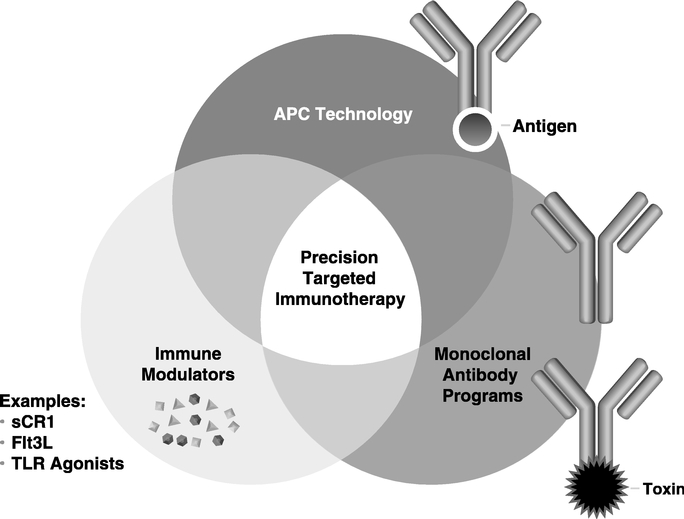

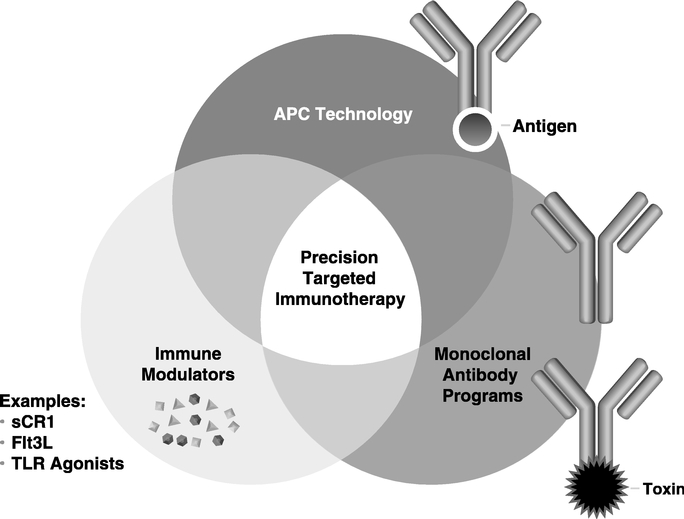

Precision Targeted Immunotherapy Platform:

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark one) | ||

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, | ||

or | ||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

Commission File Number 0-15006

CELLDEX THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 13-3191702 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

119 Fourth Avenue, Needham, Massachusetts 02494

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code:(781) 433-0771

Securities registered pursuant to Section 12(b) of the Act:

| Title of Class: | Name of Each Exchange on Which Registered: | |

|---|---|---|

| Common Stock, par value $.001 | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this Chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller Reporting Company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the voting and non-votingregistrant's common stock held by non-affiliates as of June 30, 20082009 was $103,792,910 (excludes shares held by directors and executive officers).$100.8 million. Exclusion of shares held by any person should not be construed to indicate that such person possesses the power, direct or indirect, to direct or cause the actions of the management or policies of the registrant, or that such person is controlled by or under common control with the registrant.

The number of shares of common stock outstanding at February 20, 200925, 2010 was 15,820,59331,711,124 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement for our 2010 Annual Meeting of Stockholders are incorporated by reference into Part III of this Report.

CELLDEX THERAPEUTICS, INC.

ANNUAL REPORT ON FORM 10-K

YEAR ENDED DECEMBER 31, 2008

2009

| | | | Page | |||

|---|---|---|---|---|---|---|

Part I | ||||||

Item 1. | Business | 1 | ||||

Item 1A. | Risk Factors | |||||

Item 1B. | Unresolved Staff Comments | |||||

Item 2. | Properties | 37 | ||||

Item 3. | Legal Proceedings | 37 | ||||

Item 4. |

| 37 | ||||

Part II | ||||||

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 38 | ||||

Item 6. | Selected Consolidated Financial Data | |||||

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |||||

Item 7A. | Quantitative and Qualitative Disclosure About Market Risk | |||||

Item 8. | Financial Statements and Supplementary Data | |||||

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | |||||

Item 9A. | Controls and Procedures | |||||

Item 9B. | Other information | |||||

Part III | ||||||

Item 10. | Directors, Executive Officers and Corporate Governance | |||||

Item 11. | Executive Compensation | |||||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |||||

Item 14. | Principal Accountant Fees and Services | |||||

Part IV | ||||||

Item 15. | Exhibits, Financial Statement Schedules | |||||

Signatures | ||||||

i

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: This report on Form 10-K contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as "may," "will," "can," "anticipate," "assume," "should," "indicate," "would," "believe," "contemplate," "expect," "seek," "estimate," "continue," "plan," "point to," "project," "predict," "could," "intend," "target," "potential" and other similar words and expressions of the future.

There are a number of important factors that could cause the actual results to differ materially from those expressed in any forward-looking statement made by us. These factors include, but are not limited to:

ii

All forward-looking statements are expressly qualified in their entirety by this cautionary notice. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this report or the date of the document incorporated by reference into this report. We have no obligation, and expressly disclaim any obligation, to update, revise or correct any of the forward-looking statements, whether as a result of new information, future events or otherwise. We have expressed our expectations, beliefs and projections in good faith and we believe they have a reasonable basis. However, we cannot assure you that our expectations, beliefs or projections will result or be achieved or accomplished.

iii

A. General

As used herein, the terms "we," "us," "our," the "Company", or "Celldex" refer to Celldex Therapeutics, Inc., a Delaware corporation organized in 1983 (formerly known as AVANT Immunotherapeutics, Inc.) and its direct and indirect subsidiaries: Celldex Research Corporation ("Celldex Research"), and Celldex Therapeutics, Ltd. ("Celldex Ltd.") and Megan Health, Inc. ("Megan"). The Company'sOur principal activity since our inception has been research and product development conducted on our own behalf, as well as through joint development programs with several pharmaceutical companies and other collaborators. AVANT Immunotherapeutics, Inc. changed its name to Celldex Therapeutics, Inc. on October 1, 2008.

Celldex isWe are an integrated biopharmaceutical company that applies itsour comprehensive Precision Targeted Immunotherapy Platform to generate a pipeline of candidates to treat cancer and other difficult-to-treat diseases. Celldex'sOur immunotherapy platform includes a complementary portfolio of monoclonal antibodies, antibody-targeted vaccines, antibody-drug conjugates and immunomodulators to create novel disease-specific drug candidates.

Our strategy is to develop and demonstrate proof-of-concept for our product candidates before leveraging their value through partnerships or, in appropriate situations, continuing late stage development through commercialization ourselves. Demonstrating proof-of-concept for a product candidate generally involves bringing it through Phase 1 clinical trials and one or more Phase 2 clinical trials so that we are able to demonstrate, based on human trials, good safety data for the product candidate and some data indicating its effectiveness. We thus leverage the value of our technology portfolio through corporate, governmental and non-governmental partnerships. This approach allows us to maximize the overall value of our technology and product portfolio while best ensuring the expeditious development of each individual product.

Our current collaborations encompassinclude the commercialization of an oral human rotavirus vaccine and the development of oncology and infectious disease vaccines. Our product candidates address large market opportunities for which we believe current therapies are inadequate or non-existent.

AVANT Merger between AVANT and Celldex:

On March 7, 2008, we closed the merger (the "Merger") contemplated by the Agreement and Plan of Merger dated October 19, 2007 by and among Celldex (formerly AVANT Immunotherapeutics, Inc. ("AVANT"), Callisto Merger Corporation ("Merger Sub"), a wholly owned subsidiary of Celldex, and merged with Celldex Research (formerly known as Celldex Therapeutics, Inc.), a privately-held company, (the "Merger Agreement""AVANT Merger"). PursuantEffective October 1, 2008, we changed our name from AVANT Immunotherapeutics, Inc. to the terms of the Merger Agreement, Merger Sub merged with and into Celldex Research, with Celldex Research as the surviving company and a wholly-owned subsidiary of the Company. The total value of the transaction was approximately $75 million. Approximately 8.7 million shares were issued to the former Celldex Research shareholders in connection with the Merger. The Merger created a NASDAQ-listed, fully-integrated and diversified biopharmaceutical company with a deep pipeline of product candidates addressing high-value indications including oncology, infectious and inflammatory diseases. At the Merger, former Celldex and former AVANT shareholders owned 58% and 42% of the combined company on a fully diluted basis, respectively.Therapeutics, Inc.

Our board of directors approved a 1-for-12 reverse stock split of the Company's common stock, which became effective on March 7, 2008. As a result of the reverse stock split, each twelve shares of common stock were combined and reclassified into one share of common stock and the total number of shares outstanding was reduced from approximately 180 million shares (including the shares issued to former Celldex Research stockholders in the Merger) to approximately 15 million shares.

The AVANT Merger was accounted for using the purchase method of accounting and was treated as an acquisition by Celldex Research of Celldex (then AVANT), with Celldex Research being considered the accounting acquirer based on the application of criteria specified in Statement of Financial Accounting Standards "SFAS" No. 141,Business Combinations, ("SFAS 141"),AVANT even though Celldex (then AVANT)AVANT was the issuer of common stock and the surviving legal entity in the transaction. Under the purchase method of accounting, the deemed purchase price was allocated to AVANT's underlying tangible and identifiable intangible assets acquired and liabilities assumed based upon their respective fair values with any excess deemed purchase price allocated to goodwill. The valuation analysis conducted by the Company determined that the fair value of assets acquired and the fair value of liabilities assumed by Celldex Research exceeded the purchase price for AVANT, resulting in negative goodwill of approximately $6.0 million. In accordance with SFAS 141, the negative goodwill has been allocated to all of the acquired assets which were non-financial and non-current assets, including property and equipment, identifiable intangible assets, and in-process research and development. See Note 17 to the Company's consolidated financial statements for additional information.

Because Celldex Research was determined to be the acquirer for accounting purposes, the historical financial statements of Celldex Research became theour historical financial statementsas of the Company.closing of the AVANT Merger. Accordingly, theour financial statements of the Company prior to the AVANT Merger reflect the financial position, results of operations and cash flows of Celldex Research, which during the historical periods presented in the accompanying consolidated financial statements, was then majority-owned by Medarex, Inc. ("Medarex"). Following the AVANT Merger, the financial statements of the current period reflect the financial position, results of operation and cash flows of the Company.combined companies. The results of operations of AVANT are included in our results of operations beginning March 8, 2008.

Acquisition of CuraGen Corporation ("CuraGen")

On October 1, 2009, CuraGen, then a publicly-traded company, merged with a wholly-owned subsidiary of Celldex (the "CuraGen Merger"). In connection with the CuraGen Merger, effective

October 1, 2009, we (i) issued 15,722,713 shares of our common stock, or 0.2739 shares, in exchange for each share of outstanding CuraGen common stock, plus cash in lieu of fractional shares (the "CuraGen Exchange Ratio"), (ii) assumed all of the CuraGen stock options outstanding under the CuraGen 2007 Stock Plan (the "CuraGen 2007 Options"), and (iii) assumed the obligations of the $12.5 million in CuraGen 4% convertible subordinated debt due in February 2011 (the "CuraGen Debt"). The CuraGen 2007 Options are exercisable into 931,315 shares of our common stock after applying the CuraGen Exchange Ratio.

In connection with the consummation of the CuraGen Merger, effective October 1, 2009, Celldex, CuraGen, and The Bank of New York Mellon (formerly the Bank of New York) (the "Trustee") amended the CuraGen Debt to provide that the CuraGen Debt shall be convertible into 353,563 shares of Celldex common stock at the rate of 28.27823 shares of Celldex common stock per $1,000 principal amount of notes, or $35.36 per share.

Based on the closing price of our common stock on October 1, 2009 of $5.43, the fair value of the shares issued in the CuraGen Merger was $85.4 million. We have applied acquisition accounting as of October 1, 2009. Accordingly, the results of operations of the Company beginning March 8, 2008. Accordingly, except as otherwise discussed below, this report reflects the financial condition,CuraGen have been included in our results of operations and liquidity of the combined companies atbeginning October 1, 2009.

On December 31, 20082009, we completed the merger of our CuraGen subsidiary with and historicallyinto Celldex pursuant to a short-form merger effected under Delaware law. As a result, the separate corporate existence of Celldex Research on a stand-alone basis forCuraGen has ceased and we have succeeded to all periods prior to March 8, 2008. The financial condition, resultsrights, privileges, powers and franchises of operations and liquidity of the Company as of the years ended December 31, 2008, 2007 and 2006 may not be indicative of the Company's future performance or reflect what the Company's financial conditions, results of operations and liquidity would have been had the Merger been consummated as of January 1, 2006 or had the Company operated as a separate, stand-alone entity during the periods presented.CuraGen.

Celldex'sWe are a Delaware corporation organized in 1983. Our web site is located athttp://www.celldextherapeutics.com. On Celldex'sour web site, investors can obtain a copy of Celldex'sour annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and other reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act of 1934, as amended, as soon as reasonably practicable after Celldex fileswe file such material electronically with, or furnishes it to, the Securities and Exchange Commission.Commission ("SEC"). None of the information posted on our website is incorporated by reference into this Annual Report.

Research and Development Activities:Activities Our products are derived from a broad set of complementary technologies (collectively known as our Precision Targeted Immunotherapy Platform) which have the ability to utilize the human immune system and enable the creation of preventative and therapeutic agents. We are using our Precision Targeted Immunotherapy Platform to develop vaccines, therapeutic antibodies and other targeted immunotherapeutics that prevent or treat cancer, autoimmune disorders and disease caused by infectious organisms, and treatment vaccines that modify undesirable activity by the body's own proteins or cells. A number of our immunotherapeutic and vaccine product candidates are in various stages of clinical trials. We expect that a large percentage of

our research and development expenses will be incurred in support of our current and future clinical trial programs. Below is a table of our currently active programs:

CURRENT PROGRAMS AND PARTNERSHIPS

We currently have one product on the market and six products in clinical development. Our goal is to become a leading developer of innovative products that we call Precision Targeted Immunotherapeutics which are designed to address major unmet health care needs. Our success has depended and will continue to depend upon many factors, including our ability, and thatMost of our licenseesproducts are derived from a set of complementary technologies (collectively known as our Precision Targeted Immunotherapy Platform). This platform includes monoclonal antibodies, antibody-targeted vaccines, antibody-drug conjugates and collaborators,immunomodulators to successfullycreate novel disease-specific drugs. We are using our Precision Targeted Immunotherapy Platform to develop obtain regulatory approval fortargeted immunotherapies that prevent or treat specific forms of cancer, autoimmune disorders and commercialize our product candidates. To date, commercial sales have only been generated from Rotarix® and our former Megan poultry vaccines. We have had no commercial revenues from salesdisease caused by infectious organisms.

The following table includes the programs that we may not be ablecurrently believe are material to successfully develop, obtain regulatory approval for or commercialize our product candidates, and we are subject to a number of risks that you should be aware of before investing in Celldex. These risks are described more fully in "Item 1A. Risk Factors."business:

Product (generic) | Indication/Field | Partner | Status | ||||

|---|---|---|---|---|---|---|---|

CLINICAL | |||||||

CDX-110 | Glioblastoma multiforme | Pfizer (PF-4948568) | Phase 2b | ||||

CDX-011 | Metastatic melanoma and breast cancer | — | Phase 2 | ||||

CDX-1307 | Colorectal, bladder, pancreas, ovarian and breast tumors | — | Phase 1 | ||||

CDX-1401 | Multiple solid tumors | — | Phase 1/2 | ||||

CDX-1135 | Renal disease | — | Phase 1/2 | ||||

PRECLINICAL | |||||||

CDX-301 | Cancer, autoimmune disease and transplant | — | Preclinical | ||||

CDX-1127 | Immuno-modulation, multiple tumors | — | Preclinical | ||||

CDX-014 | Renal and ovarian cancer | — | Preclinical | ||||

CDX-1189 | Renal disease | — | Preclinical | ||||

MARKETED PRODUCTS | |||||||

Rotarix® | Rotavirus infection | GlaxoSmithKline | Marketed | ||||

Using our expertise in immunology, we are building business franchises in major disease areas: oncology, inflammatory and infectious diseases. Each of our business franchises addresses large market opportunities for which current therapies are inadequate or non-existent. We have pursued some of these opportunities independently in a highly focused manner. In other cases, we have leveraged the financial support and development capabilities of corporate and public sector partners to bring our development projects to fruition. The research we have pursued over the past several years has matured into what we believe is an exciting portfolio of product candidates.

Our success has depended and will continue to depend upon many factors, including our ability, and that of our licensees and collaborators, to successfully develop, obtain regulatory approval for and commercialize our product candidates. Commercial sales are currently only being generated from Rotarix®. We have had no commercial revenues from sales of our human therapeutic or other human vaccine products and we have had a history of operating losses. It is possible that we may not be able to successfully develop, obtain regulatory approval for or commercialize our product candidates, and we are subject to a number of risks that you should be aware of before investing in us. These risks are described more fully in "Item 1A. Risk Factors."

B. Development Strategy

Precision Targeted Immunotherapy Platform:

We believe there is tremendous untapped potential in immunotherapy that can be exploited through the right combination of therapeutic agents. Our industry has traditionally taken biologics that mediate effective cancer regression in mice and expected similar results in humans. There are many explanations why this strategy often does not succeed, but the most important is that immunotherapy has difficulties when following standard drug development. The mechanism of action is complex, activity is generally not dependent on highest tolerated dose, and patient response is highly variable. Our new understanding of the immune system, cancer's effect on immune mediated mechanisms, and the impact of conventional therapies on the immune system provides a new rationale for combining therapies that may lead to significant clinical responses. The concept of Precision Targeted Immunotherapy is to exploit this knowledge and the availability of good products that may not be sufficiently effective to be commercialized as a monotherapy, but which we believe may be very effective in combination approaches. Our goal is to develop products that maximize the efficacy of immunotherapy regimens through combinations of therapeutic agents. This includes:

TheTherapeutic Antibody Programs: These programs are based on the well validated approach to using antibodies that target to cancer and other diseases directly, or through interfering with critical interactions between the patient and the disease. Our antibody programs include antibody-drug conjugates (ADCs) that are designed to deliver potent cytotoxic molecules to cancer cells, and

traditional unmodified antibody approaches. Our current programs are based on fully human sequence antibodies to minimize patient reactivity against the drug. In addition, we have access through a Research and Commercialization Agreement with Medarex (now a subsidiary of Bristol-Myers Squibb) to the UltiMAb® Technology for generating fully human monoclonal antibodies. Under this agreement, we can exercise up to ten separate licenses to develop and commercialize therapeutic antibody products, either alone or through collaboration with our licensing partners.

Our APC technology:Targeting Technology™: This is a new class of vaccines based on our proprietary antibody-targeted vaccine technology that is used to generate an immune response against cancer or other diseases.

Our APC Targeting Technology™ uses human monoclonal antibodies or mAbs, linked to disease associated antigens to efficiently deliver the attached antigens to immune cells known as antigen presenting cells, or APCs. This technology has been designed to allow us to take advantage of many important characteristics of human monoclonal antibodies, including their long circulating half-life, well known safety profile, and standardized manufacturing procedures. We believe that our APC Targeting Technology™ provides significant manufacturing, regulatory and other practical advantages over patient specific and other immune-based treatments and can substantially reduce the dosage and cost currently required in conventional immunotherapies. Preclinical studies have demonstrated that APC Targeting Technology™ is more effective than conventional non-targeted vaccines. We have developed several proprietary monoclonal antibodies that can independently be developed to generate new product opportunities. We have initiatedOur CDX-1307 and CDX-1401 programs are in clinical development with the first APC technology product, called CDX-1307. In addition, CDX-1401 is completing its preclinical development and is expected to begin clinical testing in Phase 1/2 trials during 2009.

Therapeutic Antibody Programs:technology. These programs are based on the well validated approach to using antibodies that target to cancer and other diseases directly or through interfering with critical interactions between the patient and the disease. Celldex is in preclinical development for therapeutic human antibodies to molecules important in inflammation and cancer. In addition, Celldex has access through a Research and Commercialization Agreement with Medarex to the UltiMAb® Technology for

generating fully human monoclonal antibodies. Under this agreement, Celldex can exercise up to ten separate licenses to develop and commercialize therapeutic antibody products, either alone or through collaboration with Celldex licensing partners.

Immune System Modulators: Immune system modulators include drugs that activate or suppress specific parts of the immune system, including suchsystem. Currently we are combining our APC technology product candidates with molecules known as Toll-Like Receptor (TLR) agonists that can activate patients' innate and adaptive immunity,immunity. We are also developing an immune cell growth factor called FMS-like tyrosine kinase 3 ligand (FLT3-L or CDX-301) designed to expand immune cells and stem cells. In addition, we are investigating the activity of a complement inhibitor (CDX-1135) that suppresses inflammatory reactions. These agents further support our Precision Targeted Immunotherapy Platform.

Celldex'sOur strategy is to utilize our expertise to design and develop targeted immunotherapeutics that have significant and growing market potential; to establish governmental and corporate alliances to fund development; and to commercialize our products either through corporate partners or, in appropriate circumstances, through our own direct selling efforts. Our goal is to demonstrate clinical proof-of-concept for each product, and then seek partners to help see those products which we cannot develop ourselves through to commercialization. This approach allows us to maximize the overall value of our technology and product portfolios while best ensuring the expeditious development of each individual product. Implementation of this strategy is exemplified by our lead programs which are discussed in the following sections.

Factors that may significantly harm our commercial success, and ultimately the market price of our common stock, include but are not limited to, announcements of technological innovations or new commercial products by our competitors, disclosure of unsuccessful results of clinical testing or regulatory proceedings and governmental approvals, adverse developments in patent or other proprietary rights, public concern about the safety of products developed by Celldexus and general economic and market conditions. See "Item 1A. Risk Factors."

C. Cancer VaccineClinical Development Programs

CDX-110:CDX-110

Our lead clinical development program, CDX-110, is a peptide-based immunotherapy that targets the tumor specific molecule called EGFRvIII, a functional variant of the naturally expressed epidermal growth factor receptor ("EGFR"), a protein which has been well validated as a target for cancer

therapy. Unlike EGFR, EGFRvIII is not present in normal tissues, and has been shown to be a transforming oncogene that can directly contribute to the cancer cell growth.

EGFRvIII is commonly present in glioblastoma multiforme, or GBM, the most common and aggressive form of brain cancer, and has also been observed in various other cancers such as breast, ovarian, prostate, colorectal, and head & neck cancer. Our partner,

In April 2008, we and Pfizer Inc. ("Pfizer"), entered into a License and weDevelopment Agreement (the "Pfizer Agreement") under which Pfizer was granted an exclusive worldwide license to CDX-110. The Pfizer Agreement also gives Pfizer exclusive rights to the use of EGFRvIII vaccines in other potential indications. Pfizer funds all development costs for these programs. We and Pfizer are currently pursuing the development of CDX-110 for GBM therapy and plan to expand the clinical development into other cancers through additional clinical studies. The Food and Drug Administration ("FDA") has granted orphan drug designation for CDX-110 for the treatment of EGFRvIII expressing GBM as well as fast track designation.

Initial clinical development of EGFRvIII immunotherapy was led by collaborating investigators at the Brain Center at Duke Comprehensive Cancer Center in Durham, North Carolina and at M.D. Anderson Cancer Center in Houston, Texas. The results from the Phase 1 (VICTORI) and Phase 2a (ACTIVATE) studies, which enrolled 16 and 21 patients, respectively, have demonstrated a significant increase in the time to disease progression (greater than 113%) in the patients who were vaccinated, and also in overall survival rates (greater than 100%), both relative to appropriately matched historical controls. An extension of the Phase 2a program (ACT II) at the same two institutions has enrolled 23 additional GBM patients treated in combination with temozolomide (the current standard of care). Preliminary results from this study (ACT II) currently estimates median overall survival to be 33.123.6 months, although the median has not yet been reached. Thereached, while the survival of a matched historical control group was 14.3 months and a subgroup treated with temozolomide (TMZ) of 15.215.0 months with a p value = 0.0078.0.0237. Overall time to progression for CDX-110in the ACT II study was 16.615.2 months compared with 6.46.3 months for the historical control group.

In May 2007, weWe initiated a Phase 2b/3 randomized study (ACT III) of CDX-110 combined with standard of care, temozolomide, versus standard of care alone in patients with GBM. We have opened a total ofGBM in over 30 sites inthroughout the United States for the study. The FDA has granted orphan drug designation for CDX-110 for the treatment of EGFRvIII expressing GBM as well as fast track designation.

States. In December 2008, we announced an amendment to convert the ACT III study to a single-arm Phase 2 clinical trial in which all patients will receive CDX-110 in combination with temozolomide and we will continue to enroll to approximately 60 patients.temozolomide. The decision, which followsfollowed the recommendation of the Independent Data Monitoring Committee, was based on the observation that the majority of patients randomized to the control (standard of care) arm withdrew from this open-label study after being randomized to the control arm. Patients currently participating on the control arm of the study will bewere offered the option to receive treatment with CDX-110. Under this amendment, the ACT III study will provideprovided for a multi-center, non-randomized dataset for CDX-110 in patients with newly diagnosed GBM. These data will provide important additional information that can be used to better design the future development of CDX-110. Enrollment in ACT III is complete with a total of over 60 patients enrolled and we expect to present updated results during 2010.

CDX-011

On April 16,CDX-011 (formerly CR011-vcMMAE) is an antibody-drug conjugate (ADC) that consists of a fully-human monoclonal antibody, CR011, linked to a potent cell-killing drug, monomethyl-auristatin E (MMAE). The CR011 antibody specifically targets glycoprotein NMB or (GPNMB) that is expressed in a variety of human cancers including breast cancer and melanoma. The ADC technology, comprised of MMAE and a stable linker system for attaching it to CR011, was licensed from Seattle Genetics, Inc. The ADC is designed to be stable in the bloodstream. Following intravenous administration, CDX-011 targets and binds to GPNMB, and upon internalization into the targeted cell, CDX-011 is designed to release MMAE from CR011 to produce a cell-killing effect. We acquired the rights to CDX-011 in connection with the CuraGen Merger.

Treatment of Breast Cancer: In June 2008, an open-label, multi-center Phase 1/2 study was initiated of CDX-011 administered intravenously once every three weeks to patients with locally advanced or metastatic breast cancer who have received prior therapy (median of seven prior regimens). The study began with a bridging phase to confirm the Companymaximum tolerated dose ("MTD") and Pfizer enteredhas expanded into a License and Development Agreement (the "Pfizer Agreement") under which Pfizer was granted an exclusive worldwide license to a therapeutic cancer vaccine candidate, CDX-110, in Phase 2 developmentopen-label, multi-center study.

The study confirmed the safety of CDX-011 at the pre-defined maximum dose level (1.88 mg/kg) in 6 patients. An additional 28 patients were enrolled as an expanded Phase 2 cohort (for a total of 34 treated patients at 1.88 mg/kg, the Phase 2 dose) to evaluate the progression-free survival ("PFS") rate at 12 weeks. As previously seen in melanoma patients, the 1.88 mg/kg dose was well tolerated in this patient population with the most common adverse events of rash, alopecia, and fatigue. The primary activity endpoint, which called for at least 5 of 25 (20%) patients in the Phase 2 study portion to be progression-free at twelve weeks, has been met. To date, 9 of 26 (35%) evaluable patients are without progression of disease at twelve weeks.

In addition, at the Phase 2 dose level, 4 of 32 (13%) evaluable patients achieved confirmed or unconfirmed Partial Responses ("PR") while 15 of 25 (60%) evaluable patients with measurable disease experienced some reduction in tumor size. GPNMB expression was identified in 10 of 14 (71%) of analyzed tumor samples and treatment with CDX-011 was associated with improved outcomes in all activity parameters in patients whose tumors expressed GPNMB. Notably, in patients who received the Phase 2 dose and whose tumors expressed GPNMB, 2 of 7 (29%) had confirmed PR, 5 of 7 (71%) had decreases in tumor size, and all 7 achieved at least stable disease with duration from 17.3 to 26.9 weeks. The median PFS in all patients was 9.1 weeks, but in patients whose tumors expressed GPNMB, median PFS was 18.3 weeks, compared to median PFS of 5.9 weeks for patients whose tumors did not express GPNMB. In patients with triple negative disease, 5 of 7 (71%) analyzed samples expressed GPNMB, 7 of 9 (78%) evaluable patients had tumor shrinkage, and the median PFS for these patients was 17.9 weeks.

We expect to initiate a randomized Phase 2b controlled study in patients with advanced breast cancer that express GPNMB in the second half of 2010.

Treatment of Metastatic Melanoma Cancer: In June 2006, a Phase 1/2 open-label, multi-center, dose escalation study was initiated to evaluate the safety, tolerability and pharmacokinetics of CDX-011 for patients with un-resectable Stage III or Stage IV melanoma who have failed no more than one prior line of cytotoxic therapy. During the Phase 1 portion of the study, doses of CDX-011 between 0.03 mg/kg to 2.63 mg/kg were evaluated and generally well tolerated, with rash and neutropenia emerging at higher doses. The MTD was determined to be 1.88 mg/kg administered intravenously (IV) once every three weeks.

In June 2009, CuraGen announced results for the treatment of glioblastoma multiforme. The Pfizer Agreement also gives Pfizer exclusive rights to the use of EGFRvIII vaccines in other potential indications. Under the Pfizer Agreement, Pfizer made an upfront payment to the Company of $40 million and made a $10 million equity investment36 patients who were treated in the Company. Pfizer will fund all development costs for these programs.Phase 2 portion of the study. Of the patients enrolled, 94% had Stage IV disease of which two-thirds were classified as M1c, the poorest risk group. The Company is also eligiblestudy successfully met its primary activity endpoint, with 5 objective responses (1 unconfirmed) observed in 34 evaluable patients, and median duration of response of 5.3 months. The median overall PFS was 4.4 months. Tumor shrinkage was observed in 58% of patients, and 20 patients had best response of stable disease. Dermatologic adverse events consisting of rash, alopecia, and pruritus were the most common toxicities in this study. Other adverse events included fatigue, diarrhea, musculoskeletal pain, anorexia and nausea. Grade 3 or 4 neutropenia was observed in 5 patients. The absence of rash in the first cycle of treatment predicted a worse PFS. Additionally, in a subset of patients with tumor biopsies, high levels of tumor expression of GPNMB appeared to receive potential milestone payments exceeding $390 million forcorrelate with favorable outcome.

Enrollment has been completed in the successful developmentPhase 1 portion of the melanoma trial to evaluate more frequent dosing schedules of CDX-011, including a weekly and commercializationa two out of CDX-110every three-week regimen, to explore if more frequent administration can provide additional activity in patients with metastatic

melanoma. A dose of 1.0 mg/kg given once every week has been identified as the MTD in a weekly schedule, and additional EGFRvIII vaccine products, as well as royalties on any product sales. The Pfizer Agreement became effective after clearance undera dose of 1.5mg/kg was being explored in the Hart-Scott-Rodino Antitrust Improvements Acttwo out of 1976 (as amended) on May 19, 2008.three week schedule. Although median duration of follow-up was only 6 weeks, objective responses have thus far been observed in 3 of 11 evaluable patients treated with weekly CDX011 (1 confirmed) and 1 confirmed response in 8 evaluable patients treated with CDX-011 two out of every three weeks. We expect to present updated results during the first half of 2010.

CDX-1307:CDX-1307 The Company's

Our lead APC Targeting Technology™ product candidate, CDX-1307, is in development for the treatment of epithelial tumors such as colorectal, pancreatic, bladder, ovarian and breast cancers. CDX-1307 targets the beta chain of human chorionic gonadotropin, known as hCG-Beta, which is an antigen often found in epithelial tumors. The presence of hCG-Beta in these cancers correlates with a poor clinical outcome, suggesting that this molecule may contribute to tumor growth. Normal adult tissues have minimal expression of hCG-Beta; therefore, targeted immune responses are not expected to generate significant side effects.

CelldexEnrollment is completingcomplete in our two Phase 1 studies of CDX-1307 at multiple centers that are designed to explore safety and dose/effect relationships via two administration routes—intradermal (ID), a traditional vaccine route that allows efficient access to local dermal dendritic cells and intravenous (IV), a novel systemic approach to vaccination that might target a much larger population of dendritic cells. In bothThe Phase 1 studies there are dose escalationsinvestigated the safety and immunogenicity of CDX-1307 alone and CDX-1307in combination with the adjuvantadjuvants, including GM-CSF (known to increase mannose receptor expression on dendritic cells). At the highest dose levels, additional immune system modulators (Toll-Like and Toll-Like Receptor Agonists,("TLR") agonists (poly-ICLC or TLR agonists) have been added to determine what effect they have in augmenting an immune response.Hiltonol™ and R848 or resiquimod). Patients with an assortment of different tumor types that are known to express hCG-Beta are being accruedwere enrolled with retrospective analysis for hCG-Beta expression. AAn escalating four dose regimen iswas utilized with the possibility of retreatment if patients demonstrate tumor regression or stable disease.

Over Fifty (50)The Phase 1 studies enrolled over 80 patients with epithelial cancers have been treatedheavily pretreated, advanced-stage breast, colon, bladder and pancreatic cancer, with an average of 4.6 prior therapies across the treatment population. All patient cohorts demonstrated a favorable safety profile with no dose limiting toxicity to date. The combination of CDX-1307 with TLR agonists significantly enhanced immune responses against hCG-Beta, providing humoral responses in 88% of patients and cellular immune responses in 57% of patients analyzed to date. Immune responses occurred even in the Phase 1 clinical trials and more than half have evidencepresence of high circulating levels of hCG-Beta, expression by their tumor. The immunotherapy has been well tolerated with only minor adverse events observed (reddening atsuggesting that the injection site). Analysis of the initial cohorts with GM-CSF have revealed that severalCDX-1307 can overcome antigen tolerance in advanced and heavily pretreated cancers. Nine patients developed good humoral responses to

hCG-Beta, and some have demonstrated enhancement of circulating hCG-Beta-specific CD8 T cells. Thus, we are encouraged that CDX-1307 is providing similar results as predicted in the pre-clinical studies. In addition, one patient with pancreatic cancer had a 26% overall reduction in tumor burden and two breast cancer patients were stable for sixstudies experienced disease stabilization from 2.3 months during treatment. The investigators atto 11.4 months following the Duke Comprehensive Cancer Center were awarded a two year $500,000 grant from the Avon Foundation and the National Cancer Institute to support Phase 1 work in breast cancer. The safetyinitiation of CDX-1307 vaccination. Two of these patients have received multiple courses of CDX-1307 and continue treatment with stable disease at 6.4 and 11.4 months. These data provide the basis for advancing CDX-1307 into a front-line patient population selected for hCG-Beta expressing cancers.

We expect to initiate a randomized Phase 2b controlled study in combinationpatients with defined immune system modulators is now being evaluated with intent to enter Phase 2 clinical researchnewly diagnosed invasive bladder cancer in the second halfquarter of 2009.2010. Patient's whose bladder cancer expresses hCG-Beta are predicted to have more aggressive disease and shorter survival. In this study we plan to select only patients with confirmed hCG-Beta expression using a specific diagnostic assay.

CDX-1401:CDX-1401

CDX-1401 is a fusion protein consisting of a fully human monoclonal antibody with specificity for the dendritic cell receptor, DEC-205, linked to the NY-ESO-1 tumor antigen. In humans, NY-ESO-1 is one of the most immunogenic tumor antigens and has been detected in 20 - 30% of cancers, thus representing a broad opportunity. This product is intended to selectively deliver the NY-ESO-1 antigen to APCs for generating robust immune responses against cancer cells expressing NY-ESO-1. Unlike CDX-1307, which targets the mannose receptor

expressing dendritic cells, CDX-1401 is the first APC product targeting DEC-205 expressing dendritic cells. We are developing CDX-1401 for the treatment of malignant melanoma and a variety of solid tumors which express the proprietary cancer antigen NY-ESO-1, which the Companywe licensed from the Ludwig Institute for Cancer Research in 2006. The Company believesWe believe that preclinical studies have shown that CDX-1401 is effective for activation of human T-cell responses against NY-ESO-1.

In September 2009, we initiated enrollment in a dose-escalating Phase 1/2 clinical trial aimed at determining the optimal dose for further development based on the safety, tolerability, and immunogenicity of the CDX-1401 vaccine. The IND filing is planned fortrial will evaluate three different doses of the first halfvaccine in combination with resiquimod, an activator of 2009.TLR 7 and 8. We expect to be able to enter a Phase 1 studyenroll approximately 36 patients with a combination regimen, including TLRs, and will accruesolid tumor cancers at multiple tumors that express NY-ESO-1.clinical sites in the United States.

CDX-1135

CDX-1135 is a molecule that inhibits a part of the immune system called the complement system. The complement system is a series of proteins that are important initiators of the body's acute inflammatory response against disease, infection and injury. Excessive complement activation also plays a role in some persistent inflammatory conditions. CDX-1135 is a soluble form of naturally occurring Complement Receptor 1 that inhibits the activation of the complement cascade in animal models and in human clinical trials. We believe that regulating the complement system could have therapeutic and prophylactic applications in several acute and chronic conditions, including organ transplantation, multiple sclerosis, rheumatoid arthritis, age-related macular degeneration ("AMD"), atypical Hemolytic Uremic Syndrome ("aHUS"), Paroxysmal Nocturnal Hemaglobinuria ("PNH"), Dense Deposit Disease ("DDD") in kidneys, and myasthenia gravis. We are currently defining the most appropriate clinical development path for CDX-1135 and are focusing on rare disease conditions of unregulated complement activation as the fastest route to FDA approval.

Preclinical Development Programs

CDX-1127:CDX-301

CDX-301 is a FMS-like tyrosine kinase 3 ligand (Flt3L) that we licensed from Amgen in March 2009. CDX-301 is a growth factor for stem cells and immune cells called dendritic cells. Based on previous experience with this molecule, we believe that CDX-301 has considerable opportunity in various transplant settings as a stem cell mobilizing agent. In addition, CDX-301 is an immune modulating molecule that increases the numbers and activity of specific types of immune cells. We believe CDX-301 has significant opportunity for synergistic development in combination with proprietary molecules in our portfolio. We expect to file an Investigational New Drug ("IND") application for CDX-301 before the end of 2010.

Celldex hasCDX-1127

We have entered into a License Agreement with the University of Southampton, UK, to develop human antibodies to CD27, a potentially important target for immunotherapy of various cancers. In pre-clinicalpreclinical models, antibodies to CD27 alone have been shown to mediate anti-tumor effects, and may be particularly effective in combination with other immunotherapies. CD27 is a critical molecule in the activation pathway of lymphocytes. It is downstream from CD40, and may provide a novel way to regulate the immune responses. Engaging CD27 with the appropriate monoclonal antibody has proven highly effective at promoting anti-cancer immunity in mouse models. We are currently evaluating new human monoclonal antibodies in pre-clinicalpreclinical models.

D. Inflammatory Disease Development ProgramsTable of Contents

CDX-1135CDX-014

CDX-014 (formerly TP10):CR014-vcMMAE) is a fully-human monoclonal ADC that targets TIM-1, an immunomudulatory protein that appears to down regulate immune response to tumors. The antibody, CDX-014, is linked to a potent chemotherapeutic, monomethyl auristatin E (MMAE), using Seattle Genetics' proprietary technology. The ADC is designed to be stable in the bloodstream, but to release MMAE upon internalization into TIM-1-expressing tumor cells, resulting in a targeted cell-killing effect. CDX-014 has shown potent activity in preclinical models of ovarian and renal cancer. We acquired the rights to CDX-014 in connection with the CuraGen Merger.

CDX-1189

We have been developing immunotherapeutics that inhibit a part of the immune system called the complement system. The complement system is a series of proteins that are important initiators of the body's acute inflammatory response against disease, infection and injury. Excessive complement activation also plays a role in some persistent inflammatory conditions. Our lead compound, CDX-1135, a soluble form of naturally occurring Complement Receptor 1, has effectively shown to inhibit the activation of the complement cascade in animal models and in human clinical trials. We believe that regulating the complement system could have therapeutic and prophylactic applications in several acute and chronic conditions, including organ transplantation, multiple sclerosis, rheumatoid arthritis, age-related macular degeneration ("AMD"), atypical Hemolytic Uremic Syndrome and myasthenia gravis. We are currently defining the most appropriate clinical development path for CDX-1135 and are focusing on rare disease conditions of unregulated complement activation as potentially the fastest route to FDA approval.

CDX-1189: Celldex is developing therapeutic human antibodies to a signaling molecule known as CD89 or Fca receptor type I (FcaRI). CD89 is expressed by some white blood cells and leukemic cell lines, and has been shown to be important in controlling inflammation and tumor growth in animal models. Celldex hasWe have proprietary, fully human antibodies to CD89 in preclinical development. Depending upon the specific antibody used, anti-CD89 antibodies can either be activating and thus stimulate immune responses, or down-regulating and act as an anti-inflammatory agent.

Table of ContentsPartnerships

E. Infectious Disease Development Programs

CholeraGarde® Vaccine: CholeraGarde® is designed to be a safe, effective single-dose, oral cholera vaccine. Our partner, the International Vaccine Institute ("IVI"), has received $21 million in funding from the Bill & Melinda Gates Foundation for a Cholera Vaccine Initiative ("CHOVI"), which includes conducting further clinical trials of CholeraGarde®. The IVI is presently conducting a Phase 2 clinical trial of CholeraGarde in Bangladesh, with plans to sponsor additional Phase 2 studies in India and Thailand beginning in the first half of 2009, followed by Phase 3 field studies.

ETEC Vaccine: In November 2007, we We have entered into an agreementcollaborative partnership agreements with the Division of Microbiologypharmaceutical and Infectious Diseases of the NIAID, whereby NIAID is sponsoring a Phase 1 study of Celldex's investigational single-dose, oral vaccine designedother companies and organizations that provide financial and other resources, including capabilities in research, development, manufacturing, and sales and marketing, to offer combined protection against both enterotoxigenicEscherichia coli (ETEC) and cholera. In June 2008, NIAID initiated the Phase 1 trial of the ETEC vaccine candidate at Cincinnati Children's Hospital Medical Center.

In January 2009, we entered into an Exclusive License and Development Agreement with Vaccine Technologies, Inc. ("VTI"). Under the license agreement, Celldex has granted a worldwide fee- and royalty-bearing exclusive license to VTI to development and commercialize Celldex's CholeraGarde® and ETEC vaccine programs. Financial terms of the agreement with VTI include an upfront license fee, milestone payments and royalties on net sales of licensed products during the term of the agreement.

Ty800 Typhoid Fever Vaccine: The Company has developed an oral vaccine to offer rapid, single-dose protection againstSalmonella typhi, the cause of typhoid fever. Ty800 is targeted for both the travelers' market and global health needs. In 2006, the National Institute of Allergy and Infectious Disease ("NIAID") of the National Institutes of Health ("NIH") initiated a Phase 1/2 in-patient dose-ranging clinical trial aimed at demonstrating the safety and immunogenicity of the Ty800 typhoid fever vaccine. NIAID funded the production of Ty800 vaccine for clinical testing and completed the Phase 1/2 trial at a NIH-funded clinical site in 2007. Results showed the single-dose, oral vaccine to be well tolerated and immunogenic, with over 90% of vaccinated subjects generating immune responses. We initiatedsupport our own sponsored Phase 2 trial of Ty800 in July 2007. Preliminary results reported in April 2008 from the study showed that the single-dose, oral vaccine was well tolerated and immunogenic, demonstrating that the desired immune response was achieved. Incidence of reactogenicity symptoms and adverse events post-vaccination were similar to placebo. Importantly, immunogenic response was dose-dependent. Positive immune response or seroconversion (prospectively defined as a 4-fold increase in anti-LPS titers over pre-dose level) rates were 65.5% (36/55) and 80% (44/55) in the low and high dose groups, respectively, and was significantly (p<0.001) higher than placebo.

CDX-2401: The Company is also using its APC Targeting Technology™ to develop vaccines against infectious disease. The lead program is CDX-2401, an APC-Targeting prophylactic vaccine, aimed at providing protection from infection with HIV, the virus known to cause AIDS. This program is in a Bill & Melinda Gates Foundation funded partnership with collaborators at Rockefeller University in New York City, who have shown in model systems that protective immunity can be induced with such a vaccine. Preclinical studies and manufacturing development are in progress and the Company, with its collaborators, plans to file an IND for Phase 1 clinical studies in the first half of 2009.

F. Marketed Products

Rotavirus Vaccine: Rotavirus is a major cause of diarrhea and vomiting in infants and children. In 1997, we licensed our oral rotavirus strain to GlaxoSmithKline ("Glaxo"). All of the ongoing development for this program is being conducted and funded by Glaxo. Glaxo gained approval for its

rotavirus vaccine, Rotarix®, in Mexico in July 2004, which represented the first in a series of worldwide approvals and commercial launches for the product. Glaxo subsequently launched Rotarix® in additional Latin American and Asian Pacific countries during 2005 - 2007. Additionally, Glaxo filed for market approval with the European regulatory authorities in late 2004, which triggered a $2 million milestone payment to the Company. In February 2006, the European Commission granted approval of Rotarix® in the European Union, which triggered a $4 million milestone payment from Glaxo. On April 3, 2008, Rotarix® received approval from the FDA for the prevention of rotavirus gastroenteritis in infants. FDA approval triggered a $1.5 million milestone payment from Glaxo, of which $750,000 was retained by the Company. We licensed-in the rotavirus strain in 1995 and owe a license fee of 30% to Cincinnati Children's Hospital Medical Center ("CCH") on net royalties received from Glaxo. In May 2005, the Company entered into an agreement whereby an affiliate of Paul Royalty Fund ("PRF") purchased an interest in the net royalties the Company will receive on worldwide sales of Rotarix® (see Note 10 of our consolidated financial statements). The market launch of Rotarix® by Glaxo in the U.S. market during the quarter ended September 30, 2008 resulted in a $10 million milestone payment to the Company from PRF, which the Company received on October 1, 2008. We have received a total of $60 million in milestone payments under the PRF agreement. No additional milestone payments are due from PRF under the agreement.

In September 2006, we received notice from Glaxo that Glaxo would begin paying royalties on sales of Rotarix® vaccine at the lower of two royalty rates under their 1997 license agreement. Glaxo's decision to pay the lower royalty rate (which is 70% of the full rate) is based upon Glaxo's assertion that Rotarix® is not covered by the patents Glaxo licensed from the Company in Australia and certain European countries. If Glaxo's position stands, the royalties to which PRF is entitled will no longer be limited by a $27.5 million annual threshold, which the Company projected may have been reached in later years as sales of Rotarix® increased. Irrespective of Glaxo's position, we will still retain approximately 65% of the royalties on worldwide sales of Rotarix® once PRF receives 2.45 times the aggregate cash payments of $60 million it made to the Company, though the potential amount of such residual royalties will be lower if Glaxo's position stands.

Megan®Vac 1 and Megan®Egg Vaccines: On December 1, 2000, the Company acquired all of the outstanding capital stock of Megan. Megan has commercialized three veterinary vaccines; Argus™ SC, licensed by the United States Department of Agriculture ("USDA") in March 1998 and marketed by Intervet, Inc., and Megan®Vac 1 and Megan®Egg, licensed by the USDA in November 1998 and 2003, respectively, and marketed by Lohmann Animal Health International ("LAHI"). In January 2009, we sold the poultry vaccines business, consisting of Megan®Vac 1 and Megan®Egg, to LAHI for an upfront fee and potential milestone payments.

G. Product Development and Licensing Agreements

1. GlaxoSmithKline plc and Paul Royalty Fund II, L.P.

In 1997, the Company entered into an agreement with Glaxo to collaborate on the development and commercialization of our oral rotavirus strain and Glaxo assumed responsibility for all subsequent clinical trials and all other development activities. We licensed-in the rotavirus strain that was used to develop Glaxo's Rotarix® rotavirus vaccine in 1995 and owe a license fee of 30% to CCH on net royalties received from Glaxo. We are obligated to maintain a license with CCH with respect to the Glaxo agreement. All licensing fees are included in research and development expense. The term of the Glaxo agreement is through the expiration of the last of the relevant patents covered by the agreement, although Glaxo may terminate the agreement upon 90 days prior written notice.

In May 2005, the Company entered into an agreement whereby an affiliate of PRF purchased an interest in the net royalties the Company will receive on worldwide sales of Rotarix®. Under the PRF agreement, the Company will retain 50% of future Glaxo milestone payments beginning on the effective date of the agreement with PRF, with 70% of the remaining balance payable to PRF and 30% of the remaining balance payable to CCH, respectively. The Company's retained interests in Rotarix® net royalties which were not sold to PRF are recorded as product royalty revenue and a corresponding amount that is payable to CCH is recorded as royalty expense, which is included in research and development expense.

On April 3, 2008, Rotarix® received FDA market approval for the prevention of rotavirus gastroenteritis in infants, which triggered a $1.5 million milestone payment to the Company from Glaxo, $750,000 of which the Company retained under its agreement with PRF. In connection with the Company's purchase accounting for the Merger, the present value of the Company's retained amount, or $742,300, had been recorded as a current asset as of March 31, 2008. During the quarter ended June 30, 2008, the Company also recorded $225,000 in revenue and an offsetting amount in royalty expense for the payable due to CCH for its portion of the Glaxo milestone. The market launch of Rotarix® by Glaxo in the U.S. market during the quarter ended September 30, 2008 resulted in a $10 million milestone payment to the Company from PRF, which the Company received on October 1, 2008. As of March 31, 2008, the Company had recorded the expected present value of the $10 million milestone payment due from PRF of $9,053,200, the purchase accounting value assigned to the PRF milestone payment at the time of the Merger. During the quarter ended September 30, 2008, the Company recognized the balance of $946,800 as other income in the consolidated statement of operations. We have received $60 million in total milestone payments under the PRF agreement. No additional milestone payments are due from PRF under the agreement.

Royalty rates on Rotarix® escalate from 7% to 10% based on net product sales in countries that have valid patent protection. These royalty rates are discounted by 30% for "non-patent" countries (primarily international markets). In September 2006, the Company received notice from Glaxo that Glaxo would begin paying royalties on sales of Rotarix® vaccine at the lower of the two royalty rates under their 1997 license agreement. Glaxo's decision to pay the lower royalty rate (which is 70% of the full rate) is based upon Glaxo's assertion that Rotarix® is not covered by the patents Glaxo licensed from the Company in Australia and certain European countries. If Glaxo's position stands, the royalties to which PRF is entitled will no longer be limited by a $27.5 million annual threshold, which the Company projected may have been reached in later years as sales of Rotarix® increased. Irrespective of Glaxo's position, the Company will still retain approximately 65% of the royalties on worldwide sales of Rotarix® once PRF receives 2.45 times the aggregate cash payments of $60 million it made to Celldex, though the potential amount of such residual royalties will be lower if Glaxo's position stands.

2. GlaxoSmithKline plc and Corixa Corporation ("Corixa")

On December 21, 2005, Corixa, a wholly-owned subsidiary of Glaxo, and Celldex Ltd. (formerly Lorantis Limited), entered into a termination agreement of their collaboration of CDX-2101, or HepVax, for the development of a therapeutic vaccine for Hepatitis B (the "Termination Agreement"). Under the terms of the Termination Agreement, Glaxo paid the Company the sum of approximately $1,632,000. In addition, and subject to the terms and conditions of the Termination Agreement, Glaxo granted to the Company a worldwide, fully paid up, royalty-free, perpetual, nonexclusive license under the Corixa Patent Rights, Corixa Know-How Rights and Corixa Licensed Technology (each as defined in the Termination Agreement): (a) to use RC-529SE in products being developed and/or commercialized by Celldex Ltd or its Permitted Sublicensees in the Lorantis Field; and (b) to make or have made RC-529SE using RC-529 adjuvant for the limited use permitted by the license granted to reformulate Corixa's proprietary adjuvant.

3. Pfizer Inc.

Pfizer License and Development Agreement: On April 16, 2008, the Company and Pfizer entered into a License and Development Agreement (the "Pfizer Agreement") under which Pfizer was granted an exclusive worldwide license to a therapeutic cancer vaccine candidate, CDX-110, in Phase 2 development for the treatment of glioblastoma multiforme. The Pfizer Agreement also gives Pfizer exclusive rights to the use of EGFRvIII vaccines in other potential indications. Under the Pfizer Agreement, Pfizer made an upfront payment to the Company of $40 million and made a $10 million equity investment in the Company. Pfizer will fund all development costs for these programs. The Company is also eligible to receive potential milestone payments exceeding $390 million for the successful development and commercialization of CDX-110 and additional EGFRvIII vaccine products, as well as royalties on any product sales. The Pfizer Agreement became effective after clearance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (as amended) on May 19, 2008.

On May 27, 2008, the Company received $10 million from Pfizer in exchange for 781,250 shares of the Company's common stock having a fair value of $10,867,188, or $13.91 per share, on that date. The $867,188 over the amount received from Pfizer was recorded as a reduction to deferred revenue of the $40 million upfront payment received from Pfizer on June 18, 2008.

The Company has applied the provisions of Emerging Issues Task Force (EITF) Issue No. 00-21 ("EITF 00-21"), Accounting for Revenue Arrangements with Multiple Deliverables, and determined that its performance obligations under this collaboration should be accounted for as a single unit of accounting. The Company's deliverables under this collaboration primarily include an exclusive license to its CDX-110 product candidate and its EGFRvIII technologies, research and development services as required under the collaboration and participation in the joint clinical development committee. The Company has estimated that its performance period under the collaboration will be 9.5 years based on an assessment of the period over which the Company will have met its performance obligations under the collaboration. Revenue, including research and development reimbursements, is being recognized on a straight-line basis over this period using the Contingency Adjusted Performance Model ("CAPM"). The $40,000,000 up-front payment was recorded as deferred revenue and this amount, less the $867,188 in excess fair value for the Company's common stock discussed above, is being amortized over the 9.5-year performance period at a rate of $1,029,810 per quarter.

The agreement also provides for reimbursement by Pfizer of all costs incurred by the Company in connection with the collaboration since the effective date. The Company invoices Pfizer monthly for its reimbursable costs and records the invoiced amount as deferred revenue. These deferred revenue amounts are amortized to revenue over the expected 9.5-year performance period on a straight-line basis using the CAPM model.

In connection with the initial deliverables under the Pfizer Agreement as discussed further in Note 11, the Company has paid a sublicense fee of $2,365,174 to each of two research universities, Duke University ("Duke") and Thomas Jefferson University ("TJU"), and paid TJU an additional license fee of $500,000. In October 2008, the Company paid an additional sublicense fee to TJU of $1,634,826. These payments were recorded as deferred costs in the "Other Assets" line item in the consolidated balance sheet and are being amortized over the 9.5-year performance period at a rate of $180,663 per quarter.

Pfizer Animal Health Agreement: The Company entered into a licensing agreement in December 2000 with Pfizer's Animal Health Division whereby Pfizer has licensed Megan's technology for the development of animal health and food safety vaccines. Under the agreement, the Company may receive additional milestone payments of up to $3 million based upon attainment of specified milestones. The Company may receive royalty payments on eventual product sales. The term of this agreement is through the expiration of the last of the patents covered by the agreement. The Company has no obligation to incur any research and development costs in connection with this agreement.

As of June 1, 2006, the Company entered into a Collaborative Research and Development Agreement with Pfizer aimed at the discovery and development of vaccines to protect animals. In 2007, further funded work at the Company on the joint research program was terminated by Pfizer after the Company provided two of four deliverables to Pfizer.

4. Rockefeller University ("Rockefeller")

The Company is developing a vaccine, CDX-2401, aimed at providing protection from infection with HIV, the virus known to cause AIDS. This program is in a Bill & Melinda Gates Foundation funded partnership with collaborators at Rockefeller and the Aaron Diamond AIDS Research Center, who have shown in model systems that protective immunity can be induced with such a vaccine. Preclinical studies and manufacturing development are in progress and payments to the Company are made on a time and materials basis.

5. Vaccine Technologies, Inc. ("VTI")

In January 2009, we entered into an Exclusive License and Development Agreement with VTI. Under the license agreement, Celldex has granted a worldwide fee- and royalty-bearing exclusive license to VTI to development and commercialize Celldex's CholeraGarde® and ETEC vaccine programs. Financial terms of the agreement with VTI include an upfront license fee, milestone payments and royalties on net sales of licensed products during the term of the agreement.

We depend on our collaborativethese relationships and may enter into more of them in the future. Some of the above referenced agreements give our collaboratorpartners have substantial responsibility to commercialize a product and to make decisions about the amount and timing of resources that are devoted to developing and commercializing a product. As a result, we do not have complete control over how resources are used toward some of our products.

In addition, someSome of theseour partnership agreements relate to products in the early stages of research and development. Others require Celldexus and our collaboratorcollaborators to jointly decide on the feasibility of developing a particular product using our technologies. In either case, these agreements may terminate without benefit to us if the underlying products are not fully developed. If we fail to meet our obligations under these agreements, they could terminate and we might need to enter into relationships with other collaborators and to spend additional time, money, and other valuable resources in the process.

Moreover, weWe cannot predict whether our collaborators will continue their development efforts or, if they do, whether their efforts will achieve success. Many of our collaborators face the same kinds of risks and uncertainties in their business that we face. A delay or setback to a collaborator will, at a minimum, delay the commercialization of any affected products, and may ultimately prevent it. Moreover, any collaborator could breach its agreement with us or otherwise not use best efforts to promote our products. A collaborator may choose to pursue alternative technologies or products that compete with our technologies or products. In either case, if a collaborator failed to successfully develop one of our products, we would need to find another collaborator. Our ability to do so would depend upon our legal right to do so at the time and whether the product remained commercially viable.

H. GlaxoSmithKline plc ("Glaxo") and Paul Royalty Fund II, L.P. ("PRF")

Rotavirus is a major cause of diarrhea and vomiting in infants and children. In 1997, we licensed our oral rotavirus strain to Glaxo and Glaxo assumed responsibility for all subsequent clinical trials and all other development activities. Glaxo gained approval for its rotavirus vaccine, Rotarix®, in Mexico in July 2004, which represented the first in a series of worldwide approvals and commercial launches for the product leading up to the approval in Europe in 2006 and in the U.S. in 2008. We licensed-in our

rotavirus strain in 1995 and owe a license fee of 30% to Cincinnati Children's Hospital Medical Center ("CCH") on net royalties received from Glaxo. We are obligated to maintain a license with CCH with respect to the Glaxo agreement. The term of the Glaxo agreement is through the expiration of the last of the relevant patents covered by the agreement, although Glaxo may terminate the agreement upon 90 days prior written notice.

In May 2005, we entered into an agreement whereby an affiliate of PRF purchased an interest in the milestone payments and net royalties that we will receive on the development and worldwide sales of Rotarix®. We have received a total of $60 million in milestone payments under the PRF agreement. No additional milestone payments are due from PRF under the agreement.

Royalty rates on Rotarix® escalate from 7% to 10% based on net product sales in countries that have valid patent protection. These royalty rates are discounted by 30% for "non-patent" countries (primarily international markets). In September 2006, we received notice from Glaxo that Glaxo would begin paying royalties on sales of Rotarix® vaccine at the lower of the two royalty rates under their 1997 license agreement. Glaxo's decision to pay the lower royalty rate (which is 70% of the full rate) is based upon Glaxo's assertion that Rotarix® is not covered by the patents Glaxo licensed from us in Australia and certain European countries. We are currently evaluating the basis for Glaxo's action and our potential remedies. If Glaxo's position stands, the royalties to which PRF is entitled will no longer be limited by a $27.5 million annual threshold, which we projected may have been reached in later years as sales of Rotarix® increased. Irrespective of Glaxo's position, we will still retain approximately 65% of the royalties on worldwide sales of Rotarix® once PRF receives 2.45 times the aggregate cash payments of $60 million it made to us, though the potential amount of such residual royalties will be lower if Glaxo's position stands.

Pfizer Inc.

Pfizer License and Development Agreement: In April 2008, we and Pfizer entered into the Pfizer Agreement under which Pfizer was granted an exclusive worldwide license to a therapeutic cancer vaccine candidate, CDX-110, in Phase 2 development for the treatment of glioblastoma multiforme. The Pfizer Agreement also gives Pfizer exclusive rights to the use of EGFRvIII vaccines in other potential indications. Under the Pfizer Agreement, Pfizer made an upfront payment to us of $40 million and made a $10 million equity investment in us. Pfizer will fund all development costs for these programs. We are also eligible to receive potential milestone payments exceeding $390 million for the successful development and commercialization of CDX-110 and additional EGFRvIII vaccine products, as well as royalties on any product sales. The Pfizer Agreement became effective after clearance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (as amended) on May 19, 2008. In connection with the Pfizer Agreement, we paid a total of $6.9 million in sublicense fees to Duke University and Thomas Jefferson University.

Pfizer Animal Health Agreement: We entered into a licensing agreement in December 2000 with Pfizer's Animal Health Division whereby Pfizer has licensed our technology for the development of animal health and food safety vaccines. Under the agreement, we may receive additional milestone payments of up to $3 million based upon attainment of specified milestones. We may receive royalty payments on eventual product sales. The term of this agreement is through the expiration of the last of the patents covered by the agreement. We have no obligation to incur any research and development costs in connection with this agreement.

Rockefeller University ("Rockefeller")

We are providing research and development support to Rockefeller on the development of their vaccine, DCVax-001, which we refer to as CDX-2401, aimed at providing protection from infection with HIV, the virus known to cause AIDS. Rockefeller's program is in a Bill & Melinda Gates Foundation

funded partnership called the Grand Challenges initiative. Preclinical studies and manufacturing development are in progress and our collaborators plan to file an IND for Phase 1 clinical studies in the first half of 2010. Rockefeller pays us on a time and materials basis.

Vaccine Technologies, Inc. ("VTI")

In January 2009, we entered into a license agreement with VTI under which we granted a worldwide exclusive license to VTI to develop and commercialize our CholeraGarde® and ETEC vaccine programs. We may receive milestones payments and royalties with respect to development and commercialization of the technology licensed to VTI.

TopoTarget A/S ("TopoTarget")

In connection with the CuraGen Merger, we assumed the rights under the April 2008 agreement ("TopoTarget Agreement") between CuraGen and TopoTarget whereby we could receive up to $6 million in either potential commercial milestone payments related to future net sales of Belinostat or 10% of any sublicense income received by TopoTarget ("TopoTarget Payments"). Under the TopoTarget Agreement, CuraGen sold back its Belinostat rights to TopoTarget and received $25 million in cash, 5 million shares of TopoTarget common stock (sold by CuraGen in 2008 for net proceeds of $12 million) and the right to receive the TopoTarget Payments. In addition, TopoTarget assumed all financial and operational responsibility for the clinical development of Belinostat under the TopoTarget Agreement. In February 2010, TopoTarget entered into a co-development and commercialization agreement for Belinostat with Spectrum Pharmaceuticals, Inc. resulting in our receipt of $3 million of the TopoTarget Payments.

Research Collaboration and Licensing Agreements

Celldex hasWe have entered into licensing agreements with several universities and research organizations. Under the terms of these agreements, we have received licenses or options to license technology, specified patents or patent applications.

Table Our licensing and development collaboration agreements generally provide for royalty payments equal to specified percentages of Contentsproduct sales, annual license maintenance fees and continuing patent prosecution costs. In addition, we have committed to make potential future milestone payments to third parties of up to approximately $116 million as part of our various collaborations including licensing and development programs. Payments under these agreements generally become due and payable only upon achievement of certain developmental, regulatory and/or commercial milestones.

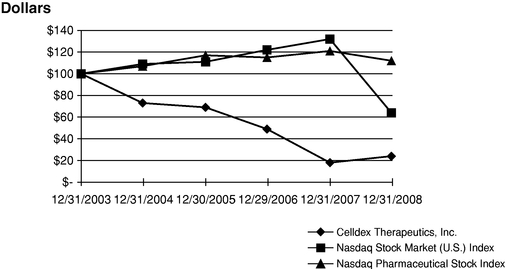

1. Medarex, Inc., a subsidiary of Bristol-Myers Squibb ("Medarex")