PART I

Item 1. Business | |

Overview

Cognizant is one of information technology (IT), consulting and business process services, dedicated to helping the world’s leading professional services companies, transforming clients’ business, operating and technology models for the digital era. Our industry-based, consultative approach helps customers envision, build strongerand run more innovative and efficient businesses. Our clients engage us to help them operate more efficiently, provideservices include digital services and solutions, for critical business and technology problems, and to help them drive technology-based innovation and growth. Our core competencies include: business, process, operations and IT consulting, application development, and systems integration, enterprise information management, application testing, application maintenance, IT infrastructure services and business process services. Digital services are becoming an increasingly important part of our portfolio of services and solutions and are often integrated or delivered along with our other services. We tailor our services and solutions to specific industries and utilizeuse an integrated global delivery model. This seamless global sourcing model combines industry-specific expertise, clientthat employs customer service teams based on-site at the clientcustomer locations and delivery teams located at customer locations and dedicated near-shoreglobal and offshore globalregional delivery centers.

We go to market across our four industry-based business environment, many companies face intense competitive pressure and rapidly changing market dynamics, driven by such factors as changes in the economy, government regulations, globalization, virtualization and other technological innovations. Companies must also evaluate the effect of emerging digital technologies, including social networks, mobile devices, advanced analytics and cloud computing, on their business operations. These technologies represent a new IT infrastructure that continues to transform the way companies relate to theirsegments. Our customers engage with employees, and bring innovative products and services to market. In response to these challenges, many companies are focused on improving efficiencies and enhancing effectiveness while also driving innovation through technology to favorably impact both the bottom-line and the top-line. Companies increasingly view a global sourcing model as a key to their efforts to operate more cost-effectively and productively. At the same time, companies are confronting secular industry shifts, changing customer requirements and new technologies that require them to innovate by building new and different capabilities with emerging technologies to ensure their businesses stay competitive.

| Financial Services | Healthcare | |||||

• Manufacturing and Logistics | ||||||

Our Financial Services segment includes banking, capital markets and insurance companies. Demand in this segment is driven by our customers’ focus on cost optimization in the face of profitability pressures, the need to be compliant with significant regulatory requirements and adaptable to regulatory change, and their adoption and integration of digital technologies, including customer experience enhancement, robotic process automation, analytics and artificial intelligence in areas such as digital lending and next generation payments.

Our Healthcare segment consists of healthcare providers and payers as well as life sciences companies, including pharmaceutical, biotech and medical device companies. Demand in this segment is driven by emerging industry trends, including enhanced compliance, integrated health management, claims investigative services, as well as services that drive operational improvements in areas such as claims processing, enrollment, membership and billing, in addition to the adoption and integration of digital technologies, such as artificial intelligence, personalized care plans and predictive data analytics to improve patient outcomes.

Our Products and Resources segment includes manufacturers, retailers, travel and hospitality companies, as well as companies providing logistics, energy and utility services. Demand in this segment is driven by our customers’ focus on improving the efficiency of their operations, the enablement and integration of mobile platforms to support sales and other omni channel commerce initiatives, and their adoption and integration of digital technologies, such as the application of intelligent systems to manage supply chain and enhance overall customer experiences.

Our Communications, Media and Technology segment includes information, media and entertainment, communications and technology companies. Demand in this segment is driven by our customers’ need to manage their digital content, create differentiated user experiences, transition to agile development methodologies, enhance their networks and adopt and integrate digital technologies, such as cloud enablement and interactive and connected products.

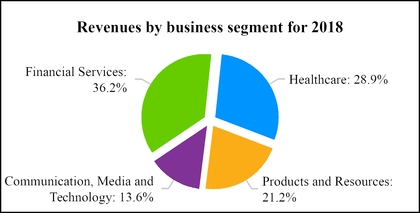

For the year ended December 31, 2015,2018, the distribution of our revenues across our four industry-based business segments was as follows: 40.3% from Financial Services, 29.5% from Healthcare, 18.9% from Manufacturing/Retail/Logistics and 11.3% from Other.

See Note 153 to our consolidated financial statements for additional information related to disaggregation of revenues by customer location, service line and contract-type for each of our business segments, including the disclosure of segment operating profitsegments.

Services and financial information by geographic area.

Our Financial Services business segment serves leading financial institutions throughout the world. Our clientsservices include banks, investment firms and insurance companies. This business segment provides services to our customers operating in the following industries:

We seek to drive organic growth through investments in our digital capabilities, including the extensive training and competition from generics, the drive to expand into new geographic markets, the need for more targeted or personalized therapies leading to research and development innovation, continued diversificationre-skilling of product portfoliosour technical teams and the related high costexpansion of product development, and a dynamic regulatory environment with greater emphasis on product safety, ethics and compliance, transparency of pricing and promotional activity. Our life sciences solutions help transform many of the business processesour local workforces in the life sciences value chain (research, clinical development, manufacturingUnited States and supply chain, sales and marketing) as well as regulatory and administrative functions and general IT. Life sciences companiesother markets around the world where we operate. Additionally, we pursue select strategic acquisitions, joint ventures, investments and alliances that can expand our digital capabilities or the geographic or industry coverage of our business. In 2018, we completed five such acquisitions: Bolder Healthcare Solutions, a provider of revenue cycle management solutions to the healthcare industry in the United States; Hedera Consulting, a business advisory and data analytics service provider in Belgium and the Netherlands; Softvision, a digital engineering and consulting company with significant operations in Romania and India that focuses on agile development of custom cloud-based software and platforms for customers primarily in the United States; ATG, a United States based consulting company that helps companies plan, implement, and optimize automated cloud-based quote-to-cash business processes and technologies; and SaaSfocus, a Salesforce services provider in Australia.

We have significantly increased their emphasis on digital engagement with all of their stakeholders while increasingly leveraging enterprise-level analytics to drive a customer-centric approach to marketingorganized our services and sales.

solutions into three practice areas: Digital Business, Digital Operations, and Digital Systems and Technology. These practice areas are supported by Cognizant Consulting, our Global Technology Office and Cognizant Accelerator.

Cognizant Digital Business

Our Manufacturing, Retail and Logisticsdigital business segment provides services for global leaders in a range of sub-sectors, including industrial, automotive, process logistics, energy and utilities, and retail. Thispractice helps customers rethink their business segment services customers in the following industry groups:

Cognizant Digital Operations

Our digital operations practice helps customers rethink their businesses.

Cognizant Digital Systems & Technology

Our digital systems and technology practice helps customers reshape their technology models to simplify, modernize and secure the enabling systems that form the backbone of their business. Areas of focus within this practice area include system integration services, infrastructure services (including cloud), quality engineering and assurance, and security and application services. Our application services include traditional development, testing and maintenance and agile development ofnew software and applications that transform existing businesses at speed and scale.

Cognizant Consulting, Global Technology Office, and Cognizant Accelerator

Supporting our three practice areas, the Cognizant Consulting team provides global business, process, operations and technology consulting services related services includeto our customers. Our consulting professionals and domain experts from our industry-focused business segments work closely with our practice areas to ensure process excellencecreate frameworks, platforms and solutions that customers find valuable as they pursue new efficiencies and look to leverage digital technologies across their operations. Our Global Technology Office and Cognizant Accelerator focus on utilizing new technologies to develop innovative and practical offerings for customers' emerging needs and support our business segments and practice areas.

Global Delivery Model

We utilize a global delivery model, with delivery centers worldwide, to provide the full range of platform-based services.services we offer to our customers. Our goals for our client relationships areglobal delivery model includes four distinct delivery methods, with most customer satisfaction, operational productivity, strategic value and business transformation. Among the factors driving growthengagements utilizing several or all of these delivery methods. Our global delivery model includes employees located in our services are the desire to improve cost-effectiveness, the emergence of digital technologies, and the need for clients to access capabilities beyond their organizations to adapt to rapid changes in technologies, markets and customer demands.

Sales and Marketing

We market and sell our services directly through our professional staff, senior management and direct sales personnel operating out of our global headquarters and business development offices, which are strategically located in various metropolitan areas around the world. The sales and marketing group works with our clientcustomer delivery team as the sales process moves closer to thea customer’s selection of a services provider. The duration of the sales process may vary widely depending on the type and complexity of services.

Customers

The services we provide are distributed among a number of customers served by us has increased significantly in recent years. As of December 31, 2015, we increased the number of strategic clients to 300. We define a strategic client as one offering the potential to generate at least $5 million to $50 million or more in annual revenues at maturity. Accordingly, we provide a significant volume of services to many customers in each of our business segments. Therefore, aA loss of a significant customer or a few significant customers in a particular segment could materially reduce revenues for suchthat segment. However, no individual customer exceeded 10.0% of our consolidated revenues for the years ended December 31, 2015, 2014 and 2013. In addition, the services we provide to our larger customers are often critical to thetheir operations of such customers and a termination of our services generally would typically require an extended transition period with gradually declining revenues. For the years ended December 31, 2015, 2014 and 2013, 78.6%, 76.8% and 77.6% of our revenue, respectively, was from North American customers. The volume of work performed for specific customers is likely to vary from year to year, and a significant customer in one year may not use our services in a subsequent year. Presented in the table below is additional information aboutRevenues from our customers.top customers as a percentage of total revenues were as follows:

| Year Ended December 31, | |||||||||

| 2015 | 2014 | 2013 | |||||||

| Revenues from top five customers as a percentage of total revenues | 11.0 | % | 12.2 | % | 13.2 | % | |||

| Revenues from top ten customers as a percentage of total revenues | 18.6 | % | 21.3 | % | 22.6 | % | |||

| Revenues under fixed-bid contracts as a percentage of total revenues | 36.5 | % | 35.5 | % | 34.0 | % | |||

| For the years ended December 31, | |||||||||

| 2018 | 2017 | 2016 | |||||||

| Top five customers | 8.6 | % | 8.9 | % | 10.0 | % | |||

| Top ten customers | 15.4 | % | 14.9 | % | 16.7 | % | |||

Competition

The intenselymarkets for our services are highly competitive, IT services and outsourcing market includescharacterized by a large number of participants and is subject to rapid change. This market includes participants from a variety of market segments, including:

Our direct competitors include, among others, Accenture, Atos, Capgemini, Computer Sciences Corporation,Deloitte Digital, DXC Technology, EPAM Systems, Genpact, HCL Technologies, HP Enterprise, IBM Global Services, Infosys Technologies, Tata Consultancy Services and Wipro. In addition, we compete with numerous smaller local companies in the various geographic markets in which we operate.

our recruiting, training and retention model;

a broad customer referral base;

Intellectual Property

We provide value to our clientscustomers based, in part, on our proprietary innovations, methodologies, reusable knowledge capital and other intellectual property ("IP") assets. We recognize the importance of intellectual propertyIP and its ability to differentiate us from our competitors. We seek IP protection for some of our innovations and rely on a combination of intellectual propertyIP laws, as well as confidentiality procedures and contractual provisions, to protect our intellectual propertyIP and our brand. We have registered, and applied for the registration of, U.S. and international trademarks, service marks, domain names and copyrights. AsWe own or are licensed under a number of December 31, 2015, we have also applied for or obtained a total of 596 trademark registrationspatents, trademarks, copyrights, and licenses, which vary in 63 countries. In addition, we have applied for or obtained 115 U.S.duration, relating to our products and international patents and patent applications and 156 U.S. and international copyright registrations covering certain ofservices. While our proprietary technology assets. AlthoughIP rights are important to our success, we believe the ownership of such patents, copyrights, trademarks and service marks is an important factor in our business and that our success does depend in partas a whole is not materially dependent on the ownership thereof, we rely primarily on the innovative skills, technical competence and marketing abilitiesany particular IP right, or any particular group of our personnel.patents, trademarks, copyrights or licenses.

Employees

We had approximately 221,700281,600 employees at the end of 2015,2018, with approximately 40,800 persons50,000 in the North American region,America, approximately 8,600 persons18,300 in the European regionEurope and approximately 172,300 persons213,300 in various other locations throughout the rest of the world, including 162,500 personsapproximately 194,700 in India. We are not party to any significant collective bargaining agreements. We consider our relations with our employees to be good.

Our Executive Officers

On February 6, 2019, we announced that the Board of Directors has appointed Brian Humphries as our Chief Executive Officer and as a member of the Board, in each case effective April 1, 2019. Francisco D’Souza will step down as the Company’s Chief Executive Officer, effective April 1, 2019, and has agreed to serve as an advisor to the new Chief Executive Officer with the title of “Executive Vice Chairman” from April 1, 2019 through June 30, 2019. Thereafter, he will continue to serve as Vice Chairman of the Board of Directors. Rajeev Mehta will step down as our President, effective on April 1, 2019, and will thereafter serve as an advisor to the new Chief Executive Officer from April 1, 2019 through May 1, 2019, at which point Mr. Mehta’s employment with us will terminate.

The following table identifies our current executive officers:

| Name | Age | Capacities in Which Served | In Current Position Since | ||||

Francisco D’Souza(1) | 47 | Chief Executive Officer | 2007 | ||||

Gordon Coburn(2) | 52 | President | 2012 | ||||

Karen McLoughlin(3) | 51 | Chief Financial Officer | 2012 | ||||

Ramakrishnan Chandrasekaran(4) | 58 | Executive Vice Chairman, Cognizant India | 2013 | ||||

Rajeev Mehta(5) | 49 | Chief Executive Officer, IT Services | 2013 | ||||

Malcolm Frank(6) | 49 | Executive Vice President, Strategy and Marketing | 2012 | ||||

Steven Schwartz(7) | 48 | Executive Vice President, Chief Legal and Corporate Affairs Officer | 2013 | ||||

Sridhar Thiruvengadam(8) | 52 | Chief Operating Officer | 2013 | ||||

Ramakrishna Prasad Chintamaneni(9) | 46 | Executive Vice President and President, Banking and Financial Services | 2013 | ||||

Venkat Krishnaswamy(10) | 62 | Executive Vice President and President, Healthcare & Life Sciences | 2013 | ||||

Debashis Chatterjee(11) | 50 | Executive Vice President and President, Technology Solutions | 2013 | ||||

Dharmendra Kumar Sinha(12) | 53 | Executive Vice President and President, Client Services | 2013 | ||||

Sumithra Gomatam(13) | 48 | Executive Vice President and President, Industry Solutions | 2013 | ||||

| Name | Age | Capacities in Which Served | In Current Position Since | ||||

Francisco D’Souza(1) | 50 | Chief Executive Officer | 2007 | ||||

Rajeev Mehta(2) | 52 | President | 2016 | ||||

Karen McLoughlin(3) | 54 | Chief Financial Officer | 2012 | ||||

Ramakrishnan Chandrasekaran(4) | 61 | Executive Vice Chairman, Cognizant India | 2013 | ||||

Debashis Chatterjee(5) | 53 | Executive Vice President and President, Global Delivery | 2016 | ||||

Ramakrishna Prasad Chintamaneni(6) | 49 | Executive Vice President and President, Global Industries and Consulting | 2016 | ||||

Malcolm Frank(7) | 52 | Executive Vice President, Strategy and Marketing | 2012 | ||||

Matthew Friedrich (8) | 52 | Executive Vice President, General Counsel, Chief Corporate Affairs Officer and Secretary | 2017 | ||||

Sumithra Gomatam(9) | 51 | Executive Vice President and President, Digital Operations | 2016 | ||||

Gajakarnan Vibushanan Kandiah(10) | 51 | Executive Vice President and President, Digital Business | 2016 | ||||

Venkat Krishnaswamy(11) | 65 | Vice Chairman, Healthcare and Life Sciences | 2013 | ||||

James Lennox(12) | 54 | Executive Vice President, Chief People Officer | 2016 | ||||

Sean Middleton(13) | 37 | Senior Vice President and President, Cognizant Accelerator | 2017 | ||||

Allen Shaheen(14) | 56 | Executive Vice President, North American Digital Hubs | 2018 | ||||

Dharmendra Kumar Sinha(15) | 56 | Executive Vice President and President, Global Client Services | 2013 | ||||

Robert Telesmanic(16) | 52 | Senior Vice President, Controller and Chief Accounting Officer | 2017 | ||||

Santosh Thomas(17) | 50 | Executive Vice President and President, Global Growth Markets | 2016 | ||||

Srinivasan Veeraraghavachary(18) | 59 | Chief Operating Officer | 2016 | ||||

| (1) | Francisco D’Souza |

| (2) | Rajeev Mehta has been our President since September 2016. From December 2013 to September 2016, Mr. Mehta served as our Chief Executive Officer, IT Services. From February 2012 to December 2013, Mr. Mehta served as our Group Chief Executive - Industries and Markets. Mr. Mehta held other senior management positions in client services and our financial services business segment from 2001 to 2012. Prior to joining Cognizant in 1997, Mr. Mehta was involved in implementing GE Information Services' offshore outsourcing program and also held consulting positions at Deloitte & Touche LLP and |

Andersen Consulting. Mr. Mehta has a Bachelor of Science degree from the University of Macau (formerly known as the University of East Asia)Maryland and a Master of Business Administrationan MBA degree from Carnegie Mellon University.

| (3) | Karen McLoughlin |

| (4) | Ramakrishnan Chandrasekaran |

| (5) |

| (6) |

Ramakrishna Prasad Chintamaneni |

| (7) | Malcolm Frank has been our Executive Vice President, Strategy and Marketing since February 2012. Mr. Frank served as our Senior Vice President of Strategy and Marketing from 2005 to 2012. Prior to joining Cognizant in 2005, Mr. Frank was a founder and the President and Chief Executive Officer of CXO Systems, Inc., an independent software vendor providing dashboard solutions for senior managers, a founder and the President, Chief Executive Officer and Chairman of NerveWire Inc., a management consulting and systems integration firm, and a founder and executive officer at Cambridge Technology Partners, an information technology professional services firm. Mr. Frank has served on the Board of Directors of Factset Research Systems Inc. since June 2016, where he is a member of the Compensation Committee. Mr. Frank has a Bachelor degree in Economics from Yale University. |

| (8) | Matthew Friedrich has been our Executive Vice President, General Counsel, Chief Corporate Affairs Officer and Secretary since May 2017. Prior to joining Cognizant, Mr. Friedrich was Chief Corporate Counsel for Chevron Corporation, a multinational energy company, from August 2014 to May 2017, a partner with the law firm of Freshfields Bruckhaus Deringer LLP from April 2013 to August 2014 and a partner with the law firm of Boies Schiller & Flexner LLP from June 2009 to April 2013. Mr. Friedrich began his legal career in 1995 as a federal prosecutor with the United States Department of Justice, where he remained for nearly 14 years, culminating with his designation as the acting assistant Attorney General of the Criminal Division in 2008. Mr. Friedrich is a life member of the Council on Foreign Relations and serves on the Board of Directors of the U.S.-India Business Council. Mr. Friedrich has a Bachelor of Arts degree in Foreign Affairs from the University of Virginia and a Juris Doctor degree from the University of Texas School of Law. |

| (9) | Sumithra Gomatam has been our Executive Vice President and President, Digital Operations since August 2016. From December 2013 to August 2016, Ms. Gomatam served as our Executive Vice President and President, Industry Solutions. From 2008 to December 2013, Ms. Gomatam served as Senior Vice President, and global leader for our Testing practice. Ms. Gomatam held other management positions in our global delivery and BFS practices from 1995 to 2008. Ms. Gomatam has a Bachelor of Engineering degree in Electronics and Communication from Anna University. |

| (10) | Gajakarnan Vibushanan Kandiah has been our Executive Vice President and President, Digital Business since August 2016. Mr. Kandiah previously served as Executive Vice President of Business Process Services ("BPS") and Digital Works from January 2014 to August 2016, and as Senior Vice President of BPS from 2011 to December 2013. Previous roles he held at |

Cognizant included roles in System Integration, Testing, BPS, Information, Media and Entertainment, and Communications practices. Before joining Cognizant in 2003, Mr. Kandiah was a founder and the Chief Operating Officer of NerveWire, Inc. and the Global Vice President of the Interactive Solutions business of Cambridge Technology Partners. Mr. Kandiah completed his advanced level education at the Royal College in Sri Lanka.

| (11) | Venkat Krishnaswamy |

| (13) | Sean Middleton has been our Senior Vice President and President, Cognizant Accelerator since January 2017. He was |

| (14) | Allen Shaheen has been our Executive Vice President, North American Digital Hubs since January 2018. He has also served as a director of the Cognizant U.S. Foundation, a non-profit organization, since April 2018. From August 2015 to December 2017, Mr. Shaheen was Executive Vice President, Corporate Development. From December 2013 to August 2016, Mr. Shaheen was also responsible for various Cognizant practices, including our Enterprise Application Services Practice. Mr. Shaheen was the General Manager for our German business unit from February 2013 to December 2014 and our Markets Delivery Leader for Europe from May 2012 to December 2014. Mr. Shaheen's prior roles included being responsible for our IT Infrastructure Services, head of our Global Technology Office and head of our Systems Integration and Testing practices. Prior to joining Cognizant in 2006, Mr. Shaheen was a consultant for Cognizant from 2004 to 2006, a founder and Executive Vice President of International Operations of Cambridge Technology Partners and the Chief Executive Officer of ArsDigita Corporation. Mr. Shaheen has a Bachelor of Arts degree in Engineering and Applied Sciences from Harvard College. |

| (15) | Dharmendra Kumar Sinha has been our Executive Vice President and President, |

| (17) | Santosh Thomas has been our Executive Vice President and President, |

| (18) | Srinivasan Veeraraghavachary has been our |

in 1998. Mr. Veeraraghavachary has a Bachelor degree in Mechanical Engineering from the National Institute of Technology (formerly the Regional Engineering College) in Trichy, India and an MBA degree from the Indian Institute of Management in Calcutta, India.

None of our executive officers is related to any other executive officer or to any of our Directors. Our executive officers are electedappointed annually by the Board of Directors and generally serve until their successors are duly electedappointed and qualified.

Corporate History

We began our IT development and maintenance services business in early 1994 as an in-house technology development center for The Dun & Bradstreet Corporation and its operating units. In 1996, we along with certain other entities, were spun-off from The Dun & Bradstreet Corporation to form a new company, Cognizant Corporation. On June 24,and, in 1998, we completed an initial public offering of our Class A common stock. On June 30, 1998,to become a majority interest in us, and certain other entities were spun-off from Cognizant Corporation to form IMS Health. Subsequently, Cognizant Corporation was renamed Nielsen Media Research, Incorporated.

Available Information

We make available the following public filings with the Securities and Exchange Commission or the SEC,("SEC") free of charge through our website at www.cognizant.com as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the SEC:

our Annual Reports on Form 10-K and any amendments thereto;

our Quarterly Reports on Form 10-Q and any amendments thereto; and

our Current Reports on Form 8-K and any amendments thereto.

In addition, we make available our code of business conduct and ethics entitled “Cognizant’s Core“Core Values and StandardsCode of Business Conduct”Ethics” free of charge through our website. We intend to disclosepost on our website all disclosures that are required by law or Nasdaq Stock Market listing standards concerning any amendments to, or waivers from, any provision of our code of business conduct and ethics that are required to be publicly disclosed pursuant to rules of the SEC and the NASDAQ Global Select Market by posting it on our website.ethics.

No information on our website is incorporated by reference into this Form 10-K or any other public filing made by us with the SEC.

Item 1A. Risk Factors

Factors That May Affect Future Results

We face various important risks and uncertainties, including those described below, that could adversely affect our business, results of operations and financial condition and, as a result, cause a decline in the trading price of our common stock.

Global macroeconomic conditions have a material adverse effect on our ability to retain and attract clients and our competitive position, which could in turn have a material adversesignificant effect on our business resultsas well as the businesses of operationsour customers. Volatile, negative or uncertain economic conditions could cause our customers to reduce, postpone or cancel spending on projects with us and financial condition.could make it more difficult for us to accurately forecast customer demand and have available the right resources to profitably address such customer demand. The short-term nature of contracts in our industry means that actions by customers may occur quickly and with little warning, which may cause us to incur extra costs where we have employed more professionals than customer demand supports.

Our business results of operationsis particularly susceptible to economic and financial condition may be affected by the rate of growthpolitical conditions in the use of technology in business and the type and level of technology spending by our clients.

concentrated. Our revenues are highly dependent on clients concentrated in certain industries, including the financial services and healthcare industries. Consolidation and factors that negatively affect these industries may adversely affect our business, results of operations and financial condition.

of operations. As a developing country, India has also recently experienced civil unrest and terrorism and has been involved in conflicts with neighboring countries. In recent years, there have been military confrontations between India and Pakistan that have occurred in the region of Kashmir and along the India-Pakistan border. The potential for hostilities between the two countries has been high in light of tensions relatedmay continue to recent terrorist incidents in India and the unsettled nature of the regional geopolitical environment, including events in and related to Afghanistan, Iraq and Syria. If India becomes engaged in armed hostilities, particularly if these hostilities are protracted or involve the threat of or use of weapons of mass destruction, it is likely that our business, results of operations and financial condition would be materially adversely affected.

Our success is dependent, in large part, on our ability to keep our supply of skilled professionals, including project managers, IT engineers and senior technical personnel, in balance with customer demand around the Indian rupeeworld and on our ability to attract and retain senior management with the knowledge and skills to lead our business globally. Each year, we must hire tens of thousands of new professionals and retrain, retain, and motivate our workforce of hundreds of thousands of professionals with diverse skills and expertise in order to serve customer demands across the globe, respond quickly to rapid and ongoing technological, industry and macroeconomic developments and grow and manage our business. We also must continue to maintain an effective senior leadership team. The loss of senior executives, or the failure to attract, integrate and retain new senior executives as the needs of our business require, could have a material adverse effect on our business and results of operations.

Competition for skilled labor is intense and, in some jurisdictions in which we operate, there are more jobs for IT professionals than qualified persons to fill these jobs. Our business has experienced significant employee attrition, which may cause us to incur increased costs to hire new professionals with the desired skills. Costs associated with recruiting and training professionals are significant. If we are unable to hire or deploy professionals with the needed skillsets or if we are unable to adequately equip our professionals with the skills needed, this could materially adversely affect our business. Additionally, if we are unable to maintain an employee environment that is competitive and contemporary, it could have an adverse effect on engagement and retention, which may materially adversely affect our business.

We face challenges related to growing our business organically as well as inorganically through acquisitions, and we may not be able to achieve our targeted growth rates.

Achievement of our targeted growth rates requires continued significant organic growth of our business as well as inorganic growth through acquisitions. To achieve such growth, we must, among other foreign currency exchange rates, restrictions on the deployment of cash acrossthings, continue to significantly expand our global operations, increase our product and service offerings and scale our use of derivative financial instruments.

We may not be able to achieve our profitability and capital return goals.

Our goals for profitability and capital return rely upon a number of assumptions, including our ability to improve the efficiency of our operations and make successful investments to grow and further develop our business. Our profitability depends on the efficiency with which we run our operations and the cost of our operations, especially the compensation and benefits costs of the professionals we employ. We may not be able to efficiently utilize our professionals if increased regulation, policy changes or administrative burdens of immigration, work visas or outsourcing prevents us from deploying our professionals globally on a timely basis, or at all, to fulfill the needs of our customers. Wage and other than the U.S. dollar.cost pressures may put pressure on our profitability. Fluctuations in foreign currency exchange rates can also have a number of adverse effects on us. Because our consolidated financial statements are presented in U.S. dollars, we must translate revenues, expenses and income, as well as assets and liabilities, into U.S. dollars at exchange rates in effect during or at the end of each reporting period. Therefore, changes in the value of the U.S. dollar against other currencies will affect our revenues, income from operations and net income and the value of balance sheetwhen items originally denominated in other currencies. There is no guarantee that our financial results will not be adversely affected by currency exchange rate fluctuations. In addition, in some countries we could be subject to strict restrictions on the movement of cash and the exchange of foreign currencies which could limit our ability to use these funds across our global operations. Further, as we continue to leverage our global delivery model, moreare translated or remeasured into U.S. dollars for presentation of our expenses are incurred in currencies other than those in which we bill for the related services. An increase in the value of certain currencies, such as the Indian rupee, against the U.S. dollar could increase costs for delivery of services at offshore sites by increasing labor and other costs that are denominated in local currency.

consolidated financial statements. We have entered into a series of foreign exchange forward contracts that are designated as cash flow hedges of certain rupee denominated payments in India. These contracts are intended to partially offset the impact of the movement of the exchange rates on future operating costs. In addition, we have also entered into foreign exchange forward contracts in ordercosts and to

mitigate foreign currency risk on foreign currency denominated net monetary assets. TheHowever, the hedging strategies that we have implemented, or may in the future implement, to mitigate foreign currency exchange rate risks may not reduce or completely offset our exposure to foreign exchange rate fluctuations and may expose our business to unexpected market, operational and counterparty credit risks. Accordingly,We are particularly susceptible to wage and cost pressures in India and the exchange rate of the Indian rupee relative to the currencies of our customer contracts due to the fact that the substantial majority of our employees are in India while our contracts with customers are typically in the local currency of the country where our customers are located. If we are unable to improve the efficiency of our operations, our operating margin may decline and our business, results of operations and financial condition may be materially adversely affected. Failure to achieve our profitability goals could adversely affect our business, financial condition and results of operations.

With respect to capital return, our ability and decisions to pay dividends and repurchase shares consistent with our announced goals or at all depend on a variety of factors, including our cash flow generated from operations, the amount and geographic location of our cash and investment balances, our net income, our overall liquidity position, potential alternative uses of cash, such as acquisitions, and anticipated future economic conditions and financial results. Failure to achieve our capital return goals may adversely impact our reputation with shareholders and shareholders’ perception of our business and the value of our common stock.

Our failure to meet specified service levels required by certain of our contracts may result in our contracts being less profitable, potential liability for penalties or damages or reputational harm.

Many of our contracts include clauses that tie our compensation to the achievement of agreed-upon performance standards or milestones. Failure to satisfy these measures could significantly reduce or eliminate our fees under the contracts, increase the cost to us of meeting performance standards or milestones, delay expected payments, subject us to potential damage claims under the contract terms or harm our reputation. Customers also often have the right to terminate a contract and pursue damage claims for serious or repeated failure to meet these service commitments. Some of our contracts provide that a portion of our compensation depends on performance measures such as cost-savings, revenue enhancement, benefits produced, business goals attained and adherence to schedule. These goals can be complex and may depend on our customers’ actual levels of business activity or may be based on assumptions that are later determined not to be achievable or accurate. As such, these provisions may increase the variability in revenues and margins earned on those contracts.

We face intense and evolving competition in the rapidly changing markets we compete in.

The markets we serve and operate in are highly competitive, subject to rapid change and characterized by a large number of participants, as described in “Part I, Item 1. Business-Competition.” In addition to large, global competitors, we face competition from numerous smaller, local competitors in many geographic markets that may have more experience with operations in these markets, have well-established relationships with our desired customers, or be able to provide services and solutions at lower costs or on terms more attractive to customers than we can. Consolidation activity may also result in new competitors with greater scale, a broader footprint or vertical integration that makes them more attractive to customers as a single provider of integrated products and services. In addition, the short-term nature of contracts in our industry and the long-term concurrent use by many customers of multiple professional service providers means that we are required to be continually competitive on the quality, scope and pricing of our offerings or face a reduction or elimination of our business.

Our success depends on our ability to continue to develop and implement services and solutions that anticipate and respond to rapid and continuing changes in technology to serve the evolving needs of our customers. If we do not sufficiently invest in new technologies, successfully adapt to industry developments and changing demand, and evolve and expand our business at sufficient speed and scale to keep pace with the demands of the markets we serve, we may be unable to develop and maintain a competitive advantage and execute on our growth strategy, which would materially adversely affect our business, results of operations and financial condition.

Our relationships with our third party alliance partners, who supply us with necessary components to the services and solutions we offer our customers, are also critical to our ability to provide many of our services and solutions that address customer demands. There can be no assurance that we will be able to maintain such relationships. Among other things, such alliance partners may in the future decide to compete with us, form exclusive or more favorable arrangements with our competitors or otherwise reduce our access to their products impairing our ability to provide the services and solutions demanded by customers.

We face legal, reputational and financial risks if we fail to protect customer and/or Cognizant data from security breaches or cyberattacks.

In order to provide our services and solutions, we depend on global information technology networks and systems, including those of third parties, to process, transmit, host and securely store electronic information (including our confidential information and the confidential information of our customers) and to communicate among our locations around the world and with our customers, suppliers and partners. Security breaches, employee malfeasance, or human or technological error could lead to shutdowns or disruptions of our operations and potential unauthorized disclosure of our or our customers’ sensitive data, which in turn could jeopardize projects that are critical to our operations or the operations of our customers’ businesses. Like other global companies, we and the businesses we interact with have experienced threats to data and systems, including by perpetrators of random or targeted malicious cyberattacks, computer viruses, malware, worms, bot attacks or other destructive or disruptive software and attempts to misappropriate customer information and cause system failures and disruptions.

A security compromise of our information systems or of those of businesses with whom we interact that results in confidential information being accessed by unauthorized or improper persons could harm our reputation and expose us to regulatory actions, customer attrition, remediation expenses, disruption of our business, and claims brought by our customers or others for breaching contractual confidentiality and security provisions or data protection laws. Monetary damages imposed on us could be significant and not covered by our liability insurance. Techniques used by bad actors to obtain unauthorized access, disable or degrade service, or sabotage systems evolve frequently and may not immediately produce signs of intrusion, and we may be unable to anticipate these techniques or to implement adequate preventative measures. In addition, a security breach could require that we expend substantial additional resources related to the security of our information systems, diverting resources from other projects and disrupting our businesses. If we experience a data security breach, our reputation could be damaged and we could be subject to additional litigation, regulatory risks and business losses.

We are required to comply with increasingly complex and changing data security and privacy regulations in the United States, the European Union and in other jurisdictions in which we operate that regulate the collection, use and transfer of personal data, including the transfer of personal data between or among countries. In the United States, for example, the Health Insurance Portability and Accountability Act imposes extensive privacy and security requirements governing the transmission, use and disclosure of protected health information by participants in the health care industry. The European Union’s General Data Protection Regulation, which became effective in May 2018, imposes new compliance obligations regarding the handling of personal data and has significantly increased financial penalties for noncompliance. Additionally, the Digital Information Security in Healthcare Act is under consideration in India, which proposed legislation includes significant penalties related to disclosure of healthcare data. Other countries have enacted or are considering enacting data localization laws that require certain data to stay within their borders. We may also face audits or investigations by one or more domestic or foreign government agencies or our customers pursuant to our contractual obligations relating to our compliance with these regulations. Complying with changing regulatory

requirements requires us to incur losses fromsubstantial costs, exposes us to potential regulatory action or litigation, and may require changes to our usebusiness practices in certain jurisdictions, any of derivative financial instruments thatwhich could materially adversely affect our business operations and operating results.

If our business continuity and disaster recovery plans are not effective and our global delivery capability is impacted, our business and results of operations may be materially adversely affected and we may suffer harm to our reputation.

Our business model is dependent on our global delivery capability, which includes coordination between our main operating offices in India, our other global delivery centers, the offices of our customers and our associates worldwide. System failures, outages and operational disruptions may be caused by factors outside of our control such as hostilities, political unrest, terrorist attacks, natural disasters or pandemics affecting the geographies where our operations and transmission equipment is located. Our business continuity and disaster recovery plans may not be effective at preventing or mitigating the effects of such disruptions, particularly in the case of a catastrophic event. Any such disruption may result in lost revenues, a loss of customers and reputational damage, which would have a materialan adverse effect on our business, results of operations and financial condition.

Anti-outsourcing legislation, if adopted, and negative perceptions associated with offshore outsourcing could impair our ability to serviceserve our customers and materially adversely affect our business, results of operations and financial condition.

The issuepractice of companies outsourcing services to organizations operating in other countries is a topic of political discussion in the United States, which is our largest market, as well as in Europe, the Asia Pacific and other regions in which we have clients.customers. For example, measures aimed at limiting or restricting outsourcing by United StatesU.S. companies are periodically considered inhave been put forward for consideration by the U.S. Congress and in numerous state legislatures to address concerns over the perceived association between offshore outsourcing and the loss of jobs domestically. If enacted,any such measures may broaden existing restrictions on outsourcing by federal and state government agencies and on government contracts with firms that outsource

In addition, from time to time there has been publicity about purported negative experiences associated with offshore outsourcing, such as alleged domestic job loss and theft and misappropriation of sensitive clientcustomer data, particularly involving service providers in India. Current or prospective clientscustomers may elect to perform certain services themselves or may be discouraged from utilizing global service delivery providers like us due to negative perceptions that may be associated with using global service delivery models or firms. Any slowdown or reversal of existing industry trends toward global service delivery would seriously harm our ability to compete effectively with competitors that provide the majority of their services from within the country in which our clientscustomers operate.

We provide services to clients, which could hamper our growthcustomers and cause our revenuehave operations in many parts of the world and in a wide variety of different industries, subjecting us to decline.numerous, and sometimes conflicting, laws and regulations on matters as diverse as import and export controls,

temporary work in the United States, Europe, the Asia Pacific and other regions in which we have clients depends on their and our ability to obtain the necessary visas and work permits for our personnel who need to travel internationally. If we are unable to obtain such visasauthorizations or work permits, content requirements, trade restrictions, tariffs, taxation, anti-corruption laws (including the U.S. Foreign Corrupt Practices Act ("FCPA") and the U.K. Bribery Act), government affairs, internal and disclosure control obligations, data privacy, intellectual property and labor relations. We are subject to a wide range of potential enforcement actions, audits or if their issuance is delayedinvestigations regarding our compliance with these laws or if their length is shortened, we may not be ableregulations in the conduct of our business, and any finding of a violation could subject us to provide servicesa wide range of civil or criminal penalties, including fines, debarment, or suspension or disqualification from government contracting, prohibitions or restrictions on doing business, loss of customers and business, legal claims by customers and damage to our clientsreputation.

We face significant regulatory compliance costs and risks as a result of the size and breadth of our business. For example, we commit significant financial and managerial resources to comply with our internal control over financial reporting requirements, but we have in the past and may in the future identify material weaknesses or deficiencies in our internal control over financial reporting that causes us to continueincur incremental remediation costs in order to provide servicesmaintain adequate controls. As another example, we had to spend significant resources on a timelyconducting an internal investigation and cost-effective basis, receive revenues as early as expected or manage our delivery centers as efficiently as we otherwise could, anycooperating with investigations by the U.S. Department of Justice ("DOJ") and the SEC, each of which is now concluded, focused on whether certain payments relating to Company-owned facilities in India were made in violation of the FCPA and other applicable laws.

Changes in tax laws or in their interpretation or enforcement, failure by us to adapt our corporate structure and intercompany arrangements to achieve global tax efficiencies or adverse outcomes of tax audits, investigations or proceedings could have a material adverse effect on our business, results of operations and financial condition.

The industriesinterpretation of tax laws and regulations in which our clients are concentrated, such as the financial services industry and the healthcare industry, are, or may be, increasingly subject to governmental regulation and intervention. For instance, the financial services industry is subject to extensive and complex federal and state regulation. As a provider of services to financial institutions, portions of our operations are examined by a number of regulatory agencies. These agencies regulate the services we provide and mannermany jurisdictions in which we operate. For example, some financial services regulators have imposed guidelines for use of cloud computing services that mandate specific controls oroperate and the related tax accounting principles are complex and require financial services enterprisesconsiderable judgment to obtain regulatory approval prior to outsourcing certain functions. If we are unable to comply with these guidelines or controls, or ifdetermine our income taxes and other tax liabilities worldwide. Tax laws and regulations affecting us and our customers, are unable to obtain regulatory approval to use our services where required, our business may be harmed. In addition, clients inincluding applicable tax rates, and the financial services sector have beeninterpretation and enforcement of such laws and regulations are subject to increased regulation following the enactmentchange as a result of the Dodd-Frank Wall Street Reform and Consumer Protection Act in the United States. New or changing regulations under Dodd-Frank, as well as other regulations or legislation affecting our customers in the financial services industry, may reduce demand for our services or cause us to incur costly changes in our processes or personnel, thereby negatively affecting our business, results of operations and financial condition.

Additionally, we are subject from time to time to tax audits, investigations and proceedings. Tax authorities have disagreed, and may in the future disagree, with our judgments, and are taking increasingly aggressive positions, including with respect to our intercompany transactions. For example, we are currently involved in an ongoing dispute with the Indian Income Tax Department ("ITD") in which the ITD asserts that we owe additional taxes for two transactions by which our principal operating subsidiary in India ("CTS India") repurchased shares from its shareholders, as more fully described in Note 11 to the consolidated financial statements. Adverse outcomes in any such audits, investigations or proceedings could increase our tax exposure and cause us to incur increased expense, which could materially adversely affect our results of operations and financial condition.

We are subject to, and may become a party to, a variety of litigation or increased government interventionother claims and suits that arise from time to time in the conduct of our business. Our business is subject to the risk of litigation involving current and former employees, clients, alliance partners, subcontractors, suppliers, competitors, shareholders, government agencies or others through private actions, class actions, whistleblower claims, administrative proceedings, regulatory actions or other industries in which our clients operate also may adversely affect the growthlitigation. While we maintain insurance for certain potential liabilities, such insurance does not cover all types and amounts of their respective businessespotential liabilities and therefore negatively impact our business, results of operations and financial condition.is subject to various exclusions as well as caps on amounts recoverable.

Our stock price continuescustomer engagements expose us to be volatile.

We also face considerable potential legal liability from a variety of other sources. Our acquisition activities have in the past and may in the future be subject to litigation or other claims, including claims from professionals, customers, stockholders, might otherwise receiveor other third parties. We have also been the subject of a premium for their shares over then-current market prices. These provisions include:

Our earnings may be adversely affected if we change our intent not to fix the rights and preferences, and issue shares of preferred stock;repatriate Indian accumulated undistributed earnings.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

| Geographic Area | Number of Locations | Square Footage Leased (in millions) | Square Footage Owned (in millions) | Total Square Footage (in millions) | ||||||||

| India | 45 | 9.8 | 12.8 | 22.6 | ||||||||

| North America | 35 | 1.1 | 0.2 | 1.3 | ||||||||

| Europe | 15 | 0.3 | — | 0.3 | ||||||||

Rest of World1 | 20 | 0.5 | — | 0.5 | ||||||||

| Total | 115 | 11.7 | 13.0 | 24.7 | ||||||||

We operate out of our Teaneck, New Jersey executive office where we lease 0.1 million square feet.feet of office space for our worldwide headquarters in Teaneck, NJ. In addition to our executive officetotal, we have offices and operations in more than 74 cities in 37 countries around the above development andworld.

We utilize a global delivery model with delivery centers weworldwide, including in-country, regional and global delivery centers. We have business development officesover 26 million square feet of owned and leased facilities for our delivery centers. Our largest delivery center presence is in approximately 68 citiesIndia: Chennai (10 million square feet); Pune (4 million square feet); Kolkata (3 million square feet); Bangalore (2 million square feet); and 35Hyderabad (2 million square feet). Our India delivery centers represent more than two-thirds of our total delivery centers on a square-foot basis. We also have a significant number of delivery centers in other countries, acrossincluding the globe.

United States, Philippines, Canada, Mexico and countries throughout Europe.

We believe that our current facilities are adequate to support our existing operations. We also believeoperations in the immediate future, and that we will be able to obtain suitable additional facilities on commercially reasonable terms on an “as needed basis.”as needed.

Item 3. Legal Proceedings

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

Our Class A common stock trades on the NASDAQNasdaq Global Select Market (NASDAQ)("Nasdaq") under the symbol “CTSH”.

| Quarter Ended | High | Low | ||||

| March 31, 2014 | 54.00 | 44.96 | ||||

| June 30, 2014 | 53.40 | 45.73 | ||||

| September 30, 2014 | 51.38 | 41.51 | ||||

| December 31, 2014 | 54.89 | 42.94 | ||||

| March 31, 2015 | 64.69 | 50.71 | ||||

| June 30, 2015 | 65.96 | 58.35 | ||||

| September 30, 2015 | 69.35 | 57.50 | ||||

| December 31, 2015 | 69.80 | 58.15 | ||||

As of December 31, 2015,2018, the approximate number of holders of record of our Class A common stock was 156125 and the approximate number of beneficial holders of our Class A common stock was 50,200.376,500.

Cash Dividends

Issuer Purchases of Equity Securities

In November 2018, the Board of Directors approved an amendment to our stock repurchase program. Under our stock repurchase program, as amended, and approved by our Board of Directors, allows for thewe are authorized to repurchase of $2.0$5.5 billion, of our outstanding shares of Class A common stock, excluding fees and expenses, through December 31, 2017. Under the stock repurchase program, the Company is authorized to repurchase itsof our Class A common stock through open market purchases, including under a trading plan adopted pursuant to Rule 10b5-1 of the Securities Exchange Act of 1934, as amended, or in private transactions, including through accelerated stock repurchase agreements entered into with financial institutions, in accordance with applicable federal securities laws.laws through December 31, 2020. The timing of repurchases and the exact number of shares to be purchased are determined by the Company's management, in its discretion, or pursuant to a Rule 10b5-1 trading plan, and will depend upon market conditions and other factors.

| Month | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Approximate Dollar Value of Shares that May Yet Be Purchased under the Plans or Programs (in millions) | ||||||||||

| October 1, 2015 - October 31, 2015 | — | $ | — | — | $ | 480.0 | ||||||||

| November 1, 2015 - November 30, 2015 | 400,000 | 64.82 | 400,000 | 454.1 | ||||||||||

| December 1, 2015 - December 31, 2015 | 250,000 | 64.65 | 250,000 | $ | 437.9 | |||||||||

| Total | 650,000 | $ | 64.76 | 650,000 | ||||||||||

| Month | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Approximate Dollar Value of Shares that May Yet Be Purchased under the Plans or Programs (in millions) | ||||||||||

| October 1, 2018 - October 31, 2018 | ||||||||||||||

| Open market purchases | 1,649,171 | $ | 71.56 | 1,649,171 | $ | 657 | ||||||||

| November 1, 2018 - November 30, 2018 | ||||||||||||||

| Open market purchases | 1,175,683 | 69.70 | 1,175,683 | 2,575 | ||||||||||

| December 1, 2018 - December 31, 2018 | ||||||||||||||

| Open market purchases | 776,935 | 64.34 | 776,935 | 2,525 | ||||||||||

| Total | 3,601,789 | $ | 69.39 | 3,601,789 | ||||||||||

______________

1 | Free cash flow is not a measurement of financial performance prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"). See “Non-GAAP Financial Measures” in Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations for more information. |

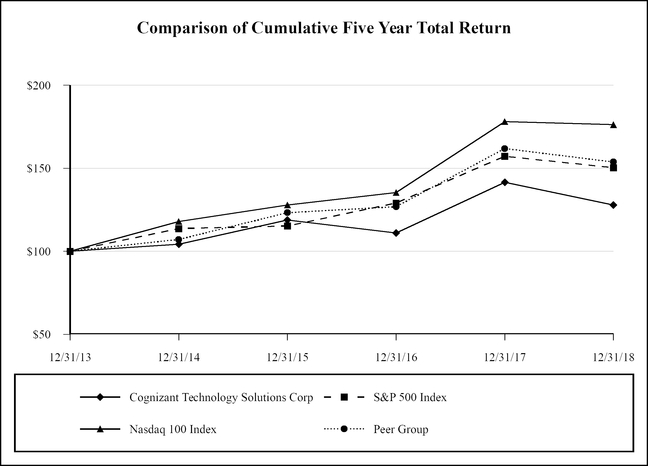

Performance Graph

The following graph compares the cumulative total stockholder return on our Class A common stock with the cumulative total return on the S&P 500 Index, NASDAQ-100Nasdaq-100 Index and a Peer Group Index (capitalization weighted) for the period beginning December 31, 20102013 and ending on the last day of our last completed fiscal year. The stock performance shown on the graph below is not indicative of future price performance.

COMPARISON OF CUMULATIVE TOTAL RETURN(1)(2)

Among Cognizant, the S&P 500 Index, the NASDAQ-100Nasdaq-100 Index

And a Peer Group Index(3) (Capitalization Weighted)

| Company / Index | Base Period 12/31/10 | 12/31/11 | 12/31/12 | 12/31/13 | 12/31/14 | 12/31/15 | ||||||||||||||||||

COGNIZANT TECHNOLOGY SOLUTIONS CORP | $ | 100 | $ | 87.75 | $ | 100.81 | $ | 137.78 | $ | 143.70 | $ | 163.79 | ||||||||||||

| S&P 500 INDEX | 100 | 102.11 | 118.45 | 156.82 | 178.29 | 180.75 | ||||||||||||||||||

| NASDAQ-100 | 100 | 102.70 | 119.98 | 161.96 | 191.01 | 207.10 | ||||||||||||||||||

| PEER GROUP | 100 | 78.87 | 83.24 | 115.16 | 122.45 | 139.40 | ||||||||||||||||||

| Company / Index | Base Period 12/31/13 | 12/31/14 | 12/31/15 | 12/31/16 | 12/31/17 | 12/31/18 | ||||||||||||||||||

| Cognizant Technology Solutions Corp | $ | 100 | $ | 104.30 | $ | 118.88 | $ | 110.97 | $ | 141.57 | $ | 127.87 | ||||||||||||

| S&P 500 Index | 100 | 113.69 | 115.26 | 129.05 | 157.22 | 150.33 | ||||||||||||||||||

| Nasdaq-100 | 100 | 117.94 | 127.88 | 135.40 | 178.07 | 176.22 | ||||||||||||||||||

| Peer Group | 100 | 107.07 | 123.24 | 126.80 | 161.82 | 153.76 | ||||||||||||||||||

| (1) | Graph assumes $100 invested on December 31, |

| (2) | Cumulative total return assumes reinvestment of dividends. |

| (3) | We have constructed a Peer Group Index of other information technology consulting |

Item 6. Selected Financial Data | |

The following table sets forth our selected consolidated historical financial data as of the dates and for the periods indicated. Our selected consolidated financial data set forth below as of December 31, 20152018 and 20142017 and for each of the years ended December 31, 2015, 20142018, 2017 and 20132016 have been derived from the audited consolidated financial statements included elsewhere herein. Our selected consolidated financial data set forth below as of December 31, 2013, 20122016, 2015 and 20112014 and for each of the years ended December 31, 20122015 and 20112014 are derived from our audited consolidated financial statements not included elsewhere herein. Our selected consolidated financial information for 2015, 20142018, 2017 and 20132016 should be read in conjunction with the Consolidated Financial Statementsconsolidated financial statements and the Notesaccompanying notes and “ItemItem 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations”Operations, which are included elsewhere in this Annual Report on Form 10-K.

| 2015 | 2014 | 2013 | 2012 | 2011 | 2018(1) | 2017 | 2016 | 2015 | 2014 | |||||||||||||||||||||||||||||||

| (in millions, except per share data) | (in millions, except per share data) | |||||||||||||||||||||||||||||||||||||||

| For the Year Ended December 31: | ||||||||||||||||||||||||||||||||||||||||

| For the year ended December 31: | ||||||||||||||||||||||||||||||||||||||||

| Revenues | $ | 12,416.0 | $ | 10,262.7 | $ | 8,843.2 | $ | 7,346.5 | $ | 6,121.2 | $ | 16,125 | $ | 14,810 | $ | 13,487 | $ | 12,416 | $ | 10,263 | ||||||||||||||||||||

| Income from operations | 2,142.0 | 1,884.9 | 1,677.9 | 1,361.5 | 1,136.5 | 2,801 | 2,481 | 2,289 | 2,142 | 1,885 | ||||||||||||||||||||||||||||||

| Net income | $ | 1,623.6 | $ | 1,439.3 | $ | 1,228.6 | $ | 1,051.3 | $ | 883.6 | 2,101 | 1,504 | 1,553 | 1,624 | 1,439 | |||||||||||||||||||||||||

| Basic earnings per share | $ | 2.67 | $ | 2.37 | $ | 2.03 | $ | 1.74 | $ | 1.46 | $ | 3.61 | $ | 2.54 | $ | 2.56 | $ | 2.67 | $ | 2.37 | ||||||||||||||||||||

| Diluted earnings per share | $ | 2.65 | $ | 2.35 | $ | 2.02 | $ | 1.72 | $ | 1.42 | $ | 3.60 | $ | 2.53 | $ | 2.55 | $ | 2.65 | $ | 2.35 | ||||||||||||||||||||

| Cash dividends declared per common share | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 0.80 | $ | 0.45 | $ | — | $ | — | $ | — | ||||||||||||||||||||

| Weighted average number of common shares outstanding-Basic | 609.1 | 608.1 | 604.0 | 602.6 | 606.6 | 582 | 593 | 607 | 609 | 608 | ||||||||||||||||||||||||||||||

| Weighted average number of common shares outstanding-Diluted | 613.3 | 612.5 | 609.7 | 611.7 | 620.7 | 584 | 595 | 610 | 613 | 613 | ||||||||||||||||||||||||||||||

| As of December 31: | ||||||||||||||||||||||||||||||||||||||||

| Cash, cash equivalents and short-term investments | $ | 4,949.5 | $ | 3,774.7 | $ | 3,747.5 | $ | 2,863.8 | $ | 2,432.3 | $ | 4,511 | $ | 5,056 | $ | 5,169 | $ | 4,949 | $ | 3,775 | ||||||||||||||||||||

Working capital | 5,194.9 | 3,828.5 | 4,117.1 | 3,235.5 | 2,766.8 | 5,900 | 6,272 | 6,182 | 5,195 | 3,829 | ||||||||||||||||||||||||||||||

Total assets | 13,065.4 | 11,479.0 | 8,129.2 | 6,454.8 | 5,480.8 | 15,913 | 15,221 | 14,262 | 13,061 | 11,473 | ||||||||||||||||||||||||||||||

| Total debt | 1,287.5 | 1,637.5 | — | — | — | 745 | 873 | 878 | 1,283 | 1,632 | ||||||||||||||||||||||||||||||

| Stockholders’ equity | 9,278.1 | 7,740.2 | 6,135.8 | 4,854.4 | 3,952.9 | 11,424 | 10,669 | 10,728 | 9,278 | 7,740 | ||||||||||||||||||||||||||||||

______________________

| (1) | On January 1, 2018, we adopted Accounting Standards |

| (2) | In |

| (3) | Includes $423 million in restricted time deposits as of December 31, 2018. See Note 11 in our consolidated financial statements. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.Operations

| Executive Summary | ||||

In 2018, we executed on our strategy to grow revenues and expand operating margins while completing our previously announced capital return plan. Revenues for the year ended December 31, 2018 increased to $16,125 million from $14,810 million for the year ended December 31, 2017, representing growth of 8.9%, or 8.5% on a constant currency basis1. Going forward, we expect to continue to invest in our digital capabilities, including the extensive training and re-skilling of our technical teams and the expansion of our local workforces in the United States and other markets around the world. We expect these investments to contribute significantly to our organic revenue growth. Additionally, we plan to supplement our organic growth through select strategic acquisitions, joint ventures, investments and alliances that can expand our digital capabilities, geographic footprint or industry capabilities. In 2018, we completed five acquisitions: Bolder Healthcare Solutions ("Bolder"), a provider of revenue cycle management solutions to the healthcare industry in the United States; Hedera Consulting, a business advisory and data analytics service provider in Belgium and the Netherlands; Softvision, a digital engineering and consulting company with significant operations in Romania and India that focuses on agile development of custom cloud-based software and platforms for customers primarily in the United States; ATG, a United States based consulting company that helps companies plan, implement, and optimize automated cloud-based quote-to-cash business processes and technologies; and SaaSfocus, a Salesforce services provider in Australia.

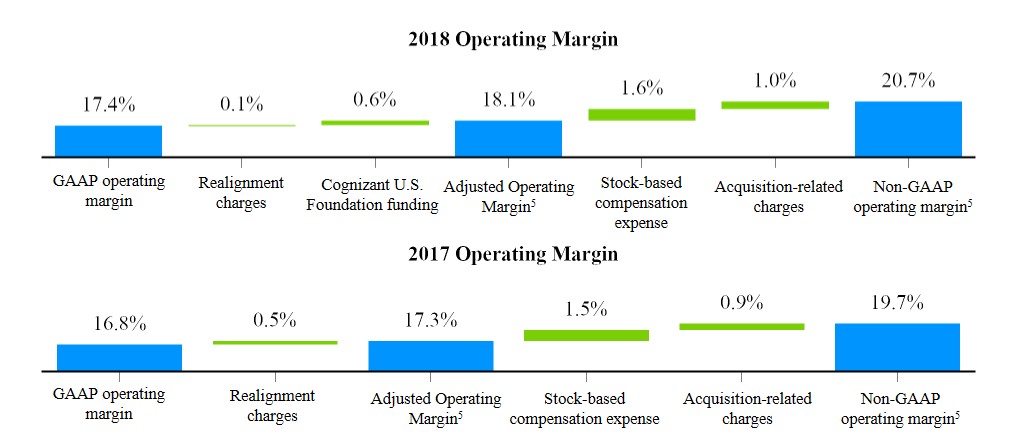

We are focused on driving margin enhancement while continuing to invest in our business. In 2018, our operating margin increased to 17.4% as compared to 16.8% in 2017, as we continued to target higher margin digital services customer contracts and improve our cost structure through our realignment program and other margin enhancement initiatives, primarily by optimizing our resource pyramid, improving utilization and containing our corporate spend.

As part of our capital return plan, we returned $3.7 billion to our stockholders through share repurchases and dividend payments over the two years ended December 31, 2015 and 2014:2018, exceeding our previously announced target of $3.4 billion as shown below.

| Increase | ||||||||||||||

| 2015 | 2014 | $ | % | |||||||||||

| (Dollars in millions, except per share data) | ||||||||||||||

| Revenue | $ | 12,416.0 | $ | 10,262.7 | $ | 2,153.3 | 21.0 | |||||||

| Net Income | 1,623.6 | 1,439.3 | 184.3 | 12.8 | ||||||||||

| Diluted earnings per share | 2.65 | 2.35 | 0.30 | 12.8 | ||||||||||

Non-GAAP diluted earnings per share1 | 3.07 | 2.60 | 0.47 | 18.1 | ||||||||||

| 2017 Capital Return Plan | |||||||||||

| 2018 | 2017 | Total | |||||||||

| (in millions) | |||||||||||

Dividends paid(1) | $ | 468 | $ | 265 | $ | 733 | |||||

| Share repurchases under our Board authorized stock repurchase plan | 1,175 | 1,800 | 2,975 | ||||||||

| Total | $ | 1,643 | $ | 2,065 | $ | 3,708 | |||||

Beginning in 2019, our new capital return plan anticipates the deployment of approximately 50% of our global free cash flow1 for dividends and share repurchases and approximately 25% of our global free cash flow1 for acquisitions, as needed. For the year ended December 31, 2018, our cash flows from operating activities were $2,592 million while our global free cash flow1 was $2,215 million. We review our capital return plan on an on-going basis, considering our financial performance and liquidity position, investments required to execute our strategic plans and initiatives, acquisition opportunities, the economic outlook, regulatory changes and other relevant factors. As these factors may change over time, the actual amounts expended on stock repurchase activity, dividends and acquisitions, if any, during any particular period cannot be predicted and may fluctuate from time to time.

______________

1 | Constant currency revenue growth and free cash flow are not |

non-GAAP financial measures. Our historical non-GAAP financial measures, non-GAAP operating margin in 2015 decreased to 19.7%2, non-GAAP income from operations2 from 20.2%and non-GAAP diluted earnings per share2 ("non-GAAP diluted EPS")2, excluded stock-based compensation expense, acquisition-related charges and unusual items, and our non-GAAP diluted EPS2 in 2014. The decrease in ouradditionally excluded net non-operating foreign currency exchange gains or losses and the tax impacts of all applicable adjustments. Our new non-GAAP operating margin was due to increases in compensationfinancial measures, Adjusted Operating Margin2, Adjusted Income From Operations2 and benefit costs (inclusive ofAdjusted Diluted Earnings Per Share2 ("Adjusted Diluted EPS")2,exclude only unusual items and Adjusted Diluted EPS2 additionally excludes net non-operating foreign currency exchange gains or losses and the tax impact of higher incentive-based compensation), partially offset byall applicable adjustments. We are also introducing two new non-GAAP financial measures, free cash flow2 and constant currency revenue growth2. Free cash flow2 is defined as cash flow from operating activities net of purchases of property and equipment. Constant currency revenue growth2 is defined as revenues for a given period restated at the impact of the depreciation of the Indian rupeecomparative period’s foreign currency exchange rates measured against the U.S. dollar, lower realized losses on our cash flow hedges and decreases in certain operating expenses, including travel, in 2015 compared to 2014. Historically, we have invested our profitability above the 19% to 20% non-GAAP operating margin level back into our business, which we believe iscomparative period's reported revenues. See “Non-GAAP Financial Measures” for more information.

2018 Financial Results

The following table sets forth a significant contributing factor to our strong revenue growth. This investment is primarily focused in the areas of hiring client partners and relationship personnel with specific industry experience or domain expertise, training our technical staff in a broader range of service offerings, strengthening our business analytics and digital technology capabilities, strengthening and expanding our portfolio of services, continuing to expand our geographic presence for both sales and delivery, as well as recognizing and rewarding employee performance by means of enhanced incentive-based compensation. In addition, this investment includes maintaining a level of resources, trained in a broad range of service offerings, to be well positioned to respond to our customer requests to take on additional projects. We expect to continue to invest amounts in excesssummary of our targeted operating margin levels back into the business.

| Increase | ||||||||||||||

2018(1) | 2017 | $ | % | |||||||||||

| (Dollars in millions, except per share data) | ||||||||||||||

| Revenues | $ | 16,125 | $ | 14,810 | $ | 1,315 | 8.9 | |||||||

| Income from operations | 2,801 | 2,481 | 320 | 12.9 | ||||||||||

| Net income | 2,101 | 1,504 | 597 | 39.7 | ||||||||||

| Diluted earnings per share | 3.60 | 2.53 | 1.07 | 42.3 | ||||||||||

Other Financial Information2 | ||||||||||||||

| Non-GAAP income from operations | $ | 3,345 | $ | 2,912 | $ | 433 | 14.9 | |||||||

| Adjusted Income From Operations | 2,920 | 2,553 | 367 | 14.4 | ||||||||||

| Non-GAAP diluted EPS | 4.57 | 3.77 | 0.80 | 21.2 | ||||||||||

| Adjusted Diluted EPS | 4.02 | 3.42 | 0.60 | 17.5 | ||||||||||

| (1) | On January 1, 2018, we adopted the New Revenue Standard using the modified retrospective method. Results for reporting periods beginning on or after January 1, 2018 are presented under the New Revenue Standard, while prior period amounts are not adjusted and continue to be reported in accordance with our historic accounting policies. During 2018, the adoption of the New Revenue Standard had a positive impact on revenue of $96 million, income from operations of $134 million and diluted earnings per share of $0.19 per share. See Note 3 to our consolidated financial statements for additional information. |

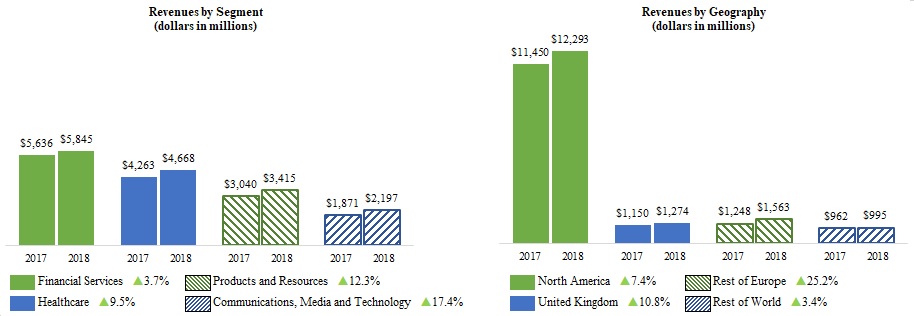

The following charts set forth revenues and revenue growth by business segment and geography for the years ended December 31, 2017 and 2018:

______________

2 | Non-GAAP income from operations, Adjusted Income From Operations, non-GAAP operating margin, |

The following factors impacted our revenue growth during the year ended December 31, 2018 as compared to the year ended December 31, 2017:

Solid performance in our Communications, Media and Technology, Products and Resources and Healthcare segments;

Revenues in our Financial Services segment grew below Company average as certain banking customers continue to optimize the cost of supporting their legacy systems and operations, including moving a portion of their services to captives, as they shift their spend to transformation and digital services;

Sustained strength in the North American market;

| • | Revenues from our customers in Europe grew 18.3%, or 15.2% on a |

| ◦ | Revenues from our Rest of Europe customers increased 25.2%, or 22.2% on a constant currency basis3; |

| ◦ | Revenues from our United Kingdom customers increased 10.8%, or 7.6% on a constant currency basis3. Revenue growth in the United Kingdom continues to be negatively affected by weakness in the banking sector in that region; |

| • | Revenues from our customers in our Rest of World region grew 3.4%, or 6.1% on a constant currency basis3; |

Increased customer spending on discretionary projects;

Expansion of our service offerings, including consulting and digital services, next-generation IT solutions and platform-based solutions;

Continued expansion of the market for global delivery of technology and business process services; and

Increased penetration of existing customers.

The following chart sets forth our GAAP operating margin, Adjusted Operating Margin3 andnon-GAAP operating margin3 for the years ended December 31, 2017 and 2018: