| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Maryland (Essex Property Trust, Inc.) California (Essex Portfolio, L.P.) | 77-0369576 (Essex Property Trust, Inc.) 77-0369575 (Essex Portfolio, L.P.) | ||

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) | ||

| Title of each class | Name of each exchange on which registered | |

| Common Stock, $.0001 par value (Essex Property Trust, Inc.) | New York Stock Exchange | |

| 7.125% Series H Cumulative Redeemable Preferred Stock (Essex Property Trust, Inc.) | New York Stock Exchange | |

Essex Property Trust, Inc. Yes x No o | Essex Portfolio, L.P. Yes o No x |

Essex Property Trust, Inc. Yes o No x | Essex Portfolio, L.P. Yes o No x |

Essex Property Trust, Inc. Yes x No o | Essex Portfolio, L.P. Yes x No o |

Essex Property Trust, Inc. Yes x No o | Essex Portfolio, L.P. Yes x No o |

Essex Property Trust, Inc. o | Essex Portfolio, L.P. o |

Large accelerated filer | Accelerated filer | Non-accelerated filer | Smaller reporting company |

Large accelerated filer o | Accelerated filer o | Non-accelerated filer x (Do not check if a smaller reporting company) | Smaller reporting company o |

Essex Property Trust, Inc. Yes o No x | Essex Portfolio, L.P. Yes o No x |

| Part I. | Page | |

| Item 1. | ||

| Item 1A. | ||

| Item 1B. | ||

| Item 2. | ||

| Item 3. | ||

| Item 4. | ||

| Part II. | ||

| Item 5. | ||

| Item 6. | ||

| Item 7. | ||

| Item 7A. | ||

| Item 8. | ||

| Item 9. | ||

| Item 9A. | ||

| Item 9B. | ||

| Part III. | ||

| Item 10. | ||

| Item 11. | ||

| Item 12. | ||

| Item 13. | ||

| Item 14. | ||

| Part IV. | ||

| Item 15. | ||

| Constraints on new supply driven by: (i) low availability of developable land sites where competing housing could be economically built; (ii) political growth barriers, such as protected land, urban growth boundaries, and potential lengthy and expensive development permit processes; and (iii) natural limitations to development, such as mountains or waterways; |

| Rental demand is enhanced by affordability of rents relative to costs of |

| Property Name | Location | Apartment Homes | Essex Ownership Percentage | Ownership | Quarter in 2015 | Purchase Price | ||||||||||

| 8th & Hope | Los Angeles, CA | 290 | 100 | % | EPLP | Q1 | $ | 200.0 | ||||||||

The Huxley (1) | Los Angeles, CA | 187 | 100 | % | EPLP | Q1 | 48.8 | |||||||||

The Dylan (1) | Los Angeles, CA | 184 | 100 | % | EPLP | Q1 | 51.3 | |||||||||

Reveal (2) | Woodland Hills, CA | 438 | 99.75 | % | EPLP | Q2 | 73.0 | |||||||||

| Avant | Los Angeles, CA | 247 | 100 | % | EPLP | Q2 | 99.0 | |||||||||

| Avant II | Los Angeles, CA | 193 | 100 | % | EPLP | Q4 | 73.0 | |||||||||

| Enso | San Jose, CA | 183 | 100 | % | EPLP | Q4 | 93.0 | |||||||||

| Total 2015 | 1,722 | $ | 638.1 | |||||||||||||

(1) | In March |

(2) | In April |

| As of 12/31/07 ($ in millions) | ||||||||||||

| Estimated | Incurred | Projected | ||||||||||

| Development Pipeline | Location | Units | Project Cost(1) | Project Cost | Stabilization | |||||||

| Development Projects | ||||||||||||

| Belmont Station | Los Angeles, CA | 275 | $ | 71.1 | $ | 55.5 | Dec-08 | |||||

| The Grand | Oakland, CA | 238 | 96.2 | 42.0 | May-09 | |||||||

| Fourth Street | Berkeley, CA | 171 | 69.4 | 13.4 | Aug-10 | |||||||

| 684 | 236.7 | 110.9 | ||||||||||

| Predevelopment projects | various | 1,658 | 508.4 | 97.1 | Nov-10 to Jul-14 | |||||||

| Land held for future development | various | 434 | 25.5 | 25.5 | - | |||||||

| Consolidated Development Pipeline | 2,776 | $ | 770.6 | $ | 233.5 | |||||||

| As of | ||||||||||||||||

| 12/31/2015 | ||||||||||||||||

| Essex | Incurred | Estimated | ||||||||||||||

| Development Pipeline | Location | Ownership% | Apartment Homes | Project Cost (1) | Project Cost(1) | |||||||||||

| Development Projects - Consolidated | ||||||||||||||||

| MB 360 - Phase II | San Francisco, CA | 100 | % | 172 | $ | 119 | $ | 135 | ||||||||

| Station Park Green | San Mateo, CA | 100 | % | 599 | 83 | 354 | ||||||||||

| Total - Consolidated Development Projects | 771 | 202 | 489 | |||||||||||||

| Development Projects - Joint Venture | ||||||||||||||||

| Epic - Phase III | San Jose, CA | 55 | % | 200 | 84 | 92 | ||||||||||

Agora(2) | Walnut Creek, CA | 51 | % | 49 | 84 | 95 | ||||||||||

| Owens | Pleasanton, CA | 55 | % | 255 | 55 | 89 | ||||||||||

| Hacienda | Pleasanton, CA | 55 | % | 251 | 37 | 86 | ||||||||||

| Century Towers | San Jose, CA | 50 | % | 376 | 93 | 172 | ||||||||||

500 Folsom (3) | San Francisco, CA | 50 | % | 545 | 62 | 381 | ||||||||||

| Total - Joint Venture Development Projects | 1,676 | 415 | 915 | |||||||||||||

| Predevelopment Projects - Consolidated | ||||||||||||||||

| Other Projects | various | 100 | % | — | 40 | 40 | ||||||||||

| Total - Predevelopment Projects | — | 40 | 40 | |||||||||||||

| Grand Total - Development and Predevelopment Pipeline | 2,447 | $ | 657 | $ | 1,444 | |||||||||||

(1) | Includes costs related to the entire project, including both the Company's and joint venture partners' costs. Includes incurred costs and estimated costs to complete these development projects. For predevelopment projects, only incurred costs are included in estimated costs. |

(2) | Estimated project costs for this development include costs to develop both residential and commercial space. |

(3) | Estimated project cost for this development is net of a projected value for low-income housing tax credit proceeds and savings from tax exempt bonds. |

| As of 12/31/07 ($ in thousands) | ||||||||||

| Estimated | Incurred | |||||||||

| Redevelopment Pipeline | Location | Units | Renovation Cost(1) | Project Cost | ||||||

| Southern California | ||||||||||

| Avondale at Warner Center | Woodland Hills, CA | 446 | $ | 14,070 | $ | 11,188 | ||||

| Highridge | Rancho Palos Verde, CA | 255 | 16,063 | 1,976 | ||||||

| Mira Monte | Mira Mesa, CA | 355 | 6,060 | 5,900 | ||||||

| Pathways | Long Beach, CA | 296 | 10,721 | 5,788 | ||||||

| Northern California | ||||||||||

| Boulevard (Treetops) | Fremont, CA | 172 | 8,387 | 5,757 | ||||||

| Bridgeport (Summerhill Commons) | Newark, CA | 184 | 4,586 | 3,869 | ||||||

| Marina Cove | Santa Clara, CA | 292 | 9,858 | 805 | ||||||

| Montclaire (Oak Pointe) - Phase I-III | Sunnyvale, CA | 390 | 15,106 | 5,688 | ||||||

| Wimbledon Woods | Hayward, CA | 560 | 9,350 | 7,195 | ||||||

| Seattle Metro | ||||||||||

| Palisades - Phase I and II | Bellevue, WA | 192 | 6,951 | 6,461 | ||||||

Sammamish View(2) | Bellevue, WA | 153 | 3,875 | 3,875 | ||||||

| Woodland Commons | Bellevue, WA | 236 | 11,779 | 1,240 | ||||||

| Foothill Commons | Bellevue, WA | 360 | 18,804 | 1,298 | ||||||

| Total Redevelopment Pipeline | 3,891 | $ | 135,610 | $ | 61,040 | |||||

| As of 12/31/07 ($ in millions) | ||||||||||||

| Estimated | Incurred | Projected | ||||||||||

| Development Pipeline - Fund II | Location | Units | Project Cost(1) | Project Cost | Stabilization | |||||||

| Development Projects | ||||||||||||

| Eastlake 2851 on Lake Union | Seattle, WA | 127 | $ | 35.4 | $ | 24.7 | Jul-08 | |||||

| Studio 40-41 | Studio City, CA | 149 | 60.6 | 30.7 | Aug-09 | |||||||

| Cielo | Chatsworth, CA | 119 | 39.4 | 12.3 | Sep-09 | |||||||

| Fund II - Development Pipeline | 395 | $ | 135.4 | $ | 67.7 | |||||||

| Redevelopment Pipeline - Fund II | ||||||||||||

| Redevelopment Projects | ||||||||||||

| Regency Tower - Phase I - II | Oakland, CA | 178 | $ | 4.5 | $ | 3.7 | ||||||

| The Renaissance | Los Angeles, CA | 168 | 5.0 | 3.6 | ||||||||

| Fund II - Redevelopment Pipeline | 346 | $ | 9.5 | $ | 7.3 | |||||||

| Rentable | ||||||||||||

| Square | Year | Year | ||||||||||

Apartment Communities (1) | Location | Units | Footage | Built | Acquired | Occupancy(2) | ||||||

| Southern California | ||||||||||||

| Alpine Country | Alpine, CA | 108 | 81,900 | 1986 | 2002 | 94% | ||||||

| Alpine Village | Alpine, CA | 306 | 254,400 | 1971 | 2002 | 96% | ||||||

| Barkley, The(3)(4) | Anaheim, CA | 161 | 139,800 | 1984 | 2000 | 97% | ||||||

| Bonita Cedars | Bonita, CA | 120 | 120,800 | 1983 | 2002 | 98% | ||||||

| Camarillo Oaks | Camarillo, CA | 564 | 459,000 | 1985 | 1996 | 96% | ||||||

| Camino Ruiz Square | Camarillo, CA | 160 | 105,448 | 1990 | 2006 | 97% | ||||||

| Mountain View | Camarillo, CA | 106 | 83,900 | 1980 | 2004 | 98% | ||||||

| Cardiff by the Sea | Cardiff, CA | 300 | 284,460 | 1986 | 2007 | 97% | ||||||

| Cambridge | Chula Vista, CA | 40 | 22,100 | 1965 | 2002 | 96% | ||||||

| Woodlawn Colonial | Chula Vista, CA | 159 | 104,500 | 1974 | 2002 | 93% | ||||||

| Mesa Village | Clairemont, CA | 133 | 43,600 | 1963 | 2002 | 99% | ||||||

| Parcwood(5) | Corona, CA | 312 | 270,000 | 1989 | 2004 | 95% | ||||||

| Coral Gardens | El Cajon, CA | 200 | 182,000 | 1976 | 2002 | 94% | ||||||

| Tierra del Sol/Norte | El Cajon, CA | 156 | 117,000 | 1969 | 2002 | 97% | ||||||

| Grand Regency | Escondido, CA | 60 | 42,400 | 1967 | 2002 | 98% | ||||||

| Valley Park(6) | Fountain Valley, CA | 160 | 169,700 | 1969 | 2001 | 96% | ||||||

| Capri at Sunny Hills(6) | Fullerton, CA | 100 | 128,100 | 1961 | 2001 | 97% | ||||||

| Wilshire Promenade | Fullerton, CA | 149 | 128,000 | 1992(7) | 1997 | 94% | ||||||

| Montejo(6) | Garden Grove, CA | 124 | 103,200 | 1974 | 2001 | 97% | ||||||

| CBC Apartments | Goleta, CA | 148 | 91,538 | 1962 | 2006 | 98% | ||||||

| Chimney Sweep Apartments | Goleta, CA | 91 | 88,370 | 1967 | 2006 | 95% | ||||||

| Hampton Court (Columbus) | Glendale, CA | 83 | 71,500 | 1974(8) | 1999 | 94% | ||||||

| Hampton Place (Lorraine) | Glendale, CA | 132 | 141,500 | 1970(9) | 1999 | 95% | ||||||

| Devonshire | Hemet, CA | 276 | 207,200 | 1988 | 2002 | 92% | ||||||

| Huntington Breakers | Huntington Beach, CA | 342 | 241,700 | 1984 | 1997 | 97% | ||||||

| Hillsborough Park | La Habra, CA | 235 | 215,500 | 1999 | 1999 | 96% | ||||||

| Trabuco Villas | Lake Forest, CA | 132 | 131,000 | 1985 | 1997 | 98% | ||||||

| Marbrisa | Long Beach, CA | 202 | 122,800 | 1987 | 2002 | 97% | ||||||

| Pathways | Long Beach, CA | 296 | 197,700 | 1975(10) | 1991 | 85% | ||||||

| Bunker Hill | Los Angeles, CA | 456 | 346,600 | 1968 | 1998 | 96% | ||||||

| Cochran Apartments | Los Angeles, CA | 58 | 51,400 | 1989 | 1998 | 93% | ||||||

| Kings Road | Los Angeles, CA | 196 | 132,100 | 1979(11) | 1997 | 96% | ||||||

| Marbella, The | Los Angeles, CA | 60 | 50,108 | 1991 | 2005 | 90% | ||||||

| Marina City Club(12) | Los Angeles, CA | 101 | 127,200 | 1971 | 2004 | 95% | ||||||

| Park Place | Los Angeles, CA | 60 | 48,000 | 1988 | 1997 | 93% | ||||||

| Renaissance, The(5) | Los Angeles, CA | 168 | 154,268 | 1990(13) | 2006 | 84% | ||||||

| Windsor Court | Los Angeles, CA | 58 | 46,600 | 1988 | 1997 | 93% | ||||||

| Mirabella(14) | Marina Del Rey, CA | 188 | 176,800 | 2000 | 2000 | 98% | ||||||

| Mira Monte | Mira Mesa, CA | 355 | 262,600 | 1982(15) | 2002 | 96% | ||||||

| Hillcrest Park | Newbury Park, CA | 608 | 521,900 | 1973(16)(17) | 1998 | 96% | ||||||

| Fairways(18) | Newport Beach, CA | 74 | 107,100 | 1972 | 1999 | 90% | ||||||

| Country Villas | Oceanside, CA | 180 | 179,700 | 1976 | 2002 | 97% | ||||||

| Mission Hills | Oceanside, CA | 282 | 244,000 | 1984 | 2005 | 97% | ||||||

| Mariner's Place | Oxnard, CA | 105 | 77,200 | 1987 | 2000 | 98% | ||||||

| Monterey Villas | Oxnard, CA | 122 | 122,100 | 1974(19) | 1997 | 98% | ||||||

| Tierra Vista | Oxnard, CA | 404 | 387,100 | 2001 | 2001 | 96% | ||||||

| Monterra del Mar | Pasadena, CA | 123 | 74,400 | 1972(20) | 1997 | 94% | ||||||

| Monterra del Rey | Pasadena, CA | 84 | 73,100 | 1972(21) | 1999 | 92% | ||||||

| Monterra del Sol | Pasadena, CA | 85 | 69,200 | 1972(22) | 1999 | 96% | ||||||

| Villa Angelina(6) | Placentia, CA | 256 | 217,600 | 1970 | 2001 | 97% | ||||||

| (continued) | ||||||||||||

| Rentable | ||||||||||||

| Square | Year | Year | ||||||||||

Apartment Communities (1) | Location | Units | Footage | Built | Acquired | Occupancy(2) | ||||||

| Southern California (continued) | ||||||||||||

| Fountain Park | Playa Vista, CA | 705 | 608,900 | 2002 | 2004 | 96% | ||||||

| Highridge(6) | Rancho Palos Verdes, CA | 255 | 290,200 | 1972(23) | 1997 | 92% | ||||||

| Bluffs II, The(24) | San Diego, CA | 224 | 126,700 | 1974 | 1997 | 98% | ||||||

| Summit Park | San Diego, CA | 300 | 229,400 | 1972 | 2002 | 97% | ||||||

| Vista Capri - North | San Diego, CA | 106 | 51,800 | 1975 | 2002 | 98% | ||||||

| Brentwood (Hearthstone)(6) | Santa Ana, CA | 140 | 154,800 | 1970 | 2001 | 96% | ||||||

| Treehouse(6) | Santa Ana, CA | 164 | 135,700 | 1970 | 2001 | 95% | ||||||

| Hope Ranch Collection | Santa Barbara, CA | 108 | 126,700 | 1965&73 | 2007 | 95% | ||||||

| Carlton Heights | Santee, CA | 70 | 48,400 | 1979 | 2002 | 94% | ||||||

| Hidden Valley (Parker Ranch)(25) | Simi Valley, CA | 324 | 310,900 | 2004 | 2004 | 94% | ||||||

| Meadowood | Simi Valley, CA | 320 | 264,500 | 1986 | 1996 | 91% | ||||||

| Shadow Point | Spring Valley, CA | 172 | 131,200 | 1983 | 2002 | 97% | ||||||

| Coldwater Canyon | Studio City, CA | 39 | 34,125 | 1979 | 2007 | 70% | ||||||

| Lofts at Pinehurst, The | Ventura, CA | 118 | 71,100 | 1971(26) | 1997 | 97% | ||||||

| Pinehurst(27) | Ventura, CA | 28 | 21,200 | 1973 | 2004 | 98% | ||||||

| Woodside Village | Ventura, CA | 145 | 136,500 | 1987 | 2004 | 96% | ||||||

| Walnut Heights | Walnut, CA | 163 | 146,700 | 1964 | 2003 | 94% | ||||||

| Avondale at Warner Center | Woodland Hills, CA | 446 | 331,000 | 1970(28) | 1997 | 92% | ||||||

| 13,205 | 11,038,017 | 95% | ||||||||||

| Northern California | ||||||||||||

| Belmont Terrace | Belmont, CA | 71 | 72,951 | 1974 | 2006 | 96% | ||||||

| Carlmont Woods(5) | Belmont, CA | 195 | 107,200 | 1971 | 2004 | 98% | ||||||

| Davey Glen(5) | Belmont, CA | 69 | 65,974 | 1962 | 2006 | 92% | ||||||

| Pointe at Cupertino, The | Cupertino, CA | 116 | 135,200 | 1963(29) | 1998 | 98% | ||||||

| Harbor Cove(5) | Foster City, CA | 400 | 306,600 | 1971 | 2004 | 97% | ||||||

| Stevenson Place | Fremont, CA | 200 | 146,200 | 1971(30) | 1983 | 95% | ||||||

| Boulevard (Treetops) | Fremont, CA | 172 | 131,200 | 1978(31) | 1996 | 87% | ||||||

| Waterstone at Fremont (Mountain Vista)(32) | Fremont, CA | 526 | 433,100 | 1975 | 2000 | 94% | ||||||

| City View (Wimbledon Woods) | Hayward, CA | 560 | 462,400 | 1975(33) | 1998 | 95% | ||||||

| Alderwood Park(5) | Newark, CA | 96 | 74,624 | 1987 | 2006 | 97% | ||||||

| Bridgeport (Summerhill Commons) | Newark, CA | 184 | 139,000 | 1987(34) | 1987 | 96% | ||||||

| Regency Towers(5) | Oakland, CA | 178 | 140,900 | 1975(35) | 2005 | 92% | ||||||

| San Marcos (Vista del Mar) | Richmond, CA | 432 | 407,600 | 2003 | 2003 | 96% | ||||||

| Mt. Sutro | San Francisco, CA | 99 | 64,000 | 1973 | 2001 | 98% | ||||||

| Carlyle, The | San Jose, CA | 132 | 129,200 | 2000 | 2000 | 97% | ||||||

| Enclave, The(5) | San Jose, CA | 637 | 525,463 | 1998 | 2005 | 96% | ||||||

| Esplanade | San Jose, CA | 278 | 279,000 | 2002 | 2004 | 97% | ||||||

| Waterford, The | San Jose, CA | 238 | 219,600 | 2000 | 2000 | 98% | ||||||

| Hillsdale Garden Apartments(36) | San Mateo, CA | 697 | 611,505 | 1948 | 2006 | 96% | ||||||

| Bel Air | San Ramon, CA | 462 | 391,000 | 1988(37) | 1997 | 96% | ||||||

| Canyon Oaks | San Ramon, CA | 250 | 237,894 | 2005 | 2007 | 94% | ||||||

| Foothill Gardens | San Ramon, CA | 132 | 155,100 | 1985 | 1997 | 94% | ||||||

| Mill Creek at Windermere | San Ramon, CA | 400 | 381,060 | 2005 | 2007 | 93% | ||||||

| Twin Creeks | San Ramon, CA | 44 | 51,700 | 1985 | 1997 | 94% | ||||||

| Le Parc Luxury Apartments | Santa Clara, CA | 140 | 113,200 | 1975(38) | 1994 | 98% | ||||||

| Marina Cove(39) | Santa Clara, CA | 292 | 250,200 | 1974(40) | 1994 | 98% | ||||||

| Harvest Park | Santa Rosa, CA | 104 | 116,628 | 2004 | 2007 | 95% | ||||||

| Bristol Commons | Sunnyvale, CA | 188 | 142,600 | 1989 | 1997 | 97% | ||||||

| Brookside Oaks(6) | Sunnyvale, CA | 170 | 119,900 | 1973 | 2000 | 99% | ||||||

| Magnolia Lane(41) | Sunnyvale, CA | 32 | 31,541 | 2001 | 2007 | 97% | ||||||

| Montclaire, The (Oak Pointe) | Sunnyvale, CA | 390 | 294,100 | 1973(42) | 1988 | 90% | ||||||

| Summerhill Park | Sunnyvale, CA | 100 | 78,500 | 1988 | 1988 | 98% | ||||||

| Thomas Jefferson(6) | Sunnyvale, CA | 156 | 110,824 | 1969 | 2007 | 100% | ||||||

| Windsor Ridge | Sunnyvale, CA | 216 | 161,800 | 1989 | 1989 | 96% | ||||||

| Vista Belvedere | Tiburon, CA | 76 | 78,300 | 1963 | 2004 | 94% | ||||||

| Tuscana | Tracy, CA | 30 | 29,088 | 2007 | 2007 | 84% | ||||||

| 8,462 | 7,195,152 | 96% | ||||||||||

| (continued) | ||||||||||||

| Rentable | ||||||||||||

| Square | Year | Year | ||||||||||

Apartment Communities (1) | Location | Units | Footage | Built | Acquired | Occupancy(2) | ||||||

| Seattle, Washington Metropolitan Area | ||||||||||||

| Cedar Terrace | Bellevue, WA | 180 | 174,200 | 1984 | 2005 | 95% | ||||||

| Emerald Ridge-North | Bellevue, WA | 180 | 144,000 | 1987 | 1994 | 95% | ||||||

| Foothill Commons | Bellevue, WA | 360 | 288,300 | 1978(43) | 1990 | 99% | ||||||

| Palisades, The | Bellevue, WA | 192 | 159,700 | 1977(44) | 1990 | 94% | ||||||

| Sammamish View | Bellevue, WA | 153 | 133,500 | 1986(45) | 1994 | 87% | ||||||

| Woodland Commons | Bellevue, WA | 236 | 172,300 | 1978(43) | 1990 | 99% | ||||||

| Canyon Pointe | Bothell, WA | 250 | 210,400 | 1990 | 2003 | 97% | ||||||

| Inglenook Court | Bothell, WA | 224 | 183,600 | 1985 | 1994 | 94% | ||||||

| Salmon Run at Perry Creek | Bothell, WA | 132 | 117,100 | 2000 | 2000 | 97% | ||||||

| Stonehedge Village | Bothell, WA | 196 | 214,800 | 1986 | 1997 | 95% | ||||||

| Park Hill at Issaquah | Issaquah, WA | 245 | 277,700 | 1999 | 1999 | 96% | ||||||

| Wandering Creek | Kent, WA | 156 | 124,300 | 1986 | 1995 | 98% | ||||||

| Bridle Trails | Kirkland, WA | 108 | 73,400 | 1986(46) | 1997 | 97% | ||||||

| Evergreen Heights | Kirkland, WA | 200 | 188,300 | 1990 | 1997 | 96% | ||||||

| Laurels at Mill Creek, The | Mill Creek, WA | 164 | 134,300 | 1981 | 1996 | 97% | ||||||

| Morning Run(5) | Monroe, WA | 222 | 221,786 | 1991 | 2005 | 97% | ||||||

| Anchor Village(6) | Mukilteo, WA | 301 | 245,900 | 1981 | 1997 | 96% | ||||||

| Castle Creek | Newcastle, WA | 216 | 191,900 | 1997 | 1997 | 95% | ||||||

| Brighton Ridge | Renton, WA | 264 | 201,300 | 1986 | 1996 | 96% | ||||||

| Fairwood Pond | Renton, WA | 194 | 189,200 | 1997 | 2004 | 95% | ||||||

| Forest View | Renton, WA | 192 | 182,500 | 1998 | 2003 | 96% | ||||||

| Cairns, The | Seattle, WA | 100 | 70,806 | 2006 | 2007 | 95% | ||||||

| Fountain Court | Seattle, WA | 320 | 207,000 | 2000 | 2000 | 96% | ||||||

| Linden Square | Seattle, WA | 183 | 142,200 | 1994 | 2000 | 97% | ||||||

| Maple Leaf | Seattle, WA | 48 | 35,500 | 1986 | 1997 | 99% | ||||||

| Spring Lake | Seattle, WA | 69 | 42,300 | 1986 | 1997 | 99% | ||||||

| Tower @ 801(5) | Seattle, WA | 173 | 118,500 | 1970 | 2005 | 97% | ||||||

| Wharfside Pointe | Seattle, WA | 142 | 119,200 | 1990 | 1994 | 97% | ||||||

| Echo Ridge(5) | Snoqualmie, WA | 120 | 124,539 | 2000 | 2005 | 97% | ||||||

| 5,520 | 4,688,531 | 96% | ||||||||||

| Other Region | ||||||||||||

| St. Cloud | Houston, TX | 302 | 306,800 | 1968 | 2002 | 93% | ||||||

| 302 | 306,800 | 93% | ||||||||||

| Total/Weighted Average | 27,489 | 23,228,500 | 96% |

| Rentable | ||||||||||||

| Square | Year | Year | ||||||||||

Other real estate assets(1) | Location | Tenants | Footage | Built | Acquired | Occupancy(2) | ||||||

| Office Buildings | ||||||||||||

| 535 - 575 River Oaks(47) | San Jose, CA | 1 | 262,500 | 1990 | 2007 | 100% | ||||||

| 925 East Meadow Drive(48) | Palo Alto, CA | 1 | 17,400 | 1988 | 1997 | 100% | ||||||

| 935 East Meadow Drive(49) | Palo Alto, CA | - | 14,500 | 1962 | 2007 | 0% | ||||||

| 6230 Sunset Blvd(47) | Los Angeles, CA | 1 | 35,000 | 1938 | 2006 | 100% | ||||||

| 17461 Derian Ave(50) | Irvine, CA | 3 | 110,000 | 1983 | 2000 | 100% | ||||||

| 22110-22120 Clarendon Street(51) | Woodland Hills, CA | 9 | 38,940 | 1982 | 2001 | 100% | ||||||

| Total Office Buildings | 15 | 478,340 | 100% | |||||||||

| Recreational Vehicle Parks | ||||||||||||

| Circle RV | El Cajon, CA | 179 spaces | 1977 | 2002 | (52) | |||||||

| Vacationer | El Cajon, CA | 159 spaces | 1973 | 2002 | (52) | |||||||

| Total Recreational Vehicle Parks | 338 spaces | |||||||||||

| Manufactured Housing Community | ||||||||||||

| Green Valley | Vista, CA | 157 sites | 1973 | 2002 | (52) | |||||||

| Total Manufactured Housing Community | 157 sites |

| Apartment | Rentable | Year | Year | |||||||||||

Communities (1) | Location | Homes | Square Footage | Built | Acquired | Occupancy(2) | ||||||||

| Southern California | ||||||||||||||

| Alpine Village | Alpine, CA | 301 | 254,400 | 1971 | 2002 | 97% | ||||||||

| Anavia | Anaheim, CA | 250 | 312,343 | 2009 | 2010 | 96% | ||||||||

| Apartment | Rentable | Year | Year | |||||||||||

Communities (1) | Location | Homes | Square Footage | Built | Acquired | Occupancy(2) | ||||||||

Barkley, The (3)(4) | Anaheim, CA | 161 | 139,800 | 1984 | 2000 | 98% | ||||||||

| Park Viridian | Anaheim, CA | 320 | 254,600 | 2008 | 2014 | 96% | ||||||||

| Bonita Cedars | Bonita, CA | 120 | 120,800 | 1983 | 2002 | 97% | ||||||||

| Camarillo Oaks | Camarillo, CA | 564 | 459,000 | 1985 | 1996 | 96% | ||||||||

| Camino Ruiz Square | Camarillo, CA | 160 | 105,448 | 1990 | 2006 | 97% | ||||||||

Enclave at Town Square (21) | Chino Hills, CA | 124 | 89,948 | 1987 | 2014 | 97% | ||||||||

The Heights I & II (21) | Chino Hills, CA | 332 | 324,370 | 2004 | 2014 | 96% | ||||||||

The Summit (5) | Chino Hills, CA | 125 | 98,420 | 1989 | 2014 | 98% | ||||||||

| Pinnacle at Otay Ranch | Chula Vista, CA | 364 | 384,192 | 2001 | 2014 | 95% | ||||||||

| Mesa Village | Clairemont, CA | 133 | 43,600 | 1963 | 2002 | 98% | ||||||||

| Villa Siena | Costa Mesa, CA | 272 | 262,842 | 1974 | 2014 | 96% | ||||||||

| Emerald Pointe | Diamond Bar, CA | 160 | 134,816 | 1989 | 2014 | 96% | ||||||||

| Regency at Encino | Encino, CA | 75 | 78,487 | 1989 | 2009 | 97% | ||||||||

The Havens (21) | Fountain Valley, CA | 440 | 414,040 | 1969 | 2014 | 96% | ||||||||

Valley Park (4) | Fountain Valley, CA | 160 | 169,700 | 1969 | 2001 | 97% | ||||||||

Capri at Sunny Hills (4) | Fullerton, CA | 100 | 128,100 | 1961 | 2001 | 97% | ||||||||

Haver Hill (5) | Fullerton, CA | 264 | 224,130 | 1973 | 2012 | 96% | ||||||||

| Pinnacle at Fullerton | Fullerton, CA | 192 | 174,336 | 2004 | 2014 | 96% | ||||||||

| Wilshire Promenade | Fullerton, CA | 149 | 128,000 | 1992 | 1997 | 96% | ||||||||

Montejo (4) | Garden Grove, CA | 124 | 103,200 | 1974 | 2001 | 97% | ||||||||

| CBC Apartments | Goleta, CA | 148 | 91,538 | 1962 | 2006 | 97% | ||||||||

| The Sweeps | Goleta, CA | 91 | 88,370 | 1967 | 2006 | 97% | ||||||||

| 416 on Broadway | Glendale, CA | 115 | 126,782 | 2009 | 2010 | 96% | ||||||||

| Hampton Court | Glendale, CA | 83 | 71,500 | 1974 | 1999 | 93% | ||||||||

| Hampton Place | Glendale, CA | 132 | 141,500 | 1970 | 1999 | 93% | ||||||||

| Devonshire | Hemet, CA | 276 | 207,200 | 1988 | 2002 | 96% | ||||||||

| Huntington Breakers | Huntington Beach, CA | 342 | 241,700 | 1984 | 1997 | 95% | ||||||||

| The Huntington | Huntington Beach, CA | 276 | 202,256 | 1975 | 2012 | 97% | ||||||||

| Axis 2300 | Irvine, CA | 115 | 170,714 | 2010 | 2010 | 97% | ||||||||

| Hillsborough Park | La Habra, CA | 235 | 215,500 | 1999 | 1999 | 97% | ||||||||

| Village Green | La Habra, CA | 272 | 175,762 | 1971 | 2014 | 97% | ||||||||

| The Palms at Laguna Niguel | Laguna Niguel, CA | 460 | 362,136 | 1988 | 2014 | 96% | ||||||||

| Trabuco Villas | Lake Forest, CA | 132 | 131,000 | 1985 | 1997 | 97% | ||||||||

| Marbrisa | Long Beach, CA | 202 | 122,800 | 1987 | 2002 | 96% | ||||||||

| Pathways | Long Beach, CA | 296 | 197,700 | 1975 | 1991 | 96% | ||||||||

| 8th & Hope | Los Angeles, CA | 290 | 298,437 | 2014 | 2015 | 79% | ||||||||

| 5600 Wilshire | Los Angeles, CA | 284 | 243,910 | 2008 | 2014 | 96% | ||||||||

| Alessio | Los Angeles, CA | 624 | 552,716 | 2001 | 2014 | 95% | ||||||||

| Avant | Los Angeles, CA | 440 | 305,989 | 2014 | 2015 | 95% | ||||||||

The Avery (4) | Los Angeles, CA | 121 | 129,393 | 2014 | 2014 | 97% | ||||||||

| Bellerive | Los Angeles, CA | 63 | 79,296 | 2011 | 2011 | 97% | ||||||||

| Belmont Station | Los Angeles, CA | 275 | 225,000 | 2009 | 2009 | 97% | ||||||||

| Bunker Hill | Los Angeles, CA | 456 | 346,600 | 1968 | 1998 | 88% | ||||||||

| Catalina Gardens | Los Angeles, CA | 128 | 117,585 | 1987 | 2014 | 97% | ||||||||

| Cochran Apartments | Los Angeles, CA | 58 | 51,400 | 1989 | 1998 | 97% | ||||||||

Gas Company Lofts (5) | Los Angeles, CA | 251 | 226,666 | 2004 | 2013 | 97% | ||||||||

| Jefferson at Hollywood | Los Angeles, CA | 270 | 238,119 | 2010 | 2014 | 94% | ||||||||

| Kings Road | Los Angeles, CA | 196 | 132,100 | 1979 | 1997 | 96% | ||||||||

| Apartment | Rentable | Year | Year | |||||||||||

Communities (1) | Location | Homes | Square Footage | Built | Acquired | Occupancy(2) | ||||||||

| Marbella | Los Angeles, CA | 60 | 50,108 | 1991 | 2005 | 97% | ||||||||

| Muse | Los Angeles, CA | 152 | 135,292 | 2011 | 2011 | 97% | ||||||||

Pacific Electric Lofts (6) | Los Angeles, CA | 314 | 277,980 | 2006 | 2012 | 94% | ||||||||

| Park Catalina | Los Angeles, CA | 90 | 72,864 | 2002 | 2012 | 96% | ||||||||

| Park Place | Los Angeles, CA | 60 | 48,000 | 1988 | 1997 | 97% | ||||||||

Regency Palm Court (5) | Los Angeles, CA | 116 | 54,844 | 1987 | 2014 | 96% | ||||||||

| Santee Court | Los Angeles, CA | 165 | 132,040 | 2004 | 2010 | 97% | ||||||||

| Santee Village | Los Angeles, CA | 73 | 69,817 | 2011 | 2011 | 97% | ||||||||

| Tiffany Court | Los Angeles, CA | 101 | 74,538 | 1987 | 2014 | 98% | ||||||||

| Wilshire La Brea | Los Angeles, CA | 478 | 354,972 | 2014 | 2014 | 95% | ||||||||

Windsor Court (5) | Los Angeles, CA | 95 | 51,266 | 1987 | 2014 | 95% | ||||||||

| Windsor Court | Los Angeles, CA | 58 | 46,600 | 1988 | 1997 | 97% | ||||||||

| Aqua at Marina Del Rey | Marina Del Rey, CA | 500 | 479,312 | 2001 | 2014 | 95% | ||||||||

Marina City Club (7) | Marina Del Rey, CA | 101 | 127,200 | 1971 | 2004 | 96% | ||||||||

| Mirabella | Marina Del Rey, CA | 188 | 176,800 | 2000 | 2000 | 97% | ||||||||

| Mira Monte | Mira Mesa, CA | 355 | 262,600 | 1982 | 2002 | 96% | ||||||||

Madrid Apartments (6) | Mission Viejo, CA | 230 | 228,099 | 2000 | 2012 | 97% | ||||||||

| Hillcrest Park | Newbury Park, CA | 608 | 521,900 | 1973 | 1998 | 96% | ||||||||

Fairways (8) | Newport Beach, CA | 74 | 107,100 | 1972 | 1999 | 96% | ||||||||

| Candlewood North | Northridge, CA | 189 | 166,910 | 1964 | 2014 | 96% | ||||||||

Canyon Creek (21) | Northridge, CA | 200 | 148,150 | 1986 | 2014 | 96% | ||||||||

| Country Villas | Oceanside, CA | 180 | 179,700 | 1976 | 2002 | 96% | ||||||||

| Mission Hills | Oceanside, CA | 282 | 244,000 | 1984 | 2005 | 96% | ||||||||

| Renaissance at Uptown Orange | Orange, CA | 460 | 432,836 | 2007 | 2014 | 96% | ||||||||

| Mariner's Place | Oxnard, CA | 105 | 77,200 | 1987 | 2000 | 97% | ||||||||

| Monterey Villas | Oxnard, CA | 122 | 122,100 | 1974 | 1997 | 97% | ||||||||

| Tierra Vista | Oxnard, CA | 404 | 387,100 | 2001 | 2001 | 96% | ||||||||

Arbors Parc Rose (6) | Oxnard, CA | 373 | 503,196 | 2001 | 2011 | 95% | ||||||||

| The Hallie del Mar | Pasadena, CA | 123 | 74,400 | 1972 | 1997 | 92% | ||||||||

| The Hallie del Rey | Pasadena, CA | 84 | 73,100 | 1972 | 1999 | 92% | ||||||||

| The Hallie del Sol | Pasadena, CA | 85 | 69,200 | 1972 | 1999 | 92% | ||||||||

| Stuart at Sierra Madre Villa | Pasadena, CA | 188 | 168,630 | 2007 | 2014 | 96% | ||||||||

Villa Angelina (4) | Placentia, CA | 256 | 217,600 | 1970 | 2001 | 97% | ||||||||

| Fountain Park | Playa Vista, CA | 705 | 608,900 | 2002 | 2004 | 97% | ||||||||

Highridge (4) | Rancho Palos Verdes, CA | 255 | 290,200 | 1972 | 1997 | 98% | ||||||||

| Cortesia at Rancho Santa Margarita | Rancho Santa Margarita, CA | 308 | 277,580 | 1999 | 2014 | 96% | ||||||||

| Pinnacle at Talega | San Clemente, CA | 362 | 355,764 | 2002 | 2014 | 96% | ||||||||

| Allure at Scripps Ranch | San Diego, CA | 194 | 207,052 | 2002 | 2014 | 96% | ||||||||

| Bernardo Crest | San Diego, CA | 216 | 205,548 | 1988 | 2014 | 96% | ||||||||

| Cambridge Park | San Diego, CA | 320 | 317,958 | 1998 | 2014 | 95% | ||||||||

| Carmel Creek | San Diego, CA | 348 | 384,216 | 2000 | 2014 | 96% | ||||||||

| Carmel Landing | San Diego, CA | 356 | 283,426 | 1989 | 2014 | 94% | ||||||||

| Carmel Summit | San Diego, CA | 246 | 225,880 | 1989 | 2014 | 97% | ||||||||

| CentrePointe | San Diego, CA | 224 | 126,700 | 1974 | 1997 | 94% | ||||||||

| Domain | San Diego, CA | 379 | 345,044 | 2013 | 2013 | 94% | ||||||||

Esplanade (21) | San Diego, CA | 616 | 479,600 | 1986 | 2014 | 96% | ||||||||

| Apartment | Rentable | Year | Year | |||||||||||

Communities (1) | Location | Homes | Square Footage | Built | Acquired | Occupancy(2) | ||||||||

| Montanosa | San Diego, CA | 472 | 414,968 | 1990 | 2014 | 96% | ||||||||

| Summit Park | San Diego, CA | 300 | 229,400 | 1972 | 2002 | 96% | ||||||||

Essex Skyline at MacArthur Place (9) | Santa Ana, CA | 349 | 512,791 | 2008 | 2010 | 96% | ||||||||

Fairhaven (4) | Santa Ana, CA | 164 | 135,700 | 1970 | 2001 | 98% | ||||||||

Parkside Court (21) | Santa Ana, CA | 210 | 152,400 | 1986 | 2014 | 97% | ||||||||

| Pinnacle at MacArthur Place | Santa Ana, CA | 253 | 262,867 | 2002 | 2014 | 96% | ||||||||

| Hope Ranch | Santa Barbara, CA | 108 | 126,700 | 1965 / 1973 | 2007 | 98% | ||||||||

Bridgeport Coast (22) | Santa Clarita, CA | 188 | 168,198 | 2006 | 2014 | 97% | ||||||||

Hidden Valley (10) | Simi Valley, CA | 324 | 310,900 | 2004 | 2004 | 97% | ||||||||

| Meadowood | Simi Valley, CA | 320 | 264,500 | 1986 | 1996 | 96% | ||||||||

| Shadow Point | Spring Valley, CA | 172 | 131,200 | 1983 | 2002 | 96% | ||||||||

The Fairways at Westridge (22) | Valencia, CA | 234 | 223,330 | 2004 | 2014 | 96% | ||||||||

Vistas of West Hills (22) | Valencia, CA | 220 | 221,119 | 2009 | 2014 | 96% | ||||||||

| Allegro | Valley Village, CA | 97 | 127,812 | 2010 | 2010 | 97% | ||||||||

| Lofts at Pinehurst, The | Ventura, CA | 118 | 71,100 | 1971 | 1997 | 97% | ||||||||

Pinehurst (11) | Ventura, CA | 28 | 21,200 | 1973 | 2004 | 98% | ||||||||

| Woodside Village | Ventura, CA | 145 | 136,500 | 1987 | 2004 | 97% | ||||||||

| Walnut Heights | Walnut, CA | 163 | 146,700 | 1964 | 2003 | 95% | ||||||||

| The Dylan | West Hollywood, CA | 184 | 150,678 | 2014 | 2014 | 92% | ||||||||

| The Huxley | West Hollywood, CA | 187 | 154,776 | 2014 | 2014 | 93% | ||||||||

| Reveal | Woodland Hills, CA | 438 | 414,892 | 2010 | 2011 | 95% | ||||||||

| Avondale at Warner Center | Woodland Hills, CA | 446 | 331,000 | 1970 | 1999 | 96% | ||||||||

| 28,039 | 24,850,294 | 96% | ||||||||||||

| Northern California | ||||||||||||||

| Belmont Terrace | Belmont, CA | 71 | 72,951 | 1974 | 2006 | 94% | ||||||||

| Fourth & U | Berkeley, CA | 171 | 146,255 | 2010 | 2010 | 96% | ||||||||

| The Commons | Campbell, CA | 264 | 153,168 | 1973 | 2010 | 97% | ||||||||

| The Pointe at Cupertino | Cupertino, CA | 116 | 135,200 | 1963 | 1998 | 98% | ||||||||

Connolly Station (23) | Dublin, CA | 309 | 286,348 | 2014 | 2014 | 96% | ||||||||

| Avenue 64 | Emeryville, CA | 224 | 196,896 | 2007 | 2014 | 94% | ||||||||

Emme (23) | Emeryville, CA | 190 | 148,935 | 2015 | 2015 | 81% | ||||||||

| Foster's Landing | Foster City, CA | 490 | 415,130 | 1987 | 2014 | 96% | ||||||||

| Stevenson Place | Fremont, CA | 200 | 146,200 | 1975 | 2000 | 95% | ||||||||

| Mission Peaks | Fremont, CA | 453 | 404,034 | 1995 | 2014 | 96% | ||||||||

| Mission Peaks II | Fremont, CA | 336 | 294,720 | 1989 | 2014 | 96% | ||||||||

| Paragon Apartments | Fremont, CA | 301 | 267,047 | 2013 | 2014 | 94% | ||||||||

| Boulevard | Fremont, CA | 172 | 131,200 | 1978 | 1996 | 97% | ||||||||

Briarwood (6) | Fremont, CA | 160 | 111,160 | 1978 | 2011 | 96% | ||||||||

The Woods (6) | Fremont, CA | 160 | 105,280 | 1978 | 2011 | 96% | ||||||||

City Centre (22) | Hayward, CA | 192 | 175,420 | 2000 | 2014 | 97% | ||||||||

| City View | Hayward, CA | 572 | 462,400 | 1975 | 1998 | 97% | ||||||||

| Lafayette Highlands | Lafayette, CA | 150 | 151,790 | 1973 | 2014 | 97% | ||||||||

| Apex | Milpitas, CA | 366 | 350,961 | 2014 | 2014 | 96% | ||||||||

Regency at Mountain View (5) | Mountain View, CA | 142 | 127,600 | 1970 | 2013 | 96% | ||||||||

| Bridgeport | Newark, CA | 184 | 139,000 | 1987 | 1987 | 98% | ||||||||

| The Landing at Jack London Square | Oakland, CA | 282 | 257,796 | 2001 | 2014 | 95% | ||||||||

| Apartment | Rentable | Year | Year | |||||||||||

Communities (1) | Location | Homes | Square Footage | Built | Acquired | Occupancy(2) | ||||||||

| The Grand | Oakland, CA | 243 | 205,026 | 2009 | 2009 | 96% | ||||||||

| Radius | Redwood City, CA | 264 | 245,862 | 2015 | 2015 | 94% | ||||||||

| San Marcos | Richmond, CA | 432 | 407,600 | 2003 | 2003 | 96% | ||||||||

| Bennett Lofts | San Francisco, CA | 165 | 184,713 | 2004 | 2012 | 95% | ||||||||

| Fox Plaza | San Francisco, CA | 443 | 230,017 | 1968 | 2013 | 95% | ||||||||

| MB 360 Phase I | San Francisco, CA | 188 | 222,810 | 2014 | 2014 | 96% | ||||||||

Mosso (23) | San Francisco, CA | 463 | 607,549 | 2014 | 2014 | 87% | ||||||||

| Park West | San Francisco, CA | 126 | 90,060 | 1958 | 2012 | 95% | ||||||||

| 101 San Fernando | San Jose, CA | 323 | 296,078 | 2001 | 2010 | 96% | ||||||||

| Bella Villagio | San Jose, CA | 231 | 227,511 | 2004 | 2010 | 97% | ||||||||

| Enso | San Jose, CA | 183 | 179,562 | 2014 | 2015 | 100% | ||||||||

Epic - Phase I & II (13) (23) | San Jose, CA | 569 | 472,236 | 2013 | 2013 | 95% | ||||||||

| Esplanade | San Jose, CA | 278 | 279,000 | 2002 | 2004 | 96% | ||||||||

| Fountains at River Oaks | San Jose, CA | 226 | 209,954 | 1990 | 2014 | 97% | ||||||||

| Museum Park | San Jose, CA | 117 | 121,329 | 2002 | 2014 | 97% | ||||||||

One South Market (23) | San Jose, CA | 312 | 283,268 | 2015 | 2015 | 46% | ||||||||

Palm Valley (16) | San Jose, CA | 1,098 | 1,132,284 | 2008 | 2014 | 96% | ||||||||

| The Carlyle | San Jose, CA | 132 | 129,200 | 2000 | 2000 | 97% | ||||||||

| The Waterford | San Jose, CA | 238 | 219,600 | 2000 | 2000 | 97% | ||||||||

| Willow Lake | San Jose, CA | 508 | 471,744 | 1989 | 2012 | 96% | ||||||||

| Lakeshore Landing | San Mateo, CA | 308 | 223,972 | 1988 | 2014 | 95% | ||||||||

| Hillsdale Garden | San Mateo, CA | 697 | 611,505 | 1948 | 2006 | 97% | ||||||||

Park 20 (23) | San Mateo, CA | 197 | 140,547 | 2015 | 2015 | 79% | ||||||||

| Deer Valley | San Rafael, CA | 171 | 167,238 | 1996 | 2014 | 97% | ||||||||

| Bel Air | San Ramon, CA | 462 | 391,000 | 1988 | 1995 | 96% | ||||||||

| Canyon Oaks | San Ramon, CA | 250 | 237,894 | 2005 | 2007 | 98% | ||||||||

| Crow Canyon | San Ramon, CA | 400 | 337,064 | 1992 | 2014 | 96% | ||||||||

| Foothill Gardens | San Ramon, CA | 132 | 155,100 | 1985 | 1997 | 97% | ||||||||

| Mill Creek at Windermere | San Ramon, CA | 400 | 381,060 | 2005 | 2007 | 97% | ||||||||

| Twin Creeks | San Ramon, CA | 44 | 51,700 | 1985 | 1997 | 97% | ||||||||

| 1000 Kiely | Santa Clara, CA | 121 | 128,486 | 1971 | 2011 | 95% | ||||||||

| Le Parc | Santa Clara, CA | 140 | 113,200 | 1975 | 1994 | 97% | ||||||||

Marina Cove (14) | Santa Clara, CA | 292 | 250,200 | 1974 | 1994 | 96% | ||||||||

Riley Square (6) | Santa Clara, CA | 156 | 126,900 | 1972 | 2012 | 95% | ||||||||

| Villa Granada | Santa Clara, CA | 270 | 238,841 | 2010 | 2014 | 96% | ||||||||

| Chestnut Street Apartments | Santa Cruz, CA | 96 | 87,640 | 2002 | 2008 | 97% | ||||||||

| Harvest Park | Santa Rosa, CA | 104 | 116,628 | 2004 | 2007 | 97% | ||||||||

| Bristol Commons | Sunnyvale, CA | 188 | 142,600 | 1989 | 1995 | 95% | ||||||||

Brookside Oaks (4) | Sunnyvale, CA | 170 | 119,900 | 1973 | 2000 | 95% | ||||||||

| Lawrence Station | Sunnyvale, CA | 336 | 297,188 | 2012 | 2014 | 96% | ||||||||

Magnolia Lane (15) | Sunnyvale, CA | 32 | 31,541 | 2001 | 2007 | 97% | ||||||||

Magnolia Square (4) | Sunnyvale, CA | 156 | 110,824 | 1963 | 2007 | 97% | ||||||||

| Montclaire | Sunnyvale, CA | 390 | 294,100 | 1973 | 1988 | 97% | ||||||||

| Reed Square | Sunnyvale, CA | 100 | 95,440 | 1970 | 2011 | 97% | ||||||||

| Solstice | Sunnyvale, CA | 280 | 571,466 | 2014 | 2014 | 96% | ||||||||

| Summerhill Park | Sunnyvale, CA | 100 | 78,500 | 1988 | 1988 | 95% | ||||||||

| Via | Sunnyvale, CA | 284 | 309,421 | 2011 | 2011 | 96% | ||||||||

| Windsor Ridge | Sunnyvale, CA | 216 | 161,800 | 1989 | 1989 | 96% | ||||||||

| Apartment | Rentable | Year | Year | |||||||||||

Communities (1) | Location | Homes | Square Footage | Built | Acquired | Occupancy(2) | ||||||||

| Vista Belvedere | Tiburon, CA | 76 | 78,300 | 1963 | 2004 | 95% | ||||||||

| Tuscana | Tracy, CA | 30 | 29,088 | 2007 | 2007 | 99% | ||||||||

Verandas (22) | Union City, CA | 282 | 199,092 | 1989 | 2014 | 96% | ||||||||

| 18,924 | 17,173,129 | 95% | ||||||||||||

| Seattle, Washington Metropolitan Area | ||||||||||||||

| Belcarra | Bellevue, WA | 296 | 241,567 | 2009 | 2014 | 96% | ||||||||

| BellCentre | Bellevue, WA | 248 | 181,288 | 2001 | 2014 | 96% | ||||||||

| Cedar Terrace | Bellevue, WA | 180 | 174,200 | 1984 | 2005 | 96% | ||||||||

| Courtyard off Main | Bellevue, WA | 110 | 108,388 | 2000 | 2010 | 96% | ||||||||

| Ellington at Bellevue | Bellevue, WA | 220 | 165,794 | 1994 | 2014 | 96% | ||||||||

| Emerald Ridge | Bellevue, WA | 180 | 144,000 | 1987 | 1994 | 96% | ||||||||

| Foothill Commons | Bellevue, WA | 394 | 288,300 | 1978 | 1990 | 96% | ||||||||

| Palisades, The | Bellevue, WA | 192 | 159,700 | 1977 | 1990 | 97% | ||||||||

| Park Highland | Bellevue, WA | 250 | 224,750 | 1993 | 2014 | 95% | ||||||||

| Piedmont | Bellevue, WA | 396 | 348,969 | 1969 | 2014 | 96% | ||||||||

| Sammamish View | Bellevue, WA | 153 | 133,500 | 1986 | 1994 | 97% | ||||||||

| Woodland Commons | Bellevue, WA | 302 | 217,878 | 1978 | 1990 | 95% | ||||||||

Bothell Ridge (21) | Bothell, WA | 214 | 167,370 | 1988 | 2014 | 96% | ||||||||

| Canyon Pointe | Bothell, WA | 250 | 210,400 | 1990 | 2003 | 95% | ||||||||

| Inglenook Court | Bothell, WA | 224 | 183,600 | 1985 | 1994 | 97% | ||||||||

| Pinnacle Sonata | Bothell, WA | 268 | 343,095 | 2000 | 2014 | 95% | ||||||||

| Salmon Run at Perry Creek | Bothell, WA | 132 | 117,100 | 2000 | 2000 | 98% | ||||||||

| Stonehedge Village | Bothell, WA | 196 | 214,800 | 1986 | 1997 | 97% | ||||||||

| Highlands at Wynhaven | Issaquah, WA | 333 | 424,674 | 2000 | 2008 | 96% | ||||||||

| Park Hill at Issaquah | Issaquah, WA | 245 | 277,700 | 1999 | 1999 | 97% | ||||||||

| Wandering Creek | Kent, WA | 156 | 124,300 | 1986 | 1995 | 97% | ||||||||

| Ascent | Kirkland, WA | 90 | 75,840 | 1988 | 2012 | 97% | ||||||||

| Bridle Trails | Kirkland, WA | 108 | 99,700 | 1986 | 1997 | 97% | ||||||||

| Corbella at Juanita Bay | Kirkland, WA | 169 | 103,339 | 1978 | 2010 | 96% | ||||||||

| Evergreen Heights | Kirkland, WA | 200 | 188,300 | 1990 | 1997 | 97% | ||||||||

| Slater 116 | Kirkland, WA | 108 | 81,415 | 2013 | 2013 | 96% | ||||||||

| Montebello | Kirkland, WA | 248 | 272,734 | 1996 | 2012 | 96% | ||||||||

Aviara (12) | Mercer Island, WA | 166 | 147,033 | 2013 | 2014 | 96% | ||||||||

| Laurels at Mill Creek | Mill Creek, WA | 164 | 134,300 | 1981 | 1996 | 97% | ||||||||

| Parkwood at Mill Creek | Mill Creek, WA | 240 | 257,160 | 1989 | 2014 | 95% | ||||||||

The Elliot at Mukilteo (4) | Mukilteo, WA | 301 | 245,900 | 1981 | 1997 | 95% | ||||||||

| Castle Creek | Newcastle, WA | 216 | 191,900 | 1998 | 1998 | 97% | ||||||||

| Delano | Redmond, WA | 126 | 116,340 | 2005 | 2011 | 97% | ||||||||

| Elevation | Redmond, WA | 158 | 138,916 | 1986 | 2010 | 97% | ||||||||

Redmond Hill (6) | Redmond, WA | 442 | 350,275 | 1985 | 2011 | 96% | ||||||||

| Shadowbrook | Redmond, WA | 418 | 338,880 | 1986 | 2014 | 97% | ||||||||

| The Trails of Redmond | Redmond, WA | 423 | 376,000 | 1985 | 2014 | 97% | ||||||||

Vesta (6) | Redmond, WA | 440 | 381,675 | 1998 | 2011 | 96% | ||||||||

| Brighton Ridge | Renton, WA | 264 | 201,300 | 1986 | 1996 | 97% | ||||||||

| Fairwood Pond | Renton, WA | 194 | 189,200 | 1997 | 2004 | 97% | ||||||||

| Forest View | Renton, WA | 192 | 182,500 | 1998 | 2003 | 97% | ||||||||

| Pinnacle on Lake Washington | Renton, WA | 180 | 190,908 | 2001 | 2014 | 96% | ||||||||

| Annaliese | Seattle, WA | 56 | 48,216 | 2009 | 2013 | 96% | ||||||||

| Apartment | Rentable | Year | Year | |||||||||||

Communities (1) | Location | Homes | Square Footage | Built | Acquired | Occupancy(2) | ||||||||

| The Audrey at Belltown | Seattle, WA | 137 | 94,119 | 1992 | 2014 | 97% | ||||||||

Ballinger Commons (21) | Seattle, WA | 485 | 407,253 | 1989 | 2014 | 96% | ||||||||

| The Bernard | Seattle, WA | 63 | 43,151 | 2008 | 2011 | 96% | ||||||||

| Cairns, The | Seattle, WA | 100 | 70,806 | 2006 | 2007 | 97% | ||||||||

Citywalk (21) | Seattle, WA | 102 | 92,010 | 1988 | 2014 | 97% | ||||||||

| Collins on Pine | Seattle, WA | 76 | 48,733 | 2013 | 2014 | 97% | ||||||||

| Domaine | Seattle, WA | 92 | 79,421 | 2009 | 2012 | 95% | ||||||||

Expo (16) | Seattle, WA | 275 | 190,176 | 2012 | 2012 | 97% | ||||||||

| Fountain Court | Seattle, WA | 320 | 207,000 | 2000 | 2000 | 95% | ||||||||

Joule (17) | Seattle, WA | 295 | 191,109 | 2010 | 2010 | 96% | ||||||||

| Taylor 28 | Seattle, WA | 197 | 155,630 | 2008 | 2014 | 95% | ||||||||

| Vox | Seattle, WA | 58 | 42,173 | 2013 | 2013 | 97% | ||||||||

| Wharfside Pointe | Seattle, WA | 155 | 119,200 | 1990 | 1994 | 94% | ||||||||

| 12,197 | 10,503,985 | 96% | ||||||||||||

| Total/Weighted Average | 59,160 | 52,527,408 | 95% | |||||||||||

| Square | Year | Year | |||||||||||

Other real estate assets (1) | Location | Tenants | Footage | Built | Acquired | Occupancy (2) | |||||||

925 / 935 East Meadow Drive (18) | Palo Alto, CA | — | 39,600 | 1988 / 1962 | 1997 / 2007 | —% | |||||||

Essex - Hollywood (19) | Los Angeles, CA | 1 | 34,000 | 1938 | 2006 | 100% | |||||||

Derian Office Building (20) | Irvine, CA | 8 | 106,564 | 1983 | 2000 | 100% | |||||||

| Santa Clara Retail | Santa Clara, CA | 3 | 138,915 | 1970 | 2011 | 100% | |||||||

| 12 | 319,079 | 88% | |||||||||||

(1) | Unless otherwise specified, the |

(2) | For |

(3) | The community is subject to a ground lease, which, unless extended, will expire in 2082. |

(4) | The |

(5) | This community is owned by Wesco III. The Company has a 50% interest in Wesco III which is accounted for using the |

(6) | This community is owned by Wesco I. The |

| This community is subject to a ground lease, which, unless extended, will expire in 2067. |

| This community is subject to a ground lease, which, unless extended, will expire in 2027. |

(9) | The |

(10) | The |

| The community is subject to a ground lease, which, unless extended, will expire in 2028. |

(12) | This community is |

(13) | The |

(14) | A portion of this community on which 84 |

(15) | The community is subject to a ground lease, which, unless extended, will expire in 2070. |

(16) | The |

(17) | The |

(18) | This property was the |

| The property is leased through January 2016 to a single |

(20) | The |

(21) | This community is owned by BEXAEW. The Company has a 50% interest in BEXAEW which is accounted for using the equity method of accounting. |

(22) | This community is owned by Wesco IV. The Company has a 50% interest in Wesco IV which is accounted for using the equity method of accounting. |

(23) | The |

| Quarter Ended | High | Low | Close | |||||||||

| December 31, 2015 | $ | 244.71 | $ | 214.29 | $ | 239.41 | ||||||

| September 30, 2015 | $ | 232.20 | $ | 205.72 | $ | 223.42 | ||||||

| June 30, 2015 | $ | 231.90 | $ | 208.85 | $ | 212.50 | ||||||

| March 31, 2015 | $ | 243.17 | $ | 207.26 | $ | 229.90 | ||||||

| December 31, 2014 | $ | 214.43 | $ | 176.70 | $ | 206.60 | ||||||

| September 30, 2014 | $ | 196.08 | $ | 177.68 | $ | 178.75 | ||||||

| June 30, 2014 | $ | 185.99 | $ | 164.76 | $ | 184.91 | ||||||

| March 31, 2014 | $ | 173.01 | $ | 141.79 | $ | 170.05 | ||||||

| 2015 | 2014 | 2013 | |||||||

| Common Stock | |||||||||

| Ordinary income | 99.28 | % | 70.03 | % | 77.34 | % | |||

| Capital gain | 0.72 | % | 21.95 | % | 17.64 | % | |||

| Unrecaptured section 1250 capital gain | — | % | 8.02 | % | 5.02 | % | |||

| 100.00 | % | 100.00 | % | 100.00 | % | ||||

| 2015 | 2014 | 2013 | |||||||

| Series G, and H Preferred stock | |||||||||

| Ordinary income | 99.28 | % | 70.03 | % | 77.34 | % | |||

| Capital gains | 0.72 | % | 21.95 | % | 17.64 | % | |||

| Unrecaptured section 1250 capital gain | — | % | 8.02 | % | 5.02 | % | |||

| 100.00 | % | 100.00 | % | 100.00 | % | ||||

| Year Ended | Annual Dividend/Distribution | Quarter Ended | 2015 | 2014 | 2013 | |||||||

| 1995 | $ | 1.69 | March 31, | $1.44 | $1.21 | $1.21 | ||||||

| 1996 | $ | 1.72 | June 30, | $1.44 | $1.30 | $1.21 | ||||||

| 1997 | $ | 1.77 | September 30, | $1.44 | $1.30 | $1.21 | ||||||

| 1998 | $ | 1.95 | December 31, | $1.44 | $1.30 | $1.21 | ||||||

| 1999 | $ | 2.15 | ||||||||||

| 2000 | $ | 2.38 | Annual Dividend/Distribution | $5.76 | $5.11 | $4.84 | ||||||

| 2001 | $ | 2.80 | ||||||||||

| 2002 | $ | 3.08 | ||||||||||

| 2003 | $ | 3.12 | ||||||||||

| 2004 | $ | 3.16 | ||||||||||

| 2005 | $ | 3.24 | ||||||||||

| 2006 | $ | 3.36 | ||||||||||

| 2007 | $ | 3.72 | ||||||||||

| 2008 | $ | 4.08 | ||||||||||

| 2009 | $ | 4.12 | ||||||||||

| 2010 | $ | 4.13 | ||||||||||

| 2011 | $ | 4.16 | ||||||||||

| 2012 | $ | 4.40 | ||||||||||

| Period | Total Number of Shares Sold | Average Price per Share | Proceeds (net of fees and commissions) | |||

| 4/5/07 to 5/6/07 | 1,670,500 | $127.91 | $213,672,000 | |||

| Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Total Amount that May Yet be Purchased Under the Plans or Programs | |||||

| 9/12/07 to 9/17/07 | 12,600 | $111.60 | 12,600 | $198,593,456 | |||||

| 11/13/07 to 11/31/07 | 196,059 | $101.90 | 208,659 | $178,615,425 | |||||

| 12/4/07 to 12/21/07 | 114,600 | $98.20 | 323,259 | $167,358,504 | |||||

| Total | 323,259 | $100.90 | 323,259 | $167,358,504 | |||||

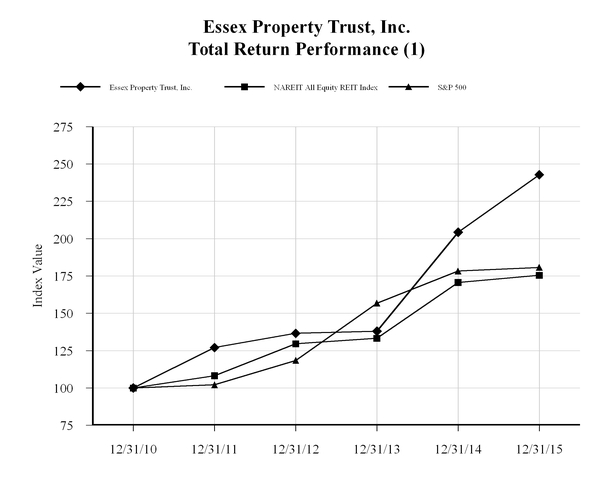

| Period Ending | ||||||||||||||||||

| Index | 12/31/2010 | 12/31/2011 | 12/31/2012 | 12/31/2013 | 12/31/2014 | 12/31/2015 | ||||||||||||

| Essex Property Trust, Inc. | 100.00 | 127.06 | 136.59 | 138.04 | 204.30 | 242.85 | ||||||||||||

| NAREIT All Equity REIT Index | 100.00 | 108.28 | 129.62 | 133.32 | 170.68 | 175.51 | ||||||||||||

| S&P 500 | 100.00 | 102.11 | 118.45 | 156.82 | 178.28 | 180.75 | ||||||||||||

(1) | Common stock performance data is provided by SNL Financial. |

| Years Ended December 31, | |||||||||||||||

| 2007 | 2006(1) | 2005(1) | 2004(1) | 2003(1) | |||||||||||

| (In thousands, except per unit amounts) | |||||||||||||||

| OPERATING DATA: | |||||||||||||||

| REVENUES | |||||||||||||||

| Rental and other property | $ | 383,433 | $ | 334,770 | $ | 303,235 | $ | 266,722 | $ | 233,800 | |||||

| Management and other fees from affiliates | 5,090 | 5,030 | 10,951 | 23,146 | 6,027 | ||||||||||

| 388,523 | 339,800 | 314,186 | 289,868 | 239,827 | |||||||||||

| EXPENSES | |||||||||||||||

| Property operating expenses, excluding depreciation | |||||||||||||||

| and amortization | 128,424 | 114,398 | 104,479 | 93,666 | 77,307 | ||||||||||

| Depreciation and amortization | 100,389 | 78,094 | 74,849 | 66,414 | 51,814 | ||||||||||

| Amortization of deferred financing costs | 3,071 | 2,745 | 1,947 | 1,560 | 1,187 | ||||||||||

| General and administrative | 26,273 | 22,234 | 19,148 | 18,042 | 9,549 | ||||||||||

| Interest | 80,995 | 72,898 | 70,784 | 60,709 | 49,985 | ||||||||||

| Other expenses | 800 | 1,770 | 5,827 | - | - | ||||||||||

| 339,952 | 292,139 | 277,034 | 240,391 | 189,842 | |||||||||||

| Earnings from operations | 48,571 | 47,661 | 37,152 | 49,477 | 49,985 | ||||||||||

| Gain on the sales of real estate | - | - | 6,391 | 7,909 | - | ||||||||||

| Interest and other income | 10,310 | 6,176 | 8,524 | 3,077 | 668 | ||||||||||

| Equity income (loss) in co-investments | 3,120 | (1,503) | 18,553 | 40,683 | 2,349 | ||||||||||

| Minority interests | (4,847) | (4,977) | (5,340) | (4,550) | (4,696) | ||||||||||

| Income from continuing operations before income tax provision | 57,154 | 47,357 | 65,280 | 96,596 | 48,306 | ||||||||||

| Income tax provision | (400) | (525) | (2,538) | (257) | - | ||||||||||

| Income from continuing operations | 56,754 | 46,832 | 62,742 | 96,339 | 48,306 | ||||||||||

| Income from discontinued operations (net of minority interests | 80,546 | 33,015 | 35,558 | 7,469 | 8,660 | ||||||||||

| Net income | 137,300 | 79,847 | 98,300 | 103,808 | 56,966 | ||||||||||

| Write off of Series C preferred units offering costs | - | - | - | - | (625) | ||||||||||

| Write off of Series E preferred units offering costs | - | - | - | (1,575) | - | ||||||||||

| Amortization of discount on Series F preferred equity | - | - | - | - | (336) | ||||||||||

| Distributions on preferred units - Series F & G | (9,174) | (5,145) | (1,953) | (1,952) | (195) | ||||||||||

| Distributions on preferred units - limited partners | (10,238) | (10,238) | (10,238) | (14,175) | (17,996) | ||||||||||

| Net income available to common units | $ | 117,888 | $ | 64,464 | $ | 86,109 | $ | 86,106 | $ | 37,814 | |||||

| Per unit data: | |||||||||||||||

| Basic: | |||||||||||||||

| Net income from continuing operations available to | |||||||||||||||

| common units | $ | 1.38 | $ | 1.23 | $ | 2.00 | $ | 3.11 | $ | 1.23 | |||||

| Net income available to common units | $ | 4.36 | $ | 2.52 | $ | 3.40 | $ | 3.41 | $ | 1.59 | |||||

| Weighted average common units outstanding | 27,044 | 25,560 | 25,344 | 25,255 | 23,737 | ||||||||||

| Diluted: | |||||||||||||||

| Net income from continuing operations available to | |||||||||||||||

| common units | $ | 1.35 | $ | 1.21 | $ | 1.97 | $ | 3.09 | $ | 1.22 | |||||

| Net income available to common units | $ | 4.27 | $ | 2.48 | $ | 3.35 | $ | 3.38 | $ | 1.58 | |||||

| Weighted average common units outstanding | 27,597 | 26,030 | 25,694 | 25,490 | 23,948 | ||||||||||

| Cash dividend per common unit | $ | 3.72 | $ | 3.36 | $ | 3.24 | $ | 3.16 | $ | 3.12 | |||||

| As of December 31, | ||||||||||||||||

| 2007 | 2006(1) | 2005(1) | 2004(1) | 2003(1) | ||||||||||||

| BALANCE SHEET DATA: | ||||||||||||||||

| Investment in rental properties (before accumulated | ||||||||||||||||

| depreciation) | $ | 3,117,759 | $ | 2,669,187 | $ | 2,431,629 | $ | 2,371,194 | $ | 1,984,122 | ||||||

| Net investment in rental proerties | 2,575,772 | 2,204,172 | 2,042,589 | 2,041,542 | 1,718,359 | |||||||||||

| Real estate under development | 233,445 | 107,620 | 54,416 | 38,320 | 55,183 | |||||||||||

| Total assets | 2,980,323 | 2,485,840 | 2,239,290 | 2,217,217 | 1,916,811 | |||||||||||

| Total secured indebtedness | 1,362,873 | 1,186,554 | 1,129,918 | 1,161,184 | 976,545 | |||||||||||

| Total unsecured indebtedness | 294,818 | 225,000 | 225,000 | 155,800 | 12,500 | |||||||||||

| Cumulative convertible preferred equity | 145,912 | 145,912 | - | - | - | - | ||||||||||

| Cumulative redeemable preferred equity | 24,412 | 24,412 | 24,412 | 24,412 | 24,412 | |||||||||||

| Partners' capital (less redeemable preferred equity) | 972,769 | 774,217 | 737,497 | 752,991 | 787,396 | |||||||||||

| As of and for the years ended December 31, | ||||||||||||||||

| 2007 | 2006(1) | 2005(1) | 2004(1) | 2003(1) | ||||||||||||

| OTHER DATA: | ||||||||||||||||

Interest coverage ratio(2) | 3.0 | X | 2.8 | X | 2.7 | X | 3.0 | X | 3.1 | X | ||||||

Same-property gross operating margin(3)(4) | 67% | 67% | 66% | 65% | 66% | |||||||||||

| Average same-property monthly rental rate per | ||||||||||||||||

apartment unit(4)(5) | $ | 1,314 | $ | 1,225 | $ | 1,149 | $ | 1,055 | $ | 1,088 | ||||||

| Average same-property monthly operating expenses | ||||||||||||||||

per apartment unit(4)(6) | $ | 437 | $ | 421 | $ | 395 | $ | 331 | $ | 325 | ||||||

| Total apartment units (at end of period) | 27,489 | 27,553 | 26,587 | 25,518 | 26,012 | |||||||||||

Same-property occupancy rate(7) | 96% | 96% | 97% | 96% | 96% | |||||||||||

| Total Properties (at end of period) | 134 | 130 | 126 | 131 | 132 | |||||||||||

| Years Ended December 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| ($ in thousands, except per share amounts) | ||||||||||||||||||||

OPERATING DATA:(1) | ||||||||||||||||||||

| Rental and other property | $ | 1,185,498 | $ | 961,591 | $ | 603,327 | $ | 527,945 | $ | 461,866 | ||||||||||

| Management and other fees from affiliates | 8,909 | 9,347 | 7,263 | 8,457 | 5,428 | |||||||||||||||

| Income before discontinued operations | $ | 248,239 | $ | 134,438 | $ | 140,882 | $ | 127,653 | $ | 46,958 | ||||||||||

| Income from discontinued operations | — | — | 31,173 | 11,937 | 10,558 | |||||||||||||||

| Net income | 248,239 | 134,438 | 172,055 | 139,590 | 57,516 | |||||||||||||||

| Net income available to common stockholders | $ | 226,865 | $ | 116,859 | $ | 150,811 | $ | 119,812 | $ | 40,368 | ||||||||||

| Per share data: | ||||||||||||||||||||

| Basic: | ||||||||||||||||||||

| Income before discontinued operations available to common stockholders | $ | 3.50 | $ | 2.07 | $ | 3.26 | $ | 3.10 | $ | 0.94 | ||||||||||

| Net income available to common stockholders | $ | 3.50 | $ | 2.07 | $ | 4.05 | $ | 3.42 | $ | 1.24 | ||||||||||

| Weighted average common stock outstanding | 64,872 | 56,547 | 37,249 | 35,032 | 32,542 | |||||||||||||||

| Diluted: | ||||||||||||||||||||

| Income before discontinued operations available to common stockholders | $ | 3.49 | $ | 2.06 | $ | 3.25 | $ | 3.09 | $ | 0.94 | ||||||||||

| Net income available to common stockholders | $ | 3.49 | $ | 2.06 | $ | 4.04 | $ | 3.41 | $ | 1.24 | ||||||||||

| Weighted average common stock outstanding | 65,062 | 56,697 | 37,335 | 35,125 | 32,629 | |||||||||||||||

| Cash dividend per common share | $ | 5.76 | $ | 5.11 | $ | 4.84 | $ | 4.40 | $ | 4.16 | ||||||||||

(1) | Reclassifications have been made in prior periods to conform to the current year’s presentation. |

| As of December 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| ($ in thousands) | ||||||||||||||||||||

BALANCE SHEET DATA:(1) | ||||||||||||||||||||

| Investment in rental properties (before accumulated depreciation) | $ | 12,331,469 | $ | 11,244,681 | $ | 5,443,757 | $ | 5,033,672 | $ | 4,313,064 | ||||||||||

| Net investment in rental properties | 10,381,577 | 9,679,875 | 4,188,871 | 3,952,155 | 3,393,038 | |||||||||||||||

| Real estate under development | 242,326 | 429,096 | 50,430 | 66,851 | 44,280 | |||||||||||||||

| Co-investments | 1,036,047 | 1,042,423 | 677,133 | 571,345 | 383,412 | |||||||||||||||

| Total assets | 12,005,091 | 11,526,732 | 5,162,320 | 4,826,356 | 4,019,519 | |||||||||||||||

| Total indebtedness | 5,315,464 | 5,080,689 | 3,009,005 | 2,797,816 | 2,343,413 | |||||||||||||||

| Redeemable noncontrolling interest | 45,452 | 23,256 | — | — | — | |||||||||||||||

| Cumulative convertible preferred stock | — | — | 4,349 | 4,349 | 4,349 | |||||||||||||||

| Cumulative redeemable preferred stock | 73,750 | 73,750 | 73,750 | 73,750 | 73,750 | |||||||||||||||

| Stockholders' equity | 6,237,733 | 6,022,672 | 1,884,619 | 1,764,804 | 1,437,527 | |||||||||||||||

(1) | Reclassifications have been made in prior periods to conform to the current year’s presentation. Additionally, due to measurement adjustments related to the BRE merger in 2014, certain amounts do not agree to previously reported balances. |

| As of and for the years ended December 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| ($ in thousands, except per share amounts) | ||||||||||||||||||||

| OTHER DATA: | ||||||||||||||||||||

Funds from operations (FFO)(1) attributable to common stockholders and unitholders: | ||||||||||||||||||||

| Net income available to common stockholders | $ | 226,865 | $ | 116,859 | $ | 150,811 | $ | 119,812 | $ | 40,368 | ||||||||||

| Adjustments: | ||||||||||||||||||||

| Depreciation and amortization | 453,423 | 360,592 | 193,518 | 170,686 | 152,543 | |||||||||||||||

| Gains not included in FFO attributable to common stockholders and unitholders | (81,347 | ) | (50,064 | ) | (67,975 | ) | (60,842 | ) | (7,543 | ) | ||||||||||

| Depreciation add back from unconsolidated co-investments | 49,826 | 33,975 | 15,748 | 14,467 | 12,642 | |||||||||||||||

| Noncontrolling interest related to Operating Partnership units | 7,824 | 4,911 | 8,938 | 7,950 | 3,228 | |||||||||||||||

| Insurance reimbursements | (1,751 | ) | — | — | — | — | ||||||||||||||

| Depreciation attributable to third party ownership and other | (781 | ) | (1,331 | ) | (1,309 | ) | (1,223 | ) | (1,066 | ) | ||||||||||

| Funds from operations attributable to common stockholders and unitholders | $ | 654,059 | $ | 464,942 | $ | 299,731 | $ | 250,850 | $ | 200,172 | ||||||||||

| Non-core items: | ||||||||||||||||||||

| Merger and integration expenses | 3,798 | 53,530 | 4,284 | — | — | |||||||||||||||

| Acquisition and investment related costs | 2,414 | 1,878 | 1,161 | 2,255 | 1,231 | |||||||||||||||

| Gain on sale of marketable securities, note prepayment, and other investments | (598 | ) | (886 | ) | (2,519 | ) | (819 | ) | (4,956 | ) | ||||||||||

| Gain on sale of co-investments | — | — | — | — | (919 | ) | ||||||||||||||

| Gain on sale of land | — | (2,533 | ) | (1,503 | ) | — | (180 | ) | ||||||||||||

| Loss on early retirement of debt | 6,114 | 268 | 300 | 5,009 | 1,163 | |||||||||||||||

| Co-investment promote income | (192 | ) | (10,640 | ) | — | (2,299 | ) | — | ||||||||||||

| Income from early redemption of preferred equity investments | (1,954 | ) | (5,250 | ) | (1,358 | ) | — | — | ||||||||||||

| Insurance reimbursements | (2,319 | ) | — | — | — | — | ||||||||||||||

Other non-core items, net (2) | (651 | ) | 1,852 | — | — | 268 | ||||||||||||||

| Core funds from operations (Core FFO) attributable to common stockholders and unitholders | $ | 660,671 | $ | 503,161 | $ | 300,096 | $ | 254,996 | $ | 196,779 | ||||||||||

Weighted average number of shares outstanding, diluted (FFO)(3) | 67,310 | 58,921 | 39,501 | 37,378 | 34,861 | |||||||||||||||

Funds from operations attributable to common stockholders and unitholders per share - diluted | $ | 9.72 | $ | 7.89 | $ | 7.59 | $ | 6.71 | $ | 5.74 | ||||||||||

Core funds from operations attributable to common stockholders and unitholders per share - diluted | $ | 9.82 | $ | 8.54 | $ | 7.60 | $ | 6.82 | $ | 5.64 | ||||||||||

(1) | FFO is a financial measure that is commonly used in the REIT industry. The Company presents funds from operations as a supplemental operating performance measure. FFO is not used by the Company, nor should it be considered to be, as an alternative to net earnings computed under GAAP as an indicator of the Company’s operating performance or as an alternative to cash from operating activities computed under GAAP as an indicator of the Company's ability to fund its cash needs. |

| Years Ended December 31, | ||||||||||||||||

| 2007 | 2006(1) | 2005(1) | 2004(1) | 2003(1) | ||||||||||||

(Dollars in thousands) | ||||||||||||||||

| RECONCILIATION OF NET INCOME TO | ||||||||||||||||

ADJUSTED EBITDA (2): | ||||||||||||||||

| Net income | $ | 137,300 | $ | 79,847 | $ | 98,300 | $ | 103,808 | $ | 56,966 | ||||||

| Interest expense | 80,995 | 72,898 | 70,784 | 60,709 | 49,985 | |||||||||||

| Tax expense | 400 | 525 | 2,538 | 257 | - | |||||||||||

| Depreciation and amortization | 100,389 | 78,094 | 74,849 | 66,414 | 51,814 | |||||||||||

| Amortization of deferred financing costs | 3,071 | 2,745 | 1,947 | 1,560 | 1,187 | |||||||||||

| Gain on the sales of real estate | - | - | (6,391) | (7,909) | - | |||||||||||

| Gain on the sales of co-investment activities, net | (2,046) | - | (18,116) | (39,242) | - | |||||||||||

| Minority interests | 4,847 | 4,977 | 5,340 | 4,550 | 4,696 | |||||||||||

| Income from discontinued operations (net of minority interest) | (80,546) | (33,015) | (35,558) | (7,469) | (8,660) | |||||||||||

Adjusted EBITDA(2) | 244,410 | 206,071 | 193,693 | 182,678 | 155,988 | |||||||||||

| Interest expense | 80,995 | 72,898 | 70,784 | 60,709 | 49,985 | |||||||||||

Interest coverage ratio(2) | 3.0 | X | 2.8 | X | 2.7 | X | 3.0 | X | 3.1 | X | ||||||

| (a) | historical cost accounting for real estate assets in accordance with GAAP assumes, through |

| (b) | REITs were created as a legal form of organization in order to encourage public ownership of real estate as an asset class through investment in firms that |

(2) | Other items, net are non-recurring in nature and |

(3) | Assumes conversion of all dilutive outstanding operating partnership interests in the Operating Partnership and excludes 744,346 DownREIT units |

| Years Ended December 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| ($ in thousands, except per unit amounts) | ||||||||||||||||||||

OPERATING DATA:(1) | ||||||||||||||||||||

| Rental and other property | $ | 1,185,498 | $ | 961,591 | $ | 603,327 | $ | 527,945 | $ | 461,866 | ||||||||||

| Management and other fees from affiliates | 8,909 | 9,347 | 7,263 | 8,457 | 5,428 | |||||||||||||||

| Income before discontinued operations | $ | 248,239 | $ | 134,438 | $ | 140,882 | $ | 127,653 | $ | 46,958 | ||||||||||

| Income from discontinued operations | — | — | 31,173 | 11,937 | 10,558 | |||||||||||||||

| Net income | 248,239 | 134,438 | 172,055 | 139,590 | 57,516 | |||||||||||||||

| Net income available to common unitholders | $ | 234,689 | $ | 121,726 | $ | 159,749 | $ | 127,771 | $ | 43,593 | ||||||||||

| Per unit data: | ||||||||||||||||||||

| Basic: | ||||||||||||||||||||

| Income before discontinued operations available to common unitholders | $ | 3.50 | $ | 2.07 | $ | 3.27 | $ | 3.11 | $ | 0.95 | ||||||||||

| Net income available to common unitholders | $ | 3.50 | $ | 2.07 | $ | 4.06 | $ | 3.43 | $ | 1.25 | ||||||||||

| Weighted average common units outstanding | 67,054 | 58,772 | 39,380 | 37,252 | 34,774 | |||||||||||||||

| Diluted: | ||||||||||||||||||||

| Income before discontinued operations available to common unitholders | $ | 3.49 | $ | 2.07 | $ | 3.26 | $ | 3.10 | $ | 0.95 | ||||||||||

| Net income available to common unitholders | $ | 3.49 | $ | 2.07 | $ | 4.05 | $ | 3.42 | $ | 1.25 | ||||||||||

| Weighted average common units outstanding | 67,244 | 58,921 | 39,467 | 37,344 | 34,861 | |||||||||||||||

| Cash distributions per common unit | $ | 5.76 | $ | 5.11 | $ | 4.84 | $ | 4.40 | $ | 4.16 | ||||||||||

(1) | Reclassifications have been made in prior periods to conform to the |

| As of December 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| ($ in thousands) | ||||||||||||||||||||

BALANCE SHEET DATA:(1) | ||||||||||||||||||||

| Investment in rental properties (before accumulated depreciation) | $ | 12,331,469 | $ | 11,244,681 | $ | 5,443,757 | $ | 5,033,672 | $ | 4,313,064 | ||||||||||

| Net investment in rental properties | 10,381,577 | 9,679,875 | 4,188,871 | 3,952,155 | 3,393,038 | |||||||||||||||

| Real estate under development | 242,326 | 429,096 | 50,430 | 66,851 | 44,280 | |||||||||||||||

| Co-investments | 1,036,047 | 1,042,423 | 677,133 | 571,345 | 383,412 | |||||||||||||||

| Total assets | 12,005,091 | 11,526,732 | 5,162,320 | 4,826,356 | 4,019,519 | |||||||||||||||

| Total indebtedness | 5,315,464 | 5,080,689 | 3,009,005 | 2,797,816 | 2,343,413 | |||||||||||||||

| Redeemable noncontrolling interest | 45,452 | 23,256 | — | — | — | |||||||||||||||

| Cumulative convertible preferred interest | — | — | 4,349 | 4,349 | 4,349 | |||||||||||||||

| Cumulative redeemable preferred interest | 71,209 | 71,209 | 71,209 | 71,209 | 71,209 | |||||||||||||||

| Partners' capital | 6,287,381 | 6,073,433 | 1,932,108 | 1,811,427 | 1,486,914 | |||||||||||||||

(1) | Reclassifications have been made in prior periods to conform to the |

| As of December 31, 2007 | As of December 31, 2006 | ||||

| Apartment Units | % | Apartment Units | % | ||

| Southern California | 12,725 | 52% | 12,965 | 55% | |

| Northern California | 6,361 | 26% | 5,389 | 23% | |

| Seattle Metro | 5,005 | 21% | 4,905 | 21% | |

| Other Regions | 302 | 1% | 302 | 1% | |

| Total | 24,393 | 100% | 23,561 | 100% | |

| As of | As of | ||||||||||

| December 31, 2015 | December 31, 2014 | ||||||||||

| Apartment Homes | % | Apartment Homes | % | ||||||||

| Southern California | 23,707 | 49 | % | 22,168 | 47 | % | |||||

| Northern California | 14,694 | 30 | % | 14,789 | 31 | % | |||||

| Seattle Metro | 10,239 | 21 | % | 10,216 | 21 | % | |||||

| Arizona | — | — | % | 552 | 1 | % | |||||

| Total | 48,640 | 100 | % | 47,725 | 100 | % | |||||

| Years ended | |||

| December 31, | |||

| 2007 | 2006 | ||

| Southern California | 95.6% | 96.3% | |

| Northern California | 96.8% | 96.7% | |

| Seattle Metro | 96.3% | 96.8% | |

| Other Regions | 92.5% | 90.6% | |

Years ended December 31, | |||||

| 2015 | 2014 | ||||

| Southern California | 96.2 | % | 96.3 | % | |

| Northern California | 96.3 | % | 96.2 | % | |

| Seattle Metro | 96.2 | % | 96.0 | % | |

| Years Ended | ||||||||||||||

| Number of | December 31, | Dollar | Percentage | |||||||||||

| Properties | 2007 | 2006 | Change | Change | ||||||||||

Property Revenues (dollars in thousands) | ||||||||||||||

| 2007/2006 Same-Properties: | ||||||||||||||

| Southern California | 56 | $ | 185,060 | $ | 177,336 | $ | 7,724 | 4.4 | % | |||||

| Northern California | 16 | 60,024 | 54,887 | 5,137 | 9.4 | |||||||||

| Seattle Metro | 22 | 56,427 | 50,852 | 5,575 | 11.0 | |||||||||

| Other Regions | 1 | 2,015 | 1,980 | 35 | 1.8 | |||||||||

| Total 2007/2006 Same-Property revenues | 95 | 303,526 | 285,055 | 18,471 | 6.5 | |||||||||

| 2007/2006 Non-Same Property Revenues (1) | 79,907 | 49,715 | 30,192 | 60.7 | ||||||||||

| Total property revenues | $ | 383,433 | $ | 334,770 | $ | 48,663 | 14.5 | % | ||||||

| Number of | Years Ended December 31, | Dollar | Percentage | |||||||||||||||

Property Revenues ($ in thousands) | Properties | 2015 | 2014 | Change | Change | |||||||||||||

2015/2014 Same-Properties: (1) | ||||||||||||||||||

| Southern California | 58 | $ | 283,435 | $ | 267,413 | $ | 16,022 | 6.0 | % | |||||||||

| Northern California | 37 | 250,478 | 226,679 | $ | 23,799 | 10.5 | % | |||||||||||

| Seattle Metro | 34 | 124,143 | 115,219 | 8,924 | 7.7 | % | ||||||||||||

| Total 2015/2014 Same-Property revenues | 129 | 658,056 | 609,311 | 48,745 | 8.0 | % | ||||||||||||

| 2015/2014 Non-Same Property Revenues | 527,442 | 352,280 | 175,162 | 49.7 | % | |||||||||||||

| Total property revenues | $ | 1,185,498 | $ | 961,591 | $ | 223,907 | 23.3 | % | ||||||||||

(1) | Same-property excludes BRE properties acquired April 1, 2014 and properties held for sale. |

| Years ended | ||||||||

| December 31, | Years ended December 31, | |||||||

| 2006 | 2005 | 2014 | 2013 | |||||

| Southern California | 96.3% | 96.5% | 96.3 | % | 96.1 | % | ||

| Northern California | 96.7% | 97.1% | 96.3 | % | 96.1 | % | ||

| Seattle Metro | 96.9% | 96.7% | 96.0 | % | 96.1 | % | ||

| Other Regions | 90.6% | 88.1% | ||||||

| Years Ended | ||||||||||||||

| Number of | December 31, | Dollar | Percentage | |||||||||||

| Properties | 2006 | 2005 | Change | Change | ||||||||||

Property Revenues (dollars in thousands) | ||||||||||||||

| 2006/2005 Same-Properties: | ||||||||||||||

| Southern California | 53 | $ | 174,156 | $ | 164,550 | $ | 9,606 | 5.8 | % | |||||

| Northern California | 16 | 54,887 | 50,625 | 4,262 | 8.4 | |||||||||

| Seattle Metro | 21 | 48,663 | 44,551 | 4,112 | 9.2 | |||||||||

| Other Regions | 1 | 1,980 | 1,843 | 137 | 7.4 | |||||||||

| Total 2006/2005 Same-Property revenues | 91 | 279,686 | 261,569 | 18,117 | 6.9 | |||||||||

| 2006/2005 Non-Same Property Revenues (1) | 55,084 | 41,666 | 13,418 | 32.2 | ||||||||||

| Total property revenues | $ | 334,770 | $ | 303,235 | $ | 31,535 | 10.4 | % | ||||||

| Number of | Years Ended December 31, | Dollar | Percentage | |||||||||||||||

Property Revenues ($ in thousands) | Properties | 2014 | 2013 | Change | Change | |||||||||||||

| 2014/2013 Same-Properties: | ||||||||||||||||||

| Southern California | 58 | $ | 267,413 | $ | 253,503 | $ | 13,910 | 5.5 | % | |||||||||

| Northern California | 35 | 218,577 | 199,395 | 19,182 | 9.6 | % | ||||||||||||

| Seattle Metro | 29 | 115,219 | 107,225 | 7,994 | 7.5 | % | ||||||||||||

| Total 2014/2013 Same-Property revenues | 122 | 601,209 | 560,123 | 41,086 | 7.3 | % | ||||||||||||

2014/2013 Non-Same Property Revenues (1) | 80,059 | 43,204 | 36,855 | 85.3 | % | |||||||||||||

2014 BRE Legacy Property Revenues (2) | 280,323 | — | 280,323 | |||||||||||||||

| Total property revenues | $ | 961,591 | $ | 603,327 | $ | 358,264 | 59.4 | % | ||||||||||

(1) | Includes eleven communities acquired after January 1, 2013, three sold communities and one redevelopment community. |

(2) | Includes 55 stabilized properties acquired in connection with the BRE merger on April 1, 2014, and two development communities in lease-up. |

| For the year ended December 31, | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| Cash flow provided by (used in): | ||||||||||||

| Operating activities | $ | 617,410 | $ | 493,312 | $ | 304,982 | ||||||

| Investing activities | $ | (725,556 | ) | $ | (1,147,156 | ) | $ | (453,696 | ) | |||

| Financing activities | $ | 108,214 | $ | 520,610 | $ | 148,599 | ||||||

| 2009 and | 2011 and | ||||||||||||||

| (In thousands) | 2008 | 2010 | 2012 | Thereafter | Total | ||||||||||

| Mortgage notes payable | $ | 116,357 | $ | 179,502 | $ | 198,728 | $ | 768,286 | $ | 1,262,873 | |||||

| Exchangeable bonds | - | - | - | 225,000 | 225,000 | ||||||||||

| Lines of credit | 8,818 | 161,000 | - | - | 169,818 | ||||||||||

| Interest on indebtedness | 87,000 | 93,100 | 57,900 | 204,800 | 442,800 | ||||||||||

| Development commitments | 153,000 | 260,600 | 89,800 | 33,700 | 537,100 | ||||||||||

| Redevelopment commitments | 42,700 | 31,900 | - | - | 74,600 | ||||||||||

| Essex Apartment Value Fund II, L.P. | |||||||||||||||

| capital commitment | 13,383 | - | - | - | 13,383 | ||||||||||

| $ | 421,258 | $ | 726,102 | $ | 346,428 | $ | 1,231,786 | $ | 2,725,574 |

| 2016 | 2017 and 2018 | 2019 and 2020 | Thereafter | Total | ||||||||||||||||

| Mortgage notes payable | $ | 29,714 | $ | 519,802 | $ | 1,279,300 | $ | 329,451 | $ | 2,158,267 | ||||||||||

| Unsecured debt | 350,000 | 365,000 | 75,000 | 2,300,000 | 3,090,000 | |||||||||||||||

| Lines of credit | — | — | 15,000 | — | 15,000 | |||||||||||||||

Interest on indebtedness (1) | 221,917 | 373,819 | 266,313 | 223,734 | 1,085,783 | |||||||||||||||

| Ground leases | 2,742 | 5,484 | 5,484 | 131,851 | 145,561 | |||||||||||||||

| Operating leases | 1,695 | 3,557 | 3,792 | 12,350 | 21,394 | |||||||||||||||

Development commitments (including co-investments) (2) | 195,218 | 329,207 | 17,235 | — | 541,660 | |||||||||||||||

| $ | 801,286 | $ | 1,596,869 | $ | 1,662,124 | $ | 2,997,386 | $ | 7,057,665 | |||||||||||

(1) | Interest on indebtedness for variable debt was calculated using interest rates as of December 31, 2015. |

(2) | Estimated project cost for development the Company's 500 Folsom project is net of a projected value for low-income housing tax credit proceeds and savings from tax exempt bonds. |

| 2015 | 2014 | 2013 | |||||||||

| Earnings from operations | $ | 331,174 | $ | 201,514 | $ | 188,705 | |||||

| Adjustments: | |||||||||||

| General and administrative | 40,090 | 40,878 | 26,684 | ||||||||

| Management and other fees from affiliates | (8,909 | ) | (9,347 | ) | (7,263 | ) | |||||

| Depreciation and amortization | 453,423 | 360,592 | 192,420 | ||||||||

| Merger and integration expenses | 3,798 | 53,530 | 4,284 | ||||||||

| Acquisition and investment related costs | 2,414 | 1,878 | 1,161 | ||||||||

| Net operating income | 821,990 | 649,045 | 405,991 | ||||||||

| Less: Non Same-Property NOI | (357,457 | ) | (229,244 | ) | (22,599 | ) | |||||

| Same-Property NOI | $ | 464,533 | $ | 419,801 | $ | 383,392 | |||||

| Carrying and | ||||||||||||||||||||||||||||||

| Notional | Maturity | Estimate Fair | + 50 | - 50 | ||||||||||||||||||||||||||

| (Dollars in thousands) | Amount | Date Range | Value | Basis Points | Basis Points | |||||||||||||||||||||||||

| Carrying and | Estimated Carrying Value | |||||||||||||||||||||||||||||

| Maturity | Estimated | + 50 | - 50 | |||||||||||||||||||||||||||

($ in thousands) | Notional Amount | Date Range | Fair Value | Basis Points | Basis Points | |||||||||||||||||||||||||

| Cash flow hedges: | Cash flow hedges: | |||||||||||||||||||||||||||||

| Interest rate forward-starting swaps | $ | 450,000 | 2008-2011 | $ | (10,240) | $ | 5,828 | $ | (27,504) | |||||||||||||||||||||

| Interest rate swaps | $ | 225,000 | 2016-2017 | $ | (1,032 | ) | $ | (56 | ) | $ | (2,003 | ) | ||||||||||||||||||

| Interest rate caps | Interest rate caps | 152,749 | 2008-2011 | 13 | 42 | 3 | 20,674 | 2018-2019 | — | — | — | |||||||||||||||||||

| Total cash flow hedges | Total cash flow hedges | $ | 602,749 | 2008-2011 | $ | (10,227) | $ | 5,870 | $ | (27,501) | $ | 245,674 | 2016-2019 | $ | (1,032 | ) | $ | (56 | ) | $ | (2,003 | ) | ||||||||

| For the Years Ended December 31 | ||||||||||||||||||||||||

2008(1) | 2009 | 2010(2) | 2011(3) | 2012 | Thereafter | Total | Fair value | |||||||||||||||||

| (In thousands) | ||||||||||||||||||||||||

| Fixed rate debt | $ | 116,357 | $ | 24,689 | $ | 154,813 | $ | 166,545 | $ | 32,183 | $ | 760,148 | $ | 1,254,735 | $ | 1,301,938 | ||||||||

| Average interest rate | 6.8% | 7.2% | 8.0% | 6.3% | 5.2% | 5.2% | ||||||||||||||||||

| Variable rate LIBOR debt | $ | 8,818 | $ | 173,150 | $ | - | $ | - | $ | - | $ | 220,988 | (4) | $ | 402,956 | $ | 402,956 | |||||||

| Average interest rate | 5.6% | 5.7% | - | - | - | 4.5% | ||||||||||||||||||

| For the Years Ended December 31, | |||||||||||||||||||||||||||||||