UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT

pursuant to Section 13 or 15 (d) of the

Securities Exchange Act of 1934

FOR THE YEAR ENDED DECEMBER 31, 20062008

1-2360

(Commission file number)

INTERNATIONAL BUSINESS MACHINES CORPORATION

(Exact name of registrant as specified in its charter)

| NEW YORK (State of Incorporation) | 13-0871985 (IRS Employer Identification Number) | |

ARMONK, NEW YORK (Address of principal executive offices) | 10504 (Zip Code) |

914-499-1900

(Registrant's telephone number)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Voting shares outstanding at February | Name of each exchange on which registered | ||

|---|---|---|---|---|

Capital stock, par value $.20 per share | New York Stock Exchange | |||

| Chicago Stock Exchange | ||||

New York Stock Exchange | ||||

| New York Stock Exchange | ||||

| New York Stock Exchange | ||||

| 7.50% Debentures due 2013 | New York Stock Exchange | |||

| 8.375% Debentures due 2019 | New York Stock Exchange | |||

| 7.00% Debentures due 2025 | New York Stock Exchange | |||

| 6.22% Debentures due 2027 | New York Stock Exchange | |||

| 6.50% Debentures due 2028 | New York Stock Exchange | |||

| 7.00% Debentures due 2045 | New York Stock Exchange | |||

| 7.125% Debentures due 2096 | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a non-accelerated filer.smaller reporting company. See definition of "accelerated filer," "large accelerated filer" and large accelerated filer""smaller reporting company" in Rule 12b-2 of the Exchange Act. Large accelerated filer ý Accelerated filer o Non-Accelerated filer o

| Large accelerated filer ý | Accelerated filer o | Non-Accelerated filer o | ||

| Smaller reporting company o | (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes o No ý

The aggregate market value of the voting stock held by non-affiliates of the registrant as of the last business day of the registrant's most recently completed second fiscal quarter was $116.9$160.6 billion.

Documents incorporated by reference:

Portions of IBM's Annual Report to Stockholders for the year ended December 31, 20062008 into Parts I, II and IV of Form 10-K.

Portions of IBM's definitive Proxy Statement to be filed with the Securities and Exchange Commission and delivered to stockholders in connection with the Annual Meeting of Stockholders to be held April 24, 200728, 2009 are incorporated by reference into Part III of Form 10-K.

Item 1. Business:

International Business Machines Corporation (IBM or the company) was incorporated in the State of New York on June 16, 1911, as the Computing-Tabulating-Recording Co. (C-T-R), a consolidation of the Computing Scale Co. of America, the Tabulating Machine Co. and The International Time Recording Co. of New York. Since that time, IBM has focused on the intersection of business insight and technological invention, and its operations and aims have been international in nature. This was signaled over 80 years ago, in 1924, when C-T-R changed its name to International Business Machines Corporation. And it continues today: IBM is a globally integrated innovation company, serving the needs of enterprises and institutions worldwide. To help clients achieve growth, effectiveness, efficiency and the realization of greater value through innovation, IBM draws upon the world's leading systems, software and services capabilities.

* * *

Description of Business

IBM is a globally integrated innovation company, serving the needs of enterprises and institutions worldwide. The company seeks to becreates business value for clients and solves business problems through integrated solutions that leverage information technology and deep knowledge of business processes. IBM solutions typically create value by reducing a partner in its clients' successclient's operational costs or by enabling their own capacity to innovate, sonew capabilities that they may differentiate themselves for competitive advantage in a globalized economy. IBM viewsgenerate revenue. These solutions draw from an industry leading portfolio of consulting, delivery and implementation services, enterprise innovation not only in terms of productssoftware, systems and services, but across all dimensions of a business: its business processes, business model, management systems, culture and role in society. To help clients achieve growth, effectiveness, efficiency and the realization of greater value through innovation, IBM draws upon the world's leading systems, software and services capabilities.financing.

IBM's Strategy

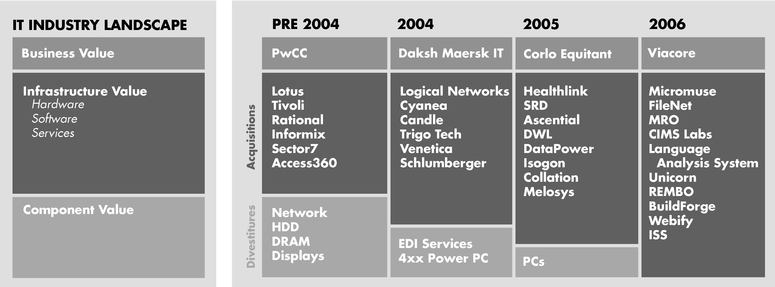

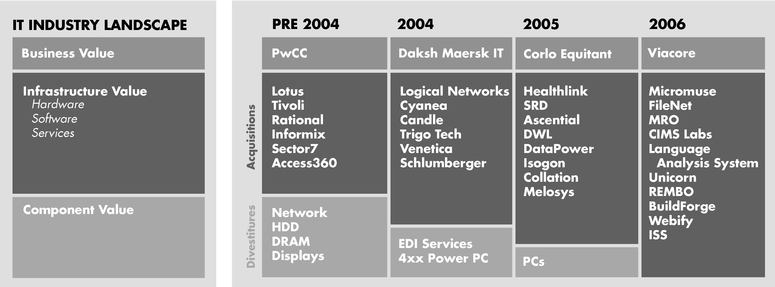

The company has divested low growth commoditizing product lines and acquired higher value opportunities to leverage IBM's infrastructure.

In IBM's view, today's networked economy has created a global business landscape and a mandate for business change. It also opens the futureopportunity to upgrade the efficiency and effectiveness of businessthe global infrastructure through embedded information technology—what IBM calls a "smarter planet." Smart airports, smart highways, smart supply chains are all possible. IBM is being shaped byworking with clients and governments around the forcesworld to explore these opportunities and implement new ideas.

Integrated global economies have opened markets of global integrationnew opportunity and innovation. They are foundationalnew sources of skills. The Internet has enabled communication and intimately related to one another. A globally integrated enterprise iscollaboration across the world and brought with it a new institutional formcomputing model premised on continuous global connection. In that shapeslandscape, companies can distribute work and technology anywhere in the world. IBM continues to adjust its footprint toward emerging geographies, tapping their higher growth, providing the technology infrastructure they need and taking advantage of the talent pools they provide to better service the company's clients.

At the same time, the current economic crisis increases the pressure on both businesses and governments around the world to adapt. The needs for additional transparency, security and efficiencies are clear.

Given these opportunities and economic challenges, IBM is working with its clients to develop new business designs and technical architectures that allow their businesses the flexibility required to compete in this new landscape. IBM's strategy managementaddresses this new era and operations globally, baseddelivers value to its clients through three strategic priorities:

Focus on economics, expertiseOpen Technologies and High-Value Solutions

A new computing model has emerged, replacing the PC-based, client/server approach. This new model is networked, modular, open business environments. Itand represents a fundamental shift in the technology requirements of the company's clients. IBM is optimized for innovation in a worldwide economywell positioned to provide its enterprise clients the open technologies and society that are increasingly integrated and specialized. IBM's strategic moves over the past several years—from divestitures and acquisitions,high-value solutions they will need to areas of focus for innovation, to the transformation of its core lines of business—have been shaped by this vision.

IBM's strategic priorities to pursue this vision include:compete.

IBM's Capabilities

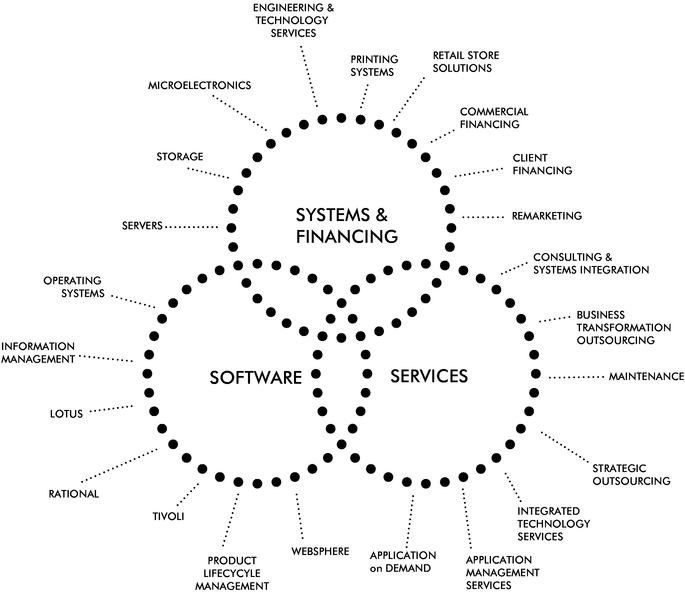

To execute its strategy, IBM's business comprises three principal business segments:

SYSTEMSDeliver Integration and Innovation to Clients

Changes in the market have caused IBM's clients to seek flexibility and innovation in everything from technical architecture to their business model. In response, IBM is focused on delivering integration and innovation to its clients—offering them technologies and services that support real value creation.

Become the Premier Globally Integrated Enterprise

As global networks and technology capabilities change business economics, legacy business designs can quickly become noncompetitive. IBM believes a globally-integrated enterprise, designed for this new landscape, can compete effectively and will benefit from the opportunities offered.

Looking forward, IBM is confident it understands the economic shift of globalization, the evolution of the new computing model and the powerful role of innovation in this new landscape. Its unique capabilities are well adapted to help the company's clients innovate and compete effectively in this new environment.

BUSINESS MODEL

The company's business model is built to support two principal goals: helping clients succeed in delivering business value by becoming more innovative, efficient and competitive through the use of business insight and IT solutions; and, providing long-term value to shareholders. The business model has been developed over time through strategic investments in capabilities and technologies that have the best long-term growth and profitability prospects based on the value they deliver to clients.

The company's global capabilities include services, software, hardware, fundamental research and related financing. The broad mix of businesses and capabilities are combined to provide business insight and solutions for the company's clients.

The business model is flexible, adapting to the continuously changing market and economic environment. The company has divested commoditizing businesses like personal computers and hard disk drives, and strengthened its position through strategic investments and acquisitions in higher value segments like business intelligence and analytics, virtualization and green solutions. In addition, the company has transformed itself into a globally integrated enterprise which has improved overall productivity and is driving investment and participation in the world's fastest growing markets. As a result, the company is a higher performing enterprise today than it was several years ago.

The business model, supported by the company's long-term financial model, has enabled the company to deliver consistently strong earnings, cash flows and returns on invested capital in changing economic environments.

BUSINESS SEGMENTS AND FINANCINGCAPABILITIES

The company's major operations are comprised of: a Global Technology Services segment; a Global Business Services segment; a Software segment; a Systems and Technology segment; and a Global Financing segment.

Global Services is a critical component of the company's strategy of providing IT infrastructure and business insight and solutions to clients. While solutions often include industry-leading IBM software and hardware, other suppliers' products are also used if a client solution requires it. Within Global Services there are two reportable segments: Global Technology Services and Global Business Services.

SystemsGlobal Technology Services (GTS) primarily provides IT infrastructure services and business process services, delivering business value through the company's global scale, standardization and automation.

GTS Capabilities

Servers. IBM systems using IBM operating systems (System z and System i), as well as AIX, the IBM UNIX operating system (System p and BladeCenter) and the Microsoft Windows operating system (System x and BladeCenter). All servers can also run Linux, a key open source operating system.

Storage. Data storage products, including disk, tape, optical and storage area networks (SAN).

Microelectronics. Semiconductor design and manufacturing of customized products including microprocessors, application specific integrated circuits and standard products for IBM systems and external clients.

Engineering and Technology Services (E&TS). System and component design services, strategic outsourcing of clients' design teams, and technology and manufacturing consulting services.

Printing Systems. Production print solutions, on demand print related solutions, enterprise workgroup print technologies, print management software, services and maintenance.

Retail Store Solutions. Point-of-sale retail systems, software and solutions.

Financing

Commercial Financing. Short-term inventory and accounts receivable financing to dealers and remarketers of IT products.

Client Financing. Lease and loan financing to external and internal clients for terms generally between two and seven years.

Remarketing. The sale and lease of used equipment (primarily sourced from the conclusion of lease transactions) to new or existing clients.

SOFTWARE

Information Management Software. Advanced database, content management and information integration software that helps companies integrate, manage and gain value from their business information.

Lotus Software. Collaboration, messaging and social networking software that enables businesses to communicate, collaborate and increase productivity.

Rational Software. Software and process automation tools that help clients manage the business process of software and systems delivery.

Tivoli Software. Software for infrastructure management, including security and storage management that will help organizations better manage their IT infrastructure to more effectively deliver IT services.

WebSphere Software. Provides the foundation for web-enabled applications and is a key product set in deploying a Service Oriented Architecture. Management of a wide variety of business processes using open standards to interconnect applications, data and operating systems.

Product Lifecycle Management (PLM). Software that enables clients to improve their product development processes and their ability to use product-related information across their businesses.

Operating Systems. Software engines that manage the fundamental processes that make computers run.

SERVICES

Business Process Services (BPS). A range of offerings from standardized processing platforms and Business Process Outsourcing (BPO) through Business Transformation Outsourcing (BTO) that delivers improved business results to clients through the strategic change and/or operation of the client's business processes, applications and infrastructure.

Consulting and Systems Integration (C&SI). Delivery of value to clients through consulting services for client relationship management, financial management, human capital, business strategy and change and supply chain management.

Strategic Outsourcing Services (SO).Services. Comprehensive IT services integrated with business insight working with clients to reduce costs and improve productivity through the outsourcing of processes and operations.

Integrated Technology Services (ITS).Services. Services offerings that help clients access, manage and support their technology infrastructures, through a combination of skilled resources, software and IBM's knowledge of business processes. The portfolio includes Service Product Lines which complement hardware from Systems and Technology and software offerings from the Software business.

Business Transformation Outsourcing. A range of offerings from standardized processing platforms and Business Process Outsourcing through transformational offerings that deliver improved business results to clients through the strategic change and/or operation of the client's business processes, applications and infrastructure.

Maintenance. A number of support services from product maintenance through solution support to maintain and improve the availability of clients' IT infrastructure.

Global Business Services (GBS) primarily provides professional services and application outsourcing services, delivering business value and innovation to clients through solutions which leverage industry-and business-process expertise.

GBS Capabilities

Consulting and Systems Integration. Delivery of value to clients through consulting services for client relationship management, financial management, human-capital management, business strategy and change, and supply-chain management.

Application Management Services (AMS).Services. Application development, management, maintenance and support services for packaged software, as well as custom and legacy applications.

Applications on Demand (AoD). Solutions for the management of clients' Web-based infrastructure and business applications, as well as a growing portfolio of industry-specific independent software vendor (ISV) solutions that are Value is delivered as a service.

Business Segments

Organizationally, the company's major operations comprise a Global Technology Services segment; a Global Business Services segment; a Systems and Technology Group segment; a Software segment; and a Global Financing segment.

GLOBAL SERVICES is a critical component of the company's strategy of providing insight and solutions to clients. While solutions often include industry-leading IBM software and hardware, other suppliers' products are also used if a client solution requires it. Contracts for IBM services—commonly referred to as "signings"—can range from less than one year to over ten years. Within Global Services there are two reportable segments: Global Technology Services and Global Business Services.

Global Technology Services (GTS) segment primarily reflects infrastructure services, delivering value through the company's global scale,resource capabilities, industry knowledge and the standardization and automation. It includes outsourcing services, Integrated Technology Services and Maintenance.automation of application development.

Global Business Services (GBS)Software segment primarily reflects professional services, delivering business value and innovation to clients through solutions which leverage industry and business process expertise. It includes consulting, systems integration and Application Management Services.

SYSTEMS AND TECHNOLOGY GROUP provides IBM's clients with business solutions requiring advanced computing power and storage capabilities. Approximately 55 percent of the Systems and Technology Group's server and storage sales transactions are through business partners; approximately 45 percent are direct to end-user clients, more than half of which are through the Web at ibm.com. In addition, the group provides leading semiconductor technology and products, packaging solutions and engineering technology services to clients and for IBM's own advanced technology needs. While not reported as external revenue, hardware is also deployed to support services solutions.

SOFTWAREconsists primarily of middleware and operating systems software. Middleware software enables clients to integrate systems, processes and applications across a standard software platform. IBM Middlewaremiddleware is designed to open standards which allows the efficient integration of disparate client applications that may have been built internally, or provided by packagepackaged software vendors or system integrators. Operating systems are the software engines that run computers. In addition, Software includes Product Lifecycle Management software which primarily serves the Industrial sector. Approximately 25 percent of software transactions are sold through business partners. Also, 50 percenttwo-thirds of external Softwaresoftware segment revenue is annuity-based, coming from recurring license charges and ongoing subscription and support from one-time charge (OTC) arrangements. The remaining one-third of external revenue relates to one-time charge (OTC)OTC arrangements, wherebyin which the client pays one up-front payment for a perpetual license. The remaining annuity-based revenue consists of both maintenance revenue sold with OTC arrangements, as well as revenue from software sold on a recurring license charge arrangement. Typically, arrangements for the sale of OTC software include one year of maintenance. The client can also purchase ongoing maintenance after the first year, which includes product upgrades and technical support. While not reported as external revenue,

Software Capabilities

WebSphere Software. Management of a wide variety of business processes using open standards to interconnect applications, data and operating systems. Provides the foundation for Web-enabled applications and is a key product set in deploying a SOA.

Information Management Software. Advanced database, content management, information integration and business intelligence software is also deployedthat helps companies integrate, manage and gain value from their business information.

Tivoli Software. Software for infrastructure management, including security and storage management that will help organizations better manage their IT infrastructure to support servicesmore effectively deliver IT services.

Lotus Software. Collaboration, messaging and social networking software that enables businesses to communicate, collaborate and increase productivity.

Rational Software. Software tools that help clients manage their software development processes and capabilities. With the acquisition of Telelogic in 2008, Rational software supports software development for both IT solutions and embedded system solutions.

GLOBAL FINANCINGOperating Systems. Software that manages the fundamental processes that make computers run.

Systems and Technology provides clients with business solutions requiring advanced computing power and storage capabilities. Approximately 55 percent of Systems and Technology's server and storage sales transactions are through the company's business partners; approximately 45 percent are direct to end-user clients. In addition, Systems and Technology provides leading semiconductor technology and products, packaging solutions and engineering technology services to clients and for IBM's own advanced technology needs.

Systems and Technology Capabilities

Servers. IBM systems, which are typically connected to a network and provide the required infrastructure for business. These systems use both IBM and non-IBM operating systems, and all IBM servers can also run Linux, a key open source operating system. (System z, legacy System i, converged System p and System x).

Storage. Information infrastructure products and solutions, which address critical client requirements for information retention and archiving, availability and virtualization, and security and compliance. The portfolio consists of a broad range of disk and tape storage systems and software.

Microelectronics. Semiconductor design and manufacturing primarily for use in IBM systems and for sale to external clients (OEM).

Retail Store Solutions. Point-of-sale retail systems (network connected cash registers) as well as solutions which connect them to other store systems.

Global Financing is described on pages 4953 through 5357 in IBM's 20062008 Annual Report to Stockholders.

Global Financing Capabilities

Client Financing. Lease and loan financing to end user and internal clients for terms generally between two and seven years.

Commercial Financing. Short-term inventory and accounts receivable financing to dealers and remarketers of IT products.

Remarketing. The sale and lease of used equipment (primarily sourced from the conclusion of lease transactions) to new or existing clients.

IBM Worldwide OrganizationsWORLDWIDE ORGANIZATIONS

The following three company-wideworldwide organizations play key roles in IBM's delivery of value to its clients:

SALES & DISTRIBUTION ORGANIZATIONSales and Distribution

WithIBM has a comprehensive knowledgesignificant global presence, operating in over 170 countries, with an increasingly broad-based geographic distribution of IBM's business and infrastructure solutions, as well as the products, technologies and services IBM and its business partners offer, therevenue. The company's global client teams gain a deep understanding of each client's organizational, infrastructure and industry-specific needs to determine the best approach for addressing their critical business and IT challenges. These professionals work in integrated teams with IBM consultants and technology representatives, combining their deep skills and expertise to deliver high-value solutions that address clients' pain points and innovational aspirations.

To facilitate its access to clients and local markets and to improve productivity, the Sales and Distribution organization utilizesmanages a strong global footprint, with dedicated country based operating units focused on delivering client value. Within these units, client relationship professionals work with integrated teams of consultants, product specialists and delivery fulfillment teams to improve clients' business performance. These teams deliver value by understanding the clients' business and needs, and then bring together capabilities from across IBM and an extensive network of Business Partners to develop and implement solutions.

By combining global expertise with local experience, IBM's geographic organizations in the Americas, Europe/Middle East/Africa (EMEA) and Asia Pacific geographies. This structure enables dedicated management focus for local clients, speed in addressing new market opportunities and timely investments in emerging opportunities. The geographic units align industry-skilled resources to serve clients' agendas. IBM extends capabilities to mid-market client segments by leveraging industry skills with marketing, ibm.com and decision makinglocal Business Partner resources.

In 2008, the company implemented a new growth markets organization to be closer toincrease its focus on the clients.emerging markets of Brazil, Russia, India and China and the additional opportunities around the world that have market growth rates greater than the global average—countries within Southeast Asia, Eastern Europe, the Middle East and Latin America. The company's major markets include the United States, Canada, the U.K., France, Germany, Italy, Japan, Denmark, Sweden, Switzerland, Austria, Belgium, Finland, Greece, Ireland, the Netherlands, Portugal, Cyprus, Norway, Israel, Spain, the Bahamas and the Caribbean region.

The majority of IBM's revenue, excluding the company's original equipment manufacturer (OEM) technology business, occurs in industries that are broadly grouped into six sectors:

Internal Routes-to-Market

Services consultants focused on selling end-to-end solutions for large, complex business challenges.

HardwareResearch, Development and software brand specialistsIntellectual Property selling IBM products as parts of discrete technology decisions and as part of broader client solutions.

ibm.com provides fast, easy access to IBM's product and business expertise via the Web and telephone. In addition, ibm.com identifies business opportunities for all of IBM's routes to market and provides online and telephone sales of standard hardware, software, services and financing for all size companies.

Business Partners Routes-to-Market

Global/major independent software vendors (ISVs). ISVs deliver business process or industry-specific applications and, in doing so, often influence the sale of IBM hardware, middleware and services.

Global/major systems integrators (SIs). SIs identify business problems and design solutions when IBM Global Services is not the preferred systems integrator; they also sell computing infrastructures from IBM and its competitors.

Regional ISVs and SIs. SIs identify the business problems, and ISVs deliver business process or industry-specific applications to medium-sized and large businesses requiring IBM computing infrastructure offerings.

Solutions providers, resellers and distributors. Resellers sell IBM platforms and value-added services as part of a discrete technology platform decision to clients wanting third-party assistance.

RESEARCH, DEVELOPMENT AND INTELLECTUAL PROPERTY

IBM's research and development (R&D) operations differentiate IBMthe company from its competitors. IBM annually spends approximately $6 billion for R&D, focusing its investments inon high-growth, high-value opportunities. In 2006, the company's investment in R&D was approximately 15 percent of its combined hardware and software revenue. As a result of innovations in these and other areas, IBM was once again awarded more U.S. patents in 20062008 than any other company. This markscompany, the 14th yearfirst company to achieve over 4,000 patents in a row that IBM achieved this distinction.year. The company will continue to actively seek intellectual property protection for its innovations, while increasing emphasis on other initiatives designed to leverage its intellectual property leadership and promote innovation.

In addition to producing world-class hardware and software products, IBM innovations are also a major differentiator in providing solutions for the company's clients through its growing services activities.businesses. The company's investments in R&D also result in intellectual property (IP) income of approximately $1 billion annually. Some of IBM's technological breakthroughs are used exclusively in IBM products, while others are licensed and may be used in either/both IBM products and/or the products of the licensee.

In addition While the company's various proprietary intellectual property rights are important to these IP income sources, the company also generates value from its patent portfolio through cross-licensing arrangements and IP licensed in divestiture transactions. The value of these transactionssuccess, IBM believes its business as a whole is not readily apparentmaterially dependent on any particular patent or license, or any particular group of patents or licenses. IBM owns or is licensed under a number of patents, which vary in the Consolidated Statement of Earnings, because income on cross-licensing arrangements is recorded onlyduration, relating to the extent that cash is received. The value received for IP involving the sale of a business is included in the overall gain or loss from the divestiture, not in the separately presented IP income amounts on the Consolidated Statement of Earnings.its products. Licenses under patents owned by IBM have been and are being granted to others under reasonable terms and conditions.

INTEGRATED SUPPLY CHAINIntegrated Supply Chain

Just as IBM worksConsistent with the company's work with clients to transform its clients'their supply chains for greater efficiency and responsiveness to global market conditions, the company continues to derive business value from its own globally integrated supply chain, reinvented aswhich provides a strategic advantage for the company to create value for clients and shareholders.clients. IBM leverages its supply chain expertise for clients through its supply-chain business

transformation outsourcing service to optimize and help runoperate clients' end-to-end supply chainsupply-chain processes, from procurement to logistics.

IBM spends approximately $36$38 billion annually through its supply chain, procuring materials and services around the world.globally. The company's supply, manufacturing and logistics and customer fulfillment operations are integrated in one operating unit that has reducedoptimized inventories over time, improved response to marketplace opportunities and external risks and converted fixed costs to variable costs. Simplifying and streamlining internal processes has improved operations, and sales force productivity and processes, and these actions have improved client satisfaction when working with the company. Since somesatisfaction.

Integrated Technology Delivery

Integrated Technology Delivery (ITD) combines all of the cost savings this unit generates are passed along to clients, they will not always result inworldwide service delivery capabilities for Strategic Outsourcing with strong local and regional management teams supported by a visible gross margin improvement inset of global competencies. ITD leverages the company's Consolidated Statement of Earnings. IBM is continuingglobal scale and advanced technology to applydeliver standardized solutions that are automated, repeatable and globally integrated. Clients gain cost advantages, access to industry-leading skills and IBM's scale and overall flexibility. ITD manages the supply-chain principles of product manufacturingworld's largest privately-owned IT infrastructure with employees in over 40 countries supporting over 450 data centers.

Business Process Delivery

Business Process Delivery (BPD) provides highly efficient, world-class delivery capabilities in IBM's business process delivery operations, which include Business Transformation Outsourcing, Business Process Outsourcing and Business Process Services. BPD has employees and delivery to service delivery across its solutions and services lines of business.

In addition to its own manufacturing operations, the company uses a number of contract manufacturing (CM) companies around the world to manufacture IBM-designed products. The use of CM companies is intended to generate cost efficiencies and reduce time-to-market for certain IBM products.centers in over 40 countries worldwide.

Key Business Drivers

The following are some of the key drivers of the company's business.

ECONOMIC ENVIRONMENT AND CORPORATE SPENDING BUDGETS

If overall demand for systems, software and services changes, whether due to general economic conditions or a shift in corporate buying patterns, sales performance could be impacted. IBM's diverse set of products and offerings is designed to provide more consistent results in both strong and weak economic environments. The company accomplishes this by not only having a mix of offerings with long-term cash and income streams, as well as cyclical transaction-based sales, but also by continually developing competitive products and solutions and effectively managing a skilled resource base. IBM continues to transform itself to take advantage of shifting demand trends, focusing on client- or industry-specific solutions, business performance and open standards.

INTERNAL BUSINESS TRANSFORMATION AND GLOBAL INTEGRATION INITIATIVES

IBM continues to drive greater productivity, flexibility and cost savings by transforming and globally integrating its own business processes and functions. In 2006, the company continued the global integration of its internal support functions—such as Legal, Finance, Human Resources, Information Technology and Real Estate Site Operations—which had been previously replicated for many of the individual countries where IBM operates. In addition to eliminating redundancies and overhead structures to drive productivity, this integration has improved IBM's capacity to innovate by providing greater clarity of key priorities around shared goals and objectives and led to a sharper focus for the company on learning, development and knowledge sharing. The company will continue to focus on global integration initiatives to improve productivity in its integrated supply chain, service delivery and internal support functions.

INNOVATION INITIATIVES

IBM invests to improve its ability to help its clients innovate. Investment may occur in the research and development of new products and services, as well as in the establishment of new collaborative and co-creation relationships with developers, other companies and other institutions. Examples include IBM's leadership position in the design and fabrication of game processors; the design of smaller, faster and energy-efficient semiconductor devices; and the design of "grid" computing networks that allow computers to share processing power.

Through the Global Innovation Outlook (GIO), IBM has opened up its technical and business forecasting processes to include external leaders from business, academia, the public sector, nongovernmental organizations and other influential constituents of the world community. The GIO takes a deep look at some of the most pressing issues facing the world and works toward providing solutions to those needs. In 2006, IBM also announced that it will invest $100 million over the next two years to pursue ten new businesses generated by InnovationJam, an on-line brainstorming session which brought together more than 150,000 people from 104 countries, including IBM employees, family members, universities, business partners and clients from 67 companies. Over two 72-hour sessions, participants posted more than 46,000 ideas as they explored IBM's most advanced research technologies and considered their application to real-world problems and emerging business opportunities.

OPEN STANDARDS

The broad adoption of open standards is essential to the computing model for an on demand business and is a significant driver of collaborative innovation across all industries. Without interoperability among all manner of computing platforms, the integration of any client's internal systems, applications and processes remains a monumental and expensive task. The broad-based acceptance of open standards—rather than closed, proprietary architectures—also allows the computing infrastructure to more easily absorb (and thus benefit from) new technical innovations. IBM's support of open standards is evidenced by the enabling of its products to support open standards such as Linux, and the development of Rational software development tools, which can be used to develop and upgrade other companies' software products.

INVESTING IN GROWTH OPPORTUNITIESCOMPETITION

The company is continuinga globally-integrated enterprise, doing business in over 170 countries. The company participates in the highly competitive information technology (IT) industry, where its competitors vary by industry segment, and range from large multinational enterprises to refocussmaller, more narrowly focused entities. Overall, across its business onsegments, the company recognizes hundreds of competitors worldwide.

The markets for each of the company's business segments is characterized by aggressive competition among all types of competitors. Across its business, the company's principal methods of

competition are: technology innovation; performance; price; quality; brand; its broad range of capabilities, products and services; client relationships; the ability to deliver business value to clients; and, service and support. In order to maintain leadership in the IT industry, a corporation must continue to invest, innovate and integrate. Over the past several years, the company has been executing a strategy to transform its business, including shifting to higher value market segments of enterprise computing—providing technology and transformation services to clients' businesses. Consistent with that focus,offerings and increasing its capabilities through internal investments and strategic acquisitions. Overall, the company continuesis the leader or among the leaders in each of its business segments.

A summary of the competitive environment for each business segment is included below:

Global Services:

The company's services segments, GTS and GBS, operate in a highly competitive and continually evolving global market. GTS competes in strategic outsourcing, business transformation outsourcing, integrated technology services and IT support services. GBS competes in consulting, system integration and application management services. The principal competitive factors in these business segments include: technical skills and capabilities, innovative service and product offerings, the ability to add value and the time-to-value, price, client relationships, quality of sales and delivery, reliability, security and the availability of resources. The company's competitive advantages in the services business include its global reach and scale, best-of-breed process and industry skills, extensive technology expertise and infrastructure management, an ability to deliver integrated solutions that can address clients' needs in any environment and a strong set of relationships with clients and strategic business partners worldwide. GTS competes with a variety of competitors worldwide across its principal market segments: the global, broad based competitors are Hewlett-Packard Company (HP), Accenture and Computer Sciences Corporation. Indian service providers, including Satyam Computer Services Ltd. and Wipro Technologies (Wipro), are moving to offer managed infrastructure services, targeting similar customer segments to GTS. The principal competitors for GBS are Accenture, Infosys Consulting and Wipro.

Software:

The enterprise management software market is highly competitive and the key competitive factors in this segment include: functionality, ease of use, scalability, compliance with open standards and total cost of ownership. The company's leadership in these areas provides it with competitive advantages. The company's software business includes middleware, operating systems and related software provided to all industry segments worldwide. The middleware portfolio is the broadest in the industry and it also covers both mainframe and distributed computing environments. The depth and breadth of the company's software offerings, coupled with its global sales and technical support infrastructure differentiate the company's software business from its competitors. In addition, the company's research and development capabilities and intellectual property patent portfolio contribute to this segment's leadership. The company's principal competitors in this segment include Oracle Corporation, Microsoft Corporation, EMC and CA, Inc. In addition, the company competes with smaller, niche competitors in specific geographic or product markets worldwide.

Systems and Technology:

The enterprise server and storage market is highly competitive and is characterized by ongoing technology innovation, with competition focused on value, function and reliability, and new entrants leveraging technology to compete against traditional offerings. The company's principal competitors include HP, Dell, Inc. (Dell), Sun Microsystems and EMC Corporation. The company's leadership in virtualization, power management, security, multi-operating system capabilities and the ability of its systems platforms to leverage the entire system, from the company's custom semiconductors through the software stack to increase efficiency and lower cost, provide the company with competitive

advantages in this segment. In addition, the company's research and development capabilities and intellectual property patent portfolio contribute significantly investto this segment's leadership.

Global Financing:

The company's Global Financing business provides client financing, commercial financing and participates in growth opportunities asthe remarketing of used equipment. In 2008, the global financial credit crisis impacted both the client and commercial financing markets. The supply of credit diminished and financial institutions faced increases in loan losses, higher borrowing costs and liquidity challenges. Global Financing's access to capital and its ability to manage increased exposures provide a way to drive revenue growthcompetitive advantage for the company. The key competitive factors include price, client service, contract flexibility, ease of doing business and market share gains. Areasresidual values. In client and commercial financing, Global Financing competes with three types of investment include strategic acquisitions, primarily in software and services, focused client- and industry-specific solutions, maintaining technology leadership and emerging growth countriescompanies: other captive financing companies such as China, Russia, IndiaHP and Brazil.Dell, non-captive companies such as General Electric Company and CIT Group, Inc. and banks or financial institutions. In the remarketing segment, the company competes with local and regional brokers plus original manufacturers the fragmented worldwide used IT equipment market.

Forward-looking and Cautionary Statements

Certain statements contained in this Form 10-K may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 ("Reform Act"). The company may also make forward-looking statements in other reports filed with the Securities and Exchange Commission, in materials delivered to stockholders and in press releases. In addition, the company's representatives may from time to time make oral forward-looking statements. Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact. Words such as "anticipates," "believes," "expects," "estimates," "intends," "plans," "projects," and similar expressions, may identify such forward-looking statements. The company assumes no obligation to update or revise any forward-looking statements. In accordance with the Reform Act, set forth under Item 1A. "Risk Factors" on pages 10 to 14through 13 are cautionary statements that accompany those forward-looking statements. Readers should carefully review such cautionary statements as they identify certain important factors that could cause actual results to differ materially from those in the forward-looking statements and from historical trends. Those cautionary statements are not exclusive and are in addition to other factors discussed elsewhere in this Form 10-K, in the company's filings with the Securities and Exchange Commission or in materials incorporated therein by reference.

The following information is included in IBM's 20062008 Annual Report to Stockholders and is incorporated herein by reference:

Segment information and revenue by classes of similar products or services—pages 111116 to 115.119.

Financial information by geographic areas—page 115.119.

Amount spent during each of the last three years on R&D activities—page 93.101.

Financial information regarding environmental activities—page 87.pages 94 and 95.

The number of persons employed by the registrant—pages 4852 and 49.53.

The management discussion overview—pages 1419 and 15.20.

Available information—page 121.125.

Also refer to Item 1A. entitled "Risk Factors" in Part I of this Form.

Executive Officers of the Registrant (at February 27, 2007)24, 2009):

| | Age | Officer since | ||

|---|---|---|---|---|

| Chairman of the Board, President and Chief Executive Officer: | ||||

| Samuel J. Palmisano(1) | 55 | 1997 | ||

| Executive Vice President: | ||||

| Nicholas M. Donofrio, Innovation and Techology | 61 | 1995 | ||

| Senior Vice Presidents: | ||||

| Michael E. Daniels, Global Technology Services | 52 | 2005 | ||

| Douglas T. Elix, Group Executive, Sales & Distribution | 58 | 1999 | ||

| J. Bruce Harreld, Marketing and Strategy | 56 | 1995 | ||

| Paul M. Horn, Research | 60 | 1996 | ||

| Jon C. Iwata, Communications | 44 | 2002 | ||

| John E. Kelly, III, Technology and Intellectual Property | 53 | 2000 | ||

| Mark Loughridge, Chief Financial Officer | 53 | 1998 | ||

| J. Randall MacDonald, Human Resources | 58 | 2000 | ||

| Steven A. Mills, Group Executive, Software Group | 55 | 2000 | ||

| Robert W. Moffat, Jr., Integrated Operations | 50 | 2002 | ||

| Virginia M. Rometty, Global Business Services | 49 | 2005 | ||

| Linda S. Sanford, Enterprise On Demand Transformation | 54 | 2000 | ||

| Robert C. Weber, Legal and Regulatory Affairs, and General Counsel | 56 | 2006 | ||

| William M. Zeitler, Group Executive, Systems and Technology Group | 59 | 2000 | ||

Vice Presidents: | ||||

| Jesse J. Greene, Jr., Treasurer | 61 | 2002 | ||

| Daniel E. O'Donnell, Secretary | 59 | 1998 | ||

| Timothy S. Shaughnessy, Controller | 49 | 2004 |

| | Age | Officer since | |||||

|---|---|---|---|---|---|---|---|

Chairman of the Board, President and Chief Executive Officer: | |||||||

Samuel J. Palmisano(1) | 57 | 1997 | |||||

Senior Vice Presidents: | |||||||

Rodney C. Adkins, Development and Manufacturing, Systems and Technology Group | 50 | 2007 | |||||

Michael E. Daniels, Global Technology Services | 54 | 2005 | |||||

Jon C. Iwata, Marketing and Communications | 46 | 2002 | |||||

John E. Kelly, III, Research and Intellectual Property | 55 | 2000 | |||||

R. Franklin Kern, Global Business Services | 55 | 2008 | |||||

Mark Loughridge, Chief Financial Officer | 55 | 1998 | |||||

J. Randall MacDonald, Human Resources | 60 | 2000 | |||||

Steven A. Mills, Software Group | 57 | 2000 | |||||

Robert W. Moffat, Jr., Systems and Technology Group | 52 | 2002 | |||||

Virginia M. Rometty, Global Sales and Distribution | 51 | 2005 | |||||

Linda S. Sanford, Enterprise On Demand Transformation | 56 | 2000 | |||||

Timothy S. Shaughnessy, Services Delivery | 51 | 2004 | |||||

Robert C. Weber, Legal and Regulatory Affairs, and General Counsel | 58 | 2006 | |||||

Vice President: | |||||||

James J. Kavanaugh, Controller | 42 | 2008 | |||||

All executive officers are elected by the Board of Directors and serve until the next election of officers in conjunction with the annual meeting of the stockholders as provided in the By-laws. Each executive officer named above, with the exception of Robert C. Weber, has been an executive of IBM or its subsidiaries during the past five years.

Mr. Weber was a partner at Jones Day, an international law firm, until joining IBM in 2006. He was with Jones Day for almost 30 years, and his career included counseling corporations, individuals and boards of directors, as well as extensive experience in corporate derivative litigation, federal and state enforcement actions and commercial litigation.

Downturn in Economic Environment and Corporate IT Spending Budgets:Budgets could impact the Company's Business: If overall demand for systems, software and services changes,decreases, whether due to general economic conditions or a shift in corporate buying patterns, sales performancethe company's revenue and profit could be impacted. IBM's diverse set of products

The Company may not meet its Growth and offerings is designed to provide more consistent results in both strong and weak economic environments. The company accomplishes this by not only having a mix of offerings with long-term cash and income streams, as well as cyclical transaction-based sales, but also by continually developing competitive products and solutions and effectively managing a skilled resource base. IBM continues to transform itself to take advantage of shifting demand trends, focusing on client or industry-specific solutions, business performance and open standards.

Productivity Objectives under its Internal Business Transformation and Global Integration Initiatives: On an ongoing basis, IBM continuesseeks to drive greater productivity, flexibility and cost savings by transforming and globally integrating its own business processes and functions. In additionfunctions to eliminating redundanciesremain competitive and overhead structures to drive productivity, this integration has improved IBM's capacity to innovate by providing greater clarityenable scaling of key priorities around shared goalsresources in both emerging and objectivesmore established geographical markets. These efforts may not yield their intended gains in overall efficiency and leads to a sharper focus forenablement of rapid scaling, which may impact the company on learning, development and knowledge sharing. As IBM continues to drive higher levels of automation and integration into its business, IBM's dependency on internal IT systems also increases.

Innovation Initiatives: IBM invests to improve itscompany's ability to helpmeet its clients innovate. Investment may occur ingrowth and productivity objectives.

Failure of Innovation Initiatives could impact the research and developmentLong-Term Success of new products and services, as well as in the establishment of new collaborative and co-creation relationships with developers, other companies and other institutions. To deliver value that helps clients differentiate themselves for competitive advantage,Company: IBM has been moving away from commoditized categories of the IT industry and into areas in which it can differentiate itself through innovation and by leveraging its investments in R&D. InIf IBM is unable to continue its cutting-edge innovation in the highly competitive IT industry, with large diversified competitors as well as smallerthe company could fail in its ongoing efforts to maintain and nimble singleincrease its market share and its profit margins. In addition, IBM has one of the strongest brand names in the world, and its brand and overall reputation could be negatively impacted by many factors, including if the company does not continue to be recognized for its industry-leading technology competitors, IBM'sand solutions. If the company's brand image is tarnished by negative perceptions, our ability to continue its cutting-edge innovation is critical to maintainingattract and increasing market share. IBM is managing this risk by more closely linking its R&D organization to industry-specific and client-specific needs.retain customers could be impacted.

Open Standards: The broad adoption of open standards is essential to the computing model for on demand business and is a significant driver of collaborative innovation across all industries. Without interoperability among all manner of computing platforms, the integration of any client's internal systems, applications and processes remains a monumental and expensive task. The broad-based acceptance of open standards—rather than closed, proprietary architectures—also allows the computing infrastructure to more easily absorb (and thus benefit from) new technical innovations. IBM is committed to fostering open standards because they are vital to the On Demand Operating Environment, and because their acceptance will expand growth opportunities across the entire business services and IT industry. There are a number of competitors in the IT industry with significant resources and investments who are committed to closed and proprietary platforms as a way to lock customers into a particular architecture. This competition will result in increased pricing pressure and/or IP claims and proceedings.

Risks from Investing in Growth Opportunities:Opportunities could impact the Company's Business: The company is continuingcontinues to refocus its business on the higher valueinvest significantly in growth opportunities, including higher-value segments of enterprise computing—providing technologycomputing and transformation services to clients' businesses. Consistent with that focus, the company continues to significantly invest in growth opportunities, as a waydozens of emerging countries, including Brazil, Russia, India and China, to drive revenue growth and market share gains. IBM continuesClient adoption rates and viable economic models are uncertain in the high-value and rapidly-growing segments. In addition, as the company expands to invest incapture emerging growth opportunities, it needs to rapidly secure the appropriate mix of trained, skilled and experienced personnel. In emerging growth countries, such as China, Russia, India and Brazil. Thethe developing nature of these countries presents potential political, social and economic risks to IBM's business, including the potential forfrom inadequate infrastructure, creditworthiness of customers and business partners, labor disruptions.disruption and corruption, which could impact the company's ability to meet its growth objectives and to deliver to its clients around the world.

Protection ofIBM's Intellectual Property:Property Portfolio may not prevent Competitive Offerings, and IBM may not be able to Obtain Necessary Licenses: While theThe company's various proprietarypatents and other intellectual property rights are important to its success, IBM believes its business as a whole is not materially dependent on

any particular patent or license, or any particular group of patents or licenses. IBM owns or is licensed under a number of patents, which vary in duration, relating to its products. Licenses under patents owned by IBM have been and are being granted to others under reasonable terms and conditions. These protections may not prevent competitors from independently developing products and services similar to or duplicative to the company's, nor can there be any assurance that these protectionsthe resources invested by the company to protect its intellectual property will be sufficient or that the company's intellectual property portfolio will adequately deter misappropriation or improper use of the company's technology. In addition, the company may be the target of aggressive and opportunistic enforcement of patents by third parties, including non-practicing entities. Also, there can be no assurances that IBM will be able to obtain from third parties the licenses it needs in the future.

SeasonalityBreaches of Data Protection could impact the Company's Business: The company's products and services, as well as its internal systems and processes, involve the storage and transmission of proprietary information and sensitive or confidential data, including personal information of employees, customers and others. Breaches in security could expose the company, its customers or the individuals affected to a risk of loss or misuse of this information, resulting in litigation and potential liability for the company, as well as the loss of existing or potential customers and damage to the company's brand and reputation. In addition, the cost and operational consequences of implementing further data protection measures could be significant.

The Company's Revenues and Purchases:for Particular Periods are Difficult to Predict: IBM's revenues are affected by such factors as the introduction of new products and services, the length of the sales cycles, the structure of products and services contracts and the seasonality of technology purchases. As a result, the company's results are difficult to predict. These factors historically have resulted in lower revenue in the first quarter than in the immediately preceding fourth quarter. In addition, the high volume of products ordered at the end of each quarter, especially at the end of the fourth quarter, may affect IBM's ability to successfully ship all orders before the end of the quarter.

Due to the Company's Global Presence, its Business and Operations could be impacted by Local Legal, Economic, Political and Health Conditions: The company operatesis a globally integrated entity, operating in more than 160over 170 countries worldwide and derivedderiving more than halfsixty percent of its revenues from sales outside the United States. Changes in the laws or policies of the countries in which the company operates, or inadequate enforcement of such laws or policies, could affect the company's business in that country and the company's overall results of operations. The company's results of operations also could be affected by economic and political changes in those countries and by macroeconomic changes, including recessions, inflation and inflation.currency fluctuations between the U.S. dollar and local currency. In addition, any widespread outbreak of an illness, pandemic or other health issue, such as severe acute respiratory syndrome (SARS), avian influenza (bird flu) or any other pandemic, or local or global health issues,issue, or any terrorist activities, could adversely affect customer demand and the company's operations and its ability to source and deliver products and services to its customers and customer demand.customers.

Insurance:The company maintains third party insurance coverage against various liability risks and risks of property loss. While we believe these arrangements are an effective way to insure against liability and property damage risks, the potential liabilities associated with those risks or other eventsCompany could exceed the coverage provided by such arrangements.

incur Substantial Costs for Environmental Matters: The company is subject to various federal, state, local and foreign laws and regulations concerning the discharge of materials into the environment or otherwise related to environmental protection, including the U.S. Superfund law. The company could incur substantial costs, including cleanup costs, fines and civil or criminal sanctions, as well as third-party claims for property damage or personal injury, if it were to violate or become liable under environmental laws and regulations. Compliance with environmental laws and regulations is not expected to have a material adverse effect on the company's capital expenditures,financial position, results of operations and competitive position.

Tax Matters:Matters could impact the Company's Results of Operations and Financial Condition: The company is subject to income taxes in both the United States and numerous foreign jurisdictions. IBM's provision for income taxes and cash tax liability in the future could be adversely affected by numerous factors including, but not limited to, income before taxes being lower than anticipated in countries with lower statutory tax rates and higher than anticipated in countries with higher statutory tax rates, changes in the valuation of deferred tax assets and liabilities, and changes in tax laws, regulations, accounting principles or interpretations thereof, which could adversely impact the company's results of operations and financial condition in future periods. In addition, IBM is subject to the continuous examination of its income tax returns by the Internal Revenue Service and other tax authorities. The company regularly assesses the likelihood of adverse outcomes resulting from these examinations to determine the adequacy of its provision for income taxes. There can be no assurance that the outcomes from these continuous examinations will not have an adverse effect on the company's provision for income taxes and cash tax liability.

Internal Controls:The Company's Results of Operations and Financial Condition could be negatively impacted by its U.S. and non-U.S. Pension Plans: Effective internal controls are necessary forAdverse equity market conditions and volatility in the credit markets may have an unfavorable impact on the value of the company's pension trust assets and its future estimated pension liabilities. As a result, the company's financial results in any period could be negatively impacted. In addition, in a period of an extended financial market downturn, the company could be required to provide reasonable assuranceincremental pension plan funding with respect to its financial reports and to effectively prevent fraud. If the company cannot provide reasonable assurance with respect to its financial reports and effectively prevent fraud,resulting liquidity risk which could negatively impact the company's operating resultsfinancial flexibility. IBM's 2008 Annual Report to Stockholders includes information about potential impacts from pension funding and the use of certain assumptions regarding pension matters.

Ineffective Internal Controls could be affected. Pursuant toimpact the Sarbanes-Oxley Act of 2002, the company is required to furnish a report by management onCompany's Business and Operating Results: The company's internal control over financial reporting, including management's assessment of the effectiveness of such control. Internal control over financial reporting may not prevent or detect misstatements because of its inherent limitations, including the possibility of human error, the circumvention or overriding of controls, or fraud. Therefore, evenEven effective internal controls can provide only reasonable assurance with respect to the preparation and fair presentation of financial statements. In addition, projections of any evaluation of effectiveness of internal control over financial reporting to future periods are subject to the risk that the control may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. If the company fails to maintain the adequacy of its internal controls, including any failure to implement required new or improved controls, or if the company experiences difficulties in their implementation, the company's business and operating results could be harmed and the company could fail to meet its financial reporting obligations, and there could be a material adverse effect on the company's stock price.obligations.

The Company's Use of Estimates:Accounting Estimates involves Judgment and could impact the Company's Financial Results: In connection with the application of GAAP and the preparation of the Consolidated Financial Statements, the company uses certain estimates and assumptions, which are based on historical experience and management's knowledge of current events and actions that the company may undertake in the future. The company's most critical accounting estimates are described in the Management Discussion on pages 45 to 47 ofin IBM's 20062008 Annual Report to Stockholders.Stockholders, under "Critical Accounting Estimates." In addition, as discussed in note O, "Contingencies and Commitments" on pages 89 to 92 ofin IBM's 20062008 Annual Report to Stockholders, the company makes certain estimates under the provisions of SFAS No. 5, "Accounting for Contingencies",Contingencies," including decisions related to legal proceedings and reserves. While management believes thatBecause by definition these estimates and assumptions are reasonable under the circumstances, by definition they involve the use of judgment, and the exercise of discretion, and therefore, actual financial results may differ.

Competitive Conditions: The company operates in businesses that are subject to intense competitive pressures. pressures (see discussion about competition in Item 1. Business above).

The company's businesses face a significant number of competitors, ranging from Fortune 50 companies to an increasing number of relatively small, rapidly growingCompany Depends on Skilled Personnel and highly specialized organizations. The company believes that its combination of technology, performance, quality, reliability, price andcould be impacted by the breadth of products and service offerings are important competitive factors. Intense competitive pressures could affect prices or demand for the company's products and services, resulting in reduced profit margins and/or loss of market opportunity. Unlike many of its competitors, the company has a broad set of capabilities and businesses and must allocate resources across these businesses while competing with companies that specialize in one or more of these product lines. As a result, the company may not fund or invest in certain of its businesses to the same degree that its competitors do, and these competitors may have greater financial, technical and marketing resources available to them than the businesses against which they compete.

Volatility of Stock Price: The company's stock price is affected by a number of factors, including quarterly variations in financial results, the competitive landscape, general economic and market conditions and estimates and projections by the investment community. As a result, like other technology companies, the company's stock price is subject to significant volatility.

Dependence on and Compensation of Key Personnel:Critical Skills: Much of the future success of the company depends on the continued service, availability and integrity of skilled personnel, including technical, marketing and staff resources. Experienced personnel in the information technology industry are in high demand, and competition for their talents is intense. There can be no assurance that IBM will be

able to successfully retainChanging demographics and attract the key personnel it needs. In addition, companieslabor work force trends may result in the information technologya loss of knowledge and services industry whose employees accept positions with IBM may claim that IBM has interfered with noncompete obligations of their former employees, engaged in unfair hiring practices or that the employment of these persons by IBM would involve the disclosure or use of trade secrets. Any such claims could limit or prevent IBM from hiring employees or cause it to incur liability for damages or substantial costs in defending the company or its employees against these claims, whether or not they have merit.skills as experienced workers retire. Further, many of IBM's key personnel receive a total compensation package that includes equity awards. New regulations, volatility in the stock market and other factors could diminish the company's use, and the value, of the company's equity awards, putting the company at a competitive disadvantage or forcing the company to use more cash compensation.

The Company's Business could be impacted by its Relationships with Critical Suppliers: IBM's business employs a wide variety of components, supplies, services and raw materials from a substantial number of suppliers around the world. Certain of the company's businesses rely on single or a limited number of suppliers. Changes in the financial or business condition of these suppliers althoughcould subject the company makes every effort to assure that alternative sources are available iflosses and affect its ability to bring products to market. Further, the need arises. The failure of the company's suppliers to deliver components, supplies, services and raw materials in sufficient quantities and in a timely manner could adversely affect the company's business. In addition, any defective components, supplies or materials, or inadequate services, received from suppliers could reduce the reliability of the company's products and services and harm the company's reputation.

The Company is exposed to Currency and Customer Financing Risks:Risks that could impact its Revenue and Business: The company derives a significant percentage of its non-U.S. revenues from its affiliates operating in local currency environments, and those results are affected by changes in the relative values of non-U.S. currencies and the U.S. dollar. Further, inherent in the company's customer financing business are risks related to the concentration of credit, risk, theclient creditworthiness, of the client, interest rate and currency fluctuations on the associated debt and liabilities, and the determination of residual values and the financing of other than traditional IT assets. The company employs a number of strategies to manage these risks, including the use of derivative financial instruments. Derivativesinstruments; derivatives involve the risk of non-performance by the counterparty. In addition, there can be no assurance that the company's efforts to manage theseits currency and customer financing risks will be successful.

The Company's Financial Performance could be impacted by Changes in Market Liquidity Conditions and by Customer Credit Risk on Trade Receivables: The company's diversifiedfinancial performance is exposed to a wide

variety of industry sector dynamics worldwide. The company's earnings and cash flows, as well as its access to funding, could be negatively impacted by changes in market liquidity conditions. IBM's 2008 Annual Report to Stockholders includes information about the company's liquidity position. The company's client base includes a large number ofmany worldwide enterprises, from small and medium businesses to the world's largest organizations companies and governments.governments, with a significant portion of the company's revenue coming from global clients across many sectors. Most of the company's sales are on an open credit basis and the company performs ongoing credit evaluations of its clients' financial conditions. The company maintains reserves that it believes are adequate to cover exposure for any uncollectible trade receivables and regularly reviews such reserves by considering factors such as write-off history, aging analysis and any specific, known troubled accounts. Customer credit risk is mitigated due to the large number of clients constituting the company's worldwide client base and their dispersion across many different industries and geographies. If the company becomes aware of additional information related to the credit worthiness of a major customer, or, if future actual default rates on trade receivables in general differ from those currently anticipated, the company may have to adjust its reserves for uncollectible receivables, which could affect the company's consolidated net income in the period the adjustments are made.

The Company's Reliance on Third Party Distribution Channels:Channels could impact its Business: The company offers its products directly and through a variety of third party distributors and resellers. Changes in the financial or business condition of these distributors and resellers could subject the company to losses and affect its ability to bring its products to market.

Risks to the Company from Acquisitions and Alliances:Alliances include Integration Challenges, Failure to Achieve Objectives, and the Assumption of Liabilities: The company has made and expects to continue to make acquisitions or enter into alliances from time to time. Acquisitions and alliances present significant challenges and risks relating to the integration of the business into the company, and there can be no assurances that the company will manage acquisitions and alliances successfully. The related risks include the company failing to achieve strategic objectives and anticipated revenue improvements and cost savings, as well as the failure to retain key personnel of the acquired business and the assumption of liabilities related to litigation or other legal proceedings involving the acquired business.

Risk Factors Related to IBM Securities: The company issuesand its subsidiaries issue debt securities in the worldwide capital markets from time to time, with a variety of different maturities and in different currencies. The value of ourthe company's debt securities fluctuates based on many factors, including changes in interest rates, the methods employed for calculating principal and interest, the maturity of the securities, the aggregate principal amount of securities outstanding, the redemption features for the securities, the level, direction and volatility of interest rates, changes in exchange rates, exchange controls, governmental and stock exchange regulations and other factors over which the company has little or no control. The company's ability to pay interest and repay the principal for its debt securities is dependent upon its ability to manage its business operations, as well as the other risks described under this Item 1A. entitled "Risk Factors".Factors." There can be no assurance that the company will be able to manage any of these risks successfully.

The company also issues its common stock from time to time in connection with various compensation plans, contributions to its pension plan and certain acquisitions. The market price of IBM common stock is subject to significant volatility, due to other factors described under this Item 1A. entitled "Risk Factors", including the section entitled "Volatility of Stock Price",Factors," as well as economic and geopolitical conditions generally, trading volumes, speculation by the press or investment community about ourthe company's financial condition, and other factors, many of which are beyond the company's control. Since the market price of IBM's common stock fluctuates significantly, stockholders may not be able to sell ourthe company's stock at attractive prices.

In addition, changes by any rating agency to the company's outlook or credit ratings can negatively impact the value and liquidity of both ourthe company's debt and equity securities. The company does not make a market in either its debt or equity securities and cannot provide any assurances with respect to the liquidity or value of such securities.

Item 1B. Unresolved Staff Comments:

Not applicable.

At December 31, 2006,2008, IBM's manufacturing and development facilities in the United States had aggregate floor space of 2019 million square feet, of which 1615 million was owned and 4 million was leased. Of these amounts, 2 million square feet was vacant and 1 million square feet was being leased to non-IBM businesses. Similar facilities in 8 other countries totaled 6 million square feet, of which 32 million was owned and 34 million was leased. Of these amounts, 1 million square feet was being leased to non-IBM businesses.

Although improved production techniques, productivity gains and infrastructure reduction actions have resulted in reduced manufacturing floor space, continuous maintenance and upgrading of facilities is essential to maintain technological leadership, improve productivity and meet customer demand.

Refer to note O, "Contingencies and Commitments" on pages 8997 to 9299 of IBM's 20062008 Annual Report to Stockholders, which is incorporated herein by reference.

Item 4. Submission of Matters to a Vote of Security Holders:

Not applicable.