modification centers, and the OEM market. We continue to build a sales and marketing force dedicated to expanding our sales efforts to these markets while at the same time maintaining our position as a provider of avionics products for the DoD.

- •

- Expanding our international presence. We plan to increase our international sales by adding sales and marketing personnel and foreign offices. As large flat panel displays become more prevalent, we believe European and other international aircraft operators and aircraft modification centers will accelerate retrofitting activities, thereby increasing

thedemand for large flat panel displays. Presently, we are in the process of obtaining EASA approval for European installations. - •

- Growth through acquisitions or joint ventures. We may pursue strategic acquisitions or joint ventures as a means of growing our business with respect to technology, distribution, customers or products. We may seek to acquire developers or suppliers of complementary products, technology or information, or we may acquire suppliers of similar products as a means of increasing our product offerings and market share.

Our Products

Our current line of products includes:

Flat Panel Display Systems

In the last severalrecent years color flat panel displays have been introduced into aircraft cockpits. Flat panel displaysPanel Displays are Liquid Crystal Display (LCD) screens that can replicate the display of one or a suite of analog or digital displays on one screen. Like other instrumentation, flat panel displays can be installed in new aircraft or used to replace existing displays in aircraft already in use. LCDs are also used for security monitoring on-board aircraft and as tactical workstations on military aircraft. The flat panel product line also presents numerous advantages for presentation of engine performance data. During fiscal 2008, 20072010, 2009 and 20062008 we derived 77%68%, 53%75% and 38%77% respectively, of our total revenues from sales of Flat Panel Display Systems.

We developed a Flat Panel Display System that can replace conventional analog and digital displays currently used in a cockpit and can display additional information that is not now commonly displayed in the cockpit. Our Cockpit Information PortalCOCKPIT/IP™ is capable of displaying nearly all types of air data, engine and fuel data, altitude, heading and navigational data, and alternative source information. As technology and information delivery systems further develop, additional information, such as surface terrain maps and data link messaging, will be displayed in the cockpit. We designed our COCKPIT/IP™ to be capable of displaying information generated from a variety of sources, including our Reduced Vertical Separation Minimum (RVSM) air data system, engine and fuel instrumentation, and third-party data and information products.

From time to time customers may order one or more flat panel display systems customized to their particular requirements. Depending on the amount of non-recurring engineering effort needed to accommodate the customized request, the Company has and will continue to charge a fee for added development cost. This will result in revenue to the Company that is characterized as Engineering- modification and development on the income statement. Consistent with this approach, engineering cost incurred in the performance of customizing the flat panel display system will be allocated from Operating expenses (Research and development) to Cost of Sales (Engineering—modification and development) and will be included in the Company's gross profit calculations.

Air Data Systems and Components

Our air data products calculate and display various measures such as aircraft speed, altitude and rate of ascent and descent. The functionality of our air data systems use advanced sensors to gather air pressure data and use customized algorithms to interpret data, thus allowing the system to more accurately calculate altitude. During fiscal 2008, 2007,2010, 2009, and 20062008 we derived 23%32%, 47%25%, and 62%23%, respectively, of our total revenues from sales of air data systems and related products.

We sell individual components as well as partial and complete air data systems. Our components and systems include:

- •

- digital air data computers, which calculate various air data parameters such as altitude, airspeed, vertical speed, angle of attack and other information derived from the measure of air pressure;

- •

- integrated air data computers and display units, which calculate and convey air data information;

- •

- altitude displays, which convey aircraft altitude measurements;

- •

- airspeed displays, which convey various types of airspeed measurements including vertical airspeed and rates of ascent and descent; and

- •

- altitude

alerter,alerters, which allow the pilot to select a desired cruising altitude that the aircraft will reach and maintain, and also provide warnings to pilots when an unacceptable deviation occurs.

Engine and Fuel Displays

We develop, manufacture and market engine and fuel displays. Our solid-state multifunction displays convey information with respect to fuel and oil levels and engine activity, such as oil and hydraulic pressure and temperature. This instrumentation includes individual and multiple displays clustered throughout an aircraft's cockpit. Our displays can be used in conjunction with our own engine and fuel data equipment or that of other manufacturers.

Engine and fuel displays are found in all aircraft and are vital to safe and proper aircraft flight. In addition, accurate conveyance of engine and fuel information is critical for monitoring of engine stress and maintenance of engine parts. Engine and fuel displays tend to be replaced more frequently than other displays and have remained largely unchanged since their introduction due to their low cost, standard design and universal use.

We believe our air data engine and fuel displays are extremely reliable, and we have designed them to be programmable to adapt easily without major modification to most modern aircraft. Our products have been installed on C-130H, DC-9, DC-10, P3P-3, F-16 and A-10 aircraft.

Customers

Our customers include the United States government (including DoD and Homeland Security), ABX Air, American Airlines, The Boeing Company, Bombardier Aerospace, Cessna Aircraft Corporation, Eclipse Aerospace, Inc., Federal Express Corporation, L-3 Spar Aerospace,Communication, Lockheed Martin Corporation, Northwest Airlines, Raytheon, Rockwell Collins, Marshalls of Cambridge, United Kingdom, and the Department of National Defense, Canada.Canada, among others.

Retrofit Market

Historically, a majority of our sales have come from the retrofit market. Among other reasons, we have pursued the retrofit market specifically because of its continued rapid growth in response to the increasing need to support the world's aging fleet of aircraft. DuringIn fiscal 2010, our two largest customers, Lockheed Martin and FedEx, accounted for 11% and 10% of our total revenue, respectively. In fiscal year 2009, our two largest customers, American Airlines and DoD, accounted for 24% and 11% of our total revenue, respectively. In fiscal year 2008 we derived 26%our two largest customers, Eclipse Aviation, Inc. and FedEx, accounted for 42%, and 10% of our revenues from three retrofit customers, DoD, Federal Express and American Airlines. We derived 47%total revenue, respectively.

Table of our revenues during fiscal year 2007 from three retrofit customers, DoD, Eclipse and Western Aircraft.Contents

Updating an individual aircraft's existing electronics equipment has become increasingly common as new technology makes existing instrumentation outdated while an aircraft is still structurally and mechanically sound. Retrofitting an aircraft is generally a substantially less expensive alternative to purchasing a new aircraft. We expect our main customers in the retrofit market to be:

- •

- the DoD and defense contractors;

- •

- aircraft operators; and

- •

- aircraft modification centers.

Department of Defense and Defense Contractors. We sell our products directly to the DoD as well as to domestic and international defense contractors for end use on military aircraft retrofit programs. DoD programs generally take one of two forms, a subcontract with a prime government contractor, such as Boeing, Lockheed Martin or Rockwell Collins, or a direct contract with the appropriate government agency such as the U.S. Air Force to satisfy its requirement for replacing Central Air Data Computers on its fleet of A-10 aircraft. The government's desire for cost-effective retrofitting of aircraft has led it to purchase commercial off-the-shelf equipment rather than requiring the development of specially designed products, which are usually more costly and take longer to develop. These contracts tend to be on arms length commercial terms, although some termination and other provisions of government contracts described under "Government Regulation" below are typically applicable to these contracts. Each government agency or general contractor retains the right to terminate a contract at any time at its convenience. Upon such alteration or termination, we typically would be entitled to an equitable adjustment to the contract price andso that we would receive the purchase price for already delivered items and reimbursement for allowable costs incurred.

Aircraft Operators. We also sell our products to aircraft operators, including commercial airlines, cargo carriers and business and general aviation. Our products are used mostly in retrofitting aircraft owned or operated by these customers, which generally retrofit and maintain their aircraft themselves. Our commercial fleet customers include or have included, among others, American Airlines, Northwest Airlines,ABX Air, Air Canada, ABX AirFederal Express and Federal Express.Northwest Airlines. We sell these customers a range of products from flat panel display systems to air data systems.

Aircraft Modification Centers. The primary retrofit market for private and corporate jets is through aircraft modification centers, which repair and retrofit private aircraft in a manner similar to the way auto mechanics service a person's car. We have established relationships with a number of aircraft modification centers throughout the United States. These modification centers essentially act as distribution outlets for our products. We believe our air data systems and related components are being promoted by aircraft modification centers to update older or outdated equipment. Our large modification center customers include Bombardier Learjet, Garrett Aviation,Western Aircraft, Aeromech, Star Aviation, Duncan Aviation, Plain Avionics and Raytheon Aircraft Services.

OEM Market

In fiscal 2008 the Company suspended work on the Eclipse VLJ program in line with the suspension of requirements from the OEM.and Eclipse Aviation Inc. filed for Chapter 11 Bankruptcy on November 25, 2008.Bankruptcy. New owners have resurrected the former Eclipse Aviation, Inc. and formed a new entity named Eclipse Aerospace, Inc to purchase Eclipse Aviation, Inc's assets. At the 2010 National Business Aviation Association (NBAA) convention, it was announced that Sikorsky Aircraft intends to invest in Eclipse Aviation, Inc. In fiscal 2010 the Company resumed deliveries to Eclipse Aerospace, Inc. of equipment and functionality to support upgrades to their existing fleet of approximately 250 aircraft. The Company believes that Eclipse aspires to begin new aircraft production.

We also market our products to other original equipment manufacturers, particularly manufacturers of corporate and private jets as well as to contractors manufacturing military jets.

Customers of our products have included Bombardier, (the manufacturer of Learjet), Gulfstream, Boeing, Raytheon, Piaggio and Lockheed.Lockheed Martin.

Backlog

As of September 30, 20082010 and 2007,2009, our backlog was $57.3$32.3 million and $70.4$34.1 million, respectively. The year over year decrease of $13.1$1.8 million or 19%5.3% was the result of $17.4$29.9 million in new business offset by $30.5$25.3 million of recognized revenue.revenue and $6.4 million of order de-bookings. The preponderance of the de-bookings relate to one customer and is due to the requirement to rebid the project in accordance with the procurement procedures. Air Data product backlog increasedas of September 30, 2010 decreased by $3.3$2.4 million from September 2007,30, 2009; while Flat Panel Display Systems backlog as of September 30, 2008 decreased2010 increased by $16.3$0.6 million from September 30, 2007.

Table of Contents2009.

Sales and Marketing

We focus our sales efforts on passenger and cargo carrying aircraft operators, general aviation operators, aircraft modification centers, the DoD, DoD contractors and OEMs. We continually evaluate our sales and marketing efforts with respect to these focus areas and, where appropriate, have made use of third-party sales representatives who receive compensation through commissions based on performance.

We believe our ability to provide prompt and effective repair and upgrade service is critical to our marketing efforts. As part of our customer service program, we offer a 24-hour hotline that customers can call for product repair or upgrade concerns. We employ field service engineers to service our equipment and, depending on the service required, we may either dispatch a service crew to make necessary repairs or request the customer return the product to us for repairs or upgrades at our facility. In the event repairs or upgrades are required to be made at our facility, we provide spare products for use by our customers during the repair time. Our in-house turnaround repair times for both repairs and upgrades average 15 days and turnaround upgrade times averageless than 30 days. Before returning our products to customers, all repaired or upgraded products are retested for airworthiness.

In connection with our customer service program, we typically provide customers with a two-year warranty on new products. We also offer customers extended warranties of varying terms for additional fees.

Almost allThe majority of the Company's sales, operating results and identifiable assets are in the United States. In fiscal year 2008, 2007,2010, 2009, and 20062008 net sales outside the United States amounted to $1.7$2.8 million, $1.1$4.4 million and $2.8$1.7 million, respectively.

Government Regulation

The manufacture and installation of our products in aircraft owned and operated in the United States is governed by FAA regulations. We maintain ana production facility that is FAA certified production facility.certified. The most significant of the product and installation regulations focus on Technical Standard Order Authorizations and Supplemental Type Certificate certifications.Certificates. These certifications set forth the minimum generalperformance standards that a certain type of equipment should meet. As required, we deliver our product in accordance with FAA regulations.

Sales of our products to European or other non-U.S. owners of aircraft also typically require approval of the European Aviation Safety Agency (EASA), the European counterpart of the FAA, or another appropriate governmental agency. EASA certification requirements for manufacturing and installation of our products in European-ownedEuropean owned aircraft mirror FAA regulations. Much like the FAA certification process, the EASA has established a process for granting European Certifications.

In addition to product-relatedproduct related regulations, we are also subject to U.S. Government procurement regulations with respect to sale of our products to government entities or government contractors. These regulations dictate the manner in which products may be sold to the government and set forth other requirements that must be met in order to do business with or on behalf of government entities. For example, the government agency or general contractor may alter the price, quantity or delivery schedule of our products. In addition, the government agency or general contractor retains the right to terminate the contract at any time at its convenience. Upon such alteration or termination, we would typically be entitled to an equitable adjustment to the contract price so that we would receive the purchase price for already delivered items and reimbursement for allowable costs incurred.

Manufacturing, Assembly and Materials Acquisition

Our manufacturing activities consist primarily of assembling and testing components and subassemblies and integrating them into a fully tested finished system. We believe this method allows us

to achieve relatively flexible manufacturing capacity while minimizing expenses. We typically purchase components for our products from third-party suppliers and assemble them in a clean room environment to reduce impurities and improve the performance of our products. Many of the components we purchase are standard products, although certain parts are made to our specifications.

When appropriate, we enter into long-term supply agreements and use our relationships with long-term suppliers to improve product quality and availability and to reduce delivery times and product costs. In addition, we continually identify alternative suppliers for important component parts. Using component parts from new suppliers in our products generally requires FAA certification of the entire finished product if the newly sourced component varies significantly from our original drawings and specifications. To date, we have not experienced any significant delays in delivery of our products caused by the inability to obtain either component parts or FAA approval of products incorporating new component parts.

Quality Assurance

Product quality is of vital importance to our customers, and we have taken steps to enhance the overall quality of our products. We are ISO 9001 and AS 91009100B certified. ISO 9001 and AS 91009100B standards are an international consensus on effective management practices with the goal of ensuring a company can consistently deliver its products and related services in a manner that meets or exceeds customer quality requirements. These standards allow us to represent to our customers that we maintain high quality industry standards in the education of our employees and the design and manufacture of our products. In addition, our products undergo extensive quality control testing prior to being delivered to customers. As part of our quality assurance procedures, we maintain detailed records of test results and our quality control processes.

Our Competition

The market for our products is highly competitive and characterized by several industry niches in which a number of manufacturers specialize. Our competitors vary in size and resources, and substantially all of our competitors are much larger than we are and have substantially greater resources than us.we do. With respect to air data systems and related products, our principal competitors include Honeywell International Inc., Kollsman Inc., Rockwell Collins, Inc., Thales, and GE Aviation. With respect to flat panel displays, our principal competitors currently include Honeywell, Rockwell Collins, Inc., L-3 Communications and GE Aviation. However, because the flat panel display industry is a new and evolving market, as the demand for flat panel displays increases we may face competition in this area from additional companies in the future.

We believe the principal competitive factors in markets we serve are cost, development cycle time, responsiveness to customer preferences, product quality, technology and reliability. We believe our significant and long-standing customer relationships reflect our ability to compete favorably with respect to these factors.

Intellectual Property and Proprietary Rights

We rely on patents to protect our proprietary technology. As of September 30, 20082010 the Company holds 1922 U.S. patents and has 62 U.S. patent applications pending relating to our technology. In addition, we hold 1627 international patents and have 3024 international patent applications pending. Certain of these patents and patent applications cover technology relating to air data measurement systems and calibration techniques while others cover technology relating to flat panel display systems and other aspects of our COCKPIT/IP™ solution. While we believe these patents have significant value in protecting our technology, we believe also believethat the innovative skill, technical expertise and know-how of our personnel in applying the technology reflected in our patents would be difficult, costly and time

consuming to reproduce. The company recently settled litigation related to a trade secret misappropriation as more fully described in Legal Proceedings, Item 3 of this report.

While we are not aware of any pending lawsuits against us regardingalleging patent infringement or the violation of other intellectual property rights, we cannot be certain such infringement claims will not be asserted against us in the future.

Innovative Solutions and Support Website

Our primary website ishttp://www.innovative-ss.com. We make available, free of charge, at our corporate website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act of 1934, as amended, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

Our Employees

As of September 30, 2008,2010, we had 165133 employees, 5245 were in engineering, research and development, 7855 in manufacturing and assembly operations, 98 in quality and 2625 in selling and general administrative positions.

Our future success depends on our ability to attract, train and retain highly qualified personnel. We plan to hire additional personnel, including, in particular, sales and marketing personnel, during the next twelve months. Competition for such qualified personnel is intense and we may not be able to attract, train and retain highly qualified personnel in the future. Our employees are not represented by a labor union.

Executive Officers of the Registrant

The following is a list of our executive officers, their ages and their positions:

Name | Age | Position | |||

|---|---|---|---|---|---|

| Geoffrey | 68 | Chairman of the Board and Chief Executive Officer | |||

| Roman G. Ptakowski | 62 | President | |||

| 65 | Chief Financial Officer | ||||

Geoffrey S. M. Hedrick has beenwas the Chief Executive Officer sincefrom the time he founded IS&Sthe Company in February 1988 through June 4, 2007 and was reappointed as Chief Executive Officer on September 8, 2008. He has also been Chairman of the Board since 1997. Prior to founding IS&S, Mr. Hedrick served as President and Chief Executive Officer of Smiths Industries North American Aerospace Companies. He also founded Harowe Systems, Inc. in 1971, which was subsequently acquired by Smiths Industries. Mr. Hedrick has over 35 years of experience in the avionics industry, and he holds a number of patents in the electronics, optoelectric, electromagnetic, aerospace and contamination-control fields.

Roman G. Ptakowski has been President since March 2003. Prior to that, Mr. Ptakowski served as a Group Vice President and General Manager and, before that, as a Vice President of Sales and Marketing at B/E Aerospace, Inc. Previously, Mr. Ptakowski held a number of positions with increasing responsibility within ASEA Brown Boveri Power T&D Company, Inc. There, he was General Manager

of the Protective Relay Division before leaving to join B/E Aerospace, Inc. Mr. Ptakowski received a B.S. in Electrical Engineering from New York University and a MBA from Duke University.

JohnRonald C. LongAlbrecht has been Chief Financial Officer since January 2008.August 2010. Prior to joining the Company, Mr. LongAlbrecht served in a varietynumber of executive positions, both operational and financial, with Arrow International, Inc., includingSmiths Aerospace (UK) and later GE Aviation Systems (GEAS) following the GEAS purchase of Smiths Aerospace in 2007. Recently he has served as Vice President from January, 2003 to January, 2008 as Treasurer from January, 2003 to October, 2007, as Secretary

Tableand General Manager of Contents

from April, 2004 to October, 2007Smiths and as Assistant Treasurer from 1995 to January 2003.later GEAS' Electro Mechanical Business. Prior to joining Arrow International, Mr. Longhis operational roles, he served as Controller for the Jaindl Companies, a groupChief Financial Officer of privately held companies involvedSmiths Aerospace, based in agribusinessLondon and real estate development, from 1989 to 1995. From 1986 to 1989,has substantial mergers & acquisition and strategic planning experience. Mr. Long was employed in the Allentown, Pennsylvania office of the accounting firm, Concannon, Gallagher, Miller & Co. Mr. Long also serves as a director and Audit Committee Chairman of D&E Communications, Inc., an integrated communications provider. Mr. LongAlbrecht received a B.S.B.A. in AccountingGovernment and Economics from Wilkes UniversityDartmouth College and an MBA in Finance from Stanford University. He is a MBA from Columbia University.Certified Public Accountant (California/Inactive).

Other

The public may read and copy any materials filed by us with the SEC at the SEC's public reference room located at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information about the operation of the SEC's public reference rooms by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website athttp://www.sec.gov that contains reports, proxy and information statements and other information about issuers such as that file electronically with the SEC.

Our primary website ishttp://www.innovative-ss.com.www.innovative-ss.com. We make available, free of charge, at our corporate website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The information on our web site is not incorporated as part of this annual report.

You should carefully consider the risks, uncertainties and other factors described below, in addition to the other information set forth in this report, because they could materially and adversely affect our business, operating results, financial condition, cash flows and prospects as well as adversely affect the value of an investment in our common stock.

Risks Related to Our Business

Our sales principally relate to flat panel display systems and air data products, and we cannot be certain that the market will continue to accept these or other products.

During fiscal 2008, 2007, and 2006 we derived 77%, 53% and 38% of our revenues from the sale of flat panel display systems, respectively. We expect that revenues from our air data products will continue to decline as a percent of total sales as peak demand associated with the FAA's RVSM mandate has been accommodated. Our revenues and profitability will decrease if new products such as our Flat Panel Display Systems do not receive market acceptance or if our existing customers do not continue to incorporate our products in their retrofitting or manufacturing of aircraft. In seeking new customers, it may be difficult for our products to displace competing products. Accordingly, we cannot assure you that potential customers will accept our products or that existing customers will not abandon them.

AThe recent global recession and continued credit tightening could adversely affect us.

Concerns about a potentialThe recent global recession and continued concern regarding credit tightening,availability, including failures of financial institutions, has initiated unprecedented government intervention in the U.S., Europe and other regions of the world. If these concerns continue or worsen, risks to us include:

- •

- Declines in revenues and profitability from reduced orders, payment delays or other factors caused by the economic problems of customers;

- •

- reprioritization of government spending away from defense programs in which we participate;

- •

- adverse impacts on our access to credit sources; and

- •

- supply problems associated with any financial constraints faced by our vendors.

A portion of our sales have been, and we expect will continue to be, to defense contractors or government agencies in connection with government aircraft retrofit or original equipment manufacturing contracts. Sales to government contractors and government agencies could decline as a result of DoD spending cuts and general budgetary constraints which may become more frequent as tax revenues decline due to the continued weakening of general economic conditions.

The loss of a key customer or a significant deterioration in the financial condition of a key customer could have a material adverse effect on our results of operations.

Our revenue is concentrated with a limited number of customers. During fiscal year 20082010 we derived 68%48% of revenuesrevenue from four customers, American Airlines, DoD, Eclipse, and Federal Express.five customers. We derived 47%56% of revenue during fiscal year 20072009 from three customers, DoD, Eclipse and Western Aircraft.five customers. We derived 47%72% of our revenuesrevenue during fiscal year 20062008 from five customers, ABX Air, Boeing, DoD, Department of National Defense-Canada, and Star Aviation.customers. We expect a relatively small number of customers to account for a majority of our revenues for the foreseeable future. As a result of our concentrated customer base, a loss of one or more of these customers or a dispute or litigation with one of these key customers could have a material adverse effect on our revenue and results of operations. In addition, we continually monitor and evaluate the credit status of our customers and attempt to adjust sales terms as appropriate. Despite these efforts, a significant deterioration in the financial condition or bankruptcy filing of a key customer could have a material adverse effect on our business, results of operations and financial condition.

On November 25, 2008, Eclipse Aviation, Inc. filed a voluntary petition for relief under Chapter 11 of the U.S. Bankruptcy Code. GivenNew owners have resurrected the early stages ifformer Eclipse Aviation, Inc. and formed a new entity named Eclipse Aerospace, Inc. to purchase Eclipse Aviation, Inc.'s assets. In fiscal 2010 the bankruptcy proceedings, it is unclear at this time what the precise impact the Eclipse's bankruptcy will have.Company began deliveries to Eclipse Aerospace, Inc. of equipment and functionality to support upgrades to their existing fleet of approximately 250 aircraft. The Company mayhas not receivereceived and does not anticipate receiving any payment on its pre-petition claims. In addition, Eclipse may choose to reject its contract withAdditionally, claims have been made against the Company which could result in a larger pre-petition claim.to try to recover amounts paid to the Company during the 90 days preceding the filing of the bankruptcy petition. See Item 3, Legal Proceedings.

Growth of our customer base could be limited by delays or difficulties in completing development and introduction of our planned products or product enhancements. If we fail to enhance existing products or to develop and achieve market acceptance for flat panel displays and other new products that meet customer requirements, our business will be adversely affected.

Although historically a substantial majority of our revenuesrevenue has come from sales of air data systems and related products, we currently spend a large portion of our research and development efforts in developing and marketing our flat panel display systems and complementary products. Our ability to grow and diversify our operations through introduction and sale of new products is dependent upon our success in continuing product development and engineering activities as well as our sales and marketing efforts and our ability to obtain requisite approvals to sell such products. Our sales growth will also depend in part on market acceptance of and demand for our CIP and future products. We cannot be certain we will be able to develop, introduce or market our CIP or other new products or product enhancements in a timely or cost-effective manner or that any new products will receive market acceptance or necessary regulatory approval.

We rely on third party suppliers for components During fiscal 2010, 2009, and 2008 we derived 68%, 75% and 77% of our products, and any interruption in supplytotal revenue from the sale of these components could hinder our ability to deliver our products.

Our manufacturing process consists primarily of assembling components purchasedflat panel display systems, respectively. We expect revenues from our supply chain. These suppliers mayair data products will decline as a percent of total sales as peak demand associated with the FAA's Reduced Vertical Separation Minimum (RVSM) mandate has been accommodated. Our revenues and profitability will decrease if new products such as our Flat Panel Display Systems do not receive market acceptance or if our existing customers do not continue to be available to us. If we are unable to maintain relationships with key third party suppliers, the development and distribution ofincorporate our products couldin their retrofitting or manufacturing of aircraft. In seeking new customers, it may be delayed until equivalent components can be obtained and integrated intodifficult for our products to displace competing products. In addition, substitution of certain components from other manufacturers may require FAA or other approval, which could delay our ability to ship products.

Government contracts can be terminated by the government at any time and therefore may not result in sales.

Our government retrofit projects are generally pursuant to either a direct contract with a government agency or a subcontract with a general contractor to a government agency. Each contract includes various federal regulations that impose certain requirements on us, including the ability of the government agency or general contractor to alter the price, quantity or delivery schedule of our products. In addition, the government agency or general contractor retains the right to terminate the contract at any time at its convenience. Upon alteration or termination of these contracts, we would be entitled to an equitable adjustment to the contract price so we may receive the purchase price for items we have delivered and reimbursement for allowable costs we have incurred. Accordingly, because these contracts can be terminated, we cannot assure yoube assured that potential customers will accept our government retrofit backlogproducts or that existing customers will result in sales.not abandon them.

We depend on key personnel to manage our business effectively, and if we are unable to retain our key employees, our ability to compete could be harmed.

Our success depends on the efforts, abilities and expertise of our senior management and other key personnel. There can be no assurance we will be able to retain such employees, the loss of some of whom could hurt our ability to execute our business strategy. We intend to continue hiring key management and sales and marketing personnel. Competition for such personnel is intense, and we may not be able to attract or retain additional qualified personnel.

Our future success will depend in part on our ability to implement and improve our operational, administrative and financial systems and controls and to manage, train and expand our employee base. We cannot assure you that after giving effect to our recent cost containment initiatives that our current and planned personnel levels, systems, procedures and controls will be adequate to support our future operations. If inadequate, we may not be able to exploit existing and potential market opportunities. Any delays or difficulties we encounter could impair our ability to attract new customers or enhance our relationships with existing customers.

Our revenue and operating results may vary significantly from quarter to quarter, which may cause our stock price to decline.

Our revenue and operating results may vary significantly from quarter to quarter due to a number of factors, including:

- •

- demand for our products

andand/or delivery scheduledeliverychanges by our customers; - •

- capital expenditure budgets of aircraft owners and operators and appropriation cycles of the U.S. government;

- •

- changes in the use of our products, including air data systems and flat panel displays;

- •

- delays in introducing or obtaining government approval for new products;

- •

- new product introductions by competitors;

- •

- changes in our pricing policies or pricing policies of our competitors, and

- •

- costs related to possible acquisition of technologies or businesses.

We plan to expand our sales and marketing operations and fund greater levels of product development.development proportionate to our total sales. As a result, a delay in generating revenues could cause significant variations in our operating results from quarter to quarter.

Contracts can be terminated by customers at any time and therefore may not result in sales.

Our retrofit projects are generally pursuant to either a direct contract with a customer or a subcontract with a general contractor to a customer (including government agencies). Each contract, including our contracts with government agencies, includes various terms and conditions that impose certain requirements on us, including the ability of the customer or general contractor to alter the

price, quantity or delivery schedule of our products. In addition, the customer or general contractor typically retains the right to terminate the contract at any time at its convenience. Upon alteration or termination of these contracts, we could be entitled to an equitable adjustment to the contract price so we may receive the purchase price for items we have delivered and reimbursement for allowable costs we have incurred. Accordingly, because these contracts can be terminated, we cannot be assured that our retrofit backlog will result in sales.

We depend on key personnel to manage our business effectively, and if we are unable to retain our key employees, our ability to compete could be harmed.

Our success depends on the efforts, abilities and expertise of our senior management and other key personnel. There can be no assurance we will be able to retain such employees, the loss of some of whom could hurt our ability to execute our business strategy. We intend to continue hiring key management and sales and marketing personnel. In spite of a U.S. unemployment rate of 9.6% as of October, 2010, competition for such personnel is intense, and we may not be able to attract or retain additional qualified personnel.

Our future success will depend in part on our ability to implement and improve our operational, administrative and financial systems and controls and to manage, train and expand our employee base. We cannot be assured that after giving effect to our cost containment initiatives that our current and planned personnel levels, systems, procedures and controls will be adequate to support our current and future customer base. If inadequate, we may not be able to exploit existing and potential market opportunities. Any delays or difficulties we encounter could impair our ability to attract new customers or maintain our relationships with existing customers.

We rely on third party suppliers for components of our products, and any interruption in supply of these components could hinder our ability to deliver our products.

Our manufacturing process consists primarily of assembling components purchased from our supply chain. These suppliers may not continue to be available to us. If we are unable to maintain relationships with key third party suppliers, the development and distribution of our products could be delayed until equivalent components can be obtained and integrated into our products. In addition, substitution of certain components from other manufacturers may require product redesign, FAA or other approval, which could delay our ability to ship products.

Our competition includes other manufacturers of air data systems and flight information displays against whom we may not be able to compete successfully.

The markets for our products are intensely competitive and subject to rapid technological change. Our competitors include Kollsman, Inc., Honeywell International Inc., Rockwell Collins, Inc., Thales, GE Aviation and L-3 Communications. Substantially all of our competitors have significantly greater financial, technical and human resources than we do. In addition, our competitors have much greater experience in and resources for marketing their products. As a result, our competitors may be able to respond more quickly to new or emerging technologies and customer preferences or devote greater resources to development, promotion and sale of their products than we can. Our competitors may also have greater name recognition and more extensive customer bases that they can use to their benefit. This competition could result in price reductions, fewer customer orders, reduced gross margins and loss of market share.

We may not be able to identify or complete acquisitions or we may consummate an acquisition that adversely affects our operating results.Table of Contents

One of our strategies is to acquire businesses or technologies that complement our existing operations. We have limited experience in acquiring businesses or technologies. There can be no assurance we will be able to acquire or profitably manage acquisitions or successfully integrate them into our operations. Furthermore, certain risks are inherent in pursuing acquisitions, such as the diversion of management's time and attention and combining disparate company cultures and facilities. Acquisitions may have an adverse effect on our operating results, particularly in quarters immediately following the consummation of such transactions, as we integrate operations of acquired businesses into our operations. Once integrated, acquisitions may not perform as expected.

Our success depends on our ability to protect our proprietary rights and there is aagainst potential risk of infringement. If we are unable to protect and enforce our intellectual property rights, we may be unable to compete effectively.

Our success and ability to compete will depend in part on our ability to obtain and maintain patent or other protection for our technology and products, both in the United States and abroad. In addition, we must operate without infringing the proprietary rights of others.

We currently hold 1922 U.S. patents and have 62 U.S. patent applications pending. In addition, we hold 1627 international patents and have 3024 international patent applications pending. We cannot be certain that patents will be issued on any of our present or future applications. In addition, our existing patents or any future patents may not adequately protect our technology if they are not broad enough, are successfully challenged or other entities are able to develop competing methods without violating our patents. If we are not successful in protecting our intellectual property, competitors could begin to offer products that incorporate our technology. Patent protection involves complex legal and factual questions and, therefore, is highly uncertain, and litigation relating to intellectual property is often very time consuming and expensive. If a successful claim of patent infringement were made against us or we are unable to develop non-infringing technology or license the infringed or similar technology on a timely and cost-effective basis, we might not be able to makeproduce and sell some of our products. In addition, we have incurred in the past and may continue in the future to incur significant legal and other costs in defense of our intellectual property.

Potential lenders may have suffered losses related to the weakening economy and may not be able to provide us with needed financing.

Potential lenders may have suffered losses related to their lending and other financial relationships, especially because of the general weakening of the national economy and increased financial instability

of many borrowers. As a result, lenders may become insolvent or tighten their lending standards, which could make it more difficult for us to borrow or to obtain new financing on favorable terms or at all.all, if we determine that it would be in our interests to obtain such financing, whether to finance acquisitions or otherwise. Our financial condition and results of operations wouldcould be adversely affected if we were unable to obtain cost-effective financing in the future.

We may not be able to identify or complete acquisitions or we may consummate an acquisition that adversely affects our operating results.

One of our strategies is to acquire businesses or technologies that complement our existing operations. We have limited experience in acquiring businesses or technologies. There can be no assurance we will be able to acquire or profitably manage acquisitions or successfully integrate them into our operations. Furthermore, certain risks are inherent in pursuing acquisitions, such as the demands of management's time and attention and combining disparate company cultures and facilities. Acquisitions may have an adverse effect on our operating results, particularly in quarters immediately following the consummation of such transactions, as we integrate operations of acquired businesses into our operations. Once integrated, acquisitions may not perform as expected.

Risks Related to Our Industry

If we are unable to respond to rapid technological change, our products could become obsolete and our reputation could suffer.

Future generations of air data systems, engine and fuel displays, and flat panel displays embodying new technologies or new industry standards could render our products obsolete. The market for

aviation products is subject to rapid technological change, new product introductions, changes in customer preferences and evolving industry standards. Our future success will depend on our ability to:

- •

- adapt to rapidly changing technologies;

- •

- adapt our products to evolving industry standards; and

- •

- develop and introduce a variety of new products and product enhancements to address the increasingly sophisticated needs of our customers.

Our future success will also depend on our developing high quality, cost-effective products and enhancements to our products that satisfy needs of customers and on our introducing these new technologies to the marketplace in a timely manner. If we fail to modify or improve our products in response to evolving industry standards, our products could rapidly become obsolete.

Our products are currently subject to direct regulation by the FAA, its European counterpart, the European Aviation Safety Administration (EASA), and other comparable organizations. Our products, as they relate to aircraft applications, must be approved by the FAA, EASA or other comparable organizations before they can be used in an aircraft. To be certified, we must demonstrate that our products are accurate and able to maintain certain levels of repeatability over time. Although certification requirements of the FAA and the EASA are substantially similar, there is no formal reciprocity between the two systems. Accordingly, even though some of our products are FAA-approved, we may need to obtain approval from the EASA or other appropriate organizations to have them certified for installation outside the United States.

Significant delay in receiving certification for newly developed products or enhancements to our products or losing certification for our existing products could result in lost sales or delays in sales. Furthermore, adoption of additional regulations or product standards, as well as changes to existing product standards, could require us to change our products and underlying technology. We cannot assure you that we will receive regulatory approval on a timely basis or at all.

Because our products utilize sophisticated technology and are deployed in complex aircraft cockpit environments, problems with these products may arise that could seriously harm our reputation for quality assurance and our business.

Our products use complex system designs and components that may contain errors, omissions or defects, particularly when we incorporate new technologies into our products or we release new versions or enhancements of our products. Despite our quality assurance process, errors, omissions or defects could occur in our current products, in new products or in new versions or enhancements of existing products after commercial shipment has begun. We may be required to redesign or recall those products or pay damages. Such an event could result in the following:

- •

- delay or loss of revenues;

- •

- cancellation of customer contracts;

- •

- diversion of development resources;

- •

- damage to our reputation;

- •

- increased service and warranty costs; or

- •

- litigation costs.

Although we currently carry product liability insurance, this insurance may not be adequate to cover our losses in the event of a product liability claim. Moreover, we may not be able to maintain such insurance in the future.

We have limited experience in marketing and distributing our products internationally.

We expect to derive an increasing amount of our revenues from sales outside the United States, particularly in Europe. There are certain risks inherent in doing business on an international basis, such as:

- •

- differing regulatory requirements for products being installed in aircraft;

- •

- legal uncertainty regarding liability;

- •

- tariffs, trade barriers, and other regulatory barriers;

- •

- political and economic instability;

- •

- changes in diplomatic and trade relationships;

- •

- potentially adverse tax consequences;

- •

- the impact of recessions in economies outside the United States; and

- •

- variance and unexpected changes in local laws and regulations.

Currently, all of our international sales are denominated in U.S. dollars. An increase in the dollar's value of the compared to other currencies could make our products less competitive in foreign markets. In the future, we may be required to conduct sales in local currencies, exposing us to changes in exchange rates that could adversely affect our operating results.

Item 1B. Unresolved Staff Comments.

None

In fiscal 2001 we purchased 7.5 acres of land in the Eagleview Corporate Park in Exton, Pennsylvania. There weShortly thereafter the Company constructed a 44,800 square foot design, manufacturing and office facility.facility on this site. Land development approval allows for expansion of up to 20,400 additional square feet. This would provide for a 65,200 square foot facility. The construction was principally funded with a Chester County, Pennsylvania, Industrial Revenue Bond. The building servesserved as security for the Industrial Revenue Bond.Bond until the bond was repaid in August 2009.

In the ordinary course of business, we are at times subject to various legal proceedings. Except with respect to the fees incurred in connection with the matters described below, weproceedings and claims. We do not believe any current legal proceedingssuch matters that are currently pending will have a material adverse effect on our results of operations or financial position.

On September 13, 2005 the Company filed a lawsuit in the United States District Court for the Western District of Tennessee against J2, Inc., a company founded and jointly owned by Joseph Cesar, a former employee of the Company, and James Zachary, a former sales consultant for the Company. The complaint alleged that the J2/Kollsman/Air Data Computer then being marketed by J2 and manufactured by Kollsman, Inc. infringed a patent assigned to IS&S.

On November 18, 2010, Jeoffrey L. Burtch, the Chapter 7 2007Trustee for AE Liquidation, Inc. (formerly Eclipse Aviation Corporation), filed avoidance actions against IS&S on behalf of AE Liquidation, Inc. for the avoidance of seven payments totaling $321,095 as allegedly preferential transfers paid to the Company received a favorable jury verdict in its trade secret misappropriation case against Kollsman, Inc. (a subsidiary of Elbit Systems Ltd.), J2 Inc., Joseph Caesar, James Zachary and Zachary Technologies, Inc. induring the United States District Court for90 days preceding the Western District of Tennessee. The jury unanimously found that eachfiling of the defendants had misappropriated IS&S's air data computer technology.bankruptcy petition of Eclipse Aviation Corporation on November 25, 2008. The jury foundCompany believes it has meritorious defenses to these avoidance actions, intends to vigorously defend against them, and believes that IS&S had suffered damages of just over $4.4 million in lost profits and $1.6 million in defendants' net profits, for a total of over $6 million. The jury also found in favor of IS&S's claims for breach of duty and contract, and unfair competition against J2 Inc., Joseph Caesar, James Zachary and Zachary Technologies, Inc.

On December 18, 2007, the court entered a temporary injunction aimed at preventing further uselikelihood of the Company's trade secret and proprietary information. On March 14, 2008, the judge presiding over the case heard the Company's claims for a permanent injunction as well as punitive and exemplary damages and attorneys' fees against Kollsman and the other defendants.

On July 7, 2008, the court issued several rulings in the case. In the rulings, the court awarded damages, interest and fees in addition to the more than $6 million in compensatory damages awarded by the jury when it rendered its verdict in the case in November 2007. The additional awards bring the damages assessed against Kollsman, Inc. to a total or more than $23 million. The court also entered an order granting the Company's request for permanent injunctive relief.

On August 27, 2008,avoidance actions prevailing is remote. Accordingly, the Company entered into a Settlement Agreement (the Settlement Agreement) with Kollsman, Inc. On August 29, 2008, the settlement became effective with respecthas not accrued any loss reserve related to all claims filed by the Company and Kollsman against each other in the United States District Court for the Western District of Tennessee and a Consent Order was entered. Under the Settlement Agreement, all claims between the Company and Kollsman have been dismissed with prejudice, a final agreed injunction has been entered and the matter has been fully and finally mutually settled without any admission of guilt by either party. In addition, an agreed settlement payment of $17 million has been made by Kollsman to the Company.

On October 9, 2008, Zachary and ZTI consented to the entry of judgment against and to a permanent injunction, which resulted in the conclusion of all claims with respect to those parties. On November 17, 2008, the court granted the Company's motion to dismiss its patent infringement claims against Caesar and J2, and dismissed Caesar and J2's counterclaims for noninfringement, invalidity and unenforceability because there was no longer a justifiable claim or controversy with respect to those counterclaims.this claim.

On January 17, 2007 the Company filed suit in the Court of Common Pleas for Delaware County, Pennsylvania state court against Strathman Associates, a former software consultant for IS&S, alleging that Strathman had improperly used IS&S trade secret and proprietary information in assisting J2 and Kollsman in developing the J2/Kollsman Air Data Computer. The case is ongoing.

Through September 30, 2008 and 2007 the Company has incurred approximately $13.6 million and $8.0 million, respectively, in legal fees in connection with the two matters discussed above.

Item 4. Submission of Matters to a Vote of Security Holders.Removed and Reserved.

No matters were submitted to a vote of our shareholders during the three months ended September 30, 2008.

Item 5. Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Repurchases of Equity Securities.

Our common stock has been traded on the Nasdaq Stock Market, LLC under the symbol "ISSC" since our initial public offering on August 4, 2000. The following table lists the high and low per share sale prices for our common stock for the periods indicated:

| | Fiscal 2008 | Fiscal 2007 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Period | High | Low | High | Low | |||||||||

First Quarter | $ | 22.20 | $ | 9.00 | $ | 18.19 | $ | 14.14 | |||||

Second Quarter | 12.61 | 7.73 | 27.21 | 16.01 | |||||||||

Third Quarter | 12.00 | 6.39 | 29.42 | 21.74 | |||||||||

Fourth Quarter | 9.18 | 4.52 | 23.99 | 14.26 | |||||||||

| | Fiscal Year 2010 | Fiscal Year 2009 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Period | High | Low | High | Low | |||||||||

First Quarter | $ | 5.37 | $ | 4.17 | $ | 7.65 | $ | 3.02 | |||||

Second Quarter | 7.14 | 3.81 | 6.06 | 2.52 | |||||||||

Third Quarter | 6.72 | 4.32 | 5.90 | 4.02 | |||||||||

Fourth Quarter | 6.28 | 2.12 | 6.00 | 3.34 | |||||||||

On December 5, 2008,06, 2010, there were 2015 holders of record of the shares of outstanding common stock. This does not reflect beneficial shareholders who hold their stock in nominee or "street" name through brokerage firms.

WeNo dividends were paid a special cash dividend of $1.00 per share on September 29, 2008 on our common stock.in fiscal 2009 or fiscal 2010. The amounts necessary to pay the special dividend were funded in cash from the proceeds received in connection with the Company's settlement with Kollsman, Inc. We doCompany does not expect to declare or pay cash dividends on our common stock in the near future. We intend to retain any earnings to finance the growth of our business.

On February 21, 200816, 2010, the Company's Board of Directors approved a common stockthe Company's repurchase program to acquire up to 1,000,000 shares of ourthe Company's outstanding Common Stock. Under the repurchase program, the Company may purchase shares of its common stock. Purchasesstock through open market transactions or in privately negotiated block purchases or other private transactions (either solicited or unsolicited). The timing and amount of the stock were to be made from time to time, subject torepurchase transactions under this program will depend on market conditions and at prevailing market prices.corporate and regulatory considerations. The programplan will remain in effect untilexpire on February 21, 2009,16, 2011, unless extended by the Board of Directors.Directors; however, the program may be discontinued or suspended at any time. During fiscalthe year 2008 weended September 30, 2010 the Company purchased 173,00012,000 shares of common stock under the program at a cost of $1.0 million,$48,630, or an average market price of $6.06$4.03 per share. Weshare, financed these purchases through ourwith available cash. We did not make any common stock repurchases during the fiscal year ended September 30, 2007. The following table sets forth the purchases made under this new plan for each month ofsince the three months endedextension date through September 30, 2008:2010:

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares that May Yet Be Purchased Under the Program | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

July 2008 | — | — | — | 993,000 | |||||||||

August 2008 | — | — | — | 993,000 | |||||||||

September 2008 | 166,000 | $ | 5.97 | 166,000 | 827,000 | ||||||||

Total | 166,000 | 166,000 | |||||||||||

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Number of Shares that May Yet Be Purchased Under the Program | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

January, 2010 | — | — | — | — | |||||||||

February, 2010 | 4,100 | $ | 4.16 | 4,100 | 995,900 | ||||||||

March, 2010 | 1,100 | 4.20 | 1,100 | 994,800 | |||||||||

April, 2010 | — | — | — | 994,800 | |||||||||

May, 2010 | — | — | — | 994,800 | |||||||||

June, 2010 | — | — | — | 994,800 | |||||||||

July, 2010 | 6,800 | 3.93 | 6,800 | 988,000 | |||||||||

August, 2010 | — | — | — | 988,000 | |||||||||

September, 2010 | — | — | — | 988,000 | |||||||||

| 12,000 | 4.03 | 12,000 | |||||||||||

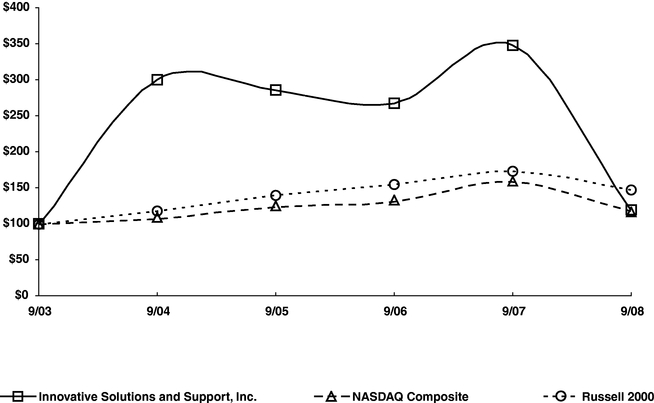

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

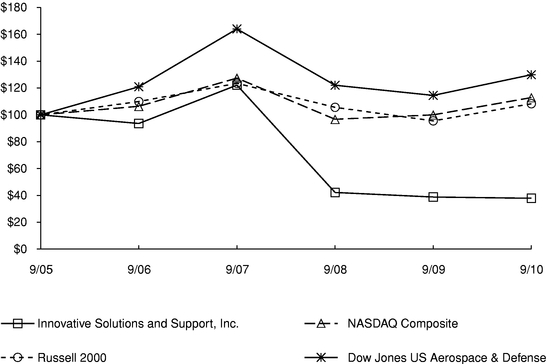

Among Innovative Solutions and Support, Inc., The NASDAQ Composite Index,And The Russell 2000 Index And Dow Jones US Aerospace & Defense Index

| | 9/03 | 9/04 | 9/05 | 9/06 | 9/07 | 9/08 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Innovative Solutions and Support, Inc. | 100.00 | 300.61 | 285.48 | 267.10 | 348.71 | 120.42 | |||||||||||||

NASDAQ Composite | 100.00 | 107.78 | 122.80 | 131.27 | 158.39 | 118.78 | |||||||||||||

Russell 2000 | 100.00 | 118.77 | 140.09 | 154.00 | 173.00 | 147.94 | |||||||||||||

| | 9/05 | 9/06 | 9/07 | 9/08 | 9/09 | 9/10 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Innovative Solutions and Support, Inc. | 100.00 | 93.56 | 122.15 | 42.18 | 38.78 | 37.85 | |||||||||||||

NASDAQ Composite | 100.00 | 106.39 | 127.37 | 96.70 | 100.00 | 112.86 | |||||||||||||

Russell 2000 | 100.00 | 109.92 | 123.49 | 105.60 | 95.52 | 108.27 | |||||||||||||

Dow Jones US Aerospace & Defense | 100.00 | 120.91 | 164.01 | 122.06 | 114.49 | 129.88 | |||||||||||||

- *

- $100 invested on 9/30/

0305 in stock or index—including reinvestment of dividends.

Fiscal year ending September 30.

The graph above shows the cumulative shareholder return on $100 invested at the market close on September 30, 20032005 through and including September 30, 2008,2010, the last trading day before the end of our most recently completed fiscal year, with the cumulative total return over the same time period of the same amount invested in the Nasdaq, Composite Index, and the Russell 2000 Index and the Dow Jones US Aerospace & Defense Index.

Item 6. Selected Consolidated Financial Data.

The following tables present portions of our consolidated financial statements. You should read theThe following selected consolidated financial data set forth below should be read together with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes to our financial statements appearing elsewhere herein. The selected statement of operations data for the fiscal years ended September 30, 2008, 20072010, 2009 and 20062008 and the balance sheet data as of September 30, 20082010 and 20072009 are derived from our audited consolidated financial statements included elsewhere in this Annual Report on Form 10-K. The selected statements

of operations data for the fiscal years ended September 30, 20052007 and 20042006 and the balance sheet data as of September 30, 2006, 20052008, 2007 and 20042006 are derived from our audited consolidated financial statements that are not included in this Annual Report on Form 10-K.

| | Fiscal year ended September 30, | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2008 | 2007 | 2006 | 2005 | 2004 | ||||||||||||

Statement of Operations Data: | |||||||||||||||||

Net sales | $ | 30,533,311 | $ | 18,348,128 | $ | 16,721,967 | $ | 63,264,359 | $ | 46,099,777 | |||||||

Cost of sales | 20,551,857 | 14,154,425 | 8,631,761 | 20,888,729 | 15,663,108 | ||||||||||||

Gross profit | 9,981,454 | 4,193,703 | 8,090,206 | 42,375,630 | 30,436,669 | ||||||||||||

Research and development | 10,304,279 | 5,180,360 | 6,749,426 | 6,057,889 | 4,811,156 | ||||||||||||

Selling, general and administrative | 22,306,016 | 15,840,255 | 9,863,758 | 8,898,622 | 7,567,959 | ||||||||||||

Asset impairment | 2,475,000 | — | — | — | — | ||||||||||||

Total operating expenses | 35,085,295 | 21,020,615 | 16,613,184 | 14,956,511 | 12,379,115 | ||||||||||||

Operating income (loss) | (25,103,841 | ) | (16,826,912 | ) | (8,522,978 | ) | 27,419,119 | 18,057,554 | |||||||||

Interest income, net | 1,415,732 | 2,886,602 | 3,091,986 | 1,764,246 | 404,727 | ||||||||||||

Other income | 17,300,000 | — | — | — | — | ||||||||||||

Income (loss) before income taxes | (6,388,109 | ) | (13,940,310 | ) | (5,430,992 | ) | 29,183,365 | 18,462,281 | |||||||||

Income tax expense (benefit), net | 1,509,139 | (5,095,022 | ) | (2,548,600 | ) | 10,598,563 | 6,530,084 | ||||||||||

Net income (loss) | $ | (7,897,248 | ) | $ | (8,845,288 | ) | $ | (2,882,392 | ) | $ | 18,584,802 | $ | 11,932,197 | ||||

Net income (loss) per common share: | |||||||||||||||||

Basic | $ | (0.47 | ) | $ | (0.52 | ) | $ | (0.17 | ) | $ | 1.04 | $ | 0.69 | ||||

Diluted | $ | (0.47 | ) | $ | (0.52 | ) | $ | (0.17 | ) | $ | 1.02 | $ | 0.67 | ||||

Weighted average shares outstanding | |||||||||||||||||

Basic | 16,887,049 | 16,865,028 | 17,388,524 | 17,873,780 | 17,400,380 | ||||||||||||

Diluted | 16,887,049 | 16,865,028 | 17,388,524 | 18,259,856 | 17,928,180 | ||||||||||||

| | Fiscal year ended September 30, | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||

Statement of Operations Data: | |||||||||||||||||

Net Sales | 25,257,323 | 36,734,150 | 30,533,311 | 18,348,128 | 16,721,967 | ||||||||||||

Cost of sales | 11,520,029 | 17,895,984 | 20,551,857 | 14,154,425 | 8,631,761 | ||||||||||||

Gross profit | 13,737,294 | 18,838,166 | 9,981,454 | 4,193,703 | 8,090,206 | ||||||||||||

Research and development | 5,234,240 | 5,313,007 | 10,304,279 | 5,180,360 | 6,749,426 | ||||||||||||

Selling, general and administrative | 8,099,587 | 8,647,506 | 22,306,016 | 15,840,255 | 9,863,758 | ||||||||||||

Asset Impairment | — | — | 2,475,000 | — | — | ||||||||||||

Total operating expenses | 13,333,827 | 13,960,513 | 35,085,295 | 21,020,615 | 16,613,184 | ||||||||||||

Operating income (loss) | 403,467 | 4,877,653 | (25,103,841 | ) | (16,826,912 | ) | (8,522,978 | ) | |||||||||

Interest income, net | 185,815 | 315,765 | 1,415,732 | 2,886,602 | 3,091,986 | ||||||||||||

Other income | 50,000 | 50,099 | 17,300,000 | — | — | ||||||||||||

Income (loss) before income taxes | 639,282 | 5,243,517 | (6,388,109 | ) | (13,940,310 | ) | (5,430,992 | ) | |||||||||

Income tax expense (benefit), net | (109,094 | ) | 234,856 | 1,509,139 | (5,095,022 | ) | (2,548,600 | ) | |||||||||

Net income (loss) | 748,376 | 5,008,661 | (7,897,248 | ) | (8,845,288 | ) | (2,882,392 | ) | |||||||||

Net income (loss) per common share: | |||||||||||||||||

Basic | 0.04 | 0.30 | (0.47 | ) | (0.52 | ) | (0.17 | ) | |||||||||

Diluted | 0.04 | 0.30 | (0.47 | ) | (0.52 | ) | (0.17 | ) | |||||||||

Weighted average shares outstanding: | |||||||||||||||||

Basic | 16,751,528 | 16,745,379 | 16,887,049 | 16,865,028 | 17,388,524 | ||||||||||||

Diluted | 16,777,886 | 16,760,500 | 16,887,049 | 16,865,028 | 17,388,524 | ||||||||||||

Cash dividends declared per Common Share | — | 1.00 | — | — | |||||||||||||

| | As of September 30, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||

Balance Sheet Data: | ||||||||||||||||

Cash and cash equivalents | $ | 35,031,932 | $ | 49,151,078 | $ | 62,984,829 | $ | 83,172,582 | $ | 65,867,167 | ||||||

Working capital | 42,491,253 | 62,453,234 | 73,751,866 | 93,455,475 | 70,627,114 | |||||||||||

Total Assets | 59,896,714 | 84,585,785 | 87,232,880 | 107,034,878 | 87,468,627 | |||||||||||

Debt and capital lease obligations, less current portion | 4,362,725 | 4,382,542 | 4,339,587 | 4,248,113 | 4,255,681 | |||||||||||

Total shareholders' equity | 59,896,714 | 70,733,779 | 78,201,353 | 97,866,098 | 75,454,987 | |||||||||||

| | As of September 30, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||

Balance Sheet Data: | ||||||||||||||||

Cash and cash equivalents | 40,916,346 | 35,565,694 | 35,031,932 | 49,151,078 | 62,984,829 | |||||||||||

Working capital | 46,311,056 | 44,624,477 | 42,491,253 | 62,453,234 | 73,751,866 | |||||||||||

Total assets | 57,590,522 | 57,536,012 | 59,896,714 | 84,585,785 | 87,232,880 | |||||||||||

Debt and capital lease obligations, less current portion | 15,560 | 26,991 | 4,362,725 | 4,382,542 | 4,339,587 | |||||||||||

Total shareholders' equity | 53,468,037 | 52,398,742 | 46,804,126 | 70,733,779 | 78,201,353 | |||||||||||

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis should be read in conjunction with "Selected Consolidated Financial Data" and our financial statements and the related notes included in this report.

Overview

Innovative Solutions and Support was founded in 1988. The Company designs, develops, manufactures and sells flight information computers, large flat-panel displays, and advanced monitoring systems that measure and display critical flight information, including data relative to aircraft separation, airspeed, altitude as well as engine and fuel data measurements.

Our sales are derived from the sale of our products to the retrofit market and, to a lesser extent, original equipment manufacturers.manufacturers ("OEMs"). Our customers include the DoDUnited States Department of Defense ("DoD") and their commercial contractors, aircraft operators, aircraft modification centers and various OEMs. Although we occasionally sell our products directly to the DoD, we primarily have sold our products primarily to commercial customers for end use in DoD programs. Sales to defense contractors are on commercial terms, although some of the termination and other provisions of government contracts are applicable to these contracts.

Our cost-of-salescost of sales related to product sales is comprised of material and components purchased through our supplier base and direct in-house assembly labor and overhead costs. Many of the components we use in assembling our products are standard, although certain parts are manufactured to meet our specifications. The overhead portion of cost of sales is primarily comprised of salaries and benefits, building occupancy, supplies, and outside service costs related to our production, purchasing, material control and quality departments, and warranty costs.

Our cost of sales related to Engineering—modification and development (EMD)("EMD") is comprised of engineering labor, consulting services, and other cost associated with specific design and development projects.projects that are billable under specific customer agreements.

We intend to continue investing in the development of new products that complement our current product offerings and will expense associated research and development costs as they are incurred.

Our selling, general and administrative expenses consist of sales, marketing, business development, professional services, and salaries and benefits for executive and administrative personnel as well as facility costs, recruiting, legal, accounting, and other general corporate expenses.

We sell our products to agencies of the United States and foreign governments, aircraft operators, aircraft modification centers and original equipment manufacturers. Our customers have been and may continue to be affected by the ongoingrecent adverse economic conditions that currently exist both in the United States and abroad. Such conditions may cause our customers to curtail or delay their spending on both new and existing aircraft. Factors that can impact general economic conditions and the level of spending by our customers include but are not limited to general levels of consumer spending, increases in fuel and energy costs, conditions in the real estate and mortgage markets, labor and healthcare costs, access to credit, consumer confidence and other macroeconomic factors affecting spending behavior. In addition, future spending by government agencies may in the future be further reduced due to declining tax revenues associated with this economic downturn. If our customers curtail or delay their spending or are forced to declare bankruptcy or liquidate their operations due to continuingrecent adverse economic conditions, our revenues and results of operations will be adversely affected. However, we believe that in a declining economic environment customersa customer that may have otherwise elected to purchase newly manufactured aircraft will instead be interested in retrofitting existing aircraft as a cost effective alternative, which will create a market opportunity for our products.

On November 25, 2008, Eclipse Aviation filed a voluntary petition for relief under Chapter 11 of the U.S. Bankruptcy Code. Given the early stages if the bankruptcy proceedings, it is unclear at this

time what the precise impact the Eclipse's bankruptcy will have. During the The Company experienced significant reductions of headcount costs in fiscal year ended September 30, 2008, Eclipse accounted for approximately 42%2010 and 2009, as a result of the Company's overall revenues.

During the fourth quarter ofa 52 person workforce reduction that was implemented in late fiscal 2008, the Company took steps to limit its overall exposure to Eclipse, including by increasing the allowance for doubtful accounts and inventory obsolescence specifically for Eclipse by $4.1 million and $1.9 million, respectively. In response to the lost future revenues from Eclipse and the overall downward turn in the economy, the Company reduced its overall headcount by 52 people.2008. The reductions affectaffected most of the departments in the Company with the majority of the reductions coming from the engineering department. The Company expects to see a significant reduction in its overall headcount costs in fiscal 2009 as a result of these actions.

Results of Operations

The following table sets forth statement of operations data expressed as a percentage of total net sales for the fiscal years indicated (some items may not add due to rounding):

| | Twelve Months Ending September 30, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2010 | 2009 | 2008 | |||||||||

Net sales: | ||||||||||||

Product | 92.6 | % | 86.7 | % | 85.0 | % | ||||||

Engineering—modification and development | 7.4 | % | 13.3 | % | 15.0 | % | ||||||

Total net sales | 100.0 | % | 100.0 | % | 100.0 | % | ||||||

Cost of sales | ||||||||||||

Product | 42.5 | % | 45.2 | % | 57.6 | % | ||||||

Engineering—modification and development | 3.1 | % | 3.5 | % | 9.7 | % | ||||||

Total cost of sales | 45.6 | % | 48.7 | % | 67.3 | % | ||||||

Gross profit | 54.4 | % | 51.3 | % | 32.7 | % | ||||||

Operating expenses: | ||||||||||||

Research and development | 20.7 | % | 14.5 | % | 33.7 | % | ||||||

Selling, general and administrative | 32.1 | % | 23.5 | % | 73.1 | % | ||||||

Asset impairment | 0.0 | % | 0.0 | % | 8.1 | % | ||||||

Total operating expenses | 52.8 | % | 38.0 | % | 114.9 | % | ||||||

Operating income (loss) | 1.6 | % | 13.3 | % | (82.2) | % | ||||||

Interest income | 0.7 | % | 1.1 | % | 5.2 | % | ||||||

Interest (expense) | (0.0 | )% | (0.2 | )% | (0.5 | )% | ||||||

Other income | 0.2 | % | 0.1 | % | 56.7 | % | ||||||

Income (loss) before income taxes | 2.5 | % | 14.3 | % | (20.9 | )% | ||||||

Income tax expense (benefit) | - -0.4 | % | 0.6 | % | 4.9 | % | ||||||

Net income (loss) | 3.0 | % | 13.6 | % | (25.9 | )% | ||||||

Fiscal Year Ended September 30, 20082010 Compared to Fiscal Year Ended September 30, 20072009