We additional option periods thereafter. As a result, the total length of a contract, if all options are exercised, may often range between five and ten years. This provides good visibility in terms of predicting revenue. Most of our contracts are related to long-term, stable programs, such as Medicaid, Medicare, Social Security, the ACA and long-term employment support programs. Our client relationships are frequently decades long. Human Services. 2016. planning. These services comprise less than one percent of the Segment’s revenue. 2016. 2016. seasonality. Demand for our services is contingent upon factors that affect governments, including: The ACA expanded access to health coverage primarily through insurance subsidies and Medicaid expansion. States are not required to expand their Medicaid programs, but the Congressional Budget Office estimates that most will expand coverage over the next several years. The Kaiser Family Foundation increase in civilian agency IT spending. We have seen a substantial increase in long-term sales opportunities as a result of the acquisition. The business has been fully integrated and now operates under the MAXIMUS Federal Services brand. programs. The implementation of the ACA also continues to impact the federal landscape. The ACA requires an independent, evidence-based external review process and the option for individuals to appeal coverage determinations or claims to insurance companies. We are presidential election as a result of the new administration. We believe ongoing Competitive advantages Expertise in competitive bidding. Government agencies typically award contracts through a comprehensive, complex and competitive request for proposals (RFP) and bidding process. Although the bidding criteria which provided 12%. In the U.S., our primary competitors in the Health Services Segment are Xerox, HP, Automated Health Systems and services. Government contracts typically contain provisions permitting government Health Services U.S. Federal Services Human Services Total for currency fluctuations and for estimated amounts associated with our performance-based contracts based upon the latest information that management has at that time. None of our other employees are covered under any such agreement. We consider our relations with our employees to be good. Year Ended September 30, 2015: First Quarter Second Quarter Third Quarter Fourth Quarter Year Ended September 30, 2014: First Quarter Second Quarter Third Quarter Fourth Quarter July 1, 2015 - July 31, 2015 August 1, 2015 - August 31, 2015 September 1, 2015 - September 30, 2015(2) Total Statement of operations data: Revenue Operating income Net income attributable to MAXIMUS Basic earnings per share attributable to MAXIMUS Diluted earnings per share attributable to MAXIMUS Weighted average shares outstanding: Basic Diluted Cash dividends per share of common stock Balance Sheet Data: Cash and cash equivalents Total assets Debt Total MAXIMUS shareholders' equity ITEM 7. Management's Discussion and Analysis of Financial Condition and Results of Operations. In addition, we have acquired businesses which have provided us opportunities to expand our skills, technology and customer relationships to complement our existing business and provide opportunities for further organic growth. 2016: Revenue Gross profit Gross profit margin Selling, general and administrative expense Selling, general and administrative expense as a percentage of revenue Amortization of intangible assets Acquisition-related expenses Operating income Operating income margin Interest expense Other income, net Income before income taxes Provision for income taxes Effective tax rate Net income Income/(loss) attributable to noncontrolling interests Net income attributable to MAXIMUS Basic earnings per share attributable to MAXIMUS Diluted earnings per share attributable to MAXIMUS Adjusted diluted earnings per share attributable to MAXIMUS Earnings Before Interest, Taxes and Amortization (EBITA) Earnings Before Interest, Taxes Depreciation and Amortization (EBITDA) Adjusted EBITDA The following provides an overview of the significant elements of our Fiscal year Revenue for fiscal year 2014 Organic revenue growth Acquired revenue from Acentia and Remploy Currency effect compared to fiscal year 2014 Revenue for fiscal year 2015 Selling, general and administrative expense (SG&A) consists of costs related to general management, marketing and administration. These costs include salaries, benefits, bid and proposal efforts, travel, recruiting, continuing education, employee training, non-chargeable labor costs, facilities costs, printing, reproduction, communications, equipment depreciation, a reduction to SG&A of $4 million. Revenue Gross profit Operating income Gross profit margin Operating profit margin Fiscal year Revenue for fiscal year 2014 Organic revenue growth Currency effect compared to fiscal year 2014 Revenue for fiscal year 2015 scale. Revenue Gross profit Operating income Gross profit margin Operating profit margin revenue and gross profit for fiscal year 2016 are summarized below. Revenue for fiscal year 2014 Organic revenue growth Acquired revenue from Acentia Revenue for fiscal year 2015 our organic revenue growth. The acquisition of Acentia. Revenue Gross profit Operating income Gross profit margin Operating profit margin foreign currency declines. Revenue for fiscal year 2014 Organic revenue growth Acquired revenue from Remploy Currency effect compared to fiscal year 2014 Revenue for fiscal year 2015 As reported Effect of terminated contract Results excluding the effect of the terminated contract Profit margins excluding the effect of the terminated contract. $164.7 million under the credit facility. Our credit facility allows us to borrow up to $400 million, subject to standard covenants. We anticipate that our cash flows from Net cash provided by (used in): Operating activities Investing activities Financing activities Effect of exchange rates on cash and cash equivalents Net (decrease)/increase in cash and cash equivalents Cash provided by operating activities for the years ended September 30, 2016, 2015 and 2014 dividend is dependent upon board discretion and is based upon similar factors which influence share repurchases. To supplement our statements of cash flows presented on a GAAP basis, we use the measure of free cash flow to analyze the funds generated from operations. Cash provided by operating activities Purchases of property and equipment Capitalized software costs Free cash flow Operating leases Debt(1) Deferred compensation plan liabilities(2) Total(3) prior periods would occur at this time. We believe that the likelihood of a significant adjustment to revenue would be remote. U.S. Federal Services Segment. The contract, which has an expected total value of approximately $0.9 billion, has completed its second full year of operations and has up to eight years of operations remaining. Our transaction billing rate for the future periods is approximately 10% lower than that for the first two years. If, at September 30, 2016, our estimate of future volumes had increased or decreased by five percent, it would not have resulted in a significant adjustment to revenue and operating income. Contingencies. From time to time, we are involved in legal proceedings, including contract and employment claims, in the ordinary course of business. We assess the likelihood of any adverse judgments or outcomes to these contingencies, as well as potential ranges of probable losses and establish reserves accordingly. The amount of reserves required may change in future periods due to new developments in each matter or changes in approach to a matter such as a change in settlement strategy. The presentation of these measures is meant to complement, but not replace, other financial measures in this document. The presentation of non-GAAP numbers is not meant to be considered in isolation, nor as an alternative to revenue growth, cash flows from operating activities or net income as measures of performance. These non-GAAP measures, as determined and presented by us, may not be comparable to related or similarly titled measures presented by other companies. Diluted earnings per share attributable to MAXIMUS Acquisition-related expenses Terminated contract Adjusted diluted earnings per share attributable to MAXIMUS Net income attributable to MAXIMUS Interest expense/(income) Provision for income taxes Amortization of intangible assets Stock compensation expense Acquisition-related expenses EBITA Depreciation and amortization of property, plant, equipment and capitalized software EBITDA Effect of terminated contract Adjusted EBITDA ITEM 7A. Quantitative and Qualitative Disclosures About Market Risk. Revenue Cost of revenue Gross profit Selling, general and administrative expenses Amortization of intangible assets Acquisition-related expenses Operating income Interest expense Other income, net Income before income taxes Provision for income taxes Net income Income/(loss) attributable to noncontrolling interests Net income attributable to MAXIMUS Basic earnings per share attributable to MAXIMUS Diluted earnings per share attributable to MAXIMUS Dividends per share Weighted average shares outstanding: Basic Diluted Net income Foreign currency translation adjustments Interest rate hedge, net of income taxes of $16, $— and $— Comprehensive income Comprehensive income/(loss) attributable to noncontrolling interests Comprehensive income attributable to MAXIMUS ASSETS Current assets: Cash and cash equivalents Accounts receivable—billed and billable, net Accounts receivable—unbilled Deferred income taxes Prepaid expenses and other current assets Total current assets Property and equipment, net Capitalized software, net Goodwill Intangible assets, net Deferred contract costs, net Deferred compensation plan assets Other assets Total assets LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable and accrued liabilities Accrued compensation and benefits Deferred revenue Income taxes payable Long-term debt, current portion Other liabilities Total current liabilities Deferred revenue, less current portion Deferred income taxes Long-term debt Deferred compensation plan liabilities, less current portion Other liabilities Total liabilities Commitments and contingencies Shareholders' equity: Common stock, no par value; 100,000 shares authorized; 65,437 and 66,613 shares issued and outstanding at September 30, 2015 and 2014, at stated amount, respectively Accumulated other comprehensive income Retained earnings Total MAXIMUS shareholders' equity Noncontrolling interests Total equity Total liabilities and equity Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization of property, plant, equipment and capitalized software Amortization of intangible assets Deferred income taxes Stock compensation expense Changes in assets and liabilities, net of effects of business combinations: Accounts receivable—billed and billable Accounts receivable—unbilled Prepaid expenses and other current assets Deferred contract costs Accounts payable and accrued liabilities Accrued compensation and benefits Deferred revenue Income taxes Other assets and liabilities Cash provided by operating activities Cash flows from investing activities: Acquisition of businesses, net of cash acquired Purchases of property and equipment Capitalized software costs Proceeds from note receivable Cash used in investing activities Cash flows from financing activities: Cash dividends paid Repurchases of common stock Stock compensation tax benefit Tax withholding related to RSU vesting Stock option exercises Issuance of debt Repayment of debt Costs for expansion of credit facility Cash provided by/(used in) financing activities Effect of exchange rate changes on cash Net (decrease) increase in cash and cash equivalents Cash and cash equivalents, beginning of period Cash and cash equivalents, end of period Balance at September 30, 2012 Net income Foreign currency translation Cash dividends Dividends on RSUs Repurchases of common stock Stock compensation expense Stock compensation tax benefit Common stock issued pursuant to acquisition of HML Tax withholding related to RSU vesting Stock option exercises and RSU releases Balance at September 30, 2013 Net income Foreign currency translation Cash dividends Dividends on RSUs Repurchases of common stock Stock compensation expense Stock compensation tax benefit Tax withholding relating to RSU vesting Stock option exercises and RSU releases Balance at September 30, 2014 Net income Foreign currency translation Interest rate hedge, net of income taxes Cash dividends Dividends on RSUs Repurchases of common stock Stock compensation expense Stock compensation tax benefit Tax withholding related to RSU vesting Stock option exercises and RSU releases Addition of noncontrolling interest from acquisition Balance at September 30, 2015 We recognize revenue on arrangements as work is performed and amounts are earned. We consider amounts to be earned once evidence of an arrangement has been obtained, services have been delivered, fees are fixed or determinable and collectability of revenue is reasonably assured. earned. Sales and purchases in jurisdictions subject to indirect taxes, such as value added tax, are recorded net of tax collected and paid. Our reporting units are consistent with our operating segments, namely Health Services, U.S. Federal Services and Human Services. We perform our annual impairment test as of July 1 of each year. method. 2014 The results of these segments for the three years ended September 30, Revenue: Health Services U.S. Federal Services Human Services Total Gross Profit: Health Services U.S. Federal Services Human Services Total Selling, general and administrative expense: Health Services U.S. Federal Services Human Services Other Total Operating income Health Services U.S. Federal Services Human Services Amortization of intangible assets Acquisition-related expenses Other Total Depreciation and amortization: Health Services U.S. Federal Services Human Services Total Our revenue was distributed as follows (in thousands): United States United Kingdom Australia Rest of World Total Health Services U.S. Federal Services Human Services Corporate/Other Total United States Australia Canada United Kingdom Rest of World Total In the year ended September 30, U.S. Federal New York Australia California Texas 4. Earnings per share Weighted average shares outstanding Effect of employee stock options and unvested restricted stock awards Denominator for diluted earnings per share acquired 100% of the share capital of Ascend for cash consideration of $44.1 million. Ascend is a provider of independent health assessments and data management tools to government agencies in the U.S. We acquired Ascend to broaden our ability to help our existing government clients deal with the rising demand for long-term care services. This business has been integrated into our Health Services Segment. Management has estimated the fair value of intangible assets acquired as $22.3 million, with an average weighted life of 18 years, and the fair value of goodwill 2014 Cash consideration, net of cash acquired Accounts receivable and unbilled receivables Other current assets Property and equipment Intangible assets—customer relationships Total identifiable assets acquired Accounts payable and other liabilities Deferred revenue Capital lease obligations Total liabilities assumed Net identifiable assets acquired Goodwill Net assets acquired Revenue Net income Basic earnings per share attributable to MAXIMUS Diluted earnings per share attributable to MAXIMUS Cash consideration, net of cash acquired Stock consideration Purchase consideration, net of cash acquired Accounts receivable and unbilled receivables Other current assets Property and equipment Intangible assets Total identifiable assets acquired Accounts payable and other liabilities Deferred revenue Current income tax liability Deferred tax liability Total liabilities assumed Net identifiable assets acquired Goodwill Net assets acquired Customer relationships Technology-based intangible assets Total intangible assets Balance at September 30, 2014 Reduction in estimate Foreign currency translation Balance at September 30, 2015 6. Debt We do not believe that the provisions of the credit agreement represent a significant restriction to the successful operation of the business or to our ability to pay dividends. Derivative Arrangement 2017. comprehensive income. Balance as of September 30, 2013 Adjustment to goodwill acquired with HML Foreign currency translation Balance as of September 30, 2014 Goodwill acquired with Acentia Foreign currency translation Balance as of September 30, 2015 The following table sets forth the components of intangible assets (in thousands): Customer contracts and relationships Trademarks and trade names Technology-based intangible assets Total Year ending September 30, 2016 Year ending September 30, 2017 Year ending September 30, 2018 Year ending September 30, 2019 Year ending September 30, 2020 Land Building and improvements Office furniture and equipment Leasehold improvements Less: Accumulated depreciation and amortization Total property and equipment, net Capitalized software Less: Accumulated amortization Total Software development costs, net Deferred contract costs Less: accumulated amortization Total deferred contract costs, net Accounts receivable reserves Balance at beginning of year Additions to reserve Deductions Balance at end of year At September 30, 2016 and 2015, Year ended September 30, 2016 2017 2018 2019 2020 Thereafter Total minimum lease payments Collective bargaining agreements We grant equity awards to officers, employees and directors in the form of restricted stock units (RSUs). RSUs issued generally vest ratably over one or five years. The fair value of the RSUs, based on our stock price at the grant date, is expensed in equal installments over the vesting period. For the fiscal years ended September 30, 2016, 2015 Non-vested shares outstanding at September 30, 2014 Granted Vested Forfeited Non-vested shares outstanding at September 30, 2015 Outstanding at September 30, 2014 Exercised Expired Outstanding and exercisable at September 30, 2015 stock options will expire if not exercised before October 2017. Aggregate intrinsic value of all stock options exercised Net cash proceeds from exercise of stock options 2014 Income before income taxes: United States Foreign Income before income taxes Current provision: Federal State and local Foreign Total current provision Deferred tax expense (benefit): Federal State and local Foreign Total deferred tax expense (benefit) Provision for income taxes Federal income tax provision at statutory rate of 35% State income taxes, net of federal benefit Foreign taxation Permanent items Tax credits Valuation allowances on net operating loss carryforwards Other Income tax expense 2014 Deferred tax assets—current: Deferred revenue Costs deductible in future periods Net operating loss carryforwards Other Total deferred tax assets—current Deferred tax liabilities—current: Accounts receivable—unbilled Net deferred tax asset—current Deferred tax assets—non-current: Net operating loss carryforwards Valuation allowance on net operating loss carryforwards Net operating loss carryforwards net of valuation reserve Deferred revenue Stock compensation Costs deductible in future periods Other Total deferred tax assets—non-current Deferred tax liabilities—non-current Amortization of goodwill and intangible assets Capitalized software Property and equipment Deferred contract costs Employee benefit costs Other Total deferred tax liability—non-current Net deferred tax liability—non-current a net deferred tax liability. Our net deferred tax position is summarized below (in thousands): 2016 and 2015, respectively. We recognize and present uncertain tax positions on a gross basis (i.e., without regard to likely offsets for deferred tax assets, deductions and/or credits that would result from payment of uncertain tax amounts). The reconciliation of the beginning and ending amount of gross unrecognized tax benefits was as follows (in thousands): Balance at beginning of year Lapse of statute of limitation Reductions for tax positions of prior years Balance at end of year 2011. Earnings per share amounts are computed independently each quarter. As a result, the sum of each quarter's earnings per share amount may not equal the total earnings per share amount for the respective year. Health Services U.S. Federal Services Human Services Revenue Health Services U.S. Federal Services Human Services Gross profit Health Services U.S. Federal Services Human Services Amortization of intangible assets Acquisition-related expenses Other/Corporate Operating Income Net income Net income attributable to MAXIMUS Diluted earnings per share attributable to MAXIMUS Health Services U.S. Federal Services Human Services Revenue Health Services U.S. Federal Services Human Services Gross profit Health Services U.S. Federal Services Human Services Amortization of intangible assets Other/Corporate Operating Income Net income attributable to MAXIMUS Diluted earnings per share attributable to MAXIMUS Equity compensation plans/arrangements approved by the shareholders(2) Equity compensation plans/arrangements not approved by the shareholders Total ITEM 13. Certain Relationships and Related Transactions, and Director Independence.•••the effects of future legislative or government budgetary and spending changes;•difficulties in integrating acquired businesses;••our failure to successfully bid for and accurately price contracts to generate our desired profit;•our ability to maintain relationships with key government entities from whom a substantial portion of our revenue is derived;•the ability of government customers to terminate contracts on short notice, with or without cause;•our ability to manage capital investments and start-up costs incurred before receiving related contract payments;•our ability to maintain technology systems and otherwise protect confidential or protected information;•••Generalprovide business process services (BPS) toare a leading operator of government health and human services agenciesprograms worldwide. We act as a partner to governments under our mission ofHelping Government Serve the People.® We are one of the largest pure-play health and human services BPS providers to governments in the United States, the United Kingdom, Australia, Canada, Saudi Arabia and New Zealand. We use our experience, business process management expertise and advanced technological solutions to help government agencies run efficient and cost-effective programs. Our solutions improve program accountability and outcomes, while enhancing the quality of services provided to program beneficiaries.who can providethat offer efficient and cost-effective solutions to problems,these trends, including:••••in the U.K., which require the implementation of new services and new programs.••sixfour entities operating state-based exchanges and a customer contact center for the federal marketplace;•U.K.;•One of the largest providers of occupational health services in the U.K.;••ArabiaArabia.New Zealand.•••• Much of our revenue is derived from long-term contractual arrangements with governments. Base contracts are typically three to five years and often have additional option periods, which provide good visibility in terms of predicting revenue. Most of our contracts are related to programs that are long-term in nature, such as Medicaid, Medicare, Social Security, the ACA and long-term employment support programs. Our client relationships are frequently decades long.provide. As our business changes, we revise our internal reporting and the manner in which our Chief Executive Officer operates and reviews the results of our business. This reporting forms the basis for our external reporting of our business segments. During the fourth quarter of fiscal year 2015, we revised our reporting structure to accommodate three business segments, adding aprovide: Health Services, U.S. Federal Services Segment that comprises the work we perform for the U.S. Federal Government, as well as some U.S.-based appeals work. The businesses within this new segment were previously included within our Health Services Segment and include the results of the businesses acquired with Acentia in April 2015. We made these changes to our operations and internal reporting due to our acknowledgement that the U.S. Federal Government is a distinct customer with different procurement methods and regulations, the scale of our business with the U.S. Federal Government and the growth of our federal business from a primarily health-focused business to a broader business covering several federal agencies.profit,income, identifiable assets and related financial information for the 2016, 2015 2014 and 20132014 fiscal years, see "Note 2. Business segments" within Item 8 of this Annual Report on Form 10-K, which we incorporate by reference herein.53%54% of our total revenue in fiscal year 2015.programs includeservices support Medicaid, CHIPthe Children's Health Insurance Program (CHIP) and the ACA in the U.S., Health Insurance BC (British Columbia) in Canada and the Health Assessment Advisory Service (HAAS)HAAS and Fit for Work Service in the U.K. The Segment's services help people access, navigate and use health benefitbenefits and other government programs. The Segment also helps governments engage with program recipients, while at the same time helping themgovernments to improve the efficiency, cost effectiveness, quality and accountability of their health and disability benefits programs. Ourprogramsprograms. These services include:••••••• •Medigent® product suite. OurSegment’s revenue is from our independent health review services. These services include:•assessments;assessments, including those related to long-term services and• Ourinclude:•planning, oversight and consulting services; and•Specialized program consulting services.24%25% of our total revenue in fiscal year 2015. In this Segment, The acquisition of Acentia in 2015 provided us with access to twelve new contract vehicles with the U.S. Federal Government. We currently serve nineteen federal agencies.servicesservices. These include:••Documentsrecordsrecord management; and• Ourservicesservices. These include:••• Oursolutionssolutions. These include:•ITinformation technology (IT) infrastructure;•••23%21% of our total revenue in fiscal year 2015. These programs include welfare-to-work, child support, higher education and K-12 special education. The Segment'sinclude:•Comprehensive welfare-to-work services tothat help disadvantaged individuals transition from government assistance programs to sustainable employment and economic independence includingServices include eligibility determination, case management, job-readinessjob‑readiness preparation, job search and employer outreach, job retention and career advancement, and selected educational and training services;services. Programs served include the Work Programme and Work Choice in the U.K.; jobactive, Disability Employment Services and Young Refugee Assistance in Australia; Temporary•Fullservices;••K-12 special education case management solutions;••SegmentSegment's business is not expected to experience seasonality related to its programs.Arabia and New Zealand.Arabia. The distribution of revenue and assets across geographies are included in "Note 2. Business Segments" within Item 8 of this Annual Report on Form 10-K. Health and welfare reform initiatives have created increased demand for our services, a trend we expect to continue over the next several years. In addition, we believe there is an increasing propensity by certain governments to use public-private partnerships and seek help from firms like MAXIMUS as a means to run more effective and efficient programs. We believe that we remain well-positioned to benefit from this increasing demand.•benefitsbenefit programs;•••benefitsbenefit programs as a result of rising caseloads and demographic trends in many developed countries; and• Overpast decade,Organization for Economic Cooperation and Development, health care costs have risen substantially, and this trend is expected to continue. For example,spending in the U.S. still far exceeds that of other high-income countries. The Kaiser Family Foundation noted an acceleration of U.S. health care spending amongin 2014 due, in part, to increased coverage under the highest of all industrialized countries, is increasingACA and predicts that spending growth will continue at a rate that outpaces inflation and national income growth. Stemminghigher rates than in recent years, but not to the double-digit growth seen in previous decades.benefitsbenefit programs. Countries like the U.K. are examining how public health relates to productivity, cost reduction and economic growth. The U.K. Government provides a range of social welfare benefits for people who are unable to work as a result of a disability, long-term illness or other health condition. For individuals with long-term sickness or disabilities, the government requires an independent health assessment provided by a vendor through HAAS. The assessment is used by the Health Assessment Advisory Servicegovernment to determine an individual's level of benefits. For individuals with shorter-term health conditions, the Government requires an occupational health assessment and general health and work advice provided by a vendor partner through the Fit for Work Service to assist employees referred by employers and general practitioners with a wellness and return-to-work plan. We believe there is continued market demand to conduct independent assessments for participants in public benefit programs and to support employers and their employees through our commercial occupational health services.new ACA health insurance exchanges.also estimatesreported that 3031 states and the District of Columbia have already expanded Medicaid. Medicaid as of October 2016. In addition, states have seen an increase in Medicaid participation as a result of the "woodwork effect" as the level of visibility for these programs has increased, more individuals who are eligible for Medicaid have applied for coverage.fundsfunds. The Medicare Access and guaranteesCHIP Reauthorization Act (MACRA) of 2015 provides new federal funding for CHIP through 2015.2017. We currently serve as the administrative CHIP vendor for CHIP in six states.2015,2016, certain states and the District of Columbia operated their own exchanges. Other states participate in a partnership model or have opted to use the federal exchange. We currently operate customer contact centers for the District of Columbia and fivethree state-based exchanges, as well as aexchanges. We also operate one customer contact center as a subcontractor for the federal marketplace. In 2017, states will have access to the State Innovation Waivers, also known as the 1332 Waivers, which give states the most comprehensive and flexible framework for best using federal funding for their public health insurance programs. As a result, we believe that these waivers may create a more palatable path for additional states to contemplate a shiftnew ways to a state-based exchange or partnership modeloperate their health benefit programs over the coming years.overall 2016 federalPresident'sfor information technology (IT) spend is expected to grow by 1.8proposal includes a 1.3 percent while the projected budget forincrease in overall federal IT services shows 2spending and a 1.1 percent growth. address many of the challenges faced by federal agencies today.programs, such as Medicare where MAXIMUS provides conflict-free reviews of appeals.systems—systems and the pressing need for infrastructure as IT modernization continues to grow. Legacy processes and systems are fundamental to government operations, yet they are unsustainably expensive to operate in an environment that requires online agility and rapid response to new demands, requirements and global challenges. We are in a prime position to help agencies modernize and operate their mission-critical systems.presently managing the eligibility appeals process for the Federally Facilitated Marketplace and we are one of the largest providers of evidence-based health insurance appeals to Medicare and 4855 state agencies. We are also presently managing the eligibility appeals process for the Federally Facilitated Marketplace. As previously mentioned, President-elect Trump's campaign platform included a goal to repeal and replace the ACA. The factors that drove the passage of the ACA are still present we believe we are well-positioned to assist the new administration and the federal government in any repeal, replacement or modification of the ACA.••••••ahead offollowing the November 2016 Presidential Election. The Human Services market has experienced increased demand driven by the need for governments to reduce costs and improve efficiency of certain social benefits programs. The most dynamic portion of the market is in the welfare-to-work arena where governments worldwide seek program reform as an important component of comprehensive fiscal austerity measures. Certain governments are modeling new welfare reforms after established programs in Australia, the U.K. and the U.S. Variations of these models, with which we have a substantial amount of experience, knowledge and expertise, are being emulated around the world through public-private partnerships, with MAXIMUS being a leading provider. However, the re-engineering of well-established programs like these may take years to adapt to new program models from conceptualization to implementation.these global welfare-to-work opportunities in Human Services because of our established presence, strong brand recognition, and ability to achieve the requisite performance requirements and outcomes outlined in the new reform measures. We offer clients demonstrated results and decades of proven experience in administering welfare-to-work programs in several states and countries.Arabia and New Zealand.Arabia. In Australia, we are one of the largest and highest rated welfare-to-work providers, with more than 250 locations nationwide.providers. We also have an established presence in the U.K.'s welfare-to-work market and presently provide employment and job training services under the Work Programme, a key component of the coalition government's austerity plan to rein in costly benefits programs and reduce mounting debt.supporthelp people with disabilities and health conditions intoobtain mainstream employment. We believe these services are transferrable to our other geographies and position us well for emerging trends in the disability services market.reform,to work programs, we have seen an increase in initiatives to use private firms for children's services, such as family maintenance and child support. We currently provide services to the Family Maintenance Enforcement Program in British Columbia, as well as several jurisdictions throughout the U.S., including Shelby County, Tennessee and Baltimore, Maryland, two of the largest child support privatization efforts in the nation. reform initiatives and measures to reduce costs and improve efficiencies, combined with our outstanding performance, expertise and proven solutions, will continue to drive demand for our core services across multiple geographies.BPSbusiness process services (BPS), technology solutions and consulting services to government agencies. The key components of our business growth strategy include the following:customersclients and provide us with predictable recurring revenue streams. We believe an incumbent has a considerable advantage in recompetes and that customerclient relationships can last for decades.customerclient base, cross-selling additional services, enhancing our technical capabilities, and establishing or expanding our geographic presence.customers.clients. We continue to seek efficiencies and optimize operations in order to achieve sustainable, profitable growth. We will continue to deliver quality BPS to government clients to improve the cost effectiveness, efficiency and scalability of their programs as they deal with rising demand and increasing caseloads.customers.clients. The following are the competitive advantages that allow us to capitalize on various market opportunities:Management believesWe believe our extensive industry focus and expertise embedded in our systems and processes provide us with a competitive advantage.We maintainOur business provides us with robust cash flows from operating activities as a strong balance sheet, generate consistent annualresult of our profitability and our management of customer receivables. In the event that we have significant cash outlays at the commencement of projects, to fund acquisitions, or where delays in payments have resulted in short-term cash flow and have accessdeclines, we may borrow up to a $400 million revolvingthrough our credit facility. We possesshave the ability to borrow in all of the principal currencies in which we operate. We believe we have strong, constructive relationships with the lenders on our credit facility. We had $230.1 million available to borrow as of September 30, 2016. We believe our financial strength provides reassurance to ensure clients can confidently trust usgovernment agencies that we will be able to safelyestablish and maintain the services they need to operate their high-profile public health and human services programs.services. specificallyalmost exclusively to government customers. Our government program expertise and proven ability to deliver defined, measurable outcomes differentiate us from other firms and non-profit organizations. This includes large consulting firms that serve multiple industries and lack the focus necessary to manage the complexities of serving government agencies efficiently.Arabia and New Zealand.Arabia. Our international efforts are focused on delivering cost effectivecost-effective welfare-to-work and health benefits services to program participants on behalf of governments.variesvary from contract to contract, we believe that typical contracts are awarded based upon a mix of technical solution and price. In some cases, governments award points for past performance tied to program outcomes. With more than 40 years of experience in responding to RFPs, we believe we have the necessary experience and resources to navigate government procurement processes. We possess the expertiseprocesses and experience to assess and allocate the appropriate resources necessary for successful project completion in accordance with contractual terms.customersclients are government agencies, with the majority at the national, provincial and state level and, to a lesser extent, some at the county and municipal level. In the U.S., even when our direct customersclients are state governments, a significant amount of our revenue is ultimately provided by the U.S. Federal Government in the form of cost-sharing arrangements with the states, such as is the case with Medicaid. In the year ended September 30, 2015,2016, approximately 50%46% of our total revenue was derived from state government agencies, many of whose programs received significant federal funding, 22%26% from foreign government agencies, 20%22% from U.S. federal governmentFederal Government agencies and 8%6% from other sources including local municipalities and commercial customers. We were not significantly affected byshut-downevent of a shutdown of the U.S. Federal Government, in October 2013.a portion of our U.S. Federal Services Segment may be impacted. Many of our federally funded health and human services programs are typically deemedTherefore, in the event ofAs a shut-down, aresult, we could incur costs tied to portion of our U.S. Federal Services Segment may incur costswork that is considered discretionary with no certainty of recovery. In all cases, an extended delay may affect certain government programs that rely upon federal funding and may also have an effect on our cash flows from operations if payments are delayed.2015, we derived approximately 20%2016, our most significant clients were the U.S. Federal Government, which provided 22% of our consolidated revenue, from contracts with the U.S. FederalU.K. Government, exclusively within our U.S. Federal Services Segment,which provided 16%, and approximately 10% from the stateState of New York, exclusively within our Health Services Segment.2015, 44%2016, 42% of our contracts were performance-based, 29%33% were cost-plus, 21%18% were fixed-price and 6%7% were time-and-materials.long-term, multi-yearlonger-term and typical contracts, thatincluding option periods, tend to be several years long before they are subject to option years and periodic rebids.be competitively rebid. See the "Backlog" section below for more details.Fanuel.Faneuil. We consider ourselves to be a significant competitor in the markets in which we operate as we are the largest provider of Medicaid and CHIP administrative programs and operate more state-based health insurance exchanges than any other commercial provider. In the U.S. Federal Services Segment, our primary competitors in the BPS market are Serco, General Dynamics Information Technology and FCi. In the U.S. Federal Services Segment, our primary competitors in the technology sector tend to be IBM, Oracle, SRACSRA and other federal contractors. Our primary competitors in the Human Services Segment vary according to specific business line, but are primarily specialized consulting service providers and local non-profit organizations.Serco;Serco, Ingeus, a Providence Service Company; Staffline;Company, Staffline, Shaw Trust;Trust, Sarina Russon;Russon, Advanced Placement Management;Management and other specialized private companies and non-profit organizations such as The Salvation Army and Goodwill Industries. Although the basis for competition varies from contract to contract, we believe that typical contracts are awarded based upon a mix of technicalcomprehensive solution and price. In some cases, customersclients award points for past performance tied to program outcomes.In MarchEnacted in 2010 and upheld through a Supreme Court decision in 2012, the U.S. Federal Government enactedACA introduced comprehensive health care reform known as the ACA, to expand access to health coverage, protect consumer rights, control health care costs and improve the overall health care delivery system. In June 2012, the Supreme Court ofin the United States upheld the ACA while allowingStates. MAXIMUS has helped states to opt out of the previously mandated Medicaid expansion. The law presents several opportunities for MAXIMUS. These includewith the operation of their health insurance exchange operations;exchanges and the expansion of their Medicaid expansion; the extension of CHIP;programs to include new populations, the integration of state eligibility processing for entitlement programs;programs and new long-term services and supports initiatives for long-term care that allow stateshave introduced more flexibility in Medicaid for homehome- and community-based services;services. MAXIMUS has also assisted the expansionfederal government with the operations of a customer contact center for the Federal Marketplace and independent medicaleligibility appeals servicesservices.demonstration projects forexpansion activities in the dual eligible population (people eligible for bothstates where we provide Medicaid and Medicare).20192019. The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) provides new federal funding has been extendedfor CHIP through 2015, which is two additional years beyond the original CHIPRA.2017. By expanding state options to find and enroll eligible children through "express lane eligibility" and "auto enrollment," CHIPRA has presented MAXIMUS with an opportunity to expand our partnerships with states for the administration of CHIP programs. The advent of state and federal exchanges at the beginning of 2014 has increased participation of eligible children in CHIP. Shift to Medicaid and CHIP Managed Care.Care Regulations. As Medicaid programs become larger, more complex and costly, states look to new models. Estimates fromIn 2016, the Centers for Medicare & Medicaid Services (CMS) indicate that although the fee-for-service system covers less than half of the total Medicaid population, it accounts for more than 80% of all Medicaid spending. In response, several states have initiatives to reduce the current costs of Medicaid by moving different populations of beneficiaries from fixed-fee-for-service models toissued managed care which represents new growth opportunitiesregulations and federal standards for MAXIMUS.Tablethe Medicaid and Children’s Health Insurance programs. These include enhancing support for consumers, improving health care delivery and quality of Contentscare, providing greater access to health care, and ensuring a modern set of rules that better align with the marketplace and Medicare Advantage plans. They also reinforce ongoing efforts to modernize and streamline the enrollment process and the continued value of independent choice counseling.(Temporary Assistance for Needy Families), to help job seekers access the necessary support services and to match employers with skilled workers they need to compete in the global economy. WIOA represents potential new opportunities for us to complement our existing TANF welfare-to-work operations in the U.S.Governmentgovernment to determine the level of benefits for individuals with long-term sickness or disabilities. MAXIMUS has been providing assessments through the resulting HAAS on behalf of the Department for Work and Pensions (DWP) since March 2015.Fit for Work Service (formerly known as the HealthProgramme, Work Choice Programme and Work Service). In 2011, the U.K. Government set up a review of the sickness absence system to help reduce the 140 million days lost to sickness absence every year. The review considered how the current sickness absence system could be changed to help people stay in work, reduce costs and contribute to economic growth. One of the outcomes of the study is the Fit for Work Service that provides occupational health assessments and general health and work advice to employees, employers and general practitioners to help people with a health condition to stay in or return to work. MAXIMUS has been operating the Fit for Work Service on behalf of DWP since August 2014. U.K. WorkHealth Programme. The Work Programme is a government-sponsored welfare-to-work model that consolidates several existing employment programs into a single comprehensive back-to-work program in an effort to achieve higher quality, longer-term and sustainable employment outcomes for job seekers in the U.K. The Work Choice Programme presentedis a voluntary, government-sponsored employment support program for people with disabilities. The U.K. Government has indicated that the two programs will be consolidated into the new opportunities forWork and Health Programme with an increased focus on people with health conditions and disabilities. MAXIMUS expects that the scope of work under Work and we have been delivering employment services throughout Thames Valley, Hampshire andHealth will be smaller than the Isle of Wight and West London since June 2011 and North East Yorkshire and the Humber since February 2015.two previous contracts combined.2015,2016, we estimate that we had approximately $4.6$4.0 billion of revenue in backlog. Backlog represents an estimate of the remaining future revenue from existing signed base contracts and revenue from contracts that have been formally awarded, but not yet signed. Our backlog estimate includes revenue expected under the current terms of executed contracts and revenue from contracts in which the scope and duration of the services required are not definite but estimable (such as performance-based contracts). Our backlog estimate does not assume any contract renewals or option period exercises.itsour estimates related to performance-based contracts and as a result backlog from these contracts may increase or decrease based upon the information that management has at that time. Additionally, backlog estimates may be affected by foreign currency fluctuations.customersclients to terminate contracts on short notice, with or without cause.20152016 and 20142015 was as follows: Backlog as of

September 30, 2015 2014 2016 2015 (In millions) (In millions) $ 2,320 $ 2,330 $ 2,429 $ 2,320 832 570 408 832 1,448 900 1,163 1,448 $ 4,600 $ 3,800 $ 4,000 $ 4,600 BPS businesses typically involve contracts covering a number of years.years, including option periods. Once contracts are signed, they typically take three to six months to begin generating revenue. At September 30, 2015,2016, the average weighted life of these contracts was approximately 5 years, including option periods. Although the exercise of options is uncertain, we believe the incumbent contractor enjoys significant advantages and these options are exercised nearly 100% of the time. The longevity of these contracts assists management in predicting revenue, operating income and cash flows. We expect approximately 45%51% of the backlog balance to be realized as revenue in fiscal 20162017 and, with the inclusion of anticipated option period renewals, to represent approximately 93% of current estimated 2017 revenue. Backlog was adjusted between September 30, 2015 and September 30, 2016 revenue.2015,2016, we had approximately 17,00018,800 employees, consisting of 9,30010,900 employees in the Health Services Segment, 3,0003,500 employees in our U.S. Federal Services Segment, 4,3004,000 employees in the Human Services Segment and 400 corporate administrative employees. Our success depends in large part on attracting, retaining and motivating talented, innovative, experienced and educated professionals at all levels.2015, 4142016, 417 of our employees in Canada were covered under three different collective bargaining agreements, each of which has different components and requirements. There are 402408 employees covered by two collective bargaining agreements with the British Columbia Government and Services Employees' Union and 12nine employees covered by a collective bargaining agreement with the Professional Employees Association. These collective bargaining agreements expire beginning in 2019 through 2020.2015, 1,9172016, 1,795 of our employees in Australia were covered under a Collective Agreement, which is similar in form to a collective bargaining agreement. The Collective Agreement is renewed annually.2015, 7322016, 746 of our employees in the United KingdomU.K. were covered under four different collective bargaining agreements, each of which has different components and requirements. There are 170153 employees covered by a collective bargaining agreement with the Union Public and Commercial Services, sixfive employees covered by a collective bargaining agreement with the Union Prospect, and a total of 556588 employees covered by a collective bargaining agreement with GMB Trade Union and Unite Amicus Trade Union. These collective bargaining agreements do not have expiration dates.SEC.Securities and Exchange Commission (SEC). Our SEC filings may be accessed through the Investor Relations page of our website. These materials, as well as similar materials for other SEC registrants, may be obtained directly from the SEC through their website athttp://www.sec.gov. This information may also be read and copied at the SEC's Public Reference Room at 100 F Street NE, Washington, DCD.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.2015,2016, we leased 114 offices in the United StatesU.S. totaling approximately 2.22.4 million square feet. In fivefour countries outside the U.S., we leased 294323 offices totaling approximately 1.11.0 million square feet. The lease terms vary from month-to-month to ten-year leases and are generally at market rates. In the event that a property is used for our services in the U.S., we typically negotiate clauses to allow termination of the lease if the service contract is terminated by our customer. Such clauses are not standard in foreign leases.United StatesU.S. Federal Government, state, local, and foreign governments, and otherwise in connection with performing services in countries outside of the U.S. Adverse findings could lead to criminal, civil or administrative proceedings, and we could be faced with penalties, fines, suspension or disbarment. Adverse findings could also have a material adverse effect on us because of our reliance on government contracts. We are subject to periodic audits by Federal, state, local and foreign governments for taxes. We are also involved in various claims, arbitrations, and lawsuits arising in the normal conduct of our business. These include but are not limited to, bid protests, employment matters, contractual disputes and charges before administrative agencies. Although we can give no assurance, based upon our evaluation and taking into account the advice of legal counsel, we do not believe that the outcome of any existingpending matter would likely have a material adverse effect on our consolidated financial position, results of operations or cash flows. Price Range High Low Dividends Price Range High Low Dividends Year Ended September 30, 2016: First Quarter $ 69.85 $ 47.95 $ 0.045 Second Quarter 55.67 45.15 0.045 Third Quarter 58.14 46.90 0.045 Fourth Quarter 61.68 54.38 0.045 $ 55.97 $ 38.93 $ 0.045 $ 55.97 $ 38.93 $ 0.045 66.93 52.36 0.045 66.93 52.36 0.045 69.04 61.90 0.045 69.04 61.90 0.045 70.00 55.99 0.045 70.00 55.99 0.045

$ 50.55 $ 42.71 $ 0.045 50.24 40.61 0.045 46.48 40.27 0.045 43.40 37.94 0.045 30, 2015,31, 2016, there were 6151 holders of record of our outstanding common stock. The number of holders of record is not representative of the number of beneficial owners due to the fact that many shares are held by depositories, brokers or nominees. We estimate there are approximately 28,00030,800 beneficial owners of our common stock.2015:2016:Period July 1, 2016 - July 31, 2016 — $ — — $ 137,455 August 1, 2016 - August 31, 2016 — — — 137,660 September 1, 2016 - September 30, 2016 (2) 162,016 $57.40 — 137,796 Total 162,016 — (1) Under a resolution adopted in August 2015, the Board of Directors authorized the repurchase, at management's discretion, of up to an aggregate of $200 million of our common stock. This resolution superseded similar authorizations from November 2011 and June 2014. The resolution also authorized the use of option exercise proceeds for the repurchase of our common stock. (2) The total number of shares purchased in September 2016 comprises restricted stock units which vested in this month but which were utilized by the recipients to net-settle personal income tax obligations. The shares were not issued and a payment for this liability was made by us in October 2016. Total

Number of

Shares

Purchased Average

Price Paid

per Share Total Number of

Shares Purchased as

Part of Publicly

Announced Plans(1) Approximate Dollar

Value of Shares that

May Yet Be

Purchased

Under the Plan

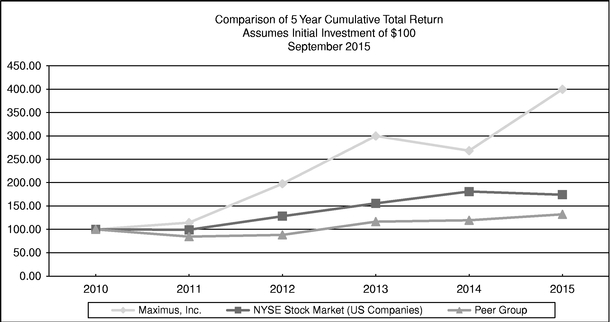

(in thousands) — $ — — $ 104,581 643,797 60.13 643,797 182,004 417,265 60.68 222,900 168,568 1,061,062 60.34 866,697 (1)Under a resolution adopted in August 2015, the Board of Directors authorized the repurchase, at management's discretion, of up to an aggregate of $200 million of our common stock. This resolution superseded similar authorizations from November 2011 and June 2014. The resolution also authorized the use of option exercise proceeds for the repurchase of our common stock.(2)The total number of shares purchased in September 2015 includes 194,365 restricted stock units which vested in this month but which were utilized by the recipients to net-settle personal income tax obligations. The shares were not issued and a payment for this liability was made by us in October 2015.20102011 to September 30, 2015,2016, with the cumulative total return for the NYSE Stock Market (U.S. Companies) Index. In addition, we have compared the results of a peer group to our performance. TheOur peer group is comprised ofbased upon the companies noted in our annual proxy statement as entities with whom we compete for executive talent. These companies are SAIC, Unisys,Sapient. TheUnisys.20102011 in our common stock, the NYSE Stock Market (U.S. Companies) Index and our peer groups and assumes dividends are reinvested.

A.The lines represent index levels derived from compounded daily returns that include all dividends.B.The indexes are reweighted daily, using the market capitalization on the previous trading day.C.If the monthly interval, based on the fiscal year-end, is not a trading day, the preceding trading day is used.D.The index level for all series was set to $100.00 on 09/30/2010.A. The lines represent index levels derived from compounded daily returns that include all dividends. B. The indexes are reweighted daily, using the market capitalization on the previous trading day. C. If the monthly interval, based on the fiscal year-end, is not a trading day, the preceding trading day is used. D. The index level for all series was set to $100.00 on September 30, 2011. Year Ended September 30, 2015 2014 2013 2012 2011 Year Ended September 30, (In thousands, except per share data) 2016 2015 2014 2013 2012 (In thousands, except per share data) Consolidated statement of operations data: $ 2,099,821 $ 1,700,912 $ 1,331,279 $ 1,050,145 $ 929,633 $ 2,403,360 $ 2,099,821 $ 1,700,912 $ 1,331,279 $ 1,050,145 259,832 225,308 185,155 127,334 122,401 286,603 259,832 225,308 185,155 127,334 157,772 145,440 116,731 76,133 81,168 178,362 157,772 145,440 116,731 76,133 $ 2.37 $ 2.15 $ 1.71 $ 1.12 $ 1.18 $ 2.71 $ 2.37 $ 2.15 $ 1.71 $ 1.12 $ 2.35 $ 2.11 $ 1.67 $ 1.09 $ 1.14 $ 2.69 $ 2.35 $ 2.11 $ 1.67 $ 1.09 66,682 67,680 68,165 67,734 68,834 65,822 66,682 67,680 68,165 67,734 67,275 69,087 69,893 69,611 71,062 66,229 67,275 69,087 69,893 69,611 $ 0.18 $ 0.18 $ 0.18 $ 0.18 $ 0.15 $ 0.18 $ 0.18 $ 0.18 $ 0.18 $ 0.18 At September 30, 2015 2014 2013 2012 2011 At September 30, (In thousands) 2016 2015 2014 2013 2012 (In thousands) Consolidated balance sheet data: $ 74,672 $ 158,112 $ 125,617 $ 189,312 $ 172,950 $ 66,199 $ 74,672 $ 158,112 $ 125,617 $ 189,312 1,280,171 900,996 857,978 695,293 565,279 1,348,819 1,271,558 900,996 857,978 695,293 210,974 1,217 1,489 1,736 1,696 165,615 210,974 1,217 1,489 1,736 612,378 555,962 529,508 451,106 374,457 749,081 612,378 555,962 529,508 451,106 Table of Contentsprovide business process services (BPS) toare a leading operator of government health and human services agenciesprograms worldwide. We act as a partner to governments under our mission ofHelping Government Serve the People.® We are one of the largest pure-play health and human services BPS providers to governments in the United States, the United Kingdom, Australia, Canada, Saudi Arabia and New Zealand. We use our experience, business process management expertise and advanced technological solutions to help government agencies run effective, efficient and cost-effective programs, improve program accountability and outcomes and enhance the quality of services provided to program beneficiaries.accountable programs.grown significantly.reported significant organic growth. We believe this growth has been driven by economic and demographic factors, such as aging populations and increased demand for health care, and the need for governments to operate programs effectively and efficiently. This growth has been driven bypolitical factors, such as health care reform efforts in the United States including the Affordable Care Act (ACA), as well as internationally with various programsand welfare reform in Australia and the United Kingdom.We believe that a combination ofAs governments look to identify and reward providers based upon results, we see opportunities to expand based upon our innovative technical solutions,technology, deep subject matter expertise, stringent adherence to our Standards of Business Conduct and Ethics, robust financial performance and global experience gives existingworldwide experience.future customers the confidence that MAXIMUS can reliably operate their high-profile public health and human services programs.Significant recent acquisitionsGovernment, andGovernment. This business has been integrated into our U.S. Federal Services Segment.United KingdomU.K. government. This business has been integrated into our Human Services Segment.boththat all four acquisitions will provide us with the ability to complement and expand our existing services in their respective markets. These acquisitions have been integrated into our U.S. Federal Services and Human Services Segments, respectively. On July 1, 2013, we acquired Health Management Limited (HML), a leading provider of independent health assessments within the United Kingdom. We acquired HML in order to expand our independent medical assessment business and to strengthen the presence of our Health Services Segment in the United Kingdom.2015 have been2016 were driven primarily by the following:•The of Acentia, HML and Remploy, which have increased revenue and profit, as well as our working capital, goodwill, intangible asset and intangible asset amortization balances;•NewUnited Kingdom, particularly the HAAS,U.K., which commenced in fiscal year 2015;•New2015, and various contracts in the United States, particularly those related to the ACA,Affordable Care Act (ACA), which resulted in growth in fiscal yearscommenced or expanded through 2014 and 2015;TableThe expansion of Contents•toof our existing work in Australia, partially offset by the initial costs of setting up this work and deferral of initial revenue received;•Additional growth, driven by new work and the expansion of existing contracts;••revenuesrevenue and profitsprofit recorded by our international businesses; and•United StatesU.S. Dollar, principally the British Pound, the Australian Dollar, the Canadian Dollar and the Saudi Arabian Riyal and the New Zealand Dollar.Riyal. During the year ended September 30, 2015,2016, we earned approximately 26%28% and 10%16% of revenue and operating income, respectively, from our foreign subsidiaries. At September 30, 2015,2016, approximately 28%25% of our assets are held by foreign subsidiaries. International business exposes us to certain risks.•International tax ruleslimit thepenalize us if we transfer funds or debt across international borders. Accordingly, we may not be able to use ofour cash in other parts of the business without increasing significant additional tax expense or withholding.locations where it is needed. We mitigate this risk by maintaining sufficient capital and access to capital both within and outside the United StatesU.S. to support the short-term and long-term capital requirements of the businesses.businesses in each region. We establish our legal entities to make efficient use of tax laws and holding companies to minimize this exposure.•year endsyears indicated, selectedinformation derived from our statements of operations data:operations. Year ended September 30, 2015 2014 2013 (dollars in thousands,

except per share data) $ 2,099,821 $ 1,700,912 $ 1,331,279 512,717 452,123 386,033 24.4 % 26.6 % 29.0 % 238,792 220,925 193,827 11.4 % 13.0 % 14.6 % 9,348 5,890 4,883 4,745 — 2,168 259,832 225,308 185,155 12.4 % 13.2 % 13.9 % 1,398 — — 1,385 2,061 3,867 259,819 227,369 189,022 99,770 81,973 71,673 38.4 % 36.1 % 37.9 % 160,049 145,396 117,349 2,277 (44 ) 618 $ 157,772 $ 145,440 $ 116,731 $ 2.37 $ 2.15 $ 1.71 $ 2.35 $ 2.11 $ 1.67 To assist our presentation of the financial statements, we also include the following performance indicators. These items are considered "non-GAAP" numbers. We have also included at the end of this section details on our use of these performance indicators and reconciliations to their respective Generally Accepted Accounting Principles (GAAP) numbers. Year ended September 30, (dollars in thousands, except per share data) 2016 2015 2014 Revenue $ 2,403,360 $ 2,099,821 $ 1,700,912 Cost of revenue 1,841,169 1,587,104 1,248,789 Gross profit 562,191 512,717 452,123 Gross profit margin 23.4 % 24.4 % 26.6 % Selling, general and administrative expense 268,259 238,792 220,925 Selling, general and administrative expense as a percentage of revenue 11.2 % 11.4 % 13.0 % Amortization of intangible assets 13,377 9,348 5,890 Acquisition-related expenses 832 4,745 — Gain on sale of a business 6,880 — — Operating income 286,603 259,832 225,308 Operating income margin 11.9 % 12.4 % 13.2 % Interest expense 4,134 1,398 — Other income, net 3,499 1,385 2,061 Income before income taxes 285,968 259,819 227,369 Provision for income taxes 105,808 99,770 81,973 Effective tax rate 37.0 % 38.4 % 36.1 % Net income 180,160 160,049 145,396 Income/(loss) attributable to noncontrolling interests 1,798 2,277 (44 ) Net income attributable to MAXIMUS $ 178,362 $ 157,772 $ 145,440 Basic earnings per share attributable to MAXIMUS $ 2.71 $ 2.37 $ 2.15 Diluted earnings per share attributable to MAXIMUS $ 2.69 $ 2.35 $ 2.11 Year ended September 30, 2015 2014 2013 (dollars in thousands,

except per share data) $ 2.39 $ 2.11 $ 1.59 $ 289,545 $ 248,766 $ 206,343 336,394 291,544 237,276 336,394 291,544 226,376 Consolidated Statementsconsolidated statements of Operations.operations. As our business segments have different factors driving revenue growth and profitability, the sections that follow cover these segments in greater detail. Our business sections have been updated in fiscal year 2015. Please refer to Note 2. Business segments in Item 8 of this Annual Report on Form 10-K.20152016 compared to fiscal year 20142015 Revenue Cost of Revenue Gross Profit (dollars in thousands) Dollars Percentage change Dollars Percentage change Dollars Percentage change Balance for fiscal year 2015 $ 2,099,821 $ 1,587,104 $ 512,717 Organic growth 194,784 9.3 % 177,732 11.2 % 17,052 3.3 % Acquired growth 157,985 7.5 % 117,425 7.4 % 40,560 7.9 % Currency effect compared to the prior period (49,230 ) (2.3 )% (41,092 ) (2.6 )% (8,138 ) (1.6 )% Balance for fiscal year 2016 $ 2,403,360 14.5 % $ 1,841,169 16.0 % $ 562,191 9.6 % 23%by approximately 14% to $2,099.8$2,403.4 million, with our cost of revenue increasing by approximately 16% to $1,841.2 million. MuchOur gross profit margin declined from 24.4% to 23.4%. We have identifiedorganic, particularly infrom our 2016 acquisitions, Ascend and Assessments Australia, as well as the Health Services Segment, supplemented with acquired growthbenefits of a full year of results from Acentia and Remploy.2015,2016, the United StatesU.S. Dollar gained in strength against the Australian Dollar and Canadian Dollar and, accordingly,all international currencies in which we do business. Accordingly, we received lower revenuesrevenue and incurred lower costs than would have been the case if currency rates had remained stable. Dollars in

Thousands Percentage

change $ 1,700,912 317,653 18.7 % 141,036 8.3 % (59,780 ) (3.5 )% $ 2,099,821 23.5 % Gross profit increased 13% to $512.7 million, representing a profit margin of 24.4% compared to 26.6% in the prior year. This decline in gross margin has been driven by several factors.•Our federal appeals business has declined year-over-year to a normal profit margin, driven by changes in related legislation.•With the acquisition of Acentia, a greater share of our customer portfolio earns income from cost-plus or time-and-materials contracts. These contracts typically offer lower margins in return for lower risk.•The HAAS contract in the United Kingdom has received reduced performance incentives as we encounter challenges in recruiting and retaining trained healthcare professionals.•We have several contracts in 2015 in start-up. We typically see lower margins in the early stages of a contract.intangible amortization, legal expenses and the costs of business combinations. Our SG&A is primarily composed of labor costs. These costs may be incurred at a segment level, for dedicated resources which are not client-facing, or at a corporate level. Corporate costs are allocated to segments on a consistent, rational basis. Unlike cost of revenue, SG&A is not directly driven by fluctuations in our revenue and, as our business expands, we would expect to see SG&A decline as a percentage of revenue as we attain economies of scale.20142015 to 2015,2016, as the revenue growth of the business overall exceeded that of our administrative cost base. InmanagementK-12 Education business, which was previously part of the Company’s Human Services Segment. As a result of this transaction, we recorded a gain of approximately $6.9 million. The K-12 Education business contributed revenue of $2.2 million, $4.7 million and $9.4 million for the years ended September 30, 2016, 2015 and 2014, respectively.bonusbalances, which have declined. Other income is not expected to be significant in future years. Revenue Cost of Revenue Gross Profit (dollars in thousands) Dollars Percentage change Dollars Percentage change Dollars Percentage change Balance for fiscal year 2014 $ 1,700,912 $ 1,248,789 $ 452,123 Organic growth 317,653 18.7 % 288,222 23.1 % 29,431 6.5 % Acquired growth 141,036 8.3 % 102,297 8.2 % 38,739 8.6 % Currency effect compared to the prior period (59,780 ) (3.5 )% (52,204 ) (4.2 )% (7,576 ) (1.7 )% Balance for fiscal year 2015 $ 2,099,821 23.5 % $ 1,587,104 27.1 % $ 512,717 13.4 % 2014. Acquisition-related expenses are costs directly incurred from2014, an increase of 8.1%. This increase was principally driven by the purchasesfollowing factors:2015our IT infrastructure resulted in additional expenditures of approximately $7 million on shared resources; HML2013, as well as any unsuccessful transactions.profitincome margin decline has been driven by the same factors as the operating profitincome decline, as well as increases in costs related to acquisitions and intangible asset amortization.have recorded interest expense in fiscal year 2015. has increased due to a greater share of our income coming from the United States, particularly with the growth of our U.S. Federal Services Segment. In addition, our fiscal year 2014 tax rate received the benefit of the utilization of additional employment-related tax credits in fiscal year, the utilization of a tax net operating loss in Canada which had previously been fully reserved, and a benefit to our state taxes for the difference between the estimates in fiscal year 2013 to the tax returns filed in the fourth quarter of fiscal year 2014. For fiscal year 2016, the Company is anticipating a tax rate between 37% and 39%.Fiscal year 2014 compared to fiscal year 2013 Revenue increased 28% to $1,701 million. Much of the growth was organic, particularly in the Health Services and U.S. Federal Services Segments, supplemented with acquired growth from HML. In fiscal year 2013, we terminated a contract which had been acquired as part of the PSI acquisition, resulting in a one-time benefit of $16.0 million to revenue, $10.9 million to pre-tax profit and $0.09 to diluted earnings per share. This contract was in the Human Services Segment. Gross profit increased 17% to $452.1 million, representing a profit margin of 26.6% compared to 29.0% in the prior year. Gross profit margins declined due to new, cost-plus contracts in the which typically operate at lower margins than performance-based or fixed fee arrangements. Margins in fiscal year 2013 had received the benefit of the terminated contract. Our SG&A as a percentage of revenue has declined between fiscal years 2013 to 2014, as the revenue growth of the business overall exceeded that of our administrative cost base. Operating income increased 22% to $225.3 million representing a profit margin of 13.2% for the year ended September 30, 2014, compared to 13.9% in the prior year. This growth was principally driven by new work tied to the ACA in our Health and U.S. Federal Services Segments. Interest and other income declined due to decreases in our international cash balances, which generated the majority of our interest income. These funds were used to acquire HML in fiscal year 2013. Our tax rate for fiscal year 2014 was 36.1%, compared to 37.9% in 2013. This decline was caused by the utilization of significant additional employment-related tax credits in fiscal year, the utilization of a tax net operating loss in Canada which had previously been fully reserved, and a benefit to our state taxes for the difference between the estimates in fiscal year 2013 to the tax returns filed in the fourth quarter of fiscal year 2014.Health Services Segmentthe Affordable Care ActACA in the U.S., Health Insurance BC (British Columbia) in Canada and the Health Assessment Advisory Service (HAAS)HAAS and Fit for Work Service in the U.K. Year ended September 30, 2015 2014 2013 Year ended September 30, (dollars in thousands) (dollars in thousands) 2016 2015 2014 $ 1,109,238 $ 906,650 $ 691,565 $ 1,298,304 $ 1,109,238 $ 906,650 Cost of revenue 1,006,123 855,130 692,922 254,108 213,728 172,336 292,181 254,108 213,728 Selling, general and administrative expense 107,155 99,815 98,172 154,293 115,556 89,205 185,026 154,293 115,556 22.9 % 23.6 % 24.9 % 13.9 % 12.7 % 12.9 % Gross profit percentage 22.5 % 22.9 % 23.6 % Operating margin percentage 14.3 % 13.9 % 12.7 % 2015 versus2016 compared to fiscal year 20142015 Revenue Cost of Revenue Gross Profit (dollars in thousands) Dollars Percentage change Dollars Percentage change Dollars Percentage change Balance for fiscal year 2015 $ 1,109,238 $ 855,130 $ 254,108 Organic growth 202,928 18.3 % 165,467 19.3 % 37,461 14.7 % Acquired growth 14,881 1.3 % 10,336 1.2 % 4,545 1.8 % Currency effect compared to the prior period (28,743 ) (2.6 )% (24,810 ) (2.9 )% (3,933 ) (1.5 )% Balance for fiscal year 2016 $ 1,298,304 17.0 % $ 1,006,123 17.7 % $ 292,181 15.0 % 22%approximately 17% to $1,109.2$1,298.3 million. Gross profit increased by 19%approximately 15% and operating profitincome increased by 34%approximately 20%. The results for the Segmentnewthree factors.including HAAS, andexpanded on our existing U.S.-based contracts, notably with the expansion of an existing contracts. Dollars

in Thousands Percentage

change $ 906,650 225,285 24.8 % (22,697 ) (2.5 )% $ 1,109,238 22.3 % marginmargins declined year-over-year driven primarily byslightly year-over-year. This expected decline is due, in part, to the ramp-up on the HAAS contract. Thiscontract which operated at lower margins than the remainder of the Segment. As expected, the Fit For Work contract, which commenced in fiscal year 2015, hasalso tempered gross profit margins. Revenue Cost of Revenue Gross Profit (dollars in thousands) Dollars Percentage change Dollars Percentage change Dollars Percentage change Balance for fiscal year 2014 $ 906,650 $ 692,922 $ 213,728 Organic growth 225,285 24.8 % 183,918 26.5 % 41,367 19.4 % Currency effect compared to the prior period (22,697 ) (2.5 )% (21,710 ) (3.1 )% (987 ) (0.5 )% Balance for fiscal year 2015 $ 1,109,238 22.3 % $ 855,130 23.4 % $ 254,108 18.9 % professionals. These difficulties,professionals which resulted in turn, have resulted inadditional costs incurred that were not recovered due to reduced fees from performance incentives in this contract. This detriment was offset by accretive new work and improvements in the performance of an unprofitable contract acquired with PSI and launched in fiscal year 2014. Our operating profit margin improved, as the increase in revenue did not result in an associated increase in the size of SG&A expenses, due to benefits of scale and a decline in the management cash bonus plan. Our performance in fiscal year 2016 will be significantly affected by our ability to address issues related to the HAAS contract, as well as successfully executing other new contracts.Fiscal year 2014 versus fiscal year 2013 Revenue increased by 31% to $906.7 million. incentives.24%approximately 19% to $254.1 million. Our gross profit margin declined by 70 basis points to 22.9%. The HAAS contract would have reduced the segment profit margin by 270 basis points, but this was more than offset by the improvements on the PSI contract and operating profit increased by 30%. The resultsgrowth in other contracts.Segment were driven by:•Work related to the ACA, including new workcompany, and the expansionHealth Services Segment, did not significantly fluctuate year-over-year. Accordingly, the segment’s operating income margin received the benefit from the company’s economies of work on existing contracts;•The benefit of a full year of HML's business, which was acquired in July 2013; and•Other significant new contracts which commenced during the 2013 and 2014 fiscal years. Gross and operating profit margins were lower than in prior years driven by:•Contract start-up activity in late fiscal year 2014, related to the U.K. Health and Work Service (Fit for Work); and•The launch, during fiscal year 2014, of an unprofitable contract which had been acquired with PSI. Year ended September 30, 2015 2014 2013 Year ended September 30, (dollars in thousands) (dollars in thousands) 2016 2015 2014 $ 502,484 $ 341,840 $ 167,258 $ 591,728 $ 502,484 $ 341,840 Cost of revenue 453,560 383,838 231,047 118,646 110,793 73,694 138,168 118,646 110,793 Selling, general and administrative expense 74,792 59,252 47,695 59,394 63,098 42,566 63,376 59,394 63,098 23.6 % 32.4 % 44.1 % 11.8 % 18.5 % 25.4 % Gross profit percentage 23.3 % 23.6 % 32.4 % Operating margin percentage 10.7 % 11.8 % 18.5 % Contents Revenue Cost of Revenue Gross Profit (dollars in thousands) Dollars Percentage change Dollars Percentage change Dollars Percentage change Balance for fiscal year 2015 $ 502,484 $ 383,838 $ 118,646 Organic growth (15,043 ) (3.0 )% (11,133 ) (2.9 )% (3,910 ) (3.3 )% Acquired growth 104,287 20.8 % 80,855 21.1 % 23,432 19.7 % Balance for fiscal year 2016 $ 591,728 17.8 % $ 453,560 18.2 % $ 138,168 16.5 % Revenue Cost of Revenue Gross Profit (dollars in thousands) Dollars Percentage change Dollars Percentage change Dollars Percentage change Balance for fiscal year 2014 $ 341,840 $ 231,047 $ 110,793 Organic growth 56,649 16.6 % 73,131 31.7 % (16,482 ) (14.9 )% Acquired growth 103,995 30.4 % 79,660 34.5 % 24,335 22.0 % Balance for fiscal year 2015 $ 502,484 47.0 % $ 383,838 66.1 % $ 118,646 7.1 % profitincome decreased by 5.9%.Segment. These increases were offset by an expected declineSegment and driving the acquired growth in our Medicare Appeals business. Dollars in

Thousands Percentage