- *

- $100 invested on

December 31, 200312/31/06 in stock or index, including reinvestment of dividends. Fiscal year ending December 31. - (1)

- For the year ended December 31, 2011, net income includes the following net pre-tax costs: restructuring charges of $10.0 million, intangibles and goodwill impairment charges of $17.4 million, pension curtailment charges of $1.5 million, separation costs related to our former CEO of $6.3 million, and costs related to our acquisition of Danfoss Socla S.A.S (Socla) in France of $5.8 million offset by pre-tax gains of $1.2 million for an earn-out adjustment, $7.7 million related to the sale of Tianjin Watts Valve Company Ltd. (TWVC) in China and $1.1 million from legal settlements. Additionally, net income includes a tax benefit of $4.2 million relating to the sale of TWVC offset by a $1.1 million tax charge in Europe related to our France restructuring. The after-tax cost of these items was $17.0 million.

- (2)

- For the year ended December 31, 2010, net income includes the following net pre-tax costs: restructuring charges of $14.1 million, intangible impairment charges of $1.4 million, and costs related to acquisitions and other items of $7.1 million offset by pre-tax gains of $4.5 million primarily for product liability and workers compensation accrual adjustments. Additionally, net income includes a tax benefit of $4.3 million related to the release of a valuation allowance in Europe offset by a tax charge of $1.5 million relating to the repatriation of earnings recognized upon our decision to dispose of a China subsidiary. The after-tax cost of these items was $10.3 million.

- (3)

- For the year ended December 31, 2009, net income includes the following net pre-tax costs: restructuring charges of $18.9 million and intangible impairment charges of $3.3 million, offset by pre-tax gains on the sale of Tianjin Tanggu Watts Valve Co. Ltd. (TWT) in China of $1.1 million, favorable product liability and workers compensation accrual adjustments of $4.9 million and legal

- (4)

- For the year ended December 31, 2008, net income includes the following net pre-tax costs: restructuring charges of $5.7 million, goodwill impairment

severance costs, asset write-downs and other costs in North Americacharges of $22.0 million$2.6 million, $0.4 million and $1.5 million respectively; accelerated depreciation and other costs in China of $1.0 million and $0.2 million, respectivelyand minority interest incomeof $0.2 million; severance costs in Europeof $0.2 million. The after-tax cost of these items was $21.2 million. (2)(5)- For the year ended December 31, 2007, net income includes the following net pre-tax costs: change in estimate of workers' compensation costs of $2.9 million, severance and product line discontinuance costs in North America of $0.4 million and $3.1 million, respectively; accelerated depreciation and asset write-downs, product line discontinuance costs and severance costs in

ChinaAsia of $2.9 million, $0.7 million and $0.4 million, respectively, and minority interest income of $0.9 million. The after-tax cost of these items was $6.9 million. (3)For the year ended December 31, 2006, net income includes the following net pre-tax gain: gain on sales of buildings of $8.2 million, restructuring costs consisting primarily of European severance of $2.2 million and amortization of $0.4 million, other costs consisting of accelerated depreciation and severance in our Chinese joint venture of $4.7 million and minority interest income of $1.5 million. The after-tax gain of these items was $1.5 million.(4)For the year ended December 31, 2005, net income includes the following pre-tax costs: restructuring of $0.7 million and other costs consisting of accelerated depreciation and asset write-downs of $1.8 million. The after-tax cost of these items was $1.6 million.(5)For the year ended December 31, 2005, net income includes a net after-tax charge of $0.9 million for a selling, general and administrative expense charge of $1.5 million related to a contingent earn-out agreement.- (6)

For the year ended December 31, 2004, net income includes a net after-tax charge of $2.3 million for certain accrued expense adjustments, which are included in selling, general and administrative expense after-tax charges of $3.5 million related to a contingent earn-out agreement and $0.7 million for various accrual adjustments and $0.5 million recorded as an income tax benefit.(7)For the year ended December 31, 2004, net income includes the following pre-tax costs: restructuring of $0.1 million and other costs consisting of accelerated depreciation of $2.9 million. The after-tax cost of these items was $1.8 million.(8)- In

December 2004, we decided to divest our interestSeptember 2009, the Company's Board of Directors approved the sale of its investment inour minority-owned subsidiary, Jameco International, LLC (Jameco LLC). We recordedCWV and subsequently sold CWV indiscontinuedJanuary 2010. Results from operationaand estimated loss on disposal are included net of taximpairment charge of $0.7 millionforthe year ended December 31, 2004. Also includedCWV in discontinued operationsisfor 2010, 2009, 2008 and 2007. In May 2009, the Company liquidated its TEAM Precision Pipework, Ltd. (TEAM) business. Results from operation and loss on disposal are included net of taxoperating resultsfrom the deconsolidation ofJameco LLC of $0.1 million of lossTEAM in discontinued operations for 2011, 2010, 2009, 2008 and$0.1 million of income for the year ended December 31, 2004 and 2003, respectively.2007. In September 1996, we divested our Municipal Water Group of businesses, which included Henry Pratt, James Jones Company and Edward Barber and Company Ltd. Costs and expenses related to the Municipal Water Group, for 2011, 2010, 2009, 20082007, 2006, 2005and20042007 relate to legal and settlement costs associated with the James JonesLitigation. The loss,Litigation and other miscellaneous costs. Discontinued operating income (loss) for 2011 and 2010 include an estimated settlement reserve adjustment in connection with the FCPA investigation at CWV (see Note 15) and in 2010 and 2009, includes legal costs associated with the FCPA investigation. Income (loss) for total discontinued operations, net of taxes, consists of$ 0.7$1.7 million,$0.2($4.3) million,$3.4($23.6) million,$0.4$1.4 million and$1.1$1.7 million for the years ended December 31, 2011, 2010, 2009, 20082007, 2006, 2005and2004,2007, respectively. - •

- Residential & commercial flow control products—includes products typically sold into plumbing and hot water

quality products, includingapplications such as backflow preventers, water pressure regulators, temperature andcheckpressure relief valves,for preventing reverse flow within water linesandfire protection systems and point-of-use water filtration and reverse osmosis systems for both commercial and residential applications;thermostatic mixing valves. - •

a wide range of water pressure regulators for both commercialHVAC & gas products—includes hydronic andresidential applications;•drainage products for industrial, commercial, marine and residential applications;•water supply products for commercial and residential applications;•temperature and pressure relief valves for water heaters, boilers and associated systems;•thermostatic mixing valves for tempering water in commercial and residential applications;•- electric heating systems for under-floor radiant applications,

and hydraulichydronic pump groups forgasboiler manufacturers andrenewablealternative energyapplications, including solarcontrol packages, andheat pump control packages; •- flexible stainless steel connectors for natural and liquid propane gas in commercial food service and residential

applications;applications. HVAC is an acronym for heating, ventilation and air conditioning. - •

large diameter butterfly valvesDrains & water re-use products—includes drainage products and engineered rain water harvesting solutions foruse in China'scommercial, industrial, marine and residential applications.- •

- Water quality products—includes point-of-use and point-of-entry water

infrastructure.filtration, conditioning and scale prevention systems for both commercial and residential applications. - (a)

- as recognized in the consolidated balance sheet

- (b)

- assumes the balance on the revolving credit facility remains at

$55.0$13.0 million and the interest rate remains at approximately3.6%3.0% for the presented periods - (c)

- includes commodity and capital

expenditurecommitments, acquisition of tekmar, CEO separation costs and other benefits at December 31,20082011 - 1)

- A review of the most recent fair value calculation to identify the extent of the cushion between fair value and carrying amount, to determine if a substantial cushion existed.

- 2)

- A review of events and circumstances that have occurred since the most recent fair value calculation to determine if those events or circumstances would have affected our previous fair value assessment. Items identified and reviewed include macroeconomic conditions, industry and market changes, cost factor changes, events that affect the reporting unit, financial performance against expectations and the reporting unit's performance relative to peers.

- •

- Weighted average discount rate—this rate is used to estimate the current value of future benefits. This rate is adjusted based on movement in long-term interest rates.

- •

- Expected long-term rate of return on assets—this rate is used to estimate future growth in investments and investment earnings. The expected return is based upon a combination of historical market performance and anticipated future returns for a portfolio reflecting the mix of equity, debt and other investments indicative of our plan assets.

- •

- Rates of increase in compensation levels—this rate is used to estimate projected annual pay increases, which are used to determine the wage base used to project employees' pension benefits at retirement.

- (i)

- pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Company;

- (ii)

- provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and

- (iii)

- provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements.

- (1)

- Represents

1,216,4711,271,892 outstanding options under the 1991 Directors' Non-Qualified Stock Option Plan, 1996 Incentive Stock Option Plan, 2003 Non-Employee Directors' Stock Option Plan and 2004 Stock Incentive Plan, and296,635392,345 outstanding restricted stock units under the Management Stock Purchase Plan. - (2)

- Includes

1,864,393999,610 shares available for future issuance under the 2004 Stock Incentive Plan, and962,825596,472 shares available for future issuance under the Management Stock Purchase Plan. - (a)

- Includes investments in common stock from diverse industries

- (b)

- Includes investments in index and exchange-traded funds

- (c)

- Includes investment grade bonds from diverse industries

- (d)

- Includes investments in real estate investment funds, exchange-traded funds, commodity mutual funds and accrued interest

- (1)

- Included in other, net on the Company's consolidated balance sheet.

- (2)

- Included in other noncurrent liabilities on the Company's consolidated balance sheet.

(1)Included in long-term investment securities on the Company's consolidated balance sheet.(2)Included in other, net on the Company's consolidated balance sheet.(3)Included in accrued expenses and other liabilities on the Company's consolidated balance sheet.(4)Included in other noncurrent liabilities on the Company's consolidated balance sheet.- *

- Corporate expenses are primarily for compensation expense, Sarbanes-Oxley compliance, professional fees, including legal and audit expenses, shareholder services and benefit administration costs. These costs are not allocated to the geographic segments as they are viewed as corporate functions that support all activities. Corporate costs in 2011 include $6.3 million in charges related to the separation agreement with the Company's former CEO.

- (1)

- Incorporated by reference to the Registrant's Current Report on Form 8-K dated

February 5, 2007July 12, 2010 (File No. 001-11499). - (2)

- Incorporated by reference to the Registrant's Current Report on Form 8-K dated November 14, 1991 (File No. 001-11499).

- (3)

- Incorporated by reference to the Registrant's Annual Report on Form 10-K for the year ended December 31, 2002 (File No. 001-11499).

- (4)

- Incorporated by reference to the Registrant's Current Report on Form 8-K dated April 27, 2006 (File No. 001-11499).

- (5)

- Incorporated by reference to the Registrant's Form S-1 (No. 33-6515) as part of the Second Amendment to such Form S-1 dated August 21, 1986.

- (6)

- Incorporated by reference to

Amendment No. 1 tothe Registrant'sAnnualQuarterly Report on Form10-K10-Q foryearthe quarter endedJune 30, 1992October 2, 2011 (File No. 001-11499). - (7)

- Incorporated by reference to the Registrant's Current Report on Form 8-K dated May 15, 2003 (File No. 001-11499).

- (8)

- Incorporated by reference to the Registrant's Current Report on Form 8-K dated May 14, 2008 (File No. 001-11499).

- (9)

- Incorporated by reference to the Registrant's Annual Report on Form 10-K for year ended June 30, 1996 (File No. 001-11499).

- (10)

- Incorporated by reference to Amendment No. 1 to the Registrant's Annual Report on Form

S-8 (No. 333-32685) dated August 1, 1997.10-K for the year ended June 30, 1992 (File No. 001-11499). - (11)

- Incorporated by reference to the Registrant's

CurrentAnnual Report on Form8-K dated September 4, 199610-K for the year ended December 31, 2009 (File No. 001-11499). - (12)

- Incorporated by reference to the Registrant's Annual Report on Form 10-K for year ended June 30,

1997(File1997 (File No. 001-11499). - (13)

- Incorporated by reference to notes to Consolidated Financial Statements, Note 2 of this Report.

- (14)

- Incorporated by reference to the Registrant's Quarterly Report on Form 10-Q for the quarter ended July 3, 2005 (File No. 001-11499).

- (15)

- Incorporated by reference to the Registrant's Annual Report on Form 10-K for year ended June 30, 1999 (File No. 001-11499).

- (16)

- Incorporated by reference to the Registrant's Quarterly Report on Form 10-Q for quarter ended September 30, 2000 (File No. 001-11499).

- (17)

- Incorporated by reference to the Registrant's

AnnualQuarterly Report on Form10-K10-Q for theyearquarter endedDecember 31, 2003July 4, 2010 (File No. 001-11499). - (18)

Incorporated by reference to the Registrant's Current Report on Form 8-K dated April 8, 2008 (File No. 001-11499).(19)- Incorporated by reference to the Registrant's Quarterly Report on Form 10-Q for the quarter ended September 26, 2004 (File No. 001-11499).

(20)(19)- Incorporated by reference to the Registrant's Quarterly Report on Form 10-Q for the quarter ended July 1, 2007 (File No. 001-11499).

(21)Incorporated by reference to the Registrant's Quarterly Report on Form 10-Q for the quarter ended March 30, 2008 (File No. 001-11499).(22)(20)- Incorporated by reference to the Registrant's Annual Report on Form 10-K for the year ended December 31, 2007 (File No. 001-11499).

- (21)

- Incorporated by reference to the Registrant's Current Report on Form 8-K dated June 18, 2010 (File No. 001-11499).

- (22)

- Incorporated by reference to the Registrant's Current Report on Form 8-K dated January 26, 2011 (File No. 001-11499).

- (23)

- Incorporated by reference to the Registrant's Current Report on Form 8-K dated July 6, 2011 (File No. 001-11499).

- (24)

- Incorporated by reference to the Registrant's Annual Report on Form 10-K for the year ended December 31, 2010 (File No. 001-11499).

- (25)

- Incorporated by reference to the Registrant's Current Report on Form 8-K dated April 1, 2011 (File No. 001-11499).

- *

- Management contract or compensatory plan or arrangement.

- **

- Attached as Exhibit 101 to this report are the following formatted in XBRL (Extensible Business Reporting

one million shares of Class A Common Stock in open market purchases or in privately negotiated transactions. On October 28, 2008, the Company announced that it had temporarily suspended its stock repurchase program. No shares were repurchased during the quarter ended December 31, 2008. Asauthorized by our Board of December 31, 2008, we had repurchased 2.45 million shares of stock forDirectors at a total cost of $68.1$27.2 million.

As a result of such repurchases, our August 2011 repurchase program expired by its terms.

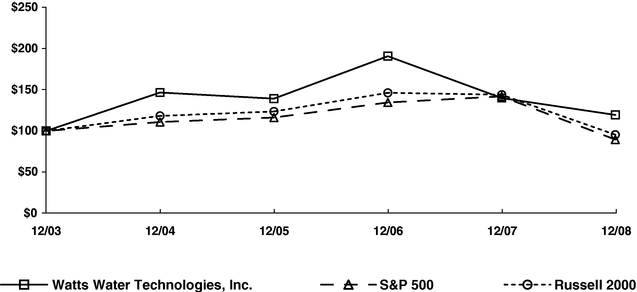

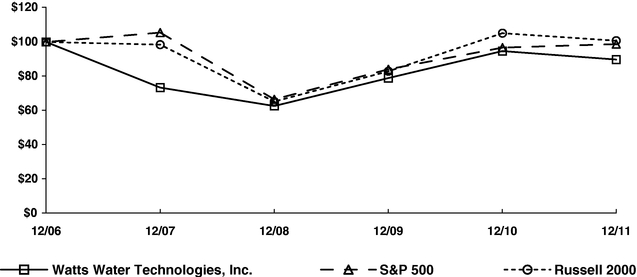

Set forth below is a line graph comparing the cumulative total shareholder return on our Class A Common Stock for the last five years with the cumulative return of companies on the Standard & Poor's 500 Stock Index and the Russell 2000 Index. We chose the Russell 2000 Index because it represents companies with a market capitalization similar to that of Watts. The graph assumes that the value of the investment in our Class A Common Stock and each index was $100 at December 31, 20032006 and that all dividends were reinvested.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Watts Water Technologies, Inc., Thethe S&P 500 Index

and Thethe Russell 2000 Index

| | 12/31/03 | 12/31/04 | 12/31/05 | 12/31/06 | 12/31/07 | 12/31/08 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Watts Water Technologies, Inc | 100.00 | 146.82 | 139.36 | 191.03 | 140.11 | 119.52 | |||||||||||||

S&P 500 | 100.00 | 110.88 | 116.33 | 134.70 | 142.10 | 89.53 | |||||||||||||

Russell 2000 | 100.00 | 118.33 | 123.72 | 146.44 | 144.15 | 95.44 | |||||||||||||

| | 12/31/06 | 12/31/07 | 12/31/08 | 12/31/09 | 12/31/10 | 12/31/11 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Watts Water Technologies, Inc | 100.00 | 73.34 | 62.57 | 78.92 | 94.70 | 89.73 | |||||||||||||

S & P 500 | 100.00 | 105.49 | 66.46 | 84.05 | 96.71 | 98.75 | |||||||||||||

Russell 2000 | 100.00 | 98.43 | 65.18 | 82.89 | 105.14 | 100.75 | |||||||||||||

The above Performance Graph and related information shall not be deemed "soliciting material" or to be "filed" with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that we specifically incorporate it by reference into such filing.

Item 6. SELECTED FINANCIAL DATA.

The selected financial data set forth below should be read in conjunction with our consolidated financial statements, related Notes thereto and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included herein.

FIVE-YEAR FINANCIAL SUMMARY

(Amounts in millions, except per share and cash dividend information)

| | Year Ended 12/31/08(1)(8) | Year Ended 12/31/07(2)(8) | Year Ended 12/31/06(3)(8) | Year Ended 12/31/05(4)(5)(8) | Year Ended 12/31/04(6)(7)(8) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Statement of operations data: | ||||||||||||||||

Net sales | $ | 1,459.4 | $ | 1,382.3 | $ | 1,230.8 | $ | 924.3 | $ | 824.6 | ||||||

Income from continuing operations | 47.3 | 77.6 | 77.1 | 55.0 | 48.7 | |||||||||||

Loss from discontinued operations, net of taxes | (0.7 | ) | (0.2 | ) | (3.4 | ) | (0.4 | ) | (1.9 | ) | ||||||

Net income | 46.6 | 77.4 | 73.7 | 54.6 | 46.8 | |||||||||||

Income per share from continuing operations—diluted | 1.28 | 1.99 | 2.29 | 1.67 | 1.49 | |||||||||||

Loss per share from discontinued operations—diluted | (0.02 | ) | (0.01 | ) | (0.10 | ) | (0.01 | ) | (0.06 | ) | ||||||

Net income per share—diluted | 1.26 | 1.99 | 2.19 | 1.66 | 1.43 | |||||||||||

Cash dividends declared per common share | $ | 0.44 | $ | 0.40 | $ | 0.36 | $ | 0.32 | $ | 0.28 | ||||||

Balance sheet data (at year end): | ||||||||||||||||

Total assets | $ | 1,660.1 | $ | 1,729.3 | $ | 1,660.9 | $ | 1,101.0 | $ | 922.7 | ||||||

Long-term debt, net of current portion | $ | 409.8 | $ | 432.2 | $ | 441.7 | $ | 293.4 | $ | 180.6 | ||||||

| | Year Ended 12/31/11(1)(6) | Year Ended 12/31/10(2)(6) | Year Ended 12/31/09(3)(6) | Year Ended 12/31/08(4)(6) | Year Ended 12/31/07(5)(6) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Statement of operations data: | ||||||||||||||||

Net sales | $ | 1,436.6 | $ | 1,274.6 | $ | 1,225.9 | $ | 1,431.4 | $ | 1,356.3 | ||||||

Net income from continuing operations attributable to Watts Water Technologies, Inc. | 64.7 | 63.1 | 41.0 | 45.2 | 75.7 | |||||||||||

Income (loss) from discontinued operations, net of taxes | 1.7 | (4.3 | ) | (23.6 | ) | 1.4 | 1.7 | |||||||||

Net income attributable to Watts Water Technologies, Inc. | 66.4 | 58.8 | 17.4 | 46.6 | 77.4 | |||||||||||

DILUTED EPS | ||||||||||||||||

Income (loss) per share attributable to Watts Water Technologies, Inc.: | ||||||||||||||||

Continuing operations | 1.73 | 1.69 | 1.10 | 1.23 | 1.94 | |||||||||||

Discontinued operations | 0.05 | (0.12 | ) | (0.63 | ) | 0.04 | 0.04 | |||||||||

NET INCOME | 1.78 | 1.57 | 0.47 | 1.26 | 1.99 | |||||||||||

Cash dividends declared per common share | $ | 0.44 | $ | 0.44 | $ | 0.44 | $ | 0.44 | $ | 0.40 | ||||||

Balance sheet data (at year end): | ||||||||||||||||

Total assets | $ | 1,697.5 | $ | 1,646.1 | $ | 1,599.2 | $ | 1,660.1 | $ | 1,729.3 | ||||||

Long-term debt, net of current portion | $ | 397.4 | $ | 378.0 | $ | 304.0 | $ | 409.8 | $ | 432.2 | ||||||

settlements of $1.5 million. Additionally, net income includes a tax charge of $3.9 million relating to previously realized tax benefits, which were expected to be recaptured as a result of our decision to restructure our operations in China. The after-tax cost of these items was $16.7 million.

Item 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Overview

We are a leading supplier of products for use in the water quality, water safety, water flow control and water conservation markets in both North America and Europe with an expandinga presence in Asia. For over 130137 years, we have designed and manufactured products that promote the comfort and safety of people and the quality and conservation of water used in commercial and residential applications. We earn revenue and income almost exclusively from the sale of our products. Our principal product lines include:

Our business is reported in three geographic segments,segments: North America, Europe and China.Asia. We distribute our products through three primary distribution channels,channels: wholesale, do-it-yourself (DIY) and original equipment manufacturers (OEMs). Interest rates have an indirect effect on the demand for our products due to the effect such rates have on the number of new residential and commercial construction starts and remodeling projects. All three of these activities have an impact on our sales and earnings. An additional factor that has had an effect on our sales is fluctuation in foreign currencies, as a portion of our sales and certain portions of our costs, assets and liabilities are denominated in currencies other than the U.S. dollar.

We believe that the factors relating to our future growth include our ability to continue to make selective acquisitions, both in our core markets as well as in new complementary markets, regulatory requirements relating to the quality and conservation of water, safe use of water, increased demand for clean water, with continued enforcement of plumbing and building codes and a healthy economic environment. We have completed 3236 acquisitions since divesting our industrial and oil and gas business in 1999. Our acquisition strategy focuses on businesses that manufacture preferred brand name products that address our themes of water quality, water conservation, water safety and water flow control and related complementary markets. We target businesses that will provide us with one or more of the following: an entry into new markets, an increase in shelf space with existing customers, a new or improved technology or an expansion of the breadth of our water quality, water conservation, water safety and water flow control products for the commercial, industrial and residential and commercial markets. In 2008 and 2007, sales from acquisitions contributed approximately 4.6% and 3.9%, to our total sales growth over the prior year.

Products representing a majority of our sales are subject to regulatory standards and code enforcement, which typically require that these products meet stringent performance criteria. Together with our commissioned manufacturers' representatives, we have consistently advocated for the

development and enforcement of such plumbing codes. We are focused on maintaining stringent quality control and testing procedures at each of our manufacturing facilities in order to manufacture products in compliance with code requirements and take advantage of the resulting demand for compliant products. We believe that the product development, product testing capability and investment in plant and equipment needed to manufacture products in compliance with code requirements, represent a barriercompetitive advantage for us.

In 2011, we experienced many of the same macro challenges that affected our business in the previous year. The commercial marketplace continued to entrystruggle, we saw low residential activity and commodity prices remained volatile. Despite the challenging end markets, we were able to grow sales organically by 2.3% and grow income from continuing operations by 2.5%. Organic sales growth

excludes the impacts of acquisitions, divestitures and foreign exchange from year-over-year comparisons. We believe this provides investors with a more complete understanding of underlying sales trends by providing sales growth on a consistent basis. We continued our restructuring programs to right size our manufacturing footprint and we sustained our continuous improvement initiatives to gain productivity in our operations.

Our performance improved as 2011 progressed. During the first half of 2011, increases in the cost of copper reduced margins for competitors.our high copper content products and we encountered operational inefficiencies as a result of our French restructuring efforts. Copper costs increased during the later portion of 2010 and into early 2011, reaching an all-time high in April 2011. We were able to balance commodity costs through price increases by mid-year, providing better results during the second half of 2011. In general, we were more successful in North America than in Europe in passing on price increases to our end customers during the year. Europe has and continues to experience uncertainties regarding its economy, driven largely by sovereign debt concerns. We believe the economic uncertainty is affecting how our competitors are pricing in end markets. We believe that over the long term, there is an increasing demand among consumers for productsprice increases may continue to ensure water quality, which creates growth opportunities forbe difficult to achieve in many of our products.

Adverse economic developmentsEuropean markets in 2008 created a challenging environment for us. The credit crisis and recessionary pressures negatively impacted the primary markets we serve. We took steps2012. Copper costs abated somewhat during the yearsecond half of 2011, but have begun to reduce coststrend upward again through early February 2012. We have announced selected price increases for 2012 in certain markets but we cannot determine whether such initiatives will be successful in the marketplace.

We continually review our business and conserve cash. During the fourth quarter of 2008, we reduced our workforce by 10%implement restructuring plans as needed. We recently completed restructuring projects in the U.S. This step is expectedand Europe which have shut down and consolidated certain of our operations. Please see Note 4 of the Notes to save us approximately $10.0 million to $11.0 million per year.Consolidated Financial Statements for a more detailed explanation of our restructuring activities.

In addition to the reductionMarch 2010, in force, we took several steps to help conserve cash into 2009, including suspending our stock repurchase program, first freezing U.S. wages and salaries and later implementing salary reductions, controlling capital spending levels and continuing to focus on working capital levels. We also announced a further operational restructuring program to consolidateconnection with our manufacturing footprint consolidation, we closed the operations of Tianjin Watts Valve Company Ltd. (TWVC) and relocated its manufacturing to other facilities in North America and China. We will continueOn April 12, 2010, we signed a definitive equity transfer agreement with a third party to evaluate acquisition candidates during 2009, but we expect funds to be spent on acquisitions will be less than that spentsell our equity ownership and remaining assets of TWVC. The sale was finalized in 2008. We are enhancing our focus on productivity and continuous improvement, and on managing our working capital levels as well as positioning many of our products to benefit when the market returns. We believe that we are well positioned to weather the current economic crisis due to our ability to continue to generate positive cash flows and control spending levels. We are not faced with any major liquidity events until 2010, at which time $50.0 million of our debt will come due.

We require substantial amounts of raw materials to produce our products, including bronze, brass, cast iron, steel and plastic, and substantially all of the raw materials we require are purchased from outside sources. We have experienced volatility in the costs of certain raw materials, particularly copper. Bronze and brass are copper-based alloys. During the fourth quarter of 2008, prices2011. We received net proceeds of copper droppedapproximately $6.1 million from highs experiencedthe sale. We recognized a net pre-tax gain of $7.7 million and an after-tax gain of approximately $11.4 million, or $0.30 per share, relating mainly to a favorable cumulative translation adjustment and a tax benefit related to the reversal of the China tax clawback.

In 2009, our Board of Directors approved the sale of our Watts Valve (Changsha) Co., Ltd. (CWV) subsidiary. We also liquidated our TEAM Precision Pipework, Ltd. (TEAM) subsidiary through an administration process under United Kingdom law, as more fully described in Note 3 of Notes to Consolidated Financial Statements. We classified CWV's and TEAM's results of operations and any related losses as discontinued operations for all periods presented in this report.

Acquisitions

On April 29, 2011, the Company completed the acquisition of Danfoss Socla S.A.S. (Socla) and the related water controls business of certain other entities controlled by Danfoss A/S, in a share and asset purchase transaction. The aggregate consideration paid was EUR 120.0 million, less than nine months earlier.

A risk we face is our ability to deal effectively with changesEUR 3.7 million in raw material costs. We manage this risk by monitoring related market prices, working with our suppliers to achieve the maximum level of stability in their costscapital and related pricing, seeking alternative supply sources when necessary, implementing cost reduction programsadjustments. The net purchase price of EUR 116.3 million was financed with cash on hand and passing increaseseuro-based borrowings under our Credit Agreement. The net purchase price is equal to approximately $172.4 million based on the exchange rate of Euro to U.S. dollars as of April 29, 2011.

Socla is a manufacturer of water protection valves and flow control solutions for the water market and the heating, ventilation and air conditioning market. Its major product lines include backflow preventers, check valves and pressure reducing valves. Socla is based in costsFrance, and its products are distributed worldwide for commercial, residential, municipal and industrial use. Socla's annual revenue for 2010 was approximately $130.0 million. Socla strengthens the Company's European residential and commercial plumbing and flow control products and also adds to our customers. Additionally from time to time we may use commodity futures contracts on a limited basis to manage this risk. We are not able to predict whether or for how long this volatility will continue. If costs continue to decrease, we may experience pressure from customers to reduce product pricing. We are unable to predict the timing and impact that these pricing decreases could have to our profit margins.its HVAC products.

Another risk we face in all areas of our business is competition. We consider brand preference, engineering specifications, code requirements, price, technological expertise, delivery times and breadth of product offerings to be the primary competitive factors. As mentioned previously, we believe that the product development, product testing capability and investment in plant and equipment needed to manufacture products in compliance with code requirements, represent a barrier to entry for competitors. We are committed to maintaining our capital equipment at a level consistent with current technologies, and thus we spent approximately $26.6 million in 2008 and $37.8 million in 2007.

Recent Developments

On February 10, 2009,January 31, 2012, we completed the acquisition of tekmar Control Systems (tekmar) in a plan was approved by the Boardshare purchase transaction. A designer and manufacturer of Directors to expand our program to consolidate our manufacturing footprintcontrol systems used in North Americaheating, ventilation, and China. The plan provides for the closure of three plants, with the relocation of those operations to existing facilities in either North America or China or to a new central facility in the United States.

The footprint consolidation pre-tax charge will be approximately $11.7 million, including severance charges of approximately $3.2 million, relocation costs of approximately $3.3 million and asset write-downs of approximately $5.2 million. We also expect to record a net gain on property sales of $2.4 million. One-time tax charges of approximately $7.0 million regarding the payback of prior tax holiday benefits are also expected to be incurred as part of the building relocations. Approximately 400 positions will be eliminated in connection with this consolidation. The net after tax charge for this manufacturing consolidation programair conditioning applications, tekmar is expected to be approximately $14.9enhance our hydronic systems product offerings in the U.S. and Canada. The initial purchase paid was CAD $18.0 million, ($4.4 million non cash), with costsan earn-out based on future earnings levels being incurred through December 2009. We expect to spend approximately $4.8 millionachieved. The total purchase price will not exceed CAD $26.2 million. Sales for tekmar in capital expenditures to consolidate operations. We expect this entire project will be self-funded through net proceeds from the sale of buildings and other assets being disposed of as part of the plan.2011 approximated CAD $11.0 million.

On February 9, 2009,7, 2012, we declared a quarterly dividend of eleven cents ($0.11) per share on each outstanding share of Class A Common Stock and Class B Common Stock.

Results of Operations

Year Ended December 31, 20082011 Compared to Year Ended December 31, 20072010

Net Sales. Our business is reported in three geographic segments: North America, Europe and China.Asia. Our net sales in each of these segments for the years ended December 31, 20082011 and 20072010 were as follows:

| | Year Ended December 31, 2008 | Year Ended December 31, 2007 | | | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Change to Consolidated Net Sales | |||||||||||||||||

| | Net Sales | % Sales | Net Sales | % Sales | Change | ||||||||||||||

| | (Dollars in millions) | ||||||||||||||||||

North America | $ | 866.2 | 59.4 | % | $ | 871.0 | 63.0 | % | $ | (4.8 | ) | (0.4 | )% | ||||||

Europe | 546.0 | 37.4 | 452.6 | 32.7 | 93.4 | 6.8 | |||||||||||||

China | 47.2 | 3.2 | 58.7 | 4.3 | (11.5 | ) | (0.8 | ) | |||||||||||

Total | $ | 1,459.4 | 100.0 | % | $ | 1,382.3 | 100.0 | % | $ | 77.1 | 5.6 | % | |||||||

| | Year Ended December 31, 2011 | Year Ended December 31, 2010 | | | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Change to Consolidated Net Sales | |||||||||||||||||

| | Net Sales | % Sales | Net Sales | % Sales | Change | ||||||||||||||

| | (Dollars in millions) | ||||||||||||||||||

North America | $ | 819.4 | 57.0 | % | $ | 785.5 | 61.6 | % | $ | 33.9 | 2.7 | % | |||||||

Europe | 595.5 | 41.5 | 468.3 | 36.8 | 127.2 | 9.9 | |||||||||||||

Asia | 21.7 | 1.5 | 20.8 | 1.6 | 0.9 | 0.1 | |||||||||||||

Total | $ | 1,436.6 | 100.0 | % | $ | 1,274.6 | 100.0 | % | $ | 162.0 | 12.7 | % | |||||||

The change in net sales iswas attributable to the following:

| | | | | | Change As a % of Consolidated Net Sales | Change As a % of Segment Net Sales | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | North America | Europe | China | Total | North America | Europe | China | Total | North America | Europe | China | |||||||||||||||||||||||

| | (Dollars in millions) | |||||||||||||||||||||||||||||||||

Organic growth | $ | (18.2 | ) | $ | 11.3 | $ | (12.1 | ) | $ | (19.0 | ) | (1.3 | )% | 0.8 | % | (0.9 | )% | (1.4 | )% | (2.1 | )% | 2.5 | % | (20.6 | )% | |||||||||

Foreign exchange | 0.5 | 31.3 | 3.8 | 35.6 | — | 2.3 | 0.3 | 2.6 | — | 6.9 | 6.5 | |||||||||||||||||||||||

Acquisitions | 12.9 | 50.8 | — | 63.7 | 0.9 | 3.7 | — | 4.6 | 1.5 | 11.2 | — | |||||||||||||||||||||||

Disposal | — | — | (3.2 | ) | (3.2 | ) | — | — | (0.2 | ) | (0.2 | ) | — | — | (5.5 | ) | ||||||||||||||||||

Total | $ | (4.8 | ) | $ | 93.4 | $ | (11.5 | )$ | 77.1 | (0.4 | )% | 6.8 | % | (0.8 | )% | 5.6 | % | (0.6 | )% | 20.6 | % | (19.6 | )% | |||||||||||

| | | | | | Change As a % of Consolidated Net Sales | Change As a % of Segment Net Sales | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | North America | Europe | Asia | Total | North America | Europe | Asia | Total | North America | Europe | Asia | |||||||||||||||||||||||

| | (Dollars in millions) | |||||||||||||||||||||||||||||||||

Organic | $ | 22.2 | $ | 8.6 | $ | (1.8 | ) | $ | 29.0 | 1.8 | % | 0.6 | % | (0.1 | )% | 2.3 | % | 2.8 | % | 1.9 | % | (8.7 | )% | |||||||||||

Foreign exchange | 3.1 | 24.0 | 0.9 | 28.0 | 0.2 | 1.9 | 0.1 | 2.2 | 0.4 | 5.1 | 4.3 | |||||||||||||||||||||||

Acquisitions | 8.6 | 94.6 | 1.8 | 105.0 | 0.7 | 7.4 | 0.1 | 8.2 | 1.1 | 20.2 | 8.7 | |||||||||||||||||||||||

Total | $ | 33.9 | $ | 127.2 | $ | 0.9 | $ | 162.0 | 2.7 | % | 9.9 | % | 0.1 | % | 12.7 | % | 4.3 | % | 27.2 | % | 4.3 | % | ||||||||||||

Organic net sales for 2008in 2011 into the North American wholesale market increased by $26.6 million, or 4.3%, compared to 2010. This increase was primarily due to improved recovery of commodity costs across our four principal product lines with larger increases in residential and commercial products sales of approximately $16.0 million and in drains and water re-use products of approximately $5.7 million. Organic sales into the North American DIY market in 2011 decreased in North America$4.4 million, or 2.6%, compared to 2010, primarily due to decreased product sales approximating $4.3 million, mostly in the wholesale market, where sales were 2.5% lower than in 2007. Unit sale declines, due in large part to the soft economy, were widespread across a number of product lines, with our backflow product line impacted the most. Organic sales in our North American retail market for 2008 remained relatively flat compared with 2007, decreasing 0.6%. Unit sale reductions in the retail market due to the soft economy were offset by selected price increasesresidential and new product rollouts. Given the current recession and more stringent bank lending standards, we believe that both the commercial and residential construction markets, which we sell into through our wholesale and DIY channels, will continue to be soft through 2009. As a result, we believe that our sales in North America may decline in 2009. Growth

in North America due to acquisitions is due to the inclusion of sales from Topway acquired in November 2007.products.

Organic net sales for 2008 increased in Europe primarilythe European wholesale market by $2.8 million, or 1.0%, compared to 2010. Wholesale sales increased marginally due to an 11.0% increasestronger sales in drains and pre-insulated pipe products along with increased sales into Eastern Europe and from geographic expansion into the Middle East. Increases were offset partially by lower unit sales into southern Europe, especially the Italian marketplace. Organic sales into the European OEM market asin 2011 increased by $9.2 million, or 4.9%, compared to 2007. OEM sales were positively impacted in Germany where sales of our products into alternative energy and energy conservation markets were strong. Sales into the wholesale market for 2008 decreased by 4.5% as compared to 2007 and were negatively affected by declines in construction activity. Acquired sales growth in Europe was2010 primarily due to the inclusion of Blücher for seven months in 2008. We expectincreased sales in Europe will increase on a constant currency basis in 2009 as Blücher will be reported for a full year and we expect alternative energy products sales to grow, hydronic under-floor manifold packages

offset by unit declines in our core product lines. Core sales are expected to be impacted by the widening recession in Europe.

Organic net sales for 2008 declined in China due to decreasedlower sales in both the Chinese domesticheat pump and export markets. China salessolar packages, which had been driven by renewable energy subsidies which either were also negatively affected as compared to 2007 from the disposal of a commodity butterfly valve business during the fourth quarter of 2008. This decrease was partially offset by an increase in sales of large diameter butterfly valves to our water infrastructure customers during 2008.reduced or had expired.

The increasesnet increase in net sales due to foreign exchange in North America, Europe and China werewas primarily due to the appreciation of the Canadian dollar, euro and yuan, respectively,the Canadian dollar against the U.S. dollar. We cannot predict whether these currencies will continue to appreciate or depreciate against the U.S. dollar in future periods or whether future foreign exchange rate fluctuations will have a positive or negative impact on our net sales. Recent fluctuations

Acquired net sales in foreign currency rates portend a reductionEurope related to the Socla and Austroflex Rohr-Isoliersysteme GmbH (Austroflex) acquisitions and in those currencies against the U.S. dollar.North America was due to Socla and Blue Ridge Atlantic Enterprises, Inc. (BRAE) acquisitions.

Gross Profit. Gross profit and gross profit as a percent of net sales (gross margin) for 20082011 and 20072010 were as follows:

| | Year Ended December 31, | | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | Point Change | |||||||||

| | 2008 | 2007 | ||||||||

| | (dollars in millions) | | ||||||||

Gross profit | $ | 488.4 | $ | 461.6 | ||||||

Gross margin | 33.5 | % | 33.4 | % | 0.1 | % | ||||

| | Year Ended December 31, | ||||||

|---|---|---|---|---|---|---|---|

| | 2011 | 2010 | |||||

| | (Dollars in millions) | ||||||

Gross profit | $ | 515.5 | $ | 464.9 | |||

Gross margin | 35.9 | % | 36.5 | % | |||

Gross margin improved by 10 basisdecreased 0.6 percentage points to 33.5% in 20082011 compared to 2007. The improvement was attributable primarily2010 for a variety of reasons. First, we were unable to margin improvements in North America and Europe offset by declines in China. North America's margin improved 70 basis points to 34.4% primarily due to the price increases implemented to offset prior raw materialcompletely recover commodity cost increases in Europe and to a lesser extent,in the mix of product sold. Further, 2007 North American gross margins were negatively impacted by approximately $6.5DIY market. Second, we incurred acquisition accounting adjustments of $4.7 million or approximately 100 basis points onin connection with the prior year gross margin, for charges associated with product discontinuances and a change in estimate for workers' compensation costs. Gross margin in Europe increased to 32.3% from 31.0% primarily due to our ability to leverage additional volume from alternative energy product sales with better factory absorption levels due to the rationalization efforts made over the last two years in Italy. China gross margin deteriorated when compared to 2007 primarily due to excess capacity due to sales declines, value added tax increases, negative impact from the increaseSocla acquisition. Third, we experienced inefficiencies in the value of the Chinese yuan against the U.S. dollar and disruptions from a plant move and labor disputes.

During 2007, we initiated a global restructuring program that was approved by our Board of Directors on October 30, 2007. The program includes plans to shut down five manufacturing facilities, right-size a sixth facility and incur costs to relocate one of our China facilities. In addition, we performed an evaluation of certain product lines in 2007. After completing this evaluation, we initiated a plan to discontinue certain product lines. In accordance with the restructuring program and product line discontinuance commenced in 2007, we anticipated spending $12.9 million. To date, we have

incurred $8.9 million of costs associated with the plans and have successfully shut down two manufacturing facilities and right sized another facility. Management is reviewing the status of the program and the timing of charges for the Europe segment. We anticipate the restructuring program will not be completed until 2010, with the expectation that our Europe segment will incur most of its costs during 2010. As such, previous estimates of savings from the programs will likely be achieved in 2010 rather than in the secondfirst half of 2009.

The following table presents the total estimated pre-tax charges2011 as our French plant consolidation project was being completed. Fourth, productivity initiatives were offset to be incurred for the global restructuring program and product line discontinuances initiated in 2007some extent by our reportable segments and amounts charged to date:higher inbound freight costs.

Reportable Segment | Total | Spent to Date | |||||

|---|---|---|---|---|---|---|---|

| | (in millions) | ||||||

North America | $ | 5.7 | $ | 5.8 | |||

Europe | 3.9 | 0.2 | |||||

China | 3.3 | 2.9 | |||||

Total | $ | 12.9 | $ | 8.9 | |||

Selling, General and Administrative Expenses. Selling, general and administrative expenses, or SG&A expenses, for 20082011 increased $27.5$43.2 million, or 8.3%12.8%, compared to 2007.2010. The increase in SG&A expenses iswas attributable to the following:

| | (in millions) | % Change | |||||

|---|---|---|---|---|---|---|---|

Organic growth | $ | 3.2 | 1.0 | % | |||

Foreign exchange | 7.7 | 2.3 | |||||

Acquisitions | 17.8 | 5.4 | |||||

Disposal | (1.2 | ) | (0.4 | ) | |||

Total | $ | 27.5 | 8.3 | % | |||

| | (in millions) | % Change | |||||

|---|---|---|---|---|---|---|---|

Organic | $ | 8.4 | 2.5 | % | |||

Foreign exchange | 6.5 | 1.9 | |||||

Acquisitions | 28.3 | 8.4 | |||||

Total | $ | 43.2 | 12.8 | % | |||

The organic increase in SG&A expenses was primarily due to increased incentive compensationseparation costs and increasedof our former CEO of $6.3 million, an increase of approximately $4.4 million in variable European selling expensescosts due to increasedthe increase in year-over-year sales, volumes partiallyand an increase in IT costs of approximately $3.0 million due primarily to the implementation of a new enterprise resource planning system (ERP system) and other licensing costs, offset by decreased shipping costs and other variable North American selling expenses due to decreased sales volumes.approximately $7.0 million in lower legal costs. The increase in SG&A expenses from foreign exchange was primarily due to the appreciation of the euro yuan and Canadian dollar against the U.S. dollar. The increase inAcquired SG&A expenses from acquisitions was duecosts related to the inclusion of BlücherSocla, Austroflex and Topway.BRAE acquisitions. Total SG&A expenses, as a percentage of sales, was 24.7%remained constant at 26.4% in 2008 compared to 24.1% 2007.both 2011 and 2010.

Restructuring and Other (Income) Charges. In 2008,2011, we recorded $5.6a net charge of $8.8 million primarily for severance and other costs incurred as part of our previously announced restructuring programs, as compared to $12.6 million for severance, asset write-downs2010. For a more detailed description of our current restructuring plans, see Notes 4 and accelerated depreciation5 of Notes to Consolidated Financial Statements in North America, China and Europe. In 2007, we recorded $3.2 million for asset write-downs, accelerated depreciation and severance in North America and China.this Annual Report on Form 10-K.

Goodwill and Other Long-Lived Asset Impairment Charge.Charges. In 2011, we recorded asset impairment charges of $17.4 million, including $14.8 million for impairment charges on long-lived assets at Austroflex, $1.4 million in goodwill and long-lived intangible asset impairments at BRAE and

$1.2 million of impairment charges in certain European trade names. The long-lived asset and goodwill impairment chargeimpairments were based on historical results being below our expectations, uncertain economic conditions in 2008 of approximately $22.0 millionEurope related to oneAustroflex, and a reduction in the expected future cash flows to be generated by these entities. In 2010, the impairment charges of our North American reporting units (Water Quality).$1.4 million relate to write-downs of certain trade names in Europe. See Note 2 of notesNotes to consolidated financial statementsConsolidated Financial Statements in this Annual Report on Form 10-K, for additional information regarding these impairments.

Gain on Disposal of Business. In 2011, we recorded a net gain of approximately $7.7 million relating primarily to the impairment.recognition of currency translation adjustments resulting from the sale of TWVC.

Operating Income. Operating income by geographic segment for 20082011 and 20072010 was as follows:

| | Years Ended | | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | % Change to Consolidated Operating Income | |||||||||||

| | December 31, 2008 | December 31, 2007 | Change | ||||||||||

| | (Dollars in millions) | ||||||||||||

North America | $ | 67.8 | $ | 93.3 | $ | (25.5 | ) | (20.3 | )% | ||||

Europe | 65.7 | 53.6 | 12.1 | 9.6 | |||||||||

China | (5.7 | ) | 7.9 | (13.6 | ) | (10.8 | ) | ||||||

Corporate | (27.2 | ) | (29.1 | ) | 1.9 | 1.5 | |||||||

Total | $ | 100.6 | $ | 125.7 | $ | (25.1 | ) | (20.0 | )% | ||||

| | Year Ended | | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | % Change to Consolidated Operating Income | |||||||||||

| | December 31, 2011 | December 31, 2010 | Change | ||||||||||

| | (Dollars in millions) | ||||||||||||

North America | $ | 112.0 | $ | 106.4 | $ | 5.6 | 4.9 | % | |||||

Europe | 28.7 | 43.7 | (15.0 | ) | (13.1 | ) | |||||||

Asia | 12.2 | (0.5 | ) | 12.7 | 11.1 | ||||||||

Corporate | (35.8 | ) | (35.4 | ) | (0.4 | ) | (0.4 | ) | |||||

Total | $ | 117.1 | $ | 114.2 | $ | 2.9 | 2.5 | % | |||||

The change in operating income iswas attributable to the following:

| | | | | | | Change As a % of Consolidated Operating Income | Change As a % of Segment Operating Income | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | North America | Europe | China | Corp. | Total | North America | Europe | China | Corp. | Total | North America | Europe | China | Corp. | |||||||||||||||||||||||||||||

| | (Dollars in millions) | ||||||||||||||||||||||||||||||||||||||||||

Organic growth | $ | (2.1 | ) | $ | 5.7 | $ | (16.7 | ) | $ | 1.9 | $ | (11.2 | ) | (1.6 | )% | 4.5 | % | (13.3 | )% | 1.5 | % | (8.9 | )% | (2.3 | )% | 10.6 | % | (211.4 | )% | 6.5 | % | ||||||||||||

Foreign exchange | — | 3.9 | (0.4 | ) | — | 3.5 | — | 3.1 | (0.2 | ) | — | 2.9 | — | 7.3 | (5.1 | ) | — | ||||||||||||||||||||||||||

Acquisitions | (0.6 | ) | 2.7 | — | — | 2.1 | (0.4 | ) | 2.1 | — | — | 1.7 | (0.6 | ) | 5.0 | — | — | ||||||||||||||||||||||||||

Disposal | — | — | 0.8 | — | 0.8 | — | — | 0.6 | — | 0.6 | — | — | 10.1 | — | |||||||||||||||||||||||||||||

Restructuring, goodwill and other | (22.8 | ) | (0.2 | ) | 2.7 | — | (20.3 | ) | (18.3 | ) | (0.1 | ) | 2.1 | — | (16.3 | ) | (24.4 | ) | (0.4 | ) | 34.2 | — | |||||||||||||||||||||

Total | $ | (25.5 | ) | $ | 12.1 | $ | (13.6 | ) | $ | 1.9 | $ | (25.1 | ) | (20.3 | )% | 9.6 | % | (10.8 | )% | 1.5 | % | (20.0 | )% | (27.3 | )% | 22.5 | % | (172.2 | )% | 6.5 | % | ||||||||||||

| | | | | | | Change as a % of Consolidated Operating Income | Change as a % of Segment Operating Income | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | North America | Europe | Asia | Corp. | Total | North America | Europe | Asia | Corp. | Total | North America | Europe | Asia | Corp. | |||||||||||||||||||||||||||||

| | (Dollars in millions) | ||||||||||||||||||||||||||||||||||||||||||

Organic | $ | 1.8 | $ | (6.2 | ) | $ | 4.4 | $ | (0.4 | ) | $ | (0.4 | ) | 1.6 | % | (5.4 | )% | 3.8 | % | (0.4 | )% | (0.4 | )% | 1.7 | % | (14.2 | )% | 880.0 | % | (1.1 | )% | ||||||||||||

Foreign exchange | 0.7 | 2.6 | 0.2 | — | 3.5 | 0.6 | 2.3 | 0.2 | — | 3.1 | 0.7 | 6.0 | 40.0 | — | |||||||||||||||||||||||||||||

Acquisitions | 0.1 | 2.9 | (0.2 | ) | — | 2.8 | 0.1 | 2.5 | (0.2 | ) | — | 2.4 | 0.1 | 6.6 | (40.0 | ) | — | ||||||||||||||||||||||||||

Restructuring, impairment charges and other | 3.0 | (14.3 | ) | 8.3 | — | (3.0 | ) | 2.6 | (12.5 | ) | 7.3 | — | (2.6 | ) | 2.8 | (32.7 | ) | 1,660.0 | — | ||||||||||||||||||||||||

Total | $ | 5.6 | $ | (15.0 | ) | $ | 12.7 | $ | (0.4 | ) | $ | 2.9 | 4.9 | % | (13.1 | )% | 11.1 | % | (0.4 | )% | 2.5 | % | 5.3 | % | (34.3 | )% | 2,540.0 | % | (1.1 | )% | |||||||||||||

The decrease in consolidated organic operating income was due primarily to underutilization of capacity,a reduction in both Chinagross margins and to a lesser extent,an increase in North America caused by recessionary unit volume declines and one-off events in China such as the labor strike, a plant move and natural disasters. Also, SG&A expenses, such as salaries, product liabilityfor reasons discussed above. Acquired operating income relates to the Socla, Austroflex and other fixed spending increased. These items were partially offset by higher sales and better productivity in Europe and reductions in certain SG&A expenses such as shipping, pension costs and bad debts. Corporate costs decreased as the result of lower benefit costs, including lower stock based compensation and reduced costs from our nonqualified deferred compensation plan, and lower costs related to our Sarbanes Oxley compliance efforts and reduced legal costs.

The Blücher acquisition accounts for the net increase in operating profits fromBRAE acquisitions.

The net increase in operating income from foreign exchange was primarily due to the appreciation of the euro and Canadian dollar against the U.S. dollar. We cannot predict whether these currencies will continue to appreciate or depreciate against the U.S. dollar in future periods or whether future foreign exchange rate fluctuations will have a positive or negative impact on our operating income.

Interest Income. Interest income decreased $9.4 million, or 64.8%, in 2008 compared to 2007, primarily due to cash used to fund the Blücher acquisition and the stock buy-back program initiated in November 2007, as well as, a lower interest rate environment in 2008 as compared to 2007.

Interest Expense. Interest expense decreased $0.7increased $3.0 million, or 2.6%13.2%, in 20082011 compared to 2007,2010, primarily due to lower outstanding balances on the revolving credit facility partially offset by an increase in the average variable rates chargedamounts outstanding during the year on theour revolving credit facility.facility that was used to partially finance the Socla acquisition and interest incurred for all 2011 from the June 2010 issuance of $75.0 million of senior notes. See Note 11 of Notes to Consolidated Financial Statements in this Annual Report on Form 10-K, for additional information regarding financing arrangements.

Other, (Income) Expense.net. Other, expensenet increased $6.8$2.9 million or 295.7%, in 20082011 compared to 2007,2010, primarily due tobecause foreign currency transactiontransactions resulted in net losses losses on metal commodity transactions and negative changes in asset valuation of our nonqualified deferred compensation plan. Foreign currency transaction losses increased2011, while in China, Europe and Canada in 2008 as compared to 2007.2010 net gains were recognized.

Income Taxes. Our effective tax rate for continuing operations increaseddecreased to 34.6% for 200829.3% in 2011 from 31.8% for 2007.33.2% in 2010. The main driverprimary cause of the increasedecrease was goodwill impairment. A portion of the goodwill relates to stock acquisitions, which when impaired is not tax deductible. Our European effective rate declined due to provision releases and favorablethe tax treatments related tobenefit realized in connection with the Blücher acquisition financing.disposition of our TWVC facility in China.

Net Income From Continuing Operations.Operation. IncomeNet income from continuing operations in 2008 decreased $30.3for 2011 was $64.7 million, or 39.0%, to $47.3 million, or $1.28$1.73 per common share, from $77.6compared to $63.1 million, or $1.99$1.69 per common share, for 2007, in each case, on a diluted basis. Repurchased shares had an accretive impact of $0.07 per common share in 2008. Income from continuing operations included2010. Results for 2011 include an after-tax goodwill impairment charge of $17.3$6.6 million, or $0.47$0.18 per common share, for 2008. Income from continuing operations for 2007 includes a tax refundrestructuring and other charges compared to an after-tax restructuring and other charge of $1.9$11.2 million, or $0.05$0.29 per common share. Income from continuing operationsshare, for 2008 and 2007 included costs, net of tax, from our restructuring plan, reduction-in-force and product line discontinuances2010. Additionally, 2011 results include an after-tax charge of $3.9 million, or $0.10$0.11 per common share, and $5.1related to our former Chief Executive Officer's separation agreement. Results for 2011 include an after-tax charge of $13.0 million, or $0.13$0.35 per common share, respectively.for goodwill and asset impairment charges compared to an after-tax asset impairment charge of $1.2 million, or $0.03 per common share, for 2010. Results for 2011 include an after-tax gain related to the sale of TWVC of $11.4 million, or $0.30 per common share. The appreciation of the euro Chinese yuan and Canadian dollar against the U.S. dollar in 2011 resulted in a positive impact on income from continuingour operations of $0.07 per common share for 20082011 compared to the comparable period last year.2010. We cannot predict whether the euro, Canadian dollar or Chinese yuan will appreciate or depreciate against the U.S. dollar in future periods or whether future foreign exchange rate fluctuations will have a positive or negative impact on our net income.

LossIncome (Loss) From Discontinued Operations. LossIncome from discontinued operations in 2008 and 20072011 was $0.7primarily attributable to a reserve adjustment of $1.7 million, or $0.02$0.05 per common share, related to the FCPA investigation originally recorded in 2010. The adjustment reflects the final disposition of the FCPA investigation. See Notes 3 and $0.2 million, or $0.01 per common share, on a diluted basis14 of Notes to Consolidated Financial Statements for the comparable period. The losses for 2008 and 2007 were primarily attributable to increased legal fees associated with the James Jones Litigation, as described in Part I, Item 1, "Business-Product Liability, Environmental and Other Litigation Matters." The 2007 loss was partially offset by reserve adjustments.additional discussion of this matter.

Year Ended December 31, 20072010 Compared to Year Ended December 31, 20062009

Net Sales. Our net sales in each of our three geographicthese segments for the years ended December 31, 20072010 and 20062009 were as follows:

| | Year Ended December 31, 2007 | Year Ended December 31, 2006 | | | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Change to Consolidated Net Sales | |||||||||||||||||

| | Net Sales | % Sales | Net Sales | % Sales | Change | ||||||||||||||

| | (Dollars in millions) | ||||||||||||||||||

North America | $ | 871.0 | 63.0 | % | $ | 821.3 | 66.7 | % | $ | 49.7 | 4.0 | % | |||||||

Europe | 452.6 | 32.7 | 367.5 | 29.9 | 85.1 | 6.9 | |||||||||||||

China | 58.7 | 4.3 | 42.0 | 3.4 | 16.7 | 1.4 | |||||||||||||

Total | $ | 1,382.3 | 100.0 | % | $ | 1,230.8 | 100.0 | % | $ | 151.5 | 12.3 | % | |||||||

| | Year Ended December 31, 2010 | Year Ended December 31, 2009 | | | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Change to Consolidated Net Sales | |||||||||||||||||

| | Net Sales | % Sales | Net Sales | % Sales | Change | ||||||||||||||

| | (Dollars in millions) | ||||||||||||||||||

North America | $ | 785.5 | 61.6 | % | $ | 738.5 | 60.2 | % | $ | 47.0 | 3.8 | % | |||||||

Europe | 468.3 | 36.8 | 466.5 | 38.1 | 1.8 | 0.2 | |||||||||||||

Asia | 20.8 | 1.6 | 20.9 | 1.7 | (0.1 | ) | — | ||||||||||||

Total | $ | 1,274.6 | 100.0 | % | $ | 1,225.9 | 100.0 | % | $ | 48.7 | 4.0 | % | |||||||

The increasechange in net sales iswas attributable to the following:

| | | | | | Change As a % of Consolidated Net Sales | Change As a % of Segment Net Sales | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | North America | Europe | China | Total | North America | Europe | China | Total | North America | Europe | China | |||||||||||||||||||||||

| | (Dollars in millions) | |||||||||||||||||||||||||||||||||

Organic growth | $ | 41.0 | $ | 13.7 | $ | 8.5 | $ | 63.2 | 3.3 | % | 1.1 | % | 0.7 | % | 5.1 | % | 5.0 | % | 3.7 | % | 20.3 | % | ||||||||||||

Foreign exchange | 3.9 | 34.1 | 2.4 | 40.4 | 0.3 | 2.8 | 0.2 | 3.3 | 0.5 | 9.3 | 5.8 | |||||||||||||||||||||||

Acquisitions | 4.8 | 37.3 | 5.8 | 47.9 | 0.4 | 3.0 | 0.5 | 3.9 | 0.6 | 10.2 | 13.8 | |||||||||||||||||||||||

Total | $ | 49.7 | $ | 85.1 | $ | 16.7 | $ | 151.5 | 4.0 | % | 6.9 | % | 1.4 | % | 12.3 | % | 6.1 | % | 23.2 | % | 39.9 | % | ||||||||||||

| | | | | | Change As a % of Consolidated Net Sales | Change As a % of Segment Net Sales | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | North America | Europe | Asia | Total | North America | Europe | Asia | Total | North America | Europe | Asia | |||||||||||||||||||||||

| | (Dollars in millions) | |||||||||||||||||||||||||||||||||

Organic | $ | 38.8 | $ | 11.7 | $ | (0.2 | ) | $ | 50.3 | 3.2 | % | 1.0 | % | — | % | 4.2 | % | 5.3 | % | 2.5 | % | (1.0 | )% | |||||||||||

Foreign exchange | 7.0 | (20.5 | ) | 0.1 | (13.4 | ) | 0.6 | (1.7 | ) | — | (1.1 | ) | 0.9 | (4.4 | ) | 0.5 | ||||||||||||||||||

Acquisitions | 1.2 | 10.6 | — | 11.8 | — | 0.9 | — | 0.9 | 0.2 | 2.3 | — | |||||||||||||||||||||||

Total | $ | 47.0 | $ | 1.8 | $ | (0.1 | ) | $ | 48.7 | 3.8 | % | 0.2 | % | — | % | 4.0 | % | 6.4 | % | 0.4 | % | (0.5 | )% | |||||||||||

The organic growth inOrganic net sales in 2010 into the North AmericaAmerican wholesale market increased by $34.6 million or 6.1% compared to 2009. This increase was primarily due to increased unit selling prices and increased unit sales of certain product lines into the wholesale market. Our sales into the wholesale market in 2007, excluding the sales from the acquisition of Calflex Manufacturing, Inc. (Calflex) and Topway, grew by 7.7% compared to 2006. This was primarily due to increased sales of our plumbing and heating and backflow products. Ourproduct lines. Organic sales into the North American DIY market in 2007 decreased by 4.4%2010

increased $4.2 million or 2.5% compared to 20062009, primarily from increased product sales volume associated with repair and remodeling activity and new product introductions.

Organic net sales increased in the European wholesale market by $12.9 million or 5.3% compared to 2009. This increase was primarily due to a stronger repair and remodeling market, strong sales in our discontinuing certaindrain product line and higher sales into Eastern Europe. Organic sales into the European OEM market in 2010 were essentially flat with 2009 primarily due to increased sales in hydronic under-floor manifold packages offset by heat pump and solar packages whose lower margin product lines,sales were driven by renewable energy subsidies which had expired. Organic sales into the European DIY market in 2010 increased $1.5 million or 6.4% compared to 2009, primarily from initial new store sales to a major retail customer.

The net decrease in sales due to foreign exchange was primarily due to the depreciation of the euro, partially offset by price increases and new product rollouts.the appreciation of the Canadian dollar against the U.S. dollar.

The acquiredAcquired net sales growth in net sales inEurope and North America was due to the inclusion of net sales of Calflex, acquired on June 2, 2006,Austroflex and Topway, acquired on November 9, 2007.

The organic sales growth in Europe was broad-based, especially in Eastern Europe and in the OEM market, which was partially offset by a weak German market. Our sales into the wholesale and OEM markets in 2007, excluding the sales from the acquisitions of ATS Expansion Group (ATS), Kim Olofsson Safe Corporation (Kimsafe) and Black Teknigas, Limited (Teknigas), grew by 3.1% and 4.4%, respectively, compared to 2006.

The acquired growth in net sales in Europe was due to the inclusion of the net sales of ATS, acquired on May 19, 2006, Kimsafe, acquired on June 7, 2006, and Teknigas, acquired on August 14, 2006.

The organic sales growth in China was primarily due to increased export sales to Europe, increased sales into the domestic Chinese markets and the elimination of the one-month reporting lag in two of our Chinese entities.

The acquired growth in net sales in China was due to the inclusion of net sales of Changsha Valve Works (Changsha), acquired on April 26, 2006.

The increases in net sales due to foreign exchange in North America, Europe and China were primarily due to the appreciation of the Canadian dollar, euro and yuan, respectively, against the U.S. dollar.BRAE, respectively.

Gross Profit. Gross profit and gross profit as a percent of net sales (gross margin)margin for 20072010 and 20062009 were as follows:

| | Year Ended December 31, | | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | Point Change | |||||||||

| | 2007 | 2006 | ||||||||

| | (dollars in millions) | | ||||||||

Gross profit | $ | 461.6 | $ | 425.0 | ||||||

Gross margin | 33.4 | % | 34.5 | % | (1.1 | %) | ||||

| | Year Ended December 31, | ||||||

|---|---|---|---|---|---|---|---|

| | 2010 | 2009 | |||||

| | (Dollars in millions) | ||||||

Gross profit | $ | 464.9 | $ | 435.1 | |||

Gross margin | 36.5 | % | 35.5 | % | |||

Gross margin decreasedincreased 1.0 percentage point in 20072010 compared to 20062009. North America's gross margin improvement was primarily dueattributable to increased material costs,sales volumes, better absorption at the write-off of inventory related to the discontinuance of certain product linesfactories and an increase inproductivity gains from our workers' compensation reserve primarily due to a change in estimate. The North American margin for 2007 was affected by a charge related to our discontinuance of certain product linesLean and forSix Sigma cost increases for copper-based alloys and stainless steel products, which exceeded realized sales price increases for most of the year. The European margin remained relatively flat primarily due to higher margins contributed by price increases that weresavings initiatives, partially offset by increased materialraw materials costs and a shift in sales to lower margin products primarily in the OEM market. Our China segment's gross margin decreased primarily due to higher material costs, underutilized capacity in certain locations primarilyinefficiencies due to the relocation of our joint venture facility, a chargemanufacturing operations related to our restructuring program in the U.S. Europe's gross margin remained relatively flat as a result of better product mix, with the discontinuance of certain product lines, value added tax increasesvarious low-margin products, increased sales volumes and a shiftbetter absorption at the factories was offset by increased commodity costs and inefficiencies from our restructuring program in product mix.France.

Selling, General and Administrative Expenses. SG&A expenses for 20072010 increased $32.5$13.2 million, or 10.8%4.1%, compared to 2006.2009. The increase in SG&A expenses iswas attributable to the following:

| | (in millions) | % Change | |||||

|---|---|---|---|---|---|---|---|

Organic growth | $ | 13.1 | 4.4 | % | |||

Foreign exchange | 7.9 | 2.6 | |||||

Acquisitions | 11.5 | 3.8 | |||||

Total | $ | 32.5 | 10.8 | % | |||

| | (in millions) | % Change | |||||

|---|---|---|---|---|---|---|---|

Organic | $ | 12.4 | 3.8 | % | |||

Foreign exchange | (3.3 | ) | (1.0 | ) | |||

Acquisitions | 4.1 | 1.3 | |||||

Total | $ | 13.2 | 4.1 | % | |||

The organic increase in SG&A expenses was primarily due to legal, due diligence and other acquisition costs of $8.1 million, increased product liabilitypersonnel-related costs increased stock-based compensation costsof $4.4 million and increased variable selling expenses due to increasedhigher sales volumes of $3.4 million, partially offset by decreased incentive compensation costs.reduced product liability costs of $3.5 million. Legal costs were higher in 2010 as a result of a legal settlement we entered into in 2009 pursuant to which we received $4.1 million, which reduced legal expense. The increasedecrease in SG&A expenses from foreign exchange was primarily due to the appreciationdepreciation of the euro Canadian dollar and the yuan against the U.S. dollar. The increase in SG&A expenses from acquisitions was due to the inclusion of Changsha, ATS, Calflex, Watts Valve (Ningbo) Co, Ltd. (Ningbo), Kimsafe, Teknigas and Topway. Total SG&A expenses, as a percentage of sales, were 24.1%remained constant at 26.4% in 2007 compared to 24.4% 2006.each of 2010 and 2009.

Restructuring and Other (Income) Charges. In 2007,2010, we recorded $3.2a charge of $12.6 million primarily for severance and other costs incurred as part of our previously announced restructuring programs, as

compared to $17.2 million for asset write-downs, accelerated depreciation2009. Included in the 2009 restructuring and severance in North Americaother charges was a $1.1 million gain from the 2008 disposition of Tianjin Tanggu Watts Valve Co. Ltd. (TWT). The gain was deferred until all legal and China. In 2006, we recorded income of $5.7 million primarily due to a gain of approximately $8.2 million relatedregulatory matters relating to the sale of two buildingsTWT were resolved. For a more detailed description of our current restructuring plans, see Notes 4 and 5 of Notes to Consolidated Financial Statements in Italy partially offset by a charge of $2.5this Annual Report on Form 10-K.

Goodwill and Other Long-Lived Asset Impairment Charges. We recorded $1.4 million primarilyand $3.3 million in 2010 and 2009, respectively, for severance costsintangible impairment charges related to our European restructuring programs.certain trademarks and technology. See Note 2 of Notes to Consolidated Financial Statements in this Annual Report on Form 10-K, for additional information regarding these impairments.

Operating Income. Operating income by geographic segment for 20072010 and 20062009 was as follows:

| | Years Ended | | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | % Change to Consolidated Operating Income | |||||||||||

| | December 31, 2007 | December 31, 2006 | Change | ||||||||||

| | (Dollars in millions) | ||||||||||||

North America | $ | 93.3 | $ | 98.5 | $ | (5.2 | ) | (4.0 | )% | ||||

Europe | 53.6 | 50.0 | 3.6 | 2.8 | |||||||||

China | 7.9 | 7.2 | 0.7 | 0.5 | |||||||||

Corporate | (29.1 | ) | (25.2 | ) | (3.9 | ) | (3.0 | ) | |||||

Total | $ | 125.7 | $ | 130.5 | $ | (4.8 | ) | (3.7 | )% | ||||

| | Years Ended | | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | % Change to Consolidated Operating Income | |||||||||||

| | December 31, 2010 | December 31, 2009 | Change | ||||||||||

| | (Dollars in millions) | ||||||||||||

North America | $ | 106.4 | $ | 78.6 | $ | 27.8 | 30.2 | % | |||||

Europe | 43.7 | 51.0 | (7.3 | ) | (7.9 | ) | |||||||

Asia | (0.5 | ) | (6.6 | ) | 6.1 | 6.6 | |||||||

Corporate | (35.4 | ) | (30.8 | ) | (4.6 | ) | (5.0 | ) | |||||

Total | $ | 114.2 | $ | 92.2 | $ | 22.0 | 23.9 | % | |||||

The change in operating income iswas attributable to the following:

| | | | | | | Change As a % of Consolidated Operating Income | Change As a % of Segment Operating Income | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | North America | Europe | China | Corp. | Total | North America | Europe | China | Corp. | Total | North America | Europe | China | Corp. | |||||||||||||||||||||||||||||

| | (Dollars in millions) | ||||||||||||||||||||||||||||||||||||||||||

Organic growth | $ | (1.3 | ) | $ | 0.9 | $ | (1.5 | ) | $ | (3.9 | ) | $ | (5.8 | ) | (1.0 | )% | 0.7 | % | (1.3 | )% | (3.0 | )% | (4.6 | )% | (1.4 | )% | 1.8 | % | (20.8 | )% | (15.5 | )% | |||||||||||

Foreign exchange | 0.9 | 4.0 | 0.4 | — | 5.3 | 0.7 | 3.1 | 0.3 | — | 4.1 | 0.9 | 8.0 | 5.5 | — | |||||||||||||||||||||||||||||

Acquisitions | (1.3 | ) | 4.8 | 0.8 | — | 4.3 | (1.0 | ) | 3.6 | 0.7 | — | 3.3 | (1.3 | ) | 9.6 | 11.1 | — | ||||||||||||||||||||||||||

Restructuring/other | (3.5 | ) | (6.1 | ) | 1.0 | — | (8.6 | ) | (2.7 | ) | (4.6 | ) | 0.8 | — | (6.5 | ) | (3.5 | ) | (12.2 | ) | 13.9 | — | |||||||||||||||||||||

Total | $ | (5.2 | ) | $ | 3.6 | $ | 0.7 | $ | (3.9 | ) | $ | (4.8 | ) | (4.0 | )% | 2.8 | % | 0.5 | % | (3.0 | )% | (3.7 | )% | (5.3 | )% | 7.2 | % | 9.7 | % | (15.5 | )% | ||||||||||||

| | | | | | | Change as a % of Consolidated Operating Income | Change as a % of Segment Operating Income | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | North America | Europe | Asia | Corp. | Total | North America | Europe | Asia | Corp. | Total | North America | Europe | Asia | Corp. | |||||||||||||||||||||||||||||

| | (Dollars in millions) | ||||||||||||||||||||||||||||||||||||||||||

Organic | $ | 24.7 | $ | 0.5 | $ | (0.7 | ) | $ | (4.8 | ) | $ | 19.7 | 26.8 | % | 0.5 | % | (0.7 | )% | (5.2 | )% | 21.4 | % | 31.4 | % | 1.0 | % | (10.6 | )% | 15.6 | % | |||||||||||||