UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

FOR ANNUAL AND TRANSITION REPORTS

PURSUANT TO SECTIONS 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

| | | | |

ý☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended | December 31, 20182019 | | |

| | OR |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission File Number 0-24429

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

|

| | | |

| Delaware | | 13-3728359 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | | |

Glenpointe Centre West | | |

| 500 Frank W. Burr Blvd. | | |

| Teaneck, | New Jersey | | 07666 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (201) (201) 801-0233 Securities registered pursuant to Section 12(b) of the Act: |

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $0.01 par value per share | CTSH | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ý☒Yes☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ��☐ Yes ý☒No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý☒Yes☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ý☒Yes☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

Large accelerated filerAccelerated Filer | ý☒ | Accelerated filerFiler | ☐ |

| | | | |

Non-accelerated filerFiler | ☐ | Smaller reporting companyReporting Company | ☐ |

| | | | |

| | Emerging Growth Company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ý☒ No

The aggregate market value of the registrant’s voting shares of common stock held by non-affiliates of the registrant on June 30, 2018,28, 2019, based on $78.99$63.39 per share, the last reported sale price on the Nasdaq Global Select Market of the Nasdaq Stock Market LLC on that date, was $45.7$34.9 billion.

The number of shares of Class A common stock, $0.01 par value, of the registrant outstanding as of February 8, 20197, 2020 was 575,099,275548,637,106 shares.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents are incorporated by reference into the Annual Report on Form 10-K: Portions of the registrant’s definitive Proxy Statement for its 20192020 Annual Meeting of Stockholders are incorporated by reference into Part III of this Report.

TABLE OF CONTENTS

| | | | Item | | Page | Item | | Page |

| | | | |

| | | |

| | 1. | | | | 1. | | | |

| | | |

| | 1A. | | | | 1A. | | | |

| | | |

| | 1B. | | | | 1B. | | | |

| | | |

| | 2. | | | | 2. | | | |

| | | |

| | 3. | | | | 3. | | | |

| | | |

| | 4. | | | | 4. | | | |

| | | |

| | | | |

| | | |

| | 5. | | | | 5. | | | |

| | | |

| | 6. | | | | 6. | | | |

| | | |

| | 7. | | | | 7. | | | |

| | | |

| | 7A. | | | | 7A. | | | |

| | | |

| | 8. | | | | 8. | | | |

| | | |

| | 9. | | | | 9. | | | |

| | | |

| | 9A. | | | | 9A. | | | |

| | | |

| | 9B. | | | | 9B. | | | |

| | | |

| | | | |

| | | |

| | 10. | | | | 10. | | | |

| | | |

| | 11. | | | | 11. | | | |

| | | |

| | 12. | | | | 12. | | | |

| | | |

| | 13. | | | | 13. | | | |

| | | |

| | 14. | | | | 14. | | | |

| | | |

| | | | |

| | | |

| | 15. | | | | 15. | | | |

| | 16. | | | | 16. | | | |

| | | | | | |

| | | | | | |

| | | | | | |

PART I

Item 1. Business

Overview

Cognizant is one of the world’s leading professional services companies, transforming clients’ business, operating and technology models for the digital era. Our industry-based, consultative approach helps customers envision, build and run more innovative and efficient businesses. Our services include digital services and solutions, consulting, application development, systems integration, application testing, application maintenance, infrastructure services and business process services. Digital services are becominghave become an increasingly important part of our portfolio, of services and solutions and are often integrated or delivered alongaligning with our other services.clients' focus on becoming data-enabled, customer-centric and differentiated businesses. We tailor our services and solutions to specific industries and usewith an integrated global delivery model that employs customerclient service and delivery teams based at customer locations and delivery teams located at customerclient locations and dedicated global and regional delivery centers.

Business Segments

We go to market across our four industry-based business segments. Our customersclients seek to partner with service providers that have a deep understanding of their businesses, industry initiatives, clients,customers, markets and cultures and the ability to create solutions tailored to meet their individual business needs. Across industries, our clients are confronted with the risk of being disrupted by nimble, digital-native competitors. They are therefore redirecting their focus and investment to digital and embracing DevOps and key technologies like IoT, analytics, AI, digital engineering, cloud and automation. We believe that our deep knowledge of the industries we serve and our clients’ businesses has been central to our revenue growth and high customer satisfaction.client satisfaction, and we continue to invest in those digital capabilities that help to enable our clients to become modern businesses. Our business segments are as follows:

|

| | | | | | |

| Financial Services | | Healthcare | | Products and Resources | | Communications, Media and Technology |

• Banking • Insurance | | • Healthcare • Life Sciences | | • Retail and Consumer Goods • Manufacturing, Logistics, Energy and LogisticsUtilities • Travel and Hospitality • Energy and Utilities

| | • Communications and Media • Technology |

Our Financial Services segment includes banking, capital markets and insurance companies. Demand in this segment is driven by our customers’ focus on cost optimization in the face of profitability pressures, theclients’ need to be compliant with significant regulatory requirements and adaptable to regulatory change, and their adoption and integration of digital technologies, including customer experience enhancement, robotic process automation, analytics and artificial intelligenceAI in areas such as digital lending, fraud detection and next generation payments.

Our Healthcare segment consists of healthcare providers and payers as well as life sciences companies, including pharmaceutical, biotech and medical device companies. Demand in this segment is driven by emerging industry trends, including enhanced compliance, integrated health management, claims investigative services and heightened focus on patient experience, as well as services that drive operational improvements in areas such as claims processing, enrollment, membership and billing, in addition tobilling. Demand is also created by the adoption and integration of digital technologies such as artificial intelligence,AI to shape personalized care plans and predictive data analytics to improve patient outcomes.

Our Products and Resources segment includes manufacturers, retailers and travel and hospitality companies, as well as companies providing logistics, energy and utility services. Demand in this segment is driven by our customers’clients’ focus on improving the efficiency of their operations, the enablement and integration of mobile platforms to support sales and other omni channelomni-channel commerce initiatives, and their adoption and integration of digital technologies, such as the application of intelligent systems to manage supply chainchains and enhance overall customer experiences.experiences, and IoT to instrument functions for factories, real estate, fleets and products to increase access to insight generating data.

Our Communications, Media and Technology segment includes information, media and entertainment, communications and technology companies. Demand in this segment is driven by our customers’ needclients’ needs to manage their digital content, create differentiated user experiences, transition to agile development methodologies, enhance their networks, manage their digital content and adopt and integrate digital technologies, such as cloud, enablement and interactive and connected products.IoT.

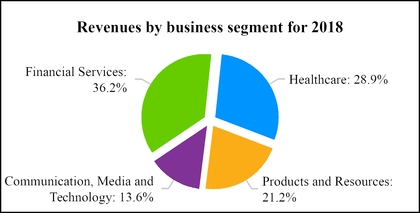

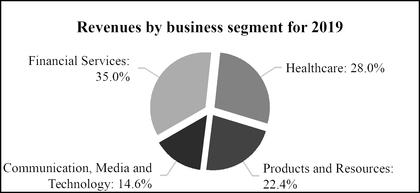

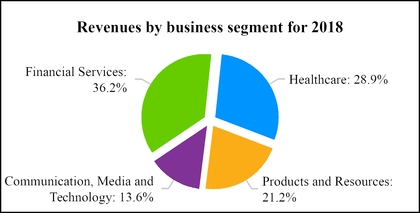

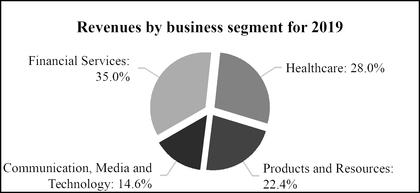

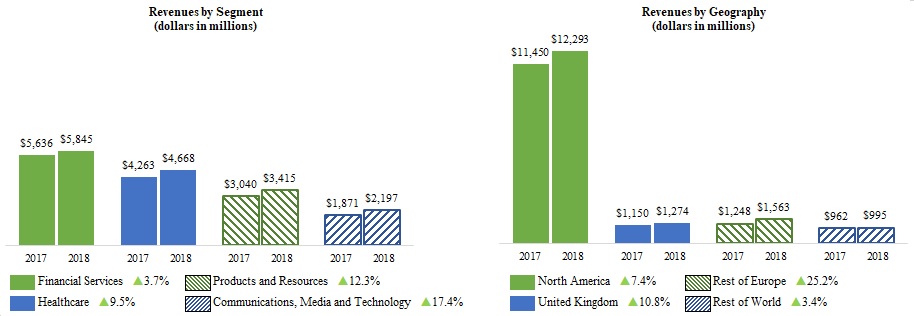

For the year ended December 31, 2018,2019, the distribution of our revenues across our four industry-based business segments was as follows:

See Note 32 to our consolidated financial statements for additional information related to disaggregation of revenues by customerclient location, service line and contract-type for each of our business segments. Services and Solutions

Our services include digital services and solutions, consulting, application development, systems integration, application testing, application maintenance, infrastructure services and business process services. Additionally, we develop, license, implement and support proprietary and third-party software products and platforms for the healthcare industry. Digital services and solutions, such as analytics and artificial intelligence,platforms. Central to our strategy to align with our clients’ need to modernize is our investment in four key areas of digital: IoT, AI, digital engineering intelligent process automation, interactive and hybrid cloud, are becoming an increasingly important partcloud. These four capabilities enable clients to put data at the core of our portfolio of servicestheir operations, improve the experiences they offer their customers, tap into new revenue streams, defend against technology-enabled competitors and solutions.reduce costs. In many cases, our customers'clients' new digital systems are built upon the backbone of their existing legacy systems. Also, customersclients often look for efficiencies in the way they run their operations so they can fund investments in new digital capabilities.technologies. We believe our deep knowledge of their infrastructure and systems provides us with a significant advantage as we work with them to build new digital capabilities and apply digital technologies to make their operations more efficient.efficient and effective. We deliver all of our services and solutions across our four industry-based business segments to best address our customersclients' individual needs.

We seek to drive organic growth through investments in our digital capabilities across industries and geographies, including the extensive training and re-skilling of our technical teams and the expansion of our local workforces in the United States and other markets around the world where we operate. Additionally, we pursue select strategic acquisitions, joint ventures, investments and alliances that can expand our digital capabilities or the geographic or industry coverage of our business. In 2018,2019, we completed five such acquisitions: Bolder Healthcare Solutions,

Mustache, a provider of revenue cycle management solutions to the healthcare industrycreative content agency based in the United States; Hedera Consulting,States, that extends our capabilities in creating original and branded content for digital, broadcast and social mediums;

Meritsoft, a business advisoryfinancial software company based in Ireland, that complements our service offerings to capital markets institutions;

Samlink, a developer of services and data analyticssolutions for the financial sector based in Finland, that strengthens our banking capabilities and brings with it a strategic partnership with three Finnish financial institutions to transform and operate a shared core banking platform;

Zenith, a life sciences company based in Ireland, that extends our service providercapabilities for connected biopharmaceutical and medical device manufacturers; and

Contino, a technology consulting firm that extends our capabilities in Belgiumenterprise DevOps and the Netherlands; Softvision, a digital engineering and consulting company with significant operations in Romania and India that focuses on agile developmentcloud transformation.

We have organized our services and solutions into threefour practice areas: Digital Business, Digital Operations, and Digital Systems and Technology.Technology and Consulting. These practice areas are supported by Cognizant Consulting, our Global Technology Office and Cognizant Accelerator.

Cognizant Digital Business

Our digital business practice helps customers rethink their business models, working with customers to reinvent existing businesses and create new ones by innovating products, services, and experiences.clients build modern enterprises. Areas of focus within this practice area are digital strategy, artificial intelligenceare:

•interactive, which is our global network of studios that help clients craft new experiences;

•application modernization, which updates legacy applications using modern technology stacks;

AI and analytics, connected products, interactive user experienceswhich drive business growth and efficiencies through a greater understanding of customers and operations;

•IoT, which unlocks greater productivity and new business models;

•digital advisory, which provides enterprise transformation expertise; and

•digital engineering, which designs, engineers, and delivers software that builds next-generation applications and experiences at speed and scale. These services are often delivered along with our application development, systems integration and digital services.powers modern businesses.

Cognizant Digital Operations

Our digital operations practice helps customersclients rethink their operating models by assessing their existing processes and modernizerecommending automation and change management, allowing clients to fundamentally transform how their business operations by re-engineering and managing their most essential business processes resulting in lower operating costs, better employee and customer outcomes and improved top-line growth.run while also realizing cost savings benefits from these process improvements. Areas of focus within this practice area are intelligentare:

•automation, analytics and consulting for business process automation, industryoutsourcing;

•platform-based operations; and platform solutions and enterprise services.

•core business process operations.

We have extensive knowledge of core front office, middle office and back office processes, including finance and accounting, procurement, data management, and research and analytics, procurement and data management, which we integrate with our industry and technology expertise to deliver targeted business process services and solutions. Our highly specialized domain expertise is important in creating industry-aligned solutions for our customers' needs in areas such as clinical data management, pharmacovigilance, equity research support, commercial operations and order management.

Cognizant Digital Systems & Technology

Our digital systems and technology practice helps customersclients reshape their technology models to simplify, modernize and secure the enabling systems that form the backbone of their business. With cloud becoming an essential catalyst for large-scale transformation efforts, cloud adoption is driving changes across the entire IT value chain. Areas of focus within this practice area include system integration services, infrastructure services (including cloud), include:

•enterprise application services;

•application development and maintenance;

•quality engineering and assurance,assurance;

•cloud;

•infrastructure; and security and application services.

•security.

Consulting

Our application services include traditional development, testing and maintenance and agile developmentconsulting practice helps clients drive the changes that the evolving technology landscape requires ofnew software and applications that transform existing businesses at speed and scale.

Cognizant Consulting, Global Technology Office, and Cognizant Accelerator

Supporting our three practice areas, the Cognizant Consulting team provides their organizations by providing global business, process, operations and technology consulting services to our customers.services. Our consulting professionals and domain experts from our industry-focusedindustry-based business segments work closely with our practice areas to create modern frameworks, platforms and solutions that customers find valuable as they pursue new efficiencies and look to leverage a wide range of digital technologies across our clients’ businesses to deliver higher levels of efficiency and new value for their operations. Our Global Technology Office and customers.

Cognizant Accelerator

Cognizant Accelerator focus on utilizing new technologies to developsupports our business segments and four practice areas by developing innovative and practical offerings for customers'clients' emerging needs and support our business segments and practice areas.through the application of new technologies.

Global Delivery Model

We utilize a global delivery model, with delivery centers worldwide to provide the full range of services we offer to our customers.clients. Our global delivery model includes four distinct delivery methods, with most customer engagements utilizing several or all of these delivery methods. Our global delivery model includes employees located in the following locations: customers’deployed at client sites, local or in-country delivery centers, regional delivery centers and offshore delivery centers.centers, as required to best serve our clients. As we scale our digital services and solutions, we are focused on hiring in the United States and other countries where we deliver services to our clients to expand our in-country delivery capabilities. Our extensive facilities, technology and communications infrastructure are designed to enable the effective collaboration of our global workforce across locations and geographies.

Sales and Marketing

We market and sell our services directly through our professional staff, senior management and direct sales personnel operating out of our global headquarters and business developmentmany offices which are strategically located around the world. TheWe are increasing our investment in sales and marketing professionals to help us expand existing accounts and acquire new ones, and amplify our brand's stature in the marketplace. These new investments are designed to support and enhance the sales and marketing group, which works with our customerclient delivery team as the sales process moves closer to a customer’sclient's selection of a services provider. The duration of the sales process may vary widely depending on the type and complexity of services.

CustomersClients

The services we provide are distributed among a number of customersclients in each of our business segments. Revenues from our top clients as a percentage of total revenues were as follows:

|

| | | | | | | | | |

| | | For the years ended December 31, |

| | | 2019 | | 2018 | | 2017 |

| Top five clients | | 7.9 | % | | 8.6 | % | | 8.9 | % |

| Top ten clients | | 14.6 | % | | 15.4 | % | | 14.9 | % |

A loss of a significant customerclient or a few significant customersclients in a particular segment could materially reduce revenues for that segment. However, theThe services we provide to our larger customersclients are often critical to their operations and a termination of our services would typically require an extended transition period with gradually declining revenues. TheNevertheless, the volume of work performed for specific customers is likely toclients may vary significantly from year to year,year.

In the fourth quarter of 2019, we announced that we will exit certain content-related work that is not in line with our long-term strategic vision for the Company. We intend to exit this work in 2020 and a significant customer in one yearthis may not usenegatively impact our relationship with the affected clients and the revenues from other services in a subsequent year. Revenues from our top customers as a percentagewe provide to them. Refer to Item 7. Management’s Discussion and Analysis of total revenues were as follows: |

| | | | | | | | | |

| | | For the years ended December 31, |

| | | 2018 | | 2017 | | 2016 |

| Top five customers | | 8.6 | % | | 8.9 | % | | 10.0 | % |

| Top ten customers | | 15.4 | % | | 14.9 | % | | 16.7 | % |

Competition

The markets for our services are highly competitive, characterized by a large number of participants and subject to rapid change. Competitors may include systems integration firms, contract programming companies, application software companies, cloud computing service providers, traditional consulting firms, professional services groups of computer equipment companies, infrastructure management andcompanies, outsourcing companies and boutique digital companies. Our direct competitors include, among others, Accenture, Atos, Capgemini, Deloitte Digital, DXC Technology, EPAM Systems, Genpact, HCL Technologies, IBM Global Services, Infosys Technologies, Tata Consultancy Services and Wipro. In addition, we compete with numerous smaller local companies in the various geographic markets in which we operate.

The principal competitive factors affecting the markets for our services include the provider’s reputation and experience, vision and strategic advisory ability,capabilities, digital services capabilities, performance and reliability, responsiveness to customer needs, financial stability, corporate governance and competitive pricing of services. Accordingly, we rely on the following to compete effectively:

investments to scale our digital services;

our recruiting, training and retention model;

our global service delivery model;

an entrepreneurial culture and approach to our work;

a broad customerclient referral base;

investment in process improvement and knowledge capture;

financial stability and good corporate governance;

continued focus on responsiveness to customerclient needs, quality of services and competitive prices; and

project management capabilities and technical expertise.

Intellectual Property

We provide value to our customersclients based, in part, on our proprietary innovations, methodologies, software, reusable knowledge capital and other intellectual property ("IP")IP assets. We recognize the importance of IP and its ability to differentiate us from our competitors. We seek IP protection for some of our innovations and rely on a combination of IP laws, confidentiality procedures and contractual provisions, to protect our IP and our brand.Cognizant brand, which is one of our most valuable assets. We have registered, and applied for the registration of, U.S. and international trademarks, service marks, domain names and copyrights. We own or are licensed under a number of patents, trademarks and copyrights and licenses, which vary inof varying duration, relating to our products and services. While our proprietary IP rights are important to our success, we believe our business as a whole is not materially dependent on any particular IP right or any particular group of patents, trademarks, copyrights or licenses.licenses, other than our Cognizant brand.

Cognizant® and other trademarks appearing in this report are registered trademarks or trademarks of Cognizant and its affiliates in the United States and other countries, or third parties, as applicable.

Employees

We had approximately 281,600292,500 employees at the end of 2018,2019, with approximately 50,00046,400 in North America, approximately 18,30021,200 in Europe and approximately 213,300224,900 in various other locations throughout the rest of the world, including approximately 194,700203,700 in India. We are not party to any significant collective bargaining agreements.

Information About Our Executive Officers

On February 6, 2019, we announced that the Board of Directors has appointed Brian Humphries as our Chief Executive Officer and as a member of the Board, in each case effective April 1, 2019. Francisco D’Souza will step down as the Company’s Chief Executive Officer, effective April 1, 2019, and has agreed to serve as an advisor to the new Chief Executive Officer with the title of “Executive Vice Chairman” from April 1, 2019 through June 30, 2019. Thereafter, he will continue to serve as Vice Chairman of the Board of Directors. Rajeev Mehta will step down as our President, effective on April 1, 2019, and will thereafter serve as an advisor to the new Chief Executive Officer from April 1, 2019 through May 1, 2019, at which point Mr. Mehta’s employment with us will terminate.

The following table identifies our current executive officers:

|

| | | | | | | |

| Name | | Age | | Capacities in Which Served | | In Current Position Since |

Francisco D’Souza(1) | | 50 |

| | Chief Executive Officer | | 2007 |

Rajeev Mehta(2) | | 52 |

| | President | | 2016 |

Karen McLoughlin(3) | | 54 |

| | Chief Financial Officer | | 2012 |

Ramakrishnan Chandrasekaran(4) | | 61 |

| | Executive Vice Chairman, Cognizant India | | 2013 |

Debashis Chatterjee(5) | | 53 |

| | Executive Vice President and President, Global Delivery | | 2016 |

Ramakrishna Prasad Chintamaneni(6) | | 49 |

| | Executive Vice President and President, Global Industries and Consulting | | 2016 |

Malcolm Frank(7) | | 52 |

| | Executive Vice President, Strategy and Marketing | | 2012 |

Matthew Friedrich (8) | | 52 |

| | Executive Vice President, General Counsel, Chief Corporate Affairs Officer and Secretary | | 2017 |

Sumithra Gomatam(9) | | 51 |

| | Executive Vice President and President, Digital Operations | | 2016 |

Gajakarnan Vibushanan Kandiah(10) | | 51 |

| | Executive Vice President and President, Digital Business | | 2016 |

Venkat Krishnaswamy(11) | | 65 |

| | Vice Chairman, Healthcare and Life Sciences | | 2013 |

James Lennox(12) | | 54 |

| | Executive Vice President, Chief People Officer | | 2016 |

Sean Middleton(13) | | 37 |

| | Senior Vice President and President, Cognizant Accelerator | | 2017 |

Allen Shaheen(14) | | 56 |

| | Executive Vice President, North American Digital Hubs | | 2018 |

Dharmendra Kumar Sinha(15) | | 56 |

| | Executive Vice President and President, Global Client Services | | 2013 |

Robert Telesmanic(16) | | 52 |

| | Senior Vice President, Controller and Chief Accounting Officer | | 2017 |

Santosh Thomas(17) | | 50 |

| | Executive Vice President and President, Global Growth Markets | | 2016 |

Srinivasan Veeraraghavachary(18) | | 59 |

| | Chief Operating Officer | | 2016 |

|

| | | | | | | |

| Name | | Age | | Capacities in Which Served | | In Current Position Since |

Brian Humphries (1) | | 46 |

| | Chief Executive Officer | | 2019 |

Karen McLoughlin (2) | | 55 |

| | Chief Financial Officer | | 2012 |

Robert Telesmanic (3) | | 53 |

| | Senior Vice President, Controller and Chief Accounting Officer | | 2017 |

Matthew Friedrich (4) | | 53 |

| | Executive Vice President, General Counsel, Chief Corporate Affairs Officer and Secretary | | 2017 |

Becky Schmitt (5) | | 46 |

| | Executive Vice President, Chief People Officer | | 2020 |

Dharmendra Kumar Sinha (6) | | 57 |

| | Executive Vice President and President, North America | | 2019 |

Santosh Thomas (7) | | 51 |

| | Executive Vice President and President, Global Growth Markets | | 2016 |

Malcolm Frank (8) | | 53 |

| | Executive Vice President and President, Cognizant Digital Business | | 2019 |

Balu Ganesh Ayyar (9) | | 58 |

| | Executive Vice President and President, Cognizant Digital Operations | | 2019 |

Greg Hyttenrauch (10) | | 52 |

| | Executive Vice President and President, Cognizant Digital Systems & Technology | | 2019 |

Pradeep Shilige (11) | | 51 |

| | Executive Vice President and Head of Global Delivery | | 2019 |

| |

| (1) | Francisco D’SouzaBrian Humphries has been our Chief Executive Officer and a member of the Board of Directors since 2007. He has been Vice Chair of our Board of Directors since 2018. He alsoApril 2019. Prior to joining Cognizant, he served as our President from 2007 to 2012. Mr. D’Souza joined Cognizant as a co-founder in 1994, the year it was started asChief Executive Officer of Vodafone Business, a division of The Dun & Bradstreet Corporation,Vodafone Group, from 2017 until 2019. Mr. Humphries joined Vodafone from Dell Technologies where his positions from 2013 to 2017 included President and was our Chief Operating Officer of Dell’s Infrastructure Solutions Group, President of Dell’s Global Enterprise Solutions, and Vice President and General Manager, EMEA Enterprise Solutions. Before joining Dell, Mr. Humphries was with Hewlett-Packard where his roles from 20032008 to 20062013 included Senior Vice President, Emerging Markets, Senior Vice President, Strategy and heldCorporate Development, and Chief Financial Officer of HP Services. The early part of his career was spent with Compaq and Digital Equipment Corporation. He holds a variety of other senior management positions at Cognizant from 1997 to 2003. Mr. D’Souza has served on the Board of Directors of General Electric Company ("GE") since 2013, where he is currently a member of the Governance & Public Affairs Committee and the Management Development & Compensation Committee. He also serves on the Board of Trustees of Carnegie Mellon University and as Co-Chairman of the Board of Trustees of The New York Hall of Science. Mr. D’Souza has a Bachelor ofbachelor’s degree in Business Administration degree from the University of Macau and a Master of Business Administration ("MBA") degree from Carnegie Mellon University.Ulster, Northern Ireland. |

| |

| (2) | Rajeev Mehta has been our President since September 2016. From December 2013 to September 2016, Mr. Mehta served as our Chief Executive Officer, IT Services. From February 2012 to December 2013, Mr. Mehta served as our Group Chief Executive - Industries and Markets. Mr. Mehta held other senior management positions in client services and our financial services business segment from 2001 to 2012. Prior to joining Cognizant in 1997, Mr. Mehta was involved in implementing GE Information Services' offshore outsourcing program and also held consulting positions at Deloitte & Touche LLP and |

Andersen Consulting. Mr. Mehta has a Bachelor of Science degree from the University of Maryland and an MBA degree from Carnegie Mellon University.

| |

(3) | Karen McLoughlin has been our Chief Financial Officer since February 2012. Ms. McLoughlin has held various senior management positions in our finance department since she joined Cognizant in 2003. Prior to joining Cognizant, Ms. McLoughlin held various financial management positions at Spherion Corporation and Ryder System, Inc. and served in various audit roles at Price Waterhouse (now PricewaterhouseCoopers). Ms. McLoughlin has served on the Board of Directors of Best Buy Co., Inc. since 2015, where she is currently a member of the Audit Committee and chair of the Finance and Investment Policy Committee. Ms. McLoughlin has a Bachelor of Arts degree in Economics from Wellesley College and an MBA degree from Columbia University. |

| |

(4)(3) | Ramakrishnan ChandrasekaranRobert Telesmanic has been our ExecutiveSenior Vice Chairman, Cognizant IndiaPresident, Controller and Chief Accounting Officer since December 2013. From February 2012January 2017, a Senior Vice President since 2010 and our Corporate Controller since 2004. Prior to December 2013, Mr. Chandrasekaranthat, he served as our Group Chief Executive - Technology and Operations. Mr. Chandrasekaran held other senior management positions in global delivery from 1999 to 2012. Prior to joining us in 1994, Mr. Chandrasekaran worked with Tata Consultancy Services. Mr. Chandrasekaran has a Mechanical Engineering degree and an MBA degree from the Indian Institute of Management.Assistant Corporate |

Controller from 2003 to 2004. Prior to joining Cognizant, Mr. Telesmanic spent over 14 years with Deloitte & Touche LLP. Mr. Telesmanic has a Bachelor of Science degree from New York University and an MBA degree from Columbia University.

| |

(5) | Debashis Chatterjee has been our Executive Vice President and President, Global Delivery and managed our Digital Systems and Technology practice area since August 2016. From December 2013 to August 2016, Mr. Chatterjee served as Executive Vice President and President, Technology Solutions. From May 2013 to December 2013, Mr. Chatterjee served as Senior Vice President and Global Head, Technology and Information Services. From March 2012 to April 2013, he was Senior Vice President, Transformational Services. Mr. Chatterjee worked at International Business Machine Corporation from 2011 to 2012 as Vice President and Sectors Leader, Global Business Services, Global Delivery. Prior to that, Mr. Chatterjee held various senior positions in the Banking and Financial Services ("BFS") practice at Cognizant from 2004 to 2011 and other management roles at Cognizant since joining us in 1996. He has been in our industry since 1987, having previously worked at Tata Consultancy Services and Mahindra & Mahindra. Mr. Chatterjee has a Bachelor of Engineering degree in Mechanical Engineering from Jadavpur University in India. |

| |

(6) | Ramakrishna Prasad Chintamaneni has been our Executive Vice President and President, Global Industries and Consulting since August 2016. Mr. Chintamaneni served as our Executive Vice President and President, BFS, from December 2013 to August 2016. From 2011 to December 2013, Mr. Chintamaneni served as our Global Head of the BFS practice. Mr. Chintamaneni held various senior positions in the BFS practice from 2006 to 2011 and was a client partner in our BFS practice from 1999 to 2006. Prior to joining Cognizant in 1999, Mr. Chintamaneni spent seven years in the investment banking and financial services industry, including working at Merrill Lynch and its affiliates for five years as an Investment Banker and a member of Merrill’s business strategy committee in India. Mr. Chintamaneni has a Bachelor of Technology degree in Chemical Engineering from the Indian Institute of Technology, Kanpur and a Postgraduate Diploma in Business Management from the XLRI - Xavier School of Management in India. |

| |

(7) | Malcolm Frank has been our Executive Vice President, Strategy and Marketing since February 2012. Mr. Frank served as our Senior Vice President of Strategy and Marketing from 2005 to 2012. Prior to joining Cognizant in 2005, Mr. Frank was a founder and the President and Chief Executive Officer of CXO Systems, Inc., an independent software vendor providing dashboard solutions for senior managers, a founder and the President, Chief Executive Officer and Chairman of NerveWire Inc., a management consulting and systems integration firm, and a founder and executive officer at Cambridge Technology Partners, an information technology professional services firm. Mr. Frank has served on the Board of Directors of Factset Research Systems Inc. since June 2016, where he is a member of the Compensation Committee. Mr. Frank has a Bachelor degree in Economics from Yale University. |

| |

(8)(4) | Matthew Friedrich has been our Executive Vice President, General Counsel, Chief Corporate Affairs Officer and Secretary since May 2017. Prior to joining Cognizant, Mr. Friedrich wasserved as Chief Corporate Counsel for Chevron Corporation a multinational energy company, from August 2014 to May 2017,2017. Mr. Friedrich was a partner with the law firmfirms of Freshfields Bruckhaus Deringer LLP from April 2013 to August 2014 and a partner with the law firm of Boies Schiller & Flexner LLP from June 2009prior to April 2013.his role with Chevron. Mr. Friedrich began his legal career in 1995 as a federal prosecutor with the United States Department of Justice,DOJ, where he remained for nearly 14 years, culminating with his designation as the acting assistantAssistant Attorney General of the Criminal Division in 2008. Mr. Friedrich ishas served as a life member of the Council on Foreign Relations and serves onsince 2016, as a member of the Board of Directors of the U.S.-India Business Council.Council since 2018 and as a member of the Board of Directors of the US Chamber of Commerce, Litigation Center since 2018. Mr. Friedrich has a Bachelor of Arts degree in Foreign Affairs from the University of Virginia and a Juris Doctor degree from the University of Texas School of Law. Following law school, Mr. Friedrich clerked for U.S. District Judge Royal Furgeson in the Western District of Texas. |

| |

(9)(5) | Sumithra Gomatam has been our Executive Vice President and President, Digital Operations since August 2016. From December 2013 to August 2016, Ms. Gomatam served as our Executive Vice President and President, Industry Solutions. From 2008 to December 2013, Ms. Gomatam served as Senior Vice President, and global leader for our Testing practice. Ms. Gomatam held other management positions in our global delivery and BFS practices from 1995 to 2008. Ms. Gomatam has a Bachelor of Engineering degree in Electronics and Communication from Anna University. |

| |

(10) | Gajakarnan Vibushanan Kandiah has been our Executive Vice President and President, Digital Business since August 2016. Mr. Kandiah previously served as Executive Vice President of Business Process Services ("BPS") and Digital Works from January 2014 to August 2016, and as Senior Vice President of BPS from 2011 to December 2013. Previous roles he held at |

Cognizant included roles in System Integration, Testing, BPS, Information, Media and Entertainment, and Communications practices. Before joining Cognizant in 2003, Mr. Kandiah was a founder and the Chief Operating Officer of NerveWire, Inc. and the Global Vice President of the Interactive Solutions business of Cambridge Technology Partners. Mr. Kandiah completed his advanced level education at the Royal College in Sri Lanka.

| |

(11) | Venkat Krishnaswamy has been our Vice Chairman, Healthcare and Life Sciences since May 2017. From December 2013 to May 2017, he served as our President of Healthcare and Life Sciences. From February 2012 to December 2013, Mr. Krishnaswamy served as our Executive Vice President of Healthcare and Life Sciences. Mr. Krishnaswamy served as our Senior Vice President and General Manager of Healthcare and Life Sciences from 2007 to 2012 and in various other management positions since he joined Cognizant in 1997. Prior to joining Cognizant, Mr. Krishnaswamy spent over ten years in retail and commercial banking with Colonial State Bank (now Commonwealth Bank of Australia). Mr. Krishnaswamy has a Bachelor of Engineering degree from the University of Madras and a Master of Electrical Engineering degree from the Indian Institute of Technology, New Delhi. |

| |

(12) | James LennoxBecky Schmitt has been our Executive Vice President, Chief People Officer since January 2016. Mr. Lennox previously served as our Senior Vice President, Chief People Officer from June 2013 to December 2016, and as Vice President, North America Human Resources ("HR") from July 2011 to June 2013. Previous roles he held at Cognizant included leading the Workforce Management team, Operations Director for our Banking and Insurance practices, leading regional HR teams, and serving as the Chief of Staff to the Company’s Chief Executive Officer.February 2020. Prior to joining Cognizant, Ms. Schmitt was the Chief People Officer of Sam’s Club, a division of Walmart, Inc. from October 2018 through January 2020. Prior to that, she served as SVP, Chief People Officer, US eCommerce & Corporate Functions for Walmart from October 2016 through September 2018 and as VP, HR - Technology from February 2016 until October 2016. Prior to joining Walmart, Ms. Schmitt spent over 20 years with Accenture plc in 2004, Mr. Lennox held various managementhuman resources roles, culminating in operations,her role as HR resource management and recruitingManaging Director, North America Business from March 2014 through February 2016. Ms. Schmitt has served as a Board Member at Large for the North American regions of Cap Gemini and Ernst & Young. He started his career at Ernst & Young Consulting. Mr. LennoxGirl Scouts National Board since 2017. Ms. Schmitt has a Bachelor of Science degree in Business Administration from St. Thomas Aquinas College and an MBAArts degree from Fordham University.University of Michigan, Ann Arbor. |

| |

(13) | Sean Middleton has been our Senior Vice President and President, Cognizant Accelerator since January 2017. He was previously Vice President and President, Cognizant Accelerator from July 2016 to January 2017. Mr. Middleton served as Chief Operating Officer of our Emerging Business Accelerator division from 2012 to July 2016 and as Chief of Staff to the Company's Chief Executive Officer from 2010 to 2013. Prior to joining Cognizant in 2010, Mr. Middleton worked at PricewaterhouseCoopers as a management consultant. Mr. Middleton has a Bachelor degree in Computer Science from Cornell University and an MBA degree from the Wharton School at the University of Pennsylvania. |

| |

(14) | Allen Shaheen has been our Executive Vice President, North American Digital Hubs since January 2018. He has also served as a director of the Cognizant U.S. Foundation, a non-profit organization, since April 2018. From August 2015 to December 2017, Mr. Shaheen was Executive Vice President, Corporate Development. From December 2013 to August 2016, Mr. Shaheen was also responsible for various Cognizant practices, including our Enterprise Application Services Practice. Mr. Shaheen was the General Manager for our German business unit from February 2013 to December 2014 and our Markets Delivery Leader for Europe from May 2012 to December 2014. Mr. Shaheen's prior roles included being responsible for our IT Infrastructure Services, head of our Global Technology Office and head of our Systems Integration and Testing practices. Prior to joining Cognizant in 2006, Mr. Shaheen was a consultant for Cognizant from 2004 to 2006, a founder and Executive Vice President of International Operations of Cambridge Technology Partners and the Chief Executive Officer of ArsDigita Corporation. Mr. Shaheen has a Bachelor of Arts degree in Engineering and Applied Sciences from Harvard College. |

| |

(15)(6) | Dharmendra Kumar Sinha has been our Executive Vice President and President, North America since June 2019. Prior to that, he served as Executive Vice President and President, Global Client Services sincefrom December 2013.2013 until June 2019. He has also served as President and a director of the Cognizant U.S. Foundation, a non-profit organization, since April 2018. From 2007 to December 2013, Mr. Sinha served as our Senior Vice President and General Manager, Global Sales and Field Marketing. From 2004 to 2007, Mr. Sinha served as our Vice President responsible for our Manufacturing and Logistics, Retail and Hospitality, and Technology verticals. From 1997 to 2004, Mr. Sinha held a variety of other management roles. Prior to joining Cognizant in 1997, Mr. Sinha worked with Tata Consultancy Services and CMC Limited, an IT solutions provider. Mr. Sinha has a Bachelor of Science degree from Patna Science College, Patna and an MBA degree from the Birla Institute of Technology, Mesra. |

| |

(16) | Robert Telesmanic has been our Senior Vice President, Controller and Chief Accounting Officer since January 2017, a Senior Vice President since 2010 and our Corporate Controller since 2004. Prior to that, he served as our Assistant Corporate Controller from 2003 to 2004. Prior to joining Cognizant, Mr. Telesmanic spent over 14 years with Deloitte & Touche LLP. Mr. Telesmanic has a Bachelor of Science degree from New York University and an MBA degree from Columbia University. |

| |

(17)(7) | Santosh Thomas has been our Executive Vice President and President, Global Growth Markets since August 2016. Prior to his current role, Mr. Thomas served as our Head, Growth Markets from 2011 through July 2016. From 1999 to 2011, Mr. Thomas held various senior positions at Cognizant including leading Continental European operations and various roles in client relationships and market development in North America. Prior to joining Cognizant in 1999, Mr. Thomas worked with Informix and HCL Hewlett Packard Limited. Mr. Thomas has an undergraduate degree in engineering from RVR.V. College of Engineering in Bangalore, India and a Postgraduate Diploma in Business Management from the XLRI - Xavier School of Management, in India. |

| |

(18)(8) | Srinivasan VeeraraghavacharyMalcolm Frank has been our Chief Operating Officer since August 2016. Prior to his current role, Mr. Veeraraghavachary served as our Executive Vice President Products and ResourcesPresident, Cognizant Digital Business since May 2019. Prior to that, he served as Executive Vice President, Strategy and Marketing at Cognizant from December 20132012 to November 2016May 2019 and as our Senior Vice President Productsof Strategy and ResourcesMarketing from 20112005 to December 2013. Previously,2012. Prior to joining Cognizant in 2005, Mr. Frank was a founder and the President and Chief Executive Officer of CXO Systems, Inc., an independent software vendor providing dashboard solutions for senior managers, a founder and the President, Chief Executive Officer and Chairman of NerveWire Inc., a management consulting and systems integration firm, and a founder and executive officer at Cambridge Technology Partners, an information technology professional services firm. Mr. Frank has served on the Board of Directors of Factset Research Systems Inc. since June 2016, where he served in various senior management positions in our BFS practice and in our central U.S. operations.is a member of the Compensation Committee. He is also a member of the Board of Directors of the US-India Strategic Partnership Forum since May 2018. Mr. Veeraraghavachary joined Cognizant |

in 1998. Mr. VeeraraghavacharyFrank has a Bachelor

of Arts degree in Economics from Yale University. | |

| (9) | Balu Ganesh Ayyar has been our Executive Vice President and President, Cognizant Digital Operations since August 2019. Prior to joining Cognizant, Mr. Ayyar was the CEO of Mphasis, a global IT services company listed in India, from 2009 to 2017. Prior to Mphasis, Mr. Ayyar spent nearly two decades with Hewlett-Packard, holding a variety of leadership roles across multiple geographies. |

| |

| (10) | Greg Hyttenrauch has been our Executive Vice President and President, Cognizant Digital Systems & Technology since December 2019. Prior to joining Cognizant, Mr. Hyttenrauch served as Director, Global Cloud and Security Services for Vodafone from October 2015 to November 2019. Prior to Vodafone, Mr. Hyttenrauch held a variety of senior leadership positions at Capgemini from 2008 to 2015, including Deputy CEO, Global Infrastructure Services, and Global Sales Officer |

and CEO of the UK and Nordic Outsourcing Business Unit. Before joining Capgemini, Mr. Hyttenrauch held positions with CSC and EDS. He began his career with 13 years in the Canadian military, rising to the rank of captain. Mr. Hyttenrauch holds a bachelor’s degree in Mechanical Engineering from the National InstituteRoyal Military College of Technology (formerly the Regional Engineering College) in Trichy, IndiaCanada and an MBA degreein International Management from the Indian InstituteUniversity of Management in Calcutta, India.Ottawa.

| |

| (11) | Pradeep Shilige has been the Executive Vice President and Head of Global Delivery at Cognizant since July 2019. Prior to that, he served as Executive Vice President, Global Delivery and Digital Systems & Technology at Cognizant from 2015 through June 2019. Mr. Shilige has held multiple other leadership roles at Cognizant since joining the organization in 1996. Mr. Shilige is a member of the IT Services Council of NASSCOM, the premier industry association for the IT-BPM sector in India since 2017. He has a bachelor’s degree in Computer Engineering from the National Institute of Technology in Karnataka, India. |

None of our executive officers is related to any other executive officer or to any of our Directors. Our executive officers are appointed annually by the Board of Directors and generally serve until their successors are duly appointed and qualified.

Corporate History

We began our IT development and maintenance services business in early 1994 as an in-house technology development center for The Dun & Bradstreet Corporation and its operating units. In 1996, we were spun-off from The Dun & Bradstreet Corporation and, in 1998, we completed an initial public offering to become a public company.

Available Information

We make available the following public filings with the Securities and Exchange Commission ("SEC")SEC free of charge through our website at www.cognizant.com as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the SEC:

our Annual Reports on Form 10-K and any amendments thereto;

our Quarterly Reports on Form 10-Q and any amendments thereto; and

our Current Reports on Form 8-K and any amendments thereto.

In addition, we make available our code of ethics entitled “Core Values and Code of Ethics” free of charge through our website. We intend to post on our website all disclosures that are required by law or Nasdaq Stock Market listing standards concerning any amendments to, or waivers from, any provision of our code of ethics.

No information on our website is incorporated by reference into this Form 10-K or any other public filing made by us with the SEC.

Item 1A. Risk Factors

Factors That May Affect Future Results

We face various important risks and uncertainties, including those described below, that could adversely affect our business, results of operations and financial condition and, as a result, cause a decline in the trading price of our common stock.

Our results of operations could be adversely affected by economic and political conditions globally and in particular in the markets in which our customersclients and operations are concentrated.

Global macroeconomic conditions have a significant effect on our business as well as the businesses of our customers.clients. Volatile, negative or uncertain economic conditions could cause our customersclients to reduce, postpone or cancel spending on projects with us and could make it more difficult for us to accurately forecast customerclient demand and have available the right resources to profitably address such customerclient demand. The short-term nature of contracts in our industry means that actions by customersclients may occur quickly and with little warning, which may cause us to incur extra costs where we have employed more professionals than customerclient demand supports.

Our business is particularly susceptible to economic and political conditions in the markets where our customersclients or operations are concentrated. Our revenues are highly dependent on customersclients located in the United States and Europe, and any adverse economic, political or legal uncertainties or adverse developments, including due to the anticipated exituncertainty related to the potential economic and regulatory impacts of the United KingdomKingdom's exit from the European Union, as a result of the 2016 United Kingdom referendum to exit the European Union (the "Brexit Referendum") may cause customersclients in these geographies to reduce their spending and materially adversely impact our business. Many of our customersclients are in the financial services and healthcare industries, so any decrease in growth or significant consolidation in these industries or regulatory policies that restrict these industries may reduce demand for our services. Economic and political developments in India, where a significant majority of our operations and technical professionals are located, or in other countries where we maintain delivery operations, may also have a significant impact on our business and costs of operations. As a developing country, India has experienced and may continue to experience high inflation and wage growth, fluctuations in gross domestic product growth and volatility in currency exchange rates, any of which could materially adversely affect our cost of operations. Additionally, we benefit from governmental policies in India that encourage foreign investment and promote the ease of doing business, such as tax incentives, and any change in policy or circumstances that results in the elimination of such benefits or degradation of the rule of law, or imposition of new adverse restrictions or costs on our operations could have a material adverse effect on our business, results of operations and financial condition.

If we are unable to attract, train and retain skilled professionals, including highly skilled technical personnel to satisfy customerclient demand and senior management to lead our business globally, our business and results of operations may be materially adversely affected.

Our success is dependent, in large part, on our ability to keep our supply of skilled professionals, including project managers, IT engineers and senior technical personnel, in balance with customerclient demand around the world and on our ability to attract and retain senior management with the knowledge and skills to lead our business globally. Each year, we must hire tens of thousands of new professionals and retrain,reskill, retain, and motivate our workforce of hundreds of thousands of professionals with diverse skills and expertise in order to serve customerclient demands across the globe, respond quickly to rapid and ongoing technological, industry and macroeconomic developments and grow and manage our business. We also must continue to maintain an effective senior leadership team.team that, among other things, is effective in executing on our strategic goals and growing our digital business. The loss of senior executives, or the failure to attract, integrate and retain new senior executives as the needs of our business require, could have a material adverse effect on our business and results of operations.

Competition for skilled labor is intense and, in some jurisdictions in which we operate, there are more jobs for IT professionals than qualified persons to fill these jobs. Our business has experienced significant employee attrition, which may cause us to incur increased costs to hire new professionals with the desired skills. Costs associated with recruiting and training professionals are significant. If we are unable to hire or deploy professionals with the needed skillsets or if we are unable to adequately equip our professionals with the skills needed, this could materially adversely affect our business. Additionally, if we are unable to maintain an employee environment that is competitive and contemporary, it could have an adverse effect on engagement and retention, which may materially adversely affect our business.

We face challenges related to growing our business organically as well as inorganically through acquisitions, and we may not be able to achieve our targeted growth rates.

Achievement of our targeted growth rates requires continued significant organic growth of our business as well as inorganic growth through acquisitions. To achieve such growth, we must, among other things, continue to significantly expand our global operations, increase our product and service offerings, in particular with respect to digital, and scale our infrastructure to support such business growth. Continued business growth increases the complexity of our business and places significant strain on our management, personnel, operations, systems, technical performance, financial resources, and internal financial control and reporting functions, which we will have to continue to develop and improve to sustain such growth. We must continually recruit and train new personnel and retain and reskill, as necessary, existing sales, technical, finance, marketing and management personnel with the knowledge, skills and experience that our business model requires and effectively manage our personnel worldwide to support our culture, values, strategies and goals. Additionally, we expect to continue pursuing strategic and targeted acquisitions, investments and joint ventures to enhance our offerings of services and solutions or to enable us to expand in certain geographic and other markets. We may not be successful in identifying suitable opportunities, completing targeted transactions or achieving the desired results, and such opportunities may divert our management's time and focus away from our core business. We may face challenges in effectively integrating acquired businesses into our ongoing operations and in assimilating and retaining employees of those businesses into our culture and organizational structure. If we are unable to manage our growth effectively, complete acquisitions of the number, magnitude and nature we have targeted, or successfully integrate any acquired businesses into our operations, we may not be able to achieve our targeted growth rates or improve our market share, profitability or competitive position generally or in specific markets or services.

We may not be able to achieve our profitability and capital return goals.

Our goals for profitability and capital return rely upon a number of assumptions, including our ability to improve the efficiency of our operations and make successful investments to grow and further develop our business. Our profitability depends on the efficiency with which we run our operations and the cost of our operations, especially the compensation and benefits costs of the professionals we employ. We have incurred, and expect to continue to incur, substantial costs related to implementing our strategy to optimize such costs, and we may not realize the ultimate cost savings that we expect. We may not be able to efficiently utilize our professionals if increased regulation, policy changes or administrative burdens of immigration, work visas or outsourcing prevents us from deploying our professionals globally on a timely basis, or at all, to fulfill the needs of our customers. Wageclients. Increases in wages and other cost pressurescosts may put pressure on our profitability. Fluctuations in foreign currency exchange rates can also have adverse effects on our revenues, income from operations and net income when items originally denominated in other currencies are translated or remeasured into U.S. dollars for presentation of our consolidated financial statements. We have entered into foreign exchange forward contracts intended to partially offset the impact of the movement of the exchange rates on future operating costs and to mitigate foreign currency risk on foreign currency denominated net monetary assets. However, the hedging strategies that we have implemented, or may in the future implement, to mitigate foreign currency exchange rate risks may not reduce or completely offset our exposure to foreign exchange rate fluctuations and may expose our business to unexpected market, operational and counterparty credit risks. We are particularly susceptible to wage and cost pressures in India and the exchange rate of the Indian rupee relative to the currencies of our customerclient contracts due to the fact that the substantial majority of our employees are in India while our contracts with customersclients are typically in the local currency of the country where our customersclients are located. If we are unable to improve the efficiency of our operations, our operating margin may decline and our business, results of operations and financial condition may be materially adversely affected. Failure to achieve our profitability goals could adversely affect our business, financial condition and results of operations.

With respect to capital return, our ability and decisions to pay dividends and repurchase shares consistent with our announced goals or at all depend on a variety of factors, including our cash flow generated from operations, the amount and geographic location of our cash and investment balances, our net income, our overall liquidity position, potential alternative uses of cash, such as acquisitions, and anticipated future economic conditions and financial results. Failure to achieve our capital return goals may adversely impact our reputation with shareholders and shareholders’ perception of our business and the value of our common stock.

Our failure to meet specified service levels or milestones required by certain of our client contracts may result in our client contracts being less profitable, potential liability for penalties or damages or reputational harm.

Many of our client contracts include clauses that tie our compensation to the achievement of agreed-upon performance standards or milestones. Failure to satisfy these measures could significantly reduce or eliminate our fees under the contracts, increase the cost to us of meeting performance standards or milestones, delay expected payments, subject us to potential damage claims under the contract terms or harm our reputation. CustomersThe use of new technologies in our offerings can expose us to additional risks if those technologies fail to work as predicted, or there are unintended consequences of new designs or uses, which could lead to cost overruns, project delays, financial penalties, or damage to our reputation. Clients also often have the right to terminate

a contract and pursue damage claims for serious or repeated failure to meet these service commitments. Some of our contracts provide that a portion of our compensation depends on performance measures such as cost-savings, revenue enhancement, benefits produced, business goals attained and adherence to schedule. These goals can be complex and may depend on our customers’clients’ actual levels of business activity or may be based on assumptions that are later determined not to be achievable or accurate. As such, these provisions may increase the variability in revenues and margins earned on those contracts.

We face intense and evolving competition and significant technological advances that our service offerings must keep pace with in the rapidly changing markets we compete in.

The markets we serve and operate in are highly competitive, subject to rapid change and characterized by a large number of participants, as described in “Part I, Item 1. Business-Competition.” In addition to large, global competitors, we face competition from numerous smaller, local competitors in many geographic markets that may have more experience with operations in these markets, have well-established relationships with our desired customers,clients, or be able to provide services and solutions at lower costs or on terms more attractive to customersclients than we can. Consolidation activity may also result in new competitors with greater scale, a broader footprint or vertical integration that makes them more attractive to customersclients as a single provider of integrated products and services. In addition, the short-term nature of contracts in our industry and the long-term concurrent use by many customersclients of multiple professional service providers means that we are required to be continually competitive on the quality, scope and pricing of our offerings or face a reduction or elimination of our business. Our success depends on our ability to continue to develop and implement services and solutions that anticipate and respond to rapid and continuing changes in technology to serve the evolving needs of our customers.clients. Examples of areas of significant change include digital-, cloud- and security-related offerings, which are continually evolving, as well as developments in areas such as AI, augmented reality, automation, blockchain, IoT, quantum computing and as-a-service solutions. If we do not sufficiently invest in new technologies, successfully adapt to industry developments and changing demand, and evolve and expand our business at sufficient speed and scale to keep pace with the demands of the markets we serve, we may be unable to develop and maintain a competitive advantage and execute on our growth strategy, which would materially adversely affect our business, results of operations and financial condition.

Our relationships with our third party alliance partners, who supply us with necessary components to the services and solutions we offer our customers,clients, are also critical to our ability to provide many of our services and solutions that address customerclient demands. There can be no assurance that we will be able to maintain such relationships. Among other things, such alliance partners may in the future decide to compete with us, form exclusive or more favorable arrangements with our competitors or otherwise reduce our access to their products impairing our ability to provide the services and solutions demanded by customers.clients.

We face legal, reputational and financial risks if we fail to protect customerclient and/or Cognizant data from security breaches or cyberattacks.

In order to provide our services and solutions, we depend on global information technology networks and systems, including those of third parties, to process, transmit, host and securely store electronic information (including our confidential information and the confidential information of our customers)clients) and to communicate among our locations around the world and with our customers,clients, suppliers and partners. Security breaches, employee malfeasance, or human or technological error could lead to shutdowns or disruptions of our operations and potential unauthorized disclosure of our or our customers’clients’ sensitive data, which in turn could jeopardize projects that are critical to our operations or the operations of our customers’clients’ businesses. Like other global companies, we and the businesses we interact with have experienced threats to data and systems, including by perpetrators of random or targeted malicious cyberattacks, computer viruses, malware, worms, bot attacks or other destructive or disruptive software and attempts to misappropriate customerclient information and cause system failures and disruptions.

A security compromise of our information systems or of those of businesses with whom we interact that results in confidential information being accessed by unauthorized or improper persons could harm our reputation and expose us to regulatory actions, customerclient attrition, remediation expenses, disruption of our business, and claims brought by our customersclients or others for breaching contractual confidentiality and security provisions or data protection laws. Monetary damages imposed on us could be significant and not covered by our liability insurance. Techniques used by bad actors to obtain unauthorized access, disable or degrade service, or sabotage systems evolve frequently and may not immediately produce signs of intrusion, and we may be unable to anticipate these techniques or to implement adequate preventative measures. In addition, a security breach could require that we expend substantial additional resources related to the security of our information systems, diverting resources from other projects and disrupting our businesses. If we experience a data security breach, our reputation could be damaged and we could be subject to additional litigation, regulatory risks and business losses.

We are required to comply with increasingly complex and changing data security and privacy regulations in the United States, the United Kingdom, the European Union and in other jurisdictions in which we operate that regulate the collection, use and transfer of personal data, including the transfer of personal data between or among countries. In the United States, forFor example, the Health Insurance Portability and Accountability Act imposes extensive privacy and security requirements governing the transmission, use and disclosureEuropean Union’s

General Data Protection Regulation which became effective in May 2018, imposes newhas imposed stringent compliance obligations regarding the handling of personal data and has significantly increasedresulted in the issuance of significant financial penalties for noncompliance. Additionally,In the Digital Information SecurityUnited States, there have been proposals for federal privacy legislation and many new state privacy laws are on the horizon. Recently enacted legislation, such as the California Consumer Privacy Act, impose extensive privacy requirements on organizations governing personal information. Existing US sectoral laws such as the Health Insurance Portability and Accountability Act also impose extensive privacy and security requirements on organizations operating in Healthcare Act is under considerationthe healthcare industry, which Cognizant serves. Additionally, in India, which proposed legislation includes significant penalties related to disclosurethe Personal Data Protection Bill, 2018 was recently cleared for introduction in the current session of healthcarethe Indian Parliament. If enacted in its current form it would impose stringent obligations on the handling of personal data, including certain localization requirements for sensitive data. Other countries have enacted or are considering enacting data localization laws that require certain data to stay within their borders. We may also face audits or investigations by one or more domestic or foreign government agencies or our customersclients pursuant to our contractual obligations relating to our compliance with these regulations. Complying with changing regulatory

requirements requires us to incur substantial costs, exposes us to potential regulatory action or litigation, and may require changes to our business practices in certain jurisdictions, any of which could materially adversely affect our business operations and operating results.

If our business continuity and disaster recovery plans are not effective and our global delivery capability is impacted, our business and results of operations may be materially adversely affected and we may suffer harm to our reputation.

Our business model is dependent on our global delivery capability, which includes coordination between our main operating offices in India, our other global and regional delivery centers, the offices of our customersclients and our associates worldwide. System failures, outages and operational disruptions may be caused by factors outside of our control such as hostilities, political unrest, terrorist attacks, natural disasters, or pandemics and public health emergencies, such as the coronavirus, affecting the geographies where our operations and transmission equipment is located. Our business continuity and disaster recovery plans may not be effective at preventing or mitigating the effects of such disruptions, particularly in the case of a catastrophic event. Any such disruption may result in lost revenues, a loss of customersclients and reputational damage, which would have an adverse effect on our business, results of operations and financial condition.

A substantial portion of our employees in the United States, United Kingdom, European Union and other jurisdictions rely on visas to work in those areas such that any restrictions on such visas or immigration more generally or increased costs of obtaining such visas may affect our ability to compete for and provide services to customersclients in these jurisdictions, which could materially adversely affect our business, results of operations and financial condition.

A substantial portion of our employees in the United States and in many other jurisdictions, including countries in Europe, rely upon temporary work authorization or work permits, which makes our business particularly vulnerable to changes and variations in immigration laws and regulations, including written changes and policy changes to the manner in which the laws and regulations are interpreted or enforced.enforced, and potential enforcement actions and penalties that might cause us to lose access to such visas. The political environment in the United States, the United Kingdom and other countries in recent years has included significant support for anti-immigrant legislation and administrative changes. Many of these recent changes have made it more difficult to obtainresulted in, and various proposed changes may result in, increased difficulty in obtaining timely visas that impact our ability to staff projects, including as a result of visa application rejects and delays in processing applications, and significantly increased the costs offor us in obtaining visas. The governments of these countries may also tighten adjudication standards for labor market tests. For example, in the United States, the current administration has implemented policy changes to increase scrutiny of the issuance of new and the renewal of existing H-1B visa applications and the placement of H-1B visa workers on third party worksites, and has issued executive orders designed to limit immigration. Recently, thereIn addition, the administration has been an increaseproposed for implementation in 2020 a policy change applicable to entities where more than 50% of the workers in the numberUnited States hold certain types of visas that, if implemented, would significantly increase the visa application rejections and delays in processingcosts for such applications. This has affected and may continue to affect our ability to timely obtain visas and staff projects. Additionally,entities. In the EU, many countries in the European Union ("EU") continue to implement new regulations to move into compliance with the EU Directive of 2014 to harmonize immigration rules for intracompany transferees in most EU member states and to facilitate the transfer of managers, specialists and graduate trainees both into and within the region. The changes have had significant impacts on mobility programs and have led to new notification and documentation requirements for companies sending professionals to EU countries. Recent changes or any additional adverse revisions to immigration laws and regulations in the jurisdictions in which we operate may cause us delays, staffing shortages, additional costs or an inability to bid for or fulfill projects for customers,clients, any of which could have a material adverse effect on our business, results of operations and financial condition.

Anti-outsourcing legislation, if adopted, and negative perceptions associated with offshore outsourcing could impair our ability to serve our customersclients and materially adversely affect our business, results of operations and financial condition.

The practice of outsourcing services to organizations operating in other countries is a topic of political discussion in the United States, which is our largest market, as well as other regions in which we have customers.clients. For example, measures aimed at limiting or restricting outsourcing by U.S. companies have been put forward for consideration by the U.S. Congress and in state

legislatures to address concerns over the perceived association between offshore outsourcing and the loss of jobs domestically. If any such measure is enacted, our ability to provide services to our customersclients could be impaired.