| (Mark One) | ||

ý | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, | ||

OR | ||

o | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

Indicate by check mark whether the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). $48.4 billion. The company's Proxy Statement in connection with the Annual Meeting of Stockholders to be held on April The company has operations in more than 90 countries worldwide and about sales through distributors. The company utilizes numerous suppliers as well as internal sources to supply a wide range of raw materials, energy, supplies, services and equipment. To ensure availability, the company maintains multiple sources for fuels and many raw materials, including hydrocarbon feedstocks. Large volume purchases are generally procured under competitively priced supply contracts. Agriculture segment include: benzene derivatives, other aromatics and carbamic acid related insect control products, natural gas and seed treatments. continued dianhydride. applications. The result is cost and process benefits, better product performance and improved environmental outcomes. Industrial Biosciences also makes DuPont industrial gases, methanol, natural gas, perchloroethylene, petroleum coke, sodium hydroxide, sulfur and titanium ore. applications. personnel to ensure consistency with the business and corporate strategy and to capitalize on the application of emerging science. See discussion under "Intellectual Property". SEC. volatility. When possible, the company purchases raw materials through negotiated long-term contracts to minimize the impact of price fluctuations. Additionally, the company enters into over-the-counter and exchange traded derivative commodity instruments to hedge its exposure to price fluctuations on certain raw material purchases. The company takes actions to offset the effects of higher energy and raw material costs through selling price increases, productivity improvements and cost reduction programs. Success in offsetting higher raw material costs with price increases is largely influenced by competitive and economic conditions and could vary significantly depending on the market served. If the company is not able to fully offset the effects of higher energy and raw material costs, it could have a significant impact on the company's financial results. number of factors including the nature of the matter, the complexity of the site, site geology, the nature and extent of contamination, the type of remedy, the outcome of discussions with regulatory agencies and other Potentially Responsible Parties (PRPs) at multi-party sites and the number and financial viability of other PRPs. ITEM 1B. UNRESOLVED STAFF COMMENTS ýo2010,2013, was approximately $31.3 billion.2011, 921,634,0002014, 927,717,000 shares (excludes 87,041,000 shares of treasury stock) of the company's common stock, $.30$0.30 par value, were outstanding.27, 2011 III 20112014 Annual Meeting Proxy Statement to be filed within 120 days after the end of the year covered by this Annual Report on Form 10-K, pursuant to Regulation 14A (the Proxy).is a world leader inbrings world-class science and innovation across a range of disciplines, including agriculture and industrial biotechnology, chemistry, biology, materials science and manufacturing. The company operates globally and offers a wide rangeengineering to the global marketplace in the form of innovative products, materials and servicesservices. The company believes that by collaborating with customers, governments, non-governmental organizations and thought leaders it can help find solutions to such global challenges as providing healthy food for markets including agriculturepeople everywhere, decreasing dependence on fossil fuels, and food, buildingprotecting life and construction, electronics and communications, general industrial, and transportation.the environment. Total worldwide employment at December 31, 2010,2013, was approximately 60,000about 64,000 people.The company consists of 13 businesses which are aggregated into seven reportable segments based on similar economic characteristics, the nature of the products and production processes, end-use markets, channels of distribution and regulatory environment. The company's reportable segments are Agriculture & Nutrition, Electronics & Communications, Performance Chemicals, Performance Coatings, Performance Materials, Safety & Protection, and Pharmaceuticals. The company includes certain embryonic businesses not included in the reportable segments, such as Applied BioSciences, and nonaligned businesses in Other.Information describing the business of the company can be found on the indicated pages of this report:ItemPageSegment ReviewsIntroduction25Agriculture & Nutrition26Electronics & Communications28Performance Chemicals29Performance Coatings30Performance Materials31Safety & Protection32Pharmaceuticals33Other34Geographic Information – Net Sales and Net PropertyF-47Segment Sales, Net Sales, Pre-tax Operating Income and Segment Net AssetsF-486560 percent of consolidated net sales are made to customers outside the United States of America (U.S.). See Note 21 to the Consolidated Financial Statements for additional details on the location of the company's sales and property.Acquisition As a science and technology based company, DuPont competes on a variety of DaniscoIn January 2011, DuPontfactors such as product quality and its wholly owned subsidiary, DuPont Denmark Holding ApS, entered into a definitive agreement forperformance or specifications, continuity of supply, price, customer service and breadth of product line, depending on the acquisitioncharacteristics of Danisco A/S (Danisco) for $6.3 billion, which includes $5.8 billion in cashthe particular market involved and the assumption of $500 million of Danisco's net debt. The transactionproduct or service provided. Most products are marketed primarily through the company's sales force, although in some regions, more emphasis is subject to customary closing conditions, including certain regulatory approvals and the tender of more than 90 percent of Danisco's shares in the tender offer. DuPont has the right to waive such tender offer conditions and accept a lesser number of shares in certain cases. The transaction is expected to close in the second quarter 2011.Danisco is a leading technology-driven organization, with outstanding research and application development capabilities in biotechnology. Danisco has specialty food ingredients, including enablers, cultures and sweeteners, which generate about 65 percent of its total sales. Genencor, its enzymes division, represents about 35 percent of its total sales. DuPont and Danisco are joint venture partners in the development of cellulosic ethanol technology. (See Applied BioSciences business discussionplaced on page 34 for more information.) Danisco has nearly 7,000 employees globally with operations in 23 countries. Upon completion, the transaction would establish DuPont as a clear leader in industrial biotechnology with science-intensive innovations that address global challenges in food production and reduced fossil fuel consumption.Part IITEM 1. BUSINESS,continuedSources of Supplywholly owned subsidiary, Pioneer Hi-Bred International, Inc. (Pioneer), operatesreportable segments are Agriculture, Electronics & Communications, Industrial Biosciences, Nutrition & Health, Performance Chemicals, Performance Materials, Safety & Protection and Pharmaceuticals. The company includes certain embryonic businesses not included in the reportable segments, such as pre-commercial programs, and nonaligned businesses in Other. Additional information with respect to business segment results is included in Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, on page 21 of this report and Note 22 to the Consolidated Financial Statements.industryproducts and well-established brands of insecticides, fungicides and herbicides. Research and development focuses on leveraging technology to increase grower productivity and enhance the value of grains and soy through improved seed traits, superior seed germplasm and effective use of insecticides, herbicides and fungicides. Agriculture accounted for approximately 50 percent of the company's total research and development expense in 2013.companybusiness or contracted with independent growers and conditioners. The company'sPioneer's ability to produce seeds primarily depends upon weather conditions and availability of reliable contract growers.company's reportable segments in 2010 include the following:& Nutrition:intermediates; copper; insect control products; natural gas; soybeans; soy flake; soy lecithin; sulfonamides;intermediates, copper, corn and soybean seeds,Communications:Communicationsco-polymers; copper; hydroxylamine; oxydianiline;co-polymers, copper, difluoroethane, hydroxylamine, oxydianiline, polyester film;film, precious metals;metals and pyromellitic dianhydridePerformance Chemicals:ammonia; benzene; chlorine; chloroform; fluorspar; hydrofluoric acid;Industrial Biosciences is a leader in developing and manufacturing a broad portfolio of bio-based products. The segment's enzymes add value and functionality to processes and products across a broad range of markets such as animal nutrition, detergents, food manufacturing, ethanol production and industrial gases; methanol; natural gas; perchloroethylene; sulfur; titanium orePerformance Coatings:TM isocyanates; pigments; resins; solventsPerformance Materials:Soronaacrylic monomers; adipic acid; butadiene; butanediol; dimethyl terephthalate; ethane; fiberglass; hexamethylenediamine; methanol; natural gas;® PTT renewably sourced polymer for use in carpet and apparel fibers.Protection:Protectionalumina hydroxide; benzene;® high strength material, Nomex® thermal resistant material and Tyvek® protective material, the business continues to hold strong positions in life protection markets and meet the continued demand for body armor and personal protective gear for the military, law enforcement personnel, firefighters and other first responders, as well as for workers in the oil and gas industry around the world.polyethylene;polyethylene, isophthaloyl chloride; metaphenylenediamine;chloride, metaphenylenediamine, methyl methacrylate; paraphenylenediamine;methacrylate, paraphenylenediamine, polyester fiber;fiber, terephthaloyl chloride;chloride and wood pulpNo commodities or raw materials are purchasedpulp.Pharmaceutical segment. This segment receives net proceedssegment's total sales in 2013.royalties from licensing arrangements for Cozaar® and Hyzaar® antihypertensive drugs,Hyzaar® (losartan potassium with hydrochlorothiazide), which are manufacturedused in the treatment of hypertension. DuPont has exclusively licensed worldwide marketing and distributed by Merck Sharp & Dohme Corp., a subsidiary ofmanufacturing rights for Cozaar® and Hyzaar® to Merck & Co., Inc. (Merck).estate providesincluding its trade secrets. When the company discovers that its trade secrets have been unlawfully taken, it with an important competitive advantage. Itreports the matter to governmental authorities for investigation and potential criminal action, as appropriate. In addition, the company takes measures to mitigate any potential impact, which may include civil actions seeking redress, restitution and/or damages based on loss to the company and/or unjust enrichment.an established global network of attorneys, as well as branding, advertising and licensing professionals,access to procure, maintain, protect, enhance and gain value from this estate.Part IITEM 1. BUSINESS,continuedThe company has a large patent portfolio, ofboth owned and is licensed under various patents. These definite-lived patents cover many products, processes and product uses. These patents protect many aspects of the company's significant research programs and the goods and services it sells. The actual protection afforded by these patents varies from country to country and depends upon the scope of coverage of each individual patent as well as the availability of legal remedies in each country. DuPont owns about 17,600 worldwide patents and 17,300 worldwide patent applications. In 2010, the company was granted about 700 U.S. patents and about 1,400 international patents. DuPont'slicensed. DuPont’s rights under itsthese patents and licenses, as well as the products made and sold under them, are important to the company in the aggregate. The protection afforded by these patents varies based on country, scope of individual patent coverage, as a whole,well as the availability of legal remedies in each country. This significant patent estate may bevarying degrees, important to each reportable segment.The environment in which Pioneer competes has been characterized byits owned patents, the use among competitors of new patents,company owns over 20,000 patent positions and patent lawsuits to gain advantage in commercial markets. Ownership of and access to intellectual property rights, particularly those relating to biotechnology and germplasm, will continue to be important to Pioneer and its competitors. Pioneer has a large collection of patents related to biotechnology and germplasm and also licenses technology from others. Pioneer will continue to address the dynamic environment in which it competes through a variety of means that includes protecting and enforcing its own intellectual property rights, challenging claims made by others and, where appropriate, obtaining licenses to important technologies on commercially reasonable terms. During 2007, Pioneer entered into a business agreement on corn herbicide tolerance and insect control trait technologies with Monsanto Company (Monsanto). Among other provisions, modifications were made to the existing corn license agreements; both parties agreed to exchange certain non-assert and other intellectual property rights; and both parties obtained rights to reference and access certain regulatory data and approvals in which the other has certain interests. For additional information, see Pioneer business discussion beginning on page 26 and the Contractual Obligations table on page 39.2,0002,140 unique trademarks for its products and services and approximately 19,00021,130 registrations for these trademarks worldwide. Ownership rights in trademarks do not expire if the trademarks are continued in use and properly protected. The company has many trademarks that have significant recognition at the consumer retail level and/or business to business level. Significant trademarks at the consumer retail level include the DuPont Oval and DuPont™ (the "DuPont Brand Trademarks"); Pioneer® brand seeds; Teflon® fluoropolymers, films, fabric protectors, fibers and dispersions; Corian® surfaces; Kevlar® high strength material; Nomex® thermal resistant material and Tyvek® protective material. The company actively pursues licensing opportunities for selected trademarks at the retail level.SeasonalitySales of the company's products in the Agriculture & Nutrition segment are affected by seasonal cropping and weather patterns. Sales and earnings performance in the Agriculture & Nutrition segment is strongest in the first half of the year. The segment generally operates at a loss during the third and fourth quarters of the year. As a result of the seasonal nature of its business, Agriculture & Nutrition's inventory is at its highest level at the end of the calendar year and is sold down in the first and second quarters. Trade receivables in the Agriculture & Nutrition segment are at a low point at year-end and increase through the selling season to peak at the end of the second quarter.In general, businesses in the remaining segments are not significantly affected by seasonal factors.MarketingWith the exception of certain products in the Agriculture & Nutrition segment, most products are marketed primarily through DuPont's sales force, although in some regions, more emphasis is placed on sales through distributors. Pioneer owns or uses a number of brands for its products and promotes them through multiple marketing channels around the world. In the corn and soybean markets of the U.S. Corn Belt, Pioneer® brand products are sold through a specialized force of independent sales representatives. Products that are co-branded or marketed under other Pioneer owned brands are distributed in this region by select seed companies. (See page 27 for a discussion of Pioneer's PROaccessSM business strategy.) In other North American markets, Pioneer® products are marketed through distributors and crop input retailers. Pioneer® products outside of North America are marketed through a network of subsidiaries, joint ventures and independent producer-distributors. Similarly, Crop Protection products are marketed and sold to growers and other end users through a network of wholesale distributors and crop input retailers. Solae®Part IITEM 1. BUSINESS,continuedisolated and functional soy proteins are marketed using a combination of outside distributors, joint ventures and direct sales.Major CustomersThe company's sales are not materially dependent on a single customer or small group of customers. However, collectively, Performance Coatings and Performance Materials have several large customers, primarily in the motor vehicle original equipment manufacturer (OEM) industry supply chain. The company has long-standing relationships with these customers and they are considered to be important to the segments' operating results.CompetitionAs a science and technology based company, DuPont competes on a variety of factors such as product quality and performance or specifications, continuity of supply, price, customer service and breadth of product line, depending on the characteristics of the particular market involved and the product or service provided.Major competitors include diversified industrial companies principally based in the U.S., Western Europe, Japan, China, Korea and India. In the aggregate, these competitors offer a wide range of products from agricultural, commodity and specialty chemicals to plastics, fibers and advanced materials. The company also competes in certain markets with smaller, more specialized firms who offer a narrow range of products or converted products that functionally compete with the company's offerings.Pioneer sells advanced plant genetics, principally for the global production of corn and soybeans and thus directly competes with other seed and plant biotechnology companies. The Nutrition & Health business also provides food safety equipment and soy-based food ingredients in competition with other major grain and food processors.in the U.S.and development (R&D) at either dedicated research facilities or manufacturing plants. The highest concentration of research is in the Wilmington, Delaware area at several large research centers. Among these, the Experimental Station laboratories engage in investigative and applied research, the Chestnut Run laboratories focus on applied research and the Stine-Haskell Research Center conducts agricultural product research and toxicological research to assure the safe manufacture, handling and use of products and raw materials.OtherThere are eleven major research locations in the U.S. include& Canada, with the highest concentration of facilities dedicated to coatingsat our corporate headquarters in the Wilmington, Delaware area. In addition, DuPont has five major research centers in Mount Clemens, Michigan; Pioneer research facilitiesthe Asia Pacific region, four major locations in Johnston, Iowa; the Europe, Middle East and Africa (EMEA) region and one major location is located in Latin America.Solae Company facilities in St. Louis, Missouri; polymer research facilities in Richmond, Virginia, and Parkersburg, West Virginia; and electronic materials research facilities in Research Triangle Park, North Carolina, and Santa Barbara, California.DuPont, reflecting the company's global interests, also operates additionalcompany’s research and development facilities at locations outsideobjectives are to leverage its unique integrated science capabilities to drive revenue and profit growth. DuPont's R&D organization is fully focused on the U.S., with major facilities located in Sao Paulo, Brazil; Kingston, Canada; Shanghai, China; Wuppertal, Germany; Hyderabad, India; Kanagawa, Japan; Utsunomiya, Japan; Seoul, Korea; and Meyrin, Switzerland.The objectivescompany's strategic priorities: extending its leadership across the high-value, science-driven segments of the company's researchagriculture and development programsfood value chains, strengthening its lead as provider of differentiated, high-value advanced industrial materials, and building transformational new bio-based industrial businesses. The company believes that its unique breadth of science, proven R&D engine, broad global reach and deep market penetration are distinctive, competitive advantages that position it to create new technologies, processesaddress demands for more and healthier food, decreasing our dependence on fossil fuel, and protecting people and the environment. Each business opportunities in relevant fields, as well as to improve existing products and processes. Each segment of the company funds research and development activities that support its business mission. Recently, the company has broadened its sustainability commitments beyond environmental footprint reduction to include market-driven targets formission, and a central research and development investment.organization supports cross-business and cross-functional growth opportunities. The companyR&D portfolio is expanding its offerings addressing safety, environment, energy and climate challenges in the global marketplace by developing and commercializing renewable, bio-based materials; advanced biofuels; energy-efficient technologies; enhanced safety and protection products; and alternative energy products and technologies. The goals are tied directly to business growth, including increasing food production, increasing renewable sources for energy and raw materials, and providing greater safety and protection for people and the environment.The corporate research laboratories are responsible for conducting research programs aligned with corporate strategy. All research and development activities are administeredmanaged by senior research and development managementPart IITEM 1. BUSINESS,continuedThe future of the company is not dependent upon the outcome of any single research program.Facility SecuritySee Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, on page 45 for a discussion of facility security.23, 41-4531, 35-37 and (3) Notes 1 and 1916 to the Consolidated Financial Statements.tabsection labeled "Investor Center""Investors", then on "Key Financials & Filings" and then on "SEC filings.Filings." These reports are made available, without charge, as soon as is reasonably practicable after the company files or furnishes them electronically with the Securities and Exchange Commission.5140 of this report.and natural gas and raw materials, affect the company's operating results from period to period. In 2013, price increases for energy and raw materials were about $500 million as compared to 2012. Price increases for energy and raw materials were not significant to earnings in 2012 as compared to 2011. Legislation to address climate change by reducing greenhouse gas emissions and establishing a price on carbon could create increases in energy costs and pricePart IITEM 1A. RISK FACTORS,continueddevelopeffectively prevent, detect and market new productsrecover from security breaches, including attacks on information technology and manage product life cyclesinfrastructureimpactresult in misuse of the company's assets, business disruptions, loss of property including trade secrets and confidential business information, legal claims or proceedings, reporting errors, processing inefficiencies, negative media attention, loss of sales and interference with regulatory compliance. Like most major corporations, DuPont is the target of industrial espionage, including cyber-attacks, from time to time. DuPont has determined that these attacks have resulted, and could result in the future, in unauthorized parties gaining access to at least certain confidential business information. However, to date, the company has not experienced any material financial impact, changes in the competitive position and have an adverse effect onenvironment or business operations that it attributes to these attacks. Although management does not believe that the company's financial results.Operating results are largely dependent on the company's assessment and management of its portfolio of current, new and developing products and services and its abilitycompany has experienced any material losses to bring those products and servicesdate related to market. The company plans to grow earnings by focusing on developing markets and solutions to meet increasing demand for food productivity, decrease dependency on fossil fuels and protect people, assets and the environment. This ability could be adversely affected by difficulties or delays in product development such as the inability to identify viable new products, successfully complete research and development, obtain relevant regulatory approvals, obtain intellectual property protection, or gain market acceptance of new products and services. Because of the lengthy development process, technological challenges and intense competition,security breaches, including cybersecurity incidents, there can be no assurance that it will not suffer such losses in the future. The company actively manages the risks within its control that could lead to business disruptions and security breaches. As these threats continue to evolve, particularly around cybersecurity, the company may be required to expend significant resources to enhance its control environment, processes, practices and other protective measures. Despite these efforts, such events could materially adversely affect the company's business, financial condition or results of operations.is currently developing, oroperates. While the company has procedures and controls to manage process safety risks, issues could begin to develop inbe created by events outside of its control including natural disasters, severe weather events, acts of sabotage and substandard performance by the future, will achieve substantial commercial success. Salescompany's external partners.new productscurrent and past operations, including operations related to divested businesses, the company could replace salesincur significant environmental liabilities.somepollutants and the management and disposal of hazardous substances. As a result of its current products, offsettingoperations, including its past operations and operations of divested businesses, the benefitcompany could incur substantial costs, including remediation and restoration costs. The costs of evencomplying with complex environmental laws and regulations, as well as internal voluntary programs, are significant and will continue to be so for the foreseeable future. The ultimate costs under environmental laws and the timing of these costs are difficult to predict. The company's accruals for such costs and liabilities may not be adequate because the estimates on which the accruals are based depend on a successful product introduction.The company's business, including its results of operations and reputation, could be adversely affected by process safety and product stewardship issues.Failure to appropriately manage safety, human health, product liability and environmental risks associated with the company's products, product life cycles and production processes could adversely impact employees, communities, stakeholders, the company's reputation and its results of operations. Public perception of the risks associated with the company's products and production processes could impact product acceptance and influence the regulatory environment in which the company operates. While the company has procedures and controls to manage process safety risks, issues could be created by events outside of its control including natural disasters, severe weather events and acts of sabotage.ITEM 1A. RISK FACTORS,continuedAs a result of the company's current and past operations, including operations related to divested businesses, the company could incur significant environmental liabilities.The company is subject to various laws and regulations around the world governing the environment, including the discharge of pollutants and the management and disposal of hazardous substances. As a result of its operations, including its past operations and operations of divested businesses, the company could incur substantial costs, including cleanup costs. The costs of complying with complex environmental laws and regulations, as well as internal voluntary programs, are significant and will continue to be so for the foreseeable future. The ultimate costs under environmental laws and the timing of these costs are difficult to predict. The company's accruals for such costs and liabilities may not be adequate because the estimates on which the accruals are based depend on a number of factors including the nature of the matter, the complexity of the site, site geology, the nature and extent of contamination, the type of remedy, the outcome of discussions with regulatory agencies and other Potentially Responsible Parties (PRPs) at multi-party sites and the number and financial viability of other PRPs.The company's ability to generate sales from genetically modified products, particularly seeds and other agricultural products, could be adversely affected by market acceptance, government policies, rules or regulations and competition.The company is using biotechnology to create and improve products, particularly in its Agriculture & Nutrition segment. The use of biotechnology to characterize the genetic and performance characteristics of Pioneer seeds provides Pioneer with competitive advantages in the development of new products, and in the most effective placement of those products on customer acres. In addition, the company uses biotechnology to enhance the performance of its seed products through the addition of specific transgenes. The company's ability to generate sales from such products could be affected by market acceptance of genetically modified products as well as governmental policies, laws and regulations that affect the development, manufacture and distribution of products, including the testing and planting of seeds containing biotechnology traits and the import of commodity grain grown from those seeds.The company competes with major global companies that have strong intellectual property estates supporting the use of biotechnology to enhance products, particularly in the agricultural products and production markets. Speed in discovering and protecting new technologies and bringing products based on them to market is a significant competitive advantage. Failure to predict and respond effectively to this competition could cause the company's existing or candidate products to become less competitive, adversely affecting sales.Changes in government policies and laws could adversely affect the company's financial results.Sales outside the U.S. constitute approximately 65 percent of the company's 2010 revenue. The company anticipates that international sales will continue to represent a substantial portion of its total sales and that continued growth and profitability will require further international expansion, particularly in developing markets. Sales from developing markets represent approximately 30 percent of the company's revenue in 2010 and the company's growth plans include focusing on expanding its presence in developing markets. The company's financial results could be affected by changes in trade, monetary and fiscal policies, laws and regulations, or other activities of U.S. and non-U.S. governments, agencies and similar organizations. These conditions include, but are not limited to, changes in a country's or region's economic or political conditions, trade regulations affecting production, pricing and marketing of products, local labor conditions and regulations, reduced protection of intellectual property rights in some countries, changes in the regulatory or legal environment, restrictions on currency exchange activities, burdensome taxes and tariffs and other trade barriers. International risks and uncertainties, including changing social and economic conditions as well as terrorism, political hostilities and war, could lead to reduced sales and profitability.Economic factors, including inflation, deflation and fluctuations in currency exchange rates, interest rates and commodity prices could affect the company's financial results.The company is exposed to fluctuations in currency exchange rates, interest rates and commodity prices. Because the company has significant international operations, there are a large number of currency transactions that result from international sales, purchases, investments and borrowings. The company actively manages currency exposures that are associated with net monetary asset positions, committed currency purchases and sales, foreign currency-Part IITEM 1A. RISK FACTORS,continueddenominated revenues and other assets and liabilities created in the normal course of business. Failure to successfully manage these risks could have an adverse impact on the company's financial position, results of operations and cash flows.Conditions in the global economy and global capital markets may adversely affect the company's results of operations, financial condition, and cash flows.The company's business and operating results may in the future be adversely affected by global economic conditions, including instability in credit markets, declining consumer and business confidence, fluctuating commodity prices, volatile exchange rates, and other challenges that could affect the global economy. The company's customers may experience deterioration of their businesses, cash flow shortages, and difficulty obtaining financing. As a result, existing or potential customers may delay or cancel plans to purchase products and may not be able to fulfill their obligations in a timely fashion. Further, suppliers could experience similar conditions, which could impact their ability to fulfill their obligations to the company. Adversity within capital markets may impact future return on pension assets, thus resulting in greater future pension costs that impact the company's results. Future weakness in the global economy could adversely affect the company's results of operations, financial condition and cash flows in future periods.The company's results of operations and financial condition could be seriously impacted by business disruptions and security threats.Business disruptions, including supply disruptions, increasing costs for energy, temporary plant and/or power outages and information technology system and network disruptions, could seriously harm the company's operations as well as the operations of its customers and suppliers. Like many other multinational organizations, the company faces security threats to its facilities, data and information technology infrastructure. Although it is impossible to predict the occurrences or consequences of business disruptions or security threats, they could result in reduced demand for the company's products, make it difficult or impossible for the company to deliver products to its customers or to receive raw materials from suppliers, and create delays and inefficiencies in the supply chain. The company actively manages the risks within its control that could lead to business disruptions or security breaches in order to mitigate any potential impact from business disruptions regardless of cause including acts of sabotage, terrorism or war, weather events and natural disasters. Despite these efforts, the impact from business disruptions and security breaches could significantly increase the cost of doing business or otherwise adversely impact the company's financial performance.Inability to protect and enforce the company's intellectual property rights could adversely affect the company's financial results.Intellectual property rights are important to the company's business. The company endeavors to protect its intellectual property rights in jurisdictions in which its products are produced or used and in jurisdictions into which its products are imported. However, the company may be unable to obtain protection for its intellectual property in key jurisdictions. Additionally, the company has designed and implemented internal controls to restrict access to and distribution of its intellectual property, including confidential information and trade secrets. Despite these precautions, it is possible that unauthorized parties may access and use such property. When misappropriation is discovered, the company reports such situations to the appropriate governmental authorities for investigation and takes measures to mitigate any potential impact.

The company's plants and equipment are well maintained and in good operating condition. ® Herbicide Claims Process DuPont is in settlement negotiations with the U.S. Environmental Protection Agency (EPA) and the Department of Justice (DOJ). 2006 and 2010 following separate environmental audits. DuPont is in settlement negotiations with EPA and 2014. Fourth Quarter Third Quarter Second Quarter First Quarter 2009 Fourth Quarter Third Quarter Second Quarter First Quarter November Total DuPont S&P 500 Index Peer Group (Dollars in millions, except per share) Summary of operations Net sales Income before income taxes Provision for income taxes Net income attributable to DuPont Basic earnings per share of common stock Diluted earnings per share of common stock Financial position at year-end Working capital Total assets Borrowings and capital lease obligations Short-term Long-term Total equity General For the year Purchases of property, plant & equipment and investments in affiliates Depreciation Research and development expense Average number of common shares Basic Diluted Dividends per common share At year-end Employees (thousands) Closing stock price Common stockholders of record (thousands) 8. to return excess cash to shareholders unless there is a compelling opportunity to invest for growth. (Dollars in millions) NET SALES The (Dollars in billions) Worldwide United States Europe, Middle East, and Africa (EMEA) Asia Pacific Latin America Canada (Dollars in billions) Worldwide United States EMEA Asia Pacific Latin America Canada (Dollars in millions) OTHER INCOME, NET (Dollars in millions) COST OF GOODS SOLD AND OTHER OPERATING CHARGES As a percent of net sales (Dollars in millions) SELLING, GENERAL AND ADMINISTRATIVE EXPENSES As a percent of net sales (Dollars in millions) RESEARCH AND DEVELOPMENT EXPENSE As a percent of net sales (Dollars in millions) INTEREST EXPENSE (Dollars in millions) EMPLOYEE SEPARATION/ASSET RELATED CHARGES, NET (Dollars in millions) PROVISION FOR INCOME TAXES Effective income tax rate In earnings, in addition to benefits associated with certain U.S. business tax provisions in 2013. provisions in 2011. (Dollars in millions) NET INCOME ATTRIBUTABLE TO DUPONT Principal U.S. Pension Plan Market-related value of assets Fair value of plan assets For plans other than the principal U.S. pension plan, pension expense is typically determined using the fair value of assets. Pre-tax Earnings Benefit (Charge) Discount Rate Expected rate of return on plan assets negotiations, settlements, rulings, advice of counsel and other information and events that may pertain to a particular matter. Predicting the outcome of claims and lawsuits and estimating related costs and exposure involves substantial uncertainties that could cause actual costs to vary materially from estimates. In making determinations of likely outcomes of litigation matters, management considers many factors. These factors include, but are not limited to, the nature of specific claims including unasserted claims, the company's experience with similar types of claims, the jurisdiction in which the matter is filed, input from outside legal counsel, the likelihood of resolving the matter through alternative dispute resolution mechanisms and the matter's current status. Considerable judgment is required in determining whether to establish a litigation accrual when an adverse judgment is rendered against the company in a court proceeding. In such situations, the company will not recognize a loss if, based upon a thorough review of all relevant facts and information, management believes that it is probable that the pending judgment will be successfully overturned on appeal. A detailed discussion of significant litigation matters is contained in Note See Note 6 to the Consolidated Financial Statements for additional details related to the deferred tax asset balance. (Dollars in millions) Agriculture & Nutrition Electronics & Communications Performance Chemicals Performance Coatings Performance Materials Safety & Protection Other Total (Charge) Credit 2010 2009 2008 2010 2009 2008 2010 2009 2008 2010 2009 2008 2010 2009 2008 2010 2009 2008 2010 2009 2008 (Dollars in millions) Cash provided by operating activities (Dollars in millions) Cash used for investing activities (Dollars in millions) Cash (used for) provided by financing activities (Dollars in millions) Cash provided by operating activities Purchases of property, plant and equipment Free cash flow Off-Balance Sheet Arrangements (Dollars in millions) (Dollars in millions) Long-term debt obligations1 Long-term debt obligations1 Expected cumulative cash requirements for interest payments through maturity Expected cumulative cash requirements for interest payments through maturity Capital leases1 Capital leases1 Operating leases Operating leases Purchase obligations2 Purchase obligations2 Information technology infrastructure & services Raw material obligations Utility obligations INVISTA-related obligations3 Human resource services Other4 Total purchase obligations Total purchase obligations Other liabilities1,5 Workers' compensation Asset retirement obligations Environmental remediation Legal settlements License agreement6 Other7 Total other long-term liabilities Total other long-term liabilities Total contractual obligations8 (Dollars in millions) Defined benefit plan charges (benefits) Defined contribution plan charges Other long-term employee benefit plan charges Net amount 2013. (Dollars in millions) Balance at December 31, 2008 Remediation Payments Increase in Accrual Balance at December 31, 2009 Remediation Payments Increase in Accrual Balance at December 31, 2010 (Dollars in millions) Environmental Operating Costs Increase in Remediation Accruals Environmental Capital Expenditures financial position or liquidity of the company. Similarly, demand is expected to grow for products that facilitate adaptation to a changing climate. This type of GHG emissions regulation by EPA, in the absence of or in addition to federal legislation, could result in more costly, less efficient facility-by-facility controls versus a federal perfluoroelastomer parts and fluoroelastomers. In Statements. Consolidated Financial Statements. (Dollars in millions) Pre-tax exchange loss Tax (expense) benefit After-tax loss (Dollars in millions) Interest rate swaps Foreign currency contracts Energy feedstocks “Stockholder Nominations for Election of Directors.” Chair of the Board of Directors and Chief Executive Officer: Chair of the Board of Directors and Chief Executive Officer: Ellen J. Kullman Ellen J. Kullman Other Executive Officers: Other Executive Officers: James C. Borel James C. Borel Executive Vice President Thomas M. Connelly, Jr. Executive Vice President and Chief Innovation Officer Nicholas C. Fanandakis Nicholas C. Fanandakis Executive Vice President and Chief Financial Officer Thomas L. Sager Thomas L. Sager Senior Vice President and General Counsel Mark P. Vergnano Mark P. Vergnano Executive Vice President Equity compensation plans approved by security holders Equity compensation plans not approved by security holders Total Information with respect to this Item is incorporated herein by reference to the Proxy, including information within the section entitled "Ownership of Company Stock." Accounts Receivable—Allowance for Doubtful Receivables Balance at beginning of period Additions charged to cost and expenses Deductions from reserves Balance at end of period Deferred Tax Assets—Valuation Allowance Balance at beginning of period Net (benefits) charges to income tax expense Additions charged to other comprehensive income (loss) Currency translation Balance at end of period Net sales Net sales Other income, net Other income, net Total Cost of goods sold and other operating charges Selling, general and administrative expenses Selling, general and administrative expenses Research and development expense Research and development expense Interest expense Interest expense Employee separation/asset related charges, net Total Income before income taxes Provision for income taxes Net income Net income Less: Net income attributable to noncontrolling interests Less: Net income attributable to noncontrolling interests Net income attributable to DuPont Net income attributable to DuPont Basic earnings per share of common stock Basic earnings per share of common stock Diluted earnings per share of common stock Diluted earnings per share of common stock Assets Current assets Cash and cash equivalents Marketable securities Accounts and notes receivable, net Inventories Prepaid expenses Deferred income taxes Total current assets Property, plant and equipment Less: Accumulated depreciation Net property, plant and equipment Goodwill Other intangible assets Investment in affiliates Other assets Total Liabilities and Stockholders' Equity Current liabilities Accounts payable Short-term borrowings and capital lease obligations Income taxes Other accrued liabilities Total current liabilities Long-term borrowings and capital lease obligations Other liabilities Deferred income taxes Total liabilities Commitments and contingent liabilities Stockholders' Equity Preferred stock, without par value – cumulative; 23,000,000 shares authorized; issued at December 31, 2010 and 2009: $4.50 Series – 1,673,000 shares (callable at $120) $3.50 Series – 700,000 shares (callable at $102) Common stock, $.30 par value; 1,800,000,000 shares authorized; Issued at December 31, 2010 – 1,004,351,000; 2009 – 990,855,000 Additional paid-in capital Reinvested earnings Accumulated other comprehensive loss Common stock held in treasury, at cost (Shares: December 31, 2010 and 2009 – 87,041,000) Total DuPont stockholders' equity Noncontrolling interests Total equity Total 2008 Balance January 1, 2008 Net income Cumulative translation adjustment Net revaluation and clearance of cash flow hedges to earnings Pension benefit plans Other benefit plans Net unrealized loss on securities Total comprehensive loss Common dividends ($1.64 per share) Preferred dividends Common stock Issued – compensation plans Balance December 31, 2008 2009 Acquisition of a majority interest in a consolidated subsidiary Purchase of subsidiary shares from noncontrolling interest Net income Cumulative translation adjustment Net revaluation and clearance of cash flow hedges to earnings Pension benefit plans Other benefit plans Net unrealized gain on securities Total comprehensive income Common dividends ($1.64 per share) Preferred dividends Common stock Issued – compensation plans Balance December 31, 2009 2010 Acquisition of a majority interest in a consolidated subsidiary Net income Cumulative translation adjustment Net revaluation and clearance of cash flow hedges to earnings Pension benefit plans Other benefit plans Net unrealized gain on securities Total comprehensive income Common dividends ($1.64 per share) Preferred dividends Common stock Issued – compensation plans Repurchased Retired Balance December 31, 2010 Operating activities Net income Adjustments to reconcile net income to cash provided by operating activities: Depreciation Amortization of intangible assets Other noncash charges and credits – net Contributions to pension plans (Increase) decrease in operating assets: Accounts and notes receivable Inventories and other operating assets Increase (decrease) in operating liabilities: Accounts payable and other operating liabilities Accrued interest and income taxes Cash provided by operating activities Investing activities Purchases of property, plant and equipment Investments in affiliates Payments for businesses – net of cash acquired Proceeds from sale of assets – net of cash sold Net (increase) decrease in short-term financial instruments Forward exchange contract settlements Other investing activities – net Cash used for investing activities Financing activities Dividends paid to stockholders Net increase (decrease) in short-term (less than 90 days) borrowings Long-term and other borrowings: Receipts Payments Repurchase of common stock Proceeds from exercise of stock options Proceeds from termination of interest rate swap Other financing activities – net Cash (used for) provided by financing activities Effect of exchange rate changes on cash Increase in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Supplemental cash flow information: Cash paid during the year for Interest, net of amounts capitalized Taxes For those consolidated subsidiaries in which the company's ownership is less than 100 percent, the outside stockholders' interests are shown as noncontrolling interests. Investments in affiliates over which the company has significant influence but not a controlling interest are carried on the equity above matters. cu the company's cash equivalents approximates its stated value as of December 31, 2013 and 2012. Marketable securities represent investments in fixed and floating rate financial instruments with maturities greater than three months and up to twelve months at time of purchase. They are classified as held-to-maturity and recorded at amortized cost. The carrying value approximates fair value due to the short-term nature of the investments. Elements of cost in inventories include raw materials, direct labor and manufacturing overhead. Stores and supplies are valued at cost or market, whichever is lower; cost is generally determined by the average cost method. Research and development expenses include costs (primarily consisting of employee costs, materials, contract services, research agreements, and other external spend) relating to the discovery and development of new products, enhancement of existing products and regulatory approval of new and existing products. A receivable for an insurance recovery is generally recognized when the loss has occurred and collection is considered probable. Cozaar®/Hyzaar® income Royalty income Interest income Equity in earnings of affiliates, excluding exchange gains/losses1 Net gains on sales of assets Net exchange gains (losses)1 Miscellaneous income and expenses, net2 Interest incurred Interest capitalized GLS/Vinyls primarily consist of inventory and property, plant and equipment. In Net charges to income in 2009 Charges to accounts Payments Net translation adjustment Net credits to income Asset write-offs and adjustments Balance at December 31, 2009 Payments Net translation adjustment Net credits to income Balance at December 31, 2010 activities were shut downs. - Net charges to income in 2008 Charges to accounts Net translation adjustment Asset write-offs Other Balance at December 31, 2008 Payments Net translation adjustment Net credits to income Balance at December 31, 2009 Payments Net translation adjustment Net credits to income Balance at December 31, 2010 December 31, 2013 and 2012, the company had long-lived assets with a remaining net book value of approximately $90 and Current tax expense (benefit): U.S. federal U.S. state and local International Total current tax expense Deferred tax expense (benefit): U.S. federal U.S. state and local International Total deferred tax expense Provision for income taxes Depreciation Accrued employee benefits Other accrued expenses Inventories Unrealized exchange gains Tax loss/tax credit carryforwards/backs Investment in subsidiaries and affiliates Amortization of intangibles Other Valuation allowance Net deferred tax asset Current deferred tax asset Non-current deferred tax asset1 Current deferred tax liability Non-current deferred tax liability Net deferred tax asset An analysis of the company's effective income tax rate (EITR) on continuing operations is as follows: Statutory U.S. federal income tax rate Exchange gains/losses1 Domestic operations Lower effective tax rates on international operations-net Tax settlements United States (including exports) International 2018. non-U.S. income tax examinations by tax authorities for years before Total Unrecognized Tax Benefits as of January 1 Gross amounts of decreases in unrecognized tax benefits as a result of tax positions taken during the prior period Gross amounts of increases in unrecognized tax benefits as a result of tax positions taken during the prior period Gross amounts of increases in unrecognized tax benefits as a result of tax positions taken during the current period Amount of decreases in the unrecognized tax benefits relating to settlements with taxing authorities Reduction to unrecognized tax benefits as a result of a lapse of the applicable statue of limitations Exchange gain (loss) Total Unrecognized Tax Benefits as of December 31 Total unrecognized tax benefits that, if recognized, would impact the effective tax rate Total amount of interest and penalties recognized in the Consolidated Income Statement Total amount of interest and penalties recognized in the Consolidated Balance Sheet Numerator: Net income attributable to DuPont Preferred dividends Net income available to common stockholders Denominator: Weighted-average number of common shares outstanding – Basic Dilutive effect of the company's employee compensation plans and accelerated share repurchase agreement Weighted average number of common shares outstanding – Diluted Average number of stock options Financial assets Derivatives Available-for-sale securities Financial liabilities Derivatives Financial assets Derivatives Available-for-sale securities Financial liabilities Derivatives Accounts receivable – trade1 Notes receivable – trade1,2 Other3 Finished products Semifinished products Raw materials, stores and supplies Adjustment of inventories to a LIFO basis Buildings Equipment Land Construction 11. GOODWILL AND OTHER INTANGIBLE ASSETS The following table summarizes changes in the carrying amount of goodwill for the years ended December 31, Agriculture & Nutrition Electronics & Communications Performance Chemicals Performance Coatings Performance Materials Safety & Protection Total Intangible assets subject to amortization (Definite-lived)1 Purchased and licensed technology Patents Trademarks Other2 Intangible assets not subject to amortization (Indefinite-lived) Trademarks/tradenames Pioneer germplasm3 Net sales1 Earnings before income taxes Net income DuPont's equity in (losses) earnings of affiliates: Partnerships-pre-tax2 Corporate joint ventures-after-tax Current assets Noncurrent assets Total assets Short-term borrowings1 Other current liabilities Long-term borrowings1 Other long-term liabilities Total liabilities DuPont's investment in affiliates (includes advances) Long-term investments in securities Deferred income taxes (Note 5) Miscellaneous Trade payables Payables to banks Miscellaneous Commercial paper Other loans-various currencies Long-term debt payable within one year Capital lease obligations Compensation and other employee-related costs Deferred revenue Employee benefits (Note 21) Discounts and rebates Derivative instruments Miscellaneous U.S. dollar: U.S. dollar: Industrial development bonds due 2026, 20291 Medium-term notes due 2013 – 20412 4.125% notes due 20103,4 4.75% notes due 2012 5.00% notes due 2013 5.00% notes due 2013 5.875% notes due 2014 4.875% notes due 2014 3.25% notes due 20154 4.75% notes due 2015 1.95% notes due 2016 5.25% notes due 2016 6.00% notes due 20185 5.75% notes due 2019 4.625% notes due 2020 3.625% notes due 2021 6.50% debentures due 2028 5.60% notes due 2036 4.90% notes due 2041 Other loans (average interest rate of 2.0 percent)3 Foreign currency denominated loans: Euro loans (average interest rate of 2.3 percent)3 Other loans (various currencies)3 Less short-term portion of long-term debt Less short-term portion of long-term debt Capital lease obligations Capital lease obligations Total Total 2043. Employee benefits: Employee benefits: Accrued other long-term benefit costs (Note 21) Accrued pension benefit costs (Note 21) Accrued environmental remediation costs Accrued environmental remediation costs Miscellaneous Miscellaneous Consolidated Financial Statements (continued) Obligations for customers and suppliers1: Bank borrowings (terms up to 5 years) Obligations for other affiliated companies2: Bank borrowings (terms up to 1 year) Obligations for equity affiliates2: Bank borrowings (terms up to 2 years) Revenue bonds (terms up to 5 years) Total obligations for customers, suppliers, other affiliated companies, and equity affiliates Obligations for divested subsidiaries3: Conoco (terms up to 16 years) Total obligations for divested subsidiaries At December 31, 2013, DuPont In DuPont denies allegations in these lawsuits and is defending itself vigorously. $1,000 in damages to Monsanto on its claims that the company willfully infringed Monsanto's RE 39,247 patent directed to Roundup® Ready® 1 glyphosate herbicide tolerancesoybean seed technology. court approval. In Remediation activities vary substantially in duration and cost from site to site. These activities, and their associated costs, depend on the mix of unique site characteristics, evolving remediation technologies, diverse regulatory agencies and enforcement policies, as well as the presence or absence of potentially responsible parties. At December 31, 2013 December 31, 2013. Balance January 1, 2008 Issued Balance December 31, 2008 Issued Balance December 31, 2009 Issued Repurchased Retired Balance December 31, 2010 28 percent interest in the Solae, LLC joint venture from Bunge Limited for $447. As the purchase of the remaining interest did not result in a change of control, the difference between the carrying value of the noncontrolling interest of $378 and the consideration paid, net of taxes of $78, was recorded as a $9 increase to additional paid-in capital. 2010 Cumulative translation adjustment Net revaluation and clearance of cash flow hedges to earnings Pension benefits (Note 21) Other benefits (Note 21) Net unrealized gains on securities Other comprehensive income attributable to noncontrolling interest Other comprehensive loss attributable to DuPont 2009 Cumulative translation adjustment Net revaluation and clearance of cash flow hedges to earnings Pension benefits (Note 21) Other benefits (Note 21) Net unrealized gains on securities Other comprehensive loss attributable to noncontrolling interest Other comprehensive loss attributable to DuPont 2008 Cumulative translation adjustment Net revaluation and clearance of cash flow hedges to earnings Pension benefits (Note 21) Other benefits (Note 21) Net unrealized losses on securities Other comprehensive loss attributable to noncontrolling interest Other comprehensive loss attributable to DuPont Cumulative translation adjustment Net revaluation and clearance of cash flow hedges to earnings Net unrealized gain (loss) on securities Pension benefits Net losses Net prior service cost Other benefits Net losses Net prior service benefit Pension coverage for employees of the company's non-U.S. consolidated subsidiaries is provided, to the extent deemed appropriate, through separate plans. Obligations under such plans are funded by depositing funds with trustees, covered by insurance contracts, or remain unfunded. Obligations and Funded Status at December 31, Obligations and Funded Status at December 31, Change in benefit obligation Change in benefit obligation Benefit obligation at beginning of year Benefit obligation at beginning of year Service cost Service cost Interest cost Interest cost Plan participants' contributions Plan participants' contributions Actuarial loss Benefits paid Benefits paid Amendments Amendments Net effects of acquisitions/divestitures Net effects of acquisitions/divestitures Benefit obligation at end of year Benefit obligation at end of year Change in plan assets Change in plan assets Fair value of plan assets at beginning of year Fair value of plan assets at beginning of year Actual gain on plan assets Actual gain on plan assets Employer contributions Employer contributions Plan participants' contributions Plan participants' contributions Benefits paid Benefits paid Net effects of acquisitions/divestitures Net effects of acquisitions/divestitures Fair value of plan assets at end of year Fair value of plan assets at end of year Funded status Funded status U.S. plans with plan assets U.S. plans with plan assets Non-U.S. plans with plan assets Non-U.S. plans with plan assets All other plans All other plans Total Amounts recognized in the Consolidated Balance Sheet consist of: Other assets (Note 13) Other accrued liabilities (Note 16) Other liabilities (Note 18) Net amount recognized Net amount recognized December 31, Net loss Prior service (cost) benefit Projected benefit obligation Accumulated benefit obligation Fair value of plan assets Projected benefit obligation Accumulated benefit obligation Fair value of plan assets Components of net periodic benefit cost (credit) and amounts recognized in other comprehensive income Net periodic benefit (credit) cost Service cost Interest cost Expected return on plan assets Amortization of loss Amortization of prior service cost Curtailment/settlement loss Net periodic benefit (credit) cost Changes in plan assets and benefit obligations recognized in other comprehensive income Net loss (gain) Amortization of loss Prior service cost Amortization of prior service cost Curtailment/settlement loss Total recognized in other comprehensive income Total recognized in net periodic benefit cost and other comprehensive income The estimated pre-tax net loss and prior service cost for the defined benefit pension plans that will be amortized from accumulated other comprehensive loss into net periodic benefit cost during Components of net periodic benefit cost and amounts recognized in other comprehensive income Net periodic benefit cost Service cost Interest cost Amortization of loss Amortization of prior service benefit Net periodic benefit cost Changes in plan assets and benefit obligations recognized in other comprehensive income Net (gain) loss Amortization of loss Prior service cost Amortization of prior service benefit Total recognized in other comprehensive income Total recognized in net periodic benefit cost and other comprehensive income Weighted-average assumptions used to determine benefit obligations at December 31, Discount rate Rate of compensation increase Weighted-average assumptions used to determine net periodic benefit cost for the years ended December 31, Discount rate Expected return on plan assets Rate of compensation increase effect of the company's active management of the plans' assets. For non-U.S. plans, assumptions reflect economic assumptions applicable to each country. Health care cost trend rate assumed for next year Rate to which the cost trend rate is assumed to decline (the ultimate trend rate) Year that the rate reaches the ultimate trend rate Increase (decrease) on total of service and interest cost Increase (decrease) on post-retirement benefit obligation U.S. equity securities Non-U.S. equity securities Fixed income securities Private market securities Real estate Total Cash and cash equivalents U.S. equity securities1 Non-U.S. equity securities Debt – government issued Debt – corporate issued Debt – asset-backed Private market securities Real estate Derivatives – asset position Derivatives – liability position Other Pension trust receivables2 Pension trust payables3 Total Cash and cash equivalents U.S. equity securities1 Non-U.S. equity securities Debt – government issued Debt – corporate issued Debt – asset-backed Private market securities Real estate Derivatives – asset position Derivatives – liability position Other Pension trust receivables2 Pension trust payables3 Total The company's pension plans hold Level 3 assets which are primarily ownership interests in investment partnerships and trusts that own private market securities and real estate. Fair value is generally based on the company's units of ownership and net asset value of the investment entity or the company's share of the investment entity's total equity. The table below presents a rollforward of activity for these assets for the years ended December 31, Beginning balance at December 31, 2008 Realized gain (loss) Change in unrealized gain (loss) Purchases, sales and settlements Transfers out of Level 3 Ending balance at December 31, 2009 Realized gain (loss) Change in unrealized gain (loss) Purchases, sales and settlements Transfers out of Level 3 Ending balance at December 31, 2010 Pension plans Other long-term employee benefit plans 2011 2012 2013 2014 2015 Years 2016-2020 Dividend yield Volatility Risk-free interest rate Expected life (years) Outstanding, December 31, 2009 Granted Exercised Forfeited Cancelled Outstanding, December 31, 20101 Exercisable, December 31, 2010 Nonvested, December 31, 2009 Granted Vested Forfeited Nonvested, December 31, 2010 company's derivative instruments were as follows: The company also uses foreign currency exchange contracts to offset a portion of the company's exposure to certain foreign currency-denominated revenues so that gains and losses on these contracts offset changes in the USD value of the related foreign currency-denominated revenues. The objective of the hedge program is to reduce earnings and cash flow volatility related to changes in foreign currency exchange rates. The company enters into over-the-counter and exchange-traded derivative commodity instruments to hedge the commodity price risk associated with energy feedstock and agricultural commodity exposures. next two-year period. Cash flow hedge results are reclassified into earnings during the same period in which the related exposure impacts earnings. Reclassifications are made sooner if it appears that a forecasted transaction will not materialize. The following table summarizes the after-tax effect of cash flow hedges on accumulated other comprehensive income (loss) for the Beginning balance Additions and revaluations of derivatives designated as cash flow hedges Clearance of hedge results to earnings Ending balance Portion of ending balance expected to be reclassified into earnings over the next twelve months $(36). soybean meal. Derivatives designated as hedging instruments Interest rate swaps Interest rate swaps Foreign currency contracts Energy feedstocks Energy feedstocks Total derivatives designated as hedging instruments Derivatives not designated as hedging instruments Foreign currency contracts Total derivatives not designated as hedging instruments Total derivatives Interest rate swaps Total 2010 Treasury rate contracts Foreign currency contracts Agricultural feedstocks Energy feedstocks Total 2009 Treasury rate contracts Foreign currency contracts Agricultural feedstocks Energy feedstocks Total Foreign currency contracts Agricultural feedstocks Total United States EMEA3 Belgium France Germany Italy Luxembourg Russia Spain The Netherlands United Kingdom Other Total EMEA Asia Pacific Australia China/Hong Kong India Japan Korea Singapore Taiwan Thailand Other Total Asia Pacific Latin America Argentina Brazil Mexico Other Total Latin America Canada Total 2010 Segment sales Less transfers Net sales Pre-tax operating income (loss) Depreciation and amortization Equity in earnings of affiliates Segment net assets Affiliate net assets Purchases of property, plant and equipment 2009 Segment sales Less transfers Net sales Pre-tax operating income (loss) Depreciation and amortization Equity in earnings of affiliates Segment net assets Affiliate net assets Purchases of property, plant and equipment 2008 Segment sales Less transfers Net sales Pre-tax operating income (loss) Depreciation and amortization Equity in earnings of affiliates Segment net assets Affiliate net assets Purchases of property, plant and equipment Total segment PTOI Net exchange (losses) gains, including affiliates Corporate expenses and net interest Income before income taxes Total segment net assets Corporate assets1 Liabilities included in net assets Total assets 2010 Depreciation and amortization Equity in earnings of affiliates Affiliate net assets Purchases of property, plant and equipment 2009 Depreciation and amortization Equity in earnings of affiliates Affiliate net assets Purchases of property, plant and equipment 2008 Depreciation and amortization Equity in earnings of affiliates Affiliate net assets Purchases of property, plant and equipment 2010 Agriculture & Nutrition1 Electronics & Communications2 Performance Chemicals2 Performance Coatings2 Performance Materials2 Safety & Protection2 Other2 2009 Agriculture & Nutrition1 Electronics & Communications1,2 Performance Chemicals1,2 Performance Coatings1,2 Performance Materials1,2,3 Safety & Protection1,2 Pharmaceuticals4 Other1,2 2008 Agriculture & Nutrition1,2 Electronics & Communications1 Performance Chemicals1,2 Performance Coatings1 Performance Materials1,2 Safety & Protection1,2 Other1,3 2010 Net sales Cost of goods sold and other expenses1 Income before income taxes Net income Basic earnings per share of common stock2 Diluted earnings per share of common stock2 2009 Net sales Cost of goods sold and other expenses1 Income before income taxes Net income Basic earnings per share of common stock2 Diluted earnings per share of common stock2 E. I. du Pont de Nemours and Company1916 and 2421 to the Consolidated Financial Statements.more significantnumber of sites are listedused by their applicable segment(s) by major geographic area around the world is as set forth below:follows: Number of Sites Agriculture Electronics & Communications Industrial Biosciences Nutrition & Health Performance Chemicals Performance Materials Safety & Protection Asia Pacific 22 10 1 9 6 19 6 73 EMEA 48 3 7 19 4 11 4 96 Latin America 20 — 1 7 1 1 — 30 U.S. & Canada 57 18 7 12 29 19 11 153 147 31 16 47 40 50 21 352 Agriculture & Nutrition1.Asia PacificShanghai, China; Savli, IndiaEuropeIeper, Belgium; Aarhus, Denmark; Cernay, France; Szarvas, Hungary; Asturias, SpainLatin AmericaBarra Mansa, Brazil; Camacari, Brazil; Esteio, Brazil; Lerma, MexicoU.S.Mobile, AL; Valdosta, GA; Johnston, IA; El Paso, IL; Pryor, OK; Manati, Puerto Rico; Memphis, TN; LaPorte, TXElectronics & CommunicationsAsia PacificDongguan, China; Shenzhen, China; Hitachi, Japan; Tokai, Japan; Hsinchu, Taiwan; Taoyuan, TaiwanEuropeNeu Isenburg, Germany; Bristol, UK; Ruabon, UKU.S.Hayward, CA; Santa Barbara, CA; Torrance, CA; Fort Madison, IA; Louisville, KY; Fayetteville, NC; Research Triangle Park, NC; Parlin, NJ; Buffalo, NY; Rochester, NY; Circleville, OH; Dayton, OH; Towanda, PA; Manati, Puerto Rico; Bayport, TX; Logan, UTPerformance ChemicalsAsia PacificChangshu, China; Shenzhen, China; Madurai, India; Chiba, Japan; Shimizu, Japan; Kuan Yin, TaiwanEuropeMechelen, Belgium; Villers-St. Paul, France; Dordrecht, The Netherlands; Sudbury, UKLatin AmericaAltamira, MexicoU.S.El Dorado, AR; Edge Moor, DE; Red Lion, DE; Starke, FL; Louisville, KY; Wurtland, KY; Burnside, LA; La Place, LA; De Lisle, MS; Pascagoula, MS; Fayetteville, NC; Chambers Works, NJ; Deepwater, NJ; Linden, NJ; Parlin, NJ; Buffalo, NY; Niagara Falls, NY; Circleville, OH; Fort Hill, OH; Towanda, PA; North Kingstown, RI; Memphis, TN; New Johnsonville, TN; Baytown, TX; Beaumont, TX; Corpus Christi, TX; El Paso, TX; LaPorte, TX; James River, VA; Belle, WV; Parkersburg, WVPerformance CoatingsAsia PacificChangchun, China; Jiading, ChinaEuropeMechelen, Belgium; Wuppertal, GermanyLatin AmericaSao Paulo, BrazilU.S.Mount Clemens, MI; Houston, TX; Front Royal, VASites that are used by multiple segments are included more than once in the figures above.Part IITEM 2. PROPERTIES,continuedPerformance MaterialsAsia PacificBeijing, China; Shenzhen, China; Wuxi, China; Zhangjigang, China; Madurai, India; Savli, India; Chiba, Japan; Gifu, Japan; Ibaraki, Japan; Otake, Japan; Utsunomiya, Japan; Ulsan, Korea; SingaporeCanadaMaitland, Canada; Sarnia, CanadaEuropeAntwerp, Belgium; Mechelen, Belgium; Uentrop, Germany; Luxembourg; Dordrecht, The Netherlands; Landgraaf, The Netherlands; Dumfries, UKLatin AmericaBerazategui, ArgentinaU.S.Newark, DE; La Place, LA; Fayetteville, NC; Deepwater, NJ; Ashland, OH; Circleville, OH; Cleveland, OH; Upper Sandusky, OH; Copper River, SC; Chattanooga, TN; La Porte, TX; Orange, TX; Victoria, TX; Hopewell, VA; Richmond, VA; Parkersburg, WVSafety & ProtectionAsia PacificGuangzhou, China; Ulsan, KoreaCanadaThetford Mines, CanadaEuropeLuxembourg; Maydown, UK; Asturias, SpainU.S.Martinez, CA; Leawood, KS; Parsippany, NJ; Buffalo, NY; Cooper River, SC; Richmond, VA; Virgina Beach, VASales as a percent ofThe company believes it has sufficient production capacity were 81, 70 and 78 percentto meet demand in 2010, 2009 and 2008, respectively.2014. Properties are primarily owned by the company; however, certain properties are leased. No title examination of the properties has been made for the purpose of this report and certain properties are shared with other tenants under long-term leases.1916 to the Consolidated Financial Statements.LitigationImprelis1916 to the Consolidated Financial Statements under the heading PFOA.U.S. Environmental Protection Agency (EPA) is investigating threealleged non-compliance relates to chemical releases at DuPont's Belle facility in West Virginiabetween 2006 and 2010, including one release which occurred in January 2010. One of the releases involved the death of a DuPont employee after exposure to phosgene.January 2010, EPA and the U.S. Attorney's Office for New Jersey, informed DuPont that the government was initiatinginitiated an enforcement action arising from alleged environmental non-compliance at the Chambers Works facility. The government allegesalleging that the facility violated recordkeeping requirements of certain provisions of the Clean Air ActCAA and the Federal Clean Air Act Regulations (FCAR) governing Leak Detection and Reporting (LDAR) and that it failed to report emissions of a compound from Chambers Works' waste water treatment facility under the Emergency Planning and Community Right-to-Know Act.EPCRA. The alleged non-compliance was identified by EPA in 2007 and 2009 following separate environmental audits. DuPont is in settlement negotiations with EPA and DOJ.DepartmentLaPorte facility in January 2008. DuPont, EPA and DOJ began discussions in the fall 2011 relating to the management of Justice (DOJ).Chambers Works Plant, Deepwater, New JerseyOn September 29, 2010, DuPont received a draft Administrative Consent Order fromcertain materials in the New Jersey Department of Environmental Protection (NJDEP) seeking a penalty for alleged violations of New Jerseyfacility's waste water treatment system, hazardous waste regulations dating backmanagement, flare and air emissions. These negotiations continue.April 2009 based on a facility-widemultimedia inspection that EPA conducted at the Sabine facility in March 2009. The discussions involve the management of materials in the facility's waste water treatment system, hazardous waste audit conductedmanagement, flare and air emissions.May 2010. DuPont is in negotiations with NJDEP.Chambers Works Plant, Deepwater, New JerseyDOJ concerning allegationsDOJ.non-complianceaudit conducted in 2007 and the submission of responses to an information request received in 2009. DuPont is in settlement negotiations with the EPA and DOJ.Chambers Works facility. The allegations arose from an ongoing investigation into DuPont's management of hazardous wastecompany's surface mine in rail cars.TSCA Voluntary AuditDuPont voluntarily undertook a self-audit concerning reporting of inhalation studies pursuantStarke, Florida is included in Exhibit 95 to Toxic Substances Control Act (TSCA) section 8(e). DuPont voluntarily reported the results of that audit to EPA. The EPA has reviewed the information submitted under this self-audit and has indicated potential violations exist with respect to some of the submitted studies. In December 2010, the agreement to settle this matter for a penalty of $3.3 million was approved by EPA's Environmental Appeals Board.81,00070,000 at January 31, 2011.20102013 and 20092012 are shown below. Market Prices Market Prices 2010 High Low Per Share

Dividend

Declared $ 50.17 $ 44.21 $ 0.41 45.87 33.73 0.41 41.45 33.66 0.41 39.04 31.88 0.41 2013 High Low $ 35.62 $ 30.06 $ 0.41 $ 65.00 $ 56.46 $ 0.45 34.59 23.91 0.41 60.86 52.04 0.45 30.23 21.62 0.41 57.25 48.21 0.45 27.98 16.05 0.41 50.20 45.11 0.43 2012 Fourth Quarter $ 50.96 $ 41.67 $ 0.43 Third Quarter 52.33 46.15 0.43 Second Quarter 53.98 46.44 0.43 First Quarter 53.95 45.84 0.41 In June 2001, the Board of Directors authorized up to $2 billion for repurchasesstock. During the fourth quarter 2010, the company paid $250 million to purchase and retire 5.4 million shares at an average price of $46.34 per share under this plan. As of December 31, 2010, cumulative purchases of common stock under this plan are 25.9 million shares at a cost of $1.2 billion. There is no expiration date on the current authorization and no determination has been made by the company to suspend or cancel purchases under the plan.The following table summarizes information with respect to the company's purchases of its common stock during the fourth quarter 2010: Month Total Number

of Shares

Purchased Average Price

Paid per Share Total Number of

Shares Purchased

as Part of Publicly

Announced

Program Approximate Value

of Shares that May

Yet Be Purchased

Under the Program

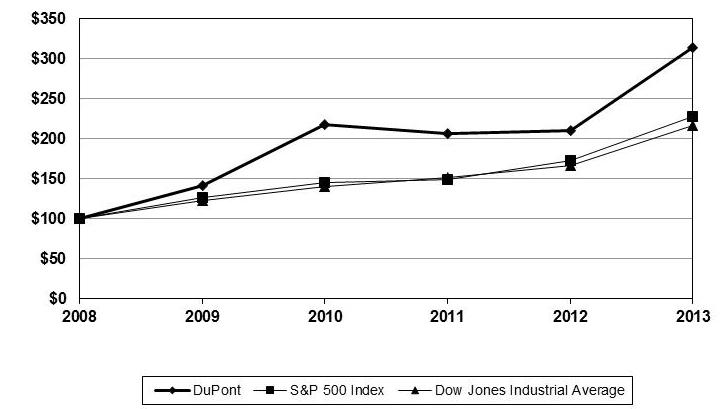

(Dollars in millions) 5,395,024 $ 46.34 5,395,024 $ 788 5,395,024 5,395,024 a self-constructed peer group of companies. The peer group companies for the year ended December 31, 2010 are 3M Company; Abbott Laboratories; Air Products & Chemicals, Inc.; Baxter International Inc.; The Boeing Company; Caterpillar Inc.; Eastman Kodak Company; Emerson Electric Co.; Hewlett-Packard Company; Honeywell International Inc.; Ingersoll-Rand Company Limited; Johnson & Johnson; Johnson Controls, Inc.; Kimberly-Clark Corporation; Merck & Co. Inc.; Monsanto Company; Motorola Inc.; The Procter & Gamble Company; and United Technologies Corporation.Stock Performance Graph