UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, | ||

or | ||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to | ||

Commission File No. 1-34062

INTERVAL LEISURE GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 26-2590997 (I.R.S. Employer Identification No.) | |

6262 Sunset Drive, Miami, FL (Address of Registrant's principal executive offices) | 33143 (Zip Code) |

(305) 666-1861

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common Stock, $0.01 par value per share | The NASDAQ Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yeso Noý

As of June 30, 2014,2015, the aggregate market value of the registrant's common stock held by non-affiliates of the registrant was $856,476,607.$894,617,693. As of February 23, 2015, 57,100,8202016, 57,490,609 shares of the registrant's common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's proxy statement for its 20142016 Annual Meeting of Stockholders are incorporated by reference into Part III herein.

TABLE OF CONTENTS

| Page | ||||

|---|---|---|---|---|

PART I | ||||

Item 1. | Business | 3 | ||

Item 1A. | Risk Factors | 21 | ||

Item 1B. | Unresolved Staff Comments | 39 | ||

Item 2. | Properties | 39 | ||

Item 3. | Legal Proceedings | 40 | ||

Item 4. | Mine Safety Disclosure | 40 | ||

Executive Officers of the Registrant | 40 | |||

PART II | ||||

Item 5. | Market For Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 41 | ||

Item 6. | Selected Financial Data | 43 | ||

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 46 | ||

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 92 | ||

Item 8. | Financial Statements and Supplementary Data | 93 | ||

Item 9. | Changes in and Disagreements with Accountant on Accounting and Financial Disclosure | 154 | ||

Item 9A. | Controls and Procedures | 154 | ||

Item 9B. | Other Information | 157 | ||

PART III | ||||

Item 10. | Directors, Executive Officers and Corporate Governance | 157 | ||

Item 11. | Executive Compensation | 157 | ||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 157 | ||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 157 | ||

Item 14. | Principal Accountant Fees and Services | 157 | ||

PART IV | ||||

Item 15. | Exhibits and Financial Statement Schedules | 159 |

i

Throughout this Annual Report on Form 10-K, the terms "ILG," "Company," "we," "us" and" "our" refer to Interval Leisure Group, Inc. and, except as the context otherwise requires, its consolidated subsidiaries. The "Hyatt Vacation Ownership" business or "HVO" refers to the group of businesses using the Hyatt® brand in the shared ownership business pursuant to a master license agreement with a subsidiary of Hyatt Hotels Corporation ("Hyatt"). All brand trademarks, service marks or trade names cited in this report are the property of their respective holders.

The information found on our corporate website, www.iilg.com, or any other website referred to in this report, is not incorporated into this Annual Report or any other report we file with or furnish to the United States Securities and Exchange Commission.

Cautionary Statement Regarding Forward-Looking Information

This annual report on Form 10-K contains certain statements which may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical fact are forward looking-statements, and are contained throughout this document. These forward-looking statements reflect management's views and assumptions as of the date of this annual report regarding future events and operating performance. The use of words such as "anticipates," "estimates," "expects," "intends," "plans," "potential," "continue," and "believes," and similar expressions or future or conditional verbs such as "will," "should," "would," "may," "might," and "could" among others, generally identify forward-looking statements. These forward-looking statements include, among others, statements relating to: our future financial performance, our business prospects and strategy, anticipated financial position, liquidity and capital needs and other similar matters. These forward-looking statements are based on management's current expectations and assumptions about future events, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict.

Actual results could differ materially from those contained in the forward-looking statements included in this annual report for a variety of reasons, including, among others: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement to acquire Vistana as described below, (2) the risk that ILG stockholders may not approve the issuance of ILG common stock in connection with the proposed merger, (3) the risk that the necessary regulatory approvals may not be obtained or may be obtained subject to conditions that are not anticipated, (4) risks that any of the closing conditions to the proposed merger, including Starwood's spin-off of Vistana, may not be satisfied in a timely manner, (5) risks related to disruption of management time from ongoing business operations due to the proposed merger, (6) failure to realize the benefits expected from the proposed merger, (7) the effect of the announcement of the proposed merger on the ability of ILG and Vistana to retain and hire key personnel and maintain relationships with their key business partners, and on their operating results and businesses generally, (8) adverse trends in economic conditions generally or in the vacation ownership, vacation rental and travel industries;industries, or adverse events or trends in key vacation destinations, (9) adverse changes to, or interruptions in, relationships with third parties;parties unrelated to the announcement, (10) lack of available financing for, or insolvency of developers;or consolidation of developers;developers, (11) decreased demand from prospective purchasers of vacation interests;interests, (12) travel related health concerns; changes in our senior management; regulatory changes; ourconcerns, (13) ILG's ability to compete effectively and successfully and to add new products and services; ourservices, (14) ILG's ability to successfully manage and integrate acquisitions;acquisitions, (15) the occurrence of a change in controltermination event under the master license agreement with Hyatt; our failure to comply with designated Hyatt® brand standards with respect to the operation of the Hyatt, Vacation Ownership business; our(16) ILG's ability to market vacation ownership interests successfully and efficiently;efficiently, (17) impairment of assets;ILG's assets, (18) the restrictive covenants in ourILG's revolving credit facility; adverse events or trends in key vacation destinations;facility and indenture; (19) business interruptions in connection with ourILG's technology systems;systems, (20) the ability of managed homeowners'homeowners associations to collect sufficient maintenance fees;fees, (21) third parties not repaying advances or extensions of credit;credit, (22) fluctuations in currency exchange rates;rates and our

(23) ILG's ability to expand successfully in international markets and manage risks specific to international operations. Certain of these and other risks and uncertainties are discussed in our filings with the SEC, including in Item 1A "Risk Factors" of this report. In light of these risks and uncertainties, the forward looking statements discussed in this report may not prove to be accurate. Accordingly, you should not place undue reliance on these forward looking statements, which only reflect the views of our management as of the date of this report. Except as required by applicable law, we do not undertake to update these forward-looking statements.

Overview

Interval Leisure Group, Inc., or ILG, is a leading global provider of non-traditional lodging, encompassing a portfolio of leisure businesses from vacation exchange and vacation rental to vacation

ownership. At the end of 2014, we re-aligned our operating segments to encompass the vacation ownership sales and marketing capabilities that we added to our company with the acquisition of the Hyatt Vacation Ownership business in October 2014. As a result, weWe operate in the following two segments: Exchange and Rental, and Vacation Ownership.

Exchange and Rental offers access to vacation accommodations and other travel-related transactions and services to leisure travelers, by providing vacation exchange services and vacation rental, working with resort developers and operating vacation rental properties. Vacation exchange services provide owners of vacation interests with flexibility and choice by delivering access to alternate accommodations through exchange networks encompassing a variety of resorts. Our principal exchange network is the Interval Network, in which more than 2,9003,000 resorts located in over 80 nations participated as of December 31, 2014.2015. We also operate additional exchange programs including the Hyatt Residence Club, which encompasses 16 resorts as of the end of 2014.2015. This segment provides vacation rental through its Aston and Aqua businessesthe Aqua-Aston business as part of a comprehensive package of marketing, management and rental services offered to vacation property owners, primarily of Hawaiian properties, as well as through the Interval Network. The Exchange and Rental segment represented approximately 73.8% of ILG's consolidated revenue for the fiscal year ended December 31, 2015 and approximately 78.7% of ILG's consolidated revenue for the fiscal year ended December 31, 2014 and approximately 88.3% of ILG's consolidated revenue for the fiscal year ended December 31, 2013.2014.

The Exchange and Rental operating segment consists of Interval International (referred to as Interval), the Hyatt Residence Club, the Trading Places International (known as TPI) operated exchange business, Aston Hotels & Resorts, Inc.and Aqua-Aston Hospitality (referred to as Aston) and Aqua Hospitality, LLC (referred to as Aqua)Aqua-Aston).

Vacation Ownership engages in the management of vacation ownership resorts; sales, marketing, and financing of vacation ownership interests; and related services to owners and associations. We provide management services to nearly 200 vacation ownership properties and/or their associations. Following the October 2014 acquisition, we also provide sales and marketing of vacation ownership interests in the Hyatt Residence Club resorts. The Vacation Ownership segment represented approximately 28.1% of ILG's consolidated revenue for the fiscal year ended December 31, 2015 and approximately 21.3% of ILG's consolidated revenue for the fiscal year ended December 31, 2014 and approximately 11.7% of ILG's consolidated revenue for the fiscal year ended December 31, 2013.2014. For information regarding the results of operations of ILG and its segments on a historical basis, see Note 15 to the Consolidated Financial Statements of ILG and the disclosure set forth under the caption "Management's Discussion and Analysis of Financial Condition and Results of Operations."

The Vacation Ownership operating segment consists of the management related lines of business of Vacation Resorts International (known as VRI), TPI, VRI Europe and Hyatt Vacation Ownership (referred to as HVO) as well as the sales and financing of vacation ownership interests.

Recent Developments

On October 28, 2015, we announced that we had entered into a merger agreement pursuant to which we will acquire the vacation ownership business of Starwood Hotels & Resorts Worldwide, Inc., or Starwood, as well as five hotels that are expected to be converted to vacation ownership properties

in the future. The acquisition will be effected through a "Reverse Morris Trust" transaction pursuant to which Starwood will spin-off Vistana Signature Experiences, or Vistana, a wholly-owned subsidiary, tax-free to Starwood shareholders and simultaneously merge with a wholly-owned subsidiary of ILG, with Vistana becoming a wholly-owned subsidiary of ILG. At the close of the proposed transactions, Starwood stockholders will own approximately 55% of ILG common stock and ILG stockholders will own approximately 45% of ILG common stock, in each case, on a fully diluted basis.

In connection with the transaction, Vistana will enter into an 80-year exclusive global license agreement for the use of the Westin® and Sheraton® brands in vacation ownership in addition to the non-exclusive license for the existing St. Regis® and The Luxury Collection® properties. Under the terms of the license agreement, Starwood will receive an annual base royalty fee of $30 million plus 2% of vacation ownership interest sales.

The merger is anticipated to close in the second quarter of 2016, subject to customary closing conditions, including regulatory and ILG shareholder approvals. Liberty Interactive Corporation and certain ILG executive officers have entered into voting and support agreements in favor of the transaction, representing approximately 31% of ILG's shares outstanding.

History

ILG was incorporated as a Delaware corporation in May 2008 in connection with a plan bythe spin-off of IAC/InterActiveCorp, or IAC, to separate into five separate publicly traded companies, referred to as the "spin-off."companies. ILG commenced trading on The NASDAQ Stock Market in August 2008 under the symbol "IILG."

The businesses operated by ILG's subsidiaries have extensive operating histories. ILG's Interval International business was founded in 1976, its Aston business traces its roots in lodging back over 60 years, while Aqua was founded in 2001. Trading Places International was founded in 1973, Vacation Resorts International in 1981; and the Hyatt Vacation Ownership business began in 1994.

On February 28, 2012, we acquired all of the equity of Vacation Resorts International, a provider of resort and homeowners' association management services to the shared ownership industry.

On November 4, 2013, VRI Europe Limited, a subsidiary of ILG, purchased the European shared ownership resort management business of CLC World Resorts and Hotels (CLC), for cash and issuance to CLC of shares totaling 24.5% of VRI Europe Limited.

On December 12, 2013, we acquired all of the equity of Aqua Hospitality LLC and Aqua Hotels and Resorts, Inc., referred to as Aqua, a Hawaii-based hotel and resort management company representing more than 25 properties in Hawaii and Guam.

On October 1, 2014, we acquired the Hyatt Vacation Ownership business, which provides vacation ownership services at 16 Hyatt Residence Club resorts, from subsidiaries of Hyatt Hotels Corporation. In connection with the acquisition, we entered into a long-term exclusive license for use of the Hyatt® brand with respect to the shared ownership business.

On October 28, 2015, we announced that we had entered into a merger agreement pursuant to which we will acquire the vacation ownership business of Starwood to be known as Vistana. Upon closing, Starwood will spin-off Vistana to its stockholders then immediately following the spin-off Vistana will merge with a wholly owned subsidiary of ILG. In the merger, the Vistana common stock to which Starwood stockholders are entitled in the spin-off will automatically convert in to ILG common stock. At the close of the proposed transactions, Starwood stockholders will own approximately 55% of ILG common stock and ILG stockholders will own approximately 45% of ILG common stock, in each case, on a fully diluted basis.

Industry Overview and Trends

The hospitality industry, which includes non-traditional lodging, is a major component of the leisure travel industry. Within non-traditional lodging, a variety of leisure accommodations are provided including vacation ownership and vacation rentals.

Vacation Ownership

Vacation ownership is the component of the non-traditional lodging industry that encompasses the development, operation, sales, marketing and management of vacation interests in traditional timeshare regimes, fractional products, private residence clubs, condo hotels and other forms of shared ownership, and vacation home ownership. VacationAccording to the American Resort Developer Association, referred to as ARDA, vacation ownership sales (excluding sales of fractional, private residence club, destination club and whole ownership products) in the U.S. for 2013,2014, the last year for which data is available, were approximately $7.6$7.9 billion, as compared to $6.9$7.6 billion in 2012.2013. U.S. sales of fractional products, private residences and destination club products were approximately $517$516 million in 2013,2014, the last year for which data is available, as comparedcomparable to $497$517 million in 2012. Although vacation ownership sales (excluding sales of fractional, private residence club, destination club and whole ownership products) have not returned to the 2007 levels of $10.6 billion, leisure travelers continue to use their vacation ownership interests as demonstrated by significantly higher average occupancy rates at2013. Notably, U.S. timeshare resorts had an average occupancy of 78% in 2014 significantly higher than average occupancy of approximately 64% at U.S. hotels.hotels for the same period.

According to the American Resort Developer Association, referred to as ARDA, as of December 31, 2013,2014, the U.S. traditional timeshare industry was comprised of 1,5401,555 resorts, representing

approximately 192,420198,490 units and an estimated 8.58.7 million vacation ownership week equivalents. The following table reflects

In the growth in ownershippast year, several developers have announced new resorts, some of vacation ownership week equivalents since 1975:

Access to financing has returned to the industry following the recessionwhich are being internally developed and slow recovery. While few new projects have been constructed in the last several years,others are using asset and capital-light arrangements with third parties. Also, developers and homeowners' associations have been taking back vacation ownership interests which are available to be sold again. This allows developers to continue to generate sales revenues without significant capital expenditure for development and causes homeowners' associations at resorts that are no longer linked to a developer to look for efficient distribution channels to resell the inventory to preserve the maintenance fee paying owner base.

In addition to sales, the vacation ownership industry provides financing or facilitates access to third-party financing for customers. Customers that choose to finance their purchase generally make a down payment of 10% to 20% of the purchase price for a seven to ten year loan. Larger timeshare companies will access the securitization markets to obtain long-term capital and liquidity. The resorts are often managed by a homeowners' association governed by a board, which generallyhistorically will have representation from the developer until the units have been substantially sold out. These homeowners' associations typically engage a management company to undertake the operation, maintenance and refurbishment of the resort as well as management of the association. This fee-for-service business providesprovides:

Vacation Exchange and Rental Services

The vacationVacation exchange and rental services industry offersbusinesses offer leisure travelers vacation accommodations at vacation homes, villas, condo hotels, hotels, vacation ownership units and condominiums, as well as other travel-related products and benefits. In addition, this fee-for-service business provides services to owners of vacation properties and developers.

Within the vacation exchange sector, there are two principal providers of vacation ownership exchange services, Interval International, an ILG business, and RCI, LLC, a subsidiary of Wyndham Worldwide Corp. Trading Places International and several third parties also operate in this industry

with a significantly more limited scope of available accommodations. In addition, many vacation ownership resort developers and managers provide exchange services to owners within their resort systems, including Hyatt Residence Club.Club and Vistana.

The fragmented vacation rental market includes both managed properties and those offered by owners. In general, the managed properties are better able to engage in market-based pricing and offer hotel-like services. Vacation rental accommodations generally offer value to travelers seeking more than a nightly stay by often providing greater space and convenience than traditional hotel rooms and offering separate living, sleeping and eating quarters. Rental companies also facilitate the rental process by handling most, if not all, aspects of interaction with vacationers. In addition, alternative lodging marketplaces, such as Airbnb and HomeAway, operate websites that market available furnished, privately-owned residential properties for nightly, weekly or monthly rental.

Currently, ILG offersprovides rental and related management services for condominium, hotel and timeshare resorts in North America, Hawaii and Guam. A significant amount of our rental revenue is derived from resorts located in Hawaii. According to the Hawaii Tourism Authority, visitor arrivals by air in Hawaii increased 2.0%4.3% for the year ended December 31, 20142015 compared to the prior year. As of the latest forecast (November 2014)(February 2016), the Hawaii Department of Business, Economic Development and Tourism forecasts increases of 1.9% in visitors to Hawaii and 3.6%2.4% in visitor expenditures in 20152016 over 2014.2015.

Industry Growth

Future growth in the non-traditional lodging industry will be driven primarily by development of new resorts and conversion of existing properties. Due to the decreased pace of vacation ownership sales since the 2008 recession coupled with the ability for developers to acquire delinquent and secondary market inventory, developers in the United States have been building fewer new resorts. Some developers are expanding the fee for service nature of their business by selling inventory acquired from defaults, resales or agreements with resort owners. Industry expansion is expected to be driven by:

DESCRIPTION OF BUSINESS SEGMENTS

Exchange and Rental

Our Exchange and Rental segment offers access to vacation accommodations and other travel-related transactions and services to leisure travelers, by providing vacation exchange services and vacation rental, working with resort developers and operating vacation rental properties.

Vacation Exchange

Exchange Services

We offer leisure and travel-related products and services to owners of vacation interests and others primarily through various membership programs, as well as related services to resort developer clients. Vacation exchange allows owners of vacation ownership interests to exchange their occupancy rights

(whether (whether denominated in weeks or points) for comparable, alternative accommodations at another resort and/or occupancy period.period or for other vacation experiences.

After their initial membership period, certain Interval Network members generally have the option of renewing their memberships for terms ranging from one to five years and paying their own

membership fees directly to us. We sometimes refer to these as traditional members. Alternatively, some resort developers incorporate the Interval Network membership fee into certain annual fees they charge to owners of vacation interests at their resorts or vacation ownership clubs, which results in these owners having their membership in the Interval Network and, where applicable, the Interval Gold or Interval Platinum program (as described below), automatically renewed through the period of their resort's or club's participation in the Interval Network. We sometimes refer to these as corporate members.

All vacation ownership accommodations relinquished to the Interval Network exchange programs are assigned a trading value based on multiple factors, including location, quality, seasonality, unit attributes and time of relinquishment prior to occupancy to determine the relinquished accommodations' relative exchange value to the exchange network. Members are offered an exchange to accommodations which are generally of comparable value to those relinquished.

Related Products and Services

accommodations available as Getaways consist of seasonal oversupply of vacation ownership accommodations within the applicable exchange network, as well as resort accommodations we source specifically for use in Getaways.

Relationships with Developers

Resort Affiliations. The Interval Network has established multi-year relationships with numerous resort developers, including leading independent and brand name developers, under exclusive affiliation agreements. Pursuant to these agreements, resort developers are obligated to enroll all purchasers of vacation interests at their resorts in the applicable exchange membership program and, in some circumstances, are obligated to renew these memberships for the term of their affiliation agreement. We do not consider our overall business to be dependent on any one of these resort developers, provided, that the loss of or unfavorable amendment of terms with a few large developers (particularly those from which Interval receives membership renewal fees directly) could materially impact our business.

Products and Services. A primary basis on which resort developers choose us as a partner is the comprehensive array of products and services that we offer to them, such as sales and marketing support and operational support, including custom vacation program design services.

The Interval Network's resort recognition program recognizes certain of its eligible Interval Network resorts as either a "Select Resort," a "Select Boutique Resort," a "Premier Resort," or a "Premier Boutique Resort," or an "Elite Resort" based upon the satisfaction of qualifying criteria, inspection, member feedback, and other resort-specific factors. Over 40% of Interval Network resorts were recognized as a Select, Select Boutique, Premier, or Premier Boutique, Elite or Elite Boutique Resort for 2014.as of December 31, 2015.

Revenue

Our Exchange and Rental segment earns most of its exchange revenue from (i) fees paid for membership in the Interval Network and the Hyatt Residence Club and (ii) Interval Network and Hyatt Residence Club transactional and service fees paid primarily for exchanges, Getaways, reservation servicing, and related transactions collectively referred to as "transaction revenue." Revenue is also derived from fees for ancillary products and services provided to members, fees from other exchange and rental programs and other products and services sold to developers.

Marketing and Technology

Our exchange businesses maintain corporate and consumer marketing departments, based in ILG's global headquarters in Miami, Florida, with input and local expertise being provided by employees in local and regional offices worldwide. Hyatt Residence Club marketing is based in St. Petersburg, Florida. These departments are responsible for implementing our overall marketing strategy and developing printed and digital materials that are necessary to secure new relationships with resort developers, homeowners' associations and resorts and obtain new members and participants, as well as promote membership renewals, exchange opportunities and other value-added services to existing members.

We market our products and services to resort developers and other parties in the vacation ownership industry through a series of business development initiatives. Our sales and services personnel proactively seek to establish strong relationships with developers during the early stages of the development of a particular resort by providing input on consumer preferences and industry trends based upon years of experience. In addition, given our long-standing relationships with others within the vacation ownership industry, we are often able to refer resort developers, management companies and owner-controlled associations to quality providers of a wide range of planning and operational resources. We believe that we have established a strong reputation within the vacation ownership industry as being highly responsive to the needs of resort developers, management companies and owners of vacation interests.

In addition, we sponsor, participate in and attend numerous industry conferences around the world. For over 15 years, we have organized and co-sponsored a proprietary, multi-day informational seminar, known as the Shared Ownership Investment Conference, where real estate developers, hospitality companies, investors and others contemplating entry into the vacation ownership industry can meet and network with industry leaders, as well as participate in educational panels on various vacation ownership issues, such as property and program planning, sales and marketing, financing and regulatory requirements. This seminar is offered annually in the U.S. with additional conferences held periodically at locations in regions that Interval views as potential market opportunities for vacation ownership development. In 2014, we held short conferences in Lima, Peru; and Bangkok, Thailand. With these programs, we work to strengthen and expand the vacation ownership industry through the education and support of viable new entrants. We have also maintained leadership roles in various industry trade organizations throughout the world since their inception, through which we have been a driving force in the promotion of constructive legislation, both in the U.S. and abroad, principally aimed at creating or enhancing consumer protection in the vacation ownership industry. In addition we operate a business to business website,www.resortdeveloper.com, and publish a trade magazine, Vacation Industry Review, for developers, industry partners and those interested in learning more about the shared ownership industry and our services.

Our consumer marketing efforts revolve around the deepening of new and existing customer relationships globally, focusing on the strategic design of consumer marketing and product development initiatives across the customer lifecycle. The design, development and execution of programs, promotions, online and offline communications, cross-sell initiatives, new technology tools and overall

enhancements to both membership and product value propositions are all aimed at increasing acquisition, usage, loyalty, retention and overall engagement of members and non-members. The online channel remains a strategic focus of growth with new technology for our online booking tools and communications created to increase the overall user experience, member service and engagement. Interval Community and other social media channels offer Interval NetworkILG's exchange companies engage with their members through a platformnumber of online resources to share theirencourage sharing of experiences and communicatecommunication with each otherone another about vacation ownership, travel and ways to utilize and maximize their membershipmemberships. Interval International hosts the members-only Interval Community at intervalworld.com, and theirboth Interval and Hyatt Residence Club are utilizing social media

channels like Facebook and Instagram to inspire vacations, share stories and promote the vacation ownership.ownership lifestyle.

Our success also depends, in part, on our ability to provide prompt, accurate and complete service to our members through voice and data networks and proprietary and third party information systems. The technology platform for the Interval Network is a proprietary, custom developed enterprise application and database that manages all aspects of membership, exchange and Getaway transaction processing and inventory management. TPI uses a separate proprietary network for its exchange program. We also use advanced telecommunications systems and technologies to promptly respond and efficiently route member calls. In addition, we operate consumer websites for our members and participants, such aswww.intervalworld.com, www.hyattresidenceclub.com, www.tradingplaces.com andwww.preferredresidences.com.

Vacation Rental

In addition to the rental opportunities provided through the Getaway program, we provide vacation rental as the key part of a comprehensive package of marketing, management and rental services offered to vacation property owners, primarily of Hawaiian properties, through Aston and Aqua.Aqua-Aston. As of December 31, 2014, Aston and Aqua2015, Aqua-Aston provided vacation rental and/or management services to more than 50 resorts primarily in Hawaii, as well as Guam, Orlando, Florida, South Lake Tahoe, California, and Lake Las Vegas, Nevada and Pocono Mountains, Pennsylvania.Nevada.

These businesses provideThis business provides vacation property rental services for condominium owners, hotel owners, and homeowners' associations. The condominium rental properties are generally investment properties, and, to a lesser extent, second homes, owned by individuals who contract with Aston or AquaAqua-Aston directly to manage, market and rent their properties, generally pursuant to short-term agreements. We also offer such owners a comprehensive package of marketing, management and rental services designed to enhance rental income and profitability. Generally, property and homeowners' association management services, including administrative, fiscal and quality assurance services, are provided pursuant to exclusive agreements with terms typically ranging from one to ten years or more, many of which are automatically renewable.

Revenue is derived principally from fees for rental services and related management of hotel, condominium resort, and homeowners' association management. Agreements with owners at many of our vacation rental's managed hotel and condominium resorts provide that owners receive either specified percentages of the rental revenue generated under our management or guaranteed dollar amounts. In these cases, the operating expenses for the rental operation are paid from the revenue generated by the rentals, the owners are then paid their contractual percentages or guaranteed amounts, and our vacation rental business either retains the balance (if any) as its fee or makes up the deficit. Management fees consist of a base management fee and, in some instances for hotels or condominium resorts, an incentive management fee which is generally a percentage of operating profits or improvement in operating profits. Service fee revenue is based on the services provided to owners including reservations, sales and marketing, property accounting and information technology services either internally or through third party providers.

Important to the success and continued growth of the vacation rental business is our ability to source vacationers interested in booking vacation properties made available through our rental services. Our sales and marketing team in Honolulu, Hawaii, utilizes a variety of sales, marketing, revenue

management and digital marketing initiatives to attract consumers and additional properties to Aston and Aqua.Aqua-Aston. The team in Hawaii focuses on many channels of distribution including traditional wholesale through tour operators and travel partners, online travel agencies and the Global Distribution System. In addition, Aston and AquaAqua-Aston focus on driving direct business through channels such as brand websites and our central reservations office. The sales team covers several market segments from corporate and government/military to travel agents and groups with a focus on the US, Canada,

Australia, Europe, Japan, China and Korea. In many of these markets we have field sales personnel. We offer a variety of leisure accommodations to visitors from around the world through consumer websites such as,www.astonhotels.com, www.aquaresorts.com, www.aquahospitality.com, www.resortquesthawaii.com andwww.mauicondo.com. As an additional distribution channel, Aston and Aqua provideAqua-Aston provides units to Interval for use as Getaways.

Vacation Ownership

Our Vacation Ownership segment engages in the management of vacation ownership resorts; sales, marketing, and financing of vacation ownership interests; as well as related services to owners and associations. Revenue from the Vacation Ownership segment is derived principally from fees for resort and homeowners' association management services, sales of Hyatt® branded vacation ownership interests, interest income earned for financing these sales, and licensing, sales and marketing, and other fees charged to non-controlled developers of Hyatt Residence Club affiliated resorts.

Management Services

We provide management services to nearly 200 vacation ownership properties and/or their associations through HVO, TPI, VRI and VRI Europe. As of December 31, 2014:2015:

All of these businesses provide resort management services for vacation ownership resorts, which generally offer leisure accommodations with certain comforts of home, such as kitchens or kitchenettes, separate seating or living room areas and in suite, private bedrooms, with actual services and features varying by property. We also provide homeowners' association management services, which include administrative, fiscal and quality assurance services.

Our management services are provided pursuant to agreements with terms generally ranging from one to ten years or more, many of which are automatically renewable. Management fees are negotiated amounts for management and other specified services, and at times are based on a cost plus arrangement. For the United States based businesses, our management fees are paid by the homeowners' association and funded from the annual maintenance fees paid by the individual owners to the association. Most of VRI Europe revenue is based on a different model. Typically, VRI Europe charges vacation owners directly an annual fee intended to cover property management, all resort operating expenses and a management profit. Consequently, VRI Europe's business model normally operates at a lower gross margin than the other management businesses, when excluding pass-through revenue.

HVO, TPI and VRI also offer vacation rental services to individual timeshare owners and homeowners' associations. HVO provides management services to homeowners' associations and resorts that participate in the Hyatt Residence Club. VRI Europe manages resorts developed by CLC World

Resorts, our joint venture partner in VRI Europe, as well as independent homeowners' associations. The loss of several of our largest management agreements could materially impact our Vacation Ownership business.

Sales, Marketing, Financing and Related Services

HVO sells, markets, finances, develops and/or licenses the brand for 16 vacation ownership resorts that participate in the Hyatt Residence Club as of December 31, 2014:2015:

HVO sells traditional vacation ownership interests of weekly intervals and, at certain properties, fractional interests, as deeded real estate. These interests provide annual usage rights for a one-week or longer interval at a specific resort. Each purchaser is automatically enrolled in the Hyatt Residence Club through which the owner may trade some or all of his or her usage rights as described above in Exchange and Rental.

In connection with the sales of vacation ownership interests, we provide financing to eligible purchasers collateralized by the deeded interest. These loans generally bear interest at a fixed rate, have a term of up to 10 years and require a minimum 10% down payment. As of December 31, 2014,2015, our consolidated loan portfolio consisted of approximately 4,4004,000 loans with an outstanding balance of $36.5$32.2 million and a weighted average interest rate of 14.0%.

In addition, we receive fees for sales and marketing, brand licensing and other services provided to properties where the developer is not controlled by us. We have a global master license agreement with a subsidiary of Hyatt Hotels Corporation which provides us with an exclusive license for the use of Hyatt® brand with respect to shared ownership, as described below. The Hyatt Residence Club resorts are able to use the Hyatt brand through agreements with us. In the event the master license agreement expires or otherwise terminates, these resorts will no longer be able to use the Hyatt® name and any of the resorts may also lose the rights to the name in the event it does not maintain certain standards or otherwise breaches its agreements with us.

In December 2014, the newest Hyatt Residence Club resort, Hyatt Ka'anapali Beach opened on Maui. This resort was developed through an unconsolidated joint venture with Host Hotels & Resorts and HVO is providing sales, marketing and management services and the license for the brand.

Marketing

Marketing efforts for TPI, VRI and VRI Europe are focused on homeowners' associations of vacation ownership resorts. VRI Europe has an agreement with CLC World Resorts to source additional management opportunities, while HVO focuses its management services on Hyatt Residence Club resorts and associations. We also market online directly to consumers through our websites,www.vriresorts.com, www.resort-solutions.co.uk, andwww.tradingplaces.com as well as provide rental units to Interval for use as Getaways.

Generally, we sell vacation ownership interests to prospective purchasers thatwho attend a resort tour and sales presentation at one of our sales preview centers and learn about the benefits of ownership in a Hyatt Residence Club resort from one of our sales associates. As of December 31, 2014,2015, we operate seven sales preview centers. Our marketing to attract potential purchasers focuses primarily on guests of our resorts and nearby Hyatt hotels, existing owners and potential customers targeted through our marketing programs. These programs include direct mailmarketing to Hyatt Gold Passport® customer loyalty program members and other databases as well as local marketing centers in high-traffic locations. We maintain a significant presence on thewww.hyatt.com website and also reach consumers through ourwww.hyattresidenceclub.com website.

Master License Agreement

On October 1, 2014, in connection with the closing of the acquisition of HVO, our subsidiary entered into a Master License Agreement with a subsidiary of Hyatt Hotels Corporation. The Master License Agreement provides an exclusive license for the use of the Hyatt® brand in connection with the shared ownership business.

Pursuant to the terms of the Master License Agreement, our subsidiary may continue to develop, market, sell and operate existing shared ownership projects as well as new shared ownership projects agreed to by us and Hyatt. HVO must comply with designated Hyatt® brand standards with respect to the operation of the licensed business. The initial term of the Master License Agreement expires on December 31, 2093, with three 20-year extensions subject to meeting sales performance tests. In consideration for the exclusive license and for access to Hyatt's various marketing channels, including the existing hotel loyalty program, we have agreed to pay Hyatt certain recurring royalty fees based on revenues generated from vacation ownership sales, management, rental and club dues collected by us related to the branded business.

There are restrictions on transfers by us without Hyatt's written consent of:

Hyatt's written consent is not required for a "change of control" of ILG if on the date of the transaction that results in a "change of control":

provided that the following conditions are satisfied as of the date of the transaction that resulted in a "change of control" of ILG:

The transfer of a "noncontrolling" interest in HVO or ILG to a hotel or shared ownership competitor of Hyatt does not require Hyatt's written consent as long as transferee does not control or direct the day-to-day operations of the licensed business and we institute controls reasonably designed to prevent the transferee from obtaining Hyatt's confidential information.

Hyatt may terminate the Master License Agreement upon the occurrence of certain uncured, material defaults by us. Such defaults include, but are not limited to, a payment default, bankruptcy, a transfer in breach of the specified transfer restrictions or a material failure to comply with Hyatt® brand standards on a systemic level.

Competitive Strengths

Leading positions within non-traditional leisure lodging

The Interval Network, with 1.8 million members, has been a pioneer and innovator in serving the vacation ownership market since 1976, providing high-quality products and services to resort developers and members worldwide. Our tenure of our relationships with our top 25 new-member producing developer clients for the last twelve months ended December 31, 2014 average over 14 years. We are also a leading manager of vacation ownership properties through VRI, VRI Europe, TPI and HVO. Our Aston and Aqua businesses offer vacation rentals in more hotels and resorts throughout Hawaii than any other manager. As an industry leader, we are well-positioned to provide a variety of non-traditional lodging products and services to vacationers, owners, associations and developers.

Increasingly diversified revenue streams

Our revenues are diversified across a variety of business models within non-traditional lodging. We derive revenue from vacation exchange, vacation rental, as well as management of vacation ownership resorts and financing, sales and marketing of vacation ownership interests. Our management offerings include property management, association management and related services. With offices in 16 nations, we have a global presence and generate revenue from customers in over 100 countries worldwide. This breadth of services provides us with multiple opportunities to participate in the future growth of the non-traditional lodging industry.

Compelling value proposition for leisure travelers, developers and property owners

The flexibility of exchange has consistently been cited by consumers as an important feature of their timeshare purchase. The flexibility Interval membership provides, coupled with its relatively low cost as a percentage of the vacation ownership interest purchase price (generally less than 0.5%), provide an attractive value proposition at point of sale. At the same time, Interval provides sales, marketing and operational support to resort developers. Our vacation rental businesses offer leisure travelers an array of vacation accommodations at properties that are professionally managed. By handling the administrative, fiscal, quality assurance, reservations, association management, maintenance and rentals, our vacation ownership management businesses provide valuable assistance to the property owners. The HVO business offers opportunities to work with an internationally recognized brand and affiliate luxury and upper upscale destinations with the Hyatt Residence Club.

Recurring revenue streams and robust cash flow generation

Our businesses generate recurring revenues from membership, club, rental and management fees. This business model provided stable revenue generation through the recent recession.

Historically, we have required relatively low levels of capital expenditures and we will continue to focus on fee-for-service revenue streams that contribute to our strong free cash flow. Since the beginning of 2010, we have generated approximately $410.0 million of cumulative free cash flow, including $91.6 million during the year ended December 31, 2014.

Seasoned management team with demonstrated history of success

Our senior management team has approximately 200 years of combined industry experience. The senior management team has been responsible for many of our core strategies, including enhancing developer and branded hospitality company relationships and entering new international markets. The management team has also been integral in expanding the vacation rental, property and association management and vacation ownership sales and marketing services through acquisitions, including the HVO transaction in October 2014.

Business Strategy

To grow our business and expand our presence within non-traditional lodging, we are pursuing the following strategic initiatives:

Enlarging the platform for growth

ILG plans to invest in and grow HVO (and following completion of the acquisition, Vistana) through enhanced marketing efforts, expanding existing projects, and executing on opportunities to develop or otherwise acquire resort inventory. ILG intends to continue providing the exceptional service and vacation experiences to which owners at branded vacation ownership resorts are accustomed.

The ILG portfolio includes companies with long and successful track records of leadership in the vacation industry, and upon closing of the pending transaction, the addition of the Vistana business will expand and fortify ILG's timeshare resort management and exchange businesses. Importantly, Vistana will provide a new platform for growth with a strong vacation ownership sales, marketing and financing infrastructure, while further advancing ILG's strategy of increasing its recurring fee-for-service revenue. ILG expects the Vistana platform revenue growth will primarily originate from the capital-efficient development and sale of vacation ownership interests in existing markets, conversion of and sales at the transferred properties and added distribution through new sales centers.

In addition, ILG plans to selectively evaluate potential joint ventures, acquisitions, and other business arrangements that focus on non-traditional lodging. These activities may be used to expand the Hyatt Residence Club and ILG's other vacation ownership, exchange and rental businesses, provide cross-selling opportunities, or otherwise enhance or complement existing operations and strategy.

Grow highly predictable fee businesses

ILG intends to grow the highly predictable fee business earned on the recurring revenue from its resort management, vacation network and owner services activities. By developing and selling vacation ownership interests, ILG expects to generate additional cost-plus management contracts and increase membership in both the branded proprietary clubs and the Interval International business. Furthermore, ILG expects to achieve incremental revenue growth from expanding the products and services provided to owners, members and guests.

Leveraging our strategic developer, vacation club and homeowners'homeowners association relationships to expand product and service offerings

ILG believes it can leverage its existing, long-standing relationships with strategic developer,developers, vacation clubclubs and homeowners' association relationshipsassociations to capitalize on expanded product offerings related to exchange, rental and management. For example, Interval International offers several membership tiers, Basic, Gold and Platinum, which developers may promote in conjunction with their product at point of

sale as well as the Club Interval points overlaypoints-based exchange program that developers and resellers can offer as an upgrade to existing owners and new purchasers. This allows owners the option to convert their weeks-based ownership into a points currency and experience the flexibility of exchanging with Interval based on points.

In addition, we are lookingILG looks to collaborate with third parties to develop additional properties that will join the Hyatt Residence Club.Club (and following completion of the acquisition, Vistana), including through asset and capital-light opportunities.

Enlarging our platform for growthDeliver world-class experiences at branded properties in premier locations

We plan to invest inWhile ILG has always been focused on providing members and grow HVO through enhanced marketing efforts, expanding some existing projects, and executing on opportunities to broaden the group's footprint. We intend to continue providing the exceptional service andresort guests with memorable vacation experiences, to which Hyatt Residence Club owners are accustomed. Theas the global master licensee for the Hyatt® (and following completion of the Vistana acquisition Westin® and Sheraton® brands) in vacation ownership, ILG portfolio includes companies with longhas an amplified role in developing, operating and successful track recordsmaintaining vacation ownership resorts at the highest level of leadershipquality and service. Existing resorts, located in the vacation industrypremier destinations in North America such as Hawaii, Florida, California, Colorado, Mexico and the addition of HVO expanded our timeshare resort management and exchange businesses. Importantly, HVO provides a new platform for growth with the inclusion of a vacation ownership sales and marketing and financing infrastructure, and further advances our strategy of increasing our recurring fee-for-service revenue.Caribbean, attract loyalists that expect world-class branded experiences. ILG will seek to establish relationships with additional developers building new resorts as well as pursue strategic partnerships.

Enhancing services with cooperation among our various businesses

As we continue to integrate the acquisitions from the past couple years, we are pursuing additional opportunities to leverage competencies between our businesses. Ourconsistently deliver remarkable vacation ownership management and vacation rental businesses partner with our exchange businesses to provide flexibility and

alternative vacation opportunities to owners. Interval's Getaway program provides an additional distribution channel for the rental of managed inventory, while our vacation rental businesses provide lead generation services to our vacation ownership businesses. We expect to continue to capitalize on opportunities for our businesses to collaboratememories in order to enhance our sales and marketing efforts, and to share best practices across our platforms.high-value resort destinations.

Continuing to expand internationally

WeILG expects to continue to make strategic investments to grow in international markets. In 2013, weILG formed the VRI Europe joint venture with CLC World Resorts and expanded ourits vacation ownership management business to Europe. Over the past several years, the Interval Network has been affiliating more resorts abroad than in the United States with 75% of the newly-affiliated resorts from 20122013 through 20142015 located outside the United States. Further, revenue generated outsideWith the United States represented 21%license for three globally-recognized upper-upscale brands in vacation ownership, ILG plans to take advantage of our total revenue during the year ended December 31, 2014 compared to 18% during fiscal 2012. We expect to continue to review opportunities to expand our presence internationally.these businesses internationally, including the three Westin properties in Mexico that are part of the Vistana transaction and are anticipated to be converted to vacation ownership.

Pursuing strategic acquisitions and joint venturesMaintain an efficient balance sheet

We planILG expects to selectively evaluate potential acquisitions, joint venturesmaintain a prudent level of debt and other business arrangements that focus on non-traditional lodging. These activities may be usedensure access to expandcapital commensurate with operating needs, growth profile and risk mitigation policies. ILG intends to meet liquidity needs through operating cash flow, credit facilities and access to the Hyatt Residence Club and our other vacation ownership and exchange and rental businesses, provide cross-sellingasset-backed financing market. Further, ILG intends to regularly review capital efficient opportunities, or otherwise enhance or complement our existing operations and strategy.balancing its capital structure with stockholder returns.

International Operations

We conduct operations through offices in the U.S. and 15 other countries. For the year ended December 31, 2014,2015, revenue is sourced from over 100 countries worldwide. Other than the United States and Europe, revenue sourced from any individual country or geographic region did not exceed 10% of consolidated revenue for the years ended December 31, 2015, 2014 2013 and 2012.2013.

Geographic information on revenue, based on sourcing, and long-lived assets, based on physical location, is presented in the table below (in thousands). Amounts in the proceeding table representing

revenue sourced from the United States and Europe versus all other countries for yearyears ended December 31, 2012 have been reclassified to conform to current period presentation.2015, 2014 and 2013.

| | Year Ended December 31, | Year Ended December 31, | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2014 | 2013 | 2012 | 2015 | 2014 | 2013 | ||||||||||||||

Revenue | ||||||||||||||||||||

United States | $ | 483,007 | $ | 404,886 | $ | 385,973 | $ | 577,052 | $ | 483,007 | $ | 404,886 | ||||||||

Europe | 73,119 | 34,306 | 26,715 | 68,237 | 73,119 | 34,306 | ||||||||||||||

All other countries(a) | 58,247 | 62,023 | 60,651 | 52,147 | 58,247 | 62,023 | ||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Total | $ | 614,373 | $ | 501,215 | $ | 473,339 | $ | 697,436 | $ | 614,373 | $ | 501,215 | ||||||||

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | December 31, | December 31, | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2014 | 2013 | 2015 | 2014 | ||||||||||

Long-lived assets (excluding goodwill and other intangible assets) | ||||||||||||||

United States | $ | 81,291 | $ | 53,056 | $ | 86,813 | $ | 81,291 | ||||||

Europe | 4,884 | 5,812 | 4,335 | 4,884 | ||||||||||

All other countries | 426 | 688 | 334 | 426 | ||||||||||

| | | | | | | | | | | | | | | |

Total | $ | 86,601 | $ | 59,556 | $ | 91,482 | $ | 86,601 | ||||||

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Competition

Exchange and Rental

The two principal companies in the globalOur main vacation ownership exchange business, our Interval International, business and RCI, aggressively competeprincipally competes for developer and consumer market share.share with RCI. TPI and several third parties that operate in this industry with a significantly more limited scope of available accommodations. Our Exchange and Rental segmentThis business also faces increasing competition from points-based vacation clubs and large resort developers, which often operate their own internal exchange systems to facilitate exchanges for owners of vacation interests at their resorts as they increase in size and scope. Increased consolidation in the industry enhances this competition. In addition, vacation clubs and resort developers may have direct exchange relationships with other developers.

We believe that developers and homeowners' associations generally choose to affiliate with an exchange network based on:

Based on the most recent disclosure statements filed by RCI and Interval for the year ended December 31, 2013,2014, RCI had approximately 3.73.8 million points and weeks members and its network for

weeks included a total of approximately 4,250 resorts while the Interval Network, at that time, had approximately 1.8 million members and included nearly 2,900approximately 3,000 resorts. Accordingly, RCI is the larger provider of vacation ownership member services with a larger exchange network. Through the resources of its corporate affiliates, particularly Wyndham Vacation Ownership, Inc., itself engaged in vacation ownership sales and significantly larger than HVO, RCI may have greater access to a significant segment of new purchasers of vacation interests.

While overall, the Interval Network's primary competitorRCI has a greater number of resorts in its exchange network and reports a larger number of owners of vacation interests participating in its vacation ownership membership programs, we believe that the Interval Network has distinguished itself as the membership and exchange provider of choice withfor developers of high quality vacation ownership properties and their owners. This belief is based primarily on the quality of the resorts in the Interval Network and related services provided by these resorts, coupled with favorable membership demographics and a continued commitment to attract distinctive resorts to the network and foster memorable vacation experiences for its members.

On the rental side, weWe also compete with hotels and other leisure accommodations providers for vacationers on the basis of our range of available accommodations, price, locations, and amenities. In addition, we also compete with alternative lodging marketplaces such as Airbnb and HomeAway, which operate websites that market available furnished, privately-owned residential properties, including homes and condominiums, in locations throughout the world, which can be rented on a nightly, weekly or monthly basis.

Vacation Ownership

The vacation ownership management businesses face competition from other management companies, developers and clubs. The principal competitive factors in attracting hotel, condominiumhomeowners' associations and timeshare resort and other vacation property owners and homeowners' associations are the ability to provide comprehensive management services at competitive prices and increasingly the ability to assist in the sale of defaulted inventory. In addition, there are low barriers to entry for new competitors.

Our vacation ownership business competes with other branded and independent vacation ownership developers for sales of vacation ownership interests based principally on location, quality of accommodations, price, financing terms, quality of service, terms of property use, opportunity for vacation ownership owners to exchange into time at other vacation ownership properties or other program benefits as well as brand name recognition and reputation. We also compete for talent, marketing channels and new projects. Hyatt Vacation Ownership's principal competitors in the sale of vacation ownership products include Diamond Resorts, Disney Vacation Club, Hilton Grand Vacations Club, Marriott Vacation Club Worldwide, Vistana and Wyndham Vacation Ownership. A number of the competitors in this business are larger with greater resources, distribution platforms, sales capabilities and access to capital for new projects than our business. Our ability to attract and retain purchasers of vacation ownership interests depends on our success in distinguishing the quality and value of our vacation ownership offerings from those offered by others.

Seasonality

Revenue at ILG is influenced by the seasonal nature of travel. Within our Exchange and Rental segment, our vacation exchange businesses generally recognize exchange and Getaway revenue based on confirmation of the vacation, with the first quarter generally experiencing higher revenue and the fourth quarter generally experiencing lower revenue. Our vacation rental businesses recognize rental revenue based on occupancy, with the first and third quarters generally generating higher revenue as a result of increased leisure travel to our Hawaii-based managed properties during these periods, and the second and fourth quarters generally generating lower revenue.

Within our Vacation Ownership segment, our sales and financing business experiences a modest impact from seasonality, with higher sales volumes during the traditional vacation periods, largely the third quarter (summer months).periods. Our vacation ownership management businesses by and large do not experience significant seasonality.

Employees

As of December 31, 2014,2015, ILG had approximately 6,1005,600 employees worldwide. With the exception of employees at two propertiesone property in Hawaii, one property in California, one property in Puerto Rico and employees in Argentina, Brazil, Italy, Mexico and Spain, employees are not represented by unions or collective bargaining agreements. ILG believes that relationships with its employees are generally good.

Intellectual Property

We regard ourhave a broad intellectual property rights,portfolio, including service marks, trademarks and domain names, copyrights, trade secrets and similar intellectual property (as applicable), which we view as critical to our success. Our businesses also rely heavily upon proprietary software, informational databases and other components that make up their products and services.

We rely on a combination of laws and contractual restrictions with employees, customers, suppliers, affiliates and others to establish and protect these proprietary rights. Despite these precautions, it may be possible for a third party to copy or otherwise obtain and use trade secret or copyrighted intellectual property without authorization which, if discovered, might require legal action to correct. In addition, third parties may independently and lawfully develop substantially similar intellectual properties.

We have generally registered and continue to apply to register, or secure by contract when appropriate, our trademarks and service marks as they are developed and used, and reserve and register domain names as we deem appropriate. We generally consider the protection of our trademarks to be important for purposes of brand maintenance and reputation. While we protect our trademarks, service marks and domain names, effective trademark protection may not be available or may not be sought in every country in which products and services are made available, and contractual disputes may affect the use of marks governed by private contract. Similarly, not every variation of a domain name may be available or be registered, even if available. Our failure to protect our intellectual property rights in a meaningful manner or challenges to related contractual rights could result in erosion of brand names and limit our ability to control marketing on or through the internet using our various domain names or otherwise, which could adversely affect our business, financial condition and results of operations.

From time to time in the ordinary course of business, we are a party to various legal proceedings and claims, including claims of alleged infringement of the trademarks, copyrights, patents and other intellectual property rights of third parties. In addition, litigation may be necessary in the future to enforce our intellectual property rights, protect trade secrets or to determine the validity and scope of proprietary rights claimed by others. Any litigation of this nature, regardless of outcome or merit, could result in substantial costs and diversion of management and technical resources, any of which could adversely affect our business, financial condition and results of operations.

Government Regulation

Our businesses are subject to and affected by international, federal, state and local laws, regulations and policies, which are subject to change. The descriptions of the laws, regulations and policies that follow are summaries of those which we believe to be most relevant to our business and do not purport to cover all of the laws, regulations and policies that affect our businesses. We believe that we are in material compliance with these laws, regulations and policies.

Regulations Generally Applicable to Our Business

Privacy and Data Collection. The collection and use of personal data of our customers, as well as the sharing of our customer data with affiliates and third parties, are governed by privacy laws and regulations enacted in the United States and in other jurisdictions around the world. For instance,

several states have introduced legislation or enacted laws and regulations that require compliance with standards for data collection and protection of privacy and, in some instances, provide for penalties for failure to notify customers when the security of a company's electronic/computer systems designed to protect such standards are breached, even by third parties. Other states, such as California, have enacted legislation that requires enhanced disclosure on Internet web sites regarding consumer privacy and information sharing among affiliated entities or have such legislation pending. In addition, the European Union Directive on Data Protection requires that, unless the use of data is "necessary" for certain specified purposes, including, for example, the performance of a contract with the individual concerned, consent must be obtained to use the data (other than in accordance with our stipulated privacy policies) or to transfer it outside of the European Union. Certain Latin American countries have also recently enacted similar data privacy laws. We believe that we are in material compliance with the laws and regulations applicable to privacy and data collection as such are relevant to our business.

��Marketing Operations. The products and services offered by our various businesses are marketed through a number of distribution channels, each of which is regulated at the federal and state level. Such regulations may limit our ability to solicit new customers or to market additional products or services to existing customers. For example, to comply with state and federal regulations on telemarketing, our affected businesses have adopted processes to routinely identify and remove phone numbers listed on the various "do not call" registries from our calling lists and have instituted procedures for preventing unsolicited or otherwise unauthorized telemarketing calls. In addition, where appropriate, our business has registered as a telemarketer and has adopted calling practices compliant with requirements of the applicable jurisdiction, such as restrictions on the methods and timing of telemarketing calls and limitations on the percentage of abandoned calls generated through the use of automated telephone-dialing equipment or software. Our business has taken steps to identify cellular telephone numbers to prevent them from being called through the use of automated dialers without consent.

Similarly, state and federal regulations may place limitations on our ability to engage our consumers in electronic mail marketing campaigns. Most notably, the CAN-SPAM Act imposes various requirements on the transmission of e-mail messages whose primary purpose is to advertise or promote a commercial product or service. Some foreign jurisdictions in which we operate have similar regulations. Our affected businesses have adopted e-mail messaging practices responsive to the requirements of such regulations.

Internet. A number of laws and regulations have been adopted to regulate the Internet, particularly in the areas of privacy and data collection. In addition, it is possible that existing laws may be interpreted to apply to the Internet in ways that the existing laws are not currently applied, particularly with respect to the imposition of state and local taxes on transactions through the Internet. Regulatory and legal requirements are particularly subject to change with respect to the Internet. We cannot predict with certainty whether such new requirements will affect our practices or impact our ability to market our products and services online.

Travel Agency Services. The travel agency products and services that we provide are subject to various federal, state and local regulations. We must comply with laws and regulations that relate to our marketing and sales of such products and services, including laws and regulations that prohibit unfair and deceptive advertising or practices and laws that require us to register as a "seller of travel" to comply with disclosure requirements. In addition, we are directly or indirectly affected by the

regulation of our travel suppliers, many of which are heavily regulated by the United States and other jurisdictions.

Regulations Applicable to Vacation Ownership Sales and the Exchange Business

Our vacation ownership business is subject to laws and regulations that govern the development of vacation ownership properties and the sale of vacation ownership interests. Developers are generally required to register in the state where the vacation property is located as well as each state having residents to whom the vacation ownership program will be marketed. Generally, registration must be completed before the program is marketed or advertised. The laws of most states require resort developers to file a detailed offering statement describing their business and all material aspects of the project and sale of vacation interests with a designated state authority. Laws in many jurisdictions where vacation interests are marketed grant the purchaser of a vacation interest the right to cancel a contract of purchase at any time within a specified rescission period following the earlier of the date the contract was signed or the date the purchaser has received the last of the documents required to be provided. Our sales and marketing practices are subject to the Equal Credit Opportunity Act as well as various federal and state fair housing laws, while our financing operations are subject to the requirements of the Truth-in-Lending Act as well as the Real Estate Settlement Procedures Act ("RESPA").

Certain jurisdictions regulate exchange services, generally requiring us to annually prepare and file disclosure guides in such jurisdictions. In the European Union, a Timeshare Directive has been implemented by member states. This directive imposes requirements on businesses offering timeshare exchange relating to disclosures, rescission and timing of acceptance of initial membership payment to the exchange provider. We have implemented compliance measures as national laws have been adopted by member states pursuant to this directive.

In addition, several jurisdictions in the future may enact regulations that would impose or increase taxes on members that complete exchanges, similar to local transient occupancy taxes.

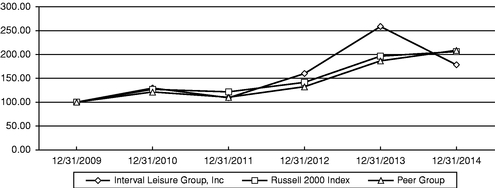

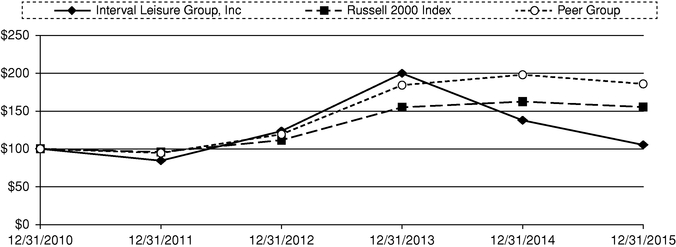

Lending Regulation