QuickLinksTable of Contents-- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 20072010

OR

o Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Commission file number 001-13913

WADDELL & REED FINANCIAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 51-0261715 (I.R.S. Employer Identification No.) |

6300 Lamar Avenue

Overland Park, Kansas 66202

913-236-2000

(Address, including zip code, and telephone number of Registrant's principal executive offices)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT

| Title of each class | Name of each exchange on which registered | |

| Class A Common Stock, $.01 par value | New York Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ý NO o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES o NO ý.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. ( )

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act).

| Large accelerated Filer | ý | Accelerated Filer | o | |||

| Non-accelerated Filer | o | Smaller Reporting Company | o | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes o No ý.

The aggregate market value of the voting and non-voting common stock equity held by non-affiliates (i.e. persons other than officers, directors and stockholders holding greater than 5% of the registrant's common stock) based on the closing sale price on June 30, 20072010 was $1.739$1.590 billion.

Shares outstanding of each of the registrant's classes of common stock as of February 22, 200817, 2011 Class A common stock, $.01 par value: 86,222,61185,912,544

DOCUMENTS INCORPORATED BY REFERENCE

In Part III of this Form 10-K, portions of the definitive proxy statement for the 20082010 Annual Meeting of Stockholders to be held April 9, 2008.6, 2011.

Index of Exhibits (Pages 8584 through 89)91)

Total Number of Pages Included Are 8991

WADDELL & REED FINANCIAL, INC.

INDEX TO ANNUAL REPORT ON FORM 10-K

For the fiscal year ended December 31, 20072010

| Part I | | Page | ||

|---|---|---|---|---|

Item 1. | Business | 3 | ||

Item 1A. | Risk Factors | |||

Item 1B. | Unresolved Staff Comments | |||

Item 2. | Properties | |||

Item 3. | Legal Proceedings | |||

Item 4. | Submission of Matters to a Vote of Security Holders | |||

Part II | ||||

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |||

Item 6. | Selected Financial Data | |||

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |||

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |||

Item 8. | Financial Statements and Supplementary Data | |||

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |||

Item 9A. | Controls and Procedures | |||

Item 9B. | Other Information | |||

Part III | ||||

Item 10. | Directors, Executive Officers and Corporate Governance | |||

Item 11. | Executive Compensation | |||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |||

Item 14. | Principal Accounting Fees and Services | |||

Part IV | ||||

Item 15. | Exhibits, Financial Statement Schedules | |||

SIGNATURES | ||||

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | ||||

INDEX TO EXHIBITS | ||||

General

Waddell & Reed Financial, Inc. (hereinafter referred to as the "Company," "we," "our" or "us") is a corporation, incorporated in the state of Delaware in 1981, that conducts business through its subsidiaries. Founded in 1937, we are one of the oldest mutual fund complexes in the United States, having introduced our largest family of mutual funds, the Waddell & Reed Advisors Group of Mutual Funds (the "Advisors Funds") in 1940. We launched our Ivy Funds in 2003 in an effort to expand our distribution to third-party outlets. As of December 31, 2007,2010, we had $64.9$83.7 billion in assets under management and approximately 3.3 million mutual fund shareholder accounts owned by individuals, plans or omnibus accounts at third parties.management.

We derive our revenues primarily from providing investment management, investment product underwriting and distribution, and shareholder services administration to mutual funds and institutional and separately managed accounts. Investment management fees are based on the amount of average assets under management and are affected by sales levels, financial market conditions, redemptions and the composition of assets. UnderwritingOur underwriting and distribution revenues consist of commissions derived from sales of investment and insurance products, Rule 12b-1 asset-based service and distribution fees, distribution fees on certain variable products, fees earned on fee-based asset allocation products, and related advisory services. The products sold have various commission structures and the revenues received from productthose sales vary based on the type and amount sold. Shareholder service fees revenue includes transfer agency fees, custodian fees from retirement plan accounts, and portfolio accounting and administration fees, and is earned based on assets under management or number of accounts.

We operate our business through three distinct distribution channels. Our retail products are distributed through our sales force of registeredindependent financial advisors (the "Advisors channel") or through third-parties such as other broker/dealers, registered investment advisors (including the retirement advisors of the Legend group of subsidiaries ("Legend")) and various retirement platforms, (collectively, the "Wholesale channel"). We also market our investment advisory services to institutional investors, either directly or through consultants (the "Institutional channel").

In the Advisors channel, our sales force consists of 2,293 financial advisors who focus theirfocuses its efforts primarily on the sale of investment products advised by the Company.financial planning, serving primarily middle class and mass affluent clients. We compete primarily with smaller broker/dealers and independent financial advisors, as well as a span of other financial providers. Assets under management acquired throughin this channel were $34.6$33.2 billion at December 31, 2007.2010.

Our Wholesale channel efforts include retail fund distribution through broker/dealers (the largest method of distributing mutual funds for the industry), registered investment advisors (fee-based financial advisors who generally sell mutual funds through financial supermarkets) and retirement platforms (401(k) platforms using multiple managers). A team of 34 national wholesalers lead the efforts in this channel.and insurance platforms. Assets under management acquired throughin this channel were $21.5$40.9 billion at the end of 2007.2010.

Through our Institutional channel, we manage assets in a variety of investment styles for defined benefit pension plans, other investment companies (as a subadvisor), defined contribution plans, endowments and high net worth clients.variety of types of institutions. The largest client type is funds that hire us to act as subadvisor; they are typically distributors who lack scale or the track record to manage internally, or choose to market multi-manager styles. Assets under management acquired throughin the Institutional channel were $8.8$9.6 billion at December 31, 2007.2010.

Organization

We operate our investment advisory business through our subsidiary companies, primarily Waddell & Reed Investment Management Company ("WRIMCO"), a registered investment adviser, and Ivy Investment Management Company ("IICO"), the registered investment adviser for Ivy Funds Inc. and the Ivy Funds portfolios (collectively, the(the "Ivy Funds"). Other investment advisory subsidiaries include and Legend Advisory Corporation, (thethe registered investment adviser for Legend) and Austin, Calvert & Flavin, Inc. ("ACF").Legend.

Our underwriting and distribution business operates through three broker/dealers: Waddell & Reed, Inc. ("W&R"), Ivy Funds Distributor, Inc. ("IFDI") and Legend Equities Corporation ("LEC"). W&R is a registered broker/dealer and investment adviser that acts primarily as the national distributor and underwriter for shares of the Advisors Funds and thea distributor of variable annuities and other

insurance products issued by Nationwide Life Insurance Company, a subsidiary of Nationwide Financial Services, Inc. ("Nationwide"), Minnesota Life Insurance Company ("Minnesota Life"), a subsidiary of Securian Financial Group, Inc. ("Securian"), and others.our business partners. In addition, W&R is the fifthninth largest distributor of our Ivy Funds. IFDI, a registered broker/dealer, is the distributor and underwriter for the Ivy Funds. LEC is the registered broker/dealer for Legend, a mutual fund distribution and retirement planning subsidiary based in Palm Beach Gardens, Florida. Through its network of 462 financial advisors, Legend primarily serves primarily employees of school districts and other not-for-profit organizations.

Waddell & Reed Services Company ("WRSCO") provides transfer agency and accounting services to the Advisors Funds, the Ivy Funds, W&R TargetIvy Funds Inc.Variable Insurance Portfolios (the "Target Funds""Ivy Funds VIP") and Waddell & Reed InvestEd Portfolios, Inc., our college savings plan ("InvestEd"). W&R, WRIMCO, WRSCO, ACF, Legend, IICO and IFDI are hereafter collectively referred to as the "Company," "we," "us" or "our" unless the context requires otherwise.

Investment Management Operations

Our investment advisory business provides one of our largest sources of revenues and profits. We earn investment management fee revenues by providing investment advisory and management services pursuant to an investment management agreementagreements with each fund within the Advisors Funds family, the Ivy Funds families,family, the TargetIvy Funds VIP family, and InvestEd (collectively, the "Funds"). While the specific terms of the agreements vary, the basic terms are similar. The agreements provide that we render overall investment management services to each of the Funds, subject to the oversight of each Fund's board of directors/trustees and in accordance with each Fund's fundamental investment objectives and policies. The agreements permit us to enter into separate agreements for shareholder services or accounting services with each respective Fund.

Each Fund's board of directors/trustees, including a majority of the directors/trustees who are not "interested persons" of the Fund or the Company within the meaning of the Investment Company Act of 1940, as amended (the "ICA") ("disinterested members") and the Fund's shareholders must approve the investment management agreement between the respective Fund and the Company. These agreements may continue in effect from year to year if specifically approved at least annually by (i) the Fund's board, including a majority of the disinterested members, or (ii) the vote of a majority of both the shareholders of the Fund and the disinterested members of each Fund's board, each vote being cast in person at a meeting called for such purpose. Each agreement automatically terminates in the event of its assignment, as defined by the ICA or the Investment Advisers Act of 1940, as amended, (the "Advisers Act"), and may be terminated without penalty by any Fund by giving us 60 days' written notice if the termination has been approved by a majority of the Fund's directors/trustees or the Fund's shareholders. We may terminate an investment management agreement without penalty on 120 days' written notice.

In addition to performing investment management services for the Funds, we act as an investment adviser for institutional and other private investors and we provide subadvisory services to other investment companies. Our fee for these services is generally based on a percentage of assets under management. Such services are provided pursuant to various written agreements.

Our investment management effort hasteam meets every morning in a strong foundation based uponcollaborative setting that fosters idea sharing, yet reinforces individual accountability. Through all market cycles, we remain dedicated to the following investment principles:

These three principles shape our investment philosophy and money management approach. Over seven decades, our investment organization has delivered consistently competitive investment performance. Through bull and bear markets, our investment professionals have not strayed from what works — a time-tested investment process and fundamental research. We believe investors turn to us because they appreciate that our investment approach continues to identify and create opportunities for wealth creation.

Our investment management team comprises 74 professionals including a team of 3029 portfolio managers who average 1920 years of industry experience and 1314 years of tenure with the Company. They have substantial resources available to them, including the efforts of internal equity and fixed income analysts who conduct primary fundamental research and attend numerous on and off-site meetings annually with management of the companies in which they invest. In addition, we use research provided by brokerage firms and independent outside

consultants. Portfolio managers participate in a collaborative process that blends their individual accountability with the ideas of their peers which, when backed by an intensive research capability, supports our efforts to deliver consistent, long-term performance. Our investment management team also includes a premier group of subadvisors who bring similar investment philosophies and additional expertise in specific asset classes.

firm. We have significant experience in virtually all major asset classes, several specialized asset classes and a range of investment styles. Our endingAt December 31, 2010, almost 80% of the Company's $83.7 billion in assets under management are summarized below by broad asset class, manywere invested in equities, of which incorporate multiple65% was domestic and 35% was international. In recent years, we have supported growth of international investments by adding investment styles.

Ending Assets Under Management by Broad Asset Class

| | December 31, 2007 | ||||||

|---|---|---|---|---|---|---|---|

| | Ending Assets | Percentage of Total | |||||

| | (in millions) | ||||||

| Investment Style: | |||||||

| Balanced & Flexible | $ | 14,317 | 22% | ||||

| Narrowly Diversified | 13,236 | 20% | |||||

| Large Capitalization Growth Equities | 8,965 | 14% | |||||

| Large Capitalization Core Equities | 7,019 | 11% | |||||

| International Equities | 4,902 | 8% | |||||

| Small Capitalization Growth Equities | 4,070 | 6% | |||||

| Taxable Investment Grade Fixed Income | 2,836 | 4% | |||||

| Multi-Capitalization Core Equities | 2,039 | 3% | |||||

| Value Equities | 2,024 | 3% | |||||

| Middle Capitalization Growth Equities | 1,655 | 3% | |||||

| High Yield Fixed Income | 1,378 | 2% | |||||

| Money Market | 1,306 | 2% | |||||

| Tax Exempt Fixed Income | 1,038 | 2% | |||||

| Other | 83 | 0% | |||||

| Total | $ | 64,868 | 100% | ||||

professionals native to countries that we consider emerging markets. They, along with other members of the investment team, focus on understanding foreign markets and capturing investment opportunities. Our investment strategy generally emphasizes investmentsmanagement team also includes subadvisors who bring similar investment philosophies and additional expertise in companies that the portfolio managers believe can produce above average growth in earnings. Our portfolio managers also strive for consistent long-term performance while seeking to provide downside protection in turbulent markets. Our investment philosophy lends itself well to the financial planning approach used by our Advisors channel while our consistent long-term investment performance record supports the distribution efforts in both our Wholesale and Institutional channels.specific asset classes.

Investment Management Products

Our mutual fund families offer a wide variety of investment options. We are the exclusive underwriter and distributor of 7282 registered open-end mutual fund portfolios, including 21 portfolioswhich include offerings in the Advisors Funds, family, 28 portfolios in the Ivy Funds, families, 20 portfolios in the TargetIvy Funds familyVIP and three portfolios in InvestEd. The Advisors Funds, variable products offering the TargetIvy Funds VIP, and InvestEd are offered primarily through our financial advisors and Legend advisors; in some circumstances, certain of these funds are also offered through the Wholesale channel. The Ivy Funds are offered through both our Advisors channel and Wholesale channel. The Funds' assets under management are included in either our Advisors channel or our Wholesale channel depending on whowhich channel marketed the client account or is the broker of record.

We added three funds to our product line in 2010. We launched the Ivy Asset Strategy New Opportunities fund for investors seeking high total return over the long term, and focus on small- and mid-cap equity securities. We invest a majority of the fund's assets among equity securities, bonds and short-term instruments of issuers in markets around the globe, as well as investments in precious metals and exposure to various foreign currencies. The fund may allocate its investments among these different types of securities in different proportions at different times, including up to 100% of equity securities of small- to mid-cap issuers, bonds or short-term instruments, respectively. The Ivy Funds VIP Global Bond fund was added for investors interested in a high level of current income. The fund invests in a diversified portfolio of debt securities of foreign and U.S. issuers, with at least 80% of its net assets in bonds during normal market conditions. We added the Ivy Funds VIP Limited-Term Bond fund to provide investors an opportunity for a high level of current income consistent with preservation of capital. The fund invests primarily in investment grade, U.S. dollar-denominated, debt securities of primarily U.S. issuers.

Other Products

Pursuant to general agency arrangements with Nationwide and Minnesota Life,Through various business partners, we distribute in our Advisors channel certain of their variable annuity products, which offer the TargetIvy Funds VIP as an investment vehicle. We also offer our Advisors channel customers retirement and life insurance products underwritten by Nationwide and Minnesota Life.our business partners. Through our insurance agency subsidiaries, ourWaddell & Reed financial advisors also sell life insurance and disability products underwritten by various carriers through a general agency arrangement with BISYS Insurance Services, Inc.carriers.

In addition, we offer our Advisors channel customers fee-based asset allocation investment advisory products, including Managed Allocation Portfolio ("MAP"), MAPPlus and Strategic Portfolio Allocation ("SPA"), which are comprised ofutilize our Funds. MAP is comprised of two mutual fund asset allocation programs, MAP and MAP Plus, that offer clients a selection of traditional asset allocation models, as well as features such as systematic rebalancing and client participation in determining (to a limited extent) asset allocation across asset classes. MAP and MAP Plus are fee-based mutual fund asset allocation programs, structured to provide advisors and clients with advisory services, a pricing option competitive with other firms' fee-based products, and flexibility to allow advisors to assist clients in selecting underlying funds based upon their individual needs. MAP Plus was introduced in the second quarter of 2007 along with a reintroduction of MAP, to include additional financial planning modules as a bundled offering. As of December 31, 2007 our2010, clients have over $1$4.5 billion invested in theour MAP, MAPPlus and MAP PlusSPA products. These assets are included in our mutual fund assets under management disclosed elsewhere.

Using a variety of funds ranging from money market and fixed income funds to domestic and international equity funds, SPA is a predictive, dynamic asset allocation system that reallocates asset classes within model portfolios. Clients investing assets in SPA can choose from five available model portfolios with objectives ranging from conservative to aggressive, based on their investment objectives, goals, risk tolerance and other factors.

A primary difference between MAP and SPA is that advisors assist clients in selecting the underlying mutual funds within MAP models in accordance with pre-established ranges, whereas for SPA, the Company's Investment Policy Committee determines the model compositions.

Underwriting and Distribution

We earn underwriting and distribution fee revenues primarily by distributing the Funds pursuant to an underwriting agreement with each Fund (except the Target Funds as explained below) and, to a lesser extent, by distributing mutual funds offered by other companies not affiliated with us. Pursuant to each agreement, we offer and sell the Funds' shares on a continuous basis (open-end funds) and pay certain costs associated with underwriting and distributing the Funds, including the costs of developing and producing sales literature and printing of prospectuses, which may be either partially or fully reimbursed by the Funds. The Funds are sold in various classes that are structured in ways that conform to industry standards (i.e., "front-end load," "back-end load," "level-load" and institutional).

When a client purchases Class A shares (front-end load), the client pays an initial sales charge of up to 5.75% of the amount invested. The sales charge for Class A shares typically declines as the investment amount increases. In addition, investors may combine their purchases of all fund shares to qualify for a reduced sales charge. Class A shares purchased at net asset value are assessed a 1% contingent deferred sales charge ("CDSC") if the shares are redeemed within 12 months of purchase. When a client purchases Class B shares (back-end load), we do not charge an initial sales charge, but we do charge a CDSC upon early redemption of shares, up to 5% of the lesser of the current market net asset value or the purchase cost of the redeemed shares in the first year and declining to zero for shares held for more than six years. Class B shares convert to Class A shares after eight years. When a client purchases Class C shares (level-load), we do not charge an initial sales charge, but we do charge investors who redeem their Class Cmanagement.

shares in the first year a CDSCTable of 1% of the current market net asset value or the purchase cost of the shares redeemed, whichever is less.

Under a Rule 12b-1 service plan, the Funds may charge a maximum fee of 0.25% of the average daily net assets under management as compensation or reimbursement for expenses paid to broker/dealers and other sales professionals in connection with providing ongoing services to the Funds' shareholders and/or maintaining the Funds' shareholder accounts. The Funds' Class B and Class C shares may charge a maximum of 0.75% of the average daily net assets under management under a Rule 12b-1 distribution plan as either compensation or reimbursement to broker/dealers and other sales professionals for their services in connection with distributing shares of that class. The Rule 12b-1 plans are subject to annual approval by the Funds' board of directors/trustees, including a majority of the disinterested members, by votes cast in person at a meeting called for the purpose of voting on such approval. All Funds may terminate the service plan at any time with approval of fund directors or portfolio shareholders (a majority of either) without penalty.

We distribute variable products offering the Target Funds as investment vehicles pursuant to general agency arrangements with Nationwide and Minnesota Life and receive commissions, marketing allowances and other compensation as stipulated by such agreements. In connection with these arrangements, the Target Funds are offered and sold on a continuous basis.

In addition to distributing variable products, we distribute a number of other insurance products through our insurance agency subsidiaries, including individual term life, group term life, whole life, accident and health, long-term care, Medicare supplement and disability insurance. We receive commissions and compensation from various underwriters for distributing these products. We are not an underwriter for any insurance policies.Contents

Distribution Channels

We distribute our investment products through the Advisors, Wholesale and Institutional channels.

Advisors Channel

OurOver the past year, we completed enhancements to our Choice brokerage platform technology and offerings that should allow us to compete in the recruitment of experienced advisors. Historically, our advisors sellhave sold investment products primarily to middle-incomemiddle income and mass affluent individuals, families and businesses across the country in geographic markets of all sizes. We assist clients on a wide range of financial issues with a significant focus on helping them plan, generally, for long-term investments such as retirement and education and offer one-on-one consultations that emphasize long-term relationships through continued service. As a result of this approach, this channel has developed a loyal customer base with clients maintaining their accounts significantly longer than the industry average. The redemption rate in the Advisors channel for the year endedAs of December 31, 2007 was 9.1%, compared to the industry average of 22.3%, as derived from statistics provided by the Investment Company Institute ("ICI").

Our2010, our sales force consisted of 2,2931,847 financial advisors including 169 district managers and 176 district supervisors as of December 31, 2007. Eight regional vice presidents and 101 managing principals oversee this sales force, which operateswho operate out of 170167 offices located throughout the United States. This sales force also occupies 333States and 258 individual advisor offices. We believe, based on industry data, that our financial advisors are currently one of the largest sales forces in the United States selling primarily mutual funds, and that W&R, our broker/dealer subsidiary, ranks among the largest independent broker/dealers. As of December 31, 2007,2010, our Advisors channel had approximately 720,000517,000 mutual fund customers with an average investmentcustomers.

Over the past several years, we have instituted more stringent production requirements for our sales force, which has resulted in a steady decline in our number of $68,000advisors. However, gross sales have not declined over this period and approximately 80,000 variable account customers with an average investment of $63,000.

The following table illustrates commissionable investment product sales by our financial advisors (including InvestEd) for the years ended December 31, 2007, 2006 and 2005. Sales are shown gross of

commissions and exclude sales by Legend advisors, sales of money market funds, non-proprietary funds, insurance products, and mutual funds sold at net asset value for which we receive no commission.

| | 2007 | 2006 | 2005 | |||||

|---|---|---|---|---|---|---|---|---|

| | (in millions) | |||||||

| Front-end load sales | $ | 1,406 | 1,700 | 1,370 | ||||

| Variable annuity products | 464 | 331 | 297 | |||||

| Front-load product total | 1,870 | 2,031 | 1,667 | |||||

Deferred-load sales | 134 | 186 | 203 | |||||

| Fee-based allocation products | 628 | 59 | 31 | |||||

| Total advisor sales | $ | 2,632 | 2,276 | 1,901 | ||||

As of December 31, 2007, 40% of our financial advisors have been with us for more than five years and 24% for more than ten years. Our New Advisor Career Transition program(s), designed to meet the needs of the different audiences from which we recruit, such as college graduates, career changers and industry experienced professionals, provide our new advisors with a unique transition experience until they can develop the skills and client base necessary to earn a stable income from commissions alone. These programs have played an important role in advisor retention and have contributed to an increase in the average productivity of our new associates. In addition, the introduction of a Sales Incentive Dashboard to this channel produced more in 2007 has made it easier for field leaders and2010 with 14% fewer advisors, on average, compared to keep track of their sales results daily with web based sales data.2009. We also undertook technology initiatives in 2007 that will allow us to provide our clients consolidated statements and more robust brokerage capabilities. We believe this effort will support the retention of existing advisors and our recruiting efforts, including those aimed at experienced advisors. Salesutilize gross revenue per advisor (investment product sales divided by the average number of advisors) were $1.2 million, $994 thousand and $776 thousand, for the years ended December 31, 2007, 2006 and 2005, respectively. Growth in this metric is important to our company since investment product sales are invested in our Funds' assets.

Gross production per advisor is an additional method of measuring advisor productivity that is more closely aligned with industry standard methods, which use gross commissions per sales representative to measure advisor productivity. For purposes of this measure, gross productionrevenue consists of front-end load sales and distribution fee revenues, as it would be received from an underwriter, from sales of both our Funds and other mutual funds. It also includes fee revenues from our asset allocation products and financial plans, and commission revenues earned on insurance products. This measure excludes underwriting fee revenues, Rule 12b-1 service fee revenues, variable annuity distribution fee revenues and all revenues related to Class Y shares, all of which do not relate to the distribution activities of our financial advisors. Gross productionrevenue per advisor was $64.7$119 thousand, $61.8$93 thousand and $53.5$103 thousand for the years 2007, 2006ended December 31, 2010, 2009 and 2005,2008, respectively.

Wholesale Channel

Our Wholesale channel consists of sales garnered through various third-party distribution outlets and Legend advisors. In an effort to accelerate sales growth, we have focused on expanding our Wholesale distribution efforts over the past four years. Our launch into this channel included acquiring Mackenzie Investment Management Inc. ("MIMI") in 2002 and entering into a strategic alliance agreement with Securian in 2003. MIMI was a Florida-based investment management subsidiary of Toronto-based Mackenzie Financial Corporation ("MFC") and adviser of the Ivy Funds sold in the United States. As part of our strategic alliance with Securian, we agreed to become the investment adviser for substantially all equity assets managed by Advantus Capital Management, Inc. ("Advantus"), a subsidiary of Securian and an affiliate of Minnesota Life, and to acquire the assets of Securian's Advantus Funds.

As a result of an increased demand for our funds in ourthe Wholesale channel due to strong investment and sales performance and assets gained through acquisitions,effective sales efforts, our assets under management from the Wholesale channel have increased from $3.8to $40.9 billion at December 31, 2003 to $21.52010, including $5.7 billion in assets at December 31, 2007, including $9.0 billion in assets2010 that are subadvised by other managers.

The following table summarizes certain components of the changes in the Wholesale channel's assets under management for the last three fiscal years.

| | 2007 | 2006 | 2005 | |||

|---|---|---|---|---|---|---|

| | (in millions) | |||||

| Sales (net of commissions) | 9,470 | 4,541 | 2,347 | |||

| Redemptions | (2,795) | (1,915) | (1,149) | |||

| Net Sales | 6,675 | 2,626 | 1,198 | |||

Market Appreciation | 3,894 | 1,263 | 738 | |||

Ending Assets Under Management | 21,537 | 10,819 | 6,729 | |||

During 2007, we achieved significant growth in mutual fund sales through wholesale distribution and built on our presence in the wholesale market. We continued to expand our team of national wholesalers, reaching a total of 34 by year-end. Throughout 2007, the Ivy Funds family increased its presence in a number of broker/dealer platforms. These third parties have a client relationship with, and maintain an account for, the investors. Typically, investors purchase our investment products at the suggestion of third parties, thereby expanding our opportunities to gain new investors. Our wholesaling efforts focus principally on distributing the Ivy Funds through three segments: broker/dealers (the largest method of distributing mutual funds for the industry and for us), retirement platforms (401(k) platforms using multiple managers) and registered investment advisors (fee-based financial advisors who generally sell institutional class mutual funds through financial supermarkets). We continued to expand our team of national wholesalers in 2010, reaching a total of 46 wholesalers by year-end. In 2010, we restructured our wholesaler territories into smaller, more manageable areas that enabled our wholesalers to focus on additional distribution partners in their territory.

Legend advisors distributeDuring 2010, our Funds, along with mutual funds managed by other investment companies, through Legend's retirement advisor sales force. At December 31, 2007, Legend had 462 registered retirement advisors in 95 offices, which are primarily individual advisor offices, located mainlyIvy Asset Strategy fund continued to play a lead role in the eastern partWholesale channel's results, comprising 60% of the United States. These retirement advisors are not included in the discussionchannel's sales and 30% of our financial advisors, nor in disclosures of the number of advisors we have licensed. For the years ended December 31, 2007, 2006 and 2005, Legend advisors sold $74.2 million, $74.0 million and $67.7 million of our mutual funds, respectively. For the years ended December 31, 2007, 2006 and 2005, Legend also sold $363.5 million, $382.5 million and $379.7 million, respectively, of unaffiliated mutual funds. Sales per Legend advisor were $890 thousand in 2007 and Legend had $5.1 billion of client assets under administrationmanagement as of December 31, 2007.2010. While we recognize the success of this fund and anticipate its growth will continue into the future, we are also aware of the concentration risks to our revenue streams created by the size of this fund, despite its flexible mandate. Our compensation program for wholesalers encourages the sales of other products with track records of strong performance. In 2010, we saw wholesalers successfully market additional products to their financial advisor clients, which resulted in Wholesale channel sales for the Ivy Asset Strategy fund decreasing from 63% in 2009 to 60% in 2010, and gross sales of funds other than Asset Strategy reaching a

record $5.8 billion. We plan to continue to stress diversification and sales within our focus firms as we enter 2011.

Institutional Channel

WRIMCO and ACFThrough this channel, we manage assets in a variety of investment styles for a variety of institutions. The largest client type is funds that hire us to act as subadvisor; they are typically distributors who lack scale or the track record to manage internally, or choose to market their investment advisory services to institutions directly or through consultants that assist with the manager selection process. Most of our institutional business is in defined benefit pension plans and subadvised mutual funds. A significant amount of assets aremulti-manager styles. Our diverse client list also managed for defined contribution pension plans,includes corporations, foundations, endowments, Taft-Hartley plans high-net worth individuals and insurance company general accounts. Duringpublic funds including defined benefit plans and defined contribution plans. Over time, the past two years, our institutional asset flows were negatively impacted by underperformance at ACF, although we maintain a solid reputationInstitutional channel has been successful in the institutional asset managementdeveloping subadvisory relationships. As of December 31, 2010, this type of business built on a good performance record and on our investment style, which over time has brought steady and consistent results.

Over the past five years, we have expanded our distribution efforts in this channel by entering into additional subadvisory agreements with certain strategic partners. As partcomprised close to 60% of the December 16, 2002 acquisitionInstitutional channel's assets, which management views as a positive development as it believes this type of MIMI's business we entered into new subadvisory and marketing agreements extending

MFC's subadvisory agreements with IICO and providing us with additional investment management opportunities in Canada. Pursuantis more likely to these subadvisory agreements, we receive investment management fees covering multiple funds. The subadvisory agreement with MFC expires in 2008 and is renewable on an annual basis.

Through our strategic alliance agreement with Securian, we agreed to become investment adviser for substantially all equity assets managed by Advantus. In addition,grow than the Company manages as separate accounts certain actively managed equities in the Minnesota Life and Securian Holding Company general accounts.

We also have a subadvisory relationship with Pictet & Cie of Switzerland, initially established in mid-2006, that employs our large-cap investment style. Assets under management for Pictet & Cie grew to $1.3 billion by December 31, 2007.defined benefit business.

Service Agreements

We earn service fee revenues by providing various services to the Funds and their shareholders pursuant to shareholder servicing and accounting service agreements with each Fund.shareholders. Pursuant to the shareholder servicing agreements, we perform shareholder servicing functions for which the Funds pay us a monthly fee, including: maintaining shareholder accounts; issuing, transferring and redeeming shares; distributing dividends and paying redemptions; furnishing information related to the Funds; and handling shareholder inquiries. Pursuant to the accounting service agreements, we provide the Funds with bookkeeping and accounting services and assistance for which the Funds pay us a monthly fee, including: maintaining the Funds' records; pricing Fund shares; and preparing prospectuses for existing shareholders, proxy statements and certain other shareholder reports.

These agreementsAgreements with the Funds may be adopted or amended with the approval of the disinterested members of each Fund's board of directors/trustees and have annually renewable terms of one year.

Regulation

The securities industry is subject to extensive regulation and virtually all aspects of our business are subject to various federal and state laws and regulations. These laws and regulations are primarily intended to protect investment advisory clients and shareholders of registered investment companies. Under such laws and regulations, agencies and organizations that regulate investment advisers, broker/dealers, and transfer agents like us have broad administrative powers, including the power to limit, restrict or prohibit an investment adviser, broker/dealer or transfer agent from carrying on its business in the event that it fails to comply with applicable laws and regulations. In such event, the possible sanctions that may be imposed include, but are not limited to, the suspension of individual employees or agents, limitations on engaging in certain lines of business for specified periods of time, censures, fines and the revocation of investment adviser and other registrations.

The Securities and Exchange Commission (the "SEC") is the federal agency responsible for the administration of federal securities laws. Certain of our subsidiaries are registered with the SEC as investment advisers under the Advisers Act, which imposes numerous obligations on registered investment advisers including, among other things, fiduciary duties, record-keeping and reporting requirements, operational requirements and disclosure obligations, as well as general anti-fraud prohibitions. Investment advisers are subject to periodic examination by the SEC, and the SEC is authorized to institute proceedings and impose sanctions for violations of the Advisers Act, ranging from censure to termination of an investment adviser's registration.

Our Funds are registered as investment companies with the SEC under the ICA, and various filings are made with states under applicable state rules and regulations. The ICA regulates the relationship between a mutual fund and its investment adviser and prohibits or severely restricts principal transactions and joint transactions. Various regulations cover certain investment strategies that may be used by the Funds for hedging and/or speculative purposes. To the extent the Funds purchase futures contracts, options on futures contracts and foreign currency contracts, they are subject to the commodities and futures regulations of the Commodity Futures Trading Commission.

We derive a large portion of our revenues from investment management agreements. Under the Advisers Act, our investment management agreements terminate automatically if assigned without the client's consent. Under the ICA, investment advisory agreements with registered investment companies such as the Funds terminate automatically upon assignment. The term "assignment" is broadly defined and includes direct assignments, as well as assignments that may be deemed to occur, under certain circumstances, upon the transfer, directly or indirectly, of a controlling interest in the Company.

The Company is also subject to federal and state laws affecting corporate governance, including the Sarbanes-Oxley Act of 2002 ("S-OX"), as well as rules adopted by the SEC. As a New York Stock Exchange (the "NYSE") listed company, we are also subject to the rules of the NYSE, including the corporate governance listing standards approved by the SEC.

Three of our subsidiaries, W&R, LEC and IFDI, are also registered as broker/dealers with the SEC and the states. Much of the regulation of broker/dealers has been delegated by the SEC to self-regulatory organizations, principally the Municipal Securities Rulemaking Board and the Financial Industry Regulatory Authority ("FINRA"), which is the primary regulator of our broker/dealer activities. These self-regulatory organizations adopt rules (subject to approval by the SEC) that govern the industry and conduct periodic examinations of our operations over which they have jurisdiction. Securities firms are also subject to regulation by state securities administrators in those states in which they conduct business. Broker/dealers are subject to regulations that cover all aspects of the securities business, including sales practices, market making and trading among broker/dealers, the use and safekeeping of clients' funds and securities, capital structure, record-keeping, and the conduct of directors, officers and employees. Violation of applicable regulations can result in the revocation of broker/dealer licenses, the imposition of censures or fines, and the suspension or expulsion of a firm, its officers or employees.

W&R, LEC and IFDI are also each subject to certain net capital requirements pursuant to the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Uniform Net Capital Rule 15c3-1 of the Exchange Act (the "Net Capital Rule") specifies the minimum level of net capital a registered broker/dealer must maintain and also requires that part of its assets be kept in a relatively liquid form. The Net Capital Rule is designed to ensure the financial soundness and liquidity of broker/dealers. Any failure to maintain the required minimum net capital may subject us to suspension or revocation of our registration or other limitations on our activity by the SEC, and suspension or expulsion by FINRA or other regulatory bodies, and ultimately could require the broker/dealer's liquidation. The maintenance of minimum net capital requirements may also limit our ability to pay dividends. As of December 31, 2007, 2006 and 2005, net capital for W&R, LEC and IFDI exceeded all minimum requirements.

Pursuant to the requirements of the Securities Investor Protection Act of 1970, W&R and LEC are members of the Securities Investor Protection Corporation (the "SIPC"). IFDI is not a member of the SIPC. The SIPC provides protection against lost, stolen or missing securities (but not loss in value due to a rise or fall in market prices) for clients in the event of the failure of a broker/dealer. Accounts are protected up to $500,000 per client with a limit of $100,000 for cash balances. However, since the Funds, and not our broker/dealer subsidiaries, maintain customer accounts, SIPC protection would not cover mutual fund shareholders.

On October 26, 2001, President Bush signed the USA PATRIOT Act, aimed at giving the government new powers in the war on terrorism. Title III of this new legislation, the International Money Laundering

Abatement and Anti-Terrorist Financing Act of 2001, imposes significant new anti-money laundering requirements on all financial institutions, including domestic banks and domestic operations of foreign banks, broker/dealers, futures commission merchants and investment companies.

In 2004, we implemented compliance with Section 404 of S-OX. Our related report on internal controls over financial reporting for 2007 is included in Part I, Item 9A.

Our businesses may be materially affected not only by regulations applicable to us as an investment adviser, broker/dealer or transfer agent, but also by law and regulations of general application. For example, the volume of our principal investment advisory business in a given time period could be affected by, among other things, existing and proposed tax legislation and other governmental regulations and policies (including the interest rate policies of the Federal Reserve Board), and changes in the interpretation or enforcement of existing laws and rules that affect the business and financial communities.

Competition

The financial services industry is a highly competitive global industry. According to the ICI, at the end of 20072010 there were more than 8,7008,500 open-end investment companies of varying sizes, investment policies and objectives whose shares are being offered to the public in the United States alone. Factors affecting our business include brand recognition, business reputation, investment performance, quality of service and the continuity of both client relationships and assets under management. A majority of mutual fund sales go to funds that are highly rated by a small number of well-known ranking services that focus on investment performance. Competition is based on distribution methods, the type and quality of shareholder services, the success of marketing efforts and the ability to develop investment products for certain market segments to meet the changing needs of investors, and to achieve competitive investment management performance.

We compete with hundreds of other mutual fund management, distribution and service companies that distribute their fund shares through a variety of methods, including affiliated and unaffiliated sales forces, broker/dealers and direct sales to the public of shares offered at a low or no sales charge. Many larger mutual fund complexes have significant advertising budgets and established relationships with brokerage houses with large distribution networks, which enable these fund complexes to reach broad client bases. Many investment management firms offer services and products similar to ours, as well as other independent financial advisors. We also compete with brokerage and investment banking firms, insurance companies, commercial banks and other financial institutions and businesses offering other financial products in all aspects of their businesses. Although no single company or group of companies consistently dominates the mutual fund management and services industry, many are larger than us, have greater resources and offer a wider array of financial services and products. We believe that competition in the mutual fund industry will increase as a result of increased flexibility afforded to banks and other financial institutions to sponsor mutual funds and distribute mutual fund shares. Additionally, barriers to

entry into the investment management business are relatively few, and thus, we face a potentially growing number of competitors, especially during periods of strong financial and economic markets.

The distribution of mutual funds and other investment products has undergone significant developments in recent years, which has intensified the competitive environment in which we operate. These developments include the introduction of new products, increasingly complex distribution systems with multiple classes of shares, the development of Internet websites providing investors with the ability to invest on-line, the introduction of sophisticated technological platforms used by financial advisors to sell and service mutual funds for their clients, the introduction of separately managed accounts—previously available only to institutional investors—to individuals, and growth in the number of mutual funds offered. We believe our business model targets customers seeking personal assistance from financial advisors or planners where the primary competition is companies distributing products through a financial advisor or broker/dealer sales force. Our financial advisors compete primarily with large and small broker/dealers, independent financial advisors and insurance representatives. The market for financial planning and advice

is extremely fragmented, consisting primarily of relatively small companies with fewer than 100 investment professionals. Competition is based on sales techniques, personal relationships and skills, and the quality of financial planning products and services offered.

We also face competition in attracting and retaining qualified financial advisors and employees. The ability to continue to compete effectively in our business depends in part on our ability to compete effectively in the labor market. In order to maximize this ability, we offer competitive compensation, a wide range of benefits and have several stock-based compensation incentive programs.

Regulation

The securities industry is subject to extensive regulation and virtually all aspects of our business are subject to various federal and state laws and regulations. These laws and regulations are primarily intended to protect investment advisory clients and shareholders of registered investment companies. Under such laws and regulations, agencies and organizations that regulate investment advisers, broker/dealers, and transfer agents like us have broad administrative powers, including the power to limit, restrict or prohibit an investment adviser, broker/dealer or transfer agent from carrying on its business in the event that it fails to comply with applicable laws and regulations. In such event, the possible sanctions that may be imposed include, but are not limited to, the suspension of individual employees or agents, limitations on engaging in certain lines of business for specified periods of time, censures, fines and the revocation of investment adviser and other registrations.

The Securities and Exchange Commission (the "SEC") is the federal agency responsible for the administration of federal securities laws. Certain of our subsidiaries are registered with the SEC as investment advisers under the Advisers Act, which imposes numerous obligations on registered investment advisers including, among other things, fiduciary duties, record-keeping and reporting requirements, operational requirements and disclosure obligations, as well as general anti-fraud prohibitions. Investment advisers are subject to periodic examination by the SEC, and the SEC is authorized to institute proceedings and impose sanctions for violations of the Advisers Act, ranging from censure to termination of an investment adviser's registration.

Our Funds are registered as investment companies with the SEC under the ICA, and various filings are made with states under applicable state rules and regulations. The ICA regulates the relationship between a mutual fund and its investment adviser and prohibits or severely restricts principal transactions and joint transactions. Various regulations cover certain investment strategies that may be used by the Funds for hedging and/or speculative purposes. To the extent the Funds purchase futures contracts, options on futures contracts and foreign currency contracts; they are subject to the commodities and futures regulations of the Commodity Futures Trading Commission.

We derive a large portion of our revenues from investment management agreements. Under the Advisers Act, our investment management agreements terminate automatically if assigned without the client's consent. Under the ICA, investment advisory agreements with registered investment companies, such as the Funds, terminate automatically upon assignment. The term "assignment" is broadly defined and includes direct assignments, as well as assignments that may be deemed to occur, under certain circumstances, upon the transfer, directly or indirectly, of a controlling interest in the Company.

The Company is also subject to federal and state laws affecting corporate governance, including the Sarbanes-Oxley Act of 2002 ("S-OX"), as well as rules adopted by the SEC. In 2004, we implemented compliance with Section 404 of S-OX. Our related report on internal controls over financial reporting for 2010 is included in Part I, Item 9A.

As a publicly traded company, we are also subject to the rules of the New York Stock Exchange (the "NYSE"), the exchange on which our stock is listed, including the corporate governance listing standards approved by the SEC.

Three of our subsidiaries, W&R, LEC and IFDI, are registered as broker/dealers with the SEC and the states. Much of the broker/dealer regulation has been delegated by the SEC to self-regulatory organizations, principally the Municipal Securities Rulemaking Board and the Financial Industry Regulatory Authority ("FINRA"), which is the primary regulator of our broker/dealer activities. These self-regulatory organizations adopt rules (subject to approval by the SEC) that govern the industry and conduct periodic examinations of our operations over which they have jurisdiction. Securities firms are also subject to regulation by state securities administrators in those states in which they conduct business. Broker/dealers are subject to regulations that cover all aspects of the securities business, including sales practices, market making and trading among broker/dealers, the use and safekeeping of clients' funds and securities, capital structure, record-keeping, and the conduct of directors, officers and employees. Violation of applicable regulations can result in the revocation of broker/dealer licenses, the imposition of censures or fines, and the suspension or expulsion of a firm, its officers or employees.

W&R, LEC and IFDI are each subject to certain net capital requirements pursuant to the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Uniform Net Capital Rule 15c3-1 of the Exchange Act (the "Net Capital Rule") specifies the minimum level of net capital a registered broker/dealer must maintain and also requires that part of its assets be kept in a relatively liquid form. The Net Capital Rule is designed to ensure the financial soundness and liquidity of broker/dealers. Any failure to maintain the required minimum net capital may subject us to suspension or revocation of our registration or other limitations on our activity by the SEC, and suspension or expulsion by FINRA or other regulatory bodies, and ultimately could require the broker/dealer's liquidation. The maintenance of minimum net capital requirements may also limit our ability to pay dividends. As of December 31, 2010, 2009 and 2008, net capital for W&R, LEC and IFDI exceeded all minimum requirements.

Pursuant to the requirements of the Securities Investor Protection Act of 1970, W&R and LEC are members of the Securities Investor Protection Corporation (the "SIPC"). IFDI is not a member of the SIPC. The SIPC provides protection against lost, stolen or missing securities (but not loss in value due to a rise or fall in market prices) for clients in the event of the failure of a broker/dealer. Accounts are protected up to $500,000 per client with a limit of $100,000 for cash balances. However, since the Funds, and not our broker/dealer subsidiaries, maintain customer accounts, SIPC protection would not cover mutual fund shareholders.

Title III of the USA PATRIOT Act, the International Money Laundering Abatement and Anti-Terrorist Financing Act of 2001, imposes significant anti-money laundering requirements on all financial institutions, including domestic banks and domestic operations of foreign banks, broker/dealers, futures commission merchants and investment companies.

Our businesses may be materially affected not only by regulations applicable to us as an investment adviser, broker/dealer or transfer agent, but also by law and regulations of general application. For example, the volume of our principal investment advisory business in a given time period could be affected by, among other things, existing and proposed tax legislation and other governmental regulations and policies (including the interest rate policies of the Federal Reserve Board), and changes in the interpretation or enforcement of existing laws and rules that affect the business and financial communities.

Intellectual Property

We regard our names as material to our business, and have registered certain service marks associated with our business with the United States Patent and Trademark Office.

Employees and Financial Advisors

At December 31, 2007,2010, we had 1,7021,485 full-time employees, consisting of 9371,095 home office employees, 145 employees of subsidiary companies in Florida and Texas, 101 managing principals, eight regional vice presidents, six associate managers, 160 field office support personnel, and 345 district managers and district supervisors; district managers and supervisors are counted as bothLegend employees and financial advisors.

At December 31, 2007, our sales force was comprised of 2,293 financial advisors, including 1,948 financial advisors who are independent contractors and 345 district managers and district supervisors who are considered employees. In addition, Legend, which is a part of our Wholesale channel, had 462 retirement advisors considered to be independent contractors.390 employees responsible for advisor field supervision.

Available Information

We file reports, proxy statements, and other information with the SEC, copies of which can be obtained from the SEC's Public Reference Room at 450 Fifth100 F Street N.W.,NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330.

Reports we file electronically with the SEC via the SEC's Electronic Data Gathering, Analysis and Retrieval system ("EDGAR") may be accessed through the Internet. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, atwww.sec.gov. The Company makes available free of charge our proxy statements, annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K and amendments to those reports under the "Corporate""Investor Relations" section of our internet website atwww.waddell.com as soon as it is reasonably practical after such filing has been made with the SEC.

Also available under the "Corporate" section is information on corporate governance. Stockholders have the ability tocan view our Corporate Code of Business Conduct and Ethics (the "Code of Ethics"), which applies to directors, officers and all employees of the Company;Company, our Corporate Governance Guidelines;Guidelines, and the charters of key committees (including the Audit, Compensation, and Nominating and Corporate Governance Committees). Printed copies of these documents are available to any stockholder upon request by calling the investor relations department at 1-800-532-2757. Any future amendments to or waivers of the Code of Ethics will be posted to our website, as required.

An Increasing Percentage Of Our Assets Under ManagementFinancial Advisors Are Distributed ThroughClassified As Independent Contractors, And Changes To Their Classification May Increase Our Wholesale Channel, Which Reflects Higher Redemption Rates Than Our Traditional Advisors Channel.Operating Expenses. In recent years, we have focusedFrom time to time, various legislative or regulatory proposals are introduced at the federal or state levels to change the status of independent contractors' classification to employees for either employment tax purposes (withholding, social security, Medicare and unemployment taxes) or other benefits available to employees. Currently, most individuals are classified as employees or independent contractors for employment tax purposes based on expanding distribution efforts relating to our Wholesale channel. The percentage20 "common law" factors, rather than any definition found in the Internal Revenue Code or Treasury regulations. We classify the majority of our assets under management infinancial advisors as independent contractors for all purposes, including employment tax and employee benefit purposes. There can be no assurance that legislative, judicial or regulatory (including tax) authorities will not introduce proposals or assert interpretations of existing rules and regulations that would change the Wholesale channel has increased from 10.4% at December 31, 2003 to 33.2% at December 31, 2007, and the percentage of our total sales represented by the Wholesale channel has increased from 16.5% for the year ended December 31, 2003 to 63.5% for the year ended December 31, 2007. The success of sales in our Wholesale channel depends upon our maintaining strong relationships with institutional accounts, certain strategic partners and our third party distributors. Manyindependent contractor/employee classification of those distribution sources also offer investors competing funds that are internally or externally managed, which could limit the distribution of our products. The loss of any of these distribution channels and the inability to continue to access new distribution channels could decrease our assets under management and adversely affect our results of operations and growth. We cannot assure you that these channels and their client bases will continue to be accessible tofinancial advisors currently doing business with us. The loss or diminution of the level of business we docosts associated with those providerspotential changes, if any, with respect to these independent contractor classifications could have a material adverse effect on the Company, including our business, especially with the high concentrationresults of assets in certain funds in this channel. In addition, the Wholesale channel had redemption ratesoperations and financial condition. See Part I, Item 3. "Legal Proceedings."

There May Be An Adverse Effect On Our RevenuesBusiness Is Subject To Substantial Risk From Litigation, Regulatory Investigations And Earnings If Our Investors Remove The Assets We Manage On Short Notice.Potential Securities Laws Liability. Mutual fund investors may redeem their investmentsMany aspects of our business involve substantial risks of litigation, regulatory investigations and/or arbitration, and from time to time, we are involved in various legal proceedings in the course of operating our mutual funds at any time without any prior notice. Additionally, our investment management agreements with institutionsbusiness. The Company is exposed to liability under federal and state securities laws, other federal and state laws and court decisions, as well as rules and regulations promulgated by the SEC, FINRA and other non-mutual fund accounts are generally terminable upon relatively short notice. Investors can terminate their relationship with us, reduce their aggregate amount of assets under management, regulatory bodies. We, our subsidiaries, and/or shift their funds to other types of accounts with different rate structures for any number of reasons, including investment performance, changes in prevailing interest rates and financial market performance. The abilitycertain of our investorspast and present officers, have been named as parties in legal actions, regulatory investigations and proceedings, and securities arbitrations in the past and have been subject to accomplish this on short notice has increased materially dueclaims alleging violation of such laws, rules and regulations, which have resulted in the payment of fines and settlements. An adverse resolution of any lawsuit, legal or regulatory proceeding or claim against us could result in substantial costs or reputational harm to the growth of assets in our Wholesale channel,Company, and with the high concentration of assets in certain funds in this channel. The decrease in revenues that could result from any such event could have a material adverse effect on the Company's business, financial condition or results of operations, which, in turn, may negatively affect the market price of our businesscommon stock and earnings.our ability to pay dividends. In addition to these financial costs and risks, the defense of litigation or arbitration may divert resources and management's attention from operations. See Part I, Item 3. "Legal Proceedings."

There May Be Adverse Effects OnRegulatory Risk Is Substantial In Our Business And Earnings UponNon-Compliance With Regulations, Or Changes In Regulations, Could Have A Significant Impact On The TerminationConduct Of Or Failure To Renew, Certain Agreements.Our Business And Our Prospects, Revenues And Earnings. A majorityOur investment advisory and broker/dealer businesses are heavily regulated, primarily at the federal level. Non-compliance with applicable laws or regulations could result in sanctions being levied against us, including fines and censures, suspension or expulsion from a certain jurisdiction or market, or the revocation of licenses. Non-compliance with applicable laws or regulations could also adversely affect our reputation, prospects, revenues and earnings. In addition, changes in current legal, regulatory, accounting, tax or compliance requirements or in governmental policies could adversely affect our operations, revenues and earnings by, among other things, increasing expenses and reducing investor interest in certain products we offer. Distribution fees paid to mutual fund distributors in accordance with Rule 12b-1 promulgated under the Investment Company Act of 1940, as amended ("Rule 12b-1") are derived from investment management agreementsan important element of the distribution of the mutual funds we manage. The SEC has recently proposed replacing Rule 12b-1 with the Fundsa new regulation that as required by law, are terminable on 60 days' notice. Each investment management agreement must be approved and renewed annually by the disinterested members of each Fund's board of directors/trustees or its shareholders, as required by law. Additionally, our investment management agreements provide for automatic terminationwould significantly change current fund distribution practices in the event of assignment, which includesindustry. If this proposed regulation is adopted, it may have a change of control, without the consent of our clients and, in the case of the Funds, approval of the Funds' board of directors/trustees and shareholders to continue the agreements. The Company also has co-exclusive arrangements with Nationwide and Minnesota Life/Securian to distribute their variable annuities containing the Target Funds managed by the Company, which are currently set to expire in the fall of 2008, and our subadvisory agreement with MFC, which is renewable annually, expires in December 2008. There can be no assurances that our clients will consent to any assignment of our investment management agreements, or that those and other contracts will not be terminated or will be renewed on favorable terms, if at all, at their expiration and new agreements may not be available. Failure to renew the Minnesota Life/Securian arrangement could have an adversematerial impact on the strategic alliance agreement with Securian wherebycompensation we pay to distributors for distributing the mutual funds we manage equity assets for their asset management affiliates. See "Business – Distribution Channels – Wholesale Channel, Institutional Channel." The decreaseand/or our ability to recover expenses related to the distribution of our funds, and thus could materially impact our revenue and net income. Additionally, our profitability could be affected by rules and regulations that impact the business and financial communities generally, including changes to the laws governing state and federal taxation.

In recent years, allegations of late trading, market timing and selective disclosure of portfolio information in revenuesthe mutual fund industry have prompted various legislative and regulatory proposals, some of which have been adopted by the SEC, the United States Congress, the legislatures in states in which we conduct operations and the various regulatory agencies that could result from any such eventsupervise our operations. In particular, new rules and regulations adopted by the SEC and FINRA place greater regulatory compliance and administrative burdens on us and could have a material adverse effectsubstantial impact on the regulation, operation and distribution of mutual funds and variable products, and could adversely affect our businessability to distribute and earnings.retain the assets we manage and our revenues and net income. For example, recently adopted rules require investment advisers and mutual funds to adopt, implement, review and administer written policies and procedures reasonably designed to prevent violation of the federal securities laws. Similarly, public disclosure requirements applicable to mutual funds have become more stringent. We may require additional staff to satisfy these obligations, which would increase our operating expenses.

Our Revenues, Earnings And Prospects Could Be Adversely Affected If The Securities Markets Decline. Our results of operations are affected by certain economic factors, including the level of the securities markets. The on-going existence of adverse market conditions, (whichwhich is particularly material to us due to our high

concentration of assets under management in the United States domestic stock market)market, and lack of investor confidence could result in investors further withdrawing from the markets or decreasing their rate of investment, either of which could adversely affect our revenues, earnings and growth prospects.prospects to a greater extent. Because our revenues are, to a large extent, investment management fees that are based on the value of assets under management, a decline in the value of these assets adversely affects our revenues and earnings. Our growth is dependent to a significant degree upon our ability to attract and retain mutual fund assets, and, in an adverse economic environment, this may prove more difficult. Our growth rate has varied from year to year and there can be no assurance that the average growth rates sustained in the recent pastyears will continue. Declines in the securities markets could significantly reduce future revenues and earnings. In addition, a decline in the market value of these assets could cause our clients to withdraw funds in favor of investments they perceive as offering greater opportunity or lower risk, which could also negatively impact our revenues and earnings. The combination of adverse markets reducing sales and investment management fees could compound on each other and materially affect earnings.

There May Be Adverse Effects On Our Revenues And Earnings If Our Funds' Performance Declines. Success in the investment management and mutual fund businesses is dependent on the investment performance of client accounts relative to market conditions and the performance of competing funds. Good relative performance stimulates sales of the Funds' shares and tends to keep redemptions low. Sales of the Funds' shares in turn generate higher management fees and distribution revenues. Good relative performance also attracts institutional and separate accounts. Conversely, poor relative performance results in decreased sales, increased redemptions of the Funds' shares and the loss of institutional and separate accounts, resulting in decreases in revenues. Failure of our Funds to perform well could, therefore, have a material adverse effect on our revenues and earnings.

An Increasing Percentage Of Our Assets Under Management Are Distributed Through Our Wholesale Channel, Which Has Higher Redemption Rates Than Our Traditional Advisors Channel. In recent years, we have focused on expanding distribution efforts relating to our Wholesale channel. The percentage of our assets under management in the Wholesale channel has increased from 10% at December 31, 2003 to 49% at December 31, 2010, and the percentage of our total sales represented by the Wholesale channel has increased from 17% for the year ended December 31, 2003 to 67% for the year ended December 31, 2010. The success of sales in our Wholesale channel depends upon our maintaining strong relationships with institutional accounts, certain strategic partners and our third party distributors. Many of those distribution sources also offer investors competing funds that are internally or externally managed, which could limit the distribution of our products. The loss of any of these distribution channels and the inability to continue to access new distribution channels could decrease our assets under management and adversely affect our results of operations and growth. There are no assurances that these channels and their client bases will continue to be accessible to us. The loss or diminution of the level of business we do with those providers could have a material adverse effect on our business, especially with the high concentration of assets in certain funds in this channel, namely the Asset Strategy fund. Compared to the industry average redemption rate of 26.3% for the years ended December 31, 2010 and 2009, the Wholesale channel had redemption rates of 29.3% and 24.0% for the years ended December 31, 2010 and 2009, respectively. Redemption rates were 9.3% and 8.4% for our Advisors channel in the same periods, reflecting the higher rate of transferability of investment assets in the Wholesale channel.

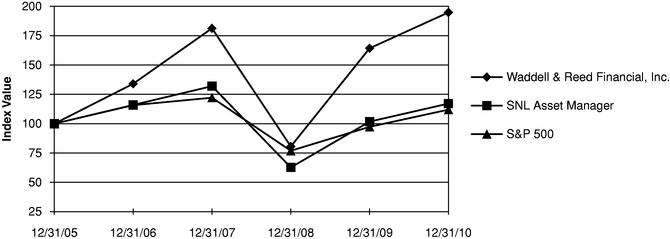

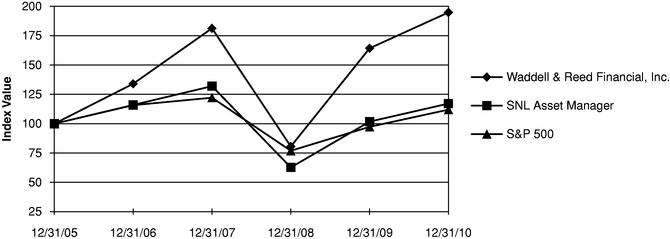

There May Be An Adverse Effect On Our Revenues And Earnings If Our Investors Redeem The Assets We Manage On Short Notice. Mutual fund investors may redeem their investments in our mutual funds at any time without any prior notice. Additionally, our investment management agreements with institutions and other non-mutual fund accounts are generally terminable upon relatively short notice. Investors can terminate their relationship with us, reduce their aggregate amount of assets under management, or shift their funds to other types of accounts with different rate structures for any number of reasons, including investment performance, changes in prevailing interest rates and financial market performance. The ability of our investors to accomplish this on short notice has increased materially due to the growth of assets in