Use these links to rapidly review the documentTable of ContentsTABLE OF CONTENTS1WADDELL & REED FINANCIAL, INC. Index to Consolidated Financial StatementsTABLE OF CONTENTS2

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 20122015

OR

o Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Commission file number 001-13913

WADDELL & REED FINANCIAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 51-0261715 (I.R.S. Employer Identification No.) |

6300 Lamar Avenue

Overland Park, Kansas 66202

913-236-2000

(Address, including zip code, and telephone number of Registrant's principal executive offices)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT

| Title of each class | Name of each exchange on which registered | |

| Class A Common Stock, $.01 par value | New York Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ý NO o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES o NO ý.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. ( )o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act).

| Large accelerated Filer | ý | Accelerated Filer | o | |||

| Non-accelerated Filer | o | Smaller Reporting Company | o | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes o No ý.

The aggregate market value of the voting and non-voting common stock equity held by non-affiliates (i.e. persons other than officers, directors and stockholders holding greater than 5% of the registrant's common stock) based on the closing sale price on June 30, 20122015 was $2.32$3.82 billion.

Shares outstanding of each of the registrant's classes of common stock as of February 15, 201312, 2016 Class A common stock, $.01 par value: 85,595,30481,758,013.

DOCUMENTS INCORPORATED BY REFERENCE

In PartParts II and III of this Form 10-K, portions of the definitive proxy statement for the 20132016 Annual Meeting of Stockholders to be held April 17, 2013.13, 2016.

Index of Exhibits (Pages 8490 through 88)94)

Total Number of Pages Included Are 8894

WADDELL & REED FINANCIAL, INC.

INDEX TO ANNUAL REPORT ON FORM 10-K

For the fiscal year ended December 31, 20122015

| | | Page | ||||

|---|---|---|---|---|---|---|

Part I | ||||||

Item 1. | Business | 3 | ||||

Item 1A. | Risk Factors | 11 | ||||

Item 1B. | Unresolved Staff Comments | |||||

Item 2. | Properties | |||||

Item 3. | Legal Proceedings | |||||

Item 4. |

| |||||

Part II | ||||||

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |||||

Item 6. | Selected Financial Data | |||||

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |||||

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |||||

Item 8. | Financial Statements and Supplementary Data | |||||

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |||||

Item 9A. | Controls and Procedures | |||||

Item 9B. | Other Information | |||||

Part III | ||||||

Item 10. | Directors, Executive Officers and Corporate Governance | |||||

Item 11. | Executive Compensation | |||||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |||||

Item 14. | Principal Accounting Fees and Services | |||||

Part IV | ||||||

Item 15. | Exhibits, Financial Statement Schedules | |||||

| ||||||

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | ||||||

INDEX TO EXHIBITS | ||||||

Forward-Looking Statements

This Annual Report on Form 10-K and the letter to stockholders contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect the current views and assumptions of management with respect to future events regarding our business and the industry in general. These forward-looking statements include all statements, other than statements of historical fact, regarding our financial position, business strategy and other plans and objectives for future operations, including statements with respect to revenues and earnings, the amount and composition of assets under management, distribution sources, expense levels, redemption rates and the financial markets and other conditions. These statements are generally identified by the use of words such as "may," "could," "should," "would," "believe," "anticipate," "forecast," "estimate," "expect," "intend," "plan," "project," "outlook," "will," "potential" and similar statements of a future or forward-looking nature. Readers are cautioned that any forward-looking information provided by or on behalf of the Company is not a guarantee of future performance. Certain important factors that could cause actual results to differ materially from our expectations are disclosed in the Item 1 "Business" and Item 1A "Risk Factors" sections of this Annual Report on Form 10-K, which include, without limitation, the adverse effect from a decline in securities markets or in the relative investment performance of our products, our inability to pay future dividends, the loss of existing distribution channels or the inability to access new ones, a reduction of the assets we manage on short notice, and adverse results of litigation and/or arbitration. The forgoing factors should not be construed as exhaustive and should be read together with other cautionary statements included in this and other reports and filings we make with the SEC. All forward-looking statements speak only as of the date on which they are made and we undertake no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

General

Waddell & Reed Financial, Inc. (hereinafter referred to as the "Company," "we," "our" or "us") is a corporation, incorporated in the state of Delaware in 1981, that conducts business through its subsidiaries. Founded in 1937, we are one of the oldest mutual fund complexes in the United States, having introduced the Waddell & Reed Advisors Groupgroup of Mutual Fundsmutual funds (the "Advisors Funds") in 1940. Over time we added additional mutual fund families: Ivy Funds (the "Ivy Funds"), Ivy Funds Variable Insurance Portfolios ("Ivy Funds VIP") and, InvestEd Portfolios, our 529 college savings plan ("InvestEd") (collectively, the Advisors Funds, Ivy Funds, Ivy Funds VIP and InvestEd are referred to as the "Funds") and the Ivy Global Investors Fund SICAV (the "SICAV") and its Ivy Global Investors sub-funds (the "IGI Funds"), an undertaking for the collective investment in transferable securities ("UCITS"). As of December 31, 2012,2015, we had $96.4$104.4 billion in assets under management.

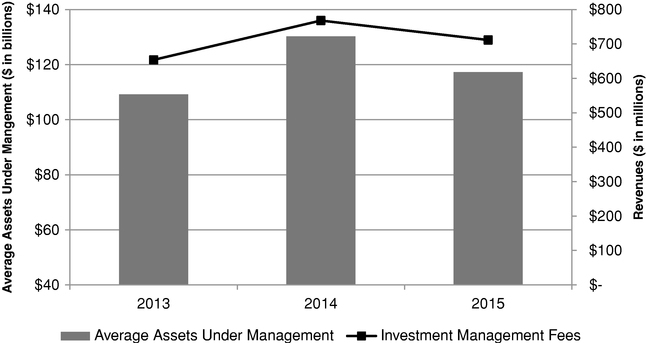

We derive our revenues from providing investment management, investment advisory, investment product underwriting and distribution, and shareholder services administration to mutual fundsthe Funds, the IGI Funds and institutional and separately managed accounts. Investment management fees are based on the amount of average assets under management and are affected by sales levels, financial market conditions, redemptions and the composition of assets. Our underwriting and distribution revenues consist of commissions derived from sales of investment and insurance products, Rule 12b-1 asset-based service and distribution fees, distribution fees on certain variable products, fees earned on fee-based asset allocation products and related advisory services.services, commissions derived from sales of investment and insurance products, and distribution fees on certain variable products. The products sold have various commission structures and the revenues received from those sales vary based on the type and dollar amount sold. Shareholder service feesfee revenue includes transfer agency fees, custodian fees from retirement plan accounts, and portfolio accounting and administration fees, and is earned based on assets under management or number of client accounts.

We operate our business through three distincta balanced distribution channels.network. Our retail products are distributed through third-partiesthird parties such as other broker/dealers, registered investment advisors and various retirement platforms (collectively, the "Wholesale channel") or through our sales force of independent financial advisors (the "Advisors channel"). We also market our investment advisory services to institutional investors, either directly or through consultants (the "Institutional channel").

Our Wholesale channel efforts include retail fund distribution through broker/dealers (the largestprimary method of distributing mutual funds for the industry), registered investment advisors (fee-based financial advisors who generally sell mutual funds through financial supermarkets) and retirement and insurance platforms. Assets under management in this channel were $48.9$45.6 billion at the end of 2012.2015.

In the Advisors channel, our sales force focuses its efforts primarily on financial planning, serving primarilymostly middle class and mass affluent clients. We compete with smaller broker/dealers and independent financial advisors, as well as a span of other financial service providers. Assets under management in this channel were $35.7$43.4 billion at December 31, 2012.2015.

Through our Institutional channel, we manage assets in a varietyserve as subadvisor for domestic and foreign distributors of investment stylesproducts for a varietypension funds, Taft-Hartley plans and endowments. Additionally, we serve as investment advisor and distributor of types of institutions. The largest client type is funds that hire us to act as subadvisor; they are typically distributors who lack scale or the track record to manage internally, or choose to market multi-manager styles.IGI Funds. Assets under management in the Institutional channel were $11.8$15.4 billion at December 31, 2012.2015.

Organization

We operate our investment advisory business through our subsidiary companies, primarily Waddell & Reed Investment Management Company ("WRIMCO"), a registered investment adviser for the Advisors Funds, the Ivy Funds VIP and InvestEd, and Ivy Investment Management Company ("IICO"), the registered investment adviser for the Ivy Funds and the IGI Funds and global distributor of the IGI Funds.

Our underwriting and distribution business operates through two broker/dealers: Waddell & Reed, Inc. ("W&R") and Ivy Funds Distributor, Inc. ("IFDI"). W&R is a registered broker/dealer and investment adviser that acts primarily as the national distributor and underwriter for shares of the Advisors

Funds, Ivy Funds VIP, InvestEd and other mutual funds, and as a distributor of variable annuities and other insurance products issued by our business partners. In addition, W&R is the ninthsixth largest distributor of ourthe Ivy Funds. IFDI is the distributor and underwriter for the Ivy Funds.

During 2012, the Company committed to a plan to sell its Legend group of subsidiaries ("Legend"), and on October 29, 2012 the Company signed a definitive agreement to execute the transaction. The sale closed effective January 1, 2013. Legend is a mutual fund distribution and retirement planning subsidiary based in Palm Beach Gardens, Florida. Through its network of financial advisors, Legend primarily serves employees of school districts and other not-for-profit organizations. Legend Advisory Corporation, the registered investment adviser for the Legend group, and Legend Equities Corporation, a registered broker/dealer ("LEC"), were among the subsidiaries sold.

Waddell & Reed Services Company ("WRSCO") provides transfer agency and accounting services to the Advisors Funds, Ivy Funds, Ivy Funds VIP and InvestEd.Funds. W&R, WRIMCO, WRSCO, IICO and IFDI are hereafter collectively referred to as the "Company," "we," "us" or "our" unless the context requires otherwise.

Investment Management Operations

Our investment advisory business provides one of our largest sources of revenues and profits.revenues. We earn investment management fee revenues by providing investment advisory and management services pursuant to investment management agreements with each fund within the Advisors Funds family, the Ivy Funds family, the Ivy Funds VIP family, and InvestEd (collectively, the "Funds").Funds. While the specific terms of the agreements vary, the basic terms are similar. The agreements provide that we render overall investment management services to each of the Funds, subject to the oversight of each Fund's board of trustees and in accordance with each Fund's investment objectives and policies. The agreements permit us to enter into separate agreements for shareholder services or accounting services with each respective Fund.

Each Fund's board of trustees, including a majority of the trustees who are not "interested persons" of the Fund or the Company within the meaning of the Investment Company Act of 1940, as amended (the "ICA") ("disinterested members") and the Fund's shareholders must approve the investment management agreement between the respective Fund and the Company. These agreements may continue in effect from year to year if specifically approved at least annually by (i) the Fund's board, including a majority of the disinterested members, or (ii) the vote of a majority of both the shareholders of the Fund and the disinterested members of each Fund's board, each vote being cast in person at a meeting called for such

purpose. Each agreement automatically terminates in the event of its assignment, as defined by the ICA or the Investment Advisers Act of 1940, as amended (the "Advisers Act"), and may be terminated without penalty by any Fund by giving us 60 days' written notice if the termination has been approved by a majority of the Fund's trustees or the Fund's shareholders. We may terminate an investment management agreement without penalty on 120 days' written notice.

In addition to performing investment management services for the Funds, we act as an investment adviser for the IGI Funds, institutional and other private investors and we provide subadvisory services to other investment companies. Such services are provided pursuant to various written agreements and our fees are generally based on a percentage of assets under management.

Our investment management team meets every morningbegins each business day in a collaborative settingdiscussion that fosters idea sharing, yet reinforces individual accountability. Through all market cycles, we remain dedicated to the following investment principles:

These three principles shape our investment philosophy and money management approach. Over seven decades,For nearly 80 years, our investment organization has delivered consistently competitive investment performance. Through bull and bear markets, our investment professionals have not strayed from what works —works—fundamental research and a time-tested investment process and fundamental research.process. We believe investors turn to us because they appreciate that our investment approach continues to identify and create opportunities for wealth creation.

Our investment management team comprises 7988 professionals, including 3234 portfolio managers who average 2123 years of industry experience and 1516 years of tenure with our firm. We have significant experience in virtually all major asset classes, several specialized asset classes and a range of investment styles. At December 31, 2012, over 75%2015, 80% of the Company's $96.4$104.4 billion in assets under management were invested in equities, of which 72%81% was domestic and 28%19% was international. In recent years, we have supported growth of international investments by adding investment professionals native to countries that we consider emerging markets. They, along with other members of the investment team, focus on understanding foreign markets and capturing investment opportunities. Our investment management team also includes subadvisors who bring similar investment philosophies and additional expertise in specific asset classes.

Investment Management Products

Our mutual fund families offer a wide variety of investment options. We are the exclusive underwriter and distributor of 8189 registered open-end mutual fund portfolios in the Advisors Funds, which includes 17 investment styles. Additionally, we have one closed-end offering through the Ivy Funds Ivyand offer the IGI Funds VIP and InvestEd.through our Institutional channel. The Advisors Funds, variable products offering the Ivy Funds VIP, and InvestEd are offered primarily through our financial advisors;advisors in the Advisors channel; in some circumstances, certain of thesethose funds are also offered through the Wholesale channel. The Ivy Funds are offered through both our Wholesale channel and Advisors channel. The Funds' assets under management are included in either our Wholesale channel or our Advisors channel depending on which channel marketed the client account or is the broker of record.

We added one fund to our product line in 2012. We launched the Ivy Global Equity Income fund for investors interested in generating a reasonable level of current income given current market conditions. The fund focuses on equity securities issued by companies located largely in developed markets, of any size. Under normal circumstances, the fund invests at least 80% of its net assets in equity securities. For this purpose, equity securities consist primarily of dividend-paying common stocks across the globe. The fund also may invest in preferred stock, convertible securities, or other instruments whose price is linked to the value of common stock. The fund may invest in U.S. and non-U.S. issuers. Although the fund primarily invests in large cap companies, it may invest in companies of any size.

Additionally, in 2012, the Ivy International Balanced fund was renamed the Ivy Global Income Allocation fund. This fund seeks to provide total return through a combination of current income and capital appreciation. The fund invests principally in equity and debt securities issued by companies and governments of any size and under normal market conditions, invests primarily in income-producing securities across the globe. The fund may invest in U.S. and non-U.S. issuers. In an attempt to enhance return, the fund may also invest, to a lesser extent, in securities not currently providing income or in companies and governments in countries with new or comparatively undeveloped and emerging economies.

During 2015, we launched two income-oriented mutual funds in partnership with Apollo Credit Management. The Ivy Apollo Strategic Income fund invests among three investment strategies: Apollo's total return and Ivy's global bond and high income. The Ivy Apollo Multi-Asset Income fund invests among four investment strategies: Apollo's total return and Ivy's high income, global equity income and global real estate, which is subadvised by LaSalle Investment Management Securities. We launched three new sub-funds of the SICAV in 2015. The Ivy Global Investors Balanced fund seeks to provide total return by investing primarily in a balanced mix of equities of medium to large U.S. companies, debt or preferred securities and short-term instruments, typically within moderate asset allocation ranges. The Ivy Global Investors Emerging Markets Equity fund will primarily invest in equity securities of companies from countries considered to be in emerging markets or those that are economically linked to emerging markets. The Ivy Global Investors Energy fund will primarily invest in the equity of companies around the world that are within the energy sector or that develop products and services to enhance energy efficiency. In January of 2016, we launched the Ivy Targeted Return Bond fund, subadvised by Pictet Asset Management. This fund seeks to provide a positive total return over the long-term across all market environments by investing in any form of debt security issued in the U.S or internationally.

During 2015, we also entered into a preliminary agreement with Navigate Fund Solutions, a subsidiary of Eaton Vance Corporation, to support the launch by Ivy Funds of a family of NextShares exchange-traded managed funds ("ETMFs"). The Ivy Funds launch of NextShares ETMFs is subject to securing exemptive order relief from the SEC to allow it to manage exchange-traded managed funds, as well as the development of implementation technology by broker/dealers and other market participants.

Other Products

We offer our Advisors channel customers fee-based asset allocation products, including Managed Allocation Portfolio ("MAP"), MAPPlus and Strategic Portfolio Allocation ("SPA"), which utilize the Funds. As of December 31, 2015, clients had $17.6 billion invested in our fee-based asset allocation products, of which $15.7 billion is invested in our mutual funds and included in our mutual fund assets under management.

In our Advisors channel, we distribute various business partners' variable annuity products, which offer the Ivy Funds VIP as an investment vehicle. We also offer our Advisors channel customers retirement and life insurance products underwritten by our business partners. Through our insurance agency subsidiaries,subsidiary, our financial advisors also sell life insurance and disability products underwritten by various carriers.

In addition, we offer our Advisors channel customers fee-based asset allocation investment advisory products, including Managed Allocation Portfolio ("MAP"), MAPPlus and Strategic Portfolio Allocation ("SPA"), which utilize our Funds. As of December 31, 2012, clients had $8.2 billion invested in our MAP, MAPPlus and SPA products. These assets are included in our mutual fund assets under management.

Distribution Channels

We distribute our investment products through the Wholesale, Advisors and Institutional channels.

Wholesale Channel

Our Wholesale channel generates sales through various third-partythird party distribution outlets. Our assets under management in the Wholesale channel were $48.9$45.6 billion at December 31, 2012, including $2.6 billion in assets subadvised by other managers.2015.

Our team of 5061 external wholesalers lead our wholesaling efforts, which focus principally on distributing the Ivy Funds through three segments: broker/dealers (the largest method of distributing mutual funds for the industry and for us), retirement platforms (401(k) platforms using multiple managers) and registered investment advisors (fee-based financial advisors who generally sell mutual funds through financial supermarkets).

During 2012, Additionally, our Ivy Asset Strategy fund continued to play a lead role inNational Accounts team, comprised of 19 employees, work with the Wholesale channel's results, comprising 32%home offices of the channel's gross salesour distribution partners managing current and 27% of total assets under management as of December 31, 2012. While we recognize the past success of this fund, we are also aware of the concentration risks to our revenue streams created by the size of this fund, despite its flexible mandate. Our compensation program for wholesalers encourages the sales of other products with track records of strong performance. Over the past three years, our wholesalers successfully marketed additional products to their financial advisor clients, which resulted in Wholesale channel sales for the Ivy Asset Strategy fund decreasing from 60% in 2010 to 32% in 2012. We plan to continue to stress diversification of sales as we enter 2013.new relationships.

Advisors Channel

Assets under management in the Advisors channel were $35.7$43.4 billion at December 31, 2012. Historically,2015. Throughout our history, our advisors have sold investment products primarily to middle income and mass

affluent individuals, families and businesses across the country in geographic markets of all sizes. We assist clients on a wide range of financial issues with a significant focus on helping them plan, generally, for long-term investments such as retirement and education, and offer one-on-one consultations that emphasize long-term relationships through continued service. As a result of this approach, this channel has developed a loyal customer base with clients maintaining their accounts significantly longer than the industry average. Over the past several years, we have expanded our Choice brokerage platform technology and offerings, and continue to do so which should allowenable us to competitively recruit experienced advisors.

As of December 31, 2012,2015, our sales force consisted of 1,7631,819 financial advisors who operate out of 165 offices located throughout the United States and 263 individual advisor offices.States. We believe, based on industry data, that our financial advisors are currently one of the largest sales forces in the United States selling primarily mutual funds, and that W&R, our broker/dealer subsidiary, ranks among the largest

independent broker/dealers. As of December 31, 2012, ourWe continue to experience growth in sales force production. Advisors channel had approximately 484 thousand mutual fund customers.

Over the past several years, we have instituted more stringent production requirements for our sales force, which has resulted in a steady decline in our number of advisors. However, gross sales have not declined, and this channel produced 12% more in 2012 with 13% fewer advisors, on average, compared to 2010. This headcount decline leveled off during 2012. We utilize gross revenue per advisor to measure advisor productivity. For purposes of this measure, gross revenue consists of front-end load salesunderwriting and distribution fee revenues as would be received from an underwriter, from salesper the average number of both our Funds and other mutual funds. It also includes fee revenues from our asset allocation products and financial plans, and commission revenues earned on insurance products. Gross revenue per advisor was $168advisors were $265 thousand, $156$254 thousand and $119$215 thousand for the years ended December 31, 2012, 20112015, 2014 and 2010,2013, respectively. As of December 31, 2015, our Advisors channel had approximately 449 thousand mutual fund customers.

Institutional Channel

Through this channel, we manage assets in a variety of investment styles for a variety of institutions. The largest client type is other asset managers that hire us to act as subadvisor; they are typically domestic and foreign distributors of investment products who lack scale or the track record to manage internally, or choose to market multi-manager styles. Our diverse client list also includes corporations, foundations, endowments, Taft-Hartley plans and public funds, including defined benefit plans and defined contribution plans. Over time, the Institutional channel has been successful in developing subadvisory relationships. Asrelationships, and as of December 31, 2012, this type of2015, subadvisory business comprised more than 65%70% of the Institutional channel's assets, which management views as a positive development as it believes this type of business has better growth potential thanassets. Our diverse client list also includes the defined benefit business.IGI Funds, pension funds, Taft-Hartley plans and endowments. Assets under management in the Institutional channel were $11.8$15.4 billion at December 31, 2012.2015.

Service Agreements

We earn service fee revenues by providing various services to the Funds and their shareholders. Pursuant to the shareholder servicing agreements, we perform shareholder servicing functions for which the Funds pay us a monthly fee, including: maintaining shareholder accounts; issuing, transferring and redeeming shares; distributing dividends and paying redemptions; furnishing information related to the Funds; and handling shareholder inquiries. Pursuant to the accounting service agreements, we provide the Funds with bookkeeping and accounting services and assistance for which the Funds pay us a monthly fee, including: maintaining the Funds' records; pricing Fund shares; and preparing prospectuses for existing shareholders, proxy statements and certain other shareholder reports.

Agreements with the Funds may be adopted or amended with the approval of the disinterested members of each Fund's board of trustees and have annually renewable terms of one year.

Competition

The financial services industry is a highly competitive global industry. According to the ICI,Investment Company Institute (the "ICI"), at the end of 20122015 there were more than 8,7009,500 open-end investment companies and more than 500 closed-end investment companies of varying sizes, investment policies and objectives whose shares are being offered to the public in the United States alone. Factors affecting our business include brand recognition, business reputation, investment performance, quality of service and the continuity of both client relationships and assets under management. A majority of mutual fund sales go to funds that are highly rated by a small number of well-known ranking services that focus on investment performance. Competition is based on distribution methods, the type and quality of shareholder services, the success of marketing efforts, and the ability to develop investment products for certain market segments to meet the changing needs of investors, and to achievethe achievement of competitive investment management performance.

We compete with hundreds of other mutual fund management, distribution and service companies that distribute their fund shares through a variety of methods, including affiliated and unaffiliated sales

forces, broker/dealers and direct sales to the public of shares offered at a low or no sales charge. Many larger mutual fund complexes have significant advertising budgets and established relationships with brokerage houses with large distribution networks, which enable these fund complexes to reach broad client bases. Many investment management firms offer services and products similar to ours, as well as other independent financial advisors. We also compete with brokerage and investment banking firms, insurance companies, commercial banks and other financial institutions and businesses offering other financial products in all aspects of their businesses. Although no single company or group of companies consistently dominates the mutual fund management and services industry, many are larger than us, have greater resources and offer a wider array of financial services and products. We believe that competition in the mutual fund industry will increase as a result of increased flexibility afforded to banks and other financial institutions to sponsor mutual funds and distribute mutual fund shares. Additionally, barriersBarriers to entry into the investment management business are relatively few, and thus, we face a potentially growing number of competitors, especially during periods of strong financial and economic markets.

The distribution of mutual funds and other investment products has undergone significant developments in recent years, which has intensified the competitive environment in which we operate. These developments include the introduction of new products, increasingly complex distribution systems with multiple classes of shares, the development of internet websites providing investors with the ability to invest on-line, the introduction of sophisticated technological platforms used by financial advisors to sell and service mutual funds for their clients, the introduction of separately managed accounts—previously available only to institutional investors—to individuals, and growth in the number of mutual funds offered.

We believe we effectively compete across multiple dimensions of the asset management and broker/dealer businesses. First, we market our products, primarily the Ivy Funds family, to unaffiliated broker/dealers and advisors and compete against other asset managers offering mutual fund products. This distribution method allows us to move beyond proprietary distribution and increases our potential pool of clients. Competition is based on sales techniques, personal relationships and skills, and the quality of financial planning products and services offered. We compete against asset managers that are both larger and smaller than our firm, but we believe that the breadth and depth of our products position us to compete in this environment. Second, our proprietary broker/dealer consists of a sales force of independent contractors affiliated with our companyCompany who have access to our proprietary financial products. We believe our business model targets customers seeking personal assistance from financial advisors or planners where the primary competition is companies distributing products through financial advisors. The market for financial advice is extremely broad and fragmented. Our financial advisors compete primarily with large and small broker/dealers, independent financial advisors, registered investment advisors, financial institutions and insurance representatives. The market for financial advice is extremely broad and fragmented. Finally, we compete in the institutional marketplace, working with consultants who select asset managers for various opportunities, as well as working directly with plan sponsors, foundations, endowments, sovereign funds and other asset managers who hire subadvisors. In this marketplace, we compete with a broad range of asset managers.

We also face competition in attracting and retaining qualified financial advisors and employees. To maximize our ability to compete effectively in our business, we offer competitive compensation.

Regulation

The securities industry is subject to extensive regulation and virtually all aspects of our business are subject to various federal and state laws and regulations. These laws and regulations are primarily intended to protect investment advisory clients and shareholders of registered investment companies. Under such laws and regulations, agencies and organizations that regulate investment advisers, broker/dealers, and transfer agents like us have broad administrative powers, including the power to limit, restrict or prohibit an investment adviser, broker/dealer or transfer agent from carrying on its business in the event that it fails to comply with applicable laws and regulations. In such event, the possible sanctions that may be imposed include, but are not limited to, the suspension of individual employees or agents, limitations on engaging in

certain lines of business for specified periods of time, censures, fines and the revocation of investment adviser and other registrations.

The United States Securities and Exchange Commission (the "SEC") is the federal agency responsible for the administration of federal securities laws. Certain of our subsidiaries are registered with the SEC as investment advisers under the Advisers Act, which imposes numerous obligations on registered investment advisers including, among other things, fiduciary duties, record-keeping and reporting requirements, operational requirements and disclosure obligations, as well as general anti-fraud prohibitions. Investment advisers are subject to periodic examination by the SEC, and the SEC is authorized to institute proceedings and impose sanctions for violations of the Advisers Act, ranging from censure to termination of an investment adviser's registration.

Our Funds are registered as investment companies with the SEC under the ICA, and various filings are made with states under applicable state rules and regulations. The ICA regulates the relationship between a mutual fund and its investment adviser and prohibits or severely restricts principal transactions and joint transactions. Various regulations cover certain investment strategies that may be used by the Funds for hedging and/or speculative purposes. To the extent the Funds purchase futures contracts, options on futures contracts, swaps and foreign currency contracts, they are subject to the commodities and futures regulations of the Commodity Futures Trading Commission.

We derive a large portion of our revenues from investment management agreements. Under the Advisers Act, our investment management agreements terminate automatically if assigned without the client's consent. Under the ICA, investment advisory agreements with registered investment companies, such as the Funds, terminate automatically upon assignment. The term "assignment" is broadly defined and includes direct assignments, as well as assignments that may be deemed to occur, under certain circumstances, upon the transfer, directly or indirectly, of a controlling interest in the Company.

The Company is also subject to federal and state laws affecting corporate governance, including the Sarbanes-Oxley Act of 2002, ("S-OX"), as well as rules adopted by the SEC. In 2004, we implemented compliance with Section 404 of S-OX. Our related report on internal controls over financial reporting for 20122015 is included in Part I, Item 9A.

As a publicly traded company, we are also subject to the rules of the New York Stock Exchange (the "NYSE"), the exchange on which our stock is listed, including the corporate governance listing standards approved by the SEC.

Two of our subsidiaries, W&R and IFDI, are registered as broker/dealers with the SEC and the states. A third broker/dealer subsidiary, LEC, was sold effective January 1, 2013. Much of the broker/dealer regulation has been delegated by the SEC to self-regulatory organizations, principally the Municipal Securities Rulemaking Board and the Financial Industry Regulatory Authority, Inc. ("FINRA"), which is the primary regulator of our broker/dealer activities. These self-regulatory organizations adopt rules (subject to approval by the SEC) that govern the industry and conduct periodic examinations of our operations over which they have jurisdiction. Securities firms are also subject to regulation by state securities administrators in those states in which they conduct business. Broker/dealers are subject to regulations that cover all aspects of the securities business, including sales practices, market making and trading among broker/dealers, the use and safekeeping of clients' funds and securities, capital structure, record-keeping, and the conduct of directors, officers and employees. Violation of applicable regulations can result in the revocation of broker/dealer licenses, the imposition of censures or fines, and the suspension or expulsion of a firm, its officers or employees.

W&R LEC and IFDI are each subject to certain net capital requirements pursuant to the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Uniform Net Capital Rule 15c3-1 of the Exchange Act (the "Net Capital Rule") specifies the minimum level of net capital a registered broker/dealer must maintain and also requires that part of its assets be kept in a relatively liquid form. The Net

Capital Rule is designed to ensure the financial soundness and liquidity of broker/dealers. Any failure to maintain the required minimum net capital may subject us to suspension or revocation of our registration

or other limitations on our activity by the SEC, and suspension or expulsion by FINRA or other regulatory bodies, and ultimately could require the broker/dealer's liquidation. The maintenance of minimum net capital requirements may also limit our ability to pay dividends. As of December 31, 2012, 20112015 and 2010,2014, net capital for W&R LEC and IFDI exceeded all minimum requirements.

Pursuant to the requirements of the Securities Investor Protection Act of 1970, W&R is a member of the Securities Investor Protection Corporation (the "SIPC"). IFDI is exempt from the membership requirements and is not a member of the SIPC. The SIPC provides protection against lost, stolen or missing securities (but not loss in value due to a rise or fall in market prices) for clients in the event of the failure of a broker/dealer. Accounts are protected up to $500,000 per client with a limit of $100,000 for cash balances. However, since the Funds, and not our broker/dealer subsidiaries, maintain customer accounts, SIPC protection would not cover mutual fund shareholders whose accounts are maintained directly with the Funds.Funds, but would apply to brokerage accounts held on our brokerage platform.

Title III of the USA PATRIOT Act, the International Money Laundering Abatement and Anti-Terrorist Financing Act of 2001, imposes significant anti-money laundering requirements on all financial institutions, including domestic banks and domestic operations of foreign banks, broker/dealers, futures commission merchants and investment companies.

Our operations outside the United States are subject to the laws and regulations of various non-U.S. jurisdictions and non-U.S. regulatory agencies and bodies, including the regulation of the IGI Funds by Luxembourg's Commission de Surveillance du Secteur Financier as UCITS. As we broaden our distribution globally, we will become subject to increased international regulations, some of which are comparable to the regulations to which our United States operations are subject. Similar to the United States, non-U.S. regulatory agencies have broad authority in the event of non-compliance with laws and regulations.

Our businesses may be materially affected not only by regulations applicable to us as an investment adviser, broker/dealer or transfer agent, but also by law and regulations of general application. For example, the volume of our principal investment advisory business in a given time period could be affected by, among other things, existing and proposed tax legislation and other governmental regulations and policies (including the interest rate policies of the Federal Reserve Board), and changes in the interpretation or enforcement of existing laws and rules that affect the business and financial communities.

Our business is also subject to new and changing laws and regulations. For additional discussion regarding the impact of current and proposed legal or regulatory requirements, please see the "Regulatory Risk Is Substantial In Our Business And Non-Compliance With Regulations, Or Changes In Regulations, Could Have A Significant Impact On The Conduct Of Our Business, Reputation And Prospects" risk factor included in Item 1A—Risk Factors in this annual report.

Intellectual Property

We regard our names as material to our business, and have registered certain service marks associated with our business with the United States Patent and Trademark Office.

Employees

At December 31, 20122015 we had 1,6561,691 full-time employees, consisting of 1,1631,351 home office employees 123 Legend employees and 370340 employees responsible for advisor field supervision and administration.

Available Information

We file reports, proxy statements, and other information with the SEC, copies of which can be obtained from the SEC's Public Reference Room at 100 F Street NE, Room 1580, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-732-0330.

Reports we file electronically with the SEC via the SEC's Electronic Data Gathering, Analysis and Retrieval system ("EDGAR") may be accessed through the internet. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, atwww.sec.gov. The Company makesmake available free of charge our proxy statements, annual reports on Form 10-K, quarterly reports on Form 10-Q,10-Q, current reports on Form 8-K and amendments to those reports under the "Reports & SEC Filings" menu on the "Investor Relations" section of our internet website atwww.waddell.com as soon as it is reasonably practical after such filing has been made with the SEC.

Also available on the "Corporate Governance" page in the "Our Firm" dropdown menu is information on corporate governance. Stockholders can view our Corporate Code of Business Conduct and Ethics (the "Code of Ethics"), which applies to directors, officers and all employees of the Company,

our Corporate Governance Guidelines, and the charters of key committees (including the Audit, Compensation, and Nominating and Corporate Governance Committees). Printed copies of these documents are available to any stockholder upon request by calling the investor relations department at 1-800-532-2757. Any future amendments to or waivers of the Code of Ethics will be posted to our website, as required.

Our Financial Advisors Are Classified As Independent Contractors, And Changes To Their Classification May Increase Our Operating Expenses. From time to time, various legislativeYou should carefully consider the following risk factors as well as the other risks and uncertainties contained in this Annual Report on Form 10-K or regulatory proposals are introduced atin our other SEC filings. The occurrence of one or more of these risks or uncertainties could materially and adversely affect our business, financial condition, operating results and cash flows. In this Annual Report on Form 10-K, unless the federal orcontext expressly requires a different reading, when we state levels to change the status of independent contractors' classification to employees for either employment tax purposes (withholding, social security, Medicare and unemployment taxes) or other benefits available to employees. Currently, most individuals are classified as employees or independent contractors for employment tax purposes based on 20 "common law" factors, rather than any definition found in the Internal Revenue Code or Treasury regulations. We classify the majority of our financial advisors as independent contractors for all purposes, including employment tax and employee benefit purposes. There can be no assurance that legislative, judicial or regulatory (including tax) authorities will not introduce proposals or assert interpretations of existing rules and regulations that would change the independent contractor/employee classification of those financial advisors currently doing business with us. The costs associated with potential changes, if any, with respect to these independent contractor classificationsa factor could "adversely affect us," have a material"material adverse effect on our business," "adversely affect our business" and similar expressions, we mean that the Company, includingfactor could materially and adversely affect our business, financial condition, operating results and cash flows. Information contained in this section may be considered "forward-looking statements." See "Part I—Forward Looking Statements" for a discussion of operations and financial condition. See Part I, Item 3. "Legal Proceedings."certain qualifications regarding forward-looking statements.

Our Business Is Subject To Substantial Risk From Litigation, Regulatory Investigations And Potential Securities Laws Liability. Many aspects of our business involve substantial risks of litigation, regulatory investigations and/or arbitration, and from time to time, we are involved in various legal proceedings in the course of operating our business. The Company is exposed to liability under federal and state securities laws, other federal and state laws and court decisions, as well as rules and regulations promulgated by the SEC, FINRA and other regulatory bodies. We, our subsidiaries, and/or certain of our past and present officers, have been named as parties in legal actions, regulatory investigations and proceedings, and securities arbitrations in the past and have been subject to claims alleging violation of such laws, rules and regulations, which have resulted in the payment of fines and settlements. An adverse resolution of any lawsuit, legal or regulatory proceeding or claim against us could result in substantial costs or reputational harm to the Company, and have a material adverse effect on the Company's business, financial condition or results of operations, which, in turn, may negatively affect the market price of our common stock and our ability to pay dividends. In addition to these financial costs and risks, the defense of litigation or arbitration may divert resources and management's attention from operations. See Part I, Item 3. "Legal Proceedings."

An IncreasingA Significant Percentage Of Our Assets Under Management Are Distributed Through Our Wholesale Channel, Which Has Higher Redemption Rates Than Our Traditional Advisors Channel. In recent years, we have focused on expanding distribution efforts relating to our Wholesale channel. The percentage of our assets under management in the Wholesale channel has increased from 10% at December 31, 2003 to 51%44% at December 31, 2012,2015, and the percentage of our total sales represented by the Wholesale channel has increased from 17% for the year ended December 31, 2003 to 70%61% for the year ended December 31, 2012.2015. The success of sales in our Wholesale channel depends upon our maintaining strong relationships with institutional accounts, certain strategic partners and our third party distributors. Many of those distribution sources also offer investors competing funds that are internally or externally managed, which could limit the distribution of our products. The loss of any of these distribution channels and the inability to continue to access new distribution channels could decrease our assets under management and adversely affect our results of operations and growth. There are no assurances that these channels and their client bases will continue to be accessible to us. The loss or diminution of the level of business we do with those providers could have a material adverse effect on our business, especially with the high concentration of assets in

certain funds in this channel, namely the Ivy Asset Strategy fund. Compared to the industry average redemption rate of 24.5% and 27.0%24.7% for the years ended December 31, 20122015 and 2011,2014, respectively, the Wholesale channel had redemption rates of 30.2%43.0% and 29.5%34.8% for the years ended December 31, 20122015 and 2011,2014, respectively. Redemption rates were 9.9%9.1% and 10.0%8.3% for our Advisors channel in the same periods, reflecting the higher rate of transferability of investment assets in the Wholesale channel.

Our Business Is Subject To Substantial Risk From Litigation, Regulatory Investigations And Potential Securities Laws Liability. Many aspects of our business involve substantial risks of litigation, regulatory investigations and/or arbitration, and from time to time, we are involved in various legal proceedings in the course of operating our business. We are exposed to liability under federal and state securities laws, other federal and state laws and court decisions, as well as rules and regulations promulgated by the SEC, FINRA and other regulatory bodies. We, our subsidiaries, and/or certain of our past and present officers, have been named as parties in legal actions, regulatory investigations and proceedings, and securities arbitrations in the past and have been subject to claims alleging violation of such laws, rules and regulations, which have resulted in the payment of fines and settlements. An adverse resolution of any lawsuit, legal or regulatory proceeding or claim against us could result in substantial costs or reputational harm to us, and have a material adverse effect on our business. In addition to these financial costs and risks, the defense of litigation, regulatory investigations or arbitration may divert resources and management's attention from operations.

Our Financial Advisors Are Classified As Independent Contractors, And Changes To Their Classification May Increase Our Operating Expenses. From time to time, various legislative or regulatory proposals are introduced at the federal or state levels to change the status of independent contractors' classification to employees for either employment tax purposes (withholding, social security, Medicare and unemployment taxes) or other benefits available to employees. Currently, most individuals are classified as employees or independent contractors for employment tax purposes based on 20 "common law" factors, rather than any

definition found in the Internal Revenue Code or Treasury regulations. We classify the majority of our financial advisors as independent contractors for all purposes, including employment tax and employee benefit purposes. There can be no assurance that legislative, judicial or regulatory (including tax) authorities will not introduce proposals or assert interpretations of existing rules and regulations that would change the independent contractor/employee classification of those financial advisors currently doing business with us. The costs associated with potential changes, if any, with respect to these independent contractor classifications could have a material adverse effect on our business.

There May Be Adverse Effects On Our Business If Our Funds' Performance Declines. Success in the investment management and mutual fund businesses is dependent on the investment performance of client accounts relative to market conditions and the performance of competing funds. Good relative performance stimulates sales of the Funds' shares and tends to keep redemptions low. Sales of the Funds' shares in turn generate higher management fees and distribution revenues. Good relative performance also attracts institutional and separate accounts. Conversely, poor relative performance results in decreased sales, increased redemptions of the Funds' shares and the loss of institutional and separate accounts, resulting in decreases in revenues. As of December 31, 2015, 15% our assets under management were concentrated in the Ivy Asset Strategy fund. As a result, our operating results are significantly affected by the performance of that fund and our ability to minimize redemptions from and maintain assets under management in that fund. If a significant amount of investments are withdrawn from that fund for any reason, our revenues would decline and our operating results would be adversely affected. Further, given the size and prominence of the Ivy Asset Strategy fund within our product line, any adverse performance of that fund may also indirectly affect the net sales and redemptions in our other products, which in turn may adversely affect our business.

There May Be An Adverse Effect On Our Revenues And EarningsBusiness If Our Investors Redeem The Assets We Manage On Short Notice. Mutual fund investors may redeem their investments in our mutual funds at any time without any prior notice. Additionally, our investment management agreements with institutions and other non-mutual fund accounts are generally terminable upon relatively short notice. Investors can terminate their relationship with us, reduce their aggregate amount of assets under management, or shift their funds to other types of accounts with different rate structures for any number of reasons, including investment performance, changes in prevailing interest rates and financial market performance. The abilityrisk of our investors to accomplish thisredeeming their investments in our mutual funds on short notice has increased materially due to the growth of assets in our Wholesale channel and with the high concentration of assets in certain funds in this channel, including the Ivy Asset Strategy fund. The decrease in revenues that could result from any such event could have a material adverse effect on our business and earnings.business.

There Is No Assurance That New Information Systems Will Be Implemented Successfully.We May Not Reduce Our Expenses Rapidly Enough To Align With Decreases In Our Revenues. We expect that, as we transition our load-waived Class A number of the Company's key information technology systems were developed solelyshares to handle the Company's particular information technology infrastructure. The Company isClass I shares in the process of evaluating and implementing new information technology and systems that it believes could facilitate and improve our core businesses andinvestments advisory products, our productivity. There can be no assurance that the Companyoperating revenue will be successfulsignificantly lower in implementing the new information technology and systems or that their implementation will be completed2016. If we are unable to effect appropriate expense reductions in a timely manner through operational changes or cost effective manner. Failureperformance improvement initiatives in response to implementthis expected decline in our revenues or maintain adequate information technology infrastructure could impededue to, among other things, the level of our ability to supportassets under management or our current business growth.environment, our business may be adversely affected.

Regulatory Risk Is Substantial In Our Business And Non-Compliance With Regulations, Or Changes In Regulations, Could Have A Significant Impact On The Conduct Of Our Business, Reputation And Our Prospects, Revenues And Earnings.Prospects. Our investment advisory and broker/dealer businesses are heavily regulated, primarily at the federal level. Non-compliance with applicable laws or regulations could result in sanctions being levied against us, including fines and censures, suspension or expulsion from a certain jurisdiction or market, or the revocation of licenses. Non-compliance with applicable laws or regulations could also adversely affect our business, reputation prospects, revenues and earnings.prospects. In addition, changes in current legal, regulatory, accounting, tax or compliance requirements or in governmental policies could adversely affect our operations, revenues and

earnings by, among other things, increasing expenses and reducing investor interest in certain products we offer. Distribution fees paid to mutual fund distributors in accordance with Rule 12b-1 promulgated under the Investment Company Act of 1940, as amended ("Rule 12b-1"), are an important element of the distribution of the mutual funds we manage. TheIn 2010, the SEC has proposed replacing Rule 12b-1 with a new regulation that would significantly change current fund distribution practices in the industry. If this proposed regulation is adopted, it may have a material impact on the compensation we pay to distributors for distributing the mutual funds we manage and/or our ability to recover expenses related to the distribution of our funds, and thus could materially affect our business. In 2015, the U.S. Department of Labor (the "DOL") proposed regulations to expand the scope of a "fiduciary" under the Employee Retirement Income Security Act of 1974, as amended ("ERISA"), and Section 4975 of the Internal Revenue Code of 1986, as amended (the "Code"), which, if enacted, would impact how advice can be provided to retirement account holders in 401(k) plans, individual retirement accounts and other qualified retirement programs. The DOL proposal also would create new exemptions and amend existing exemptions from the prohibited transaction rules applicable to fiduciaries under ERISA and the Code that would allow broker/dealers, investment advisers and others to continue to receive a variety of common forms of compensation that otherwise would be prohibited as conflicts of interest. If the proposed regulations are enacted, they may have a material impact on the provision of investment services to retirement accounts, including imposing additional compliance, reporting and operational requirements, which could negatively affect our revenue and net income.business. Additionally, our profitability could be affected by rules and regulations that impact the business and financial communities generally, including changes to the laws governing state and federal taxation.

Our Revenues, EarningsBusiness And Prospects Could Be Adversely Affected If The Securities Markets Decline. Our results of operations are affected by certain economic factors, including the levelsuccess of the securities markets. The on-going existence of adverseAdverse market conditions, which is particularly material to usthe U.S. domestic stock market due to our high concentration of assets under management in the United States domestic stockthat market, and lack of investor confidence could result in investors further withdrawing from the markets or decreasing their rate of investment, either of which could adversely affect our revenues, earnings and growth prospects to a greater extent. Because our revenues are, to a large extent, investment management fees that are based on the value of assets under management, a decline in the value of these assets adversely affects our revenues and earnings. Our growth is dependent to a significant degree upon our ability to attract and retain mutual fund assets, and, in an adverse economic environment, this may prove more difficult. Our growth rate has varied from year to year and there can be no assurance that theour average growth rates sustained in recent years will continue. Declines in the securities markets could significantly reduce our future revenues and earnings. In addition, a decline in the market value of these assets could cause our clients to withdraw funds in favor of investments they perceive as offering greater opportunity or lower risk, which could also negatively impact our revenues and earnings. The combination of adverse marketsmarket conditions reducing sales and investment management fees could compound on each other and materially affect earnings.

There May Be Adverse Effects On Our Revenues And Earnings If Our Funds' Performance Declines. Success in the investment management and mutual fund businesses is dependent on the investment performance of client accounts relative to market conditions and the performance of competing funds. Good relative performance stimulates sales of the Funds' shares and tends to keep redemptions low. Sales of the Funds' shares in turn generate higher management fees and distribution revenues. Good relative performance also attracts institutional and separate accounts. Conversely, poor relative performance results in decreased sales, increased redemptions of the Funds' shares and the loss of institutional and separate accounts, resulting in decreases in revenues. Failure of our Funds to perform well could, therefore, have a material adverse effect on our revenues and earnings.business.

Our Ability To Hire And Retain Senior Executive Management And Other Key Personnel Is Significant To Our Success And Growth. Our continued success depends to a substantial degree on our ability to attract and retain qualified senior executive management and other key personnel to conduct our broker/dealer, fund management and investment advisory businesses. The market for qualified fund managers, investment analysts, financial advisors and wholesalers is extremely competitive. Additionally, we are dependent on our financial advisors and select wholesale distributors to sell our mutual funds and other investment products. Our growth prospects will be directly affected by the quality, quantity and productivity of financial advisors and wholesalers we are able to successfully recruit and retain. There can be no assurances that we will be successful in our efforts to recruit and retain the required personnel.

A Failure In Or Breach Of Our Operational Or Security Systems Or Our Technology Infrastructure, Or Those Of Third Parties, Could Result In A Material Adverse Effect On Our Business And Reputation. We are highly dependent upon the use of various proprietary and third party software applications and other technology

systems to operate our business. As part of our normal operations, we process a large number of transactions on a daily basis and maintain and transmit confidential client and employee information, the safety and security of which is dependent upon the effectiveness of our information security policies, procedures and capabilities to protect such systems and the data that reside on or are transmitted through them.

Although we take protective measures and endeavor to modify these protective measures as circumstances warrant, technology is subject to rapid change and the nature of the threats continue to evolve. As a result, our operating and technology systems, software and networks may fail to operate properly or become disabled, or may be vulnerable to unauthorized access, inadvertent disclosure, loss or destruction of data (including confidential client information), computer viruses or other malicious code, cyber attacks and other events that could materially damage our operations, have an adverse security impact, or cause the disclosure or modification of sensitive or confidential information. Most of the software applications that we use in our business are licensed from, and supported, upgraded and maintained by, third party vendors. A suspension or termination of certain of these licenses or the related support, upgrades and maintenance could cause temporary system delays or interruption. We also take precautions to password protect and/or encrypt our laptops and other mobile electronic hardware. If such hardware is stolen, misplaced or left unattended, it may become vulnerable to hacking or other unauthorized use, creating a possible security risk and resulting in potentially costly actions by us. Further, while we have in place a disaster recovery plan to address catastrophic and unpredictable events, there is no guarantee that this plan will be sufficient in responding to or ameliorating the effects of all disaster scenarios, and we may experience system delays and interruptions as a result of natural disasters, power failures, acts of war, and third party failures.

The breach of our operational or security systems or our technology infrastructure, or those of third parties, due to one or more of these events could cause interruptions, malfunctions or failures in our operations and/or the loss or inadvertent disclosure of confidential client information could result in substantial financial loss or costs, liability for stolen assets or information, breach of client contracts, client dissatisfaction and/or loss, regulatory actions, remediation costs to repair damage caused by the breach, additional security costs to mitigate against future incidents and litigation costs resulting from the incident. These events, and those discussed above, could have a material adverse effect on our business and reputation.

There Is No Assurance That New Information Technology Systems Will Be Implemented Successfully. A number of our key information technology systems were developed solely to handle our particular information technology infrastructure. We are in the process of implementing new information technology systems that we believe could facilitate and improve our core businesses and our productivity. There can be no assurance that we will be successful in implementing the new information technology systems or that their implementation will be completed in a timely or cost effective manner. Failure to implement or maintain adequate information technology infrastructure could impede our ability to support business growth.

Support Provided To New Products May Reduce Fee Revenue, Increase Expenses And Expose Us To Potential Loss On Invested Capital. We may support the development of new investment products by waiving a portion of the fees we usually receive for managing such products, by subsidizing expenses or by making seed capital investments. There can be no assurance that new investment products we develop will be successful, which could have a material adverse effect on our business. Failure to have or devote sufficient capital to support new products could have an adverse impact on our future growth. Seed capital investments in new products utilize Company capital that would otherwise be available for general corporate purposes and expose us to capital losses due to investment market risk. Our non-operating investment and other income could be adversely affected by the realization of losses upon the disposition of our investments or the recognition of significant other-than-temporary impairments in the case of our available-for-sale portfolio and the recognition of unrealized losses related to our sponsored investment

portfolios that are held as trading and accounted for under the equity method. We may use various derivative instruments to mitigate the risk of our seed capital investments, although some market risk would remain. The risk of loss may be greater for seed capital investments that are not hedged, or if an intended hedge does not perform as expected. Our use of derivatives would result in counterparty risk in the event of non-performance by counterparties to these derivative instruments, regulatory risk and the risk that the underlying positions do not move identically to the related derivative instruments. As a result, volatility in the capital markets may affect the value of our seed capital investments, which may increase the volatility of our earnings and adversely affect our business.

Expansion Into International Markets May Increase Operational And Regulatory Risks. As we broaden our distribution globally, we face increased operational and regulatory risks. The failure of our systems of internal control to properly mitigate such additional risks, or of our operating infrastructure to support such international expansion could result in operational failures and regulatory fines or sanctions. Local regulatory environments may vary widely and place additional demands on our sales, legal and compliance personnel. Identifying and hiring well qualified personnel and adopting policies, procedures and controls to address local or regional requirements require time and resources. Regulators in non-U.S. jurisdictions could also change their policies or laws in a manner that might restrict or otherwise impede our ability to offer our investment strategies in their respective markets. Any of these local requirements, activities or needs could increase the costs and expenses we incur in a specific jurisdiction without any corresponding increase in revenues and income from operating in the jurisdiction.

We Have Substantial Intangibles On Our Balance Sheet, And Any Impairment Of Our Intangibles Could Adversely Affect Our Results of Operations And Financial Position.Operations. At December 31, 2012,2015, our total assets were approximately $1.2$1.6 billion, of which approximately $162.0$158.1 million, or 14%10%, consisted of goodwill and identifiable intangible assets. We complete an ongoing review of goodwill and intangible assets for impairment on an annual basis or more frequently whenever events or a change in circumstances warrant. Important factors in determining whether an impairment of goodwill or intangible assets might exist include significant continued underperformance compared to peers, the likelihood of termination or non-renewal of a mutual fund advisory or subadvisory contract or substantial changes in revenues earned from such contracts, significant changes in our business and products, material and ongoing negative industry or economic trends, or other factors specific to each asset or subsidiary being tested. Because of the significance of goodwill and other intangibles to our consolidated balance sheets, the annual impairment analysis is critical. Any changes in key assumptions about our business and our prospects, or changes in market conditions or other externalities, could result in an impairment charge. Any such charge could have a material effect on our results of operations and financial position.

Table of Contentsoperations.

There May Be Adverse Effects On Our Business And Earnings Upon The Termination Of, Or Failure To Renew, Certain Agreements. A majority of our revenues are derived from investment management agreements with the Funds that, as required by law, are terminable on 60 days' notice. Each investment management agreement must be approved and renewed annually by the disinterested members of each Fund's board of trustees or its shareholders, as required by law. Additionally, our investment management agreements provide for automatic termination in the event of assignment, which includes a change of control, without the consent of our clients and, in the case of the Funds, approval of the Funds' board of directors/trustees and shareholders to continue the agreements. There can be no assurances that our clients will consent to any assignment of our investment management agreements, or that those and other contracts will not be terminated or will be renewed on favorable terms, if at all, at their expiration and new agreements may not be available. See "Business—Distribution Channels—Wholesale Channel, Institutional Channel." The decrease in revenues that could result from any such event could have a material adverse effect on our business and earnings.business.

A Failure In Or Breach Of Our Operational Or Security Systems Or Our Technology Infrastructure, Or Those Of Third Parties, Could Result In A Material Adverse Effect On Our Business, Reputation, Cash Flows and Results Of Operations. We are highly dependent upon the use of various proprietary and third-party software applications and other technology systems to operate our business. As part of our normal operations, we process a large number of transactions on a daily basis and maintain and transmit confidential client and employee information, the safety and security of which is dependent upon the effectiveness of our information security policies, procedures and capabilities to protect such systems and the data that reside on or are transmitted through them.

Although we take protective measures and endeavor to modify these protective measures as circumstances warrant, technology is subject to rapid change and the nature of the threats continue to evolve. As a result, our operating and technology systems, software and networks may fail to operate properly or become disabled, or may be vulnerable to unauthorized access, inadvertent disclosure, loss or destruction of data (including confidential client information), computer viruses or other malicious code, cyber attacks and other events that could materially damage our operations, have an adverse security impact, or cause the disclosure or modification of sensitive or confidential information. Most of the software applications that we use in our business are licensed from, and supported, upgraded and maintained by, third-party vendors. A suspension or termination of certain of these licenses or the related support, upgrades and maintenance could cause temporary system delays or interruption. We also take precautions to password protect and/or encrypt our laptops and other mobile electronic hardware. If such hardware is stolen, misplaced or left unattended, it may become vulnerable to hacking or other unauthorized use, creating a possible security risk and resulting in potentially costly actions by us. Further, while we have in place a disaster recovery plan to address catastrophic and unpredictable events, there is no guarantee that this plan will be sufficient in responding to or ameliorating the effects of all disaster scenarios, and we may experience system delays and interruptions as a result of natural disasters, power failures, acts of war, and third-party failures.

The breach of our operational or technology systems, software and networks, or those of third parties, due to one or more of these events could cause interruptions, malfunctions or failures in our operations and/or the loss or inadvertent disclosure of confidential client information could result in substantial financial loss or costs, liability for stolen assets or information, breach of client contracts, client dissatisfaction and/or loss, regulatory actions, remediation costs to repair damage caused by the breach, additional security costs to mitigate against future incidents and litigation costs resulting from the incident. These events, and those discussed above, could have a material adverse effect on our business, reputation, results of operations, financial position, cash flow, revenues and income.

Regulations Restricting The Use Of "Soft Dollars" Could Result In An Increase In Our Expenses. On behalf of our mutual fund and investment advisory clients, we make decisions to buy and sell securities for each

portfolio, select broker/dealers to execute trades, and negotiate brokerage commission rates. In connection