Use these links to rapidly review the document

TABLE OF CONTENTSTABLE OF CONTENTS2ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, | ||

OR | ||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

Commission file number 00-30747

PACWEST BANCORP

(Exact Name of Registrant as Specified in Its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) | 33-0885320 (I.R.S. Employer Identification No.) | |

10250 Constellation Blvd., Suite 1640 | ||

| Los Angeles, California | 90067 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code:(310) 286-1144

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

|---|---|---|

| Common stock, $.01 par value per share | The Nasdaq Stock Market, LLC |

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes oý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated filer o | Accelerated filer ý | Non-Accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act.) Yes o No ý

As of June 30, 2010,2011, the aggregate market value of the voting common stock held by non-affiliates of the registrant, computed by reference to the average high and low sales prices on The Nasdaq Global Select Market as of the close of business on June 30, 2010,2011, was approximately $562.8$615.0 million. Registrant does not have any nonvoting common equities.

As of March 2, 2011,2012, there were 35,461,61035,680,378 shares of registrant's common stock outstanding, excluding 1,426,687treasury shares and 1,617,760 shares of unvested restricted stock.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Items 10, 11, 12, 13 and 14 of Part III of this Annual Report on Form 10-K will be found in the Company's definitive proxy statement for its 20112012 Annual Meeting of Stockholders, to be filed pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended, and such information is incorporated herein by this reference.

PACWEST BANCORP20102011 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

PART I | ||||||

ITEM 1. | Business | 3 | ||||

General | 3 | |||||

Recent Transactions | 3 | |||||

Banking Business | ||||||

Strategic Evolution and Acquisition Strategy | ||||||

Competition | ||||||

Employees | ||||||

Financial and Statistical Disclosure | ||||||

Supervision and Regulation | ||||||

Available Information | ||||||

Forward-Looking Information | ||||||

ITEM 1A. | Risk Factors | |||||

ITEM 1B. | Unresolved Staff Comments | |||||

ITEM 2. | Properties | |||||

ITEM 3. | Legal Proceedings | |||||

ITEM 4. |

| |||||

| ||||||

ITEM 5. | Market For Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities | |||||

Marketplace Designation, Sales Price Information and Holders | ||||||

Dividends | ||||||

Securities Authorized for Issuance under Equity Compensation Plans | ||||||

Recent Sales of Unregistered Securities and Use of Proceeds | ||||||

Repurchases of Common Stock | ||||||

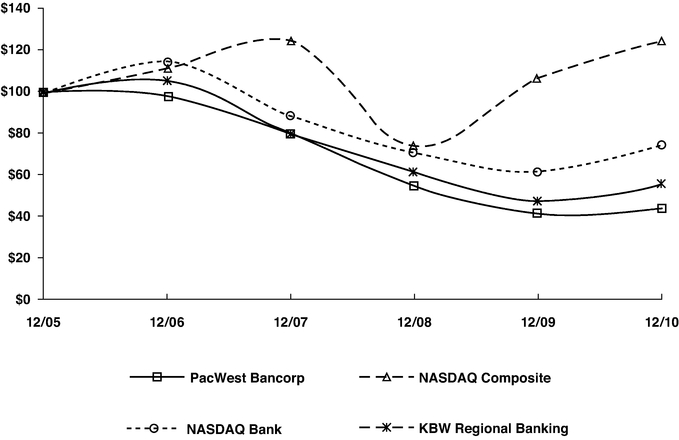

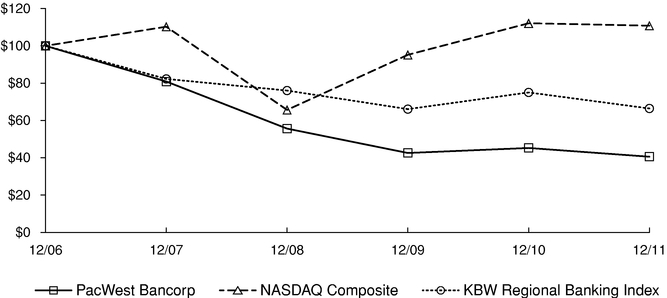

Five-Year Stock Performance Graph | ||||||

ITEM 6. | Selected Financial Data | |||||

ITEM 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |||||

Overview | ||||||

Key Performance Indicators | ||||||

Critical Accounting Policies | ||||||

Non-GAAP Measurements | 50 | |||||

Results of Operations | ||||||

Financial Condition | ||||||

Borrowings | ||||||

Capital Resources | ||||||

Liquidity | ||||||

Contractual Obligations | ||||||

Off-Balance Sheet Arrangements | ||||||

Recent Accounting Pronouncements | ||||||

ITEM 7A. | Quantitative and Qualitative Disclosures About Market Risk | |||||

PACWEST BANCORP

20102011 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS (Continued)

ITEM 8. | Financial Statements and Supplementary Data | |||||

Contents | ||||||

Management's Report on Internal Control Over Financial Reporting | ||||||

Report of Independent Registered Public Accounting Firm | ||||||

Consolidated Balance Sheets as of December 31, | ||||||

Consolidated Statements of Earnings (Loss) for the Years Ended December 31, 2011, 2010, | ||||||

Consolidated Statements of Comprehensive Income (Loss) for the Years Ended December 31, 2011, 2010, and 2009 | 103 | |||||

Consolidated Statements of Changes in Stockholders' Equity | ||||||

Consolidated Statements of Cash Flows for the Years Ended December 31, 2011, 2010, | ||||||

Notes to Consolidated Financial Statements | ||||||

ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |||||

ITEM 9A. | Controls and Procedures | |||||

ITEM 9B. | Other Information | |||||

| ||||||

ITEM 10. | Directors, Executive Officers and Corporate Governance | |||||

ITEM 11. | Executive Compensation | |||||

ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||||

ITEM 13. | Certain Relationships and Related Transactions, and Director Independence | |||||

ITEM 14. | Principal Accountant Fees and Services | |||||

| ||||||

ITEM 15. | Exhibits and Financial Statement Schedules | |||||

SIGNATURES | ||||||

CERTIFICATIONS | ||||||

PacWest Bancorp is a bank holding company registered under the Bank Holding Company Act of 1956, as amended. Our principal business is to serve as the holding company for our banking subsidiary, Pacific Western Bank, which we refer to as Pacific Western or the Bank. When we say "we", "our" or the "Company", we mean the Company on a consolidated basis with the Bank. When we refer to "PacWest" or to the holding company, we are referring to the parent company on a stand-alone basis.

PacWest Bancorp was formerly known as First Community Bancorp. At a special meeting of the Company's shareholders held on April 23, 2008, the shareholders approved the reincorporation of the Company in Delaware from California and the change of the Company's name to PacWest Bancorp from First Community Bancorp. The reincorporation became effective on May 14, 2008. In connection with the reincorporation and name change, the Company also changed its ticker symbol on the NASDAQ Global Select Market to "PACW." Other than the name change, change in ticker symbol and change in corporate domicile, the reincorporation did not result in any change in the business, physical location, management, assets, liabilities or total stockholders' equity of the Company, nor did it result in any change in location of the Company's employees, including the Company's management. Additionally, the reincorporation did not alter any shareholder's percentage ownership interest or number of shares owned in the Company. The stockholders' equity section of the accompanying consolidated financial statements has been restated retroactively

In January 2012, Pacific Western Bank acquired Marquette Equipment Finance, or MEF, an equipment leasing company, for $35 million in cash. At January 3, 2012, MEF had $162.2 million in gross leases and leases in process outstanding, with no leases on nonaccrual status. In addition, Pacific Western Bank assumed $154.8 million in outstanding debt and other liabilities, which included $129 million payable to give effect to the reincorporation. Such reclassification had no effectMEF's former parent. Pacific Western Bank repaid MEF's intercompany debt on the results of operations orclosing date from its excess liquidity on deposit at the total amount of stockholders' equity.Federal Reserve Bank.

During 2010, we completed the following transactions:

During 2009, we completed the following transactions:

SeeAcquisition Strategy", "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Overview", and NotesNote 3,Acquisitions, Note 4,Goodwill and Other Intangible Assets, Note 6,Loans, and 18Note 23,Subsequent Events, of the Notes to Consolidated Financial Statements contained in "Item 8. Financial Statements and Supplementary Data" for further information regarding recent transactions.

Pacific Western is a full-service commercial bank offering a broad range of banking products and services including: accepting timedemand, money market, and demandtime deposits; originating loans, including commercial, real estate construction, real estate miniperm, SBA guaranteed and consumer loans; and providing other business-oriented products. We have 7776 full-service community banking branches. Our operations are primarily located in Southern California andextending from California's Central Coast to San Diego County; we also operate three banking offices in the San Francisco Bay area, all of which were added through the Affinity acquisition. The Bank focuses on conducting business with small to medium size businesses in our marketplace and the owners and employees of those businesses. The majority of our loans are secured by the real estate collateral of such businesses. We extend credit to customers located primarily in counties we serve. We also provideOur asset-based lending and factoring of accounts receivable to small businesses located throughoutfunction operates in Arizona, California, Texas, and the Pacific NorthwestNorthwest. Our equipment leasing function, added through BFI Business Finance, or BFI, basedthe January 2012 MEF acquisition, operates in San Jose, CaliforniaUtah and First Community Financial, or FCF, basedhas lease receivables in Phoenix, Arizona.45 states. Special services, including international banking services, multi-state deposit

services and investment services, or requests beyond the lending limitsservice area or current offerings of the Bank can be arranged through correspondent banks. The Bank also issues ATM and debit cards, has a network of branded ATMs and offers access to ATM networks through other major service providers. We provide access to customer accounts via a 24-hour seven day a week toll-free automated telephone customer service and a secure online banking service.

At December 31, 2010 our assets totaled $5.5 billion, of which gross non-covered loans totaled $3.2 billion, or 57% of assets, and covered loans totaled $908.6 million, or 16% of assets. At this date, the non-covered loans were composed of approximately 22% in commercial loans, 64% in commercial real estate loans, 8% in residential real estate loans, 3% in commercial real estate construction loans, 2% in residential real estate construction loans, and 1% in consumer and other loans. These percentages include some foreign loans, primarily to entities, and on a limited basis to individuals, with business in Mexico, representing 1% of non-covered loans.

We are committed to maintaining premier, relationship-based community banking in Southern California serving the needs of those businesses in our marketplace, as well as serving the needs of growing businesses that may not yet meet the credit standards of the Bank, through tightly controlled asset-based lending and factoring of accounts receivable. We compete actively for deposits, and emphasize solicitation of noninterest-bearing deposits. In managing the top line of our business, we focus on making quality loans and gathering low-cost deposits to maximize our net interest margin, as

net interest income accounted for 84% of our net revenues (net interest income plus noninterest income) in 2010.margin. The strategy for serving our target markets is the delivery of a finely-focused set of value-added products and services that satisfy the primary needs of our customers, emphasizing superior service and relationships over transaction volume or low pricing.

We generate our revenue primarily from the interest received on the various loan products and investment securities and fees from providing deposit services, foreign exchange services and extending credit. Our major operating expenses are the interest paid by the Bank on deposits and borrowings, employee compensation and general operating expenses. The Bank relies on a foundation of locally generated and relationship-based deposits to fund loans. Our Bank has a relatively low cost of funds due to a high percentage of noninterest-bearing and low cost deposits to total deposits. Our operations, similar to other financial institutions with operations predominately focused in Southern California, are significantly influenced by economic conditions in Southern California, including the strength of the real estate market, the fiscal and regulatory policies of the federal and state governmentgovernments and the regulatory authorities that govern financial institutions. See "—Supervision and Regulation." Through our offices located in Northern California, and our asset-based lending operations with production and marketing offices located in Arizona, Northern California, and the Pacific Northwest, and our equipment leasing operations located in Utah, we are also subject to the economic conditions affecting these markets.

Lending Activities

Through the Bank, the Company concentrates its lending activities in four principal areas:

(1) Real Estate Loans. Real estate loans are comprised of construction loans, miniperm loans collateralized by first or junior deeds of trust on specific commercial properties and equity lines of credit. The properties collateralizing real estate loans are principally located in our primary market areas of Los Angeles, Orange, San Bernardino, Riverside, San Diego, Ventura, Santa Barbara and San Luis Obispo counties in California and the neighboring communities. Construction loans are comprised of loans on commercial, residential and income producing properties that generally have terms of less than two years and typically bear an interest rate that floats with the Bank's base rate or another established index. Miniperm loans finance the purchase and/or ownership of commercial properties, including owner-occupied and income producing properties. Miniperm loans are generally made with an amortization schedule ranging from 15 to 25 years with a lump sum balloon payment due in one to ten years. Equity lines of credit are revolving lines of credit collateralized by junior deeds of trust on residential real properties. They generally bear a rate of interest that floats with the Bank's base rate or the prime rate and have maturities of ten years. From time to time, we purchase participation interests in loans originated by other financial institutions. These loans are subject generally to the same underwriting criteria and approval process as loans originated directly by us.

The Bank's real estate portfolio is subject to certain risks, including, but not limited to: (i) the effects of economic downturns in the Southern California economy and in general; (ii) interest rate

increases; (iii) reduction in real estate values in Southern California and in general; (iv) increased competition in pricing and loan structure; (v) the borrower's ability to refinance or payoff the balloon or line of credit at maturity; and (vi) environmental risks, including natural disasters. In addition to the foregoing, construction loans are also subject to project specific risks including, but not limited to: (a) construction costs being more than anticipated; (b) construction taking longer than anticipated; (c) failure by developers and contractors to meet project specifications; (d) disagreement between contractors, subcontractors and developers; (e) demand for completed projects being less than anticipated; (f) buyers being unable to secure financing; and (g) loss through foreclosure.

When underwriting loans, we strive to reduce the exposure to such risks by (i) reviewing each loan request and renewal individually, (ii) using a dual signature approval system for the approval of each loan request for loans over a certain dollar amount, (iii) adhering to written loan policies, including,

among other factors, minimum collateral requirements, maximum loan-to-value ratio requirements, cash flow requirements and personal guarantees, (iv) obtaining independent third party appraisals which are reviewed by the Bank's appraisal department, (v) obtaining external independent credit reviews, (vi) evaluating concentrations as a percentage of capital and loans, and (vii) conducting environmental reviews, where appropriate. With respect to construction loans, in addition to the foregoing, we attempt to mitigate project specific risks by: (a) implementing a controlled disbursement process for loan proceeds in accordance with an agreed upon schedule; (b) conducting project site visits; and (c) adhering to release-price schedules to ensure the prices for which newly-built units to be sold are sufficient to repay the Bank. The risks related to buyer inability to secure financing and loss through foreclosure are not controllable. We review each loan request on the basis of our ability to recover both principal and interest in view of the inherent risks.

(2) Commercial Loans. Commercial loans, both domestic and foreign, are made to finance operations, to provide working capital, or for specific purposes such as to finance the purchase of assets, equipment or inventory. Since a borrower's cash flow from operations is generally the primary source of repayment, our policies provide specific guidelines regarding required debt coverage and other important financial ratios. Commercial loans include lines of credit and commercial term loans. Lines of credit are extended to businesses or individuals based on the financial strength and integrity of the borrower and guarantor(s) and generally (with some exceptions) are collateralized by short-term assets such as accounts receivable, inventory, equipment or real estate and have a maturity of one year or less. Such lines of credit bear an interest rate that floats with the Bank's base rate, LIBOR or another established index. Commercial term loans are typically made to finance the acquisition of fixed assets, refinance short-term debt originally used to purchase fixed assets or, in rare cases, to finance the purchase of businesses. Commercial term loans generally have terms from one to five years. They may be collateralized by the asset being acquired or other available assets and bear interest rates which either float with the Bank's base rate, LIBOR or another established index or remain fixed for the term of the loan.

The Bank's portfolio of commercial loans is subject to certain risks, including, but not limited to: (i) the effects of economic downturns in the Southern California economy; (ii) interest rate increases; (iii) deterioration of the value of the underlying collateral; and (iv) the deterioration of a borrower's or guarantor's financial capabilities. We strive to reduce the exposure to such risks through: (a) reviewing each loan request and renewal individually; (b) using a dual signature approval system; (c) adhering to written loan policies; (d) obtaining external independent credit reviews, and (e) in the case of certain commercial loans to Mexican or foreign entities, third party insurance which limits our exposure to anywhere from 20 to 30 percent of the underlying loan. In addition, loans based on short-term asset values and factoring arrangements are monitored on a daily, weekly, monthly or quarterly basis and may include lockbox or control account arrangements. In general, the Bank receives and reviews financial statements and other documents of borrowing customers on an ongoing basis during the term of the relationship and responds to any deterioration noted.

(3) SBA Loans. SBA loans are made through programs designed by the federal government to assist the small business community in obtaining financing from financial institutions that are given government guarantees as an incentive to make the loans. Our SBA loans fall into two categories, loans originated under the SBA's 7a Program ("7a Loans") and loans originated under the SBA's 504 Program ("504 Loans"). SBA 7a Loans are commercial business loans generally made for the purpose of purchasing real estate to be occupied by the business owner, providing working capital, and/or purchasing equipment, accounts receivable or inventory. SBA 504 Loans are collateralized by commercial real estate and are generally made to business owners for the purpose of purchasing or improving real estate for their use and for equipment used in their business. Due to declining SBA loan origination and loan sale opportunities, we suspended our loan sale operation during 2008 and reduced staff accordingly.

SBA lending is subject to federal legislation that can affect the availability and funding of the program. From time to time, this dependence on legislative funding causes limitations and uncertainties with regard to the continued funding of such programs, which could potentially have an adverse financial impact on our business.

The Bank's portfolio of SBA loans is subject to certain risks, including, but not limited to: (i) the effects of economic downturns in the Southern California economy; (ii) interest rate increases; (iii) deterioration of the value of the underlying collateral; and (iv) the deterioration of a borrower's or guarantor's financial capabilities. We strive to reduce the exposure of such risks through: (a) reviewing each loan request and renewal individually; (b) using a dual signature approval system; (c) adhering to written loan policies; (d) adhering to SBA written policies and regulations; (e) obtaining independent third party appraisals which are reviewed by the Bank's appraisal department; and (f) obtaining external independent credit reviews. In addition, SBA loans normally require monthly installment payments of principal and interest and therefore are continually monitored for past due conditions. In general, the Bank receives and reviews financial statements and other documents of borrowing customers on an ongoing basis during the term of the relationship and responds to any deterioration noted.

(4) Consumer Loans. Consumer loans include personal loans, auto loans, boat loans, home improvement loans, revolving lines of credit and other loans typically made by banks to individual borrowers. The Bank does not currently originate first trust deed home mortgage loans. The Bank's consumer loan portfolio is subject to certain risks, including: (i) amount of credit offered to consumers in the market; (ii) interest rate increases; and (iii) consumer bankruptcy laws which allow consumers to discharge certain debts. We strive to reduce the exposure to such risks through the direct approval of all consumer loans by: (a) reviewing each loan request and renewal individually; (b) using a dual signature approval system; (c) adhering to written credit policies; and (d) obtaining external independent credit reviews.

As part of our efforts to achieve long-term stable profitability and respond to a changing economic environment in Southern California and in other areas where we operate, we constantly evaluate a variety of options to augment our traditional focus by broadening the services and products we provide. Possible avenues of growth include more branch locations, expanded days and hours of operation and new types of loan and deposit products. To date, we have not expanded into areas of brokerage, annuity, insurance or similar investment products and services and have concentrated primarily on the core businesses of accepting deposits, making loans and extending credit.

Business Concentrations

The following tables present the composition of our loan portfolio by segment and class, showing the non-covered and covered components, as of the dates indicated:

| | December 31, 2011 | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Total Loans | Non-Covered Loans | Covered Loans | ||||||||||||||||

| | Amount | % of Total | Amount | % of Total | Amount | % of Total | |||||||||||||

| | (Dollars in thousands) | ||||||||||||||||||

Real estate mortgage: | |||||||||||||||||||

Hospitality | $ | 147,346 | 4 | % | $ | 144,402 | 5 | % | $ | 2,944 | — | ||||||||

SBA 504 | 58,377 | 2 | % | 58,377 | 2 | % | — | — | |||||||||||

Other | 2,513,099 | 69 | % | 1,779,685 | 63 | % | 733,414 | 91 | % | ||||||||||

Total real estate mortgage | 2,718,822 | 75 | % | 1,982,464 | 70 | % | 736,358 | 91 | % | ||||||||||

Real estate construction: | |||||||||||||||||||

Residential | 39,190 | 1 | % | 17,669 | 1 | % | 21,521 | 3 | % | ||||||||||

Commercial | 120,787 | 3 | % | 95,390 | 3 | % | 25,397 | 3 | % | ||||||||||

Total real estate construction | 159,977 | 4 | % | 113,059 | 4 | % | 46,918 | 6 | % | ||||||||||

Total real estate loans | 2,878,799 | 79 | % | 2,095,523 | 74 | % | 783,276 | 97 | % | ||||||||||

Commercial: | |||||||||||||||||||

Collateralized | 438,828 | 12 | % | 414,020 | 15 | % | 24,808 | 3 | % | ||||||||||

Unsecured | 79,739 | 2 | % | 78,937 | 3 | % | 802 | — | |||||||||||

Asset-based | 149,987 | 4 | % | 149,987 | 5 | % | — | — | |||||||||||

SBA 7(a) | 28,995 | 1 | % | 28,995 | 1 | % | — | — | |||||||||||

Total commercial | 697,549 | 19 | % | 671,939 | 24 | % | 25,610 | 3 | % | ||||||||||

Consumer | 24,446 | 1 | % | 23,711 | 1 | % | 735 | — | |||||||||||

Foreign | 20,932 | 1 | % | 20,932 | 1 | % | — | — | |||||||||||

Total gross loans | $ | 3,621,726 | 100 | % | $ | 2,812,105 | 100 | % | 809,621 | 100 | % | ||||||||

Covered loans: | |||||||||||||||||||

Discount | (75,323 | ) | |||||||||||||||||

Allowance for loan losses | (31,275 | ) | |||||||||||||||||

Covered loans, net | $ | 703,023 | |||||||||||||||||

| | December 31, 2010 | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Total Loans | Non-Covered Loans | Covered Loans | ||||||||||||||||

| | Amount | % of Total | Amount | % of Total | Amount | % of Total | |||||||||||||

| | (Dollars in thousands) | ||||||||||||||||||

Real estate mortgage: | |||||||||||||||||||

Hospitality | $ | 159,650 | 4 | % | $ | 156,652 | 5 | % | $ | 2,998 | — | ||||||||

SBA 504 | 69,287 | 2 | % | 69,287 | 2 | % | — | — | |||||||||||

Other | 2,965,094 | 70 | % | 2,048,794 | 65 | % | 916,300 | 87 | % | ||||||||||

Total real estate mortgage | 3,194,031 | 76 | % | 2,274,733 | 72 | % | 919,298 | 87 | % | ||||||||||

Real estate construction: | |||||||||||||||||||

Residential | 109,680 | 2 | % | 65,043 | 2 | % | 44,637 | 4 | % | ||||||||||

Commercial | 161,539 | 4 | % | 114,436 | 3 | % | 47,103 | 5 | % | ||||||||||

Total real estate construction | 271,219 | 6 | % | 179,479 | 5 | % | 91,740 | 9 | % | ||||||||||

Total real estate loans | 3,465,250 | 82 | % | 2,454,212 | 77 | % | 1,011,038 | 96 | % | ||||||||||

Commercial: | |||||||||||||||||||

Collateralized | 396,400 | 9 | % | 358,427 | 11 | % | 37,973 | 4 | % | ||||||||||

Unsecured | 130,945 | 3 | % | 129,743 | 4 | % | 1,202 | — | |||||||||||

Asset-based | 144,748 | 4 | % | 143,167 | 5 | % | 1,581 | — | |||||||||||

SBA 7(a) | 32,220 | 1 | % | 32,220 | 1 | % | — | — | |||||||||||

Total commercial | 704,313 | 17 | % | 663,557 | 21 | % | 40,756 | 4 | % | ||||||||||

Consumer | 26,005 | 1 | % | 25,058 | 1 | % | 947 | — | |||||||||||

Foreign | 22,608 | 0 | % | 22,608 | 1 | % | — | — | |||||||||||

Total gross loans | $ | 4,218,176 | 100 | % | $ | 3,165,435 | 100 | % | 1,052,741 | 100 | % | ||||||||

Covered loans: | |||||||||||||||||||

Discount | (110,901 | ) | |||||||||||||||||

Allowance for loan losses | (33,264 | ) | |||||||||||||||||

Covered loans, net | $ | 908,576 | |||||||||||||||||

No individual or single group of related accounts is considered material in relation to our total assets or deposits of the Bank, or in relation to the overall business of the Company. However, approximately 77%79% of our total gross non-covered and covered loan portfolio at December 31, 20102011 consisted of real estate-relatedestate loans, including construction loans, miniperm loans, commercial real estate mortgageSBA 504 loans, and commercial loans secured by commercial real estate.construction loans. See "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Financial Condition—Non-coveredNon-Covered Loans," and also "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Financial Condition—Covered Loans." Since our business activities are currently focused primarily in Southern California, with the majority of our business concentrated in Los Angeles, Orange, Riverside, San Bernardino, San Diego, Ventura, Santa Barbara and San Luis Obispo Counties, our results of operations and financial condition are dependent upon the general trends in the Southern California economies and, in particular, the residential and commercial real estate markets. The concentration of our operations in Southern California exposes us to greater risk than other banking companies with a wider geographic base in the event of catastrophes, such as earthquakes, fires and floods in this region. We conduct

Our foreign lending activities includingloans consist predominately of commercial and real estate lending, consisting predominantly of loans to individuals or entities located in Mexico. At December 31, 2010, our foreign loans consisted of approximatelyMexico and represent less than 1% of our non-covered loan portfolio.portfolio at December 31, 2011. Such foreign loans are denominated in U.S. dollars and most are collateralized by assets located in the United States or are guaranteed or insured by businesses located

in the United States. We have continued to allow our foreign loan portfolio to repay in the ordinary course of business without making any new privately-insured foreign loans other than those under existing commitments.

Strategic Evolution and Acquisition Strategy

The Company was organized on October 22, 1999 as a California corporation for the purpose of becoming a bank holding company and to acquire all the outstanding capital stock of Rancho Santa Fe National Bank. Since that time, we have grown through a series of business acquisitions. Most recently, in August 2010 we purchased certain assets and assumed certain liabilities of Los Padres Bank from the FDIC, as receiver of Los Padres Bank.

The following chart summarizes the acquisitions completed since our inception, some of which are described in more detail below. See also Note 3,Acquisitions, of the Notes to Consolidated Financial Statements contained in "Item 8. Financial Statements and Supplementary Data" in Part II of this Annual Report on Form 10-K for further details regarding ourrecent acquisitions.

| | Date | Institution/Company Acquired | ||

|---|---|---|---|---|

| (1) | May 2000 | Rancho Santa Fe National Bank | ||

| (2) | May 2000 | First Community Bank of the Desert | ||

| (3) | January 2001 | Professional Bancorp, Inc. | ||

| (4) | October 2001 | First Charter Bank | ||

| (5) | January 2002 | Pacific Western National Bank | ||

| (6) | March 2002 | W.H.E.C., Inc. | ||

| (7) | August 2002 | Upland Bank | ||

| (8) | August 2002 | Marathon Bancorp | ||

| (9) | September 2002 | First National Bank | ||

| (10) | January 2003 | Bank of Coronado | ||

| (11) | August 2003 | Verdugo Banking Company | ||

| (12) | March 2004 | First Community Financial Corporation | ||

| (13) | April 2004 | Harbor National Bank | ||

| (14) | August 2005 | First American Bank | ||

| (15) | October 2005 | Pacific Liberty Bank | ||

| (16) | January 2006 | Cedars Bank | ||

| (17) | May 2006 | Foothill Independent Bancorp | ||

| (18) | October 2006 | Community Bancorp Inc. | ||

| (19) | June 2007 | Business Finance Capital Corporation | ||

| (20) | November 2008 | Security Pacific Bank (deposits only) | ||

| (21) | August 2009 | Affinity Bank | ||

| (22) | August 2010 | Los Padres Bank | ||

| (23) | January 2012 | Marquette Equipment Finance |

Our acquisitions focused generally on increasing our banking presence in California and increasing earning assets. Our most recent acquisition of an interest-earning asset generation company added earning assets and deployed excess liquidity and the FDIC-assisted banking acquisitions expanded our operations and branch banking network in California.

Security Pacific Bank DepositMarquette Equipment Finance Acquisition

On November 7, 2008, we assumed $427.5January 3, 2012, Pacific Western Bank completed the acquisition of Marquette Equipment Finance, or MEF, an equipment leasing company located in Midvale, Utah. Pacific Western Bank acquired all of the capital stock of MEF from Meridian Bank, N.A. for $35 million in deposits fromcash. MEF focuses on business-essential equipment leases throughout the FDIC as receiver of Security Pacific Bank, or SPB, formerly a Los Angeles-based bank. We assumed all insuredUnited States with transactions primarily in the mid-ticket segment. This acquisition diversifies our loan portfolio, expands our product line, and uninsured deposits and paid a 2% premium of approximately $5.1 million related to the non-brokered deposit base of $258 million. The estimated brokered deposits as of the assumption date totaled $169 million. Such deposit assumption was net of acquiring cash, certificates of deposit in other financial institutions, federal funds sold, securities, and loans secured by assumed deposits. As part of the SPB deposit acquisition weprovides growth opportunities. It also purchased an additional $31importantly deployed our excess liquidity into higher-yielding assets.

At January 3, 2012, MEF had $162.2 million in loans. The Security Pacific Bank acquisition was made to expand our presencegross leases and leases in process outstanding, with no leases on nonaccrual status. MEF's leases are spread across 18 industries, with the Los Angeles area and to gain experience with FDIC-assisted transactions.top three being

Affinity Bank Acquisition

On August 28, 2009, we acquired substantially allfinancial services/insurance, manufacturing, and health care and representing 68% of the assets of Affinity Bank, including all loans,lease portfolio balance. The weighted average yield on the lease portfolio at year end 2011 was approximately 9% and assumed substantially all of its liabilities, including the insured and uninsured deposits and excluding certain brokered deposits, from the FDIC in an FDIC-assisted transaction, which we refer to as the Affinity acquisition.weighted average remaining maturity was 34 months. In addition, Pacific Western (i) acquired $675.6Bank assumed $154.8 million in loans, $22.9 million in foreclosed assets, $175.4 million in investments and $371.5 million in cashoutstanding debt and other liabilities, which included $129 million payable to MEF's former parent. Pacific Western Bank repaid MEF's intercompany debt on the closing date from its excess liquidity on deposit at the Federal Reserve Bank. This resulted in MEF's interest-earning assets and (ii) assumed $868.2 million in deposits, $305.8 million in borrowings, and $32.6 million in other liabilities. In connectionbeing funded with the Affinity acquisition, the FDIC made a cash paymentour low-cost deposit base.

Effective March 23, 2012, MEF will change its name to Pacific Western Equipment Finance and operate under this name as a division of $87.2 million. We entered into a loss sharing agreement with the FDIC, whereby the FDIC agreed to cover a substantial portion of any future losses on acquired loans, other real estate owned and certain investment securities. Under the terms of such loss sharing agreement, the FDIC will absorb 80% of losses and receive 80% of loss recoveries on the first $234 million of losses on covered assets and absorb 95% of losses and receive 95% of loss recoveries on covered assets exceeding $234 million. The loss sharing agreement is in effect for 5 years for commercial assets (non-residential loans, OREO and certain securities) and 10 years for residential loans from the August 28, 2009 acquisition date. The loss recovery provisions are in effect for 8 years for commercial assets and 10 years for residential loans from the acquisition date. We refer to the acquired assets subject to the loss sharing agreement collectively as "covered assets." Affinity was a full service commercial bank headquartered in Ventura, California that operated 10 branch locations in California. We made this acquisition to expand our presence in California.Pacific Western Bank. Pacific Western Bank retained all 71 MEF employees.

Los Padres Bank Acquisition

On August 20, 2010, we acquired certain assets of Los Padres Bank, including all loans, and assumed substantially all of its liabilities, including all deposits, from the FDIC in an FDIC-assisted acquisition, which we refer to as the Los Padres acquisition. Pacific Western (i) acquired $437.1 million in loans, $33.9 million in other real estate owned, $44.3 million in investments, and $261.5 million in cash and other assets and (ii) assumed $752.2 million in deposits, $70.0 million in borrowings, and $1.9 million in other liabilities. In connection with the Los Padres acquisition, the FDIC made a cash payment to Pacific Western of $144.0 million. Other than a deposit premium of $3.4 million, we paid no cash or other consideration to acquire Los Padres.

We entered into a loss sharing agreement with the FDIC, whereby the FDIC agreed to cover a substantial portion of any future losses on acquired loans, with the exception of consumer loans, and other real estate owned. Under the terms of such loss sharing agreement, the FDIC is obligated to reimburse the Bank for 80% of losses with respect to the covered assets. The Bank will reimburse the FDIC for 80% of recoveries with respect to losses for which the FDIC paid the Bank 80% reimbursement under the loss sharing agreement. The loss sharing arrangementprovisions for single family covered assets and commercial (non-single family) covered assets isare in effect for 10 years and 5 years, respectively, from the acquisition date, and the loss recovery provisions are in effect for 10 years and 8 years, respectively, from the acquisition date. We refer to the acquired assets subject to the loss sharing agreement collectively as "covered assets."

Los Padres was a federally chartered savings bank headquartered in Solvang, California that operated 14 branches, including 11 branches in California (three in Ventura County, four in Santa Barbara County, and four in San Luis Obispo County) and three branches in Arizona (Maricopa County). After office consolidations in February 2011, therewe are nine remainingoperating eight of the former Los Padres branch offices, with eightall of which are located in California and one in Arizona.California. We made this acquisition to expand our presence in the Central Coast of California.

Affinity Bank Acquisition

On August 28, 2009, we acquired substantially all of the assets of Affinity Bank, including all loans, and assumed substantially all of its liabilities, including the insured and uninsured deposits and excluding certain brokered deposits, from the FDIC in an FDIC-assisted transaction, which we refer to as the Affinity acquisition. Pacific Western (i) acquired $675.6 million in loans, $22.9 million in foreclosed assets, $175.4 million in investments and $371.5 million in cash and other assets, and (ii) assumed $868.2 million in deposits, $305.8 million in borrowings, and $32.6 million in other liabilities. In connection with the Affinity acquisition, the FDIC made a cash payment to Pacific Western of $87.2 million.

We entered into a loss sharing agreement with the FDIC, whereby the FDIC agreed to cover a substantial portion of any future losses on acquired loans, other real estate owned, or OREO, and

certain investment securities. Under the terms of such loss sharing agreement, the FDIC will absorb 80% of losses and receive 80% of loss recoveries on the first $234 million of losses on covered assets and absorb 95% of losses and receive 95% of loss recoveries on covered assets exceeding $234 million. The loss sharing provisions are in effect for 5 years for commercial assets (non-residential loans, OREO and certain securities) and 10 years for residential loans from the August 28, 2009 acquisition date. The loss recovery provisions are in effect for 8 years for commercial assets and 10 years for residential loans from the acquisition date. We refer to the acquired assets subject to the loss sharing agreement collectively as "covered assets." Affinity was a full service commercial bank headquartered in Ventura, California that operated 10 branch locations in California, all of which we continue to operate. We made this acquisition to expand our presence in California.

The banking business in California, and specifically in the Bank's primary service areas, is highly competitive with respect to originating loans, acquiring deposits and providing other banking services. The market is dominated by commercial banks in Southern California with assets between $500 million

and $25 billion, including ourselves, and a few banking giants with a large number of offices and full-service operations over a wide geographic area. In recent years, competition has increased from institutions not subject to the same regulatory restrictions as domestic banks and bank holding companies. Those competitors include savings and loan associations, brokerage houses, insurance companies, mortgage companies, credit unions, credit card companies, and other financial and non-financial institutions and entities.

Economic factors, along with legislative and technological changes, will have an ongoing impact on the competitive environment within the financial services industry. We work to anticipate and adapt to dynamic competitive conditions whether it may be developing and marketing innovative products and services, adopting or developing new technologies that differentiate our products and services, cross marketing, or providing highly personalized banking services. We strive to distinguish ourselves from other community banks and financial services providers in our marketplace by providing an extremely high level of service to enhance customer loyalty and to attract and retain business. However, we can provide no assurance as to the effectiveness of these efforts on our future business or results of operations, as to our continued ability to anticipate and adapt to changing conditions, and as to sufficiently improving our services and/or banking products in order to successfully compete in our primary service areas.

As of February 28, 2011,2012, the Company had 929982 full time equivalent employees.

Financial and Statistical Disclosure

Certain of our statistical information is presented within "Item 6. Selected Financial Data," "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Item 7A. Qualitative and Quantitative Disclosure About Market Risk." This information should be read in conjunction with the consolidated financial statements contained in "Item 8. Financial Statements and Supplementary Data."

General

The banking and financial services business in which we engage is highly regulated. Such regulation is intended, among other things, to protect the interests of customers, including depositors. These regulations are not, however, generally charged with protecting the interests of our shareholders or

creditors. Described below are the material elements of selected laws and regulations applicable to PacWest and its subsidiaries. The descriptions are not intended to be complete and are qualified in their entirety by reference to the full text of the statutes and regulations described. Changes in applicable law or regulations, and in their application by regulatory agencies, cannot be predicted, but they may have a material effect on the business and results of PacWest and its subsidiaries.

The commercial banking business is also influenced by the monetary and fiscal policies of the federal government and the policies of the Board of Governors of the Federal Reserve Bank,System, or FRB. The FRB implements national monetary policies (with the dual mandate of price stability and maximum employment) by its open-market operations in United States Government securities, by adjusting the required level of and paying interest on reserves for financial intermediaries subject to its reserve requirements and by varying the discount rates applicable to borrowings by depository institutions. The actions of the FRB in these areas influence the growth of bank loans, investments and deposits and also affect interest rates charged on loans and paid on deposits. Indirectly, such actions may also impact the ability of non-bank financial institutions to compete with the Bank. The nature and impact of any future changes in monetary policies cannot be predicted.

The events of the past few years have led to numerous new laws in the United States and internationally for financial institutions. The Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act" or "Dodd-Frank"), which was enacted in July 2010, significantly restructuresrestructured the financial regulatory regime in the United States, including through the creation of a new systemic risk oversight body, the Financial Stability Oversight Council ("FSOC"). The FSOC will overseeoversees and coordinate the efforts of the primary U.S. financial regulatory agencies (including the FRB, the SEC, the Commodity Futures Trading Commission and the FDIC) in establishing regulations to address financial stability concerns. In addition to the framework for systemic risk oversight implemented through the FSOC, the Dodd-Frank Act broadly affectsaffected the financial services industry by creating a resolution authority, mandating higher capital and liquidity requirements, requiring banks to pay increased fees to regulatory agencies, and through numerous other provisions aimed at strengthening the sound operation of the financial services sector. As discussed further throughout this section, many aspects of Dodd-Frank arecontinue to be subject to further rulemaking and will take effect over several years, making it difficult to anticipate the overall financial impact on PacWest or across the industry.

Bank Holding Company Regulation

As a bank holding company, PacWest is registered with and subject to regulation by the FRB under the Bank Holding Company Act of 1956, as amended, or the BHCA. FRB policy historically has required bank holding companies to act as a source of financial strength to their bank subsidiaries and to commit capital and financial resources to support those subsidiaries in circumstances where it might not otherwise do so. The Dodd-Frank Act codifiescodified this policy as a statutory requirement. Under this requirement, the Company is expected to commit resources to support the Bank, including at times when we may not be in a financial position to do so. Similarly, under the cross-guarantee provisions of the Federal Deposit Insurance Act, the FDIC can hold any FDIC-insured depository institution liable for any loss suffered or anticipated by the FDIC in connection with (i) the default of a commonly controlled FDIC-insured depository institution or (ii) any assistance provided by the FDIC to such a commonly controlled institution. Under the BHCA, we are subject to periodic examination by the FRB. We are also required to file with the FRB periodic reports of our operations and such additional information regarding the Company and its subsidiaries as the FRB may require. Pursuant to the BHCA, we are required to obtain the prior approval of the FRB before we acquire all or substantially all of the assets of any bank or ownership or control of voting shares of any bank if, after giving effect to such acquisition, we would own or control, directly or indirectly, more than 5 percent of such bank.

Under the BHCA, we may not engage in any business other than managing or controlling banks or furnishing services to our subsidiaries that the FRB deems to be so closely related to banking as "to be a proper incident thereto." We are also prohibited, with certain exceptions, from acquiring direct or indirect ownership or control of more than 5 percent of the voting shares of any company unless the company is engaged in banking activities or the FRB determines that the activity is so closely related to banking as to be a proper incident to banking. The FRB's approval must be obtained before the shares of any such company can be acquired and, in certain cases, before any approved company can open new offices.

The BHCA and regulations of the FRB also impose certain constraints on the redemption or purchase by a bank holding company of its own shares of stock.

Additionally, bank holding companies that meet certain eligibility requirements prescribed by the BHCA and elect to operate as financial holding companies may engage in, or own shares in companies engaged in, a wider range of nonbanking activities, including securities and insurance activities and any other activity that the FRB, in consultation with the Secretary of the Treasury, determines by regulation or order is financial in nature, incidental to any such financial activity or complementary to any such financial activity and does not pose a substantial risk to the safety or soundness of depository institutions or the financial system generally. As of the date of this filing, we do not operate as a financial holding company.

Our earnings and activities are affected by legislation, by regulations and by local legislative and administrative bodies and decisions of courts in the jurisdictions in which we and the Bank conduct business. For example, these include limitations on the ability of the Bank to pay dividends to us and our ability to pay dividends to our shareholders. It is the policy of the FRB that bank holding companies should pay cash dividends on common stock only out of income available over the past year and only if prospective earnings retention is consistent with the organization's expected future needs and financial condition. The policy provides that bank holding companies should not maintain a level of cash dividends that undermines the bank holding company's ability to serve as a source of strength to its banking subsidiaries. Various federal and state statutory provisions limit the amount of dividends that subsidiary banks and savings associations can pay to their holding companies without regulatory approval.

In addition to these explicit limitations, the federal regulatory agencies have general authority to prohibit a banking subsidiary or bank holding company from engaging in an unsafe or unsound banking practice. Depending upon the circumstances, the agencies could take the position that paying a dividend would constitute an unsafe or unsound banking practice. Further, as discussed below under "—Regulation of the Bank", a bank holding company such as the Company is required to maintain minimum ratios of Tier 1 capital and total capital to total risk-weighted assets, and a minimum ratio of Tier 1 capital to total adjusted quarterly average assets as defined in such regulations. The level of our capital ratios may affect our ability to pay dividends. See "Item 5. Market for Registrant's Common Equity and Related Stockholder Matters—Dividends" and Note 19,Dividend Availability and Regulatory Matters, of the Notes to Consolidated Financial Statements contained in "Item 8. Financial Statements and Supplementary Data."

Banking subsidiaries of bank holding companies are also subject to certain restrictions imposed by federal law in dealings with their holding companies and other affiliates. Subject to certain exceptions set forth in the Federal Reserve Act, a bank can make a loan or extend credit to an affiliate, purchase or invest in the securities of an affiliate, purchase assets from an affiliate, accept securities of an affiliate as collateral for a loan or extension of credit to any person or company, issue a guarantee or accept letters of credit on behalf of an affiliate only if the aggregate amount of the above transactions of such subsidiary does not exceed 10 percent of such subsidiary's capital stock and surplus on an individual basis or 20 percent of such subsidiary's capital stock and surplus on an aggregate basis. Such

transactions must be on terms and conditions that are consistent with safe and sound banking practices. A bank holding company and its subsidiaries generally may not purchase a "low-quality asset," as that term is defined in the Federal Reserve Act, from an affiliate. Such restrictions also prevent a holding company and its other affiliates from borrowing from a banking subsidiary of the holding company unless the loans are secured by collateral. The Dodd-Frank Act significantly expands the coverage and scope of the limitations on affiliate transactions within a banking organization.

The FRB has cease and desist powers over parent bank holding companies and non-banking subsidiaries where the action of a parent bank holding company or its non-financial institutions represent an unsafe or unsound practice or violation of law. The FRB has the authority to regulate debt obligations, other than commercial paper, issued by bank holding companies by imposing interest ceilings and reserve requirements on such debt obligations.

The Dodd-Frank Act requires the federal financial regulatory agencies to adopt rules that prohibit banks and their affiliates from engaging in proprietary trading and investing in and sponsoring certain unregistered investment companies (defined as hedge funds and private equity funds), with implementation starting as early as July 2012. The statutory provision is commonly called the "Volcker Rule". In October 2011, federal regulators proposed rules to implement the Volcker Rule which were issued for public comment, with comments due by February 13, 2012. The proposed rules are highly complex, and many aspects of their application remain uncertain. Based on the proposed rules, we do not currently anticipate that the Volcker Rule will have a material effect on our operations since we do not engage in the businesses prohibited by the Volcker Rule. We may incur costs if we are required to adopt additional policies and systems to ensure compliance with the Volcker Rule, but any such costs are not expected to be material. Until a final rule is adopted, the precise financial impact of the rule on the Company, its customers or the financial industry more generally, cannot be determined.

Regulation of the Bank

The Bank is extensively regulated under both federal and state law.

Various requirements and restrictions under federal and state law affect the operations of the Bank. Federal and state statutes and regulations relate to many aspects of the Bank's operations, including standards for safety and soundness, reserves against deposits, interest payable on certain deposit products, investments, mergers and acquisitions, borrowings, dividends, locations of branch offices, fair lending requirements, Community Reinvestment Act activities and loans to affiliates.

Further, eachThe Dodd-Frank Act applies the same leverage and risk-based capital requirements that apply to insured depository institutions to bank holding companies, such as the Company. The guidelines of the Company and the Bank is required to maintain certain levels of capital. The FRB and the FDIC have substantially similar risk-based capital ratio and leverage ratio guidelines for banking organizations. The guidelines are intended to ensure that banking organizations have adequate capital given the risk levels of assets and off-balance sheet financial instruments. Under the guidelines, banking organizations are required to maintain minimum ratios for Tier 1 capital and total capital to risk-weighted assets (including certain off-balance sheet items, such as letters of credit). For purposes of calculating the ratios, a banking organization's assets and some of its specified off-balance sheet commitments and obligations are assigned to various risk categories. A depository institution's or holding company's capital, in turn, is classified in one of three tiers, depending on type:

convertible debt securities, qualifying subordinated debt, and allowances for possible credit losses, subject to limitations.

The following are the regulatory capital guidelines and the actual capitalization levels for Pacific Western and the Company as of December 31, 2010. Regulatory capital requirements limit the amount of deferred tax assets that may be included when determining the amount of regulatory capital. Deferred tax asset amounts in excess of the calculated limit are deducted from regulatory capital. AtSee "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Capital Resources" for further information on regulatory capital requirements and ratios as of December 31, 2010, such amount was $51.0 million. No assurance can be given that2011 for Pacific Western and the regulatory capital deferred tax asset limitation will not increase in the future. There was no limitation on the Bank's regulatory capital due to deferred tax assets.Company.

| | December 31, 2010 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Adequately Capitalized | Well Capitalized | Pacific Western Bank | PacWest Bancorp Consolidated | |||||||||

Tier 1 leverage capital ratio | 4.00 | % | 5.00 | % | 8.51 | % | 8.54 | % | |||||

Tier 1 risk-based capital ratio | 4.00 | % | 6.00 | % | 12.71 | % | 12.68 | % | |||||

Total risk-based capital ratio | 8.00 | % | 10.00 | % | 13.99 | % | 13.96 | % | |||||

The Company issued subordinated debentures to trusts that were established by us or entities we have acquired, which, in turn, issued trust preferred securities, which totaled $123.0 million at December 31, 2010. These securities are currently included in our Tier I capital for purposes of determining the Company's Tier I and total risk-based capital ratios.2011. The Board of Governors of the Federal Reserve System, which is the holding company's banking regulator, has promulgated a modification of the capital regulations affecting trust preferred securities. Although this modification was scheduled to be effective on March 31, 2009, the Federal Reserve postponed the effective date to March 31, 2011. At that time, the Company will be allowed to includeincludes in Tier I1 capital an amount of trust preferred securities equal to no more than 25% of the sum of all core capital elements, which is generally defined as shareholders' equity less goodwill, net of any related deferred income tax liability. The regulations currently in effect through December 31, 2010, limit the amount of trust preferred securities that can be included in Tier I capital to 25% of the sum of core capital elements without a deduction for goodwill. We have determined that our Tier I capital ratios would remain above the well-capitalized level had the modification of the capital regulations been in effect at December 31, 2010. We expect that our Tier I capital ratios will be at or above the existing well-capitalized levels on

March 31, 2011, the first date on which the modified capital regulations must be applied. While our existing trust preferred securities are grandfathered under the Dodd-Frank precludesWall Street Reform and Consumer Protection Act that was enacted in July 2010, new issuances from qualifyingwill not qualify as Tier 1 capital. See "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Borrowings" for information regarding the redemption in March 2012 of certain of our subordinated debentures.

The FDIC and FRB risk-based capital guidelines are based upon the 1988 Capital Accord ("Basel I") of the Basel Committee on Banking Supervision (the "Basel Committee"). The Basel Committee is a committee of central banks and bank supervisors/regulators from the major industrialized countries that develops broad policy guidelines that each country's supervisors can use to determine the supervisory policies they apply. After working on revisions for a number of years, in June 2004, the Basel Committee released the final version of itsa proposed new capital framework, with an update in November 2005 ("Basel II). Basel II proposes two approaches for setting capital standards for credit risk—an internal ratings-based approach tailored to individual institutions' circumstances (which for many asset classes is itself broken into a "foundation" approach and an "advanced" or "A-IRB" approach, the availability of which is subject to additional restrictions) and a standardized approach that bases risk weightings on external credit assessments to a much greater extent than permitted in existing risk-based capital guidelines. Basel II also would set capital requirements for operational risk and refine the existing capital requirements for market risk exposures.

The U.S. banking and thrift agencies are developing proposed revisions to their existing capital adequacy regulations and standards based on Basel II. In December 2006, the agencies issued a notice of proposed rulemaking setting forth a definitive proposal for implementing Basel II in the United States that would apply only to internationally active banking organizations—defined as those with consolidated total assets of $250 billion or more or consolidated on-balance sheet foreign exposures of $10 billion or more—but that other U.S. banking organizations could elect but would not be required to apply. In November 2007, the agencies adopted a definitive final rule for implementing Basel II in the United States that would apply only to internationally active banking organizations, or "core banks"—defined as those with consolidated total assets of $250 billion or more or consolidated on-balance sheet foreign exposures of $10 billion or more. The final rule was effective on April 1, 2008.

The Company is not required to comply with Basel II and we have not adopted the Basel II approach.

In June 2008, the U.S. banking and thrift agencies announced a proposed rule that would provide all non-core banking organizations (that is, banking organizations not required to adopt the advanced approaches) with the option to adopt a way to determine required regulatory capital that is more risk sensitive than the current Basel I-based rules, yet is less complex than the advanced approaches in the

final rule. The proposed standardized framework addresses (i) expanding the number of risk-weight categories to which credit exposures may be assigned; (ii) using loan-to-value ratios to risk weight most residential mortgages to enhance the risk sensitivity of the capital requirement; (iii) providing a capital charge for operational risk using the Basic Indicator Approach under the international Basel II capital accord; (iv) emphasizing the importance of a bank's assessment of its overall risk profile and capital adequacy; and (v) providing for comprehensive disclosure requirements to complement the minimum capital requirements and supervisory process through market discipline. This new proposal will replace the agencies' earlier Basel I-A proposal, issued in December 2006.

In December 2010, the Basel Committee released its final framework for strengthening international capital and liquidity regulation, now officially identified by the Basel Committee as "Basel III". Basel III, when implemented by the U.S. banking agencies and fully phased-in, will require bank holding companies and their bank subsidiaries to maintain substantially more capital, with a greater emphasis on common equity.

The Basel III final capital framework, among other things:

The capital conservation buffer is designed to absorb losses during periods of economic stress. Banking institutions with a ratio of CET1 to risk-weighted assets above the minimum but below the conservation buffer (or below the combined capital conservation buffer and countercyclical capital buffer, when the latter is applied) will face constraints on dividends, equity repurchases and compensation based on the amount of the short fall.

The implementation of the Basel III final framework will commence January 1, 2013. On that date, banking institutions will be required to meet the following minimum capital ratios:

The Basel III final framework provides for a number of new deductions from and adjustments to CET1. These include, for example, the requirement that mortgage servicing rights, deferred tax assets dependent upon future taxable income and significant investments in non-consolidated financial entities be deducted from CET1 to the extent that any one such category exceeds 10% of CET1 or all such categories in the aggregate exceed 15% of CET1.

Implementation of the deductions and other adjustments to CET1 will begin on January 1, 2014 and will be phased-in over a five-year period (20% per year). The implementation of the capital conservation buffer will begin on January 1, 2016 at 0.625% and be phased in over a four-year period (increasing by that amount on each subsequent January 1, until it reaches 2.5% on January 1, 2019).

The U.S. banking agencies have indicated informally that they expectare expected to propose regulations implementingpublish notice of proposed rule-making with respect to at least certain portions of Basel III in mid-2011 with final adoptionduring the first half of implementing regulations in mid-2012.2012. Given that the Basel III rules are subject to change, and the scope and content of capital regulations that the U.S. banking agencies may adopt under Dodd-Frank is uncertain, we cannot be certain of the impact new capital regulations will have on our capital ratios.

Historically, regulation and monitoring of bank and bank holding company liquidity has been addressed as a supervisory matter, both in the U.S. and internationally, without required formulaic measures. The Basel III final framework requires banks and bank holding companies to measure their liquidity against specific liquidity tests that, although similar in some respects to liquidity measures historically applied by banks and regulators for management and supervisory purposes, going forward will be required by regulation. One test, referred to as the liquidity coverage ratio ("LCR"), is designed to ensure that the banking entity maintains an adequate level of unencumbered high-quality liquid assets equal to the entity's expected net cash outflow for a 30-day time horizon (or, if greater, 25% of its expected total cash outflow) under an acute liquidity stress scenario. The other, referred to as the net stable funding ratio ("NSFR"), is designed to promote more medium- and long-term funding of the assets and activities of banking entities over a one-year time horizon. These requirements will incent banking entities to increase their holdings of U.S. Treasury securities and other sovereign debt as a component of assets and increase the use of long-term debt as a funding source. The LCR would be implemented subject to an observation period beginning in 2011, but would not be introduced as a requirement until January 1, 2015, and the NSFR would not be introduced as a requirement until January 1, 2018. These new standards are subject to further rulemaking and their terms may well change before implementation.

Prompt Corrective Action

The Federal Deposit Insurance Corporation Improvement Act, or FDICIA, requires each federal banking agency to take prompt corrective action to resolve the problems of insured depository institutions, including but not limited to those that fall below one or more prescribed minimum capital ratios. Pursuant to FDICIA, the FDIC promulgated regulations defining the following five categories in which an insured depository institution will be placed, based on the level of its capital ratios: well capitalized, adequately capitalized, undercapitalized, significantly undercapitalized and critically undercapitalized. Under the prompt corrective action provisions of FDICIA, an insured depository institution generally will be classified as undercapitalized if its total risk-based capital is less than 8% or its Tier 1 risk-based capital or leverage ratio is less than 4%. An institution that, based upon its capital

levels, is classified as "well capitalized", "adequately capitalized" or "undercapitalized" may be treated as though it were in the next lower capital category if the appropriate federal banking agency, after notice and opportunity for hearing, determines that an unsafe or unsound condition or an unsafe or unsound practice warrants such treatment. At each successive lower capital category, an insured depository institution is subject to more restrictions and prohibitions, including restrictions on growth, restrictions on interest rates paid on deposits, prohibitions on payment of dividends and restrictions on the acceptance of brokered deposits. Furthermore, if a bank is classified in one of the undercapitalized categories, it is required to submit a capital restoration plan to the federal bank regulator, and the holding company must guarantee the performance of that plan.

In addition to measures taken under the prompt corrective action provisions, commercial banking organizations may be subject to potential enforcement actions by the federal or state banking agencies for unsafe or unsound practices in conducting their businesses or for violations of any law, rule,

regulation or any condition imposed in writing by the agency or any written agreement with the agency. Enforcement actions may include the imposition of a conservator or receiver, the issuance of a cease-and-desist order that can be judicially enforced, the termination of insurance for deposits (in the case of a depository institution), the imposition of civil money penalties, the issuance of directives to increase capital, the issuance of formal and informal agreements, the issuance of removal and prohibition orders against institution-affiliatedinstitution- affiliated parties. The enforcement of such actions through injunctions or restraining orders may be based upon a judicial determination that the agency would be harmed if such equitable relief was not granted.

Deposit Insurance

Pacific Western is a state-chartered, "non-member" bank and therefore is regulated by the California Department of Financial Institutions, or DFI, and the FDIC. Pacific Western is also an FDIC insured financial institution whereby the FDIC provides deposit insurance for a certain maximum dollar amount per customer.

The Bank, as is the case with all FDIC insured banks, is subject to deposit insurance assessments as determined by the FDIC. Historically, the FDIC imposed insurance premiums based on the amount of deposits held and a risk matrix that takestook into account, among other factors, a bank's capital level and supervisory rating. ThePursuant to the Dodd-Frank Act, requires the FDIC to amendamended its regulations to determine insurance assessments based on the average consolidated assets less the average tangible equity of the insured depository institution during the assessment period. Based on the current FDIC insurance assessment methodology our FDIC insurance assessment was $5.6 million for 2011 and is estimated to be $4.3 million for 2012. In addition, the Dodd-Frank Act requires the FDIC to adopt a new Deposit Insurance Fund restoration plan to ensure that the fund reserve ratio reaches 1.35% by September 30, 2020. At least semi-annually, the FDIC will update its loss and income projections for the fund and, if needed, will increase or decrease assessment rates, following notice-and-comment rulemaking if required.

The proposed regulations could increasechanges to the assessments paid byFDIC insurance assessment calculation and fund requirements are a result of the Bank.

liquidity concerns that arose during the market disruption in 2008. In late 2008, in an effort to strengthen confidence and encourage liquidity in the banking system, the FDIC temporarily increased the maximum amount of deposit insurance to $250,000 per customer and adopted a number of programs, including the Transaction Account Guarantee Program. The Transaction Account Guarantee Program guaranteed the entire balance of non-interest bearing deposit transaction accounts through December 31, 2010. Institutions participating in the Transaction Account Guarantee Program were charged a 10-basis point fee on the balance of non-interest bearing deposit transaction accounts exceeding the existing deposit insurance limit of $250,000. The cost to the Bank for participating in this program was $794,000 for 2010 and $452,000 for 2009. Under Dodd-Frank, the $250,000 maximum amount was made permanent, and the unlimited protection for noninterest-bearing transaction accounts

was extended to December 31, 2012 and to all insured depository institutions.institutions without a separate surcharge.

On November 12,In the second quarter of 2009, the FDIC imposed a special assessment on all depository institutions; such assessment was $2.0 million for the Bank. In addition, the FDIC required insured depository institutions to prepay on December 30, 2009, their estimated quarterly assessments for the fourth quarter of 2009, and for all of 2010, 2011, and 2012. The amount of Pacific Western's FDIC assessment prepayment was $19.5 million, which we paid on December 30, 2009. In addition, the FDIC imposed a special assessment on all depository institutions in the second quarter of 2009; such assessment was $2.0 million for the Bank.

The 2009 prepayments and special assessment for FDIC insurance are in contrast to the lower FDIC insurance assessment expense for Pacific Western in 2008 and 2007. Because of favorable loss experience and a healthy reserve ratio in the deposit insurance fund of the FDIC, well-capitalized and well-managed banks, including Pacific Western, paid minimal premiums for FDIC insurance during 2008 and 2007. A deposit premium refund, in the form of credit offsets, was given to banks that were in existence on December 31, 1996 and paid deposit insurance premiums prior to that date. Pacific Western utilized its credit offset to eliminate a portion of its 2008 and nearly all of its 2007 FDIC insurance assessments.

Incentive Compensation

BasedThe Dodd-Frank Act requires the Federal bank regulatory agencies and the Securities and Exchange Commission to establish joint regulations or guidelines prohibiting incentive-based payment arrangements at specified regulated entities, such as the Company and the Bank, having at least $1 billion in total assets that encourage inappropriate risks by providing an executive officer, employee, director or principal shareholder with excessive compensation, fees, or benefits or that could lead to material financial loss to the entity. In addition, these regulators must establish regulations or guidelines requiring enhanced disclosure to regulators of incentive-based compensation arrangements. The agencies proposed such regulations in April 2011, which may become effective before the end of 2012. If the regulations are adopted in the form initially proposed, they will impose limitations on the currentmanner in which we may structure compensation for our executives.