Use these links to rapidly review the document

FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 20132014 TABLE OF CONTENTS

TABLE OF CONTENTS

PART IV

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | |

ý |

|

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 20132014 |

o |

|

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | | | |

| Commission File Number | | Exact name of registrant as specified in their charters, its charter,

addresses of principal executive offices,

telephone numbers

and states or other jurisdictions of incorporation or organization | | I.R.S. Employer

Identification Number |

|---|

814-00839 | | New Mountain Finance Holdings, L.L.C.

787 Seventh Avenue, 48th Floor

New York, New York 10019

Telephone: (212) 720-0300

State of Incorporation: Delaware | | 26-3633318 |

| 814-00832 | | New Mountain Finance Corporation

787 Seventh Avenue, 48th Floor

New York, New York 10019

Telephone: (212) 720-0300

State of Incorporation: Delaware | | 27-2978010 |

814-00902 | | New Mountain Finance AIV Holdings Corporation

787 Seventh Avenue, 48th Floor

New York, New York 10019

Telephone: (212) 720-0300

State of Incorporation: Delaware | | 80-0721242 |

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Registrant

| | Title of each class | | Name of each exchange on which registered |

|---|

New Mountain Finance Holdings, L.L.C. | | None | | None |

New Mountain Finance Corporation | | Common stock, $0.01 par value | | The New York Stock Exchange |

New Mountain Finance AIV Holdings Corporation | | None | | None |

Securities registered pursuant to Section 12(g) of the Act:

| | | | |

Registrant

| | Title of each class | |

|

|---|

New Mountain Finance Holdings, L.L.C. | | Common membership units |

New Mountain Finance CorporationNone | | None |

New Mountain Finance AIV Holdings Corporation | | Common stock, $0.01 par value |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

| | | | |

New Mountain Finance Holdings, L.L.C. | | Yes o No ý | | |

New Mountain Finance Corporation | | Yes o No ý | | |

New Mountain Finance AIV Holdings Corporation | | Yes o No ý | | |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

| | | | |

New Mountain Finance Holdings, L.L.C. | | Yes o No ý | | |

New Mountain Finance Corporation | | Yes o No ý | | |

New Mountain Finance AIV Holdings Corporation | | Yes o No ý | | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

| | | | |

New Mountain Finance Holdings, L.L.C. | | Yes ý No o | | |

New Mountain Finance Corporation | | Yes ý No o | | |

New Mountain Finance AIV Holdings Corporation | | Yes ý No o | | |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

| | | | |

New Mountain Finance Holdings, L.L.C. | | Yes o No o | | |

New Mountain Finance Corporation | | Yes o No o | | |

New Mountain Finance AIV Holdings Corporation | | Yes o No o | | |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.ý

| | | | |

New Mountain Finance Holdings, L.L.C. | | ý | | |

New Mountain Finance Corporation | | ý | | |

New Mountain Finance AIV Holdings Corporation | | ý | | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act:

| | | | |

New Mountain Finance Holdings, L.L.C. | | Large accelerated filer oý | | Accelerated filer ýo |

| | Non-accelerated filer o

| | Smaller(Do not check if a

smaller reporting company o |

New Mountain Finance Corporation | | Large accelerated filer o | | Accelerated filer ý |

| | Non-accelerated filer o | | Smaller reporting company o |

New Mountain Finance AIV Holdings Corporation | | Large accelerated filer o | | Accelerated filer ý |

| | Non-accelerated filer ocompany) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| | | | |

New Mountain Finance Holdings, L.L.C. | | Yes o No ý | | |

New Mountain Finance Corporation | | Yes o No ý | | |

New Mountain Finance AIV Holdings Corporation | | Yes o No ý | | |

There is no established market for New Mountain Finance AIV Holdings Corporation's shares of common stock. Additionally, there is no established market for New Mountain Finance Holdings, L.L.C.'s common membership units.

The aggregate market value of common stock held by non-affiliates of the publicly traded registrant, New Mountain Finance Corporation on June 28, 201330, 2014, based on the closing price on that date of $14.16$14.86, on the New York Stock Exchange was $501.7$728.3 million. For the purposes of calculating this amount only, all directors and executive officers of the registrant have been treated as affiliates.

| | | | | | |

Registrant

| | Description | | Shares / Units as of March 5, 20142, 2015 | |

|---|

New Mountain Finance Holdings, L.L.C.

| | Common membership units | | | 47,896,693 | |

New Mountain Finance Corporation

| | Common stock, $0.01 par value | | | 47,896,693 | |

New Mountain Finance AIV Holdings Corporation

| | Common stock, $0.01 par value | | | 100 | 57,997,890 |

This combined Form 10-K is filed separately by three registrants: New Mountain Finance Holdings, L.L.C., New Mountain Finance Corporation and New Mountain Finance AIV Holdings Corporation (collectively, the "New Mountain Finance Registrants"). Information contained herein relating to any New Mountain Finance Registrant is filed by such registrant solely on its own behalf. Each New Mountain Finance Registrant makes no representation as to information relating exclusively to the other registrants.

Portions of the New Mountain Finance Registrants' Joint Proxy Statement for their joint 2014its 2015 Annual Meeting of Stockholders to be filed not later than 120 days after the end of the fiscal year covered by this Annual Report on this combined Form 10-K are incorporated by reference into Part III on this combined Form 10-K.

Table of Contents

FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 20132014

TABLE OF CONTENTS

| | | | | | |

| |

| | PAGE | |

|---|

PART I | |

Item 1. | | Business | | | 1 | |

Item 1A. | | Risk Factors | | | 2529 | |

Item 1B. | | Unresolved Staff Comments | | | 61 | |

Item 2. | | Properties | | | 61 | |

Item 3. | | Legal Proceedings | | | 61 | |

Item 4. | | Mine Safety Disclosures | | | 61 | |

PART II | |

Item 5. | | Market for Registrants' Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | | 62 | |

Item 6. | | Selected Financial Data | | | 6766 | |

Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | | 7270 | |

Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | | | 98103 | |

Item 8. | | Financial Statements and Supplementary Data | | | 99105 | |

Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | | 172170 | |

Item 9A. | | Controls and Procedures | | | 172170 | |

Item 9B. | | Other Information | | | 174173 | |

PART III | |

Item 10. | | Directors, Executive Officers and Corporate Governance | | | 175174 | |

Item 11. | | Executive Compensation | | | 175174 | |

Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | | 175174 | |

Item 13. | | Certain Relationships and Related Transactions, and Director Independence | | | 175174 | |

Item 14. | | Principal Accountant Fees and Services | | | 175174 | |

PART IV | |

Item 15. | | Exhibits and Financial Statement Schedules | | | 176175 | |

Table of Contents

PART I

The information in this combined Form 10-K relates to each of the three separate registrants: New Mountain Finance Holdings, L.L.C., New Mountain Finance Corporation and New Mountain Finance AIV Holdings Corporation (collectively, "we", "us", "our" or the "Companies"). Information that relates to an individual registrant will be specifically referenced to the respective company. None of the Companies make any representation as to the information related solely to the other registrants other than itself.

Item 1. Business

New Mountain Finance Holdings, L.L.C.Corporation

New Mountain Finance Holdings, L.L.C. (the "Operating Company"Corporation ("NMFC", the "Company", "we", "us" or the "Master Fund""our") is a Delaware limited liability company. The Operating Companycorporation that was originally incorporated on June 29, 2010. NMFC is externally managed anda closed-end, non-diversified management investment company that has elected to be treatedregulated as a business development company ("BDC") under the Investment Company Act of 1940, as amended (the "1940 Act"). As such, the Operating CompanyNMFC is obligated to comply with certain regulatory requirements. The Operating CompanyNMFC has elected to be treated, and intends to becomply with the requirements to continue to qualify annually, as a regulated investment company ("RIC") under Subchapter M of the Internal Revenue Code of 1986, as amended, (the "Code"). NMFC is also registered as an investment adviser under the Investment Advisers Act of 1940, as amended (the "Advisers Act").

On May 19, 2011, NMFC priced its initial public offering (the "IPO") of 7,272,727 shares of common stock at a public offering price of $13.75 per share. Concurrently with the closing of the IPO and at the public offering price of $13.75 per share, NMFC sold an additional 2,172,000 shares of its common stock to certain executives and employees of, and other individuals affiliated with, New Mountain Capital (defined as New Mountain Capital Group, L.L.C. and its affiliates) in a concurrent private placement (the "Concurrent Private Placement"). Additionally, 1,252,964 shares were issued to the partners of New Mountain Guardian Partners, L.P. at that time for their ownership interest in the Predecessor Entities (as defined below). In connection with NMFC's IPO and through a series of transactions, New Mountain Finance Holdings, L.L.C. ("NMF Holdings" or the "Predecessor Operating Company") acquired all of the operations of the Predecessor Entities, including all of the assets and liabilities related to such operations.

New Mountain Finance Holdings, L.L.C.

NMF Holdings is a Delaware limited liability company. Until May 8, 2014, NMF Holdings was externally managed and was regulated as a BDC under the 1940 Act. As such, NMF Holdings was obligated to comply with certain regulatory requirements. NMF Holdings was treated as a partnership for United States ("U.S.") federal income tax purposes for so long as it hashad at least two members. With the completion of the underwritten secondary offering on February 3, 2014, NMF Holdings' existence as a partnership for U.S. federal income tax purposes terminated and NMF Holdings became an entity that is disregarded as a separate entity from its owner for U.S. federal tax purposes. For additional information on the Company's organizational structure prior to May 8, 2014, see "—Restructuring".

The Operating Company isUntil May 8, 2014, NMF Holdings was externally managed by New Mountain Finance Advisers BDC, L.L.C. (the "Investment Adviser"). As of May 8, 2014, the Investment Adviser serves as the external investment adviser to NMFC. New Mountain Finance Administration, L.L.C. (the "Administrator") provides the administrative services necessary for operations. The Investment Adviser and Administrator are wholly-owned subsidiaries of New Mountain Capital (defined as New Mountain Capital Group, L.L.C. and its affiliates).Capital. New Mountain Capital is a firm with a track record of investing in the middle market and with assets under management (which includes amounts committed, not all of which have been drawn down and invested to date) totaling more than $12.0 billion as of December 31, 2013,$15.0 billion(1), which includes total assets held by the Operating Company. New Mountain Capital focuses on investing in defensive growth companies across its private equity, public equity and credit investment vehicles. The Operating Company,NMF Holdings, formerly known as New Mountain Guardian (Leveraged), L.L.C., was originally formed as a subsidiary of New Mountain Guardian AIV, L.P. ("Guardian AIV") by New Mountain Capital in October 2008. Guardian AIV was formed through an allocation of approximately $300.0

- (1)

- Includes amounts committed, not all of which have been drawn down and invested to date, as of December 31, 2014.

Table of Contents

$300.0 million of the $5.1 billion of commitments supporting New Mountain Partners III, L.P., a private equity fund managed by New Mountain Capital. In February 2009, New Mountain Capital formed a co-investment vehicle, New Mountain Guardian Partners, L.P., comprising $20.4 million of commitments. New Mountain Guardian (Leveraged), L.L.C. and New Mountain Guardian Partners, L.P., together with their respective direct and indirect wholly-owned subsidiaries, are defined as the "Predecessor Entities".

Prior to December 18, 2014, New Mountain Finance Corporation

New Mountain Finance CorporationSPV Funding, L.L.C. ("NMFC"NMF SLF") iswas a Delaware corporation thatlimited liability company. NMF SLF was originally incorporated on June 29, 2010. NMFC is a closed-end, non-diversified management investment company that has elected to be treated aswholly-owned subsidiary of NMF Holdings and thus a BDC under the 1940 Act. As such, NMFC is obligated to comply with certain regulatory requirements. NMFC has elected to be treated, and intends to comply with the requirements to continue to qualify annually, as a regulated investment company ("RIC") under Subchapter Mwholly-owned indirect subsidiary of the Internal Revenue CodeCompany. NMF SLF was bankruptcy-remote and non-recourse to NMFC. As part of 1986, as amended, (the "Code").

On May 19, 2011, NMFC priced its initial public offering (the "IPO") of 7,272,727 shares of common stock at a public offering price of $13.75 per share. Concurrently with the closing of the IPO and at the public offering price of $13.75 per share, NMFC sold an additional 2,172,000 shares of its common stock to certain executives and employees of, and other individuals affiliated with, New Mountain Capital in a concurrent private placement (the "Concurrent Private Placement"). Additionally, 1,252,964 shares were issuedamendment to the partners of New Mountain Guardian Partners, L.P. at that timeCompany's existing credit facilities with Wells Fargo Bank, National Association, NMF SLF merged with and into NMF Holdings on December 18, 2014. SeeItem 8.—Financial Statements and Supplementary Data—Note 7, Borrowings for their ownership interest inadditional information on the Predecessor Entities.

Table of ContentsCompany's credit facilities.

New Mountain Finance AIV Holdings Corporation

Until April 25, 2014, New Mountain Finance AIV Holdings Corporation ("AIV Holdings") iswas a Delaware corporation that was originally incorporated on March 11, 2011. AIV Holdings was dissolved on April 25, 2014. Guardian AIV, a Delaware limited partnership, iswas AIV Holdings' sole stockholder. AIV Holdings iswas a closed-end, non-diversified management investment company that has elected to be treatedwas regulated as a BDC under the 1940 Act. As such, AIV Holdings iswas obligated to comply with certain regulatory requirements. AIV Holdings has elected to bewas treated, and intends to complycomplied with the requirements to continue to qualify annually, as a RIC under the Code.

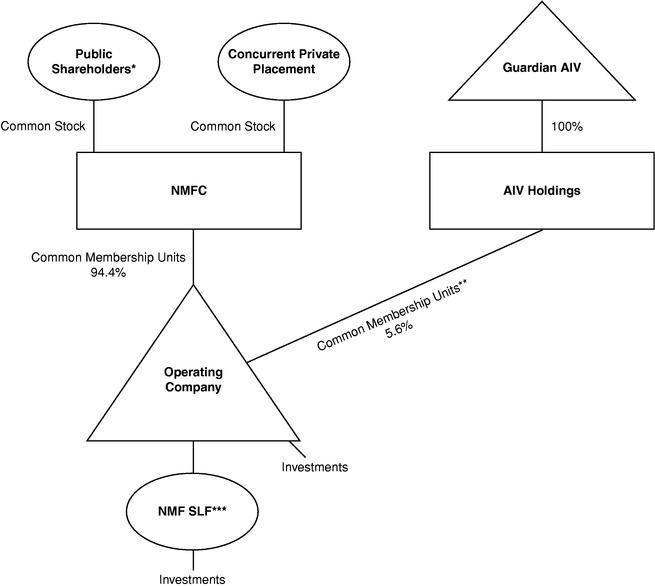

Structure

Prior to the Restructuring (as defined below) on May 8, 2014, NMFC and AIV Holdings were holding companies with no direct operations of their own, and their sole asset was their ownership in NMF Holdings. In connection with NMFC'sthe IPO, NMFC and AIV Holdings each entered into a joinder agreement with respect to the Limited Liability Company Agreement, as amended and restated (the "Operating Agreement"), of NMF Holdings, pursuant to which NMFC and AIV Holdings were admitted as members of NMF Holdings. NMFC acquired from NMF Holdings, with the gross proceeds of the IPO and throughthe Concurrent Private Placement, common membership units ("units") of NMF Holdings (the number of units were equal to the number of shares of NMFC's common stock sold in the IPO and the Concurrent Private Placement). Additionally, NMFC received units of NMF Holdings equal to the number of shares of common stock of NMFC issued to the partners of New Mountain Guardian Partners, L.P. Guardian AIV was the parent of NMF Holdings prior to the IPO and, as a series of transactions, the Operating Company acquired allresult of the operationstransactions completed in connection with the IPO, obtained units in NMF Holdings. Guardian AIV contributed its units in NMF Holdings to its newly formed subsidiary, AIV Holdings, in exchange for common stock of AIV Holdings. AIV Holdings had the Predecessor Entities, includingright to exchange all or any portion of the assets and liabilities related to such operations.its units in NMF Holdings for shares of NMFC's common stock on a one-for-one basis at any time.

The currentoriginal structure was designed to generally prevent NMFC from being allocated taxable income with respect to unrecognized gains that existed at the time of the IPO in the Predecessor Entities' assets, and rather such amounts would be allocated generally to AIV Holdings. The result iswas that any distributions made to NMFC's stockholders that arewere attributable to such gains generally willwere not be treated as taxable dividends but rather as return of capital.

As a result of the transactions completed in connection with the IPO, Guardian AIV obtained units in the Operating Company. Guardian AIV contributed its units in the Operating Company to its newly formed subsidiary, AIV Holdings, in exchange for common stock of AIV Holdings. AIV Holdings has the right to exchange all or any portion of its units in the Operating Company for shares of NMFC's common stock on a one-for-one basis at any time.

NMFC and AIV Holdings are holding companies with no direct operations of their own, and their sole asset is their ownership in the Operating Company. NMFC and AIV Holdings each entered into a joinder agreement with respect to the Limited Liability Company Agreement, as amended and restated, of the Operating Company, pursuant to which NMFC and AIV Holdings were admitted as members of the Operating Company. NMFC acquired from the Operating Company, with the gross proceeds of the IPO and the Concurrent Private Placement, common membership units ("units") of the Operating Company (the number of units are equal to the number of shares of NMFC's common stock sold in the IPO and the Concurrent Private Placement). Additionally, NMFC received units of the Operating Company equal to the number of shares of common stock of NMFC issued to the partners of New Mountain Guardian Partners, L.P.

Since NMFC's IPO, and through December 31, 2013,2014, NMFC raised approximately $233.4$374.6 million in net proceeds from additional offerings of common stock and issued shares of its common stock valued at approximately $249.6$288.4 million on behalf of AIV Holdings for exchanged units. NMFC

Table of Contents

acquired from the Operating CompanyNMF Holdings units of the Operating CompanyNMF Holdings equal to the number of shares of NMFC's common stock sold in the additional offerings. With the completion of the final secondary offering on February 3, 2014, NMFC owned 100.0% of the units of NMF Holdings, which became a wholly-owned subsidiary of NMFC.

Restructuring

As a BDC, AIV Holdings had been subject to the 1940 Act, including certain provisions applicable only to BDCs. Accordingly, and after careful consideration of the 1940 Act requirements applicable to BDCs, the cost of 1940 Act compliance and a thorough assessment of AIV Holdings' business model, AIV Holdings' board of directors determined that continuation as a BDC was not in the best interests of AIV Holdings and Guardian AIV. Specifically, given that AIV Holdings was formed for the sole purpose of holding units of NMF Holdings and AIV Holdings had disposed of all of the units of NMF Holdings that it was holding as of February 3, 2014, the board of directors of AIV Holdings approved and declared advisable at an in-person meeting held on March 25, 2014 the withdrawal of AIV Holdings' election to be regulated as a BDC under the 1940 Act. In addition, the board of directors of AIV Holdings approved and declared advisable for AIV Holdings to terminate its registration under Section 12(g) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") and to dissolve AIV Holdings under the laws of the State of Delaware.

Upon receipt of the necessary stockholder consent to authorize the board of directors of AIV Holdings to withdraw AIV Holdings' election to be regulated as a BDC, the withdrawal was filed and became effective upon receipt by the U.S. Securities and Exchange Commission ("SEC") of AIV Holdings' notification of withdrawal on Form N-54C on April 15, 2014. The board of directors of AIV Holdings believed that AIV Holdings met the requirements for filing the notification to withdraw its election to be regulated as a BDC, upon the receipt of the necessary stockholder consent. After the notification of withdrawal of AIV Holdings' BDC election was filed with the SEC, AIV Holdings was no longer subject to the regulatory provisions of the 1940 Act applicable to BDCs generally, including regulations related to insurance, custody, composition of its board of directors, affiliated transactions and any compensation arrangements.

In addition, on April 15, 2014, AIV Holdings filed a Form 15 with the SEC to terminate AIV Holdings' registration under Section 12(g) of the Exchange Act. After these SEC filings and any other federal or state regulatory or tax filings were made, AIV Holdings proceeded to dissolve under Delaware law by filing a certificate of dissolution in Delaware on April 25, 2014.

Until May 8, 2014, as a BDC, NMF Holdings had been subject to the 1940 Act, including certain provisions applicable only to BDCs. Accordingly, and after careful consideration of the 1940 Act requirements applicable to BDCs, the cost of 1940 Act compliance and a thorough assessment of NMF Holdings' current business model, NMF Holdings' board of directors determined at an in-person meeting held on March 25, 2014 that continuation as a BDC was not in the best interests of NMF Holdings.

At the 2014 joint annual meeting of the stockholders of NMFC and the sole unit holder of NMF Holdings held on May 6, 2014, the stockholders of NMFC and the sole unit holder of NMF Holdings approved a proposal which authorized the board of directors of NMF Holdings to withdraw NMF Holdings' election to be regulated as a BDC. Additionally, the stockholders of NMFC approved a new investment advisory and management agreement between NMFC and the Investment Adviser. Upon receipt of the necessary stockholder/unit holder approval to authorize the board of directors of NMF Holdings to withdraw NMF Holdings' election to be regulated as a BDC, the withdrawal was filed and became effective upon receipt by the SEC of NMF Holdings' notification of withdrawal on Form N-54C on May 8, 2014.

Table of Contents

Effective May 8, 2014, NMF Holdings amended and restated its Operating Agreement such that the board of directors of NMF Holdings was dissolved and NMF Holdings remained a wholly-owned subsidiary of NMFC with the sole purpose of serving as a special purpose vehicle for NMF Holdings' credit facility, and NMFC assumed all other operating activities previously undertaken by NMF Holdings under the management of the Investment Adviser (collectively, the "Restructuring"). After the Restructuring, all wholly-owned direct and indirect subsidiaries of NMFC are consolidated with NMFC for both 1940 Act and financial statement reporting purposes, subject to any financial statement adjustments required in accordance with accounting principles generally accepted in the United States of America ("GAAP"). NMFC continues to remain a BDC under the 1940 Act.

Also, on May 8, 2014, NMF Holdings filed Form 15 with the SEC to terminate NMF Holdings' registration under Section 12(g) of the Exchange Act. As a special purpose entity, NMF Holdings is bankruptcy-remote and non-recourse to NMFC. In addition, the assets held at NMF Holdings will continue to be used to secure NMF Holdings' credit facility.

Current Organization

During the year ended December 31, 2014, the Company established wholly-owned subsidiaries, NMF Ancora Holdings Inc. ("NMF Ancora") and NMF YP Holdings Inc. ("NMF YP"), which are structured as Delaware entities that serve as tax blocker corporations which hold equity or equity-like investments in portfolio companies organized as limited liability companies (or other forms of pass-through entities). Tax blocker corporations are not consolidated for income tax purposes and may incur income tax expense as a result of their ownership of portfolio companies. Additionally, the Company has a wholly-owned subsidiary, New Mountain Finance Servicing, L.L.C. ("NMF Servicing") that serves as the administrative agent on certain investment transactions. New Mountain Finance SBIC, L.P. ("SBIC LP"), and its general partner, New Mountain Finance SBIC G.P., L.L.C. ("SBIC GP"), were organized in Delaware as a limited partnership and limited liability company, respectively. SBIC LP and SBIC GP are consolidated wholly-owned direct and indirect subsidiaries of the Company. SBIC LP received a license from the U.S. Small Business Association (the "SBA") to operate as a small business investment company ("SBIC") under Section 301(c) of the Small Business Investment Act of 1958, as amended (the "1958 Act").

Table of Contents

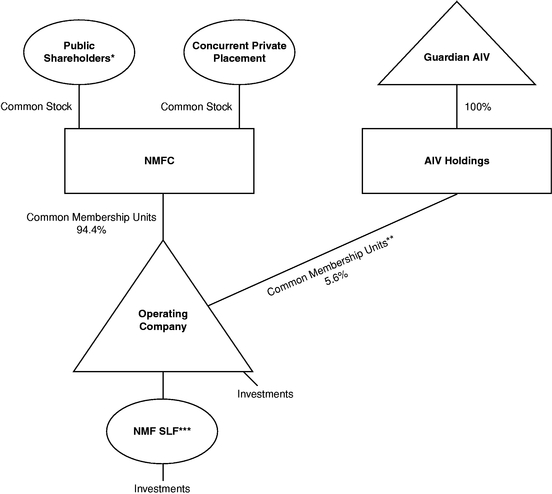

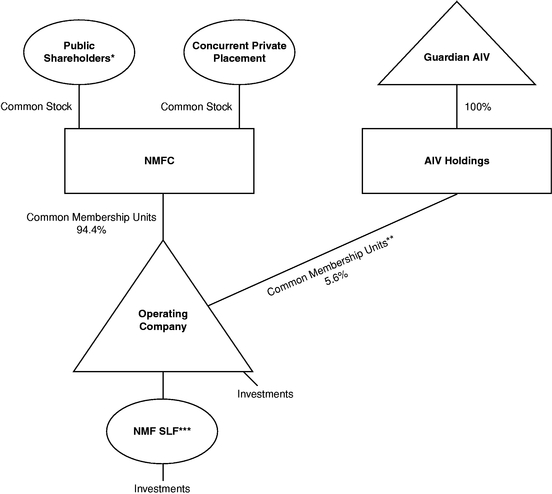

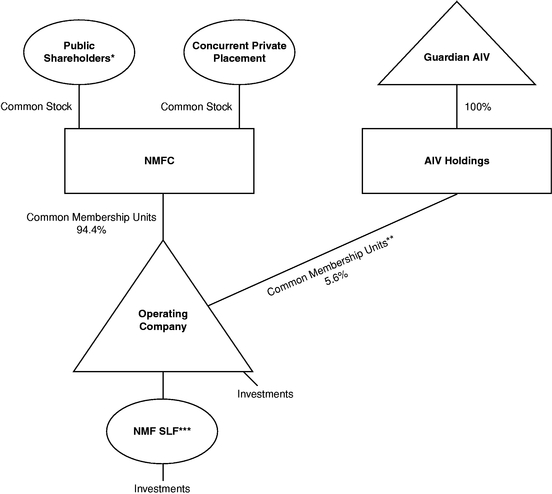

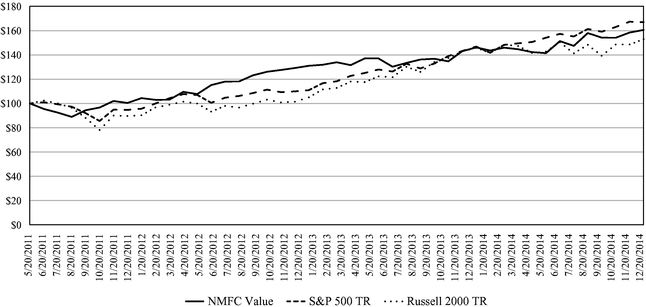

The diagram below depicts the Companies'Company's organizational structure as of December 31, 2013.2014.

- *

- Includes partners of New Mountain Guardian Partners, L.P.

- **

These common membership units are exchangeable into sharesNMFC is the sole limited partner of SBIC LP. NMFC, common stock on a one-for-one basis.

***New Mountain Finance SPV Funding, L.L.C. ("NMF SLF").directly or indirectly through SBIC GP, wholly-owns SBIC LP. NMFC owns 100.0% of SBIC GP which owns 1.0% of SBIC LP. NMFC owns 99.0% of SBIC LP.

The Operating Company consolidates its wholly-owned subsidiary, New Mountain Finance SPV Funding, L.L.C. ("NMF SLF"). NMFC and AIV Holdings do not consolidate the Operating Company. NMFC and AIV Holdings apply investment company master-feeder financial statement presentation, as described in Accounting Standards Codification 946,Financial Services—Investment Companies, ("ASC 946") to their interest in the Operating Company. NMFC and AIV Holdings observe that it is industry practice to follow the presentation prescribed for a master fund-feeder fund structure in ASC 946 in instances in which a master fund is owned by more than one feeder fund and that such presentation provides stockholders of NMFC and AIV Holdings with a clearer depiction of their investment in the Master Fund.

New Mountain Finance Advisers BDC, L.L.C.

The Investment Adviser manages the Operating Company's day-to-day operations and provides it with investment advisory and management services. In particular, the Investment Adviser is responsible for identifying attractive investment opportunities, conducting research and due diligence on

Table of Contents

prospective investments, structuring the Operating Company's investments and monitoring and servicing the Operating Company's investments. The Investment Adviser is managed by a five member investment committee, which is responsible for approving purchases and sales of the Operating Company's investments above $5.0$10.0 million in aggregate by issuer. For additional information on the investment committee, see "Investment Committee" section.

New Mountain Finance Administration, L.L.C.

The Administrator provides the administrative services necessary to conduct our day-to-day operations. The Administrator also performs, or oversees the performance of, our financial records, our reports to stockholders and reports filed with the Securities and Exchange Commission.SEC. The Administrator performs the calculation and publication of our net asset values, the payment of our expenses and oversees the performance of various third-party service providers and the preparation and filing of our tax returns. The Administrator may also provide, on the Operating Company's behalf, managerial assistance to its portfolio companies.

Competition

The Operating Company competes for investments with a number of BDCs and investment funds (including private equity and hedge funds), as well as traditional financial services companies such as commercial

Table of Contents

banks and other sources of financing. Many of these entities have greater financial and managerial resources than we do. We believe the Operating Company is able to be competitive with these entities primarily on the basis of the experience and contacts of its management team, the Operating Company's responsive and efficient investment analysis and decision-making processes, the investment terms the Operating Company offers, the leveraged model that the Operating Company employs to perform its due diligence with the broader New Mountain Capital team and the Operating Company's model of investing in companies and industries it knows well.

We believe that some of the Operating Company's competitors may make investments with interest rates and returns that are comparable to or lower than the rates and returns that the Operating Company targets. Therefore, the Operating Company does not seek to compete solely on the interest rates and returns that it offers to potential portfolio companies. For additional information concerning the competitive risks we face, seeItem 1A.—Risk Factors.

Investment Objectives and Portfolio

The Operating Company's investment objective is to generate current income and capital appreciation through the sourcing and origination of debt securities at all levels of the capital structure, including first and second lien debt, notes, bonds and mezzanine securities. In some cases, the Operating Company's investments may also include equity interests such as preferred stock, common stock, warrants or options received in connection with the Operating Company's debt investments or may include a direct investment in the equity of private companies.

The Operating Company makes investments through both primary originations and open-market secondary purchases. The Operating Company primarily targets loans to, and invests in, United States ("U.S.") middle market businesses, a market segment we believe continues to be underserved by other lenders. We define middle market businesses as those businesses with annual earnings before interest, taxes, depreciation, and amortization ("EBITDA") between $20.0 million and $200.0 million. The primary focus is in the debt of defensive growth companies, which are defined as generally exhibiting the following characteristics: (i) sustainable secular growth drivers, (ii) high barriers to competitive entry, (iii) high free cash flow after capital expenditure and working capital needs, (iv) high returns on assets and (v) niche market dominance. Similar to the Company, SBIC LP's investment objective is to generate current income and capital appreciation under the investment criteria used by the Company, however, SBIC LP's investments must be SBA eligible companies. The OperatingCompany's portfolio may be concentrated in a limited number of industries. As of December 31, 2014, the Company's top five industry concentrations were software, business services, education, federal services and healthcare services. The Company's targeted investments typically have maturities of between five and ten years and generally range in size between $10.0 million and

Table of Contents

$50.0 $50.0 million. This investment size may vary proportionately as the size of the Operating Company's capital base changes. At December 31, 2013,2014, the Operating Company's portfolio consisted of 5971 portfolio companies and was invested 47.6% in first lien loans, 42.4% in second lien loans, 4.3% in subordinated debt and 5.7% in equity and other, as measured at fair value versus the Predecessor Operating Company's portfolio which consisted of 59 portfolio companies invested 49.6% in first lien loans, 42.0% in second lien loans, 2.4% in subordinated debt and 6.0% in equity and other as measured at fair value versus 63 portfolio companies invested 49.8% in first lien loans, 44.6% in second lien loans, 4.6% in subordinated debt and 1.0% in equity and other at December 31, 2012.2013.

The fair value of the Company's investments was approximately $1,424.7 million in 71 portfolio companies at December 31, 2014. At December 31, 2013 and December 31, 2012, the Company's only investment was its investment in the Predecessor Operating Company. The fair value of the Predecessor Operating Company's investments was approximately $1,115.7 million in 59 portfolio companies at December 31, 2013 and $989.8 million in 63 portfolio companies at December 31, 2012 and $703.5 million in 55 portfolio companies at December 31, 2011.2012.

Table of Contents

The following table shows the Company's portfolio and investment activity for the year ended December 31, 2014 and the Predecessor Operating Company's portfolio and investment activity for the years ended December 31, 2013 December 31, 2012 and December 31, 2011:2012:

| | | | | | | | | | |

| | Years ended December 31, | |

|---|

(in millions)

| | 2014(1) | | 2013 | | 2012 | |

|---|

New investments in 43, 34 and 45 portfolio companies, respectively | | $ | 720.9 | | $ | 529.3 | | $ | 673.2 | |

Debt repayments in existing portfolio companies | | | 267.5 | | | 395.4 | | | 299.2 | |

Sales of securities in 14, 12 and 22 portfolio companies, respectively | | | 117.0 | | | 31.2 | | | 124.7 | |

Change in unrealized appreciation on 20, 45 and 48 portfolio companies, respectively | | | 21.2 | | | 27.9 | | | 27.0 | |

Change in unrealized depreciation on 60, 29 and 30 portfolio companies, respectively | | | (63.9 | ) | | (19.9 | ) | | (17.1 | ) |

| | | | | | | | | | |

| | Years ended December 31, | |

|---|

(in millions)

| | 2013 | | 2012 | | 2011 | |

|---|

New investments in 34, 45 and 37 portfolio companies, respectively | | $ | 529.3 | | $ | 673.2 | | $ | 493.3 | |

Debt repayments in existing portfolio companies | | | 395.4 | | | 299.2 | | | 146.4 | |

Sales of securities in 12, 22 and 17 portfolio companies, respectively | | | 31.2 | | | 124.7 | | | 85.6 | |

Change in unrealized appreciation on 45, 48 and 17 portfolio companies, respectively | | | 27.9 | | | 27.0 | | | 6.1 | |

Change in unrealized depreciation on 29, 30 and 48 portfolio companies, respectively | | | (19.9 | ) | | (17.1 | ) | | (29.2 | ) |

- (1)

- For the year ended December 31, 2014, amounts represent the investment activity of the Predecessor Operating Company through and including May 7, 2014 and the investment activity of the Company from May 8, 2014 through December 31, 2014.

At December 31, 2013 and2014, the Company's weighted average Yield to Maturity at Cost was approximately 10.7%. At December 31, 2012,2013, the Predecessor Operating Company's weighted average Yield to Maturity was approximately 10.6%at Cost and 10.1%, respectively. Thisweighted average Yield to Maturity was approximately 11.0% and 10.6%, respectively. The Yield to Maturity at Cost ("Yield to Maturity at Cost") calculation assumes that all investments, including secured collateralized agreements, not on non-accrual are purchased at fair valuethe adjusted cost on December 31, 2013 and December 31, 2012, respectively,the quarter end date and held until their respective maturities with no prepayments or losses and exited at par at maturity. Adjusted cost reflects the GAAP cost for post-IPO investments and a stepped up cost basis of pre-IPO investments (assuming a step-up to fair market value occurred on the IPO date). This calculation excludes the impact of existing leverage. Yield to Maturity at Cost uses the London Interbank Offered Rate ("LIBOR") curves at each quarter's end date. The actual yield to maturity may be higher or lower due to the future selection of the London Interbank Offered Rate ("LIBOR")LIBOR contracts by the individual companies in the Operating Company's portfolio or other factors. The Yield to Maturity calculation used in prior years for the Predecessor Operating Company assumed that all investments not on non-accrual were purchased at fair value on December 31, 2013 and held until their respective maturities with no prepayments or losses and exited at par at maturity.

The following summarizes the Operating Company's ten largest portfolio company investments and top ten industries in which the Operating Company was invested as of December 31, 2013,2014, calculated as a percentage of total assets as of December 31, 2013.2014.

| | | | |

Portfolio Company | | Percent of

Total Assets | |

|---|

Global Knowledge Training LLC | | | 3.4 | % |

Ascend Learning, LLC | | | 2.9 | % |

TIBCO Software Inc. | | | 2.9 | % |

Tenawa Resource Holdings LLC | | | 2.8 | % |

Deltek, Inc. | | | 2.7 | % |

Kronos Incorporated | | | 2.5 | % |

McGraw-Hill Global Education Holdings, LLC | | | 4.02.4 | % |

Global Knowledge Training LLC

| | | 3.9 | % |

Deltek,Tolt Solutions, Inc.

| | | 3.6 | % |

UniTek Global Services, Inc.

| | | 3.5 | % |

Edmentum, Inc. (fka Plato, Inc.).

| | | 3.32.4 | % |

Crowley Holdings Preferred, LLC | | | 3.12.4 | % |

SRA International, Inc. Acrisure, LLC

| | | 3.0 | % |

Kronos Incorporated

| | | 2.8 | % |

Rocket Software, Inc.

| | | 2.7 | % |

Pinnacle Holdco S.à r.l. / Pinnacle (US) Acquisition Co Limited

| | | 2.62.3 | % |

Table of Contents

| | | | |

Industry | | Percent of

Total Assets | |

|---|

Software | | | 21.7 | % |

Education

| | | 20.519.0 | % |

Business Services | | | 12.717.2 | % |

Education | | | 16.6 | % |

Federal Services | | | 8.2 | % |

Healthcare Services | | | 7.6 | % |

Distribution & Logistics | | | 10.5 | % |

Federal Services

| | | 7.3 | % |

Healthcare Services

| | | 7.06.4 | % |

Energy | | | 6.05.5 | % |

Media | | | 4.0 | % |

Healthcare Products

| | | 3.6 | % |

Consumer Services | | | 1.43.5 | % |

Business Products | | | 1.7 | % |

Investment Criteria

The Investment Adviser has identified the following investment criteria and guidelines for use in evaluating prospective portfolio companies. However, not all of these criteria and guidelines were, or will be, met in connection with each of the Operating Company's investments.

- •

- Defensive growth industries. The

Operating Company seeks to invest in industries that can succeed in both robust and weak economic environments but which are also sufficiently large and growing to achieve high valuations providing enterprise value cushion for ourthe Company's targeted debt securities.

- •

- High barriers to competitive entry. The

Operating Company targets industries and companies that have well defined industries and well established, understandable barriers to competitive entry.

- •

- Recurring revenue. Where possible, the

Operating Company focuses on companies that have a high degree of predictability in future revenue.

- •

- Flexible cost structure. The

Operating Company seeks to invest in businesses that have limited fixed costs and therefore modest operating leverage.

- •

- Strong free cash flow and high return on assets. The

Operating Company focuses on businesses with a demonstrated ability to produce meaningful free cash flow from operations. The Operating Company typically targets companies that are not asset intensive and that have minimal capital expenditure and minimal working capital growth needs.

- •

- Sustainable business and niche market dominance. The

Operating Company seeks to invest in businesses that exert niche market dominance in their industry and that have a demonstrated history of sustaining market leadership over time.

- •

- Established companies. The

Operating Company seeks to invest in established companies with sound historical financial performance. The Operating Company does not intend to invest in start-up companies or companies with speculative business plans.

- •

- Private equity sponsorship. The

Operating Company generally seeks to invest in companies in conjunction with private equity sponsors who it knows and trusts and who have proven capabilities in building value.

- •

- Seasoned management team. The

Operating Company generally requires that its portfolio companies have a seasoned management team with strong corporate governance. Oftentimes the Operating Company has a historical relationship with or direct knowledge of key managers from previous investment experience.

Table of Contents

Investment Selection and Process

The Investment Adviser believes it has developed a proven, consistent and replicable investment process to execute the Operating Company's investment strategy. The Investment Adviser seeks to identify the most attractive investment sectors from the top down and then works to become the most advantaged investor in these sectors. The steps in the Investment Adviser's process include:

- •

- Identifying attractive investment sectors top down;

- •

- Creating competitive advantages in the selected industry sectors; and

- •

- Targeting companies with leading market share and attractive business models in its chosen sectors.

Investment Committee

The Investment Adviser's investment committee (the "Investment Committee") currently consists of Steven B. Klinsky, Robert A. Hamwee, Adam Collins, Douglas LondalB. Weinstein, Michael B. Ajouz and John R. Kline. In addition, the executive officers and certain investment professionals are invited to all Investment Committee meetings. The Investment Committee is responsible for approving all of the Operating Company's investment purchases above $5.0$10.0 million. The Investment Committee also approves all asset dispositions above $5.0$10.0 million. Purchases and dispositions below $5.0$10.0 million may be approved by the Operating Company's Chief Executive Officer. These approval thresholds are subject to change over time. We expect to benefit from the extensive and varied relevant experience of the investment professionals serving on the Investment Committee, which includes expertise in private equity, primary and secondary leveraged credit, private mezzanine finance and distressed debt.

The purpose of the Investment Committee is to evaluate and approve, as deemed appropriate, all investments by the Investment Adviser, subject to certain thresholds. The Investment Committee process is intended to bring the diverse experience and perspectives of the Investment Committee's members to the analysis and consideration of every investment. The Investment Committee also serves to provide investment consistency and adherence to the Investment Adviser's investment philosophies and policies. The Investment Committee also determines appropriate investment sizing.

In addition to reviewing investments, the Investment Committee meetings serve as a forum to discuss credit views and outlooks. Potential transactions and investment opportunities are also reviewed on a regular basis. Members of the Operating Company's investment team are encouraged to share information and views on credits with the committee early in their analysis. This process improves the quality of the analysis and assistsenables the deal team members to work more efficiently.

Investment Structure

The Operating Company targets debt investments that will yield meaningful current income and occasionally provide the opportunity for capital appreciation through equity securities. The Operating Company's debt investments are typically structured with the maximum seniority and collateral that the Operating Company can reasonably obtain while seeking to achieve its total return target.

Debt Investments

The terms of the Operating Company's debt investments are tailored to the facts and circumstances of the transaction and prospective portfolio company and structured to protect its rights and manage its risk while creating incentives for the portfolio company to achieve its business plan. A substantial source of return is the cash interest that the Operating Company collects on its debt investments.

Table of Contents

- •

- First Lien Loans and Bonds. First lien loans and bonds generally have terms of four to seven years, provide for a variable or fixed interest rate, may contain prepayment penalties and are

Table of Contents

In addition, from time to time the Operating Company may also enter into revolving credit facilities, bridge financing commitments, delayed draw commitments or other commitments which can result in providing future financing to a portfolio company.

Equity Investments

When the Operating Company makes a debt investment, it may be granted equity in the portfolio company in the same class of security as the sponsor receives upon funding. In addition, the Operating Company may from time to time make non-control, equity co-investments in conjunction with private equity sponsors. The Operating Company generally seeks to structure its equity investments, such as direct equity co-investments, to provide it with minority rights provisions and event-driven put rights. The Operating Company also seeks to obtain limited registration rights in connection with these investments, which may include "piggyback" registration rights.

Portfolio Company Monitoring

The Operating Company monitors the performance and financial trends of its portfolio companies on at least a quarterly basis. The Operating Company attempts to identify any developments within the portfolio company, the industry or the macroeconomic environment that may alter any material element of its original investment strategy. The Operating Company uses several methods of evaluating and monitoring the performance of its investments, including but not limited to, the following:

- •

- review of monthly

andand/or quarterly financial statements and financial projections for portfolio companies provided by its management;

- •

- ongoing dialogue with and review of original diligence sources;

- •

- periodic contact with portfolio company management (and, if appropriate, the private equity sponsor) to discuss financial position, requirements and accomplishments; and

- •

- assessment of business development success, including product development, profitability and the portfolio company's overall adherence to its business plan.

The Operating Company uses an investment rating system to characterize and monitor the credit profile and expected level of returns on each investment in the portfolio. The Operating Company uses a four-level numeric rating scale as follows:

- •

- Investment Rating 1—Investment is performing materially above expectations;

Table of Contents

- •

- Investment Rating 2—Investment is performing materially in-line with expectations. All new loans are rated 2 at initial purchase;

Table of Contents

- •

- Investment Rating 3—Investment is performing materially below expectations and risk has increased materially since the original investment; and

- •

- Investment Rating 4—Investment is performing substantially below expectations and risks have increased substantially since the original investment. Payments may be delinquent. There is meaningful possibility that the

Operating Company will not recoup its original cost basis in the investment and may realize a substantial loss upon exit.

The following table shows the distribution of the Operating Company's investments on the 1 to 4 investment rating scale at fair value as of December 31, 2013:2014:

|

| | As of December 31, 2013 | | | As of December 31, 2014 | |

|---|

(in millions)

Investment Rating | | Par Value(1) | | Percent | | Fair Value | | Percent | | | Par Value(1) | | Percent | | Fair Value | | Percent | |

|---|

Investment Rating 1 | | $ | 169.6 | | 15.8 | % | $ | 178.1 | | 16.0 | % | | $ | 255.7 | | 18.1 | % | $ | 277.4 | | 19.5 | % |

Investment Rating 2 | | 883.6 | | 82.7 | % | | 929.9 | | 83.3 | % | | 1,061.6 | | 75.0 | % | | 1,089.7 | | 76.5 | % |

Investment Rating 3 | | 13.6 | | 1.3 | % | | 7.3 | | 0.7 | % | | 82.9 | | 5.9 | % | | 48.3 | | 3.4 | % |

Investment Rating 4 | | 1.8 | | 0.2 | % | | 0.4 | | — | %(2) | | 14.2 | | 1.0 | % | | 9.3 | | 0.6 | % |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 1,068.6 | | 100.0 | % | $ | 1,115.7 | | 100.0 | % | | $ | 1,414.4 | | 100.0 | % | $ | 1,424.7 | | 100.0 | % |

- (1)

- Excludes shares and warrants.

(2)Percent was less than 0.05%.

Exit Strategies/Refinancing

The Operating Company exits its investments typically through one of four scenarios: (i) the sale of the portfolio company itself resulting in repayment of all outstanding debt, (ii) the recapitalization of the portfolio company in which the Operating Company's loan is replaced with debt or equity from a third party or parties (in some cases, the Operating Company may choose to participate in the newly issued loan(s)), (iii) the repayment of the initial or remaining principal amount of the Operating Company's loan then outstanding at maturity or (iv) the sale of the debt investment by the Operating Company. In some investments, there may be scheduled amortization of some portion of the Operating Company's loan which would result in a partial exit of its investment prior to the maturity of the loan.

Valuation

At all times consistent with accounting principles generally accepted in the United States of America ("GAAP")GAAP and the 1940 Act, the Operating Company conducts a valuation of assets, which impacts its net asset value, and, consequently, the net asset values of NMFC and AIV Holdings. NMFC and AIV Holdings value their ownership interest on a quarterly basis, or more frequently if required under the 1940 Act.value.

The Operating Company applies fair value accounting in accordance with GAAP. The Operating Company values its assets on a quarterly basis, or more frequently if required under the 1940 Act. In all cases, the Operating Company's board of directors is ultimately and solely responsible for determining the fair value of theits portfolio investments on a quarterly basis in good faith, including investments that are not publicly traded, those whose market prices are not readily available and any other situation where its portfolio investments require a fair value determination. Security transactions

Table of Contents

are accounted for on a trade date basis. The Operating Company's quarterly valuation procedures are set forth in more detail below:

- (1)

- Investments for which market quotations are readily available on an exchange are valued at such market quotations based on the closing price indicated from independent pricing services.

- (2)

- Investments for which indicative prices are obtained from various pricing services and/or brokers or dealers are valued through a multi-step valuation process, as described below, to determine whether the quote(s) obtained is representative of fair value in accordance with GAAP.

Table of Contents

- a.

- Bond quotes are obtained through independent pricing services. Internal reviews are performed by the investment professionals of the Investment Adviser to ensure that the quote obtained is representative of fair value in accordance with GAAP and if so, the quote is used. If the Investment Adviser is unable to sufficiently validate the quote(s) internally and if the investment's par value or its fair value exceeds the materiality threshold, the investment is valued similarly to those assets with no readily available quotes (see (3) below); and

- b.

- For investments other than bonds, the

Operating Company looks at the number of quotes readily available and performs the following:

- i.

- Investments for which two or more quotes are received from a pricing service are valued using the mean of the mean of the bid and ask of the quotes obtained;

- ii.

- Investments for which one quote is received from a pricing service are validated internally. The investment professionals of the Investment Adviser analyze the market quotes obtained using an array of valuation methods (further described below) to validate the fair value. If the Investment Adviser is unable to sufficiently validate the quote internally and if the investment's par value or its fair value exceeds the materiality threshold, the investment is valued similarly to those assets with no readily available quotes (see (3) below).

- (3)

- Investments for which quotations are not readily available through exchanges, pricing services, brokers, or dealers are valued through a multi-step valuation process:

- a.

- Each portfolio company or investment is initially valued by the investment professionals of the Investment Adviser responsible for the credit monitoring;

- b.

- Preliminary valuation conclusions will then be documented and discussed with the

Operating Company's senior management;

- c.

- If an investment falls into (3) above for four consecutive quarters and if the investment's par value or its fair value exceeds the materiality threshold, then at least once each fiscal year, the valuation for each portfolio investment for which the

Operating Company does not have a readily available market quotation will be reviewed by an independent valuation firm engaged by the Companies'Company's board of directors; and

- d.

- When deemed appropriate by the

Operating Company's management, an independent valuation firm may be engaged to review and value investment(s) of a portfolio company, without any preliminary valuation being performed by the Investment Adviser. The investment professionals of the Investment Adviser will review and validate the value provided.

For investments in revolving credit facilities and delayed draw commitments, the cost basis of the funded investments purchased is offset by any costs/netbacks received for any unfunded portion on the total balance committed. The fair value is also adjusted for the price appreciation or depreciation on the

Table of Contents

unfunded portion. As a result, the purchase of commitments not completely funded may result in a negative fair value until it is called and funded.

The values assigned to investments are based upon available information and do not necessarily represent amounts which might ultimately be realized, since such amounts depend on future circumstances and cannot be reasonably determined until the individual positions are liquidated. Due to the inherent uncertainty of determining the fair value of investments that do not have a readily available market value, the fair value of the Operating Company's investments may fluctuate from period to period and the fluctuations could be material.

Table of Contents

Operating and Regulatory Environment

As with other companies regulated by the 1940 Act, a BDC must adhere to certain regulatory requirements. The 1940 Act contains prohibitions and restrictions relating to investments by a BDC in another investment company as well as transactions between BDCs and their affiliates, principal underwriters and affiliates of those affiliates or underwriters. A BDC must be organized in the U.S. for the purpose of investing in or lending to primarily private companies and making significant managerial assistance available to them. A BDC may use capital provided by public stockholders and from other sources to make long-term, private investments in businesses. A BDC provides stockholders the ability to retain the liquidity of a publicly traded stock while sharing in the possible benefits, if any, of investing in primarily privately owned companies.

The Operating Company NMFC and AIV Holdings each havehas a board of directors. A majority of the Companies'Company's board of directors must be persons who are not interested persons, as that term is defined in the 1940 Act. As BDCs,a BDC, we are prohibited from protecting any director or officer against any liability to us or ourthe Company's stockholders arising from willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of such person's office. Additionally, we are required to provide and maintain a bond issued by a reputable fidelity insurance company to protect the BDC.

As a BDC, each of the CompaniesCompany is required to meet a coverage ratio of the value of total assets to total senior securities, which include all of its borrowings, excluding SBA-guaranteed debentures, and any preferred stock we may issue in the future, of at least 200.0% (i.e., the amount of debt may not exceed 50.0% of the value of the Operating Company's total assets or the Operating Company may borrow an amount equal to 100.0% of net assets). The Operating Company monitors its compliance with this coverage ratio on a regular basis, however, NMFC and AIV Holdings have no material long-term liabilities themselves and their only business and sole asset is their ownership of the Operating Company. NMFC and AIV Holdings are relying on the provisions of Section 12(d)(1)(E) of the 1940 Act, which requires, among other things, that their respective investment in the Operating Company be their only asset and that their respective stockholders are entitled to vote on a "pass-through" basis with the Operating Company's other voting security holders.basis.

NMFCThe Company may, to the extent permitted under the 1940 Act, issue additional equity capital, which would in turn increase the equity capital available to the Operating Company. NMFCcapital. The Company is generally not able to issue and sell its common stock at a price below net asset value per share. NMFCThe Company may, however, sell its common stock, or warrants, options or rights to acquire its common stock, at a price below the then-current net asset value of its common stock if its board of directors determines that such sale is in the best interests of NMFCthe Company and the best interests of its stockholders, and its stockholders approve such sale. In addition, NMFCthe Company may generally issue new shares of its common stock at a price below net asset value in rights offerings to existing stockholders and in certain other limited circumstances.

As a BDC, the Operating Company is generally not permitted to invest in any portfolio company in which the Investment Adviser or any of its affiliates currently have an investment or to make any

Table of Contents

co-investments with the Investment Adviser or its affiliates without an exemptive order from the Securities and Exchange Commission.SEC.

We may not change the nature of our business so as to cease to be, or withdraw our election as, a BDC unless authorized by vote of a majority of the outstanding voting securities, as required by the 1940 Act. A majority of the outstanding voting securities of a company is defined under the 1940 Act as the lesser of: (a) 67.0% or more of such company's voting securities present at a meeting if more than 50.0% of the outstanding voting securities of such company are present or represented by proxy, or (b) more than 50.0% of the outstanding voting securities of such company. We do not anticipate any substantial change in the nature of our business.

In addition, as BDCs,a BDC, the Companies areCompany is not permitted to issue stock or units in consideration for services.

NMFC's and AIV Holdings' Table of Contents

Taxation as a Regulated Investment Company

NMFC and AIV Holdings haveThe Company has elected to be treated, and intendintends to comply with the requirements to continue to qualify annually, as RICsa RIC under Subchapter M of the Code. As RICs, NMFC and AIV Holdingsa RIC, the Company generally will not pay corporate-level U.S. federal income taxes on any net ordinary income or capital gains that theyit timely distributedistributes to theirits stockholders as dividends. Rather, dividends distributed by NMFC or AIV Holdingsthe Company generally will be taxable to NMFC's or AIV Holdings'its stockholders, and any net operating losses, foreign tax credits and other tax attributes of NMFC or AIV Holdingsthe Company generally will not pass through to NMFC's or AIV Holdings'its stockholders, subject to special rules for certain items such as net capital gains and qualified dividend income recognized by NMFC and AIV Holdings.the Company.

To qualify as RICs, NMFC and AIV Holdingsa RIC, the Company must, among other things, meet certain source-of-income and asset diversification requirements. In addition, to qualify as RICs, NMFC and AIV Holdingsa RIC, the Company must distribute to theirits stockholders, for each taxable year, at least 90.0% of theirits "investment company taxable income", which is generally theirits net ordinary income plus the excess of realized net short-term capital gains over realized net long-term capital losses (the "Annual Distribution Requirement").

NMFC and AIV HoldingsThe Company will be subject to a 4.0% nondeductible federal excise tax on certain undistributed income unless they distributeit distributes in a timely manner an amount at least equal to the sum of (1) 98.0% of theirits respective net ordinary income for each calendar year, (2) 98.2% of theirits respective capital gain net income for the one-year period ending October 31 in that calendar year and (3) any income recognized, but not distributed, in preceding years (the "Excise Tax Avoidance Requirement"). While NMFC and AIV Holdings intendthe Company intends to make distributions to theirits stockholders in each taxable year that will be sufficient to avoid any federal excise tax on theirits earnings, there can be no assurance that NMFC or AIV Holdingsthe Company will be successful in entirely avoiding this tax. For the year ended December 31, 2013, NMFC and AIV Holdings accrued federal excise taxes of $2.3 thousand and zero, respectively.

In order to qualify as RICs for U.S. federal income tax purposes, NMFC and AIV Holdingsthe Company must, among other things:

- •

- continue to qualify as

BDCsa BDC under the 1940 Act at all times during each taxable year;

- •

- derive in each taxable year at least 90.0% of

theirits respective gross income from dividends, interest, payments with respect to loans of certain securities, gains from the sale of stock or other securities, net income from certain "qualified publicly traded partnerships", or other income derived with respect to NMFC's or AIV Holdings'the Company's business of investing in such stock or securities (the "90.0% Income Test"); and

Table of Contents

- •

- diversify

theirits holdings so that at the end of each quarter of the taxable year:

- •

- at least 50.0% of the

respective valuesvalue of NMFC's or AIV Holdings'the Company's assets consists of cash, cash equivalents, U.S. government securities, securities of other RICs, and other securities if such other securities of any one issuer do not represent more than 5.0% of the respective valuesvalue of NMFC's or AIV Holdings'the Company's assets or more than 10.0% of the outstanding voting securities of the issuer; and

- •

- no more than 25.0% of the

respective valuesvalue of NMFC's or AIV Holdings'the Company's assets is invested in the securities, other than U.S. government securities or securities of other RICs, of one issuer, of two or more issuers that are controlled, as determined under applicable Code rules, by NMFC or AIV Holdingsthe Company and that are engaged in the same or similar or related trades or businesses or of certain "qualified publicly traded partnerships" (the "Diversification Tests").

A RIC is limited in its ability to deduct expenses in excess of its "investment company taxable income" (which is, generally, net ordinary income plus the excess of realized net short-term capital gains over realized net long-term capital losses). If the Company's expenses in a given year exceed its investment company taxable income, the Company would experience a net operating loss for that year. However, a RIC is not permitted to carry forward net operating losses to subsequent years and such net operating losses do not pass through to its stockholders. In addition, expenses can be used only to

Table of Contents

offset investment company taxable income, not net capital gain. A RIC may not use any net capital losses (that is, realized capital losses in excess of realized capital gains) to offset the RIC's investment company taxable income, but may carry forward such losses, and use them to offset capital gains, indefinitely. Due to these limits on the deductibility of expenses and net capital losses, the Company may for tax purposes have aggregate taxable income for several years that it is required to distribute and that is taxable to its stockholders even if such income is greater than the aggregate net income the Company actually earned during those years.

Failure to Qualify as a Regulated Investment Company

If NMFC or AIV Holdingsthe Company fails to satisfy the 90.0% Income Test or the Diversification Tests for any taxable year or quarter of such taxable year, theyit may nevertheless continue to qualify as a RIC for such year if certain relief provisions of the Code apply (which may, among other things, require it to pay certain corporate-level U.S. federal income taxes or to dispose of certain assets). If NMFC or AIV Holdingsthe Company fails to qualify for treatment as a RIC and such relief provisions do not apply, to NMFC or AIV Holdings, NMFC or AIV Holdingsthe Company will be subject to U.S. federal income tax on all of its taxable income at regular corporate rates (and also will be subject to any applicable state and local taxes), regardless of whether NMFC or AIV Holdingsthe Company makes any distributions to its stockholders. Distributions would not be required. However, if distributions were made, any such distributions would be taxable to its stockholders as ordinary dividend income and, subject to certain limitations under the Code, any such distributions would be eligible for the 20.0% maximum rate applicable to non-corporate taxpayers to the extent of NMFC's or AIV Holdings'the Company's current or accumulated earnings and profits. Subject to certain limitations under the Code, corporate distributees would be eligible for the dividends-received deduction. Distributions in excess of NMFC's or AIV Holdings'the Company's current and accumulated earnings and profits would be treated first as a return of capital to the extent of the stockholder's tax basis, and any remaining distributions would be treated as a capital gain.

Subject to a limited exception applicable to RICs that qualified as such under Subchapter M of the Code for at least one year prior to disqualification and that requalify as a RIC no later than the second year following the non-qualifying year, NMFC and AIV Holdingsthe Company could be subject to tax on any unrealized net built-in gains in the assets held by NMFC or AIV Holdingsthe Company during the period in which NMFC or AIV Holdingsit failed to qualify as a RIC that are recognized during the ten-year period (or five-year period for taxable years beginning during 2013) after its requalification as a RIC, unless NMFC or AIV Holdingsthe Company made a special election to pay corporate-level U.S. federal income tax on such built-in gain at the time of NMFC's or AIV Holdings'the Company's requalification as a RIC. NMFC or AIV HoldingsThe Company may decide to be taxed as a regular corporation even if NMFC or AIV Holdingsit would otherwise qualify as a RIC if NMFC or AIV Holdingsthe Company determines that treatment as a corporation for a particular year would be in its best interests.

SBA Regulation

On August 1, 2014, the Company's wholly-owned direct and indirect subsidiary, SBIC LP received a license from the SBA to operate as a SBIC under Section 301(c) of the 1958 Act. SBIC LP has an investment strategy and philosophy substantially similar to the Company and makes similar types of investments in accordance with SBA regulations.

A license allows SBIC LP to incur leverage by issuing SBA-guaranteed debentures, subject to the issuance of a capital commitment and certain approvals by the SBA and customary procedures. SBA-guaranteed debentures carry long-term fixed rates that are generally lower than rates on comparable bank and other debt. Under the regulations applicable to SBICs, a standard debenture licensed SBIC is eligible for two tiers of leverage capped at $150.0 million, where each tier is equivalent to the SBIC's regulatory capital, which generally equates to the amount of equity capital in the SBIC. Debentures guaranteed by the SBA have a maturity of ten years, require semi-annual payments of interest and do not require any principal payments prior to maturity. As of December 31, 2014, SBIC LP had $37.5 million of outstanding SBA-guaranteed debentures. SBIC LP is subject to

Table of Contents

regulation and oversight by the SBA, including requirements with respect to reporting financial information, such as the extent of capital impairment if applicable, on a regular basis and annual examinations conducted by the SBIC. The SBA, as a creditor, will have a superior claim to SBIC LP's assets over the Company's stockholders in the event SBIC LP is liquidated or the SBA exercises its remedies under the SBA-guaranteed debentures issued by SBIC LP upon an event of default.

On November 5, 2014, the Company received exemptive relief from the SEC to permit the Company to exclude the SBA-guaranteed debentures of SBIC LP from the Company's 200.0% asset coverage test under the 1940 Act. As such, the Company's ratio of total consolidated assets to outstanding indebtedness may be less than 200.0%. This provides the Company with increased investment flexibility but also increases the Company's risks related to leverage.

SBICs are designed to stimulate the flow of private investor capital to eligible small businesses as defined by the SBA. Under SBA regulations, SBICs may make loans to eligible small businesses, invest in the equity securities of such businesses and provide them with consulting and advisory services. Under present SBA regulations, eligible small businesses generally include businesses that (together with their affiliates) have a tangible net worth not exceeding $19.5 million for the most recent fiscal year and have average annual net income after U.S. federal income taxes not exceeding $6.5 million (average net income to be computed without benefit of any carryover loss) for the two most recent fiscal years. In addition, an SBIC must invest 25.0% of its investment capital to "smaller business", as defined by the SBA. The definition of a smaller business generally includes businesses that have a tangible net worth not exceeding $6.0 million for the most recent fiscal year and have average annual net income after U.S. federal income taxes not exceeding $2.0 million (average net income to be computed without benefit of any net carryover loss) for the two most recent fiscal years. SBA regulations also provide alternative size standard criteria to determine eligibility for designation as an eligible small business or smaller concern, which criteria depend on the primary industry in which the business is engaged and is based on such factors as the number of employees and gross revenue. However, once an SBIC has invested in an eligible small business, it may continue to make follow on investments in the company, regardless of the size of the company at the time of the follow on investment.

The SBA prohibits an SBIC from providing funds to small businesses with certain characteristics, such as businesses with the majority of their employees located outside the U.S., or from investing in project finance, real estate, farmland, financial intermediaries or "passive" (i.e. non-operating) businesses. Without prior SBA approval, an SBIC may not invest an amount equal to more than approximately 30.0% of the SBIC's regulatory capital in any one company and its affiliates.

The SBA places certain limitations on the financing terms of investments by SBICs in portfolio companies (such as limiting the permissible interest rate on debt securities held by an SBIC in a portfolio company). An SBIC may exercise control over a small business for a period of up to seven years from the date on which the SBIC initially acquires its control position. This control period may be extended for an additional period of time with the SBA's prior written approval.

The SBA restricts the ability of an SBIC to lend money to any of its officers, directors and employees or to invest in associates thereof. The SBA also prohibits, without prior SBA approval, a "change of control" of an SBIC or transfers that would result in any person (or a group of persons acting in concert) owning 10.0% or more of a class of capital stock of a licensed SBIC. A "change of control" is any event which would result in the transfer of the power, direct or indirect, to direct the management and policies of a SBIC, whether through ownership, contractual arrangements or otherwise.

The SBA regulations require, among other things, an annual periodic examination of a licensed SBIC by an SBA examiner to determine the SBIC's compliance with the relevant SBA regulations, and the performance of a financial audit by an independent auditor.

Table of Contents

Investment Management Agreement

The Companies areCompany is a closed-end, non-diversified management investment companiescompany that havehas elected to be treatedregulated as BDCsa BDC under the 1940 Act. NMFC and AIV Holdings are holding companies with no direct operations of their own, and their only business and sole asset are their ownership of units of the Operating Company. As a result, NMFC and AIV Holdings do not pay any external investment advisory or management fees. However, the OperatingThe Company is externally managed by

Table of Contents

the Investment Adviser and pays the Investment Adviser a fee for its services. The following summarizes the arrangements between the Operating Company and the Investment Adviser pursuant to an investment advisory and management agreement as amended and restated (the "Investment Management Agreement").

Management Services

The Investment Adviser is registered as an Investment Adviser under the Investment Advisers Act of 1940 (the "Advisers Act").Act. The Investment Adviser serves pursuant to the Investment Management Agreement in accordance with the 1940 Act. Subject to the overall supervision of the Operating Company's board of directors, the Investment Adviser manages the Operating Company's day-to-day operations and provides it with investment advisory and management services. Under the terms of the Investment Management Agreement, the Investment Adviser:

- •

- determines the composition of the

Operating Company's portfolio, the nature and timing of the changes to its portfolio and the manner of implementing such changes;

- •

- determines the securities and other assets that the

Operating Company will purchase, retain or sell;

- •

- identifies, evaluates and negotiates the structure of the

Operating Company's investments that the Operating Company makes;

- •

- executes, monitors and services the investments the

Operating Company makes;

- •

- performs due diligence on prospective portfolio companies;

- •

- votes, exercises consents and exercises all other rights appertaining to such securities and other assets on behalf of the

Operating Company; and

- •

- provides the