•our ability to

satisfy the required conditionsobtain andotherwise completemaintain regulatory approvals for ourplanned merger, or the Merger, with Oncternal Therapeutics, Inc., or Oncternal, pursuant to the Agreement and Plan of Merger and Reorganization, dated March 6, 2019, or the Merger Agreement, by and among GTx, Grizzly Merger Sub, Inc., a wholly-owned subsidiary of GTx, and Oncternal, on a timely basis or at all;•- product candidates;

the expected

benefitstiming for achieving key milestones, including completing andpotential value created byannouncing results of clinical trials of cirmtuzumab and TK216 and announcing theproposed Mergerfirst-in-human dosing of our Receptor tyrosine kinase-like Orphan Receptor 1, or ROR-1, chimeric antigen receptor T cell, CAR-T, product candidate currently in preclinical development;the timing or likelihood of regulatory filings and approvals;

the estimated size of the patient population and anticipated market potential for our

stockholders, includingproduct candidates;the

ownership percentageimpact of products that compete with ourstockholders inproduct candidates that are or may become available;the

combined organization immediately following the consummationsize and growth potential of theproposed Mergermarkets for our product candidates, andthe potential value of the contingent value rights to be received by our stockholders in connection with the proposed Merger if it is completed;•the implementation of our business strategies, includingour ability topreserve or realize any significant value from our selective androgen receptor degrader, or SARD, program and our selective androgen receptor modulators, or SARMs;•our expectations regarding the near-term development of our SARD program, includingserve those markets;our ability to

advance a SARD compound into a first-in-human clinical trial;•- obtain and maintain favorable regulatory designations for our product candidates and preclinical programs;

the

therapeutic and commercial potentialscope ofour SARD program;•our abilityprotection we are able to establish and maintainpotential new collaborative, partnering or other strategic arrangementsforthe development ofintellectual property rights covering ourSARD program;•- product candidates and our ability to

establish and maintain potential new collaborative, partnering or other strategic arrangements for our SARM assets, including a sale or other divestiture of our SARM assets;•our ability to raise additional capital, whether through potential new collaborative, partnering or other strategic arrangements or otherwise;•our ability to protect our intellectual property andoperate our business without infringing upon the intellectual property rights of others;•our projected operatingthe plans and

financial performance;objectives of management for future operations and•- future results of anticipated products; and

our estimates regarding the sufficiency of our cash resources and our expenses,

including those related to the consummation of the proposed Merger,capital requirements andneedsneed for additional financing, and our ability to obtain additionalfinancing and to continue as a going concern if the Merger is not completed.

financing.In some cases, you can identifyThese forward-lookingstatements by terms such as "anticipates," "believes," "could," "estimates," "expects," "intends," "may," "plans," "potential," "predicts," "projects," "should," "will," "would," and similar expressions intended to identify forward-looking statements. Forward-lookingstatements reflect ourcurrentmanagement’s beliefs and views with respect to future events and are based on estimates and assumptions as of the date of this Annual Report and are subject to risksuncertaintiesandother important factors.uncertainties. We discuss many of these risks inthis Annual Report on Form 10-K ingreater detail under “Risk Factors.” Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess thesection entitled "Risk Factors" under Part I, Item 1A below.impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Given theserisks,uncertainties,and other important factors,you should not place undue reliance on these forward-looking statements.Also,We qualify all of the forward-looking statements

represent our estimates and assumptions only as of the date ofin this Annual Reporton Form 10-K. You should read this Annual Report on Form 10-K and the documents that we incorporatebyreference in and have filed as exhibits to this Annual Report on Form 10-K, completely and with the understanding that our actual future results may be materially different from what we expect.these cautionary statements. Except as required by law, we

assumeundertake no obligation to publicly update any forward-looking statements,publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even ifwhether as a result of new information,becomes availablefuture events or otherwise.Overview

Oncternal Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on the development of novel oncology therapies for cancers with critical unmet medical need. Our development efforts are focused on promising, yet untapped, biological pathways implicated in cancer generation or progression. Our pipeline includes cirmtuzumab, an investigational monoclonal antibody that is designed to inhibit Receptor tyrosine kinase-like Orphan Receptor 1, or ROR1, a growth factor receptor that is widely expressed on many tumors and that activates pathways leading to increased tumor proliferation, invasiveness and drug resistance. Cirmtuzumab is being evaluated in a Phase 1/2 clinical trial in combination with ibrutinib (Imbruvica®) for the treatment of patients with B-cell lymphoid malignancies, including mantle cell lymphoma, or MCL, and chronic lymphocytic leukemia, or CLL, and in an investigator-sponsored, Phase 1b clinical trial in combination with paclitaxel for the treatment of women with HER2-negative metastatic or locally advanced, unresectable breast cancer. We are also developing TK216, an investigational small molecule that is designed to inhibit the ETS, or E26 Transformation Specific, family of oncoproteins, which have been shown in preclinical studies to alter gene transcription and RNA processing and lead to increased cell proliferation and invasion. TK216 is being evaluated in a Phase 1 clinical trial as a single agent and in combination with vincristine in patients with relapsed or refractory Ewing sarcoma, a rare pediatric cancer. In addition, we are developing a chimeric antigen receptor T cell, or CAR-T, therapy candidate that targets ROR1, which is currently in preclinical development as a potential treatment for hematologic cancers and solid tumors.

Cirmtuzumab is an investigational, humanized, potentially first-in-class, anti-ROR1 monoclonal antibody that is designed to bind to a specific functionally important epitope of ROR1, which is a protein expressed on many tumors. ROR1 is a potentially attractive target for cancer therapy because it is an onco-embryonic antigen, which is a protein typically expressed only during embryogenesis that may confer a survival and fitness advantage when reactivated and expressed by tumor cells. ROR1 overexpression in various tumor types, including MCL, CLL and breast cancer, has been associated with more aggressive disease, resistance to therapy and shorter progression-free and overall survival. In preclinical models, inhibition of ROR1 has shown anti-tumor activity, and we believe may have additive or synergistic effects when combined with either targeted therapy or chemotherapy. Preclinical data indicated that when cirmtuzumab bound to ROR1, it blocked growth factor Wnt5a signaling, inhibited tumor cell proliferation, migration and survival, and induced differentiation of CLL tumor cells. Cirmtuzumab was developed in the

future.laboratory of one of our scientific advisors, Professor Thomas Kipps, M.D., Ph.D., Professor of Medicine and Evelyn and Edwin Tasch Chair in Cancer Research at the University of California San Diego, or UC San Diego, with support from the California Institute for Regenerative Medicine, or CIRM. We have an exclusive license to cirmtuzumab for therapeutic uses from UC San Diego.We have completed a Phase 1 study of single-agent cirmtuzumab in patients with CLL and have completed enrollment of dose-finding and expansion cohorts of a Phase 1/2 clinical study of cirmtuzumab in combination with ibrutinib in patients with CLL, as well as a dose-finding cohort of cirmtuzumab in combination with ibrutinib in patients with MCL. We are currently enrolling a Phase 1b clinical trial of cirmtuzumab in combination with ibrutinib in patients with MCL and a randomized Phase 2 clinical trial in patients with CLL. Cirmtuzumab is also being evaluated in an investigator-sponsored, Phase 1b clinical trial in combination with paclitaxel in patients with HER2 negative breast cancer. In addition, based on the high levels of ROR1 expression in multiple tumors and the importance of ROR1 for tumor proliferation and metastases, we believe that cirmtuzumab has potential as a therapeutic agent in other solid tumors and hematologic malignancies with high unmet medical need.

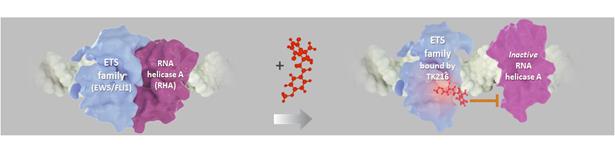

TK216 is an investigational, potentially first-in-class, targeted small molecule that is designed to specifically inhibit the biological activity of the ETS family of oncoproteins. Tumorigenic gene fusions involving ETS factors are frequently found in tumors such as Ewing sarcoma and prostate cancer, and ETS factors are often overexpressed in other tumors, such as acute myeloid leukemia, or AML, and diffuse large B cell lymphoma, or DLBCL. Researchers in the laboratory of Professor Jeffrey Toretsky, M.D., at Georgetown Lombardi Comprehensive Cancer Center, identified the precursor to TK216 using a novel chemical screening assay they developed based on a deep understanding of the underlying biological mechanism of ETS factors. Following this early work, TK216, which is designed to be a specific inhibitor of ETS factors, was created by us through the rational design and screening of novel small molecule inhibitors of a critical protein-protein interaction. In preclinical models, TK216 inhibited the interaction between ETS family members and RNA helicase A, or RHA, and by doing so, shut down excessive cell proliferation. We own intellectual property related to TK216 and have an exclusive license to product candidates targeting ETS oncoproteins for therapeutic, diagnostic or research tool purposes from Georgetown University.

We are evaluating TK216, as a

biopharmaceutical company dedicatedsingle agent and in combination with vincristine, in a Phase 1 clinical trial in patients with relapsed or refractory Ewing sarcoma. The dose-finding portion of the study was completed in 2019, and we are enrolling patients in an expansion cohort to evaluate thediscovery, development and commercializationclinical response ofmedicinestreatment with TK216 in combination with vincristine using the recommended Phase 2 dosing regimen. Ewing sarcoma is a rare pediatric cancer that has historically been very challenging to treatserious and/effectively, particularly for recurrent and metastatic disease. ETS fusion proteins have been shown to be present in over 90% of Ewing sarcoma cases. TK216 has received an Orphan Drug Designation and Fast Track Designation from the U.S. Food and Drug Administration, or FDA, for the treatment of patients with relapsed or refractory Ewing sarcoma.We are also developing a ROR1-targeted CAR-T therapy based on the binding domain of cirmtuzumab as a single-chain fragment variable, or scFv, as a potential treatment for patients with aggressive hematological malignancies or solid tumors. Because the epitope of ROR1 recognized by cirmtuzumab has appeared to be restricted to tumor cells in preclinical studies, we believe that a cirmtuzumab-based CAR-T may be selective in distinguishing cancer from normal tissues. Our ROR1-targeted CAR-T therapy candidate is in preclinical development in collaboration with UC San Diego, supported by funding from CIRM, and with Shanghai Pharmaceuticals Holding Co., Ltd., or SPH, in China.

We have assembled a management team, board of directors and scientific founders who have significant experience in successfully developing and commercializing therapeutics in oncology and orphan diseases, having worked or served on the Board of companies such as Amgen, Inc., Bavarian Nordic, Inc. (lead cancer asset acquired by Bristol Meyers Squibb Company), Cadence Pharmaceuticals, Inc.(acquired by Mallinckrodt plc), Dynavax Technologies Corporation, Elan Corporation (acquired by Perrigo), Eli Lilly and Co., Genzyme Corporation (acquired by Sanofi S.A.), Gilead Sciences, Inc., Halozyme Therapeutics, Inc., Ignyta, Inc. (acquired by Roche Holding AG), Immune Design Corporation (acquired by Merck Co., Inc.), Janssen Pharmaceuticals, Inc., Merck & Co., Inc., Micromet, Inc. (acquired by Amgen, Inc.), Pfizer, Inc., Roche Holding AG, Sorrento Therapeutics, Inc., and Zavante Therapeutics, Inc. (acquired by Nabriva Therapeutics plc).

Our strategy

Our mission is to build a leading oncology company that creates novel and transformative treatments for a wide range of oncology indications for which there are significant unmet medical

conditions. Underneeds. We believe our investigational agents target novel cancer pathways and have unique mechanisms of action. Our current pipeline is derived from our ability to identify therapeutic candidates that have generated promising, late-stage preclinical results or early clinical data, and in-license them for further development. We are particularly focused on therapeutic approaches for which there is a genetic or protein biomarker that can be used to identify populations of patients most likely to respond. We prioritize targets that we believe have the potential to transform the treatment paradigm of difficult-to-treat cancers with either single agent or combination therapy. As is the case for many oncology products, we believe that potential efficacy in one indication suggests the potential for application in other indications that carry the same target.Key elements of our strategy are as follows:

Generateclinicalproof-of-conceptdatawithTK216 inEwingsarcoma, an orphan pediatric cancer indication;

Advancecirmtuzumabthroughclinicaldevelopment,initiallyinMCL,CLLandbreast cancer;

Advance our ROR1-targeting CAR-Ttherapy to clinical testing, initially in hematological cancers and then in solid tumors;

EvaluatecirmtuzumabinadditionalROR1-positive solid tumorssuchaslung,ovarian andprostatecancers, as well as in additional hematological malignancies; and

EvaluateTK216inadditionaltumors with ETS fusion proteins or overexpression, suchasprostatecancer, lymphoma and AML.

The following figure summarizes our current programs:

Cirmtuzumab - monoclonal antibody targeting ROR1

Cirmtuzumab is an investigational, humanized, potentially first-in-class, anti-ROR1 monoclonal antibody that was designed to bind to a specific functionally important epitope of ROR1, which is a protein expressed on many tumors. ROR1 is a potentially attractive target for cancer therapy because it is an onco-embryonic antigen, which is a protein typically expressed only during embryogenesis that may confer a survival and fitness advantage when reactivated and expressed by tumor cells. ROR1 is over-expressed in many different cancers, including MCL, CLL and breast cancer, and has been reported to be associated with more aggressive disease, resistance to therapy and shorter progression-free and overall survival. In preclinical models, inhibition of ROR1 has shown anti-tumor activity and we believe may have additive or synergistic effects when combined with other agents.Preclinical data demonstrated that when cirmtuzumab bound to ROR1, it blocked Wnt5a signaling, inhibited tumor cell proliferation, migration and survival, and induced differentiation of CLL tumor cells. In preclinical models, cirmtuzumab showed synergy with both targeted therapy (e.g., ibrutinib and venetoclax (Venclexta®) in CLL models) and chemotherapy (e.g., paclitaxel in breast cancer models).

Cirmtuzumab was developed in the laboratory of one of our scientific advisors, Thomas Kipps, M.D., Ph.D., Professor of Medicine and Evelyn and Edwin Tasch Chair in Cancer Research at UC San Diego with support from CIRM. We have an exclusive, worldwide license to cirmtuzumab for therapeutic uses from UC San Diego.

A Phase 1 study of single agent cirmtuzumab in patients with CLL was completed at UCSD, and a Phase 1/2 clinical study of cirmtuzumab in combination with ibrutinib in patients with MCL and CLL is ongoing. The combination therapy study was designed to evaluate the safety of cirmtuzumab plus ibrutinib, determine a recommended dosing regimen, and evaluate efficacy in a randomized comparison study. Based on completed cohorts of the study, a recommended dosing regimen was chosen and the randomized portion of the study, comparing ibrutinib alone to cirmtuzumab plus ibrutinib in patients with CLL, is now enrolling. Similarly, a recommended dose regimen has been chosen for patients with MCL and enrollment in an expansion arm of the study is ongoing. Cirmtuzumab is also being evaluated in an investigator-sponsored, Phase 1b clinical trial in combination with paclitaxel in patients with HER2 negative metastatic or locally advanced, unresectable breast cancer. In addition, high levels of ROR1 expression have been reported in multiple additional cancers, and this expression appears to be a driver for tumor proliferation and metastases. As a result, we believe that cirmtuzumab has potential as a therapeutic agent in other solid tumors and hematologic malignancies with high unmet medical need.

Cirmtuzumab scientific background: inhibition of ROR1 as a therapeutic strategy in cancer

ROR1 is an onco-embryonic protein essential for normal fetal development that is suppressed in adults unless reactivated as a survival factor by many different cancers. The switching-on of ROR1 is consistent with a typical pattern in cancer, in which normal cells lose their highly differentiated functions and return to a more primal state, where they exhibit a greatly increased capacity for invasion, metastasis and resistance to treatment. This de-differentiation activates a number of genes normally restricted to fetal development, one of which is ROR1. Cancer cells with the highest potential for self-renewal are sometimes referred to as tumor-initiating cells or cancer stem cells and are capable of invading other tissues or metastasizing to disseminate tumors to distant sites in the body. These tumor-initiating cells are also the cells that have been found to be the most resistant to current therapies including chemotherapy and radiation therapy. Expression of ROR1 in ovarian cancer, for example, appears highest in a subpopulation of tumor cells that also have other markers of cancer stem cells. Cells that overexpress ROR1 show increased survival, migration, and resistance to chemotherapy.

Over-expression of ROR1 has been reported in multiple hematological and solid tumor types. Histological staining of over 350 human tumor samples identified that a majority expressed ROR1, including 90% or more of uterine cancers, lymphomas, and prostate cancers.

Cancer type

ROR1

Expressed (%)

Cancer type

ROR1 Expressed (%)

Uterus

96%

Adrenal

83%

MCL

>95%

Lung

77%

CLL

95%

Breast

75%

Lymphoma

90%

Testicular

73%

Prostate

90%

Colon

57%

Skin

89%

Ovarian

54%

Pancreas

83%

Bladder

43%

High ROR1 expression on patients’ tumor cells in a variety of cancers is associated with early relapse after therapy or the development of metastases. ROR1 expression levels on patients’ tumor cells is substantially higher in cancers that are more advanced and that contain poorly differentiated cells. Whereas Grade 1 or 2 ovarian tumors have been found to be 21% positive for ROR1, Grade 3 or 4 tumors have been found to be 62% positive for ROR1. Similar patterns in the percentage of ROR1-positive tumors were seen in pancreatic cancers, with 54% of Grade 1 or 2 tumors and 100% of Grade 3 or 4 tumors testing positive for ROR1 by immunohistochemistry. High expression of ROR1 has been associated with more aggressive disease and shorter patient survival in multiple tumor types, including CLL, breast cancer and ovarian cancer. High expression of ROR1 has also been associated with resistance to targeted therapy and chemotherapy.

Inhibition of ROR1 signaling or silencing ROR1 in multiple preclinical cancer models, including breast cancer, ovarian cancer, and glioblastoma, and was associated with suppressing the expression of genes characteristic of tumor-initiating cells, and with repression of cancer migration and metastasis. Preclinical models have also demonstrated that inhibition of ROR1, and blocking of Wnt5a signaling, inhibited tumor cell proliferation, migration and survival, and induced differentiation of the tumor cells – resulting in fewer metastases and improved survival.

Inhibition of ROR1 has been demonstrated in preclinical models to be additive to, or synergistic with, chemotherapy agents such as paclitaxel, and with targeted therapy agents such as ibrutinib and venetoclax. In addition, inhibition of ROR1 has been shown to enhance sensitivity of cancer cells to targeted therapy with agents such as erlotinib and may increase apoptosis and decrease proliferation.

In summary, we believe that ROR1 is an attractive therapeutic target in oncology for several reasons:

ROR1 is widely expressed on many tumors, including hematological malignancies and solid tumors;

Expression ofhighlevelsofROR1 on patients’ tumors is associated withmorerapid disease progression, resistance to therapy andshorter patient survival;

Blocking of ROR1 in preclinical models inhibited tumor cell proliferation, migration and survival, and induced differentiation of the tumor cells; and

Inhibition of ROR1 has been observed in preclinical models to be synergistic with chemotherapy and targeted therapy.

Cirmtuzumab development in Mantle Cell Lymphoma and Chronic Lymphocytic Leukemia

MCL disease overview

MCL is an aggressive form of non-Hodgkin’s lymphoma. There are approximately 4,200 new cases of MCL each year in the United States, with the average age at diagnosis in the mid-60s. MCL is an aggressive lymphoma and carries a poor prognosis, with a median survival of about two to five years. The 10-year survival rate is only approximately 5%-10%.

While there are several therapeutic options available to treat patients with relapsed or refractory MCL, none of these options offers long-term benefit, with most patients relapsing in less than 20 months. In an open-label Phase 2 clinical trial, ibrutinib (Imbruvica®), a BTK inhibitor that is approved by the FDA for the treatment of patients with relapsed MCL, demonstrated an overall response rate, or ORR, of 67% and a complete response, or CR, rate of 23%, with a median duration of response, or DoR, of 17.5 months, median progression-free survival, or PFS, of 13 months and median overall survival, or OS, of 22.5 months. In an open-label Phase 2 clinical trial, acalabrutinib (Calquence®), another BTK inhibitor approved by the FDA for the treatment of patients with relapsed MCL, demonstrated an ORR of 80% and CR rate of 40%. Another BTK inhibitor approved in 2019, zanubrutinib (Brukinsa®), demonstrated an ORR of 84% and CR rate of 59%, with a median DoR of 19.5 months in an open-label Phase 2 clinical trial. These therapies are given continuously for prolonged periods of time, and their use can be associated with significant toxicity. The majority of patients with MCL are older, and remissions are not durable for most patients treated with continuous ibrutinib therapy. As a result, we believe that more effective and better tolerated therapies with shorter treatment periods represent a significant unmet need.

CLL disease overview

CLL is the most common form of leukemia in adults, accounting for 25-30% of all leukemias in the United States. An estimated 20,720 new cases of CLL were expected to occur in the United States in 2019, and in 2016 the prevalence of CLL in the United States was estimated to be 178,000 patients. CLL is primarily a disease of older adults. The median age at diagnosis is 71 years of age. Most patients are diagnosed as a result of routine blood work when elevated levels of lymphocytes are detected.

Significant progress has been made in the treatment of CLL since the advent of targeted therapies and FDA approval of ibrutinib for CLL in 2014. A treatment paradigm shift has taken place, from chemotherapies to targeted therapies. Three classes of targeted therapies have been approved for the treatment of patients with CLL: inhibitors of Bruton’s tyrosine kinase, or BTK, a key component of cell signaling in B-cells, such as ibrutinib, which is marketed as Imbruvica® by AbbVie, Inc., and Johnson & Johnson, and acalabrutinib, which is marketed as Calquence® by AstraZeneca PLC; inhibitors of the protein B-cell lymphoma-2, or Bcl-2, such as venetoclax, which is marketed as Venclexta® and Venclyxto® by AbbVie, Inc., and Roche/Genentech; and inhibitors of Phosphoinositide 3-kinase, or PI3K, which include idelalisib, which is marketed as Zydelig® by Gilead Sciences, Inc., and duvelisib, which is marketed as Copiktra® by Verastem, Inc.. These targeted therapies are now the core of the recommended treatment regimens for patients with both first-line and relapsed or refractory CLL, and have achieved objective response rates of 85-90%, two-year PFS of 65-90%, and two-year overall survival of 75-95%. The outcomes are worse for patients with certain prognostic factors, such as 17p or 11q chromosome deletions; for such patients with relapsed or refractory CLL treated with ibrutinib, the reported PFS is 50-75%. While CLL is treatable, it generally remains incurable, and patients with CLL will generally experience a recurrence of their cancer.

While these new targeted therapies improve outcomes for patients with CLL, only a limited number of patients achieve a CR. The proportion of patients with treatment-naïve or relapsed or refractory CLL who achieve a CR when treated with single-agent ibrutinib after twelve months of therapy is below 10%. The trade-off of these new and more effective targeted therapies is the paradigm of continuous treatment required for BTK inhibitors, resulting in accumulating costs and toxicities. Adverse events have been shown in a real-world analysis to limit ibrutinib treatment duration for almost half of all patients.

We believe that the next goals for CLL therapies will be to achieve deeper anti-tumor responses and more complete remissions, and to progress towards achieving the ultimate goal of developing a cure, while maintaining an acceptable safety profile. An acceptable safety profile may be particularly important for patients with CLL who are older (the median age at diagnosis is 71) and have multiple co-morbidities.

The market for CLL therapies in the United States, France, Germany, Italy, Spain, the UK, and Canada is estimated to be approximately $8 billion, largely driven by recently approved therapies, including ibrutinib, venetoclax, and idelalisib. We believe that CLL represents an attractive clinical and commercial opportunity for cirmtuzumab.

Cirmtuzumab preclinical data in CLL and MCL

Cirmtuzumab is an investigational, humanized monoclonal antibody that was designed to bind to a specific epitope of ROR1. The ligand for ROR1 in hematologic malignancies is Wnt5a, a secreted glycoprotein that has a critical role in embryonic and fetal development. Researchers at the UC San Diego School of Medicine discovered that targeting a critical epitope on ROR1 was key to inhibiting Wnt5a activation, specifically targeting ROR1 expressing tumors. This led to the development of cirmtuzumab, which binds this critical epitope of ROR1. Unlike antibodies that bind to other epitopes of ROR1, cirmtuzumab was not observed to bind to normal adult tissues in a GLP tissue cross-reactivity study.

Wnt5a controls the ability of cancer stem cells to self-renew and regulates cell migration and adhesion. Cancer patients whose tumors have high levels of Wnt5a have a lower probability of long-term survival than patients with low Wnt5a levels, analogous to the situation for patients whose tumors express more ROR1. In tumor models derived from primary human tumors, such as glioblastoma, overexpression of Wnt5a has been associated with tumors with more rapid growth that have increased invasiveness into other tissues. Similarly, cells from human melanoma that were engineered to overexpress Wnt5a have shown increased motility and invasiveness.

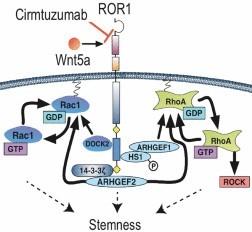

Figure 1. Cirmtuzumab blocked activation of ROR1 by Wnt5a in CLL cells, preventing a cascade of intracellular signaling events that leads to expression of genes associated with dedifferentiated stem cells.

Studies in mice have shown that ROR1 expression on the tumor cells accelerated the development and progression of leukemia in models of CLL and that Wnt5a enhanced CLL cell viability, migration and proliferation in a ROR1-dependent manner.

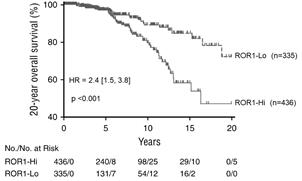

Patients with high levels of ROR1 on their CLL cells have more aggressive disease and have a significant reduction in survival: patients with CLL having high ROR1 expression have an approximately 50% survival rate at twenty years compared to an 80% survival rate for those with low ROR1 expression.

Figure 2. Patients with CLL having high levels of ROR1 expression had lower overall survival than those with low levels of ROR1.

In vivo studies conducted in mouse CLL models have shown that ibrutinib and cirmtuzumab exerted antitumor activities through independent pathways; that is, inhibition of BTK by ibrutinib did not alter ROR1 signaling nor did it impair the rate at which cirmtuzumab blocked ROR1 signaling. The combination of both drugs reduced the size of the spleen, the primary site of leukemic disease in these mice, as well as the number of CLL cells in these spleens. Further preclinical studies suggested that cirmtuzumab was synergistic with venetoclax in vitro.

Figure 3. Combined administration of cirmtuzumab and ibrutinib reduced leukemic cell count in the spleen in a mouse model of CLL.

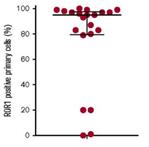

An analysis of patient samples indicated that ROR1 is highly and uniformly expressed on MCL cells but not on cells from multiple myeloma or follicular lymphoma patients.

Figure 4: Analysis of cell lines and clinical samples from MCL, multiple myeloma and follicular lymphoma patients indicate that ROR1 is uniformly expressed on MCL patient cells.

The presence of ROR1 on MCL patient cells was confirmed by another analysis evaluating the expression of ROR1 using clinical samples from 21 patients with MCL. These data indicated that ROR1 was expressed by a very high percentage of the analyzed patient cells.

Figure 5. ROR1 is expressed on most MCL cells in most MCL patient samples.

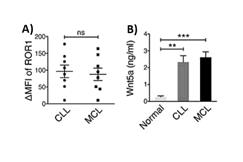

Furthermore, an analysis of MCL and CLL patient samples has shown that ROR1 surface expression, as well as secreted Wnt5a levels, were comparable between patients with MCL and CLL.

Figure 6: Analyses of samples from patients with CLL and MCL indicated that surface ROR1 expression levels as well as serum Wnt5a concentrations were similar.

In preclinical studies with cirmtuzumab, it has been demonstrated that the treatment of MCL patient cells with a combination of cirmtuzumab and ibrutinib led to reduced MCL cell proliferation.

Figure 7. Cirmtuzumab inhibited Wnt5a-enhanced proliferation in ibrutinib-treated MCL Cells.

Lastly, in a published study using a research reagent anti-ROR1 antibody it was shown that pretreatment with an anti-ROR1 mAb and subsequent combination with a BCL2 inhibitor (venetoclax or navitoclax) led to an increase in anti-cancer activity against MCL cell lines as well as in several MCL patient samples tested with the combination therapy compared to the single agents.

Figure 8. Percentage of cell viability (compared with controls) of untreated or treated cells with anti-ROR1 for 24 hours followed by addition of indicated drugs for 24 hours.

Cirmtuzumab clinical development in MCL and CLL

Cirmtuzumab Phase 1 clinical trial in patients with CLL

A Phase 1 dose escalation clinical trial of cirmtuzumab, which was funded jointly by us, CIRM, and others, was conducted in 26 patients with actively progressing CLL who had relapsed or refractory disease. Patients received four doses of cirmtuzumab administered every two weeks in cohorts of three, with each patient receiving escalating doses from 0.15 to 20 mg/kg/dose. Cirmtuzumab infusions were generally well tolerated. There were no dose-limiting toxicities, no serious adverse events, and no discontinuations related to adverse events. The main laboratory findings included anemia, thrombocytopenia and neutropenia, which were primarily attributed to the underlying CLL. Pharmacokinetic data showed a plasma half-life of approximately 32 days following four doses of cirmtuzumab at 16 mg/kg. In this clinical trial, 22 patients were evaluable for response assessment; four patients who discontinued cirmtuzumab early without meeting criteria for progressive disease were not considered evaluable. No patients met criteria for complete or partial remission following this brief treatment. Seventeen of 22 evaluable patients had stable disease. Five patients had progressive disease. Most patients experienced reductions in their leukemic lymphocyte counts and were able to delay initiation of further treatments for an average of 262 days, at which point plasma levels of cirmtuzumab were undetectable. Although cirmtuzumab therapy was limited to four doses, one patient who received cirmtuzumab at 20 mg/kg had a greater than 50% reduction in lymphadenopathy. Analysis of blood samples from these patients showed significantly higher plasma levels of Wnt5a compared to healthy matched controls. Patients also had high levels of expression of ROR1 on their CLL cells. Patients receiving doses of cirmtuzumab of 2 mg/kg or greater had a 33% reduction in ROR1 expression on their CLL cells relative to their baseline. In addition, when compared to baseline, cells from cirmtuzumab treated patients showed a reversal in the enrichment for genes that were identified as being the most highly correlated with stem cells and oncogenic de-differentiation. These results were consistent with other preclinical observations that cirmtuzumab induced ROR1 inhibition drove cells away from a stem-cell-like profile.

Cirmtuzumab Phase 1/2 clinical trial in combination with ibrutinib in patients with MCL and CLL (CIRLL)

We and UC San Diego, with major funding from CIRM and a donation of ibrutinib product from Pharmacyclics LLC, are conducting a Phase 1/2 trial of cirmtuzumab in combination with ibrutinib in patients with treatment-naïve or relapsed or refractory CLL and previously treated patients with MCL (Cirmtuzumab and Ibrutinib targeting ROR1 for Leukemia and Lymphoma, or CIRLL). Despite its efficacy in extending progression-free survival, ibrutinib does not provide complete tumor responses for the majority of patients even after prolonged dosing. Therefore, we believe there is potential to improve efficacy and overall outcomes by combining ibrutinib with cirmtuzumab. This clinical trial was designed to evaluate the safety, pharmacokinetics, pharmacodynamics, immunogenicity, and antitumor activity of cirmtuzumab in combination with ibrutinib in adult subjects with adequate performance status and organ function. The study has three parts:

Part 1

is a Phase 1b, open-label, sequential allocation, dose-finding evaluation of the administration of cirmtuzumab monotherapy followed by cirmtuzumab/ibrutinib combination therapy in subjects with CLL or relapsed/refractory MCL;

Part 2

is an open-label dose-confirming or expansion evaluation of the concurrent administration of cirmtuzumab and ibrutinib in CLL or MCL using the recommended cirmtuzumab dose regimen derived from Part 1; and

Part 3

is a Phase 2 open-label, randomized, controlled evaluation of the clinical activity and safety of cirmtuzumab plus ibrutinib versus ibrutinib alone in patients with CLL.

We have completed enrollment of patients with CLL in Parts 1 and 2, and those patients are completing therapy or are in long-term follow-up. Following an evaluation of safety and PK data from Part 1, the recommended dose regimen, or RDR, of cirmtuzumab for Part 2 was determined to be 600 mg of cirmtuzumab administered intravenously every two weeks for three doses, followed by dosing every four weeks until disease progression or intolerance develop. This cirmtuzumab regimen was designed and chosen to be used in combination with 420 mg of ibrutinib administered once daily for patients with CLL, or 560 mg of ibrutinib once daily for patients with MCL, which are the FDA-approved doses of ibrutinib in these indications. In August 2019, we opened enrollment in Part 3, which is a randomized Phase 2 study in patients with CLL, and in October 2019, we opened enrollment in the Part 2 expansion cohort of this clinical trial for patients with MCL. In mid-2020, we expect to announce additional data from this study of patients with CLL, including 12-month follow-up data for 34 patients enrolled in Parts 1 and 2 of the study.

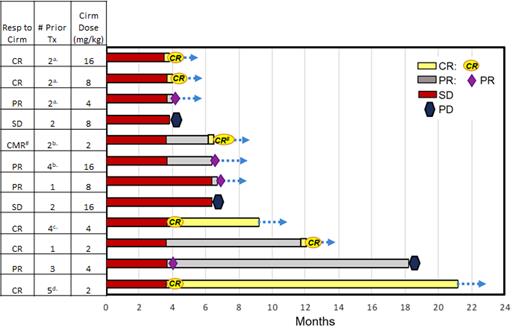

Cirmtuzumab CIRLL clinical trial Part 1 interim data in MCL

Twelve patients with relapsed or refractory MCL were enrolled in the dose-finding cohort of this clinical trial. Patients had received a median of two prior therapies before participating in this study. As of the data cut-off on March 6, 2020, at a median follow-up of 6.4 months, the complete response rate was 50% (6 of 12), with an additional 33% achieving a PR (4 of 12) and 17% with stable disease (2 of 12), for a best ORR of 83% and clinical benefit rate of 100%. Of the six patients who achieved CRs, most did so within three to four months on the combination of cirmtuzumab and ibrutinib. All six patients who achieved CRs were heavily pre-treated. These patients had received, prior to participating in this clinical trial, chemotherapy and additional therapies including an autologous stem cell transplant (SCT); autologous SCT and CAR-T therapy; autologous SCT and allogeneic SCT; and ibrutinib with rituximab. As of March 6, 2020, all six CRs were ongoing and one patient had remained in CR at over 21 months on study.

��

Figure 9. Best tumor response over time in the MCL cohort of 9 patients, based on investigator assessments, in Phase 1/2 clinical trial of cirmtuzumab in combination with ibrutinib as of March 6, 2020.

a. Prior ibrutinib/rituximab (7-10 months), R-HyperCVAD. b. Prior chemo, auto-stem cell transplant (SCT). c. Prior chemo, auto-SCT, CAR-T. d. Prior chemo, auto-SCT, allo-SCT.

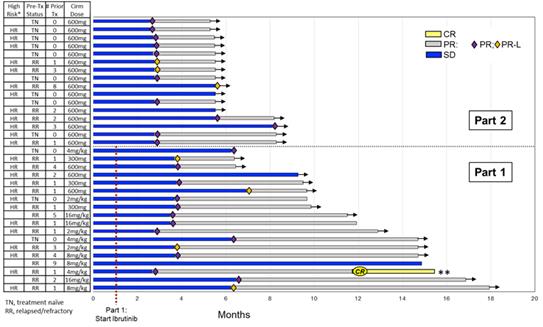

Cirmtuzumab CIRLL clinical trial Part 1 and 2 interim data in CLL

Thirty-four patients with CLL who had never been treated with a BTK inhibitor were enrolled in the dose-finding and dose-expansion cohorts of this clinical trial, including 12 treatment-naïve and 22 relapsed/refractory patients. Patients with relapsed/refractory CLL had received a median of two prior therapies before participating in this clinical trial. As of the data cut-off on January 29, 2020, at a median follow-up of 9.9 months, 30 of the 34 patients achieved a response, for a best ORR of 88%. One patient achieved a CR and remained in remission six months after completion of the trial, without receiving any further anti-CLL therapy. In addition, three patients met radiographic and hematologic response criteria for Clinical CR, pending completion and evaluation of bone marrow biopsies. An additional four patients had stable disease, for a total clinical benefit rate of 100%. One patient was discontinued from the study after missing treatment and later passed away due to unrelated medical issues. None of the patients progressed or died while participating in the study, for a progression-free survival, or PFS, of 100%. As of an early November 2019 data cut-off, the rise in leukemic cell counts that is typically seen in the first six months with ibrutinib monotherapy was blunted with the cirmtuzumab plus ibrutinib combination, and leukemic cell counts returned toward baseline and normal levels rapidly.

Figure 10. Best tumor response over time in the CLL cohort of 34 patients, based on investigator assessments, in Phase 1/2 clinical trial of cirmtuzumab in combination with ibrutinib, as of January 29, 2020.

* HR = known high risk factors: unmutated IgVH, del 17p/ TP53, and/or deletion 11q; ** Sustained CR for 6+ months on no CLL therapy

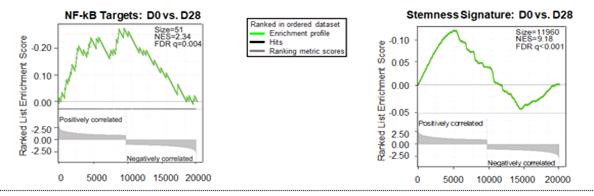

Genetic analysis of CLL cells from three patients showed pre-treatment transcriptome profiles associated with a stemness signature and NF-kB-driven inflammation. Both genetic signatures were reversed in these patients following cirmtuzumab treatment.

Figure 11. Reversal of NF-kB target genes and cancer-cell-stemness transcriptome signature observed in three patients with CLL in Phase 1/2 clinical trial of cirmtuzumab in combination with ibrutinib, as of November 2019.

In Part 3 of this trial, which is currently enrolling patients, up to 90 additional patients with CLL will be randomized 2:1 to receive cirmtuzumab plus ibrutinib or ibrutinib alone. The primary endpoint of Part 3 is to determine the CR rate, with a secondary endpoint of PFS. The data emerging from this trial will be used to determine our regulatory strategy, including whether we will plan to seek regulatory approval through standard review or an accelerated approval pathway. This trial is co-sponsored by UC San Diego with support from CIRM.

Cirmtuzumab as a single agent has been well tolerated in the CIRLL study. The combination of cirmtuzumab plus ibrutinib has also been well tolerated, with adverse events consistent with those reported for ibrutinib alone. As of the January 29, 2020, cut-off date, there were no dose limiting toxicities, no discontinuations and no serious adverse events attributed to cirmtuzumab alone. The rate of neutropenia, which is a common hematological side effect reported for ibrutinib in patients with CLL or MCL, was only 13% for ibrutinib plus cirmtuzumab (Grade 3-4 neutropenia of 8.7%). In mid-2020, we expect to announce additional data from this study of patients with MCL, including follow-up data for 12 patients enrolled in Part 1 of the study.

Cirmtuzumab development in breast cancer

Breast cancer disease overview

Breast cancer is the most common type of invasive cancer among women and the second leading cause of cancer deaths among women. There are approximately 266,000 new diagnoses and 41,000 breast cancer deaths in the United States each year, and 12.4% of women will develop breast cancer in their lifetime. The Centers for Disease Control and Prevention, or CDC, estimates that there are approximately one million women in the United States living with breast cancer that has been diagnosed within the past five years.

Breast cancers can be segregated into subtypes based upon the presence of three protein receptors: estrogen receptor (“ER”), progesterone receptor (“PR”) and humanepidermal growthfactorreceptor2 (“HER2”). Therapies have been developed that target tumors containing one or more of these receptors. Approximately 10% to 15% of breast cancers, however, do not express any of these three receptors and are referred to as triple-negative breast cancers, or TNBC. These tumors have a more aggressive phenotype and a poorer prognosis due to the high propensity for metastatic progression and absence of specific targeted treatments. The five-year survival rate for patients with breast cancer other than TNBC has been reported to be 80.8%, but only 62.1% for patients with TNBC. One hypothesis for the high rate of metastasis and poor response to chemotherapy for patients with TNBC is that these tumors contain a high number of tumor-initiating cells, or cancer stem cells, that are highly migratory and insensitive to standard chemotherapy. Treatment options for TNBC are limited and include chemotherapy, targeted therapy (such as PARP inhibitors), surgery, radiation, and immunotherapy. Additional targeted and immuno-therapeutic approaches are in clinical development.

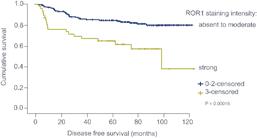

ROR1 Expression and Historical Clinical Outcomes in Patients with Breast Cancer

Approximately 75% of breast tumors have been shown to express ROR1. In a retrospective analysis, patients with TNBC with high levels of ROR1 were found to have a significantly reduced disease-free survival (p< 0.00015) as well as overall survival (p<0.026) compared to patients with low ROR1 levels.

Figure 12. TNBC patients with high levels of ROR1 expression had lower disease-free survival.

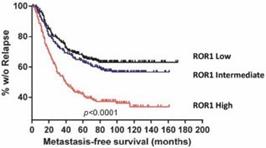

Another retrospective, long-term analysis that included all breast cancer types showed that patients with tumors expressing high levels of ROR1 were at a statistically significantly higher risk of developing metastases within the first several years. Over 60% of patients with high ROR1 developed metastases, compared to only 35% of patients with the lowest levels of ROR1.

Figure 13. High levels of ROR1 in breast cancer was associated with shorter metastasis-free survival.

Preclinical experiments have shown that treatment of breast tumors with paclitaxel increased the percentage of cells with high levels of ROR1. In these experiments, immunodeficient mice were implanted with patient-derived xenografts, or PDX, then were treated with paclitaxel. While paclitaxel either slowed tumor growth or reduced the size of tumors in these mice, the surviving cells were enriched for expression of ROR1. This increased expression of ROR1 was also associated with a shift in the properties of cells from these tumors towards a more metastatic and more tumorigenic phenotype. Cells from tumors that had been treated with paclitaxel were more likely to form spheroids in tissue culture and were enriched for cells with the ability to form new tumors when transplanted, both properties that are correlated with tumor aggressiveness.

Together, these clinical and preclinical data are consistent with a model of the natural disease progression in breast cancer centered on the critical role played by tumor-initiating cells or stem-like cancer cells that express high levels of ROR1:

TNBCisinitiallyresponsivetochemotherapysuchaspaclitaxel,becausechemotherapykillsthemajorityofcancercells,leavingcells with stem-like properties that expressROR1;

TNBCreturnsmoreoftenthanothertypesofbreastcancerinpartbecausetheinitialchemotherapyenrichesforcellswithahigher propensity to formtumors;

Thesiteofrecurrenceisoftenatanotherplaceinthebodythantheoriginaltumorbecausecellswithstemcell-likepropertiesareableto metastasize; and

Therecurringtumormay beresistanttotherapybecauseitcontainsahighpercentageofcellswith stemcell-likeproperties.

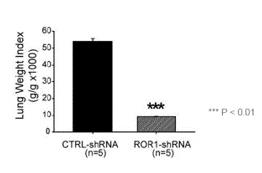

Preclinical experiments in an MDA-MD-231 TNBC model in mice provided evidence that reduction in ROR1 expression levels can limit metastases and improve overall survival. In that model, ROR1 levels were selectively reduced using a genetic construct that delivers a short-hairpin RNA, or shRNA, that is designed to prevent ROR1 protein from being produced. Inhibition of ROR1 production resulted in significantly fewer cancer cells that have metastasized to the lungs.

Figure 14. Suppression of ROR1 led to fewer metastases to the lungs in an MDA-MD-231 model TNBC model.

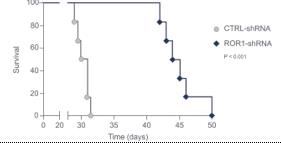

Inhibition of ROR1 production in these mice also improved overall survival to a mean of approximately 43 days compared to 30 days for mice containing control shRNA.

Figure 15. Inhibition of ROR1 expression led to improved survival in an MDA-MD-231 TNBC model.

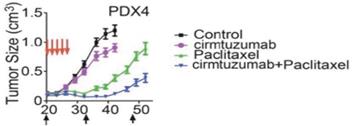

In a preclinical model, cirmtuzumab reduced the growth rate of primary human breast cancers in immunodeficient mice and led to complete suppression of tumor growth for twenty days when used in combination with paclitaxel. Even after tumors did eventually grow, they lacked the ability to form new tumors. All tumor samples isolated from control mice, most of the tumor samples from paclitaxel-treated mice, and some of the cirmtuzumab-treated mice were able to establish new tumors when transplanted into other mice. No tumors, however, were formed when equal numbers of tumor cells from mice treated with the combination of cirmtuzumab and paclitaxel were introduced into other mice.

Figure 16. Combination of cirmtuzumab and paclitaxel suppressed growth of primary human breast tumors in a mouse model.

Cirmtuzumab clinical development in breast cancer

An investigator-sponsored single-arm, open-label, Phase 1b trial of cirmtuzumab in combination with paclitaxel in patients with locally-advanced, unresectable or metastatic HER2-negative breast cancer has been initiated at UC San Diego. The objectives of the trial include the evaluation of safety, tolerability, pharmacokinetics, and clinical activity. The treatment regimen is cirmtuzumab at a dose of 600 mg on days 1 and 15 of cycle 1, and then on day 1 of each subsequent 28-day cycle, and paclitaxel weekly at a dose of 80 mg/m. In December 2019, an interim clinical data update for this clinical trial was presented by the investigator at the 2019 San Antonio Breast Cancer Symposium. As of the data cut-off date of November 27, 2019, a total of eight patients with HER2-negative, metastatic or locally-advanced unresectable breast cancer were enrolled in the study. Seven of the eight patients were evaluable for safety and efficacy. Four of the patients had TNBC at study enrollment. Four of the seven evaluable patients achieved a partial response, for an ORR of 57%, including one patient who had a partial response that continued on cirmtuzumab alone for 30 weeks after discontinuing paclitaxel. It was reported that the combination of cirmtuzumab and paclitaxel was well tolerated in this trial, with no study discontinuations for toxicity and no dose-limiting toxicities observed as of the cutoff date. Adverse events were consistent with the known safety profile of paclitaxel alone. Pharmacokinetic analysis of serial plasma samples for free unbound antibody from two patients provided results similar to those observed in previous studies of patients with CLL, consistent with a projected half-life of 30 days. No abrupt decline in antibody concentration over time was observed, consistent with the absence of anti-drug or neutralizing antibodies. In the second half of 2020, we expect to announce additional data from this study of patients with HER2-negative, metastatic or locally-advanced unresectable breast cancer.

Potential additional clinical opportunities for cirmtuzumab in solid tumors

Lung cancer. ROR1 is expressed by approximately 77% to 93% of lung cancers. In adenocarcinoma of the lung, higher levels of ROR1 expression were correlated with advanced stages of disease and with positive lymph node metastases. In addition, Kaplan-Meier survival analysis indicated an association of high ROR1 expression with worse overall survival in lung adenocarcinoma patients. ROR1 expression has been shown to be correlated with the presence of other negative prognostic factors such as phosphorylated AKT, or p-AKT, or phosphorylated CREB, or p-CREB. Inhibition of ROR1 in lung cancer cell lines induced apoptosis and cell cycle arrest and led to a reduction in levels of p-CREB and p-AKT. Notably, a recent preclinical study has shown that downregulating ROR1 expression re-sensitizes erlotinib-resistant lung cancer cells to an EGFR inhibitor drug.

Ovarian cancer. ROR1 is expressed by approximately 54% of ovarian cancers, which is the most lethal gynecologic malignancy among women worldwide. Analysis of ROR1 expression on ovarian cancer patient samples revealed that disease-free survival and overall survival rate in patients with high ROR1 expression were significantly lower than in patients with low or no ROR1 expression. In a preclinical study, it was shown that a ROR1 antibody inhibited growth of ovarian cancer cell lines in vitro and slowed tumor growth in a mouse model.

Prostate cancer. ROR1 is expressed by approximately 90% of prostate cancers, and the Wnt5a signaling pathway is activated in patients with advanced prostate cancer that is progressing while on treatment with an androgen receptor, or AR, inhibitor. Treatment of prostate cancer cell lines with an AR inhibitor was found to increase the expression of Wnt5a, and the addition of Wnt5a attenuated the antiproliferative effect of AR inhibition. The expression of Wnt5a in patients with metastatic castrate resistant prostate cancer, or mCRPC, has been associated with poor overall survival. We are collaborating with academic investigators to investigate the potential effects of cirmtuzumab on this disease.

Pancreatic cancer. ROR1 is expressed by approximately 83% of pancreatic cancers. A recent preclinical study has shown that blocking ROR1 led to apoptotic cell death, which was further enhanced in combination with chemotherapeutic drugs such as erlotinib and ibrutinib, when tested against a panel of pancreatic cancer cell lines.

In mid-2020, we expect to announce data from IND-enabling preclinical studies of cirmtuzumab for additional indications.

TK216 - ETS oncoprotein inhibitor

TK216 is an investigational, potentially first-in-class, targeted small molecule that was designed to specifically inhibit the biological activity of the ETS family of oncoproteins. Tumorigenic gene fusions involving ETS factors are frequently found in tumors such as Ewing sarcoma and prostate cancer, and ETS factors are often overexpressed in other tumors, such as AML and DLBCL. Researchers in the laboratory of Professor Jeffrey Toretsky, M.D. at Georgetown Lombardi Comprehensive Cancer Center identified the precursor to TK216 by using a novel chemical screening assay that they developed based on a deep understanding of the underlying biological mechanism of ETS factors. Following this early work, TK216, which is designed to be a specific, high-affinity inhibitor of ETS factors, was created by us through the rational design and screening of novel small molecule inhibitors of a critical protein-protein interaction. In preclinical models, TK216 has inhibited the interaction between ETS family members and RNA helicase A, or RHA, and by doing so, shut down excessive cell proliferation.

We are evaluating TK216 as a single agent and in combination with vincristine in a Phase 1 clinical trial in patients with relapsed or refractory Ewing sarcoma. The dose-finding portion of the study was completed in 2019, and we are currently enrolling patients in an expansion cohort to evaluate the clinical response of treatment with TK216 in combination with vincristine using the recommended Phase 2 dosing regimen. Ewing sarcoma is a rare pediatric cancer that has historically been very challenging to treat effectively, particularly for recurrent and metastatic disease. ETS fusion proteins have been shown to be present in over 90% of Ewing sarcoma cases. TK216 has received an Orphan Drug Designation and Fast Track Designation from the FDA for the treatment of patients with relapsed or refractory Ewing sarcoma.

TK216 scientific background: ETS transcription factors and oncogenesis

TK216 targets the ETS family of oncoproteins known to be associated with both solid tumors and hematological malignancies. In normal development and physiology, ETS transcription factors govern processes such as cell cycle control, differentiation, proliferation, apoptosis, tissue remodeling and angiogenesis. However, when alterations in the functions of ETS factors develop, through overexpression, gene fusion or modulation, they have been shown to lead to tumor initiation, progression, and metastasis. Fusion proteins are a well-known category of targets for small molecule cancer therapy that have been cited in the scientific literature as providing a number of diagnostic and therapeutic advantages because of their tumor-specific expression. ETS overexpression or fusion proteins incorporating an ETS factor have been observed in multiple tumor types:

Ewing sarcoma*

98%

Prostate cancer*

55%

Diffuse Large B Cell Lymphoma

52%

Head & Neck cancer

33%

Acute Myeloid Leukemia*

30%

Breast cancer*

25%

Melanoma

25%

Ovarian cancer

23%

Lung cancer

21%

Glioblastoma multiforme

15%

* Fusion identified

Fusion proteins involving ETS factors have been implicated in various solid tumors, including Ewing sarcoma and prostate cancer. For example, approximately 85% of Ewing sarcomas contain a genomic rearrangement between chromosomes 11 and 22. DNA is exchanged between these chromosomes in a pathological manner, and this exchange results in a fusion of two genes: the FLI1 gene, an ETS family member, and the EWSR1 gene, an unrelated transcription factor. This gene fusion, known as EWS/FLI1, functions as a transcription activator that is no longer controlled by the relevant regulatory machinery in the cell. In addition to escaping regulation, the dysregulated function of the EWS/FLI1 fusion causes a series of abnormalities in RNA processing including aberrant mRNA expression and splicing, where it leads to defects in the synthesis of proteins such as BRCA1, a DNA repair protein. EWS/FLI1 fusions also cause the formation of abnormal and potentially deleterious DNA and RNA structures known as R-loops that are associated with replication and transcriptional blocks as well as being prone to increased DNA damage.

Multiple other tumors contain gene fusions of other ETS factors. For example, over 50% of metastatic prostate cancers carry a TMPRSS2-ETS gene fusion. Other tumors have genetic changes that result in overexpression of ETS factors.

ETS Fusions

ETS Overexpression

•

Ewing sarcoma

•

AML

•

EWS-FLI1

•

FLI1, ERG, ETV5, ETS2

•

Prostate cancer

•

DLBCL

•

TMPRSS2-ERG

•

ETV1, FLI1, ETV4, SPIB

•

AML

•

Prostate cancer

•

ETV6-various (20+)

•

ERG, ETV1, ETV4, ETV6

•

ALL

•

Lung cancer

•

ETV6-RUNX1

•

ETV5, ETV1, FLI1, ETS1

•

Secretory breast cancer

•

Breast cancer

•

ETV6-NTRK3

•

ETV6, ETV4, SPIB, ETV5

Despite the genetic associations between ETS factors and tumorigenesis and the reported correlation between high levels of ETS factor expression and survival, there are currently no approved therapeutics available that target these factors. It had been widely considered that transcription factors are difficult to target due to their non-enzymatic mechanism of action. Researchers in the laboratory of Jeffrey Toretsky, M.D., Professor at Georgetown University, identified the precursor to TK216 by using a chemical screening assay that they developed based on a deep understanding of the underlying biological mechanism of ETS factors. TK216 has been observed to inhibit the interaction between ETS family members and RNA helicase A, or RHA, a critical component of the human transcriptional complex, and by doing so, shuts down excessive cell proliferation in preclinical tumor models. We believe that our approach of inhibiting protein-protein interactions is novel and that our product candidate TK216 targeting ETS factors could fill an important gap in the treatment landscape for both solid tumors and hematological malignancies.

TK216 development in Ewing sarcoma

Ewing sarcoma disease overview

Ewing sarcoma is the second most common bone tumor of children that occurs most often in adolescents and accounts for approximately 2% of all childhood cancer diagnoses. The incidence of Ewing sarcoma for all ages is approximately 1.3 cases per 1 million people in the United States, corresponding to approximately 430 new patients diagnosed per year in the United States. The median age at diagnosis of patients with Ewing sarcoma is 15.

Nearly all Ewing sarcoma cases are driven by translocations of ETS family oncogenes, including 85-90% of cases driven by the EWS-FLI1 fusion, and approximately 10% by EWS-ERG.

Ewing sarcoma typically develops in the pelvis, femur, and bones of the head and trunk, but its diagnosis often takes months as other causes for non-specific symptoms such as localized pain, fever, fatigue, weight loss, or anemia are ruled out. The five-year survival of patients who are diagnosed with non-metastatic disease is between 50% and 70%. Patients diagnosed with metastatic disease have five-year survival between 18% and 30%. The prognosis for patients with recurrent Ewing sarcoma is particularly poor, and five-year survival after recurrence is approximately 10 to 15%.

Ewing sarcoma is usually treated systemically due to the fact that local treatments, even in patients without overt metastases, have an 80% to 90% relapse rate. The current standard therapy for patients with localized Ewing sarcoma in the United States is a combination of chemotherapy agents, including vincristine, doxorubicin and cyclophosphamide, with alternating cycles of ifosfamide and etoposide – a therapy known as VDC/IE. Patients that respond to this therapy may be candidates for tumor resection and continued treatment for a total of 14 to 17 cycles. This therapeutic regimen, however, is associated with significant toxicities. Patients with metastatic disease are often treated with VDC/IE or variations of this therapy with higher or more compressed dosing. This may also be supplemented by local radiation therapy or systemic radiation followed by autologous hematopoietic stem cell transplant. We believe that more effective therapies are needed for this rare and severe pediatric disease.

TK216 preclinical data in Ewing sarcoma

TK216 was the product of a novel approach based on developing small molecule inhibitors of a critical protein-protein interaction linked to the ETS family of transcription factors. Researchers at Georgetown University identified YK-4-279, the precursor to TK216, by using a novel chemical screening assay. Following this early work, TK216, a specific inhibitor of ETS factors, was then created by Oncternal through the rational design and screening of novel small molecule inhibitors of a critical protein-protein interaction linked to the ETS family of transcription factors. TK216 is a structural analog of YK-4-279 that has shown increased potency in biochemical, cellular and xenograft tumor models.

Figure 17. TK216 inhibits interaction of ETS fusion protein EWS/FLI1 with RNA helicase A (RHA).

In Ewing sarcoma, a key heterodimer between EWS/FLI1 and RHA forms the core of a transcriptome complex causing activated oncogenes, inhibited tumor suppressors, abnormal RNA transcription and abnormal RNA splicing. TK216 was developed to disrupt that heterodimer, thereby potentially preventing transcription and leading to inhibition of the oncogenic activity of EWS/FLI1, by decreasing oncogene expression, increasing tumor suppressor function, and apoptotic cell death. In preclinical models, TK216 inhibited the interaction between ETS family members and RNA helicase A (“RHA”), and by doing so, shut down excessive cell proliferation and cause apoptotic cell death.

Treatment in vitro with TK216 led to dose-dependent inhibition of transcription from a luciferase reporter assay in COS7 cells. TK216 also inhibited proliferation of Ewing sarcoma cell line A4573.

Figure 18. TK216 inhibited transcription of a reporter gene dependent on EWS/FLI (left). TK216 inhibited proliferation of a Ewing sarcoma cell line A4573 (right).

TK216 has inhibited proliferation of multiple cell lines containing EWS/FLI1 fusions, as well as other cell lines containing other ETS translocations or overexpressing ETS factors. These results suggest that TK216 binds to a site that is commonly used by multiple ETS family members to interact with other factors such as RHA. Therefore, we believe that TK216 has potential beyond targeting the EWS/FLI1 fusion that is commonly found in patients with Ewing sarcoma.

1

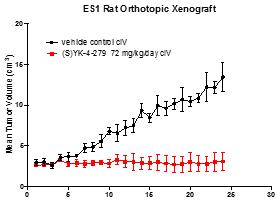

Figure 19. YK-4-279 (analog of TK216) showed activity in a Ewing sarcoma rat xenograft model.

Treatment of aggressive tumors such as Ewing sarcoma typically requires a combination of agents. A systematic analysis combining approved agents tested in combination with YK-4-279, a precursor of TK216, was conducted using Ewing sarcoma cell lines. YK-4-279 led to synergistic cytotoxicity with 28% of the agents tested including antimetabolites, nucleic acid synthesis inhibitors, immunosuppressive or immunomodulating agents and microtubule inhibitors. In vivo activity in an A4573 xenograft model of Ewing sarcoma showed tumor shrinkage and increased survival when YK-4-279 was combined with vincristine.

Figure 20. Combination of YK-4-279 (analog of TK216) and vincristine resulted in rapid tumor shrinkage in an A4573 model of Ewing sarcoma.

TK216 clinical development in Ewing sarcoma

We are conducting an open-label, first-in-human, multicenter Phase 1 clinical trial of TK216 as a single agent and in combination with vincristine, in patients with relapsed or refractory Ewing sarcoma. In November 2019, we reported an interim clinical data update for this clinical trial at the Connective Tissue Oncology Society (CTOS) 2019 Annual Meeting. As of the data cut-off date in November 2019, 32 patients had been treated in the dose-finding part of the trial. Patients entering the trial had previously been treated with a median of four, and up to nine, prior lines of systemic therapy. TK216 was reported to be generally well tolerated in this trial, with common side effects including myelosuppression, fatigue, nausea and alopecia. No unexpected off-target toxicities were observed. Based on the dose-finding part of the trial, the recommended Phase 2 dose (RP2D) was selected to be 200 mg/m2/day for 14 days. Clinical pharmacology data suggest that this dosing regimen may result in drug levels that meet or exceed those that killed tumor cells in vitro and inhibited tumor growth in animal models.

Subsequent to the CTOS presentation, additional patients were enrolled in the cohort treated at RP2D. Of the three evaluable patients treated at RP2D in the dose-finding part of the trial, one patient achieved a deep and sustained PR on single-agent TK216, followed by a surgical CR; another patient had stable disease; and a third had progressive disease. One additional patient had been enrolled but developed rapidly progressive disease. This patient exited the study before completing the DLT observation period and, per protocol, was replaced.

One patient who achieved a deep and sustained clinical response at RP2D had relapsed/refractory Ewing sarcoma with lung metastases and had received and failed multiple lines of therapy prior to participating in this clinical trial, including radiation, chemotherapies and targeted therapies. Multiple lung nodules in this patient regressed following two cycles of TK216 as a single agent and, after six months of treatment that included concomitant vincristine starting in the third cycle, a single remaining 7 mm lung nodule was resected, resulting in a surgical complete remission. The patient had no evidence of disease after more than ten months of treatment. TK216, with or without vincristine, was well tolerated by this patient, with minimal myelosuppression.

In December 2019, we announced that we had opened for enrollment an expansion cohort of our clinical trial in patients with relapsed or refractory Ewing sarcoma. The expansion cohort will further evaluate the recommended Phase 2 dose regimen of TK216 (200 mg/m2/day for 14 days) in combination with vincristine and is anticipated to enroll approximately 18 patients. By mid-2020, we expect to enroll seven to 12 additional patients in the expansion cohort of this study and we anticipate announcing data from these patients in the second half of 2020.

Potential additional clinical opportunities for TK216

Acute myeloid leukemia (AML). AML is a hematologic malignancy characterized by dysregulated maturation of myeloid or blood stem cells and failure of the bone marrow to properly function, leaving patients with anemia and immune deficiency, and at high risk of infections and bleeding. AML is the most common type of acute leukemia in adults. Approximately 21,450 new AML cases and 10,920 AML associated deaths occur annually in the United States. The average age of an AML patient is 68 years. The National Cancer Institute estimated in 2018 that the five-year survival rate for adult patients with AML was approximately 27%. We believe that there is a need for more effective and less toxic therapies for AML.

ETS overexpression or fusion proteins incorporating ETS family member have been observed in about 30% of AML cases. The ETS family member ERG is overexpressed in many cancers, such as AML. In a retrospective analysis of patients with AML, the quartile of patients with the highest levels of ERG expression had a significantly higher rate of relapse and poorer overall survival than patients with lower levels of ERG expression. Those with the highest levels of ERG had a five-year survival rate of 20%, while those with lower levels of ERG had a survival rate of approximately 50%. ERG overexpression was an independent negative prognostic factor. Similarly, AML patients with high levels of ETS2, another ETS family member, had a significantly lower five-year survival rate of approximately 15% compared to 40% for patients with lower levels of ETS2. ETS2 overexpression was an independent negative prognostic factor.

Figure 21.SurvivalofthequartileofAMLpatientswiththehighestERG(left)orETS2(right)expressionwassignificantlylowerthanthosewith lowerexpression.

Multiple AML cell lines have been shown to be sensitive to being killed by TK216, with sensitivity proportional to ETS expression. TK216 may provide a novel therapeutic strategy for the treatment of patients with relapsed and refractory AML, a patient population known to express, in certain cases, fusion proteins involving ETV6, and to have overexpression of ETS family members including FLI1, ERG, ETS2, and ETV5.

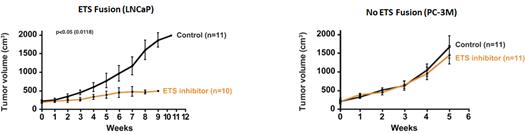

Prostate cancer. Approximately 174,650 new cases of prostate cancer are diagnosed annually in the United States. Incidence of metastatic prostate cancer is increasing, causing an estimated 31,620 deaths per year in the United States. New therapeutic options are needed after failure of androgen antagonism and prior to chemotherapy. Approximately 55% of men with advanced prostate cancer carry the ETS family fusion gene TMPRSS2-ERG that is related to androgen resistance.

We believe TK216 may provide a novel therapeutic strategy for the treatment of patients with advanced prostate cancer, in particular those who carry the ETS family fusion gene TMPRSS2-ERG. In a preclinical in vivo study, YK-4-279, which is an analog of TK216, showed anti-tumor activity against a prostate cancer cell line harboring the ETS-family translocation, while growth of a prostate cancer cell without the translocation was not inhibited.

In the second half of 2020, we expect to announce data from IND-enabling preclinical studies of TK216 in additional ETS-driven tumors.

Figure 22.Prostate cancer sensitivity was associated with an ETS-family fusion protein in human prostate cancer xenograft models.

ROR1 CAR-T Program

We are developing a CAR-T therapy based on the ROR1 binding domain of cirmtuzumab to treat patients with aggressive hematological malignancies or solid tumors. We believe that the selective expression of ROR1 on tumor cells and its absence on normal cells make it an ideal target for a CAR-T approach. In addition, we believe that the survival benefit imparted on cancer cells by expressing ROR1 may limit the development of ROR1-negative resistant tumors, and that tumors that generate mutations that escape an ROR1 CAR-T therapeutic by inactivating or suppressing ROR1 may lose their stem cell-like properties, limiting their ability to metastasize or establish new tumors. Our ROR1 targeted CAR-T therapy is in preclinical development at UC San Diego, with funding from CIRM.

We also plan to collaborate with our strategic partner SPH for our CAR-T program. Through its United States subsidiary Shanghai Pharmaceutical (USA) Inc., or SPH USA. SPH USA has entered into the SPH USA License Agreement with us to develop ROR1 targeted CAR-T products in greater China. Our plans to collaborate with SPH USA include a collaboration to develop processes to produce and manufacture lentiviruses carrying the ROR1 construct. We believe that this represents a potential advantage for our CAR-T program, because viral manufacturing capacity is constrained in the United States and European Union. We and SPH USA also intend to collaborate by conducting one or more initial clinical trials of our potential CAR-T product candidate at hospitals in China that have experience with processing cellular immunotherapy materials and conducting CAR-T clinical trials. Initial clinical trials of our CAR-T program may occur both in the United States, for example at UC San Diego and at sites in China. In the fourth quarter of 2020, we expect to announce first-in-human dosing of our ROR-1 CART therapy in China.

Scientific background: CAR-T therapy overview

Immuno-oncology approaches to treating cancer involve redirecting one of the pillars of the immune system, the adaptive immune system, so that it specifically and efficaciously recognizes cancerous cells that might previously have escaped immune recognition. A key element in the adaptive immune response is the T cell. T cells are white blood cells that can recognize and kill infected and abnormal cells. T cells also act to signal other immune cells to respond to threats. T cells recognize their targets because they are created in a way that allows them to specifically recognize foreign antigens on the surface of other cells.

T cells are ideally suited for immuno-oncology applications based on several characteristics. They are created to be exquisitely specific and avid killers. One T cell can eliminate numerous target cells. T cells are extremely specific, able to recognize a cancer cell and kill it, while ignoring an almost identical healthy cell. T cells are thought to be active all the time, eliminating cancer cells from the body before they can form tumors. However, tumor cells sometimes evolve to escape killing by T cells by activating a number of pathways that suppress T cell function. Adoptive T cell therapies, and specifically CAR-T, were developed to provide a method to generate large quantities of T cells capable of specifically recognizing and killing tumor cells despite tumor suppressive mechanisms.

CAR-T therapeutics are created by isolating T cells from patients and modifying them to recognize specific antigens on tumors. T cells have potent cell killing activity that is directed to target cells that are recognized by specific T cell receptors, or TCRs, that are expressed on the surface of these T cells. While some T cells have TCRs that can recognize cancer cells leading to their killing, potent T cells do not develop to all targets. In some cases, the potential cancer cell target is also a protein that has an essential role in other tissues or at other stages of development, and TCRs that recognize these targets are eliminated during normal T cell development.

CAR-T therapy has emerged as a way to engineer T cells to recognize specific targets, such as those that are selectively expressed on cancer cells. A gene encoding a chimeric protein is constructed that contains a single antigen-binding domain of an antibody that recognizes the target, which is coupled to a T cell costimulatory domain and a portion of the T cell receptor.

CAR-T therapies are typically produced from a patient’s own T cells which are isolated by leukapheresis. These cells are then genetically modified with the chimeric antigen gene construct which can be delivered by various mechanisms such as lentiviral gene delivery vectors. Transduced cells are then expanded and undergo quality testing before being reintroduced into the same patient.

Figure 23. CAR-T production and patient treatment.

Two CAR-T cell therapies, Yescarta®, developed by Kite Pharma, Inc., a wholly-owned subsidiary of Gilead Sciences, Inc., and Kymriah®, developed by Novartis Pharmaceuticals Corporation, have been approved by the FDA. Both of these therapies target the CD19 protein, a protein expressed on the surface of the majority of B cells, including B cell tumorigenic cells. Yescarta has been approved for the treatment of relapsed or refractory large B-cell lymphoma and Kymriah for the treatment of relapsed or refractory B-cell precursor acute lymphoblastic leukemia. These therapies have shown high response rates with prolonged treatment effects for a subset of patients. No CAR-T therapies have been approved for use in patients with solid tumors. Despite the high response rates and prolonged treatment effects observed for a subset of patients, we believe that novel CAR-T approaches have the potential to improve efficacy, duration of response as well as safety.

Prior to the Merger as defined below, GTx had been developing selective androgen receptor modulators, or SARMs, under an exclusive, worldwide license agreement with the University of Tennessee Research Foundation, or