ||||

| Louisville, KY | 181,000 | ||||

| Owensboro, KY | 145,000 | ||||

| Paducah, KY Complex | 288,000 | ||||

| Baton Rouge Dock | — | ||||

| Greenville, MS (Clay Street) | 150,000 | ||||

| Greenville, MS (Industrial Road) | 56,000 | ||||

| Cape Girardeau, MO | 140,000 | ||||

| East Liverpool, OH | 227,000 | ||||

| River Total | 2,708,000 | ||||

TOTAL CAPACITY | 11,262,000 | ||||

Brownsville Operations. At our Brownsville terminal facilities, we handle a large volume of liquid product movements between Mexico and south Texas including refined petroleum products, chemicals, vegetable oils, naphtha, wax and propane on behalf of, and provide integrated terminaling services to, third parties engaged in the distribution and marketing of refined products and natural gas liquids. Our Brownsville facilities receive refined products on behalf of our customers from waterborne vessels, by truck or railcar. We also receive natural gas liquids by pipeline.

We also operate and maintain a 17-mile bi-directional refined products pipeline owned by PMI. The pipeline connects our Brownsville terminal complex to a terminal facility located in Matamoros, Tamuligas, Mexico, approximately seven miles from the United States-Mexico border. The pipeline can accommodate natural gas liquids and refined petroleum products. We operate and manage the pipeline for PMI on a "cost-plus" basis under which we are reimbursed for our expenses and earn a fee equal to a fixed percentage of the costs we incur.

The customers we serve at our Brownsville terminal complex consist principally of wholesale and retail marketers of refined products and industrial and commercial end-users of refined petroleum products, waxes and industrial chemicals. Our principal customers are Morgan Stanley Capital Group and PMI.

Florida Operations Gulf Coast Operations.

Our Florida assetsGulf Coast operations include seveneight refined product terminals. At our FloridaGulf Coast terminals, we handle refined products and crude oil on behalf of, and provide integrated terminaling services to TransMontaigne Inc., other companies engaged in the distribution and marketing of refined products and crude oil, and the United States government. All of our FloridaOur Gulf Coast terminals receive refined products from waterborne vessels on behalf of our customers. In addition, our Jacksonville terminal also receives asphalt by rail and our Port Everglades (North) terminal receives product by rail and truck as well as barge. We distribute by truck or barge at all of our Gulf Coast terminals. In addition, we distribute refined products by pipeline at our Port Everglades and Tampa terminals and by rail at our Port Everglades (North) and Jacksonville terminals. Our Port Everglades (South) terminal is connected by pipeline to our Port Everglades (North) terminal. CITGO Petroleum Corporation retains an ownership interest, ranging from 25% to 50%, in specific tank capacity at our Port Everglades (South) terminal. We operate the Port Everglades (South) terminal, and we are reimbursed by CITGO for a share of our expenses. Our Mobile, Alabama terminal facility receives and distributes refined product by truck and barge.

The principal customers at our Gulf Coast facilities are TransMontaigne Inc. and Marathon. The customers TransMontaigne Inc. serves from our FloridaGulf Coast terminals consist principally of wholesale and retail marketers of refined products, cruise ships, an electric utility and industrial and commercial end-users. The principal products that we handle at our FloridaGulf Coast terminals are light refined products, (such as gasolines), distillates (including heating oils), and jet fuels, heavy refined products such as residual fuel oils and asphalt, and crude oil.

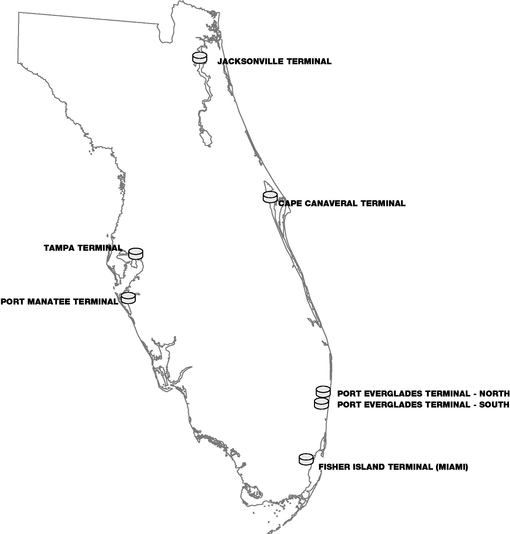

The following chart sets forth information about our existing assets in Florida:

| | Active Storage Capacity (shell bbls) | Number of Active Tanks | Supply Modes | Delivery Modes | Products Handled | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Port Everglades | |||||||||||

Port Everglades—North | 1,600,000 | 24 | Vessel, rail, truck | Pipeline, truck, rail, vessel | Gasolines, distillates, residual fuel oils, asphalt, jet fuels, crude oil | ||||||

Port Everglades—South | 370,000 | (1) | 10 | Vessel | Pipeline, truck, vessel | Gasolines, distillates | |||||

Jacksonville(2) | 280,000 | 10 | Vessel, rail | Truck, rail | Asphalt | ||||||

Cape Canaveral | 730,000 | 16 | Vessel | Truck, vessel | Gasolines, distillates, residual fuel oils, asphalt | ||||||

Port Manatee(3) | 1,150,000 | 9 | Vessel | Truck, vessel | Distillates, residual fuel oils, asphalt | ||||||

Fisher Island | 670,000 | 12 | Vessel | Vessel | Residual fuel oils, marine fuels | ||||||

Tampa(4) | 420,000 | 6 | Vessel | Pipeline, truck, vessel | Gasolines, distillates | ||||||

7

The following map shows our Florida operations:

Port Everglades Terminals. River Operations. Our Port EvergladesRiver facilities include twelve refined product terminals are located near Fort Lauderdale,along the Mississippi and includeOhio rivers and the Baton Rouge, Louisiana dock facility. At our Port Everglades (North) terminalRiver terminals, we handle refined products, including gasolines and our Port Everglades (South) terminal.

Port Everglades (North) Terminal. Our Port Everglades (North), Florida marine terminal is connected by pipelinedistillates, and fertilizer on behalf of, and provide integrated terminaling services to four ship berths for receivingcompanies engaged in the distribution and marketing of refined products and is equipped with three truck racks, one for residual fuel oil, one for lightindustrial and commercial end-users. Our River terminals receive refined products and one for asphalt. The terminal receives gasolines, distillates, jet fuels, residual fuel oils and asphalt from ships and bargeswaterborne vessels on behalf of our customers for delivery via (a) ourcustomers. We distribute products primarily by truck racks to our customers for redistribution to locations throughout south Florida, including Miami, Fort Lauderdale and West Palm Beach; (b) barges to our customers for redistribution to bunker fuel and residual oil customers and gasoline, distillate and jet fuel customers, primarily in the Bahamas; (c) TransMontaigne Inc.'s proprietary pipeline delivery

8

system for delivery of bunker fuels to cruise ships and other vessels in Port Everglades; and (d) the Buckeye Pipeline for jet fuel delivery to the Fort Lauderdale and Miami Airports. The terminal also receives crude oil through a separate truck rack for delivery to ships or barges, and has facilities for the receipt and delivery of refined products to and from railcars. The Port Everglades (North) terminal has room for an additional 1.0 million barrels of storage capacity.waterborne vessels. Our customers include a marketer of asphalt, the United States Government, major oil companies and TransMontaigne Inc. TransMontaigne Inc. markets gasolines, distillates and residual fuel oils from the terminal to wholesale and retail marketers of refined products, cruise ships, shipping companies and the utility industry.

Port Everglades (South) Terminal. Our Port Everglades (South), Florida marine terminal is connected by pipeline to our Port Everglades (North) terminal. CITGO Petroleum Corporation owns varying percentage interests, ranging from 25% to 50%, in specific assets at the terminal. We operate the terminal, and we are reimbursed by CITGO for a share of our expenses. The terminal is connected by pipeline to four ship berths for receiving refined products and is equipped with a truck rack that can load up to eight trucks simultaneously. The terminal receives gasolines and distillates from ships and barges for delivery via our truck rack for redistribution to locations throughout southern Florida, including Miami, Fort Lauderdale and West Palm Beach. TransMontaigne Inc., currently our onlyprincipal customer at the terminal, markets gasolines and distillates from the terminal to wholesale and retail marketers of refined products.

Competition to our Port Everglades terminals includes other terminals located in Port Everglades owned by BP p.l.c., Chevron U.S.A. Inc., CITGO Petroleum Corporation, Exxon Mobil Corporation, Amerada Hess Corporation, Marathon Ashland Petroleum, LLC and Motiva Enterprises LLC.

Jacksonville Terminal. Our Jacksonville, Florida terminal stores asphalt and provides integrated terminaling services for a marketer of asphalt pursuant to a contract that extends through 2013. This terminal receives asphalt via rail and our ship berth for delivery via our truck rack to our customer for redistribution to locations throughout northern Florida and southern Georgia. Competition to our terminal includes the local Valero L.P. and Trumball Asphalt, Inc. terminals.River facilities is Valero.

Cape Canaveral Terminal. Midwest Terminals and Pipeline Operations. Our Cape Canaveral, Florida terminal receives gasolines, distillates, residual fuel oils and asphalt from ships and barges for delivery via our truck rack to our customers for redistribution to locations throughout central Florida, including Orlando, and via barges to TransMontaigne Inc. for delivery to cruise ships and a power plant. Our customers include TransMontaigne Inc. and a marketer of asphalt. TransMontaigne Inc. supplies gasolines, distillates and residual fuel oils from the terminal to wholesale and retail marketers of refined products, cruise ships, shipping companies and the utility industry. Competition to our terminal includes the Central Florida Pipeline terminal in Taft, an asphalt terminal in West Palm Beach and various terminals in Jacksonville and Port Everglades.

Port Manatee Terminal. Our Port Manatee, Florida terminal receives distillates, residual fuel oils and asphalt from ships and barges for delivery via our truck rack to our customers for redistribution to locations throughout southwestern Florida, including Sarasota and Fort Myers, and via barges to residual fuel oil customers. Our customers include TransMontaigne Inc., a marketer of residual fuel oil and a marketer of asphalt. Competition to our terminal includes the various terminals in the Tampa area owned by BP p.l.c., Chevron U.S.A. Inc., CITGO Petroleum Corporation, Amerada Hess Corporation, Kinder Morgan, Inc. and its affiliate Kinder Morgan Energy Partners, L.P., Marathon Ashland Petroleum, LLC, Motiva Enterprises LLC and Murphy Oil Corporation.

9

Fisher Island Terminal. Our Fisher Island, Florida marine terminal receives residual fuel oils and marine distillates from ships and barges on behalf of our customers for redistribution via barges to residual fuel oil customers and bunker fuel customers. TransMontaigne Inc. currently is our only customer at the terminal. TransMontaigne Inc. supplies marine fuels to cruise ships and shipping companies located within the Port of Miami, and residual fuel oils to the utility industry. Competition to our terminal includes other terminals located in Port Everglades and terminals located in the Caribbean.

Tampa Terminal. Our Tampa, Florida marine terminal receives gasolines and distillates from ships and barges for delivery via our truck rack to TransMontaigne Inc. for redistribution to locations throughout west central Florida, including Tampa, St Petersburg, Sarasota and Fort Myers, and via the Central Florida Pipeline to Taft, Florida. TransMontaigne Inc. currently is our only customer at the terminal. TransMontaigne Inc. markets gasolines and distillates from the terminal to wholesale and retail marketers of refined products. Competition to our terminal includes other terminals located in the Tampa area owned by BP p.l.c., Chevron U.S.A. Inc., CITGO Petroleum Corporation, Amerada Hess Corporation, Kinder Morgan, Inc. and its affiliate Kinder Morgan Energy Partners, L.P., Marathon Ashland Petroleum, LLC, Motiva Enterprises LLC and Murphy Oil Corporation.

SouthwestIn Missouri and Northwest Arkansas Operations

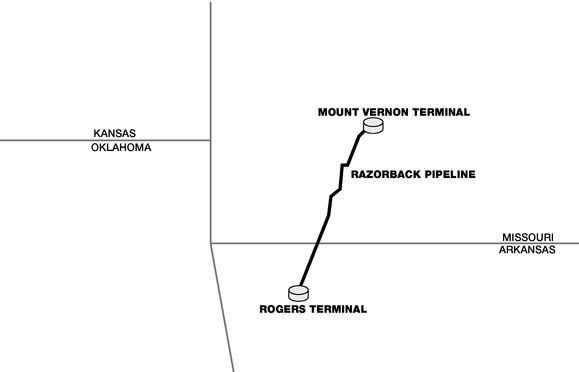

In Southwest Missouri and Northwest Arkansas we own and operate the Razorback Pipeline and terminals in Rogers, Arkansas, at the terminus of the pipeline, and Mt. Vernon, Missouri, at the origin of the pipeline.

The following sets forth information about our existing terminaling assets in Southwest Missouri We also own and Northwest Arkansas:

| | Active Storage Capacity (shell bbls) | Number of Tanks | Supply Modes | Delivery Modes | Products Handled | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Rogers and Mt. Vernon (aggregate amounts) | 400,000 | 9 | Pipeline | Truck | Gasolines, distillates | |||||

10

operate a terminal facility at Oklahoma City, Oklahoma. The following map shows our existing Southwest Missouri and Northwest Arkansas operations:

Razorback Pipeline. Our Razorback Pipeline is a 67 mile, 8-inch diameter interstate common carrier pipeline that transports light oil refined product on behalf of TransMontaigne Inc. from our terminal at Mt. Vernon, Missouri, where it is interconnected with a pipeline system owned by Magellan Midstream Partners, to our terminal at Rogers, Arkansas. The pipelineRazorback Pipeline has a capacity of approximately 30,000 barrels per day. The FERC regulates the transportation tariffs for interstate shipments on the Razorback Pipeline. TransMontaigne Inc. currently is the only shipper on the Razorback Pipeline.

Mt. Vernon and Rogers Terminals. Our Mt. Vernon, Missouri terminal is the origin of the Razorback Pipeline; our Rogers, Arkansas terminal is located at the terminus of the Razorback Pipeline. The Mt. Vernon terminal receives gasolines and distillates from Magellan and ConocoPhillips pipelines for delivery via our truck rack to TransMontaigne Inc. for redistribution to locations throughout southwest Missouri and to the Razorback Pipeline for shipment to our Rogers terminal. The Rogers terminal receives gasolines and distillates from the Razorback Pipeline for delivery via our truck rack to TransMontaigne Inc. for redistribution to locations throughout northwest Arkansas. TransMontaigne Inc. currently is the only customer of the two terminals. TransMontaigne Inc. markets gasolines and distillates from the facilities to wholesale and retail marketers of refined products. Competition to our facilities includes

Our Oklahoma City terminal receives gasolines and distillates from the Magellan Pipeline terminals in Carthage and Springfield, Missouri and Fort Smith, Arkansas; the ConocoPhillips terminal in Mt Vernon, Missouri; various terminals in North Little Rock, Arkansas; and the Sunoco and Sinclair refineries and terminal facilities in Tulsa, Oklahoma.

11

OUR RELATIONSHIP WITH TRANSMONTAIGNE INC.

General

The substantial majority ofpipeline for delivery via our business is devotedtruck rack to providing integrated terminaling and pipeline servicesa major oil company's customers for redistribution to TransMontaigne Inc. TransMontaigne Inc. accounted for approximately 64%, 59% and 70% of our revenues for the years ended June 30, 2005, 2004 and 2003, respectively. TransMontaigne Inc., formed in 1995, is a terminaling, distribution and marketing company that supplies, distributes and markets refined petroleum products to refiners, wholesalers, distributors, marketers and industrial and commercial end userslocations throughout the United States, primarily in the Gulf Coast, Florida, East Coast and Midwest regions. TransMontaigne Inc. also provides supply chain management services to various customers throughout the United States. TransMontaigne Inc. relies on us to provide substantially all of the integrated terminaling services it requires to support its operations in Florida, Southwest Missouri and Northwest Arkansas. Pursuant to the terms of our terminaling services agreement with TransMontaigne Inc., we expect to continue to derive a substantial majority of our revenues from TransMontaigne Inc. for the foreseeable future.Oklahoma City region.

At June 30, 2005, TransMontaigne Inc. owns 43 refined product terminals, including those subject to our exclusive options to purchase, a dock facility in Baton Rouge, Louisiana, 11 tug boats and 13 barges, a hydrant system in Port Everglades, and its distribution and marketing business. TransMontaigne Inc.'s distribution and marketing operations generally consist of the distribution and marketing of refined petroleum products through contract sales, rack spot sales and bulk sales in the physical markets, and providing related value-added fuel procurement and supply chain management services. TransMontaigne Inc. has a significant interest in our partnership through its indirect ownership of a 39.4% limited partner interest and a 2% general partner interest in us. TransMontaigne Inc.'s common stock trades on the New York Stock Exchange under the symbol "TMG" and is subject to the information requirements of the Securities Exchange Act of 1934.

Exclusive Options to Purchase Additional Refined Product Terminals

Pursuant to the omnibus agreement, TransMontaigne Inc. granted us exclusive options to purchase additional refined product terminals. In the event we exercise our option, we would seek to enter into a terminaling services agreement with TransMontaigne Inc. for these terminals.

The assets and operations subject to the option include:

The option with respect to the Brownsville complex will be exercisable for one year beginning in January 2006, the option with respect to the terminals along the Plantation and Colonial pipeline corridors will be exercisable for one year beginning in December 2007, and the option with respect to the terminals along the Mississippi and Ohio River areas will be exercisable for one year beginning in December 2008.

12

The exercise of any of the options will be subject to the negotiation of a purchase price and a terminaling services agreement relating to the terminals proposed to be purchased, and may be conditioned on obtaining various consents. Such consents may include consents of the holders of TransMontaigne Inc.'s equity or debt securities or governmental consents.

The exercise price would be determined according to a process in which, within 45 days of our notification that we wish to exercise the option, TransMontaigne Inc. would propose to our general partner the terms on which it would be willing to sell the asset, including the terms of a terminaling services agreement. Within 45 days after TransMontaigne Inc.'s delivery of its proposed terms, we would propose a cash purchase price for the assets. If we cannot agree on a purchase price after negotiating in good faith for 60 days, TransMontaigne Inc. would have the right to seek an alternative purchaser willing to pay at least 105% of the purchase price we proposed; if an alternative transaction on such terms has not been consummated within six months, we would have the right to purchase the assets at the price we originally proposed. If we do not exercise this right, TransMontaigne Inc. would be free to retain or sell the assets without restriction.

The omnibus agreement also provides that, in certain circumstances, TransMontaigne Inc. offer to sell us tangible assets it acquires or constructs in the future. These circumstances are discussed in greater detail under "Item 13. Certain Relationships and Related Transactions-Omnibus Agreement; Obligation to Offer to Sell Acquired or Constructed Assets."

Terminaling Services Agreement

We have a terminaling and transportation services agreement with TransMontaigne Inc. that will expire on December 31, 2011. Under this agreement, TransMontaigne Inc. agreed to transport on the Razorback Pipeline and throughput at our terminals a volume of refined products that will, at the fee and tariff schedule contained in the agreement, result in minimum revenues to us of $5 million per calendar quarter. In exchange for TransMontaigne Inc.'s minimum revenue commitment, we agreed to provide TransMontaigne Inc. approximately 2.0 million barrels of light oil storage capacity and approximately 1.4 million barrels of heavy oil storage capacity at certain of our Florida terminals.

TransMontaigne Inc.'s minimum revenue commitment applies only to our initial assets and may not be spread among assets we subsequently acquire. If TransMontaigne Inc. fails to meet its minimum revenue commitment in any quarter, it must pay us the amount of any shortfall within 15 days following receipt of an invoice from us. A shortfall payment may be applied as a credit in the following four quarters after TransMontaigne Inc.'s minimum obligations are met.

Furthermore, if new laws or regulations that affect terminals generally are enacted that require us to make substantial and unanticipated capital expenditures at any of our terminals, we have the right to negotiate a monthly surcharge to be paid by TransMontaigne Inc. for the use of our terminals. The surcharge is intended to cover TransMontaigne Inc.'s pro rata portion of the cost of complying with these laws or regulations, after we have made efforts to mitigate their effect. If we cannot agree on a surcharge, and if we are not able to direct the affected refined products to mutually acceptable alternative terminaling assets that we own, either party has the right to remove the assets from the terminaling services agreement, and TransMontaigne Inc.'s minimum revenue commitment will be correspondingly reduced. The surcharge does not apply in respect of routine capital expenditures.

Under the agreement, we are responsible for all refined product losses in excess of 0.10% of the refined product we receive from TransMontaigne Inc. at our terminals. We are also entitled to all product gains, including 0.10% of the refined product we receive from TransMontaigne Inc. at our terminals.

13

In the event of a force majeure event, that renders performance impossible with respect to an asset for at least 30 days, TransMontaigne Inc.'s obligations would be temporarily suspended with respect to that asset. If a force majeure event continues for 30 days or more and results in a diminution in the storage capacity we make available to TransMontaigne Inc., TransMontaigne Inc.'s minimum revenue commitment would be reduced proportionately for the duration of the force majeure event. If such a force majeure event continues for twelve consecutive months or more, either party has the right to terminate the entire terminaling services agreement.

After the initial term, the terminaling services agreement will automatically renew for subsequent one-year periods, subject to either party's right to terminate with six months' notice. TransMontaigne Inc.'s obligations under the terminaling services agreement will not terminate if TransMontaigne Inc. no longer owns our general partner. TransMontaigne Inc. may assign the terminaling services agreement only with the consent of the conflicts committee of our general partner. Upon termination of the agreement, TransMontaigne Inc. has a right of first refusal to enter into a new terminaling services agreement with us, provided it pays no less than 105% of the fees offered by the third party.

TransMontaigne Inc. also has a right of first refusal to control any petroleum product storage capacity that is put into commercial service after May 27, 2005 or is subject to a contract which terminates or becomes terminable by us (excluding a contract renewable solely at the option of our customer), provided that TransMontaigne Inc. pays 105% of the fees offered by the third party customer.

We face competition from other terminals and pipelines that may be able to supply TransMontaigne Inc. and our other customers with refined product integrated terminaling and pipeline services on a more competitive basis. We compete with national, regional and local terminal and pipeline companies, including the major integrated oil companies, of widely varying sizes, financial resources and experience. These competitors include BP p.l.c., Chevron U.S.A. Inc., CITGO Petroleum Corporation, Exxon Mobil Corporation, Amerada Hess Corporation, Magellan Midstream Partners, L.P., Marathon Ashland Petroleum, LLC, Motiva Enterprises LLC, Murphy Oil Corporation and terminals in the Caribbean. Several of our competitors conduct portions of their operations through publicly traded partnerships with structures similar to ours, including Sunoco, Inc. and its affiliate Sunoco Logistics Partners L.P., Holly Corporation and its affiliate Holly Energy Partners, L.P., Valero Energy Corporation and its affiliate Valero L.P., and Kinder Morgan, Inc. and its affiliate Kinder Morgan Energy Partners, L.P. In particular, our ability to compete could be harmed by factors we cannot control, including:

We also compete with national, regional and local terminal and pipeline companies for asset acquisition and expansion opportunities. Some of these competitors are substantially larger than us and have greater financial resources and lower costs of capital than we do.

14

Our primary business objective is to increase distributable cash flow per unit. The most effective means of growing our business and increasing distributions to our unitholders is to expand our asset base and infrastructure, and to increase utilization of our existing infrastructure. We intend to accomplish this by executing the following strategies:

Generate stable cash flows through the use of long-term contracts with our customers. We generate revenues from customers who pay us fees based on the volume of storage capacity contracted for, volume of refined products throughput at our terminals or volume of product transported in our pipeline.the Razorback Pipeline. We have no direct commodity price risk because we do not own any of the products throughput at our terminals or transported on our pipeline. We have a long-term terminaling services agreementagreements with Marathon, Morgan Stanley Capital Group, PMI, TransMontaigne Inc. pursuant to which TransMontaigne Inc. has agreed to pay us a guaranteedand Valero. Based on our terminaling services contracts in effect at March 1, 2007, we have minimum amountrevenue commitments from our customers of approximately $50 million for the year ending December 31, 2007. We expect that our actual revenues for the year ending December 31, 2007 will be higher because of $5 million per calendar quarter.throughput agreements with customers that do not contain minimum revenue commitments and because our customers often use other services we provide that are separate from the services covered by the minimum revenue commitments. We believe that the fee-based nature of our business, our minimum revenue commitmentcommitments from TransMontaigne Inc.,our customers, and the long-term nature of our contracts with many of our customers will provide us with stable cash flows.

Pursue strategic and accretive acquisitions in new and existing markets. We plan to pursue acquisitions from third parties of petroleum product terminaling and transportation and terminaling assetsfacilities that are complementary to those we currently own. We also may purchase assetsfacilities outside our existing area of operations. In many cases, we would expect to pursue these acquisitions jointly with TransMontaigne Inc. and Morgan Stanley Capital Group. We also have the right under the omnibus agreement to purchase certain assetsfacilities TransMontaigne Inc. purchases or constructs in the future, subject to the negotiation of satisfactory terms and obtaining required consents. We expect that TransMontaigne Inc. will operate the assetsfacilities it offers to us pursuant to the omnibus agreement for a period of up to two years, during which time TransMontaigne Inc.'s distribution and marketing operations will seek to increase the utilization of the assetsfacilities as well as its knowledge of the areas in which the assetsfacilities operate. We believe we will benefit from TransMontaigne Inc.'s operation of such assetsfacilities because we anticipate TransMontaigne Inc. will be more likely to enter into a long-term terminaling services agreement that includes a minimum revenue commitment with us once it has gained greater operating and market knowledge with respect to the assets.facilities. In light of the recent industry trend of large energy companies divesting their distribution and logistic assets, we believe there will continue to be significant acquisition opportunities.

We believe that our affiliation with TransMontaigne Inc. and Morgan Stanley Capital Group will provide us with a competitive advantage in situations where we jointly pursue acquisition opportunities or where we purchase assets previously purchased or constructed by TransMontaigne Inc. As is frequently the case in the energy industry, potential acquisition opportunities maycandidates have an element of commodity price risk inherent in their pre-acquisition operations. We expect to be able to pursue such acquisitions jointly with TransMontaigne Inc. and Morgan Stanley Capital Group in a manner that minimizes commodity price exposure to us. In these circumstances, TransMontaigne Inc. or one of its affiliatesMorgan Stanley Capital Group may assume most or all of the direct commodity price exposure inherent in the acquired business and incorporate these risks into itstheir overall trading, distribution and marketing operations. As a result of this affiliation, we believe we will be able to aggressively pursue acquisitions that otherwise would not be attractive to us or other competing potential acquirers because of theWe currently have no direct commodity price risk inherent inbecause we do not own any of the target's operations.products throughput at our terminals or transported on the pipelines we own or manage.

Maximize the benefits of our relationship with TransMontaigne Inc. and Morgan Stanley Capital Group. OurWe believe that our exclusive options with TransMontaigne Inc. to purchase additional refined product terminals, and our affiliation with Morgan Stanley Capital Group, will provide us an opportunityopportunities to acquire additional assetsterminaling and transportation facilities and expand our operations in a manner whichthat allows us to achieve substantial utilization of our assets by linkingfacilities because of the strategic fit between our

infrastructure with Morgan Stanley Capital Group's global supply capabilities and TransMontaigne Inc.'s distribution and marketing business. In addition, our relationship with TransMontaigne Inc. and Morgan Stanley Capital Group will

15

provide us with access to a significant pool of management talent and strong relationships throughout the energy industry that we intend to utilize to implement our strategies. TransMontaigne Inc. intendsand Morgan Stanley Capital Group intend to utilize our partnershipus as athe primary growth vehicle for itstheir terminaling and transportation business. For this reason,business and to support their physical trading and delivery businesses. As a result, we expect to have the opportunity to participate with TransMontaigne Inc. and Morgan Stanley Capital Group in considering transactions that we would not be able to aggressively pursue on our own.

Execute cost-effective expansion and asset enhancement opportunities. We continually evaluate opportunities to expand our existing asset base and we will consider constructing new refined product terminals and expanding existing terminal capacity where product demand is expected to increase. In addition, for markets served by waterborne terminals, larger terminal capacity can help significantly reduce freight costs for our customers because they can bring in high-growth areas in Florida and elsewhere. During the year ended June 30, 2005,larger shipments on a single vessel. As a result, we placed 355,000 barrels ofare actively examining our opportunities to expand our active storage capacity into commercial service at our Florida terminals, andGulf Coast terminals. We have been approved to expand the storage capacity at our Port Everglades terminal complex facilities by approximately 1.4 million barrels. We will continue to evaluate adding new tanks or bringing out-of-service tankage into commercial service in order to meet increasing demand for integrated terminaling services.

We believe we are well-positioned to successfully execute our business strategies successfully using the following competitive strengths:

TheWe benefit from the strategic fit between our operations and the operations of Morgan Stanley Capital Group and TransMontaigne Inc. Morgan Stanley is a leading global energy trading company with extensive trading activities focused on the energy markets, including crude oil and refined petroleum products. Morgan Stanley Capital Group's trading and risk management activities cover a broad spectrum of the energy industry with extensive resources dedicated to refined product supply and transportation. TransMontaigne Inc. is a leading distributor of unbranded refined petroleum products to independent wholesalers and industrial and commercial end users delivering approximately 300,000 barrels per day. These operations of Morgan Stanley Capital Group and TransMontaigne Inc. fit strategically with our broad geographical terminal and transportation distribution capability. Our long-term terminaling services agreement we haveservice agreements with TransMontaigne Inc. willand Morgan Stanley Capital Group, enable them to support their refined product supply, risk management and marketing businesses and, at the same time, provide us with predictable cash flows. Westeady revenues and help ensure that our facilities are well-positioned to focus our efforts to execute our strategy of expanding our asset base because our existing operations generate predictable revenues. Under the terminaling services agreement, TransMontaigne Inc. has agreed to pay us fees to transport refined products on the Razorback Pipeline and to receive integrated terminaling services through December 31, 2011, with a guaranteed minimum amount of revenues each calendar quarter.more fully utilized.

Our relationshiprelationships with TransMontaigne Inc., including our exclusive options to purchase additional refined product terminals, enhancesand with Morgan Stanley Capital Group enhance our ability to make strategic acquisitions. Our exclusive options offer us an attractive means of expanding our asset base by allowing us to purchase from TransMontaigne Inc. additional refined product terminals that complement our existing operations. The assetsfacilities subject to the options are linked tosupport TransMontaigne Inc.'s distributionmarketing operations and marketing operations,Morgan Stanley Capital Group's trading activities, thereby allowing us to achieve substantial utilization of the assets.facilities. In addition, TransMontaigne Inc. generally is required to offer us the opportunity to buy terminal and pipeline assetstransportation facilities it purchases or constructs in the future. In connection with any purchase of assetsterminaling and transportation facilities from TransMontaigne Inc., pursuant to the exclusive options or otherwise, we expect to have the opportunity to negotiate an appropriate terminaling services agreement with TransMontaigne Inc. relating to the new assets.facilities. We believe the value of any terminaling assetsfacilities we acquire will be enhanced if we can concurrently obtain a long-term terminaling services agreement with TransMontaigne Inc., or Morgan Stanley Capital Group and, therefore, our efforts to make strategic

acquisitions will be improved by our ability to jointly pursue these acquisitions with TransMontaigne Inc. and Morgan Stanley Capital Group.

We have the financial flexibility to pursue expansion and acquisition opportunities. We have a $75.0 million credit facility that expires in May 2010, of which we have approximately $33.0 million available at June 30, 2005 for general partnership purposes, including capital expenditures and acquisitions. In combination with our ability to issue new partnership units, we have significant resources to finance expansion projects and acquisitions.

16

We have a substantial presence in Florida, which has above-average population growth and significant cruise ship activity, and is not currently served by any local refinery or interstate refined product pipeline. Seven of our terminals serve TransMontaigne Inc.'s and our other customers' operations in metropolitan areas in Florida, which we believe to be an attractive area for the following reasons:

The terminaling services agreements we have with TransMontaigne Inc. and other significant customers will provide us with predictable cash flows. We are well-positioned to execute our strategy of expanding our asset base because our existing operations generate predictable revenues. We have a high occupancy rate of our storage capacity, which enables us to focus on expanding existing terminal capacities and acquiring additional terminal capacity for our current and future customers. A detailed discussion of the terms of several of our significant terminaling services agreements is provided below under "—Significant Customer Relationships—Terminaling Services Agreements."

Our geographical diversification allows us to provide customers with broad geographical presence to meet their needs. With the addition of the Brownsville terminal complex and the River facilities, we have significantly increased the geographic distribution of our terminals. Brownsville is the primary point of receipt and delivery for refined petroleum products and other chemicals between the United States and Mexico. Our Brownsville terminal complex handles a variety of products in addition to refined petroleum products, such as: liquefied petroleum gas, or LPG, naphtha, wax, fertilizer and chemicals. The River facilities significantly expand our terminal facilities outside of the Gulf Coast and the Midwest. As a result, we are able to provide more services to customers in more areas, and to serve customers that were not operating in our prior geographic areas.

Through TransMontaigne Inc. and Morgan Stanley Capital Group, our general partner has access to a knowledgeable management team with significant experience in the energy industry and in executing acquisition and expansion strategies. The members of our general partner's management team have significant experience with regard to the implementation of acquisition, operating and growth strategies in many facets of the energy industry, including crude oil marketing and transportation; natural gas and natural gas liquid gathering, processing, transportation and marketing; propane storage, transportation and marketing; and refined petroleum product storage, transportation and marketing. In addition, overOver the course of their respective careers, members of theour general partner's management team have established strong, long-standing relationships within the energy industry, which we believe will enable us to grow and expand our business through both acquisition and internal expansion. In addition, through our affiliation with Morgan Stanley Capital Group, we have strong relationships throughout the energy industry.

We face competition from other terminals and pipelines that may be able to supply our customers with refined product integrated terminaling and transportation services on a more competitive basis. We compete with national, regional and local terminal and transportation companies, including the major integrated oil companies, of widely varying sizes, financial resources and experience. These competitors include BP p.l.c., Chevron U.S.A. Inc., CITGO Petroleum Corporation, Conoco Phillips, Exxon Mobil Corporation, Amerada Hess Corporation, Holly Corporation and its affiliate Holly Energy Partners, L.P., Kinder Morgan, Inc. and its affiliate Kinder Morgan Energy Partners, L.P., Magellan Midstream Partners, L.P., Marathon Ashland Petroleum, LLC, Motiva Enterprises LLC, Murphy Oil Corporation, Sunoco, Inc. and its affiliate Sunoco Logistics Partners L.P., Valero L.P. and terminals in the Caribbean. In particular, our ability to compete could be harmed by factors we cannot control, including:

We also compete with national, regional and local terminal and transportation companies for acquisition and expansion opportunities. Some of these competitors are substantially larger than us and have greater financial resources and lower costs of capital than we do.

SIGNIFICANT CUSTOMER RELATIONSHIPS

We have several significant customer relationships that we expect to continue to derive the substantial majority of our revenues from for the foreseeable future. These relationships include:

| Customer | Location | |

|---|---|---|

| TransMontaigne Inc. | Gulf Coast, Midwest and Brownsville, Texas facilities | |

| Morgan Stanley Capital Group | Brownsville, Texas facilities | |

| Valero | River and Brownsville, Texas facilities | |

| Marathon | Gulf Coast and River facilities | |

| PMI | Brownsville, Texas facilities |

Our Relationship With TransMontaigne Inc. And Morgan Stanley Capital Group

General. A significant portion of our business is devoted to providing integrated terminaling and transportation services to TransMontaigne Inc. Pursuant to the terms of our terminaling services agreement with TransMontaigne Inc., we expect to continue to derive a substantial portion of our revenues from TransMontaigne Inc. for the foreseeable future.

We are controlled by our general partner, TransMontaigne GP L.L.C., which is a wholly-owned subsidiary of TransMontaigne Inc. TransMontaigne Inc., formed in 1995, is a terminaling, distribution and marketing company that markets refined petroleum products to wholesalers, distributors, marketers and industrial and commercial end users throughout the United States, primarily in the Gulf Coast, East Coast and Midwest regions. TransMontaigne Inc. also provides supply chain management services to various customers throughout the United States. At December 31, 2006, TransMontaigne Inc. owned 26 refined product terminals, of which 24 terminals are subject to our exclusive options to purchase, 14 tug boats and 20 barges, a hydrant system in Port Everglades, and its distribution and marketing

business. TransMontaigne Inc.'s marketing operations generally consist of the distribution and marketing of refined petroleum products through contract and rack spot sales in the physical markets, and providing related value-added fuel procurement and supply chain management services. On September 1, 2006, a wholly-owned subsidiary of Morgan Stanley Capital Group purchased all of the issued and outstanding common stock of TransMontaigne Inc. TransMontaigne Inc. and Morgan Stanley Capital Group have a significant interest in our partnership through their indirect ownership of approximately 44.6% limited partner interest and a 2% general partner interest.

Morgan Stanley Capital Group is a leading global commodity trader involved in proprietary and counterparty-driven trading in numerous commodities markets including crude oil and refined petroleum products, natural gas and natural gas liquids, coal, electric power, base and precious metals and others. Morgan Stanley Capital Group has been actively trading crude oil and products for over 20 years and on a daily basis trades millions of barrels of physical crude oil and refined petroleum products and exchange-traded and over-the-counter crude oil and refined petroleum product derivative instruments. Morgan Stanley Capital Group also invests as principal in acquisitions, including the acquisition of TransMontaigne Inc., that complement Morgan Stanley's commodity trading activities. Morgan Stanley Capital Group has substantial strategic long-term storage capacity located on all three coasts of the United States, in Northwest Europe and Asia.

Exclusive Options to Purchase Additional Refined Product Terminals. TransMontaigne Inc. has granted us an exclusive option to purchase its refined product terminals located at various points along the Plantation and Colonial pipeline corridors, which extend from the Gulf Coast through the Southeast and Mid-Atlantic regions, with a current aggregate active storage capacity of approximately 8.5 million barrels. The option with respect to the terminals along the Plantation and Colonial pipeline corridors will be exercisable for one year beginning in December 2007.

The exercise of the option will be subject to the negotiation of a purchase price and a terminaling services agreement relating to the terminals proposed to be purchased, and may be conditioned on obtaining various consents. Such consents may include consents of the holders of TransMontaigne Inc.'s credit facilities or governmental consents.

The exercise price would be determined according to a process in which, within 45 days of our notification that we wish to exercise the option, TransMontaigne Inc. would propose to our general partner the terms on which it would be willing to sell the terminals, including the terms of a terminaling services agreement. Within 45 days after TransMontaigne Inc.'s delivery of its proposed terms, we would propose a cash purchase price for the terminals. If we cannot agree on a purchase price after negotiating in good faith for 60 days, TransMontaigne Inc. would have the right to seek an alternative purchaser willing to pay at least 105% of the purchase price we proposed; if an alternative transaction on such terms has not been consummated within six months, we would have the right to purchase the terminals at the price we originally proposed. If we do not exercise this right, TransMontaigne Inc. would be free to retain or sell the facilities without restriction.

TransMontaigne Inc. also has offered to sell us tangible assets it acquires or constructs in the future. These circumstances are discussed in greater detail under "Item 13. Certain Relationships and Related Transactions—Omnibus Agreement; Obligation to Offer to Sell Acquired or Constructed Assets."

Terminaling Services Agreements

Terminaling Services Agreement Relating to Gulf Coast (Florida) and Midwest Facilities. We have a terminaling and transportation services agreement with TransMontaigne Inc. relating to our Florida and Midwest terminals that will expire on December 31, 2013. Under this agreement, TransMontaigne Inc. agreed to throughput at our Florida and Midwest terminals and transport on the Razorback Pipeline a volume of refined products that will, at the fee and tariff schedule contained in the agreement, result in

minimum revenues to us of $5 million per quarter, or $20 million per year. TransMontaigne Inc.'s minimum revenue commitment applies only to the Florida terminals and Midwest terminals acquired by us on May 27, 2005, and may not be spread among facilities we subsequently acquire. In exchange for TransMontaigne Inc.'s minimum revenue commitment, we agreed to provide TransMontaigne Inc. approximately 2.6 million barrels of light oil storage capacity and approximately 1.3 million barrels of heavy oil storage capacity at certain of our Florida terminals. If TransMontaigne Inc. fails to meet its minimum revenue commitment in any quarter, it must pay us the amount of any shortfall within 15 business days following receipt of an invoice from us. A shortfall payment may be applied as a credit in the following four quarters after TransMontaigne Inc.'s minimum obligations are met.

Gulf Coast (Mobile) Terminaling Services Agreement. We have a terminaling and transportation services agreement with TransMontaigne Inc. that will expire on December 31, 2012. Under this agreement, TransMontaigne Inc. agreed to throughput at our Mobile terminal certain minimum volumes of refined products that will result in minimum revenues to us of $2.1 million per year. In exchange for TransMontaigne Inc.'s minimum throughput commitment, we agreed to provide TransMontaigne Inc. approximately 46,000 barrels of light oil storage capacity and approximately 65,000 barrels of heavy oil storage capacity at the terminal. If TransMontaigne Inc. fails to meet its minimum revenue commitment in any year, it must pay us the amount of any shortfall within 15 business days following receipt of an invoice from us. A shortfall payment may be applied as a credit in the following year after TransMontaigne Inc.'s minimum obligations are met.

Asphalt Terminaling Services Agreement. On February 20, 2006, we entered into a new five-year terminaling services agreement with Marathon regarding approximately 1.0 million barrels of asphalt storage capacity throughout our Florida facilities. The terminaling services agreement became effective February 20, 2006 at our Jacksonville and Port Manatee, Florida facilities and on May 1, 2006 at our Cape Canaveral and Port Everglades, Florida facilities. Concurrently with the effective dates of the Marathon Agreement, our prior agreement with our former asphalt customer for the use of this storage capacity expired.

River Facilities Terminaling Services Agreement. We have a terminaling services agreement with Valero that will expire on April 1, 2013. Pursuant to the terminaling services agreement, we agreed to provide Valero with approximately 1.0 million barrels of light oil storage capacity at our Cape Girardeau, Evansville, Greenville, Henderson, Owensboro and Paducah terminals. Valero also has a right to match any third-party offer to use or lease any new or converted light oil petroleum product storage capacity that we put into commercial service at any of the terminals subject to the agreement. If Valero fails to exercise its right to match, it has the right to terminate the agreement in its entirety or with respect to the applicable terminal.

Brownsville LPG Terminaling Services Agreement. We have a terminaling and transportation services agreement with TransMontaigne Inc. relating to our Brownsville terminal that will expire on March 31, 2010. Under this agreement, TransMontaigne Inc. agreed to throughput at our terminals certain minimum volumes of natural gas liquids that will result in minimum revenues to us of $1.4 million per year. In exchange for TransMontaigne Inc.'s minimum throughput commitment, we agreed to provide TransMontaigne Inc. approximately 33,700 barrels of storage capacity at our Brownsville, Texas terminal complex.

PMI Terminaling Services Agreements. We have five (5) terminaling services agreements with PMI relating to our Brownsville facilities that, if not renewed, will expire between May 31, 2007 and June 30, 2016. Under these agreements, PMI agreed to throughput and store at our terminals certain minimum volumes of diesel, gasoline, natural gasoline, distillate, and naphtha liquids. We also manage and operate a 17-mile bi-directional pipeline on behalf of PMI on a cost-plus basis.

Morgan Stanley Capital Group Terminaling Services Agreement. On November 1, 2006, we entered into a terminaling services agreement with Morgan Stanley Capital Group relating to our Brownsville facilities that will expire on October 31, 2010. Under this agreement, Morgan Stanley Capital Group agreed to store a specified minimum amount of fuel oils at our terminals that will result in minimum revenues to us of approximately $2.2 million per year. In exchange for its minimum revenue commitment, we agreed to provide Morgan Stanley Capital Group a minimum amount of storage capacity for such fuel oils.

Oklahoma City Terminaling Services Agreement. We have a revenue support agreement with TransMontaigne Inc. that provides that in the event any current third-party terminaling agreement should expire, TransMontaigne Inc. agrees to enter into a terminaling services agreement that will expire no earlier than November 1, 2012. The agreement provides that TransMontaigne Inc. agrees to throughput certain minimum volumes of refined product that will result in minimum revenues to us of $0.8 million per year. TransMontaigne Inc.'s minimum revenue commitment currently is not in effect because a major oil company is under contract for the utilization of the light oil storage capacity at the terminal.

Other Terminaling Services Agreements. We also have terminaling service agreements with other customers at our terminal facilities for throughput and storage of refined petroleum products, LPGs and other products. These agreements include various minimum throughput commitments, storage commitments and other terms, including duration, that we negotiate on a case-by-case basis.

TERMINALS AND PIPELINE CONTROL OPERATIONS

Our pipeline is The pipelines we own or operate are operated via geosynchronous satellite, microwave, radio and frame relay communication systems from a central control room located in Atlanta, Georgia. We also monitor activity at our terminals from this control room.

The control center operates with state-of-the-art System Control and Data Acquisition, or SCADA, systems. Our control center is equipped with computer systems designed to continuously monitor operational data, including refined product throughput, flow rates and pressures. In addition, the control center monitors alarms and throughput balances. The control center operates remote pumps, motors, engines, and valves associated with the receipt of refined products. The computer systems are designed to enhance leak-detection capabilities, sound automatic alarms if operational conditions outside of pre-established parameters occur, and provide for remote-controlled shutdown of pump stations on the pipeline. Pump stations and meter-measurement points on the pipeline are linked by satellite or telephone communication systems for remote monitoring and control, which reduces our requirement for full-time on-site personnel at most of these locations.

Despite these controls, during the year ended December 31, 2006, two unrelated releases of product (gasoline and fuel oil, respectively) resulted in aggregate unreimbursed environmental remediation costs and product losses of approximately $1.2 million. Each was due to human error and did not involve any system malfunctions. We have analyzed the causes of these accidents and have taken steps designed to reduce the likelihood of similar events in the future.

We perform preventive and normal maintenance on ourthe pipeline and terminal systemsystems we operate or own and make repairs and replacements when necessary or appropriate. We also conduct routine and required inspections of ourthe pipeline and terminal tanks we operate or own as required by code or regulation. External coatings and impressed current cathodic protection systems are used to protect against external corrosion. We conduct all

17

cathodic protection work in accordance with National Association of Corrosion Engineers standards. We continually monitor, test, and record the effectiveness of these corrosion inhibiting systems.

We monitor the structural integrity of selected segments of our Razorback Pipeline, systemwhich we own, and the bi-directional refined products pipeline that we operate and maintain on behalf of PMI through a program of periodic internal inspections as well as hydrostatic testing that conforms to Federal standards. Beginning in 2002, the Department of Transportation, or DOT, required internal inspections or other integrity testing of all DOT-regulated crude oil and refined product pipelines. We internally tested the Razorback Pipeline in 2004 and have completed all necessary repairs and maintenance.

Maintenance facilities containing equipment for pipe repairs, spare parts, and trained response personnel are located along the Razorback Pipeline.Pipeline and the bi-directional refined products pipeline that we manage for PMI. Employees participate in simulated spill deployment exercises on a regular basis. They also participate in actual spill response boom deployment exercises in planned spill scenarios in accordance with Oil Pollution Act of 1990 requirements. We believe that the Razorback Pipeline haspipelines we own and manage have been constructed and isare maintained in all material respects in accordance with applicable federal, state, and local laws and the regulations and standards prescribed by the American Petroleum Institute, the DOT, and accepted industry practice.

At our terminals, tanks designed for gasoline storage are equipped with internal or external floating roofs that minimize emissions and prevent potentially flammable vapor accumulation between fluid levels and the roof of the tank. Our terminal facilities have facility response plans, spill prevention and control plans, and other plans and programs to respond to emergencies.

Many of our terminal loading racks are protected with water deluge systems activated by either heat sensors or an emergency switch. Several of our terminals also are protected by foam systems that are activated in case of fire. All of our terminals are subject to participation in a comprehensive environmental management program to assure compliance with applicable air, solid waste, and wastewater regulations.

We are subject to regulation by the United States Department of Transportation under the Accountable Pipeline and Safety Partnership Act of 1996, sometimes referred to as the Hazardous Liquid Pipeline Safety Act or HLPSA, and comparable state statutes relating to the design, installation, testing, construction, operation, replacement and management of ourthe pipeline facilities.facilities we operate or own. HLPSA covers petroleum and petroleum products and requires any entity that owns or operates pipeline facilities to comply with such regulations and also to permit access to and copying of records and to make certain reports and provide information as required by the Secretary of Transportation. We believe that we are in material compliance with these HLPSA regulations.

The United States Department of Transportation Office of Pipeline Safety, or OPS, has promulgated regulations that require qualification of pipeline personnel. These regulations require pipeline operators to develop and maintain a written qualification program for individuals performing covered tasks on pipeline facilities. The intent of this regulationthese regulations is to ensure a qualified work force and to reduce the probability and consequence of incidents caused by human error. The regulation establishesregulations establish qualification requirements for individuals performing covered tasks, and amends certain training requirements in existing regulations. We believe that we are in material compliance with these OPS regulations.

We also are subject to OPS regulation for High Consequence Areas, or HCAs, for Category 2 pipeline systems (companies operating less than 500 miles of jurisdictional pipeline). This regulation specifies how to assess, evaluate, repair and validate the integrity of pipeline segments that could impact

18